Management Accounting Assignment: Cost Analysis and Reporting

VerifiedAdded on 2019/12/03

accounting

Paraphrase This Document

Introduction......................................................................................................................................4

Task 1...............................................................................................................................................4

1.1 Different types of classification of cost.................................................................................4

1.2 Computation of total cost and unit cost of job 444 by making use of job costing................5

1.3 Computation of cost of exquisite by making use of absorption costing technique...............5

1.4 Analysis of cost data of exquisite using appropriate techniques...........................................7

Task 2...............................................................................................................................................8

2.1 Preparation and analysis of routine cost reports....................................................................8

2.2 Use of performance indicators in order to identify potential improvements in business....10

2.3 Recommendation for cost reduction and value enhancement for business.........................10

Task 3.............................................................................................................................................11

3.1 Explanation of purpose and nature of the budgeting process..............................................11

3.2 Selection of appropriate budgeting methods in accordance with the needs of organization

...................................................................................................................................................12

3.3 Preparation of production and material purchase budget....................................................12

3.4 Preparation of cash budget...................................................................................................13

Task 4.............................................................................................................................................16

4.1 Computation of variances along with the identification of possible causes and

recommendation for corrective actions......................................................................................16

4.2 Preparation of reconciliation operating statement...............................................................17

4.3 Management report in accordance with the identified responsibility centres.....................17

Conclusion.....................................................................................................................................18

References......................................................................................................................................19

2

Table 1: Computation of cost of Job 444.........................................................................................5

Table 2: Computation of total cost of exquisite...............................................................................5

Table 3: Allocation of cost of support departments on the basis of machine hours........................6

Table 4: Allocation Criteria of cost.................................................................................................6

Table 5: Units to be produced.........................................................................................................6

Table 6: Statement showing computation of exquisite....................................................................7

Table 7: Statement showing computation of exquisite....................................................................7

Table 8: Routine cost report of September......................................................................................8

Table 9: Computation of standard budget at 1900 units..................................................................8

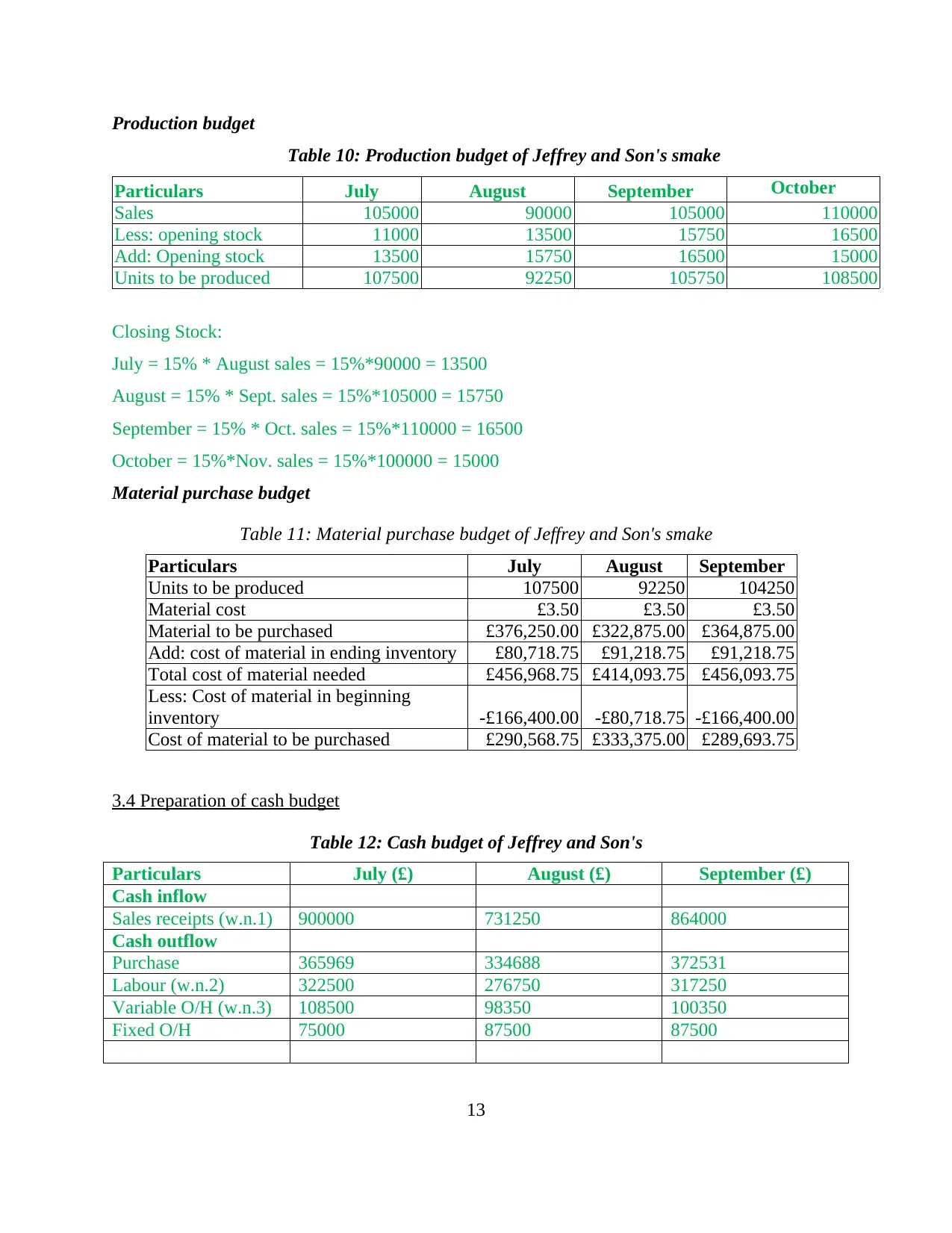

Table 10: Production budget of Jeffrey and Son's smake..............................................................13

Table 11: Material purchase budget of Jeffrey and Son's smake...................................................13

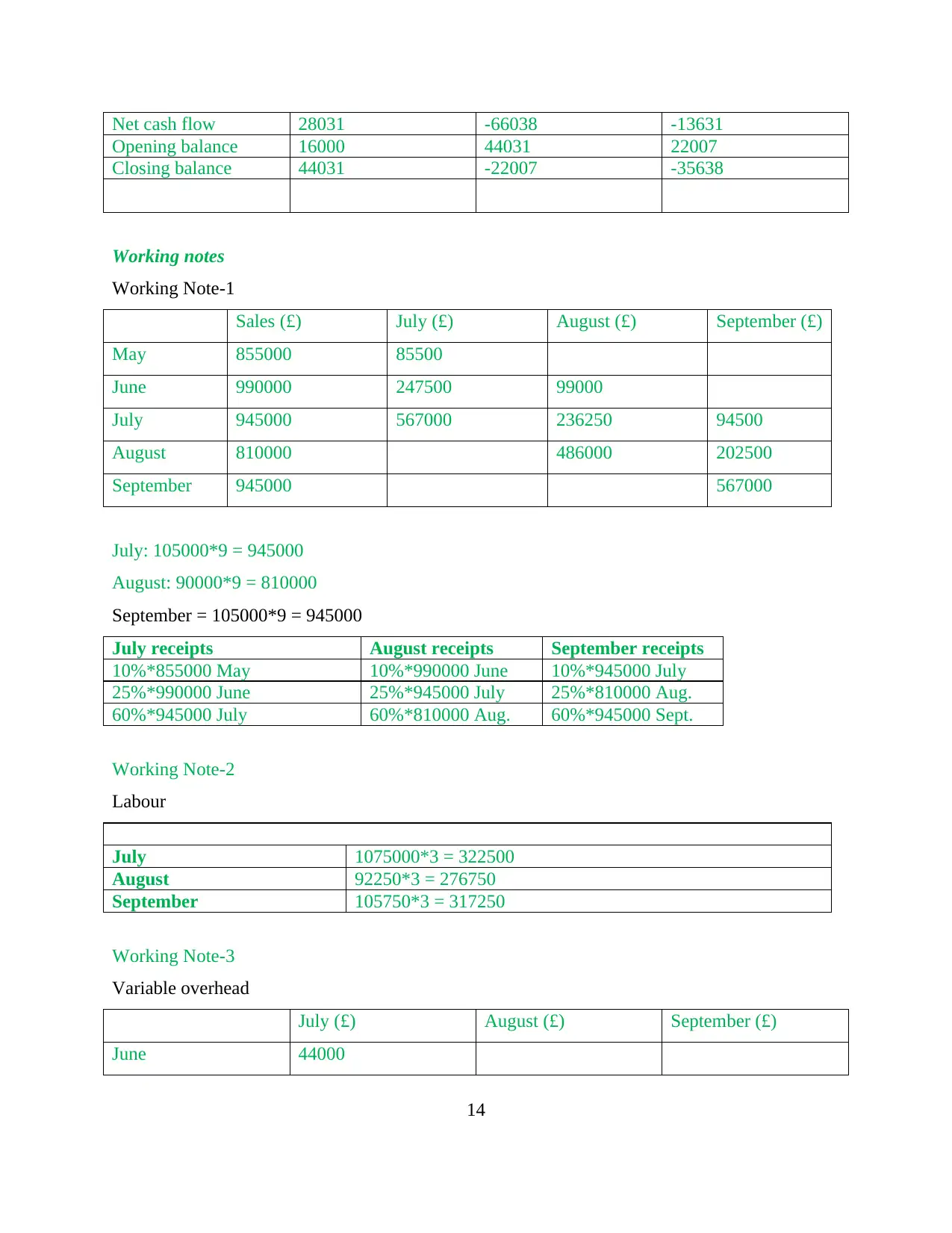

Table 12: Cash budget of Jeffrey and Son's...................................................................................13

Table 17: Computation of variances of Jeffrey and Son's smake..................................................16

Table 18: Reconciliation operating statement of Jeffrey and Son's smake...................................17

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Management accounting is field of accounting which combines norms of costing and

budgeting. By making use of these techniques, organization can determine cost of their

production and operational activities in order to make viable decisions. For this aspect, they are

required to record their cost and expenses by making use of appropriate costing technique

(Banks, 2008). These techniques assist organization in making reduction in their costs in order to

enhance their profitability. Present study is based on the practical and theoretical description of

various costing techniques. For this aspect, different types of cost and budgets will be explained

along with its practical applicability in the given case scenario. In addition to this, cost report

will be prepared in order to analyse information of business and making viable decisions.

TASK 1

1.1 Different types of classification of cost

Cost can be termed as expense incurred by an organization for the completion of business

activities. Cost of business can be classified on the basis of following elements:

Elements- Element factor classifies cost into direct and indirect cost. Direct costs are

expenses incurred for the production activities of business. Example of direct cost is material,

labour, lighting and heating etc (Burns, Hopper and Yazdifar, 2004). Further, indirect cost is

incurred for smooth run of production activities. Example of indirect cost is lubricating oil, small

tools etc.

Function- Classification of cost can also be done on the basis of various functions and

activities. Common classification of costs are Administration, Distribution, Finance, Production,

Quality Check, Research and Development and selling.

Nature- On the basis of nature of expense, cost can be classified into material, labour and

overhead expenses (Zawawi and Hoque, 2010). Material expenses are incurred for the purchase

of raw material, labour expenses are made for the payment of wage rate to the human resources

and overhead expenses are related to the other costs of business organization.

Behaviour- By considering the behavior factor, cost can be classified into fixed, variable

and semi variable cost. Fixed costs are those expenses which does not fluctuate with the change

4

Paraphrase This Document

produced. Semi variable costs have attributes of both variable and fixed expenses.

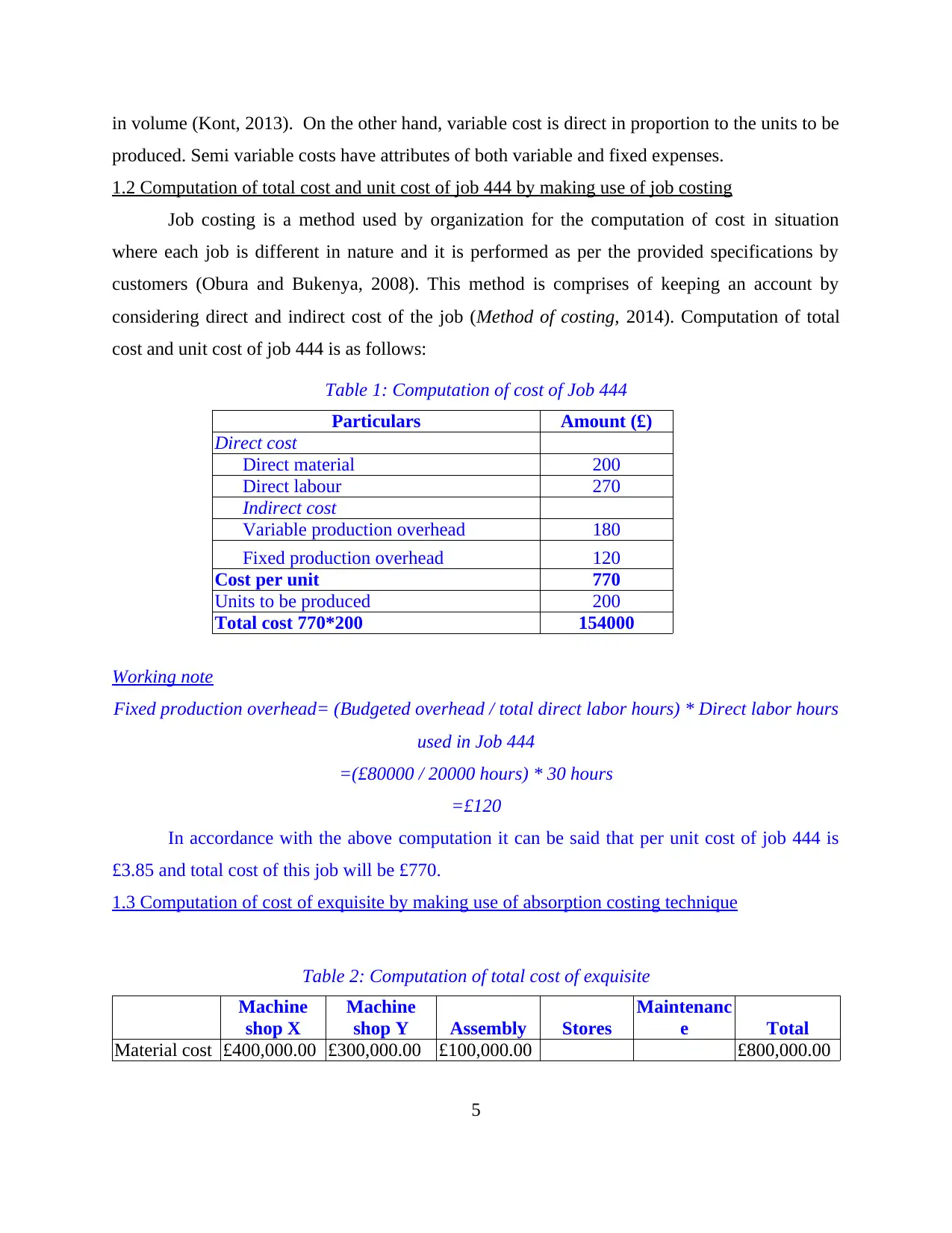

1.2 Computation of total cost and unit cost of job 444 by making use of job costing

Job costing is a method used by organization for the computation of cost in situation

where each job is different in nature and it is performed as per the provided specifications by

customers (Obura and Bukenya, 2008). This method is comprises of keeping an account by

considering direct and indirect cost of the job (Method of costing, 2014). Computation of total

cost and unit cost of job 444 is as follows:

Table 1: Computation of cost of Job 444

Particulars Amount (£)

Direct cost

Direct material 200

Direct labour 270

Indirect cost

Variable production overhead 180

Fixed production overhead 120

Cost per unit 770

Units to be produced 200

Total cost 770*200 154000

Working note

Fixed production overhead= (Budgeted overhead / total direct labor hours) * Direct labor hours

used in Job 444

=(£80000 / 20000 hours) * 30 hours

=£120

In accordance with the above computation it can be said that per unit cost of job 444 is

£3.85 and total cost of this job will be £770.

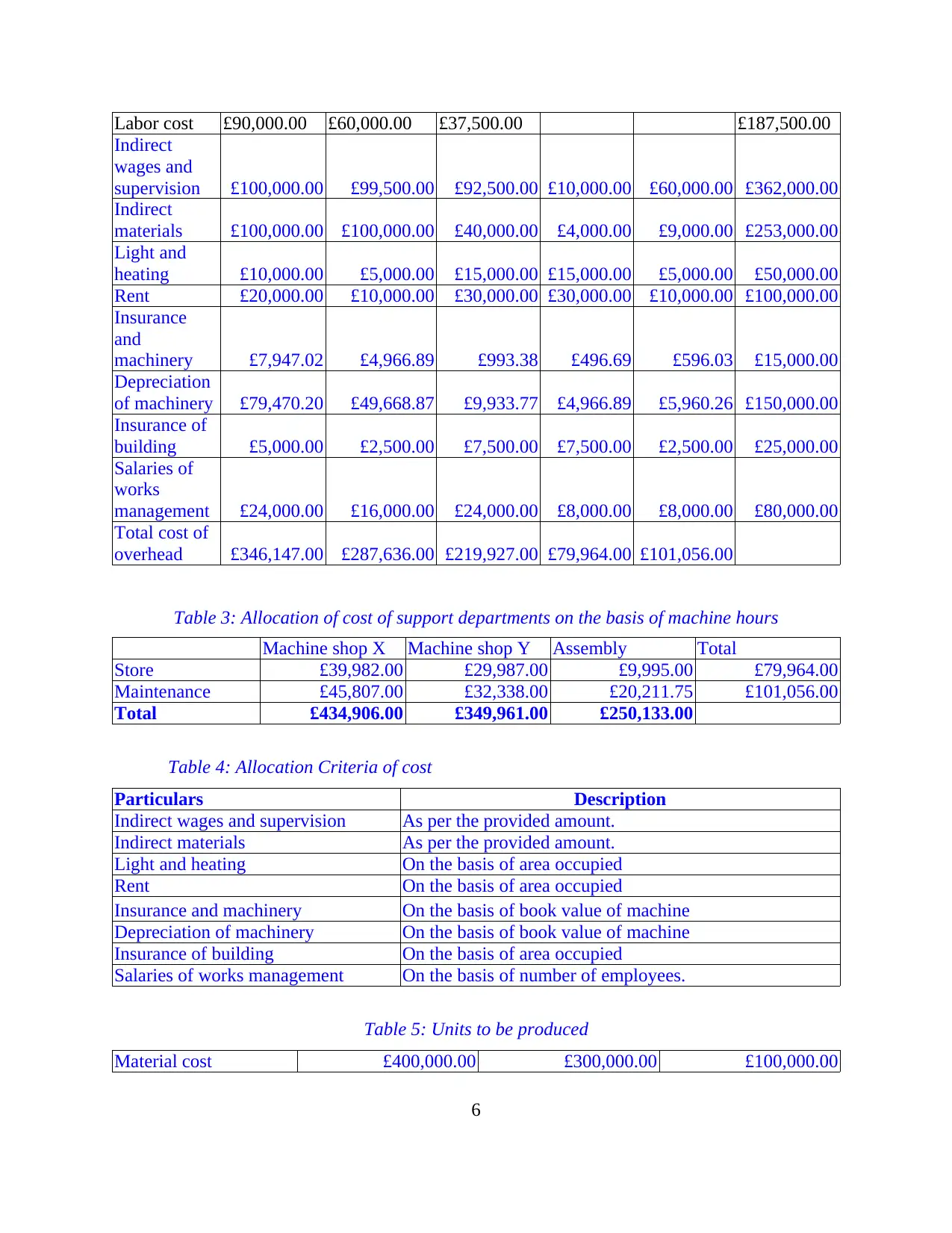

1.3 Computation of cost of exquisite by making use of absorption costing technique

Table 2: Computation of total cost of exquisite

Machine

shop X

Machine

shop Y Assembly Stores

Maintenanc

e Total

Material cost £400,000.00 £300,000.00 £100,000.00 £800,000.00

5

Indirect

wages and

supervision £100,000.00 £99,500.00 £92,500.00 £10,000.00 £60,000.00 £362,000.00

Indirect

materials £100,000.00 £100,000.00 £40,000.00 £4,000.00 £9,000.00 £253,000.00

Light and

heating £10,000.00 £5,000.00 £15,000.00 £15,000.00 £5,000.00 £50,000.00

Rent £20,000.00 £10,000.00 £30,000.00 £30,000.00 £10,000.00 £100,000.00

Insurance

and

machinery £7,947.02 £4,966.89 £993.38 £496.69 £596.03 £15,000.00

Depreciation

of machinery £79,470.20 £49,668.87 £9,933.77 £4,966.89 £5,960.26 £150,000.00

Insurance of

building £5,000.00 £2,500.00 £7,500.00 £7,500.00 £2,500.00 £25,000.00

Salaries of

works

management £24,000.00 £16,000.00 £24,000.00 £8,000.00 £8,000.00 £80,000.00

Total cost of

overhead £346,147.00 £287,636.00 £219,927.00 £79,964.00 £101,056.00

Table 3: Allocation of cost of support departments on the basis of machine hours

Machine shop X Machine shop Y Assembly Total

Store £39,982.00 £29,987.00 £9,995.00 £79,964.00

Maintenance £45,807.00 £32,338.00 £20,211.75 £101,056.00

Total £434,906.00 £349,961.00 £250,133.00

Table 4: Allocation Criteria of cost

Particulars Description

Indirect wages and supervision As per the provided amount.

Indirect materials As per the provided amount.

Light and heating On the basis of area occupied

Rent On the basis of area occupied

Insurance and machinery On the basis of book value of machine

Depreciation of machinery On the basis of book value of machine

Insurance of building On the basis of area occupied

Salaries of works management On the basis of number of employees.

Table 5: Units to be produced

Material cost £400,000.00 £300,000.00 £100,000.00

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

A/B no. of units 50000 37500 12500

Overhead absorption rate

Machinery X= 434906/80000=5.44

Machinery Y= 349960/60000= 5.83

Assembly=250134/10000=25.01

Computation of absorption rate

Table 6: Statement showing computation of exquisite

£ £

Materials 8

Labour 15

Overheads

X (0.8*5.44) 4.34

Y (.6*5.83) 3.5

Assembly (.1*25.01) 2.5

Total cost 33.35

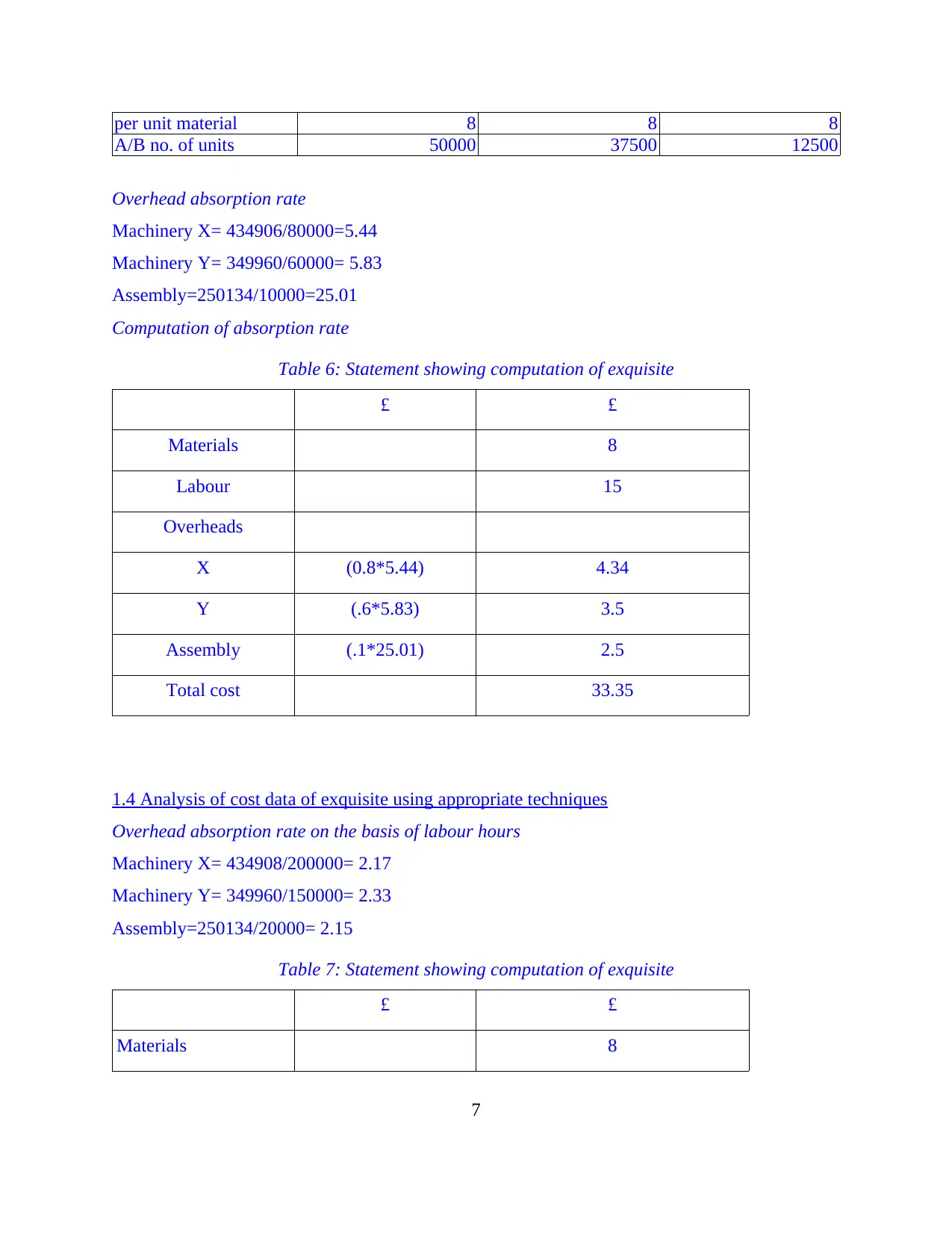

1.4 Analysis of cost data of exquisite using appropriate techniques

Overhead absorption rate on the basis of labour hours

Machinery X= 434908/200000= 2.17

Machinery Y= 349960/150000= 2.33

Assembly=250134/20000= 2.15

Table 7: Statement showing computation of exquisite

£ £

Materials 8

7

Paraphrase This Document

Overheads

X (2*2.17) 4.34

Y (1.5*2.33) 3.5

Assembly (1*1.25) 1.25

Total cost 32.09

In accordance with the change in absorption rate from machine hour to labour hour there

is drastic change in per unit absorption rate (Management accounting, 2014). As per the norms

of costing standards, absorption from labour hours is better method.

TASK 2

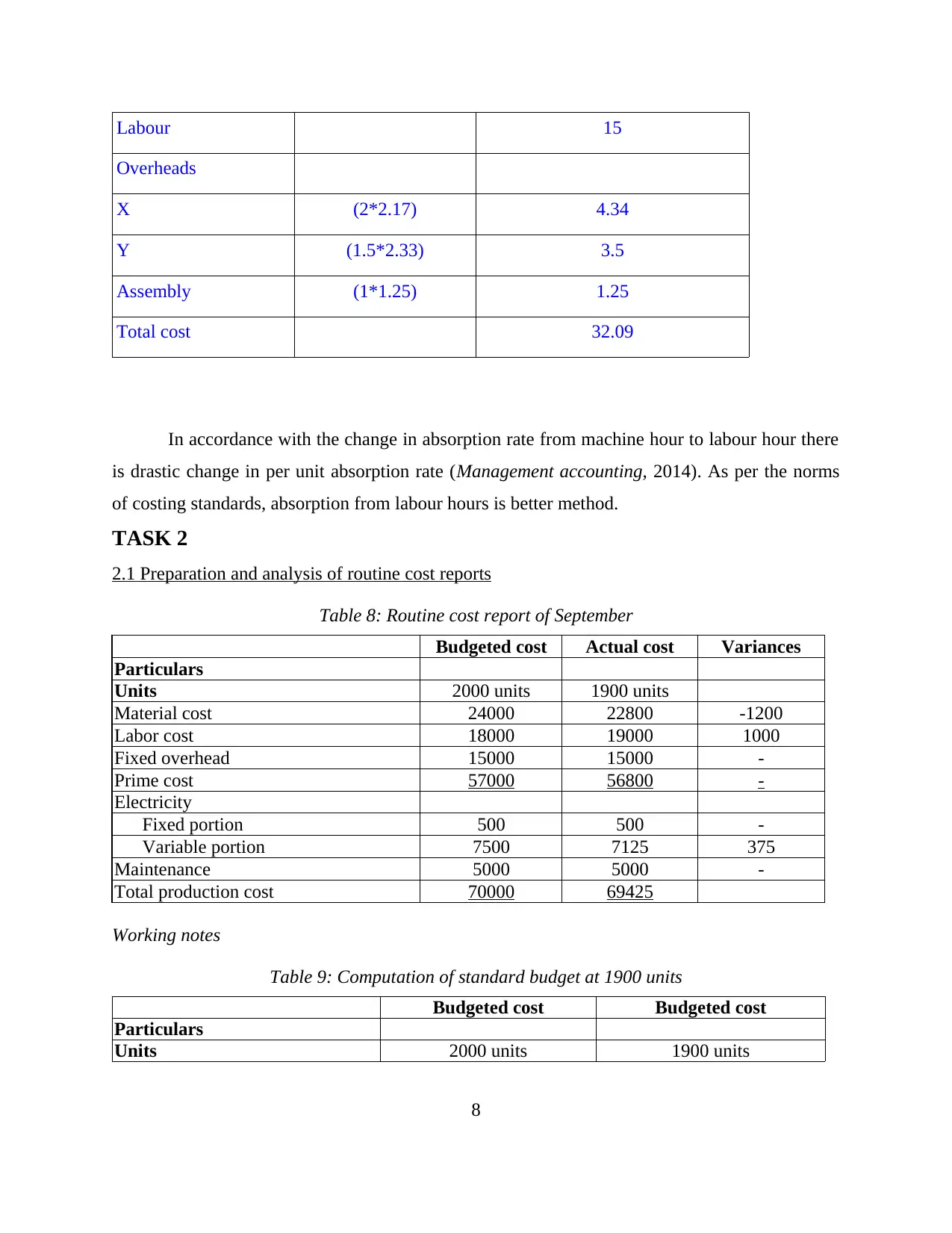

2.1 Preparation and analysis of routine cost reports

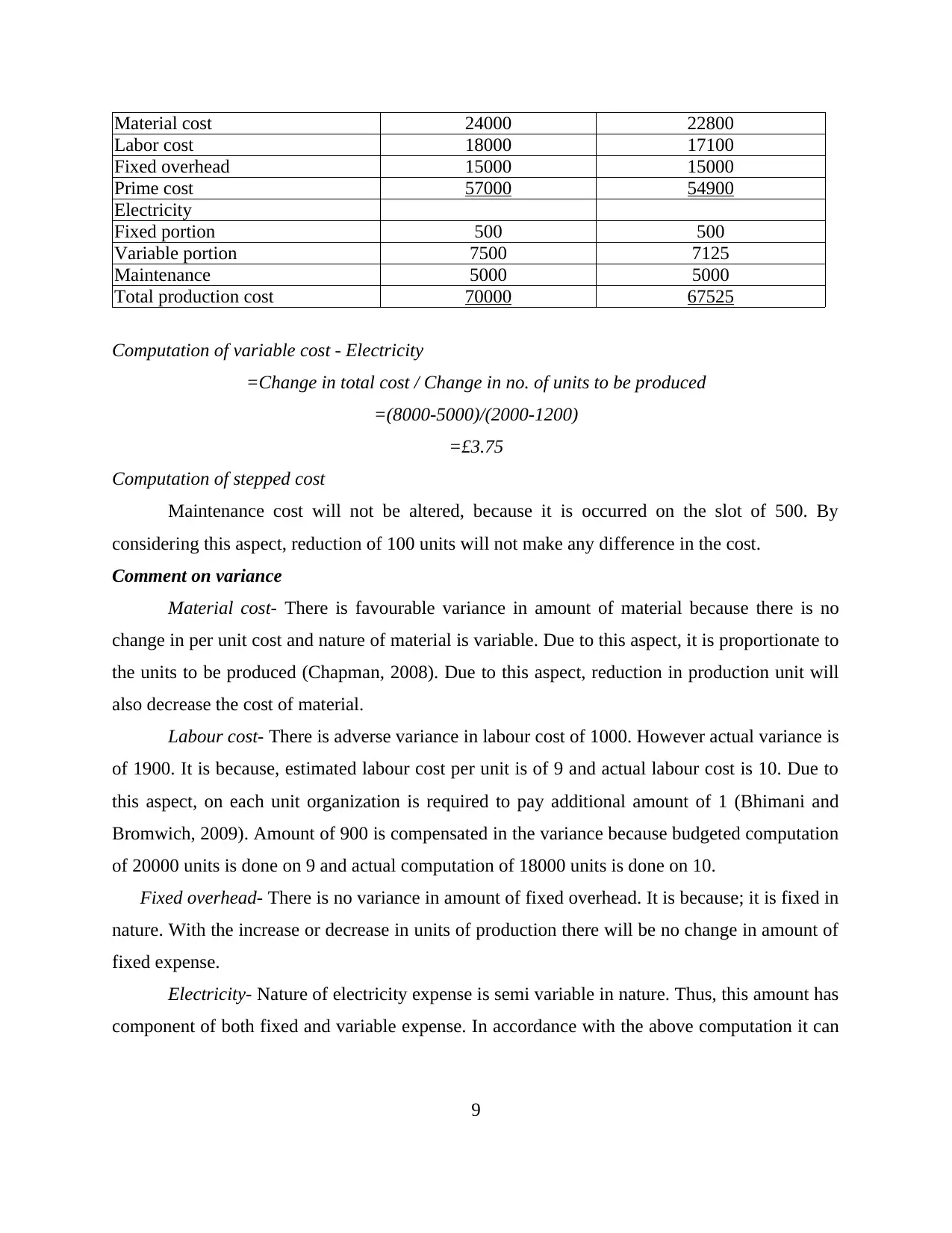

Table 8: Routine cost report of September

Budgeted cost Actual cost Variances

Particulars

Units 2000 units 1900 units

Material cost 24000 22800 -1200

Labor cost 18000 19000 1000

Fixed overhead 15000 15000 -

Prime cost 57000 56800 -

Electricity

Fixed portion 500 500 -

Variable portion 7500 7125 375

Maintenance 5000 5000 -

Total production cost 70000 69425

Working notes

Table 9: Computation of standard budget at 1900 units

Budgeted cost Budgeted cost

Particulars

Units 2000 units 1900 units

8

Labor cost 18000 17100

Fixed overhead 15000 15000

Prime cost 57000 54900

Electricity

Fixed portion 500 500

Variable portion 7500 7125

Maintenance 5000 5000

Total production cost 70000 67525

Computation of variable cost - Electricity

=Change in total cost / Change in no. of units to be produced

=(8000-5000)/(2000-1200)

=£3.75

Computation of stepped cost

Maintenance cost will not be altered, because it is occurred on the slot of 500. By

considering this aspect, reduction of 100 units will not make any difference in the cost.

Comment on variance

Material cost- There is favourable variance in amount of material because there is no

change in per unit cost and nature of material is variable. Due to this aspect, it is proportionate to

the units to be produced (Chapman, 2008). Due to this aspect, reduction in production unit will

also decrease the cost of material.

Labour cost- There is adverse variance in labour cost of 1000. However actual variance is

of 1900. It is because, estimated labour cost per unit is of 9 and actual labour cost is 10. Due to

this aspect, on each unit organization is required to pay additional amount of 1 (Bhimani and

Bromwich, 2009). Amount of 900 is compensated in the variance because budgeted computation

of 20000 units is done on 9 and actual computation of 18000 units is done on 10.

Fixed overhead- There is no variance in amount of fixed overhead. It is because; it is fixed in

nature. With the increase or decrease in units of production there will be no change in amount of

fixed expense.

Electricity- Nature of electricity expense is semi variable in nature. Thus, this amount has

component of both fixed and variable expense. In accordance with the above computation it can

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

portion is decreased proportionately.

Maintenance- Maintenance charges are stepped cost. It increased with the increase in slot

of 500. By considering this aspect, there will not be any change in amount of maintenance cost.

It is because; reduction of 100 units will not make any difference in the cost.

2.2 Use of performance indicators in order to identify potential improvements in business

By making use of enumerated performance indicators management of Jeffrey and Son's smake

can identify scope of potential improvement in their business-

Financial statements- Through analysis of this statement, change in financial position

can be noticed by management of Jeffrey and Son's smake. In situation where there is decrease in

amount of sales and profitability or increase in amount of cost then organization is required to

make changes in their operational strategies (Keown, 2005). These statements will provide

description of change in all financial values in an accounting year. By considering this

information, organization can identify the areas where there is increase in the amount of cost.

Quality of product and services- By the assessment of quality of product and services

areas of improvement can be identified (Key Performance Indicators, 2014). This aspect can be

done by monitoring of operational activities in business. This assessment will provide

information of loopholes in operating performance due to which quality of the product is

adversely affected.

Customer satisfaction- Further, potential improvement can be identified through

considering reviews of the customers (Jiambalvo, 2001). By considering their feedback and

complaints, management of Jeffrey and Son's smake can make improvement in their production

process in order to enhance their level of satisfaction.

2.3 Recommendation for cost reduction and value enhancement for business

By making use of following techniques, management of Jeffrey and Son's smake can achieve

their objective of cost reduction and value enhancement for business-

Just in time system and economic order quantity- By making use of these techniques,

organization can make reduction in their storage and carrying cost. As per this approach,

management of Jeffrey and Son's smake will purchase raw material as per the demand in the

10

Paraphrase This Document

business.

Total quality management- This tool makes qualitative improvement in the operational

activities of business. Total quality management approach is based on the improvement in

overall production process by resolving loop holes (Vanderbeck, 2012). By this implementation

of this approach, organization can enhance the productivity and quality of production in order to

satisfy needs of customers in an effective manner.

Kaizen costing- Similar to the TQM approach, Kaizen costing is also mainly focused on

making continuous betterment in the overall functioning of the business organization. This

technique motivate employees to accomplish operational tasks with the perfection (Vance,

2002). With this motive, it makes drastic reduction in the wastage by making prevention of

enumerated aspects- Decrements in valuation because of high waiting time, Inappropriate

allocation of human resources, Production more than requirement, Increase in faulty production

units, Holding high inventory, Non-economical processing for value addition and Poor strategies

for transportation

Management audits- Through this technique, organization can monitor the performance

of employees in order to assure standard outcome. Management audits in timely manner will

influence employees to provide standard performance in order to attain quality remark. For this

aspect, management of Jeffrey and Son's smake can also make provision of surprise audit in their

business strategies.

TASK 3

3.1 Explanation of purpose and nature of the budgeting process

Purpose of budgeting process

Budgets can be defined as statements prepared for the forecasting of future operational

activities. Main objective of budgeting process is make estimation of future expenses and

revenue, in order to allocate resources in an optimum manner (Vaivio, 2008). With these

statements, profit of business is determined. On the basis of these statements, decisions are made

by managerial persons. In addition to this, budgeting helps in making comparison of actual

performance with the standard performance.

Nature of budgeting process

11

accounting period. With this estimation, computation of possible amount of cash is done from

the sales and other activities of business. For this aspect, various expenses such as material,

labour and production expenses (Statements on Management Accounting, 2015). Amount of

expenditure is deducted from the estimated amount of profits in order to determine proposes

deficit or surplus from operating activities. This budget is reviewed by senior manager and it is

submitted to the board of directors for practical applicability.

3.2 Selection of appropriate budgeting methods in accordance with the needs of organization

Preparation of budgets can be done by various methods in accordance with the needs and

requirements of the commercial entity. Description of various budgeting methods is enumerated

below:

Operational budgets- In this method, budgets are prepared by considering separate

operational activities of business such as production, selling and distribution etc (Vanderbeck,

2012). These budgets are prepared on periodical basis that can be annual, monthly or quarterly.

On the basis of these budgets, strategies are implemented by business organization.

Zero based budgeting- This method of budget is selected in situation where there is previous

base for preparation of budget. This situation is arises mainly when there is drastic change in

market situations or there is development of new product (Vance, 2002). In this method, there

are no measures of forecasted thus there is high possibility of variances.

Incremental budgeting- This method is selected for the computation of budget in situation

when there are minor changes in environment. This the traditional technique for budgeting

because in this method budgets are prepared by considering previous financial information.

In accordance with the above description, most suitable method of preparation of budget

for Jeffrey and Son's smake is operational budgeting. It is because, in this technique different

statements are prepared for forecasting by considering operating activities of business.

3.3 Preparation of production and material purchase budget

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Table 10: Production budget of Jeffrey and Son's smake

Particulars July August September October

Sales 105000 90000 105000 110000

Less: opening stock 11000 13500 15750 16500

Add: Opening stock 13500 15750 16500 15000

Units to be produced 107500 92250 105750 108500

Closing Stock:

July = 15% * August sales = 15%*90000 = 13500

August = 15% * Sept. sales = 15%*105000 = 15750

September = 15% * Oct. sales = 15%*110000 = 16500

October = 15%*Nov. sales = 15%*100000 = 15000

Material purchase budget

Table 11: Material purchase budget of Jeffrey and Son's smake

Particulars July August September

Units to be produced 107500 92250 104250

Material cost £3.50 £3.50 £3.50

Material to be purchased £376,250.00 £322,875.00 £364,875.00

Add: cost of material in ending inventory £80,718.75 £91,218.75 £91,218.75

Total cost of material needed £456,968.75 £414,093.75 £456,093.75

Less: Cost of material in beginning

inventory -£166,400.00 -£80,718.75 -£166,400.00

Cost of material to be purchased £290,568.75 £333,375.00 £289,693.75

3.4 Preparation of cash budget

Table 12: Cash budget of Jeffrey and Son's

Particulars July (£) August (£) September (£)

Cash inflow

Sales receipts (w.n.1) 900000 731250 864000

Cash outflow

Purchase 365969 334688 372531

Labour (w.n.2) 322500 276750 317250

Variable O/H (w.n.3) 108500 98350 100350

Fixed O/H 75000 87500 87500

13

Paraphrase This Document

Opening balance 16000 44031 22007

Closing balance 44031 -22007 -35638

Working notes

Working Note-1

Sales (£) July (£) August (£) September (£)

May 855000 85500

June 990000 247500 99000

July 945000 567000 236250 94500

August 810000 486000 202500

September 945000 567000

July: 105000*9 = 945000

August: 90000*9 = 810000

September = 105000*9 = 945000

July receipts August receipts September receipts

10%*855000 May 10%*990000 June 10%*945000 July

25%*990000 June 25%*945000 July 25%*810000 Aug.

60%*945000 July 60%*810000 Aug. 60%*945000 Sept.

Working Note-2

Labour

July 1075000*3 = 322500

August 92250*3 = 276750

September 105750*3 = 317250

Working Note-3

Variable overhead

July (£) August (£) September (£)

June 44000

14

August 55350 36900

September 63450

Total 108500 98350 100350

Based on Junes Sales = 40% * 110000 and it should be based on production of June and the

difference is in immaterial.

40%*110000 units = 44000*1 = £44000 from June and payable in July

60%*107500 units = 64500*1 = £64500 from July and payable in July

40%*107500 units = 43000*1 = £43000 from June and payable in Aug.

60%*92250 units = 55350*1 = £55350 from June and payable in Aug.

40%*92250 units = 36900*1 = £36900 from July and payable in Sept.

60%*105750 units = 55350*1 = £63450 from June payable in Sept.

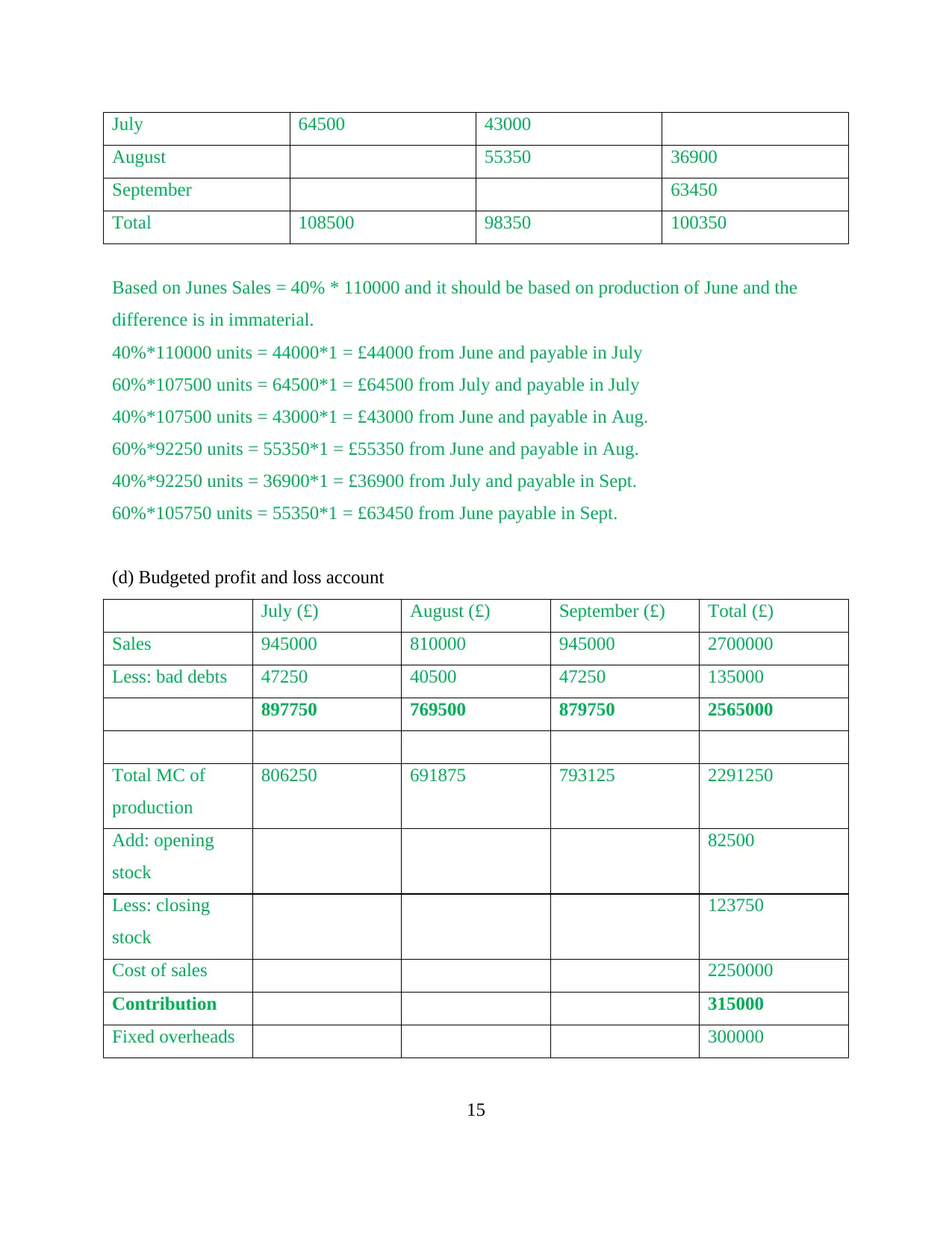

(d) Budgeted profit and loss account

July (£) August (£) September (£) Total (£)

Sales 945000 810000 945000 2700000

Less: bad debts 47250 40500 47250 135000

897750 769500 879750 2565000

Total MC of

production

806250 691875 793125 2291250

Add: opening

stock

82500

Less: closing

stock

123750

Cost of sales 2250000

Contribution 315000

Fixed overheads 300000

15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

July (£) August (£) September (£) Total (£)

Material 376250 322875 370125 1060500

Direct labour 322500 276750 317250 916500

Variable O/H 107500 92250 105750 305500

Total MC of

production

806250 691875 943125 2582500

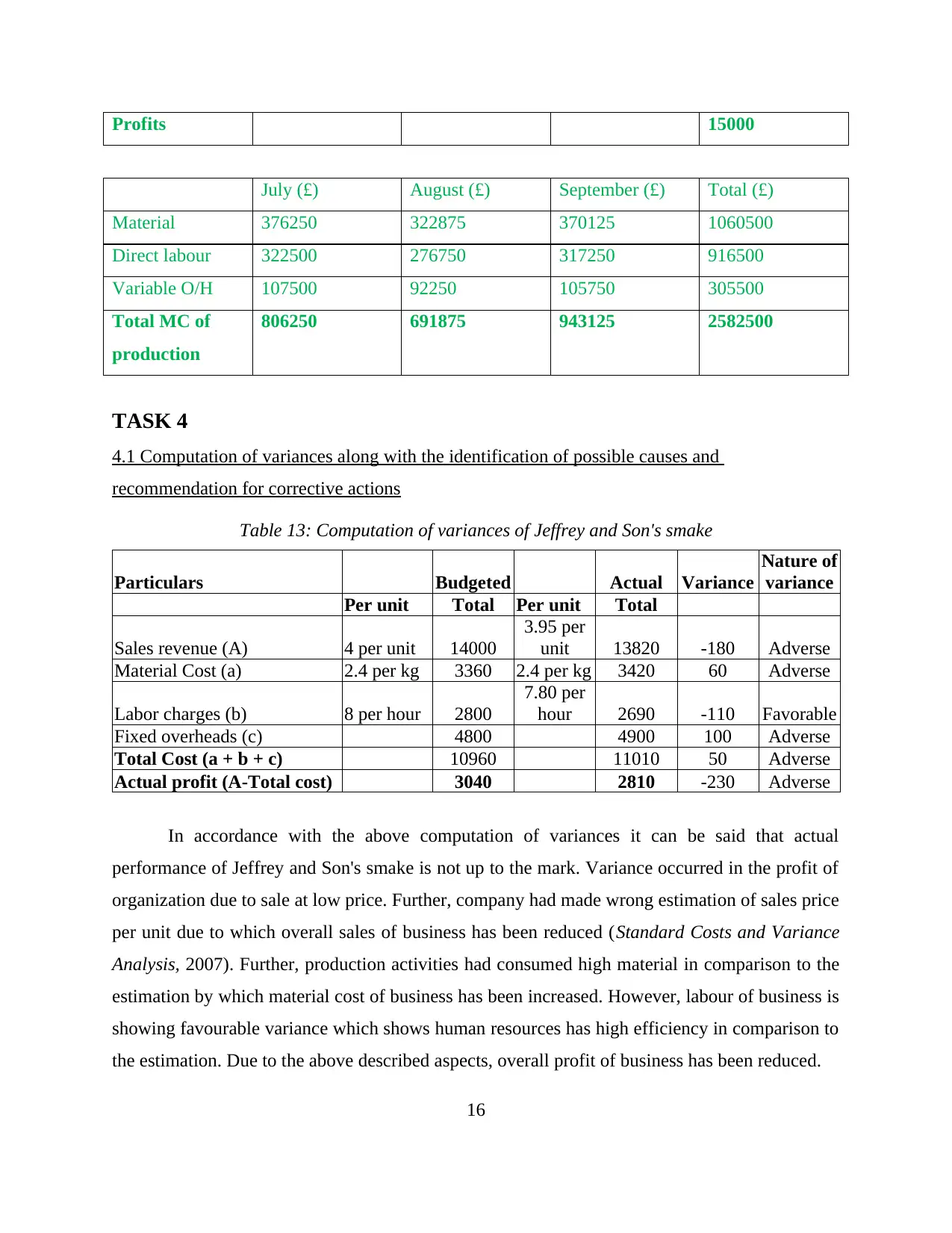

TASK 4

4.1 Computation of variances along with the identification of possible causes and

recommendation for corrective actions

Table 13: Computation of variances of Jeffrey and Son's smake

Particulars Budgeted Actual Variance

Nature of

variance

Per unit Total Per unit Total

Sales revenue (A) 4 per unit 14000

3.95 per

unit 13820 -180 Adverse

Material Cost (a) 2.4 per kg 3360 2.4 per kg 3420 60 Adverse

Labor charges (b) 8 per hour 2800

7.80 per

hour 2690 -110 Favorable

Fixed overheads (c) 4800 4900 100 Adverse

Total Cost (a + b + c) 10960 11010 50 Adverse

Actual profit (A-Total cost) 3040 2810 -230 Adverse

In accordance with the above computation of variances it can be said that actual

performance of Jeffrey and Son's smake is not up to the mark. Variance occurred in the profit of

organization due to sale at low price. Further, company had made wrong estimation of sales price

per unit due to which overall sales of business has been reduced (Standard Costs and Variance

Analysis, 2007). Further, production activities had consumed high material in comparison to the

estimation by which material cost of business has been increased. However, labour of business is

showing favourable variance which shows human resources has high efficiency in comparison to

the estimation. Due to the above described aspects, overall profit of business has been reduced.

16

Paraphrase This Document

forecasting by considering market factors. Further, to reduce consumption of material,

management can make use updated techniques (Statements on Management Accounting, 2015).

With this approach, organization will be able to generate higher output with the available

resources. In order to set, appropriate measure of labour monitoring of performance is required to

be done. On the basis of this monitoring, standard should be set for the employees.

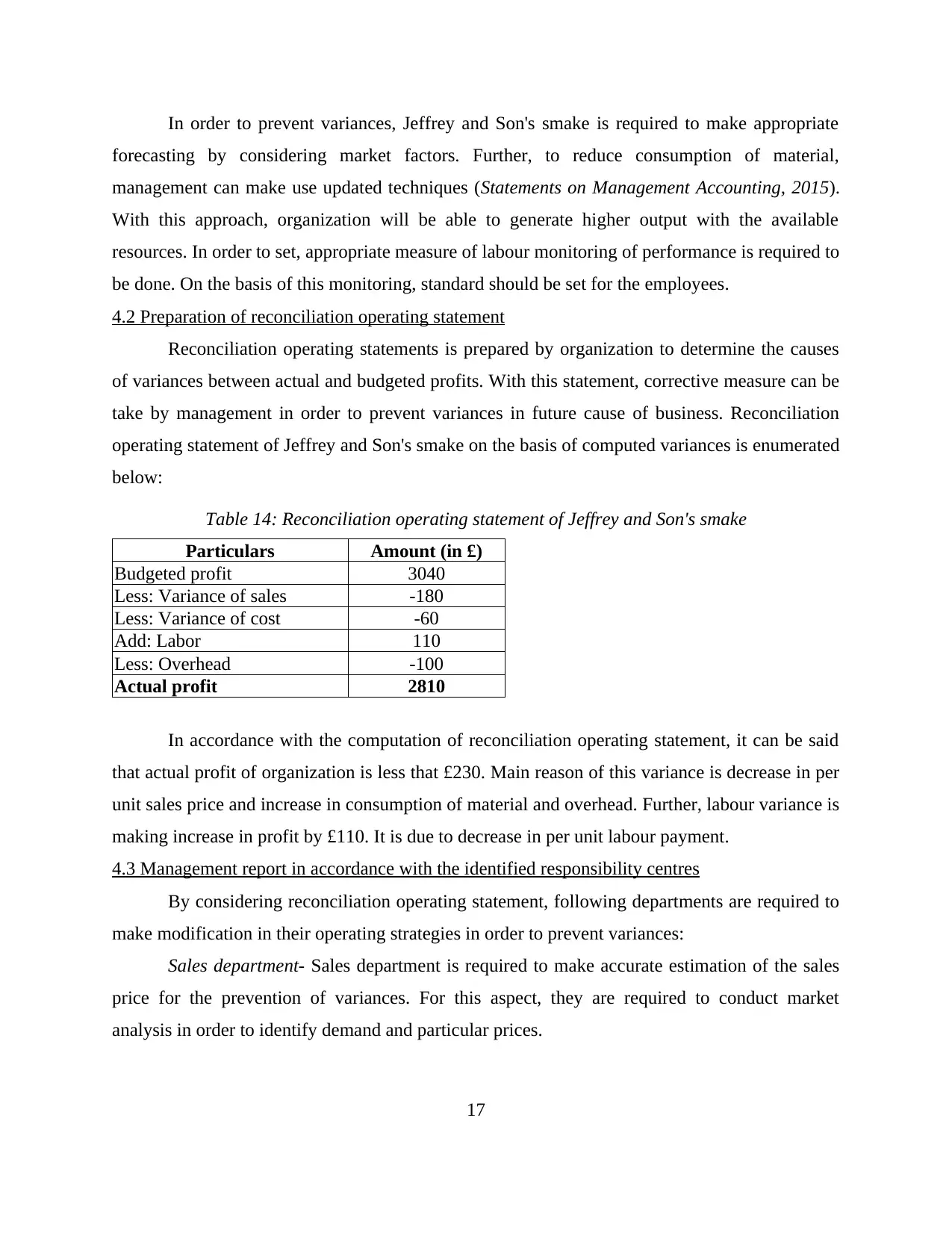

4.2 Preparation of reconciliation operating statement

Reconciliation operating statements is prepared by organization to determine the causes

of variances between actual and budgeted profits. With this statement, corrective measure can be

take by management in order to prevent variances in future cause of business. Reconciliation

operating statement of Jeffrey and Son's smake on the basis of computed variances is enumerated

below:

Table 14: Reconciliation operating statement of Jeffrey and Son's smake

Particulars Amount (in £)

Budgeted profit 3040

Less: Variance of sales -180

Less: Variance of cost -60

Add: Labor 110

Less: Overhead -100

Actual profit 2810

In accordance with the computation of reconciliation operating statement, it can be said

that actual profit of organization is less that £230. Main reason of this variance is decrease in per

unit sales price and increase in consumption of material and overhead. Further, labour variance is

making increase in profit by £110. It is due to decrease in per unit labour payment.

4.3 Management report in accordance with the identified responsibility centres

By considering reconciliation operating statement, following departments are required to

make modification in their operating strategies in order to prevent variances:

Sales department- Sales department is required to make accurate estimation of the sales

price for the prevention of variances. For this aspect, they are required to conduct market

analysis in order to identify demand and particular prices.

17

production department should make use improved technologies (Vaivio, 2008). Further, they

should attempt to make reduction in wastage in order to utilize available resources in an

optimum manner.

Human resource department- However, labour variances are favourable which is making

increasing in profit, still HRD is required to improve their forecasting techniques. It is because,

variance is occurring due to decrease in labour charges.

CONCLUSION

In accordance with the present study, conclusion can be drawn that management

accounting assists managers in making better decisions for the business. Techniques of

management accounting makes reduction in the costs of business in order to enhance their

profitability. By making use of appropriable performance indicators management of commercial

entities can identify scope of potential improvement in their business in order achieve their

objective of cost reduction and value enhancement. With the preparation of budgetary

statements, organization can forecast operational activities in order to make optimum utilization

of available resources. These budgets also provides comparison of expected and actual

performance through variance analysis. With the analysis, organization will be in position to

make valuable modification in their operating strategies to prevent variances and to attain

standard outcome.

18

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Books and journals

Banks, A., 2008. Budgeting. 3rd ed. McGraw-Hill Australia.

Bhimani, A., and Bromwich, M., 2009. Management Accounting: Retrospect and prospect.

Elsevier.

Burns, J., Hopper, T. and Yazdifar, H., 2004. Management accounting education and training:

putting management in and taking accounting out. Qualitative Research in Accounting &

Management. 1(1). pp.1 – 29.

Chapman, S. C, 2008. We are not alone: qualitative management accounting research: Rationale,

pitfalls and potential. Qualitative Research in Accounting & Management, 5 (3). pp.247

- 252

Jiambalvo, J., 2001. Managerial accounting. Wiley.

Keown, A., 2005. Financial management. Upper Saddle River, N.J.: Pearson/Prentice Hall.

Kont, R. K., 2013. Cost accounting and scientific management in libraries: a historical overview.

Journal of Management History. 19(2). pp.225 – 240.

Lucey, T., 2002. Costing. Continuum.

Obura, O. C. and Bukenya, K. N. M. I., 2008. Financial management and budgeting strategies

for LIS programmes: Uganda's experience. Library Review.57(7). pp.514 – 527.

Prior, P. B., 2004. Managing Financial Resources and Decisions. BPP Professional Education.

Vaivio, J., 2008. Qualitative management accounting research: rationale, pitfalls and potential.

Qualitative Research in Accounting & Management. 5(1). pp.64 – 86.

Vance, D., 2002. Financial Analysis and Decision Making. McGraw Hill Professional.

Vanderbeck, J. E., 2012. Principles of Cost Accounting. 16th ed. Cengage Learning.

Zawawi, M. H. N., and Hoque, Z., 2010. Research in management accounting innovations: An

overview of its recent development. Qualitative Research in Accounting & Management.

7(4). pp.505 – 568.

Online

Key Performance Indicators. 2014. [Online]. Available at:

<http://blog.claytonmckervey.com/blog/2011/01/24/key-performance-indicators/>

[Accessed on 3rd December 2015].

19

Paraphrase This Document

http://www.e-conomic.co.uk/accountingsystem/glossary/management-accounting>

[Accessed on 3rd December 2015].

Method of costing. 2014. [Online]. Available at: <http://www.svtuition.org/2012/09/method-of-

costing.html>. [Accessed on 3rd December 2015].

Standard Costs and Variance Analysis. 2007. [pdf]. Available through: <http://www.cma-

ontario.org/portals/6/Media/CaseExam/Standard%20Cost%20And%20Variance

%20Analysis.pdf>. [Accessed on 3rd December 2015].

Statements on Management Accounting. 2015. [Online]. Available through:

<http://www.imanet.org/docs/default-source/thought_leadership/transforming_the_financ

e_function/definition_of_management_accounting.pdf?sfvrsn=2>. [Accessed on 3rd

December 2015].

20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

© 2024 | Zucol Services PVT LTD | All rights reserved.