Comprehensive Report on Management Accounting for Jupiter PLC

VerifiedAdded on 2020/11/12

|16

|3912

|438

Report

AI Summary

This report provides a comprehensive overview of management accounting principles and their application within Jupiter PLC. It begins by defining management accounting and exploring various systems, including job costing, inventory management, cost accounting, and price optimization. The report then examines different management accounting reports such as budget reports, accounts receivable aging reports, and cost management reports. The analysis extends to evaluating the benefits of these systems and their integration within the company, with a focus on the importance of accounting for financial and non-financial information for decision-making. The report delves into absorption costing and marginal costing, presenting income statements for each method and comparing their implications. It further discusses the advantages and disadvantages of planning tools used in budgetary control, analyzing their application in budget preparation and forecasting. Finally, the report assesses the role of management accounting techniques in responding to financial problems and achieving sustainable success, emphasizing the importance of budgetary tools in financial planning and organizational growth.

Management Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

1. Explaining the management accounting and the essential requirement of the different

accounting system in Jupiter plc..................................................................................................3

2. Explaining different methods for management accounting system. .......................................4

3.Evaluating the benefit of management accounting system and its application........................5

4. Integration of management accounting system and management accounting reports in

Jupiter PLC..................................................................................................................................6

TASK 2............................................................................................................................................6

1. What is Absorption Costing.....................................................................................................6

Income statement as per absorption costing:...............................................................................7

Income statement on basis of marginal costing...........................................................................8

TASK 3..........................................................................................................................................10

1. Explaining the advantage and disadvantage of planning tool used in budgetary control......10

2. Analyzing the use of different planning tool and their application in preparing and

forecasting budget......................................................................................................................12

TASK 4..........................................................................................................................................12

1.Comparing the organization and adopting management accounting techniques in responding

to financial problem...................................................................................................................12

2.Analysing how management accounting in organization leads to suitable success by

responding to financial problems...............................................................................................13

3. Evaluating the planning tool for organizational sustainable success by responding to its

financial problems:.....................................................................................................................13

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

TASK 1............................................................................................................................................3

1. Explaining the management accounting and the essential requirement of the different

accounting system in Jupiter plc..................................................................................................3

2. Explaining different methods for management accounting system. .......................................4

3.Evaluating the benefit of management accounting system and its application........................5

4. Integration of management accounting system and management accounting reports in

Jupiter PLC..................................................................................................................................6

TASK 2............................................................................................................................................6

1. What is Absorption Costing.....................................................................................................6

Income statement as per absorption costing:...............................................................................7

Income statement on basis of marginal costing...........................................................................8

TASK 3..........................................................................................................................................10

1. Explaining the advantage and disadvantage of planning tool used in budgetary control......10

2. Analyzing the use of different planning tool and their application in preparing and

forecasting budget......................................................................................................................12

TASK 4..........................................................................................................................................12

1.Comparing the organization and adopting management accounting techniques in responding

to financial problem...................................................................................................................12

2.Analysing how management accounting in organization leads to suitable success by

responding to financial problems...............................................................................................13

3. Evaluating the planning tool for organizational sustainable success by responding to its

financial problems:.....................................................................................................................13

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

INTRODUCTION

Management accounting is an important process which helps in the presentation of the

information to the top executives of the organization. It is essential system for the proper

functioning of the management. The report will help in understanding the management

accounting and its system to the Jupiter plc. Further, the report will explain the different

management system of the Jupiter plc. The study will also help in understanding various type of

management accounting report. present report has mentioned the application of management

accounting and report in Jupiter plc. report will discuss the absorption costing and will include

different income statement with absorption and marginal costing. The report will discuss

different planning tool for budgetary controlling process. The report will also helped in

understanding the application of the management accounting system in different organization.

report will discuss the importance of management accounting and budgetary tool in responding

to the financial problems and leading the organization to the sustainable success.

TASK 1

1. Explaining the management accounting and the essential requirement of the different

accounting system in Jupiter plc.

It is the process which helps in gathering, analyzing and interpretation and presenting the

accounting information to the management is termed as the management accounting. Business

operations on day to day basis to compete in order to make better strategies are accomplished

trough management accounting, so that they can achieve higher goals and strive to make place in

today’s competitive world

The system of management accounting helps all stratus to collect proper and accurate

information so that it can be showcased in a manner which will help Jupiter PLC. to make more

strategic and firm decisions which will be helpful to them in long term (Ward, 2012). There are

various types of management accounting systems to help out companies with their business

operation and to make it run more smoothly:

1. Job costing system: the system wherein the manufacturing cost is issued or assigned to

individual product or to same collective batches of the same product this system assists in

Management accounting is an important process which helps in the presentation of the

information to the top executives of the organization. It is essential system for the proper

functioning of the management. The report will help in understanding the management

accounting and its system to the Jupiter plc. Further, the report will explain the different

management system of the Jupiter plc. The study will also help in understanding various type of

management accounting report. present report has mentioned the application of management

accounting and report in Jupiter plc. report will discuss the absorption costing and will include

different income statement with absorption and marginal costing. The report will discuss

different planning tool for budgetary controlling process. The report will also helped in

understanding the application of the management accounting system in different organization.

report will discuss the importance of management accounting and budgetary tool in responding

to the financial problems and leading the organization to the sustainable success.

TASK 1

1. Explaining the management accounting and the essential requirement of the different

accounting system in Jupiter plc.

It is the process which helps in gathering, analyzing and interpretation and presenting the

accounting information to the management is termed as the management accounting. Business

operations on day to day basis to compete in order to make better strategies are accomplished

trough management accounting, so that they can achieve higher goals and strive to make place in

today’s competitive world

The system of management accounting helps all stratus to collect proper and accurate

information so that it can be showcased in a manner which will help Jupiter PLC. to make more

strategic and firm decisions which will be helpful to them in long term (Ward, 2012). There are

various types of management accounting systems to help out companies with their business

operation and to make it run more smoothly:

1. Job costing system: the system wherein the manufacturing cost is issued or assigned to

individual product or to same collective batches of the same product this system assists in

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

keeping proper records and data and the cost of each product. it also helps in maintain records of

materials used and labor involved. This system also provides the management team of Jupiter

PLC to track expenditures allocated to the particular product, therein finalizing the selling price

of each product (Renz, 2016). It also helps the management team set a proper selling price of

their commodity wherein the production cost is covered and profit is attained.

2. Inventory Management: Tracking the flow of goods from manufacturers to retailers is a

system known as Inventory Management. Till the time the final product reaches the customer

trough retailers where they get it through warehouses from the manufacturers of the Jupiter plc.

It is an extremely efficient manner to manage inventory and keep track of all available stocks

whenever it is needed.

3.Cost Accounting System: Jupiter plc use this system to set the exact or estimated price of

their product with the value of the raw material used and the cost control involved in order to

make it profitable (Otley and Emmanuel, 2013). This system known as the Cost Accounting

system that helps in deciding the accurate price set up of the selling price for profitable gains.

4.Price optimizing system: Prices of available resources are controlled using the price

optimizing system which helps companies decides prices of multiple products at one time .It

helps the Jupiter plc in knowing the fluctuation in the demand of the product with the changes in

the price of the product. It is essential and an important factor in deciding the pricing structure

for setting up the promotional price of any commodity.

2. Explaining different methods for management accounting system.

Process which helps providing exact and efficient timely information about the financial

and statistical information of the company is known as Managerial accounting reporting. It will

prove to be of great help to Jupiter PLC and its management team in taking the right decisions

and planning strategies that will help them for a future growth and for the welfare and

development of their company. For smooth business operations different kinds of reports are

being prepared in order to evaluate the business performance of the company. The different types

of management accounting reports are as followed:

Budget Reports: The rudimentary element which is very crucial and plays an important part in

every organization is the Budget Report. The overall performance of a company in a specific

materials used and labor involved. This system also provides the management team of Jupiter

PLC to track expenditures allocated to the particular product, therein finalizing the selling price

of each product (Renz, 2016). It also helps the management team set a proper selling price of

their commodity wherein the production cost is covered and profit is attained.

2. Inventory Management: Tracking the flow of goods from manufacturers to retailers is a

system known as Inventory Management. Till the time the final product reaches the customer

trough retailers where they get it through warehouses from the manufacturers of the Jupiter plc.

It is an extremely efficient manner to manage inventory and keep track of all available stocks

whenever it is needed.

3.Cost Accounting System: Jupiter plc use this system to set the exact or estimated price of

their product with the value of the raw material used and the cost control involved in order to

make it profitable (Otley and Emmanuel, 2013). This system known as the Cost Accounting

system that helps in deciding the accurate price set up of the selling price for profitable gains.

4.Price optimizing system: Prices of available resources are controlled using the price

optimizing system which helps companies decides prices of multiple products at one time .It

helps the Jupiter plc in knowing the fluctuation in the demand of the product with the changes in

the price of the product. It is essential and an important factor in deciding the pricing structure

for setting up the promotional price of any commodity.

2. Explaining different methods for management accounting system.

Process which helps providing exact and efficient timely information about the financial

and statistical information of the company is known as Managerial accounting reporting. It will

prove to be of great help to Jupiter PLC and its management team in taking the right decisions

and planning strategies that will help them for a future growth and for the welfare and

development of their company. For smooth business operations different kinds of reports are

being prepared in order to evaluate the business performance of the company. The different types

of management accounting reports are as followed:

Budget Reports: The rudimentary element which is very crucial and plays an important part in

every organization is the Budget Report. The overall performance of a company in a specific

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

year is measured by this report and is prepared on the basis of the companies past years

performance. It helps the management in making reports analyzing the performance of the

company on past and present basis (Wickramasinghe and Alawattage, 2012). It helps in cost

controlling process and in controlling the management to understand the way the company

operates .Jupiter PLC can gain in finding the difference in their actual performance and their

budgeted performance trough Budget Reports

Accounts Receivable Aging Reports: These reports play a vital part for any business firm that

provides credit facilities to it customers, clients and distributors. The management is able to gain

information about the defaulters of the company trough this report. The companies credit policies

are also showcased trough this and it also helps in the need for improvement in the collection

process of the company. The need to tighten the credit policy of the company can be analyzed by

this report.

Cost managerial reports: This report covers the cost of products manufactured. It gives proper

knowledge of the exact amount of material cost, overhead, labor and other miscellaneous cost

involved in production and the selling process. the report will help the manager of the Jupiter plc

in determining the selling price of the product by evaluating the cost of production.

Job cost reports: The expense of a specific job or project is shown in this report which helps the

revenue or monetary earned by the product and the estimated price of the product. It can be

fruitful in assessment of the profit to be gained (Banerjee, 2012).

3.Evaluating the benefit of management accounting system and its application.

To obtain information of financial and non financial information of business operations

which play a key role in decision making and for creating strategies for a better growth and

development to help attain the desired goals management accounting system role plays a key

role and are as follows:

Job Costing System: the system keeps records of individual products manufactured and can be

used to keep track of the expenses involved in manufacturing goods and to set the selling price

performance. It helps the management in making reports analyzing the performance of the

company on past and present basis (Wickramasinghe and Alawattage, 2012). It helps in cost

controlling process and in controlling the management to understand the way the company

operates .Jupiter PLC can gain in finding the difference in their actual performance and their

budgeted performance trough Budget Reports

Accounts Receivable Aging Reports: These reports play a vital part for any business firm that

provides credit facilities to it customers, clients and distributors. The management is able to gain

information about the defaulters of the company trough this report. The companies credit policies

are also showcased trough this and it also helps in the need for improvement in the collection

process of the company. The need to tighten the credit policy of the company can be analyzed by

this report.

Cost managerial reports: This report covers the cost of products manufactured. It gives proper

knowledge of the exact amount of material cost, overhead, labor and other miscellaneous cost

involved in production and the selling process. the report will help the manager of the Jupiter plc

in determining the selling price of the product by evaluating the cost of production.

Job cost reports: The expense of a specific job or project is shown in this report which helps the

revenue or monetary earned by the product and the estimated price of the product. It can be

fruitful in assessment of the profit to be gained (Banerjee, 2012).

3.Evaluating the benefit of management accounting system and its application.

To obtain information of financial and non financial information of business operations

which play a key role in decision making and for creating strategies for a better growth and

development to help attain the desired goals management accounting system role plays a key

role and are as follows:

Job Costing System: the system keeps records of individual products manufactured and can be

used to keep track of the expenses involved in manufacturing goods and to set the selling price

Price Optimizing System: The pricing structure is defined in this system, to manage the starting

price and discounting price. This system decides customer preference according to price change

and vice versa

Cost Accounting System: This system helps in production cost control and estimating the

expense which will provide profit to the company.

4. Integration of management accounting system and management accounting reports in Jupiter

PLC

The integration of management accounting system balances and controls the method in

recording transactions and financial data..It interconnects and combines the activates of all the

areas of work such as point of sales, back office and front office. The input and output is

managed trough the management accounting and financial accounting functions. the integrated

management accounting system serves its purpose in increasing the speed efficiency of the exact

and right processing in financial data

The management gets the timely information and accurate data about the proper and original

operation and workings of each and every function in the company trough the management

accounting report (Dillard and Roslender, 2011). The strategies which are responsible for the

success of the organization and the decision making process for this purpose is made trough this

system. The Budgeting reports help companies achieve real performance with approximate

performance that takes the company on a path to achieve their set goals with the desired

performance.

TASK 2

1. What is Absorption Costing

The value of the inventory is calculated trough the cost accounting method. Absorption costing is

about the finance that goes into manufacturing a product, all the fixed cost and the variable cost

are brought into consideration while calculating the final cost of the manufactured product. it is

needful as it ensures proper valuation of the cost including the direct cost i.e. the material cost

and indirect cost such as the overhead cost (Crowther, 2018). This costing system is helpful in

providing a exact and accurately comprehensive cost of the manufactured product. The person in

price and discounting price. This system decides customer preference according to price change

and vice versa

Cost Accounting System: This system helps in production cost control and estimating the

expense which will provide profit to the company.

4. Integration of management accounting system and management accounting reports in Jupiter

PLC

The integration of management accounting system balances and controls the method in

recording transactions and financial data..It interconnects and combines the activates of all the

areas of work such as point of sales, back office and front office. The input and output is

managed trough the management accounting and financial accounting functions. the integrated

management accounting system serves its purpose in increasing the speed efficiency of the exact

and right processing in financial data

The management gets the timely information and accurate data about the proper and original

operation and workings of each and every function in the company trough the management

accounting report (Dillard and Roslender, 2011). The strategies which are responsible for the

success of the organization and the decision making process for this purpose is made trough this

system. The Budgeting reports help companies achieve real performance with approximate

performance that takes the company on a path to achieve their set goals with the desired

performance.

TASK 2

1. What is Absorption Costing

The value of the inventory is calculated trough the cost accounting method. Absorption costing is

about the finance that goes into manufacturing a product, all the fixed cost and the variable cost

are brought into consideration while calculating the final cost of the manufactured product. it is

needful as it ensures proper valuation of the cost including the direct cost i.e. the material cost

and indirect cost such as the overhead cost (Crowther, 2018). This costing system is helpful in

providing a exact and accurately comprehensive cost of the manufactured product. The person in

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

charge is ensured that the entire cost will be recovered from the selling price that has been used

in the production or manufacturing. It also helps in the decision making process in utilizing the

cost management.

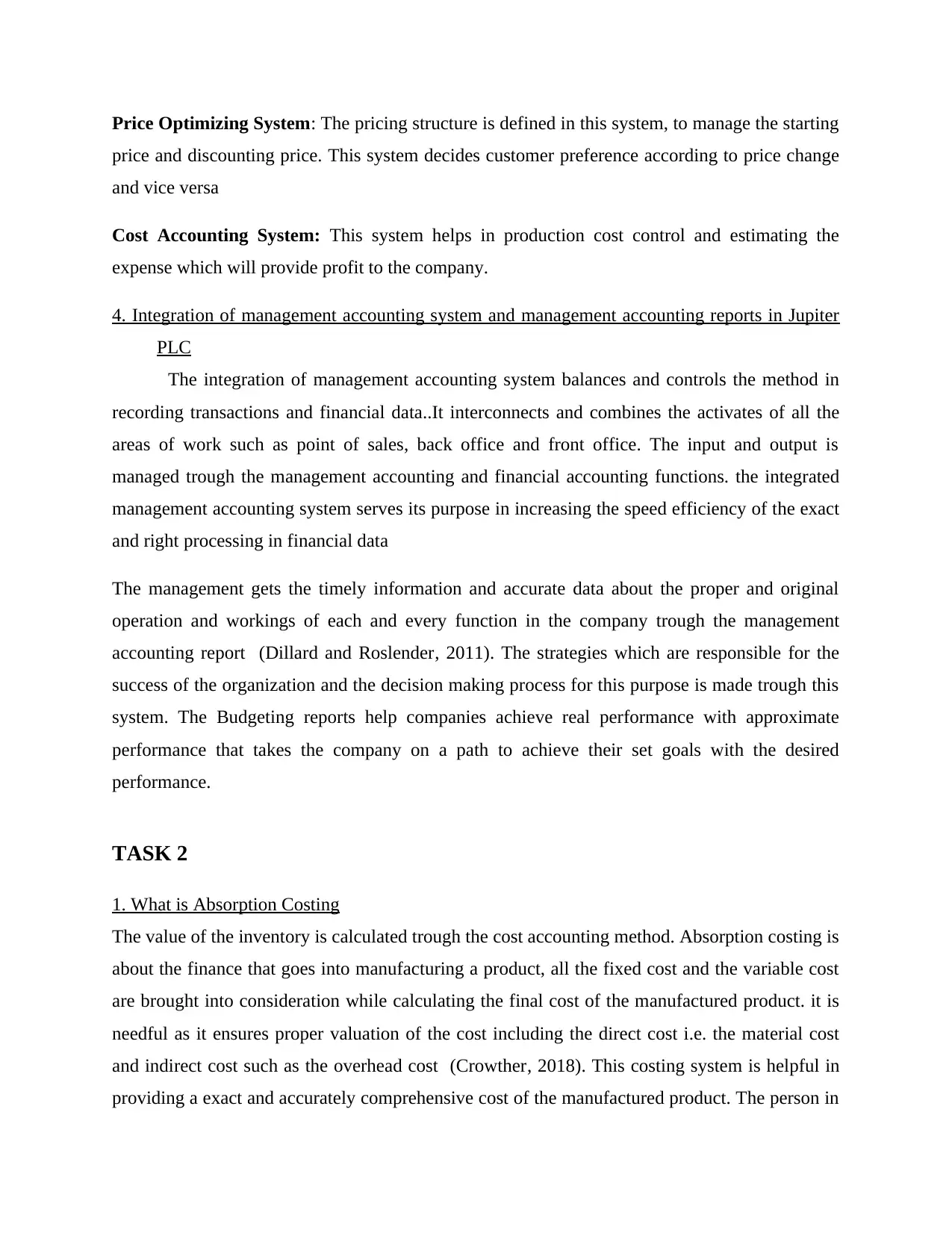

Income statement as per absorption costing:

Particulars

F

igures

(in £)

F

igures

(in £)

Sales revenue (16000 * 50) 8

00000

Production cost (19000 * 37.6) 7

14400

Less: inventory at the end of period

(3000*37.6)

1

12800

6

01600

Gross profit (Sales – COGS) 1

98400

Less: Under absorption

Net gross margin

in the production or manufacturing. It also helps in the decision making process in utilizing the

cost management.

Income statement as per absorption costing:

Particulars

F

igures

(in £)

F

igures

(in £)

Sales revenue (16000 * 50) 8

00000

Production cost (19000 * 37.6) 7

14400

Less: inventory at the end of period

(3000*37.6)

1

12800

6

01600

Gross profit (Sales – COGS) 1

98400

Less: Under absorption

Net gross margin

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

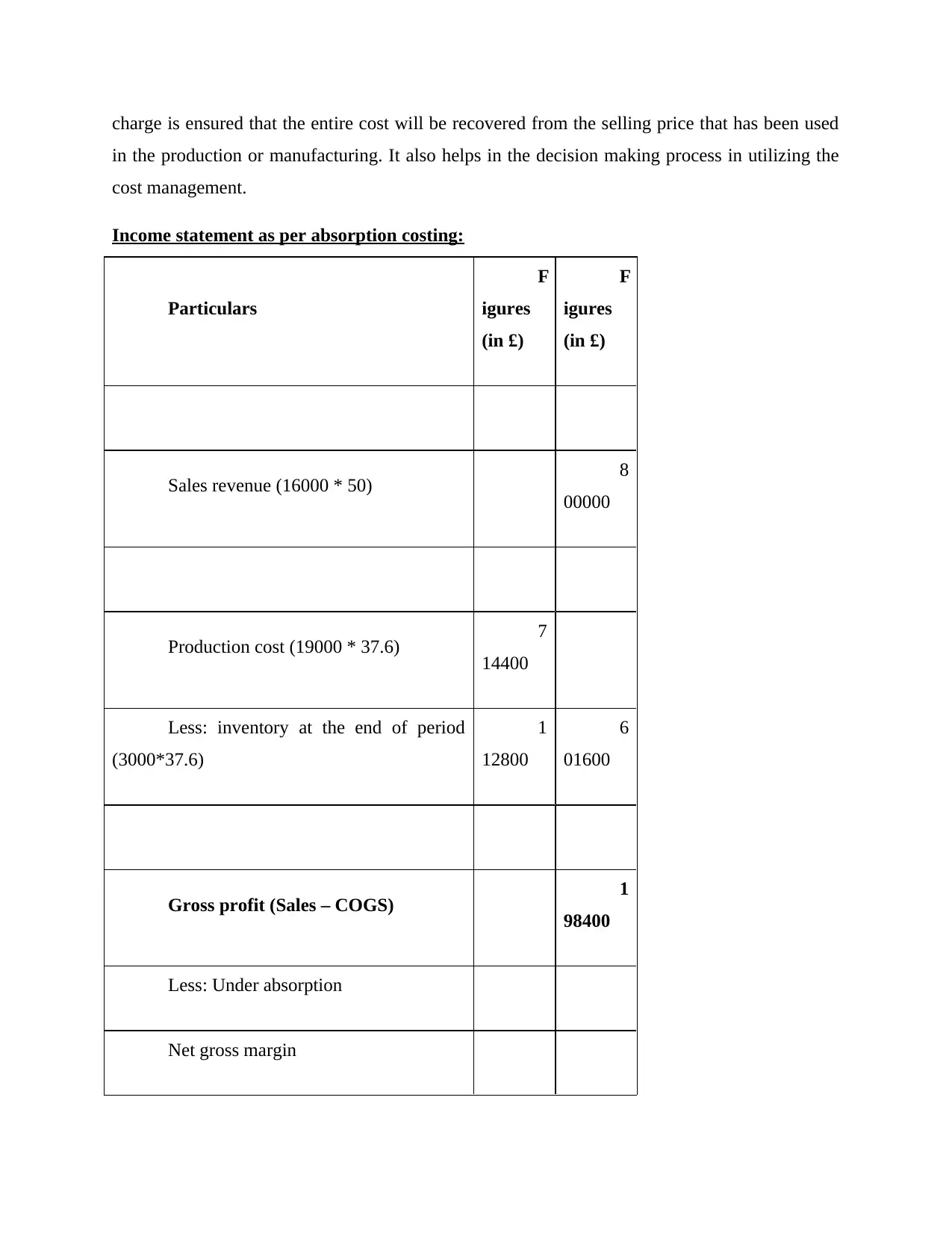

Computation of manufacturing cost per unit :

Particulars Figures (in £)

Direct labour 20

Direct material 10

Variable production overhead 2

Fixed production overhead 5.6

Total manufacturing cost per unit 37.6

Income statement on basis of marginal costing

Marginal costing

Particulars

F

igures

(in £)

F

igures

(in £)

Sales revenue (16000*50) 8

00000

Less: Variable expenses

Direct labour (19000 * 20) 3

Particulars Figures (in £)

Direct labour 20

Direct material 10

Variable production overhead 2

Fixed production overhead 5.6

Total manufacturing cost per unit 37.6

Income statement on basis of marginal costing

Marginal costing

Particulars

F

igures

(in £)

F

igures

(in £)

Sales revenue (16000*50) 8

00000

Less: Variable expenses

Direct labour (19000 * 20) 3

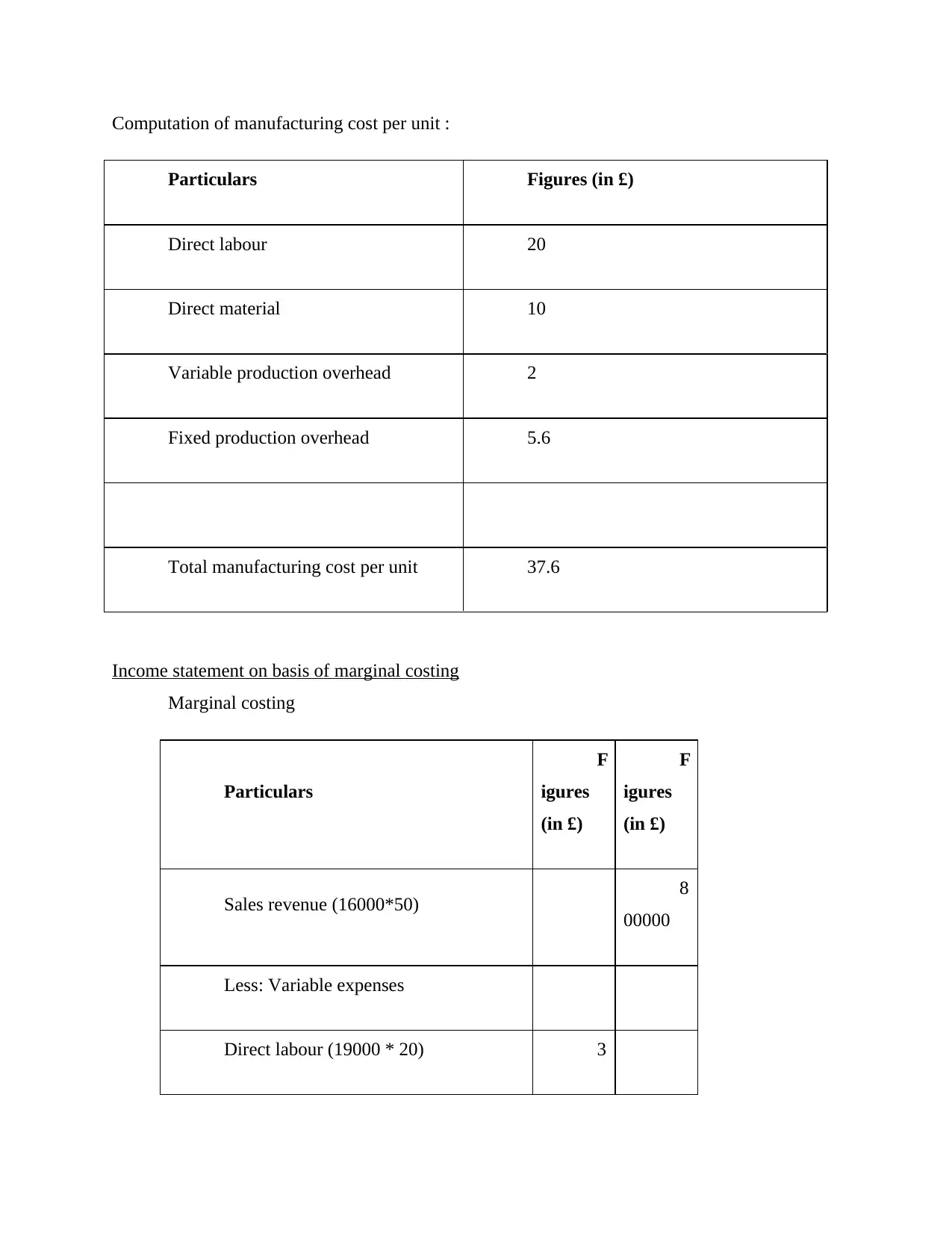

80000

Material cost (19000 * 10) 1

90000

Variable production overhead (19000 *

5)

9

5000

Less: closing inventory (3000 * 35) 1

05000

5

60000

Contribution (sales – variable cost) 2

40000

Less fixed production overhead cost 1

00000

Net profit 1

40000

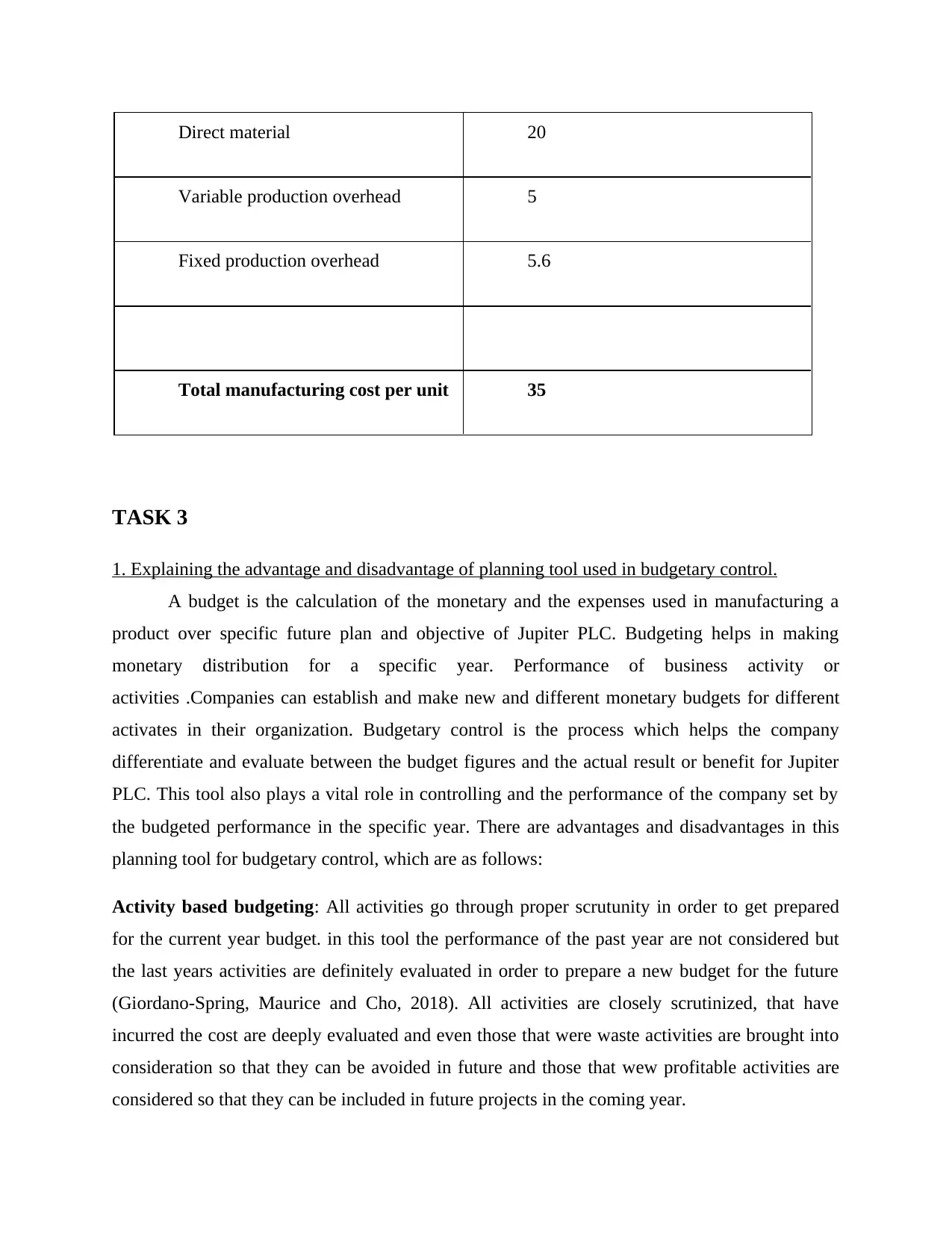

Computation of manufacturing cost per unit :

Particulars Figures (in £)

Direct labour 10

Material cost (19000 * 10) 1

90000

Variable production overhead (19000 *

5)

9

5000

Less: closing inventory (3000 * 35) 1

05000

5

60000

Contribution (sales – variable cost) 2

40000

Less fixed production overhead cost 1

00000

Net profit 1

40000

Computation of manufacturing cost per unit :

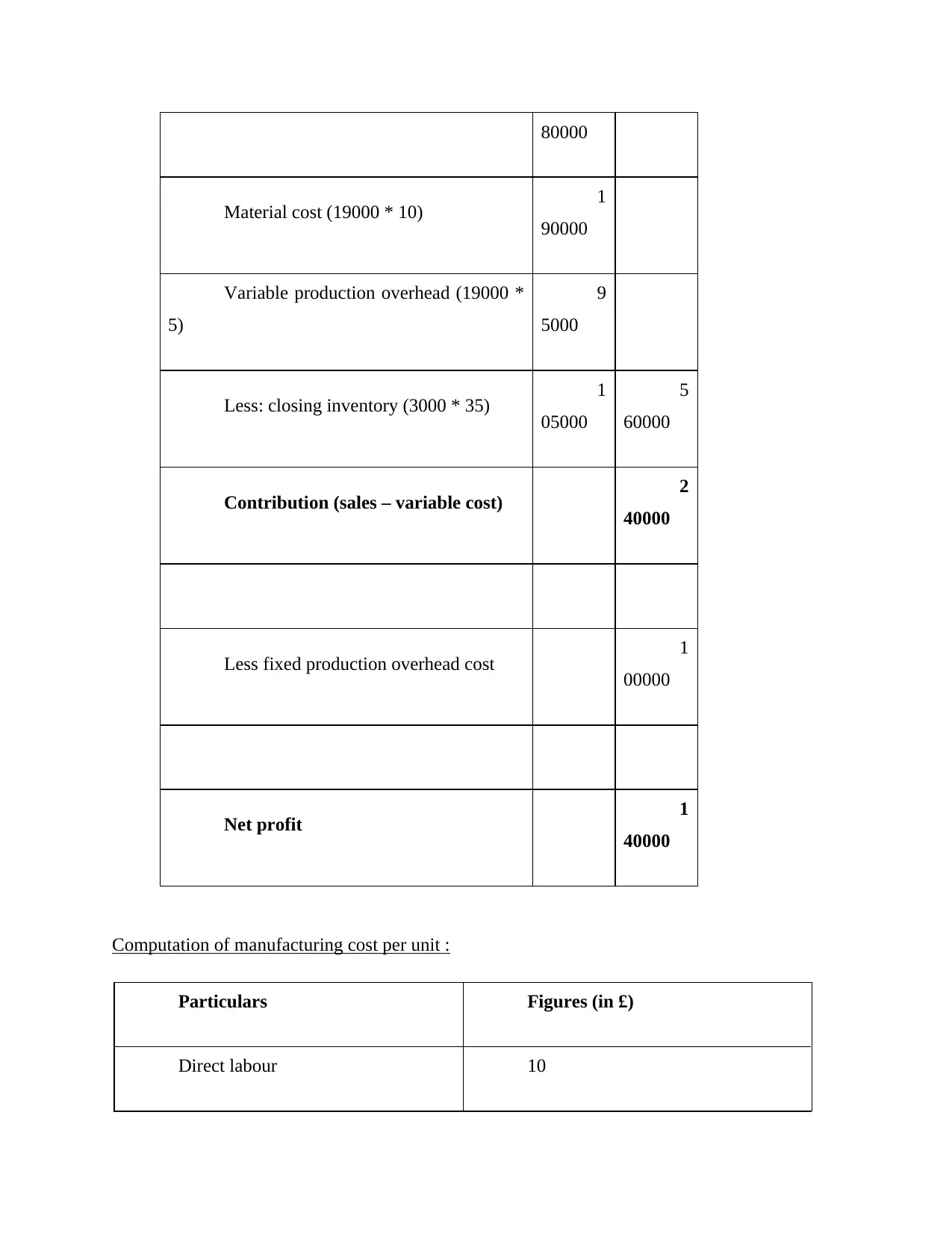

Particulars Figures (in £)

Direct labour 10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Direct material 20

Variable production overhead 5

Fixed production overhead 5.6

Total manufacturing cost per unit 35

TASK 3

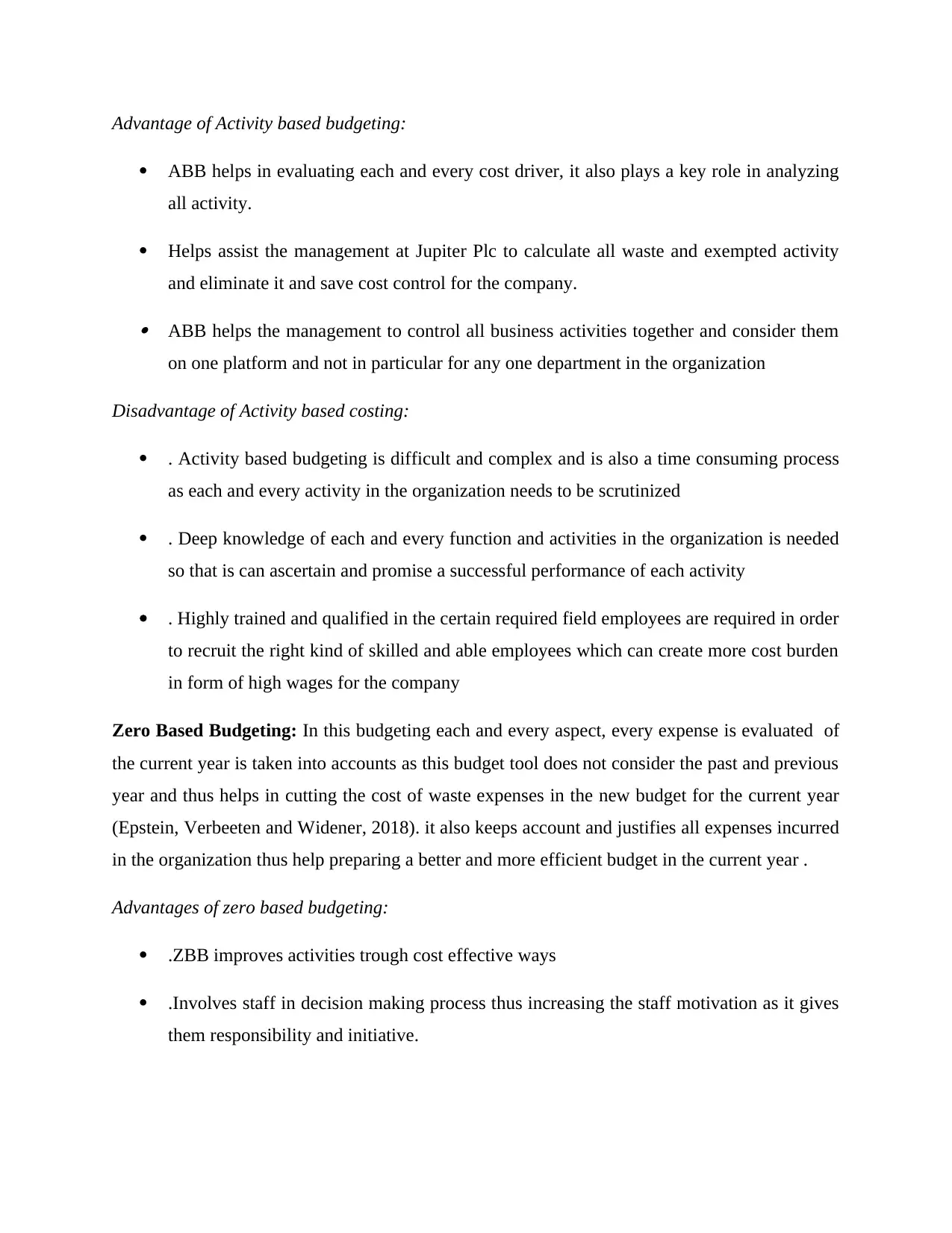

1. Explaining the advantage and disadvantage of planning tool used in budgetary control.

A budget is the calculation of the monetary and the expenses used in manufacturing a

product over specific future plan and objective of Jupiter PLC. Budgeting helps in making

monetary distribution for a specific year. Performance of business activity or

activities .Companies can establish and make new and different monetary budgets for different

activates in their organization. Budgetary control is the process which helps the company

differentiate and evaluate between the budget figures and the actual result or benefit for Jupiter

PLC. This tool also plays a vital role in controlling and the performance of the company set by

the budgeted performance in the specific year. There are advantages and disadvantages in this

planning tool for budgetary control, which are as follows:

Activity based budgeting: All activities go through proper scrutunity in order to get prepared

for the current year budget. in this tool the performance of the past year are not considered but

the last years activities are definitely evaluated in order to prepare a new budget for the future

(Giordano-Spring, Maurice and Cho, 2018). All activities are closely scrutinized, that have

incurred the cost are deeply evaluated and even those that were waste activities are brought into

consideration so that they can be avoided in future and those that wew profitable activities are

considered so that they can be included in future projects in the coming year.

Variable production overhead 5

Fixed production overhead 5.6

Total manufacturing cost per unit 35

TASK 3

1. Explaining the advantage and disadvantage of planning tool used in budgetary control.

A budget is the calculation of the monetary and the expenses used in manufacturing a

product over specific future plan and objective of Jupiter PLC. Budgeting helps in making

monetary distribution for a specific year. Performance of business activity or

activities .Companies can establish and make new and different monetary budgets for different

activates in their organization. Budgetary control is the process which helps the company

differentiate and evaluate between the budget figures and the actual result or benefit for Jupiter

PLC. This tool also plays a vital role in controlling and the performance of the company set by

the budgeted performance in the specific year. There are advantages and disadvantages in this

planning tool for budgetary control, which are as follows:

Activity based budgeting: All activities go through proper scrutunity in order to get prepared

for the current year budget. in this tool the performance of the past year are not considered but

the last years activities are definitely evaluated in order to prepare a new budget for the future

(Giordano-Spring, Maurice and Cho, 2018). All activities are closely scrutinized, that have

incurred the cost are deeply evaluated and even those that were waste activities are brought into

consideration so that they can be avoided in future and those that wew profitable activities are

considered so that they can be included in future projects in the coming year.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Advantage of Activity based budgeting:

ABB helps in evaluating each and every cost driver, it also plays a key role in analyzing

all activity.

Helps assist the management at Jupiter Plc to calculate all waste and exempted activity

and eliminate it and save cost control for the company.

ABB helps the management to control all business activities together and consider them

on one platform and not in particular for any one department in the organization

Disadvantage of Activity based costing:

. Activity based budgeting is difficult and complex and is also a time consuming process

as each and every activity in the organization needs to be scrutinized

. Deep knowledge of each and every function and activities in the organization is needed

so that is can ascertain and promise a successful performance of each activity

. Highly trained and qualified in the certain required field employees are required in order

to recruit the right kind of skilled and able employees which can create more cost burden

in form of high wages for the company

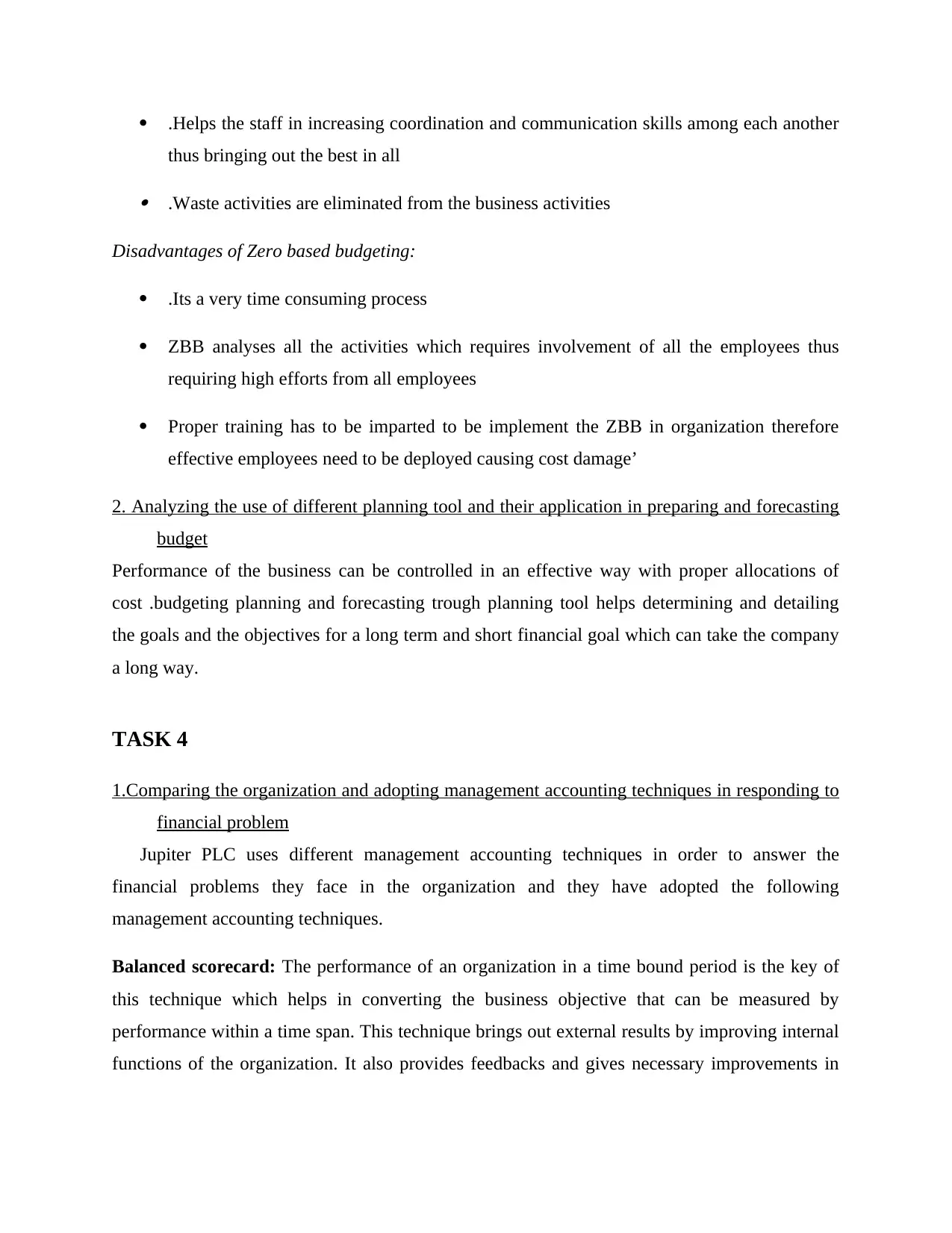

Zero Based Budgeting: In this budgeting each and every aspect, every expense is evaluated of

the current year is taken into accounts as this budget tool does not consider the past and previous

year and thus helps in cutting the cost of waste expenses in the new budget for the current year

(Epstein, Verbeeten and Widener, 2018). it also keeps account and justifies all expenses incurred

in the organization thus help preparing a better and more efficient budget in the current year .

Advantages of zero based budgeting:

.ZBB improves activities trough cost effective ways

.Involves staff in decision making process thus increasing the staff motivation as it gives

them responsibility and initiative.

ABB helps in evaluating each and every cost driver, it also plays a key role in analyzing

all activity.

Helps assist the management at Jupiter Plc to calculate all waste and exempted activity

and eliminate it and save cost control for the company.

ABB helps the management to control all business activities together and consider them

on one platform and not in particular for any one department in the organization

Disadvantage of Activity based costing:

. Activity based budgeting is difficult and complex and is also a time consuming process

as each and every activity in the organization needs to be scrutinized

. Deep knowledge of each and every function and activities in the organization is needed

so that is can ascertain and promise a successful performance of each activity

. Highly trained and qualified in the certain required field employees are required in order

to recruit the right kind of skilled and able employees which can create more cost burden

in form of high wages for the company

Zero Based Budgeting: In this budgeting each and every aspect, every expense is evaluated of

the current year is taken into accounts as this budget tool does not consider the past and previous

year and thus helps in cutting the cost of waste expenses in the new budget for the current year

(Epstein, Verbeeten and Widener, 2018). it also keeps account and justifies all expenses incurred

in the organization thus help preparing a better and more efficient budget in the current year .

Advantages of zero based budgeting:

.ZBB improves activities trough cost effective ways

.Involves staff in decision making process thus increasing the staff motivation as it gives

them responsibility and initiative.

.Helps the staff in increasing coordination and communication skills among each another

thus bringing out the best in all

.Waste activities are eliminated from the business activities

Disadvantages of Zero based budgeting:

.Its a very time consuming process

ZBB analyses all the activities which requires involvement of all the employees thus

requiring high efforts from all employees

Proper training has to be imparted to be implement the ZBB in organization therefore

effective employees need to be deployed causing cost damage’

2. Analyzing the use of different planning tool and their application in preparing and forecasting

budget

Performance of the business can be controlled in an effective way with proper allocations of

cost .budgeting planning and forecasting trough planning tool helps determining and detailing

the goals and the objectives for a long term and short financial goal which can take the company

a long way.

TASK 4

1.Comparing the organization and adopting management accounting techniques in responding to

financial problem

Jupiter PLC uses different management accounting techniques in order to answer the

financial problems they face in the organization and they have adopted the following

management accounting techniques.

Balanced scorecard: The performance of an organization in a time bound period is the key of

this technique which helps in converting the business objective that can be measured by

performance within a time span. This technique brings out external results by improving internal

functions of the organization. It also provides feedbacks and gives necessary improvements in

thus bringing out the best in all

.Waste activities are eliminated from the business activities

Disadvantages of Zero based budgeting:

.Its a very time consuming process

ZBB analyses all the activities which requires involvement of all the employees thus

requiring high efforts from all employees

Proper training has to be imparted to be implement the ZBB in organization therefore

effective employees need to be deployed causing cost damage’

2. Analyzing the use of different planning tool and their application in preparing and forecasting

budget

Performance of the business can be controlled in an effective way with proper allocations of

cost .budgeting planning and forecasting trough planning tool helps determining and detailing

the goals and the objectives for a long term and short financial goal which can take the company

a long way.

TASK 4

1.Comparing the organization and adopting management accounting techniques in responding to

financial problem

Jupiter PLC uses different management accounting techniques in order to answer the

financial problems they face in the organization and they have adopted the following

management accounting techniques.

Balanced scorecard: The performance of an organization in a time bound period is the key of

this technique which helps in converting the business objective that can be measured by

performance within a time span. This technique brings out external results by improving internal

functions of the organization. It also provides feedbacks and gives necessary improvements in

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.