Analysis of Management Accounting

VerifiedAdded on 2020/10/22

|18

|5303

|72

AI Summary

The assignment provided is an analysis of management accounting, which involves the use of planning tools to make fruitful and efficient decision-making for business activities. It provides accuracy to stakeholders about the working of a business. The document concludes that taking help from such analysis can improve business performance and lead to better decision-making. References are provided from books and journals, including Management Accounting Research, Journal of Operations Management, and International Journal of Business Performance Management.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................4

Task 1...............................................................................................................................................4

A. Explain the management accounting and give the essential requirements of the different

types of management accounting system ...................................................................................4

B. Providing the different types of management accounting report used by the OVATION

SYSTEMS...................................................................................................................................5

C. Assessing the benefits of the different types of management accounting systems ...............6

D. How management accounting system and management accounting reporting is integrated

in an organization. ......................................................................................................................8

Task 2...............................................................................................................................................9

A. Explain the absorption costing and marginal costing methods .............................................9

B.1 Solve the following problem with marginal and absorption costing methods.....................9

B.2 . With the use of break even analysis solve the following question...................................10

C . Apply the range of management accounting techniques and produce appropriate financial

reporting documents accurately................................................................................................11

D. Produce financial reports that accurately apply and interpret the data for the business

activities shown in the scenarios in Task 2 above.....................................................................12

Task 3.............................................................................................................................................12

A. Explain the advantage and disadvantages for different types of planning tools..................12

B. Show the application of the planning tools for preparing, forecasting and analysing

budgets. ....................................................................................................................................14

C. Compare how the organization is different in adopting management accounting system

with responds with the financial problems...............................................................................14

D. Analyse how your management accounting techniques could respond to financial problems

and lead the organization to sustainable success.......................................................................16

E. Evaluate how planning tools could be used to solve financial problems and lead the

organization to sustainable success...........................................................................................16

Planning tools helps in identifying the social and environment trends which can provides

companies' ability to create value over time. ...........................................................................16

INTRODUCTION...........................................................................................................................4

Task 1...............................................................................................................................................4

A. Explain the management accounting and give the essential requirements of the different

types of management accounting system ...................................................................................4

B. Providing the different types of management accounting report used by the OVATION

SYSTEMS...................................................................................................................................5

C. Assessing the benefits of the different types of management accounting systems ...............6

D. How management accounting system and management accounting reporting is integrated

in an organization. ......................................................................................................................8

Task 2...............................................................................................................................................9

A. Explain the absorption costing and marginal costing methods .............................................9

B.1 Solve the following problem with marginal and absorption costing methods.....................9

B.2 . With the use of break even analysis solve the following question...................................10

C . Apply the range of management accounting techniques and produce appropriate financial

reporting documents accurately................................................................................................11

D. Produce financial reports that accurately apply and interpret the data for the business

activities shown in the scenarios in Task 2 above.....................................................................12

Task 3.............................................................................................................................................12

A. Explain the advantage and disadvantages for different types of planning tools..................12

B. Show the application of the planning tools for preparing, forecasting and analysing

budgets. ....................................................................................................................................14

C. Compare how the organization is different in adopting management accounting system

with responds with the financial problems...............................................................................14

D. Analyse how your management accounting techniques could respond to financial problems

and lead the organization to sustainable success.......................................................................16

E. Evaluate how planning tools could be used to solve financial problems and lead the

organization to sustainable success...........................................................................................16

Planning tools helps in identifying the social and environment trends which can provides

companies' ability to create value over time. ...........................................................................16

CONCLUSION..............................................................................................................................16

REFERENCES..............................................................................................................................18

REFERENCES..............................................................................................................................18

INTRODUCTION

To solve the financial and managerial issues in the organization there are lots of tools and

techniques management accounting have. Management accounting plays an important role in the

to achieve the organizational goals. The present report will provide the meaning of management

accounting and the essential requirements of the management accounting system and their

implement in business accounting. The report will also depict the uses of marginal and

absorption costing and importance of break-even analysis in an organization to find out the

financial health of the organization apart from that this assignment will provide benefit and uses

of different planning tools with their benefits and drawbacks.

Task 1

A. Explain the management accounting and give the essential requirements of the different types

of management accounting system

Management accounting is process of identifying, interpreting, analyzing and

communicating all the financial information in the shadow of the OVATIONS SYSTEMS goals.

In between financial and management accounting there lies only one basic difference I.e the

information provided by management accounting aims at assisting the managers in decision

making, while in the financial accounting targets at providing information to the outsiders which

are related with organization (Ax and Greve, 2017). Managers of the organization requires the

financial information and accurate statistical data day by day to interpret day to day short run

decision. Management needs report which is contained by the management accounting.

Accounting is the process of finding, measuring, and communication profitable data to

permit the decision and judgments by the users accordingly American accounting association.

Management accounting system help in varying their application (Cooper, Ezzamel and Qu,

2017). Inside the organization various departments are there and each are fashioned to provide

the information which the management needs for assessing the decision. Management

accounting is consisted of the various system which are discussed under -

Cost accounting system

To do the valuation of inventory, profitability analysis and cost control for the

approximate cost of product OVATION SYSTEM applied the framework named costing system

or cost accounting system. In this system of accounting the allocation of cost is done by the

managers with the help of activity based costing or traditional costing system. Approaching the

To solve the financial and managerial issues in the organization there are lots of tools and

techniques management accounting have. Management accounting plays an important role in the

to achieve the organizational goals. The present report will provide the meaning of management

accounting and the essential requirements of the management accounting system and their

implement in business accounting. The report will also depict the uses of marginal and

absorption costing and importance of break-even analysis in an organization to find out the

financial health of the organization apart from that this assignment will provide benefit and uses

of different planning tools with their benefits and drawbacks.

Task 1

A. Explain the management accounting and give the essential requirements of the different types

of management accounting system

Management accounting is process of identifying, interpreting, analyzing and

communicating all the financial information in the shadow of the OVATIONS SYSTEMS goals.

In between financial and management accounting there lies only one basic difference I.e the

information provided by management accounting aims at assisting the managers in decision

making, while in the financial accounting targets at providing information to the outsiders which

are related with organization (Ax and Greve, 2017). Managers of the organization requires the

financial information and accurate statistical data day by day to interpret day to day short run

decision. Management needs report which is contained by the management accounting.

Accounting is the process of finding, measuring, and communication profitable data to

permit the decision and judgments by the users accordingly American accounting association.

Management accounting system help in varying their application (Cooper, Ezzamel and Qu,

2017). Inside the organization various departments are there and each are fashioned to provide

the information which the management needs for assessing the decision. Management

accounting is consisted of the various system which are discussed under -

Cost accounting system

To do the valuation of inventory, profitability analysis and cost control for the

approximate cost of product OVATION SYSTEM applied the framework named costing system

or cost accounting system. In this system of accounting the allocation of cost is done by the

managers with the help of activity based costing or traditional costing system. Approaching the

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

actual product, cost is an important function of management accounting (Eldenburg and et.al.,

2016). Cost accounting is the system which focus on the reducing the cost of production with

the help of weighing the inputs' production cost plus fixed cost. It is a key concept of the

management accounting as it provides with the analytical tool like variance analysis, budgeting

tool, marginal costing etc to take the decision.

Inventory management

It is the method to inspecting, controlling, oversee the ordering, storage and the uses of

the ingredients which OVATION SYSTEM apply in the production of goods it sells. This

system of inventory management uses the various application like bar code scanners, desktop

software, etc in consumable, stocks and goods (Fullerton, Kennedy and Widener, 2014). It

includes all the information regarding the inventory from the raw material to the selling. It helps

in improving the bottom line of the company, enhances the inventory accuracy and the work

flow of an organization.

Job costing system

Job costing system is the system of allocation of the cost of manufacturing to the

independent batches or items of the product. When goods processed are different from one

another the job costing system is applied (Kihn, and Ihantola, 2015). Information obtained from

this is important for determining the correctness of estimating system of company to quote the

price. The three kinds of information job costing requires that are labor, direct material and lab

our.

Price optimizing system

Price optimization is the technique give to the organization to determine how the

consumer will react at different pricing of product and services through different channels. It

also helps in deciding the cost which the OVATION SYSTEM determines will be best to fulfill

its goals and objectives (Management Accounting: Meaning, Functions and Characteristics,

2017).

B. Providing the different types of management accounting report used by the OVATION

SYSTEMS

The internal information received by the financial accounting is focused by the

managerial accounting. It is applied for the planning, analysis, controlling and decision making

in the organization (Malmi, 2016). It is depended upon the financial statements such as, balance

2016). Cost accounting is the system which focus on the reducing the cost of production with

the help of weighing the inputs' production cost plus fixed cost. It is a key concept of the

management accounting as it provides with the analytical tool like variance analysis, budgeting

tool, marginal costing etc to take the decision.

Inventory management

It is the method to inspecting, controlling, oversee the ordering, storage and the uses of

the ingredients which OVATION SYSTEM apply in the production of goods it sells. This

system of inventory management uses the various application like bar code scanners, desktop

software, etc in consumable, stocks and goods (Fullerton, Kennedy and Widener, 2014). It

includes all the information regarding the inventory from the raw material to the selling. It helps

in improving the bottom line of the company, enhances the inventory accuracy and the work

flow of an organization.

Job costing system

Job costing system is the system of allocation of the cost of manufacturing to the

independent batches or items of the product. When goods processed are different from one

another the job costing system is applied (Kihn, and Ihantola, 2015). Information obtained from

this is important for determining the correctness of estimating system of company to quote the

price. The three kinds of information job costing requires that are labor, direct material and lab

our.

Price optimizing system

Price optimization is the technique give to the organization to determine how the

consumer will react at different pricing of product and services through different channels. It

also helps in deciding the cost which the OVATION SYSTEM determines will be best to fulfill

its goals and objectives (Management Accounting: Meaning, Functions and Characteristics,

2017).

B. Providing the different types of management accounting report used by the OVATION

SYSTEMS

The internal information received by the financial accounting is focused by the

managerial accounting. It is applied for the planning, analysis, controlling and decision making

in the organization (Malmi, 2016). It is depended upon the financial statements such as, balance

sheet, income statements etc. The organization needs various reports like budget, cost report,

performance report etc.

Cost reports

Management accounting helps in calculating the cost of the products and services. By

taking into consideration all raw product expenses, labour, cost plus any other cost. After taking

all the expenses and cost the sums are then divided into amounts of good manufactured. This all

data is presented in the cost report. This report helps the managers to identify the capability of

cost to its cost value of the products and services with the selling price. It assesses the managers

to control the loop hole of cost and develop the plan for profit margin.

Budgets

Budget estimates all the expenses of the organization. Budget is the very important

element of management accounting. Budget is the systematic procedure which is consisted of all

the past expenses upcoming expenses so that the goals and objectives can be received. For an

OVATION SYSTEM it is necessary while attempt to attaining its goals whereas staying In

budgeted amount. If the amount exceed the variance in actual and standard cost takes place.

Performance report

The accountant managers takes the help of budget to compare the actual outcomes of

revenues and expenses to budgeted amount (Nitzl, 2018). The variances occur and evaluated

when the new budgets is prepared including all the essential information is listed on the

performance report. Performance report is actually the evaluation of the performance presented

in the systematic format. Mostly these reports are made every year, but some organization make

them monthly or quarterly. Performance reports assist mangers in future planning of demands for

the production and cost enhancement

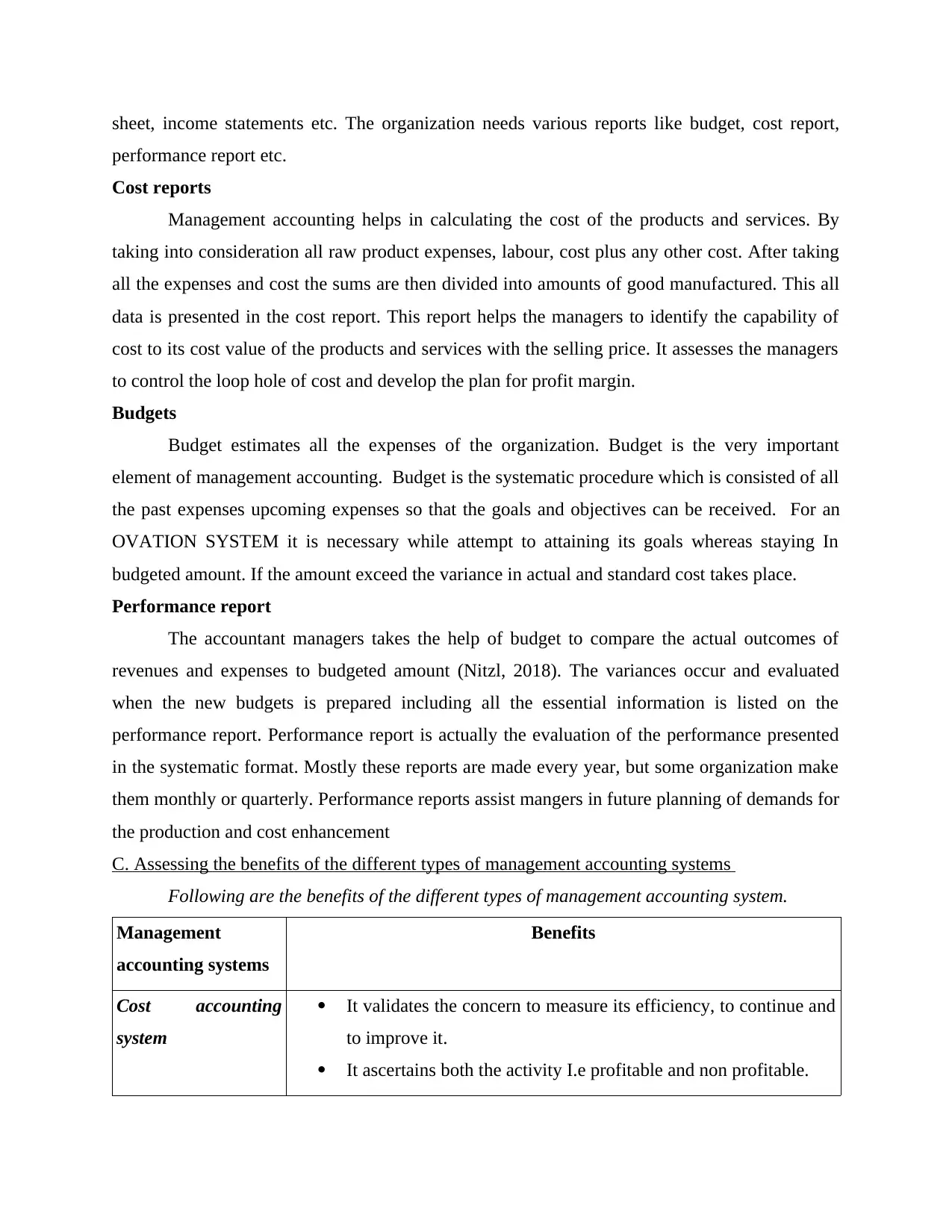

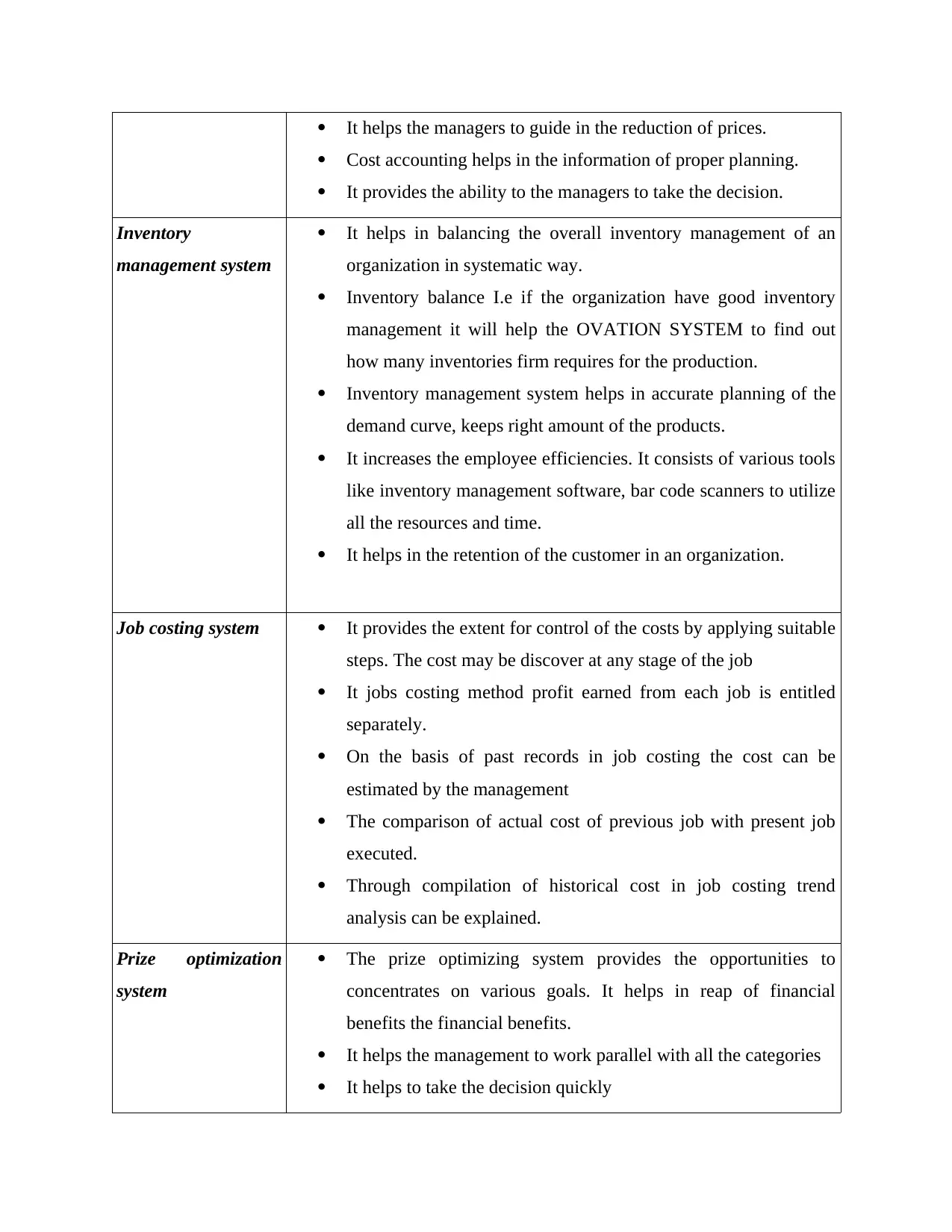

C. Assessing the benefits of the different types of management accounting systems

Following are the benefits of the different types of management accounting system.

Management

accounting systems

Benefits

Cost accounting

system

It validates the concern to measure its efficiency, to continue and

to improve it.

It ascertains both the activity I.e profitable and non profitable.

performance report etc.

Cost reports

Management accounting helps in calculating the cost of the products and services. By

taking into consideration all raw product expenses, labour, cost plus any other cost. After taking

all the expenses and cost the sums are then divided into amounts of good manufactured. This all

data is presented in the cost report. This report helps the managers to identify the capability of

cost to its cost value of the products and services with the selling price. It assesses the managers

to control the loop hole of cost and develop the plan for profit margin.

Budgets

Budget estimates all the expenses of the organization. Budget is the very important

element of management accounting. Budget is the systematic procedure which is consisted of all

the past expenses upcoming expenses so that the goals and objectives can be received. For an

OVATION SYSTEM it is necessary while attempt to attaining its goals whereas staying In

budgeted amount. If the amount exceed the variance in actual and standard cost takes place.

Performance report

The accountant managers takes the help of budget to compare the actual outcomes of

revenues and expenses to budgeted amount (Nitzl, 2018). The variances occur and evaluated

when the new budgets is prepared including all the essential information is listed on the

performance report. Performance report is actually the evaluation of the performance presented

in the systematic format. Mostly these reports are made every year, but some organization make

them monthly or quarterly. Performance reports assist mangers in future planning of demands for

the production and cost enhancement

C. Assessing the benefits of the different types of management accounting systems

Following are the benefits of the different types of management accounting system.

Management

accounting systems

Benefits

Cost accounting

system

It validates the concern to measure its efficiency, to continue and

to improve it.

It ascertains both the activity I.e profitable and non profitable.

It helps the managers to guide in the reduction of prices.

Cost accounting helps in the information of proper planning.

It provides the ability to the managers to take the decision.

Inventory

management system

It helps in balancing the overall inventory management of an

organization in systematic way.

Inventory balance I.e if the organization have good inventory

management it will help the OVATION SYSTEM to find out

how many inventories firm requires for the production.

Inventory management system helps in accurate planning of the

demand curve, keeps right amount of the products.

It increases the employee efficiencies. It consists of various tools

like inventory management software, bar code scanners to utilize

all the resources and time.

It helps in the retention of the customer in an organization.

Job costing system It provides the extent for control of the costs by applying suitable

steps. The cost may be discover at any stage of the job

It jobs costing method profit earned from each job is entitled

separately.

On the basis of past records in job costing the cost can be

estimated by the management

The comparison of actual cost of previous job with present job

executed.

Through compilation of historical cost in job costing trend

analysis can be explained.

Prize optimization

system

The prize optimizing system provides the opportunities to

concentrates on various goals. It helps in reap of financial

benefits the financial benefits.

It helps the management to work parallel with all the categories

It helps to take the decision quickly

Cost accounting helps in the information of proper planning.

It provides the ability to the managers to take the decision.

Inventory

management system

It helps in balancing the overall inventory management of an

organization in systematic way.

Inventory balance I.e if the organization have good inventory

management it will help the OVATION SYSTEM to find out

how many inventories firm requires for the production.

Inventory management system helps in accurate planning of the

demand curve, keeps right amount of the products.

It increases the employee efficiencies. It consists of various tools

like inventory management software, bar code scanners to utilize

all the resources and time.

It helps in the retention of the customer in an organization.

Job costing system It provides the extent for control of the costs by applying suitable

steps. The cost may be discover at any stage of the job

It jobs costing method profit earned from each job is entitled

separately.

On the basis of past records in job costing the cost can be

estimated by the management

The comparison of actual cost of previous job with present job

executed.

Through compilation of historical cost in job costing trend

analysis can be explained.

Prize optimization

system

The prize optimizing system provides the opportunities to

concentrates on various goals. It helps in reap of financial

benefits the financial benefits.

It helps the management to work parallel with all the categories

It helps to take the decision quickly

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

It monitors results and upgrade the input data to maintain the

accuracy

Managerial accounting helps the OVATION SYSTEM to do effective planning and

working with the help of various types of management accounting system. These system plays

an important role in the organization to assessing the good decision making so that firm can

accomplish its goals and objectives.

D. How management accounting system and management accounting reporting is integrated in

an organization.

The management accounting systems and the reporting are in organization for the

supporting of the competitive advantages by the processing communicating and collecting the

information which are required by the management for the efficient planning, controlling and

evaluating the processes of the business and company strategies (Otley, 2016). The top

accountant of the organization is the controller of these two techniques which helps the

management to reach the goals and objectives. Following are some important facts which helps

organization in the integration of management techniques-

Helping forecasts the future

The word forecasting delivers the meaning that is related to the future. Before starting the

venture many questions arises in the mind of the owner like should company invest more

equipment, should the company should diversify in different market or not. The answer of all

question are provided with the help of management techniques and reporting system.

Helping in make or buy decision

To control the cost and exceed the profit of the organization it is very important to do

right decision-making regarding whether to buy or to do the production to reduce the cost.

Through these techniques, insights will be developed which will be enable decision-making

making at strategic and operational levels.

Helps to understand the performance variances

In every organization there is a set standard for each and every activity. The

discrepancies in the business performance is the variance between what is set and what is

actually achieved. This reporting and system techniques helps to identify the cause behind the

variances and appropriate solution.

accuracy

Managerial accounting helps the OVATION SYSTEM to do effective planning and

working with the help of various types of management accounting system. These system plays

an important role in the organization to assessing the good decision making so that firm can

accomplish its goals and objectives.

D. How management accounting system and management accounting reporting is integrated in

an organization.

The management accounting systems and the reporting are in organization for the

supporting of the competitive advantages by the processing communicating and collecting the

information which are required by the management for the efficient planning, controlling and

evaluating the processes of the business and company strategies (Otley, 2016). The top

accountant of the organization is the controller of these two techniques which helps the

management to reach the goals and objectives. Following are some important facts which helps

organization in the integration of management techniques-

Helping forecasts the future

The word forecasting delivers the meaning that is related to the future. Before starting the

venture many questions arises in the mind of the owner like should company invest more

equipment, should the company should diversify in different market or not. The answer of all

question are provided with the help of management techniques and reporting system.

Helping in make or buy decision

To control the cost and exceed the profit of the organization it is very important to do

right decision-making regarding whether to buy or to do the production to reduce the cost.

Through these techniques, insights will be developed which will be enable decision-making

making at strategic and operational levels.

Helps to understand the performance variances

In every organization there is a set standard for each and every activity. The

discrepancies in the business performance is the variance between what is set and what is

actually achieved. This reporting and system techniques helps to identify the cause behind the

variances and appropriate solution.

Task 2

A. Explain the absorption costing and marginal costing methods

For the valuation of the inventory the two approaches are their, they are marginal costing

and other in absorption costing. Marginal costing is a method of valuation of inventory is done

by bifurcating variable cost and fixed cost. In the marginal costing only the variable cost are

charged to operation, whereas fixed cost cannot be taken into consideration and are charged to

Loss and profit account for the period. In marginal costing the variable cost includes all the

variables which are change with change in their out put. It is a principle costing technique for the

decision making. The basic reason behind this is the marginal costing approach permits the

attention of management to be focused on the changes which results from decision under the

consideration (Saeidi and et.al., 2018). It finds out the Marginal production cost and depicts its

effect on change in profit in the output units. It is the movement in the total variable cost and

fixed cost, due to the production of an additional unit of output.

Talking about the absorption costing, it is known as full costing technique in which both

the cost whether fixed or variable are taken into consideration are absorbed by the total units

produced. It basically used for the purpose of reporting that is financial and tax reporting. It is

method of valuation of inventory in which all the production expenses are distributed to the cost

centers to identify the cost of production. Therefore, it is a traditional method for inventory

valuation.

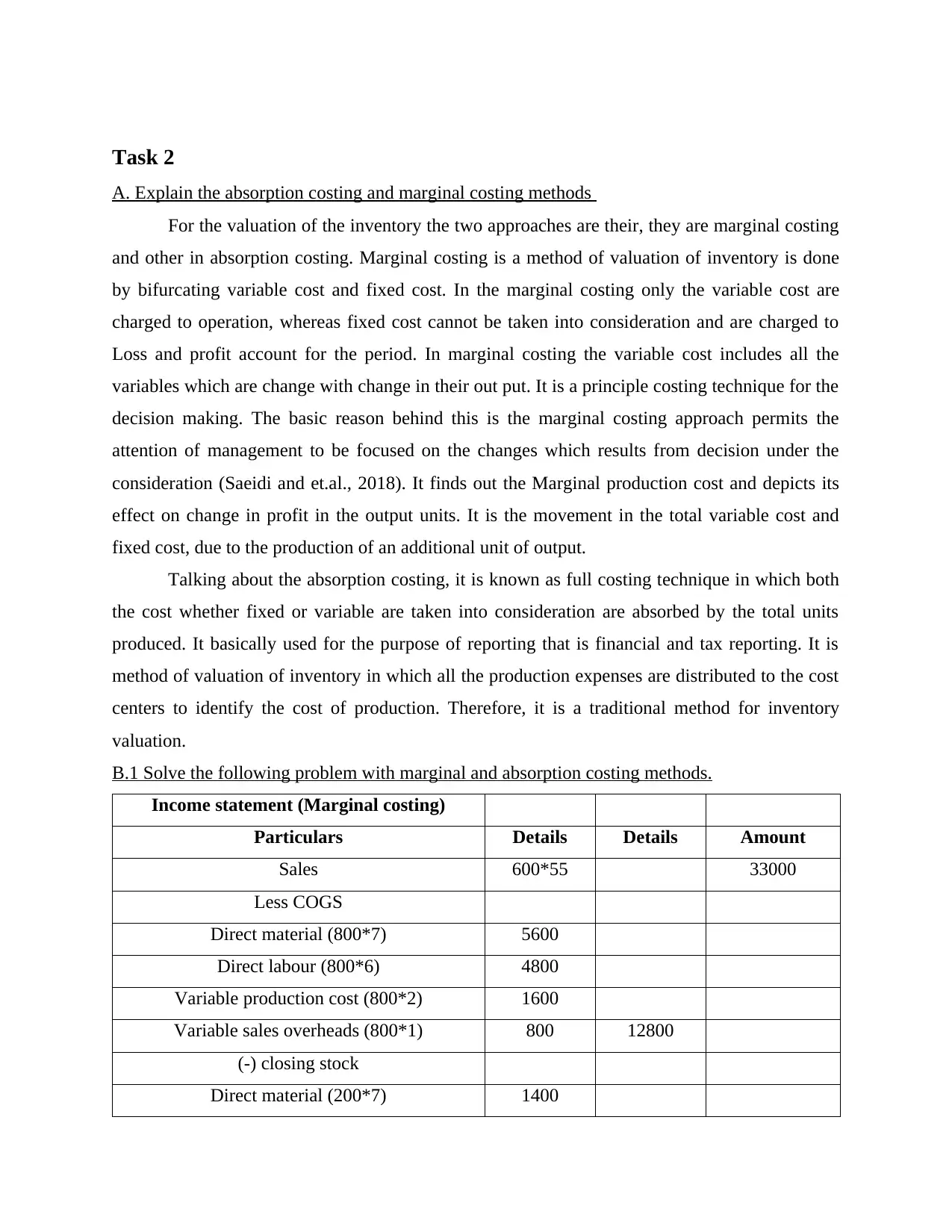

B.1 Solve the following problem with marginal and absorption costing methods.

Income statement (Marginal costing)

Particulars Details Details Amount

Sales 600*55 33000

Less COGS

Direct material (800*7) 5600

Direct labour (800*6) 4800

Variable production cost (800*2) 1600

Variable sales overheads (800*1) 800 12800

(-) closing stock

Direct material (200*7) 1400

A. Explain the absorption costing and marginal costing methods

For the valuation of the inventory the two approaches are their, they are marginal costing

and other in absorption costing. Marginal costing is a method of valuation of inventory is done

by bifurcating variable cost and fixed cost. In the marginal costing only the variable cost are

charged to operation, whereas fixed cost cannot be taken into consideration and are charged to

Loss and profit account for the period. In marginal costing the variable cost includes all the

variables which are change with change in their out put. It is a principle costing technique for the

decision making. The basic reason behind this is the marginal costing approach permits the

attention of management to be focused on the changes which results from decision under the

consideration (Saeidi and et.al., 2018). It finds out the Marginal production cost and depicts its

effect on change in profit in the output units. It is the movement in the total variable cost and

fixed cost, due to the production of an additional unit of output.

Talking about the absorption costing, it is known as full costing technique in which both

the cost whether fixed or variable are taken into consideration are absorbed by the total units

produced. It basically used for the purpose of reporting that is financial and tax reporting. It is

method of valuation of inventory in which all the production expenses are distributed to the cost

centers to identify the cost of production. Therefore, it is a traditional method for inventory

valuation.

B.1 Solve the following problem with marginal and absorption costing methods.

Income statement (Marginal costing)

Particulars Details Details Amount

Sales 600*55 33000

Less COGS

Direct material (800*7) 5600

Direct labour (800*6) 4800

Variable production cost (800*2) 1600

Variable sales overheads (800*1) 800 12800

(-) closing stock

Direct material (200*7) 1400

Direct labour (200*6) 1200

Variable production cost (200*2) 400

Variable sales overheads (200*1) 200 3200 9600

Gross profit 23400

Less: production overheads 3200

less: administration cost 1200

less: selling cost 1500 5900

Net profit 17500

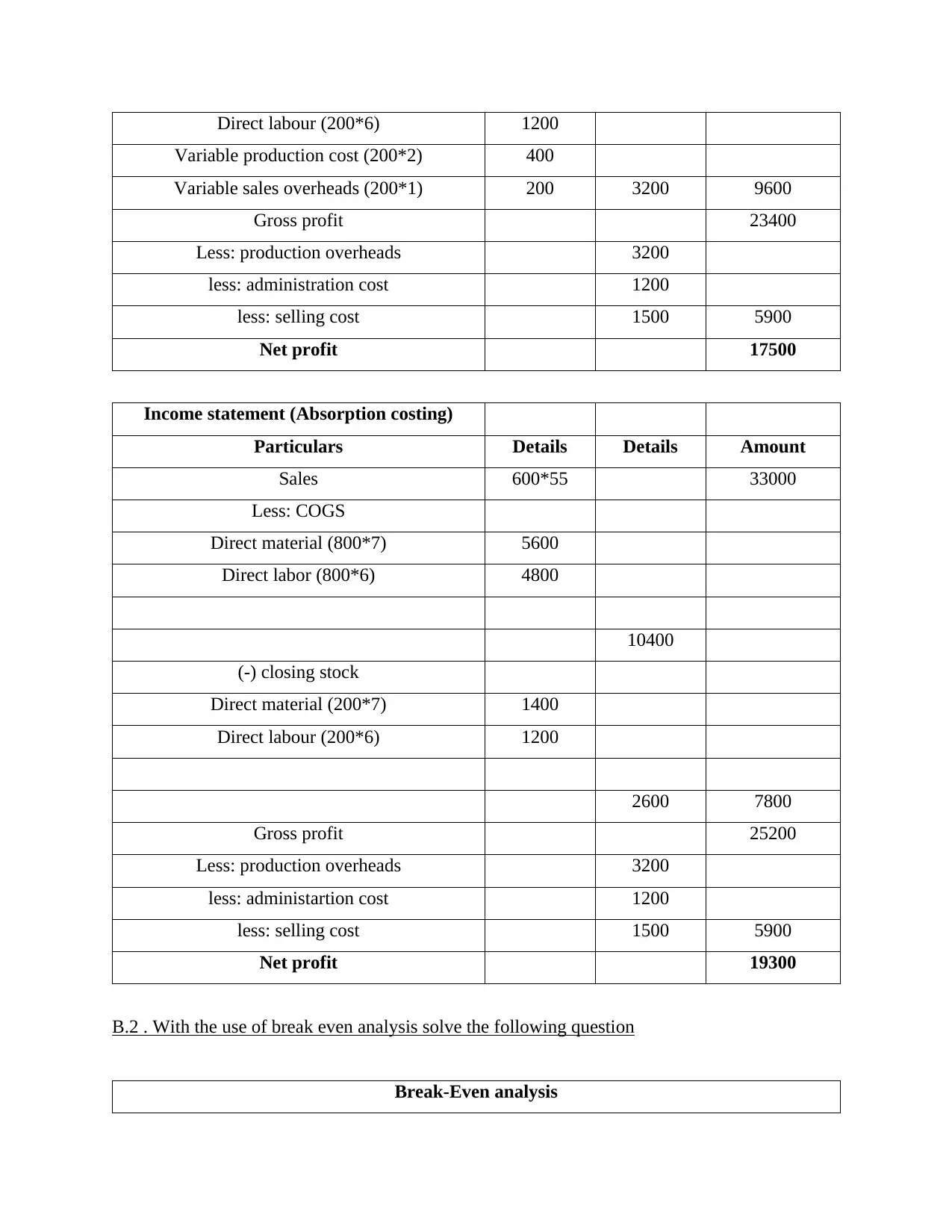

Income statement (Absorption costing)

Particulars Details Details Amount

Sales 600*55 33000

Less: COGS

Direct material (800*7) 5600

Direct labor (800*6) 4800

10400

(-) closing stock

Direct material (200*7) 1400

Direct labour (200*6) 1200

2600 7800

Gross profit 25200

Less: production overheads 3200

less: administartion cost 1200

less: selling cost 1500 5900

Net profit 19300

B.2 . With the use of break even analysis solve the following question

Break-Even analysis

Variable production cost (200*2) 400

Variable sales overheads (200*1) 200 3200 9600

Gross profit 23400

Less: production overheads 3200

less: administration cost 1200

less: selling cost 1500 5900

Net profit 17500

Income statement (Absorption costing)

Particulars Details Details Amount

Sales 600*55 33000

Less: COGS

Direct material (800*7) 5600

Direct labor (800*6) 4800

10400

(-) closing stock

Direct material (200*7) 1400

Direct labour (200*6) 1200

2600 7800

Gross profit 25200

Less: production overheads 3200

less: administartion cost 1200

less: selling cost 1500 5900

Net profit 19300

B.2 . With the use of break even analysis solve the following question

Break-Even analysis

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

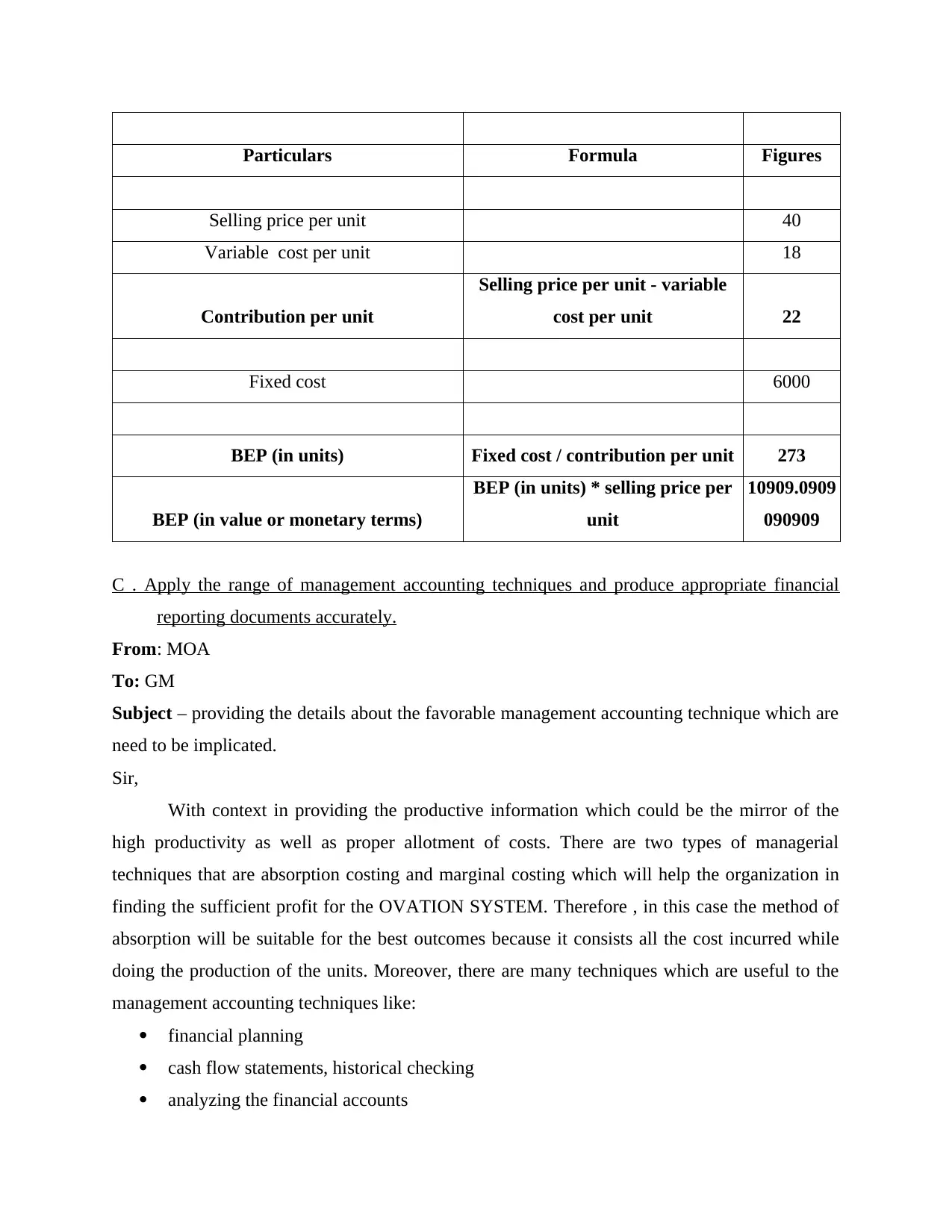

Particulars Formula Figures

Selling price per unit 40

Variable cost per unit 18

Contribution per unit

Selling price per unit - variable

cost per unit 22

Fixed cost 6000

BEP (in units) Fixed cost / contribution per unit 273

BEP (in value or monetary terms)

BEP (in units) * selling price per

unit

10909.0909

090909

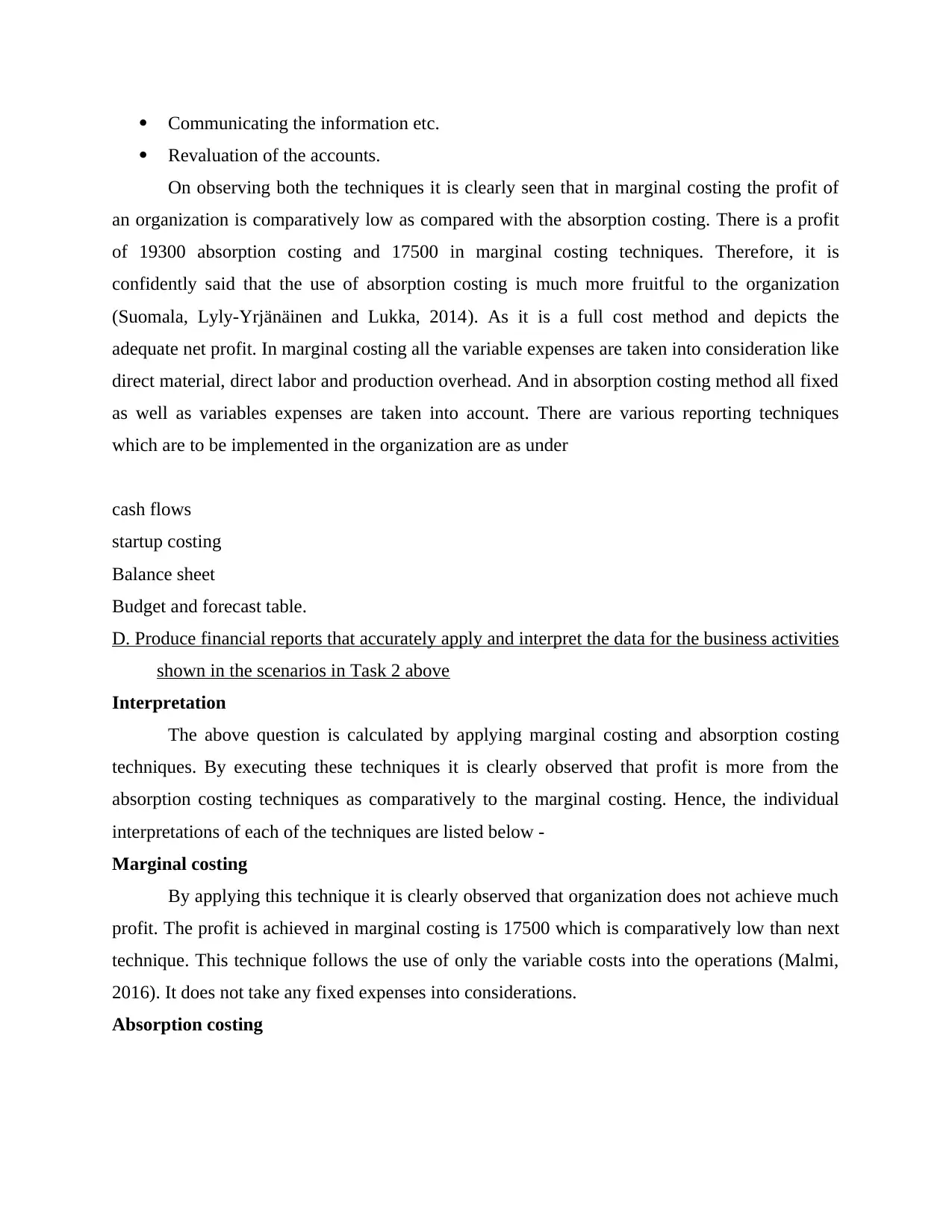

C . Apply the range of management accounting techniques and produce appropriate financial

reporting documents accurately.

From: MOA

To: GM

Subject – providing the details about the favorable management accounting technique which are

need to be implicated.

Sir,

With context in providing the productive information which could be the mirror of the

high productivity as well as proper allotment of costs. There are two types of managerial

techniques that are absorption costing and marginal costing which will help the organization in

finding the sufficient profit for the OVATION SYSTEM. Therefore , in this case the method of

absorption will be suitable for the best outcomes because it consists all the cost incurred while

doing the production of the units. Moreover, there are many techniques which are useful to the

management accounting techniques like:

financial planning

cash flow statements, historical checking

analyzing the financial accounts

Selling price per unit 40

Variable cost per unit 18

Contribution per unit

Selling price per unit - variable

cost per unit 22

Fixed cost 6000

BEP (in units) Fixed cost / contribution per unit 273

BEP (in value or monetary terms)

BEP (in units) * selling price per

unit

10909.0909

090909

C . Apply the range of management accounting techniques and produce appropriate financial

reporting documents accurately.

From: MOA

To: GM

Subject – providing the details about the favorable management accounting technique which are

need to be implicated.

Sir,

With context in providing the productive information which could be the mirror of the

high productivity as well as proper allotment of costs. There are two types of managerial

techniques that are absorption costing and marginal costing which will help the organization in

finding the sufficient profit for the OVATION SYSTEM. Therefore , in this case the method of

absorption will be suitable for the best outcomes because it consists all the cost incurred while

doing the production of the units. Moreover, there are many techniques which are useful to the

management accounting techniques like:

financial planning

cash flow statements, historical checking

analyzing the financial accounts

Communicating the information etc.

Revaluation of the accounts.

On observing both the techniques it is clearly seen that in marginal costing the profit of

an organization is comparatively low as compared with the absorption costing. There is a profit

of 19300 absorption costing and 17500 in marginal costing techniques. Therefore, it is

confidently said that the use of absorption costing is much more fruitful to the organization

(Suomala, Lyly-Yrjänäinen and Lukka, 2014). As it is a full cost method and depicts the

adequate net profit. In marginal costing all the variable expenses are taken into consideration like

direct material, direct labor and production overhead. And in absorption costing method all fixed

as well as variables expenses are taken into account. There are various reporting techniques

which are to be implemented in the organization are as under

cash flows

startup costing

Balance sheet

Budget and forecast table.

D. Produce financial reports that accurately apply and interpret the data for the business activities

shown in the scenarios in Task 2 above

Interpretation

The above question is calculated by applying marginal costing and absorption costing

techniques. By executing these techniques it is clearly observed that profit is more from the

absorption costing techniques as comparatively to the marginal costing. Hence, the individual

interpretations of each of the techniques are listed below -

Marginal costing

By applying this technique it is clearly observed that organization does not achieve much

profit. The profit is achieved in marginal costing is 17500 which is comparatively low than next

technique. This technique follows the use of only the variable costs into the operations (Malmi,

2016). It does not take any fixed expenses into considerations.

Absorption costing

Revaluation of the accounts.

On observing both the techniques it is clearly seen that in marginal costing the profit of

an organization is comparatively low as compared with the absorption costing. There is a profit

of 19300 absorption costing and 17500 in marginal costing techniques. Therefore, it is

confidently said that the use of absorption costing is much more fruitful to the organization

(Suomala, Lyly-Yrjänäinen and Lukka, 2014). As it is a full cost method and depicts the

adequate net profit. In marginal costing all the variable expenses are taken into consideration like

direct material, direct labor and production overhead. And in absorption costing method all fixed

as well as variables expenses are taken into account. There are various reporting techniques

which are to be implemented in the organization are as under

cash flows

startup costing

Balance sheet

Budget and forecast table.

D. Produce financial reports that accurately apply and interpret the data for the business activities

shown in the scenarios in Task 2 above

Interpretation

The above question is calculated by applying marginal costing and absorption costing

techniques. By executing these techniques it is clearly observed that profit is more from the

absorption costing techniques as comparatively to the marginal costing. Hence, the individual

interpretations of each of the techniques are listed below -

Marginal costing

By applying this technique it is clearly observed that organization does not achieve much

profit. The profit is achieved in marginal costing is 17500 which is comparatively low than next

technique. This technique follows the use of only the variable costs into the operations (Malmi,

2016). It does not take any fixed expenses into considerations.

Absorption costing

The absorption costing techniques has achieved the profit of the 19300 which is more

than in marginal costing. Marginal costings takes all the expenses both variable and fixed into it

and then trigger out the profits.

Task 3

A. Explain the advantage and disadvantages for different types of planning tools

Zero based budgeting

Zero based budgeting is basic planning tool for the budgetary control. This technique is

also known as DE Nova budgeting. According to its name it can be identified tats it starts from

zero or clean state. In this budgeting technique the budget is prepared with the help of new

analysis, fresh data, new estimates. Zero based budget is not linked with the numbers of previous

budget. It is a traditional way of preparing the budget (Otley, 2016). In this technique of zero

based budgeting budget is prepared in new times. While the preparation of budget any

shortcomings occurs then they are deleted. In this budgeting technique all the activities are

ranked according to their priorities. Activity with high priority are taken first according to the

sources available scratching each time and justifying each dollar depended on the goals of the

organization the manager or accountant of OVATION SYSTEM provides the fair chance to

work on inefficiencies and to find the innovative to reduce the task.

Advantages of ZBB

It provides the better cost control, as it has the efficiency to prove effective control over

the cost. The systematic evaluation of the various operations is done according to their priorities.

Disadvantages of ZBB

It is a time consuming technique because sometimes it becomes very intensive for

company to prepare the budget every year.

ZBB requires the high human resources for making the entire budget.

Activity based budgeting

It is a procedure of budgeting created to give liquidity into a budget process. Activity

based budgeting is a method in which revenues are occurred from research-act ivies and refining

the allocation straight towards the units are responsible for. It emphasizes the great planning and

incentives are created for the activities to more efficiently .

than in marginal costing. Marginal costings takes all the expenses both variable and fixed into it

and then trigger out the profits.

Task 3

A. Explain the advantage and disadvantages for different types of planning tools

Zero based budgeting

Zero based budgeting is basic planning tool for the budgetary control. This technique is

also known as DE Nova budgeting. According to its name it can be identified tats it starts from

zero or clean state. In this budgeting technique the budget is prepared with the help of new

analysis, fresh data, new estimates. Zero based budget is not linked with the numbers of previous

budget. It is a traditional way of preparing the budget (Otley, 2016). In this technique of zero

based budgeting budget is prepared in new times. While the preparation of budget any

shortcomings occurs then they are deleted. In this budgeting technique all the activities are

ranked according to their priorities. Activity with high priority are taken first according to the

sources available scratching each time and justifying each dollar depended on the goals of the

organization the manager or accountant of OVATION SYSTEM provides the fair chance to

work on inefficiencies and to find the innovative to reduce the task.

Advantages of ZBB

It provides the better cost control, as it has the efficiency to prove effective control over

the cost. The systematic evaluation of the various operations is done according to their priorities.

Disadvantages of ZBB

It is a time consuming technique because sometimes it becomes very intensive for

company to prepare the budget every year.

ZBB requires the high human resources for making the entire budget.

Activity based budgeting

It is a procedure of budgeting created to give liquidity into a budget process. Activity

based budgeting is a method in which revenues are occurred from research-act ivies and refining

the allocation straight towards the units are responsible for. It emphasizes the great planning and

incentives are created for the activities to more efficiently .

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Activity based budgeting is a type of system that researches, records, analyzes activities

that leads the cost of the business. It adjusts the previous budget for the inflation and the

development of the business (Malmi, 2016). It permits the more control overt he budgets

process. It also permits the management to have a more control over the align for the budget with

the organizational goals. It is a process which permits a very high planning of cost and paid

attention the volume or types of activity. The resulted outcome of utilizing this system is merely

to generate the revenue, which likely improves the profits.

Advantages of ABB

It is evaluated with lots of practices and the to the cost results in production of goods and

services at lower cost.

The process of activity based budgeting is done after deep research and analysis so it

removes all the unnecessary activities.

Disadvantages of activity based budgeting

It requires sound understanding everyone could not perform this process of budgeting.

It is complex in nature because it takes lots of research analysis to be made. It is time

consuming as well.

B. Show the application of the planning tools for preparing, forecasting and analysing budgets.

Strategic planning, costing system and various planning tools will provide help to the

expert in analysis of the forecasting, preparation of budget. These all provide the all the

requirement so that they can easily take the suitable decision (Renz, 2016).

With the proper use of the planning tools it can be observed that organization has got the

effective control over the circulation of the capital. Therefore, it can be said that an organization

need the planning tolls for analyzing the productivity of the upcoming transaction. There are

different types of the planning tools to analyze the productivity like NPV,IRR and ARR which

are useful in identifying the profitability of the plans of the firm. To have increment in profit and

revenue of the firm it is very important to implement the use of planning tool in the working of

the organization.

C. Compare how the organization is different in adopting management accounting system with

responds with the financial problems.

Major financial problems

that leads the cost of the business. It adjusts the previous budget for the inflation and the

development of the business (Malmi, 2016). It permits the more control overt he budgets

process. It also permits the management to have a more control over the align for the budget with

the organizational goals. It is a process which permits a very high planning of cost and paid

attention the volume or types of activity. The resulted outcome of utilizing this system is merely

to generate the revenue, which likely improves the profits.

Advantages of ABB

It is evaluated with lots of practices and the to the cost results in production of goods and

services at lower cost.

The process of activity based budgeting is done after deep research and analysis so it

removes all the unnecessary activities.

Disadvantages of activity based budgeting

It requires sound understanding everyone could not perform this process of budgeting.

It is complex in nature because it takes lots of research analysis to be made. It is time

consuming as well.

B. Show the application of the planning tools for preparing, forecasting and analysing budgets.

Strategic planning, costing system and various planning tools will provide help to the

expert in analysis of the forecasting, preparation of budget. These all provide the all the

requirement so that they can easily take the suitable decision (Renz, 2016).

With the proper use of the planning tools it can be observed that organization has got the

effective control over the circulation of the capital. Therefore, it can be said that an organization

need the planning tolls for analyzing the productivity of the upcoming transaction. There are

different types of the planning tools to analyze the productivity like NPV,IRR and ARR which

are useful in identifying the profitability of the plans of the firm. To have increment in profit and

revenue of the firm it is very important to implement the use of planning tool in the working of

the organization.

C. Compare how the organization is different in adopting management accounting system with

responds with the financial problems.

Major financial problems

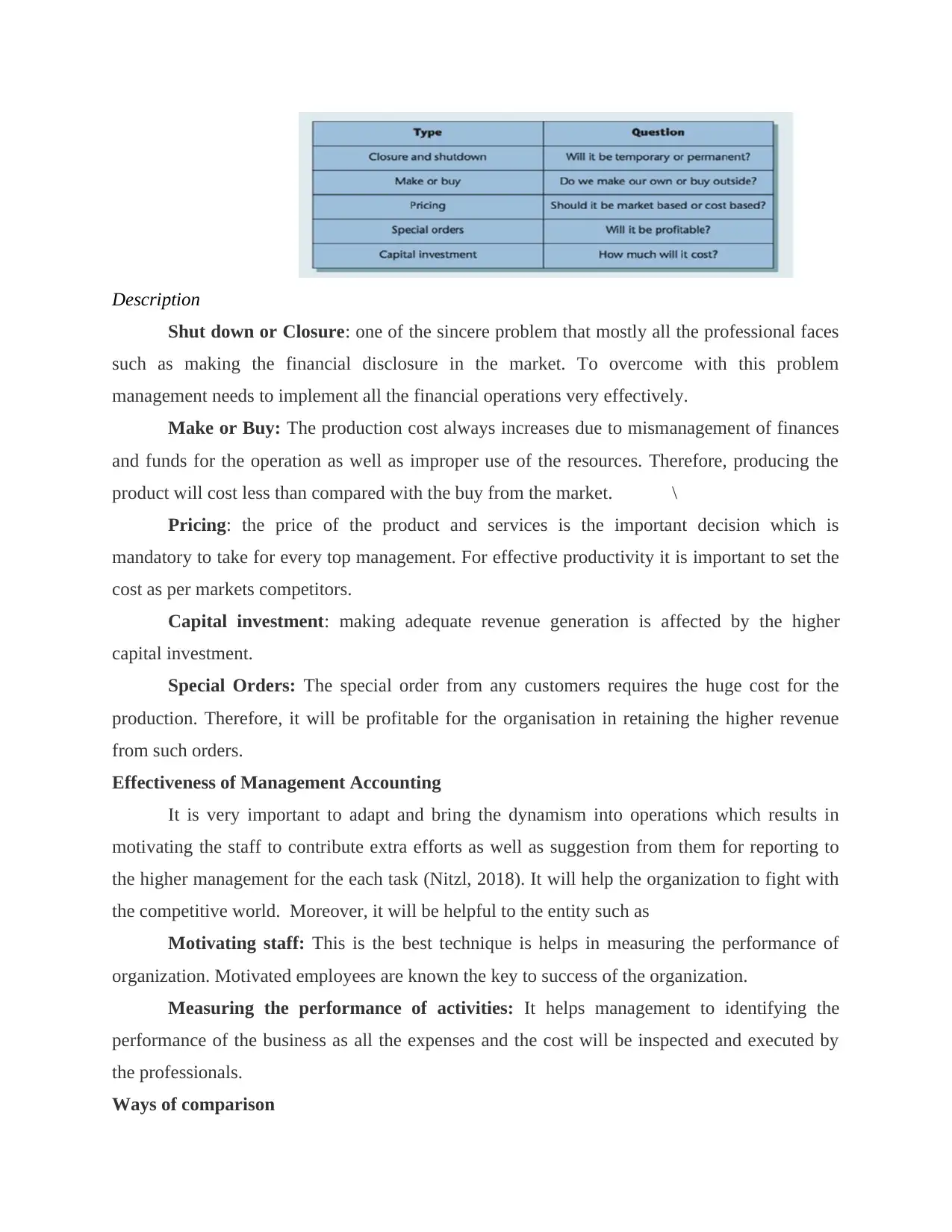

Description

Shut down or Closure: one of the sincere problem that mostly all the professional faces

such as making the financial disclosure in the market. To overcome with this problem

management needs to implement all the financial operations very effectively.

Make or Buy: The production cost always increases due to mismanagement of finances

and funds for the operation as well as improper use of the resources. Therefore, producing the

product will cost less than compared with the buy from the market. \

Pricing: the price of the product and services is the important decision which is

mandatory to take for every top management. For effective productivity it is important to set the

cost as per markets competitors.

Capital investment: making adequate revenue generation is affected by the higher

capital investment.

Special Orders: The special order from any customers requires the huge cost for the

production. Therefore, it will be profitable for the organisation in retaining the higher revenue

from such orders.

Effectiveness of Management Accounting

It is very important to adapt and bring the dynamism into operations which results in

motivating the staff to contribute extra efforts as well as suggestion from them for reporting to

the higher management for the each task (Nitzl, 2018). It will help the organization to fight with

the competitive world. Moreover, it will be helpful to the entity such as

Motivating staff: This is the best technique is helps in measuring the performance of

organization. Motivated employees are known the key to success of the organization.

Measuring the performance of activities: It helps management to identifying the

performance of the business as all the expenses and the cost will be inspected and executed by

the professionals.

Ways of comparison

Shut down or Closure: one of the sincere problem that mostly all the professional faces

such as making the financial disclosure in the market. To overcome with this problem

management needs to implement all the financial operations very effectively.

Make or Buy: The production cost always increases due to mismanagement of finances

and funds for the operation as well as improper use of the resources. Therefore, producing the

product will cost less than compared with the buy from the market. \

Pricing: the price of the product and services is the important decision which is

mandatory to take for every top management. For effective productivity it is important to set the

cost as per markets competitors.

Capital investment: making adequate revenue generation is affected by the higher

capital investment.

Special Orders: The special order from any customers requires the huge cost for the

production. Therefore, it will be profitable for the organisation in retaining the higher revenue

from such orders.

Effectiveness of Management Accounting

It is very important to adapt and bring the dynamism into operations which results in

motivating the staff to contribute extra efforts as well as suggestion from them for reporting to

the higher management for the each task (Nitzl, 2018). It will help the organization to fight with

the competitive world. Moreover, it will be helpful to the entity such as

Motivating staff: This is the best technique is helps in measuring the performance of

organization. Motivated employees are known the key to success of the organization.

Measuring the performance of activities: It helps management to identifying the

performance of the business as all the expenses and the cost will be inspected and executed by

the professionals.

Ways of comparison

key performance indicator

It is a performance indicator technique used to identify the performance of the employees

in an organization. It is techniques which tells how magnificently an organization is pro founding

its set targets. It focused on the financial requirement of management that should be

implemented to identify the occurring problems. It helps in the measurement of the financial data

such as working capital, operating cash flow, financial health of an organization.

Benchmarking

Entity is build up with lots of policies, programs, strategies, etc. while moving a business

every manager sets a benchmark of each and every activity whether they are managerial or

financial. For an organization it is very important to work in the boundary of the set benchmarks

in order to achieve the goals and objectives (Eldenburg and et.al., 2016). It the working of the

department crosses the boundaries of benchmark it can affect the organization negatively.

D. Analyse how your management accounting techniques could respond to financial problems

and lead the organization to sustainable success.

The appropriate allocation of cost and optimum utilization of resources are the major

problem which every organization is being facing in today era (Saeidi and et.al., 2018). Going

towards the management accounting techniques methods and costing technique method are very

helpful in delivering the feasible information about the requirement of the cost as well as

capacity to retained the revenue of the firm. Hence, there are lots of suggestion which needs to

be made by organization are as follows-

Identifying the environmental and social trends which can impact the entity's goodwill

To have a appropriate business model an organization needs to analyses the challenges

faced by it.

There are some financial problems like imbalanced cash flow, bad economic cycle which

needs to modified for the good productivity of an organization.

E. Evaluate how planning tools could be used to solve financial problems and lead the

organization to sustainable success.

To lead the organization and sustainable success it is very important to use the planning

tools effectively and efficiently. Management accounting is the technique which provide lots of

planning tools for the better decision making and sustainability of the growth (Eldenburg and

It is a performance indicator technique used to identify the performance of the employees

in an organization. It is techniques which tells how magnificently an organization is pro founding

its set targets. It focused on the financial requirement of management that should be

implemented to identify the occurring problems. It helps in the measurement of the financial data

such as working capital, operating cash flow, financial health of an organization.

Benchmarking

Entity is build up with lots of policies, programs, strategies, etc. while moving a business

every manager sets a benchmark of each and every activity whether they are managerial or

financial. For an organization it is very important to work in the boundary of the set benchmarks

in order to achieve the goals and objectives (Eldenburg and et.al., 2016). It the working of the

department crosses the boundaries of benchmark it can affect the organization negatively.

D. Analyse how your management accounting techniques could respond to financial problems

and lead the organization to sustainable success.

The appropriate allocation of cost and optimum utilization of resources are the major

problem which every organization is being facing in today era (Saeidi and et.al., 2018). Going

towards the management accounting techniques methods and costing technique method are very

helpful in delivering the feasible information about the requirement of the cost as well as

capacity to retained the revenue of the firm. Hence, there are lots of suggestion which needs to

be made by organization are as follows-

Identifying the environmental and social trends which can impact the entity's goodwill

To have a appropriate business model an organization needs to analyses the challenges

faced by it.

There are some financial problems like imbalanced cash flow, bad economic cycle which

needs to modified for the good productivity of an organization.

E. Evaluate how planning tools could be used to solve financial problems and lead the

organization to sustainable success.

To lead the organization and sustainable success it is very important to use the planning

tools effectively and efficiently. Management accounting is the technique which provide lots of

planning tools for the better decision making and sustainability of the growth (Eldenburg and

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

et.al., 2016). These planning tools suggest number of ways to lead the organization towards the

sustainable growth. Few of them are mentioned under-absorption

Planning tools helps in identifying the social and environment trends which can provides

companies' ability to create value over time.

Planning tools helps to link the sustainability challenges of business with the company's

strategy

Planning tools develop the KPIs that support the long term goals of an organization.

CONCLUSION

With respect to the above mentioned report it can be concluded that the use of

management accounting is to make the fruitful and efficient decision-making for each and every

business activities. It provides the accuracy of the results to the stakeholders about the working

of the business. Therefore, it can be said that by taking the help of the such analysis the

organization can improve its performance and come up with the better decision making.

sustainable growth. Few of them are mentioned under-absorption

Planning tools helps in identifying the social and environment trends which can provides

companies' ability to create value over time.

Planning tools helps to link the sustainability challenges of business with the company's

strategy

Planning tools develop the KPIs that support the long term goals of an organization.

CONCLUSION

With respect to the above mentioned report it can be concluded that the use of

management accounting is to make the fruitful and efficient decision-making for each and every

business activities. It provides the accuracy of the results to the stakeholders about the working

of the business. Therefore, it can be said that by taking the help of the such analysis the

organization can improve its performance and come up with the better decision making.

REFERENCES

Books and Journals

Ax, C. and Greve, J., 2017. Adoption of management accounting innovations: Organizational

culture compatibility and perceived outcomes. Management Accounting Research. 34.

pp.59-74.

Cooper, D. J., Ezzamel, M. and Qu, S. Q., 2017. Popularizing a management accounting idea:

The case of the balanced scorecard. Contemporary Accounting Research. 34(2). pp.991-

1025.

Eldenburg, L. G. And et.al. 2016. Cost management: Measuring, monitoring, and motivating

performance. Wiley Global Education.

Fullerton, R. R., Kennedy, F. A. and Widener, S. K., 2014. Lean manufacturing and firm

performance: The incremental contribution of lean management accounting practices.

Journal of Operations Management. 32(7-8). pp.414-428.

Kihn, L. A. and Ihantola, E. M., 2015. Approaches to validation and evaluation in qualitative

studies of management accounting. Qualitative Research in Accounting & Management,

12(3), pp.230-255.

Malmi, T., 2016. Managerialist studies in management accounting: 1990–2014. Management

Accounting Research. 31. pp.31-44.

Nitzl, C., 2018. Management Accounting and Partial Least Squares-Structural Equation

Modelling (PLS-SEM): Some Illustrative Examples. In Partial Least Squares Structural

Equation Modeling (pp. 211-229). Springer, Cham.

Otley, D., 2016. The contingency theory of management accounting and control: 1980–2014.

Management accounting research. 31. pp.45-62.

Renz, D. O., 2016. The Jossey-Bass handbook of nonprofit leadership and management. John

Wiley & Sons.

Saeidi, S. P., and et.al. 2018. The moderating role of environmental management accounting

between environmental innovation and firm financial performance. International Journal

of Business Performance Management. 19(3). pp.326-348.

Suomala, P., Lyly-Yrjänäinen, J. and Lukka, K., 2014. Battlefield around interventions: A

reflective analysis of conducting interventionist research in management accounting.

Management Accounting Research.25(4). pp.304-314.

Books and Journals

Ax, C. and Greve, J., 2017. Adoption of management accounting innovations: Organizational

culture compatibility and perceived outcomes. Management Accounting Research. 34.

pp.59-74.

Cooper, D. J., Ezzamel, M. and Qu, S. Q., 2017. Popularizing a management accounting idea:

The case of the balanced scorecard. Contemporary Accounting Research. 34(2). pp.991-

1025.

Eldenburg, L. G. And et.al. 2016. Cost management: Measuring, monitoring, and motivating

performance. Wiley Global Education.

Fullerton, R. R., Kennedy, F. A. and Widener, S. K., 2014. Lean manufacturing and firm

performance: The incremental contribution of lean management accounting practices.

Journal of Operations Management. 32(7-8). pp.414-428.

Kihn, L. A. and Ihantola, E. M., 2015. Approaches to validation and evaluation in qualitative

studies of management accounting. Qualitative Research in Accounting & Management,

12(3), pp.230-255.

Malmi, T., 2016. Managerialist studies in management accounting: 1990–2014. Management

Accounting Research. 31. pp.31-44.

Nitzl, C., 2018. Management Accounting and Partial Least Squares-Structural Equation

Modelling (PLS-SEM): Some Illustrative Examples. In Partial Least Squares Structural

Equation Modeling (pp. 211-229). Springer, Cham.

Otley, D., 2016. The contingency theory of management accounting and control: 1980–2014.

Management accounting research. 31. pp.45-62.

Renz, D. O., 2016. The Jossey-Bass handbook of nonprofit leadership and management. John

Wiley & Sons.

Saeidi, S. P., and et.al. 2018. The moderating role of environmental management accounting

between environmental innovation and firm financial performance. International Journal

of Business Performance Management. 19(3). pp.326-348.

Suomala, P., Lyly-Yrjänäinen, J. and Lukka, K., 2014. Battlefield around interventions: A

reflective analysis of conducting interventionist research in management accounting.

Management Accounting Research.25(4). pp.304-314.

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.