Management Accounting Report on Costing, Budgeting, and Performance

VerifiedAdded on 2020/09/08

|22

|4577

|50

Report

AI Summary

This report delves into the core principles of management accounting, providing a detailed analysis of costing and budgeting techniques. It begins by classifying costs into fixed, variable, and semi-variable categories, followed by an examination of direct and indirect costs, and functional cost classifications. The report then computes total costs and cost per unit at various production levels, supported by graphical presentations. Inventory valuation methods, including FIFO, LIFO, and average cost, are thoroughly examined, with COGS reports prepared for each method. Critical success factors and key performance indicators (KPIs) are discussed, along with suggestions for cost reduction and value enhancement. The report also covers budgeting, including sales, production, raw materials, labor, and overhead budgets, culminating in a cash budget and profit variance analysis. Finally, recommendations are provided to improve financial performance and aid in informed decision-making within a business context.

Management accounting

costing and budgeting

costing and budgeting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

Q1................................................................................................................................................1

a) Classify costs into fixed, variable and semi-variable costs.....................................................1

b) Other ways of classifying costs..............................................................................................2

Q2................................................................................................................................................3

a) Compute the total cost and cost per unit at different level of unit..........................................3

b) Analyse cost using graphical presentation..............................................................................3

Q3................................................................................................................................................5

1. FIFO........................................................................................................................................5

2. LIFO........................................................................................................................................5

3. Average cost............................................................................................................................5

Q4 Prepare COGS report for FIFO, LIFO and Average cost.....................................................6

Q5................................................................................................................................................7

a) Two critical success factors and KPI......................................................................................7

b) Suggestion...............................................................................................................................8

Cost reduction.............................................................................................................................8

Value and quality enhancement..................................................................................................9

Q6................................................................................................................................................9

a) Describe budget.......................................................................................................................9

b) Purpose of budget...................................................................................................................9

c) Methods of budget................................................................................................................10

Q7..............................................................................................................................................10

a) Sales budget..........................................................................................................................10

b) Production budget.................................................................................................................11

c) Raw material budget.............................................................................................................11

d) Labour budget.......................................................................................................................12

e) Total overhead budget...........................................................................................................12

Q8 Cash budget.........................................................................................................................12

Q9..............................................................................................................................................13

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

Q1................................................................................................................................................1

a) Classify costs into fixed, variable and semi-variable costs.....................................................1

b) Other ways of classifying costs..............................................................................................2

Q2................................................................................................................................................3

a) Compute the total cost and cost per unit at different level of unit..........................................3

b) Analyse cost using graphical presentation..............................................................................3

Q3................................................................................................................................................5

1. FIFO........................................................................................................................................5

2. LIFO........................................................................................................................................5

3. Average cost............................................................................................................................5

Q4 Prepare COGS report for FIFO, LIFO and Average cost.....................................................6

Q5................................................................................................................................................7

a) Two critical success factors and KPI......................................................................................7

b) Suggestion...............................................................................................................................8

Cost reduction.............................................................................................................................8

Value and quality enhancement..................................................................................................9

Q6................................................................................................................................................9

a) Describe budget.......................................................................................................................9

b) Purpose of budget...................................................................................................................9

c) Methods of budget................................................................................................................10

Q7..............................................................................................................................................10

a) Sales budget..........................................................................................................................10

b) Production budget.................................................................................................................11

c) Raw material budget.............................................................................................................11

d) Labour budget.......................................................................................................................12

e) Total overhead budget...........................................................................................................12

Q8 Cash budget.........................................................................................................................12

Q9..............................................................................................................................................13

a) Budget profit.........................................................................................................................13

b) Actual profit .........................................................................................................................14

c) Material and labour sub variances........................................................................................15

d) Operating statement for reconciling budgeted and actual profit...........................................15

Q10 Recommendation...............................................................................................................15

CONCLUSION..............................................................................................................................16

REFERENCES..............................................................................................................................17

b) Actual profit .........................................................................................................................14

c) Material and labour sub variances........................................................................................15

d) Operating statement for reconciling budgeted and actual profit...........................................15

Q10 Recommendation...............................................................................................................15

CONCLUSION..............................................................................................................................16

REFERENCES..............................................................................................................................17

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Index of Tables

Table 1: Classification of costs........................................................................................................1

Table 2: Cost per unit and total cost................................................................................................3

Table 3: Closing stock of FIFO.......................................................................................................5

Table 4: Closing stock of LIFO.......................................................................................................5

Table 5: Closing inventory of Average cost....................................................................................5

Table 6: COGS report of FIFO method...........................................................................................6

Table 7: COGS report of LIFO method...........................................................................................6

Table 8: COGS report of Average cost method...............................................................................6

Table 9: Sales budget.....................................................................................................................10

Table 10: Production budget..........................................................................................................11

Table 11: Raw material budget......................................................................................................11

Table 12: Labour budget................................................................................................................12

Table 13: Overhead budget............................................................................................................12

Table 14: Cash budget...................................................................................................................12

Table 15: Budgeted Profit..............................................................................................................13

Table 16: Actual profit...................................................................................................................14

Table 17: Reconciliation statement................................................................................................15

Illustration Index

Illustration 1: Material and labour variances.................................................................................15

Table 1: Classification of costs........................................................................................................1

Table 2: Cost per unit and total cost................................................................................................3

Table 3: Closing stock of FIFO.......................................................................................................5

Table 4: Closing stock of LIFO.......................................................................................................5

Table 5: Closing inventory of Average cost....................................................................................5

Table 6: COGS report of FIFO method...........................................................................................6

Table 7: COGS report of LIFO method...........................................................................................6

Table 8: COGS report of Average cost method...............................................................................6

Table 9: Sales budget.....................................................................................................................10

Table 10: Production budget..........................................................................................................11

Table 11: Raw material budget......................................................................................................11

Table 12: Labour budget................................................................................................................12

Table 13: Overhead budget............................................................................................................12

Table 14: Cash budget...................................................................................................................12

Table 15: Budgeted Profit..............................................................................................................13

Table 16: Actual profit...................................................................................................................14

Table 17: Reconciliation statement................................................................................................15

Illustration Index

Illustration 1: Material and labour variances.................................................................................15

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTRODUCTION

Role of management accounting increases with the increasing external market difficulties

located in the external business environment. This project is about using several techniques if

budgeting in identifying all the problems incurred in business along with the proper management

of financial resources. This report also emphasises on different kinds of costs incurred in an

entity.

TASK 1

Q1

a) Classify costs into fixed, variable and semi-variable costs

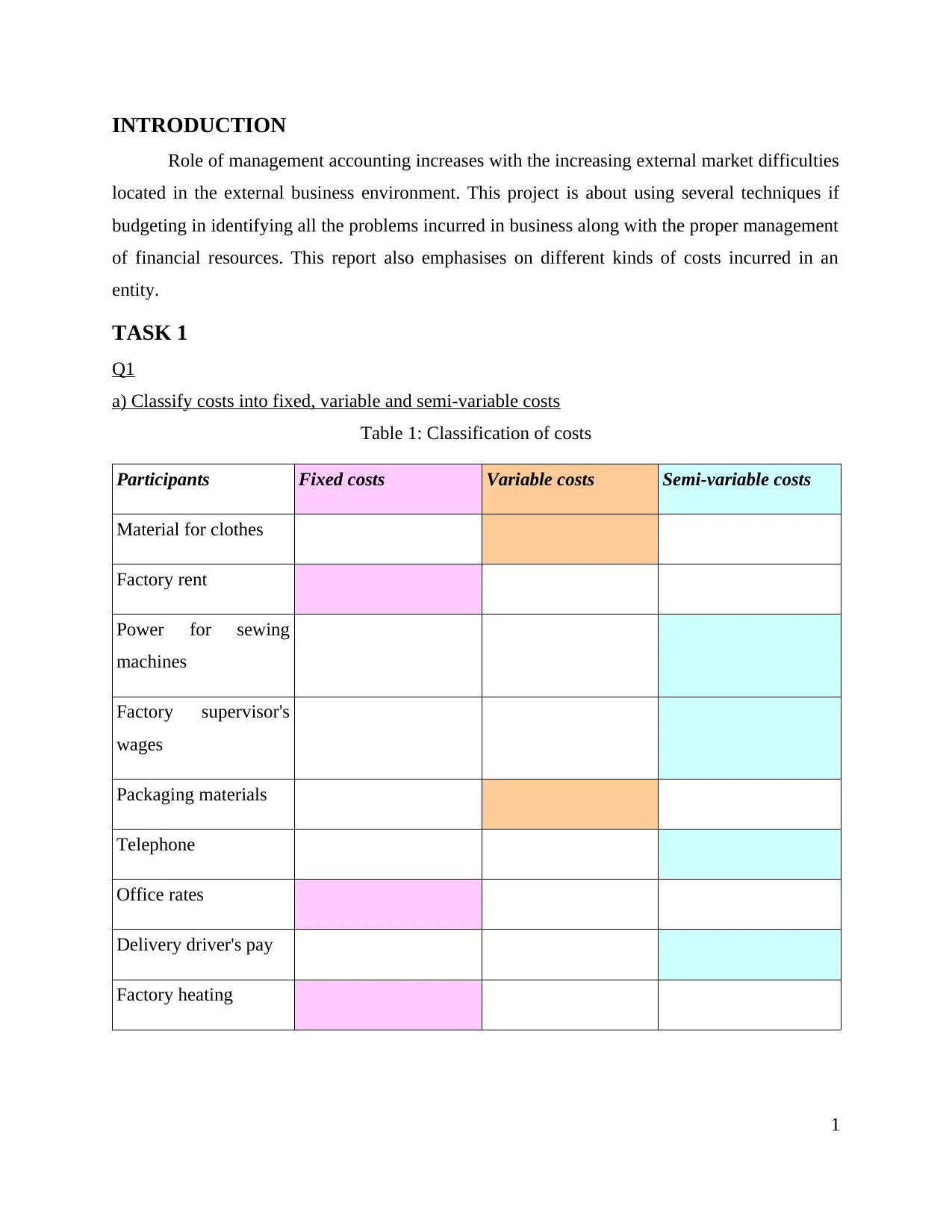

Table 1: Classification of costs

Participants Fixed costs Variable costs Semi-variable costs

Material for clothes

Factory rent

Power for sewing

machines

Factory supervisor's

wages

Packaging materials

Telephone

Office rates

Delivery driver's pay

Factory heating

1

Role of management accounting increases with the increasing external market difficulties

located in the external business environment. This project is about using several techniques if

budgeting in identifying all the problems incurred in business along with the proper management

of financial resources. This report also emphasises on different kinds of costs incurred in an

entity.

TASK 1

Q1

a) Classify costs into fixed, variable and semi-variable costs

Table 1: Classification of costs

Participants Fixed costs Variable costs Semi-variable costs

Material for clothes

Factory rent

Power for sewing

machines

Factory supervisor's

wages

Packaging materials

Telephone

Office rates

Delivery driver's pay

Factory heating

1

In the above classification of costs of various expenses incurred in the business in several

criteria such as fixed cost, variable cost and semi variable costs. Three colours are taken in order

to reflect the three different costs (Management accounting, 2017). Above classification of cots

is shows like a matrix in which an entity will easily identify which expenses falls under which

particular category in order to help an entity in reducing the current cost incurred in the business.

Performance of the business is regarded as one of the important aspects to be considered by an

enterprise owner in uplifting their existing business conditions (Leite, Fernandes and Leite,

2016). It can be seen from the classification matrix that majority of costs incurred in the Smart

looks entity falls under the category of semi variable costs which ave constituent of both costs

such as variable as well as fixed costs incurred in the business. Semi variable costs is widely

incurred in the corporation but due to its wrong classification an employer is not able to identify

its nature and categorise them as fixed costs or variable costs which in turn induces the overall

costs incurred in the business.

b) Other ways of classifying costs

Direct costs- It is that type of costs incurred in the business which is directly attributable

to a product such as raw material used in the making of a particular product. Expenses

incurred by an enterprise owner which is related directly with the manufacturing of a

single product. Direct costs of a singular product can be easily traced out by the

management as this falls under the nature of costs.

Indirect costs- Another costs incurred in a firm is opposite version of the above mention

costs in which the costs is indirectly associated with the making of a product. Lubricating

oil used in improving the condition of machine helps in manufacturing of a product.

These costs are considered as indirect as there is no close relationship among this

particular costs with the manufactured product in the business enterprise.

Function costs- Costs are also segregated in an entity according to various business

function such as productions, finance, human resource and marketing, selling and

distribution and information technology. All these functions are performed by an

employee in achieving desired aims and targets in the business concern (Leite, Fernandes

and Leite, 2016). Sole responsibility of business manager is to emphasise on each and

every factors included in an entity as this helps in achieving desired aims and targets

2

criteria such as fixed cost, variable cost and semi variable costs. Three colours are taken in order

to reflect the three different costs (Management accounting, 2017). Above classification of cots

is shows like a matrix in which an entity will easily identify which expenses falls under which

particular category in order to help an entity in reducing the current cost incurred in the business.

Performance of the business is regarded as one of the important aspects to be considered by an

enterprise owner in uplifting their existing business conditions (Leite, Fernandes and Leite,

2016). It can be seen from the classification matrix that majority of costs incurred in the Smart

looks entity falls under the category of semi variable costs which ave constituent of both costs

such as variable as well as fixed costs incurred in the business. Semi variable costs is widely

incurred in the corporation but due to its wrong classification an employer is not able to identify

its nature and categorise them as fixed costs or variable costs which in turn induces the overall

costs incurred in the business.

b) Other ways of classifying costs

Direct costs- It is that type of costs incurred in the business which is directly attributable

to a product such as raw material used in the making of a particular product. Expenses

incurred by an enterprise owner which is related directly with the manufacturing of a

single product. Direct costs of a singular product can be easily traced out by the

management as this falls under the nature of costs.

Indirect costs- Another costs incurred in a firm is opposite version of the above mention

costs in which the costs is indirectly associated with the making of a product. Lubricating

oil used in improving the condition of machine helps in manufacturing of a product.

These costs are considered as indirect as there is no close relationship among this

particular costs with the manufactured product in the business enterprise.

Function costs- Costs are also segregated in an entity according to various business

function such as productions, finance, human resource and marketing, selling and

distribution and information technology. All these functions are performed by an

employee in achieving desired aims and targets in the business concern (Leite, Fernandes

and Leite, 2016). Sole responsibility of business manager is to emphasise on each and

every factors included in an entity as this helps in achieving desired aims and targets

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

framed by an enterprise owner. It includes products costs which is regarded as that type

of costs which helps in producing or manufacturing single product in an entity.

Production costs incurred in the business such as cost of raw material. Raw material is

regarded as basic factor of costs included in the business. Marketing costs involved in an

entity includes cost of advertising incurred in the business for creating market awareness

about al the products or services offered by an employer to all the clients located in the

external business environment. Information technology costs is regarded as the important

costs as communicating important information from one end to another is essential for an

entity in achieving all aims and targets within a given span of time. Role of business gets

increases with the passage of time as all types of costs are identified by the management

in initial stage in order to target all important type of costs with higher value which an

enterprise tries to minimise it within a given span of time.

Q2

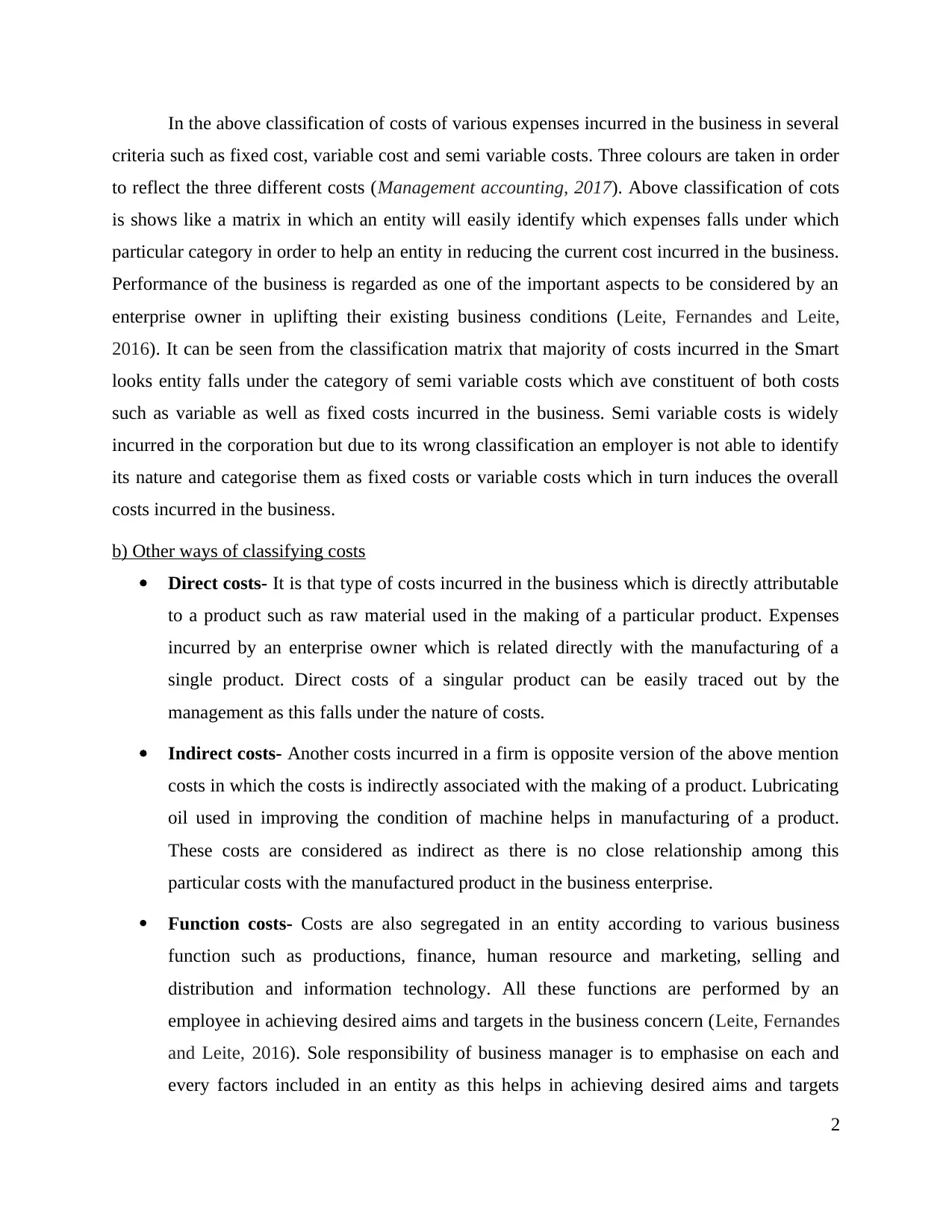

a) Compute the total cost and cost per unit at different level of unit

Table 2: Cost per unit and total cost

Particulars Cost per unit 15000 units 20000 units 25000 units

Material £5 £75000 £100000 £125000

Labour £6 £90000 £120000 £150000

Fixed costs £50000 £50000 £50000 £50000

Total costs £215000 £270000 £325000

Cost per unit £14.33 £13.5 £13

3

of costs which helps in producing or manufacturing single product in an entity.

Production costs incurred in the business such as cost of raw material. Raw material is

regarded as basic factor of costs included in the business. Marketing costs involved in an

entity includes cost of advertising incurred in the business for creating market awareness

about al the products or services offered by an employer to all the clients located in the

external business environment. Information technology costs is regarded as the important

costs as communicating important information from one end to another is essential for an

entity in achieving all aims and targets within a given span of time. Role of business gets

increases with the passage of time as all types of costs are identified by the management

in initial stage in order to target all important type of costs with higher value which an

enterprise tries to minimise it within a given span of time.

Q2

a) Compute the total cost and cost per unit at different level of unit

Table 2: Cost per unit and total cost

Particulars Cost per unit 15000 units 20000 units 25000 units

Material £5 £75000 £100000 £125000

Labour £6 £90000 £120000 £150000

Fixed costs £50000 £50000 £50000 £50000

Total costs £215000 £270000 £325000

Cost per unit £14.33 £13.5 £13

3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

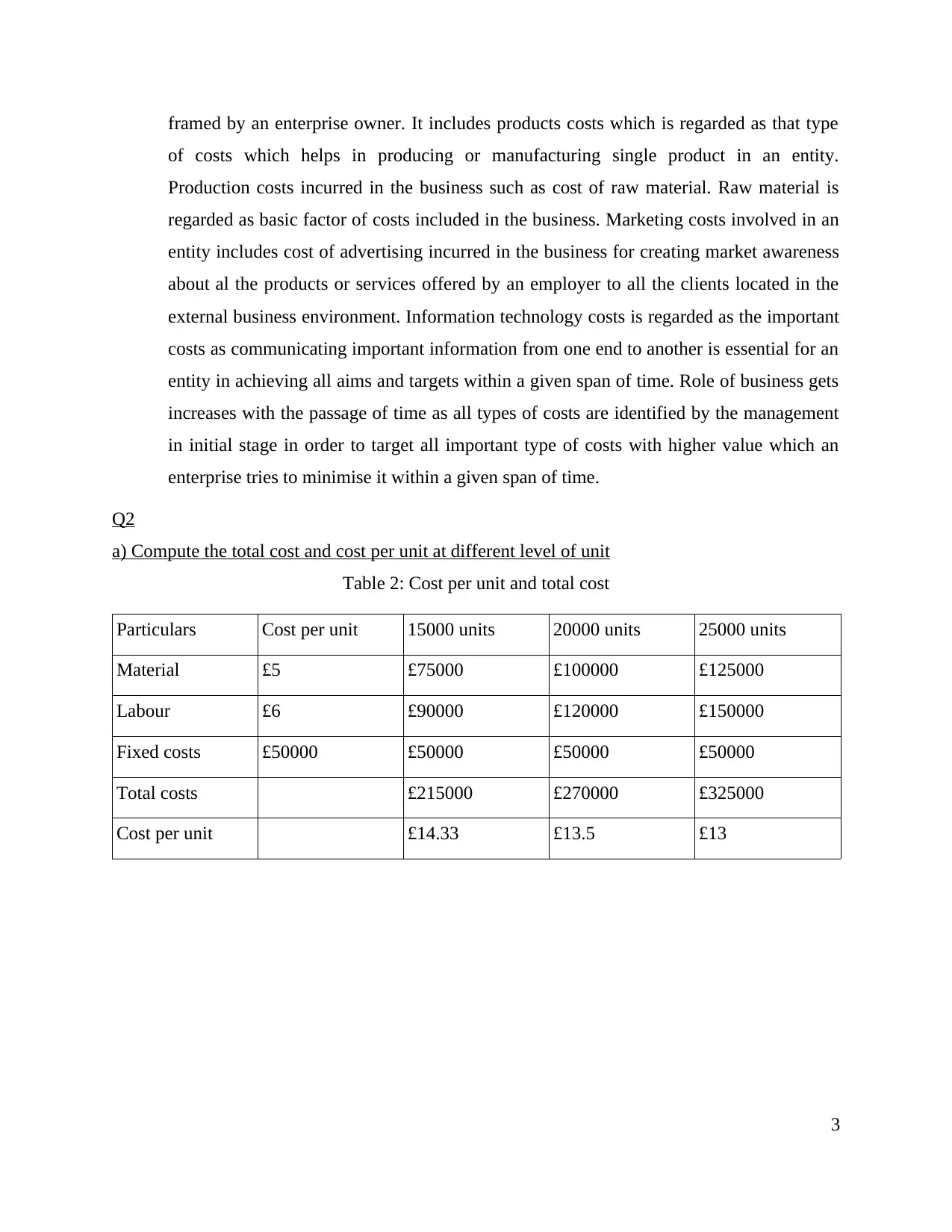

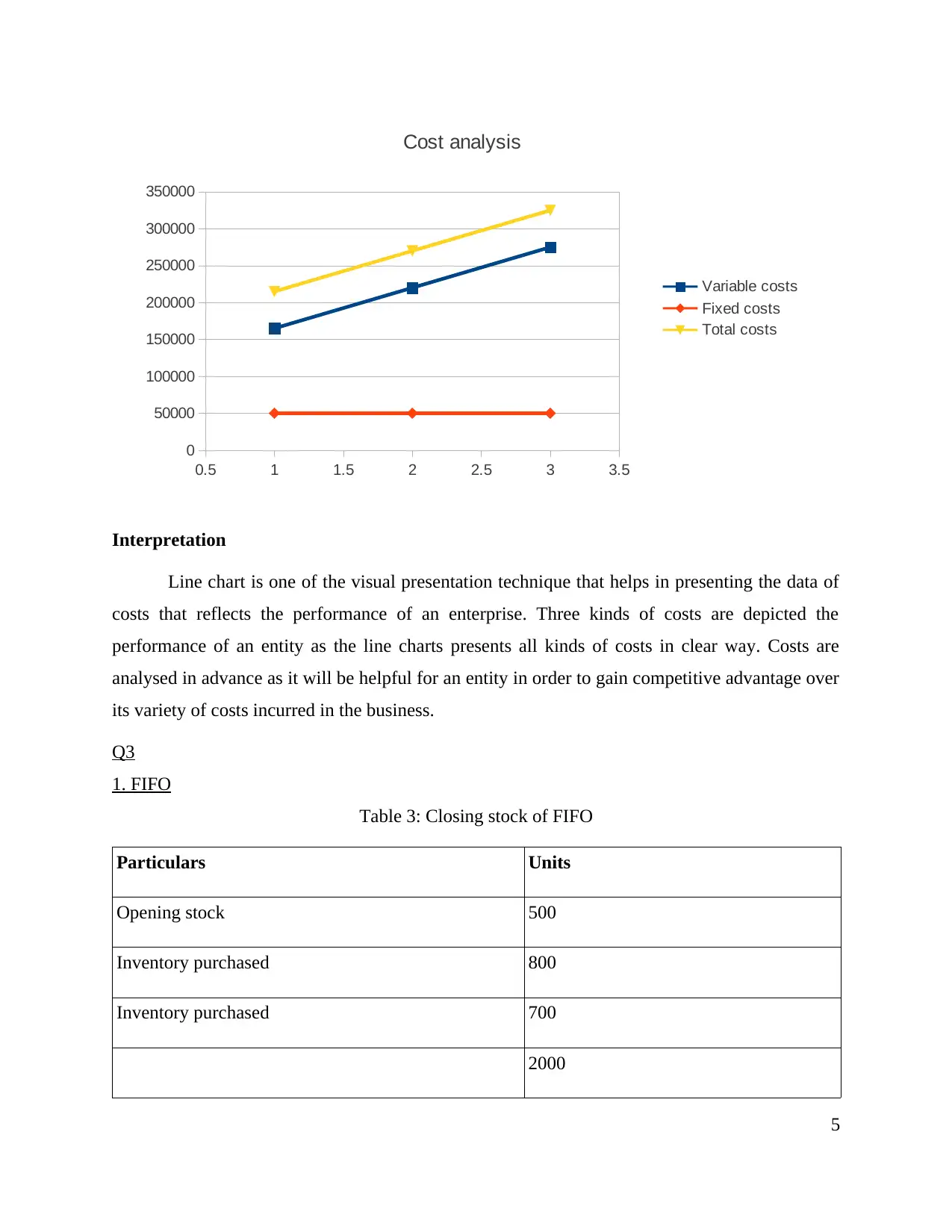

b) Analyse cost using graphical presentation

15000 units 20000 units 25000 units

0

50000

100000

150000

200000

250000

300000

350000

Cost analysis

Variable costs

Fixed costs

Total costs

Interpretation

Costs is regarded as one of the important aspects of the organisation which will be

identified at initial stage in order to improve the overall performance of an entity. Cost is the

negative element incurred in the corporation that will be minimised by the firm as it has

categorised into various categories such as fixed cost, variable costs and semi variable costs

takes places in an entity (Kaplan and Atkinson, 2015). There are different types of costs incurred

in the business as fixed costs which incurred in the business in zero or more production units

manufactured by an entity. In the current case scenario, Costs are evaluated on three different

unit level such as in an increasing order from 15000 units, 20000 units and 25000 units. It can be

seen from the above graph that apart from fixed costs increasing variable costs in an entity at

different activity level he overall costs incurred in the business has increases with the passage of

time. Total cost increases in an enterprise due to variable costs as it increases or decreases the

overall cost in an entity.

4

15000 units 20000 units 25000 units

0

50000

100000

150000

200000

250000

300000

350000

Cost analysis

Variable costs

Fixed costs

Total costs

Interpretation

Costs is regarded as one of the important aspects of the organisation which will be

identified at initial stage in order to improve the overall performance of an entity. Cost is the

negative element incurred in the corporation that will be minimised by the firm as it has

categorised into various categories such as fixed cost, variable costs and semi variable costs

takes places in an entity (Kaplan and Atkinson, 2015). There are different types of costs incurred

in the business as fixed costs which incurred in the business in zero or more production units

manufactured by an entity. In the current case scenario, Costs are evaluated on three different

unit level such as in an increasing order from 15000 units, 20000 units and 25000 units. It can be

seen from the above graph that apart from fixed costs increasing variable costs in an entity at

different activity level he overall costs incurred in the business has increases with the passage of

time. Total cost increases in an enterprise due to variable costs as it increases or decreases the

overall cost in an entity.

4

0.5 1 1.5 2 2.5 3 3.5

0

50000

100000

150000

200000

250000

300000

350000

Cost analysis

Variable costs

Fixed costs

Total costs

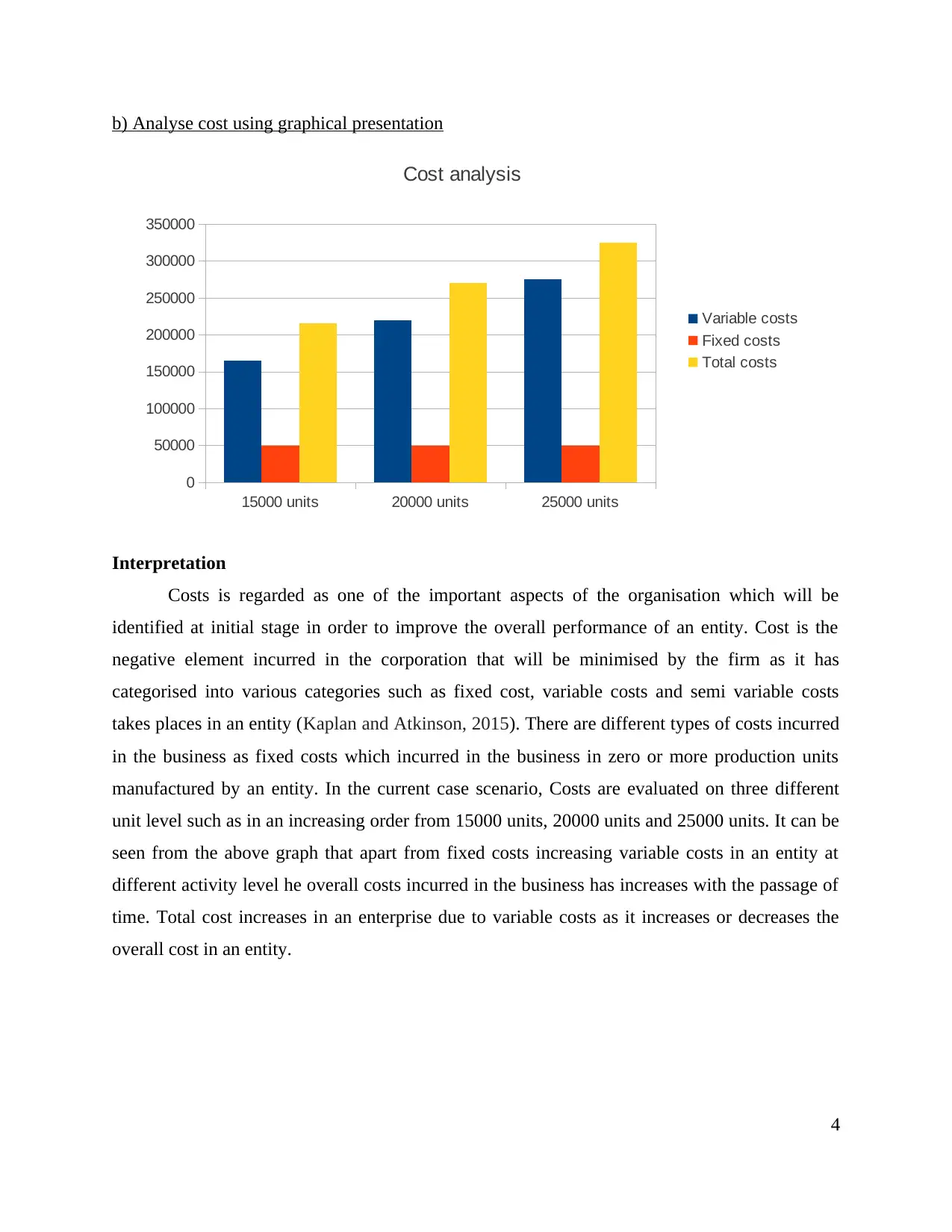

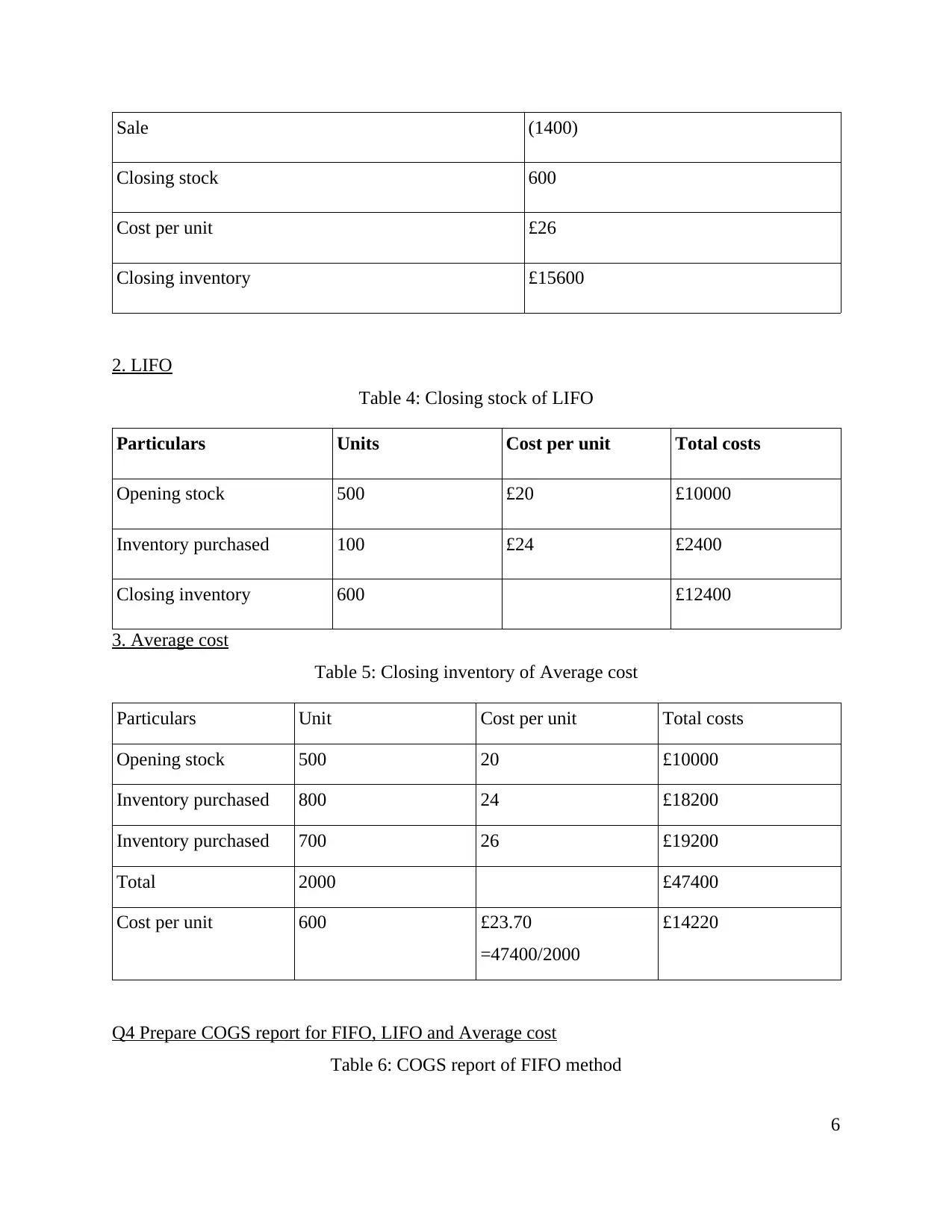

Interpretation

Line chart is one of the visual presentation technique that helps in presenting the data of

costs that reflects the performance of an enterprise. Three kinds of costs are depicted the

performance of an entity as the line charts presents all kinds of costs in clear way. Costs are

analysed in advance as it will be helpful for an entity in order to gain competitive advantage over

its variety of costs incurred in the business.

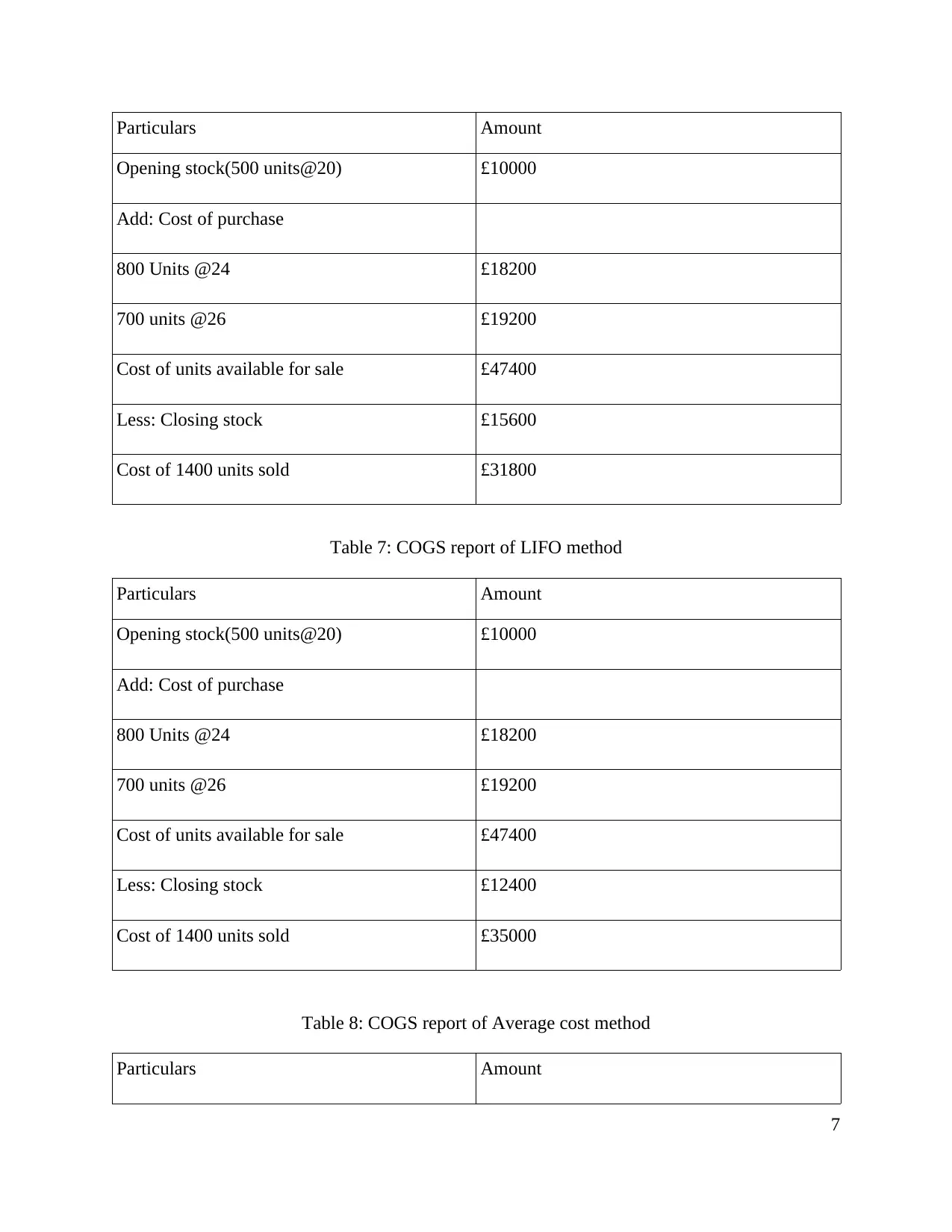

Q3

1. FIFO

Table 3: Closing stock of FIFO

Particulars Units

Opening stock 500

Inventory purchased 800

Inventory purchased 700

2000

5

0

50000

100000

150000

200000

250000

300000

350000

Cost analysis

Variable costs

Fixed costs

Total costs

Interpretation

Line chart is one of the visual presentation technique that helps in presenting the data of

costs that reflects the performance of an enterprise. Three kinds of costs are depicted the

performance of an entity as the line charts presents all kinds of costs in clear way. Costs are

analysed in advance as it will be helpful for an entity in order to gain competitive advantage over

its variety of costs incurred in the business.

Q3

1. FIFO

Table 3: Closing stock of FIFO

Particulars Units

Opening stock 500

Inventory purchased 800

Inventory purchased 700

2000

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Sale (1400)

Closing stock 600

Cost per unit £26

Closing inventory £15600

2. LIFO

Table 4: Closing stock of LIFO

Particulars Units Cost per unit Total costs

Opening stock 500 £20 £10000

Inventory purchased 100 £24 £2400

Closing inventory 600 £12400

3. Average cost

Table 5: Closing inventory of Average cost

Particulars Unit Cost per unit Total costs

Opening stock 500 20 £10000

Inventory purchased 800 24 £18200

Inventory purchased 700 26 £19200

Total 2000 £47400

Cost per unit 600 £23.70

=47400/2000

£14220

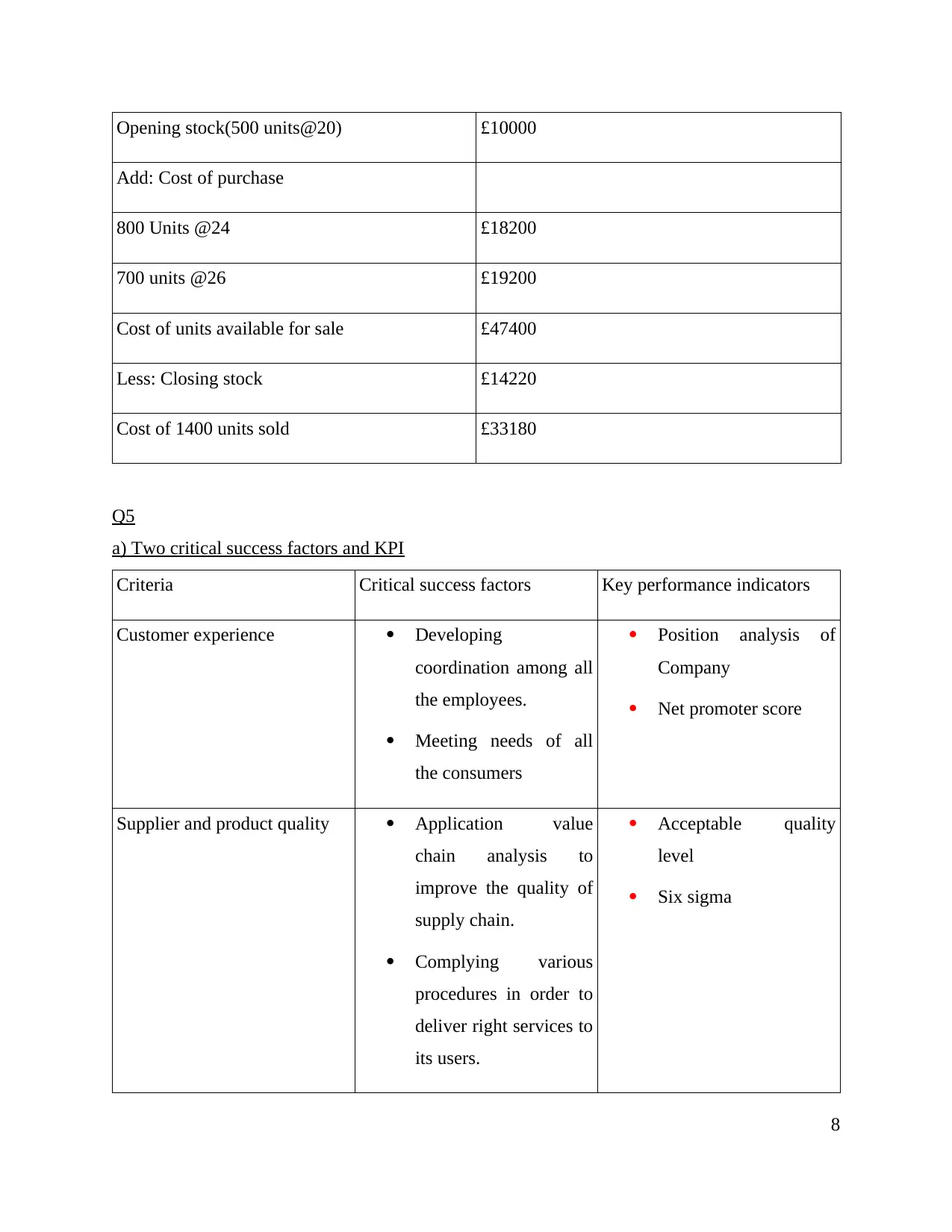

Q4 Prepare COGS report for FIFO, LIFO and Average cost

Table 6: COGS report of FIFO method

6

Closing stock 600

Cost per unit £26

Closing inventory £15600

2. LIFO

Table 4: Closing stock of LIFO

Particulars Units Cost per unit Total costs

Opening stock 500 £20 £10000

Inventory purchased 100 £24 £2400

Closing inventory 600 £12400

3. Average cost

Table 5: Closing inventory of Average cost

Particulars Unit Cost per unit Total costs

Opening stock 500 20 £10000

Inventory purchased 800 24 £18200

Inventory purchased 700 26 £19200

Total 2000 £47400

Cost per unit 600 £23.70

=47400/2000

£14220

Q4 Prepare COGS report for FIFO, LIFO and Average cost

Table 6: COGS report of FIFO method

6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Particulars Amount

Opening stock(500 units@20) £10000

Add: Cost of purchase

800 Units @24 £18200

700 units @26 £19200

Cost of units available for sale £47400

Less: Closing stock £15600

Cost of 1400 units sold £31800

Table 7: COGS report of LIFO method

Particulars Amount

Opening stock(500 units@20) £10000

Add: Cost of purchase

800 Units @24 £18200

700 units @26 £19200

Cost of units available for sale £47400

Less: Closing stock £12400

Cost of 1400 units sold £35000

Table 8: COGS report of Average cost method

Particulars Amount

7

Opening stock(500 units@20) £10000

Add: Cost of purchase

800 Units @24 £18200

700 units @26 £19200

Cost of units available for sale £47400

Less: Closing stock £15600

Cost of 1400 units sold £31800

Table 7: COGS report of LIFO method

Particulars Amount

Opening stock(500 units@20) £10000

Add: Cost of purchase

800 Units @24 £18200

700 units @26 £19200

Cost of units available for sale £47400

Less: Closing stock £12400

Cost of 1400 units sold £35000

Table 8: COGS report of Average cost method

Particulars Amount

7

Opening stock(500 units@20) £10000

Add: Cost of purchase

800 Units @24 £18200

700 units @26 £19200

Cost of units available for sale £47400

Less: Closing stock £14220

Cost of 1400 units sold £33180

Q5

a) Two critical success factors and KPI

Criteria Critical success factors Key performance indicators

Customer experience Developing

coordination among all

the employees.

Meeting needs of all

the consumers

Position analysis of

Company

Net promoter score

Supplier and product quality Application value

chain analysis to

improve the quality of

supply chain.

Complying various

procedures in order to

deliver right services to

its users.

Acceptable quality

level

Six sigma

8

Add: Cost of purchase

800 Units @24 £18200

700 units @26 £19200

Cost of units available for sale £47400

Less: Closing stock £14220

Cost of 1400 units sold £33180

Q5

a) Two critical success factors and KPI

Criteria Critical success factors Key performance indicators

Customer experience Developing

coordination among all

the employees.

Meeting needs of all

the consumers

Position analysis of

Company

Net promoter score

Supplier and product quality Application value

chain analysis to

improve the quality of

supply chain.

Complying various

procedures in order to

deliver right services to

its users.

Acceptable quality

level

Six sigma

8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.