Accounting Principles: Cost Analysis, Costing & Decision Making

VerifiedAdded on 2023/06/10

|9

|1313

|187

Homework Assignment

AI Summary

This assignment covers several key concepts in accounting, including the high-low method for estimating variable and fixed costs, the preparation of a cost of goods sold schedule and income statement, and relevant cost analysis for make-or-buy decisions. The high-low method is used to determine v...

Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

Contents...........................................................................................................................................2

Question 1........................................................................................................................................1

Question 2........................................................................................................................................2

(i)..................................................................................................................................................2

(ii)................................................................................................................................................3

Question 3........................................................................................................................................4

(a).................................................................................................................................................4

(b).................................................................................................................................................5

Question 5........................................................................................................................................5

(a).................................................................................................................................................5

(b).................................................................................................................................................6

(c).................................................................................................................................................6

Contents...........................................................................................................................................2

Question 1........................................................................................................................................1

Question 2........................................................................................................................................2

(i)..................................................................................................................................................2

(ii)................................................................................................................................................3

Question 3........................................................................................................................................4

(a).................................................................................................................................................4

(b).................................................................................................................................................5

Question 5........................................................................................................................................5

(a).................................................................................................................................................5

(b).................................................................................................................................................6

(c).................................................................................................................................................6

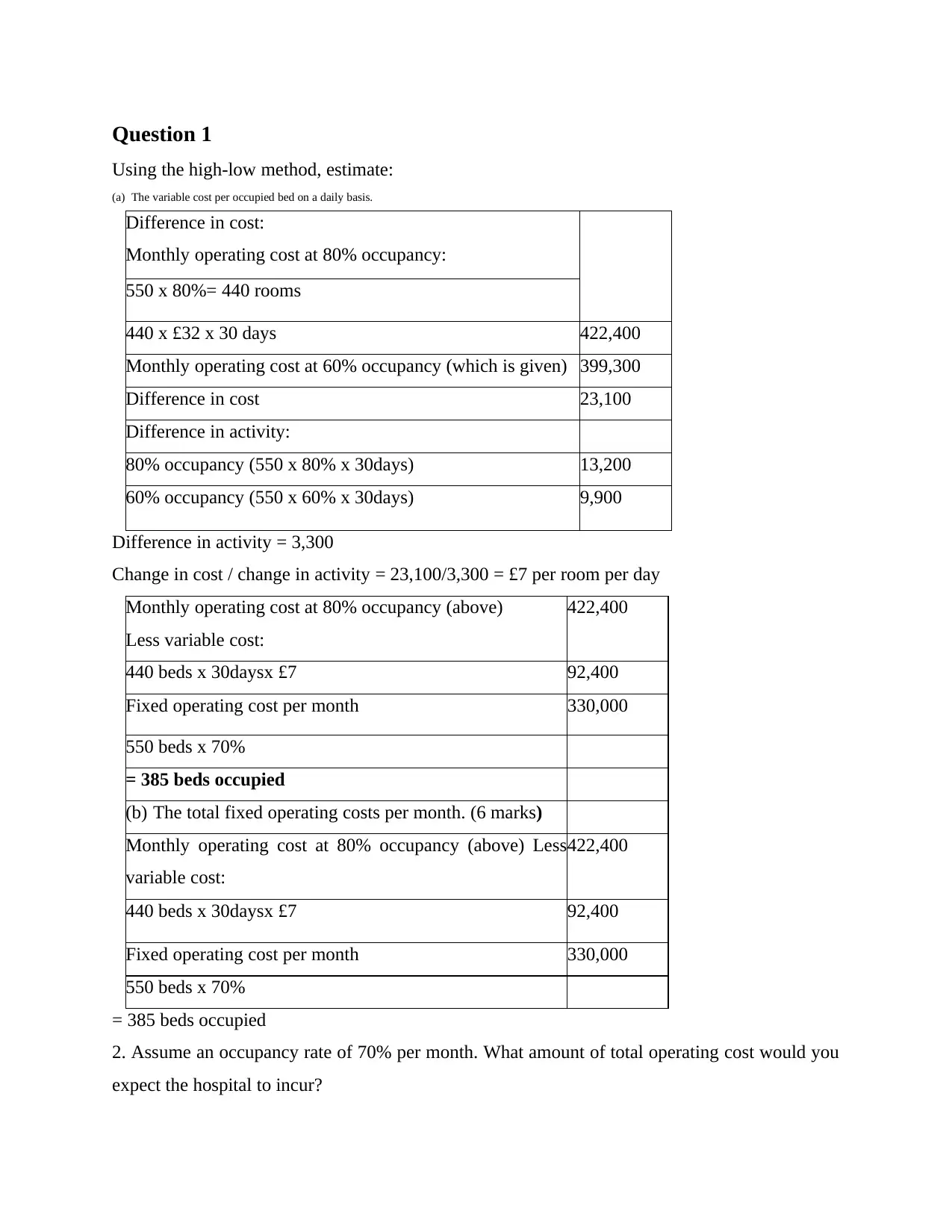

Question 1

Using the high-low method, estimate:

(a) The variable cost per occupied bed on a daily basis.

Difference in cost:

Monthly operating cost at 80% occupancy:

550 x 80%= 440 rooms

440 x £32 x 30 days 422,400

Monthly operating cost at 60% occupancy (which is given) 399,300

Difference in cost 23,100

Difference in activity:

80% occupancy (550 x 80% x 30days) 13,200

60% occupancy (550 x 60% x 30days) 9,900

Difference in activity = 3,300

Change in cost / change in activity = 23,100/3,300 = £7 per room per day

Monthly operating cost at 80% occupancy (above)

Less variable cost:

422,400

440 beds x 30daysx £7 92,400

Fixed operating cost per month 330,000

550 beds x 70%

= 385 beds occupied

(b) The total fixed operating costs per month. (6 marks)

Monthly operating cost at 80% occupancy (above) Less

variable cost:

422,400

440 beds x 30daysx £7 92,400

Fixed operating cost per month 330,000

550 beds x 70%

= 385 beds occupied

2. Assume an occupancy rate of 70% per month. What amount of total operating cost would you

expect the hospital to incur?

Using the high-low method, estimate:

(a) The variable cost per occupied bed on a daily basis.

Difference in cost:

Monthly operating cost at 80% occupancy:

550 x 80%= 440 rooms

440 x £32 x 30 days 422,400

Monthly operating cost at 60% occupancy (which is given) 399,300

Difference in cost 23,100

Difference in activity:

80% occupancy (550 x 80% x 30days) 13,200

60% occupancy (550 x 60% x 30days) 9,900

Difference in activity = 3,300

Change in cost / change in activity = 23,100/3,300 = £7 per room per day

Monthly operating cost at 80% occupancy (above)

Less variable cost:

422,400

440 beds x 30daysx £7 92,400

Fixed operating cost per month 330,000

550 beds x 70%

= 385 beds occupied

(b) The total fixed operating costs per month. (6 marks)

Monthly operating cost at 80% occupancy (above) Less

variable cost:

422,400

440 beds x 30daysx £7 92,400

Fixed operating cost per month 330,000

550 beds x 70%

= 385 beds occupied

2. Assume an occupancy rate of 70% per month. What amount of total operating cost would you

expect the hospital to incur?

You're viewing a preview

Unlock full access by subscribing today!

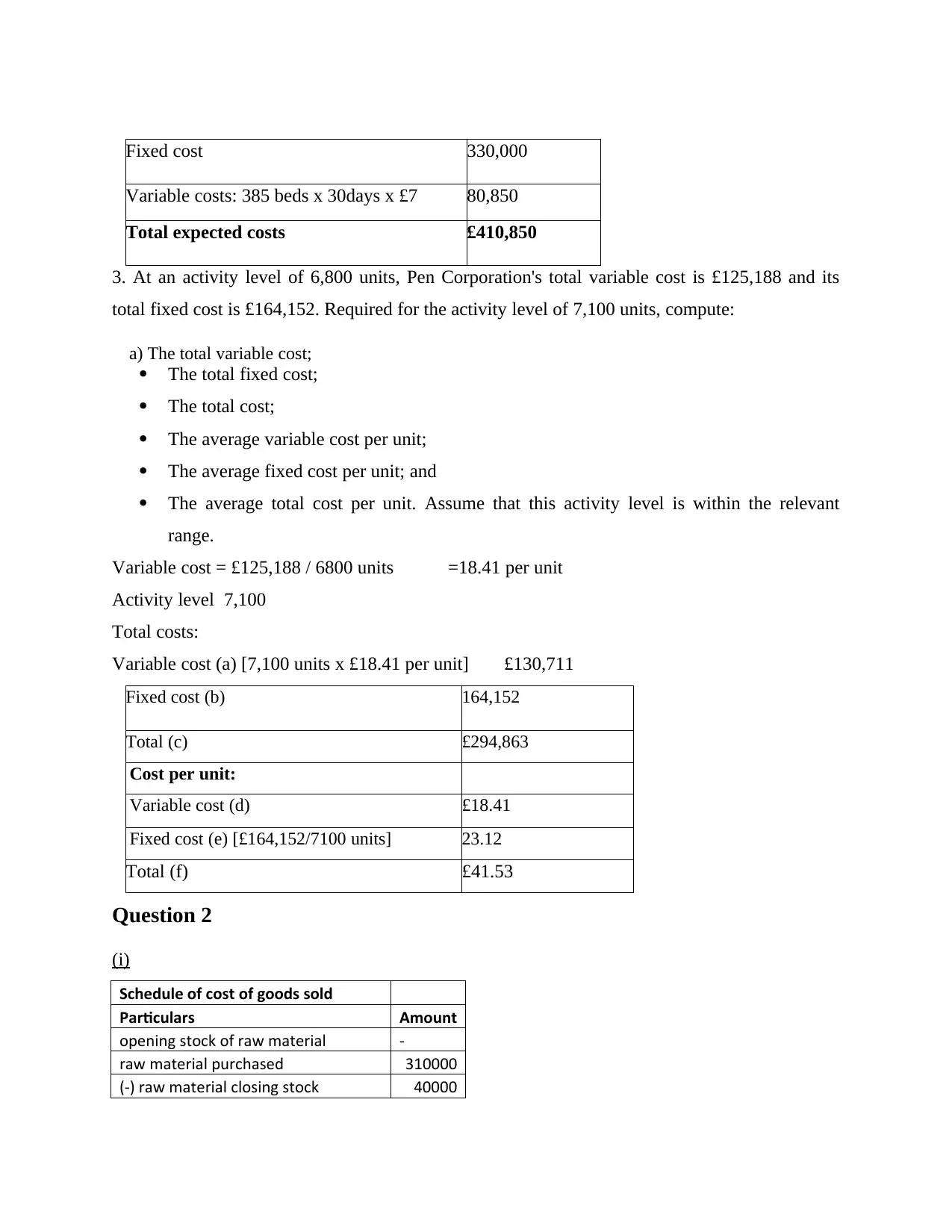

Fixed cost 330,000

Variable costs: 385 beds x 30days x £7 80,850

Total expected costs £410,850

3. At an activity level of 6,800 units, Pen Corporation's total variable cost is £125,188 and its

total fixed cost is £164,152. Required for the activity level of 7,100 units, compute:

a) The total variable cost;

The total fixed cost;

The total cost;

The average variable cost per unit;

The average fixed cost per unit; and

The average total cost per unit. Assume that this activity level is within the relevant

range.

Variable cost = £125,188 / 6800 units =18.41 per unit

Activity level 7,100

Total costs:

Variable cost (a) [7,100 units x £18.41 per unit] £130,711

Fixed cost (b) 164,152

Total (c) £294,863

Cost per unit:

Variable cost (d) £18.41

Fixed cost (e) [£164,152/7100 units] 23.12

Total (f) £41.53

Question 2

(i)

Schedule of cost of goods sold

Particulars Amount

opening stock of raw material -

raw material purchased 310000

(-) raw material closing stock 40000

Variable costs: 385 beds x 30days x £7 80,850

Total expected costs £410,850

3. At an activity level of 6,800 units, Pen Corporation's total variable cost is £125,188 and its

total fixed cost is £164,152. Required for the activity level of 7,100 units, compute:

a) The total variable cost;

The total fixed cost;

The total cost;

The average variable cost per unit;

The average fixed cost per unit; and

The average total cost per unit. Assume that this activity level is within the relevant

range.

Variable cost = £125,188 / 6800 units =18.41 per unit

Activity level 7,100

Total costs:

Variable cost (a) [7,100 units x £18.41 per unit] £130,711

Fixed cost (b) 164,152

Total (c) £294,863

Cost per unit:

Variable cost (d) £18.41

Fixed cost (e) [£164,152/7100 units] 23.12

Total (f) £41.53

Question 2

(i)

Schedule of cost of goods sold

Particulars Amount

opening stock of raw material -

raw material purchased 310000

(-) raw material closing stock 40000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

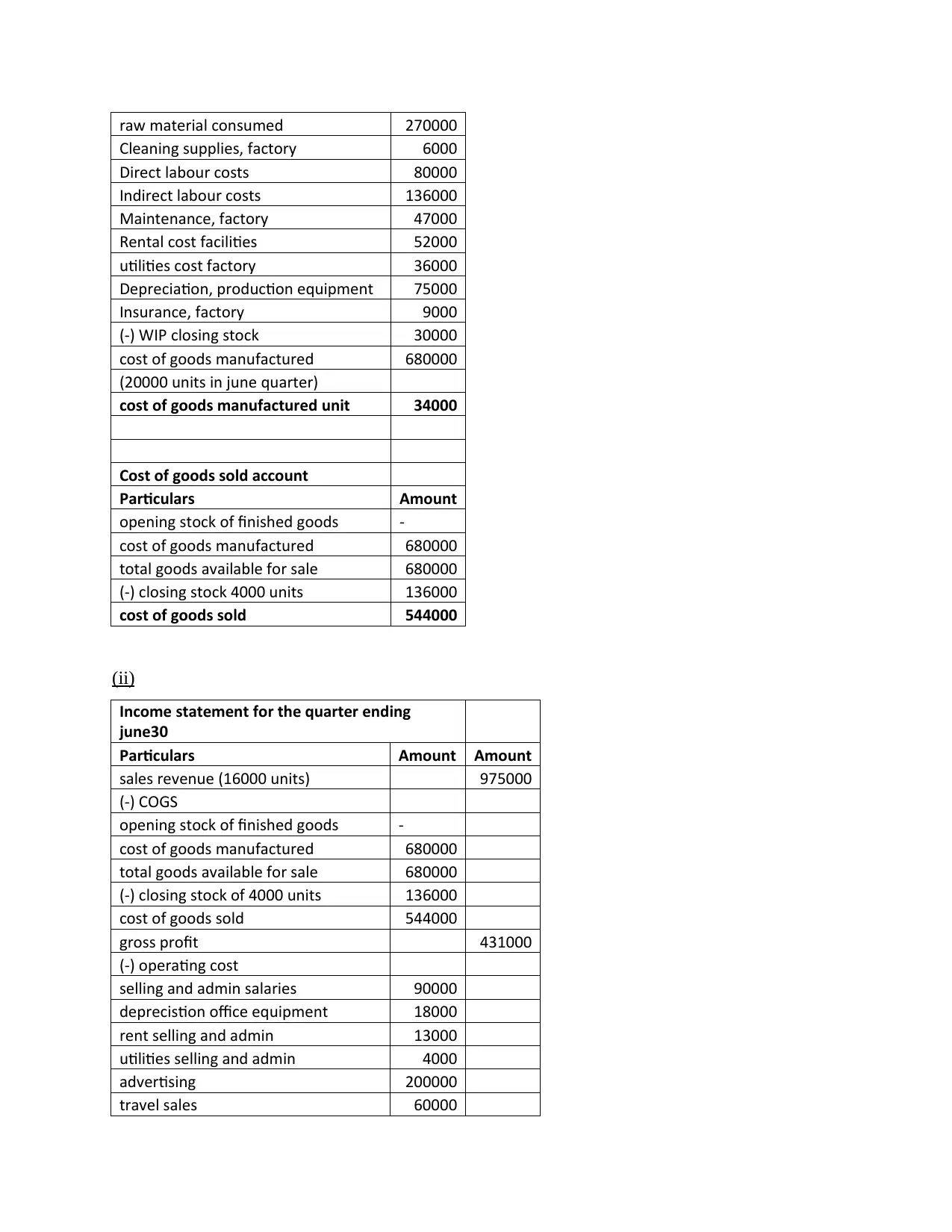

raw material consumed 270000

Cleaning supplies, factory 6000

Direct labour costs 80000

Indirect labour costs 136000

Maintenance, factory 47000

Rental cost facilities 52000

utilities cost factory 36000

Depreciation, production equipment 75000

Insurance, factory 9000

(-) WIP closing stock 30000

cost of goods manufactured 680000

(20000 units in june quarter)

cost of goods manufactured unit 34000

Cost of goods sold account

Particulars Amount

opening stock of finished goods -

cost of goods manufactured 680000

total goods available for sale 680000

(-) closing stock 4000 units 136000

cost of goods sold 544000

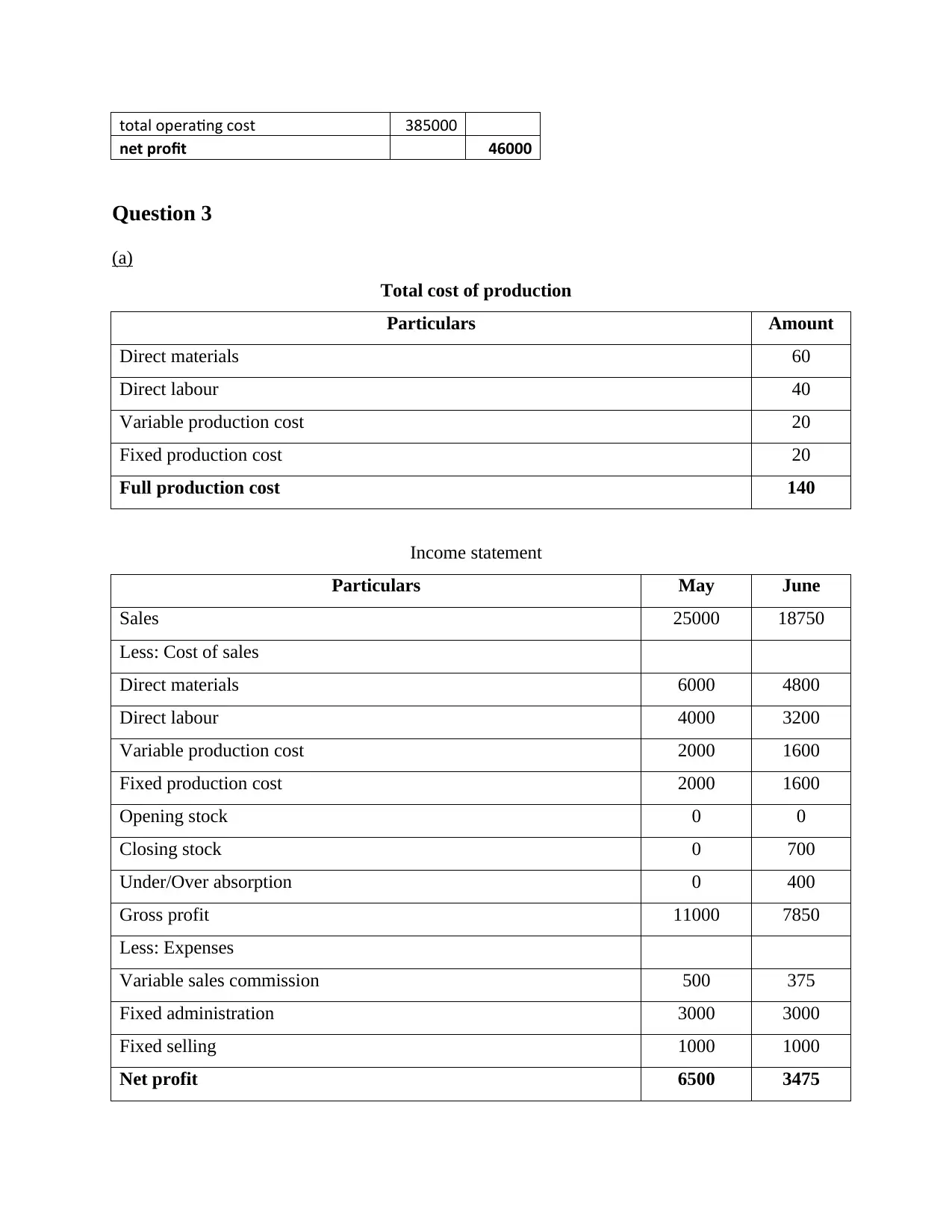

(ii)

Income statement for the quarter ending

june30

Particulars Amount Amount

sales revenue (16000 units) 975000

(-) COGS

opening stock of finished goods -

cost of goods manufactured 680000

total goods available for sale 680000

(-) closing stock of 4000 units 136000

cost of goods sold 544000

gross profit 431000

(-) operating cost

selling and admin salaries 90000

deprecistion office equipment 18000

rent selling and admin 13000

utilities selling and admin 4000

advertising 200000

travel sales 60000

Cleaning supplies, factory 6000

Direct labour costs 80000

Indirect labour costs 136000

Maintenance, factory 47000

Rental cost facilities 52000

utilities cost factory 36000

Depreciation, production equipment 75000

Insurance, factory 9000

(-) WIP closing stock 30000

cost of goods manufactured 680000

(20000 units in june quarter)

cost of goods manufactured unit 34000

Cost of goods sold account

Particulars Amount

opening stock of finished goods -

cost of goods manufactured 680000

total goods available for sale 680000

(-) closing stock 4000 units 136000

cost of goods sold 544000

(ii)

Income statement for the quarter ending

june30

Particulars Amount Amount

sales revenue (16000 units) 975000

(-) COGS

opening stock of finished goods -

cost of goods manufactured 680000

total goods available for sale 680000

(-) closing stock of 4000 units 136000

cost of goods sold 544000

gross profit 431000

(-) operating cost

selling and admin salaries 90000

deprecistion office equipment 18000

rent selling and admin 13000

utilities selling and admin 4000

advertising 200000

travel sales 60000

total operating cost 385000

net profit 46000

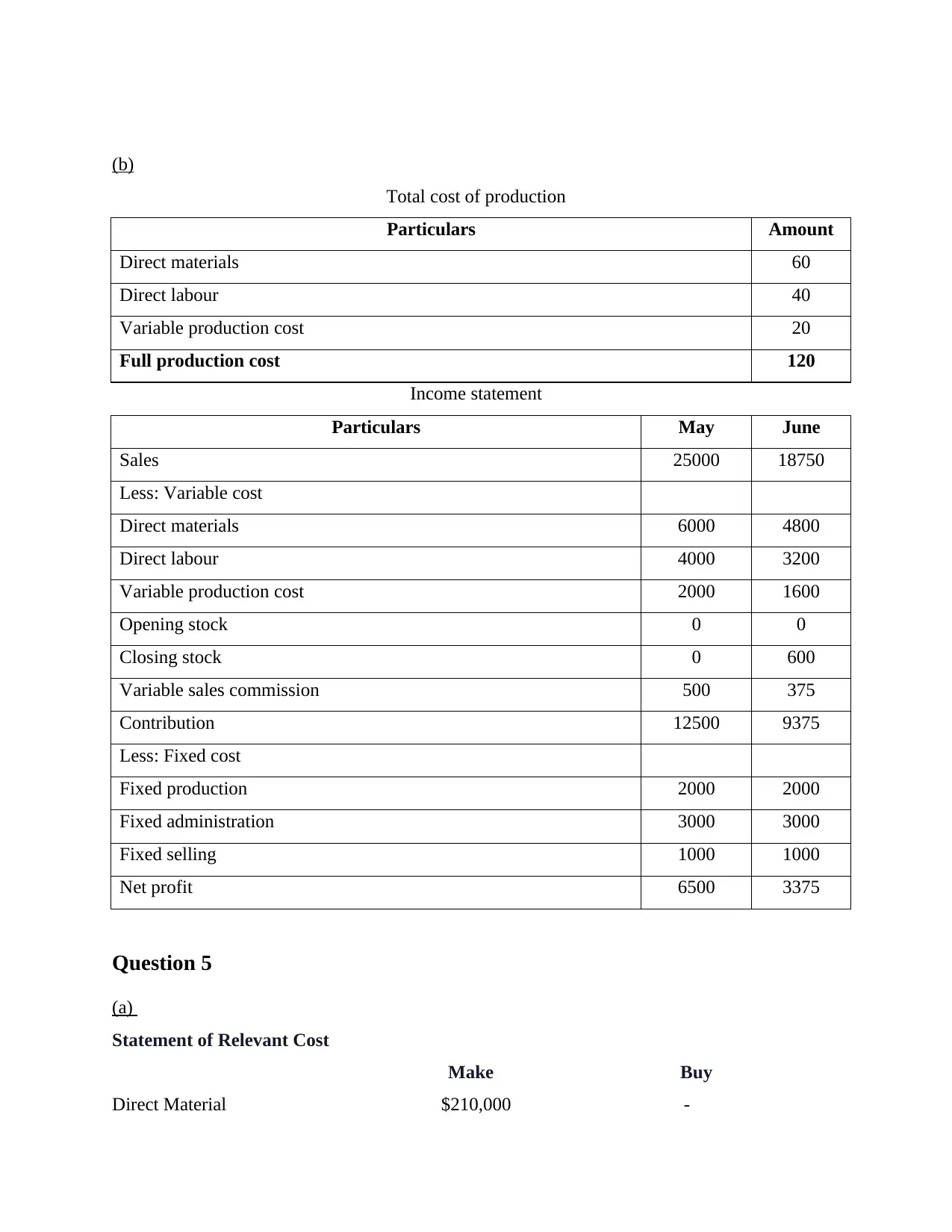

Question 3

(a)

Total cost of production

Particulars Amount

Direct materials 60

Direct labour 40

Variable production cost 20

Fixed production cost 20

Full production cost 140

Income statement

Particulars May June

Sales 25000 18750

Less: Cost of sales

Direct materials 6000 4800

Direct labour 4000 3200

Variable production cost 2000 1600

Fixed production cost 2000 1600

Opening stock 0 0

Closing stock 0 700

Under/Over absorption 0 400

Gross profit 11000 7850

Less: Expenses

Variable sales commission 500 375

Fixed administration 3000 3000

Fixed selling 1000 1000

Net profit 6500 3475

net profit 46000

Question 3

(a)

Total cost of production

Particulars Amount

Direct materials 60

Direct labour 40

Variable production cost 20

Fixed production cost 20

Full production cost 140

Income statement

Particulars May June

Sales 25000 18750

Less: Cost of sales

Direct materials 6000 4800

Direct labour 4000 3200

Variable production cost 2000 1600

Fixed production cost 2000 1600

Opening stock 0 0

Closing stock 0 700

Under/Over absorption 0 400

Gross profit 11000 7850

Less: Expenses

Variable sales commission 500 375

Fixed administration 3000 3000

Fixed selling 1000 1000

Net profit 6500 3475

You're viewing a preview

Unlock full access by subscribing today!

(b)

Total cost of production

Particulars Amount

Direct materials 60

Direct labour 40

Variable production cost 20

Full production cost 120

Income statement

Particulars May June

Sales 25000 18750

Less: Variable cost

Direct materials 6000 4800

Direct labour 4000 3200

Variable production cost 2000 1600

Opening stock 0 0

Closing stock 0 600

Variable sales commission 500 375

Contribution 12500 9375

Less: Fixed cost

Fixed production 2000 2000

Fixed administration 3000 3000

Fixed selling 1000 1000

Net profit 6500 3375

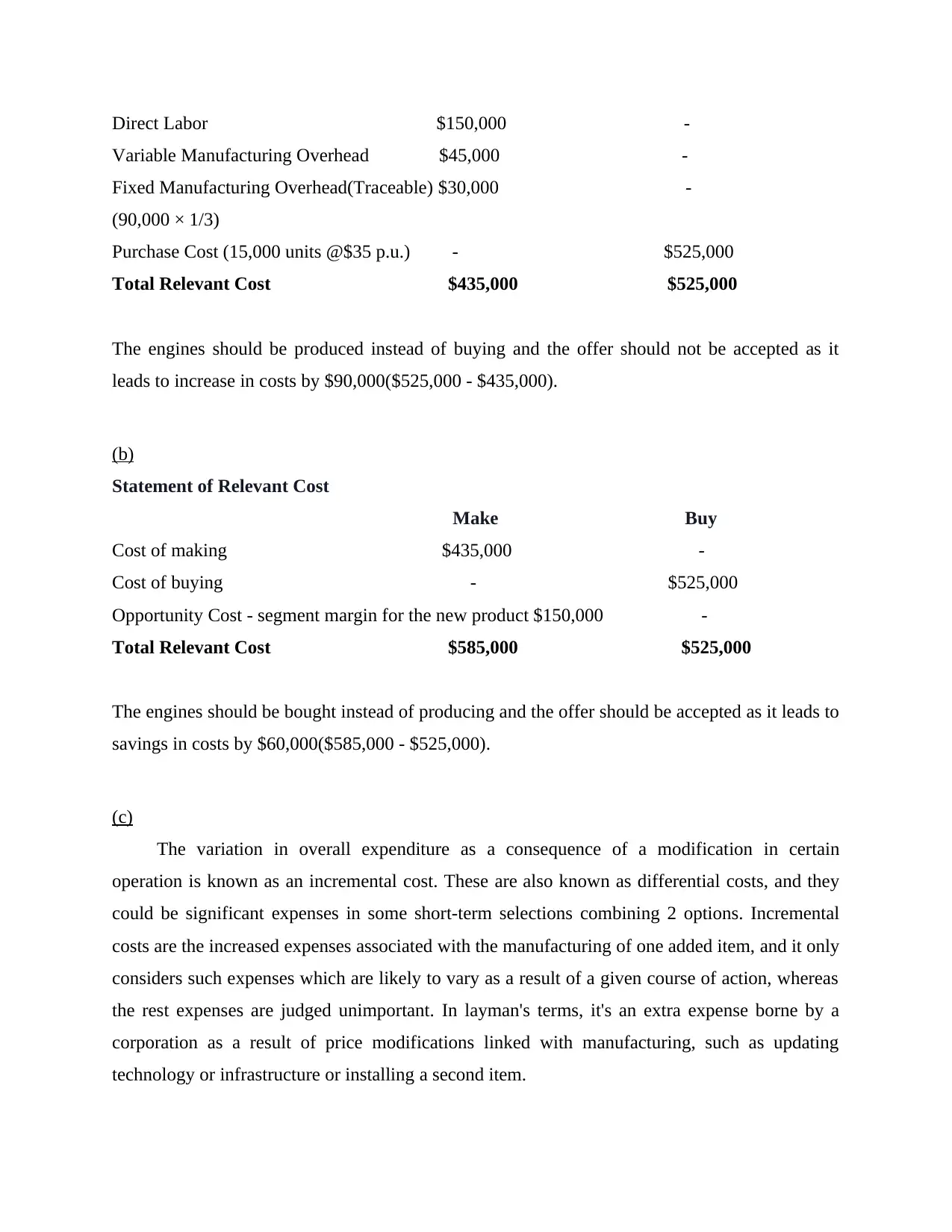

Question 5

(a)

Statement of Relevant Cost

Make Buy

Direct Material $210,000 -

Total cost of production

Particulars Amount

Direct materials 60

Direct labour 40

Variable production cost 20

Full production cost 120

Income statement

Particulars May June

Sales 25000 18750

Less: Variable cost

Direct materials 6000 4800

Direct labour 4000 3200

Variable production cost 2000 1600

Opening stock 0 0

Closing stock 0 600

Variable sales commission 500 375

Contribution 12500 9375

Less: Fixed cost

Fixed production 2000 2000

Fixed administration 3000 3000

Fixed selling 1000 1000

Net profit 6500 3375

Question 5

(a)

Statement of Relevant Cost

Make Buy

Direct Material $210,000 -

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Direct Labor $150,000 -

Variable Manufacturing Overhead $45,000 -

Fixed Manufacturing Overhead(Traceable) $30,000 -

(90,000 × 1/3)

Purchase Cost (15,000 units @$35 p.u.) - $525,000

Total Relevant Cost $435,000 $525,000

The engines should be produced instead of buying and the offer should not be accepted as it

leads to increase in costs by $90,000($525,000 - $435,000).

(b)

Statement of Relevant Cost

Make Buy

Cost of making $435,000 -

Cost of buying - $525,000

Opportunity Cost - segment margin for the new product $150,000 -

Total Relevant Cost $585,000 $525,000

The engines should be bought instead of producing and the offer should be accepted as it leads to

savings in costs by $60,000($585,000 - $525,000).

(c)

The variation in overall expenditure as a consequence of a modification in certain

operation is known as an incremental cost. These are also known as differential costs, and they

could be significant expenses in some short-term selections combining 2 options. Incremental

costs are the increased expenses associated with the manufacturing of one added item, and it only

considers such expenses which are likely to vary as a result of a given course of action, whereas

the rest expenses are judged unimportant. In layman's terms, it's an extra expense borne by a

corporation as a result of price modifications linked with manufacturing, such as updating

technology or infrastructure or installing a second item.

Variable Manufacturing Overhead $45,000 -

Fixed Manufacturing Overhead(Traceable) $30,000 -

(90,000 × 1/3)

Purchase Cost (15,000 units @$35 p.u.) - $525,000

Total Relevant Cost $435,000 $525,000

The engines should be produced instead of buying and the offer should not be accepted as it

leads to increase in costs by $90,000($525,000 - $435,000).

(b)

Statement of Relevant Cost

Make Buy

Cost of making $435,000 -

Cost of buying - $525,000

Opportunity Cost - segment margin for the new product $150,000 -

Total Relevant Cost $585,000 $525,000

The engines should be bought instead of producing and the offer should be accepted as it leads to

savings in costs by $60,000($585,000 - $525,000).

(c)

The variation in overall expenditure as a consequence of a modification in certain

operation is known as an incremental cost. These are also known as differential costs, and they

could be significant expenses in some short-term selections combining 2 options. Incremental

costs are the increased expenses associated with the manufacturing of one added item, and it only

considers such expenses which are likely to vary as a result of a given course of action, whereas

the rest expenses are judged unimportant. In layman's terms, it's an extra expense borne by a

corporation as a result of price modifications linked with manufacturing, such as updating

technology or infrastructure or installing a second item.

The opportunity cost is the amount of money someone have had to forego in order to

obtain whatever they desire in perspective of alternative products or solutions. Whenever people

say "cost" in economics, humans generally imply "opportunity cost." The revenue missed

whenever one option is chosen over another is known as opportunity cost. Broadly said, the idea

serves as a caution to consider various plausible options when reaching a choice. For instance,

suppose you possess $1,000,000 and decide to put it in an item category which might yield a 5%

yield. If you can somehow have put the funds into another venture which might have yielded a

7% yield, the shortfall of 2% among the two options is the missed opportunity cost of this

choice. Cash isn't always involved in opportunity cost. It could likewise apply to different ways

of spending energy.

obtain whatever they desire in perspective of alternative products or solutions. Whenever people

say "cost" in economics, humans generally imply "opportunity cost." The revenue missed

whenever one option is chosen over another is known as opportunity cost. Broadly said, the idea

serves as a caution to consider various plausible options when reaching a choice. For instance,

suppose you possess $1,000,000 and decide to put it in an item category which might yield a 5%

yield. If you can somehow have put the funds into another venture which might have yielded a

7% yield, the shortfall of 2% among the two options is the missed opportunity cost of this

choice. Cash isn't always involved in opportunity cost. It could likewise apply to different ways

of spending energy.

You're viewing a preview

Unlock full access by subscribing today!

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.