Management Accounting Report: Financial Performance and Planning

VerifiedAdded on 2020/06/06

|14

|3869

|28

Report

AI Summary

This report delves into the core concepts of management accounting, providing a comprehensive analysis of its role in organizational success. It begins by exploring different types of accounting systems, such as price optimization, cost accounting, inventory management, and job costing, highlighting their essential utilization in business operations. The report then examines various management accounting reports, including inventory management, job cost, accounts receivable, performance, and budget reports, emphasizing their significance in decision-making, risk management, and financial performance. Furthermore, the report discusses different costing methods, specifically marginal and absorption costing, illustrating their application in calculating net profit. It also addresses the advantages and disadvantages of planning tools, such as budgeting, and explores financial problems along with effective control measures. The report underscores the importance of management accounting in providing valuable insights for informed decision-making, financial planning, and overall organizational success. The provided report is a helpful resource for students seeking to understand the key principles and applications of management accounting. The assignment provides details of different accounting systems, management accounting reports, costing methods and planning tools.

MANAGEMENT

ACCOUNITNG

ACCOUNITNG

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1: Different types of accounting system and their essential utilisation................................1

P2: Different types of management accounting report and their importance.........................3

P3: Different costing methods using for calculating net profit..............................................5

P4: Advantage and disadvantage of using planning tools......................................................7

P5: various financial problems and their effective control measure......................................8

CONCLUSION................................................................................................................................9

REFERENCES..............................................................................................................................11

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1: Different types of accounting system and their essential utilisation................................1

P2: Different types of management accounting report and their importance.........................3

P3: Different costing methods using for calculating net profit..............................................5

P4: Advantage and disadvantage of using planning tools......................................................7

P5: various financial problems and their effective control measure......................................8

CONCLUSION................................................................................................................................9

REFERENCES..............................................................................................................................11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Management accounting refers to the process of identifying, measuring, analysing and

preparing financial statement which help company in knowing their actual financial position in

competitive market world. The manager of company is held responsible to record and analyse

the accounting data and resources which will be useful in making an effective decision for

company. Preparing financial reports annually easily attracts investors, shareholders etc. to invest

more in an organisation through which an organisation can achieve growth and success for

longer duration. The main purpose of preparing this report is providing the role of management

accounting in the success of an organisation. Various accounting and reporting systems which is

helpful in improving the performance of company also discussed under this report. The project

also covers different planning tools which are used to control budgetary process and also other

techniques in order to resolve all financial issues are also mentioned under this report

(Schermann, Wiesche and Krcmar, 2012).

TASK 1

P1: Different types of accounting system and their essential utilisation

For every business organisation, it is important to record accounting transaction in order

to find out the actual revenue and expenses through which the manager can able to implement

corrective actions if any deviation found. The manager of company is held responsible to store

material accounting information regarding investors, shareholders, customers etc. which will be

helpful for them to take an effective decision in order to get positive outcome in near future.

Adopting accounting system enables manager to focus on important matters which will bring

beneficial to company. There are some advantages of adopting management accounting system

which are as follows:

Increase in efficiency: It will help in bringing efficiency in various business activities in

order to achieve desired goals and objectives within limited period of time.

Measurement of performance: It helps manager to measure the performance of

employees through comparing their actual performance with standard so that efficient workers

are easily identified.

1

Management accounting refers to the process of identifying, measuring, analysing and

preparing financial statement which help company in knowing their actual financial position in

competitive market world. The manager of company is held responsible to record and analyse

the accounting data and resources which will be useful in making an effective decision for

company. Preparing financial reports annually easily attracts investors, shareholders etc. to invest

more in an organisation through which an organisation can achieve growth and success for

longer duration. The main purpose of preparing this report is providing the role of management

accounting in the success of an organisation. Various accounting and reporting systems which is

helpful in improving the performance of company also discussed under this report. The project

also covers different planning tools which are used to control budgetary process and also other

techniques in order to resolve all financial issues are also mentioned under this report

(Schermann, Wiesche and Krcmar, 2012).

TASK 1

P1: Different types of accounting system and their essential utilisation

For every business organisation, it is important to record accounting transaction in order

to find out the actual revenue and expenses through which the manager can able to implement

corrective actions if any deviation found. The manager of company is held responsible to store

material accounting information regarding investors, shareholders, customers etc. which will be

helpful for them to take an effective decision in order to get positive outcome in near future.

Adopting accounting system enables manager to focus on important matters which will bring

beneficial to company. There are some advantages of adopting management accounting system

which are as follows:

Increase in efficiency: It will help in bringing efficiency in various business activities in

order to achieve desired goals and objectives within limited period of time.

Measurement of performance: It helps manager to measure the performance of

employees through comparing their actual performance with standard so that efficient workers

are easily identified.

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

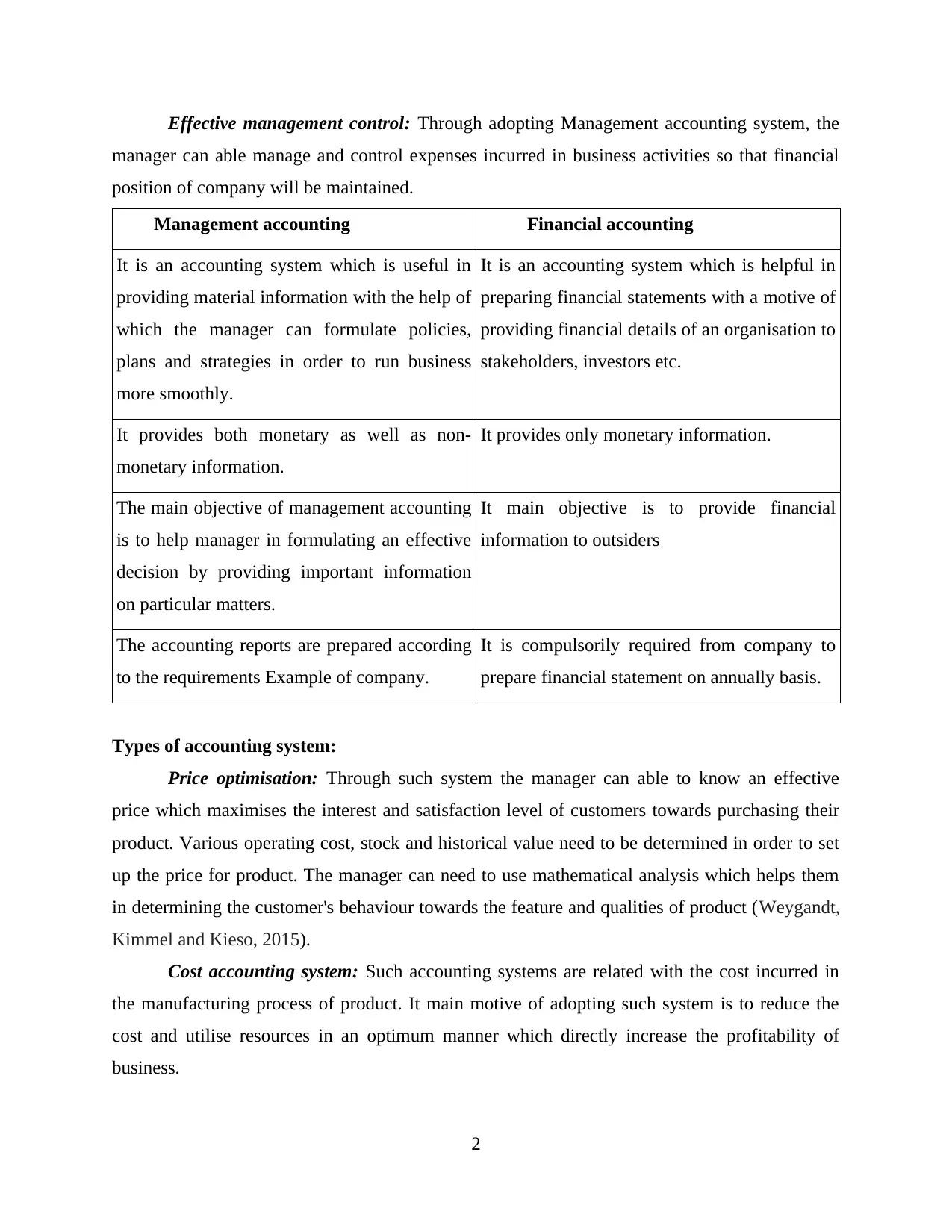

Effective management control: Through adopting Management accounting system, the

manager can able manage and control expenses incurred in business activities so that financial

position of company will be maintained.

Management accounting Financial accounting

It is an accounting system which is useful in

providing material information with the help of

which the manager can formulate policies,

plans and strategies in order to run business

more smoothly.

It is an accounting system which is helpful in

preparing financial statements with a motive of

providing financial details of an organisation to

stakeholders, investors etc.

It provides both monetary as well as non-

monetary information.

It provides only monetary information.

The main objective of management accounting

is to help manager in formulating an effective

decision by providing important information

on particular matters.

It main objective is to provide financial

information to outsiders

The accounting reports are prepared according

to the requirements Example of company.

It is compulsorily required from company to

prepare financial statement on annually basis.

Types of accounting system:

Price optimisation: Through such system the manager can able to know an effective

price which maximises the interest and satisfaction level of customers towards purchasing their

product. Various operating cost, stock and historical value need to be determined in order to set

up the price for product. The manager can need to use mathematical analysis which helps them

in determining the customer's behaviour towards the feature and qualities of product (Weygandt,

Kimmel and Kieso, 2015).

Cost accounting system: Such accounting systems are related with the cost incurred in

the manufacturing process of product. It main motive of adopting such system is to reduce the

cost and utilise resources in an optimum manner which directly increase the profitability of

business.

2

manager can able manage and control expenses incurred in business activities so that financial

position of company will be maintained.

Management accounting Financial accounting

It is an accounting system which is useful in

providing material information with the help of

which the manager can formulate policies,

plans and strategies in order to run business

more smoothly.

It is an accounting system which is helpful in

preparing financial statements with a motive of

providing financial details of an organisation to

stakeholders, investors etc.

It provides both monetary as well as non-

monetary information.

It provides only monetary information.

The main objective of management accounting

is to help manager in formulating an effective

decision by providing important information

on particular matters.

It main objective is to provide financial

information to outsiders

The accounting reports are prepared according

to the requirements Example of company.

It is compulsorily required from company to

prepare financial statement on annually basis.

Types of accounting system:

Price optimisation: Through such system the manager can able to know an effective

price which maximises the interest and satisfaction level of customers towards purchasing their

product. Various operating cost, stock and historical value need to be determined in order to set

up the price for product. The manager can need to use mathematical analysis which helps them

in determining the customer's behaviour towards the feature and qualities of product (Weygandt,

Kimmel and Kieso, 2015).

Cost accounting system: Such accounting systems are related with the cost incurred in

the manufacturing process of product. It main motive of adopting such system is to reduce the

cost and utilise resources in an optimum manner which directly increase the profitability of

business.

2

Inventory management system: It helps manager in tracking the movement of goods

used in the business operation through which they can able to know the level of inventory

available in warehouses in order to avoid situation of shortage in production process. Thus

manager is held liable to maintain minimum level of stock in order to meet customer's needs and

demands.

Job costing system: It refers to such accounting system in which the total cost is

allocated for the purpose of completing specific project activity. It is helpful in deciding the costs

to a client which is needed to incur to execute specific project.

P2: Different types of management accounting report and their importance

Reporting: It is important concept which includes the collection and disbursement of

information. Every kind of organization, whether small or large in nature required to adopt

effective reporting system. Through implementation of reporting system large numbers of

benefits are obtained by organization like planning of future operations, disbursement of roles

and responsibilities, improved performance of employees, improved decision making of internal

parties etc. It provides the opportunity to the management of organization to attain sustainability

in their performance and improvement of profitability.

There are large numbers of management accounting reports are prepared by the cited

organization like job cost, performance, budgeted, inventory management report etc. Different

kind of reports contains various information regarding different departmental activities. It also

helps in maintaining effective communication and coordination among the different departments

of cited organization. Such reports are further used by the management of organization for

preparation of the budgets and standards to provide direction to employees in performance of

their tasks. Through such budgets goals and objectives are set by the organization which is

required to achieve by employees. It also helps in comparison of actual performance of

employees with such predetermined standards and find out the deviations. According to such

deviations, solutions are provided by managers to improve their performances. Different kinds of

reports which are prepared by organization are mentioned below:

Inventory management report: This report contains the information regarding the stock

which is actually present in organization. It provides the opportunity regarding optimum

3

used in the business operation through which they can able to know the level of inventory

available in warehouses in order to avoid situation of shortage in production process. Thus

manager is held liable to maintain minimum level of stock in order to meet customer's needs and

demands.

Job costing system: It refers to such accounting system in which the total cost is

allocated for the purpose of completing specific project activity. It is helpful in deciding the costs

to a client which is needed to incur to execute specific project.

P2: Different types of management accounting report and their importance

Reporting: It is important concept which includes the collection and disbursement of

information. Every kind of organization, whether small or large in nature required to adopt

effective reporting system. Through implementation of reporting system large numbers of

benefits are obtained by organization like planning of future operations, disbursement of roles

and responsibilities, improved performance of employees, improved decision making of internal

parties etc. It provides the opportunity to the management of organization to attain sustainability

in their performance and improvement of profitability.

There are large numbers of management accounting reports are prepared by the cited

organization like job cost, performance, budgeted, inventory management report etc. Different

kind of reports contains various information regarding different departmental activities. It also

helps in maintaining effective communication and coordination among the different departments

of cited organization. Such reports are further used by the management of organization for

preparation of the budgets and standards to provide direction to employees in performance of

their tasks. Through such budgets goals and objectives are set by the organization which is

required to achieve by employees. It also helps in comparison of actual performance of

employees with such predetermined standards and find out the deviations. According to such

deviations, solutions are provided by managers to improve their performances. Different kinds of

reports which are prepared by organization are mentioned below:

Inventory management report: This report contains the information regarding the stock

which is actually present in organization. It provides the opportunity regarding optimum

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

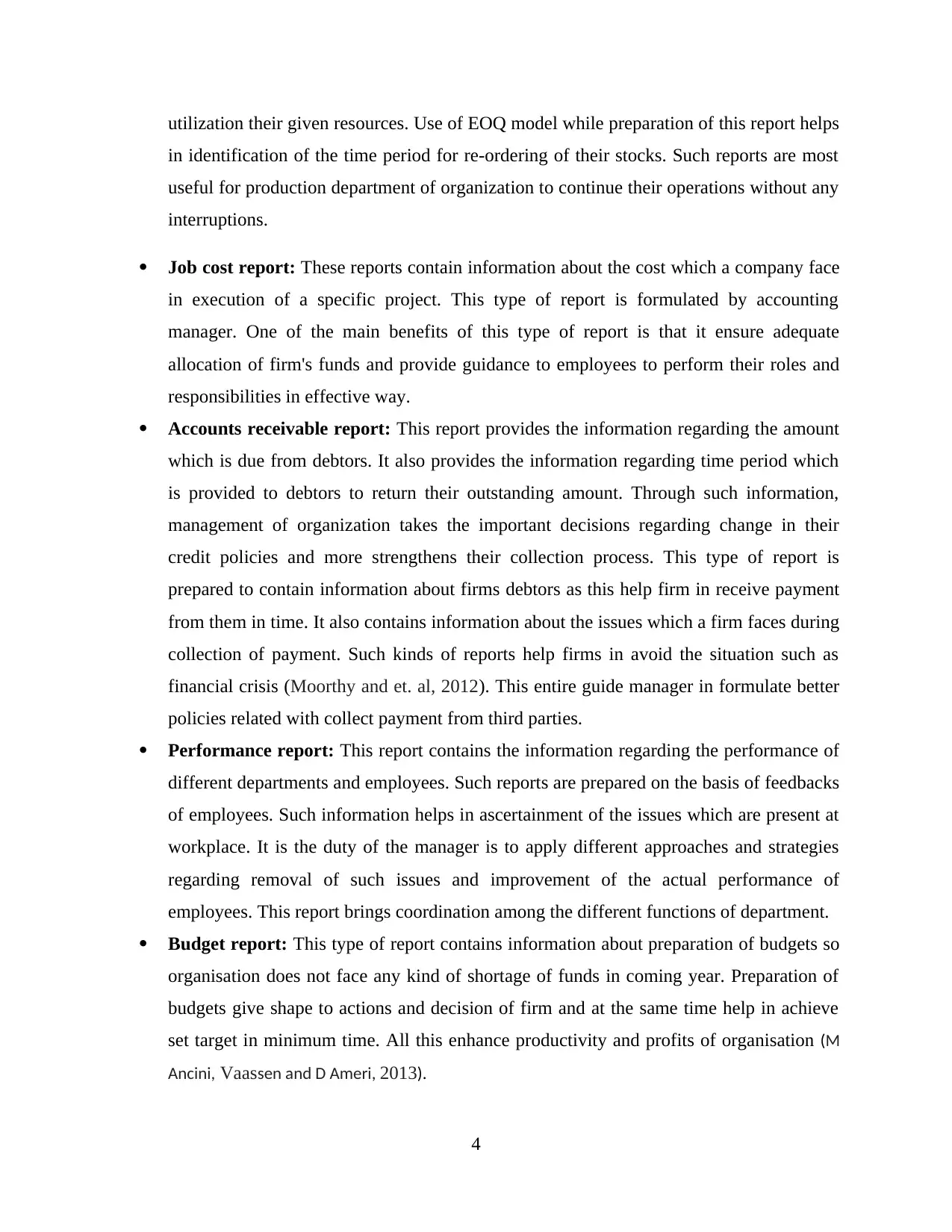

utilization their given resources. Use of EOQ model while preparation of this report helps

in identification of the time period for re-ordering of their stocks. Such reports are most

useful for production department of organization to continue their operations without any

interruptions.

Job cost report: These reports contain information about the cost which a company face

in execution of a specific project. This type of report is formulated by accounting

manager. One of the main benefits of this type of report is that it ensure adequate

allocation of firm's funds and provide guidance to employees to perform their roles and

responsibilities in effective way.

Accounts receivable report: This report provides the information regarding the amount

which is due from debtors. It also provides the information regarding time period which

is provided to debtors to return their outstanding amount. Through such information,

management of organization takes the important decisions regarding change in their

credit policies and more strengthens their collection process. This type of report is

prepared to contain information about firms debtors as this help firm in receive payment

from them in time. It also contains information about the issues which a firm faces during

collection of payment. Such kinds of reports help firms in avoid the situation such as

financial crisis (Moorthy and et. al, 2012). This entire guide manager in formulate better

policies related with collect payment from third parties.

Performance report: This report contains the information regarding the performance of

different departments and employees. Such reports are prepared on the basis of feedbacks

of employees. Such information helps in ascertainment of the issues which are present at

workplace. It is the duty of the manager is to apply different approaches and strategies

regarding removal of such issues and improvement of the actual performance of

employees. This report brings coordination among the different functions of department.

Budget report: This type of report contains information about preparation of budgets so

organisation does not face any kind of shortage of funds in coming year. Preparation of

budgets give shape to actions and decision of firm and at the same time help in achieve

set target in minimum time. All this enhance productivity and profits of organisation (M

Ancini, Vaassen and D Ameri, 2013).

4

in identification of the time period for re-ordering of their stocks. Such reports are most

useful for production department of organization to continue their operations without any

interruptions.

Job cost report: These reports contain information about the cost which a company face

in execution of a specific project. This type of report is formulated by accounting

manager. One of the main benefits of this type of report is that it ensure adequate

allocation of firm's funds and provide guidance to employees to perform their roles and

responsibilities in effective way.

Accounts receivable report: This report provides the information regarding the amount

which is due from debtors. It also provides the information regarding time period which

is provided to debtors to return their outstanding amount. Through such information,

management of organization takes the important decisions regarding change in their

credit policies and more strengthens their collection process. This type of report is

prepared to contain information about firms debtors as this help firm in receive payment

from them in time. It also contains information about the issues which a firm faces during

collection of payment. Such kinds of reports help firms in avoid the situation such as

financial crisis (Moorthy and et. al, 2012). This entire guide manager in formulate better

policies related with collect payment from third parties.

Performance report: This report contains the information regarding the performance of

different departments and employees. Such reports are prepared on the basis of feedbacks

of employees. Such information helps in ascertainment of the issues which are present at

workplace. It is the duty of the manager is to apply different approaches and strategies

regarding removal of such issues and improvement of the actual performance of

employees. This report brings coordination among the different functions of department.

Budget report: This type of report contains information about preparation of budgets so

organisation does not face any kind of shortage of funds in coming year. Preparation of

budgets give shape to actions and decision of firm and at the same time help in achieve

set target in minimum time. All this enhance productivity and profits of organisation (M

Ancini, Vaassen and D Ameri, 2013).

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

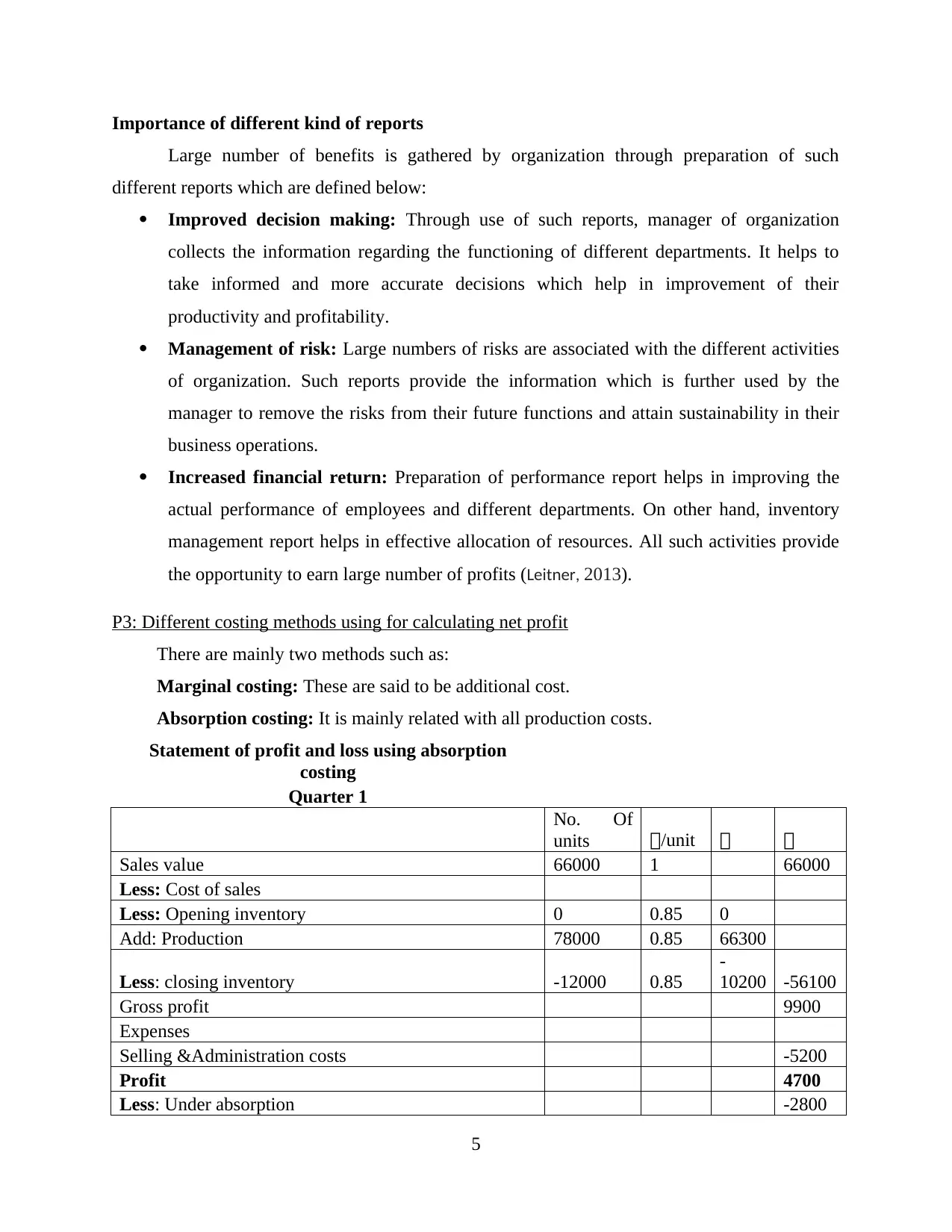

Importance of different kind of reports

Large number of benefits is gathered by organization through preparation of such

different reports which are defined below:

Improved decision making: Through use of such reports, manager of organization

collects the information regarding the functioning of different departments. It helps to

take informed and more accurate decisions which help in improvement of their

productivity and profitability.

Management of risk: Large numbers of risks are associated with the different activities

of organization. Such reports provide the information which is further used by the

manager to remove the risks from their future functions and attain sustainability in their

business operations.

Increased financial return: Preparation of performance report helps in improving the

actual performance of employees and different departments. On other hand, inventory

management report helps in effective allocation of resources. All such activities provide

the opportunity to earn large number of profits (Leitner, 2013).

P3: Different costing methods using for calculating net profit

There are mainly two methods such as:

Marginal costing: These are said to be additional cost.

Absorption costing: It is mainly related with all production costs.

Statement of profit and loss using absorption

costing

Quarter 1

No. Of

units £/unit £ £

Sales value 66000 1 66000

Less: Cost of sales

Less: Opening inventory 0 0.85 0

Add: Production 78000 0.85 66300

Less: closing inventory -12000 0.85

-

10200 -56100

Gross profit 9900

Expenses

Selling &Administration costs -5200

Profit 4700

Less: Under absorption -2800

5

Large number of benefits is gathered by organization through preparation of such

different reports which are defined below:

Improved decision making: Through use of such reports, manager of organization

collects the information regarding the functioning of different departments. It helps to

take informed and more accurate decisions which help in improvement of their

productivity and profitability.

Management of risk: Large numbers of risks are associated with the different activities

of organization. Such reports provide the information which is further used by the

manager to remove the risks from their future functions and attain sustainability in their

business operations.

Increased financial return: Preparation of performance report helps in improving the

actual performance of employees and different departments. On other hand, inventory

management report helps in effective allocation of resources. All such activities provide

the opportunity to earn large number of profits (Leitner, 2013).

P3: Different costing methods using for calculating net profit

There are mainly two methods such as:

Marginal costing: These are said to be additional cost.

Absorption costing: It is mainly related with all production costs.

Statement of profit and loss using absorption

costing

Quarter 1

No. Of

units £/unit £ £

Sales value 66000 1 66000

Less: Cost of sales

Less: Opening inventory 0 0.85 0

Add: Production 78000 0.85 66300

Less: closing inventory -12000 0.85

-

10200 -56100

Gross profit 9900

Expenses

Selling &Administration costs -5200

Profit 4700

Less: Under absorption -2800

5

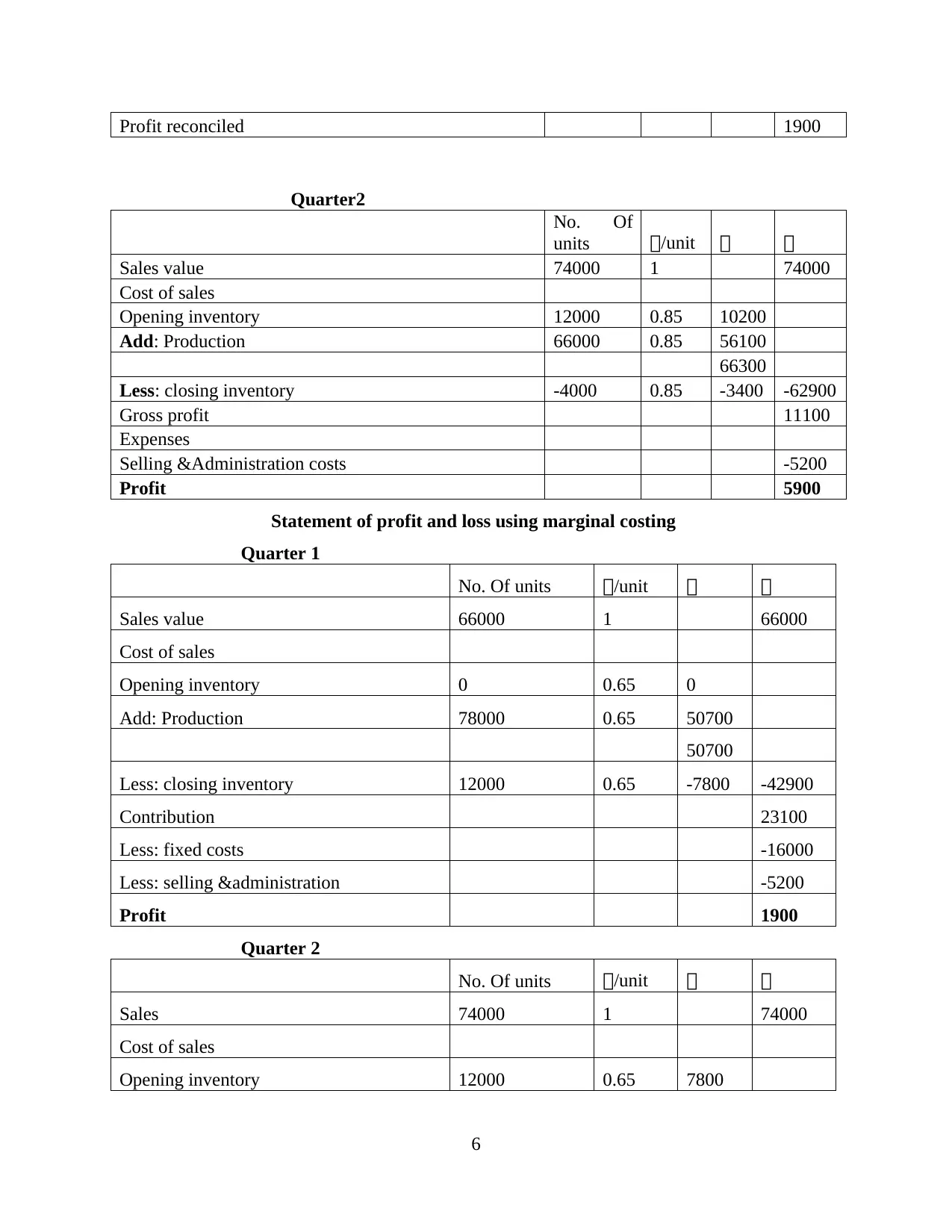

Profit reconciled 1900

Quarter2

No. Of

units £/unit £ £

Sales value 74000 1 74000

Cost of sales

Opening inventory 12000 0.85 10200

Add: Production 66000 0.85 56100

66300

Less: closing inventory -4000 0.85 -3400 -62900

Gross profit 11100

Expenses

Selling &Administration costs -5200

Profit 5900

Statement of profit and loss using marginal costing

Quarter 1

No. Of units £/unit £ £

Sales value 66000 1 66000

Cost of sales

Opening inventory 0 0.65 0

Add: Production 78000 0.65 50700

50700

Less: closing inventory 12000 0.65 -7800 -42900

Contribution 23100

Less: fixed costs -16000

Less: selling &administration -5200

Profit 1900

Quarter 2

No. Of units £/unit £ £

Sales 74000 1 74000

Cost of sales

Opening inventory 12000 0.65 7800

6

Quarter2

No. Of

units £/unit £ £

Sales value 74000 1 74000

Cost of sales

Opening inventory 12000 0.85 10200

Add: Production 66000 0.85 56100

66300

Less: closing inventory -4000 0.85 -3400 -62900

Gross profit 11100

Expenses

Selling &Administration costs -5200

Profit 5900

Statement of profit and loss using marginal costing

Quarter 1

No. Of units £/unit £ £

Sales value 66000 1 66000

Cost of sales

Opening inventory 0 0.65 0

Add: Production 78000 0.65 50700

50700

Less: closing inventory 12000 0.65 -7800 -42900

Contribution 23100

Less: fixed costs -16000

Less: selling &administration -5200

Profit 1900

Quarter 2

No. Of units £/unit £ £

Sales 74000 1 74000

Cost of sales

Opening inventory 12000 0.65 7800

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

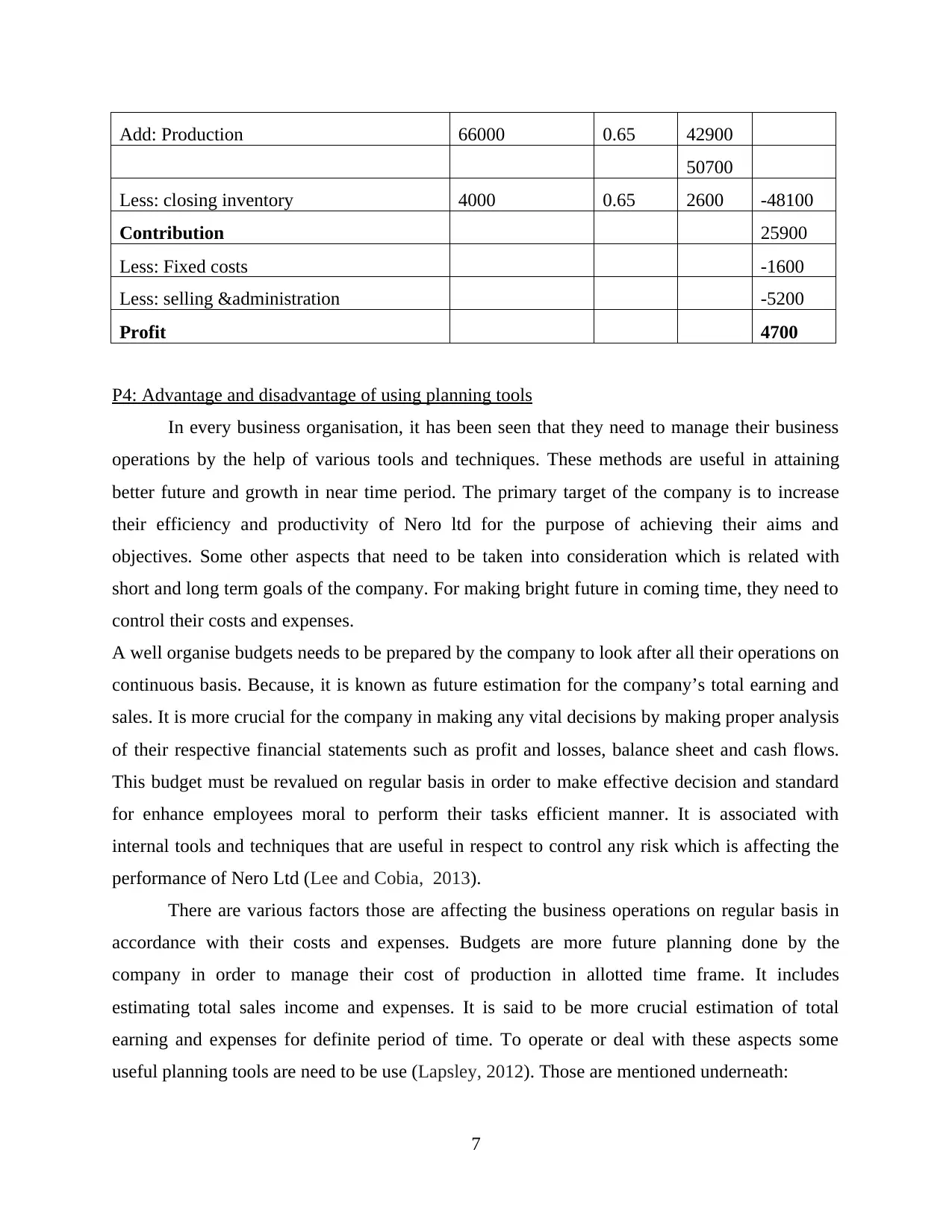

Add: Production 66000 0.65 42900

50700

Less: closing inventory 4000 0.65 2600 -48100

Contribution 25900

Less: Fixed costs -1600

Less: selling &administration -5200

Profit 4700

P4: Advantage and disadvantage of using planning tools

In every business organisation, it has been seen that they need to manage their business

operations by the help of various tools and techniques. These methods are useful in attaining

better future and growth in near time period. The primary target of the company is to increase

their efficiency and productivity of Nero ltd for the purpose of achieving their aims and

objectives. Some other aspects that need to be taken into consideration which is related with

short and long term goals of the company. For making bright future in coming time, they need to

control their costs and expenses.

A well organise budgets needs to be prepared by the company to look after all their operations on

continuous basis. Because, it is known as future estimation for the company’s total earning and

sales. It is more crucial for the company in making any vital decisions by making proper analysis

of their respective financial statements such as profit and losses, balance sheet and cash flows.

This budget must be revalued on regular basis in order to make effective decision and standard

for enhance employees moral to perform their tasks efficient manner. It is associated with

internal tools and techniques that are useful in respect to control any risk which is affecting the

performance of Nero Ltd (Lee and Cobia, 2013).

There are various factors those are affecting the business operations on regular basis in

accordance with their costs and expenses. Budgets are more future planning done by the

company in order to manage their cost of production in allotted time frame. It includes

estimating total sales income and expenses. It is said to be more crucial estimation of total

earning and expenses for definite period of time. To operate or deal with these aspects some

useful planning tools are need to be use (Lapsley, 2012). Those are mentioned underneath:

7

50700

Less: closing inventory 4000 0.65 2600 -48100

Contribution 25900

Less: Fixed costs -1600

Less: selling &administration -5200

Profit 4700

P4: Advantage and disadvantage of using planning tools

In every business organisation, it has been seen that they need to manage their business

operations by the help of various tools and techniques. These methods are useful in attaining

better future and growth in near time period. The primary target of the company is to increase

their efficiency and productivity of Nero ltd for the purpose of achieving their aims and

objectives. Some other aspects that need to be taken into consideration which is related with

short and long term goals of the company. For making bright future in coming time, they need to

control their costs and expenses.

A well organise budgets needs to be prepared by the company to look after all their operations on

continuous basis. Because, it is known as future estimation for the company’s total earning and

sales. It is more crucial for the company in making any vital decisions by making proper analysis

of their respective financial statements such as profit and losses, balance sheet and cash flows.

This budget must be revalued on regular basis in order to make effective decision and standard

for enhance employees moral to perform their tasks efficient manner. It is associated with

internal tools and techniques that are useful in respect to control any risk which is affecting the

performance of Nero Ltd (Lee and Cobia, 2013).

There are various factors those are affecting the business operations on regular basis in

accordance with their costs and expenses. Budgets are more future planning done by the

company in order to manage their cost of production in allotted time frame. It includes

estimating total sales income and expenses. It is said to be more crucial estimation of total

earning and expenses for definite period of time. To operate or deal with these aspects some

useful planning tools are need to be use (Lapsley, 2012). Those are mentioned underneath:

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Forecasting tools: These are said to be more effective tools which is useful in making

crucial estimation of future events on continuous basis of their previous and present data in

easier manner. This planning technique begins with assumption that is being associated with

administration assumption, ability and decision making.

Advantage: The primary benefits of using these tools is said to be helpful for the business with

effective decision making. As the major aspects of this is related with the future growth and

sustainability of the company. This helps in determining more positive outcomes for Nero Ltd. In

case of forecasting qualitative data is mostly depending on taking crucial decision making for the

experts (Harris and Mongiello, 2012).

Disadvantage: In few cases, it is not possible to estimate accurate target and growth

results. Because future is uncertain, it is done so because of their qualitative nature of estimation

of business plan they cannot be able to come up with modern ideas and innovative thinking.

Scenario tools: it is known as the most thinking evaluating techniques. Thus, planning is

more crucial according to their mention situation in the manufacturing firm. This will assists in

long term planning and investment decision for the company. In large business organisation, they

primarily use to adapt these techniques to make their team action under their control.

Advantage: These planning techniques are final estimation of effective thinking ability

which is related with different alternatives. It is mostly helpful in determining better capability

and objectives of employees and their staff members. It will lead to focus on various critical

conditions as per the mentioned results (Eierle and Schultze, 2013).

Disadvantage: The major limitation of these planning tools is that it becomes sometime

very difficult to handle any critical situations. Because these are arises uniform and make huge

impacts on the productivity and growth of the company.

Contingency tools: It is said to be an effective strategies which devise for a perfect

results which often useful in getting more positive results. It mainly helpful in managing and

hedging risk factors those are present in any financial or non-financial term. It is mostly concern

with local authorities and large business enterprises.

Advantages: One of the biggest merits of these tools is to recognise company’s total

limitation and operations those are useful for the success of their company. They are always

ready to face any issues arises without giving any alarm.

8

crucial estimation of future events on continuous basis of their previous and present data in

easier manner. This planning technique begins with assumption that is being associated with

administration assumption, ability and decision making.

Advantage: The primary benefits of using these tools is said to be helpful for the business with

effective decision making. As the major aspects of this is related with the future growth and

sustainability of the company. This helps in determining more positive outcomes for Nero Ltd. In

case of forecasting qualitative data is mostly depending on taking crucial decision making for the

experts (Harris and Mongiello, 2012).

Disadvantage: In few cases, it is not possible to estimate accurate target and growth

results. Because future is uncertain, it is done so because of their qualitative nature of estimation

of business plan they cannot be able to come up with modern ideas and innovative thinking.

Scenario tools: it is known as the most thinking evaluating techniques. Thus, planning is

more crucial according to their mention situation in the manufacturing firm. This will assists in

long term planning and investment decision for the company. In large business organisation, they

primarily use to adapt these techniques to make their team action under their control.

Advantage: These planning techniques are final estimation of effective thinking ability

which is related with different alternatives. It is mostly helpful in determining better capability

and objectives of employees and their staff members. It will lead to focus on various critical

conditions as per the mentioned results (Eierle and Schultze, 2013).

Disadvantage: The major limitation of these planning tools is that it becomes sometime

very difficult to handle any critical situations. Because these are arises uniform and make huge

impacts on the productivity and growth of the company.

Contingency tools: It is said to be an effective strategies which devise for a perfect

results which often useful in getting more positive results. It mainly helpful in managing and

hedging risk factors those are present in any financial or non-financial term. It is mostly concern

with local authorities and large business enterprises.

Advantages: One of the biggest merits of these tools is to recognise company’s total

limitation and operations those are useful for the success of their company. They are always

ready to face any issues arises without giving any alarm.

8

Disadvantage: It is very hard to deal with automatically problems those are arising in the

company. In those situations, they are not able to work in proper manner because manager

cannot control risk those are uncertain (Belfo and Trigo, 2013).

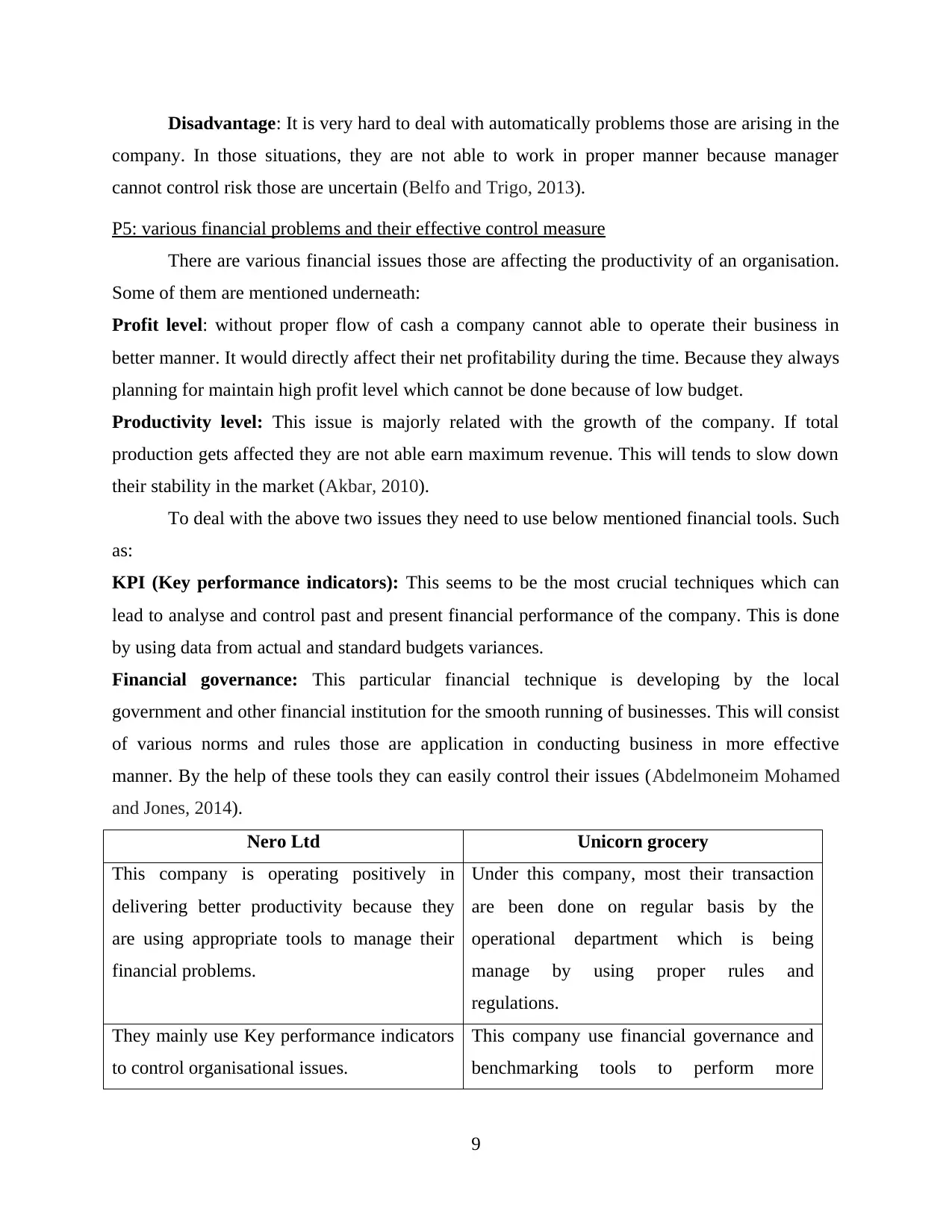

P5: various financial problems and their effective control measure

There are various financial issues those are affecting the productivity of an organisation.

Some of them are mentioned underneath:

Profit level: without proper flow of cash a company cannot able to operate their business in

better manner. It would directly affect their net profitability during the time. Because they always

planning for maintain high profit level which cannot be done because of low budget.

Productivity level: This issue is majorly related with the growth of the company. If total

production gets affected they are not able earn maximum revenue. This will tends to slow down

their stability in the market (Akbar, 2010).

To deal with the above two issues they need to use below mentioned financial tools. Such

as:

KPI (Key performance indicators): This seems to be the most crucial techniques which can

lead to analyse and control past and present financial performance of the company. This is done

by using data from actual and standard budgets variances.

Financial governance: This particular financial technique is developing by the local

government and other financial institution for the smooth running of businesses. This will consist

of various norms and rules those are application in conducting business in more effective

manner. By the help of these tools they can easily control their issues (Abdelmoneim Mohamed

and Jones, 2014).

Nero Ltd Unicorn grocery

This company is operating positively in

delivering better productivity because they

are using appropriate tools to manage their

financial problems.

Under this company, most their transaction

are been done on regular basis by the

operational department which is being

manage by using proper rules and

regulations.

They mainly use Key performance indicators

to control organisational issues.

This company use financial governance and

benchmarking tools to perform more

9

company. In those situations, they are not able to work in proper manner because manager

cannot control risk those are uncertain (Belfo and Trigo, 2013).

P5: various financial problems and their effective control measure

There are various financial issues those are affecting the productivity of an organisation.

Some of them are mentioned underneath:

Profit level: without proper flow of cash a company cannot able to operate their business in

better manner. It would directly affect their net profitability during the time. Because they always

planning for maintain high profit level which cannot be done because of low budget.

Productivity level: This issue is majorly related with the growth of the company. If total

production gets affected they are not able earn maximum revenue. This will tends to slow down

their stability in the market (Akbar, 2010).

To deal with the above two issues they need to use below mentioned financial tools. Such

as:

KPI (Key performance indicators): This seems to be the most crucial techniques which can

lead to analyse and control past and present financial performance of the company. This is done

by using data from actual and standard budgets variances.

Financial governance: This particular financial technique is developing by the local

government and other financial institution for the smooth running of businesses. This will consist

of various norms and rules those are application in conducting business in more effective

manner. By the help of these tools they can easily control their issues (Abdelmoneim Mohamed

and Jones, 2014).

Nero Ltd Unicorn grocery

This company is operating positively in

delivering better productivity because they

are using appropriate tools to manage their

financial problems.

Under this company, most their transaction

are been done on regular basis by the

operational department which is being

manage by using proper rules and

regulations.

They mainly use Key performance indicators

to control organisational issues.

This company use financial governance and

benchmarking tools to perform more

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.