Management Accounting Systems Explained

VerifiedAdded on 2020/11/23

|15

|4625

|206

Literature Review

AI Summary

This assignment delves into the concept of management accounting systems, analyzing various types of reports used for informed decision-making. It summarizes different accounting techniques for profitability analysis and explores planning tools for budgetary control. The report aims to demonstrate how implementing a management accounting system can help users analyze financial issues effectively.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Management Accounting

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1: Management Accounting and its essential requirement ..................................................1

P2: Types of accounting reporting methods are ....................................................................4

M1: several important benefits of using management accounting systems..........................5

D1: Evaluation of various reporting method and accounting system integration..................6

TASK 2............................................................................................................................................6

P3: Types of costing methods used for calculating net profit...............................................6

M2: Different types of accounting tools and techniques........................................................8

D2: Analysis of data collected from income statement..........................................................8

TASK 3............................................................................................................................................8

M3: Analysis of various planning tool and its application for forecasting .........................10

TASK 4..........................................................................................................................................10

P5: Comparison with other organisation to overcome financial issues................................10

M4: Analysis of planning tools to deal with financial issues ..............................................12

CONCLUSION .............................................................................................................................12

REFERENCES .............................................................................................................................13

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1: Management Accounting and its essential requirement ..................................................1

P2: Types of accounting reporting methods are ....................................................................4

M1: several important benefits of using management accounting systems..........................5

D1: Evaluation of various reporting method and accounting system integration..................6

TASK 2............................................................................................................................................6

P3: Types of costing methods used for calculating net profit...............................................6

M2: Different types of accounting tools and techniques........................................................8

D2: Analysis of data collected from income statement..........................................................8

TASK 3............................................................................................................................................8

M3: Analysis of various planning tool and its application for forecasting .........................10

TASK 4..........................................................................................................................................10

P5: Comparison with other organisation to overcome financial issues................................10

M4: Analysis of planning tools to deal with financial issues ..............................................12

CONCLUSION .............................................................................................................................12

REFERENCES .............................................................................................................................13

INTRODUCTION

In current business era the management in a company is performing a crucial part in

managing business operations and it gives the importance to the management accounting

process. The main purpose of using the management accounting is to manage the business

operations and comprises with maintaining the systematic recording, summarising and

communicating the managerial information in systematic analysation form to ascertain the

business transactions . It assists the organisations to manage their all business activities in most

effective way is helpful in ascertainment(Kihn and Ihantola, 2015). The main objective of using

appropriate accounting system is to manage appropriately the activities of the business and to

achieve the desired goals. Everyjoy enterprises operates in entertainment industry which

provides leisure and entertainment services. This study pertain the knowledge about management

accounting and its system and types of management accounting aims to provide specific

information about various types of management accounting methods used for proper evaluation.

Besides this, explanation about the different types of costing methods use for calculating the

profits according to different kind of costing techniques. Along with this, there are advantages

and disadvantages of budgetary planning tools used in budgetary control process.

TASK 1

P1: Management Accounting and its essential requirement

In present time, that the manager engaged in managing the activities regarding the

business operations and perform the activities like analysing, summarising in a significant

manner or in terms of money and interpret the results there of. Management accounting is the

most effective and efficient way of presenting the of financial data in such a significant manner

as it provide company's crucial direction towards the goals in order to run their business.

Management use management accounting systems in order to form effective policy which is

beneficial in performing the daily business activities and operation those are adopted and utilises

by the company. It comprises with the various accounting tools and methods as well as

approaches which helps in summarising and analysing the managerial data. it is also helpful in

analysation of management activity. This will help them to ascertainment of profit by effective

and efficient utilisation of business resources. The analysis of all data prepared and maintain in a

manner that it will be maintained under the systematic framework which is helpful in deciding

1

In current business era the management in a company is performing a crucial part in

managing business operations and it gives the importance to the management accounting

process. The main purpose of using the management accounting is to manage the business

operations and comprises with maintaining the systematic recording, summarising and

communicating the managerial information in systematic analysation form to ascertain the

business transactions . It assists the organisations to manage their all business activities in most

effective way is helpful in ascertainment(Kihn and Ihantola, 2015). The main objective of using

appropriate accounting system is to manage appropriately the activities of the business and to

achieve the desired goals. Everyjoy enterprises operates in entertainment industry which

provides leisure and entertainment services. This study pertain the knowledge about management

accounting and its system and types of management accounting aims to provide specific

information about various types of management accounting methods used for proper evaluation.

Besides this, explanation about the different types of costing methods use for calculating the

profits according to different kind of costing techniques. Along with this, there are advantages

and disadvantages of budgetary planning tools used in budgetary control process.

TASK 1

P1: Management Accounting and its essential requirement

In present time, that the manager engaged in managing the activities regarding the

business operations and perform the activities like analysing, summarising in a significant

manner or in terms of money and interpret the results there of. Management accounting is the

most effective and efficient way of presenting the of financial data in such a significant manner

as it provide company's crucial direction towards the goals in order to run their business.

Management use management accounting systems in order to form effective policy which is

beneficial in performing the daily business activities and operation those are adopted and utilises

by the company. It comprises with the various accounting tools and methods as well as

approaches which helps in summarising and analysing the managerial data. it is also helpful in

analysation of management activity. This will help them to ascertainment of profit by effective

and efficient utilisation of business resources. The analysis of all data prepared and maintain in a

manner that it will be maintained under the systematic framework which is helpful in deciding

1

the future plans and operations. Management accounting system is crucial element and is

comprises with accounting terms and concepts and of process preparation informative

statements that identifying, measuring, summarising and communicating the information

regarding the business operations to managerial level for the effective decision making

(DRURY, 2013).

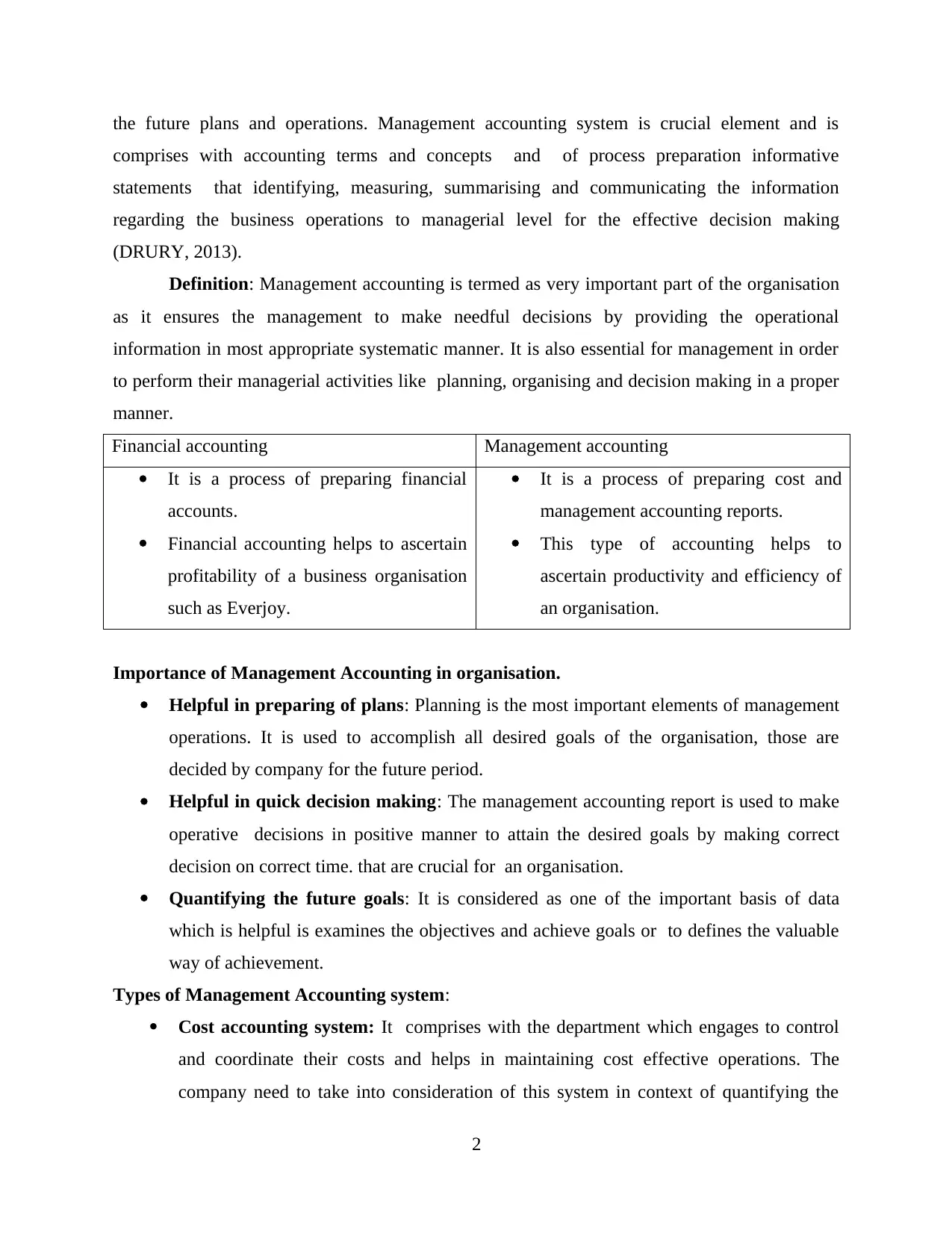

Definition: Management accounting is termed as very important part of the organisation

as it ensures the management to make needful decisions by providing the operational

information in most appropriate systematic manner. It is also essential for management in order

to perform their managerial activities like planning, organising and decision making in a proper

manner.

Financial accounting Management accounting

It is a process of preparing financial

accounts.

Financial accounting helps to ascertain

profitability of a business organisation

such as Everjoy.

It is a process of preparing cost and

management accounting reports.

This type of accounting helps to

ascertain productivity and efficiency of

an organisation.

Importance of Management Accounting in organisation.

Helpful in preparing of plans: Planning is the most important elements of management

operations. It is used to accomplish all desired goals of the organisation, those are

decided by company for the future period.

Helpful in quick decision making: The management accounting report is used to make

operative decisions in positive manner to attain the desired goals by making correct

decision on correct time. that are crucial for an organisation.

Quantifying the future goals: It is considered as one of the important basis of data

which is helpful is examines the objectives and achieve goals or to defines the valuable

way of achievement.

Types of Management Accounting system:

Cost accounting system: It comprises with the department which engages to control

and coordinate their costs and helps in maintaining cost effective operations. The

company need to take into consideration of this system in context of quantifying the

2

comprises with accounting terms and concepts and of process preparation informative

statements that identifying, measuring, summarising and communicating the information

regarding the business operations to managerial level for the effective decision making

(DRURY, 2013).

Definition: Management accounting is termed as very important part of the organisation

as it ensures the management to make needful decisions by providing the operational

information in most appropriate systematic manner. It is also essential for management in order

to perform their managerial activities like planning, organising and decision making in a proper

manner.

Financial accounting Management accounting

It is a process of preparing financial

accounts.

Financial accounting helps to ascertain

profitability of a business organisation

such as Everjoy.

It is a process of preparing cost and

management accounting reports.

This type of accounting helps to

ascertain productivity and efficiency of

an organisation.

Importance of Management Accounting in organisation.

Helpful in preparing of plans: Planning is the most important elements of management

operations. It is used to accomplish all desired goals of the organisation, those are

decided by company for the future period.

Helpful in quick decision making: The management accounting report is used to make

operative decisions in positive manner to attain the desired goals by making correct

decision on correct time. that are crucial for an organisation.

Quantifying the future goals: It is considered as one of the important basis of data

which is helpful is examines the objectives and achieve goals or to defines the valuable

way of achievement.

Types of Management Accounting system:

Cost accounting system: It comprises with the department which engages to control

and coordinate their costs and helps in maintaining cost effective operations. The

company need to take into consideration of this system in context of quantifying the

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

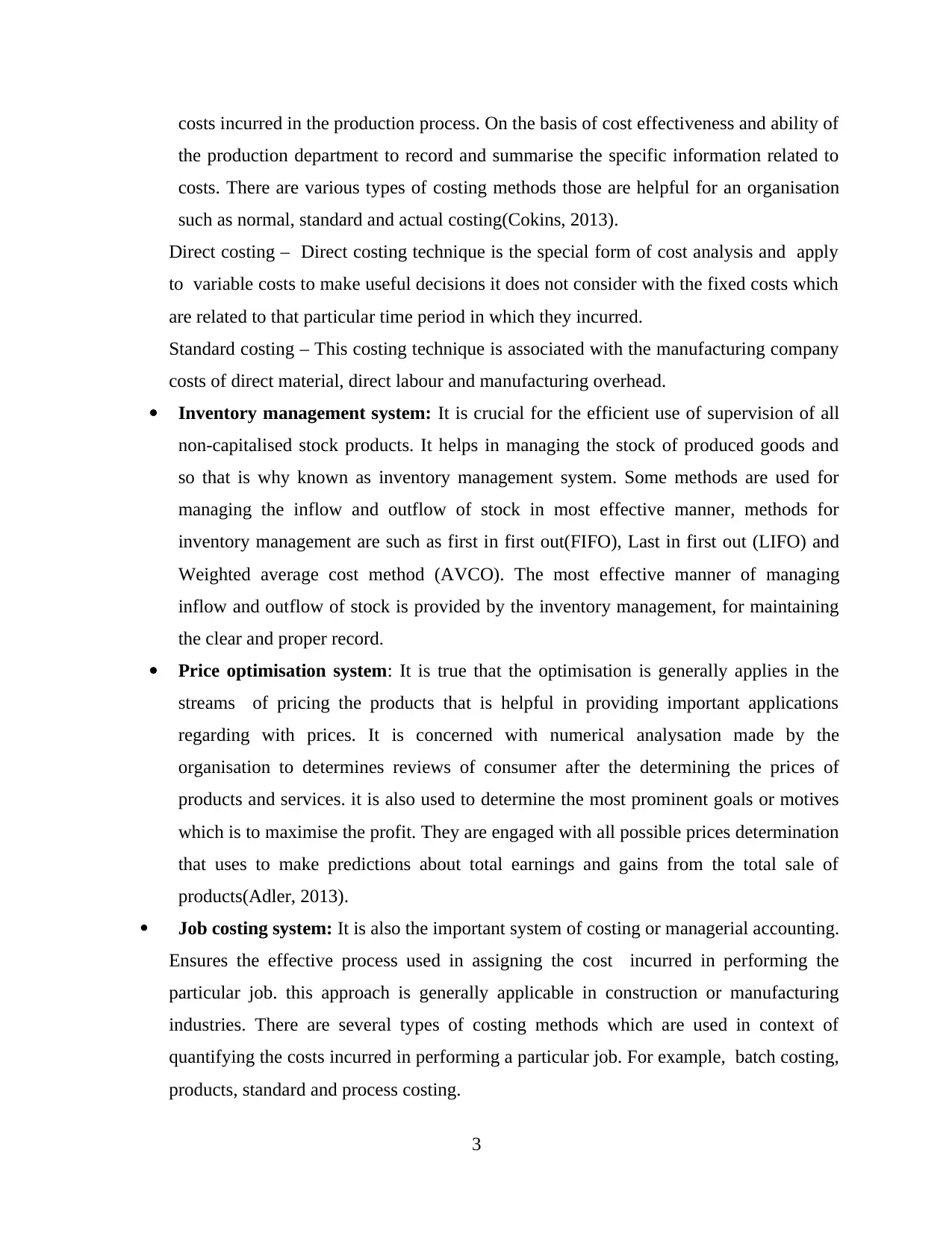

costs incurred in the production process. On the basis of cost effectiveness and ability of

the production department to record and summarise the specific information related to

costs. There are various types of costing methods those are helpful for an organisation

such as normal, standard and actual costing(Cokins, 2013).

Direct costing – Direct costing technique is the special form of cost analysis and apply

to variable costs to make useful decisions it does not consider with the fixed costs which

are related to that particular time period in which they incurred.

Standard costing – This costing technique is associated with the manufacturing company

costs of direct material, direct labour and manufacturing overhead.

Inventory management system: It is crucial for the efficient use of supervision of all

non-capitalised stock products. It helps in managing the stock of produced goods and

so that is why known as inventory management system. Some methods are used for

managing the inflow and outflow of stock in most effective manner, methods for

inventory management are such as first in first out(FIFO), Last in first out (LIFO) and

Weighted average cost method (AVCO). The most effective manner of managing

inflow and outflow of stock is provided by the inventory management, for maintaining

the clear and proper record.

Price optimisation system: It is true that the optimisation is generally applies in the

streams of pricing the products that is helpful in providing important applications

regarding with prices. It is concerned with numerical analysation made by the

organisation to determines reviews of consumer after the determining the prices of

products and services. it is also used to determine the most prominent goals or motives

which is to maximise the profit. They are engaged with all possible prices determination

that uses to make predictions about total earnings and gains from the total sale of

products(Adler, 2013).

Job costing system: It is also the important system of costing or managerial accounting.

Ensures the effective process used in assigning the cost incurred in performing the

particular job. this approach is generally applicable in construction or manufacturing

industries. There are several types of costing methods which are used in context of

quantifying the costs incurred in performing a particular job. For example, batch costing,

products, standard and process costing.

3

the production department to record and summarise the specific information related to

costs. There are various types of costing methods those are helpful for an organisation

such as normal, standard and actual costing(Cokins, 2013).

Direct costing – Direct costing technique is the special form of cost analysis and apply

to variable costs to make useful decisions it does not consider with the fixed costs which

are related to that particular time period in which they incurred.

Standard costing – This costing technique is associated with the manufacturing company

costs of direct material, direct labour and manufacturing overhead.

Inventory management system: It is crucial for the efficient use of supervision of all

non-capitalised stock products. It helps in managing the stock of produced goods and

so that is why known as inventory management system. Some methods are used for

managing the inflow and outflow of stock in most effective manner, methods for

inventory management are such as first in first out(FIFO), Last in first out (LIFO) and

Weighted average cost method (AVCO). The most effective manner of managing

inflow and outflow of stock is provided by the inventory management, for maintaining

the clear and proper record.

Price optimisation system: It is true that the optimisation is generally applies in the

streams of pricing the products that is helpful in providing important applications

regarding with prices. It is concerned with numerical analysation made by the

organisation to determines reviews of consumer after the determining the prices of

products and services. it is also used to determine the most prominent goals or motives

which is to maximise the profit. They are engaged with all possible prices determination

that uses to make predictions about total earnings and gains from the total sale of

products(Adler, 2013).

Job costing system: It is also the important system of costing or managerial accounting.

Ensures the effective process used in assigning the cost incurred in performing the

particular job. this approach is generally applicable in construction or manufacturing

industries. There are several types of costing methods which are used in context of

quantifying the costs incurred in performing a particular job. For example, batch costing,

products, standard and process costing.

3

P2: Types of accounting reporting methods are

In management accounting a large analysation is made on the basis of cost related data it

is true that all organisations which are not using appropriate accounting system they are

incurring the losses from many financial years. Hence it is essential to adopt suitable costing

techniques.

It is important for the manager to get essential data in appropriate manner so that future

decisions can make quickly and can be done in effective manner. Favourable uses of accounting

reports involves of several roles and responsibilities to manager various difficult conditions that

are examines under a reporting system. The main aim of accounting reporting is to record,

evaluate and report to account manager and to it's useful users, about overall earning and

expenses incurred during the financial era by organisation. It helps the accountant and investors

to make decisions regarding investment and adjustment or preparation of statements. It is playing

the dominant role presenting business environment(Quattrone, 2016). There are some accounting

reporting methods in form of many kinds of reports are as below.

Performance report: The preparation of performance report is an ascertainment activity

concerned with the project work information which is to be communicated with the

management. It concerned with of collecting all relevant information and crucial data

regarding the project or operational work of the organisation. It ensures the effective

utilisation resources and estimates the future progress and future project plan. In order to

analyse the work performance this report is being prepared by the management. It helps

in determining, whether they are working with full potential in the given project or in

correct direction( Suomala and Lyly-Yrjänäinen, 2012)

Inventory management report: Inventory management report is used to analyse the

systematic record of inventory transactions. This is used to show and ascertain the

inventory related transactions. For the perfect analysation the inventory management

involves the methods like LIFO, FIFO and AVCO. So that the proper report of closing

stock is being calculated for the preparation other financial statements like balance sheet.

Therefore it is also an essential report.

Account receivable report: It refers to the form of periodic report that is prepared under

a company’s final reports as per the amount of outstanding invoices. It is taken into

account as one of the most valuable report that used to examines the overall financial

4

In management accounting a large analysation is made on the basis of cost related data it

is true that all organisations which are not using appropriate accounting system they are

incurring the losses from many financial years. Hence it is essential to adopt suitable costing

techniques.

It is important for the manager to get essential data in appropriate manner so that future

decisions can make quickly and can be done in effective manner. Favourable uses of accounting

reports involves of several roles and responsibilities to manager various difficult conditions that

are examines under a reporting system. The main aim of accounting reporting is to record,

evaluate and report to account manager and to it's useful users, about overall earning and

expenses incurred during the financial era by organisation. It helps the accountant and investors

to make decisions regarding investment and adjustment or preparation of statements. It is playing

the dominant role presenting business environment(Quattrone, 2016). There are some accounting

reporting methods in form of many kinds of reports are as below.

Performance report: The preparation of performance report is an ascertainment activity

concerned with the project work information which is to be communicated with the

management. It concerned with of collecting all relevant information and crucial data

regarding the project or operational work of the organisation. It ensures the effective

utilisation resources and estimates the future progress and future project plan. In order to

analyse the work performance this report is being prepared by the management. It helps

in determining, whether they are working with full potential in the given project or in

correct direction( Suomala and Lyly-Yrjänäinen, 2012)

Inventory management report: Inventory management report is used to analyse the

systematic record of inventory transactions. This is used to show and ascertain the

inventory related transactions. For the perfect analysation the inventory management

involves the methods like LIFO, FIFO and AVCO. So that the proper report of closing

stock is being calculated for the preparation other financial statements like balance sheet.

Therefore it is also an essential report.

Account receivable report: It refers to the form of periodic report that is prepared under

a company’s final reports as per the amount of outstanding invoices. It is taken into

account as one of the most valuable report that used to examines the overall financial

4

position and deciding the future decision making. This happens to be the primary tools

which is being used for the collection of unpaid invoices from the debtor.

Job cost report: Job cost report is used by the management to maintain the record of

costs incurred in performing the relevant task or in generating the revenues. It helps the

organisation in quantifying the profitability from the particular job. Overall it is the report

which shows the profitability and expenditure incurred while performing the operational

activity. It is also helpful in preparation of other accounting statements.

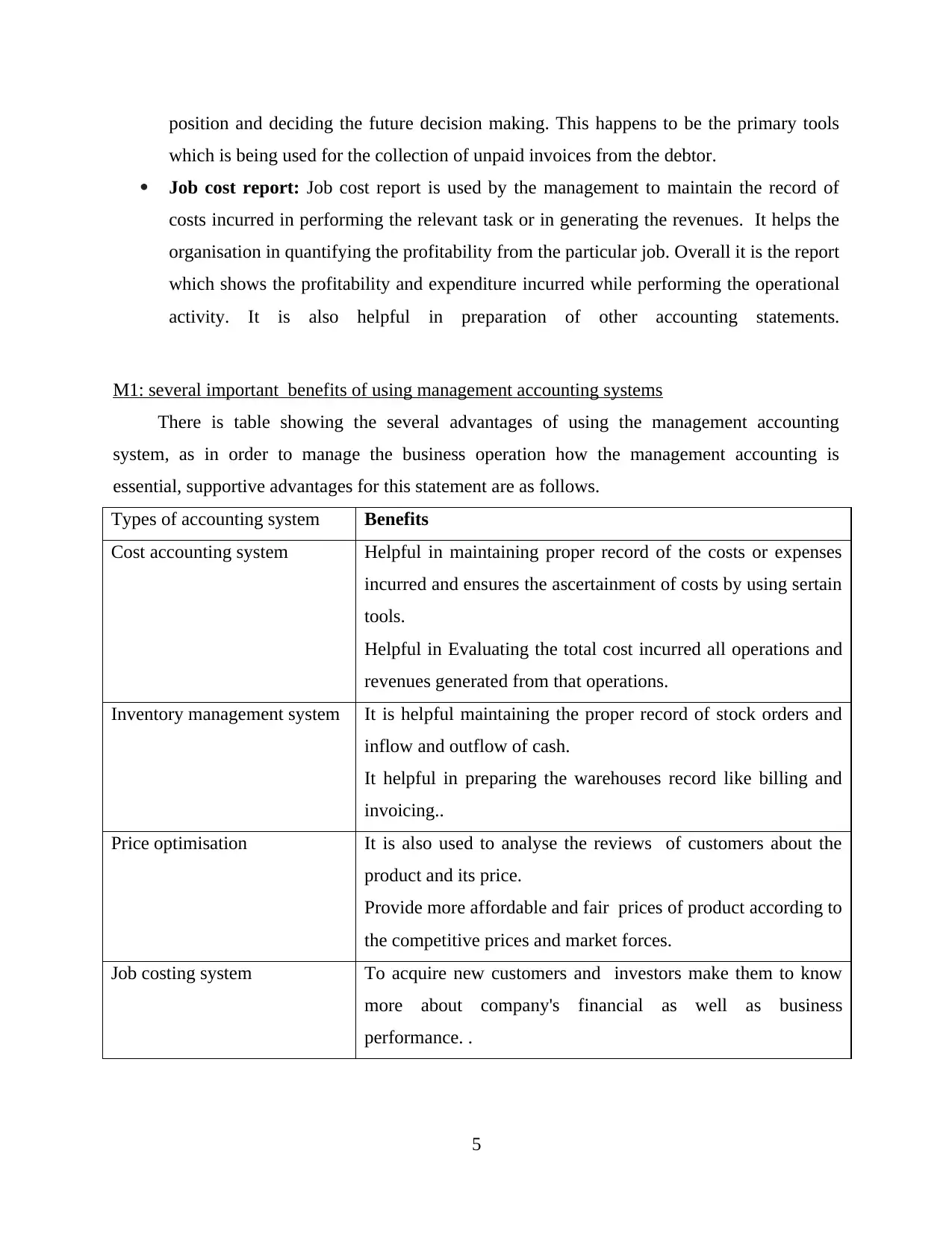

M1: several important benefits of using management accounting systems

There is table showing the several advantages of using the management accounting

system, as in order to manage the business operation how the management accounting is

essential, supportive advantages for this statement are as follows.

Types of accounting system Benefits

Cost accounting system Helpful in maintaining proper record of the costs or expenses

incurred and ensures the ascertainment of costs by using sertain

tools.

Helpful in Evaluating the total cost incurred all operations and

revenues generated from that operations.

Inventory management system It is helpful maintaining the proper record of stock orders and

inflow and outflow of cash.

It helpful in preparing the warehouses record like billing and

invoicing..

Price optimisation It is also used to analyse the reviews of customers about the

product and its price.

Provide more affordable and fair prices of product according to

the competitive prices and market forces.

Job costing system To acquire new customers and investors make them to know

more about company's financial as well as business

performance. .

5

which is being used for the collection of unpaid invoices from the debtor.

Job cost report: Job cost report is used by the management to maintain the record of

costs incurred in performing the relevant task or in generating the revenues. It helps the

organisation in quantifying the profitability from the particular job. Overall it is the report

which shows the profitability and expenditure incurred while performing the operational

activity. It is also helpful in preparation of other accounting statements.

M1: several important benefits of using management accounting systems

There is table showing the several advantages of using the management accounting

system, as in order to manage the business operation how the management accounting is

essential, supportive advantages for this statement are as follows.

Types of accounting system Benefits

Cost accounting system Helpful in maintaining proper record of the costs or expenses

incurred and ensures the ascertainment of costs by using sertain

tools.

Helpful in Evaluating the total cost incurred all operations and

revenues generated from that operations.

Inventory management system It is helpful maintaining the proper record of stock orders and

inflow and outflow of cash.

It helpful in preparing the warehouses record like billing and

invoicing..

Price optimisation It is also used to analyse the reviews of customers about the

product and its price.

Provide more affordable and fair prices of product according to

the competitive prices and market forces.

Job costing system To acquire new customers and investors make them to know

more about company's financial as well as business

performance. .

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

D1: Evaluation of various reporting method and accounting system integration

It is examined that the accounting system and its reporting is used to facilitates the valuable

information about the current position of It is crucial for the accountant to make proper

information about both of them or its integration. The methodology of link among these two

important aspects within an organisational process is said to be integrated accounting system. It

used to provide standardised process for recording various transaction and use of finance is

effective manner. There are various types of reporting method such as performance report which

is related with present and last year performance of While, with the use of account receivable

report they can easily be able to determine analyse total amount outstanding and timing of

recovery. Inventory management report used to give valuable information about total position of

stock kept by the company with them( Edwards and Boyns, 2012)

TASK 2

P3: Types of costing methods used for calculating net profit

Cost is the value of some amount or worth which is to be paid by the person in order to

get something. Such as in case of production, manager use to collected necessary amount of raw

material or other crucial need from several parties. These are useful for producing specific

products within an accounting period of time. The two techniques of costing are as follows.

Absorption costing: It refers to the technique in which all manufacturing costs are

absorbed by the units produced. Or the cost of finished products in inventory will

includes in direct materials, direct labour and both variable and fixed overhead, that is

why it is also known full costing and full absorption costing method. Absorption costing

is used for the reporting to external parties.

Marginal costing: It refers to the technique in which a all direct costs are charged with

the variable overhead and fixed cost for the period is fully written off against the

contribution. The marginal cost applies with the additional cost incurred due to the

purchase of an additional unit of output, which is considered with the total variable cost

of one unit.

An illustrative example for better understandings of two techniques is below.

Particular Amount

6

It is examined that the accounting system and its reporting is used to facilitates the valuable

information about the current position of It is crucial for the accountant to make proper

information about both of them or its integration. The methodology of link among these two

important aspects within an organisational process is said to be integrated accounting system. It

used to provide standardised process for recording various transaction and use of finance is

effective manner. There are various types of reporting method such as performance report which

is related with present and last year performance of While, with the use of account receivable

report they can easily be able to determine analyse total amount outstanding and timing of

recovery. Inventory management report used to give valuable information about total position of

stock kept by the company with them( Edwards and Boyns, 2012)

TASK 2

P3: Types of costing methods used for calculating net profit

Cost is the value of some amount or worth which is to be paid by the person in order to

get something. Such as in case of production, manager use to collected necessary amount of raw

material or other crucial need from several parties. These are useful for producing specific

products within an accounting period of time. The two techniques of costing are as follows.

Absorption costing: It refers to the technique in which all manufacturing costs are

absorbed by the units produced. Or the cost of finished products in inventory will

includes in direct materials, direct labour and both variable and fixed overhead, that is

why it is also known full costing and full absorption costing method. Absorption costing

is used for the reporting to external parties.

Marginal costing: It refers to the technique in which a all direct costs are charged with

the variable overhead and fixed cost for the period is fully written off against the

contribution. The marginal cost applies with the additional cost incurred due to the

purchase of an additional unit of output, which is considered with the total variable cost

of one unit.

An illustrative example for better understandings of two techniques is below.

Particular Amount

6

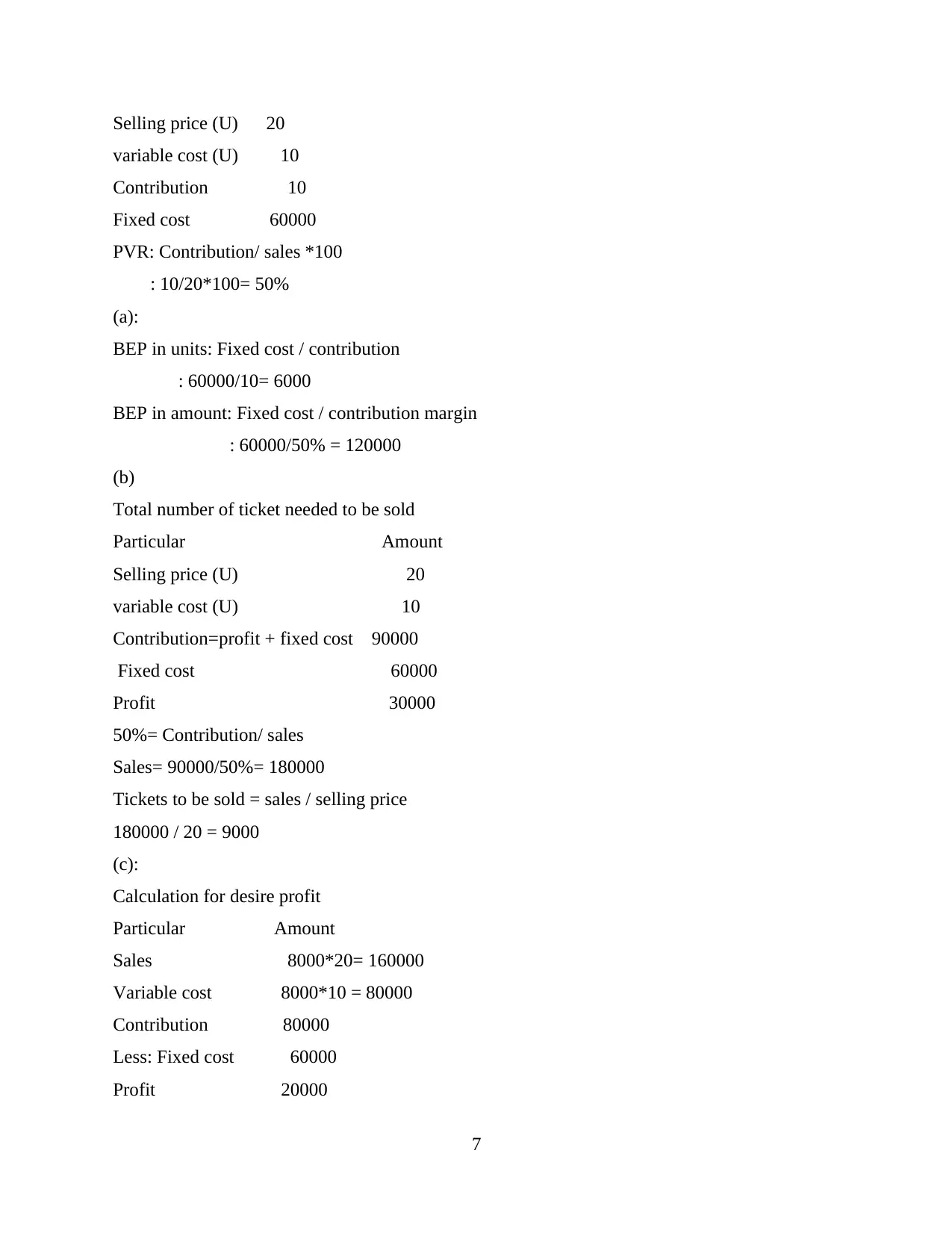

Selling price (U) 20

variable cost (U) 10

Contribution 10

Fixed cost 60000

PVR: Contribution/ sales *100

: 10/20*100= 50%

(a):

BEP in units: Fixed cost / contribution

: 60000/10= 6000

BEP in amount: Fixed cost / contribution margin

: 60000/50% = 120000

(b)

Total number of ticket needed to be sold

Particular Amount

Selling price (U) 20

variable cost (U) 10

Contribution=profit + fixed cost 90000

Fixed cost 60000

Profit 30000

50%= Contribution/ sales

Sales= 90000/50%= 180000

Tickets to be sold = sales / selling price

180000 / 20 = 9000

(c):

Calculation for desire profit

Particular Amount

Sales 8000*20= 160000

Variable cost 8000*10 = 80000

Contribution 80000

Less: Fixed cost 60000

Profit 20000

7

variable cost (U) 10

Contribution 10

Fixed cost 60000

PVR: Contribution/ sales *100

: 10/20*100= 50%

(a):

BEP in units: Fixed cost / contribution

: 60000/10= 6000

BEP in amount: Fixed cost / contribution margin

: 60000/50% = 120000

(b)

Total number of ticket needed to be sold

Particular Amount

Selling price (U) 20

variable cost (U) 10

Contribution=profit + fixed cost 90000

Fixed cost 60000

Profit 30000

50%= Contribution/ sales

Sales= 90000/50%= 180000

Tickets to be sold = sales / selling price

180000 / 20 = 9000

(c):

Calculation for desire profit

Particular Amount

Sales 8000*20= 160000

Variable cost 8000*10 = 80000

Contribution 80000

Less: Fixed cost 60000

Profit 20000

7

M2: Different types of accounting tools and techniques

There are many kinds of accounting techniques and tools which are used to esure the

management for acting as more reliable in order to make effective decision making. Some of

them are mentioned underneath:

Marginal costing tools: It is one of the appropriate technique that helps in evaluation of

net profitability of the company and charge costs as variable units can be helpful for effective

decision making (Yalcin, 2012).

Historical costing tools: It is important tool providing base for comparison of current

position with the past position of the business. It measure of value use to measure price of an

assets on balance sheet on their nominal cost instead of original cost.

D2: Analysis of data collected from income statement

From the above report with several issues that occurs in an organisation in performing the

activities time they need to make use of various costing method. It would be make reliable

aspects to the company which will be essential for effective decision making. In order to utilising

the marginal cost technique for net profit calculation and by using the absorption costing they get

different amount of profit as due to fundamental differences among these two techniques. All

differences and changes are analyse and profit from absorption costing is beneficial for external

reporting while the profit from the marginal costing is beneficial for organisational internal

purpose.

TASK 3

P4: Advantages and disadvantages of using planning tools used in budgetary control

Budget is termed as the pre-planned set that provides the estimated details about different

cost and expenses incurred in performing the particular project by organisation, basically for the

specified period. It is based on prediction and estimation made on the basis of past year records

of the organisation.

Budgetary control process:

8

There are many kinds of accounting techniques and tools which are used to esure the

management for acting as more reliable in order to make effective decision making. Some of

them are mentioned underneath:

Marginal costing tools: It is one of the appropriate technique that helps in evaluation of

net profitability of the company and charge costs as variable units can be helpful for effective

decision making (Yalcin, 2012).

Historical costing tools: It is important tool providing base for comparison of current

position with the past position of the business. It measure of value use to measure price of an

assets on balance sheet on their nominal cost instead of original cost.

D2: Analysis of data collected from income statement

From the above report with several issues that occurs in an organisation in performing the

activities time they need to make use of various costing method. It would be make reliable

aspects to the company which will be essential for effective decision making. In order to utilising

the marginal cost technique for net profit calculation and by using the absorption costing they get

different amount of profit as due to fundamental differences among these two techniques. All

differences and changes are analyse and profit from absorption costing is beneficial for external

reporting while the profit from the marginal costing is beneficial for organisational internal

purpose.

TASK 3

P4: Advantages and disadvantages of using planning tools used in budgetary control

Budget is termed as the pre-planned set that provides the estimated details about different

cost and expenses incurred in performing the particular project by organisation, basically for the

specified period. It is based on prediction and estimation made on the basis of past year records

of the organisation.

Budgetary control process:

8

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

It is important planning tool which is used to evaluate estimated the actual results with

the estimated results of project or operation. It is concerned with the budgeted and actual aspects

which are used to know and remove all kind of deviations that are arises between the actual

outcomes and estimated budget. There are several useful centres that comprises of systematic

process to manage with other budgets. it requires planning, as it is inevitable tools that be

beneficial in context of controlling all issues which occurs in an organisation regarding

budgeting. Some of them are discussed below:

Forecasting tools: It is said to be as systematic process of making predictions of future,

past and current data in more effective way, for the purpose of analysing trends or changes.

predictions regarding future are used to prepare a pre- planned budget for the particular project.

It is important techniques that is used by business for planning their future projects(Bennett,

Schaltegger and Zvezdov, 2013)

Advantage: The main aim of forecasting is to providing the information regarding the

expenses and costs would incurred in particular project which is useful for management

in making decisions regarding the project and for future project.

Disadvantage: forecasting tool is depend upon the estimations or predictions made by the

individual on the basis of relevant information, but predictions are not confirmed because

the future is full of uncertainties.

Contingency tool: It is important budgeting tool as it is comprises with the contingent

planning, contingent tool or planning helps the organisation in managing the uncertainties arises

suddenly which can affects the organisational work. It advantage and drawback are.

Advantage: It is helpful in removing or minimising the losses from uncertainties.

Disadvantage: Inadequate literature can lead to make company suffer from any kind of

issues that are arising within an organisation and it requires the additional costs and time

for preparation.

Scenario tool: It is termed as one of the efficient or systematic structure for the

organisation to think for their future plans and projects. Within the organisation a separate team

of executives engages in building the scenario plan set for which number of scenario cases are

used to help in future to deal with any kind of issues(Bovens, Goodin and Schillemans, 2014).

9

the estimated results of project or operation. It is concerned with the budgeted and actual aspects

which are used to know and remove all kind of deviations that are arises between the actual

outcomes and estimated budget. There are several useful centres that comprises of systematic

process to manage with other budgets. it requires planning, as it is inevitable tools that be

beneficial in context of controlling all issues which occurs in an organisation regarding

budgeting. Some of them are discussed below:

Forecasting tools: It is said to be as systematic process of making predictions of future,

past and current data in more effective way, for the purpose of analysing trends or changes.

predictions regarding future are used to prepare a pre- planned budget for the particular project.

It is important techniques that is used by business for planning their future projects(Bennett,

Schaltegger and Zvezdov, 2013)

Advantage: The main aim of forecasting is to providing the information regarding the

expenses and costs would incurred in particular project which is useful for management

in making decisions regarding the project and for future project.

Disadvantage: forecasting tool is depend upon the estimations or predictions made by the

individual on the basis of relevant information, but predictions are not confirmed because

the future is full of uncertainties.

Contingency tool: It is important budgeting tool as it is comprises with the contingent

planning, contingent tool or planning helps the organisation in managing the uncertainties arises

suddenly which can affects the organisational work. It advantage and drawback are.

Advantage: It is helpful in removing or minimising the losses from uncertainties.

Disadvantage: Inadequate literature can lead to make company suffer from any kind of

issues that are arising within an organisation and it requires the additional costs and time

for preparation.

Scenario tool: It is termed as one of the efficient or systematic structure for the

organisation to think for their future plans and projects. Within the organisation a separate team

of executives engages in building the scenario plan set for which number of scenario cases are

used to help in future to deal with any kind of issues(Bovens, Goodin and Schillemans, 2014).

9

Advantage: In the organisation there are several department and therefore several types

of uncertainties can be occurs which can be solved with the help of management

techniques.

Disadvantage: It requires the more time to prepare and it involves the delays in decision

making, so the lack of decision making power can affects the scenario planning the

progress of organisation.

M3: Analysis of various planning tool and its application for forecasting

According to the management accounting the preparation of controlling budgets for an

organisation, manager has to make different uses of various planning tools. There are some types

of tools such as forecasting that is used to forecast total costs or expenditure may be incurs in a

particular project by Everyjoy Ltd.. Contingency tools which is useful in reducing the affects of

uncertainties and acts as the backup plan. This all helps in maximising the profits of the

organisation by reducing uncertainties and making the effective budgets for the organisational

like Everyjoy (U.K).

D3: Evaluation of planning tools for solving the financial issues

The organisation have to face several internal and external problems that are arises due to

improper conducting of operational activities. Improper conducting arises due to ineffective

planning and occurrence of contingencies. This all affects the business performance and the

reduces the revenues this will leads to financial problem after some times, so by forecasting tool

and contingency planning and effective budgetary planning the organisation can reduce the

chance of financial crisis and can easily solve the financial problems.

TASK 4

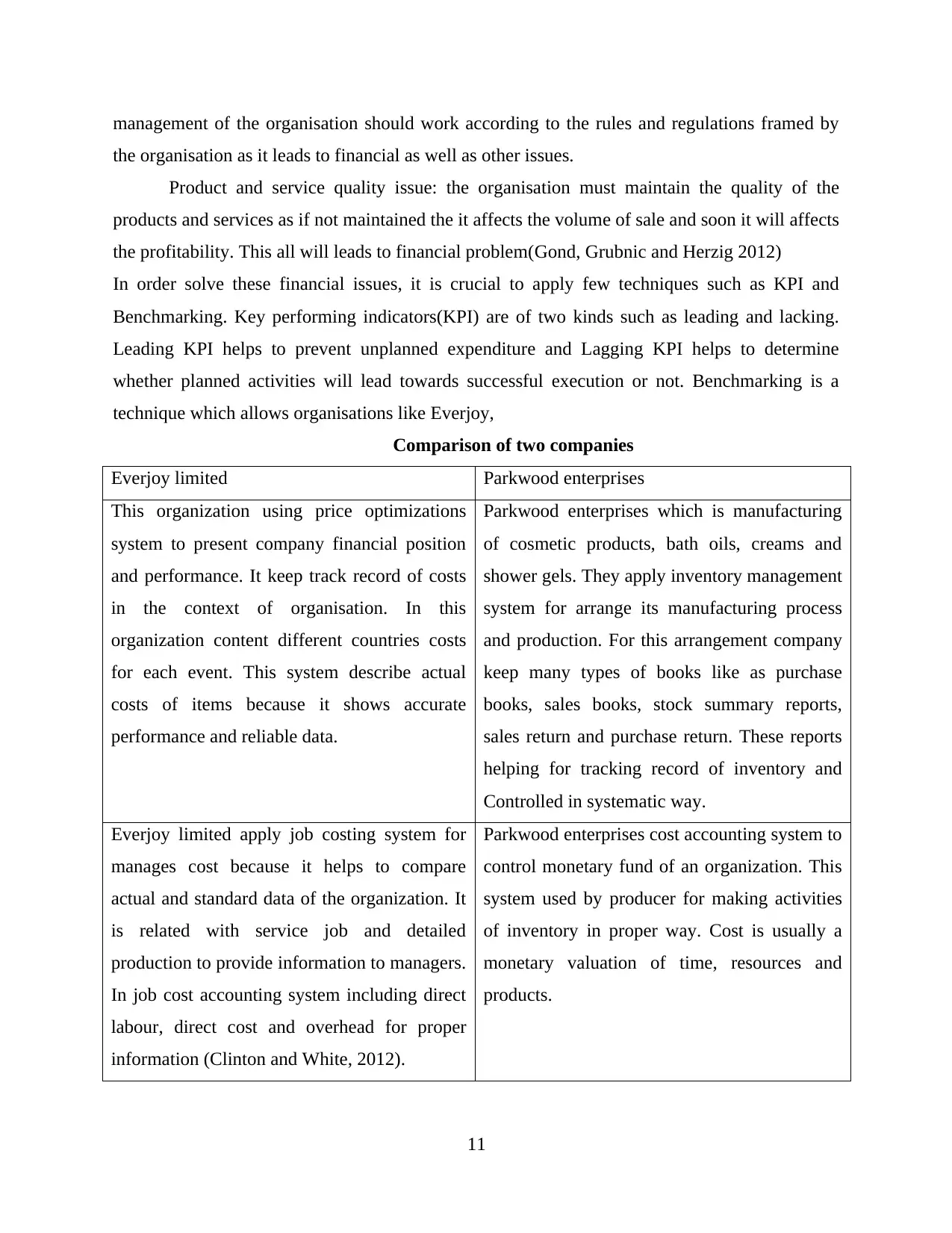

P5: Comparison with other organisation to overcome financial issues

In order to perfectly compare the two organisation in context of solving the financial problems

the budgetary planning tools are essential for getting the recovery from the financial problems

that are arises in an organisation Everyjoy Ltd.. Therefore some aspects and comparative

statement is described as below.

Rules and regulation aspect: The rules and regulations aspects helps the organisations to work or

perform the business activities according to set of rules and regulation as same as the

10

of uncertainties can be occurs which can be solved with the help of management

techniques.

Disadvantage: It requires the more time to prepare and it involves the delays in decision

making, so the lack of decision making power can affects the scenario planning the

progress of organisation.

M3: Analysis of various planning tool and its application for forecasting

According to the management accounting the preparation of controlling budgets for an

organisation, manager has to make different uses of various planning tools. There are some types

of tools such as forecasting that is used to forecast total costs or expenditure may be incurs in a

particular project by Everyjoy Ltd.. Contingency tools which is useful in reducing the affects of

uncertainties and acts as the backup plan. This all helps in maximising the profits of the

organisation by reducing uncertainties and making the effective budgets for the organisational

like Everyjoy (U.K).

D3: Evaluation of planning tools for solving the financial issues

The organisation have to face several internal and external problems that are arises due to

improper conducting of operational activities. Improper conducting arises due to ineffective

planning and occurrence of contingencies. This all affects the business performance and the

reduces the revenues this will leads to financial problem after some times, so by forecasting tool

and contingency planning and effective budgetary planning the organisation can reduce the

chance of financial crisis and can easily solve the financial problems.

TASK 4

P5: Comparison with other organisation to overcome financial issues

In order to perfectly compare the two organisation in context of solving the financial problems

the budgetary planning tools are essential for getting the recovery from the financial problems

that are arises in an organisation Everyjoy Ltd.. Therefore some aspects and comparative

statement is described as below.

Rules and regulation aspect: The rules and regulations aspects helps the organisations to work or

perform the business activities according to set of rules and regulation as same as the

10

management of the organisation should work according to the rules and regulations framed by

the organisation as it leads to financial as well as other issues.

Product and service quality issue: the organisation must maintain the quality of the

products and services as if not maintained the it affects the volume of sale and soon it will affects

the profitability. This all will leads to financial problem(Gond, Grubnic and Herzig 2012)

In order solve these financial issues, it is crucial to apply few techniques such as KPI and

Benchmarking. Key performing indicators(KPI) are of two kinds such as leading and lacking.

Leading KPI helps to prevent unplanned expenditure and Lagging KPI helps to determine

whether planned activities will lead towards successful execution or not. Benchmarking is a

technique which allows organisations like Everjoy,

Comparison of two companies

Everjoy limited Parkwood enterprises

This organization using price optimizations

system to present company financial position

and performance. It keep track record of costs

in the context of organisation. In this

organization content different countries costs

for each event. This system describe actual

costs of items because it shows accurate

performance and reliable data.

Parkwood enterprises which is manufacturing

of cosmetic products, bath oils, creams and

shower gels. They apply inventory management

system for arrange its manufacturing process

and production. For this arrangement company

keep many types of books like as purchase

books, sales books, stock summary reports,

sales return and purchase return. These reports

helping for tracking record of inventory and

Controlled in systematic way.

Everjoy limited apply job costing system for

manages cost because it helps to compare

actual and standard data of the organization. It

is related with service job and detailed

production to provide information to managers.

In job cost accounting system including direct

labour, direct cost and overhead for proper

information (Clinton and White, 2012).

Parkwood enterprises cost accounting system to

control monetary fund of an organization. This

system used by producer for making activities

of inventory in proper way. Cost is usually a

monetary valuation of time, resources and

products.

11

the organisation as it leads to financial as well as other issues.

Product and service quality issue: the organisation must maintain the quality of the

products and services as if not maintained the it affects the volume of sale and soon it will affects

the profitability. This all will leads to financial problem(Gond, Grubnic and Herzig 2012)

In order solve these financial issues, it is crucial to apply few techniques such as KPI and

Benchmarking. Key performing indicators(KPI) are of two kinds such as leading and lacking.

Leading KPI helps to prevent unplanned expenditure and Lagging KPI helps to determine

whether planned activities will lead towards successful execution or not. Benchmarking is a

technique which allows organisations like Everjoy,

Comparison of two companies

Everjoy limited Parkwood enterprises

This organization using price optimizations

system to present company financial position

and performance. It keep track record of costs

in the context of organisation. In this

organization content different countries costs

for each event. This system describe actual

costs of items because it shows accurate

performance and reliable data.

Parkwood enterprises which is manufacturing

of cosmetic products, bath oils, creams and

shower gels. They apply inventory management

system for arrange its manufacturing process

and production. For this arrangement company

keep many types of books like as purchase

books, sales books, stock summary reports,

sales return and purchase return. These reports

helping for tracking record of inventory and

Controlled in systematic way.

Everjoy limited apply job costing system for

manages cost because it helps to compare

actual and standard data of the organization. It

is related with service job and detailed

production to provide information to managers.

In job cost accounting system including direct

labour, direct cost and overhead for proper

information (Clinton and White, 2012).

Parkwood enterprises cost accounting system to

control monetary fund of an organization. This

system used by producer for making activities

of inventory in proper way. Cost is usually a

monetary valuation of time, resources and

products.

11

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

M4: Analysis of planning tools to deal with financial issues

Management accounting techniques pertains the task of cost accounting or costing, under

which by using various types of cost techniques like Absorption costing, marginal costing and

Activity based costing helps in minimising the costs and ascertaining the profit of the

organisation like Everjoy Ltd. (U.K) by utilising the financial and non financial resources in

more effective and efficient manner and by effective planning tools and budgets, all these tasks

of management accounting helps in solving the financial problems of the organisation

(Malmmose, 2015).

CONCLUSION

The above report summarises the concept of management accounting systems. It is

analysed that various type of management accounting reports helps in consolidating the

information subject to decision making process. Different type of accounting techniques are

summarised to analyse the profitability. Various type of planning tools are analysed in terms of

managing the budgetary control process. Users will be able to analyse the financial issues after

implementing the management accounting system.

12

Management accounting techniques pertains the task of cost accounting or costing, under

which by using various types of cost techniques like Absorption costing, marginal costing and

Activity based costing helps in minimising the costs and ascertaining the profit of the

organisation like Everjoy Ltd. (U.K) by utilising the financial and non financial resources in

more effective and efficient manner and by effective planning tools and budgets, all these tasks

of management accounting helps in solving the financial problems of the organisation

(Malmmose, 2015).

CONCLUSION

The above report summarises the concept of management accounting systems. It is

analysed that various type of management accounting reports helps in consolidating the

information subject to decision making process. Different type of accounting techniques are

summarised to analyse the profitability. Various type of planning tools are analysed in terms of

managing the budgetary control process. Users will be able to analyse the financial issues after

implementing the management accounting system.

12

REFERENCES

Books and Journal:

Kihn, L.A. and Ihantola, E.M., 2015. Approaches to validation and evaluation in qualitative

studies of management accounting. Qualitative Research in Accounting & Management,

12(3), pp.230-255.

DRURY, C.M., 2013. Management and cost accounting. Springer.

Cokins, G., 2013. Top 7 trends in management accounting. Strategic Finance, 95(6), pp.21-30.

Adler, R., 2013. Management Accounting. Routledge.

Quattrone, P., 2016. Management accounting goes digital: Will the move make it wiser?.

Management Accounting Research, 31, pp.118-122.

Suomala, P. and Lyly-Yrjänäinen, J., 2012. Management accounting research in practice:

Lessons learned from an interventionist approach. Routledge.

Edwards, R. and Boyns, T., 2012. A history of management accounting: The British experience.

Routledge.

Yalcin, S., 2012. Adoption and benefits of management accounting practices: an inter-country

comparison. Accounting in Europe, 9(1), pp.95-110.

Bennett, M.D., Schaltegger, S. and Zvezdov, D., 2013. Exploring corporate practices in

management accounting for sustainability (pp. 1-56). London: ICAEW.

Bovens, M., Goodin, R.E. and Schillemans, T. eds., 2014. The Oxford handbook public

accountability. Oxford University Press.

Gond, J.P., Grubnic, S., Herzig, C. and Moon, J., 2012. Configuring management control

systems: Theorizing the integration of strategy and sustainability. Management

Accounting Research, 23(3), pp.205-223.

Clinton, D.B. and White, L.R., 2012. Roles and practices in management accounting: 2003-

2012: this article is based on research supported by SAP, Alta Via Consulting, and IMA

[R]. Strategic Finance, 94(5), pp.37-44.

Malmmose, M., 2015. Management accounting versus medical profession discourse: Hegemony

in a public health care debate–A case from Denmark. Critical perspectives on

Accounting, 27, pp.144-159.

13

Books and Journal:

Kihn, L.A. and Ihantola, E.M., 2015. Approaches to validation and evaluation in qualitative

studies of management accounting. Qualitative Research in Accounting & Management,

12(3), pp.230-255.

DRURY, C.M., 2013. Management and cost accounting. Springer.

Cokins, G., 2013. Top 7 trends in management accounting. Strategic Finance, 95(6), pp.21-30.

Adler, R., 2013. Management Accounting. Routledge.

Quattrone, P., 2016. Management accounting goes digital: Will the move make it wiser?.

Management Accounting Research, 31, pp.118-122.

Suomala, P. and Lyly-Yrjänäinen, J., 2012. Management accounting research in practice:

Lessons learned from an interventionist approach. Routledge.

Edwards, R. and Boyns, T., 2012. A history of management accounting: The British experience.

Routledge.

Yalcin, S., 2012. Adoption and benefits of management accounting practices: an inter-country

comparison. Accounting in Europe, 9(1), pp.95-110.

Bennett, M.D., Schaltegger, S. and Zvezdov, D., 2013. Exploring corporate practices in

management accounting for sustainability (pp. 1-56). London: ICAEW.

Bovens, M., Goodin, R.E. and Schillemans, T. eds., 2014. The Oxford handbook public

accountability. Oxford University Press.

Gond, J.P., Grubnic, S., Herzig, C. and Moon, J., 2012. Configuring management control

systems: Theorizing the integration of strategy and sustainability. Management

Accounting Research, 23(3), pp.205-223.

Clinton, D.B. and White, L.R., 2012. Roles and practices in management accounting: 2003-

2012: this article is based on research supported by SAP, Alta Via Consulting, and IMA

[R]. Strategic Finance, 94(5), pp.37-44.

Malmmose, M., 2015. Management accounting versus medical profession discourse: Hegemony

in a public health care debate–A case from Denmark. Critical perspectives on

Accounting, 27, pp.144-159.

13

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.