Ask a question from expert

ACCM 4100 Management Accounting Assignment( MA)

12 Pages2880 Words99 Views

Management Accountin (ACCM 4100)

Added on 2020-05-28

ACCM 4100 Management Accounting Assignment( MA)

Management Accountin (ACCM 4100)

Added on 2020-05-28

BookmarkShareRelated Documents

Running head: MANAGEMENT ACCOUNTINGManagement AccountingName of the Student:Name of the University:Author Note

2MANAGEMENT ACCOUNTINGTable of ContentsPart 1................................................................................................................................................3Answer to Question 1..................................................................................................................3Answer to Question 2..................................................................................................................4Answer to Question 3..................................................................................................................5Answer to Question 4..................................................................................................................6Part 2................................................................................................................................................7Introduction..................................................................................................................................7Group Description.......................................................................................................................8My role.........................................................................................................................................8Others’ roles.................................................................................................................................8Group Stages................................................................................................................................8Conflict within the group.............................................................................................................9Leadership and decision making in the group.............................................................................9Achievements by the team and scope of improvement...............................................................9Conclusion.....................................................................................................................................10References......................................................................................................................................11

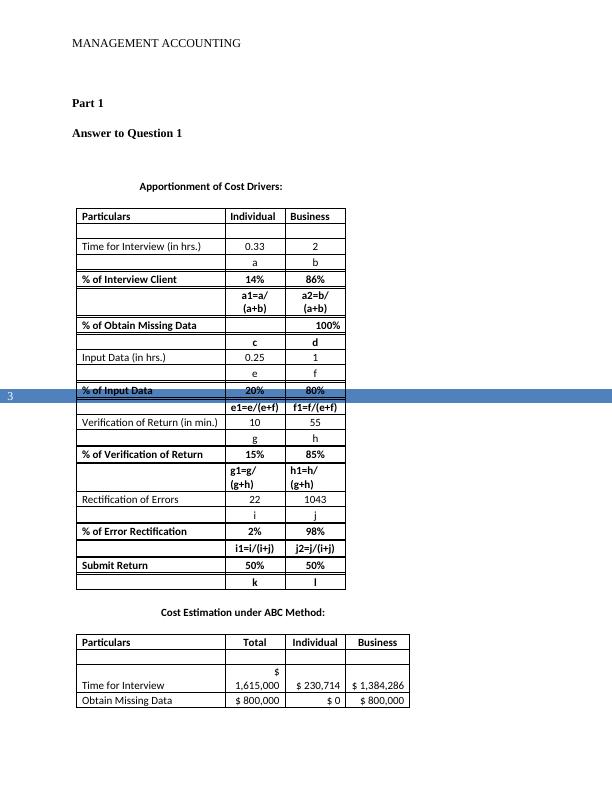

3MANAGEMENT ACCOUNTINGPart 1Answer to Question 1Apportionment of Cost Drivers:ParticularsIndividual BusinessTime for Interview (in hrs.)0.332ab% of Interview Client14%86%a1=a/(a+b)a2=b/(a+b)% of Obtain Missing Data100%cdInput Data (in hrs.)0.251ef% of Input Data20%80%e1=e/(e+f)f1=f/(e+f)Verification of Return (in min.)1055gh% of Verification of Return15%85%g1=g/(g+h)h1=h/(g+h)Rectification of Errors221043ij% of Error Rectification2%98%i1=i/(i+j)j2=j/(i+j)Submit Return50%50%klCost Estimation under ABC Method:ParticularsTotalIndividualBusinessTime for Interview$1,615,000$ 230,714$ 1,384,286Obtain Missing Data$ 800,000$ 0$ 800,000

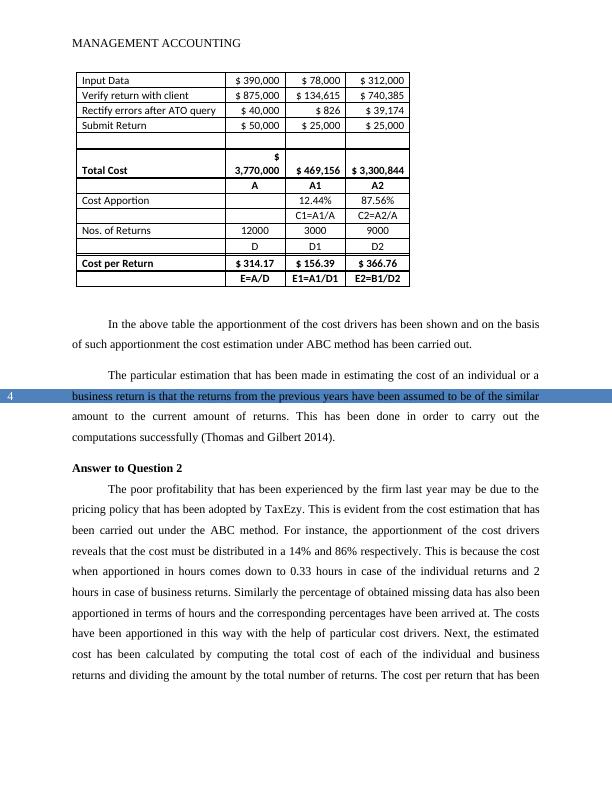

4MANAGEMENT ACCOUNTINGInput Data$ 390,000$ 78,000$ 312,000Verify return with client$ 875,000$ 134,615$ 740,385Rectify errors after ATO query$ 40,000$ 826$ 39,174Submit Return$ 50,000$ 25,000$ 25,000Total Cost$3,770,000$ 469,156$ 3,300,844AA1A2Cost Apportion12.44%87.56%C1=A1/AC2=A2/ANos. of Returns1200030009000DD1D2Cost per Return$ 314.17$ 156.39$ 366.76E=A/DE1=A1/D1E2=B1/D2In the above table the apportionment of the cost drivers has been shown and on the basisof such apportionment the cost estimation under ABC method has been carried out.The particular estimation that has been made in estimating the cost of an individual or abusiness return is that the returns from the previous years have been assumed to be of the similaramount to the current amount of returns. This has been done in order to carry out thecomputations successfully (Thomas and Gilbert 2014).Answer to Question 2The poor profitability that has been experienced by the firm last year may be due to thepricing policy that has been adopted by TaxEzy. This is evident from the cost estimation that hasbeen carried out under the ABC method. For instance, the apportionment of the cost driversreveals that the cost must be distributed in a 14% and 86% respectively. This is because the costwhen apportioned in hours comes down to 0.33 hours in case of the individual returns and 2hours in case of business returns. Similarly the percentage of obtained missing data has also beenapportioned in terms of hours and the corresponding percentages have been arrived at. The costshave been apportioned in this way with the help of particular cost drivers. Next, the estimatedcost has been calculated by computing the total cost of each of the individual and businessreturns and dividing the amount by the total number of returns. The cost per return that has been

End of preview

Want to access all the pages? Upload your documents or become a member.