Analysis of Management Accounting Systems and Techniques - Zylla

VerifiedAdded on 2024/05/30

1

Paraphrase This Document

Introduction........................................................................................................................3

LO1: Demonstrate an understanding of management accounting systems.....................3

Explain management accounting and give the essential requirements of different types

of management accounting. [P1].......................................................................................3

Explain different methods used for management accounting reporting. [P2]...................5

LO2: Apply a range of management accounting techniques............................................8

Calculate costs using appropriate techniques of cost analysis to prepare an income

statement using marginal and absorption costing. (You may use attached data or your

own) [P3]............................................................................................................................8

LO3: Explain the use of planning tools used in management accounting......................11

Explain the advantages and disadvantages of different types of planning tools used in

budgetary control [P4]......................................................................................................11

LO4: Compare ways in which organizations could use management accounting to

respond to financial problems..........................................................................................15

Compare how organizations are adapting management accounting systems to respond

to financial problems. [P 5]..............................................................................................15

Conclusion.......................................................................................................................18

Reference List..................................................................................................................19

2

Business process in the last few years got very much complicated and even tough to

run in a systematic way. Therefore, many companies have adopted the use of

accounting management, which is considered to be one of the best way to handle

business operations. In this assignment, evaluation of system management from the

business context of Zylla is made to understand the effectiveness of system

management in the organization. Business accounting management is considered to be

a set of actions that are made to ease the complexity of the business process. Zylla is a

company that has business market in different parts of the world with its headquarter in

UK. This assignment will analyze the impact of accounting management in the business

process and this assignment will help the higher authorizes regarding the suitability of

accounting management in the business process.

LO1: Demonstrate an understanding of management accounting systems

Explain management accounting and give the essential requirements of different

types of management accounting. [P1].

Business accounting management is the set of activities through which an organization

makes effectives business process by reducing the various hindrances, which limits the

business performances. Management accounting is the systematic process, which

allows an organization like, Zylla to perform their business process in the required

manner. As Zylla, an international company, which performs business activities in

different parts of the world, it is very much necessary to adopt management accounting

in order to perform the business activities more effectively. Management accounting will

help the managers of the business to understand the business conditions more

specifically, which will allow them to make proper decision regarding business

strategies.

Financial accounting and management accounting are completely different activities,

which allow the business to understand the business process more closely.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

discussed below:

Financial management are activities that are limited by various rules that are

made by the standard boards of accounting while, management accounting are

not restricted by any rules and regulations.

Financial accounting is compulsory for any business that is making business in

the market. Whereas, management accounting is not mandatory for any firm that

is making business in the market.

Purpose of various external public of a business is met with financial accounting

while, management accounting does not meet any purpose of any external public

of the business.

Before implementing the management accounting in the business process of Zylla, the

managers of the business must look upon few factors like, management of the

inventory, cost accounting and costing of job. These factors will help the managers to

understand in which area there is need for management accounting. The following

factors and their systems are discussed below:

Inventory management system

The management of inventory is an essential part of a business because it determines

the sales of the business. It is important to make a smooth and effective sale in order to

grow the company, which can get managed by choosing the appropriate management

accounting system for inventory (Gluhovsky et al., 2016). Some of the effective

management accounting systems involves FIFO, AVCO and LIFO. The managers of the

chosen firm must understand the importance of these three systems to identify which

system can support the business and must adopt the suitable system. This will allow the

business to make proper sales in the market.

Cost accounting system

One of the essential factor that a business always consider is controlling the level of

cost and level of income and this system is designed in order to control these factors.

4

Paraphrase This Document

motive is to make effective cost accounting (da Rosa et al., 2015). Cost is the most

essential part of the business cost accounting system. Cost accounting system’s

effectiveness totally depends on the selection process of cost accounting system

methods by the management teams of the business. The various systems of cost

accounting involve standard costing, managerial costing and absorption costing. This is

essential for the authority of the organization to make right choice among the available

systems in order to make effective costing.

Job costing system

In this business system, the complete process of production is broke down into smaller

units and each small part is called to be job, which enables the managers of the chosen

business to make effective controlling of business activities (Weygandt et al., 2015).

This is an essential part of the business, which the managers of the chosen business

must consider in order to ease the activities that are there in the business. The use of

job costing system enables the managers of the firm to control the business cost easily.

Explain different methods used for management accounting reporting. [P2].

The process of management accounting works on the information that is gathered from

different business reports. The received reports from various department of the

business help the managers of the chosen company Zylla, to understand the recent

business position by measuring the recent performance of the company. To make the

management accounting, the reports that are required by the manager to make effective

process are mentioned below:

Reporting through sales report:

Sales report of an organization is the key to understand the turnover ratio of the firm by

the manager. This allows the managers to determine whether the business is

performing according to the desired manner or not (Lys et al., 2015). The sales report

also reflects the income level of the firm, which allows the manager to identify the cash

5

performance level of the company.

Reporting through budgets:

Budget reports are the most essential factor for any organization because it reflects the

pre-assumed cost estimation for running the business for the coming financial year. This

budget report also reflects the financial performance of the business in the past years

(Kerr et al., 2015). This business report helps the managers of the chosen business to

control the financial resources and to utilize them in the needed place to establish the

business and also helps in reducing the cost.

Reporting through variance analysis:

Report of variance analysis shed light on the gap that is there in the performed

performance and the actual needed performance of the business. This helps the

managers of the business to understand the areas in which there is the need of

development. This report identifies the performances of various department, which

enables the managers of the firm to understand the departmental performance

individually (Shamseer et al., 2015). Thus, this is one of the essential part of the

management accounting that helps in improving the performance level of the

department and the company as a whole.

Reporting through production report:

Report of production helps the managers of the chosen organization in determining the

standard of production, which is an essential part of the business for its growth. The

report from the production shed light on the resources that are used for the production

purposes, cost that is related to the production and the total volume of produced goods

or services (AE et al., 2018). As it involves all these three factors related to production,

the managers can easily control the cost and volume and even the standard of the

produced product, which is directly proportional to the growth of the business and its

functioning.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

managers of the business to understand the number of commodity or service that is

already produced by the firm and what additional quantity is required to meet the

business performance (Chang et al., 2014). This report gives the clear picture of the

firm’s inventory and even determines the number of goods that are required to get

produced by the organization. Thus, the manager of the firm can understand the sales

flow of the business.

Hence, it can be concluded from the above discussion that, reporting system of the

management accounting is an essential part of the business because it helps the

manager of the organization to make closer look to various areas of the business

process. The need for management accounting in Zylla is extreme at the time of

strategy making and planning. It helps the managers of the organization to access all

the current performance report from various departments, which will allow them to make

effective business plans.

7

Paraphrase This Document

Calculate costs using appropriate techniques of cost analysis to prepare an

income statement using marginal and absorption costing. (You may use attached

data or your own) [P3].

Cost analysis is a tool that is used by the manager of an organization in order to create

the income statement of the business (Boardman et al., 2017). This is done by

analyzing the profit rate of the business and the costs that the business used in various

departments.

Cost is the financial resource that is used by the company to acquire other resources

that can be both material resource and human resource. Costs are mainly of three types

and they are:

Fixed cost, are the cost that are constant such as, electric bills and rent (if any)

Semi Cost, are the cost that are partial and can be controlled like, telephone

bills.

Variable Cost, are the costs that can easy be replaced like, incentives of an

employee.

By conducting cost analysis, the managers of an organization can fetch the amount of

financial resource that the company uses as cost. Absorption costing technique is a

process, which involves measurement of both the fixed and variable cost that are used

in the production process. Marginal costing is the process where the manager of the

organization considers the variable costs, which the business uses for its production

purpose.

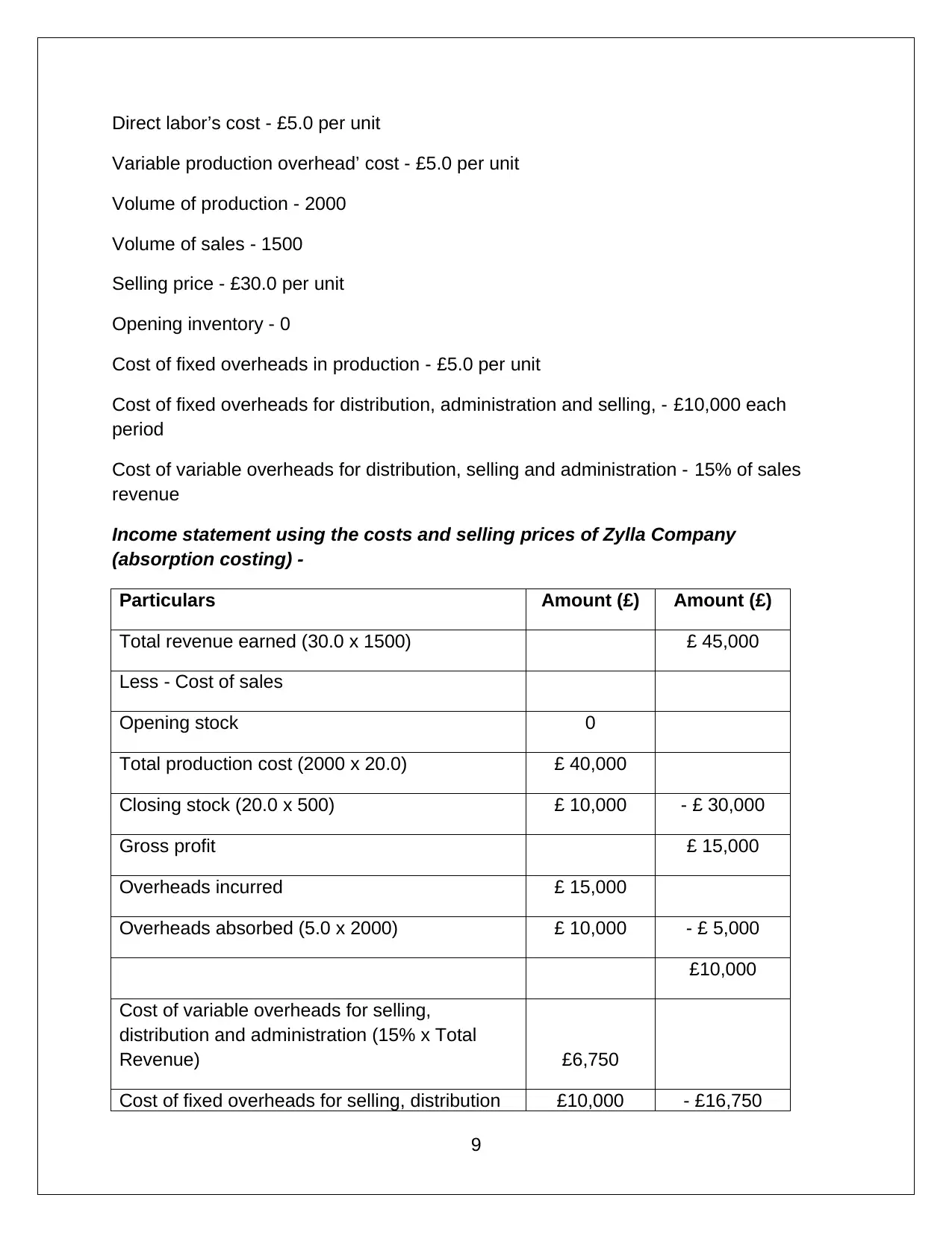

In case for Zylla, the assumed cost for a specific timeframe is given below, which

involves the marginal and absorption cost that is used by the company to execute the

business process.

Direct material’s cost - £8.0 per unit

8

Variable production overhead’ cost - £5.0 per unit

Volume of production - 2000

Volume of sales - 1500

Selling price - £30.0 per unit

Opening inventory - 0

Cost of fixed overheads in production - £5.0 per unit

Cost of fixed overheads for distribution, administration and selling, - £10,000 each

period

Cost of variable overheads for distribution, selling and administration - 15% of sales

revenue

Income statement using the costs and selling prices of Zylla Company

(absorption costing) -

Particulars Amount (£) Amount (£)

Total revenue earned (30.0 x 1500) £ 45,000

Less - Cost of sales

Opening stock 0

Total production cost (2000 x 20.0) £ 40,000

Closing stock (20.0 x 500) £ 10,000 - £ 30,000

Gross profit £ 15,000

Overheads incurred £ 15,000

Overheads absorbed (5.0 x 2000) £ 10,000 - £ 5,000

£10,000

Cost of variable overheads for selling,

distribution and administration (15% x Total

Revenue) £6,750

Cost of fixed overheads for selling, distribution £10,000 - £16,750

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Net profit - £6750

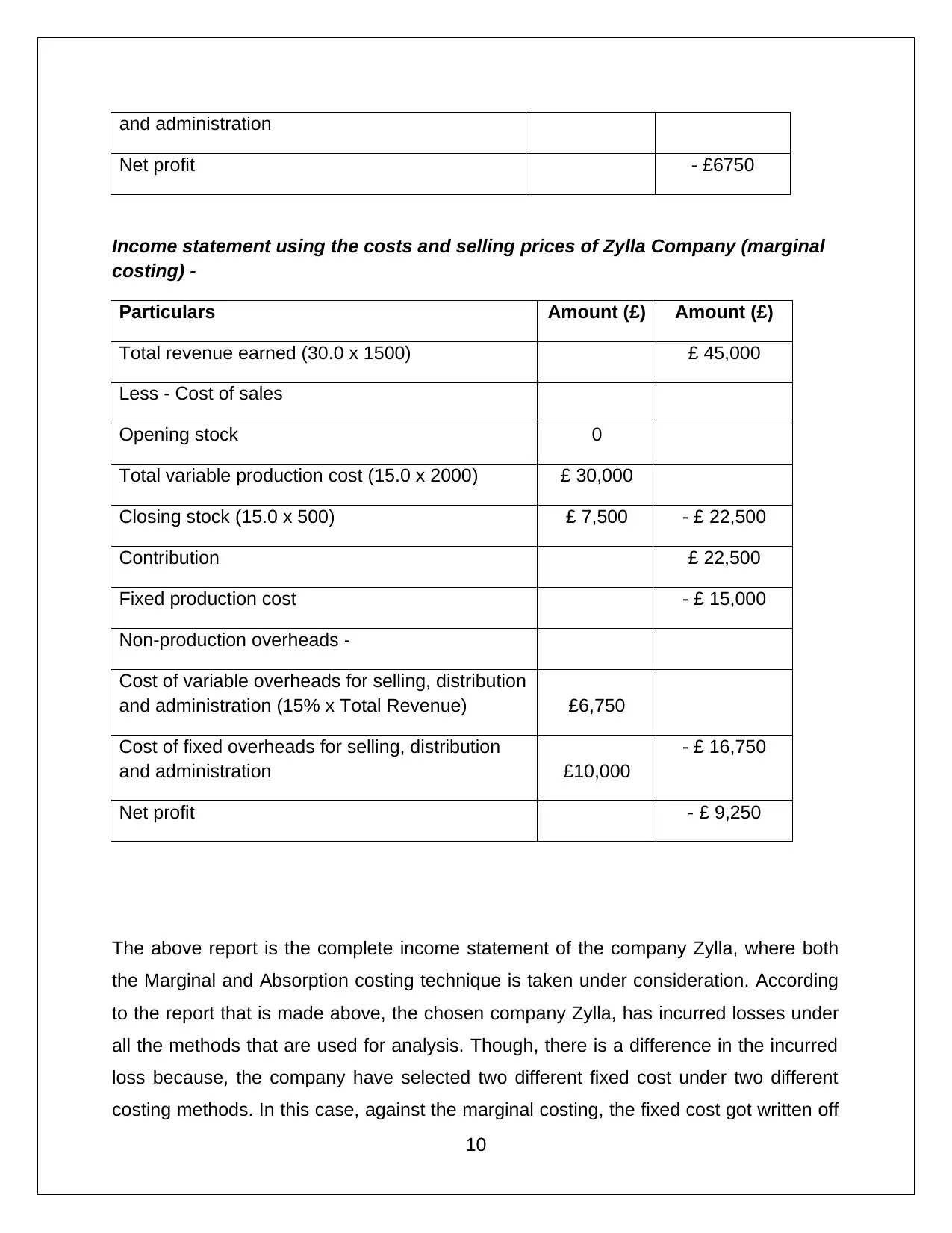

Income statement using the costs and selling prices of Zylla Company (marginal

costing) -

Particulars Amount (£) Amount (£)

Total revenue earned (30.0 x 1500) £ 45,000

Less - Cost of sales

Opening stock 0

Total variable production cost (15.0 x 2000) £ 30,000

Closing stock (15.0 x 500) £ 7,500 - £ 22,500

Contribution £ 22,500

Fixed production cost - £ 15,000

Non-production overheads -

Cost of variable overheads for selling, distribution

and administration (15% x Total Revenue) £6,750

Cost of fixed overheads for selling, distribution

and administration £10,000

- £ 16,750

Net profit - £ 9,250

The above report is the complete income statement of the company Zylla, where both

the Marginal and Absorption costing technique is taken under consideration. According

to the report that is made above, the chosen company Zylla, has incurred losses under

all the methods that are used for analysis. Though, there is a difference in the incurred

loss because, the company have selected two different fixed cost under two different

costing methods. In this case, against the marginal costing, the fixed cost got written off

10

Paraphrase This Document

process of the business. As the incurred loss got lowered in the absorption technique of

costing method, it is considered to be the suitable costing technique for this case study,

as per the view point of the managers of the business.

LO3: Explain the use of planning tools used in management accounting

Explain the advantages and disadvantages of different types of planning tools used

in budgetary control [P4].

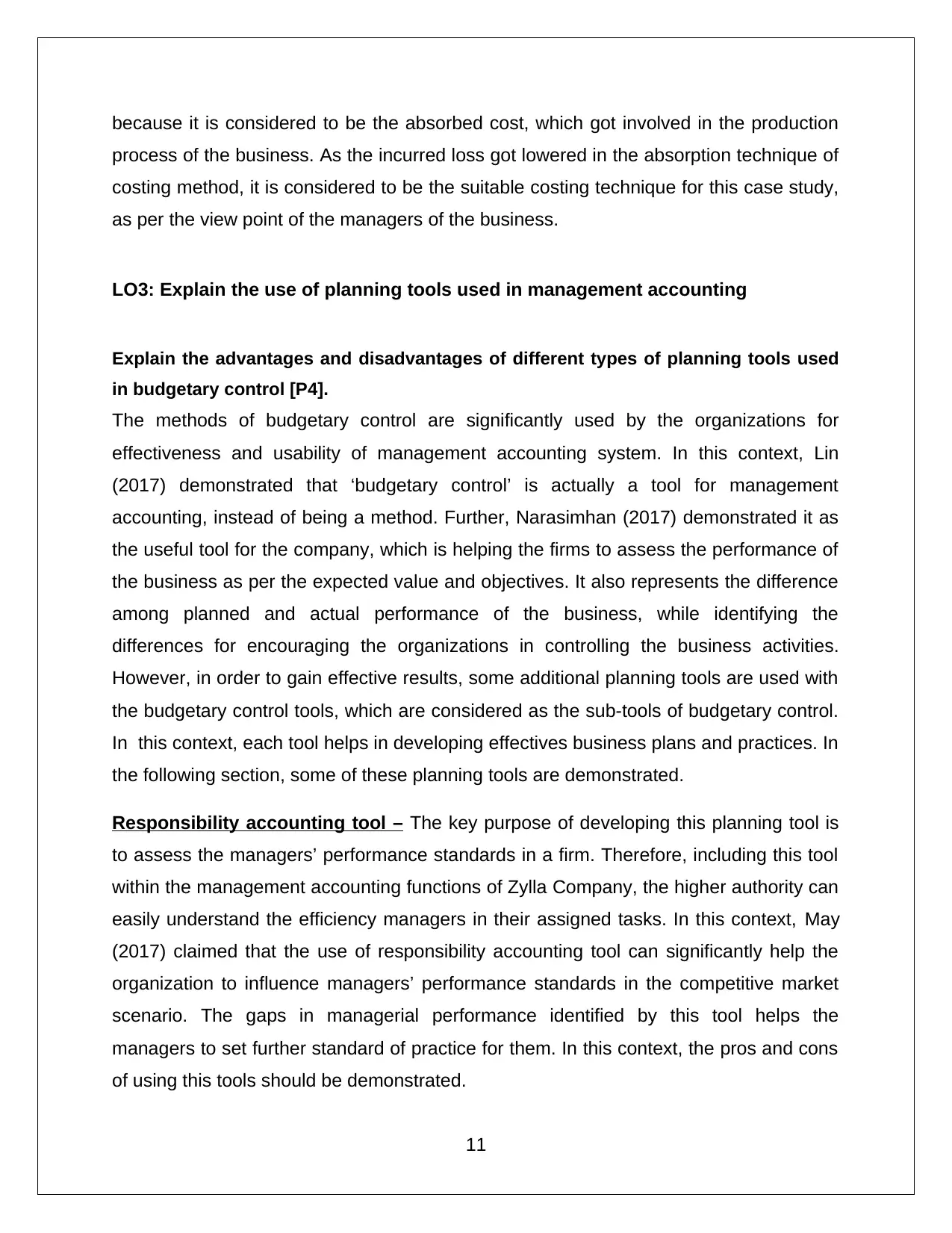

The methods of budgetary control are significantly used by the organizations for

effectiveness and usability of management accounting system. In this context, Lin

(2017) demonstrated that ‘budgetary control’ is actually a tool for management

accounting, instead of being a method. Further, Narasimhan (2017) demonstrated it as

the useful tool for the company, which is helping the firms to assess the performance of

the business as per the expected value and objectives. It also represents the difference

among planned and actual performance of the business, while identifying the

differences for encouraging the organizations in controlling the business activities.

However, in order to gain effective results, some additional planning tools are used with

the budgetary control tools, which are considered as the sub-tools of budgetary control.

In this context, each tool helps in developing effectives business plans and practices. In

the following section, some of these planning tools are demonstrated.

Responsibility accounting tool – The key purpose of developing this planning tool is

to assess the managers’ performance standards in a firm. Therefore, including this tool

within the management accounting functions of Zylla Company, the higher authority can

easily understand the efficiency managers in their assigned tasks. In this context, May

(2017) claimed that the use of responsibility accounting tool can significantly help the

organization to influence managers’ performance standards in the competitive market

scenario. The gaps in managerial performance identified by this tool helps the

managers to set further standard of practice for them. In this context, the pros and cons

of using this tools should be demonstrated.

11

It is a self-motivating tool for the managers, as this tool helps the manager to

understand their own performance status and can set goals for improving performance

by identifying weaknesses

It has significant contribution in managerial performance development, which is in turn

contributing in reshaping the organizational overall performance

Disadvantages:

This responsibility accounting tool can only be applied, upon clarifying the roles and

responsibilities of the manager

Using this tool is complex for the new managers, as they would not have enough

knowledge of utilizing this accounting tool

Variance analysis tool – Another crucial planning tool for budgetary control method,

which is useful managers of Zylla Company, is variance analysis tool. According to

Shepherd (2015), this tool is highly effective in terms of influencing managers working in

firms, which are operating its business highly competitive business environment. in this

context, while using this analysis tool, managers become able to set standards, aligning

with each activity, they are serving for the business. These standards further help the

managers to highlight the gap in their performance, aligning with the expected

performance in the business context. Further, this planning tool also helps the

organization to identify the loopholes in the performance of the entire business

(Soderstrom et al., 2017). It is compatible to be used in modern business scenario, but

in some cases it’s application is limited. These limitations and benefits are

demonstrated below.

Benefits:

Variance analysis helps the firm to develop enhanced strategies for business

development, which further improves the overall performance standard of the

organization

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

business performance standards, while focusing upon the weak areas in the business

(Taipaleenmaki and Ikaheimo, 2013)

Limitations:

Although variance analysis indicates the presence of gaps in organizational

performance, the tool is unable to indicate the reasons for which the performance

standard gaps are raised, which is a key limitation of the tool

The process need huge time, as it needs to analyze each activity separately, for which

the entire time for completing the assessment enhances (Soderstrom et al., 2017)

Standard costing tool – Several organizations in the current era are using this

management accounting tool in budget control. This tool has significant similarity with

the variance analysis method, only difference is that it is focusing upon the cost levels of

the business. It attempts to lower the overall cost for the business operations, by

utilizing the resources properly. In the following section, the pros and cons of the tool

has been demonstrated briefly.

Advantages:

Standard costing is highly effective for improving the performance standard at

departmental level. It highlights that the performance of each managers at each

company unit are able to identify and understand the performance status of the

particular year, which ultimately influences the managers to create improved

strategies for the betterment of the performance (Taipaleenmaki and Ikaheimo, 2013)

Standard costing can effectively control overall cost of the business. The tool

considers both the variable and fixed cost, thereby controlling the total cost of the

business becomes easier

Disadvantages:

This tool is complex to understand and implement, as the managers often lack

adequate knowledge and skills to implement the tool successfully, which hinders it’s

effective outcomes (May, 2017)

13

Paraphrase This Document

performance of employees, thereby contributing negatively in the performance

enhancement of the company

CVP analysis – The CVP analysis tool has been used as a planning tool within the

budgetary control system of the business from long time. This tool has wider

application, due to its easy and simple nature. The CVP analysis allows the managers

to gain awareness about the key consequences related to change in cost and volume of

business, in terms of total and net revenue of the business (Soderstrom et al., 2017).

The key pros and cons of the system are demonstrated below.

Advantages:

The tool is easily understood and easily implemented, which makes it easy to be

adopted by the new managers, as it does not include complex statistics

This tool also establishes the association among cost, volume and business revenue,

which helps in developing improved business strategies

Disadvantages:

This tool significantly time-consuming, which limits its’ application

Sometimes this tool fails in forecasting future performance standard, which further

limits its usability in current era

14

respond to financial problems.

Compare how organizations are adapting management accounting systems to

respond to financial problems. [P 5].

Financial problem or crisis is something that is faced by every company while making

their business in the market, which limits the businesses to generate more revenue..

This happens because of the high involvement of competition among the competitors of

the business in the market. Management accounting system being a complete package

of problem solving techniques have some sub-systems, which enables the managers in

solving financial problems that are faced by the chosen company, Zylla. The sub-

systems are discussed below:

Activity-based costing

This sub-system of management accounting system deals with the activities that are

performed in the business process in order to accomplish and meet the business goals

and objectives. This sub-system monitors every single activity that are getting

performed and even prioritize them according the contribution that they make in the

business process (Kaplan et al., 2014). This sub-system is adopted in order to reduce

the financial hindrances and even to control the cost of activities by omitting the

unnecessary activities. As this sub-system controls the cost of activities, it will help in

enhancing the level of income of the business by limiting the cost that the company

uses in different unnecessary areas. By doing this the company can get benefited in

solving their financial problems, which will allow the business to gain financial health.

Balanced scorecard system

This sub-system of management accounting system deals with various financial crisis

that are generated from various perspective like, internal process, knowledge of the

employees, satisfaction of the targeted customers and finance. According to

Hladchenko (2015), it is a modernize management tool that are used to analyze the

15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

analyzed under four legs and they are:

First leg: In this leg, the analysis is made to understand in what manned the

information is gathered and how the gathered information can be converted to

make competitive advantage over the competitors.

Second leg: In this leg, evaluation of the business process is made to

understand the quality of the manufactured products. This leg also analyzed in

order to track if there in any gap, shortage or any waste.

Third leg: It is measured by collection of customers’ satisfaction level information

by receiving feedback of the produced product, which is compared with the

quality of the product, price of the product and availability of the product.

Fourth leg: This involves the collection of data like the income and the sales of

the product that is produced by the business, which is necessary to understand

the financial performance of the business. This fourth leg is the financial metrics,

which includes financial ratios, income targets and dollar amounts.

With the help of this sub-system of the management, accounting system the managers

of the organization analyses the business financial problems, which helps them to

understand the errors of the business more closely. This helps the management team of

the organization in making proper decision to overcome the financial problems.

Budgeting

Budgeting is the estimation of a business finance that the business is about to meet

within a financial year. Budgeting is a tool that is used for developing effective financial

strategies. With the help of budgeting, the managers of an organization understand the

past and current financial performances and even the various hindrances that the

organization is facing in the financial areas (Schick, 2015). This tool of planning helps

the managers of the chosen organization to make effective planning, which will help the

organization to overcome the financial crisis and helps in improving the financial

performances. While the managers of the firm develop the budget, the practical

16

Paraphrase This Document

the business, which makes the development of the organization.

17

From the above assessment is can easily be concluded that management accounting is

an essential part of a business like, Zylla. As i is a company that operated from various

parts of the world, the company must adopt the management accounting in order to

make effective performance in the market. From the above assessment, it can be seen

that many areas of the business can be understood that needs proper controlling. The

various sub-systems can help the managers of the business in understanding the

various areas where the business is lacking proper strategy making. Tools like,

inventory management has helped the managers to understand the scope of production

by looking at the sales number and the number of produced product, which enabled

them to produce the right quantity. Thus, the managers can make strategies to abolish

the unimportant production, which helped in monitoring the cost that was getting

wasted. This has helped in gaining the financial health of the organization. The other

tools like activity-based costing technique has helped the management team of the

chosen organization in monitoring the performed activities of the employees and the

business process, which helped the managers to develop plans against the unwanted

activities, which again controls the financial wastages. This helped the company to

increase the income and even to overcome the financial crisis that the business was

facing.

18

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

AE, A.E., Schouten, K. and Klijn, E.H., 2018. Framing a Conflict! How Media Report on

Earthquake Risks Caused by Gas Drilling: A Longitudinal Analysis Using Machine

Learning Techniques of Media Reporting on Gas Drilling from 1990 to 2015. Journalism

Studies, pp.1-21.

Boardman, A.E., Greenberg, D.H., Vining, A.R. and Weimer, D.L., 2017. Cost-benefit

analysis: concepts and practice. Cambridge University Press.

Chang, K., Manohar, N.D. and Wilhm, R.K., International Business Machines Corp,

2014. Dynamic report mapping apparatus to physical data source when creating report

definitions for information technology service management reporting for peruse of report

definition transparency and reuse. U.S. Patent 8,712,965.

da Rosa, F.S., da Silva, L.C. and Soares, S.V., 2015. International Public Sector

Accounting Standards: the perception municipal accountants in Santa Catarina state

have about implementing a cost accounting system. CONTABILIDAD Y

NEGOCIOS, 10(19), pp.27-42.

Gluhovsky, I., Vernitsky, A. and Strygin, A., Bcd Travel Technology BV, 2016. Inventory

management system. U.S. Patent Application 15/264,225.

Hladchenko, M., 2015. Balanced Scorecard–a strategic management system of the

higher education institution. International Journal of Educational Management, 29(2),

pp.167-176.

Kaplan, R.S., Witkowski, M., Abbott, M., Guzman, A.B., Higgins, L.D., Meara, J.G.,

Padden, E., Shah, A.S., Waters, P., Weidemeier, M. and Wertheimer, S., 2014. Using

time-driven activity-based costing to identify value improvement opportunities in

healthcare. Journal of Healthcare Management, 59(6), pp.399-412.

Kerr, J., Rouse, P. and de Villiers, C., 2015. Sustainability reporting integrated into

management control systems. Pacific Accounting Review, 27(2), pp.189-207.

19

Paraphrase This Document

Accounting in Asia (pp. 105-108). Routledge.

Lys, T., Naughton, J.P. and Wang, C., 2015. Signaling through corporate accountability

reporting. Journal of Accounting and Economics, 60(1), pp.56-72.

May, R.A., 2017. An Investigation of Financial Accounting Statements and Reporting

Techniques (Doctoral dissertation, University of Mississippi).

Narasimhan, M.S., 2017. Variance Analysis: Labour Cost Variance.

Schick, A., 2015. The road to PPB: The stages of budget reform. In Public

Budgeting (pp. 39-56). Routledge.

Shamseer, L., Moher, D., Clarke, M., Ghersi, D., Liberati, A., Petticrew, M., Shekelle, P.

and Stewart, L.A., 2015. Preferred reporting items for systematic review and meta-

analysis protocols (PRISMA-P) 2015: elaboration and explanation. Bmj, 349, p.g7647.

Shepherd, R.W., 2015. Theory of cost and production functions. Princeton University

Press.

Soderstrom, K.M., Soderstrom, N.S. and Stewart, C.R., 2017. Sustainability/CSR

research in management accounting: A review of the literature. In Advances in

Management Accounting (pp. 59-85). Emerald Publishing Limited.

Taipaleenmaki, J. and Ikaheimo, S., 2013. On the convergence of management

accounting and financial accounting–the role of information technology in accounting

change. International Journal of Accounting Information Systems, 14(4), pp.321-348.

Weygandt, J.J., Kimmel, P.D. and Kieso, D.E., 2015. Financial & managerial

accounting. John Wiley & Sons.

20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

© 2024 | Zucol Services PVT LTD | All rights reserved.