Comprehensive Report on Management Accounting Systems and Techniques

VerifiedAdded on 2020/06/06

|30

|6646

|181

Report

AI Summary

This report provides a comprehensive overview of management accounting, covering various techniques and their applications. It begins by defining management accounting and outlining the essential requirements of different management accounting systems, including cost accounting, tax accounting, budgetary control, and financial accounting. The report then delves into specific techniques and methods used for management accounting reporting, such as job costing, overhead allocation, life cycle costing, standard costing, integrated cost, and financial accounts. Furthermore, the report explores the benefits of management accounting systems and their practical application within Marks and Spencer, evaluating the effectiveness of these systems in real-world scenarios. The analysis includes the calculation of costs using marginal and absorption costing to prepare an income statement and an examination of planning tools and budgetary control techniques, including their merits and demerits. Finally, the report compares organizations using various management accounting techniques to address financial problems, analyzing how these techniques can lead to sustainable success.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1 Explain management accounting and give the essential requirements of different types of

management accounting systems. .........................................................................................1

Essential requirements of different types of management accounting systems.....................4

P2: Explain different techniques and methods used for management accounting reporting. 5

M1 Evaluate the benefits of management accounting systems and their application within

Marks and Spencer...............................................................................................................11

TASK 2..........................................................................................................................................12

P3: Calculate costs using appropriate techniques of cost analysis to prepare an income

statement using marginal and absorption costs....................................................................12

M2 Accurately apply a range of management accounting techniques and produce appropriate

financial reporting documents. ............................................................................................13

TASK 3..........................................................................................................................................15

P4 Ascertaining planning tools and budgetary control technique with merits and demerits15

M3 Analyse the use of different planning tools and their application for preparing and

forecasting budgets. .............................................................................................................23

TASK 4..........................................................................................................................................23

P5 Comparing the organisations implicating various management accounting techniques to

deal with financial problems................................................................................................23

M4 Analyse how, in responding to financial problems, management accounting can lead

organisations to sustainable success. ...................................................................................25

CONCLUSION..............................................................................................................................26

REFERENCES..............................................................................................................................27

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1 Explain management accounting and give the essential requirements of different types of

management accounting systems. .........................................................................................1

Essential requirements of different types of management accounting systems.....................4

P2: Explain different techniques and methods used for management accounting reporting. 5

M1 Evaluate the benefits of management accounting systems and their application within

Marks and Spencer...............................................................................................................11

TASK 2..........................................................................................................................................12

P3: Calculate costs using appropriate techniques of cost analysis to prepare an income

statement using marginal and absorption costs....................................................................12

M2 Accurately apply a range of management accounting techniques and produce appropriate

financial reporting documents. ............................................................................................13

TASK 3..........................................................................................................................................15

P4 Ascertaining planning tools and budgetary control technique with merits and demerits15

M3 Analyse the use of different planning tools and their application for preparing and

forecasting budgets. .............................................................................................................23

TASK 4..........................................................................................................................................23

P5 Comparing the organisations implicating various management accounting techniques to

deal with financial problems................................................................................................23

M4 Analyse how, in responding to financial problems, management accounting can lead

organisations to sustainable success. ...................................................................................25

CONCLUSION..............................................................................................................................26

REFERENCES..............................................................................................................................27

INTRODUCTION

To resolve the financial and managerial issues in the organisation there is implication of

various management accounting system techniques. These are the techniques which will be

beneficial and adequate for the professionals in recording the transaction, summarizing it and

having the adequate analysis over the issues of the operations. In the present report there will be

various costing and reporting technique which helps in ascertain the costs and fund requirements

for venture. It also highlights the use of planning tools and budgetary control techniques in the

business performance as to have the better information regarding the profitably and efficiency of

the business. There has been analysis of the financial data of Eastern Ltd on the basis of marginal

and adsorption costing techniques.

TASK 1

P1 Explain management accounting and give the essential requirements of different types of

management accounting systems.

Management accounting

Management accounting can be understand as per analysing the role of management and

accounting techniques therefore, management is denoted as making the effective plans and

control system to set the overall operational criteria of venture. On the other side, accounting

refers to recording all the transaction held in a period to analyse the cost and profits (Cooper,

Ezzamel and Qu, 2017). However, the management accounting is the process where all the

transactions were recorded by the accountants and they analyse the outcomes and make

necessary decisions.

Features of management accounting system:

There has been several features of management accounting system which will be

beneficial and helpful to the entity in terms of making the adequate analysis of performance and

efforts made by professionals of venture (Ax and Greve, 2017). However, the managements

accounting mainly used for decision making which enables the entity to have standards costing

and budgeting techniques. The main features of this technique are:

It studies the causes and effect relationship in consideration of financial accounting,

profits and loss accounts.

1

To resolve the financial and managerial issues in the organisation there is implication of

various management accounting system techniques. These are the techniques which will be

beneficial and adequate for the professionals in recording the transaction, summarizing it and

having the adequate analysis over the issues of the operations. In the present report there will be

various costing and reporting technique which helps in ascertain the costs and fund requirements

for venture. It also highlights the use of planning tools and budgetary control techniques in the

business performance as to have the better information regarding the profitably and efficiency of

the business. There has been analysis of the financial data of Eastern Ltd on the basis of marginal

and adsorption costing techniques.

TASK 1

P1 Explain management accounting and give the essential requirements of different types of

management accounting systems.

Management accounting

Management accounting can be understand as per analysing the role of management and

accounting techniques therefore, management is denoted as making the effective plans and

control system to set the overall operational criteria of venture. On the other side, accounting

refers to recording all the transaction held in a period to analyse the cost and profits (Cooper,

Ezzamel and Qu, 2017). However, the management accounting is the process where all the

transactions were recorded by the accountants and they analyse the outcomes and make

necessary decisions.

Features of management accounting system:

There has been several features of management accounting system which will be

beneficial and helpful to the entity in terms of making the adequate analysis of performance and

efforts made by professionals of venture (Ax and Greve, 2017). However, the managements

accounting mainly used for decision making which enables the entity to have standards costing

and budgeting techniques. The main features of this technique are:

It studies the causes and effect relationship in consideration of financial accounting,

profits and loss accounts.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

It determines the total elementary costs such as fixed, variable and semi-variable costs.

It is totally different from financial accounting as it is useful for managerial decisions.

It helps in modifying the data and have the proper interpretation of such analysis.

Principles of management accounting:

There are various kinds of management accounting techniques which will be helpful to

venture in terms of attaining the adequate revenue with better efficiency. However, such

techniques will be helpful to the entity in terms of achieving the business objectives with proper

allocation of the resources (Kenno and Free, 2017). However, the main principles of this system

are as follows:

The transactions were to be designed, recorded, reported and relevant statements were

presented by the accounting professionals on periodic basis.

These cost are to be controlled on the basis of relevant sources and proper analysis.

The accounting system facilitate the return on investment over the projected plan of

venture.

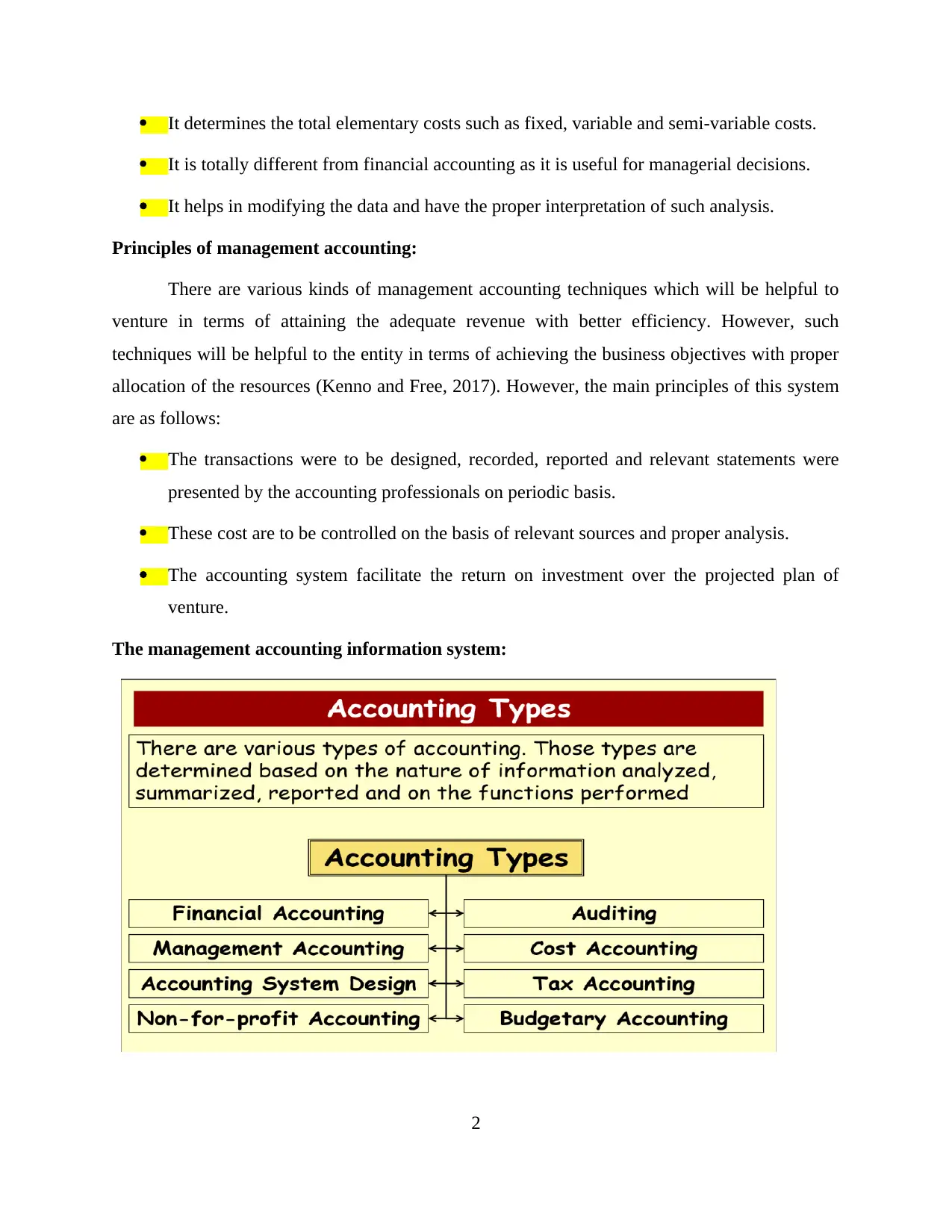

The management accounting information system:

2

It is totally different from financial accounting as it is useful for managerial decisions.

It helps in modifying the data and have the proper interpretation of such analysis.

Principles of management accounting:

There are various kinds of management accounting techniques which will be helpful to

venture in terms of attaining the adequate revenue with better efficiency. However, such

techniques will be helpful to the entity in terms of achieving the business objectives with proper

allocation of the resources (Kenno and Free, 2017). However, the main principles of this system

are as follows:

The transactions were to be designed, recorded, reported and relevant statements were

presented by the accounting professionals on periodic basis.

These cost are to be controlled on the basis of relevant sources and proper analysis.

The accounting system facilitate the return on investment over the projected plan of

venture.

The management accounting information system:

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

There are various kinds of management accounting reporting system which are meant to

be performed and analysed by the professionals of venture. Managerial professionals need to

make proper analysis of the financial accounting techniques for the operations of the business. It

helps in recording the transactions in the data set and provide the accurate results (Latan and

et.al., 2018).

Types management accounting system:

Cost accounting: The costs accounting will be profitable in terms of analysing the costs

incurred in each functions of venture. There are various costs accounts which will be helpful to

the entity in terms of analysing the requirement of funds for the operations. However, these costs

includes job costing, batch costing, variable, fixed, direct and indirect.

Tax accounting: This is necessary for the business growth of venture to have the better

revenue as well as periodically making payments of the taxes. It is essential for entity in terms of

making the payments of corporate taxes, duties, transportation charges etc.

Budgetary: The professionals in venture need to present their estimation towards the

requirement of funds and costs going to be incurred in the particular activity. The budgets

include several budgets such as sales, cash, production, promotion etc.

Auditing: It will be helpful to entity in context with having a periodical audit of the

accounts which will facilitate the overall information regarding the performance of venture.

Financial accounting: It includes preparation and presentation of all the financials of

firm such as balance sheet, income statements, cash flow statement etc.

Management accounting: There is need to include all the management accounting

techniques which will be helpful to them in terms of analysing status of the costs and resources

available to them.

Accounting system designing: This a computer based data system which keeps the

records of all the necessary transactions held in venture. Therefore, the motive is to design the

accounts and the source of information which must be cost effective in order to facilitate the

information. It includes Single or double entry, account code structure, cash or accrual basis,

Divisional representation, Reports, Procedure, controls etc.

3

be performed and analysed by the professionals of venture. Managerial professionals need to

make proper analysis of the financial accounting techniques for the operations of the business. It

helps in recording the transactions in the data set and provide the accurate results (Latan and

et.al., 2018).

Types management accounting system:

Cost accounting: The costs accounting will be profitable in terms of analysing the costs

incurred in each functions of venture. There are various costs accounts which will be helpful to

the entity in terms of analysing the requirement of funds for the operations. However, these costs

includes job costing, batch costing, variable, fixed, direct and indirect.

Tax accounting: This is necessary for the business growth of venture to have the better

revenue as well as periodically making payments of the taxes. It is essential for entity in terms of

making the payments of corporate taxes, duties, transportation charges etc.

Budgetary: The professionals in venture need to present their estimation towards the

requirement of funds and costs going to be incurred in the particular activity. The budgets

include several budgets such as sales, cash, production, promotion etc.

Auditing: It will be helpful to entity in context with having a periodical audit of the

accounts which will facilitate the overall information regarding the performance of venture.

Financial accounting: It includes preparation and presentation of all the financials of

firm such as balance sheet, income statements, cash flow statement etc.

Management accounting: There is need to include all the management accounting

techniques which will be helpful to them in terms of analysing status of the costs and resources

available to them.

Accounting system designing: This a computer based data system which keeps the

records of all the necessary transactions held in venture. Therefore, the motive is to design the

accounts and the source of information which must be cost effective in order to facilitate the

information. It includes Single or double entry, account code structure, cash or accrual basis,

Divisional representation, Reports, Procedure, controls etc.

3

Non for profit accounting: This type of accounting technique is not having any

commercial owner as the funds generated in the accounts will be utilised for the welfare of the

society. It will be used in health and social care services, educational or technical development,

donations etc.

Inventory management system: this technique will be helpful to venture in terms of

making the adequate analysis over the availability of resources in the organisation as well as

proper management of inventory it checks the numbers of imported goods as well as numbers of

exported goods. Therefore, such determination will be beneficial in decisioning the production

level of the business.

Job costing: To determine the level of funds utilised while performing a particular job or

tasks. However, there are various departments and different jobs are being performed by the

individual which is need to be managed and monitored. Moreover, it helps in analysing the costs

incurred in each operations such a direct material, labour and overhead expenses.

Price optimisation: To analyse the satisfactory costs over the products and services there

is need to have appropriate pricing decisions. It must meet the costs of the operations as well as

must be convenient for the consumers.

Essential requirements of different types of management accounting systems

The requirements of different kinds of management accounting system which will be

helpful in various operational factors such as:

It helps the ascertaining the costs incurred in each business operations such as labour,

material, manufacturing, selling etc.

It manages and executes the price fixation with the help of various budgetary techniques.

It will be beneficial in reducing the costs as well as proper control over the level of

wastage.

The Unprofitable or unfruitful activities will be identified and which will help the

managers to make the decision to find the alternative solution.

The accuracy of the financial accounts will be checked and analysed

4

commercial owner as the funds generated in the accounts will be utilised for the welfare of the

society. It will be used in health and social care services, educational or technical development,

donations etc.

Inventory management system: this technique will be helpful to venture in terms of

making the adequate analysis over the availability of resources in the organisation as well as

proper management of inventory it checks the numbers of imported goods as well as numbers of

exported goods. Therefore, such determination will be beneficial in decisioning the production

level of the business.

Job costing: To determine the level of funds utilised while performing a particular job or

tasks. However, there are various departments and different jobs are being performed by the

individual which is need to be managed and monitored. Moreover, it helps in analysing the costs

incurred in each operations such a direct material, labour and overhead expenses.

Price optimisation: To analyse the satisfactory costs over the products and services there

is need to have appropriate pricing decisions. It must meet the costs of the operations as well as

must be convenient for the consumers.

Essential requirements of different types of management accounting systems

The requirements of different kinds of management accounting system which will be

helpful in various operational factors such as:

It helps the ascertaining the costs incurred in each business operations such as labour,

material, manufacturing, selling etc.

It manages and executes the price fixation with the help of various budgetary techniques.

It will be beneficial in reducing the costs as well as proper control over the level of

wastage.

The Unprofitable or unfruitful activities will be identified and which will help the

managers to make the decision to find the alternative solution.

The accuracy of the financial accounts will be checked and analysed

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

The influence of such technique will be helpful for the entity in terms of having the

satisfactory internal control, pricing strategies as well as in estimating the business

requirements.

P2: Explain different techniques and methods used for management accounting reporting.

The decision making will be successful only if there will be proper reporting and records

of the transactional information. Therefore, there are various reporting techniques which can be

analysed as follows:

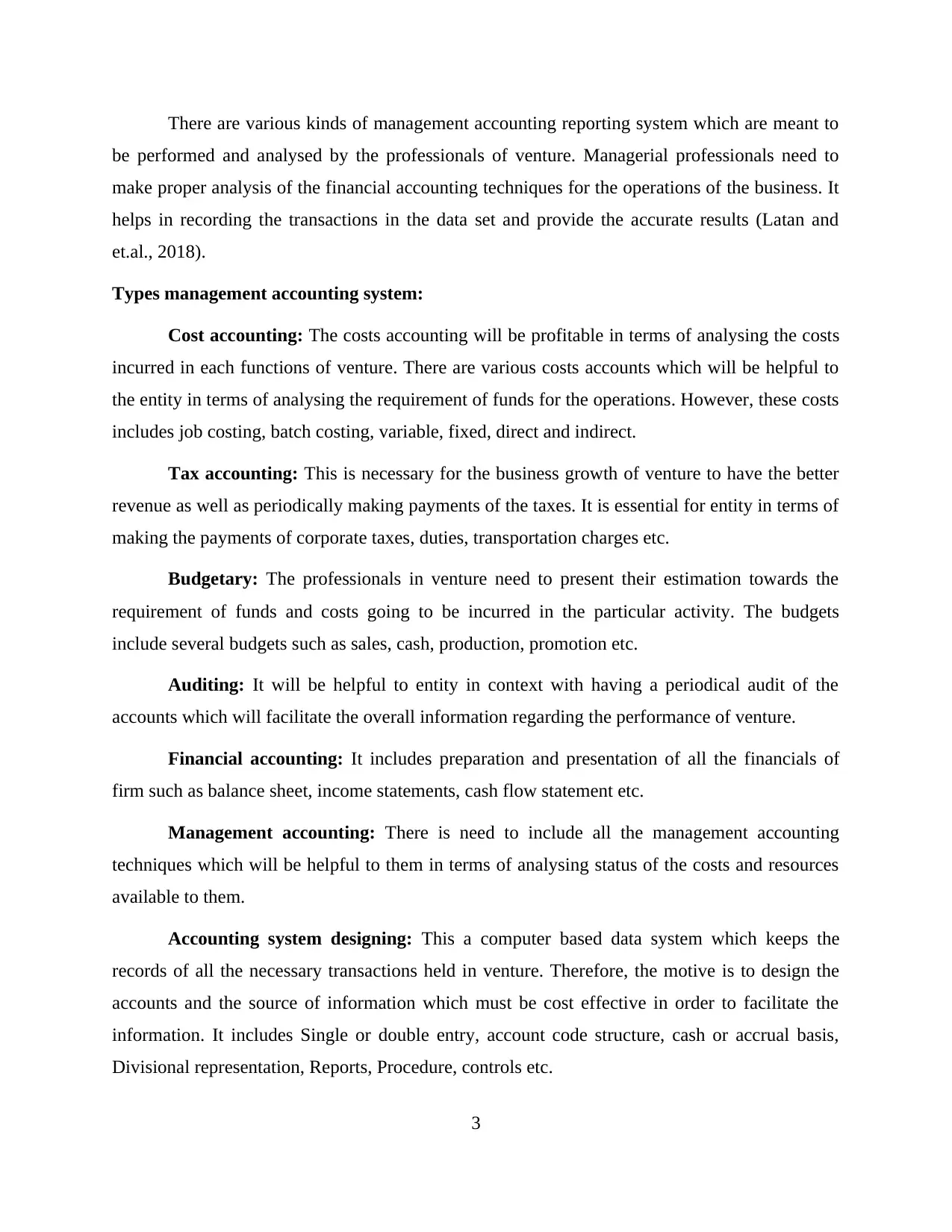

A. Job costing: There is the analysis which will be based on level of operations made the

professionals and the profits earned over such operations (Dekker, Kawai and Sakaguchi,

2018). However, it helps them in analysing the costs incurred in finishing a particular unit

of operations.

Importance: It will be helpful tool in determining the requirement of funds in each

department as well as satisfactory estimation. It will be helpful in analysing the costs

incurred in each business activities such as direct labour, material and various overheads.

It determines the capital utilised while performing a job which will be helpful to

managers in cost decisions.

Example:

5

satisfactory internal control, pricing strategies as well as in estimating the business

requirements.

P2: Explain different techniques and methods used for management accounting reporting.

The decision making will be successful only if there will be proper reporting and records

of the transactional information. Therefore, there are various reporting techniques which can be

analysed as follows:

A. Job costing: There is the analysis which will be based on level of operations made the

professionals and the profits earned over such operations (Dekker, Kawai and Sakaguchi,

2018). However, it helps them in analysing the costs incurred in finishing a particular unit

of operations.

Importance: It will be helpful tool in determining the requirement of funds in each

department as well as satisfactory estimation. It will be helpful in analysing the costs

incurred in each business activities such as direct labour, material and various overheads.

It determines the capital utilised while performing a job which will be helpful to

managers in cost decisions.

Example:

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

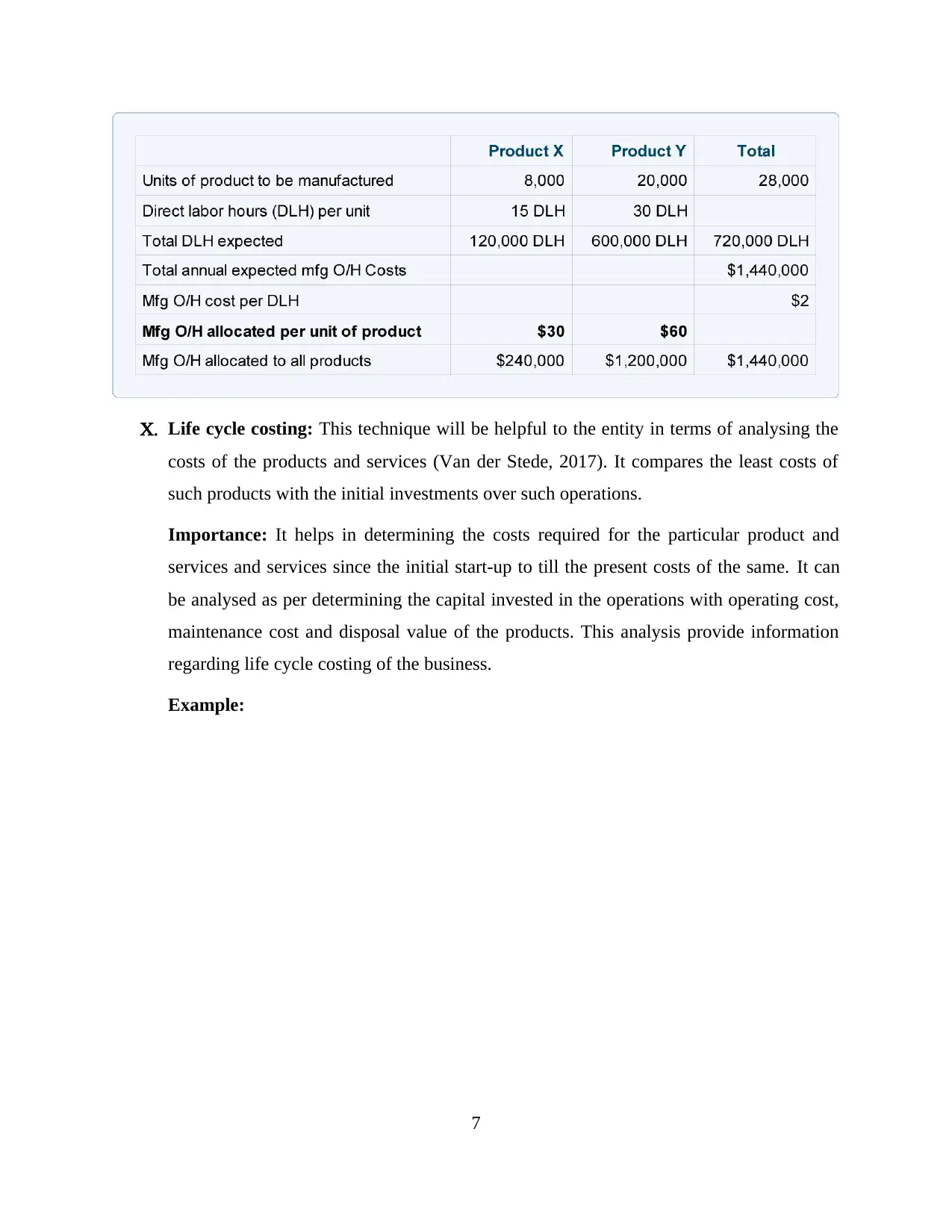

B. Overhead allocation: This is the reporting technique which will helpful to the entity in

contact with allocating the funds to the overhead expenses of the organisation (Christ and

Burritt, 2017). However, it includes the costs such as direct labour, machine hours and

various relevant costs which are meant to be analyse and financed by the business.

Importance: The importance of this tool which will be helpful in determining the cost

incurred in all the business transactions such as Direct labour, Material costs etc.

Therefore, the allocation of various overheads will be profitable in terms of saving the

costs incurred in each unit operations.

Example:

6

contact with allocating the funds to the overhead expenses of the organisation (Christ and

Burritt, 2017). However, it includes the costs such as direct labour, machine hours and

various relevant costs which are meant to be analyse and financed by the business.

Importance: The importance of this tool which will be helpful in determining the cost

incurred in all the business transactions such as Direct labour, Material costs etc.

Therefore, the allocation of various overheads will be profitable in terms of saving the

costs incurred in each unit operations.

Example:

6

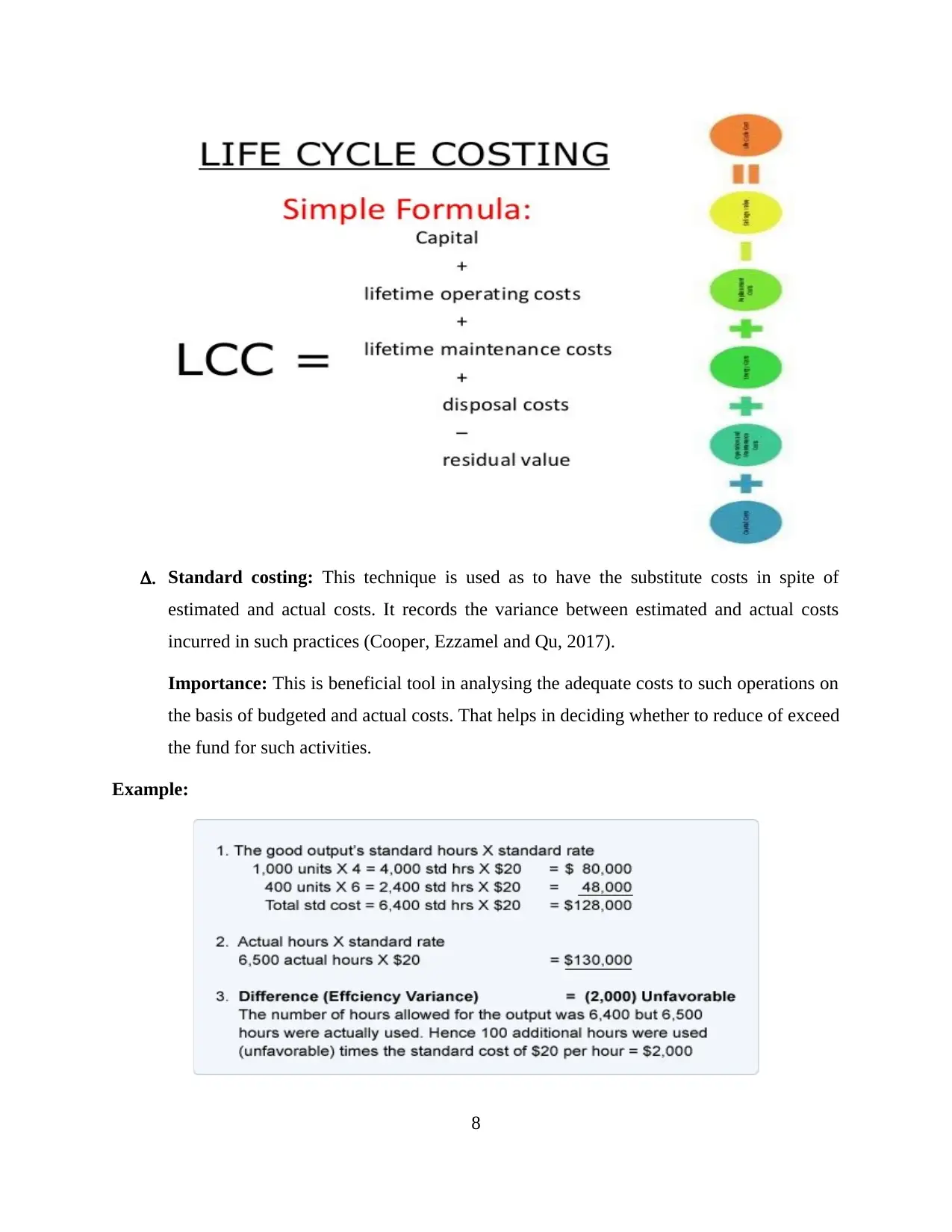

C. Life cycle costing: This technique will be helpful to the entity in terms of analysing the

costs of the products and services (Van der Stede, 2017). It compares the least costs of

such products with the initial investments over such operations.

Importance: It helps in determining the costs required for the particular product and

services and services since the initial start-up to till the present costs of the same. It can

be analysed as per determining the capital invested in the operations with operating cost,

maintenance cost and disposal value of the products. This analysis provide information

regarding life cycle costing of the business.

Example:

7

costs of the products and services (Van der Stede, 2017). It compares the least costs of

such products with the initial investments over such operations.

Importance: It helps in determining the costs required for the particular product and

services and services since the initial start-up to till the present costs of the same. It can

be analysed as per determining the capital invested in the operations with operating cost,

maintenance cost and disposal value of the products. This analysis provide information

regarding life cycle costing of the business.

Example:

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

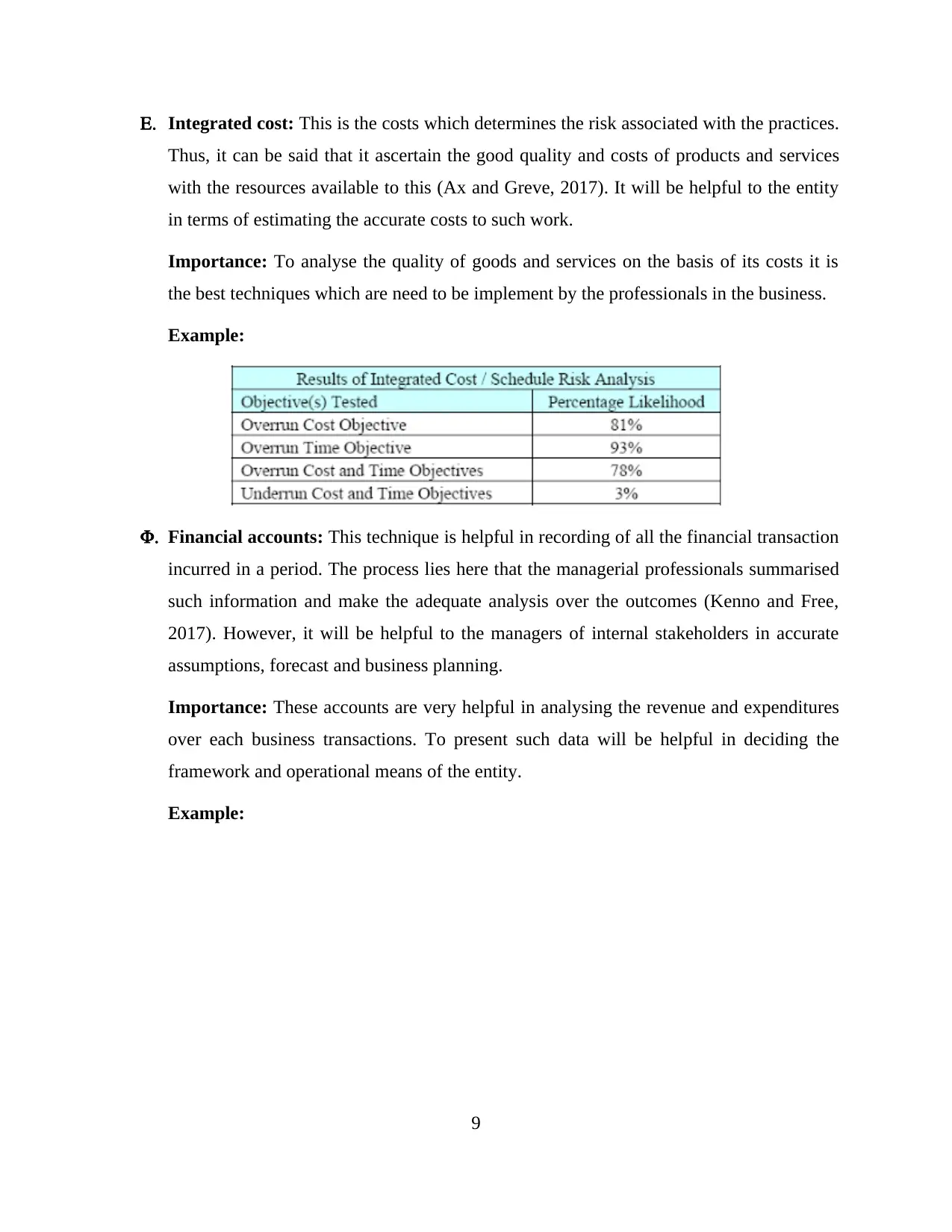

D. Standard costing: This technique is used as to have the substitute costs in spite of

estimated and actual costs. It records the variance between estimated and actual costs

incurred in such practices (Cooper, Ezzamel and Qu, 2017).

Importance: This is beneficial tool in analysing the adequate costs to such operations on

the basis of budgeted and actual costs. That helps in deciding whether to reduce of exceed

the fund for such activities.

Example:

8

estimated and actual costs. It records the variance between estimated and actual costs

incurred in such practices (Cooper, Ezzamel and Qu, 2017).

Importance: This is beneficial tool in analysing the adequate costs to such operations on

the basis of budgeted and actual costs. That helps in deciding whether to reduce of exceed

the fund for such activities.

Example:

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

E. Integrated cost: This is the costs which determines the risk associated with the practices.

Thus, it can be said that it ascertain the good quality and costs of products and services

with the resources available to this (Ax and Greve, 2017). It will be helpful to the entity

in terms of estimating the accurate costs to such work.

Importance: To analyse the quality of goods and services on the basis of its costs it is

the best techniques which are need to be implement by the professionals in the business.

Example:

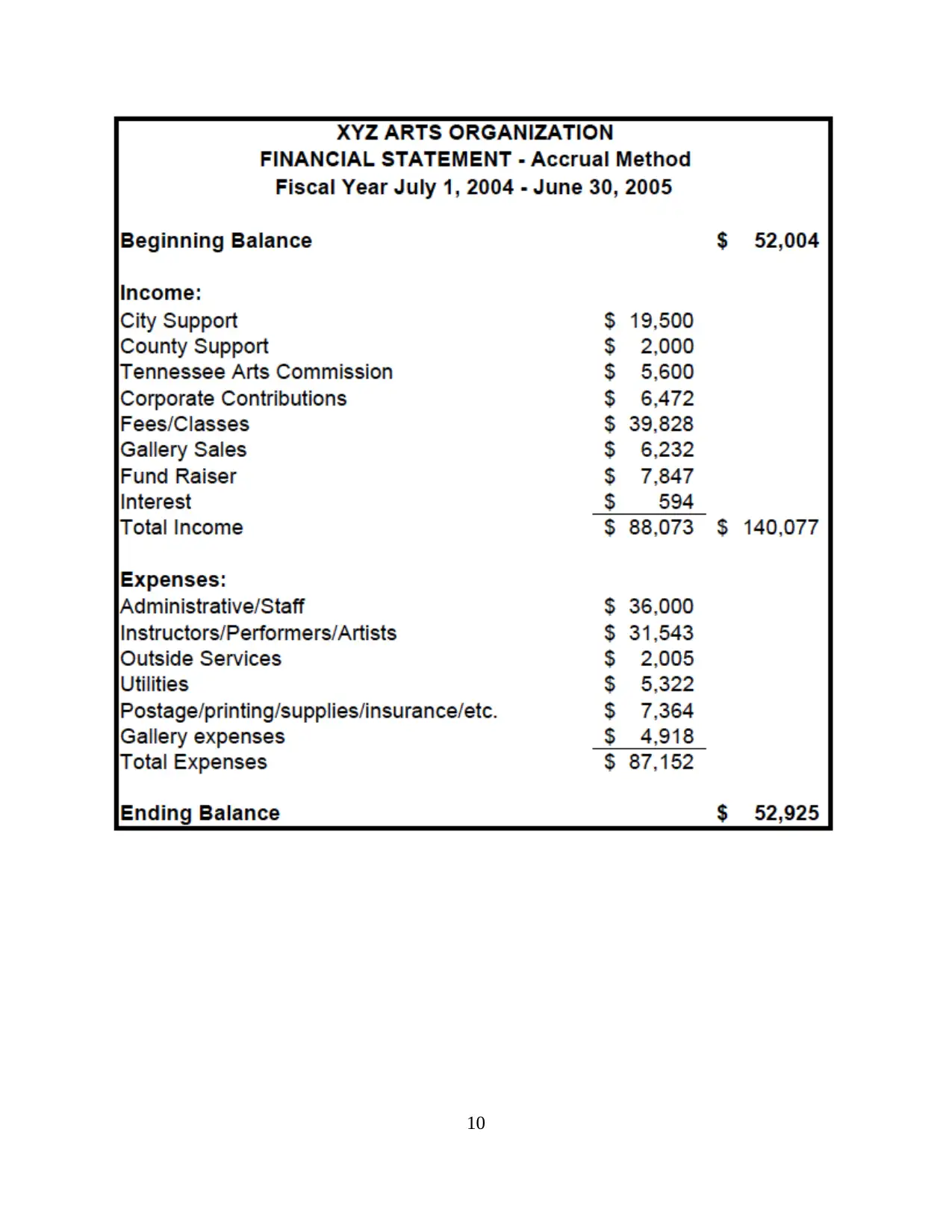

F. Financial accounts: This technique is helpful in recording of all the financial transaction

incurred in a period. The process lies here that the managerial professionals summarised

such information and make the adequate analysis over the outcomes (Kenno and Free,

2017). However, it will be helpful to the managers of internal stakeholders in accurate

assumptions, forecast and business planning.

Importance: These accounts are very helpful in analysing the revenue and expenditures

over each business transactions. To present such data will be helpful in deciding the

framework and operational means of the entity.

Example:

9

Thus, it can be said that it ascertain the good quality and costs of products and services

with the resources available to this (Ax and Greve, 2017). It will be helpful to the entity

in terms of estimating the accurate costs to such work.

Importance: To analyse the quality of goods and services on the basis of its costs it is

the best techniques which are need to be implement by the professionals in the business.

Example:

F. Financial accounts: This technique is helpful in recording of all the financial transaction

incurred in a period. The process lies here that the managerial professionals summarised

such information and make the adequate analysis over the outcomes (Kenno and Free,

2017). However, it will be helpful to the managers of internal stakeholders in accurate

assumptions, forecast and business planning.

Importance: These accounts are very helpful in analysing the revenue and expenditures

over each business transactions. To present such data will be helpful in deciding the

framework and operational means of the entity.

Example:

9

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 30

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.