ABC Ltd Management Accounting Report: Costing and Budgeting

VerifiedAdded on 2020/11/12

|12

|3372

|134

Report

AI Summary

This report analyzes the financial performance of ABC Ltd, a chair manufacturing company, over three years, focusing on management accounting principles. It delves into the calculation and interpretation of both marginal and absorption costing methods, providing income statements for each year under both approaches. The report calculates key financial metrics such as sales, cost of goods sold, gross profit, and net profit. It also includes an analysis of variable and fixed costs, along with selling, distribution, and administrative overheads. Furthermore, the report provides interpretations of the financial results, highlighting trends and insights into the company's profitability and operational efficiency. The report also touches upon the advantages and disadvantages of budgeting control planning tools.

Management Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

TASK...............................................................................................................................................1

P3 Calculation of marginal and absorption costing................................................................1

P4-Advantages and disadvantage of budgeting control planning tools.................................7

CONCLUSION ...............................................................................................................................8

REFERENCES .............................................................................................................................10

INTRODUCTION...........................................................................................................................1

TASK...............................................................................................................................................1

P3 Calculation of marginal and absorption costing................................................................1

P4-Advantages and disadvantage of budgeting control planning tools.................................7

CONCLUSION ...............................................................................................................................8

REFERENCES .............................................................................................................................10

INTRODUCTION

Management accounting is a process of preparing financial report and accounting of the

company. It is usually used for internal management and it is not regulated by any law. It is

significant tool that supports managers of company to make correct decision. Present report is

based on ABC ltd company which is engaged in chair manufacturing and the business is running

for 3 years. Report will explain budgeting control tools which are very useful for evaluate actual

performance of firm. This report also includes marginal costing and absorption costing

calculations and interpretation of net operating income is added in study (Chi and Ho, 2017).

TASK

P3 Calculation of marginal and absorption costing

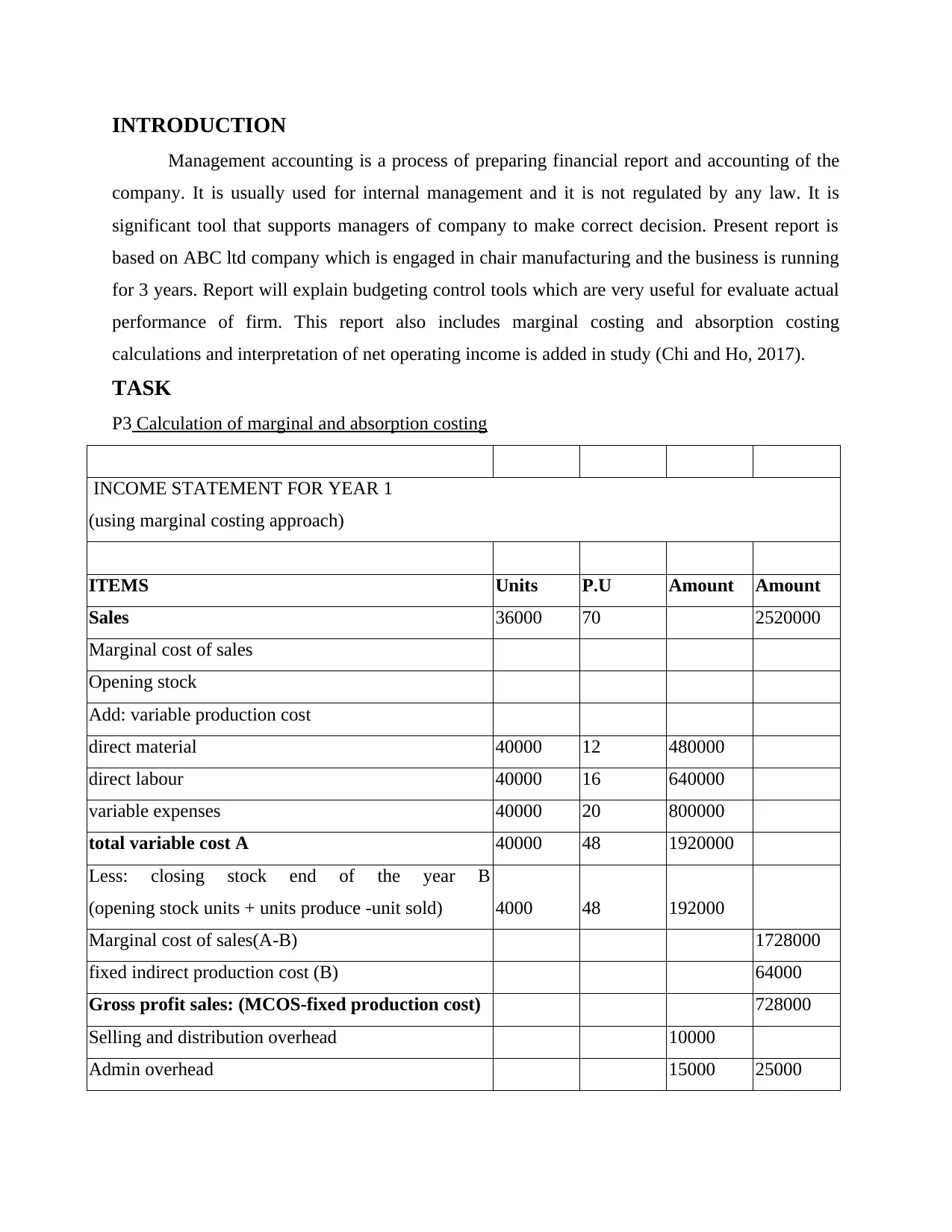

INCOME STATEMENT FOR YEAR 1

(using marginal costing approach)

ITEMS Units P.U Amount Amount

Sales 36000 70 2520000

Marginal cost of sales

Opening stock

Add: variable production cost

direct material 40000 12 480000

direct labour 40000 16 640000

variable expenses 40000 20 800000

total variable cost A 40000 48 1920000

Less: closing stock end of the year B

(opening stock units + units produce -unit sold) 4000 48 192000

Marginal cost of sales(A-B) 1728000

fixed indirect production cost (B) 64000

Gross profit sales: (MCOS-fixed production cost) 728000

Selling and distribution overhead 10000

Admin overhead 15000 25000

Management accounting is a process of preparing financial report and accounting of the

company. It is usually used for internal management and it is not regulated by any law. It is

significant tool that supports managers of company to make correct decision. Present report is

based on ABC ltd company which is engaged in chair manufacturing and the business is running

for 3 years. Report will explain budgeting control tools which are very useful for evaluate actual

performance of firm. This report also includes marginal costing and absorption costing

calculations and interpretation of net operating income is added in study (Chi and Ho, 2017).

TASK

P3 Calculation of marginal and absorption costing

INCOME STATEMENT FOR YEAR 1

(using marginal costing approach)

ITEMS Units P.U Amount Amount

Sales 36000 70 2520000

Marginal cost of sales

Opening stock

Add: variable production cost

direct material 40000 12 480000

direct labour 40000 16 640000

variable expenses 40000 20 800000

total variable cost A 40000 48 1920000

Less: closing stock end of the year B

(opening stock units + units produce -unit sold) 4000 48 192000

Marginal cost of sales(A-B) 1728000

fixed indirect production cost (B) 64000

Gross profit sales: (MCOS-fixed production cost) 728000

Selling and distribution overhead 10000

Admin overhead 15000 25000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

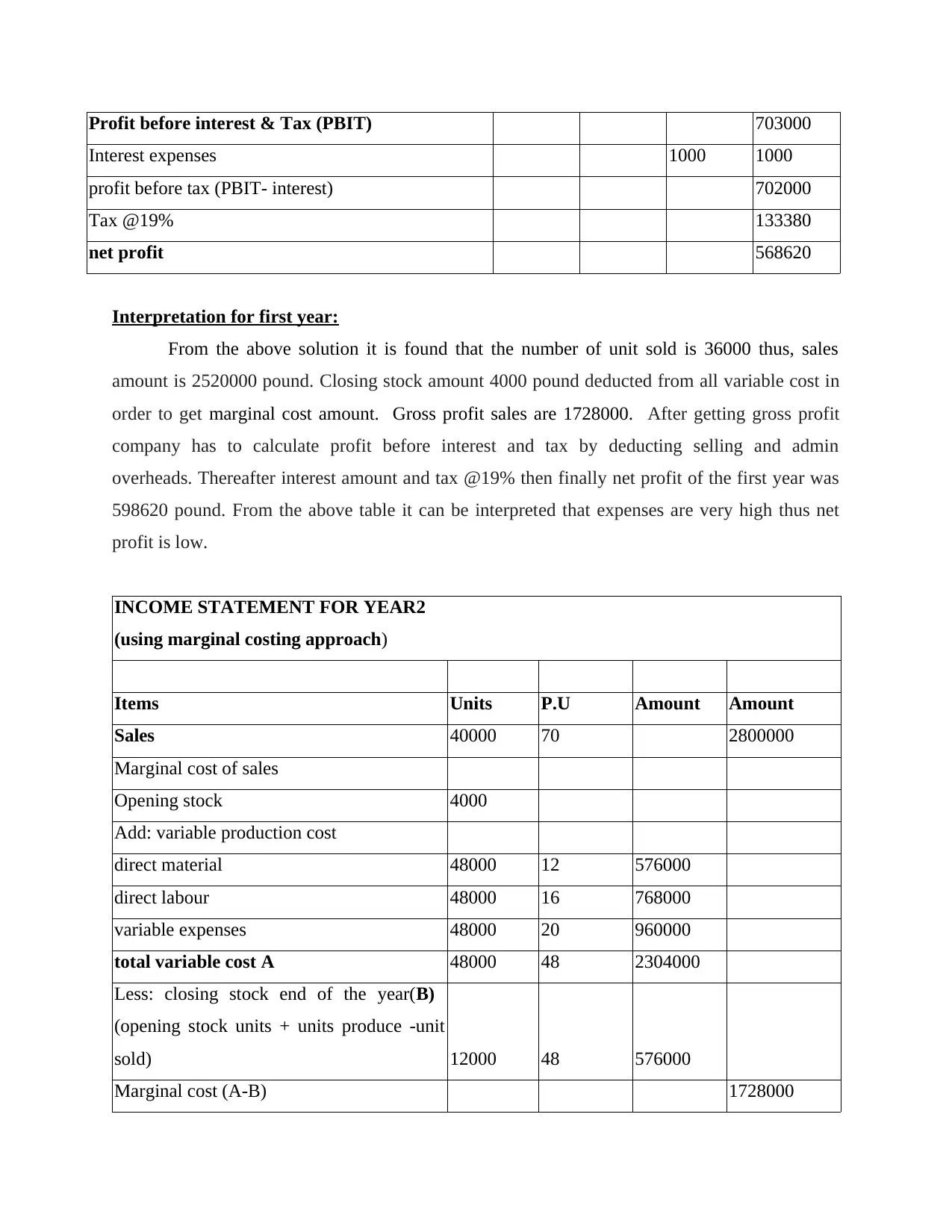

Profit before interest & Tax (PBIT) 703000

Interest expenses 1000 1000

profit before tax (PBIT- interest) 702000

Tax @19% 133380

net profit 568620

Interpretation for first year:

From the above solution it is found that the number of unit sold is 36000 thus, sales

amount is 2520000 pound. Closing stock amount 4000 pound deducted from all variable cost in

order to get marginal cost amount. Gross profit sales are 1728000. After getting gross profit

company has to calculate profit before interest and tax by deducting selling and admin

overheads. Thereafter interest amount and tax @19% then finally net profit of the first year was

598620 pound. From the above table it can be interpreted that expenses are very high thus net

profit is low.

INCOME STATEMENT FOR YEAR2

(using marginal costing approach)

Items Units P.U Amount Amount

Sales 40000 70 2800000

Marginal cost of sales

Opening stock 4000

Add: variable production cost

direct material 48000 12 576000

direct labour 48000 16 768000

variable expenses 48000 20 960000

total variable cost A 48000 48 2304000

Less: closing stock end of the year(B)

(opening stock units + units produce -unit

sold) 12000 48 576000

Marginal cost (A-B) 1728000

Interest expenses 1000 1000

profit before tax (PBIT- interest) 702000

Tax @19% 133380

net profit 568620

Interpretation for first year:

From the above solution it is found that the number of unit sold is 36000 thus, sales

amount is 2520000 pound. Closing stock amount 4000 pound deducted from all variable cost in

order to get marginal cost amount. Gross profit sales are 1728000. After getting gross profit

company has to calculate profit before interest and tax by deducting selling and admin

overheads. Thereafter interest amount and tax @19% then finally net profit of the first year was

598620 pound. From the above table it can be interpreted that expenses are very high thus net

profit is low.

INCOME STATEMENT FOR YEAR2

(using marginal costing approach)

Items Units P.U Amount Amount

Sales 40000 70 2800000

Marginal cost of sales

Opening stock 4000

Add: variable production cost

direct material 48000 12 576000

direct labour 48000 16 768000

variable expenses 48000 20 960000

total variable cost A 48000 48 2304000

Less: closing stock end of the year(B)

(opening stock units + units produce -unit

sold) 12000 48 576000

Marginal cost (A-B) 1728000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

fixed indirect production cost 64000

Gross profit: (MCOS-fixed production

cost) 1008000

Selling and distribution overhead 10500

Admin overhead 15000 25500

Profit before interest & Tax(PBIT) 982500

Interest expenses 1250 1250

profit before tax(PBIT- interest) 981250

Tax @19% 186437.5

Net profit 794812.5

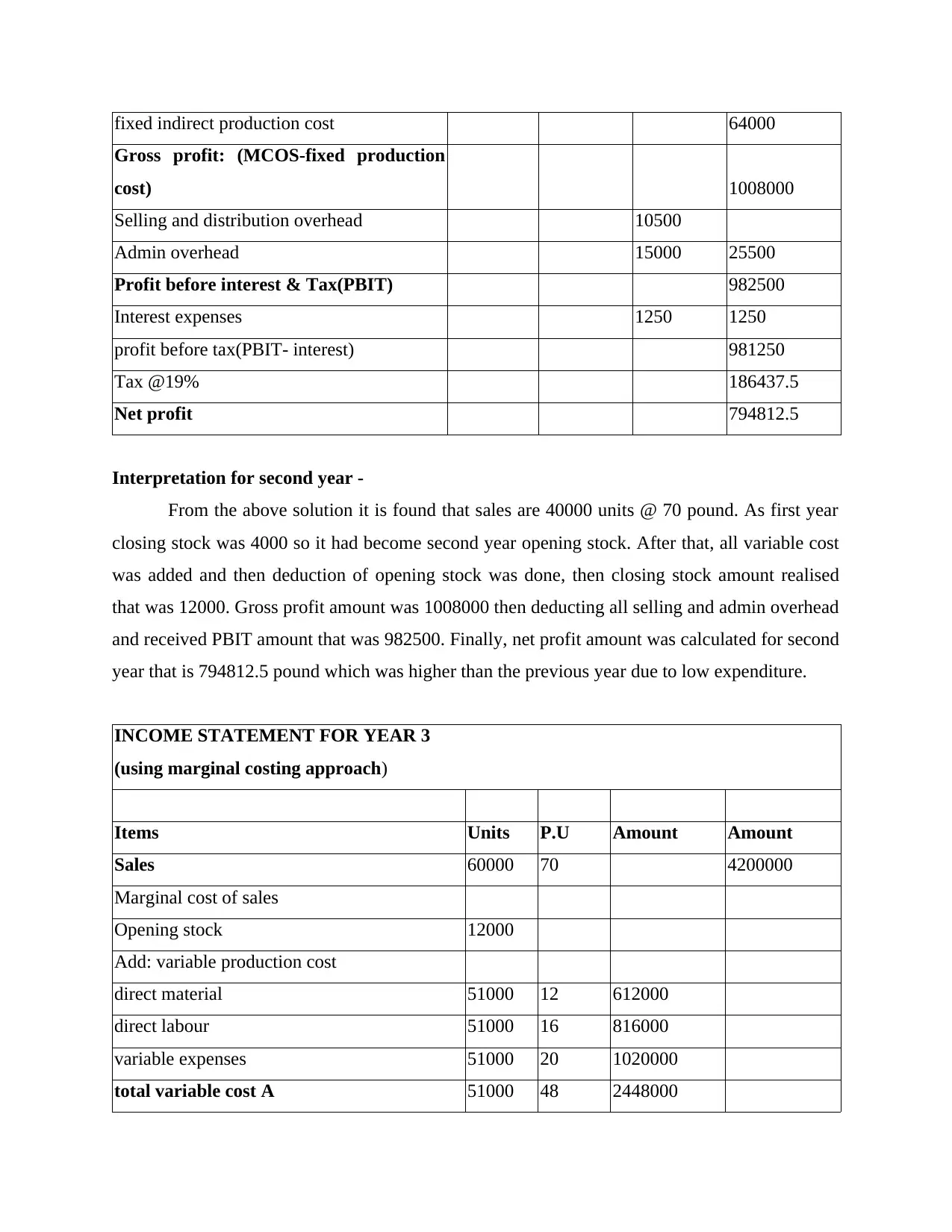

Interpretation for second year -

From the above solution it is found that sales are 40000 units @ 70 pound. As first year

closing stock was 4000 so it had become second year opening stock. After that, all variable cost

was added and then deduction of opening stock was done, then closing stock amount realised

that was 12000. Gross profit amount was 1008000 then deducting all selling and admin overhead

and received PBIT amount that was 982500. Finally, net profit amount was calculated for second

year that is 794812.5 pound which was higher than the previous year due to low expenditure.

INCOME STATEMENT FOR YEAR 3

(using marginal costing approach)

Items Units P.U Amount Amount

Sales 60000 70 4200000

Marginal cost of sales

Opening stock 12000

Add: variable production cost

direct material 51000 12 612000

direct labour 51000 16 816000

variable expenses 51000 20 1020000

total variable cost A 51000 48 2448000

Gross profit: (MCOS-fixed production

cost) 1008000

Selling and distribution overhead 10500

Admin overhead 15000 25500

Profit before interest & Tax(PBIT) 982500

Interest expenses 1250 1250

profit before tax(PBIT- interest) 981250

Tax @19% 186437.5

Net profit 794812.5

Interpretation for second year -

From the above solution it is found that sales are 40000 units @ 70 pound. As first year

closing stock was 4000 so it had become second year opening stock. After that, all variable cost

was added and then deduction of opening stock was done, then closing stock amount realised

that was 12000. Gross profit amount was 1008000 then deducting all selling and admin overhead

and received PBIT amount that was 982500. Finally, net profit amount was calculated for second

year that is 794812.5 pound which was higher than the previous year due to low expenditure.

INCOME STATEMENT FOR YEAR 3

(using marginal costing approach)

Items Units P.U Amount Amount

Sales 60000 70 4200000

Marginal cost of sales

Opening stock 12000

Add: variable production cost

direct material 51000 12 612000

direct labour 51000 16 816000

variable expenses 51000 20 1020000

total variable cost A 51000 48 2448000

Less: closing stock end of the year B

(opening stock units + units produce -unit

sold) 3000 48 144000

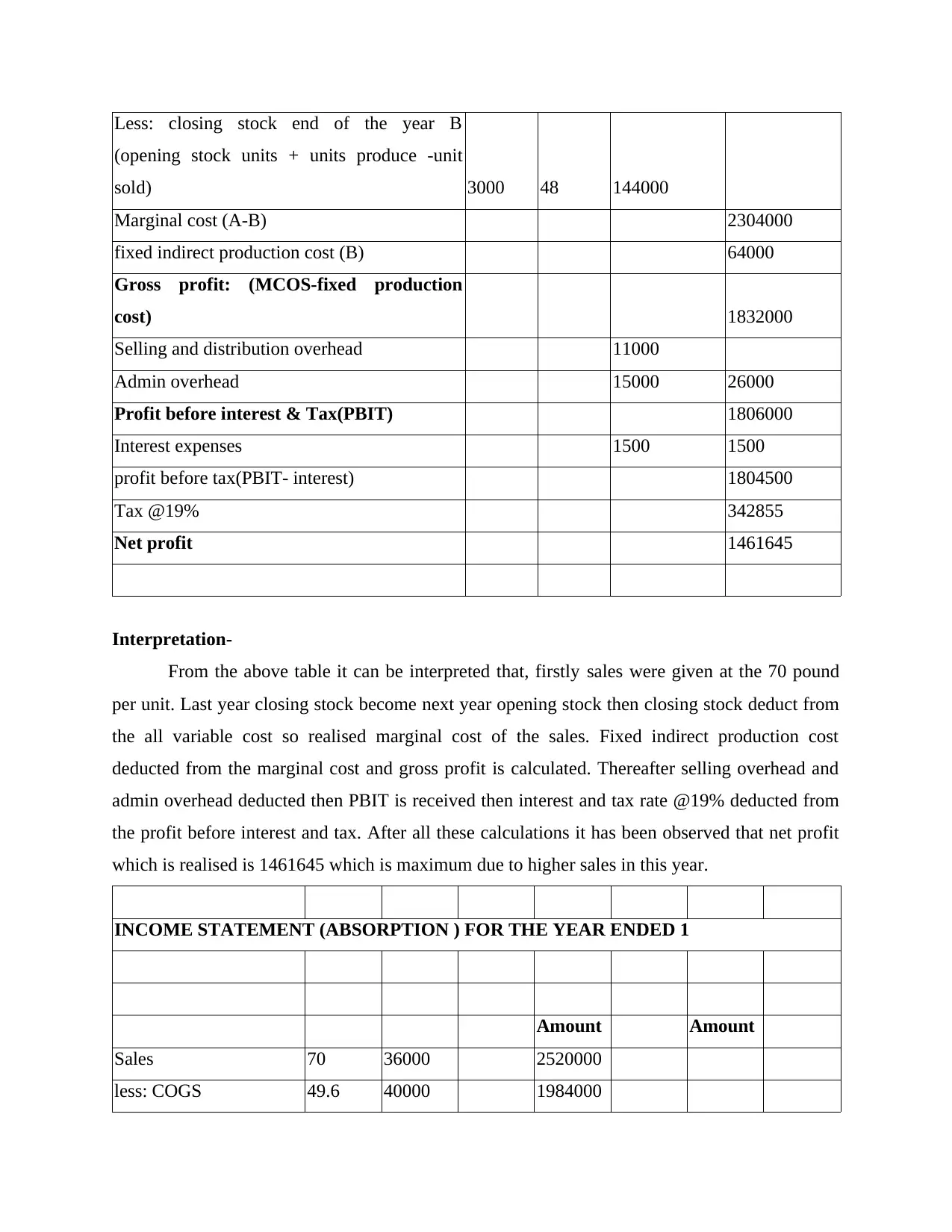

Marginal cost (A-B) 2304000

fixed indirect production cost (B) 64000

Gross profit: (MCOS-fixed production

cost) 1832000

Selling and distribution overhead 11000

Admin overhead 15000 26000

Profit before interest & Tax(PBIT) 1806000

Interest expenses 1500 1500

profit before tax(PBIT- interest) 1804500

Tax @19% 342855

Net profit 1461645

Interpretation-

From the above table it can be interpreted that, firstly sales were given at the 70 pound

per unit. Last year closing stock become next year opening stock then closing stock deduct from

the all variable cost so realised marginal cost of the sales. Fixed indirect production cost

deducted from the marginal cost and gross profit is calculated. Thereafter selling overhead and

admin overhead deducted then PBIT is received then interest and tax rate @19% deducted from

the profit before interest and tax. After all these calculations it has been observed that net profit

which is realised is 1461645 which is maximum due to higher sales in this year.

INCOME STATEMENT (ABSORPTION ) FOR THE YEAR ENDED 1

Amount Amount

Sales 70 36000 2520000

less: COGS 49.6 40000 1984000

(opening stock units + units produce -unit

sold) 3000 48 144000

Marginal cost (A-B) 2304000

fixed indirect production cost (B) 64000

Gross profit: (MCOS-fixed production

cost) 1832000

Selling and distribution overhead 11000

Admin overhead 15000 26000

Profit before interest & Tax(PBIT) 1806000

Interest expenses 1500 1500

profit before tax(PBIT- interest) 1804500

Tax @19% 342855

Net profit 1461645

Interpretation-

From the above table it can be interpreted that, firstly sales were given at the 70 pound

per unit. Last year closing stock become next year opening stock then closing stock deduct from

the all variable cost so realised marginal cost of the sales. Fixed indirect production cost

deducted from the marginal cost and gross profit is calculated. Thereafter selling overhead and

admin overhead deducted then PBIT is received then interest and tax rate @19% deducted from

the profit before interest and tax. After all these calculations it has been observed that net profit

which is realised is 1461645 which is maximum due to higher sales in this year.

INCOME STATEMENT (ABSORPTION ) FOR THE YEAR ENDED 1

Amount Amount

Sales 70 36000 2520000

less: COGS 49.6 40000 1984000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

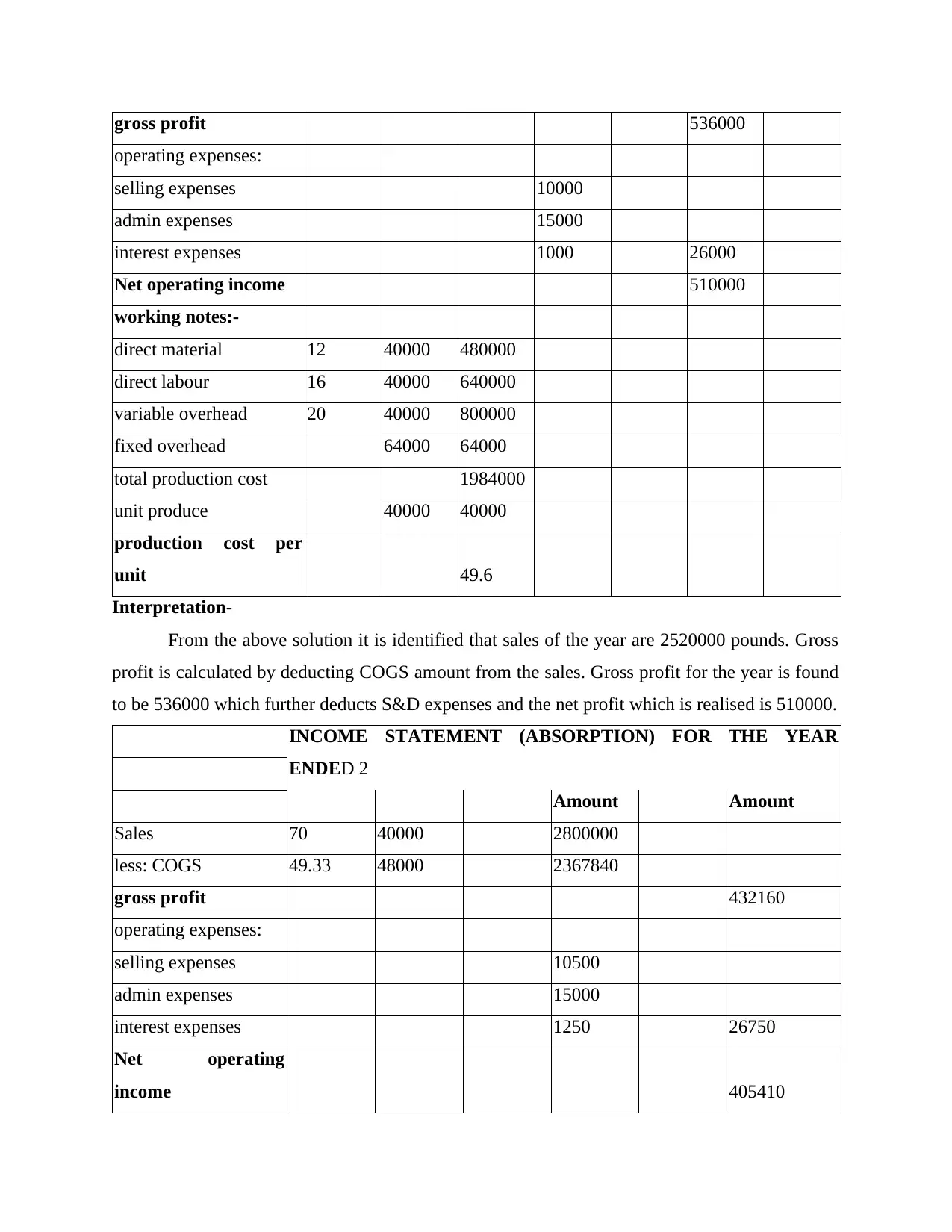

gross profit 536000

operating expenses:

selling expenses 10000

admin expenses 15000

interest expenses 1000 26000

Net operating income 510000

working notes:-

direct material 12 40000 480000

direct labour 16 40000 640000

variable overhead 20 40000 800000

fixed overhead 64000 64000

total production cost 1984000

unit produce 40000 40000

production cost per

unit 49.6

Interpretation-

From the above solution it is identified that sales of the year are 2520000 pounds. Gross

profit is calculated by deducting COGS amount from the sales. Gross profit for the year is found

to be 536000 which further deducts S&D expenses and the net profit which is realised is 510000.

INCOME STATEMENT (ABSORPTION) FOR THE YEAR

ENDED 2

Amount Amount

Sales 70 40000 2800000

less: COGS 49.33 48000 2367840

gross profit 432160

operating expenses:

selling expenses 10500

admin expenses 15000

interest expenses 1250 26750

Net operating

income 405410

operating expenses:

selling expenses 10000

admin expenses 15000

interest expenses 1000 26000

Net operating income 510000

working notes:-

direct material 12 40000 480000

direct labour 16 40000 640000

variable overhead 20 40000 800000

fixed overhead 64000 64000

total production cost 1984000

unit produce 40000 40000

production cost per

unit 49.6

Interpretation-

From the above solution it is identified that sales of the year are 2520000 pounds. Gross

profit is calculated by deducting COGS amount from the sales. Gross profit for the year is found

to be 536000 which further deducts S&D expenses and the net profit which is realised is 510000.

INCOME STATEMENT (ABSORPTION) FOR THE YEAR

ENDED 2

Amount Amount

Sales 70 40000 2800000

less: COGS 49.33 48000 2367840

gross profit 432160

operating expenses:

selling expenses 10500

admin expenses 15000

interest expenses 1250 26750

Net operating

income 405410

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

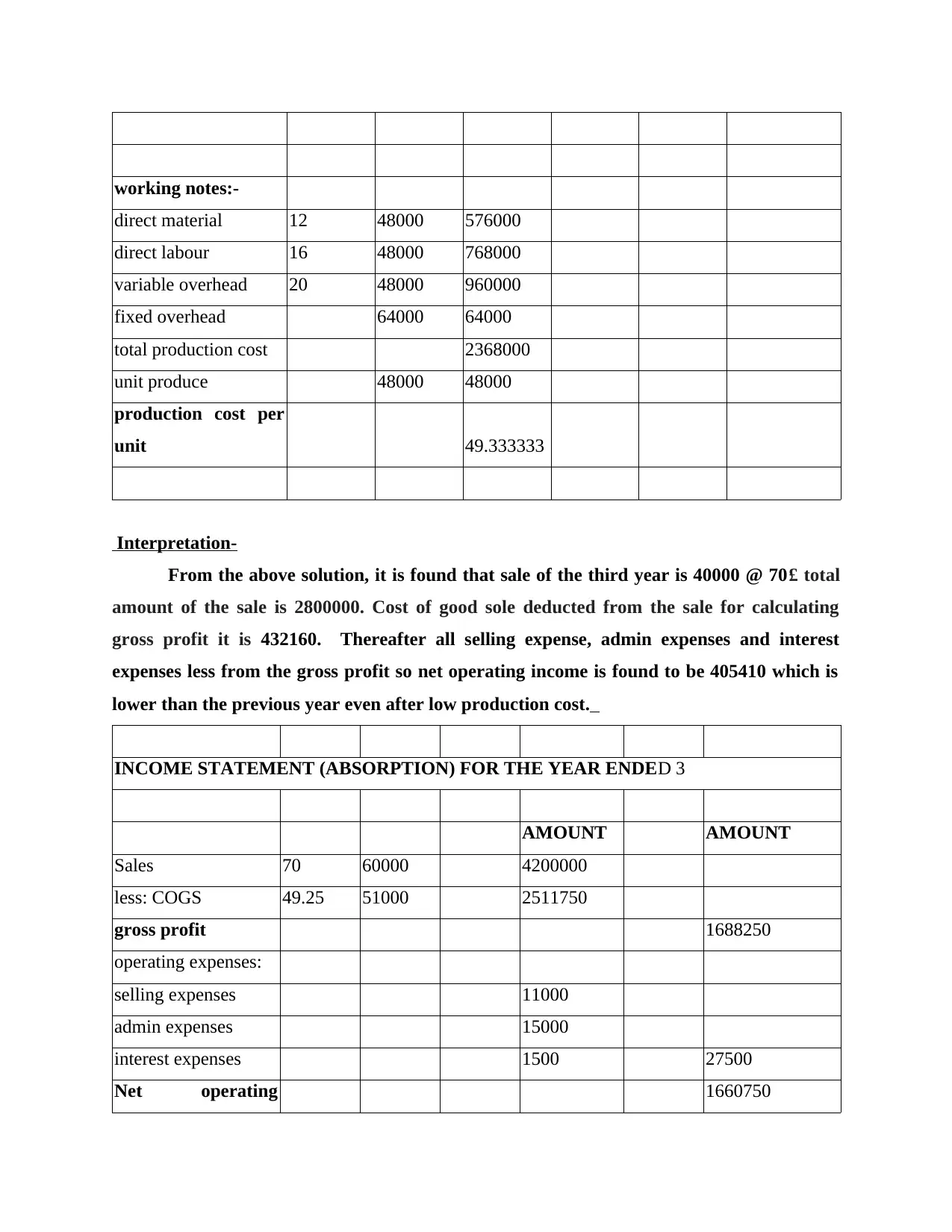

working notes:-

direct material 12 48000 576000

direct labour 16 48000 768000

variable overhead 20 48000 960000

fixed overhead 64000 64000

total production cost 2368000

unit produce 48000 48000

production cost per

unit 49.333333

Interpretation-

From the above solution, it is found that sale of the third year is 40000 @ 70£ total

amount of the sale is 2800000. Cost of good sole deducted from the sale for calculating

gross profit it is 432160. Thereafter all selling expense, admin expenses and interest

expenses less from the gross profit so net operating income is found to be 405410 which is

lower than the previous year even after low production cost.

INCOME STATEMENT (ABSORPTION) FOR THE YEAR ENDED 3

AMOUNT AMOUNT

Sales 70 60000 4200000

less: COGS 49.25 51000 2511750

gross profit 1688250

operating expenses:

selling expenses 11000

admin expenses 15000

interest expenses 1500 27500

Net operating 1660750

direct material 12 48000 576000

direct labour 16 48000 768000

variable overhead 20 48000 960000

fixed overhead 64000 64000

total production cost 2368000

unit produce 48000 48000

production cost per

unit 49.333333

Interpretation-

From the above solution, it is found that sale of the third year is 40000 @ 70£ total

amount of the sale is 2800000. Cost of good sole deducted from the sale for calculating

gross profit it is 432160. Thereafter all selling expense, admin expenses and interest

expenses less from the gross profit so net operating income is found to be 405410 which is

lower than the previous year even after low production cost.

INCOME STATEMENT (ABSORPTION) FOR THE YEAR ENDED 3

AMOUNT AMOUNT

Sales 70 60000 4200000

less: COGS 49.25 51000 2511750

gross profit 1688250

operating expenses:

selling expenses 11000

admin expenses 15000

interest expenses 1500 27500

Net operating 1660750

income

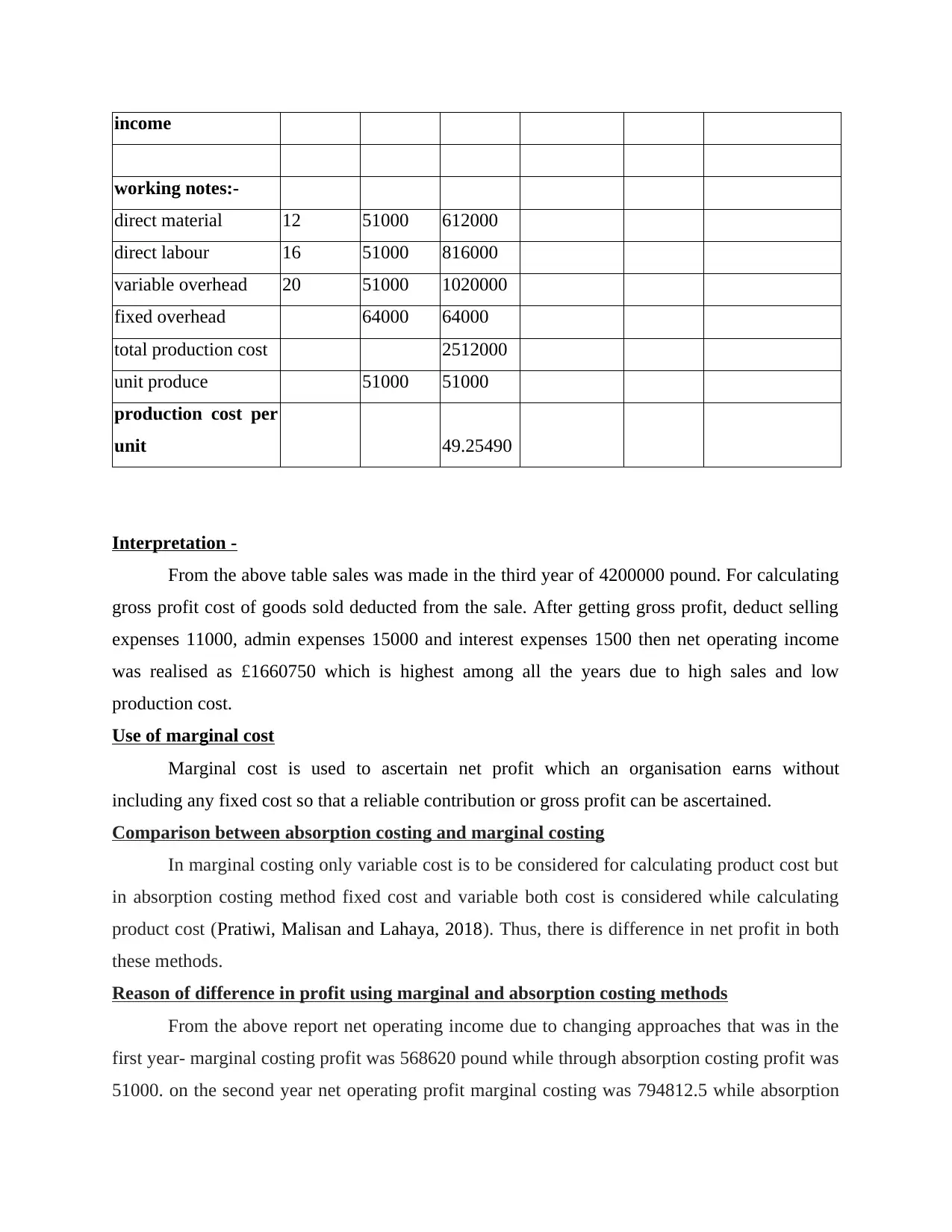

working notes:-

direct material 12 51000 612000

direct labour 16 51000 816000

variable overhead 20 51000 1020000

fixed overhead 64000 64000

total production cost 2512000

unit produce 51000 51000

production cost per

unit 49.25490

Interpretation -

From the above table sales was made in the third year of 4200000 pound. For calculating

gross profit cost of goods sold deducted from the sale. After getting gross profit, deduct selling

expenses 11000, admin expenses 15000 and interest expenses 1500 then net operating income

was realised as £1660750 which is highest among all the years due to high sales and low

production cost.

Use of marginal cost

Marginal cost is used to ascertain net profit which an organisation earns without

including any fixed cost so that a reliable contribution or gross profit can be ascertained.

Comparison between absorption costing and marginal costing

In marginal costing only variable cost is to be considered for calculating product cost but

in absorption costing method fixed cost and variable both cost is considered while calculating

product cost (Pratiwi, Malisan and Lahaya, 2018). Thus, there is difference in net profit in both

these methods.

Reason of difference in profit using marginal and absorption costing methods

From the above report net operating income due to changing approaches that was in the

first year- marginal costing profit was 568620 pound while through absorption costing profit was

51000. on the second year net operating profit marginal costing was 794812.5 while absorption

working notes:-

direct material 12 51000 612000

direct labour 16 51000 816000

variable overhead 20 51000 1020000

fixed overhead 64000 64000

total production cost 2512000

unit produce 51000 51000

production cost per

unit 49.25490

Interpretation -

From the above table sales was made in the third year of 4200000 pound. For calculating

gross profit cost of goods sold deducted from the sale. After getting gross profit, deduct selling

expenses 11000, admin expenses 15000 and interest expenses 1500 then net operating income

was realised as £1660750 which is highest among all the years due to high sales and low

production cost.

Use of marginal cost

Marginal cost is used to ascertain net profit which an organisation earns without

including any fixed cost so that a reliable contribution or gross profit can be ascertained.

Comparison between absorption costing and marginal costing

In marginal costing only variable cost is to be considered for calculating product cost but

in absorption costing method fixed cost and variable both cost is considered while calculating

product cost (Pratiwi, Malisan and Lahaya, 2018). Thus, there is difference in net profit in both

these methods.

Reason of difference in profit using marginal and absorption costing methods

From the above report net operating income due to changing approaches that was in the

first year- marginal costing profit was 568620 pound while through absorption costing profit was

51000. on the second year net operating profit marginal costing was 794812.5 while absorption

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

costing profit was 405410 and in the end third year net profit was 1461645 by using marginal

costing and 1660750 pounds’ net profit by using absorption costing due to variation in

production cost in both the methods which occurred as fixed cost is not included in marginal

costing method. So ABC LTD company should use marginal costing because of higher net profit.

P4-Advantages and disadvantage of budgeting control planning tools

Budgeting control is a process in which actual performance is compared with predefine

budget (standard budget), it helps to find out variance so that corrective actions can be taken

without any delay (Saha, 2017).

BUDGETING CONTROL TOOLS OF ABC LTD COMPANY-

ZERO BASE BUDGET

Zero base budget is budgeting controlling tool in which all expenses are approved for

new year. Zero base budging starts from new base at the beginning of every financial year.

Company analysis cost of every function and accordingly funds are allocated within departments

(Wilhelm and Sydow, 2018). This budget is also known as DE NOVA budgeting.

ADVANTAGES

ABC LTD company able to efficiently allocate resources because zero base budget

prepare on the basis of needs and cost of every function department.

This budget helps in enhance coordination and effective communication within the

company because all member wants to involve to take decision (Pratiwi, Malisan and

Lahaya, 2018).

It can be prepared with accuracy because budget is prepared by current scenario instead

of past figures or past scenario.

DISADVANTAGE

In large scale organization it will become threat for manager because it is required large

number of decision and data are also large so calculation become also complex (Saha,

2017).

It is time consuming process because company have to analysis expenditure for the new

year so sometimes managers are not able to define necessary expenditure for particular

function then it will create complexity.

Fixed budget

costing and 1660750 pounds’ net profit by using absorption costing due to variation in

production cost in both the methods which occurred as fixed cost is not included in marginal

costing method. So ABC LTD company should use marginal costing because of higher net profit.

P4-Advantages and disadvantage of budgeting control planning tools

Budgeting control is a process in which actual performance is compared with predefine

budget (standard budget), it helps to find out variance so that corrective actions can be taken

without any delay (Saha, 2017).

BUDGETING CONTROL TOOLS OF ABC LTD COMPANY-

ZERO BASE BUDGET

Zero base budget is budgeting controlling tool in which all expenses are approved for

new year. Zero base budging starts from new base at the beginning of every financial year.

Company analysis cost of every function and accordingly funds are allocated within departments

(Wilhelm and Sydow, 2018). This budget is also known as DE NOVA budgeting.

ADVANTAGES

ABC LTD company able to efficiently allocate resources because zero base budget

prepare on the basis of needs and cost of every function department.

This budget helps in enhance coordination and effective communication within the

company because all member wants to involve to take decision (Pratiwi, Malisan and

Lahaya, 2018).

It can be prepared with accuracy because budget is prepared by current scenario instead

of past figures or past scenario.

DISADVANTAGE

In large scale organization it will become threat for manager because it is required large

number of decision and data are also large so calculation become also complex (Saha,

2017).

It is time consuming process because company have to analysis expenditure for the new

year so sometimes managers are not able to define necessary expenditure for particular

function then it will create complexity.

Fixed budget

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Fixed budget doesn't change or vary due to changes in sales volume and other activity.

This budget also called static budget because company prepare set static data which helps for

comparing actual performance (Pratiwi, Malisan and Lahaya, 2018).

ADVANTAGES

Through static budget ABC LTD company easy to track budget in every month and time

saving budget because it doesn't change due to changes in sales volume (The fixed

budget, 2018).

Fixed budget helps in reduce cost because manger needs not to make budget all over the

business period (Dereje,2015).

DISADVANTAGE

Fixed budget has no significantly use because every moment company's activities and

sales volume are unpredictable so there is no use of static budget because it will not able

to give accurate profit of the company.

Unfavourable variances may impact on overall predicted budget thus; entity may fail to

run operations successfully.

Flexible budget

Flexible budget is a budget which changes with the change in the level of activity. It is

also called as variance budget (Chi and Ho, 2017).

ADVANTAGES

Through Flexible budget ABC ltd company can be done effectively forecasting that will

help in maximization of the profit.

DISADVANTAGES

Flexible budget is more confusing budget because ABC LTD company need more

planning to track expenses and more adjustment to be required within a business period

(Abdallah, 2017).

Variance analysis- it is quantitative investigation of the difference between actual and planned

behaviour. The variance analysis is used by the organization to maintain and control the

operation of business. Variance analysis uses numerical in the evaluation of the progress of

company.

Advantages

It is useful for identifying the deviation in the performance.

This budget also called static budget because company prepare set static data which helps for

comparing actual performance (Pratiwi, Malisan and Lahaya, 2018).

ADVANTAGES

Through static budget ABC LTD company easy to track budget in every month and time

saving budget because it doesn't change due to changes in sales volume (The fixed

budget, 2018).

Fixed budget helps in reduce cost because manger needs not to make budget all over the

business period (Dereje,2015).

DISADVANTAGE

Fixed budget has no significantly use because every moment company's activities and

sales volume are unpredictable so there is no use of static budget because it will not able

to give accurate profit of the company.

Unfavourable variances may impact on overall predicted budget thus; entity may fail to

run operations successfully.

Flexible budget

Flexible budget is a budget which changes with the change in the level of activity. It is

also called as variance budget (Chi and Ho, 2017).

ADVANTAGES

Through Flexible budget ABC ltd company can be done effectively forecasting that will

help in maximization of the profit.

DISADVANTAGES

Flexible budget is more confusing budget because ABC LTD company need more

planning to track expenses and more adjustment to be required within a business period

(Abdallah, 2017).

Variance analysis- it is quantitative investigation of the difference between actual and planned

behaviour. The variance analysis is used by the organization to maintain and control the

operation of business. Variance analysis uses numerical in the evaluation of the progress of

company.

Advantages

It is useful for identifying the deviation in the performance.

Disadvantages

It takes long time to examine the effect of variance.

Cash budgeting-

Cash budget is a budget or plan which refers to the estimation of future cash receipts and

disbursements during the period. The cash budget depicts the company's cash position in the

future. The cash inflow and outflow includes revenues collected, expenses paid, and loans

receipts and payments.

Advantages :

It assists in identifying the future needs of the cash for [performing the different

operations of organisation.

Disadvantages

It is very expensive to operate a budget

CONCLUSION

Management accounting report summarised that ABC LTD company adapt budgeting

control tools because it helps to compare actual performance with standard performance and

company able to found variance and corrective action can be taken. These report also concluded

that net operating profit of the company vary by using different costing approaches. Total net

profit of the 3 years using marginal costing is higher than absorption costing. So, it can be

concluded that ABC LTD company should follow marginal costing as company can report high

net operating income as compare to absorption costing.

It takes long time to examine the effect of variance.

Cash budgeting-

Cash budget is a budget or plan which refers to the estimation of future cash receipts and

disbursements during the period. The cash budget depicts the company's cash position in the

future. The cash inflow and outflow includes revenues collected, expenses paid, and loans

receipts and payments.

Advantages :

It assists in identifying the future needs of the cash for [performing the different

operations of organisation.

Disadvantages

It is very expensive to operate a budget

CONCLUSION

Management accounting report summarised that ABC LTD company adapt budgeting

control tools because it helps to compare actual performance with standard performance and

company able to found variance and corrective action can be taken. These report also concluded

that net operating profit of the company vary by using different costing approaches. Total net

profit of the 3 years using marginal costing is higher than absorption costing. So, it can be

concluded that ABC LTD company should follow marginal costing as company can report high

net operating income as compare to absorption costing.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.