Management Accounting Techniques for Agmet Ltd Financial Analysis

VerifiedAdded on 2020/10/22

|11

|3151

|280

Report

AI Summary

This report delves into the intricacies of management accounting, exploring its essential requirements and various system types such as cost accounting and job costing. It examines different management accounting reports, including budget and cost reports, and evaluates the benefits and drawbacks of management accounting systems. The report further analyzes the integration of management accounting systems, emphasizing the importance of planning tools like zero-based budgeting and ratio analysis for budgetary control and forecasting. The report includes a detailed analysis of a cash flow forecast. The report then evaluates how organizations, specifically Agmet Ltd, adapt management accounting to address financial challenges, highlighting the role of these techniques in achieving sustainable success. The report provides a comprehensive overview of management accounting principles and their practical applications in a business context.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

P1 Explaining management accounting and providing essential requirements of various types

of management accounting systems............................................................................................1

P2 Stating different methods of management accounting reports..............................................2

M1 Evaluating benefits of management accounting system.......................................................2

D1 Critical evaluation of management accounting reports integration of management

accounting systematic.................................................................................................................3

P4 Explaining advantages and disadvantages of various types of planning tools implied for

budgetary control........................................................................................................................4

M3 Analysing use of planning tool for budget forecasting and preparing.................................5

D3 Evaluating planning tools for accounting for solving financial problems attains sustainable

success.........................................................................................................................................6

P5 Evaluating that how organizations are adapting management accounting system for

responding financial problems....................................................................................................6

M4 Analysing while responding financial problems , management accounting lead company

to sustainable success..................................................................................................................8

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................9

INTRODUCTION...........................................................................................................................1

P1 Explaining management accounting and providing essential requirements of various types

of management accounting systems............................................................................................1

P2 Stating different methods of management accounting reports..............................................2

M1 Evaluating benefits of management accounting system.......................................................2

D1 Critical evaluation of management accounting reports integration of management

accounting systematic.................................................................................................................3

P4 Explaining advantages and disadvantages of various types of planning tools implied for

budgetary control........................................................................................................................4

M3 Analysing use of planning tool for budget forecasting and preparing.................................5

D3 Evaluating planning tools for accounting for solving financial problems attains sustainable

success.........................................................................................................................................6

P5 Evaluating that how organizations are adapting management accounting system for

responding financial problems....................................................................................................6

M4 Analysing while responding financial problems , management accounting lead company

to sustainable success..................................................................................................................8

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................9

INTRODUCTION

Management accounting is referred as presentation of information related to accounting

with context of formulating the policies adopted through management for purpose of assisting

regular activities. The present report would discuss about essential requirements of types of

management accounting systems and various methods of management accounting reports.

Similarly, it will be providing application of range of management accounting techniques and

explaining use of multiple planning tools for budgetary control. Lastly, it would reflect

comparison of methods in which company could imply management accounting for responding

financial problems on basis of Agmet Ltd which is chemical manufacturer in UK.

P1 Explaining management accounting and providing essential requirements of various types of

management accounting systems

Management accounting involves providing and preparing financial and statistical

information on timely basis to business managers so it could make daily and short term

managerial information. It directly differs from financial accounting where it produces reports

for internal stakeholders of company as it is opposed to external stakeholders. The management

accounting directly leads for tracking actual performance as compared to budgets and for

maximising rate of return on capital employed. The types of management accounting systems are

stated below:

Cost accounting system: This is replicated as framework used through business to

estimate the product's cost for purpose of gaining information that it leads to profitability or not,

cost control along with valuation of inventory. Generally, it is used through manufacturers for

recording activities of production with application of perpetual inventory systems. In simple

terms, this accounting system is framed for manufacturers which tracks inventory flow on

continual basis via different production stages (Horton and de Araujo Wanderley, 2018). On

basis of its requirements, it leads to control cost within budgetary constraints management has

set specific service or product. In the similar aspect, it helps for cost accounting as source of

other functions of cost accounting. Further, cost computation provides help to company to

decrease cost of projects and processes.

Job costing systems: This system is used for assigning and accumulating cost of

manufacturing of particular individual unit of output. Usually, this information might be required

for submitting cost information to customer within contract where each cost are reimbursed. It

1

Management accounting is referred as presentation of information related to accounting

with context of formulating the policies adopted through management for purpose of assisting

regular activities. The present report would discuss about essential requirements of types of

management accounting systems and various methods of management accounting reports.

Similarly, it will be providing application of range of management accounting techniques and

explaining use of multiple planning tools for budgetary control. Lastly, it would reflect

comparison of methods in which company could imply management accounting for responding

financial problems on basis of Agmet Ltd which is chemical manufacturer in UK.

P1 Explaining management accounting and providing essential requirements of various types of

management accounting systems

Management accounting involves providing and preparing financial and statistical

information on timely basis to business managers so it could make daily and short term

managerial information. It directly differs from financial accounting where it produces reports

for internal stakeholders of company as it is opposed to external stakeholders. The management

accounting directly leads for tracking actual performance as compared to budgets and for

maximising rate of return on capital employed. The types of management accounting systems are

stated below:

Cost accounting system: This is replicated as framework used through business to

estimate the product's cost for purpose of gaining information that it leads to profitability or not,

cost control along with valuation of inventory. Generally, it is used through manufacturers for

recording activities of production with application of perpetual inventory systems. In simple

terms, this accounting system is framed for manufacturers which tracks inventory flow on

continual basis via different production stages (Horton and de Araujo Wanderley, 2018). On

basis of its requirements, it leads to control cost within budgetary constraints management has

set specific service or product. In the similar aspect, it helps for cost accounting as source of

other functions of cost accounting. Further, cost computation provides help to company to

decrease cost of projects and processes.

Job costing systems: This system is used for assigning and accumulating cost of

manufacturing of particular individual unit of output. Usually, this information might be required

for submitting cost information to customer within contract where each cost are reimbursed. It

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

directly leads to identify accuracy of estimating system of company which enables to quote

prices that directly allows for reasonable margin. This information is used with context to assign

inventoriable cost to manufactured products. It is distinctive method costing as particular form

which is adopted for execution of work on strict basis according to customer specification.

P2 Stating different methods of management accounting reports

Management accounting reports are replicated as tool to understand numbers related to

business performance. In the same series, standard traditional accounting reports which should

be completed for tax objective and it includes data collection which is gives important

information related to operations. The management accounting reports could be organised in

such aspect which creates sense with context of business. The types of management accounting

reports are stated below:

Budget Reports: The budget managerial accounting reports are very censorious for

measuring performance of company. Every business generates overall budget for understanding

business's grand scheme. The budget estimate is created on basis of previous experience although

appropriate budget caters multiple unforeseen circumstances which might arise (Nishimura,

2019). In addition to this, managerial accounting reports on basis of budgeting could guide

managers for offering better incentives to employees, cutting cost along with renegotiating terms

with suppliers and vendors. This, budget is very critical with context of business perspective.

Cost Managerial accounting reports: Managerial accounting directly calculate costs of

various articles which are manufactured. Every raw material costs., labour, overhead and

aggregated cost undertaken for purpose of deliberation. In this aspect, total cost is categorised

through amounts of products generated. The cost reports provides summary of entire information

and even offers capacity to managers for realizing cost prices of item compared to selling prices.

The profit margin is estimated and directly monitored and estimated via reports which gives clear

picture of each cost which went for procurement or production of articles. The inventory waste,

overhead and hourly labour costs are part of cost managerial accounting reports. These provide

exact understanding of every expense which is mandatory for resource optimisation in every

departments.

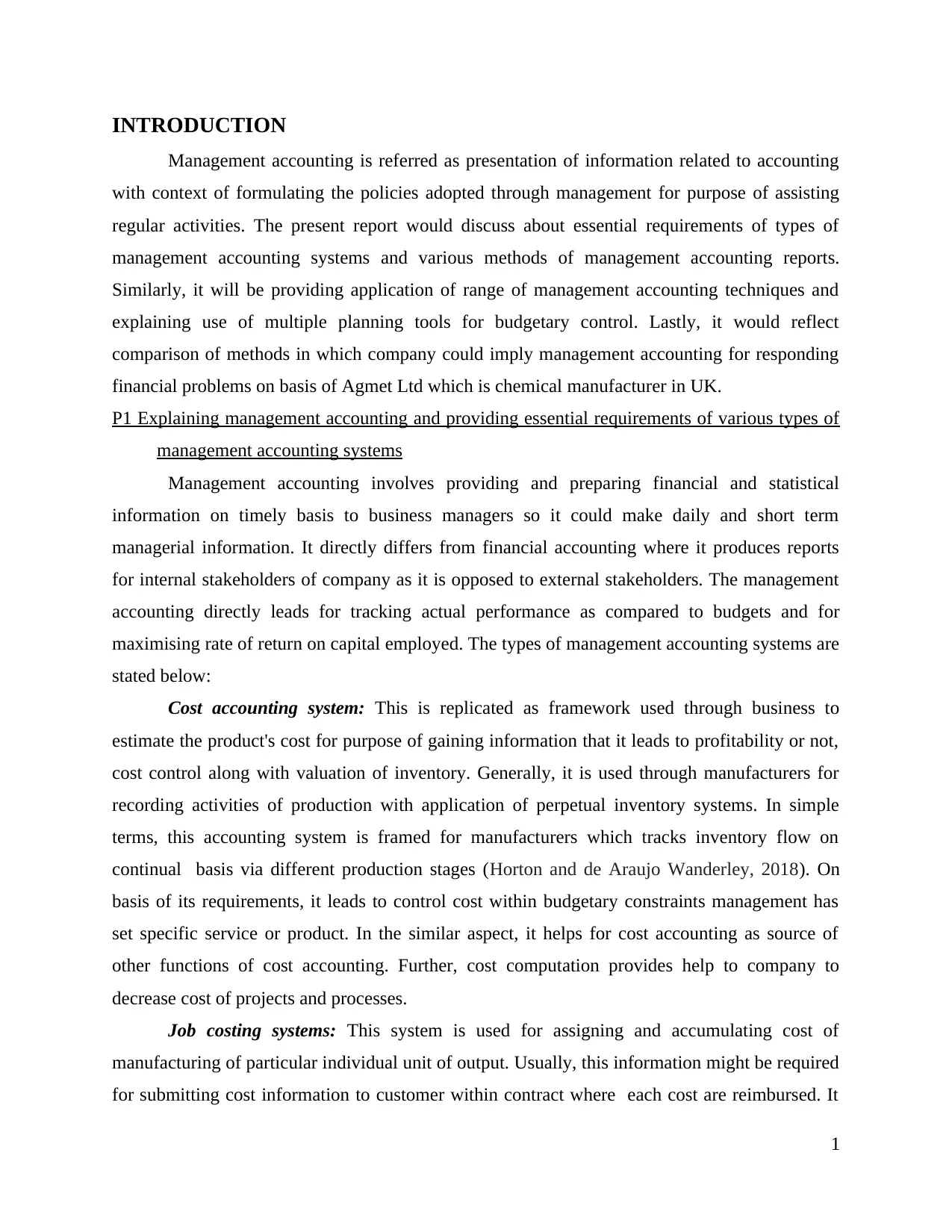

M1 Evaluating benefits of management accounting system

Cost accounting system

2

prices that directly allows for reasonable margin. This information is used with context to assign

inventoriable cost to manufactured products. It is distinctive method costing as particular form

which is adopted for execution of work on strict basis according to customer specification.

P2 Stating different methods of management accounting reports

Management accounting reports are replicated as tool to understand numbers related to

business performance. In the same series, standard traditional accounting reports which should

be completed for tax objective and it includes data collection which is gives important

information related to operations. The management accounting reports could be organised in

such aspect which creates sense with context of business. The types of management accounting

reports are stated below:

Budget Reports: The budget managerial accounting reports are very censorious for

measuring performance of company. Every business generates overall budget for understanding

business's grand scheme. The budget estimate is created on basis of previous experience although

appropriate budget caters multiple unforeseen circumstances which might arise (Nishimura,

2019). In addition to this, managerial accounting reports on basis of budgeting could guide

managers for offering better incentives to employees, cutting cost along with renegotiating terms

with suppliers and vendors. This, budget is very critical with context of business perspective.

Cost Managerial accounting reports: Managerial accounting directly calculate costs of

various articles which are manufactured. Every raw material costs., labour, overhead and

aggregated cost undertaken for purpose of deliberation. In this aspect, total cost is categorised

through amounts of products generated. The cost reports provides summary of entire information

and even offers capacity to managers for realizing cost prices of item compared to selling prices.

The profit margin is estimated and directly monitored and estimated via reports which gives clear

picture of each cost which went for procurement or production of articles. The inventory waste,

overhead and hourly labour costs are part of cost managerial accounting reports. These provide

exact understanding of every expense which is mandatory for resource optimisation in every

departments.

M1 Evaluating benefits of management accounting system

Cost accounting system

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Advantages Disadvantages

It eliminates losses, inefficiencies and

wastes through fixing standard of each

aspect.

This helps management for decisions

related to cost information as to buy or

sell product in open market.

It is performed to facilitate decisions of

short term perspective and mostly in

depression period.

The introduction of cost audit could

help in preventing frauds.

The previous year's cost is not similar

in succeeding year as cost data is not

highly useful.

Requirement of maintaining many costs

records with outcome in heavy

expenditure.

Each purpose is not served through

rigid cost accounting systems.

Availability of past performances in

costing records for future decisions.

Job costing system

Advantages Disadvantages

Cost could be estimated of job with

reference to past records.

Helps for preparing trend analysis via

compilation of historical costs.

Absence of under or over recovery of

overheads.

Absence of standardisation of job along

with requirement of close supervision.

It is very expensive.

It does not give accurate cost

information whereas large numbers of

small jobs are executed at a time.

D1 Critical evaluation of management accounting reports integration of management accounting

systematic

Integrated management accounting system directly leads to integrate each systems and

process and reports into a complete framework and enables organization to operate as single unit

with context to unified objectives. It has been stated that album of reporting forms consists of set

of non financial and financial indicators which provide level of detail needed for different user

groups (Nitzl, 2018). However, management accounting policy along with description of

principles of management reporting and regulations for managing data through reporting and

3

It eliminates losses, inefficiencies and

wastes through fixing standard of each

aspect.

This helps management for decisions

related to cost information as to buy or

sell product in open market.

It is performed to facilitate decisions of

short term perspective and mostly in

depression period.

The introduction of cost audit could

help in preventing frauds.

The previous year's cost is not similar

in succeeding year as cost data is not

highly useful.

Requirement of maintaining many costs

records with outcome in heavy

expenditure.

Each purpose is not served through

rigid cost accounting systems.

Availability of past performances in

costing records for future decisions.

Job costing system

Advantages Disadvantages

Cost could be estimated of job with

reference to past records.

Helps for preparing trend analysis via

compilation of historical costs.

Absence of under or over recovery of

overheads.

Absence of standardisation of job along

with requirement of close supervision.

It is very expensive.

It does not give accurate cost

information whereas large numbers of

small jobs are executed at a time.

D1 Critical evaluation of management accounting reports integration of management accounting

systematic

Integrated management accounting system directly leads to integrate each systems and

process and reports into a complete framework and enables organization to operate as single unit

with context to unified objectives. It has been stated that album of reporting forms consists of set

of non financial and financial indicators which provide level of detail needed for different user

groups (Nitzl, 2018). However, management accounting policy along with description of

principles of management reporting and regulations for managing data through reporting and

3

gathering, specifying performance of employee and organization as well. On the contrary, it

standardizes procedures for tracing transactions and disseminate financial information.

Simultaneously, this forms interconnection of reporting activities of various functional areas of

business like point of sales, back and front office and stores as well.

P4 Explaining advantages and disadvantages of various types of planning tools implied for

budgetary control

Zero based budget: It is budgeting in management accounting which engages in

formation of budget through scratch with considering zero as base. This involves to re-evaluate

each line item of statement of cash flow and justify every expenditure which is going to be

incurred through department. While implying this in Agmet it must consider merits and demerits

as well:

Merits

It does not carry inefficiency and forwarded similar to next year.

It helps to save cost with context to inefficient operations.

This leads to determine opportunities and cost effective methods of doing things by

ridding each redundant and unproductive activities. It leads to careful planning and efficient resource allocation.

Demerits

On basis of large scale business, numerous decision packages are formed along with

involving high expenses.

This process is very time consuming as there is high involvement of paper work.

Managers might create fear and opposing innovative ideas and alterations.

There is presence of personal bias for ranking decision packages.

Ratio analysis: This is replicated as interpretation and analysis of figures directly

appearing within financial statements. This is process of comparing one figure to another and

enables users such as shareholders, creditors, analysts and government etc (Ratio analysis, 2019).

for undertaking better understanding of financial statements of Agmet.

Merits

It helps in assessing position of liquidity such as short term debt repaying ability of

business.

4

standardizes procedures for tracing transactions and disseminate financial information.

Simultaneously, this forms interconnection of reporting activities of various functional areas of

business like point of sales, back and front office and stores as well.

P4 Explaining advantages and disadvantages of various types of planning tools implied for

budgetary control

Zero based budget: It is budgeting in management accounting which engages in

formation of budget through scratch with considering zero as base. This involves to re-evaluate

each line item of statement of cash flow and justify every expenditure which is going to be

incurred through department. While implying this in Agmet it must consider merits and demerits

as well:

Merits

It does not carry inefficiency and forwarded similar to next year.

It helps to save cost with context to inefficient operations.

This leads to determine opportunities and cost effective methods of doing things by

ridding each redundant and unproductive activities. It leads to careful planning and efficient resource allocation.

Demerits

On basis of large scale business, numerous decision packages are formed along with

involving high expenses.

This process is very time consuming as there is high involvement of paper work.

Managers might create fear and opposing innovative ideas and alterations.

There is presence of personal bias for ranking decision packages.

Ratio analysis: This is replicated as interpretation and analysis of figures directly

appearing within financial statements. This is process of comparing one figure to another and

enables users such as shareholders, creditors, analysts and government etc (Ratio analysis, 2019).

for undertaking better understanding of financial statements of Agmet.

Merits

It helps in assessing position of liquidity such as short term debt repaying ability of

business.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

It is used for controlling performances of various departments or division undertaking

along with cost control.

It indicates degree of efficiency in management along with appropriate utilisation of its

assets. These are effective mode of communication and plays vital role to inform position of

progress made through concern of business to other parties and owners.

Demerits

These are calculated through historical information traced in financial statements and

does not reflect present conditions.

Multiple accounting policies on basis of inventory valuation, charging depreciation and

making accounting data and accounting ratios of two business non-comparable.

This tool is used for only quantitative analysis whereas qualitative factors are avoided

during ratio computation (Richards and et.al., 2019).

Ratios account for single variable as they could not provide appropriate picture since

multiple other variables like economic conditions, resource availability, government

policy etc. must be kept in mind during ratio interpretation.

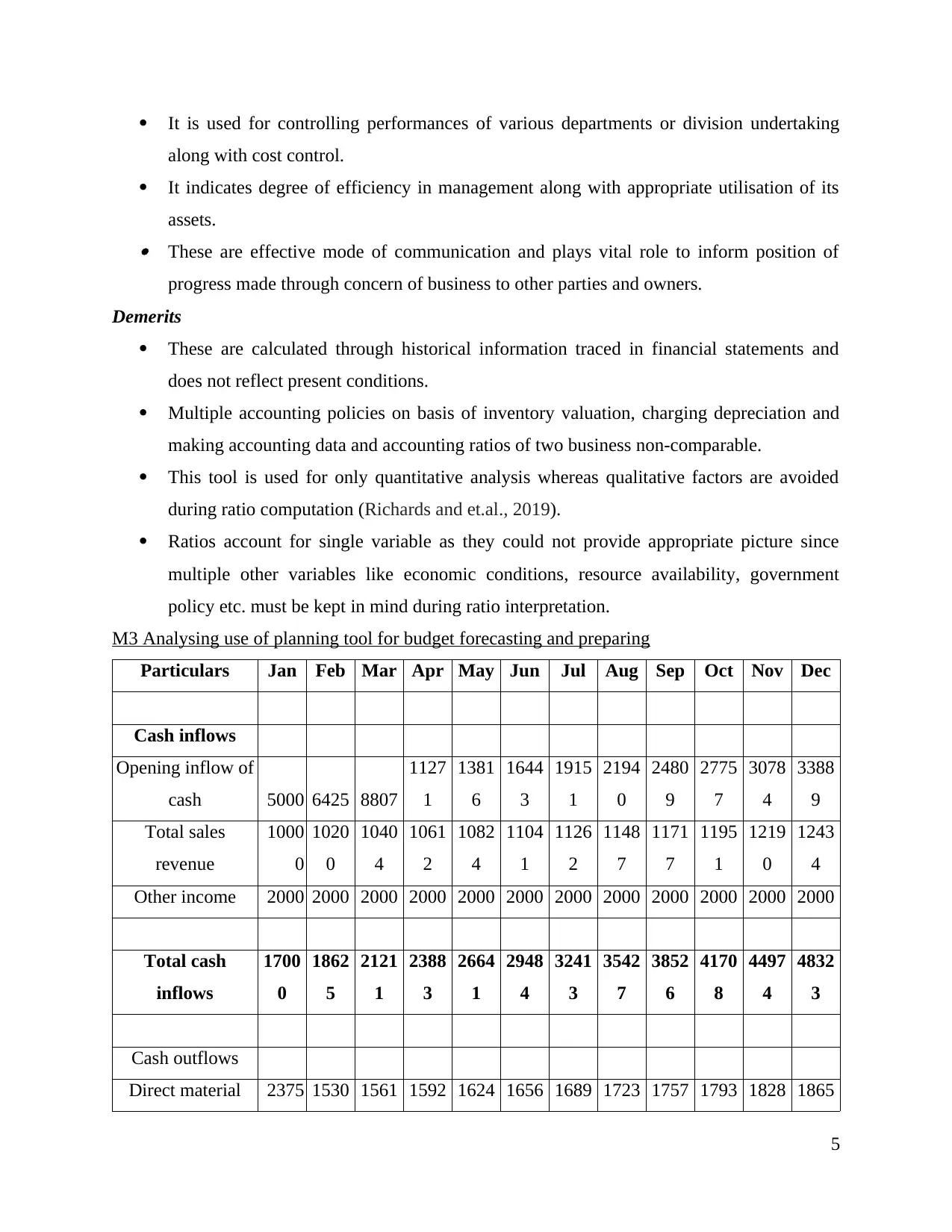

M3 Analysing use of planning tool for budget forecasting and preparing

Particulars Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Cash inflows

Opening inflow of

cash 5000 6425 8807

1127

1

1381

6

1644

3

1915

1

2194

0

2480

9

2775

7

3078

4

3388

9

Total sales

revenue

1000

0

1020

0

1040

4

1061

2

1082

4

1104

1

1126

2

1148

7

1171

7

1195

1

1219

0

1243

4

Other income 2000 2000 2000 2000 2000 2000 2000 2000 2000 2000 2000 2000

Total cash

inflows

1700

0

1862

5

2121

1

2388

3

2664

1

2948

4

3241

3

3542

7

3852

6

4170

8

4497

4

4832

3

Cash outflows

Direct material 2375 1530 1561 1592 1624 1656 1689 1723 1757 1793 1828 1865

5

along with cost control.

It indicates degree of efficiency in management along with appropriate utilisation of its

assets. These are effective mode of communication and plays vital role to inform position of

progress made through concern of business to other parties and owners.

Demerits

These are calculated through historical information traced in financial statements and

does not reflect present conditions.

Multiple accounting policies on basis of inventory valuation, charging depreciation and

making accounting data and accounting ratios of two business non-comparable.

This tool is used for only quantitative analysis whereas qualitative factors are avoided

during ratio computation (Richards and et.al., 2019).

Ratios account for single variable as they could not provide appropriate picture since

multiple other variables like economic conditions, resource availability, government

policy etc. must be kept in mind during ratio interpretation.

M3 Analysing use of planning tool for budget forecasting and preparing

Particulars Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Cash inflows

Opening inflow of

cash 5000 6425 8807

1127

1

1381

6

1644

3

1915

1

2194

0

2480

9

2775

7

3078

4

3388

9

Total sales

revenue

1000

0

1020

0

1040

4

1061

2

1082

4

1104

1

1126

2

1148

7

1171

7

1195

1

1219

0

1243

4

Other income 2000 2000 2000 2000 2000 2000 2000 2000 2000 2000 2000 2000

Total cash

inflows

1700

0

1862

5

2121

1

2388

3

2664

1

2948

4

3241

3

3542

7

3852

6

4170

8

4497

4

4832

3

Cash outflows

Direct material 2375 1530 1561 1592 1624 1656 1689 1723 1757 1793 1828 1865

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Direct labour 2000 2000 2000 2000 2000 2000 2000 2000 2000 2000 2000 2000

Other expenses 2200 2288 2380 2475 2574 2677 2784 2895 3011 3131 3257 3387

Cost of

administration 4000 4000 4000 4000 4000 4000 4000 4000 4000 4000 4000 4000

Total cash

outflows

1057

5 9818 9940

1006

7

1019

7

1033

3

1047

3

1061

8

1076

8

1092

4

1108

5

1125

2

Cash deficit /

surplus or closing

cash balance 6425 8807

1127

1

1381

6

1644

3

1915

1

2194

0

2480

9

2775

7

3078

4

3388

9

3707

1

D3 Evaluating planning tools for accounting for solving financial problems attains sustainable

success

With context of zero based budget as planning tool it comprises causal relationships

among various activities, outcome as needs of resources and its expenses, then this model could

be easily developed into driver based planning and model of budgeting which gives

advantageous to replace or supplement existing financial planning and analysis processes

(Schaltegger, 2018). However, on basis of ratio analysis the top-line growth of Agmet is very

important parameter for creditors and investors as well. It is significant for extracting sustainable

growth rate as it is function of two variables as return on equity along with retention rate.

P5 Evaluating that how organizations are adapting management accounting system for

responding financial problems

There are multiple businesses which are adapting management accounting system as in

this scenario, Agmet and its rival Monarch Chemical Ltd are UK based chemical manufacturer

companies. It has been analysed that both are facing financial problems such as cash flow so they

have used different tools which are stated below:

Agmet has implied Benchmarking to solve issue related to cash flow which is described

in detailed aspect below:

Benchmarking: It is replicated as process to measure performance of products of

company, services and process which are against other considered business to be best in entire

6

Other expenses 2200 2288 2380 2475 2574 2677 2784 2895 3011 3131 3257 3387

Cost of

administration 4000 4000 4000 4000 4000 4000 4000 4000 4000 4000 4000 4000

Total cash

outflows

1057

5 9818 9940

1006

7

1019

7

1033

3

1047

3

1061

8

1076

8

1092

4

1108

5

1125

2

Cash deficit /

surplus or closing

cash balance 6425 8807

1127

1

1381

6

1644

3

1915

1

2194

0

2480

9

2775

7

3078

4

3388

9

3707

1

D3 Evaluating planning tools for accounting for solving financial problems attains sustainable

success

With context of zero based budget as planning tool it comprises causal relationships

among various activities, outcome as needs of resources and its expenses, then this model could

be easily developed into driver based planning and model of budgeting which gives

advantageous to replace or supplement existing financial planning and analysis processes

(Schaltegger, 2018). However, on basis of ratio analysis the top-line growth of Agmet is very

important parameter for creditors and investors as well. It is significant for extracting sustainable

growth rate as it is function of two variables as return on equity along with retention rate.

P5 Evaluating that how organizations are adapting management accounting system for

responding financial problems

There are multiple businesses which are adapting management accounting system as in

this scenario, Agmet and its rival Monarch Chemical Ltd are UK based chemical manufacturer

companies. It has been analysed that both are facing financial problems such as cash flow so they

have used different tools which are stated below:

Agmet has implied Benchmarking to solve issue related to cash flow which is described

in detailed aspect below:

Benchmarking: It is replicated as process to measure performance of products of

company, services and process which are against other considered business to be best in entire

6

industry. The main objective of benchmarking financial performance is to extract opportunities

for improving cash flow (Benchmark, 2019). On basis of this approach for benchmarking itself

against other organizations in the industry within different stages of life cycle. Some information

could be extracted online or via conversations at different networking events as cash flow

benchmarking is attained through comparing its history but on the contrary, attainment of

business and failure history to accomplish insight along with implementing new plans.

Furthermore, there should be appropriate implication of optimising benchmarking the cash flow

to improve about managing cash and control. Generally, cash flow benchmarking is directly

attained when situation is not avoided along with idea implementations for improvements (Agmet

Ltd, 2019).

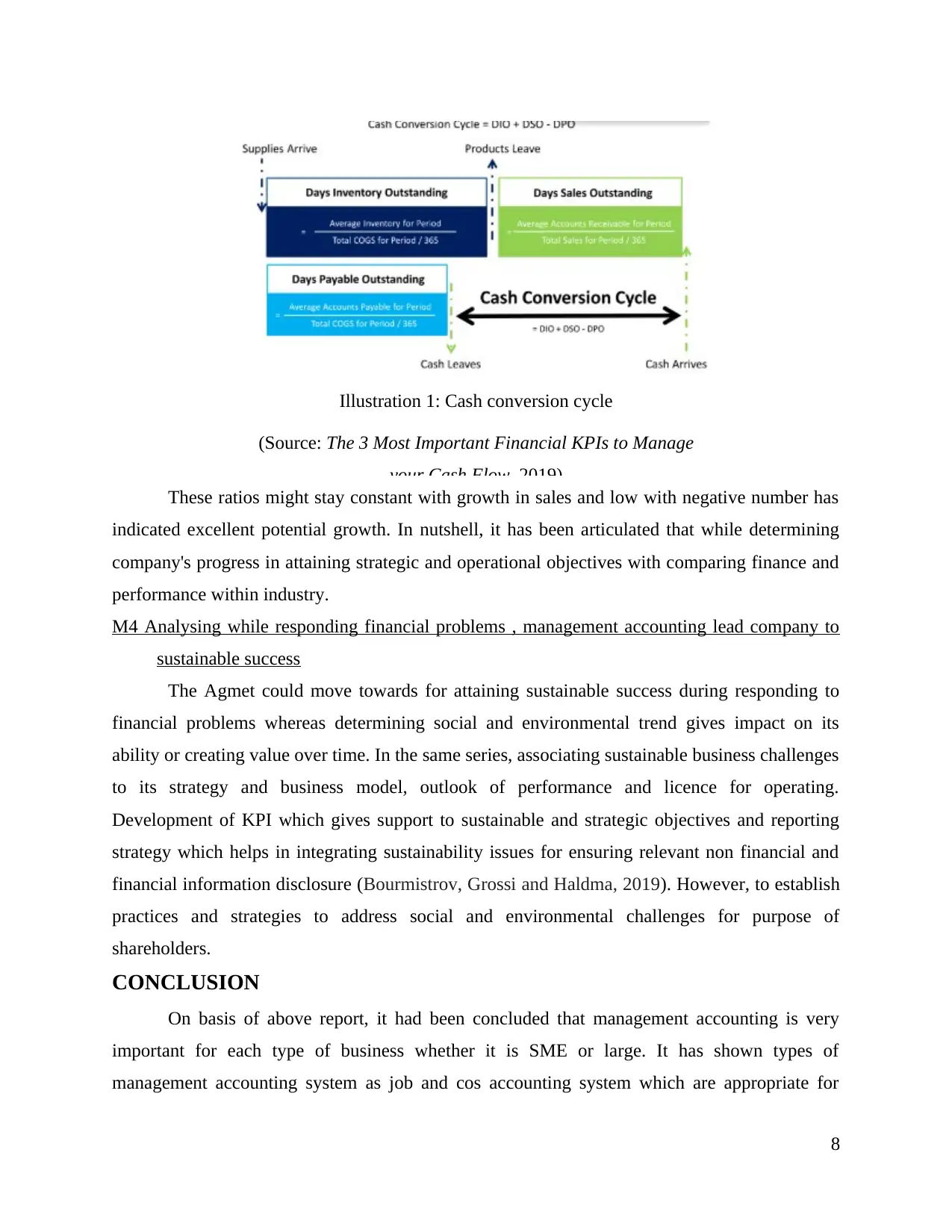

Monarch Chemical Ltd has used different key performance indicators for resolving issues

on basis of cash flow which is stated below in detailed manner:

Key performance indicators: It is a business metrics used through numerous corporate

executives along with managers with context to analyse and track factors directly deemed

important for organization's success. The effective key performance indicators lays special

emphasis of processes and function of businesses which senior management observes to

measure progress for attaining strategic objectives along with performance targets. The

organization has used cash conversion cycle which shows amount of time among spending and

receiving cash for every sale (Curry, 2019). There is consideration of inventory, accounts

payable and receivable which gives direct impact on entire cash position through indicating that

how long cash is directly tied in processes of business as working capital.

7

for improving cash flow (Benchmark, 2019). On basis of this approach for benchmarking itself

against other organizations in the industry within different stages of life cycle. Some information

could be extracted online or via conversations at different networking events as cash flow

benchmarking is attained through comparing its history but on the contrary, attainment of

business and failure history to accomplish insight along with implementing new plans.

Furthermore, there should be appropriate implication of optimising benchmarking the cash flow

to improve about managing cash and control. Generally, cash flow benchmarking is directly

attained when situation is not avoided along with idea implementations for improvements (Agmet

Ltd, 2019).

Monarch Chemical Ltd has used different key performance indicators for resolving issues

on basis of cash flow which is stated below in detailed manner:

Key performance indicators: It is a business metrics used through numerous corporate

executives along with managers with context to analyse and track factors directly deemed

important for organization's success. The effective key performance indicators lays special

emphasis of processes and function of businesses which senior management observes to

measure progress for attaining strategic objectives along with performance targets. The

organization has used cash conversion cycle which shows amount of time among spending and

receiving cash for every sale (Curry, 2019). There is consideration of inventory, accounts

payable and receivable which gives direct impact on entire cash position through indicating that

how long cash is directly tied in processes of business as working capital.

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Illustration 1: Cash conversion cycle

(Source: The 3 Most Important Financial KPIs to Manage

your Cash Flow, 2019)

These ratios might stay constant with growth in sales and low with negative number has

indicated excellent potential growth. In nutshell, it has been articulated that while determining

company's progress in attaining strategic and operational objectives with comparing finance and

performance within industry.

M4 Analysing while responding financial problems , management accounting lead company to

sustainable success

The Agmet could move towards for attaining sustainable success during responding to

financial problems whereas determining social and environmental trend gives impact on its

ability or creating value over time. In the same series, associating sustainable business challenges

to its strategy and business model, outlook of performance and licence for operating.

Development of KPI which gives support to sustainable and strategic objectives and reporting

strategy which helps in integrating sustainability issues for ensuring relevant non financial and

financial information disclosure (Bourmistrov, Grossi and Haldma, 2019). However, to establish

practices and strategies to address social and environmental challenges for purpose of

shareholders.

CONCLUSION

On basis of above report, it had been concluded that management accounting is very

important for each type of business whether it is SME or large. It has shown types of

management accounting system as job and cos accounting system which are appropriate for

8

(Source: The 3 Most Important Financial KPIs to Manage

your Cash Flow, 2019)

These ratios might stay constant with growth in sales and low with negative number has

indicated excellent potential growth. In nutshell, it has been articulated that while determining

company's progress in attaining strategic and operational objectives with comparing finance and

performance within industry.

M4 Analysing while responding financial problems , management accounting lead company to

sustainable success

The Agmet could move towards for attaining sustainable success during responding to

financial problems whereas determining social and environmental trend gives impact on its

ability or creating value over time. In the same series, associating sustainable business challenges

to its strategy and business model, outlook of performance and licence for operating.

Development of KPI which gives support to sustainable and strategic objectives and reporting

strategy which helps in integrating sustainability issues for ensuring relevant non financial and

financial information disclosure (Bourmistrov, Grossi and Haldma, 2019). However, to establish

practices and strategies to address social and environmental challenges for purpose of

shareholders.

CONCLUSION

On basis of above report, it had been concluded that management accounting is very

important for each type of business whether it is SME or large. It has shown types of

management accounting system as job and cos accounting system which are appropriate for

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Agmet. Moreover, it has shown planning tools such as zero based budget and ratio analysis

which are implied in management accounting. Thus, it had concluded with adaption of

management accounting system to respond financial problems.

9

which are implied in management accounting. Thus, it had concluded with adaption of

management accounting system to respond financial problems.

9

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.