Management Accounting Report: Costing and Budgeting in ABC Ltd

VerifiedAdded on 2020/01/21

|18

|4929

|198

Report

AI Summary

This report provides a comprehensive overview of management accounting principles and practices, specifically focusing on costing and budgeting within the context of ABC Ltd. It begins by classifying different types of costs, including material, labor, and overhead, and explores various costing methods such as job costing and unit costing, with detailed calculations and examples. The report then delves into techniques for calculating costs using tools like absorption costing and overhead absorption rates. Furthermore, it analyzes cost data using appropriate techniques, including the preparation and interpretation of routine cost reports, and the use of performance indicators to identify areas for improvement. The report also addresses the budgeting process, exploring appropriate budgeting methods and the preparation of budgets and cash budgets. Finally, it examines variance analysis, identifying possible causes and reporting findings to management, culminating in suggestions for cost reduction and value enhancement within the organization. The report uses tables and calculations to illustrate the concepts. Overall, the report aims to provide a practical understanding of management accounting tools and techniques.

Management Accounting:

Costing and Budgeting

1

Costing and Budgeting

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

1.1 Classification of different types of cost.................................................................................3

1.2 Using different costing methods............................................................................................4

1.3 Calculating costs using appropriate tools..............................................................................5

1.4 Analysis of cost data using appropriate techniques...............................................................7

2.1 Preparing and analysis of routine cost reports.......................................................................7

2.2 Use of performance indicators to identify potential improvements.......................................8

2.3 Suggesting improvements to reduce costs and enhance value as well as quality..................9

TASK 2..........................................................................................................................................10

3.1 Purpose and nature of budgeting process.............................................................................10

3.2 Appropriate budgeting methods for organization and its need............................................11

3.3 Preparing budget..................................................................................................................12

3.4 Preparation of cash budget...................................................................................................13

4.1 Calculating variances, identifying possible causes..............................................................14

4.2 Preparation of operating statement reconciling...................................................................15

4.3 Reporting findings to management......................................................................................15

CONCLUSION .............................................................................................................................15

REFERENCES .............................................................................................................................17

2

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

1.1 Classification of different types of cost.................................................................................3

1.2 Using different costing methods............................................................................................4

1.3 Calculating costs using appropriate tools..............................................................................5

1.4 Analysis of cost data using appropriate techniques...............................................................7

2.1 Preparing and analysis of routine cost reports.......................................................................7

2.2 Use of performance indicators to identify potential improvements.......................................8

2.3 Suggesting improvements to reduce costs and enhance value as well as quality..................9

TASK 2..........................................................................................................................................10

3.1 Purpose and nature of budgeting process.............................................................................10

3.2 Appropriate budgeting methods for organization and its need............................................11

3.3 Preparing budget..................................................................................................................12

3.4 Preparation of cash budget...................................................................................................13

4.1 Calculating variances, identifying possible causes..............................................................14

4.2 Preparation of operating statement reconciling...................................................................15

4.3 Reporting findings to management......................................................................................15

CONCLUSION .............................................................................................................................15

REFERENCES .............................................................................................................................17

2

INTRODUCTION

Management accounting is referred to as the procedure of preparing management reports

as well accounts that assist in offering accurate financial and statistical information on time.

Such is needed by the managers for the purpose of making short term decision on regular basis.

Management accounting produces monthly and weekly reports for the internal audience of the

business that includes department managers as well as chief executive officer. Such reports

demonstrates the amount of orders in hand, state of accounts payable, accounts receivables,

outstanding dents, raw material as well as inventory. Further it is comprised of trend charts,

variance analysis and other statistics (Beard, 2009).

In the present report management accounting has been discussed with respect to ABC

Ltd. The study entails to make analysis of cost information in the firm. Further it includes

methods to reduce costs and enhance value in the organization. The report involves performance

monitoring against budgets within organization.

TASK 1

1.1 Classification of different types of cost

Cost is being divided into several manner that depends upon its nature and particular

purpose. Such categorization makes the information relating cost meaningful for the firm. The

classification of cost is done is the manner as follows: On the basis of nature: By the nature of expenses, classification of cost can be done into

material, labour and overhead. Raw material is considered an essential part of the product

that is being traced by ABC Ltd in an appropriate manner. The cost of labour are the one

that are traced to individual units of products (Bhagwat and Sharma, 2007). On the basis of behavior: With the alteration in the extent of business activities there is

change in certain cost with the alteration in output but some does not alter. Based on the

behavior classification of cost can be done into fixed, variable and semi variable cost.

Fixed cost can be defined as the cost that remain fixed and does not change with the

alteration in the level of output (Götze, Northcott and Schuster, 2008). Variable cost are

the one that get changed with the alteration in output level. Semi variable cost includes

the attributes of both fixed and variable cost.

3

Management accounting is referred to as the procedure of preparing management reports

as well accounts that assist in offering accurate financial and statistical information on time.

Such is needed by the managers for the purpose of making short term decision on regular basis.

Management accounting produces monthly and weekly reports for the internal audience of the

business that includes department managers as well as chief executive officer. Such reports

demonstrates the amount of orders in hand, state of accounts payable, accounts receivables,

outstanding dents, raw material as well as inventory. Further it is comprised of trend charts,

variance analysis and other statistics (Beard, 2009).

In the present report management accounting has been discussed with respect to ABC

Ltd. The study entails to make analysis of cost information in the firm. Further it includes

methods to reduce costs and enhance value in the organization. The report involves performance

monitoring against budgets within organization.

TASK 1

1.1 Classification of different types of cost

Cost is being divided into several manner that depends upon its nature and particular

purpose. Such categorization makes the information relating cost meaningful for the firm. The

classification of cost is done is the manner as follows: On the basis of nature: By the nature of expenses, classification of cost can be done into

material, labour and overhead. Raw material is considered an essential part of the product

that is being traced by ABC Ltd in an appropriate manner. The cost of labour are the one

that are traced to individual units of products (Bhagwat and Sharma, 2007). On the basis of behavior: With the alteration in the extent of business activities there is

change in certain cost with the alteration in output but some does not alter. Based on the

behavior classification of cost can be done into fixed, variable and semi variable cost.

Fixed cost can be defined as the cost that remain fixed and does not change with the

alteration in the level of output (Götze, Northcott and Schuster, 2008). Variable cost are

the one that get changed with the alteration in output level. Semi variable cost includes

the attributes of both fixed and variable cost.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

On the basis of element: Such classification is on the basis of association of cost elements

with the objects of cost. The division is done into direct as well as indirect cost. The

expenses that are incurred by ABC Ltd on material and labor and are traceable for

product, service and job economically is referred to as direct cost. On the other hand

indirect cost is defined as the expenses that are not chargeable directly into the production

(Goyenko, Holden and Trzcinka, 2009).

On the basis of controllability: Under this classification of cost is done into controllable

and uncontrollable cost. Controllable cost is are the one that are controlled by particular

members of t he firm. Example of this includes material as well as labour cost. In contrast

to this uncontrollable cost is referred to as the one that are not regulated by particular

member. For instance, factory rent and salary are regarded as uncontrollable cost (Haka,

2006).

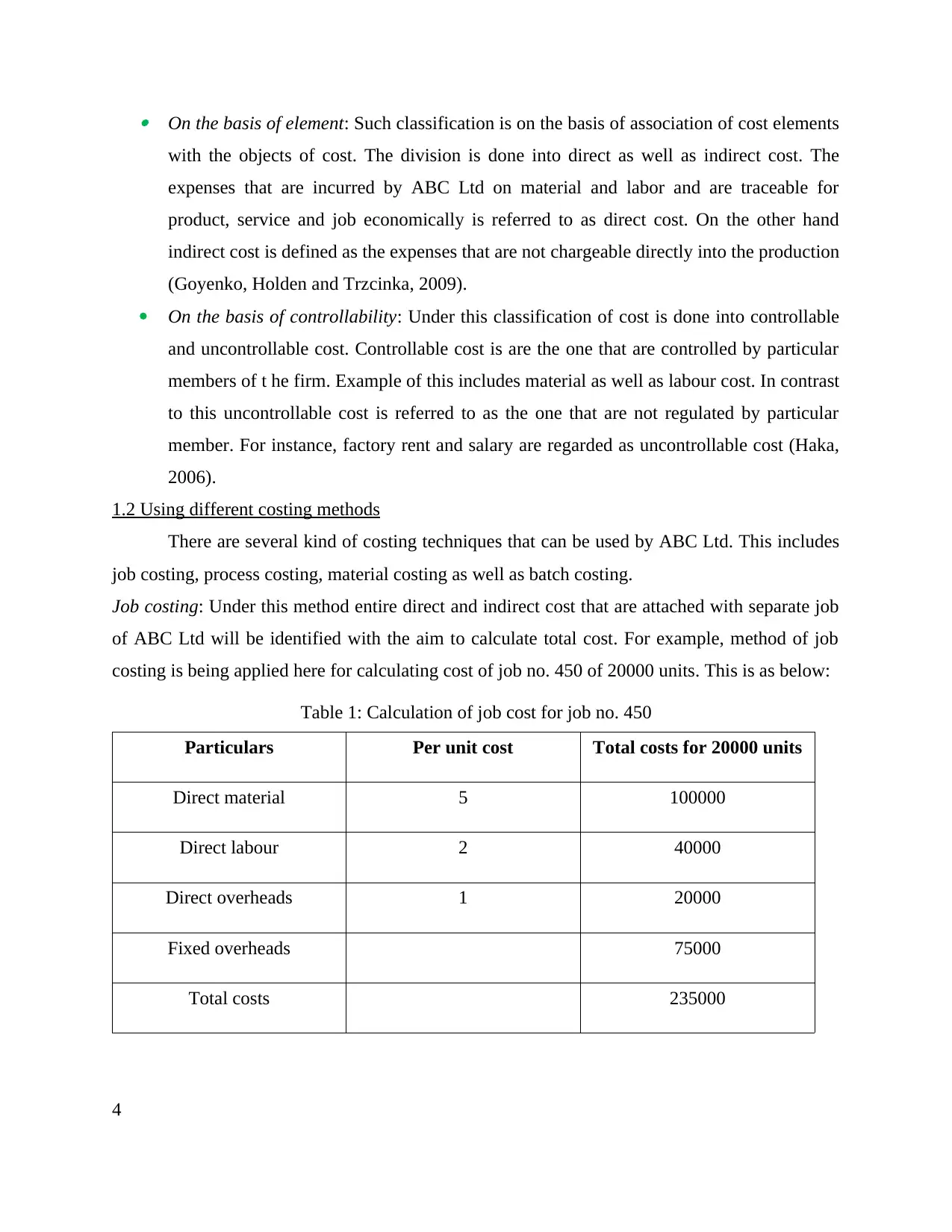

1.2 Using different costing methods

There are several kind of costing techniques that can be used by ABC Ltd. This includes

job costing, process costing, material costing as well as batch costing.

Job costing: Under this method entire direct and indirect cost that are attached with separate job

of ABC Ltd will be identified with the aim to calculate total cost. For example, method of job

costing is being applied here for calculating cost of job no. 450 of 20000 units. This is as below:

Table 1: Calculation of job cost for job no. 450

Particulars Per unit cost Total costs for 20000 units

Direct material 5 100000

Direct labour 2 40000

Direct overheads 1 20000

Fixed overheads 75000

Total costs 235000

4

with the objects of cost. The division is done into direct as well as indirect cost. The

expenses that are incurred by ABC Ltd on material and labor and are traceable for

product, service and job economically is referred to as direct cost. On the other hand

indirect cost is defined as the expenses that are not chargeable directly into the production

(Goyenko, Holden and Trzcinka, 2009).

On the basis of controllability: Under this classification of cost is done into controllable

and uncontrollable cost. Controllable cost is are the one that are controlled by particular

members of t he firm. Example of this includes material as well as labour cost. In contrast

to this uncontrollable cost is referred to as the one that are not regulated by particular

member. For instance, factory rent and salary are regarded as uncontrollable cost (Haka,

2006).

1.2 Using different costing methods

There are several kind of costing techniques that can be used by ABC Ltd. This includes

job costing, process costing, material costing as well as batch costing.

Job costing: Under this method entire direct and indirect cost that are attached with separate job

of ABC Ltd will be identified with the aim to calculate total cost. For example, method of job

costing is being applied here for calculating cost of job no. 450 of 20000 units. This is as below:

Table 1: Calculation of job cost for job no. 450

Particulars Per unit cost Total costs for 20000 units

Direct material 5 100000

Direct labour 2 40000

Direct overheads 1 20000

Fixed overheads 75000

Total costs 235000

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Fixed overheads for 40000 direct labor hours = £100000

Direct labour hours per unit for job no. 450= 3

Fixed overhead for 20000 units = £100000/40000 hours*(3 hours*20000 units) = £75000

Therefore, it has been stated that total job costs for 20000 units will be £235000

Unit costing: Another method of costing is referred to as unit costing that assist in determining

the per unit cost. It is referred to as single output costing. It is majorly utilized for assessing the

production of cost that is being denoted in quantitative terms. For example, per unit cost from the

job 450 demonstrated above can be:

Unit cost = Total cost of production/number of units produced

= £235000/20000 units = £11.75

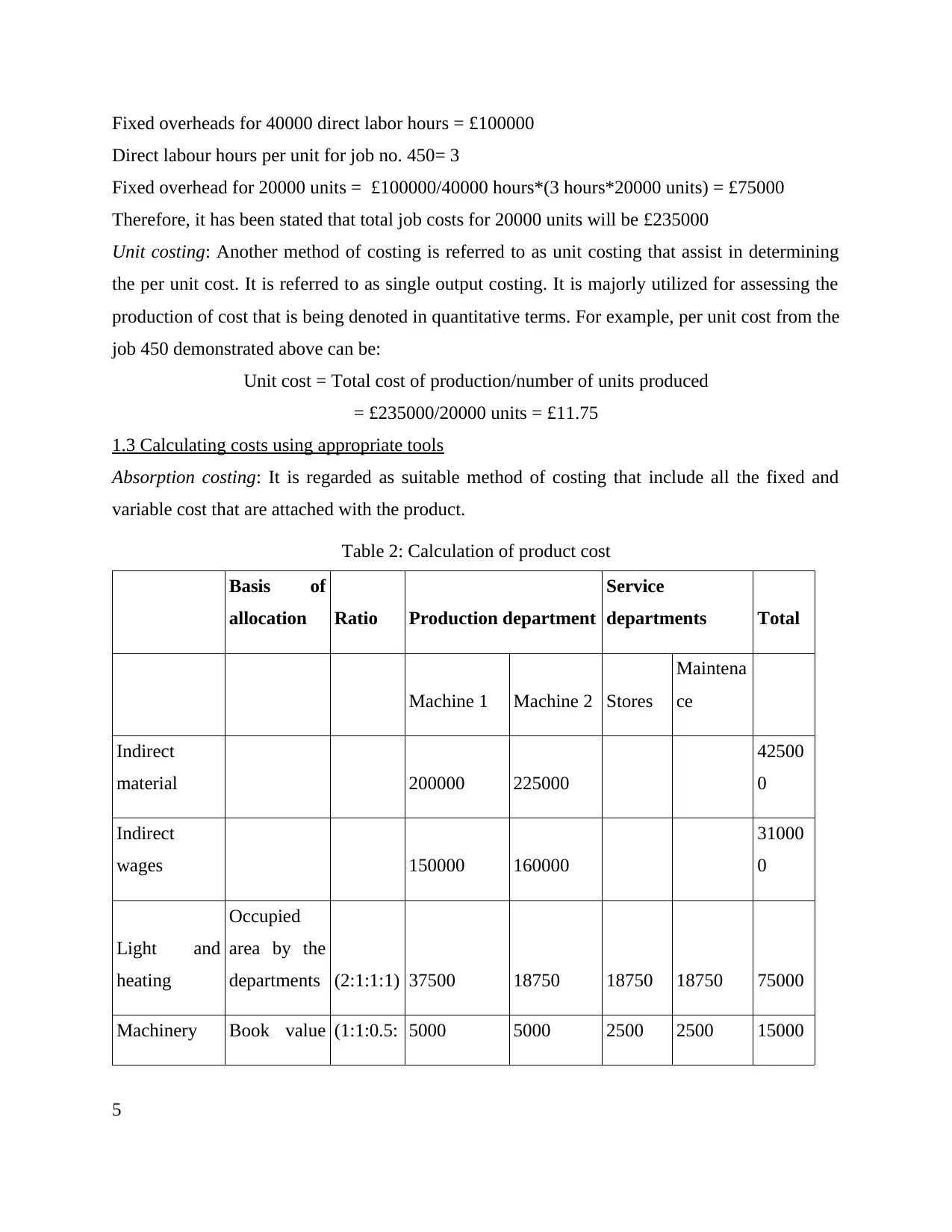

1.3 Calculating costs using appropriate tools

Absorption costing: It is regarded as suitable method of costing that include all the fixed and

variable cost that are attached with the product.

Table 2: Calculation of product cost

Basis of

allocation Ratio Production department

Service

departments Total

Machine 1 Machine 2 Stores

Maintena

ce

Indirect

material 200000 225000

42500

0

Indirect

wages 150000 160000

31000

0

Light and

heating

Occupied

area by the

departments (2:1:1:1) 37500 18750 18750 18750 75000

Machinery Book value (1:1:0.5: 5000 5000 2500 2500 15000

5

Direct labour hours per unit for job no. 450= 3

Fixed overhead for 20000 units = £100000/40000 hours*(3 hours*20000 units) = £75000

Therefore, it has been stated that total job costs for 20000 units will be £235000

Unit costing: Another method of costing is referred to as unit costing that assist in determining

the per unit cost. It is referred to as single output costing. It is majorly utilized for assessing the

production of cost that is being denoted in quantitative terms. For example, per unit cost from the

job 450 demonstrated above can be:

Unit cost = Total cost of production/number of units produced

= £235000/20000 units = £11.75

1.3 Calculating costs using appropriate tools

Absorption costing: It is regarded as suitable method of costing that include all the fixed and

variable cost that are attached with the product.

Table 2: Calculation of product cost

Basis of

allocation Ratio Production department

Service

departments Total

Machine 1 Machine 2 Stores

Maintena

ce

Indirect

material 200000 225000

42500

0

Indirect

wages 150000 160000

31000

0

Light and

heating

Occupied

area by the

departments (2:1:1:1) 37500 18750 18750 18750 75000

Machinery Book value (1:1:0.5: 5000 5000 2500 2500 15000

5

insurance of machine 0.5)

Workers

salary

Number of

workers

(30:20:1

5:10) 30000 20000 15000 10000 75000

Total costs 422500 428750 36250 31250

90000

0

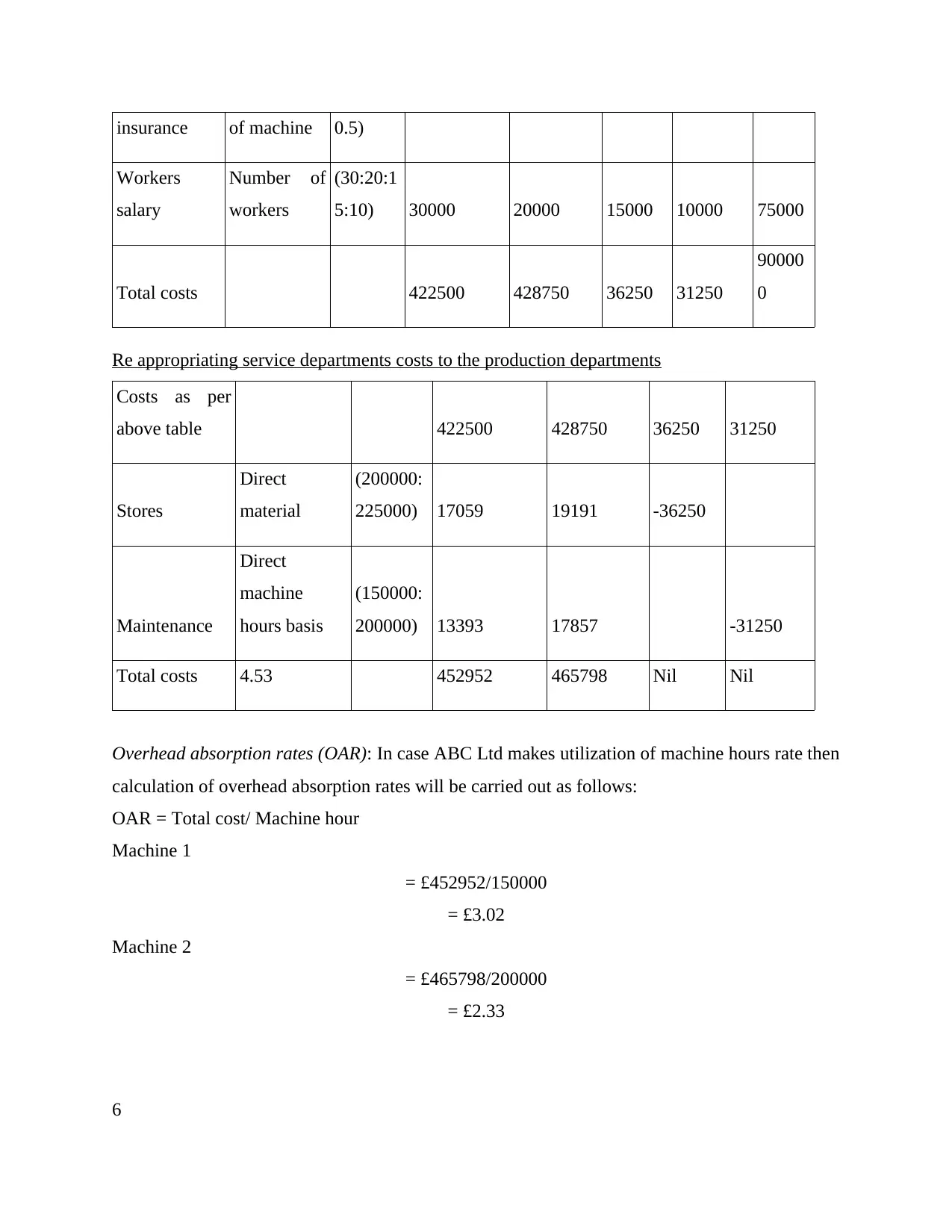

Re appropriating service departments costs to the production departments

Costs as per

above table 422500 428750 36250 31250

Stores

Direct

material

(200000:

225000) 17059 19191 -36250

Maintenance

Direct

machine

hours basis

(150000:

200000) 13393 17857 -31250

Total costs 4.53 452952 465798 Nil Nil

Overhead absorption rates (OAR): In case ABC Ltd makes utilization of machine hours rate then

calculation of overhead absorption rates will be carried out as follows:

OAR = Total cost/ Machine hour

Machine 1

= £452952/150000

= £3.02

Machine 2

= £465798/200000

= £2.33

6

Workers

salary

Number of

workers

(30:20:1

5:10) 30000 20000 15000 10000 75000

Total costs 422500 428750 36250 31250

90000

0

Re appropriating service departments costs to the production departments

Costs as per

above table 422500 428750 36250 31250

Stores

Direct

material

(200000:

225000) 17059 19191 -36250

Maintenance

Direct

machine

hours basis

(150000:

200000) 13393 17857 -31250

Total costs 4.53 452952 465798 Nil Nil

Overhead absorption rates (OAR): In case ABC Ltd makes utilization of machine hours rate then

calculation of overhead absorption rates will be carried out as follows:

OAR = Total cost/ Machine hour

Machine 1

= £452952/150000

= £3.02

Machine 2

= £465798/200000

= £2.33

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Table 3: Calculation of product cost

Particulars Computation Per unit cost

Direct material £8

Direct labour £7

Overheads

Machinery 1 £3.02*1.5 4.53

Machinery 2 £2.33*2 4.66

Total costs 2.33 24.19

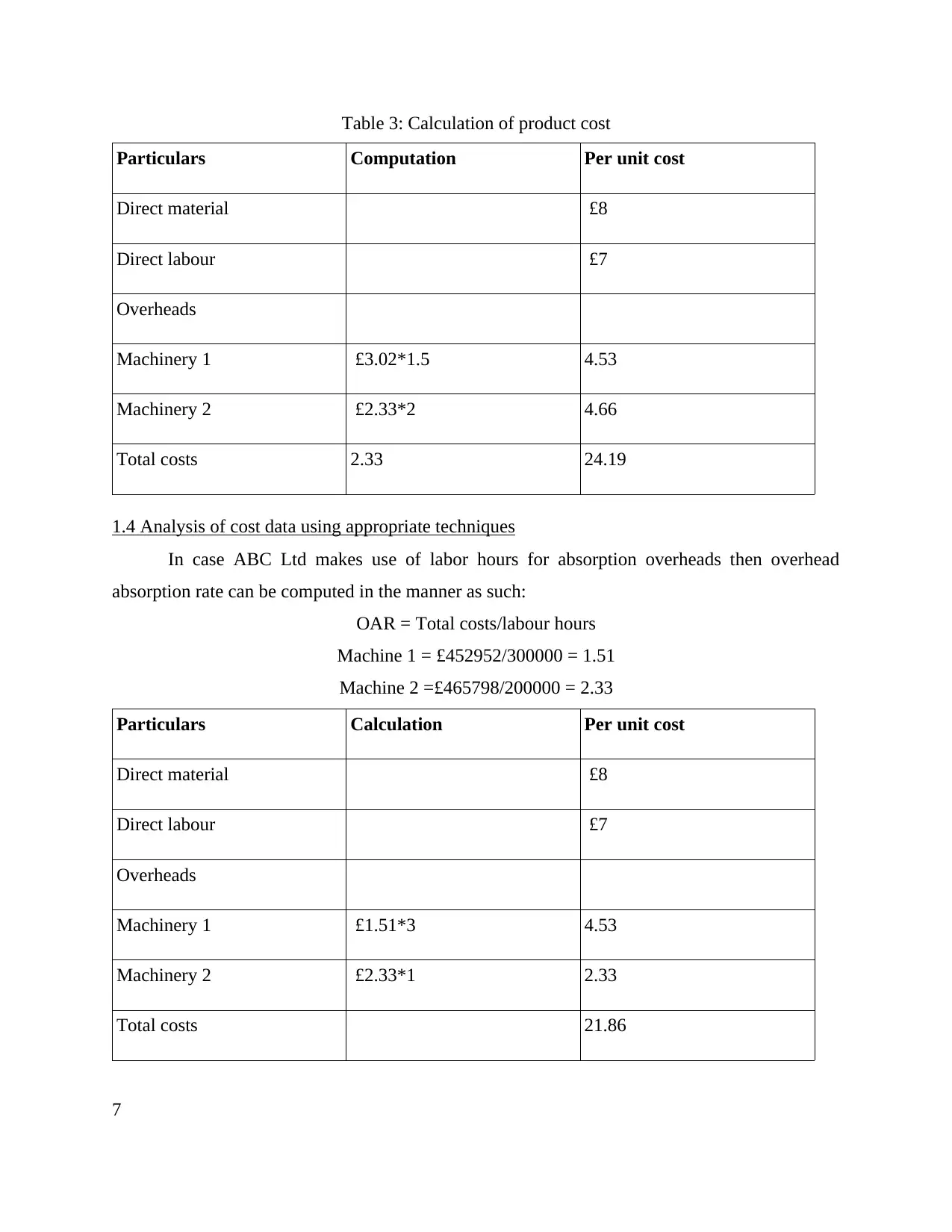

1.4 Analysis of cost data using appropriate techniques

In case ABC Ltd makes use of labor hours for absorption overheads then overhead

absorption rate can be computed in the manner as such:

OAR = Total costs/labour hours

Machine 1 = £452952/300000 = 1.51

Machine 2 =£465798/200000 = 2.33

Particulars Calculation Per unit cost

Direct material £8

Direct labour £7

Overheads

Machinery 1 £1.51*3 4.53

Machinery 2 £2.33*1 2.33

Total costs 21.86

7

Particulars Computation Per unit cost

Direct material £8

Direct labour £7

Overheads

Machinery 1 £3.02*1.5 4.53

Machinery 2 £2.33*2 4.66

Total costs 2.33 24.19

1.4 Analysis of cost data using appropriate techniques

In case ABC Ltd makes use of labor hours for absorption overheads then overhead

absorption rate can be computed in the manner as such:

OAR = Total costs/labour hours

Machine 1 = £452952/300000 = 1.51

Machine 2 =£465798/200000 = 2.33

Particulars Calculation Per unit cost

Direct material £8

Direct labour £7

Overheads

Machinery 1 £1.51*3 4.53

Machinery 2 £2.33*1 2.33

Total costs 21.86

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Interpretation: In case ABC Ltd makes utilization of material basis for allocation than

cost per unit would be £24.19. However in labour basis this has been minimized to £21.86.

Therefore it can be said that ABC Ltd utilizes basis of labor as such would be most suitable due

to presence of lower cost. This would result in reducing the overall cost and attaining maximum

profitability.

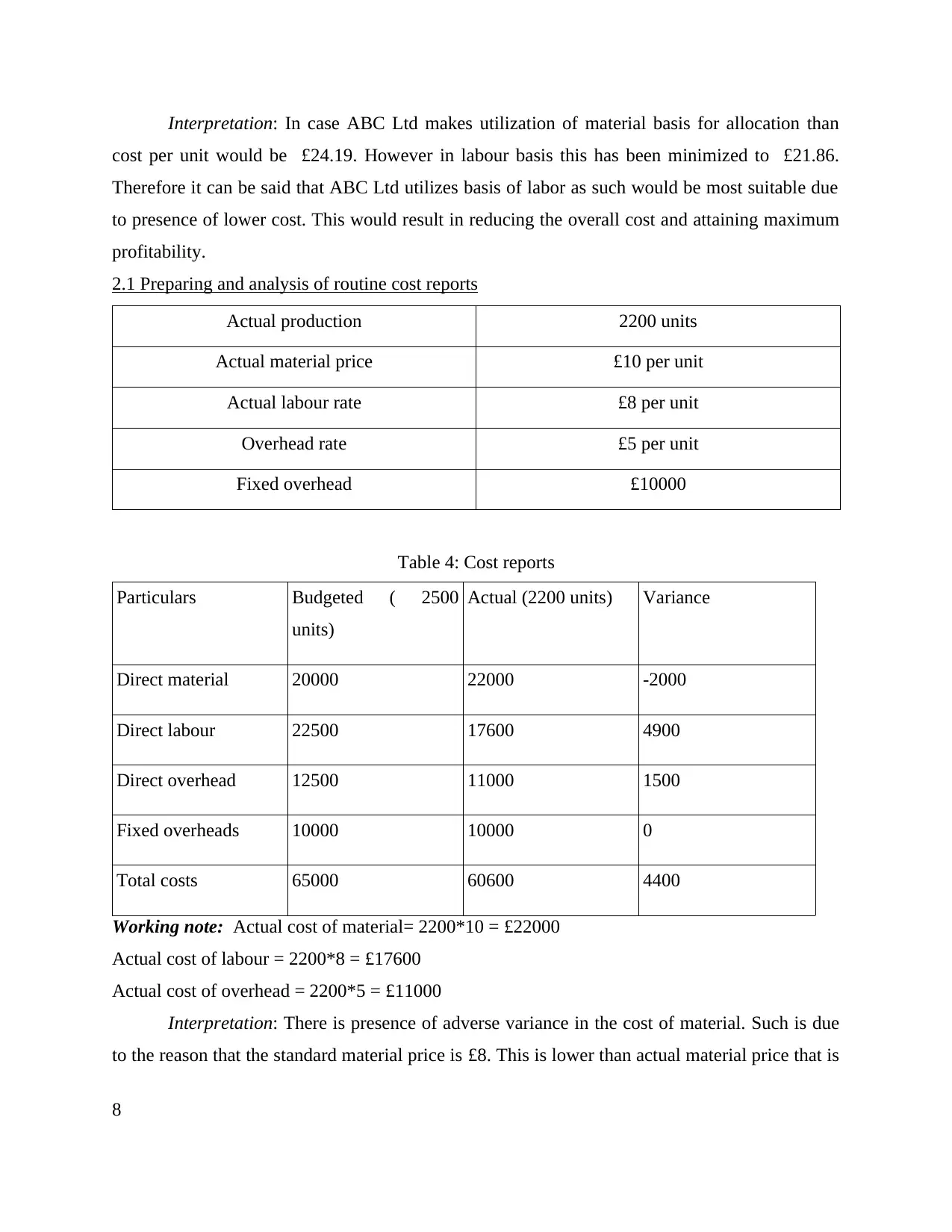

2.1 Preparing and analysis of routine cost reports

Actual production 2200 units

Actual material price £10 per unit

Actual labour rate £8 per unit

Overhead rate £5 per unit

Fixed overhead £10000

Table 4: Cost reports

Particulars Budgeted ( 2500

units)

Actual (2200 units) Variance

Direct material 20000 22000 -2000

Direct labour 22500 17600 4900

Direct overhead 12500 11000 1500

Fixed overheads 10000 10000 0

Total costs 65000 60600 4400

Working note: Actual cost of material= 2200*10 = £22000

Actual cost of labour = 2200*8 = £17600

Actual cost of overhead = 2200*5 = £11000

Interpretation: There is presence of adverse variance in the cost of material. Such is due

to the reason that the standard material price is £8. This is lower than actual material price that is

8

cost per unit would be £24.19. However in labour basis this has been minimized to £21.86.

Therefore it can be said that ABC Ltd utilizes basis of labor as such would be most suitable due

to presence of lower cost. This would result in reducing the overall cost and attaining maximum

profitability.

2.1 Preparing and analysis of routine cost reports

Actual production 2200 units

Actual material price £10 per unit

Actual labour rate £8 per unit

Overhead rate £5 per unit

Fixed overhead £10000

Table 4: Cost reports

Particulars Budgeted ( 2500

units)

Actual (2200 units) Variance

Direct material 20000 22000 -2000

Direct labour 22500 17600 4900

Direct overhead 12500 11000 1500

Fixed overheads 10000 10000 0

Total costs 65000 60600 4400

Working note: Actual cost of material= 2200*10 = £22000

Actual cost of labour = 2200*8 = £17600

Actual cost of overhead = 2200*5 = £11000

Interpretation: There is presence of adverse variance in the cost of material. Such is due

to the reason that the standard material price is £8. This is lower than actual material price that is

8

£10. Beside this actual labor price is £10. Such is greater than standard price of labor £8. This

leads to favorable variance within cost of labor. Under overhead, standard and actual prices are

similar but change in units leads to alteration in the variances.

2.2 Use of performance indicators to identify potential improvements

ABC Ltd is required to carry out measurement of its performance on day to day basis.

There is presence of several kind of performance indicators that assist in making identification of

areas for potential improvements. Certain key indicators have been enumerated in the manner

below: Sales revenue: As there is increasing trend in the sales revenue, this demonstrates better

performance. But in case the sales revenue are declining continuously then ABC Ltd

needs to make determination of reason and increase efforts to improve it. The reason

beside this can be decrease in demand of customers, high prices, ineffective marketing,

availability of substitute products as well as poor quality (Hays, De Lurgio and Gilbert,

2009). Profitability:Rise in trend is considered effective. However decrease in trend

demonstrates inadequate performance. By gaining higher sales revenue and cost of

controlling ABC can enhance operational performance as well as profitability (Jennifer

Danielson Pharm and Krueger, 2011). Cost: It is considered as an essential element which ABC Ltd is required to analyze. A

balance between increase in cost as well as rise in sales is quite good but in situation

there is increase in cost at higher rate without increase in sales then ABC Ltd needs to

pay attention towards such. The reason to this can be higher price of material, wage rate,

administrative and selling cost. ABC Ltd needs to implement suitable control over its

factors and ensure maintenance of cost (Kaplan, Norton and Rugelsjoen, 2010). Quality of product: With the assistance of qualitative product there is increase in

satisfaction among customers of ABC Ltd to a significant level. Thus negative aspect can

have adverse impact on customers and leads to lowering down their performance.

Waiting time: It is regarded as the length of time or gap in the time among the demand as

well as receipt of product by the customers. Reduction is the waiting time is regarded

sound for ABC Ltd and vice versa (Kotas, 2014).

9

leads to favorable variance within cost of labor. Under overhead, standard and actual prices are

similar but change in units leads to alteration in the variances.

2.2 Use of performance indicators to identify potential improvements

ABC Ltd is required to carry out measurement of its performance on day to day basis.

There is presence of several kind of performance indicators that assist in making identification of

areas for potential improvements. Certain key indicators have been enumerated in the manner

below: Sales revenue: As there is increasing trend in the sales revenue, this demonstrates better

performance. But in case the sales revenue are declining continuously then ABC Ltd

needs to make determination of reason and increase efforts to improve it. The reason

beside this can be decrease in demand of customers, high prices, ineffective marketing,

availability of substitute products as well as poor quality (Hays, De Lurgio and Gilbert,

2009). Profitability:Rise in trend is considered effective. However decrease in trend

demonstrates inadequate performance. By gaining higher sales revenue and cost of

controlling ABC can enhance operational performance as well as profitability (Jennifer

Danielson Pharm and Krueger, 2011). Cost: It is considered as an essential element which ABC Ltd is required to analyze. A

balance between increase in cost as well as rise in sales is quite good but in situation

there is increase in cost at higher rate without increase in sales then ABC Ltd needs to

pay attention towards such. The reason to this can be higher price of material, wage rate,

administrative and selling cost. ABC Ltd needs to implement suitable control over its

factors and ensure maintenance of cost (Kaplan, Norton and Rugelsjoen, 2010). Quality of product: With the assistance of qualitative product there is increase in

satisfaction among customers of ABC Ltd to a significant level. Thus negative aspect can

have adverse impact on customers and leads to lowering down their performance.

Waiting time: It is regarded as the length of time or gap in the time among the demand as

well as receipt of product by the customers. Reduction is the waiting time is regarded

sound for ABC Ltd and vice versa (Kotas, 2014).

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

2.3 Suggesting improvements to reduce costs and enhance value as well as quality

The suggestion regarding improvement for reducing costs and enhancement in value and

quality has been presented in the manner as under:

Reduce costs: As it has been presented earlier, reduction in cost is regarded as appropriate sign of

ABC Ltd. It can be carried out in the manner as below: Lower price of buying material: It can be carried out by determining the supplier whose

sales price of material is lower in comparison with other suppliers. However it is essential

to keep in mind that quality must nit be affected (McCabe, 2014). Bargaining with labor: Through appointment of labour at lower wages there is greater

assistance offered towards reducing the direct wages payment and reduction in cost. Large production: This would offer benefits in terms of economies of scale. It has greater

role towards assisting for reducing the cost per unit of the product. This in turn result in

maximizing the profit per unit (Megginson, Ullah and Wei, 2014).

Monitoring and controlling: By monitoring entire operational functions continuously

huge assistance is provided towards controlling the cost of ABC Ltd in an effective

manner (Mohanty, 2014). Decrease in unnecessary expenses would assist in reduce the overall cost of ABC Ltd. Sale of waste material: Waste material is regarded as unusable product that can be sold

by the organization in the market in order to gain certain income. Such would assist in

declining cost (Rumble, 2012).

Enhancing value as well as quality: The value and quality within ABC Ltd can be enhanced in

the manner as such:

Quality can be enhanced by making use of better quality of material and utilizing

advanced as well as better technological machinery for the purpose of production. Standard

quality of products acts as an aid in offering satisfaction to large number of customers and

increase purchase on repeatedly. In addition to this innovation, expansion, diversification of

customer base, huge product range, high market share and market growth assists in the

enhancing the value of ABC (Sherris, 2006). Moreover strategic capabilities, world wide

operations, loyal customers, competitive strength as well as high return on shareholder would

enhance the image as well as value of organization in the market for longer term.

10

The suggestion regarding improvement for reducing costs and enhancement in value and

quality has been presented in the manner as under:

Reduce costs: As it has been presented earlier, reduction in cost is regarded as appropriate sign of

ABC Ltd. It can be carried out in the manner as below: Lower price of buying material: It can be carried out by determining the supplier whose

sales price of material is lower in comparison with other suppliers. However it is essential

to keep in mind that quality must nit be affected (McCabe, 2014). Bargaining with labor: Through appointment of labour at lower wages there is greater

assistance offered towards reducing the direct wages payment and reduction in cost. Large production: This would offer benefits in terms of economies of scale. It has greater

role towards assisting for reducing the cost per unit of the product. This in turn result in

maximizing the profit per unit (Megginson, Ullah and Wei, 2014).

Monitoring and controlling: By monitoring entire operational functions continuously

huge assistance is provided towards controlling the cost of ABC Ltd in an effective

manner (Mohanty, 2014). Decrease in unnecessary expenses would assist in reduce the overall cost of ABC Ltd. Sale of waste material: Waste material is regarded as unusable product that can be sold

by the organization in the market in order to gain certain income. Such would assist in

declining cost (Rumble, 2012).

Enhancing value as well as quality: The value and quality within ABC Ltd can be enhanced in

the manner as such:

Quality can be enhanced by making use of better quality of material and utilizing

advanced as well as better technological machinery for the purpose of production. Standard

quality of products acts as an aid in offering satisfaction to large number of customers and

increase purchase on repeatedly. In addition to this innovation, expansion, diversification of

customer base, huge product range, high market share and market growth assists in the

enhancing the value of ABC (Sherris, 2006). Moreover strategic capabilities, world wide

operations, loyal customers, competitive strength as well as high return on shareholder would

enhance the image as well as value of organization in the market for longer term.

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TASK 2

3.1 Purpose and nature of budgeting process

Budgeting may be defined as a tool in which finance manager make estimation of 5the

expenditure which they need to incur during the accounting period. Besides this, it also reflects

the revenue which will be generated by the firm during the year (Tricco and et.al., 2015). Thus, it

is the plan which provides deeper insight to the manager about the monetary activities of firm.

Purpose of budgeting process are as follows:

ABC company prepares budget with the aim to assess the future income and expenses.

Through this, company is able to manage their cash related activities in an effectual

manner.

Further, it offers financial framework which facilitates quick and easy decision making.

By preparing budget company is able to make further investment decision which makes

contribution in the attainment of organizational goals and objectives (Ulubeyli and et.al.,

2014).

Business organization circulates budget within the different departments such as sales,

production, marketing etc. Through this, they are able to spend money in an effectual

manner by preventing the financial wastage. Company also prepares budget to make comparison of the actual performance with the

budgeted amount. Through this, business organization can easily evaluate the efficiency

of their employees and thereby exert control on unnecessary financial expenditure (van

den End and Kruidhof, 2013).

Nature of budgeting process

In this, finance makes estimation or evaluate the financial environment by taking into

consideration the previous years budget.

Once estimation has done thereafter manager makes estimation of the revenue abnd

expenditure which are associated with the upcoming year. Revenue aspect includes sales

and other income. Whereas, expenditure side contains raw material, labor and other

administrative expenses (Cost - What is cost?. 2015).

At this step of budgeting manager subtracts expenses from the revenue which helps in

determining the budget surplus or deficit.

11

3.1 Purpose and nature of budgeting process

Budgeting may be defined as a tool in which finance manager make estimation of 5the

expenditure which they need to incur during the accounting period. Besides this, it also reflects

the revenue which will be generated by the firm during the year (Tricco and et.al., 2015). Thus, it

is the plan which provides deeper insight to the manager about the monetary activities of firm.

Purpose of budgeting process are as follows:

ABC company prepares budget with the aim to assess the future income and expenses.

Through this, company is able to manage their cash related activities in an effectual

manner.

Further, it offers financial framework which facilitates quick and easy decision making.

By preparing budget company is able to make further investment decision which makes

contribution in the attainment of organizational goals and objectives (Ulubeyli and et.al.,

2014).

Business organization circulates budget within the different departments such as sales,

production, marketing etc. Through this, they are able to spend money in an effectual

manner by preventing the financial wastage. Company also prepares budget to make comparison of the actual performance with the

budgeted amount. Through this, business organization can easily evaluate the efficiency

of their employees and thereby exert control on unnecessary financial expenditure (van

den End and Kruidhof, 2013).

Nature of budgeting process

In this, finance makes estimation or evaluate the financial environment by taking into

consideration the previous years budget.

Once estimation has done thereafter manager makes estimation of the revenue abnd

expenditure which are associated with the upcoming year. Revenue aspect includes sales

and other income. Whereas, expenditure side contains raw material, labor and other

administrative expenses (Cost - What is cost?. 2015).

At this step of budgeting manager subtracts expenses from the revenue which helps in

determining the budget surplus or deficit.

11

In the last phase finance personnel makes review of budget and make necessary control

which are required. Thereafter, manager submits budget to the higher authority for the

approval (Types of cost. 2014).

3.2 Appropriate budgeting methods for organization and its need

ABC undertakes incremental budgeting method to prepare the financial framework for

the predetermined time period. In incremental budgeting, company prepares budget on the

estimation. In this, company assumes the change which take place in the revenue and expenses

by evaluating the market conditions and trend. In the present time, this method of budgeting has

very low relevance due to the deficiencies which are associated with it (Beard, 2009). Thus,

business unit needs to make use of zero base budgeting which proves to be more beneficial for

the firm. In zero base budgeting, manager ignores the past budget and makes focus on the

activities which they need to perform during the financial year.

In this, business organization prepares budget by considering the zero as a base. In this,

finance personnel make evaluation of the activities which business organization needs to perform

for producing the desired level of output. In this, manager makes effort to identify the alternative

ways to perform the activities at low cost. Further, manager records actual expenses which they

need to incur in the future and thereby prevents biasness (Bhagwat and Sharma, 2007). In this,

manager only places emphasis on the preparation of budget by taking into account the future

activities. Thus, zero base budgeting method proves to more profitable for the firm. By

identifying the alternative ways company is able to reduce the cash outflow to the large extent.

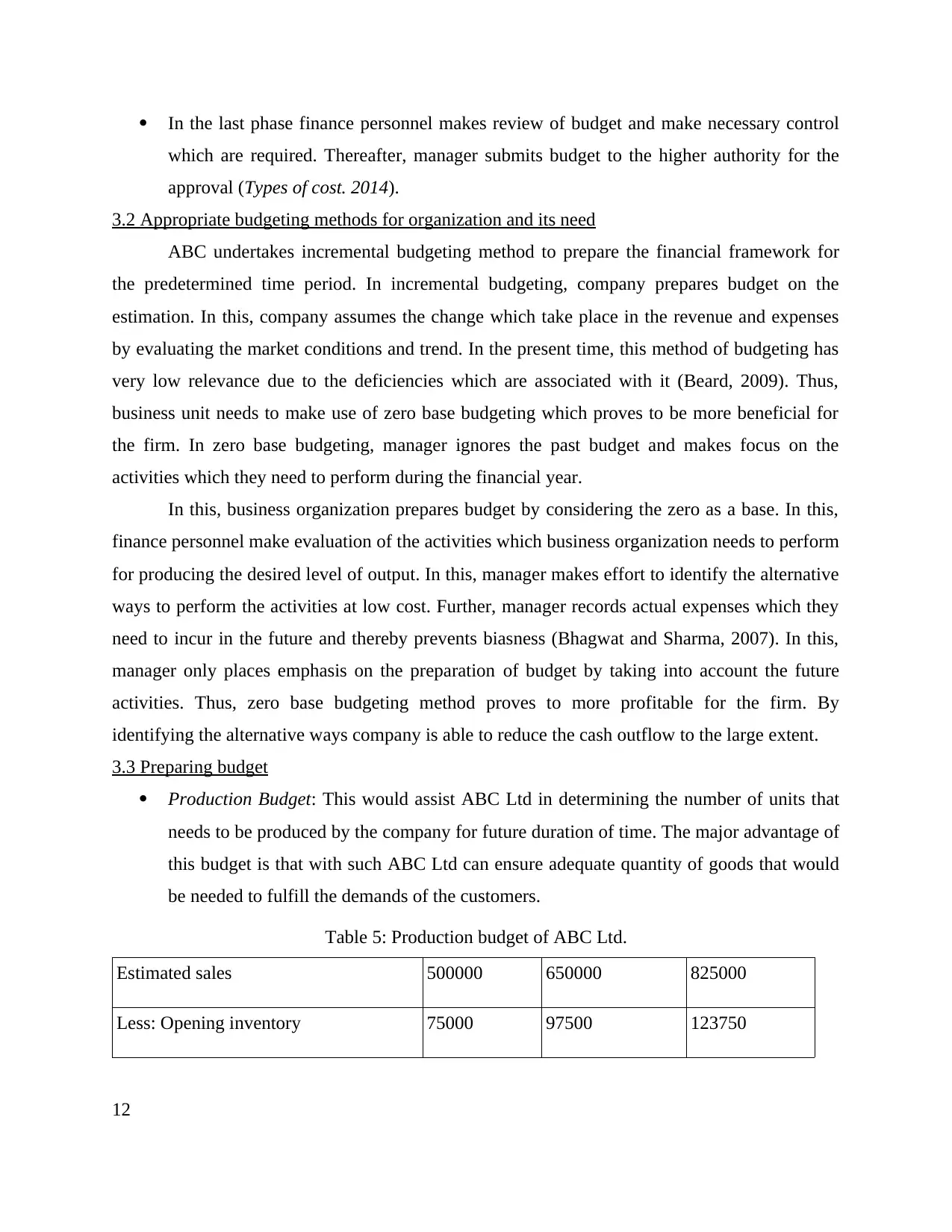

3.3 Preparing budget

Production Budget: This would assist ABC Ltd in determining the number of units that

needs to be produced by the company for future duration of time. The major advantage of

this budget is that with such ABC Ltd can ensure adequate quantity of goods that would

be needed to fulfill the demands of the customers.

Table 5: Production budget of ABC Ltd.

Estimated sales 500000 650000 825000

Less: Opening inventory 75000 97500 123750

12

which are required. Thereafter, manager submits budget to the higher authority for the

approval (Types of cost. 2014).

3.2 Appropriate budgeting methods for organization and its need

ABC undertakes incremental budgeting method to prepare the financial framework for

the predetermined time period. In incremental budgeting, company prepares budget on the

estimation. In this, company assumes the change which take place in the revenue and expenses

by evaluating the market conditions and trend. In the present time, this method of budgeting has

very low relevance due to the deficiencies which are associated with it (Beard, 2009). Thus,

business unit needs to make use of zero base budgeting which proves to be more beneficial for

the firm. In zero base budgeting, manager ignores the past budget and makes focus on the

activities which they need to perform during the financial year.

In this, business organization prepares budget by considering the zero as a base. In this,

finance personnel make evaluation of the activities which business organization needs to perform

for producing the desired level of output. In this, manager makes effort to identify the alternative

ways to perform the activities at low cost. Further, manager records actual expenses which they

need to incur in the future and thereby prevents biasness (Bhagwat and Sharma, 2007). In this,

manager only places emphasis on the preparation of budget by taking into account the future

activities. Thus, zero base budgeting method proves to more profitable for the firm. By

identifying the alternative ways company is able to reduce the cash outflow to the large extent.

3.3 Preparing budget

Production Budget: This would assist ABC Ltd in determining the number of units that

needs to be produced by the company for future duration of time. The major advantage of

this budget is that with such ABC Ltd can ensure adequate quantity of goods that would

be needed to fulfill the demands of the customers.

Table 5: Production budget of ABC Ltd.

Estimated sales 500000 650000 825000

Less: Opening inventory 75000 97500 123750

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.