Managerial Accounting: Case Study Analysis and Financial Review

VerifiedAdded on 2023/06/10

|18

|2317

|176

Case Study

AI Summary

This document presents a comprehensive solution to a managerial accounting case study, involving financial analysis, cost estimation, budgeting, and decision-making. It covers various aspects such as cost equations, regression analysis, overhead allocation, process costing using the FIFO method, and break-even analysis. The solution addresses specific problems related to cost estimation, overhead application, production reports, and income statement preparation. Additionally, it includes an analysis of Cafe Xaragua's financial performance and reopening decisions for Norgan Theatre, providing insights into revenue changes, gross margin analysis, and key assumptions for budgeting. Desklib offers more solved assignments and past papers for students.

Running head: MANAGEMENT ACCOUNTING 1

Management Accounting

Name

University Affiliation

Management Accounting

Name

University Affiliation

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MANAGEMENT ACCOUNTING 2

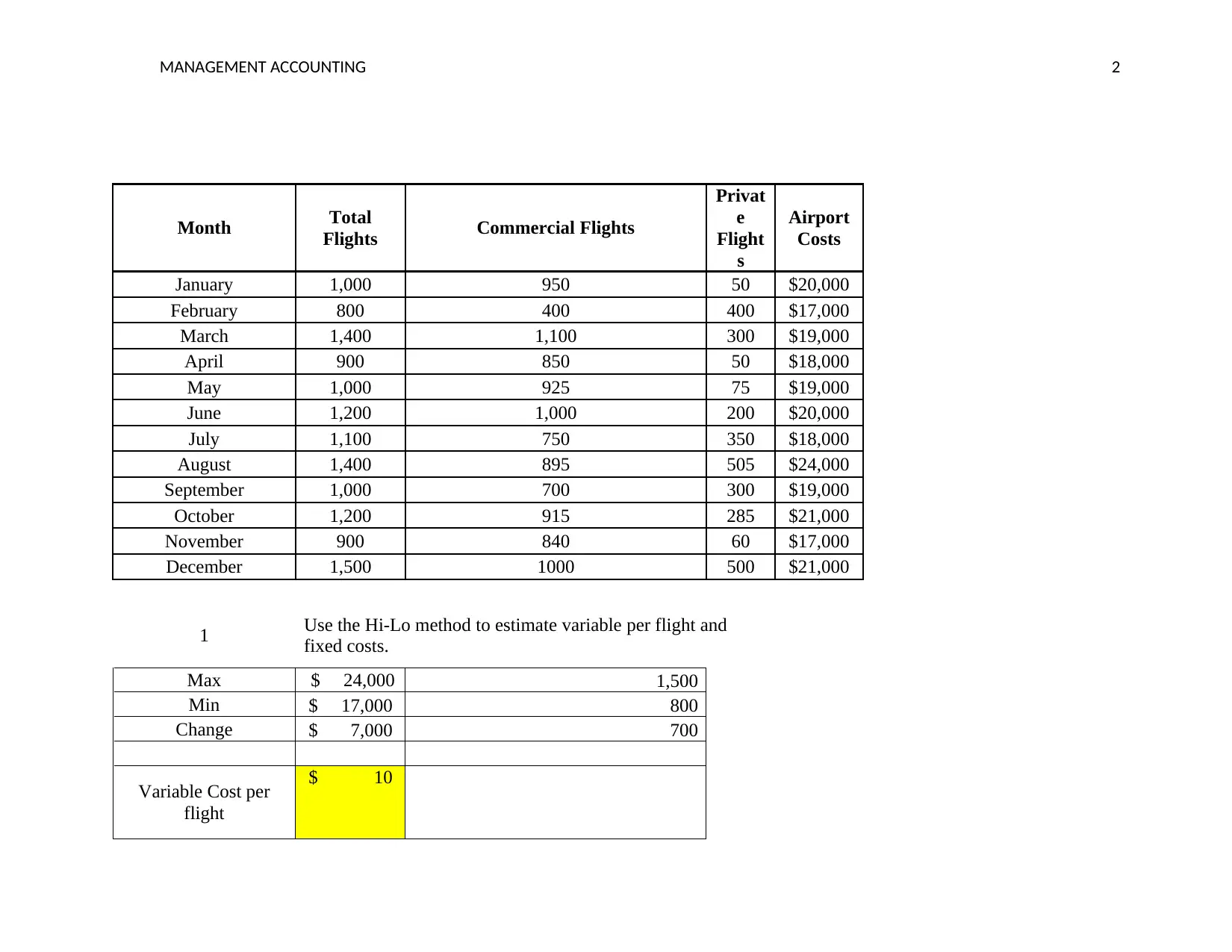

Month Total

Flights Commercial Flights

Privat

e

Flight

s

Airport

Costs

January 1,000 950 50 $20,000

February 800 400 400 $17,000

March 1,400 1,100 300 $19,000

April 900 850 50 $18,000

May 1,000 925 75 $19,000

June 1,200 1,000 200 $20,000

July 1,100 750 350 $18,000

August 1,400 895 505 $24,000

September 1,000 700 300 $19,000

October 1,200 915 285 $21,000

November 900 840 60 $17,000

December 1,500 1000 500 $21,000

1 Use the Hi-Lo method to estimate variable per flight and

fixed costs.

Max $ 24,000 1,500

Min $ 17,000 800

Change $ 7,000 700

Variable Cost per

flight

$ 10

Month Total

Flights Commercial Flights

Privat

e

Flight

s

Airport

Costs

January 1,000 950 50 $20,000

February 800 400 400 $17,000

March 1,400 1,100 300 $19,000

April 900 850 50 $18,000

May 1,000 925 75 $19,000

June 1,200 1,000 200 $20,000

July 1,100 750 350 $18,000

August 1,400 895 505 $24,000

September 1,000 700 300 $19,000

October 1,200 915 285 $21,000

November 900 840 60 $17,000

December 1,500 1000 500 $21,000

1 Use the Hi-Lo method to estimate variable per flight and

fixed costs.

Max $ 24,000 1,500

Min $ 17,000 800

Change $ 7,000 700

Variable Cost per

flight

$ 10

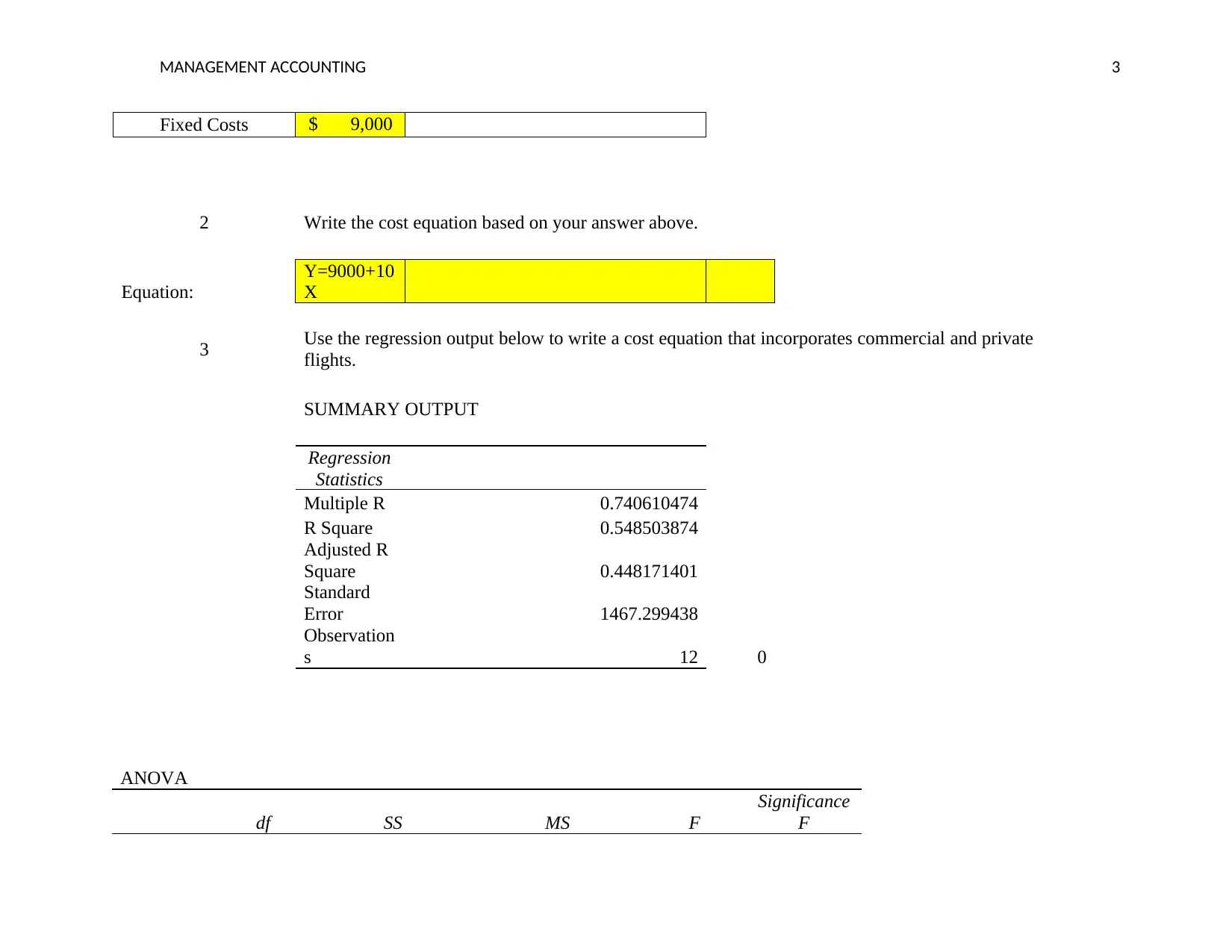

MANAGEMENT ACCOUNTING 3

Fixed Costs $ 9,000

2 Write the cost equation based on your answer above.

Equation:

Y=9000+10

X

3 Use the regression output below to write a cost equation that incorporates commercial and private

flights.

SUMMARY OUTPUT

Regression

Statistics

Multiple R 0.740610474

R Square 0.548503874

Adjusted R

Square 0.448171401

Standard

Error 1467.299438

Observation

s 12 0

ANOVA

df SS MS F

Significance

F

Fixed Costs $ 9,000

2 Write the cost equation based on your answer above.

Equation:

Y=9000+10

X

3 Use the regression output below to write a cost equation that incorporates commercial and private

flights.

SUMMARY OUTPUT

Regression

Statistics

Multiple R 0.740610474

R Square 0.548503874

Adjusted R

Square 0.448171401

Standard

Error 1467.299438

Observation

s 12 0

ANOVA

df SS MS F

Significance

F

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

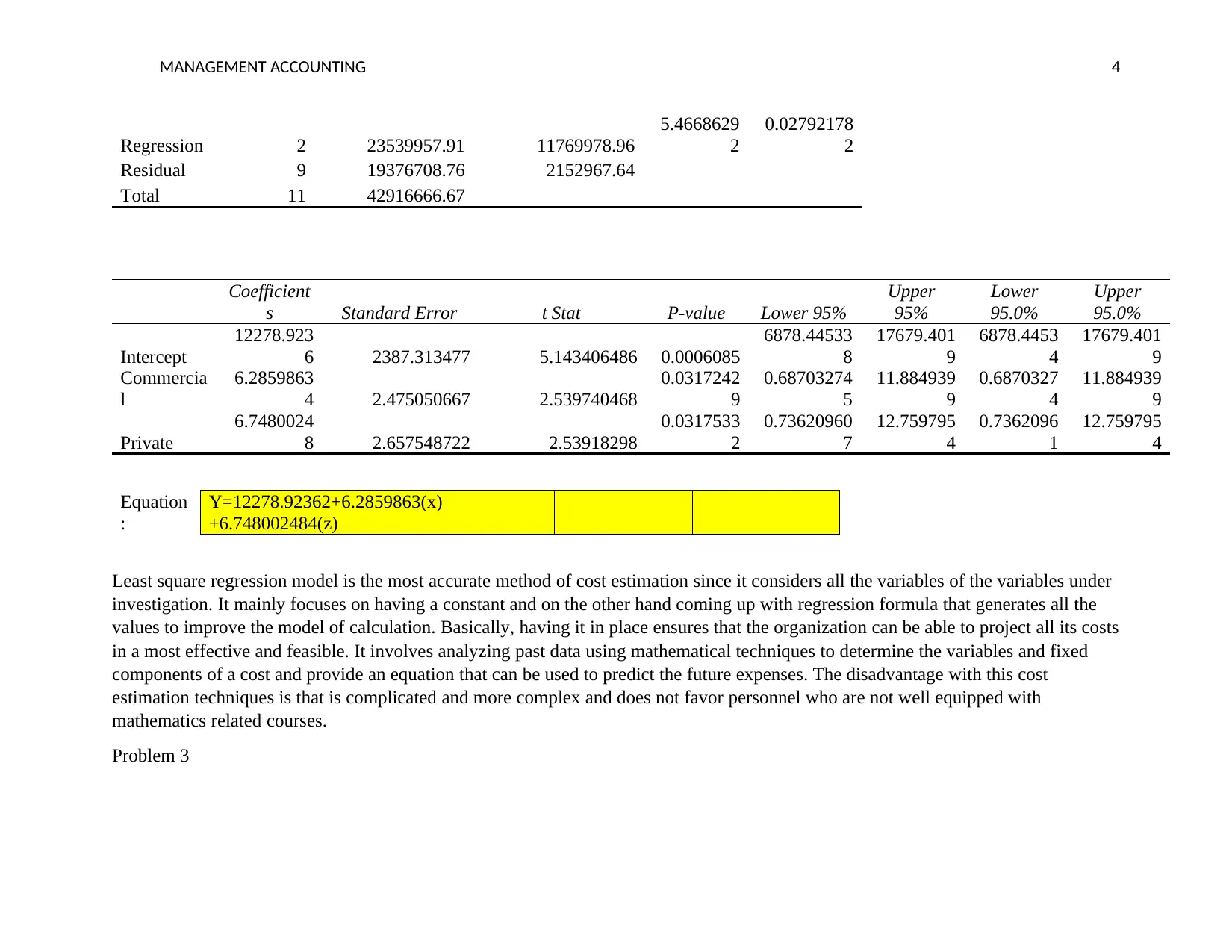

MANAGEMENT ACCOUNTING 4

Regression 2 23539957.91 11769978.96

5.4668629

2

0.02792178

2

Residual 9 19376708.76 2152967.64

Total 11 42916666.67

Coefficient

s Standard Error t Stat P-value Lower 95%

Upper

95%

Lower

95.0%

Upper

95.0%

Intercept

12278.923

6 2387.313477 5.143406486 0.0006085

6878.44533

8

17679.401

9

6878.4453

4

17679.401

9

Commercia

l

6.2859863

4 2.475050667 2.539740468

0.0317242

9

0.68703274

5

11.884939

9

0.6870327

4

11.884939

9

Private

6.7480024

8 2.657548722 2.53918298

0.0317533

2

0.73620960

7

12.759795

4

0.7362096

1

12.759795

4

Equation

:

Y=12278.92362+6.2859863(x)

+6.748002484(z)

Least square regression model is the most accurate method of cost estimation since it considers all the variables of the variables under

investigation. It mainly focuses on having a constant and on the other hand coming up with regression formula that generates all the

values to improve the model of calculation. Basically, having it in place ensures that the organization can be able to project all its costs

in a most effective and feasible. It involves analyzing past data using mathematical techniques to determine the variables and fixed

components of a cost and provide an equation that can be used to predict the future expenses. The disadvantage with this cost

estimation techniques is that is complicated and more complex and does not favor personnel who are not well equipped with

mathematics related courses.

Problem 3

Regression 2 23539957.91 11769978.96

5.4668629

2

0.02792178

2

Residual 9 19376708.76 2152967.64

Total 11 42916666.67

Coefficient

s Standard Error t Stat P-value Lower 95%

Upper

95%

Lower

95.0%

Upper

95.0%

Intercept

12278.923

6 2387.313477 5.143406486 0.0006085

6878.44533

8

17679.401

9

6878.4453

4

17679.401

9

Commercia

l

6.2859863

4 2.475050667 2.539740468

0.0317242

9

0.68703274

5

11.884939

9

0.6870327

4

11.884939

9

Private

6.7480024

8 2.657548722 2.53918298

0.0317533

2

0.73620960

7

12.759795

4

0.7362096

1

12.759795

4

Equation

:

Y=12278.92362+6.2859863(x)

+6.748002484(z)

Least square regression model is the most accurate method of cost estimation since it considers all the variables of the variables under

investigation. It mainly focuses on having a constant and on the other hand coming up with regression formula that generates all the

values to improve the model of calculation. Basically, having it in place ensures that the organization can be able to project all its costs

in a most effective and feasible. It involves analyzing past data using mathematical techniques to determine the variables and fixed

components of a cost and provide an equation that can be used to predict the future expenses. The disadvantage with this cost

estimation techniques is that is complicated and more complex and does not favor personnel who are not well equipped with

mathematics related courses.

Problem 3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

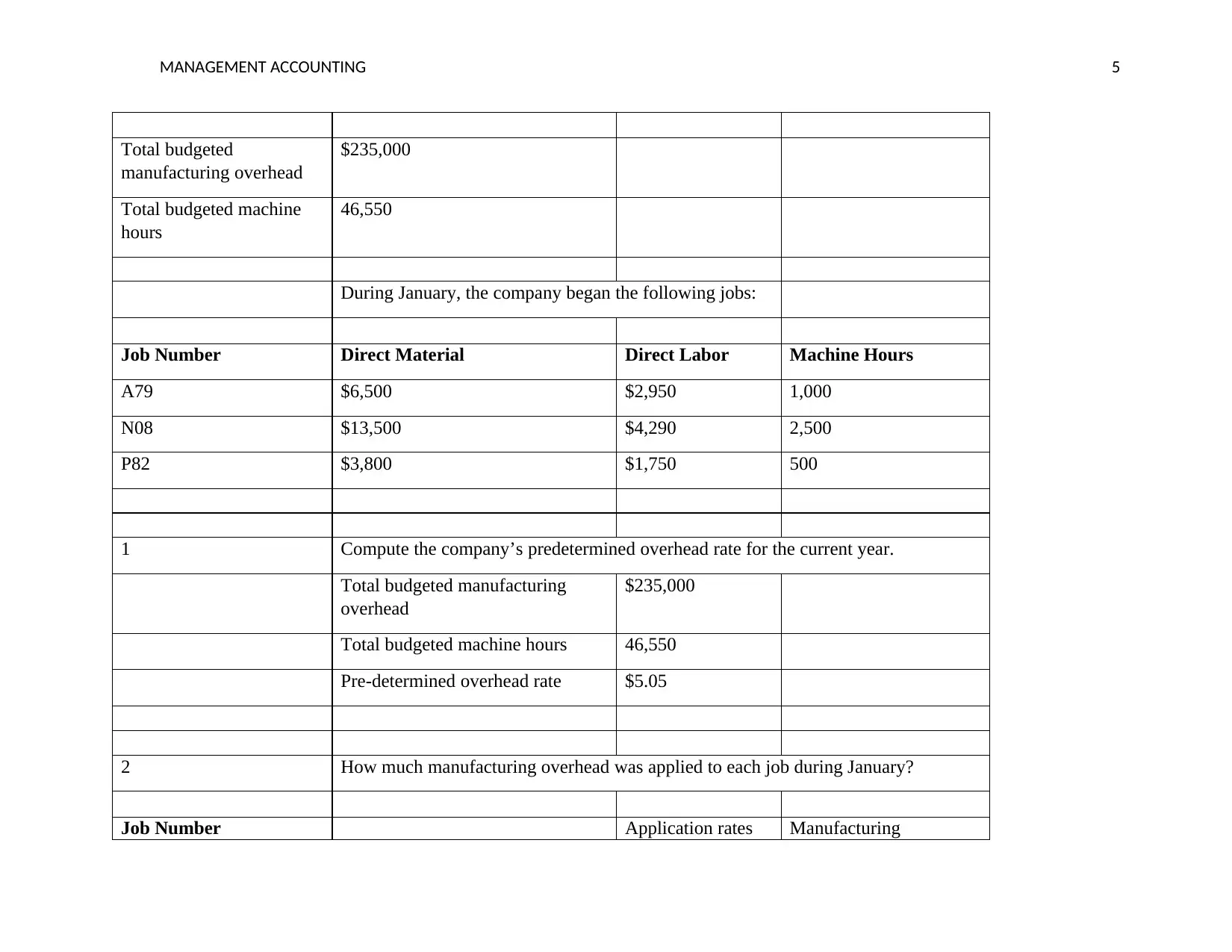

MANAGEMENT ACCOUNTING 5

Total budgeted

manufacturing overhead

$235,000

Total budgeted machine

hours

46,550

During January, the company began the following jobs:

Job Number Direct Material Direct Labor Machine Hours

A79 $6,500 $2,950 1,000

N08 $13,500 $4,290 2,500

P82 $3,800 $1,750 500

1 Compute the company’s predetermined overhead rate for the current year.

Total budgeted manufacturing

overhead

$235,000

Total budgeted machine hours 46,550

Pre-determined overhead rate $5.05

2 How much manufacturing overhead was applied to each job during January?

Job Number Application rates Manufacturing

Total budgeted

manufacturing overhead

$235,000

Total budgeted machine

hours

46,550

During January, the company began the following jobs:

Job Number Direct Material Direct Labor Machine Hours

A79 $6,500 $2,950 1,000

N08 $13,500 $4,290 2,500

P82 $3,800 $1,750 500

1 Compute the company’s predetermined overhead rate for the current year.

Total budgeted manufacturing

overhead

$235,000

Total budgeted machine hours 46,550

Pre-determined overhead rate $5.05

2 How much manufacturing overhead was applied to each job during January?

Job Number Application rates Manufacturing

MANAGEMENT ACCOUNTING 6

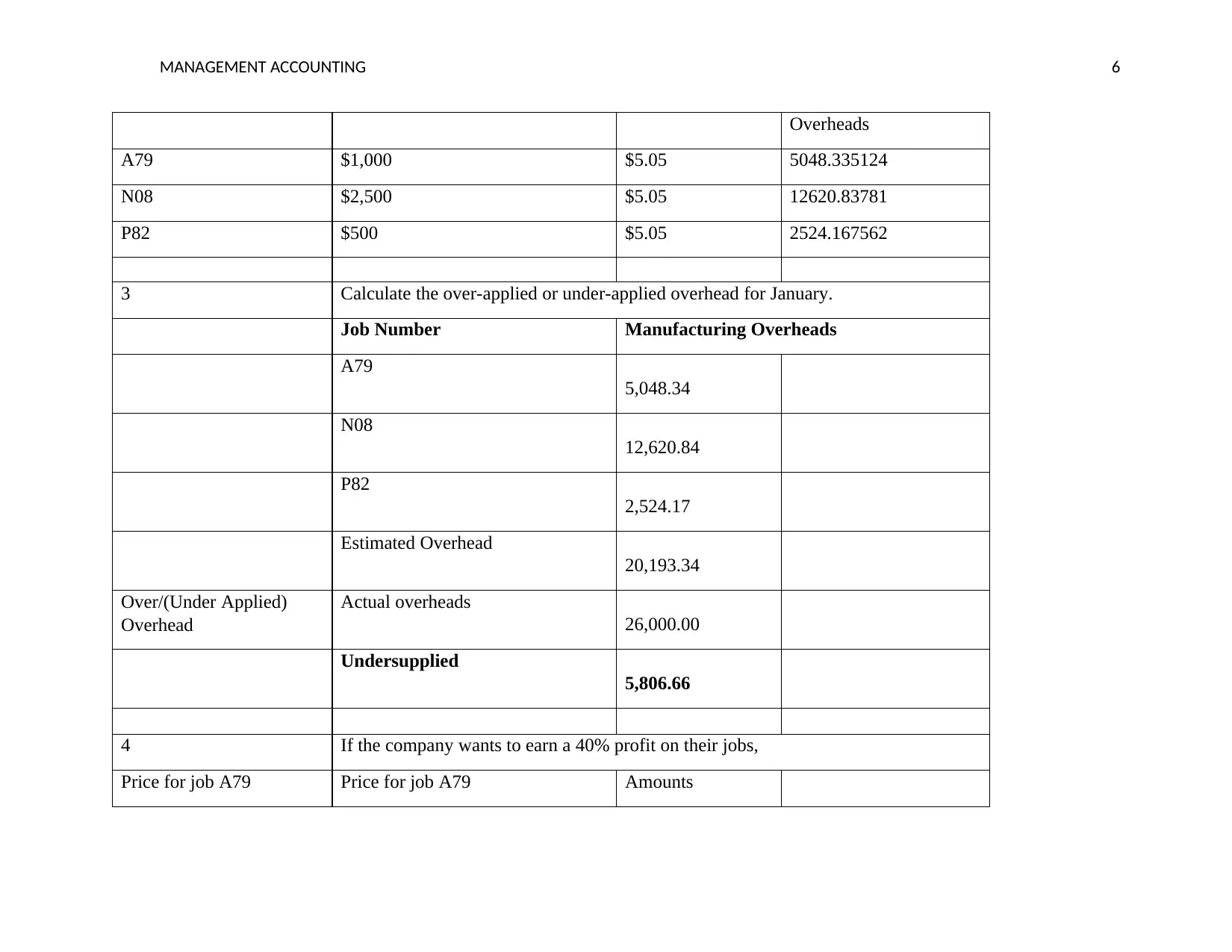

Overheads

A79 $1,000 $5.05 5048.335124

N08 $2,500 $5.05 12620.83781

P82 $500 $5.05 2524.167562

3 Calculate the over-applied or under-applied overhead for January.

Job Number Manufacturing Overheads

A79

5,048.34

N08

12,620.84

P82

2,524.17

Estimated Overhead

20,193.34

Over/(Under Applied)

Overhead

Actual overheads

26,000.00

Undersupplied

5,806.66

4 If the company wants to earn a 40% profit on their jobs,

Price for job A79 Price for job A79 Amounts

Overheads

A79 $1,000 $5.05 5048.335124

N08 $2,500 $5.05 12620.83781

P82 $500 $5.05 2524.167562

3 Calculate the over-applied or under-applied overhead for January.

Job Number Manufacturing Overheads

A79

5,048.34

N08

12,620.84

P82

2,524.17

Estimated Overhead

20,193.34

Over/(Under Applied)

Overhead

Actual overheads

26,000.00

Undersupplied

5,806.66

4 If the company wants to earn a 40% profit on their jobs,

Price for job A79 Price for job A79 Amounts

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

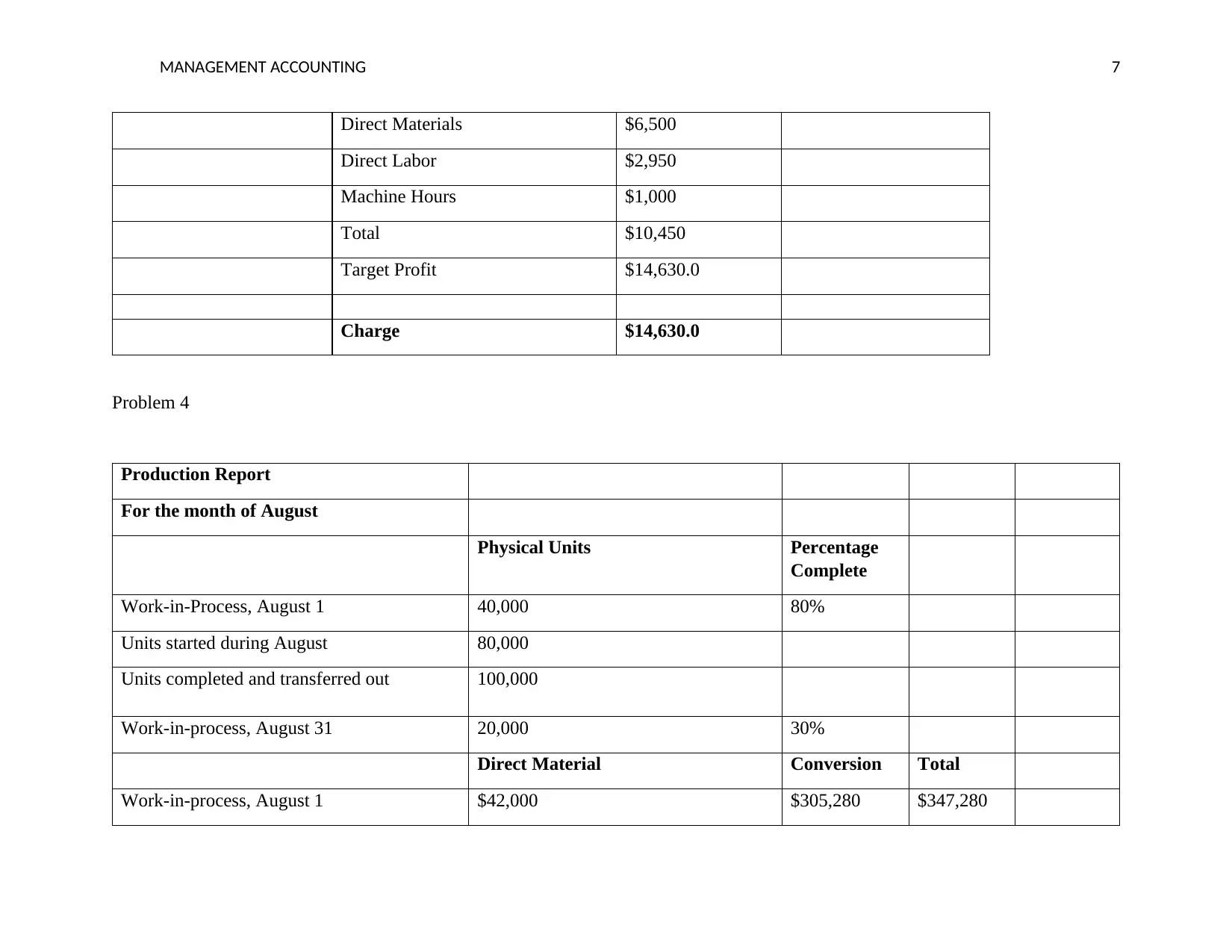

MANAGEMENT ACCOUNTING 7

Direct Materials $6,500

Direct Labor $2,950

Machine Hours $1,000

Total $10,450

Target Profit $14,630.0

Charge $14,630.0

Problem 4

Production Report

For the month of August

Physical Units Percentage

Complete

Work-in-Process, August 1 40,000 80%

Units started during August 80,000

Units completed and transferred out 100,000

Work-in-process, August 31 20,000 30%

Direct Material Conversion Total

Work-in-process, August 1 $42,000 $305,280 $347,280

Direct Materials $6,500

Direct Labor $2,950

Machine Hours $1,000

Total $10,450

Target Profit $14,630.0

Charge $14,630.0

Problem 4

Production Report

For the month of August

Physical Units Percentage

Complete

Work-in-Process, August 1 40,000 80%

Units started during August 80,000

Units completed and transferred out 100,000

Work-in-process, August 31 20,000 30%

Direct Material Conversion Total

Work-in-process, August 1 $42,000 $305,280 $347,280

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MANAGEMENT ACCOUNTING 8

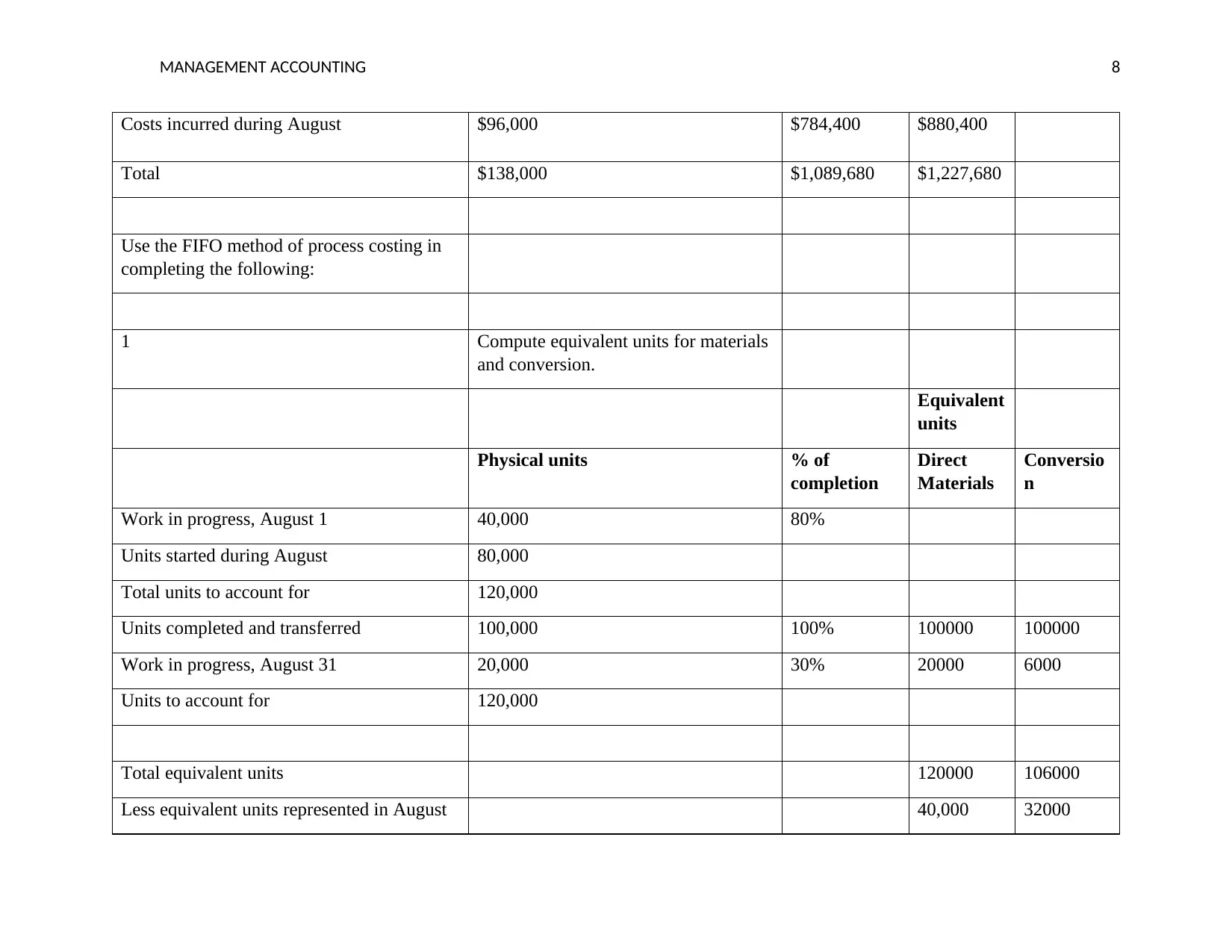

Costs incurred during August $96,000 $784,400 $880,400

Total $138,000 $1,089,680 $1,227,680

Use the FIFO method of process costing in

completing the following:

1 Compute equivalent units for materials

and conversion.

Equivalent

units

Physical units % of

completion

Direct

Materials

Conversio

n

Work in progress, August 1 40,000 80%

Units started during August 80,000

Total units to account for 120,000

Units completed and transferred 100,000 100% 100000 100000

Work in progress, August 31 20,000 30% 20000 6000

Units to account for 120,000

Total equivalent units 120000 106000

Less equivalent units represented in August 40,000 32000

Costs incurred during August $96,000 $784,400 $880,400

Total $138,000 $1,089,680 $1,227,680

Use the FIFO method of process costing in

completing the following:

1 Compute equivalent units for materials

and conversion.

Equivalent

units

Physical units % of

completion

Direct

Materials

Conversio

n

Work in progress, August 1 40,000 80%

Units started during August 80,000

Total units to account for 120,000

Units completed and transferred 100,000 100% 100000 100000

Work in progress, August 31 20,000 30% 20000 6000

Units to account for 120,000

Total equivalent units 120000 106000

Less equivalent units represented in August 40,000 32000

MANAGEMENT ACCOUNTING 9

1 WIP

New equivalent units for August 80,000 74000

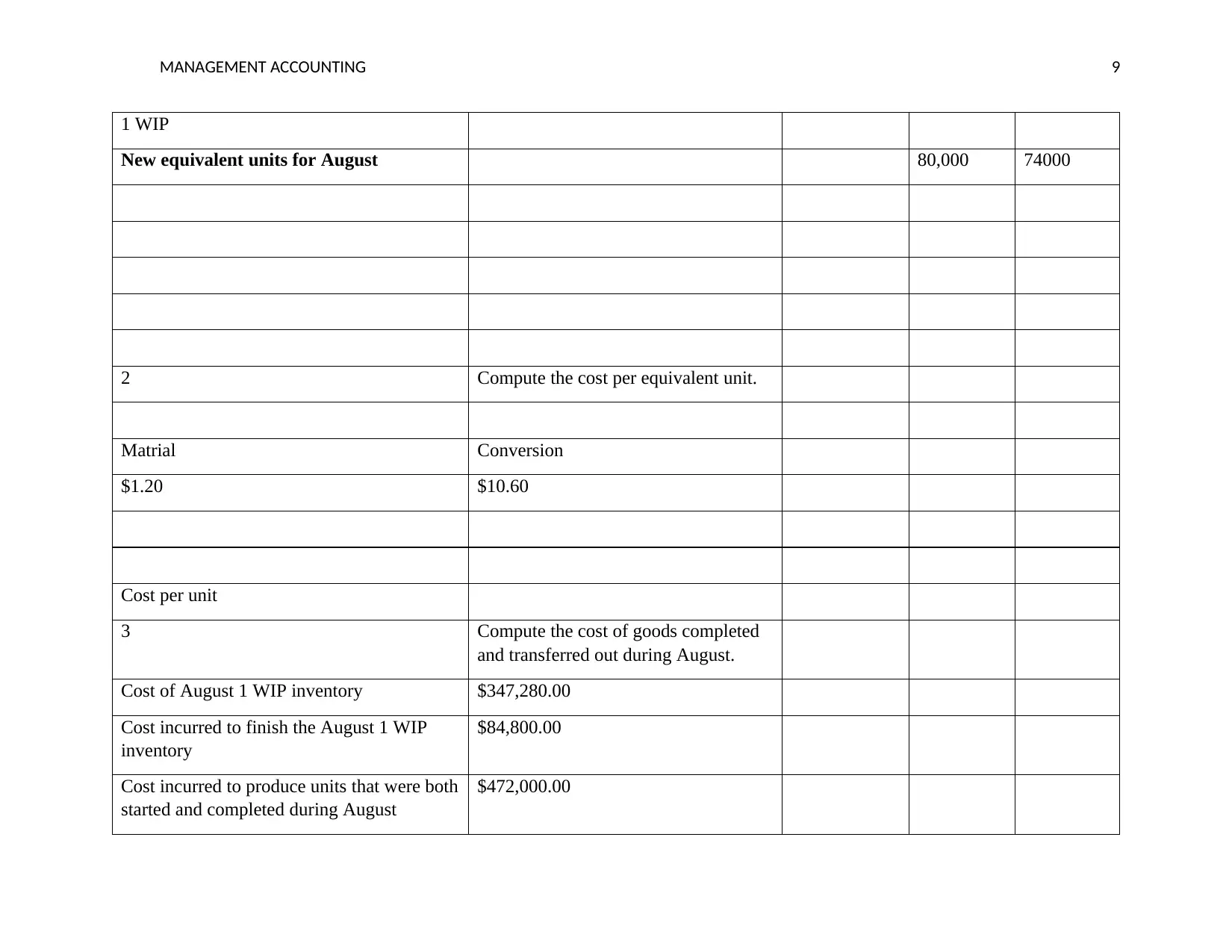

2 Compute the cost per equivalent unit.

Matrial Conversion

$1.20 $10.60

Cost per unit

3 Compute the cost of goods completed

and transferred out during August.

Cost of August 1 WIP inventory $347,280.00

Cost incurred to finish the August 1 WIP

inventory

$84,800.00

Cost incurred to produce units that were both

started and completed during August

$472,000.00

1 WIP

New equivalent units for August 80,000 74000

2 Compute the cost per equivalent unit.

Matrial Conversion

$1.20 $10.60

Cost per unit

3 Compute the cost of goods completed

and transferred out during August.

Cost of August 1 WIP inventory $347,280.00

Cost incurred to finish the August 1 WIP

inventory

$84,800.00

Cost incurred to produce units that were both

started and completed during August

$472,000.00

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

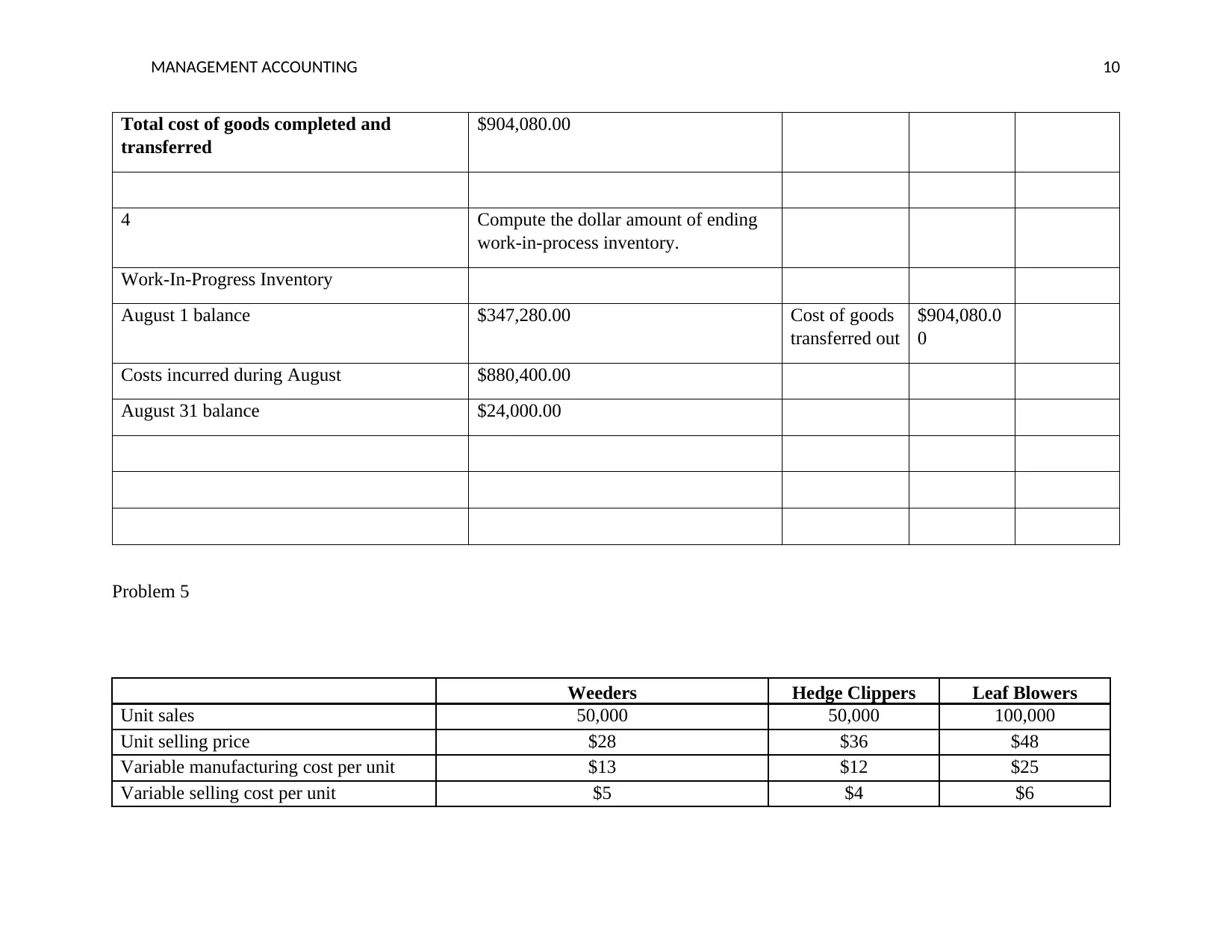

MANAGEMENT ACCOUNTING 10

Total cost of goods completed and

transferred

$904,080.00

4 Compute the dollar amount of ending

work-in-process inventory.

Work-In-Progress Inventory

August 1 balance $347,280.00 Cost of goods

transferred out

$904,080.0

0

Costs incurred during August $880,400.00

August 31 balance $24,000.00

Problem 5

Weeders Hedge Clippers Leaf Blowers

Unit sales 50,000 50,000 100,000

Unit selling price $28 $36 $48

Variable manufacturing cost per unit $13 $12 $25

Variable selling cost per unit $5 $4 $6

Total cost of goods completed and

transferred

$904,080.00

4 Compute the dollar amount of ending

work-in-process inventory.

Work-In-Progress Inventory

August 1 balance $347,280.00 Cost of goods

transferred out

$904,080.0

0

Costs incurred during August $880,400.00

August 31 balance $24,000.00

Problem 5

Weeders Hedge Clippers Leaf Blowers

Unit sales 50,000 50,000 100,000

Unit selling price $28 $36 $48

Variable manufacturing cost per unit $13 $12 $25

Variable selling cost per unit $5 $4 $6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MANAGEMENT ACCOUNTING 11

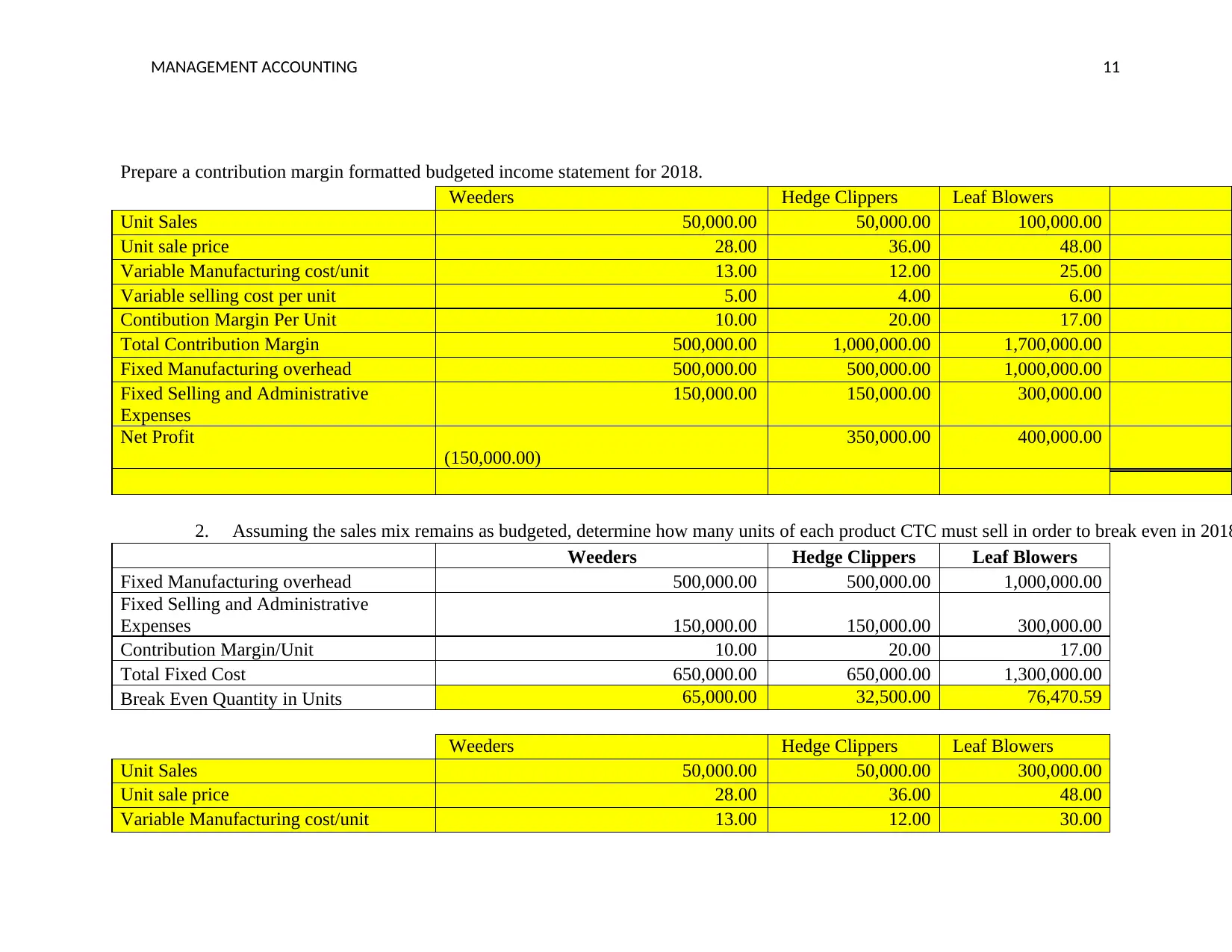

Prepare a contribution margin formatted budgeted income statement for 2018.

Weeders Hedge Clippers Leaf Blowers

Unit Sales 50,000.00 50,000.00 100,000.00

Unit sale price 28.00 36.00 48.00

Variable Manufacturing cost/unit 13.00 12.00 25.00

Variable selling cost per unit 5.00 4.00 6.00

Contibution Margin Per Unit 10.00 20.00 17.00

Total Contribution Margin 500,000.00 1,000,000.00 1,700,000.00

Fixed Manufacturing overhead 500,000.00 500,000.00 1,000,000.00

Fixed Selling and Administrative

Expenses

150,000.00 150,000.00 300,000.00

Net Profit

(150,000.00)

350,000.00 400,000.00

2. Assuming the sales mix remains as budgeted, determine how many units of each product CTC must sell in order to break even in 2018

Weeders Hedge Clippers Leaf Blowers

Fixed Manufacturing overhead 500,000.00 500,000.00 1,000,000.00

Fixed Selling and Administrative

Expenses 150,000.00 150,000.00 300,000.00

Contribution Margin/Unit 10.00 20.00 17.00

Total Fixed Cost 650,000.00 650,000.00 1,300,000.00

Break Even Quantity in Units 65,000.00 32,500.00 76,470.59

Weeders Hedge Clippers Leaf Blowers

Unit Sales 50,000.00 50,000.00 300,000.00

Unit sale price 28.00 36.00 48.00

Variable Manufacturing cost/unit 13.00 12.00 30.00

Prepare a contribution margin formatted budgeted income statement for 2018.

Weeders Hedge Clippers Leaf Blowers

Unit Sales 50,000.00 50,000.00 100,000.00

Unit sale price 28.00 36.00 48.00

Variable Manufacturing cost/unit 13.00 12.00 25.00

Variable selling cost per unit 5.00 4.00 6.00

Contibution Margin Per Unit 10.00 20.00 17.00

Total Contribution Margin 500,000.00 1,000,000.00 1,700,000.00

Fixed Manufacturing overhead 500,000.00 500,000.00 1,000,000.00

Fixed Selling and Administrative

Expenses

150,000.00 150,000.00 300,000.00

Net Profit

(150,000.00)

350,000.00 400,000.00

2. Assuming the sales mix remains as budgeted, determine how many units of each product CTC must sell in order to break even in 2018

Weeders Hedge Clippers Leaf Blowers

Fixed Manufacturing overhead 500,000.00 500,000.00 1,000,000.00

Fixed Selling and Administrative

Expenses 150,000.00 150,000.00 300,000.00

Contribution Margin/Unit 10.00 20.00 17.00

Total Fixed Cost 650,000.00 650,000.00 1,300,000.00

Break Even Quantity in Units 65,000.00 32,500.00 76,470.59

Weeders Hedge Clippers Leaf Blowers

Unit Sales 50,000.00 50,000.00 300,000.00

Unit sale price 28.00 36.00 48.00

Variable Manufacturing cost/unit 13.00 12.00 30.00

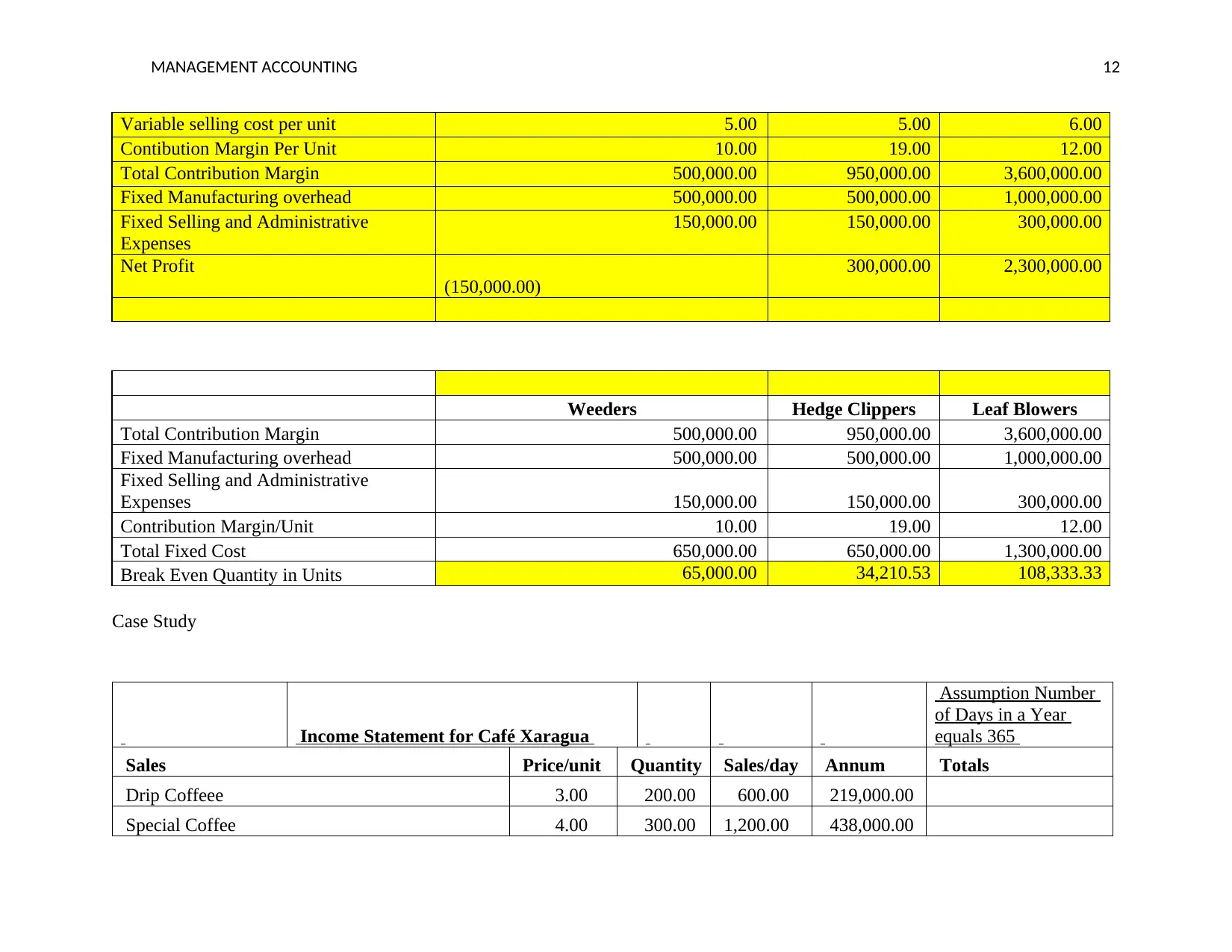

MANAGEMENT ACCOUNTING 12

Variable selling cost per unit 5.00 5.00 6.00

Contibution Margin Per Unit 10.00 19.00 12.00

Total Contribution Margin 500,000.00 950,000.00 3,600,000.00

Fixed Manufacturing overhead 500,000.00 500,000.00 1,000,000.00

Fixed Selling and Administrative

Expenses

150,000.00 150,000.00 300,000.00

Net Profit

(150,000.00)

300,000.00 2,300,000.00

Weeders Hedge Clippers Leaf Blowers

Total Contribution Margin 500,000.00 950,000.00 3,600,000.00

Fixed Manufacturing overhead 500,000.00 500,000.00 1,000,000.00

Fixed Selling and Administrative

Expenses 150,000.00 150,000.00 300,000.00

Contribution Margin/Unit 10.00 19.00 12.00

Total Fixed Cost 650,000.00 650,000.00 1,300,000.00

Break Even Quantity in Units 65,000.00 34,210.53 108,333.33

Case Study

Income Statement for Café Xaragua

Assumption Number

of Days in a Year

equals 365

Sales Price/unit Quantity Sales/day Annum Totals

Drip Coffeee 3.00 200.00 600.00 219,000.00

Special Coffee 4.00 300.00 1,200.00 438,000.00

Variable selling cost per unit 5.00 5.00 6.00

Contibution Margin Per Unit 10.00 19.00 12.00

Total Contribution Margin 500,000.00 950,000.00 3,600,000.00

Fixed Manufacturing overhead 500,000.00 500,000.00 1,000,000.00

Fixed Selling and Administrative

Expenses

150,000.00 150,000.00 300,000.00

Net Profit

(150,000.00)

300,000.00 2,300,000.00

Weeders Hedge Clippers Leaf Blowers

Total Contribution Margin 500,000.00 950,000.00 3,600,000.00

Fixed Manufacturing overhead 500,000.00 500,000.00 1,000,000.00

Fixed Selling and Administrative

Expenses 150,000.00 150,000.00 300,000.00

Contribution Margin/Unit 10.00 19.00 12.00

Total Fixed Cost 650,000.00 650,000.00 1,300,000.00

Break Even Quantity in Units 65,000.00 34,210.53 108,333.33

Case Study

Income Statement for Café Xaragua

Assumption Number

of Days in a Year

equals 365

Sales Price/unit Quantity Sales/day Annum Totals

Drip Coffeee 3.00 200.00 600.00 219,000.00

Special Coffee 4.00 300.00 1,200.00 438,000.00

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.