University Management Accounting: Cost Analysis and Decision Making

VerifiedAdded on 2020/02/24

|7

|1266

|42

Homework Assignment

AI Summary

This assignment analyzes various aspects of management accounting, focusing on cost analysis and decision-making. It begins by calculating the cost per unit under a traditional approach, providing a breakdown of direct materials, direct labor, variable overhead, and fixed overhead. The assignment then evaluates a make-or-buy decision regarding canisters, determining that purchasing the canisters would result in a loss. It proceeds to assess the acceptance of a special order, concluding that accepting the order would decrease overall profit. The factors to be considered before accepting the offer are also discussed. The assignment further explores the manufacturing of special coffee cups and compares the profitability of producing coffee cups versus canisters. Finally, it outlines the key factors to consider when deciding between purchasing and manufacturing a product, including cost analysis, product quality, and quantity requirements. The document references several academic sources to support its analysis.

Running head: MANAGEMENT ACCOUNTING

Management accounting

Name of the student

Name of the university

Author note

Management accounting

Name of the student

Name of the university

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1MANAGEMENT ACCOUNTING

Table of Contents

(a) Calculation of cost per unit under traditional approach..................................................2

(a) Purchase of canister.........................................................................................................2

(b) Accepting the special order.............................................................................................3

(c) Factors to be be considered before accepting the offer...................................................3

(d) Manufacturing of special coffee cup...............................................................................4

(e) Factors to be considered while deciding between purchase and manufacture................4

Reference....................................................................................................................................6

Table of Contents

(a) Calculation of cost per unit under traditional approach..................................................2

(a) Purchase of canister.........................................................................................................2

(b) Accepting the special order.............................................................................................3

(c) Factors to be be considered before accepting the offer...................................................3

(d) Manufacturing of special coffee cup...............................................................................4

(e) Factors to be considered while deciding between purchase and manufacture................4

Reference....................................................................................................................................6

2MANAGEMENT ACCOUNTING

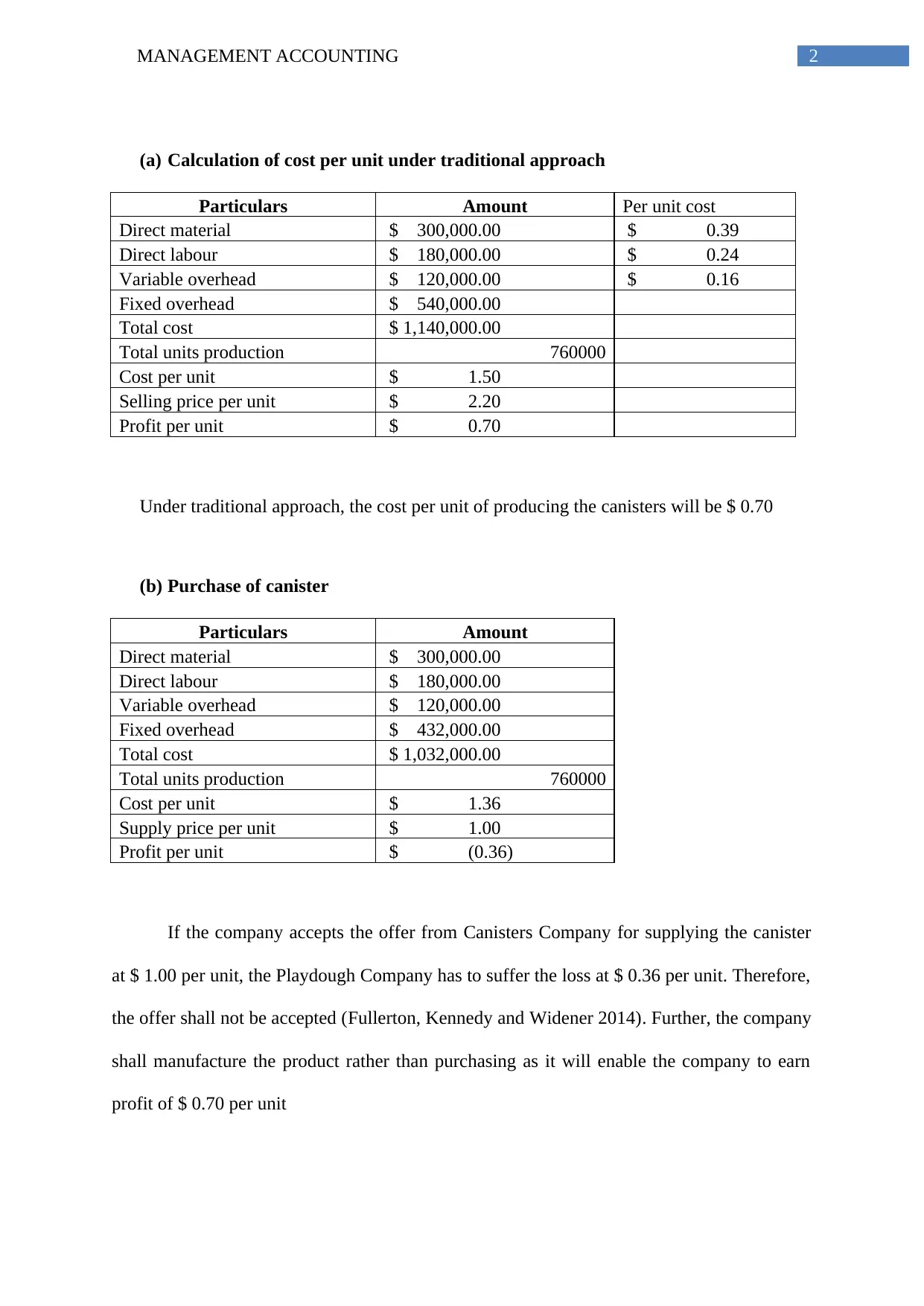

(a) Calculation of cost per unit under traditional approach

Particulars Amount Per unit cost

Direct material $ 300,000.00 $ 0.39

Direct labour $ 180,000.00 $ 0.24

Variable overhead $ 120,000.00 $ 0.16

Fixed overhead $ 540,000.00

Total cost $ 1,140,000.00

Total units production 760000

Cost per unit $ 1.50

Selling price per unit $ 2.20

Profit per unit $ 0.70

Under traditional approach, the cost per unit of producing the canisters will be $ 0.70

(b) Purchase of canister

Particulars Amount

Direct material $ 300,000.00

Direct labour $ 180,000.00

Variable overhead $ 120,000.00

Fixed overhead $ 432,000.00

Total cost $ 1,032,000.00

Total units production 760000

Cost per unit $ 1.36

Supply price per unit $ 1.00

Profit per unit $ (0.36)

If the company accepts the offer from Canisters Company for supplying the canister

at $ 1.00 per unit, the Playdough Company has to suffer the loss at $ 0.36 per unit. Therefore,

the offer shall not be accepted (Fullerton, Kennedy and Widener 2014). Further, the company

shall manufacture the product rather than purchasing as it will enable the company to earn

profit of $ 0.70 per unit

(a) Calculation of cost per unit under traditional approach

Particulars Amount Per unit cost

Direct material $ 300,000.00 $ 0.39

Direct labour $ 180,000.00 $ 0.24

Variable overhead $ 120,000.00 $ 0.16

Fixed overhead $ 540,000.00

Total cost $ 1,140,000.00

Total units production 760000

Cost per unit $ 1.50

Selling price per unit $ 2.20

Profit per unit $ 0.70

Under traditional approach, the cost per unit of producing the canisters will be $ 0.70

(b) Purchase of canister

Particulars Amount

Direct material $ 300,000.00

Direct labour $ 180,000.00

Variable overhead $ 120,000.00

Fixed overhead $ 432,000.00

Total cost $ 1,032,000.00

Total units production 760000

Cost per unit $ 1.36

Supply price per unit $ 1.00

Profit per unit $ (0.36)

If the company accepts the offer from Canisters Company for supplying the canister

at $ 1.00 per unit, the Playdough Company has to suffer the loss at $ 0.36 per unit. Therefore,

the offer shall not be accepted (Fullerton, Kennedy and Widener 2014). Further, the company

shall manufacture the product rather than purchasing as it will enable the company to earn

profit of $ 0.70 per unit

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3MANAGEMENT ACCOUNTING

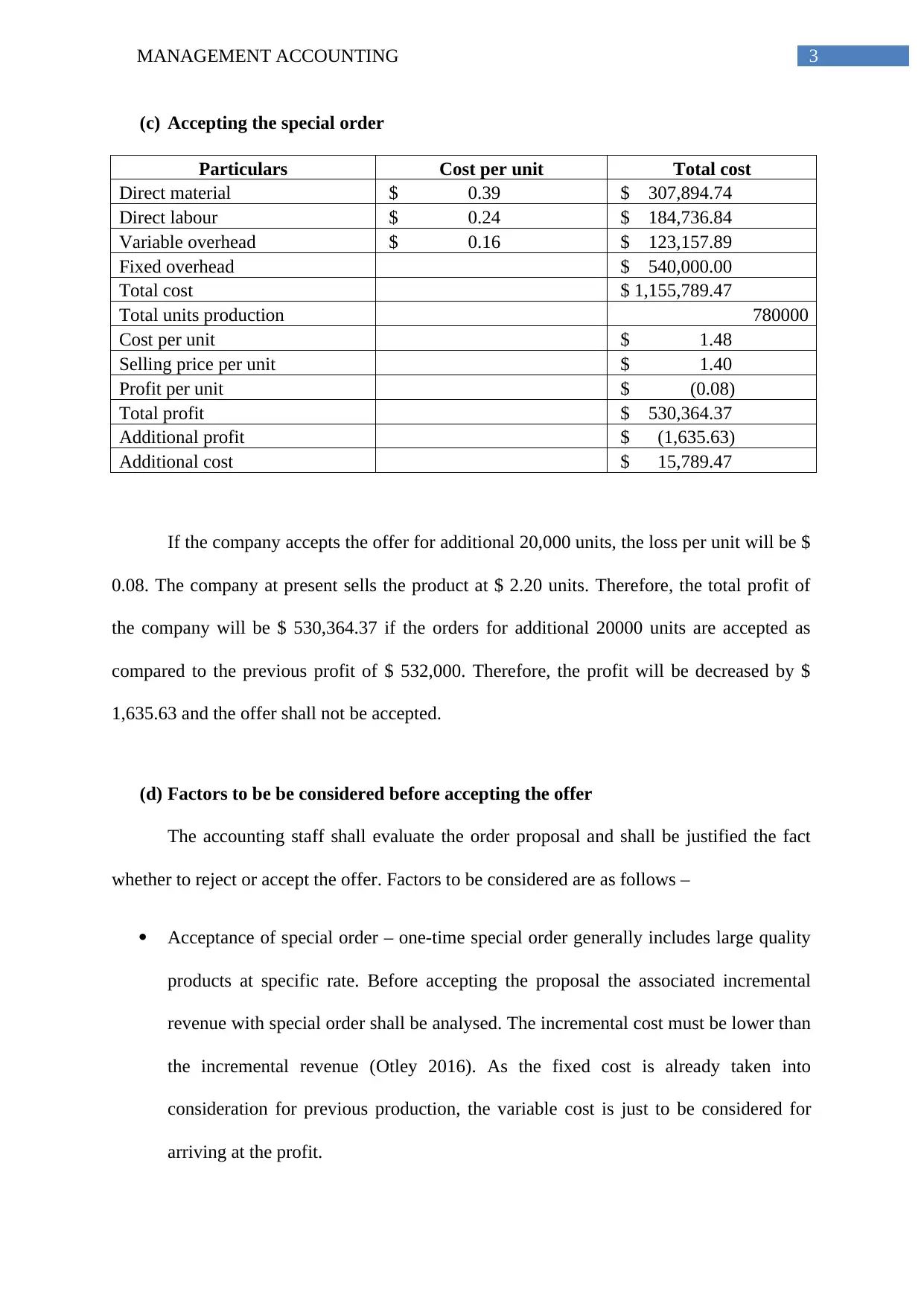

(c) Accepting the special order

Particulars Cost per unit Total cost

Direct material $ 0.39 $ 307,894.74

Direct labour $ 0.24 $ 184,736.84

Variable overhead $ 0.16 $ 123,157.89

Fixed overhead $ 540,000.00

Total cost $ 1,155,789.47

Total units production 780000

Cost per unit $ 1.48

Selling price per unit $ 1.40

Profit per unit $ (0.08)

Total profit $ 530,364.37

Additional profit $ (1,635.63)

Additional cost $ 15,789.47

If the company accepts the offer for additional 20,000 units, the loss per unit will be $

0.08. The company at present sells the product at $ 2.20 units. Therefore, the total profit of

the company will be $ 530,364.37 if the orders for additional 20000 units are accepted as

compared to the previous profit of $ 532,000. Therefore, the profit will be decreased by $

1,635.63 and the offer shall not be accepted.

(d) Factors to be be considered before accepting the offer

The accounting staff shall evaluate the order proposal and shall be justified the fact

whether to reject or accept the offer. Factors to be considered are as follows –

Acceptance of special order – one-time special order generally includes large quality

products at specific rate. Before accepting the proposal the associated incremental

revenue with special order shall be analysed. The incremental cost must be lower than

the incremental revenue (Otley 2016). As the fixed cost is already taken into

consideration for previous production, the variable cost is just to be considered for

arriving at the profit.

(c) Accepting the special order

Particulars Cost per unit Total cost

Direct material $ 0.39 $ 307,894.74

Direct labour $ 0.24 $ 184,736.84

Variable overhead $ 0.16 $ 123,157.89

Fixed overhead $ 540,000.00

Total cost $ 1,155,789.47

Total units production 780000

Cost per unit $ 1.48

Selling price per unit $ 1.40

Profit per unit $ (0.08)

Total profit $ 530,364.37

Additional profit $ (1,635.63)

Additional cost $ 15,789.47

If the company accepts the offer for additional 20,000 units, the loss per unit will be $

0.08. The company at present sells the product at $ 2.20 units. Therefore, the total profit of

the company will be $ 530,364.37 if the orders for additional 20000 units are accepted as

compared to the previous profit of $ 532,000. Therefore, the profit will be decreased by $

1,635.63 and the offer shall not be accepted.

(d) Factors to be be considered before accepting the offer

The accounting staff shall evaluate the order proposal and shall be justified the fact

whether to reject or accept the offer. Factors to be considered are as follows –

Acceptance of special order – one-time special order generally includes large quality

products at specific rate. Before accepting the proposal the associated incremental

revenue with special order shall be analysed. The incremental cost must be lower than

the incremental revenue (Otley 2016). As the fixed cost is already taken into

consideration for previous production, the variable cost is just to be considered for

arriving at the profit.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4MANAGEMENT ACCOUNTING

Idle capacity – fro justifying the special order, the company must have the additional

capacity for fulfilling the order. For avoiding the disruption of the regular production

the company must have excess capacity with regard to the equipment and personnel

under the production line. If the company is already operating in full capacity, it will

not be in a position to accept new order.

Pricing of special order – as the special order is the one-time order, it indicates the

pricing decision over the short-term period. The minimum possible price at which the

order can be accepted shall be evaluated. While the idle capacity is there and the sales

levels are low, the order can be accepted for new orders (Messner 2016).

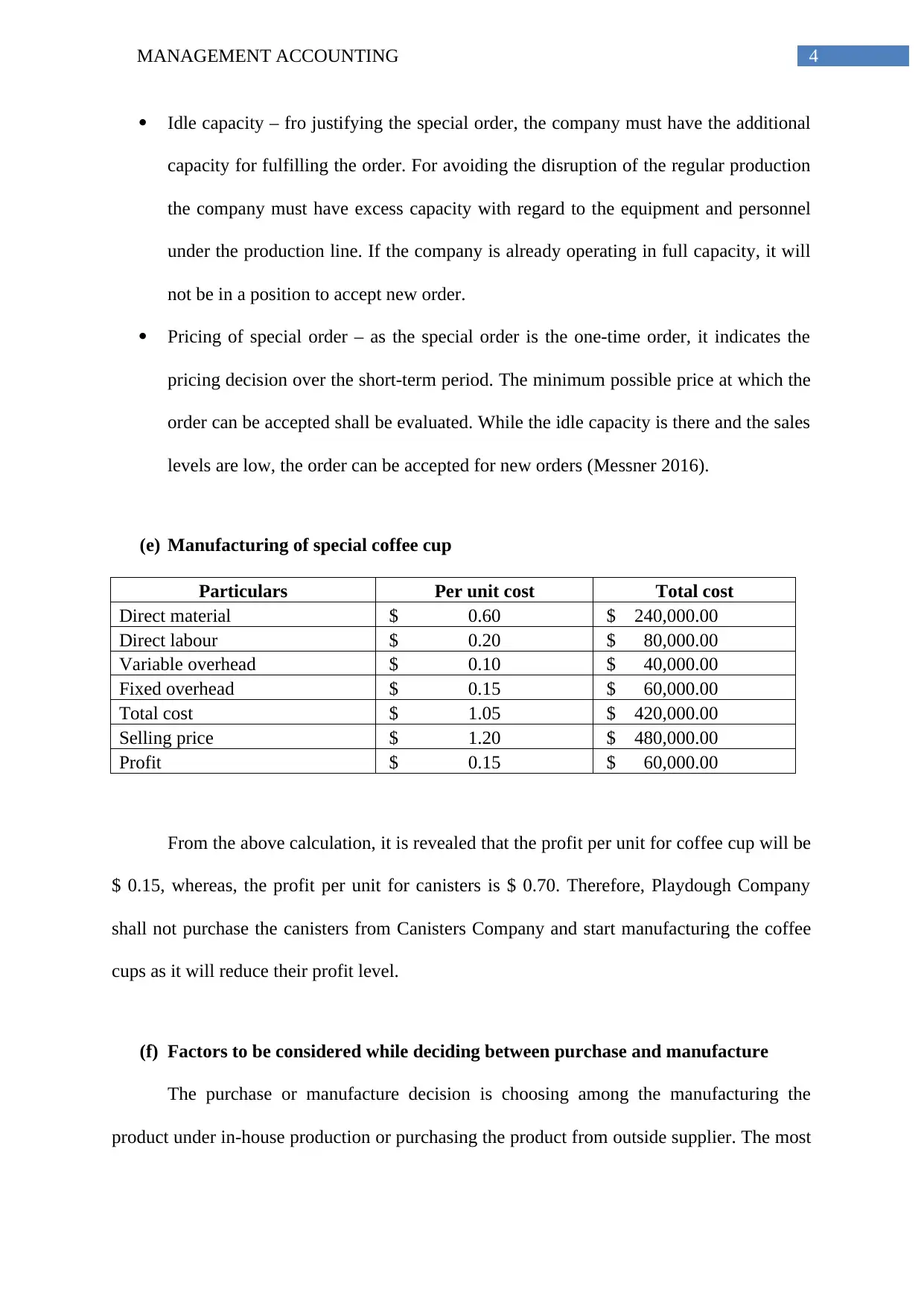

(e) Manufacturing of special coffee cup

Particulars Per unit cost Total cost

Direct material $ 0.60 $ 240,000.00

Direct labour $ 0.20 $ 80,000.00

Variable overhead $ 0.10 $ 40,000.00

Fixed overhead $ 0.15 $ 60,000.00

Total cost $ 1.05 $ 420,000.00

Selling price $ 1.20 $ 480,000.00

Profit $ 0.15 $ 60,000.00

From the above calculation, it is revealed that the profit per unit for coffee cup will be

$ 0.15, whereas, the profit per unit for canisters is $ 0.70. Therefore, Playdough Company

shall not purchase the canisters from Canisters Company and start manufacturing the coffee

cups as it will reduce their profit level.

(f) Factors to be considered while deciding between purchase and manufacture

The purchase or manufacture decision is choosing among the manufacturing the

product under in-house production or purchasing the product from outside supplier. The most

Idle capacity – fro justifying the special order, the company must have the additional

capacity for fulfilling the order. For avoiding the disruption of the regular production

the company must have excess capacity with regard to the equipment and personnel

under the production line. If the company is already operating in full capacity, it will

not be in a position to accept new order.

Pricing of special order – as the special order is the one-time order, it indicates the

pricing decision over the short-term period. The minimum possible price at which the

order can be accepted shall be evaluated. While the idle capacity is there and the sales

levels are low, the order can be accepted for new orders (Messner 2016).

(e) Manufacturing of special coffee cup

Particulars Per unit cost Total cost

Direct material $ 0.60 $ 240,000.00

Direct labour $ 0.20 $ 80,000.00

Variable overhead $ 0.10 $ 40,000.00

Fixed overhead $ 0.15 $ 60,000.00

Total cost $ 1.05 $ 420,000.00

Selling price $ 1.20 $ 480,000.00

Profit $ 0.15 $ 60,000.00

From the above calculation, it is revealed that the profit per unit for coffee cup will be

$ 0.15, whereas, the profit per unit for canisters is $ 0.70. Therefore, Playdough Company

shall not purchase the canisters from Canisters Company and start manufacturing the coffee

cups as it will reduce their profit level.

(f) Factors to be considered while deciding between purchase and manufacture

The purchase or manufacture decision is choosing among the manufacturing the

product under in-house production or purchasing the product from outside supplier. The most

5MANAGEMENT ACCOUNTING

crucial factors to be considered are the quantitative analysis like associated cost for

production or the capacity of the company to produce at the required level.

Purchase versus manufacture cost – under the manufacture cost the expenses like

maintenance cost; material cost, labour cost and overhead costs shall be considered.

Further, storage requirements and additional space of storage shall be considered. On

the contrary, for purchasing the expenses related to price of the product, importing

fees, shipping cost, sales tax charges shall be considered. Apart from this, the

expenses with regard to storage of purchased product, labour cost associated with

product receiving labour shall also be considered (Bianchi et al. 2016).

Quality of product – if the manufactured product is of better quality as compared to

the purchased product, then the product must be produced in-hose. However, if the

company is not specialist in the product type, then the speciality supplier shall be

selected for purchasing the product.

Quantity – the volume of the product required by the company has an influence on the

decision of the company. If the company requires very small quantity of product, then

it will not be feasible to produce the product. However, if the required quality is large

then it may be cost- effective for in-house production for the product (Rodrigues,

Leichsenring and Winkelmann 2014).

crucial factors to be considered are the quantitative analysis like associated cost for

production or the capacity of the company to produce at the required level.

Purchase versus manufacture cost – under the manufacture cost the expenses like

maintenance cost; material cost, labour cost and overhead costs shall be considered.

Further, storage requirements and additional space of storage shall be considered. On

the contrary, for purchasing the expenses related to price of the product, importing

fees, shipping cost, sales tax charges shall be considered. Apart from this, the

expenses with regard to storage of purchased product, labour cost associated with

product receiving labour shall also be considered (Bianchi et al. 2016).

Quality of product – if the manufactured product is of better quality as compared to

the purchased product, then the product must be produced in-hose. However, if the

company is not specialist in the product type, then the speciality supplier shall be

selected for purchasing the product.

Quantity – the volume of the product required by the company has an influence on the

decision of the company. If the company requires very small quantity of product, then

it will not be feasible to produce the product. However, if the required quality is large

then it may be cost- effective for in-house production for the product (Rodrigues,

Leichsenring and Winkelmann 2014).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6MANAGEMENT ACCOUNTING

Reference

Bianchi, A., Barnett, J., Dempsey, W., Giachinta, M., Hugenberg, M. and Talley, A., 2016.

Applying Value-Focused Thinking to a Make Versus Buy Decision. Industrial and Systems

Engineering Review, 4(2), pp.171-177.

Fullerton, R.R., Kennedy, F.A. and Widener, S.K., 2014. Lean manufacturing and firm

performance: The incremental contribution of lean management accounting

practices. Journal of Operations Management, 32(7), pp.414-428.

Messner, M., 2016. Does industry matter? How industry context shapes management

accounting practice. Management Accounting Research, 31, pp.103-111.

Otley, D., 2016. The contingency theory of management accounting and control: 1980–

2014. Management accounting research, 31, pp.45-62.

Rodrigues, R., Leichsenring, K. and Winkelmann, J., 2014. The ‘Make or Buy’Decision in

Long-term Care: Lessons for Policy. Report commissioned by the Swedish Ministry of

Health and Social Affairs.

Reference

Bianchi, A., Barnett, J., Dempsey, W., Giachinta, M., Hugenberg, M. and Talley, A., 2016.

Applying Value-Focused Thinking to a Make Versus Buy Decision. Industrial and Systems

Engineering Review, 4(2), pp.171-177.

Fullerton, R.R., Kennedy, F.A. and Widener, S.K., 2014. Lean manufacturing and firm

performance: The incremental contribution of lean management accounting

practices. Journal of Operations Management, 32(7), pp.414-428.

Messner, M., 2016. Does industry matter? How industry context shapes management

accounting practice. Management Accounting Research, 31, pp.103-111.

Otley, D., 2016. The contingency theory of management accounting and control: 1980–

2014. Management accounting research, 31, pp.45-62.

Rodrigues, R., Leichsenring, K. and Winkelmann, J., 2014. The ‘Make or Buy’Decision in

Long-term Care: Lessons for Policy. Report commissioned by the Swedish Ministry of

Health and Social Affairs.

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.