Management Accounting Systems and Techniques: A Study on Creams Ltd

VerifiedAdded on 2023/01/11

|16

|4493

|33

AI Summary

This study focuses on the management accounting systems and techniques used by Creams Ltd, including inventory management, cost accounting, and job costing. It also discusses the benefits and applications of these systems in resolving financial issues.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TABLE OF CONTENTS

TABLE OF CONTENTS................................................................................................................2

INTRODUCTION...........................................................................................................................1

PART 1............................................................................................................................................1

Management Accounting systems and its benefits......................................................................1

Management accounting reporting methods................................................................................4

PART 2............................................................................................................................................5

Cost accounting techniques used by the organization.................................................................5

PART 3............................................................................................................................................7

Different types of budgetary planning tools used by organisation..............................................7

Management accounting helps the business in resolving financial issues................................10

CONCLUSION..............................................................................................................................10

REFERENCES..............................................................................................................................12

TABLE OF CONTENTS................................................................................................................2

INTRODUCTION...........................................................................................................................1

PART 1............................................................................................................................................1

Management Accounting systems and its benefits......................................................................1

Management accounting reporting methods................................................................................4

PART 2............................................................................................................................................5

Cost accounting techniques used by the organization.................................................................5

PART 3............................................................................................................................................7

Different types of budgetary planning tools used by organisation..............................................7

Management accounting helps the business in resolving financial issues................................10

CONCLUSION..............................................................................................................................10

REFERENCES..............................................................................................................................12

INTRODUCTION

Management accounting refers to analysing cost & operations of the business firms for

preparation of the internal financial reports and accounts. They help the business in effective

decision making process and to achieve the organisational goal and objectives with the available

resources in the most efficient manner. In simple words it refers to making using the financial

and costing information for taking the decisions of the business. management accounting is

mainly concerned with the internal affairs of the company for increasing the productivity and

profitability of the company. Present report is focused on the Creams Ltd that sells doughnuts,

ice cream, waffles etc. Study will provide the knowledge about management accounting system

and its application & the MA reporting methods. Study will also be providing about the costing

techniques used by company. Lastly, report will provide the planning tools of management and

its usage for resolving financial issues faced by the company.

PART 1

Management Accounting system & its benefits.

Management Accounting

It is the method of presentation of accounting information for formulating policies

adopted by management for carrying out daily operation of the business. it helps the

management to undertake all its activities such planning, staffing, organising, directing &

controlling. In the words of (Bromwich and Scapens, 2016)

“Management accounting is term used for describing accounting methods as well as

techniques with the special ability and knowledge, assisting the management to maximise the

profits and minimise the losses.”

As per the Institute of Cost & Management Accountants, London

“It is the application of professional knowledge & skills in preparation of various

accounting information in the way for assisting the management in formulation of the policies

and planning & controlling the operations of undertakings”

Management accounting Systems

MA systems are described as the methods used for managing the different operation of

organisation. There are various types of management accounting systems used by the Cream ltd.

Inventory Management System

1

Management accounting refers to analysing cost & operations of the business firms for

preparation of the internal financial reports and accounts. They help the business in effective

decision making process and to achieve the organisational goal and objectives with the available

resources in the most efficient manner. In simple words it refers to making using the financial

and costing information for taking the decisions of the business. management accounting is

mainly concerned with the internal affairs of the company for increasing the productivity and

profitability of the company. Present report is focused on the Creams Ltd that sells doughnuts,

ice cream, waffles etc. Study will provide the knowledge about management accounting system

and its application & the MA reporting methods. Study will also be providing about the costing

techniques used by company. Lastly, report will provide the planning tools of management and

its usage for resolving financial issues faced by the company.

PART 1

Management Accounting system & its benefits.

Management Accounting

It is the method of presentation of accounting information for formulating policies

adopted by management for carrying out daily operation of the business. it helps the

management to undertake all its activities such planning, staffing, organising, directing &

controlling. In the words of (Bromwich and Scapens, 2016)

“Management accounting is term used for describing accounting methods as well as

techniques with the special ability and knowledge, assisting the management to maximise the

profits and minimise the losses.”

As per the Institute of Cost & Management Accountants, London

“It is the application of professional knowledge & skills in preparation of various

accounting information in the way for assisting the management in formulation of the policies

and planning & controlling the operations of undertakings”

Management accounting Systems

MA systems are described as the methods used for managing the different operation of

organisation. There are various types of management accounting systems used by the Cream ltd.

Inventory Management System

1

Inventory or stock management is described as the method that is used by company for

managing the inventories. Companies are using manual inventory management methods by

combining the technology for the effective management of stocks of the company. Stock

management is used by the organisation for keeping the record of all the inventories that are

coming within the organisations such as raw materials and other input products to the finished

stocks that are sold by the organisation (Otley, 2016). Stock management is required by the

company for keeping the record of raw materials purchased for preparing the ice creams, number

of outputs produced and the amount of output sold and remaining in the company. It uses

different methods of inventory management such as LIFO – This is the method where the goods purchased last are sold for the first by the

entity. Good are sold at the prices by adding profit margin and that is seen generally in

perishable goods. FIFO – It refers to method where the inventory that is purchased first is also sold first.

The method is mostly used by the organisations WAC – This includes the method of using inventory by combining all the inventories

purchased and using the prices of inventory on average basis.

Benefits

Inventory management helps in tracking record of all the inventory movements within

organisation.

This helps in keeping required stock of inventories for the production process. This helps the management in effective decision making by assessing the frequency of

movements.

Application

Stock management is applied by the company for keeping track record of all the

inventories that are produced by the organisation and materials purchased for production.

Cost Accounting Systems

Cost accounting system is of great use to companies for identifying costs involved in

items for the profitability analysis, valuation of inventories and for cost control. This system is

used by company for keeping the complete record of all the activities and operations that are

consuming costs. It accounts for all the variable and fixed costs. Cost accounting systems also

helps organisation in keeping its cost and expenses of the company under control. This is

2

managing the inventories. Companies are using manual inventory management methods by

combining the technology for the effective management of stocks of the company. Stock

management is used by the organisation for keeping the record of all the inventories that are

coming within the organisations such as raw materials and other input products to the finished

stocks that are sold by the organisation (Otley, 2016). Stock management is required by the

company for keeping the record of raw materials purchased for preparing the ice creams, number

of outputs produced and the amount of output sold and remaining in the company. It uses

different methods of inventory management such as LIFO – This is the method where the goods purchased last are sold for the first by the

entity. Good are sold at the prices by adding profit margin and that is seen generally in

perishable goods. FIFO – It refers to method where the inventory that is purchased first is also sold first.

The method is mostly used by the organisations WAC – This includes the method of using inventory by combining all the inventories

purchased and using the prices of inventory on average basis.

Benefits

Inventory management helps in tracking record of all the inventory movements within

organisation.

This helps in keeping required stock of inventories for the production process. This helps the management in effective decision making by assessing the frequency of

movements.

Application

Stock management is applied by the company for keeping track record of all the

inventories that are produced by the organisation and materials purchased for production.

Cost Accounting Systems

Cost accounting system is of great use to companies for identifying costs involved in

items for the profitability analysis, valuation of inventories and for cost control. This system is

used by company for keeping the complete record of all the activities and operations that are

consuming costs. It accounts for all the variable and fixed costs. Cost accounting systems also

helps organisation in keeping its cost and expenses of the company under control. This is

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

achieved by carrying out variance analysis. This method is required by creams limited for

measuring the cost of preparing the waffles, ice creams and the other products so that the profit

margins could be set after identifying the cost of each product separately. There are different

costing methods such as

Process Costing – This is the costing technique involved in carrying out the costs involved in the

process carried out for production purposes. It identifies the costs associated with each process of

business.

Standard Costing – Standard costing is the cost accounting method where standards are set for

the business and costs are controlled by carrying out variance analysis comparing budgeted and

actual output.

Application

Cost accounting is established in the production process to ensure that all activities are

carried out in a manner with minimum wastage in production and making efficient utilisation of

resources. This system is used by the Cream limited for reducing the wastage and taking

effective steps for making the process cost efficient.

Benefits

Cost accounting help the firm in measuring the costs of product manufactured.

This helps the management in adopting cost efficient strategies for production process.

Cost accounting helps in taking corrective measures by carrying out variance analysis.

Job Costing System

Job Costing is described as costing method used by the organisation for assessing the cost

associated with each job. The costing method takes into account only the cost associated with job

and not with the process. It records all costs like raw material, labour and other associated costs.

Using the job costing method companies can analyse cost of predicting a job (Youssef,

Moustafa and Mahama, 2020). There are several production processes that involve carrying out

the different job before the production of finished goods. This is the process is required when the

Creams limited get the special orders regarding the ice creams waffles for calculating the cost of

special orders separately.

Application

3

measuring the cost of preparing the waffles, ice creams and the other products so that the profit

margins could be set after identifying the cost of each product separately. There are different

costing methods such as

Process Costing – This is the costing technique involved in carrying out the costs involved in the

process carried out for production purposes. It identifies the costs associated with each process of

business.

Standard Costing – Standard costing is the cost accounting method where standards are set for

the business and costs are controlled by carrying out variance analysis comparing budgeted and

actual output.

Application

Cost accounting is established in the production process to ensure that all activities are

carried out in a manner with minimum wastage in production and making efficient utilisation of

resources. This system is used by the Cream limited for reducing the wastage and taking

effective steps for making the process cost efficient.

Benefits

Cost accounting help the firm in measuring the costs of product manufactured.

This helps the management in adopting cost efficient strategies for production process.

Cost accounting helps in taking corrective measures by carrying out variance analysis.

Job Costing System

Job Costing is described as costing method used by the organisation for assessing the cost

associated with each job. The costing method takes into account only the cost associated with job

and not with the process. It records all costs like raw material, labour and other associated costs.

Using the job costing method companies can analyse cost of predicting a job (Youssef,

Moustafa and Mahama, 2020). There are several production processes that involve carrying out

the different job before the production of finished goods. This is the process is required when the

Creams limited get the special orders regarding the ice creams waffles for calculating the cost of

special orders separately.

Application

3

Job costing is applied by the organisation when the cost associated with specific job order

are required to be carried out by Cream ltd in manufacturing or ice creams. For instance when it

receives the orders for particular type of ice creams it helps to measure the associated costs.

Benefits

Job costing enables the company to carry out the cost of each job individually.

It gives detailed information of all cost incurred in producing the job.

It helps the company enterprise in measuring the cost of specific business orders.

Essential Requirements of Management Accounting Systems

Inventory Management System

Inventory management is very essential for the enterprise for managing all the inventories

of the entity. It is very difficult for the entity to keep record of all the entities manually. An

inventory management system is required for having proper record of all the inventories.

Cost Accounting System

A company without cost accounting system could not make proper record of all the cost

associated with manufacturing of products. It is required for estimating the price of the product

and deciding the profit margins.

Job Costing System

This is required by the entity for having cost record of the individual jobs. Entities using

this approach give quote the prices of the job for conducting a particular process.

Management accounting reporting methods

There are different methods used by the management for reporting the management

accounting information for effective decision making.

Budgeting Report

Budgeting report is used by the organisation in the decision making process. Budget

reports are the proposed plan of the business regarding the income and expenditures. Budget

reports are prepared by making projections of the future incomes and expenditures to be carried

out by the business. Organisations prepare the budget reports by making analysis of previous

budgets and making adjustments for preparing the budgets for current year (Fleischman and

McLean, 2020). Budget report contains the comparison of budgeted figures with that of the

actual figures of the enterprise and carrying out the differences. This is essential for the business

to take the measures for reducing the variance in the budgeted and actual figures.

4

are required to be carried out by Cream ltd in manufacturing or ice creams. For instance when it

receives the orders for particular type of ice creams it helps to measure the associated costs.

Benefits

Job costing enables the company to carry out the cost of each job individually.

It gives detailed information of all cost incurred in producing the job.

It helps the company enterprise in measuring the cost of specific business orders.

Essential Requirements of Management Accounting Systems

Inventory Management System

Inventory management is very essential for the enterprise for managing all the inventories

of the entity. It is very difficult for the entity to keep record of all the entities manually. An

inventory management system is required for having proper record of all the inventories.

Cost Accounting System

A company without cost accounting system could not make proper record of all the cost

associated with manufacturing of products. It is required for estimating the price of the product

and deciding the profit margins.

Job Costing System

This is required by the entity for having cost record of the individual jobs. Entities using

this approach give quote the prices of the job for conducting a particular process.

Management accounting reporting methods

There are different methods used by the management for reporting the management

accounting information for effective decision making.

Budgeting Report

Budgeting report is used by the organisation in the decision making process. Budget

reports are the proposed plan of the business regarding the income and expenditures. Budget

reports are prepared by making projections of the future incomes and expenditures to be carried

out by the business. Organisations prepare the budget reports by making analysis of previous

budgets and making adjustments for preparing the budgets for current year (Fleischman and

McLean, 2020). Budget report contains the comparison of budgeted figures with that of the

actual figures of the enterprise and carrying out the differences. This is essential for the business

to take the measures for reducing the variance in the budgeted and actual figures.

4

Cost accounting Report

Cost accounting report is used by the business for taking effective business decisions

related to the costs. Cost accounting report contains details of all the information regarding the

raw material, labour and all the other variable and fixed costs associated with manufacturing the

products of Cream ltd. Cost accounting report helps the business in keeping track records of all

the costs of business (Selivanoff and Hammer, 2019). The report helps the business enterprise in

keeping the costs and expenditures under control by implementing strategies that helps the entity

in achieving its desired goals and objectives. it also involves comparison of actual costs of

products with the budgeted costs of production. This enables the company to identify areas of

improvement an to take corrective steps effectively to increase the profitability of company and

to minimise the costs. Motive of every company is to achieve maximum profits with minimum

costs.

Performance Report

Performance report is prepared by the organisation for measuring the performance of

organisation during the given time frames. Performance reports helps the business enterprise to

ensure whether the company is performing as per the required standards or not. This requires the

business to set achievable and practical target levels to achieve by the different departments.

After the end of specified period their performance is measured by the management (Hoitash and

Hoitash, 2018). This helps the business in identifying the area that is required to be given focus

by the enterprise for increasing the efficiency and productivity of the business enterprise.

Performance report is an essential report that is used by the management for motivating the

employees by giving them rewards and incentives. This enables the company to increase the

efficiency of the employees of business.

PART 2

Cost accounting techniques used by the organization

Income Statement under marginal and absorption costing.

Income statement as per Marginal Costing

Particulars January February

Sales Revenue (10000*25) 250000 (5000*25) 125000

Marginal Cost of Sales

Direct Materials (10000*5) 50000 (10000*5) 50000

Direct Labour (10000*3) 30000 (10000*3) 30000

Variable Production (10000*2) 20000 (10000*2) 20000

5

Cost accounting report is used by the business for taking effective business decisions

related to the costs. Cost accounting report contains details of all the information regarding the

raw material, labour and all the other variable and fixed costs associated with manufacturing the

products of Cream ltd. Cost accounting report helps the business in keeping track records of all

the costs of business (Selivanoff and Hammer, 2019). The report helps the business enterprise in

keeping the costs and expenditures under control by implementing strategies that helps the entity

in achieving its desired goals and objectives. it also involves comparison of actual costs of

products with the budgeted costs of production. This enables the company to identify areas of

improvement an to take corrective steps effectively to increase the profitability of company and

to minimise the costs. Motive of every company is to achieve maximum profits with minimum

costs.

Performance Report

Performance report is prepared by the organisation for measuring the performance of

organisation during the given time frames. Performance reports helps the business enterprise to

ensure whether the company is performing as per the required standards or not. This requires the

business to set achievable and practical target levels to achieve by the different departments.

After the end of specified period their performance is measured by the management (Hoitash and

Hoitash, 2018). This helps the business in identifying the area that is required to be given focus

by the enterprise for increasing the efficiency and productivity of the business enterprise.

Performance report is an essential report that is used by the management for motivating the

employees by giving them rewards and incentives. This enables the company to increase the

efficiency of the employees of business.

PART 2

Cost accounting techniques used by the organization

Income Statement under marginal and absorption costing.

Income statement as per Marginal Costing

Particulars January February

Sales Revenue (10000*25) 250000 (5000*25) 125000

Marginal Cost of Sales

Direct Materials (10000*5) 50000 (10000*5) 50000

Direct Labour (10000*3) 30000 (10000*3) 30000

Variable Production (10000*2) 20000 (10000*2) 20000

5

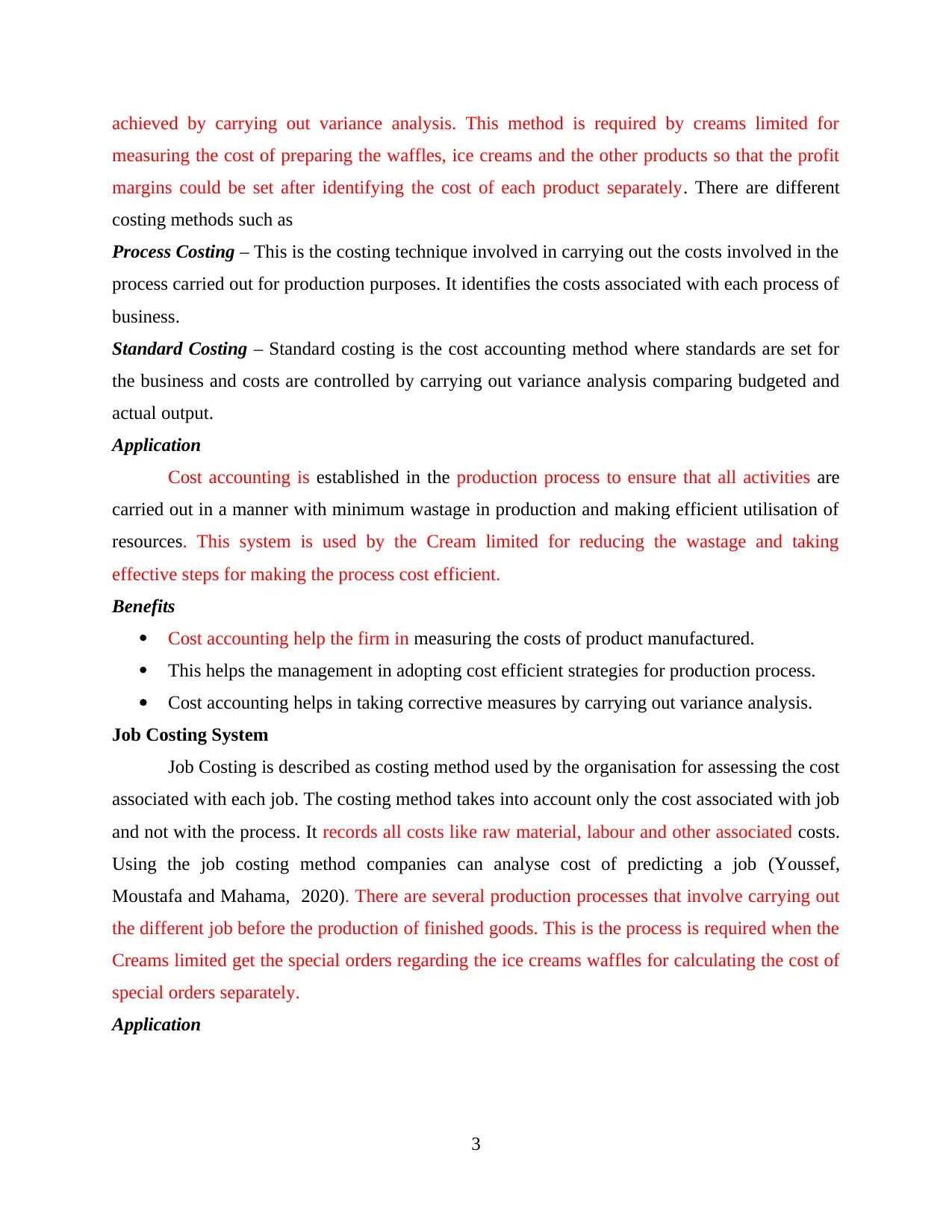

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Overheads

100000 100000

Add:

Opening Stock 0 0

Less:

Closing Stock 0 (5000/10000)*100000 50000

100000 50000

Contribution 150000 75000

Fixed production overheads 40000 40000

Fixed selling & admin Overhead 30000 30000

Variable sell. Overhead (10000*3) 30000 (5000*6) 30000

Net Income 50000 -25000

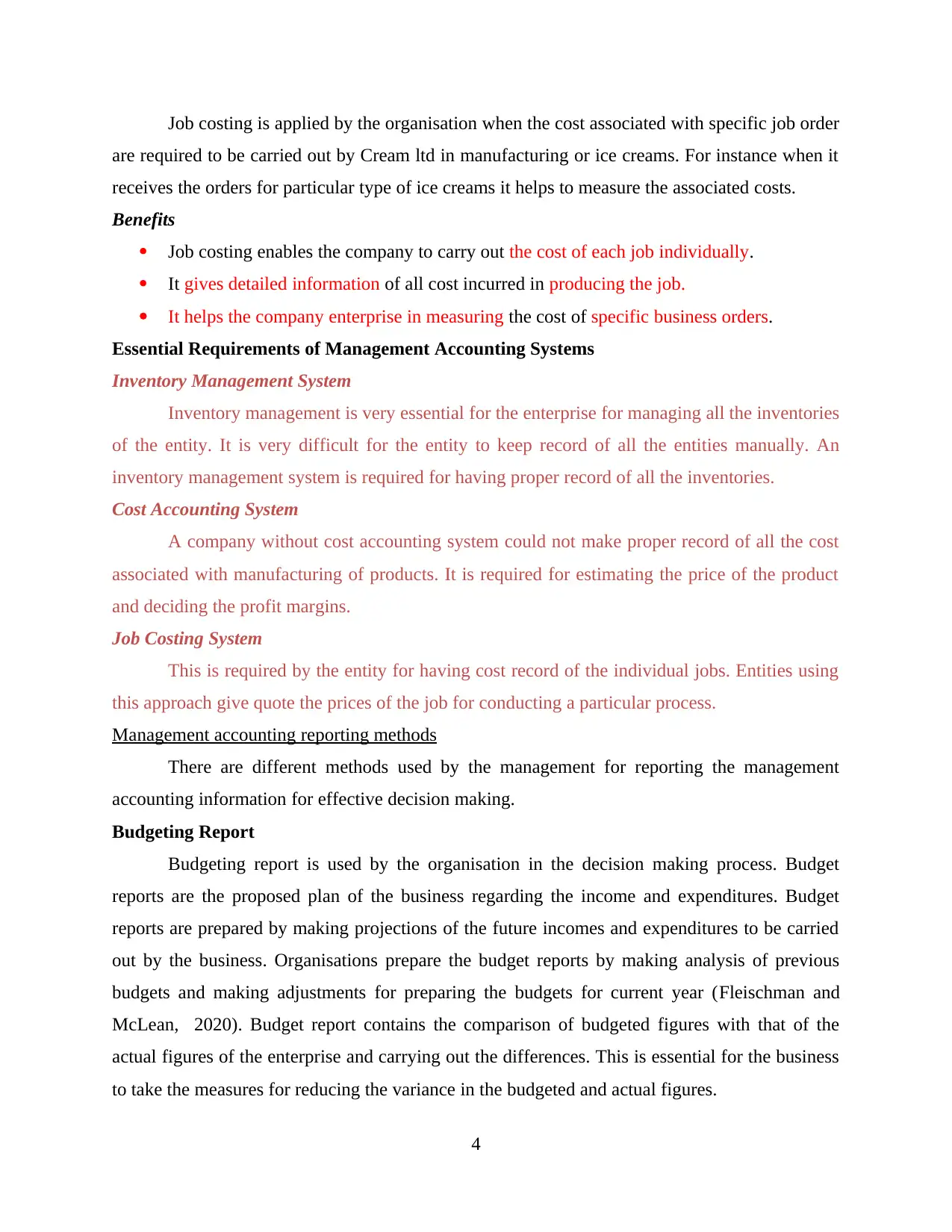

Income statement as per Absorption Costing

Particulars January February

Sales Revenue (10000*25) 250000 (5000*25) 125000

Marginal Cost of Sales

Direct Materials (10000*5) 50000 (10000*5) 50000

Direct Labour (10000*3) 30000 (10000*3) 30000

Variable Production

Overheads (10000*2) 20000 (10000*2) 20000

Fixed production overheads 40000 40000

140000 140000

Add:

Opening Stock 0 0

Less:

Closing Stock 0.00 (5000/10000)*140000 70000.00

140000.00 70000.00

Gross profit 110000.00 55000.00

Fixed selling & admin. Overhead 30000 30000

Variable sell. Overhead (10000*3) 30000 (5000*6) 30000

Net Income 50000.00 -5000.00

6

100000 100000

Add:

Opening Stock 0 0

Less:

Closing Stock 0 (5000/10000)*100000 50000

100000 50000

Contribution 150000 75000

Fixed production overheads 40000 40000

Fixed selling & admin Overhead 30000 30000

Variable sell. Overhead (10000*3) 30000 (5000*6) 30000

Net Income 50000 -25000

Income statement as per Absorption Costing

Particulars January February

Sales Revenue (10000*25) 250000 (5000*25) 125000

Marginal Cost of Sales

Direct Materials (10000*5) 50000 (10000*5) 50000

Direct Labour (10000*3) 30000 (10000*3) 30000

Variable Production

Overheads (10000*2) 20000 (10000*2) 20000

Fixed production overheads 40000 40000

140000 140000

Add:

Opening Stock 0 0

Less:

Closing Stock 0.00 (5000/10000)*140000 70000.00

140000.00 70000.00

Gross profit 110000.00 55000.00

Fixed selling & admin. Overhead 30000 30000

Variable sell. Overhead (10000*3) 30000 (5000*6) 30000

Net Income 50000.00 -5000.00

6

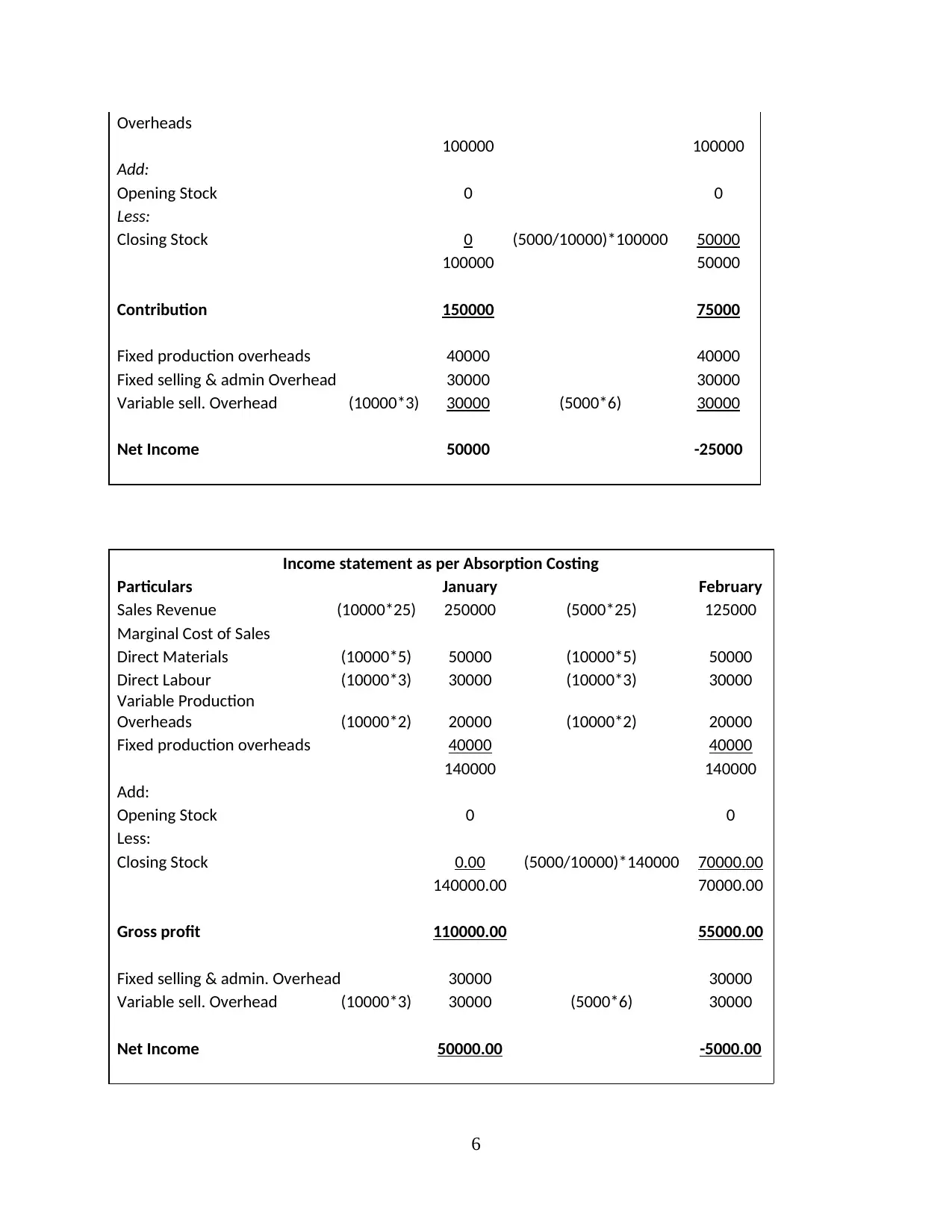

Working Notes

Cost per unit

Marginal Costing

Sales 25

Direct Materials 5

Direct Labour 3

Overheads 2

Contribution 15

Fixed production overhead 4

Fixed selling & admin overhead 3

Variable sell overhead 3

Net Income 5

Cost per unit

Absorption Costing

Sales 25

Direct Materials 5

Direct Labour 3

Overheads 2

Fixed production overhead 4

Gross profit 11

Fixed selling & admin overhead 3

Variable sell overhead 3

Net Income 5

Reconciliation Statement Jan Feb

Profit as per absorption costing 50000 -5000

Opening stock 0 0

Closing stock 0 -20000

Profit as per marginal costing 50000 -25000

CALCULATION OF VARIANCES:

i) Material Price Variance = Standard Price - Actual Price

= (Std Price - Actual Price) x Actual Qty)

(£10 - £9.5) * 2200 kg

1100 (Fav)

7

Cost per unit

Marginal Costing

Sales 25

Direct Materials 5

Direct Labour 3

Overheads 2

Contribution 15

Fixed production overhead 4

Fixed selling & admin overhead 3

Variable sell overhead 3

Net Income 5

Cost per unit

Absorption Costing

Sales 25

Direct Materials 5

Direct Labour 3

Overheads 2

Fixed production overhead 4

Gross profit 11

Fixed selling & admin overhead 3

Variable sell overhead 3

Net Income 5

Reconciliation Statement Jan Feb

Profit as per absorption costing 50000 -5000

Opening stock 0 0

Closing stock 0 -20000

Profit as per marginal costing 50000 -25000

CALCULATION OF VARIANCES:

i) Material Price Variance = Standard Price - Actual Price

= (Std Price - Actual Price) x Actual Qty)

(£10 - £9.5) * 2200 kg

1100 (Fav)

7

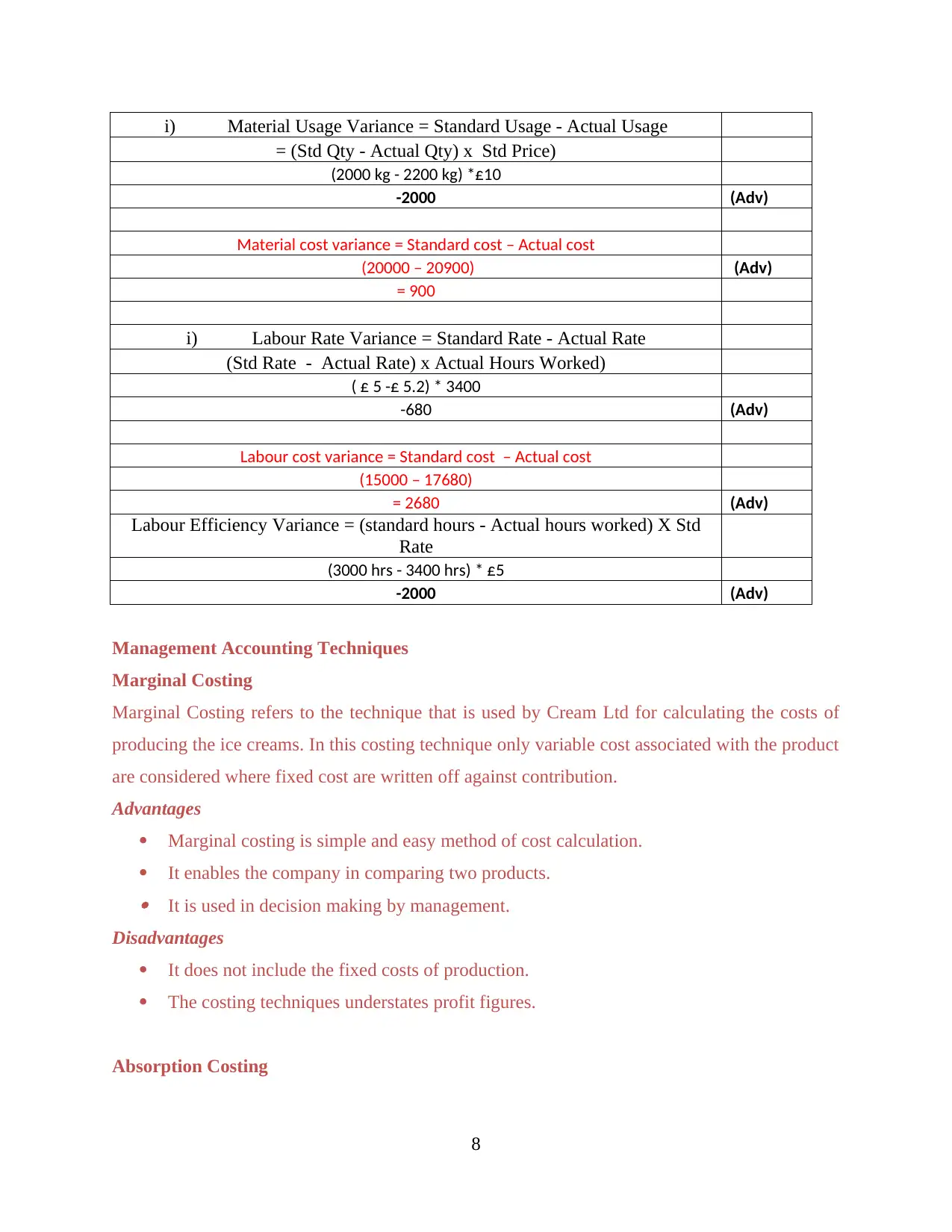

i) Material Usage Variance = Standard Usage - Actual Usage

= (Std Qty - Actual Qty) x Std Price)

(2000 kg - 2200 kg) *£10

-2000 (Adv)

Material cost variance = Standard cost – Actual cost

(20000 – 20900) (Adv)

= 900

i) Labour Rate Variance = Standard Rate - Actual Rate

(Std Rate - Actual Rate) x Actual Hours Worked)

( £ 5 -£ 5.2) * 3400

-680 (Adv)

Labour cost variance = Standard cost – Actual cost

(15000 – 17680)

= 2680 (Adv)

Labour Efficiency Variance = (standard hours - Actual hours worked) X Std

Rate

(3000 hrs - 3400 hrs) * £5

-2000 (Adv)

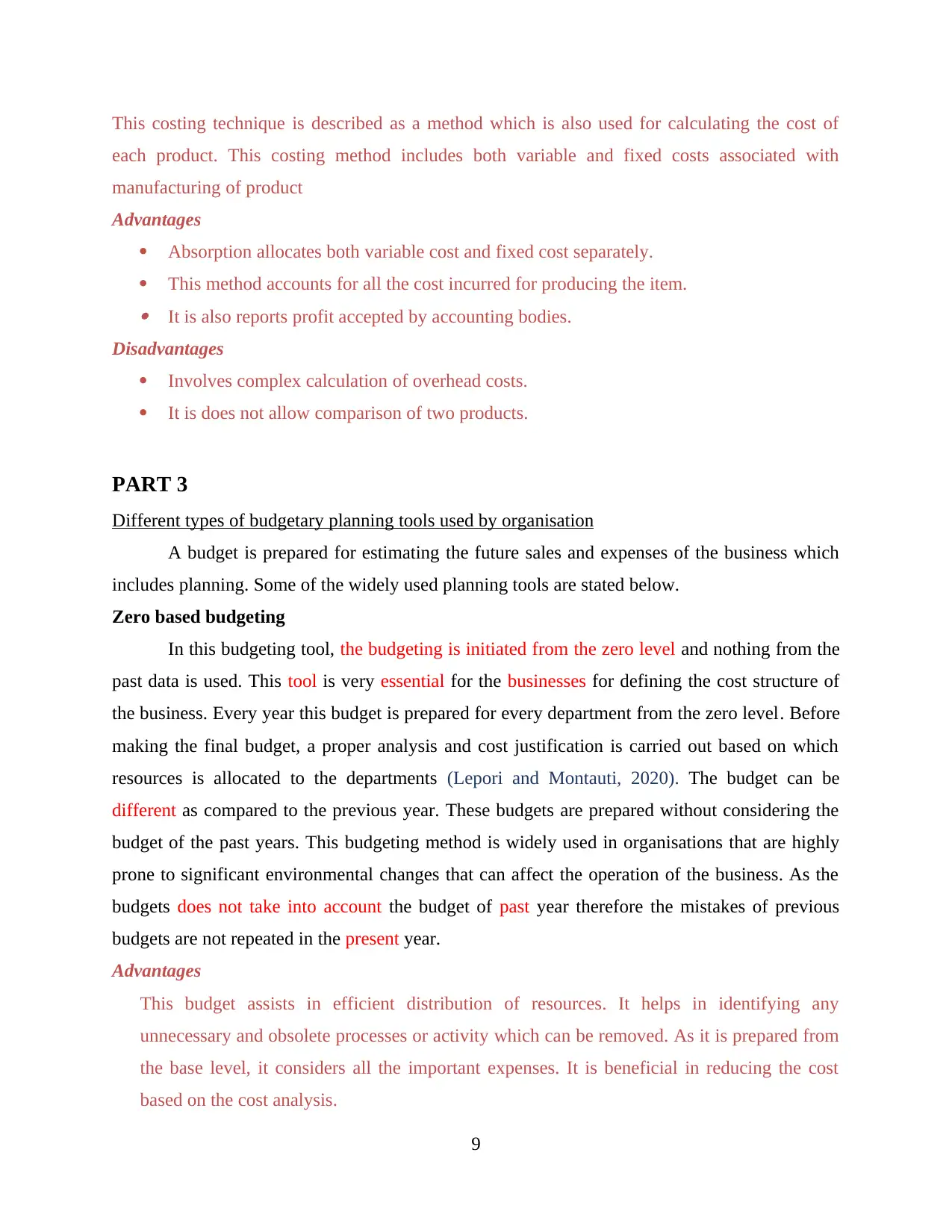

Management Accounting Techniques

Marginal Costing

Marginal Costing refers to the technique that is used by Cream Ltd for calculating the costs of

producing the ice creams. In this costing technique only variable cost associated with the product

are considered where fixed cost are written off against contribution.

Advantages

Marginal costing is simple and easy method of cost calculation.

It enables the company in comparing two products. It is used in decision making by management.

Disadvantages

It does not include the fixed costs of production.

The costing techniques understates profit figures.

Absorption Costing

8

= (Std Qty - Actual Qty) x Std Price)

(2000 kg - 2200 kg) *£10

-2000 (Adv)

Material cost variance = Standard cost – Actual cost

(20000 – 20900) (Adv)

= 900

i) Labour Rate Variance = Standard Rate - Actual Rate

(Std Rate - Actual Rate) x Actual Hours Worked)

( £ 5 -£ 5.2) * 3400

-680 (Adv)

Labour cost variance = Standard cost – Actual cost

(15000 – 17680)

= 2680 (Adv)

Labour Efficiency Variance = (standard hours - Actual hours worked) X Std

Rate

(3000 hrs - 3400 hrs) * £5

-2000 (Adv)

Management Accounting Techniques

Marginal Costing

Marginal Costing refers to the technique that is used by Cream Ltd for calculating the costs of

producing the ice creams. In this costing technique only variable cost associated with the product

are considered where fixed cost are written off against contribution.

Advantages

Marginal costing is simple and easy method of cost calculation.

It enables the company in comparing two products. It is used in decision making by management.

Disadvantages

It does not include the fixed costs of production.

The costing techniques understates profit figures.

Absorption Costing

8

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

This costing technique is described as a method which is also used for calculating the cost of

each product. This costing method includes both variable and fixed costs associated with

manufacturing of product

Advantages

Absorption allocates both variable cost and fixed cost separately.

This method accounts for all the cost incurred for producing the item. It is also reports profit accepted by accounting bodies.

Disadvantages

Involves complex calculation of overhead costs.

It is does not allow comparison of two products.

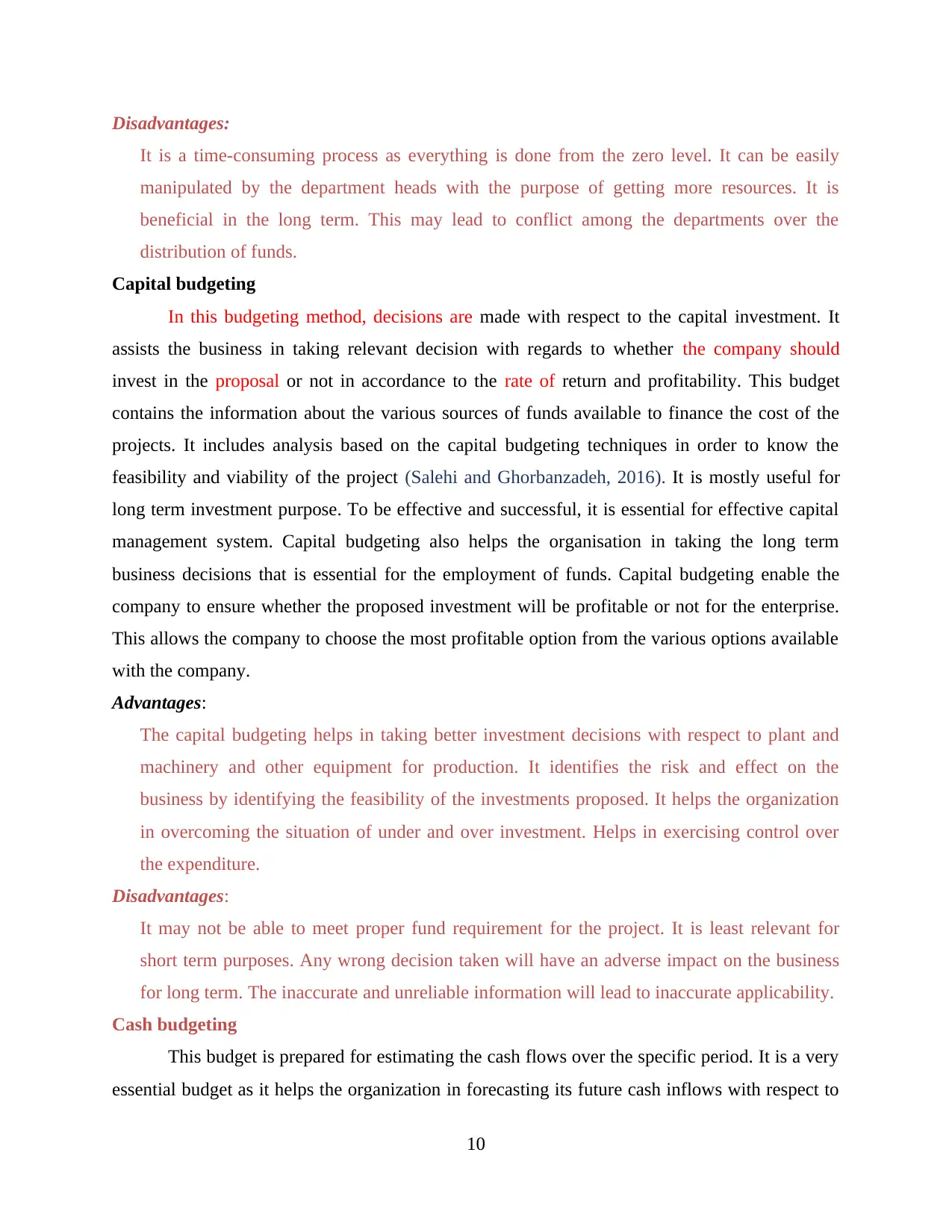

PART 3

Different types of budgetary planning tools used by organisation

A budget is prepared for estimating the future sales and expenses of the business which

includes planning. Some of the widely used planning tools are stated below.

Zero based budgeting

In this budgeting tool, the budgeting is initiated from the zero level and nothing from the

past data is used. This tool is very essential for the businesses for defining the cost structure of

the business. Every year this budget is prepared for every department from the zero level. Before

making the final budget, a proper analysis and cost justification is carried out based on which

resources is allocated to the departments (Lepori and Montauti, 2020). The budget can be

different as compared to the previous year. These budgets are prepared without considering the

budget of the past years. This budgeting method is widely used in organisations that are highly

prone to significant environmental changes that can affect the operation of the business. As the

budgets does not take into account the budget of past year therefore the mistakes of previous

budgets are not repeated in the present year.

Advantages

This budget assists in efficient distribution of resources. It helps in identifying any

unnecessary and obsolete processes or activity which can be removed. As it is prepared from

the base level, it considers all the important expenses. It is beneficial in reducing the cost

based on the cost analysis.

9

each product. This costing method includes both variable and fixed costs associated with

manufacturing of product

Advantages

Absorption allocates both variable cost and fixed cost separately.

This method accounts for all the cost incurred for producing the item. It is also reports profit accepted by accounting bodies.

Disadvantages

Involves complex calculation of overhead costs.

It is does not allow comparison of two products.

PART 3

Different types of budgetary planning tools used by organisation

A budget is prepared for estimating the future sales and expenses of the business which

includes planning. Some of the widely used planning tools are stated below.

Zero based budgeting

In this budgeting tool, the budgeting is initiated from the zero level and nothing from the

past data is used. This tool is very essential for the businesses for defining the cost structure of

the business. Every year this budget is prepared for every department from the zero level. Before

making the final budget, a proper analysis and cost justification is carried out based on which

resources is allocated to the departments (Lepori and Montauti, 2020). The budget can be

different as compared to the previous year. These budgets are prepared without considering the

budget of the past years. This budgeting method is widely used in organisations that are highly

prone to significant environmental changes that can affect the operation of the business. As the

budgets does not take into account the budget of past year therefore the mistakes of previous

budgets are not repeated in the present year.

Advantages

This budget assists in efficient distribution of resources. It helps in identifying any

unnecessary and obsolete processes or activity which can be removed. As it is prepared from

the base level, it considers all the important expenses. It is beneficial in reducing the cost

based on the cost analysis.

9

Disadvantages:

It is a time-consuming process as everything is done from the zero level. It can be easily

manipulated by the department heads with the purpose of getting more resources. It is

beneficial in the long term. This may lead to conflict among the departments over the

distribution of funds.

Capital budgeting

In this budgeting method, decisions are made with respect to the capital investment. It

assists the business in taking relevant decision with regards to whether the company should

invest in the proposal or not in accordance to the rate of return and profitability. This budget

contains the information about the various sources of funds available to finance the cost of the

projects. It includes analysis based on the capital budgeting techniques in order to know the

feasibility and viability of the project (Salehi and Ghorbanzadeh, 2016). It is mostly useful for

long term investment purpose. To be effective and successful, it is essential for effective capital

management system. Capital budgeting also helps the organisation in taking the long term

business decisions that is essential for the employment of funds. Capital budgeting enable the

company to ensure whether the proposed investment will be profitable or not for the enterprise.

This allows the company to choose the most profitable option from the various options available

with the company.

Advantages:

The capital budgeting helps in taking better investment decisions with respect to plant and

machinery and other equipment for production. It identifies the risk and effect on the

business by identifying the feasibility of the investments proposed. It helps the organization

in overcoming the situation of under and over investment. Helps in exercising control over

the expenditure.

Disadvantages:

It may not be able to meet proper fund requirement for the project. It is least relevant for

short term purposes. Any wrong decision taken will have an adverse impact on the business

for long term. The inaccurate and unreliable information will lead to inaccurate applicability.

Cash budgeting

This budget is prepared for estimating the cash flows over the specific period. It is a very

essential budget as it helps the organization in forecasting its future cash inflows with respect to

10

It is a time-consuming process as everything is done from the zero level. It can be easily

manipulated by the department heads with the purpose of getting more resources. It is

beneficial in the long term. This may lead to conflict among the departments over the

distribution of funds.

Capital budgeting

In this budgeting method, decisions are made with respect to the capital investment. It

assists the business in taking relevant decision with regards to whether the company should

invest in the proposal or not in accordance to the rate of return and profitability. This budget

contains the information about the various sources of funds available to finance the cost of the

projects. It includes analysis based on the capital budgeting techniques in order to know the

feasibility and viability of the project (Salehi and Ghorbanzadeh, 2016). It is mostly useful for

long term investment purpose. To be effective and successful, it is essential for effective capital

management system. Capital budgeting also helps the organisation in taking the long term

business decisions that is essential for the employment of funds. Capital budgeting enable the

company to ensure whether the proposed investment will be profitable or not for the enterprise.

This allows the company to choose the most profitable option from the various options available

with the company.

Advantages:

The capital budgeting helps in taking better investment decisions with respect to plant and

machinery and other equipment for production. It identifies the risk and effect on the

business by identifying the feasibility of the investments proposed. It helps the organization

in overcoming the situation of under and over investment. Helps in exercising control over

the expenditure.

Disadvantages:

It may not be able to meet proper fund requirement for the project. It is least relevant for

short term purposes. Any wrong decision taken will have an adverse impact on the business

for long term. The inaccurate and unreliable information will lead to inaccurate applicability.

Cash budgeting

This budget is prepared for estimating the cash flows over the specific period. It is a very

essential budget as it helps the organization in forecasting its future cash inflows with respect to

10

different sources of income and cash outflow in terms of expenditures. This helps the company

in analysing whether it is having sufficient cash or not to carry out its business operations

efficiently. The forecasts about the cash flow is done in accordance with the sales budget

prepared by the organization (Karagiorgos and et.al, 2020). This budget is very crucial for the

organization for effectively allocating the funds to different business activities and departments.

Cash budget helps the organisation in keeping its costs of goods and services under control. this

ensures efficient allocation of the monetary funds among different department of the company.

Using cash budget management can analyse the previous budget and allocating the funds after

analysing the possible changes that me occur in the company. This budget is mainly prepared

after the preparation of all other budgets such as production, sales etc.

Advantages

This budget helps in adequate allocation of funds to the various business departments. It

provides a complete plan about the expenditure to be incurred which helps in preventing

overspending on the business operation. It helps in identifying the difference so that timely

actions can be taken in order to control it. This budget helps in establishing proper

coordination with the different business activities.

Disadvantages

It completely based on estimation and any error in it will affect the structure of the

organization and fund requirements. It may affect or restrict the spending power of the

organization. It does not reflect the right amount of profit and also it can be easily

manipulated.

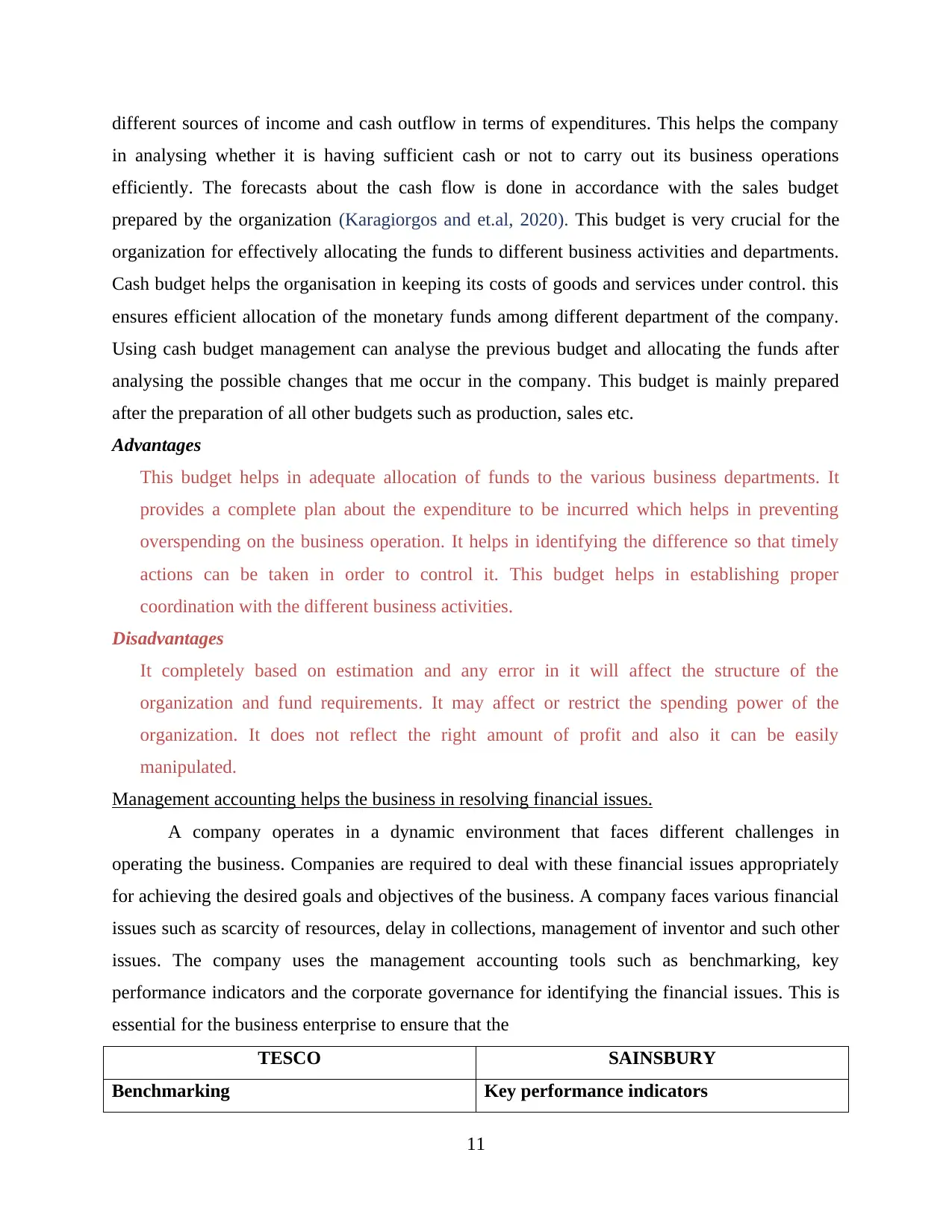

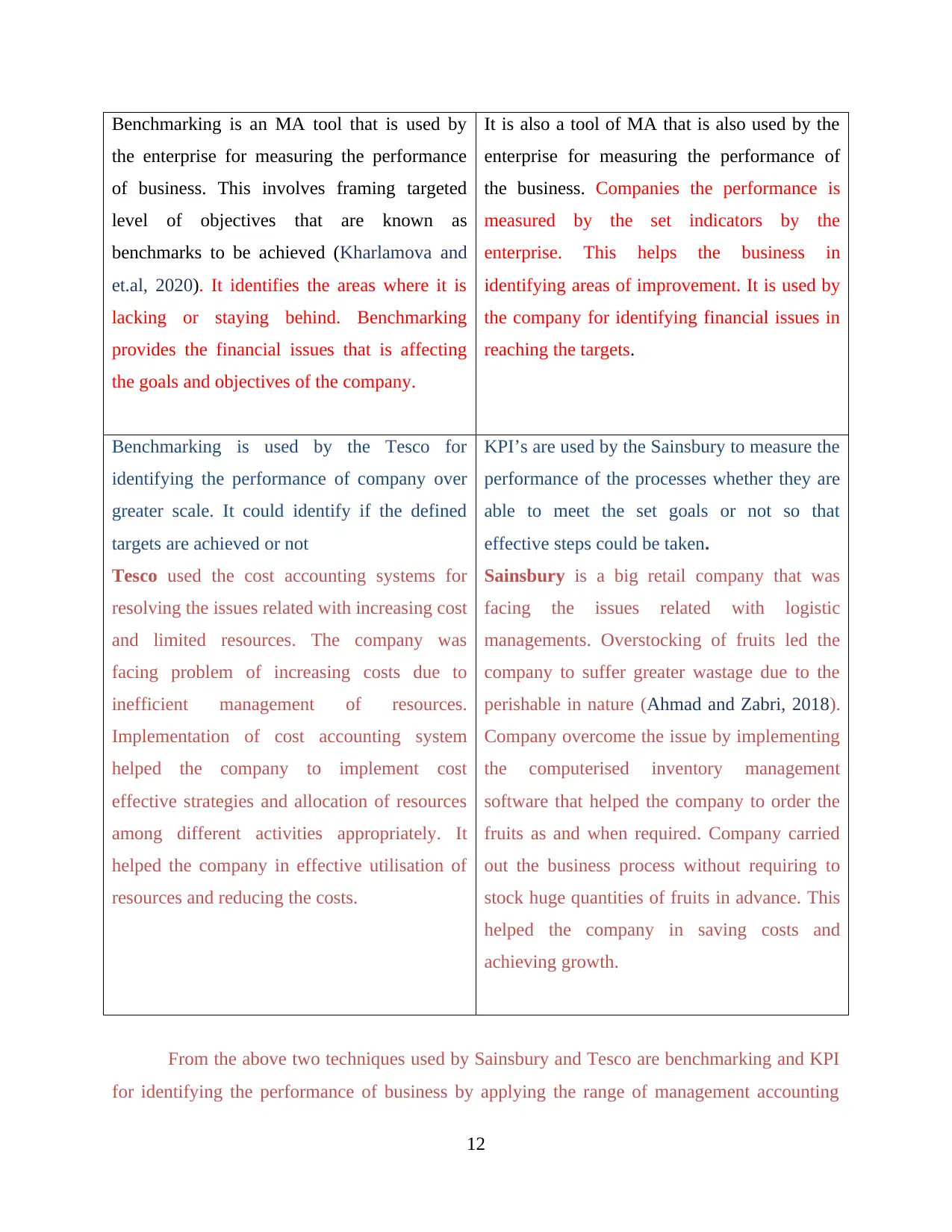

Management accounting helps the business in resolving financial issues.

A company operates in a dynamic environment that faces different challenges in

operating the business. Companies are required to deal with these financial issues appropriately

for achieving the desired goals and objectives of the business. A company faces various financial

issues such as scarcity of resources, delay in collections, management of inventor and such other

issues. The company uses the management accounting tools such as benchmarking, key

performance indicators and the corporate governance for identifying the financial issues. This is

essential for the business enterprise to ensure that the

TESCO SAINSBURY

Benchmarking Key performance indicators

11

in analysing whether it is having sufficient cash or not to carry out its business operations

efficiently. The forecasts about the cash flow is done in accordance with the sales budget

prepared by the organization (Karagiorgos and et.al, 2020). This budget is very crucial for the

organization for effectively allocating the funds to different business activities and departments.

Cash budget helps the organisation in keeping its costs of goods and services under control. this

ensures efficient allocation of the monetary funds among different department of the company.

Using cash budget management can analyse the previous budget and allocating the funds after

analysing the possible changes that me occur in the company. This budget is mainly prepared

after the preparation of all other budgets such as production, sales etc.

Advantages

This budget helps in adequate allocation of funds to the various business departments. It

provides a complete plan about the expenditure to be incurred which helps in preventing

overspending on the business operation. It helps in identifying the difference so that timely

actions can be taken in order to control it. This budget helps in establishing proper

coordination with the different business activities.

Disadvantages

It completely based on estimation and any error in it will affect the structure of the

organization and fund requirements. It may affect or restrict the spending power of the

organization. It does not reflect the right amount of profit and also it can be easily

manipulated.

Management accounting helps the business in resolving financial issues.

A company operates in a dynamic environment that faces different challenges in

operating the business. Companies are required to deal with these financial issues appropriately

for achieving the desired goals and objectives of the business. A company faces various financial

issues such as scarcity of resources, delay in collections, management of inventor and such other

issues. The company uses the management accounting tools such as benchmarking, key

performance indicators and the corporate governance for identifying the financial issues. This is

essential for the business enterprise to ensure that the

TESCO SAINSBURY

Benchmarking Key performance indicators

11

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Benchmarking is an MA tool that is used by

the enterprise for measuring the performance

of business. This involves framing targeted

level of objectives that are known as

benchmarks to be achieved (Kharlamova and

et.al, 2020). It identifies the areas where it is

lacking or staying behind. Benchmarking

provides the financial issues that is affecting

the goals and objectives of the company.

It is also a tool of MA that is also used by the

enterprise for measuring the performance of

the business. Companies the performance is

measured by the set indicators by the

enterprise. This helps the business in

identifying areas of improvement. It is used by

the company for identifying financial issues in

reaching the targets.

Benchmarking is used by the Tesco for

identifying the performance of company over

greater scale. It could identify if the defined

targets are achieved or not

Tesco used the cost accounting systems for

resolving the issues related with increasing cost

and limited resources. The company was

facing problem of increasing costs due to

inefficient management of resources.

Implementation of cost accounting system

helped the company to implement cost

effective strategies and allocation of resources

among different activities appropriately. It

helped the company in effective utilisation of

resources and reducing the costs.

KPI’s are used by the Sainsbury to measure the

performance of the processes whether they are

able to meet the set goals or not so that

effective steps could be taken.

Sainsbury is a big retail company that was

facing the issues related with logistic

managements. Overstocking of fruits led the

company to suffer greater wastage due to the

perishable in nature (Ahmad and Zabri, 2018).

Company overcome the issue by implementing

the computerised inventory management

software that helped the company to order the

fruits as and when required. Company carried

out the business process without requiring to

stock huge quantities of fruits in advance. This

helped the company in saving costs and

achieving growth.

From the above two techniques used by Sainsbury and Tesco are benchmarking and KPI

for identifying the performance of business by applying the range of management accounting

12

the enterprise for measuring the performance

of business. This involves framing targeted

level of objectives that are known as

benchmarks to be achieved (Kharlamova and

et.al, 2020). It identifies the areas where it is

lacking or staying behind. Benchmarking

provides the financial issues that is affecting

the goals and objectives of the company.

It is also a tool of MA that is also used by the

enterprise for measuring the performance of

the business. Companies the performance is

measured by the set indicators by the

enterprise. This helps the business in

identifying areas of improvement. It is used by

the company for identifying financial issues in

reaching the targets.

Benchmarking is used by the Tesco for

identifying the performance of company over

greater scale. It could identify if the defined

targets are achieved or not

Tesco used the cost accounting systems for

resolving the issues related with increasing cost

and limited resources. The company was

facing problem of increasing costs due to

inefficient management of resources.

Implementation of cost accounting system

helped the company to implement cost

effective strategies and allocation of resources

among different activities appropriately. It

helped the company in effective utilisation of

resources and reducing the costs.

KPI’s are used by the Sainsbury to measure the

performance of the processes whether they are

able to meet the set goals or not so that

effective steps could be taken.

Sainsbury is a big retail company that was

facing the issues related with logistic

managements. Overstocking of fruits led the

company to suffer greater wastage due to the

perishable in nature (Ahmad and Zabri, 2018).

Company overcome the issue by implementing

the computerised inventory management

software that helped the company to order the

fruits as and when required. Company carried

out the business process without requiring to

stock huge quantities of fruits in advance. This

helped the company in saving costs and

achieving growth.

From the above two techniques used by Sainsbury and Tesco are benchmarking and KPI

for identifying the performance of business by applying the range of management accounting

12

systems. Company could use benchmarking resolving the financial issues faced in meeting the

financial issue related with effective utilisation of the resources. it could set benchmarks and

identify the level of success achieved using the management accounting systems.

CONCLUSION

From above research it could be concluded the MA concepts and techniques helps the

organisation in decision making. MA system helps in efficient management of operations and the

reporting method in effective decision making for implementing the strategies. Companies are

able their able to solve their financial issues with the help of different planning tools and MA

accounting systems. The management accounting concepts and techniques are helping the

organisation to achieve sustainable growth and success of the organisations. The costing

techniques provide the management to use the most appropriate techniques of recording the

costing transactions.

13

financial issue related with effective utilisation of the resources. it could set benchmarks and

identify the level of success achieved using the management accounting systems.

CONCLUSION

From above research it could be concluded the MA concepts and techniques helps the

organisation in decision making. MA system helps in efficient management of operations and the

reporting method in effective decision making for implementing the strategies. Companies are

able their able to solve their financial issues with the help of different planning tools and MA

accounting systems. The management accounting concepts and techniques are helping the

organisation to achieve sustainable growth and success of the organisations. The costing

techniques provide the management to use the most appropriate techniques of recording the

costing transactions.

13

REFERENCES

Books and Journals

Bromwich, M. and Scapens, R.W., 2016. Management accounting research: 25 years

on. Management Accounting Research. 31. pp.1-9.

Otley, D., 2016. The contingency theory of management accounting and control: 1980–

2014. Management accounting research.31. pp.45-62.

Youssef, M.A.E.A., Moustafa, E.E. and Mahama, H., 2020. The mediating role of management

control system characteristics in the adoption of management accounting

techniques. Pacific Accounting Review.

Fleischman, R. and McLean, T., 2020. Management accounting: theory and practice. Routledge.

Selivanoff, P. and Hammer, D., 2019. Cost management and the renewed imperative for cost

accounting. Management in Healthcare. 4(2). pp.130-144.

Hoitash, R. and Hoitash, U., 2018. Measuring accounting reporting complexity with XBRL. The

Accounting Review, 93(1), pp.259-287.

Kharlamova, O. and et.al, 2020. Management Accounting Using Benchmarking Tools. Academy

of Accounting and Financial Studies Journal. 24(2). pp.1-7.

Ahmad, K. and Zabri, S. M., 2018. The mediating effect of knowledge of inventory management

in the relationship between inventory management practices and performance: The case of

micro retailing enterprises. Journal of Business and Retail Management Research. 12(2).

pp.83-93.

Lepori, B. and Montauti, M., 2020. Bringing the organization back in: Flexing structural

responses to competing logics in budgeting. Accounting, Organizations and Society. 80.

p.101075.

Salehi, M. and Ghorbanzadeh, R., 2016. The influence of firms' capital expenditure on firms'

working capital management. International Journal of Economics and Business

Research. 11(3). pp.287-301.

Karagiorgos, A. and et.al, 2020. Role and contribution of administrative accounting to small and

very small businesses. Journal of Accounting and Taxation. 12(2). pp.75-84.

14

Books and Journals

Bromwich, M. and Scapens, R.W., 2016. Management accounting research: 25 years

on. Management Accounting Research. 31. pp.1-9.

Otley, D., 2016. The contingency theory of management accounting and control: 1980–

2014. Management accounting research.31. pp.45-62.

Youssef, M.A.E.A., Moustafa, E.E. and Mahama, H., 2020. The mediating role of management

control system characteristics in the adoption of management accounting

techniques. Pacific Accounting Review.

Fleischman, R. and McLean, T., 2020. Management accounting: theory and practice. Routledge.

Selivanoff, P. and Hammer, D., 2019. Cost management and the renewed imperative for cost

accounting. Management in Healthcare. 4(2). pp.130-144.

Hoitash, R. and Hoitash, U., 2018. Measuring accounting reporting complexity with XBRL. The

Accounting Review, 93(1), pp.259-287.

Kharlamova, O. and et.al, 2020. Management Accounting Using Benchmarking Tools. Academy

of Accounting and Financial Studies Journal. 24(2). pp.1-7.

Ahmad, K. and Zabri, S. M., 2018. The mediating effect of knowledge of inventory management

in the relationship between inventory management practices and performance: The case of

micro retailing enterprises. Journal of Business and Retail Management Research. 12(2).

pp.83-93.

Lepori, B. and Montauti, M., 2020. Bringing the organization back in: Flexing structural

responses to competing logics in budgeting. Accounting, Organizations and Society. 80.

p.101075.

Salehi, M. and Ghorbanzadeh, R., 2016. The influence of firms' capital expenditure on firms'

working capital management. International Journal of Economics and Business

Research. 11(3). pp.287-301.

Karagiorgos, A. and et.al, 2020. Role and contribution of administrative accounting to small and

very small businesses. Journal of Accounting and Taxation. 12(2). pp.75-84.

14

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.