Management Accounting: Cost Analysis and Reporting for R.L. Maynard

VerifiedAdded on 2020/06/06

ACCOUNTING

Paraphrase This Document

Administrative choices are exceptionally key for the association that gives the fresh

recruits to the association. It deals with every one of the assets, limiting cost, control spending

plans and arranging respect to business. It can be conceivable through the data that are given in

the administration bookkeeping that encourage them in to settling on budgetary choices respect

to back. The examination extend is setting to the R.L. Maynard organization in which it chief

receive different arranging devices, administration bookkeeping framework and detailing

(Burritt, Schaltegger and Zvezdov, 2011). There is an essential talk on the administration

bookkeeping and concentrate on the distinctive sorts of administration of bookkeeping

framework that effectively reacting money related issue. From there on, it there is dialog on

minor costing and assimilation costing procedures that are embraced by organization to arranged

net benefit. Further, there is an investigation on the clarification on focal points and

inconveniences of different sorts of arranging devices that can be utilized for budgetary control.

TASK 1

P1 Clarify administration bookkeeping and give the basic prerequisites of different sort of

administration bookkeeping framework

Administration bookkeeping is utilized by the directors keeping in mind the end goal to

settle on viable choices respect to firm. The data incorporates into it are useful for the chief to

maintain their everyday business operation in successful way. Therefore, it includes a

bookkeeping data that are helpful for the administration for the primary reason for execution

administration framework, concocting arranging and furthermore controlling in definition of

business' system. The primary point of this kind of bookkeeping is that to give legitimate

guidance to the administrators respect to money related results of firms choices, help in

controlling monetary viewpoints, additionally depict the impacts of the focused scene (Elbashir,

Collier and Sutton, 2011). In this way, it is unique in relation to the monetary bookkeeping as it

is continually searching for future as opposed to authentic information. organization utilized

administration bookkeeping and it gives necessities of various sort of administration

bookkeeping framework that are portrayed underneath.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

financial performance of the company so as to devise plans, policies and strategies for the

successful and sustainable growth. It facilitates R.L. Maynard to make day to day decisions.

Job Costing System: It helps in recording of cost and revenues which can impact the

probability of Job. Moreover, it is used by the business to measure is profits and losses. It

comprises three major components of the organisation which are Material, labour and overhead.

Cost Accounting System: This helps R.L. Maynard in maintaining the record of all the

cost which can be minimized in order to improve the management system of the firm. The major

objective behind using this accounting system is to make business operations effective and

efficient.

Inventory Management system: It assists the business in tracking the inventory orders

and sales on order to make optimum utilisation of resources. Moreover, it is beneficial in

reducing time as it track the work order, bills of material and all the documents which are related

to production function of the R.L. Maynard.

Price Optimization system: This system is used by R.L. Maynard to forecast the prices of

its goods and services according to the customer demand because it is a mathematical program

which assists the organisation in calculating demand at different prices in order to make good

pricing decisions and enjoy good return.

Lean accountancy – They are able to control, execution estimation strategies as well as

bookkeeping that is helping the assembling process of lean presentation. This is doesn't

bolster a lean assembling however utilized a lean techniques. This is primarily focuses

over limiting cost price from products sold-out instead of deciding net price which can be

acquire as a season of assembling operation. On the basis of that few capacities are

identified at bookkeeping which can be executed with the help of lean bookkeeping

which incorporates expelling non-esteem - include methodology in revealing and

bookkeeping. Further, give an unmistakable comprehension of likelihood in juxtaposition

to product offerings and it creates an on-going report on general premise. Along these

lines, disregard the months end and also chronicled weekly documentation.

Paraphrase This Document

costs which can be created at the season about assembling merchandise. This can be

considered otherwise called an ordinary technique as it doling out the backhanded cost

brings about in industrial facility at the season of assembling a thing. It incorporates

chiefly in it are the creation machine hours, number of units delivered and coordinate

work hours and so forth. R.L. Maynard embraces the conventional costing strategy in

which it doles out the assembling expense and it bombs in designating the non-

fabricating. The principle focal points from it is that to produce the money related reports

as it helps them in giving an incentive to COGS. Aside from this, with the headway of PC

and machines now this framework ends up plainly obsolete. This can be considered as

terrible regarding administration through which choices process of making selection is

not implemented.

Throughput accountancy - It depends on standard and it is new in the administration

bookkeeping. It is a bookkeeping through it recognizes factor that encourage them in

accomplish its objectives and targets in successful way. It for the most part focuses on

money exchange and overlooks the costing and also cost bookkeeping. It doesn't dole out

every one of the costs, for example, factor and settled cost and in addition it likewise

includes overheads identified with products which are being offered by organization

(Elbashir, Collier and Sutton, 2011). It is a hypothesis about imperatives by that

administrator from an organization is able to do without much of a stretch settle on

choices that are identify with development reason.

Transfer pricing - It is that cost in which an administration defining the standards when

one ventures exchange any sort of products crosswise over fringes. Hence, it can be

utilized with the help of administration bookkeeper towards deciding costs which can be

cause over season about exchange between sections. Moreover, this costs can be

regularly implemented on the halfway merchandise that is provided by pitching into

purchasing separation. Primarily preferred standpoint for it can be gives precision and

additionally reasonableness for the organisation elements as it is consisting of different

control can be detailed for exchange cost.

The R.L. Maynard implemented various accountancy management approaches some of

them are mentioned below:

Sales document -It depends on business exercises which can be done through any single

business group into the specific era. This compressing various offers about items either

administrations towards clients, execution about sales representative as well as benefit from an

organization and so on. Besides, there is a likewise data of e-mail, customer meeting, discussion,

outbound calls that are made on every day and in addition week by week and month to month

premise. The principle favourable circumstances of offers study which is able to utilized through

organization with end goal about deliberating money related execution (Garrison and et.al.,

2010). It is conceivable by examination between previous money related execution on the basis

of present benefits. With the help of this they are able to make promoting arrangement as needs

be to convey the item or administrations according to the client's desire.

Cost accounting - It is valuable for the administration keeping in mind the end goal to

give a precise sum on money related explanations as it decided the cost of activities, process and

items and so on. It is additionally help the chief in taking choice in compelling way, controlling

the association capacities and so on. Subsequently, this is considered as best administration

accountancy framework which can be utilized over the vast majority for assembling

organizations for processing elementary price of product which can be produced (Ward, 2012).

With this end goal for reportage stock value over COGS and B/S for pay articulation. R.L.

Maynard utilized expenditure accountancy for deciding expenditure, controlling price in order to

provide future options identified with the values that are depend on chronicled cost information.

Budgetary document – This is considered as a nitty gritty data which are mostly

involved into two segments are the planned expenses and real. It encourages them in decide the

spending change among planned and real sum by an accountancy period of time. It is an inside

report in which it can without much of a stretch composed spending plan for a future through

correlation evaluated and examination planned. This report is distributed into two issues. Out of

which anyone can be considered while considering working environment respect towards back

which can be effortlessly evaluation done spending document. Besides, there are various other

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

organization's money related execution.

The methods of Management accounting reporting which are as follows:

Budget Report: It is used by R.L. Maynard to identify its performance; it is a reporting

which assists the manager of the organisation monitoring and controlling costs by the

comparison of actual and budgeted figures Moreover, it is specially used by the enterprise to

estimate budget of standard and actual expenses as per the performance of the company from

past 3 4 years.

Accounts Receivable Aging: This accounting reporting method is used by R.L. Maynard

to monitor over its credit policies like, management of Cash flow in order to extend credit period

to its buyers. It is beneficial of the company as it helps the enterprise on overlooking over its old

debts.

Job Cost Reports: This method is used by R.L. Maynard to estimate expenses for specific

project. Further, it assists the firm in time management, job and profit evaluation, and identifying

the low profit margin areas of business.

Inventory and Manufacturing: It is used by the organisations to making its production

process effective and efficient. Moreover, It is used by R.L. Maynard to measure and compare

the performance of operations in order to offer bonus for deserving department of the unit.

TASK 2

P3 Figure out value by considering an appropriate cost analysis approaches. Also explain

difference.

Salary articulations is considered as a monetary fund perspective for the organisation. It

can be partitioned into two units such as consumption and income. This is based on the money

related explanation about an organization which has been set up at particular accounting duration

which can be analysed by association's budgetary execution in view of net benefit or net

misfortune. The bookkeeper put every one of the exercises that are identified with working and

non-working exercises related to the charge as well as credit entry side (Zimmerman and Yahya-

Zadeh, 2011). This could be set up through organization's bookkeeper over receiving

administration costing procedures or negligible including ingestion expenditure. R.L Maynard

administration bookkeeper arranged pay proclamation by embracing the two procedures to

Paraphrase This Document

well as 2. It is representing Gross benefit/misfortune arranged by both administration costing

methods are as per the following:

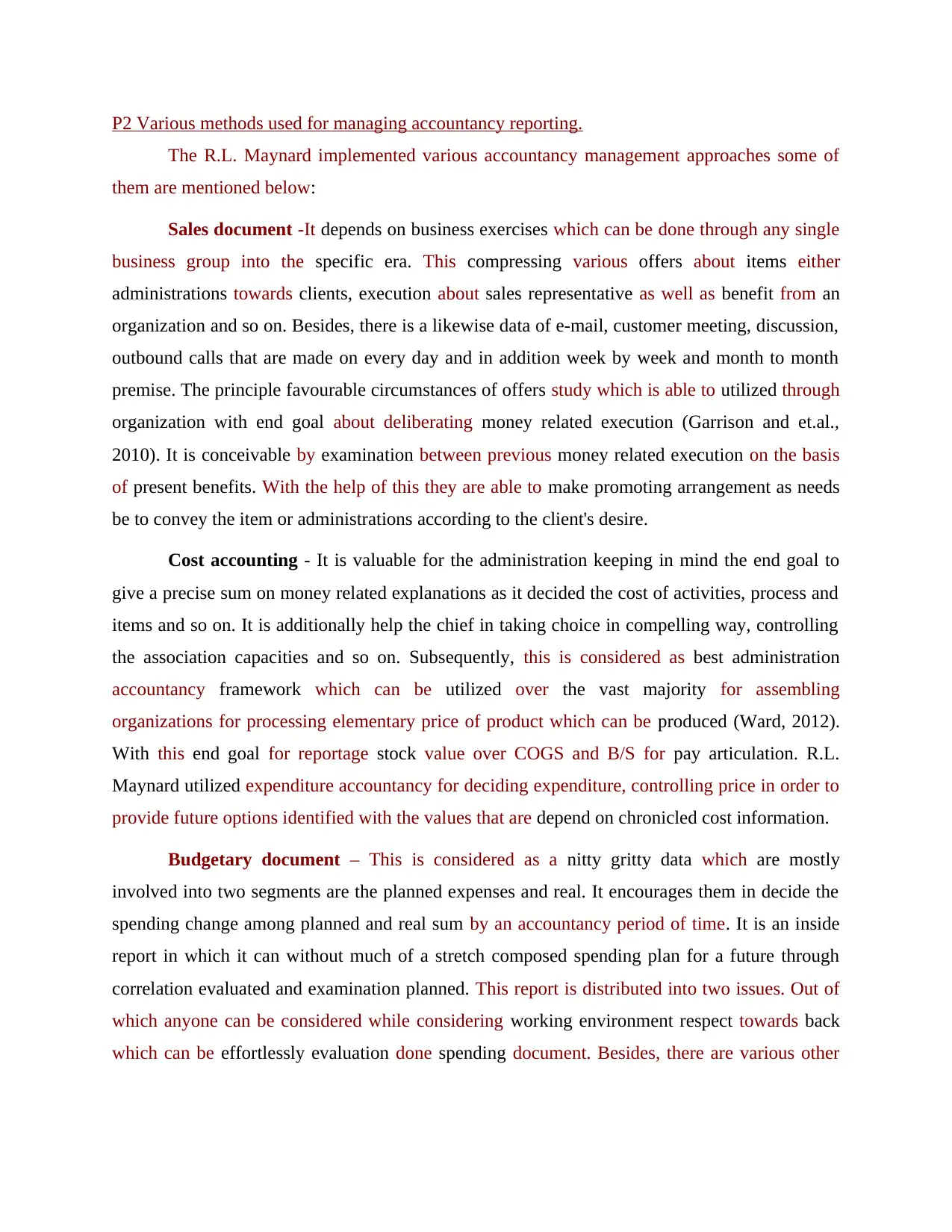

Absorption/full costing method

Particulars Absorption

Direct material 6

Direct labor 5

Variable production overheads 2

Fixed production overheads 3

Costs/unit 16

Income statement using Absorption costing

Particulars Amount

Sales (600*35) 21000

Minus: Costs of production

(16*700) 11200

Less: closing stock (100*16) 1600 9600

Less: over absorbed fixed overheads 100

Cost of production 9500

Gross profit (GP) 11500

Minus: Other costs

Administration costs 700

Selling costs (SC) 600

Sales overheads 600 1900

Net profit 9600

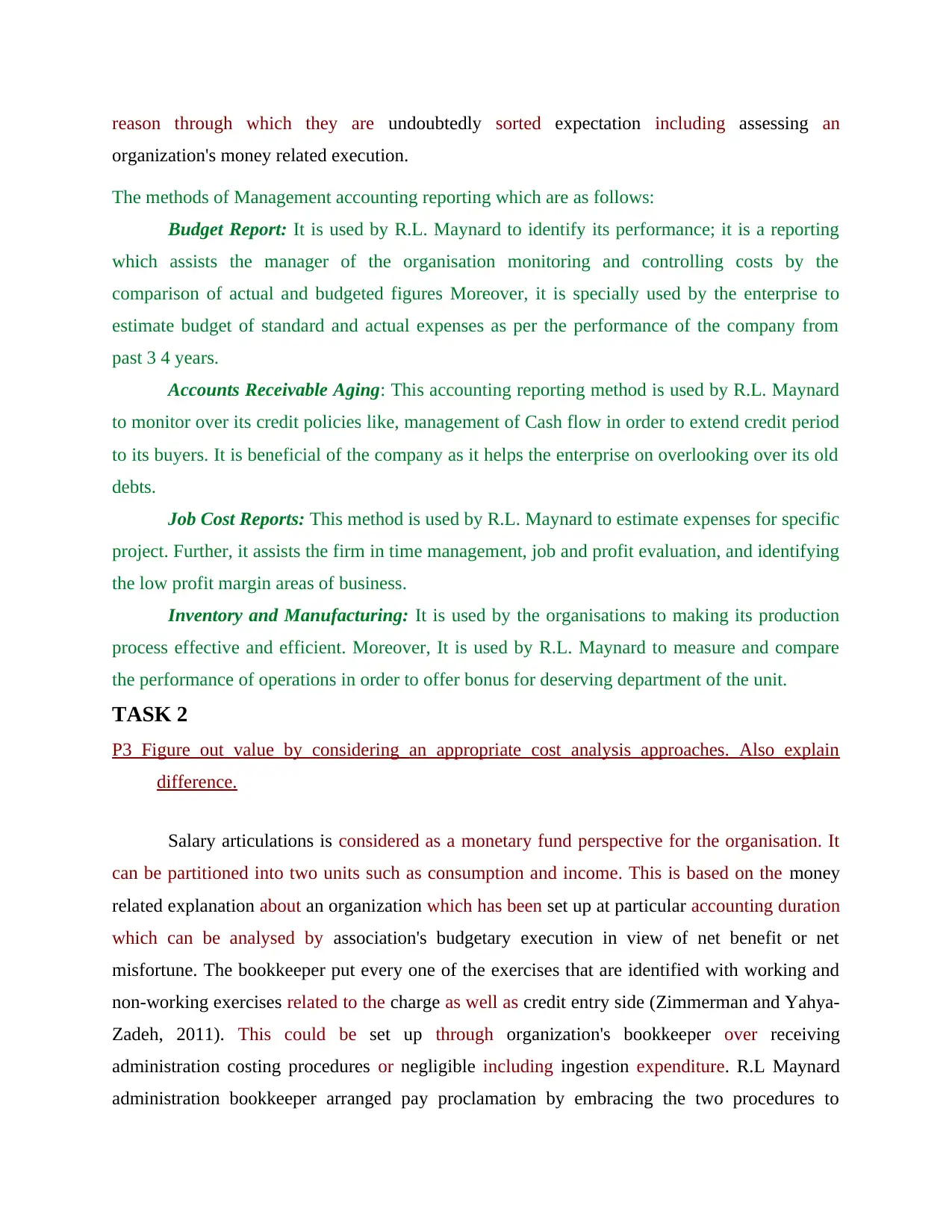

Marginal costing/variable costing method

Items Amount/unit

Direct material purchase 6

Variable manufacturing overheads 2

Cost/unit 13.00

Income statement using marginal costing

Particulars Amount

Sales (600*35) 21000

Minus: Variable cost of sales

(13*700) 9100

Minus: closing stock (100*13) 1300 7800

Gross profit (GP) 13200

Minus: Other costs

Fixed production overheads 2000

Administration costs 700

Selling costs (SC) 600

Sales overheads 600 3900

Net Gains (Profit) 9300

Computing of overhead absorption rate for fixed production overhead

= Budgeted fixed production overheads or Number of units

= 1800/600

= 3

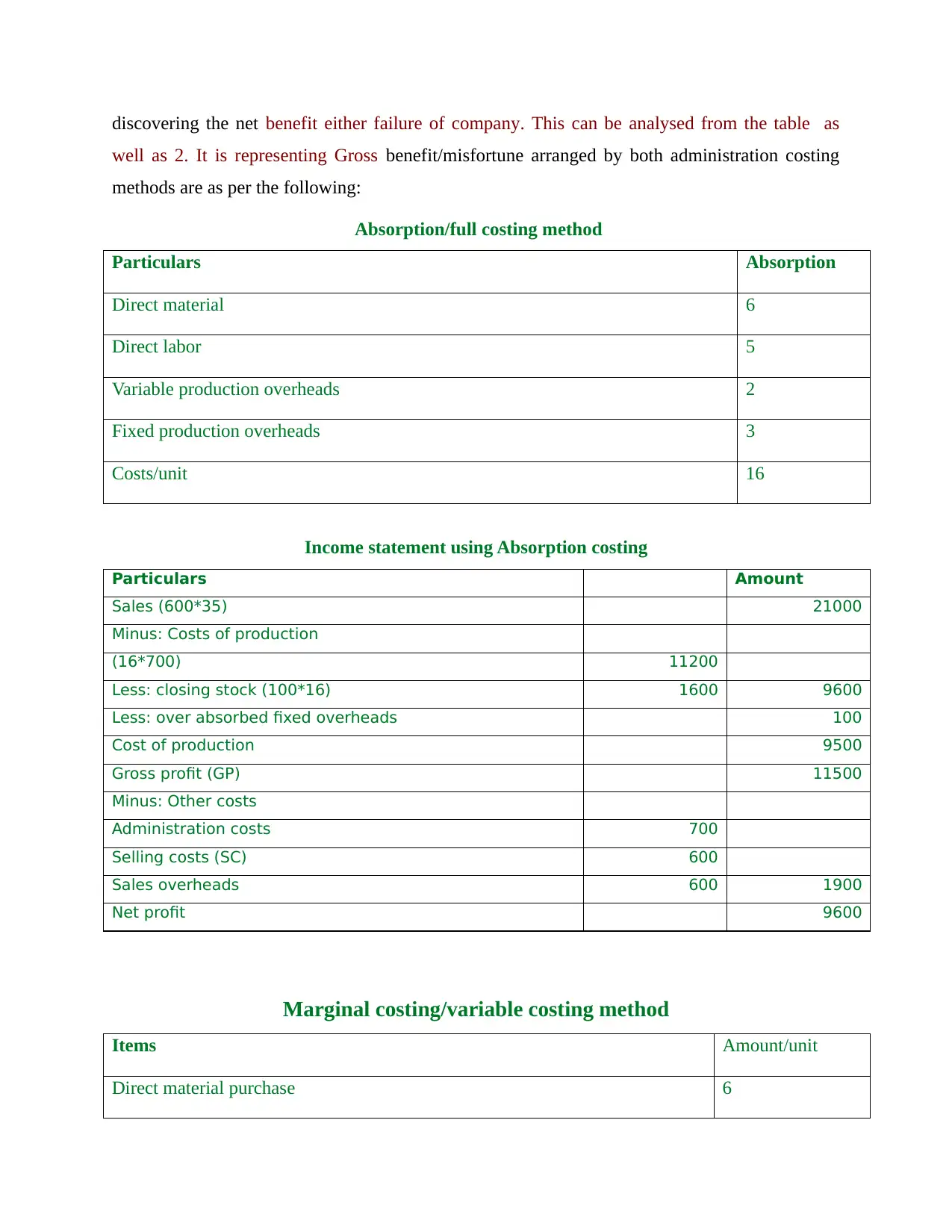

Income argument based on marginal costing and absorption costing

Retention valuation, it is consisting of all the cost that are imposed at various units. There

is an alternative work for this process, in which the value of merchandise sold-out incorporate

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

overall cost which has been eluded in the retention costing. According to the calculation, it can

be evaluated that proclaimed that value of merchandise sold out is approx. £21000. From that

point, it denotes that it includes several deductions and addition to reach net profit which is 9600.

It can be analysed that total benefit over negligible costing is higher than the assimilation which

looks like the settled costs. Moreover, the net profit in absorption costing is 9600 at a per unit

cost of 16 higher than that of marginal cost in which per unit cost is 13 because it includes fixed

overhead's production of 3 per unit. . Thus, the income statement of absorption and marginal

costing also have as difference of 300 in its net profit as the absorption costing includes fixed

overheads of 2000. Therefore, the ultimate cost of sales is 96000 and 7800 which demonstrated

the profits of 9400 and 11300.

Very few are reasoned which are retention valuation can be considered as one of the

suitable procedures which leads at end goal about figuring overall benefit. This can be expected

towards in light of the fact that it takes both kind of costs, for example, settled as well as

changeable price up to season for processing total success/failure about an organization around

monetary year. During this process vital element is one which is figuring benefit related to the

costs which should be approve as well as solid information. Moreover, the greater part of the

assembling association receives assimilation costing techniques in readiness of pay

proclamation.

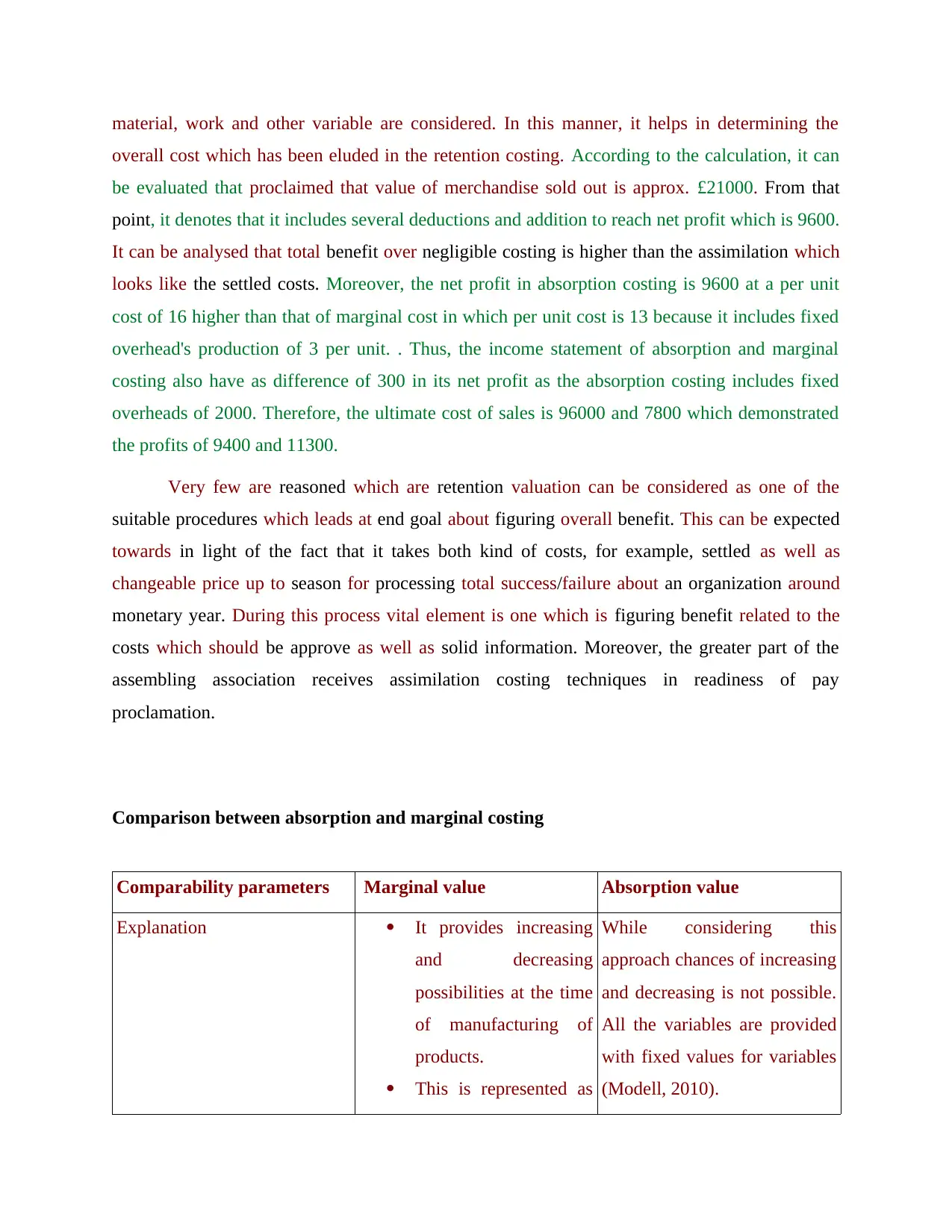

Comparison between absorption and marginal costing

Comparability parameters Marginal value Absorption value

Explanation It provides increasing

and decreasing

possibilities at the time

of manufacturing of

products.

This is represented as

While considering this

approach chances of increasing

and decreasing is not possible.

All the variables are provided

with fixed values for variables

(Modell, 2010).

Paraphrase This Document

approach which is

based on the fixed

value for uncertain cost

for generating net

profit by sold products.

While considering

computation variable

is take variable values

can be considered. In

this process cost is

represented as a fixed

parameter. In this profit

and loss statements

depends.

Cost acknowledgement It is considering changeable

expenses for the product cost

including fixed cost.

Absorption is provided with

both variable and fixed value

for the products.

Division of expenditure It can be distributed into

variable and fixed cost

(Macintosh and Quattrone,

2010).

In this approach data is

segmented into various units

such as distribution,

manufacturing, sales etc.

Net profit With the help of profit-

volume ratio, profitability of

the company can be measured.

Intuitionism in fixed pricing

creates huge impact on the

profit.

Per unit price It is not creating huge impact

on the opening and closing

inventory.

The cost is highly get

influenced while making any

variation into the opening and

closing stack values.

Purpose The purpose of implementing Through this approach

provide sense of effective

decision to their internal

members of the organisation.

information about internal and

external bodies of the firm can

be managed effectively.

Highlighting Share per unit ( CPU) Net income( NPU)

TASK 3

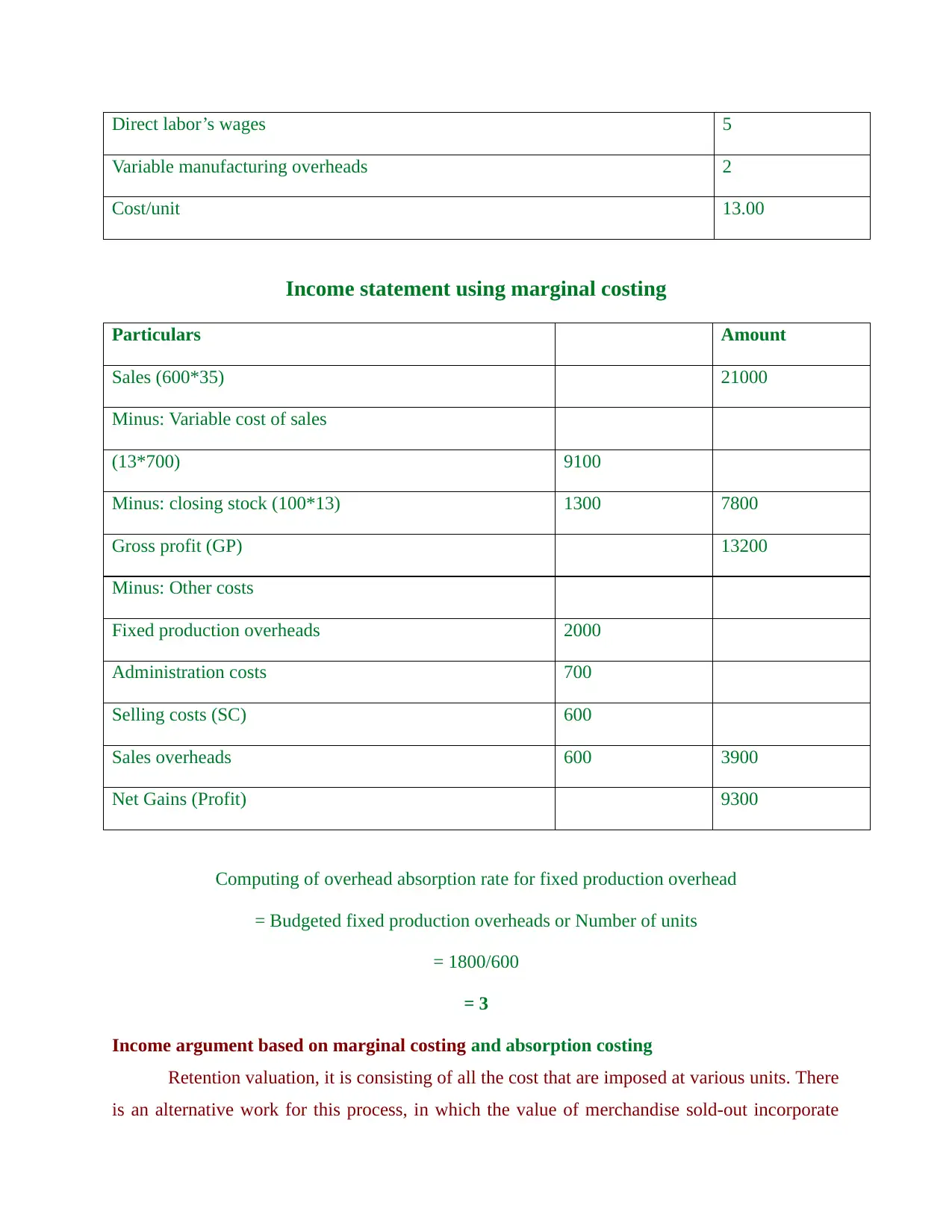

P4 Advantages and disadvantages of implementing different planning approaches for controlling

budget.

Monetary fund controlling is considered as a procedure that helps in demonstrating the

genuine result by make examination among standard spending plan along with real spending

plan all over a bookkeeping period. This helps in determining the spending difference because of

which they can without much of a stretch discovering the inadequacy because it can undoubtedly

take healing activities. They can without much of a stretch control with the assistance of different

arranging instruments which has been received by the R.L. Maynard that are mentioned below:

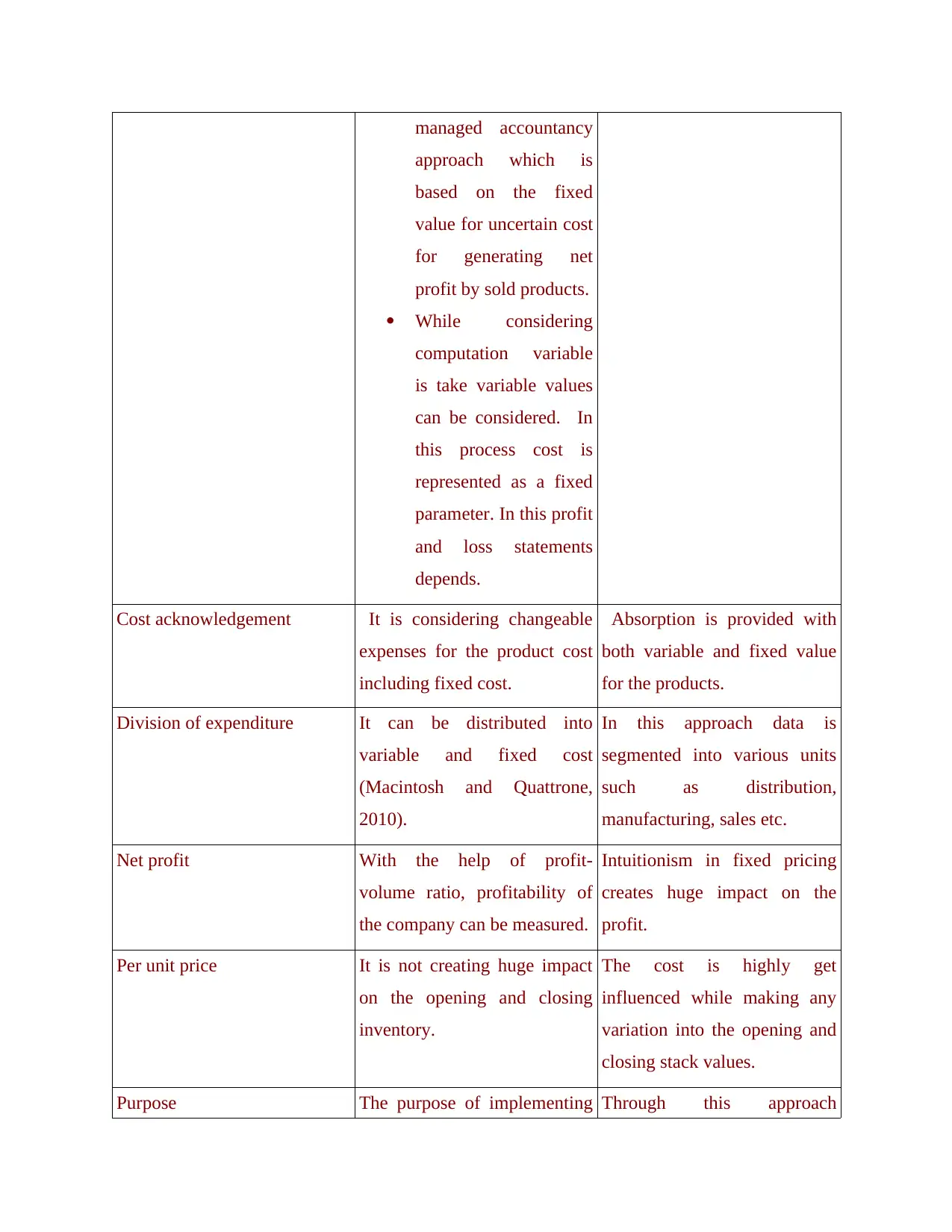

• Deviation examination – This is considered as an approach thorough which variation

among expectation and reality can be determined for the organisations. With the help of this

approach forbidding difference between process can be analysed. There are few favourable

circumstances and disservice that are portrayed beneath:

Advantages Disadvantages

The biggest of advantaged of considering

this approach is identified as it helps the

company in order to implement

improvisation measures on time.

It will facilitate them in minimization of

commercial enterprise jeopardy (Lukka

and Modell, 2010).

Through this approaches' relationship

between various element of the company

can be determined. It helps in analysing

the risk factors.

With the help of elaborated analysis

The main demerit of implementing this

method is calculation process is time taking

and complex.

The organisation required to spend large

amount of finance along with this

professionals are also required for

generating effective outcome.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

maximise the profit by controlling the cost

and expenses.

Through this approach plans and designing

can be developed in order to maximise

profitability.

It helps in generating better outcomes

through decreasing the values of variance

analysis.

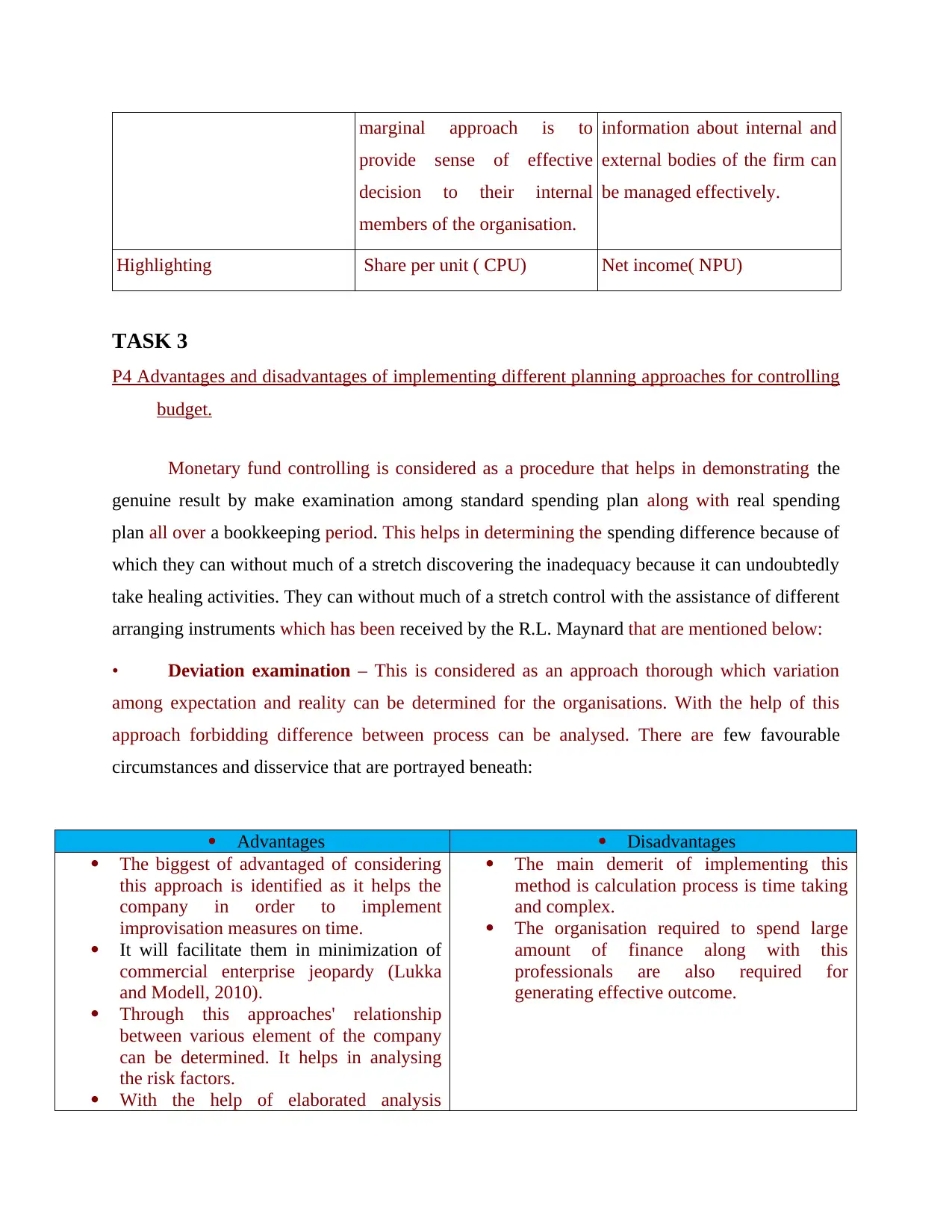

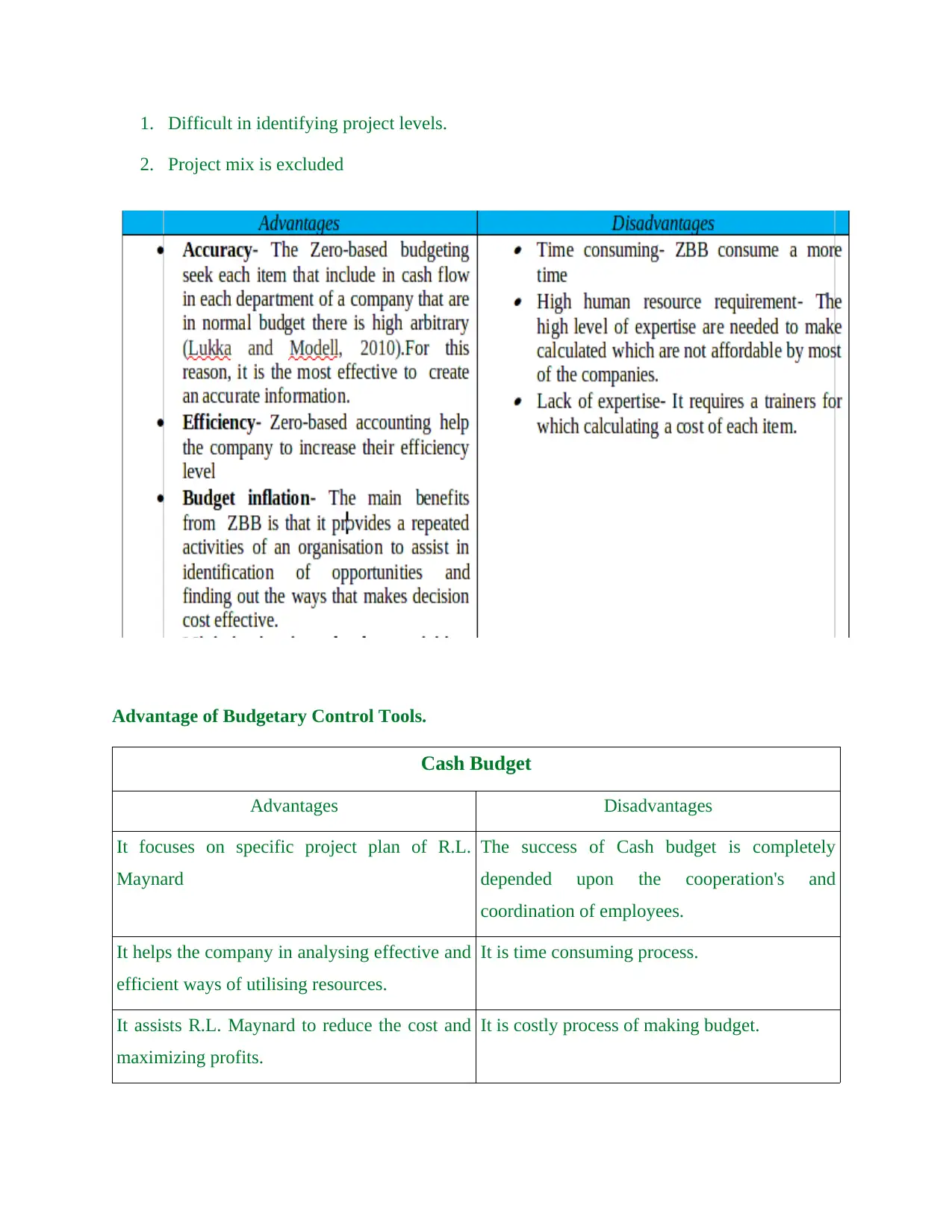

Zero-based budgeting – It is proved that all the elements that are included in the business

purpose. It helps in determining the significant financial requirements and companies

expenditure. Hence, on the basis of that following are advantages and disadvantages are

determined:

Incremental Budgeting: This used by R.L. Maynard because it helps the company in

examining its budget of past few years and the actual performance. Using this helps the

firm in getting incremental amount which should be added to make new budget for a

specific period

Advantages

1. Consistent and relevant

2. Establishes coordination between budgets.

Disadvantages

1. Neglect the impact of changes

2. Costly process

Activity based budgeting: This budgeting strategy is used by the organisations to enhance

the capabilities of generating revenues by ensuring appropriated innovation, creativeness

and by increasing effectiveness and efficiency in business operations.

Advantages

1. Establishes a link between all the finance activity.

2. Easy to explain and understand

Disadvantages

Paraphrase This Document

2. Project mix is excluded

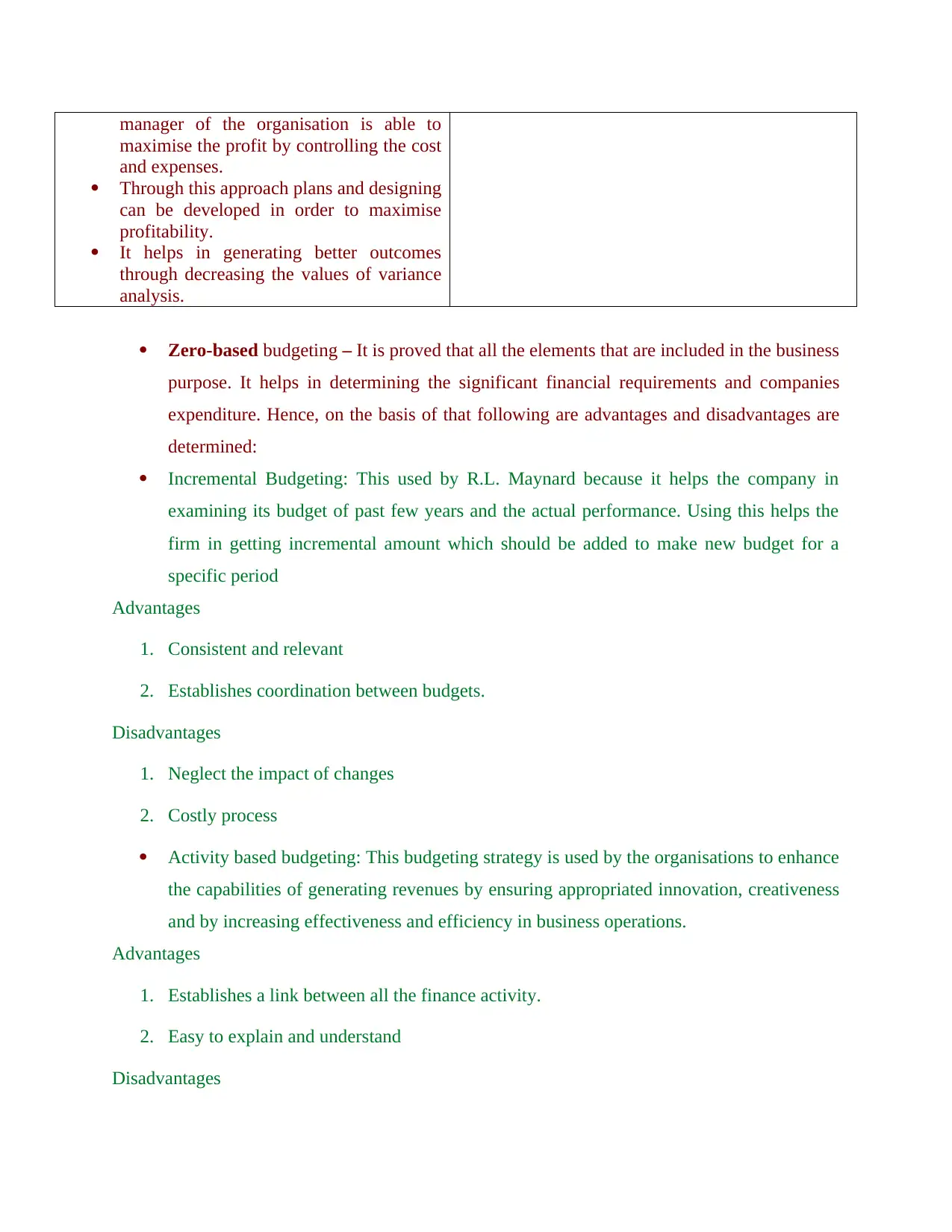

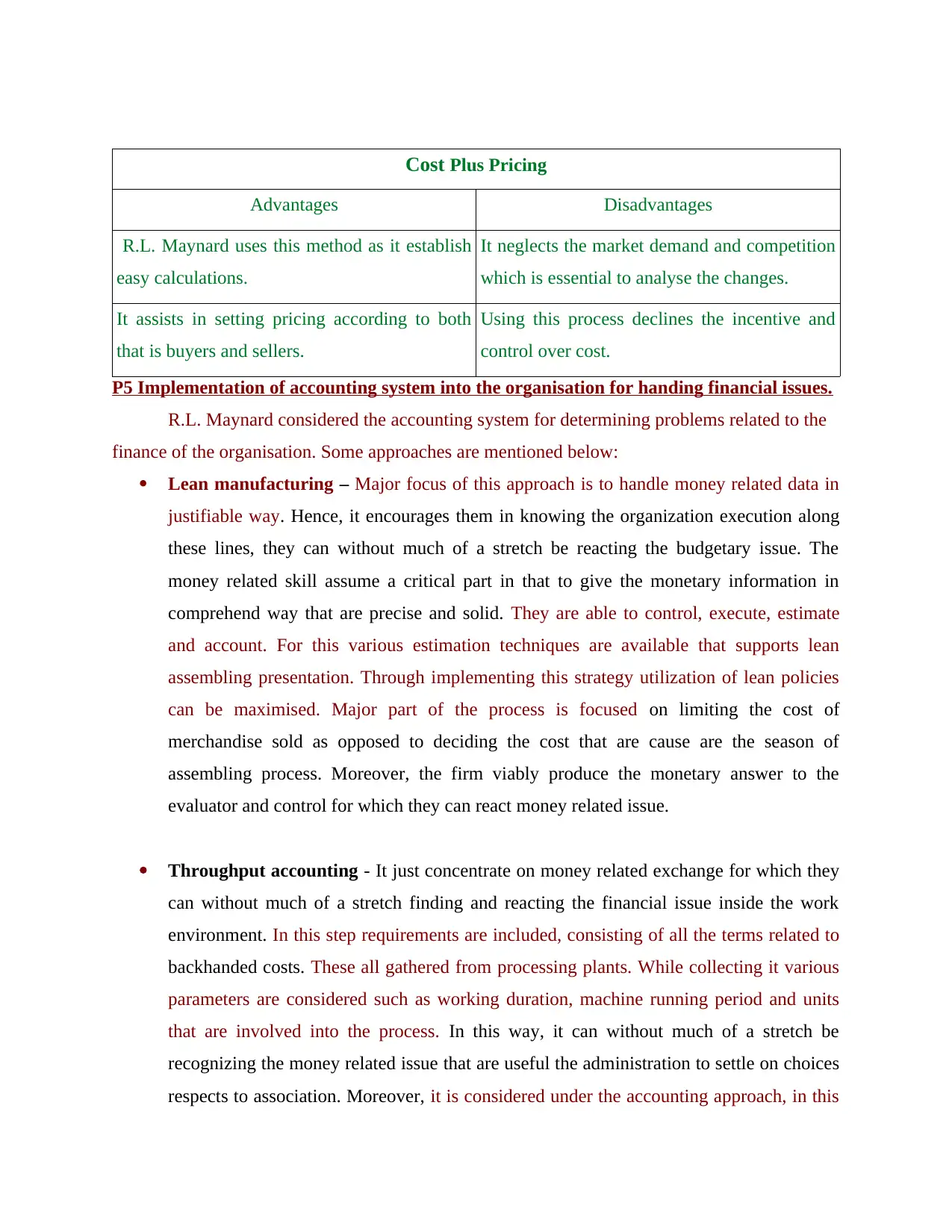

Advantage of Budgetary Control Tools.

Cash Budget

Advantages Disadvantages

It focuses on specific project plan of R.L.

Maynard

The success of Cash budget is completely

depended upon the cooperation's and

coordination of employees.

It helps the company in analysing effective and

efficient ways of utilising resources.

It is time consuming process.

It assists R.L. Maynard to reduce the cost and

maximizing profits.

It is costly process of making budget.

Advantages Disadvantages

R.L. Maynard uses this method as it establish

easy calculations.

It neglects the market demand and competition

which is essential to analyse the changes.

It assists in setting pricing according to both

that is buyers and sellers.

Using this process declines the incentive and

control over cost.

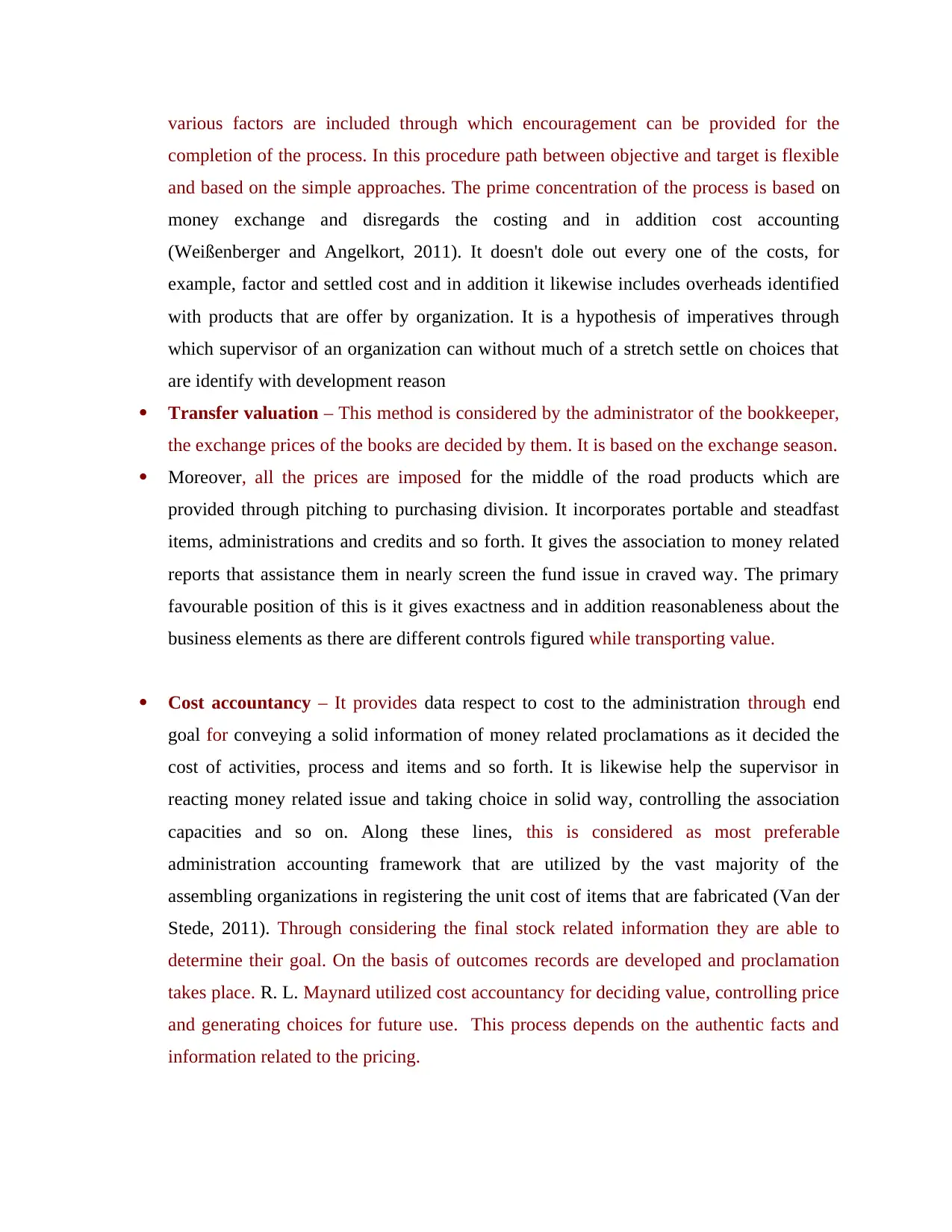

P5 Implementation of accounting system into the organisation for handing financial issues.

R.L. Maynard considered the accounting system for determining problems related to the

finance of the organisation. Some approaches are mentioned below:

Lean manufacturing – Major focus of this approach is to handle money related data in

justifiable way. Hence, it encourages them in knowing the organization execution along

these lines, they can without much of a stretch be reacting the budgetary issue. The

money related skill assume a critical part in that to give the monetary information in

comprehend way that are precise and solid. They are able to control, execute, estimate

and account. For this various estimation techniques are available that supports lean

assembling presentation. Through implementing this strategy utilization of lean policies

can be maximised. Major part of the process is focused on limiting the cost of

merchandise sold as opposed to deciding the cost that are cause are the season of

assembling process. Moreover, the firm viably produce the monetary answer to the

evaluator and control for which they can react money related issue.

Throughput accounting - It just concentrate on money related exchange for which they

can without much of a stretch finding and reacting the financial issue inside the work

environment. In this step requirements are included, consisting of all the terms related to

backhanded costs. These all gathered from processing plants. While collecting it various

parameters are considered such as working duration, machine running period and units

that are involved into the process. In this way, it can without much of a stretch be

recognizing the money related issue that are useful the administration to settle on choices

respects to association. Moreover, it is considered under the accounting approach, in this

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

completion of the process. In this procedure path between objective and target is flexible

and based on the simple approaches. The prime concentration of the process is based on

money exchange and disregards the costing and in addition cost accounting

(Weißenberger and Angelkort, 2011). It doesn't dole out every one of the costs, for

example, factor and settled cost and in addition it likewise includes overheads identified

with products that are offer by organization. It is a hypothesis of imperatives through

which supervisor of an organization can without much of a stretch settle on choices that

are identify with development reason

Transfer valuation – This method is considered by the administrator of the bookkeeper,

the exchange prices of the books are decided by them. It is based on the exchange season.

Moreover, all the prices are imposed for the middle of the road products which are

provided through pitching to purchasing division. It incorporates portable and steadfast

items, administrations and credits and so forth. It gives the association to money related

reports that assistance them in nearly screen the fund issue in craved way. The primary

favourable position of this is it gives exactness and in addition reasonableness about the

business elements as there are different controls figured while transporting value.

Cost accountancy – It provides data respect to cost to the administration through end

goal for conveying a solid information of money related proclamations as it decided the

cost of activities, process and items and so forth. It is likewise help the supervisor in

reacting money related issue and taking choice in solid way, controlling the association

capacities and so on. Along these lines, this is considered as most preferable

administration accounting framework that are utilized by the vast majority of the

assembling organizations in registering the unit cost of items that are fabricated (Van der

Stede, 2011). Through considering the final stock related information they are able to

determine their goal. On the basis of outcomes records are developed and proclamation

takes place. R. L. Maynard utilized cost accountancy for deciding value, controlling price

and generating choices for future use. This process depends on the authentic facts and

information related to the pricing.

Paraphrase This Document

deal with its financial problems which are as follows:

Key Performance indicator: It helps the company in analysing the performance of its

business using various performance measures. This method of evaluating performance

establishes two levels of measuring performance like KPIs such as profitability, solvency and

liquidity measures. R.L. Maynard can measure the growth and success of overall firm

covering various departments such as, sales, marketing, Research and development etc. and

take well rationalized plans to maximize profitability and strengthen their solvency position

also.

Bench marking: This can be used to compare the rivalry’s performancewith the own

performance, so that, firms can detect areas where they needs to make financial decisions for

the financial success such as liquidity management, capital structure decisions and others.

Budgetary control: It can be used by R.L. Maynard by monitoring and controlling cost

and operation in a defined accounting period. Moreover, in this process manager sets the

performance of enterprise according to the success of set goals. Company can measures

variances by comparing difference between actual and standard performance of the

organisation and make good plans and strategies i.e. quality management, cost control, profit

maximization etc.

CONCLUSION

Compressing the entire report, it has been presumed that R.L. Maynard organization

utilized administration bookkeeping and it give fundamental necessities of various kind of

administration bookkeeping framework. Hence, with the end goal of giving appropriate

encourage to the administrators respect to budgetary results of company's choices, help in

controlling monetary viewpoints, additionally portray the impacts of the focused scene. It has

been likewise investigated that assimilation costing is the most fitting methods for ascertaining

the net benefit. It is expected to in light of the fact that it takes both sort of costs, for example,

settled and variable cost at the season of figuring net benefit/loss of an organization in the money

related year.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Paraphrase This Document

1

? References not editable

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

© 2024 | Zucol Services PVT LTD | All rights reserved.