Management Accounting Control Report & Efficiency Analysis: Amana Ltd

VerifiedAdded on 2023/06/11

|11

|3329

|154

Report

AI Summary

This report provides a comprehensive analysis of Amana Ltd's financial performance in the fiscal year 2020. It includes a monthly control report detailing the original budget, flexible budget, and variances, followed by an examination of the company's efficiency. The analysis identifies areas where Amana Ltd underperformed, such as revenue generation and cost management, and offers recommendations to the CEO for improvement, including focusing on increasing income, preparing robust budget plans, and preparing for future scenarios. Furthermore, the report evaluates the strategic options of establishing an online presence, comparing the costs and benefits of creating a dedicated online shop versus selling through Amazon, considering factors like reach, management costs, and fulfillment expenses. The report aims to provide actionable insights for Amana Ltd to enhance its financial performance and strategic decision-making.

Management

Accounting

Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

INTRODUCTION...........................................................................................................................3

PART A...........................................................................................................................................3

Create a monthly control report that includes the original budget, the flexible budget, and the

variations......................................................................................................................................3

Examine the control report and evaluate Amana Ltd.'s efficiency in the fiscal year 2020.........4

Make some suggestions for Amana's CEO on how to enhance the company.............................6

PART B...........................................................................................................................................7

Estimate after determining if Amana should accept to go online or establish its own online

shop, taking into account all of the company's expenditures.......................................................7

CONCLUSION................................................................................................................................9

REFERENCES..............................................................................................................................10

INTRODUCTION...........................................................................................................................3

PART A...........................................................................................................................................3

Create a monthly control report that includes the original budget, the flexible budget, and the

variations......................................................................................................................................3

Examine the control report and evaluate Amana Ltd.'s efficiency in the fiscal year 2020.........4

Make some suggestions for Amana's CEO on how to enhance the company.............................6

PART B...........................................................................................................................................7

Estimate after determining if Amana should accept to go online or establish its own online

shop, taking into account all of the company's expenditures.......................................................7

CONCLUSION................................................................................................................................9

REFERENCES..............................................................................................................................10

INTRODUCTION

This report discusses the productivity of the Amana Ltd company in the accounting year

2020, and if there is any misunderstanding in the enterprise's task or a difficulty in performance,

provide recommendations to the company's CEO for enhancing the department's operations.

Thus, generally, this aids in the understanding of the organization's numerous challenges, and

then they design a strategy plan to fix the firm's disruption (Pelz, 2019). Its major focus is on the

business's expansion and development in general. In the second section of this report, examine

what moves Mr. Amana made to improve the firm's efficiency, as well as how Mr. Amana set up

his business on his own website or sold his items on Amazon, both of which caused costs for the

company. This report, on the other hand, incorporates the idea of a budget. It covers budget

analysis and determining the sum of costs and income incurred over a specific period of time. It

essentially expresses how much money a person can spend and save over a set length of time.

PART A

Create a monthly control report that includes the original budget, the flexible budget, and the

variations.

The study discusses budget planning in terms of creativity, flexibility, and deviations. First

and foremost, it's critical to comprehend the monthly control budget. In general, the budget

expresses information based on data from the company's payroll operations, whereas overhead

expenses represent changes in spending and their utility (Hiebl, and Richter, 2018). The

company's most significant component is to assist the owner or leader in analysing the sample of

investments made by the entrepreneur. The corporation may find it challenging to comprehend

its disclosure. This report also enables the organization's high department to construct the

department's operating cost maintenance and begin to understand the techniques for lowering

business costs and expenditures.

Flexed budget: The budget also addresses the company's set of performance or

stages. In other words, the budget discusses the pricing structure that does not alter.

When a flexible budget is created, it is a back-to-back adjustment with firm

fluctuations in expenditure, and the benefit of this flexing budget is that it helps to

reduce money destruction. High opportunities and quick performance, on the other

hand, to transform the market and company environment. Data originality: This

This report discusses the productivity of the Amana Ltd company in the accounting year

2020, and if there is any misunderstanding in the enterprise's task or a difficulty in performance,

provide recommendations to the company's CEO for enhancing the department's operations.

Thus, generally, this aids in the understanding of the organization's numerous challenges, and

then they design a strategy plan to fix the firm's disruption (Pelz, 2019). Its major focus is on the

business's expansion and development in general. In the second section of this report, examine

what moves Mr. Amana made to improve the firm's efficiency, as well as how Mr. Amana set up

his business on his own website or sold his items on Amazon, both of which caused costs for the

company. This report, on the other hand, incorporates the idea of a budget. It covers budget

analysis and determining the sum of costs and income incurred over a specific period of time. It

essentially expresses how much money a person can spend and save over a set length of time.

PART A

Create a monthly control report that includes the original budget, the flexible budget, and the

variations.

The study discusses budget planning in terms of creativity, flexibility, and deviations. First

and foremost, it's critical to comprehend the monthly control budget. In general, the budget

expresses information based on data from the company's payroll operations, whereas overhead

expenses represent changes in spending and their utility (Hiebl, and Richter, 2018). The

company's most significant component is to assist the owner or leader in analysing the sample of

investments made by the entrepreneur. The corporation may find it challenging to comprehend

its disclosure. This report also enables the organization's high department to construct the

department's operating cost maintenance and begin to understand the techniques for lowering

business costs and expenditures.

Flexed budget: The budget also addresses the company's set of performance or

stages. In other words, the budget discusses the pricing structure that does not alter.

When a flexible budget is created, it is a back-to-back adjustment with firm

fluctuations in expenditure, and the benefit of this flexing budget is that it helps to

reduce money destruction. High opportunities and quick performance, on the other

hand, to transform the market and company environment. Data originality: This

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

budgeting idea aids in the understanding of previous expenditure and income data.

The budget is made with expenditures in mind, and it also aids in determining the

firm's new income.

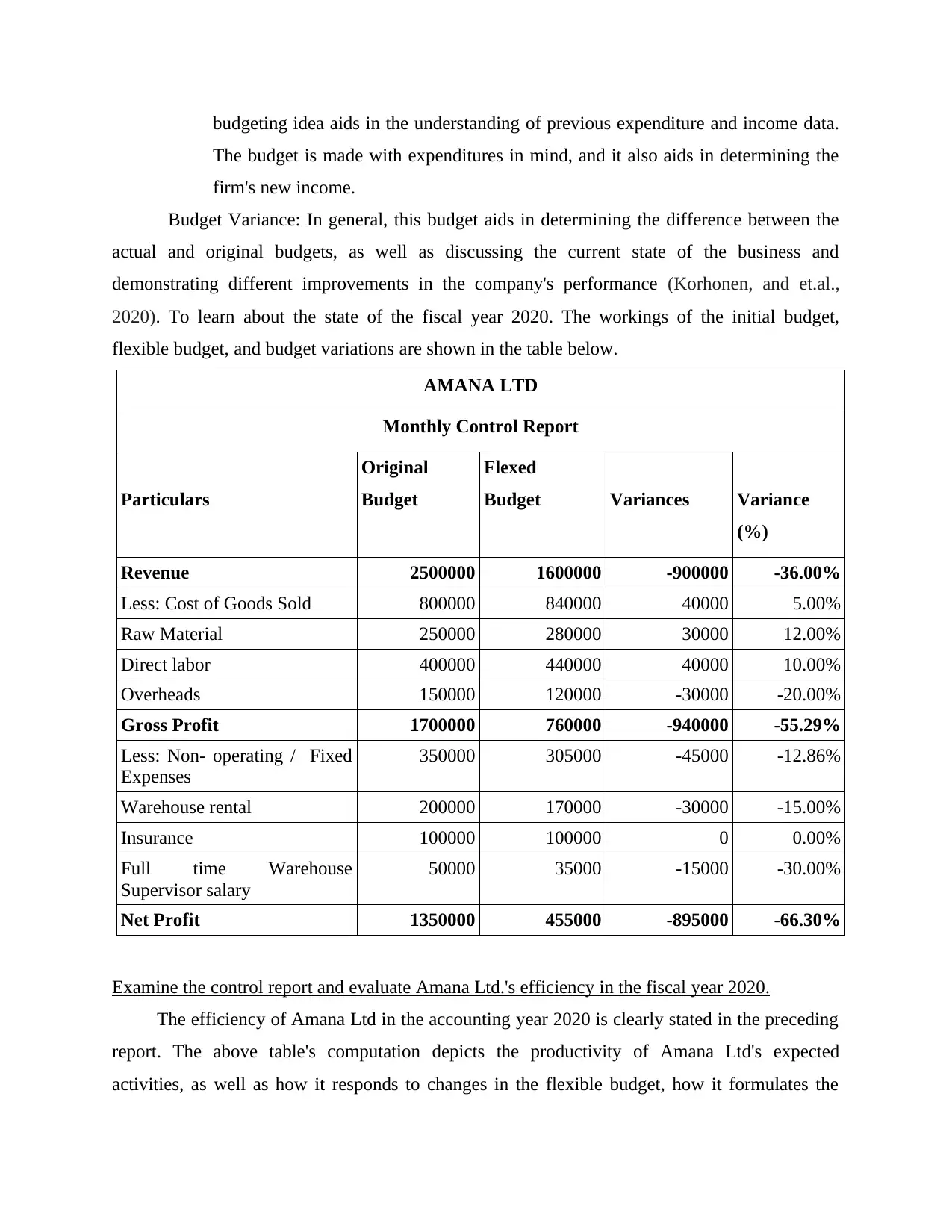

Budget Variance: In general, this budget aids in determining the difference between the

actual and original budgets, as well as discussing the current state of the business and

demonstrating different improvements in the company's performance (Korhonen, and et.al.,

2020). To learn about the state of the fiscal year 2020. The workings of the initial budget,

flexible budget, and budget variations are shown in the table below.

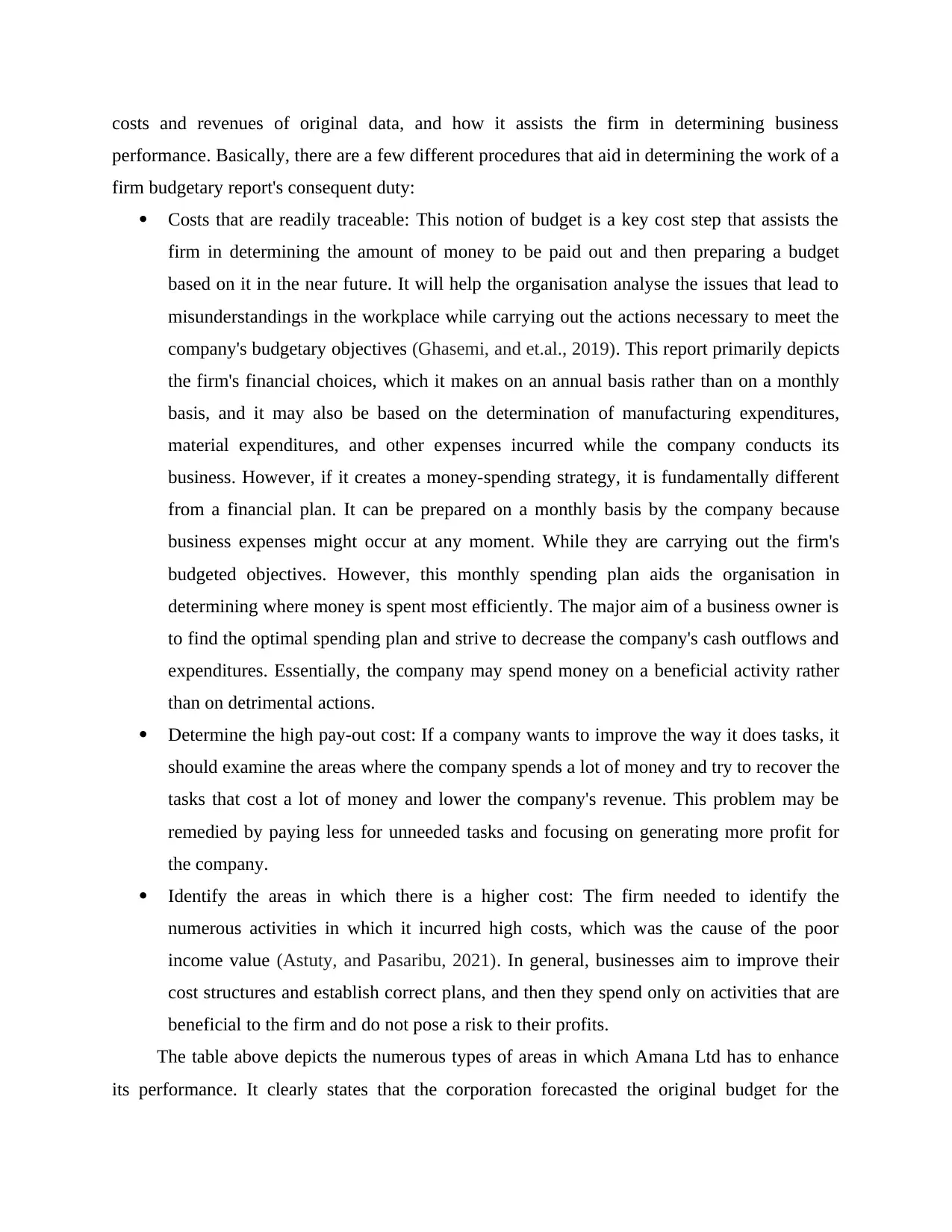

AMANA LTD

Monthly Control Report

Particulars

Original

Budget

Flexed

Budget Variances Variance

(%)

Revenue 2500000 1600000 -900000 -36.00%

Less: Cost of Goods Sold 800000 840000 40000 5.00%

Raw Material 250000 280000 30000 12.00%

Direct labor 400000 440000 40000 10.00%

Overheads 150000 120000 -30000 -20.00%

Gross Profit 1700000 760000 -940000 -55.29%

Less: Non- operating / Fixed

Expenses

350000 305000 -45000 -12.86%

Warehouse rental 200000 170000 -30000 -15.00%

Insurance 100000 100000 0 0.00%

Full time Warehouse

Supervisor salary

50000 35000 -15000 -30.00%

Net Profit 1350000 455000 -895000 -66.30%

Examine the control report and evaluate Amana Ltd.'s efficiency in the fiscal year 2020.

The efficiency of Amana Ltd in the accounting year 2020 is clearly stated in the preceding

report. The above table's computation depicts the productivity of Amana Ltd's expected

activities, as well as how it responds to changes in the flexible budget, how it formulates the

The budget is made with expenditures in mind, and it also aids in determining the

firm's new income.

Budget Variance: In general, this budget aids in determining the difference between the

actual and original budgets, as well as discussing the current state of the business and

demonstrating different improvements in the company's performance (Korhonen, and et.al.,

2020). To learn about the state of the fiscal year 2020. The workings of the initial budget,

flexible budget, and budget variations are shown in the table below.

AMANA LTD

Monthly Control Report

Particulars

Original

Budget

Flexed

Budget Variances Variance

(%)

Revenue 2500000 1600000 -900000 -36.00%

Less: Cost of Goods Sold 800000 840000 40000 5.00%

Raw Material 250000 280000 30000 12.00%

Direct labor 400000 440000 40000 10.00%

Overheads 150000 120000 -30000 -20.00%

Gross Profit 1700000 760000 -940000 -55.29%

Less: Non- operating / Fixed

Expenses

350000 305000 -45000 -12.86%

Warehouse rental 200000 170000 -30000 -15.00%

Insurance 100000 100000 0 0.00%

Full time Warehouse

Supervisor salary

50000 35000 -15000 -30.00%

Net Profit 1350000 455000 -895000 -66.30%

Examine the control report and evaluate Amana Ltd.'s efficiency in the fiscal year 2020.

The efficiency of Amana Ltd in the accounting year 2020 is clearly stated in the preceding

report. The above table's computation depicts the productivity of Amana Ltd's expected

activities, as well as how it responds to changes in the flexible budget, how it formulates the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

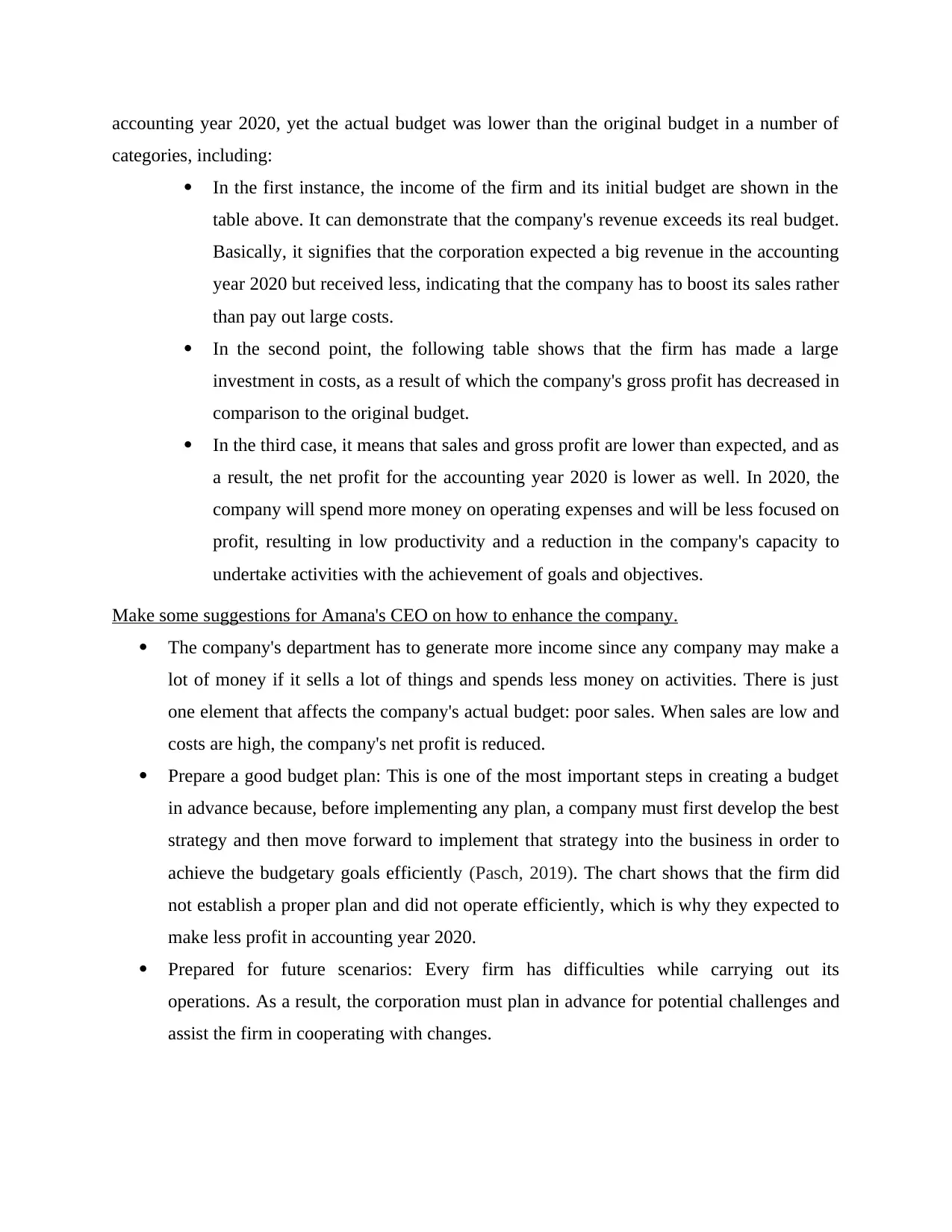

costs and revenues of original data, and how it assists the firm in determining business

performance. Basically, there are a few different procedures that aid in determining the work of a

firm budgetary report's consequent duty:

Costs that are readily traceable: This notion of budget is a key cost step that assists the

firm in determining the amount of money to be paid out and then preparing a budget

based on it in the near future. It will help the organisation analyse the issues that lead to

misunderstandings in the workplace while carrying out the actions necessary to meet the

company's budgetary objectives (Ghasemi, and et.al., 2019). This report primarily depicts

the firm's financial choices, which it makes on an annual basis rather than on a monthly

basis, and it may also be based on the determination of manufacturing expenditures,

material expenditures, and other expenses incurred while the company conducts its

business. However, if it creates a money-spending strategy, it is fundamentally different

from a financial plan. It can be prepared on a monthly basis by the company because

business expenses might occur at any moment. While they are carrying out the firm's

budgeted objectives. However, this monthly spending plan aids the organisation in

determining where money is spent most efficiently. The major aim of a business owner is

to find the optimal spending plan and strive to decrease the company's cash outflows and

expenditures. Essentially, the company may spend money on a beneficial activity rather

than on detrimental actions.

Determine the high pay-out cost: If a company wants to improve the way it does tasks, it

should examine the areas where the company spends a lot of money and try to recover the

tasks that cost a lot of money and lower the company's revenue. This problem may be

remedied by paying less for unneeded tasks and focusing on generating more profit for

the company.

Identify the areas in which there is a higher cost: The firm needed to identify the

numerous activities in which it incurred high costs, which was the cause of the poor

income value (Astuty, and Pasaribu, 2021). In general, businesses aim to improve their

cost structures and establish correct plans, and then they spend only on activities that are

beneficial to the firm and do not pose a risk to their profits.

The table above depicts the numerous types of areas in which Amana Ltd has to enhance

its performance. It clearly states that the corporation forecasted the original budget for the

performance. Basically, there are a few different procedures that aid in determining the work of a

firm budgetary report's consequent duty:

Costs that are readily traceable: This notion of budget is a key cost step that assists the

firm in determining the amount of money to be paid out and then preparing a budget

based on it in the near future. It will help the organisation analyse the issues that lead to

misunderstandings in the workplace while carrying out the actions necessary to meet the

company's budgetary objectives (Ghasemi, and et.al., 2019). This report primarily depicts

the firm's financial choices, which it makes on an annual basis rather than on a monthly

basis, and it may also be based on the determination of manufacturing expenditures,

material expenditures, and other expenses incurred while the company conducts its

business. However, if it creates a money-spending strategy, it is fundamentally different

from a financial plan. It can be prepared on a monthly basis by the company because

business expenses might occur at any moment. While they are carrying out the firm's

budgeted objectives. However, this monthly spending plan aids the organisation in

determining where money is spent most efficiently. The major aim of a business owner is

to find the optimal spending plan and strive to decrease the company's cash outflows and

expenditures. Essentially, the company may spend money on a beneficial activity rather

than on detrimental actions.

Determine the high pay-out cost: If a company wants to improve the way it does tasks, it

should examine the areas where the company spends a lot of money and try to recover the

tasks that cost a lot of money and lower the company's revenue. This problem may be

remedied by paying less for unneeded tasks and focusing on generating more profit for

the company.

Identify the areas in which there is a higher cost: The firm needed to identify the

numerous activities in which it incurred high costs, which was the cause of the poor

income value (Astuty, and Pasaribu, 2021). In general, businesses aim to improve their

cost structures and establish correct plans, and then they spend only on activities that are

beneficial to the firm and do not pose a risk to their profits.

The table above depicts the numerous types of areas in which Amana Ltd has to enhance

its performance. It clearly states that the corporation forecasted the original budget for the

accounting year 2020, yet the actual budget was lower than the original budget in a number of

categories, including:

In the first instance, the income of the firm and its initial budget are shown in the

table above. It can demonstrate that the company's revenue exceeds its real budget.

Basically, it signifies that the corporation expected a big revenue in the accounting

year 2020 but received less, indicating that the company has to boost its sales rather

than pay out large costs.

In the second point, the following table shows that the firm has made a large

investment in costs, as a result of which the company's gross profit has decreased in

comparison to the original budget.

In the third case, it means that sales and gross profit are lower than expected, and as

a result, the net profit for the accounting year 2020 is lower as well. In 2020, the

company will spend more money on operating expenses and will be less focused on

profit, resulting in low productivity and a reduction in the company's capacity to

undertake activities with the achievement of goals and objectives.

Make some suggestions for Amana's CEO on how to enhance the company.

The company's department has to generate more income since any company may make a

lot of money if it sells a lot of things and spends less money on activities. There is just

one element that affects the company's actual budget: poor sales. When sales are low and

costs are high, the company's net profit is reduced.

Prepare a good budget plan: This is one of the most important steps in creating a budget

in advance because, before implementing any plan, a company must first develop the best

strategy and then move forward to implement that strategy into the business in order to

achieve the budgetary goals efficiently (Pasch, 2019). The chart shows that the firm did

not establish a proper plan and did not operate efficiently, which is why they expected to

make less profit in accounting year 2020.

Prepared for future scenarios: Every firm has difficulties while carrying out its

operations. As a result, the corporation must plan in advance for potential challenges and

assist the firm in cooperating with changes.

categories, including:

In the first instance, the income of the firm and its initial budget are shown in the

table above. It can demonstrate that the company's revenue exceeds its real budget.

Basically, it signifies that the corporation expected a big revenue in the accounting

year 2020 but received less, indicating that the company has to boost its sales rather

than pay out large costs.

In the second point, the following table shows that the firm has made a large

investment in costs, as a result of which the company's gross profit has decreased in

comparison to the original budget.

In the third case, it means that sales and gross profit are lower than expected, and as

a result, the net profit for the accounting year 2020 is lower as well. In 2020, the

company will spend more money on operating expenses and will be less focused on

profit, resulting in low productivity and a reduction in the company's capacity to

undertake activities with the achievement of goals and objectives.

Make some suggestions for Amana's CEO on how to enhance the company.

The company's department has to generate more income since any company may make a

lot of money if it sells a lot of things and spends less money on activities. There is just

one element that affects the company's actual budget: poor sales. When sales are low and

costs are high, the company's net profit is reduced.

Prepare a good budget plan: This is one of the most important steps in creating a budget

in advance because, before implementing any plan, a company must first develop the best

strategy and then move forward to implement that strategy into the business in order to

achieve the budgetary goals efficiently (Pasch, 2019). The chart shows that the firm did

not establish a proper plan and did not operate efficiently, which is why they expected to

make less profit in accounting year 2020.

Prepared for future scenarios: Every firm has difficulties while carrying out its

operations. As a result, the corporation must plan in advance for potential challenges and

assist the firm in cooperating with changes.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

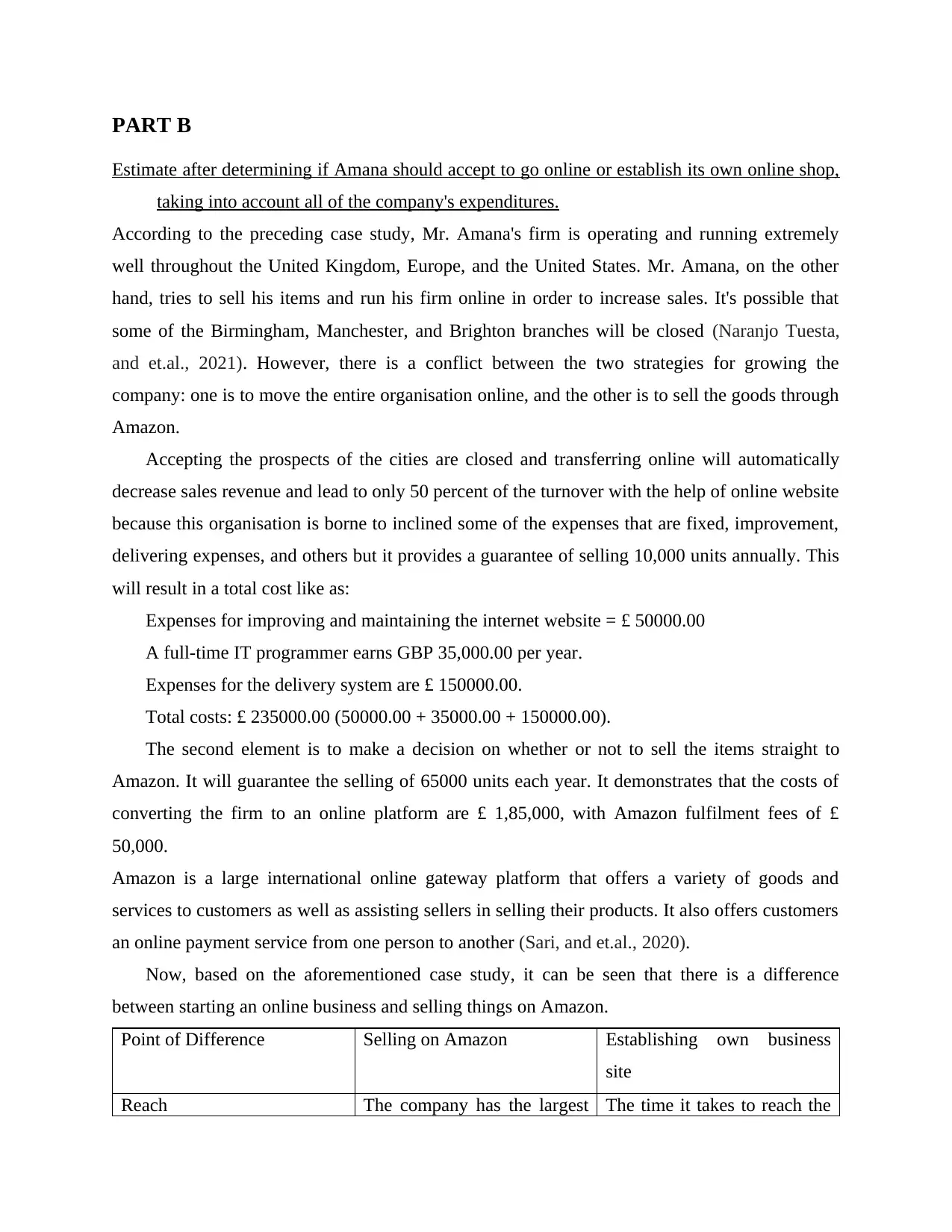

PART B

Estimate after determining if Amana should accept to go online or establish its own online shop,

taking into account all of the company's expenditures.

According to the preceding case study, Mr. Amana's firm is operating and running extremely

well throughout the United Kingdom, Europe, and the United States. Mr. Amana, on the other

hand, tries to sell his items and run his firm online in order to increase sales. It's possible that

some of the Birmingham, Manchester, and Brighton branches will be closed (Naranjo Tuesta,

and et.al., 2021). However, there is a conflict between the two strategies for growing the

company: one is to move the entire organisation online, and the other is to sell the goods through

Amazon.

Accepting the prospects of the cities are closed and transferring online will automatically

decrease sales revenue and lead to only 50 percent of the turnover with the help of online website

because this organisation is borne to inclined some of the expenses that are fixed, improvement,

delivering expenses, and others but it provides a guarantee of selling 10,000 units annually. This

will result in a total cost like as:

Expenses for improving and maintaining the internet website = £ 50000.00

A full-time IT programmer earns GBP 35,000.00 per year.

Expenses for the delivery system are £ 150000.00.

Total costs: £ 235000.00 (50000.00 + 35000.00 + 150000.00).

The second element is to make a decision on whether or not to sell the items straight to

Amazon. It will guarantee the selling of 65000 units each year. It demonstrates that the costs of

converting the firm to an online platform are £ 1,85,000, with Amazon fulfilment fees of £

50,000.

Amazon is a large international online gateway platform that offers a variety of goods and

services to customers as well as assisting sellers in selling their products. It also offers customers

an online payment service from one person to another (Sari, and et.al., 2020).

Now, based on the aforementioned case study, it can be seen that there is a difference

between starting an online business and selling things on Amazon.

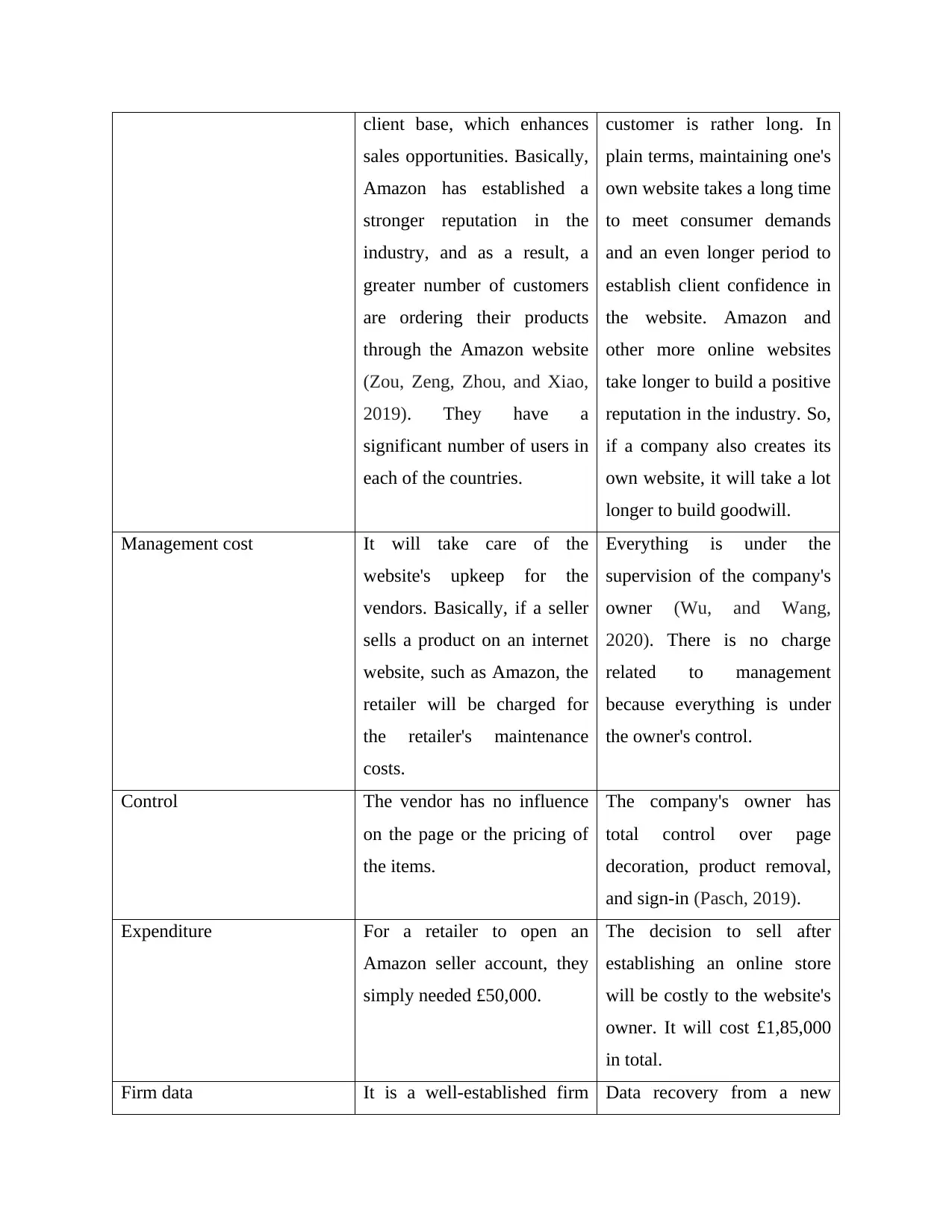

Point of Difference Selling on Amazon Establishing own business

site

Reach The company has the largest The time it takes to reach the

Estimate after determining if Amana should accept to go online or establish its own online shop,

taking into account all of the company's expenditures.

According to the preceding case study, Mr. Amana's firm is operating and running extremely

well throughout the United Kingdom, Europe, and the United States. Mr. Amana, on the other

hand, tries to sell his items and run his firm online in order to increase sales. It's possible that

some of the Birmingham, Manchester, and Brighton branches will be closed (Naranjo Tuesta,

and et.al., 2021). However, there is a conflict between the two strategies for growing the

company: one is to move the entire organisation online, and the other is to sell the goods through

Amazon.

Accepting the prospects of the cities are closed and transferring online will automatically

decrease sales revenue and lead to only 50 percent of the turnover with the help of online website

because this organisation is borne to inclined some of the expenses that are fixed, improvement,

delivering expenses, and others but it provides a guarantee of selling 10,000 units annually. This

will result in a total cost like as:

Expenses for improving and maintaining the internet website = £ 50000.00

A full-time IT programmer earns GBP 35,000.00 per year.

Expenses for the delivery system are £ 150000.00.

Total costs: £ 235000.00 (50000.00 + 35000.00 + 150000.00).

The second element is to make a decision on whether or not to sell the items straight to

Amazon. It will guarantee the selling of 65000 units each year. It demonstrates that the costs of

converting the firm to an online platform are £ 1,85,000, with Amazon fulfilment fees of £

50,000.

Amazon is a large international online gateway platform that offers a variety of goods and

services to customers as well as assisting sellers in selling their products. It also offers customers

an online payment service from one person to another (Sari, and et.al., 2020).

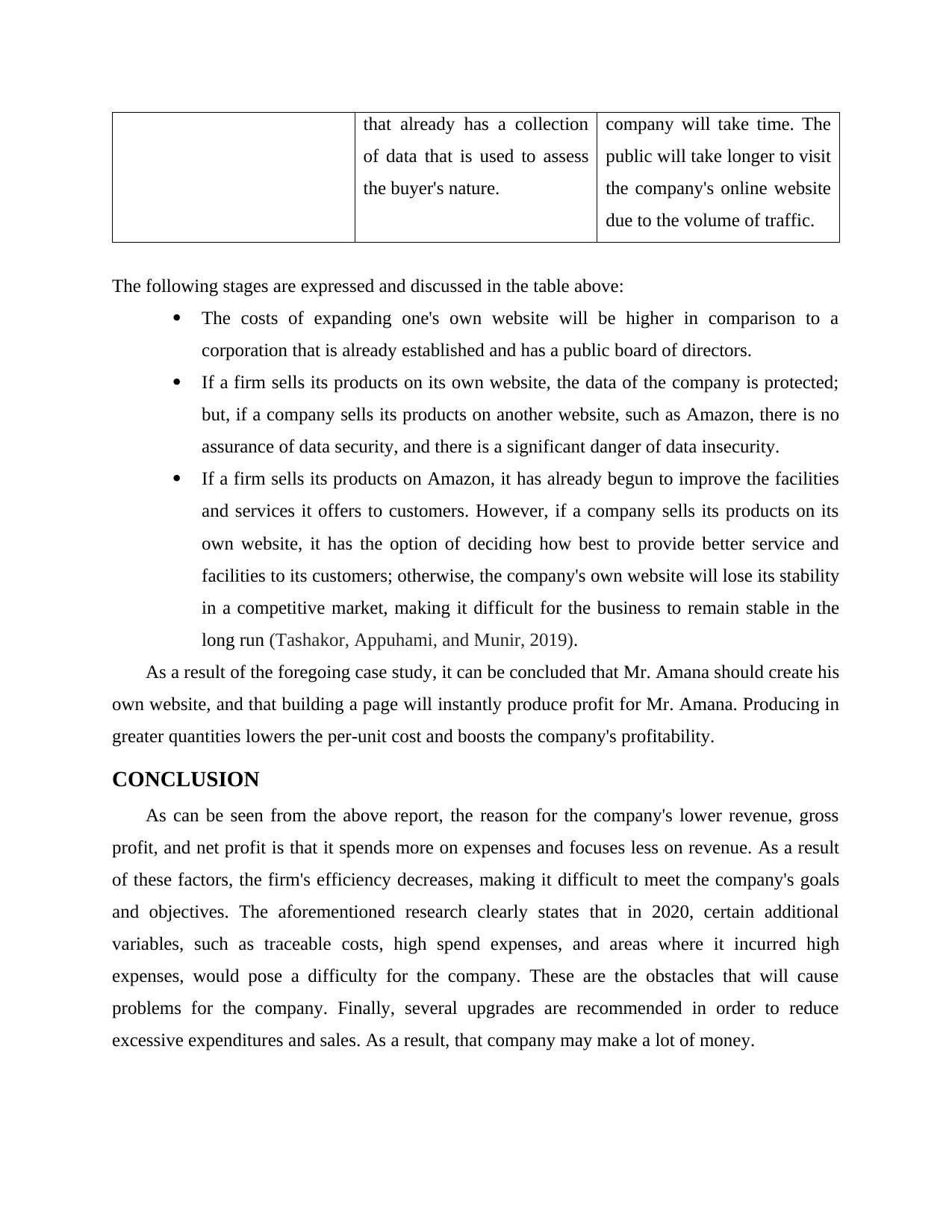

Now, based on the aforementioned case study, it can be seen that there is a difference

between starting an online business and selling things on Amazon.

Point of Difference Selling on Amazon Establishing own business

site

Reach The company has the largest The time it takes to reach the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

client base, which enhances

sales opportunities. Basically,

Amazon has established a

stronger reputation in the

industry, and as a result, a

greater number of customers

are ordering their products

through the Amazon website

(Zou, Zeng, Zhou, and Xiao,

2019). They have a

significant number of users in

each of the countries.

customer is rather long. In

plain terms, maintaining one's

own website takes a long time

to meet consumer demands

and an even longer period to

establish client confidence in

the website. Amazon and

other more online websites

take longer to build a positive

reputation in the industry. So,

if a company also creates its

own website, it will take a lot

longer to build goodwill.

Management cost It will take care of the

website's upkeep for the

vendors. Basically, if a seller

sells a product on an internet

website, such as Amazon, the

retailer will be charged for

the retailer's maintenance

costs.

Everything is under the

supervision of the company's

owner (Wu, and Wang,

2020). There is no charge

related to management

because everything is under

the owner's control.

Control The vendor has no influence

on the page or the pricing of

the items.

The company's owner has

total control over page

decoration, product removal,

and sign-in (Pasch, 2019).

Expenditure For a retailer to open an

Amazon seller account, they

simply needed £50,000.

The decision to sell after

establishing an online store

will be costly to the website's

owner. It will cost £1,85,000

in total.

Firm data It is a well-established firm Data recovery from a new

sales opportunities. Basically,

Amazon has established a

stronger reputation in the

industry, and as a result, a

greater number of customers

are ordering their products

through the Amazon website

(Zou, Zeng, Zhou, and Xiao,

2019). They have a

significant number of users in

each of the countries.

customer is rather long. In

plain terms, maintaining one's

own website takes a long time

to meet consumer demands

and an even longer period to

establish client confidence in

the website. Amazon and

other more online websites

take longer to build a positive

reputation in the industry. So,

if a company also creates its

own website, it will take a lot

longer to build goodwill.

Management cost It will take care of the

website's upkeep for the

vendors. Basically, if a seller

sells a product on an internet

website, such as Amazon, the

retailer will be charged for

the retailer's maintenance

costs.

Everything is under the

supervision of the company's

owner (Wu, and Wang,

2020). There is no charge

related to management

because everything is under

the owner's control.

Control The vendor has no influence

on the page or the pricing of

the items.

The company's owner has

total control over page

decoration, product removal,

and sign-in (Pasch, 2019).

Expenditure For a retailer to open an

Amazon seller account, they

simply needed £50,000.

The decision to sell after

establishing an online store

will be costly to the website's

owner. It will cost £1,85,000

in total.

Firm data It is a well-established firm Data recovery from a new

that already has a collection

of data that is used to assess

the buyer's nature.

company will take time. The

public will take longer to visit

the company's online website

due to the volume of traffic.

The following stages are expressed and discussed in the table above:

The costs of expanding one's own website will be higher in comparison to a

corporation that is already established and has a public board of directors.

If a firm sells its products on its own website, the data of the company is protected;

but, if a company sells its products on another website, such as Amazon, there is no

assurance of data security, and there is a significant danger of data insecurity.

If a firm sells its products on Amazon, it has already begun to improve the facilities

and services it offers to customers. However, if a company sells its products on its

own website, it has the option of deciding how best to provide better service and

facilities to its customers; otherwise, the company's own website will lose its stability

in a competitive market, making it difficult for the business to remain stable in the

long run (Tashakor, Appuhami, and Munir, 2019).

As a result of the foregoing case study, it can be concluded that Mr. Amana should create his

own website, and that building a page will instantly produce profit for Mr. Amana. Producing in

greater quantities lowers the per-unit cost and boosts the company's profitability.

CONCLUSION

As can be seen from the above report, the reason for the company's lower revenue, gross

profit, and net profit is that it spends more on expenses and focuses less on revenue. As a result

of these factors, the firm's efficiency decreases, making it difficult to meet the company's goals

and objectives. The aforementioned research clearly states that in 2020, certain additional

variables, such as traceable costs, high spend expenses, and areas where it incurred high

expenses, would pose a difficulty for the company. These are the obstacles that will cause

problems for the company. Finally, several upgrades are recommended in order to reduce

excessive expenditures and sales. As a result, that company may make a lot of money.

of data that is used to assess

the buyer's nature.

company will take time. The

public will take longer to visit

the company's online website

due to the volume of traffic.

The following stages are expressed and discussed in the table above:

The costs of expanding one's own website will be higher in comparison to a

corporation that is already established and has a public board of directors.

If a firm sells its products on its own website, the data of the company is protected;

but, if a company sells its products on another website, such as Amazon, there is no

assurance of data security, and there is a significant danger of data insecurity.

If a firm sells its products on Amazon, it has already begun to improve the facilities

and services it offers to customers. However, if a company sells its products on its

own website, it has the option of deciding how best to provide better service and

facilities to its customers; otherwise, the company's own website will lose its stability

in a competitive market, making it difficult for the business to remain stable in the

long run (Tashakor, Appuhami, and Munir, 2019).

As a result of the foregoing case study, it can be concluded that Mr. Amana should create his

own website, and that building a page will instantly produce profit for Mr. Amana. Producing in

greater quantities lowers the per-unit cost and boosts the company's profitability.

CONCLUSION

As can be seen from the above report, the reason for the company's lower revenue, gross

profit, and net profit is that it spends more on expenses and focuses less on revenue. As a result

of these factors, the firm's efficiency decreases, making it difficult to meet the company's goals

and objectives. The aforementioned research clearly states that in 2020, certain additional

variables, such as traceable costs, high spend expenses, and areas where it incurred high

expenses, would pose a difficulty for the company. These are the obstacles that will cause

problems for the company. Finally, several upgrades are recommended in order to reduce

excessive expenditures and sales. As a result, that company may make a lot of money.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books and Journals

Pelz, M., 2019. Can management accounting be helpful for young and small companies?

Systematic review of a paradox. International Journal of Management Reviews, 21(2),

pp.256-274.

Hiebl, M.R. and Richter, J.F., 2018. Response rates in management accounting survey

research. Journal of Management Accounting Research, 30(2), pp.59-79.

Korhonen, T., Selos, E., Laine, T. and Suomala, P., 2020. Exploring the programmability of

management accounting work for increasing automation: an interventionist case

study. Accounting, Auditing & Accountability Journal.

Ghasemi, R., Habibi, H.R., Ghasemlo, M. and Karami, M., 2019. The effectiveness of

management accounting systems: evidence from financial organizations in

Iran. Journal of Accounting in Emerging Economies.

Astuty, W. and Pasaribu, F., 2021. The Impact of Business Environment and Organizational

Culture on The Implementation of Management Accounting Information System in

Some Hotels. Budapest International Research and Critics Institute (BIRCI-Journal):

Humanities and Social Sciences, 4(3), pp.6251-6262.

Pasch, T., 2019. Organizational lifecycle and strategic management accounting. Journal of

Accounting & Organizational Change.

Naranjo Tuesta, Y., Crespo Soler, C. and Ripoll Feliu, V., 2021. Carbon management accounting

and financial performance: Evidence from the European Union emission trading

system. Business Strategy and the Environment, 30(2), pp.1270-1282.

Sari, R.N., Pratadina, A., Anugerah, R., Kamaliah, K. and Sanusi, Z.M., 2020. Effect of

environmental management accounting practices on organizational performance: role of

process innovation as a mediating variable. Business Process Management Journal.

Zou, T., Zeng, H., Zhou, Z. and Xiao, X., 2019. A three-dimensional model featuring material

flow, value flow and organization for environmental management accounting. Journal

of Cleaner Production, 228, pp.619-633.

Pasch, T., 2019. Essays on the design of the management accounting system: Determinants,

components and effects (Doctoral dissertation, University Utrecht).

Tashakor, S., Appuhami, R. and Munir, R., 2019. Environmental management accounting

practices in Australian cotton farming: The use of the theory of planned

behaviour. Accounting, Auditing & Accountability Journal.

Wu, Y. and Wang, X., 2020, February. Application of blockchain technology in the integration

of management accounting and financial accounting. In The International Conference

on Cyber Security Intelligence and Analytics (pp. 26-34). Springer, Cham.

Books and Journals

Pelz, M., 2019. Can management accounting be helpful for young and small companies?

Systematic review of a paradox. International Journal of Management Reviews, 21(2),

pp.256-274.

Hiebl, M.R. and Richter, J.F., 2018. Response rates in management accounting survey

research. Journal of Management Accounting Research, 30(2), pp.59-79.

Korhonen, T., Selos, E., Laine, T. and Suomala, P., 2020. Exploring the programmability of

management accounting work for increasing automation: an interventionist case

study. Accounting, Auditing & Accountability Journal.

Ghasemi, R., Habibi, H.R., Ghasemlo, M. and Karami, M., 2019. The effectiveness of

management accounting systems: evidence from financial organizations in

Iran. Journal of Accounting in Emerging Economies.

Astuty, W. and Pasaribu, F., 2021. The Impact of Business Environment and Organizational

Culture on The Implementation of Management Accounting Information System in

Some Hotels. Budapest International Research and Critics Institute (BIRCI-Journal):

Humanities and Social Sciences, 4(3), pp.6251-6262.

Pasch, T., 2019. Organizational lifecycle and strategic management accounting. Journal of

Accounting & Organizational Change.

Naranjo Tuesta, Y., Crespo Soler, C. and Ripoll Feliu, V., 2021. Carbon management accounting

and financial performance: Evidence from the European Union emission trading

system. Business Strategy and the Environment, 30(2), pp.1270-1282.

Sari, R.N., Pratadina, A., Anugerah, R., Kamaliah, K. and Sanusi, Z.M., 2020. Effect of

environmental management accounting practices on organizational performance: role of

process innovation as a mediating variable. Business Process Management Journal.

Zou, T., Zeng, H., Zhou, Z. and Xiao, X., 2019. A three-dimensional model featuring material

flow, value flow and organization for environmental management accounting. Journal

of Cleaner Production, 228, pp.619-633.

Pasch, T., 2019. Essays on the design of the management accounting system: Determinants,

components and effects (Doctoral dissertation, University Utrecht).

Tashakor, S., Appuhami, R. and Munir, R., 2019. Environmental management accounting

practices in Australian cotton farming: The use of the theory of planned

behaviour. Accounting, Auditing & Accountability Journal.

Wu, Y. and Wang, X., 2020, February. Application of blockchain technology in the integration

of management accounting and financial accounting. In The International Conference

on Cyber Security Intelligence and Analytics (pp. 26-34). Springer, Cham.

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.