Management Accounting Report: Beztec Ltd Costing and Ethics

VerifiedAdded on 2023/06/05

|12

|2917

|266

Report

AI Summary

This report examines the management accounting practices of Beztec Limited, a company producing printing machines (Lexon and Protox). It critiques the firm's use of traditional costing, which allocates overheads based on machine hours, leading to potentially inaccurate product costing. The report advocates for activity-based costing (ABC) to more accurately allocate costs based on activities like soldering, shipments, and quality control. It provides a detailed ABC analysis, comparing costs and profitability under both methods. The report also addresses ethical considerations, particularly the conflict of interest arising from the CEO's compensation tied to product revenues, and emphasizes the accountant's responsibility to act in the public interest, advocating for the implementation of ABC despite potential resistance. The conclusion highlights how ABC provides a more accurate picture of product profitability, guiding better decision-making, and ensuring ethical conduct in the face of conflicting interests.

Running Head: Management Accounting

Management Accounting

Management Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Running Head: Management Accounting

Introduction:

This report presents the case of Beztec Limited which is engaged in the business of producing

printing machines. The company is currently dealing in two types of printers: Lexon and

Protox. Currently, the use of traditional costing approach is being made by the company for

the determination of product cost. Under traditional costing approach, the cost of each

product is calculated on the basis of pre-determined overheads recovery rate. The overhead

recovery rate is applied to the number of machine hours or labour hours actually consumed in

manufacturing the products. In the present case of Beztec Limited, the overhead recovery rate

for both the printers is commonly applied to the number of machine hours utilised in

producing each individual type of printer as to calculated the total factory overheads.

Part 1

Accurate product costing is necessary in order to identify the actual cost involved in

producing and selling the products dealt by the company. The information regarding the true

cost of the product helps the manager in fixing the selling price of such products by setting a

desired profit margin on the basis of cost. The availability of accurate information about the

cost involved in manufacturing the products is not necessary from the price fixation

perspective but also for various other purposes. When correct cost information available with

the firm it becomes easy to decide on the matters like whether to manufacture a particular

product internally or to buy such product from the outside market. Further, to implement

control or cost reduction methods and to decide on the matters like product continuation or

discontinuation decisions, determination of appropriate product mix, the availability of

accurate cost information is vital for the business.

In the case of Beztec Limited, the allocation of overheads to both the products is done in

accordance with the traditional costing approach in order to determine the total costs of the

Introduction:

This report presents the case of Beztec Limited which is engaged in the business of producing

printing machines. The company is currently dealing in two types of printers: Lexon and

Protox. Currently, the use of traditional costing approach is being made by the company for

the determination of product cost. Under traditional costing approach, the cost of each

product is calculated on the basis of pre-determined overheads recovery rate. The overhead

recovery rate is applied to the number of machine hours or labour hours actually consumed in

manufacturing the products. In the present case of Beztec Limited, the overhead recovery rate

for both the printers is commonly applied to the number of machine hours utilised in

producing each individual type of printer as to calculated the total factory overheads.

Part 1

Accurate product costing is necessary in order to identify the actual cost involved in

producing and selling the products dealt by the company. The information regarding the true

cost of the product helps the manager in fixing the selling price of such products by setting a

desired profit margin on the basis of cost. The availability of accurate information about the

cost involved in manufacturing the products is not necessary from the price fixation

perspective but also for various other purposes. When correct cost information available with

the firm it becomes easy to decide on the matters like whether to manufacture a particular

product internally or to buy such product from the outside market. Further, to implement

control or cost reduction methods and to decide on the matters like product continuation or

discontinuation decisions, determination of appropriate product mix, the availability of

accurate cost information is vital for the business.

In the case of Beztec Limited, the allocation of overheads to both the products is done in

accordance with the traditional costing approach in order to determine the total costs of the

Running Head: Management Accounting

products. Thus, the production overheads of the company are allocated on the basis of pre-

determined overhead recovery rate. The given rate is applied to the number of machine hours

consumed in both the products. But looking at the nature of activities involved in the

production of Lexon and Protox, it can be suggested that the company must have adopted the

activity based costing in place of traditional costing for the purpose of cost allocation. There

are various factors that are driving the production overhead of the company such as Machine

set-ups, Machine power, Purchase orders, Quality control, Shipments and Soldering. Under

the traditional costing system, the overall costs of performing of all the different activities of

the company are contained in only one cost pool and such cost pool is divided by the total

number of machine hours consumed in the production of both the products (Molis, 2018).

This has resulted in application of common average rate to both the products irrespective of

the total number of activities and the complexity involved in the activities (Accounting

Coach, 2018). Moreover, the cost of different activities do not correspond at all to number of

machine hours consumed such as soldering cost, shipment cost, quality control and purchase

orders. All these practices leads to provision of inaccurate information to the mangers

regarding the actual cost involved in the production of Lexon and Protox. The inaccurate

information could lead to incorrect decision making by the top management if they use it is

for the purpose of price fixation of Lexon and Protox. Moreover, the inaccurate product

costing could lead to disrupting the true profitability position of both the printers. In order to

undertake decision making, the company must adopt the system of activity based costing

which will provide them accurate information regarding product cost. Activity based costing

will allow the allocation of production overheads to both the products on the reasonable

basis. As there are multiple activities involved in the production of both the printers, the cost

related to each cost is assigned to both the printers in the proportion of their usage or

consumption. The activities that are involved in the production process of the company are

products. Thus, the production overheads of the company are allocated on the basis of pre-

determined overhead recovery rate. The given rate is applied to the number of machine hours

consumed in both the products. But looking at the nature of activities involved in the

production of Lexon and Protox, it can be suggested that the company must have adopted the

activity based costing in place of traditional costing for the purpose of cost allocation. There

are various factors that are driving the production overhead of the company such as Machine

set-ups, Machine power, Purchase orders, Quality control, Shipments and Soldering. Under

the traditional costing system, the overall costs of performing of all the different activities of

the company are contained in only one cost pool and such cost pool is divided by the total

number of machine hours consumed in the production of both the products (Molis, 2018).

This has resulted in application of common average rate to both the products irrespective of

the total number of activities and the complexity involved in the activities (Accounting

Coach, 2018). Moreover, the cost of different activities do not correspond at all to number of

machine hours consumed such as soldering cost, shipment cost, quality control and purchase

orders. All these practices leads to provision of inaccurate information to the mangers

regarding the actual cost involved in the production of Lexon and Protox. The inaccurate

information could lead to incorrect decision making by the top management if they use it is

for the purpose of price fixation of Lexon and Protox. Moreover, the inaccurate product

costing could lead to disrupting the true profitability position of both the printers. In order to

undertake decision making, the company must adopt the system of activity based costing

which will provide them accurate information regarding product cost. Activity based costing

will allow the allocation of production overheads to both the products on the reasonable

basis. As there are multiple activities involved in the production of both the printers, the cost

related to each cost is assigned to both the printers in the proportion of their usage or

consumption. The activities that are involved in the production process of the company are

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Running Head: Management Accounting

called as cost pool and the units of activities that drives changes in the cost of activity are

called as Cost drivers (Granof, Platt & Vaysman, 2000). The cost related to soldering activity

involved in the present case shall be allocated to the both the printers in the proportion of

number of soldering points made in both the products as this is the most reasonable basis of

allocation of cost related to soldering. The shipment cost must be allocated to the printers on

the basis of number of shipments undertaken for both the printers. The quality control of the

company is also an activity which is undertaken in respect of both the products and hence

such cost shall be assigned to both the printers in the proportion of number of inspections

carried in respect of such printers individually as this is the most reasonable basis of

apportionment of cost (Drury, 2013). Further, the purchase orders have been made for both

the printers and hence such cost must allow be apportioned to both of them on the basis of

number of respective purchase orders. Furthermore, the cost related to machine set-ups must

also be allocated among both the printers on the basis of number of machine sets involved in

the production of both the units. All these allocations will promote the appropriate

assignment of the costs to the two different products of the company (Dickinson & Lere,

2003).

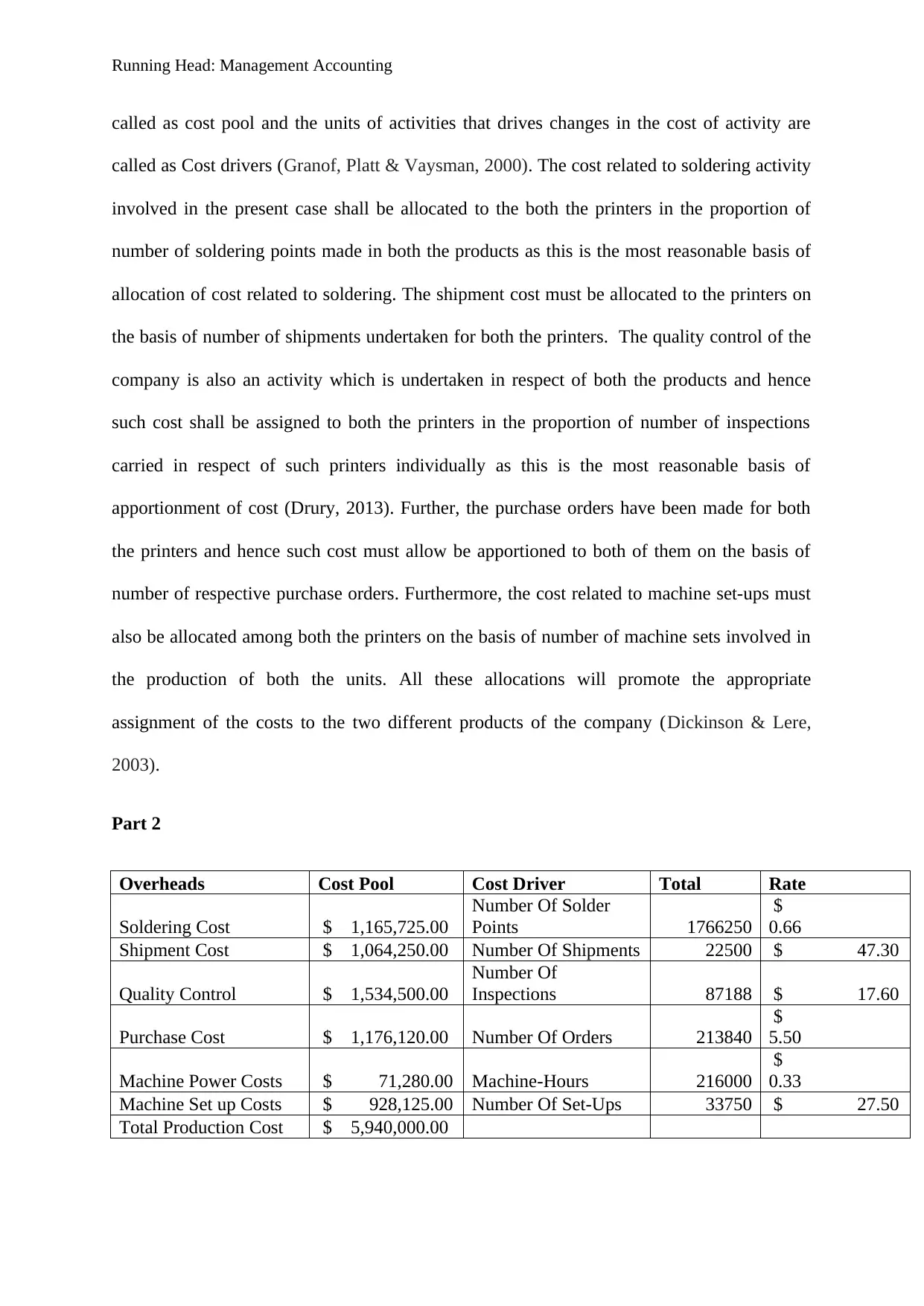

Part 2

Overheads Cost Pool Cost Driver Total Rate

Soldering Cost $ 1,165,725.00

Number Of Solder

Points 1766250

$

0.66

Shipment Cost $ 1,064,250.00 Number Of Shipments 22500 $ 47.30

Quality Control $ 1,534,500.00

Number Of

Inspections 87188 $ 17.60

Purchase Cost $ 1,176,120.00 Number Of Orders 213840

$

5.50

Machine Power Costs $ 71,280.00 Machine-Hours 216000

$

0.33

Machine Set up Costs $ 928,125.00 Number Of Set-Ups 33750 $ 27.50

Total Production Cost $ 5,940,000.00

called as cost pool and the units of activities that drives changes in the cost of activity are

called as Cost drivers (Granof, Platt & Vaysman, 2000). The cost related to soldering activity

involved in the present case shall be allocated to the both the printers in the proportion of

number of soldering points made in both the products as this is the most reasonable basis of

allocation of cost related to soldering. The shipment cost must be allocated to the printers on

the basis of number of shipments undertaken for both the printers. The quality control of the

company is also an activity which is undertaken in respect of both the products and hence

such cost shall be assigned to both the printers in the proportion of number of inspections

carried in respect of such printers individually as this is the most reasonable basis of

apportionment of cost (Drury, 2013). Further, the purchase orders have been made for both

the printers and hence such cost must allow be apportioned to both of them on the basis of

number of respective purchase orders. Furthermore, the cost related to machine set-ups must

also be allocated among both the printers on the basis of number of machine sets involved in

the production of both the units. All these allocations will promote the appropriate

assignment of the costs to the two different products of the company (Dickinson & Lere,

2003).

Part 2

Overheads Cost Pool Cost Driver Total Rate

Soldering Cost $ 1,165,725.00

Number Of Solder

Points 1766250

$

0.66

Shipment Cost $ 1,064,250.00 Number Of Shipments 22500 $ 47.30

Quality Control $ 1,534,500.00

Number Of

Inspections 87188 $ 17.60

Purchase Cost $ 1,176,120.00 Number Of Orders 213840

$

5.50

Machine Power Costs $ 71,280.00 Machine-Hours 216000

$

0.33

Machine Set up Costs $ 928,125.00 Number Of Set-Ups 33750 $ 27.50

Total Production Cost $ 5,940,000.00

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Running Head: Management Accounting

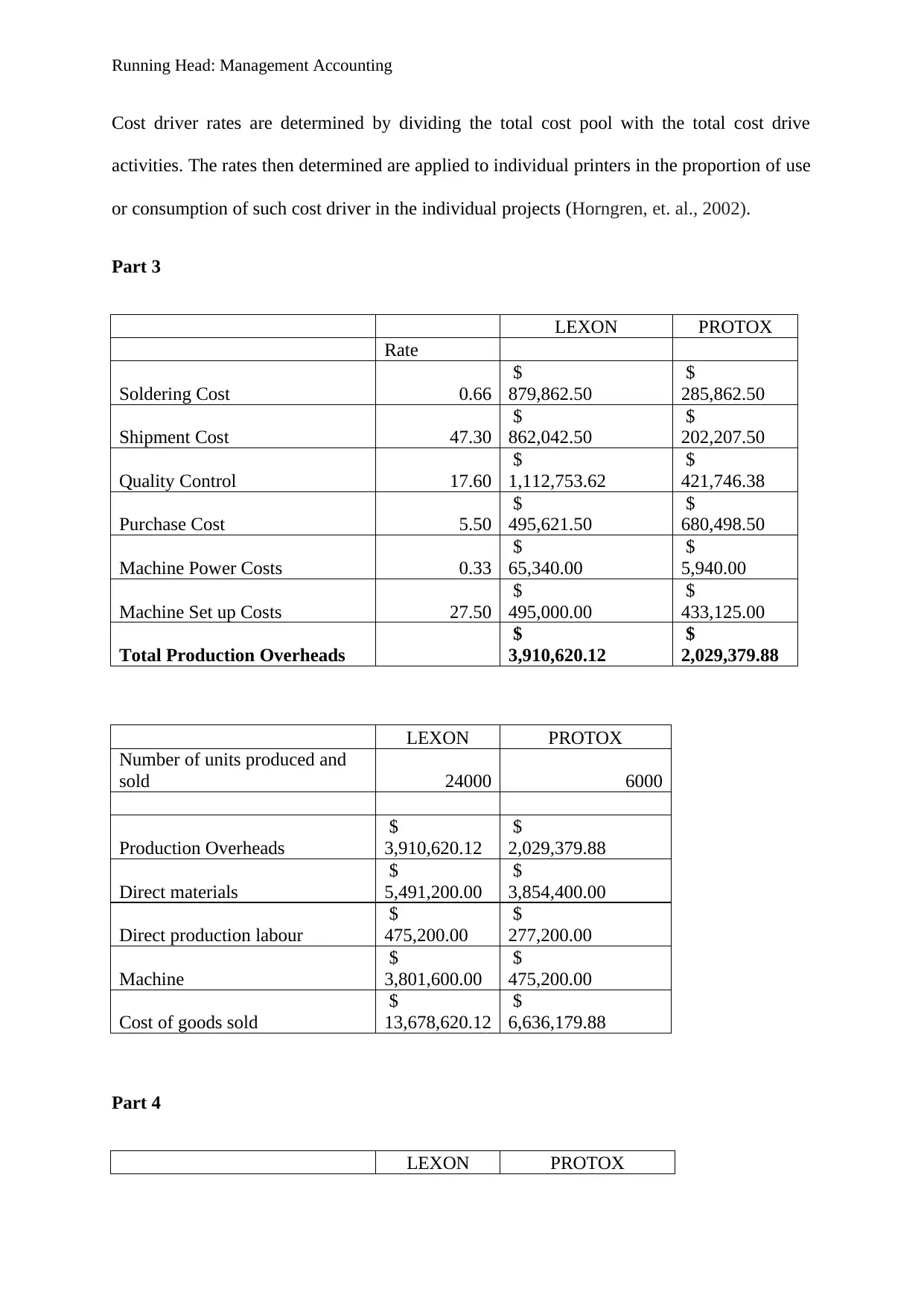

Cost driver rates are determined by dividing the total cost pool with the total cost drive

activities. The rates then determined are applied to individual printers in the proportion of use

or consumption of such cost driver in the individual projects (Horngren, et. al., 2002).

Part 3

LEXON PROTOX

Rate

Soldering Cost 0.66

$

879,862.50

$

285,862.50

Shipment Cost 47.30

$

862,042.50

$

202,207.50

Quality Control 17.60

$

1,112,753.62

$

421,746.38

Purchase Cost 5.50

$

495,621.50

$

680,498.50

Machine Power Costs 0.33

$

65,340.00

$

5,940.00

Machine Set up Costs 27.50

$

495,000.00

$

433,125.00

Total Production Overheads

$

3,910,620.12

$

2,029,379.88

LEXON PROTOX

Number of units produced and

sold 24000 6000

Production Overheads

$

3,910,620.12

$

2,029,379.88

Direct materials

$

5,491,200.00

$

3,854,400.00

Direct production labour

$

475,200.00

$

277,200.00

Machine

$

3,801,600.00

$

475,200.00

Cost of goods sold

$

13,678,620.12

$

6,636,179.88

Part 4

LEXON PROTOX

Cost driver rates are determined by dividing the total cost pool with the total cost drive

activities. The rates then determined are applied to individual printers in the proportion of use

or consumption of such cost driver in the individual projects (Horngren, et. al., 2002).

Part 3

LEXON PROTOX

Rate

Soldering Cost 0.66

$

879,862.50

$

285,862.50

Shipment Cost 47.30

$

862,042.50

$

202,207.50

Quality Control 17.60

$

1,112,753.62

$

421,746.38

Purchase Cost 5.50

$

495,621.50

$

680,498.50

Machine Power Costs 0.33

$

65,340.00

$

5,940.00

Machine Set up Costs 27.50

$

495,000.00

$

433,125.00

Total Production Overheads

$

3,910,620.12

$

2,029,379.88

LEXON PROTOX

Number of units produced and

sold 24000 6000

Production Overheads

$

3,910,620.12

$

2,029,379.88

Direct materials

$

5,491,200.00

$

3,854,400.00

Direct production labour

$

475,200.00

$

277,200.00

Machine

$

3,801,600.00

$

475,200.00

Cost of goods sold

$

13,678,620.12

$

6,636,179.88

Part 4

LEXON PROTOX

Running Head: Management Accounting

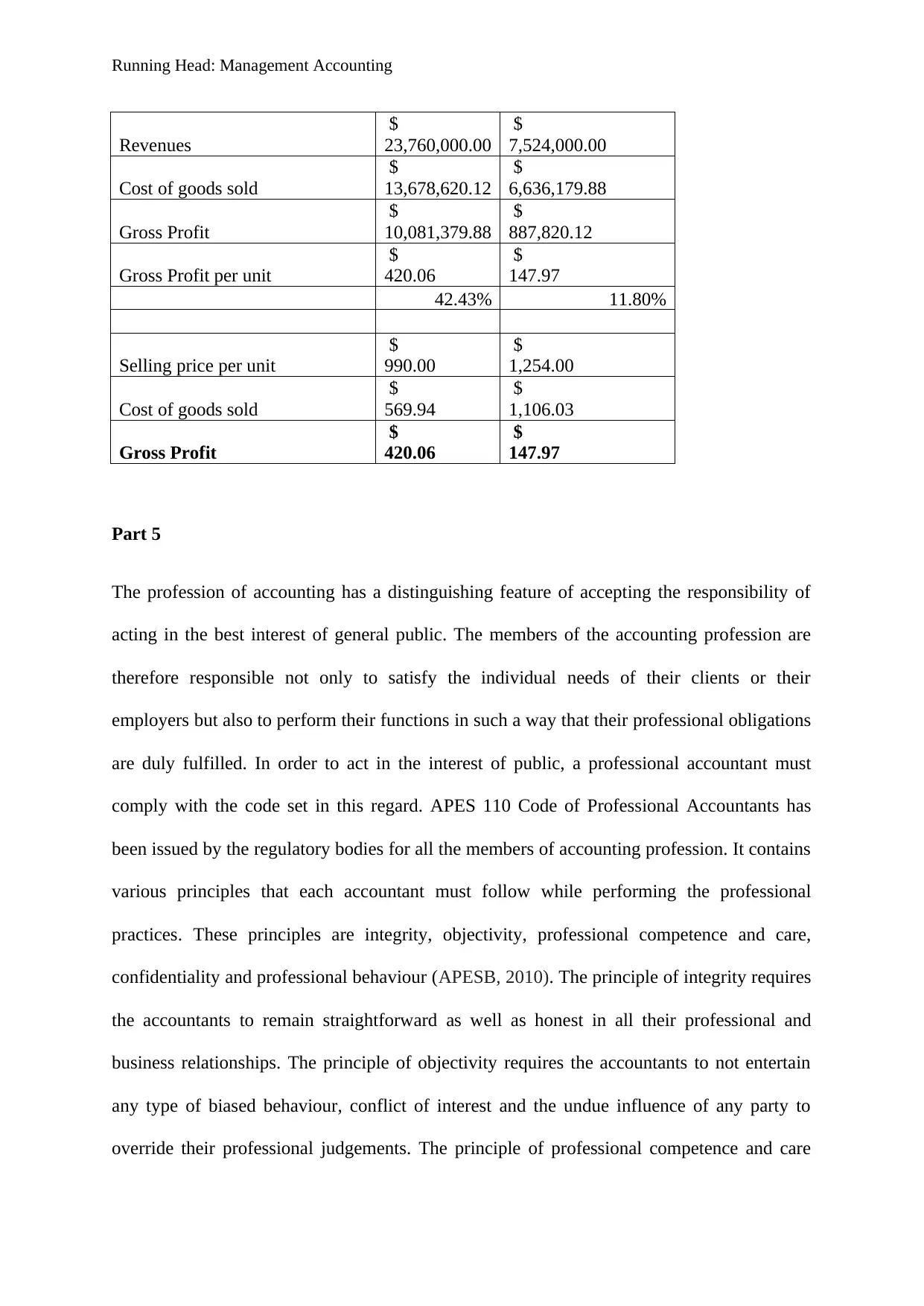

Revenues

$

23,760,000.00

$

7,524,000.00

Cost of goods sold

$

13,678,620.12

$

6,636,179.88

Gross Profit

$

10,081,379.88

$

887,820.12

Gross Profit per unit

$

420.06

$

147.97

42.43% 11.80%

Selling price per unit

$

990.00

$

1,254.00

Cost of goods sold

$

569.94

$

1,106.03

Gross Profit

$

420.06

$

147.97

Part 5

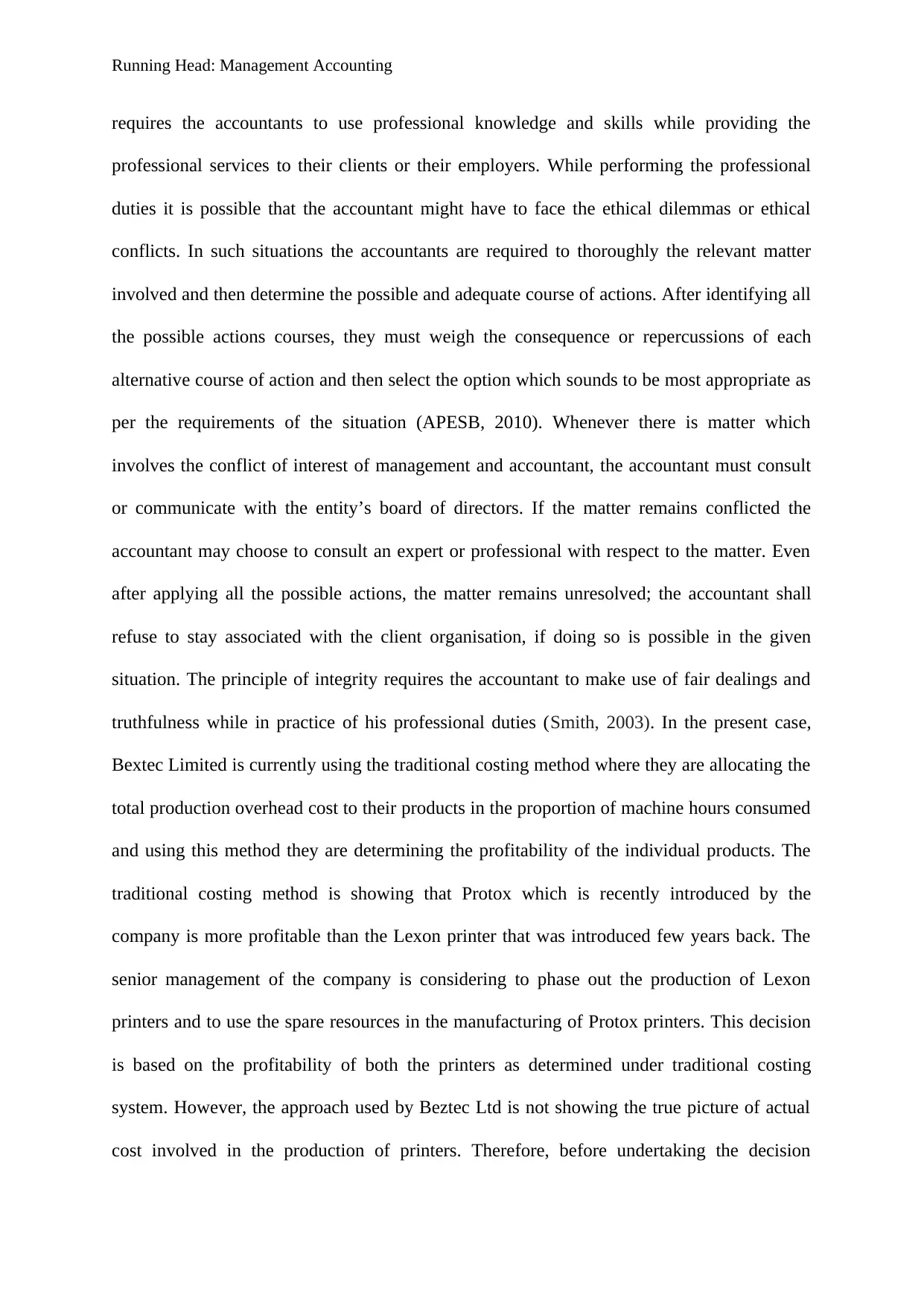

The profession of accounting has a distinguishing feature of accepting the responsibility of

acting in the best interest of general public. The members of the accounting profession are

therefore responsible not only to satisfy the individual needs of their clients or their

employers but also to perform their functions in such a way that their professional obligations

are duly fulfilled. In order to act in the interest of public, a professional accountant must

comply with the code set in this regard. APES 110 Code of Professional Accountants has

been issued by the regulatory bodies for all the members of accounting profession. It contains

various principles that each accountant must follow while performing the professional

practices. These principles are integrity, objectivity, professional competence and care,

confidentiality and professional behaviour (APESB, 2010). The principle of integrity requires

the accountants to remain straightforward as well as honest in all their professional and

business relationships. The principle of objectivity requires the accountants to not entertain

any type of biased behaviour, conflict of interest and the undue influence of any party to

override their professional judgements. The principle of professional competence and care

Revenues

$

23,760,000.00

$

7,524,000.00

Cost of goods sold

$

13,678,620.12

$

6,636,179.88

Gross Profit

$

10,081,379.88

$

887,820.12

Gross Profit per unit

$

420.06

$

147.97

42.43% 11.80%

Selling price per unit

$

990.00

$

1,254.00

Cost of goods sold

$

569.94

$

1,106.03

Gross Profit

$

420.06

$

147.97

Part 5

The profession of accounting has a distinguishing feature of accepting the responsibility of

acting in the best interest of general public. The members of the accounting profession are

therefore responsible not only to satisfy the individual needs of their clients or their

employers but also to perform their functions in such a way that their professional obligations

are duly fulfilled. In order to act in the interest of public, a professional accountant must

comply with the code set in this regard. APES 110 Code of Professional Accountants has

been issued by the regulatory bodies for all the members of accounting profession. It contains

various principles that each accountant must follow while performing the professional

practices. These principles are integrity, objectivity, professional competence and care,

confidentiality and professional behaviour (APESB, 2010). The principle of integrity requires

the accountants to remain straightforward as well as honest in all their professional and

business relationships. The principle of objectivity requires the accountants to not entertain

any type of biased behaviour, conflict of interest and the undue influence of any party to

override their professional judgements. The principle of professional competence and care

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Running Head: Management Accounting

requires the accountants to use professional knowledge and skills while providing the

professional services to their clients or their employers. While performing the professional

duties it is possible that the accountant might have to face the ethical dilemmas or ethical

conflicts. In such situations the accountants are required to thoroughly the relevant matter

involved and then determine the possible and adequate course of actions. After identifying all

the possible actions courses, they must weigh the consequence or repercussions of each

alternative course of action and then select the option which sounds to be most appropriate as

per the requirements of the situation (APESB, 2010). Whenever there is matter which

involves the conflict of interest of management and accountant, the accountant must consult

or communicate with the entity’s board of directors. If the matter remains conflicted the

accountant may choose to consult an expert or professional with respect to the matter. Even

after applying all the possible actions, the matter remains unresolved; the accountant shall

refuse to stay associated with the client organisation, if doing so is possible in the given

situation. The principle of integrity requires the accountant to make use of fair dealings and

truthfulness while in practice of his professional duties (Smith, 2003). In the present case,

Bextec Limited is currently using the traditional costing method where they are allocating the

total production overhead cost to their products in the proportion of machine hours consumed

and using this method they are determining the profitability of the individual products. The

traditional costing method is showing that Protox which is recently introduced by the

company is more profitable than the Lexon printer that was introduced few years back. The

senior management of the company is considering to phase out the production of Lexon

printers and to use the spare resources in the manufacturing of Protox printers. This decision

is based on the profitability of both the printers as determined under traditional costing

system. However, the approach used by Beztec Ltd is not showing the true picture of actual

cost involved in the production of printers. Therefore, before undertaking the decision

requires the accountants to use professional knowledge and skills while providing the

professional services to their clients or their employers. While performing the professional

duties it is possible that the accountant might have to face the ethical dilemmas or ethical

conflicts. In such situations the accountants are required to thoroughly the relevant matter

involved and then determine the possible and adequate course of actions. After identifying all

the possible actions courses, they must weigh the consequence or repercussions of each

alternative course of action and then select the option which sounds to be most appropriate as

per the requirements of the situation (APESB, 2010). Whenever there is matter which

involves the conflict of interest of management and accountant, the accountant must consult

or communicate with the entity’s board of directors. If the matter remains conflicted the

accountant may choose to consult an expert or professional with respect to the matter. Even

after applying all the possible actions, the matter remains unresolved; the accountant shall

refuse to stay associated with the client organisation, if doing so is possible in the given

situation. The principle of integrity requires the accountant to make use of fair dealings and

truthfulness while in practice of his professional duties (Smith, 2003). In the present case,

Bextec Limited is currently using the traditional costing method where they are allocating the

total production overhead cost to their products in the proportion of machine hours consumed

and using this method they are determining the profitability of the individual products. The

traditional costing method is showing that Protox which is recently introduced by the

company is more profitable than the Lexon printer that was introduced few years back. The

senior management of the company is considering to phase out the production of Lexon

printers and to use the spare resources in the manufacturing of Protox printers. This decision

is based on the profitability of both the printers as determined under traditional costing

system. However, the approach used by Beztec Ltd is not showing the true picture of actual

cost involved in the production of printers. Therefore, before undertaking the decision

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Running Head: Management Accounting

regarding the termination of manufacturing the Lexon printers the company must use an

advanced technique of management accounting to allocate the production overheads to the

printers. For this purpose Activity Based Costing technique could be made by the company

which would enable it to appropriately allocate the production overheads on the reasonable

business (Zimmerman & Yahya-Zadeh, 2011). The implementation of ABC technique will

prevent the overstatement or understatement of the prices of the printer.

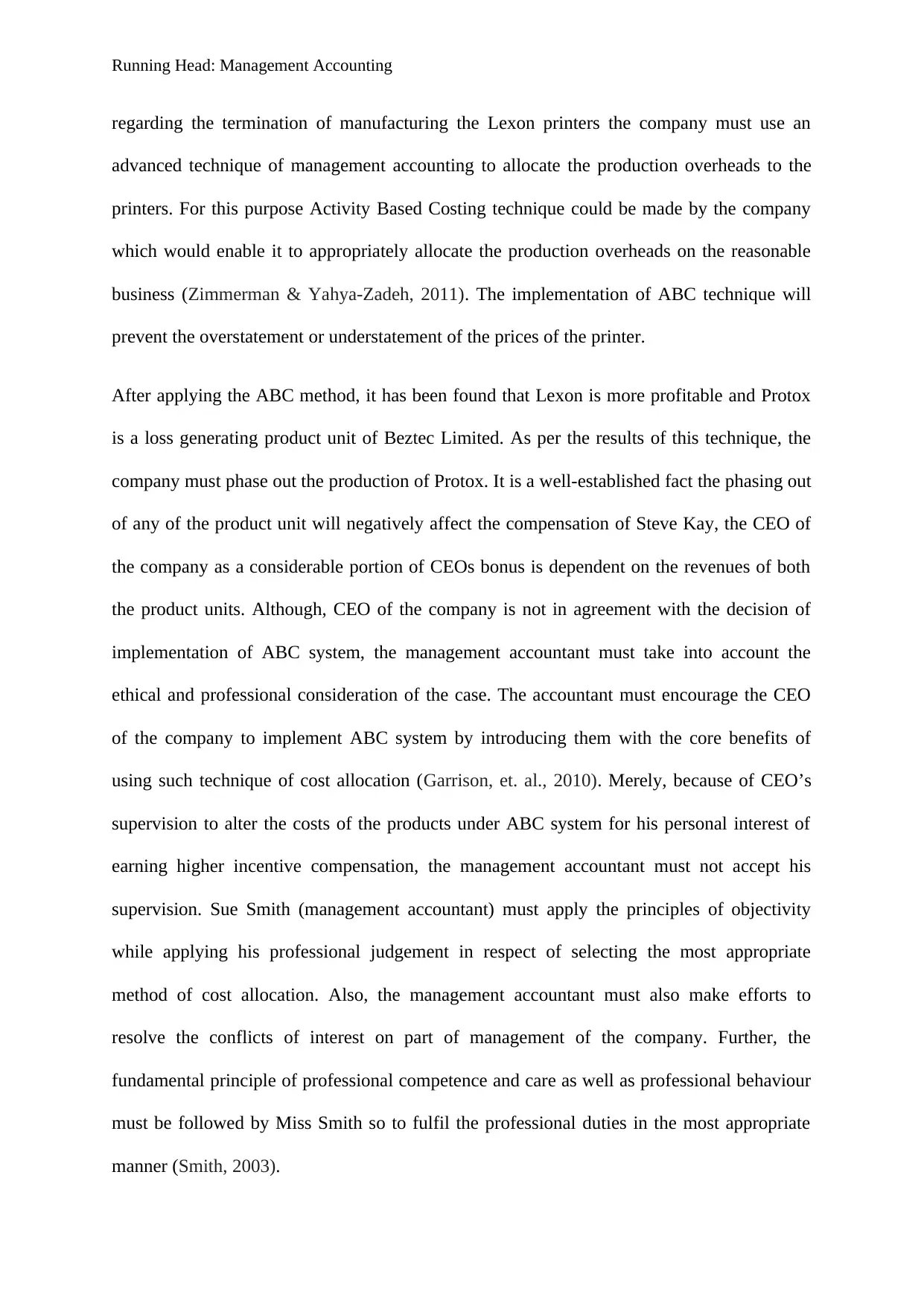

After applying the ABC method, it has been found that Lexon is more profitable and Protox

is a loss generating product unit of Beztec Limited. As per the results of this technique, the

company must phase out the production of Protox. It is a well-established fact the phasing out

of any of the product unit will negatively affect the compensation of Steve Kay, the CEO of

the company as a considerable portion of CEOs bonus is dependent on the revenues of both

the product units. Although, CEO of the company is not in agreement with the decision of

implementation of ABC system, the management accountant must take into account the

ethical and professional consideration of the case. The accountant must encourage the CEO

of the company to implement ABC system by introducing them with the core benefits of

using such technique of cost allocation (Garrison, et. al., 2010). Merely, because of CEO’s

supervision to alter the costs of the products under ABC system for his personal interest of

earning higher incentive compensation, the management accountant must not accept his

supervision. Sue Smith (management accountant) must apply the principles of objectivity

while applying his professional judgement in respect of selecting the most appropriate

method of cost allocation. Also, the management accountant must also make efforts to

resolve the conflicts of interest on part of management of the company. Further, the

fundamental principle of professional competence and care as well as professional behaviour

must be followed by Miss Smith so to fulfil the professional duties in the most appropriate

manner (Smith, 2003).

regarding the termination of manufacturing the Lexon printers the company must use an

advanced technique of management accounting to allocate the production overheads to the

printers. For this purpose Activity Based Costing technique could be made by the company

which would enable it to appropriately allocate the production overheads on the reasonable

business (Zimmerman & Yahya-Zadeh, 2011). The implementation of ABC technique will

prevent the overstatement or understatement of the prices of the printer.

After applying the ABC method, it has been found that Lexon is more profitable and Protox

is a loss generating product unit of Beztec Limited. As per the results of this technique, the

company must phase out the production of Protox. It is a well-established fact the phasing out

of any of the product unit will negatively affect the compensation of Steve Kay, the CEO of

the company as a considerable portion of CEOs bonus is dependent on the revenues of both

the product units. Although, CEO of the company is not in agreement with the decision of

implementation of ABC system, the management accountant must take into account the

ethical and professional consideration of the case. The accountant must encourage the CEO

of the company to implement ABC system by introducing them with the core benefits of

using such technique of cost allocation (Garrison, et. al., 2010). Merely, because of CEO’s

supervision to alter the costs of the products under ABC system for his personal interest of

earning higher incentive compensation, the management accountant must not accept his

supervision. Sue Smith (management accountant) must apply the principles of objectivity

while applying his professional judgement in respect of selecting the most appropriate

method of cost allocation. Also, the management accountant must also make efforts to

resolve the conflicts of interest on part of management of the company. Further, the

fundamental principle of professional competence and care as well as professional behaviour

must be followed by Miss Smith so to fulfil the professional duties in the most appropriate

manner (Smith, 2003).

Running Head: Management Accounting

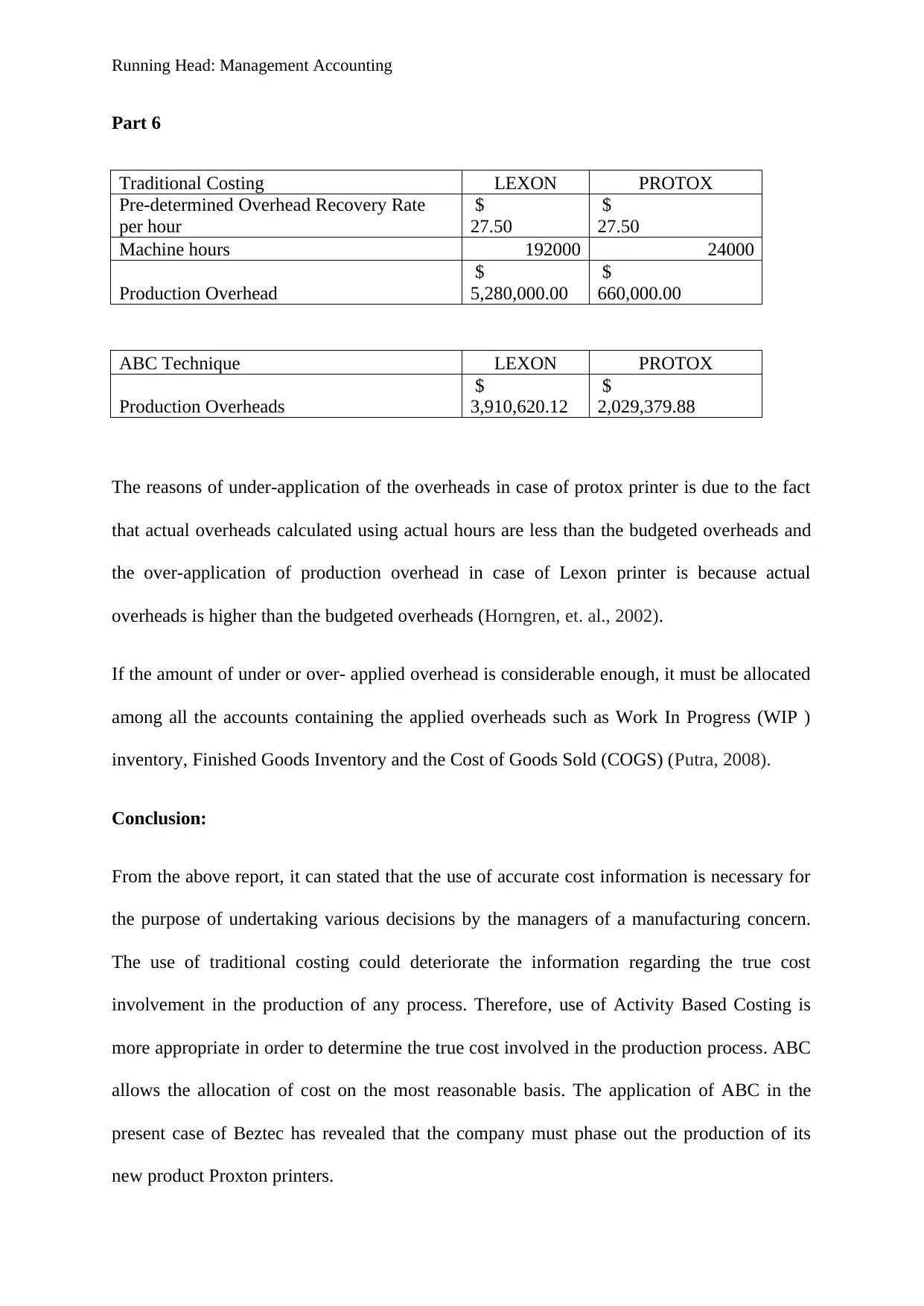

Part 6

Traditional Costing LEXON PROTOX

Pre-determined Overhead Recovery Rate

per hour

$

27.50

$

27.50

Machine hours 192000 24000

Production Overhead

$

5,280,000.00

$

660,000.00

ABC Technique LEXON PROTOX

Production Overheads

$

3,910,620.12

$

2,029,379.88

The reasons of under-application of the overheads in case of protox printer is due to the fact

that actual overheads calculated using actual hours are less than the budgeted overheads and

the over-application of production overhead in case of Lexon printer is because actual

overheads is higher than the budgeted overheads (Horngren, et. al., 2002).

If the amount of under or over- applied overhead is considerable enough, it must be allocated

among all the accounts containing the applied overheads such as Work In Progress (WIP )

inventory, Finished Goods Inventory and the Cost of Goods Sold (COGS) (Putra, 2008).

Conclusion:

From the above report, it can stated that the use of accurate cost information is necessary for

the purpose of undertaking various decisions by the managers of a manufacturing concern.

The use of traditional costing could deteriorate the information regarding the true cost

involvement in the production of any process. Therefore, use of Activity Based Costing is

more appropriate in order to determine the true cost involved in the production process. ABC

allows the allocation of cost on the most reasonable basis. The application of ABC in the

present case of Beztec has revealed that the company must phase out the production of its

new product Proxton printers.

Part 6

Traditional Costing LEXON PROTOX

Pre-determined Overhead Recovery Rate

per hour

$

27.50

$

27.50

Machine hours 192000 24000

Production Overhead

$

5,280,000.00

$

660,000.00

ABC Technique LEXON PROTOX

Production Overheads

$

3,910,620.12

$

2,029,379.88

The reasons of under-application of the overheads in case of protox printer is due to the fact

that actual overheads calculated using actual hours are less than the budgeted overheads and

the over-application of production overhead in case of Lexon printer is because actual

overheads is higher than the budgeted overheads (Horngren, et. al., 2002).

If the amount of under or over- applied overhead is considerable enough, it must be allocated

among all the accounts containing the applied overheads such as Work In Progress (WIP )

inventory, Finished Goods Inventory and the Cost of Goods Sold (COGS) (Putra, 2008).

Conclusion:

From the above report, it can stated that the use of accurate cost information is necessary for

the purpose of undertaking various decisions by the managers of a manufacturing concern.

The use of traditional costing could deteriorate the information regarding the true cost

involvement in the production of any process. Therefore, use of Activity Based Costing is

more appropriate in order to determine the true cost involved in the production process. ABC

allows the allocation of cost on the most reasonable basis. The application of ABC in the

present case of Beztec has revealed that the company must phase out the production of its

new product Proxton printers.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Running Head: Management Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Running Head: Management Accounting

References:

Accounting Coach, 2018. What is the major weakness of the traditional method of allocating

factory overhead? Available at: https://www.accountingcoach.com/blog/traditional-method-

allocating-overhead Accessed on 13.09.2018.

APESB, 2010. APES 110 Code of Ethics for Professional Accountants. Available at:

https://www.apesb.org.au/uploads/standards/apesb_standards/standard1.pdf Accessed on

13.09.2018.

Dickinson, V. and Lere, J.C., 2003. Problems evaluating sales representative performance?:

try activity-based costing. Industrial Marketing Management, 32(4), pp.301-307.

DRURY, C.M., 2013. Management and cost accounting. Springer.

Garrison, R.H., Noreen, E.W., Brewer, P.C. and McGowan, A., 2010. Managerial

accounting. Issues in Accounting Education, 25(4), pp.792-793.

Granof, M.H., Platt, D.E. and Vaysman, I., 2000. Using activity-based costing to manage

more effectively. PricewaterhouseCoopers Endowment for the Business of Government.

Hansen, D., Mowen, M. and Guan, L., 2007. Cost management: accounting and control.

Cengage Learning.

Horngren, C.T., Bhimani, A., Datar, S.M., Foster, G. and Horngren, C.T., 2002. Management

and cost accounting. Harlow: Financial Times/Prentice Hall.

Horngren, C.T., Sundem, G.L., Stratton, W.O., Burgstahler, D. and Schatzberg, J.,

2002. Introduction to Management Accounting: Chapters 1-19. Prentice Hall.

References:

Accounting Coach, 2018. What is the major weakness of the traditional method of allocating

factory overhead? Available at: https://www.accountingcoach.com/blog/traditional-method-

allocating-overhead Accessed on 13.09.2018.

APESB, 2010. APES 110 Code of Ethics for Professional Accountants. Available at:

https://www.apesb.org.au/uploads/standards/apesb_standards/standard1.pdf Accessed on

13.09.2018.

Dickinson, V. and Lere, J.C., 2003. Problems evaluating sales representative performance?:

try activity-based costing. Industrial Marketing Management, 32(4), pp.301-307.

DRURY, C.M., 2013. Management and cost accounting. Springer.

Garrison, R.H., Noreen, E.W., Brewer, P.C. and McGowan, A., 2010. Managerial

accounting. Issues in Accounting Education, 25(4), pp.792-793.

Granof, M.H., Platt, D.E. and Vaysman, I., 2000. Using activity-based costing to manage

more effectively. PricewaterhouseCoopers Endowment for the Business of Government.

Hansen, D., Mowen, M. and Guan, L., 2007. Cost management: accounting and control.

Cengage Learning.

Horngren, C.T., Bhimani, A., Datar, S.M., Foster, G. and Horngren, C.T., 2002. Management

and cost accounting. Harlow: Financial Times/Prentice Hall.

Horngren, C.T., Sundem, G.L., Stratton, W.O., Burgstahler, D. and Schatzberg, J.,

2002. Introduction to Management Accounting: Chapters 1-19. Prentice Hall.

Running Head: Management Accounting

Molis, J., 2018. Advantages & Disadvantages of Traditional Costing. Available at:

https://bizfluent.com/info-8645304-advantages-disadvantages-traditional-costing.html

Accessed on 13.09.2018.

Putra, L.D. 2008. Disposition Of Under-applied And Over-applied Overhead Cost. Available

at: http://accounting-financial-tax.com/2008/11/disposition-of-underapplied-and-overapplied-

overhead-cost/ Accessed on 13.09.2018.

Smith, L.M., 2003. A fresh look at accounting ethics (or Dr. Smith goes to Washington).

Accounting Horizons, 17(1), pp.47-49.

Zimmerman, J.L. and Yahya-Zadeh, M., 2011. Accounting for decision making and

control. Issues in Accounting Education, 26(1), pp.258-259.

Molis, J., 2018. Advantages & Disadvantages of Traditional Costing. Available at:

https://bizfluent.com/info-8645304-advantages-disadvantages-traditional-costing.html

Accessed on 13.09.2018.

Putra, L.D. 2008. Disposition Of Under-applied And Over-applied Overhead Cost. Available

at: http://accounting-financial-tax.com/2008/11/disposition-of-underapplied-and-overapplied-

overhead-cost/ Accessed on 13.09.2018.

Smith, L.M., 2003. A fresh look at accounting ethics (or Dr. Smith goes to Washington).

Accounting Horizons, 17(1), pp.47-49.

Zimmerman, J.L. and Yahya-Zadeh, M., 2011. Accounting for decision making and

control. Issues in Accounting Education, 26(1), pp.258-259.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.