Detailed Report on Management Accounting Systems and Reporting

VerifiedAdded on 2021/02/22

|23

|6728

|51

Report

AI Summary

This report provides a detailed analysis of management accounting, focusing on its systems, reporting methods, and costing techniques. It begins with an introduction to management accounting and its role in decision-making, using Renishaw Plc as a case study. The report explores various management accounting systems, including cost accounting, inventory management, price optimization, and job costing, highlighting their benefits and applications. It then delves into management accounting reporting methods such as account receivable reports, budget reports, performance reports, and inventory management reports. The report also examines the integration of these systems with organizational processes. Furthermore, it discusses planning tools for budgetary control and compares different approaches to resolving financial problems, emphasizing how management accounting contributes to sustainable success. The report includes a conclusion summarizing the key findings and a list of references.

Management Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

ACTIVITY 1 .................................................................................................................................1

PART A.......................................................................................................................................1

P1. Management accounting with its systems.............................................................................1

P2. Methods for management accounting reporting....................................................................3

M1. Benefits of management accounting system........................................................................4

D1. Integration of management accounting systems as well as reporting with organisational

processes......................................................................................................................................5

PART B........................................................................................................................................6

P3. Calculation of costs and preparation of income statements...................................................6

M2. Application of management accounting techniques...........................................................10

D2. Interpretation of data...........................................................................................................11

ACTIVITY 2..................................................................................................................................11

Part A.........................................................................................................................................11

P4. Planning tools for budgetary control...................................................................................11

M3. Uses with application of tools so to forecast budgets........................................................13

PART B......................................................................................................................................15

P5. Comparison of ways in which management accounting systems are adopted to respond

financial problems......................................................................................................................15

M4. Analyses of ways management accounting helps in resolving financial problems...........17

D3. Evaluation of the ways planning tools respond appropriately to solve financial problems

as to lead sustainable success.....................................................................................................17

CONCLUSION..............................................................................................................................17

REFERENCES..............................................................................................................................19

INTRODUCTION...........................................................................................................................1

ACTIVITY 1 .................................................................................................................................1

PART A.......................................................................................................................................1

P1. Management accounting with its systems.............................................................................1

P2. Methods for management accounting reporting....................................................................3

M1. Benefits of management accounting system........................................................................4

D1. Integration of management accounting systems as well as reporting with organisational

processes......................................................................................................................................5

PART B........................................................................................................................................6

P3. Calculation of costs and preparation of income statements...................................................6

M2. Application of management accounting techniques...........................................................10

D2. Interpretation of data...........................................................................................................11

ACTIVITY 2..................................................................................................................................11

Part A.........................................................................................................................................11

P4. Planning tools for budgetary control...................................................................................11

M3. Uses with application of tools so to forecast budgets........................................................13

PART B......................................................................................................................................15

P5. Comparison of ways in which management accounting systems are adopted to respond

financial problems......................................................................................................................15

M4. Analyses of ways management accounting helps in resolving financial problems...........17

D3. Evaluation of the ways planning tools respond appropriately to solve financial problems

as to lead sustainable success.....................................................................................................17

CONCLUSION..............................................................................................................................17

REFERENCES..............................................................................................................................19

INTRODUCTION

Management accounting is a concept which makes a proper use of financial and non-

financial data to translate it into meaningful information that facilitates decision making of

managers of organisations (Bandy, 2014). It involves methods as well as techniques which plays

necessary aspects while planning business actions and controlling performances. It enables

administrators to minimise losses together with maximising profits. Using statistical devices such

as graphs, charts or diagrams, management accounting presents as well as interprets financial

information in numerical terms. To develop knowledge about management accounting,

Renishaw Plc is selected which is one of the top engineering firm having headquarters at

Wotton-Under-Edge, UK. The entity is popular for its coordinate measuring machines addition

to machine tool products.

This report includes concepts such as management accounting systems, reporting

mechanisms and costing techniques that are further used in producing management reports. It

also comprises planning tools with their benefits and shortcomings for budgetary control. In

addition, financial problems are discussed that are resolved using systems and appropriate

accounting approach so that business can lead sustainable success.

ACTIVITY 1

PART A

P1. Management accounting with its systems.

Management accounting: Management accounting is aforementioned to procedures of

identifying, measuring, gathering, preparing, explaining and spreading information to assist

managing directors while decision making in context to fulfilling organisational goals. It is

categorised as input measurement basis, cost accumulation methods, inventory cost flows,

inventory valuation techniques as well as cost flow assumption. It also benefits in planning

ahead, analysing and controlling business performances so to work on the path of ongoing

improvements. In relevance to Renishaw Plc, it is used to measure revenues, assets as well as

costs (Berry, Broadbent and Otley, 2016). It aids towards selecting appropriate alternative in

decision making. It comprises certain accounting systems that are discussed as:

Cost accounting system: While estimating product costs, preferred framework is cost

accounting system. It benefits in making evaluations for inventory valuation in accordance with

1

Management accounting is a concept which makes a proper use of financial and non-

financial data to translate it into meaningful information that facilitates decision making of

managers of organisations (Bandy, 2014). It involves methods as well as techniques which plays

necessary aspects while planning business actions and controlling performances. It enables

administrators to minimise losses together with maximising profits. Using statistical devices such

as graphs, charts or diagrams, management accounting presents as well as interprets financial

information in numerical terms. To develop knowledge about management accounting,

Renishaw Plc is selected which is one of the top engineering firm having headquarters at

Wotton-Under-Edge, UK. The entity is popular for its coordinate measuring machines addition

to machine tool products.

This report includes concepts such as management accounting systems, reporting

mechanisms and costing techniques that are further used in producing management reports. It

also comprises planning tools with their benefits and shortcomings for budgetary control. In

addition, financial problems are discussed that are resolved using systems and appropriate

accounting approach so that business can lead sustainable success.

ACTIVITY 1

PART A

P1. Management accounting with its systems.

Management accounting: Management accounting is aforementioned to procedures of

identifying, measuring, gathering, preparing, explaining and spreading information to assist

managing directors while decision making in context to fulfilling organisational goals. It is

categorised as input measurement basis, cost accumulation methods, inventory cost flows,

inventory valuation techniques as well as cost flow assumption. It also benefits in planning

ahead, analysing and controlling business performances so to work on the path of ongoing

improvements. In relevance to Renishaw Plc, it is used to measure revenues, assets as well as

costs (Berry, Broadbent and Otley, 2016). It aids towards selecting appropriate alternative in

decision making. It comprises certain accounting systems that are discussed as:

Cost accounting system: While estimating product costs, preferred framework is cost

accounting system. It benefits in making evaluations for inventory valuation in accordance with

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

controlling costs. Accurate cost estimation is fundamental for profitable operations. In addition,

this system is also essentially required at Renishaw Plc to ascertain appropriate product costs as

well as estimating material inventory during closing duration, work in progress addition to

inventory of finished commodities so that financial statements can be prepared. Further, the

system is essentially required to identify distinct costs, eliminating associated unit costs so to

increase revenues addition to building effective strategies for future related functions. This

system is typically classified as product and process costing in which product costing is used to

ascertain cost involved in a product and process costing is essential to estimate cost of a whole

process depending upon the manufacturing model of organisation.

Inventory management system: Monitoring addition to maintaining stocked products

requires inventory management system (Bovens, Goodin and Schillemans, 2014). It is a system

that helps in identification of inventory items together with associated information through asset

tags and barcode labels. Its categories are Stock Review, LIFO, Just In Time, FIFO and ABC

Analysis. At Renishaw Plc, the system is used for carefully maintaining stock level and for this

separate warehouses are designed where centralised records associated with inventory are

recorded with other information. Essential requirements of the system at Renishaw is to track

stocks and categorising materials so to deliver inventory at production units at right time such

that delays are eliminated in working.It provides appropriate information to mangers about

location of items, specifications, totality of items held as stock and details about vendor or

supplier. In addition, with this system, documents related to work order, material bills as well as

many more are systematically recorded and provided to top authorities for taking future

inventory decisions.

Price optimising system: Calculating perceptions or demand during changes in product

and combining data with costs as well as inventory levels as to make changes in prices is only

done through price optimising system. The system begins with customer segmentation and ends

with setting new prices as per customer responses. It is primarily preferred by companies to tailor

prices accordance with customer segments and stimulating the ways targeted audiences responds

towards altered prices (Taylor & Francis, Suomala and Lyly-Yrjänäinen, 2012). Marketers of

Renishaw Plc makes analysis of certain demand impacts in relevance to price changes of wide

machines including motion control, spectroscopy and measurement products. Managers with

price optimisation system usually modifies their pricing to segment customers and analysing the

2

this system is also essentially required at Renishaw Plc to ascertain appropriate product costs as

well as estimating material inventory during closing duration, work in progress addition to

inventory of finished commodities so that financial statements can be prepared. Further, the

system is essentially required to identify distinct costs, eliminating associated unit costs so to

increase revenues addition to building effective strategies for future related functions. This

system is typically classified as product and process costing in which product costing is used to

ascertain cost involved in a product and process costing is essential to estimate cost of a whole

process depending upon the manufacturing model of organisation.

Inventory management system: Monitoring addition to maintaining stocked products

requires inventory management system (Bovens, Goodin and Schillemans, 2014). It is a system

that helps in identification of inventory items together with associated information through asset

tags and barcode labels. Its categories are Stock Review, LIFO, Just In Time, FIFO and ABC

Analysis. At Renishaw Plc, the system is used for carefully maintaining stock level and for this

separate warehouses are designed where centralised records associated with inventory are

recorded with other information. Essential requirements of the system at Renishaw is to track

stocks and categorising materials so to deliver inventory at production units at right time such

that delays are eliminated in working.It provides appropriate information to mangers about

location of items, specifications, totality of items held as stock and details about vendor or

supplier. In addition, with this system, documents related to work order, material bills as well as

many more are systematically recorded and provided to top authorities for taking future

inventory decisions.

Price optimising system: Calculating perceptions or demand during changes in product

and combining data with costs as well as inventory levels as to make changes in prices is only

done through price optimising system. The system begins with customer segmentation and ends

with setting new prices as per customer responses. It is primarily preferred by companies to tailor

prices accordance with customer segments and stimulating the ways targeted audiences responds

towards altered prices (Taylor & Francis, Suomala and Lyly-Yrjänäinen, 2012). Marketers of

Renishaw Plc makes analysis of certain demand impacts in relevance to price changes of wide

machines including motion control, spectroscopy and measurement products. Managers with

price optimisation system usually modifies their pricing to segment customers and analysing the

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ways in which targeted audiences will give responses to modified prices. The system is

essentially required so that pricing structure is optimised for initial pricing, mark down pricing

together with promotional pricing. In addition, the system is used to mould pricing structures in

distinct scenario.

Job costing system: Accumulating production costs and assigning them to individual

output of particular job is done with job costing system. The system primarily accumulates

manufacturing costs linked with each job in separate manner. When organisation manufactures

wide range of items and all have significant differences addition to significant costs, appropriate

system used is job costing system (Job costing system. 2016). Renishaw Plc adopts the system to

produce products as per specific client orders. Product costs are tracked with associated job and

rendered services. The system is usually opted by entity so to manufacture products on special

orders. The system is essentially required to reduce risks, track costs, improving controlling

methods so that chances of profits are enhanced in appropriate manner.

Thus, management of Renishaw Plc adopts all the systems as per the necessities such as

inventory management system for tracking available and required inventory or stocked goods,

price optimising system to optimise product prices as per customer perceptions and cost

accounting system to estimate appropriate product costs.

P2. Methods for management accounting reporting

Management accounting reporting: A framework to provide information in written

manner including facts and figures. Accounting reports are produced as per the business

requirements such as to evaluate performance or forecasting budgets. Management Accounting

reports plays important function to make decisions for existing or upcoming period. With the

reports, managers of Renishaw Plc acknowledge improvement areas in order to accomplish high

outcomes. Some methods which are widely used for accounting reports are the followings:

Account receivable report: It list out information about credit memos addition to unpaid

customer invoices. It helps in determining allowances together with doubtful accounts as

accountants tabulates information about receivable accounts and to cater aspects of discount to

pursuant clients. As Renishaw Plc relies on extending credit so they break down balances that are

due of clients into peculiar time in order to determine defaulters. This report benefits institutions

to regular contact with clients in order to realise them that no acceptance is given to late

payments. As large entities are not able to make recognition of each credit sale, they prepare

3

essentially required so that pricing structure is optimised for initial pricing, mark down pricing

together with promotional pricing. In addition, the system is used to mould pricing structures in

distinct scenario.

Job costing system: Accumulating production costs and assigning them to individual

output of particular job is done with job costing system. The system primarily accumulates

manufacturing costs linked with each job in separate manner. When organisation manufactures

wide range of items and all have significant differences addition to significant costs, appropriate

system used is job costing system (Job costing system. 2016). Renishaw Plc adopts the system to

produce products as per specific client orders. Product costs are tracked with associated job and

rendered services. The system is usually opted by entity so to manufacture products on special

orders. The system is essentially required to reduce risks, track costs, improving controlling

methods so that chances of profits are enhanced in appropriate manner.

Thus, management of Renishaw Plc adopts all the systems as per the necessities such as

inventory management system for tracking available and required inventory or stocked goods,

price optimising system to optimise product prices as per customer perceptions and cost

accounting system to estimate appropriate product costs.

P2. Methods for management accounting reporting

Management accounting reporting: A framework to provide information in written

manner including facts and figures. Accounting reports are produced as per the business

requirements such as to evaluate performance or forecasting budgets. Management Accounting

reports plays important function to make decisions for existing or upcoming period. With the

reports, managers of Renishaw Plc acknowledge improvement areas in order to accomplish high

outcomes. Some methods which are widely used for accounting reports are the followings:

Account receivable report: It list out information about credit memos addition to unpaid

customer invoices. It helps in determining allowances together with doubtful accounts as

accountants tabulates information about receivable accounts and to cater aspects of discount to

pursuant clients. As Renishaw Plc relies on extending credit so they break down balances that are

due of clients into peculiar time in order to determine defaulters. This report benefits institutions

to regular contact with clients in order to realise them that no acceptance is given to late

payments. As large entities are not able to make recognition of each credit sale, they prepare

3

such report to analyse circumstances due to which company is facing issues in collection

procedures.

Budget report: To determine expenditure levels with revenues, preferences are given to

budget report as it helps in taking appropriate action to bring expenditures on track accordance

with budgeted amount. Proper management of budget reports helps an entity in planning

orientation, evaluation performances, reviewing profits, allocation cash and reviewing

assumptions in accurate manner. Monitoring, analysis, recording and controlling expenses of

various products such as healthcare addition to spectroscopy with effective techniques,

management of Renishaw Plc uses budgetary report (Boyns, Edwards and Nikitin, 2013). At

such company, the report is designed to compare the closeness of budgeted performance with

that of actual one in accounting period. Future estimates are made through the past budget report

so that organisation can function towards profitability by forecasting circumstances and facing

them appropriately.

Performance reports: It is linked with business performance and that of its employees in

certain time period. It helps in strengthening knowledge about predicted performance level in

terms of sale together income. Management team of Renishaw Plc by using the report makes

strategic decisions that can define sustainable future. Other than this, individual performances are

closely monitored to award the commitments of high performers. It also avails deep insight about

functions or operations of enterprise. Performance reports are vital as they keep correct measures

of organisational strategies, plans or policies towards mission.

Inventory management report: For categorising inventories in distinct types and

keeping proper record, inventory management report is prepared so to get accurate picture of

actual stock within organisation. Analysing the report, decisions for further inventory are taken.

Entities that properly manages inventory report are likely to increase information transparency,

lowers costs, improves delivery performances, plans future inventory accurately and decreases

stock out chances. With this report, Administrators of Renishaw Plc analyses the level of

inventory which is used addition to the inventory that is on hold. It also alerts managers about the

stock that requires purchase decision as well as quantity of materials available with company so

to pursue operations.

4

procedures.

Budget report: To determine expenditure levels with revenues, preferences are given to

budget report as it helps in taking appropriate action to bring expenditures on track accordance

with budgeted amount. Proper management of budget reports helps an entity in planning

orientation, evaluation performances, reviewing profits, allocation cash and reviewing

assumptions in accurate manner. Monitoring, analysis, recording and controlling expenses of

various products such as healthcare addition to spectroscopy with effective techniques,

management of Renishaw Plc uses budgetary report (Boyns, Edwards and Nikitin, 2013). At

such company, the report is designed to compare the closeness of budgeted performance with

that of actual one in accounting period. Future estimates are made through the past budget report

so that organisation can function towards profitability by forecasting circumstances and facing

them appropriately.

Performance reports: It is linked with business performance and that of its employees in

certain time period. It helps in strengthening knowledge about predicted performance level in

terms of sale together income. Management team of Renishaw Plc by using the report makes

strategic decisions that can define sustainable future. Other than this, individual performances are

closely monitored to award the commitments of high performers. It also avails deep insight about

functions or operations of enterprise. Performance reports are vital as they keep correct measures

of organisational strategies, plans or policies towards mission.

Inventory management report: For categorising inventories in distinct types and

keeping proper record, inventory management report is prepared so to get accurate picture of

actual stock within organisation. Analysing the report, decisions for further inventory are taken.

Entities that properly manages inventory report are likely to increase information transparency,

lowers costs, improves delivery performances, plans future inventory accurately and decreases

stock out chances. With this report, Administrators of Renishaw Plc analyses the level of

inventory which is used addition to the inventory that is on hold. It also alerts managers about the

stock that requires purchase decision as well as quantity of materials available with company so

to pursue operations.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Management accounting reports at Renishaw Plc are used by all departments in order to

estimate budgets and work within that, identify business defaulters as well as ascertain company

performances with its resources.

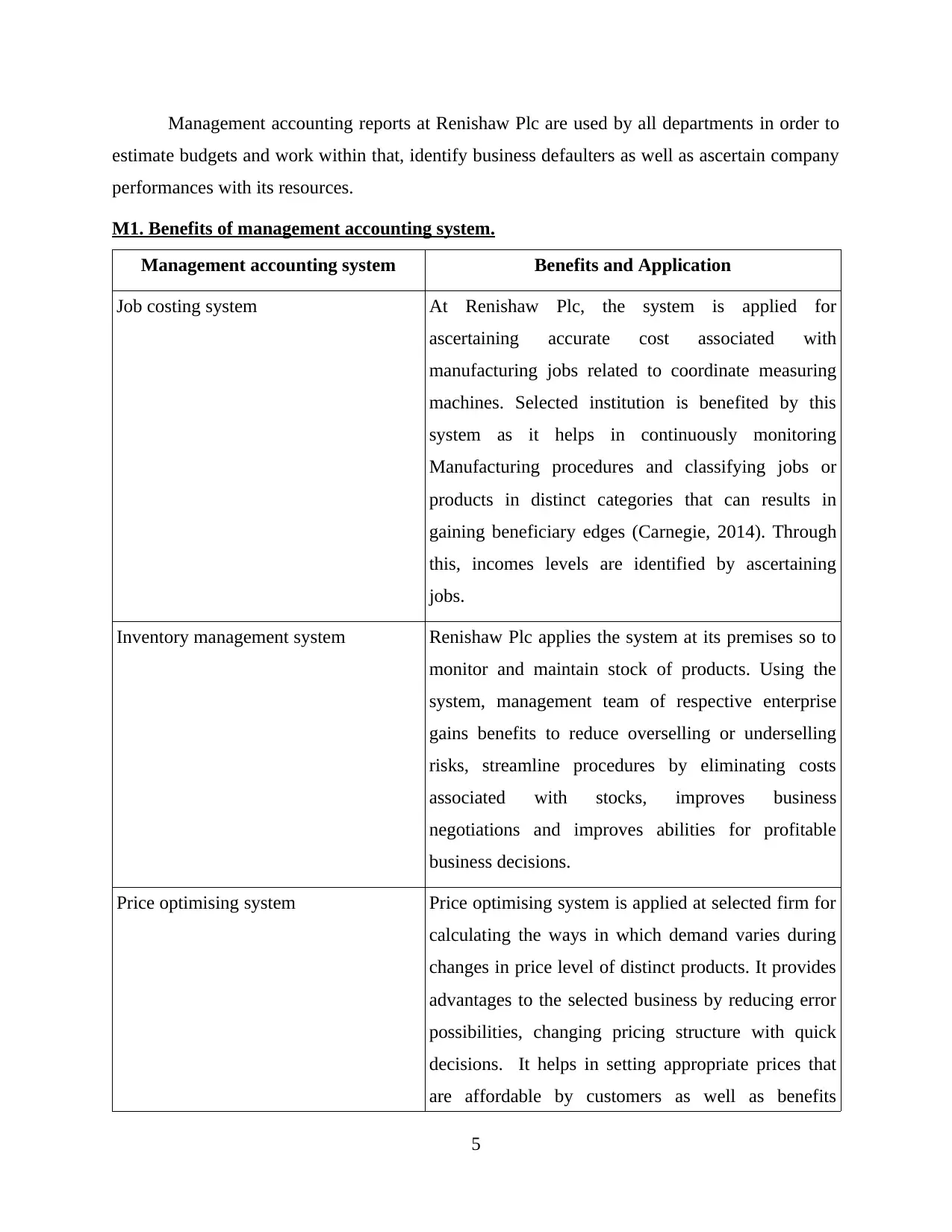

M1. Benefits of management accounting system.

Management accounting system Benefits and Application

Job costing system At Renishaw Plc, the system is applied for

ascertaining accurate cost associated with

manufacturing jobs related to coordinate measuring

machines. Selected institution is benefited by this

system as it helps in continuously monitoring

Manufacturing procedures and classifying jobs or

products in distinct categories that can results in

gaining beneficiary edges (Carnegie, 2014). Through

this, incomes levels are identified by ascertaining

jobs.

Inventory management system Renishaw Plc applies the system at its premises so to

monitor and maintain stock of products. Using the

system, management team of respective enterprise

gains benefits to reduce overselling or underselling

risks, streamline procedures by eliminating costs

associated with stocks, improves business

negotiations and improves abilities for profitable

business decisions.

Price optimising system Price optimising system is applied at selected firm for

calculating the ways in which demand varies during

changes in price level of distinct products. It provides

advantages to the selected business by reducing error

possibilities, changing pricing structure with quick

decisions. It helps in setting appropriate prices that

are affordable by customers as well as benefits

5

estimate budgets and work within that, identify business defaulters as well as ascertain company

performances with its resources.

M1. Benefits of management accounting system.

Management accounting system Benefits and Application

Job costing system At Renishaw Plc, the system is applied for

ascertaining accurate cost associated with

manufacturing jobs related to coordinate measuring

machines. Selected institution is benefited by this

system as it helps in continuously monitoring

Manufacturing procedures and classifying jobs or

products in distinct categories that can results in

gaining beneficiary edges (Carnegie, 2014). Through

this, incomes levels are identified by ascertaining

jobs.

Inventory management system Renishaw Plc applies the system at its premises so to

monitor and maintain stock of products. Using the

system, management team of respective enterprise

gains benefits to reduce overselling or underselling

risks, streamline procedures by eliminating costs

associated with stocks, improves business

negotiations and improves abilities for profitable

business decisions.

Price optimising system Price optimising system is applied at selected firm for

calculating the ways in which demand varies during

changes in price level of distinct products. It provides

advantages to the selected business by reducing error

possibilities, changing pricing structure with quick

decisions. It helps in setting appropriate prices that

are affordable by customers as well as benefits

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

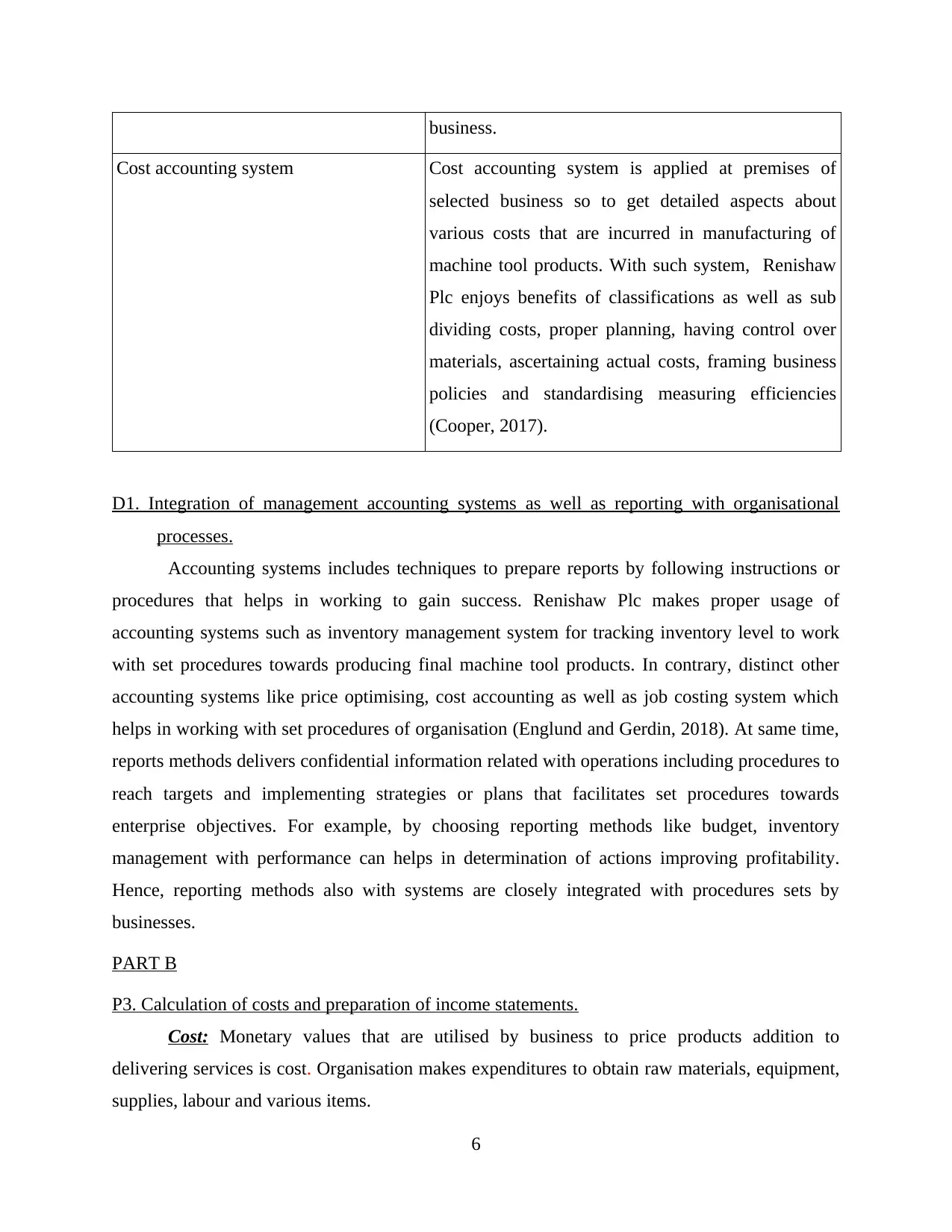

business.

Cost accounting system Cost accounting system is applied at premises of

selected business so to get detailed aspects about

various costs that are incurred in manufacturing of

machine tool products. With such system, Renishaw

Plc enjoys benefits of classifications as well as sub

dividing costs, proper planning, having control over

materials, ascertaining actual costs, framing business

policies and standardising measuring efficiencies

(Cooper, 2017).

D1. Integration of management accounting systems as well as reporting with organisational

processes.

Accounting systems includes techniques to prepare reports by following instructions or

procedures that helps in working to gain success. Renishaw Plc makes proper usage of

accounting systems such as inventory management system for tracking inventory level to work

with set procedures towards producing final machine tool products. In contrary, distinct other

accounting systems like price optimising, cost accounting as well as job costing system which

helps in working with set procedures of organisation (Englund and Gerdin, 2018). At same time,

reports methods delivers confidential information related with operations including procedures to

reach targets and implementing strategies or plans that facilitates set procedures towards

enterprise objectives. For example, by choosing reporting methods like budget, inventory

management with performance can helps in determination of actions improving profitability.

Hence, reporting methods also with systems are closely integrated with procedures sets by

businesses.

PART B

P3. Calculation of costs and preparation of income statements.

Cost: Monetary values that are utilised by business to price products addition to

delivering services is cost. Organisation makes expenditures to obtain raw materials, equipment,

supplies, labour and various items.

6

Cost accounting system Cost accounting system is applied at premises of

selected business so to get detailed aspects about

various costs that are incurred in manufacturing of

machine tool products. With such system, Renishaw

Plc enjoys benefits of classifications as well as sub

dividing costs, proper planning, having control over

materials, ascertaining actual costs, framing business

policies and standardising measuring efficiencies

(Cooper, 2017).

D1. Integration of management accounting systems as well as reporting with organisational

processes.

Accounting systems includes techniques to prepare reports by following instructions or

procedures that helps in working to gain success. Renishaw Plc makes proper usage of

accounting systems such as inventory management system for tracking inventory level to work

with set procedures towards producing final machine tool products. In contrary, distinct other

accounting systems like price optimising, cost accounting as well as job costing system which

helps in working with set procedures of organisation (Englund and Gerdin, 2018). At same time,

reports methods delivers confidential information related with operations including procedures to

reach targets and implementing strategies or plans that facilitates set procedures towards

enterprise objectives. For example, by choosing reporting methods like budget, inventory

management with performance can helps in determination of actions improving profitability.

Hence, reporting methods also with systems are closely integrated with procedures sets by

businesses.

PART B

P3. Calculation of costs and preparation of income statements.

Cost: Monetary values that are utilised by business to price products addition to

delivering services is cost. Organisation makes expenditures to obtain raw materials, equipment,

supplies, labour and various items.

6

Techniques to calculate costs:

Absorption costing: It is a technique where consideration is on accounting indirect

expenses with direct costs. With this method, actual analysis of all assigned manufacturing costs

is done to units produced. Such method helps in accumulating costs that are connected with

manufacturing procedures addition to allotting them for individual products. The cost associates

with finished products includes costs associated with fixed manufacturing overheads, material,

labour together with variable manufacturing overhead.

ANNEXURE (A)

Q1.

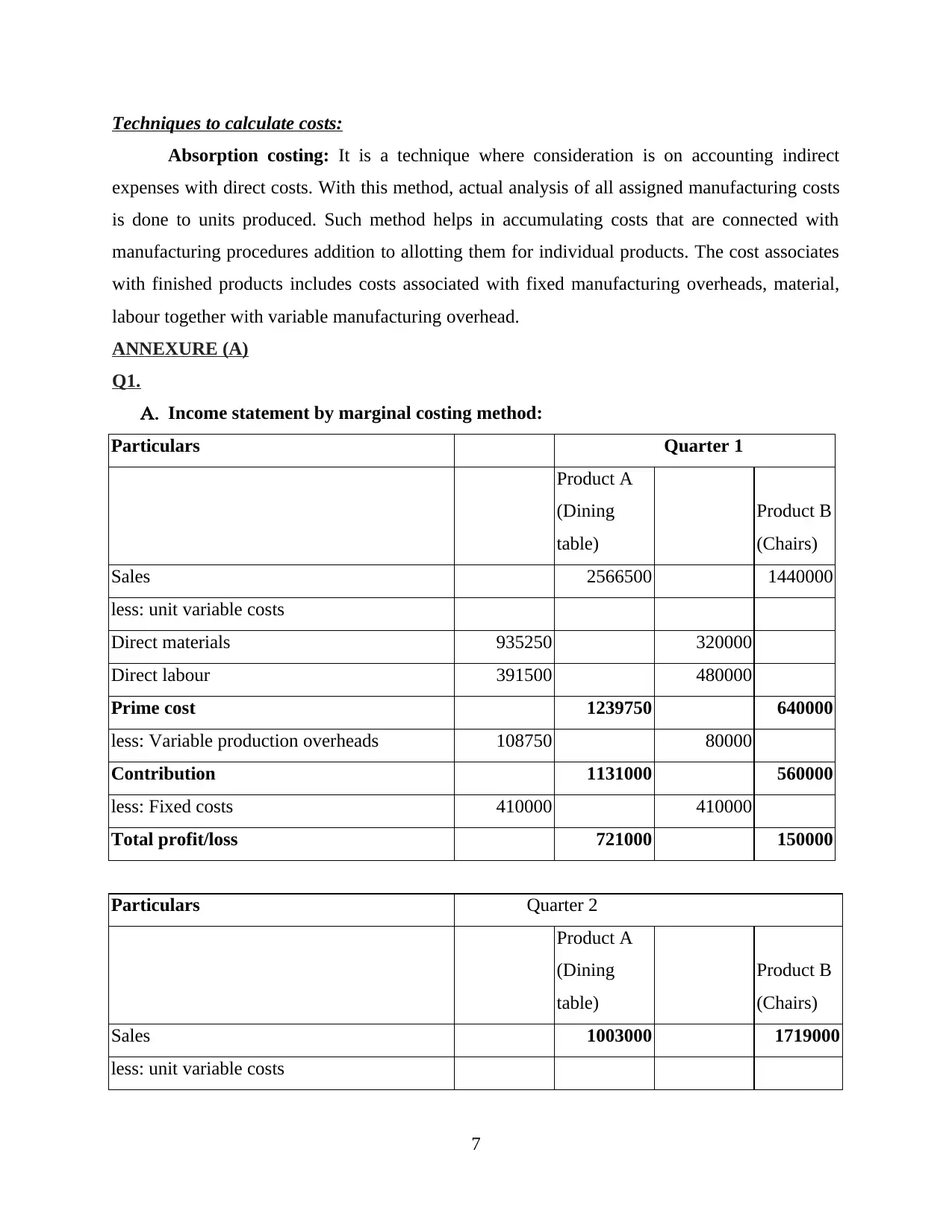

A. Income statement by marginal costing method:

Particulars Quarter 1

Product A

(Dining

table)

Product B

(Chairs)

Sales 2566500 1440000

less: unit variable costs

Direct materials 935250 320000

Direct labour 391500 480000

Prime cost 1239750 640000

less: Variable production overheads 108750 80000

Contribution 1131000 560000

less: Fixed costs 410000 410000

Total profit/loss 721000 150000

Particulars Quarter 2

Product A

(Dining

table)

Product B

(Chairs)

Sales 1003000 1719000

less: unit variable costs

7

Absorption costing: It is a technique where consideration is on accounting indirect

expenses with direct costs. With this method, actual analysis of all assigned manufacturing costs

is done to units produced. Such method helps in accumulating costs that are connected with

manufacturing procedures addition to allotting them for individual products. The cost associates

with finished products includes costs associated with fixed manufacturing overheads, material,

labour together with variable manufacturing overhead.

ANNEXURE (A)

Q1.

A. Income statement by marginal costing method:

Particulars Quarter 1

Product A

(Dining

table)

Product B

(Chairs)

Sales 2566500 1440000

less: unit variable costs

Direct materials 935250 320000

Direct labour 391500 480000

Prime cost 1239750 640000

less: Variable production overheads 108750 80000

Contribution 1131000 560000

less: Fixed costs 410000 410000

Total profit/loss 721000 150000

Particulars Quarter 2

Product A

(Dining

table)

Product B

(Chairs)

Sales 1003000 1719000

less: unit variable costs

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

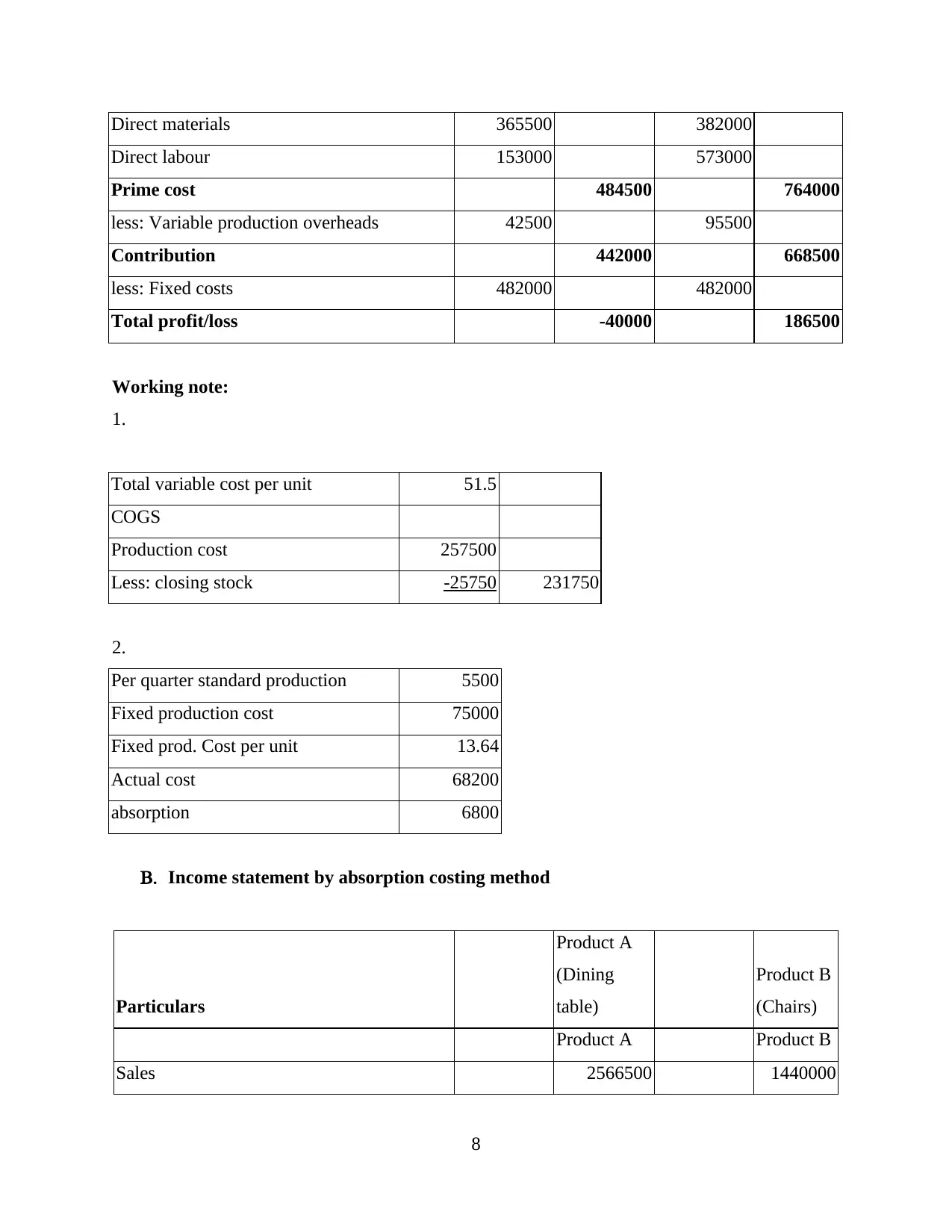

Direct materials 365500 382000

Direct labour 153000 573000

Prime cost 484500 764000

less: Variable production overheads 42500 95500

Contribution 442000 668500

less: Fixed costs 482000 482000

Total profit/loss -40000 186500

Working note:

1.

Total variable cost per unit 51.5

COGS

Production cost 257500

Less: closing stock -25750 231750

2.

Per quarter standard production 5500

Fixed production cost 75000

Fixed prod. Cost per unit 13.64

Actual cost 68200

absorption 6800

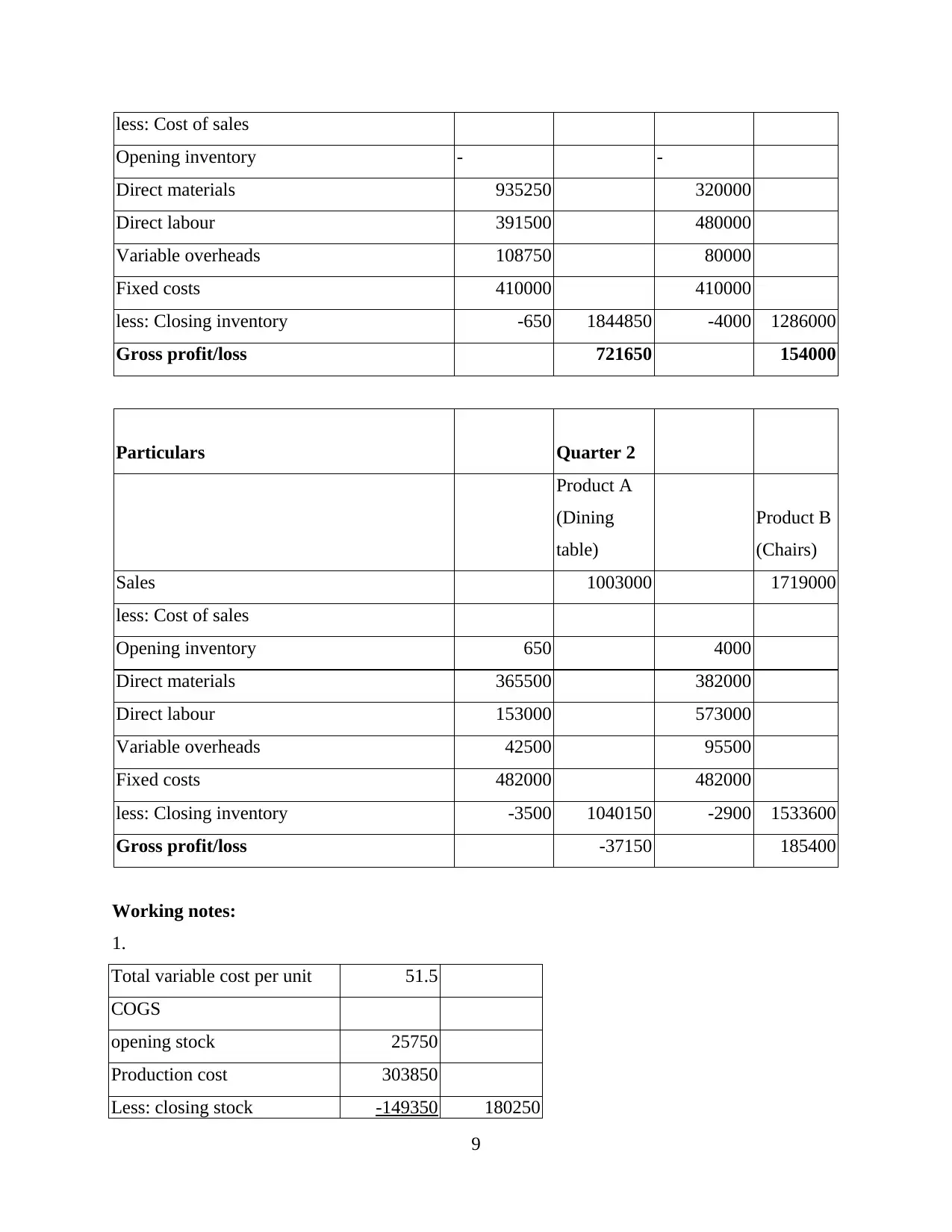

B. Income statement by absorption costing method

Particulars

Product A

(Dining

table)

Product B

(Chairs)

Product A Product B

Sales 2566500 1440000

8

Direct labour 153000 573000

Prime cost 484500 764000

less: Variable production overheads 42500 95500

Contribution 442000 668500

less: Fixed costs 482000 482000

Total profit/loss -40000 186500

Working note:

1.

Total variable cost per unit 51.5

COGS

Production cost 257500

Less: closing stock -25750 231750

2.

Per quarter standard production 5500

Fixed production cost 75000

Fixed prod. Cost per unit 13.64

Actual cost 68200

absorption 6800

B. Income statement by absorption costing method

Particulars

Product A

(Dining

table)

Product B

(Chairs)

Product A Product B

Sales 2566500 1440000

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

less: Cost of sales

Opening inventory - -

Direct materials 935250 320000

Direct labour 391500 480000

Variable overheads 108750 80000

Fixed costs 410000 410000

less: Closing inventory -650 1844850 -4000 1286000

Gross profit/loss 721650 154000

Particulars Quarter 2

Product A

(Dining

table)

Product B

(Chairs)

Sales 1003000 1719000

less: Cost of sales

Opening inventory 650 4000

Direct materials 365500 382000

Direct labour 153000 573000

Variable overheads 42500 95500

Fixed costs 482000 482000

less: Closing inventory -3500 1040150 -2900 1533600

Gross profit/loss -37150 185400

Working notes:

1.

Total variable cost per unit 51.5

COGS

opening stock 25750

Production cost 303850

Less: closing stock -149350 180250

9

Opening inventory - -

Direct materials 935250 320000

Direct labour 391500 480000

Variable overheads 108750 80000

Fixed costs 410000 410000

less: Closing inventory -650 1844850 -4000 1286000

Gross profit/loss 721650 154000

Particulars Quarter 2

Product A

(Dining

table)

Product B

(Chairs)

Sales 1003000 1719000

less: Cost of sales

Opening inventory 650 4000

Direct materials 365500 382000

Direct labour 153000 573000

Variable overheads 42500 95500

Fixed costs 482000 482000

less: Closing inventory -3500 1040150 -2900 1533600

Gross profit/loss -37150 185400

Working notes:

1.

Total variable cost per unit 51.5

COGS

opening stock 25750

Production cost 303850

Less: closing stock -149350 180250

9

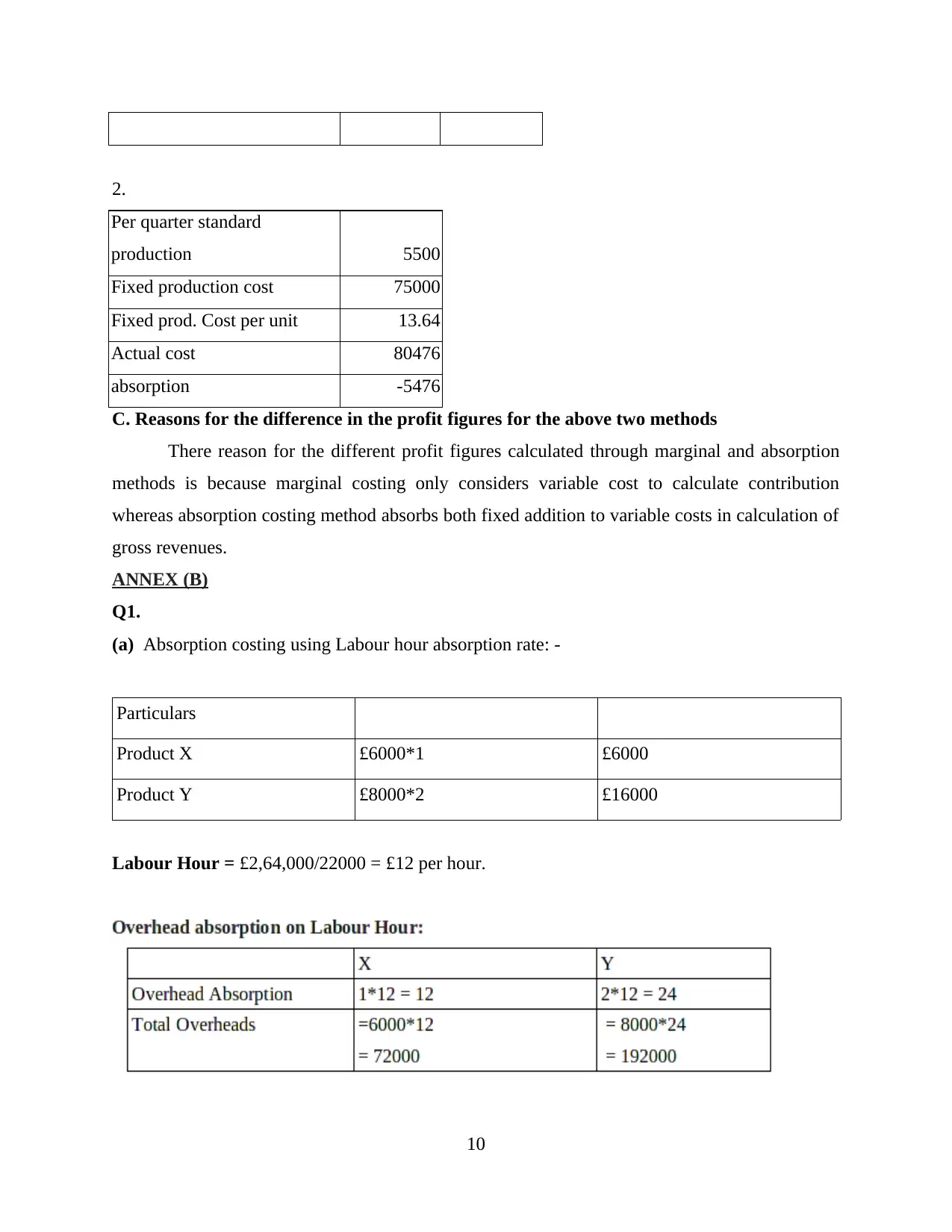

2.

Per quarter standard

production 5500

Fixed production cost 75000

Fixed prod. Cost per unit 13.64

Actual cost 80476

absorption -5476

C. Reasons for the difference in the profit figures for the above two methods

There reason for the different profit figures calculated through marginal and absorption

methods is because marginal costing only considers variable cost to calculate contribution

whereas absorption costing method absorbs both fixed addition to variable costs in calculation of

gross revenues.

ANNEX (B)

Q1.

(a) Absorption costing using Labour hour absorption rate: -

Particulars

Product X £6000*1 £6000

Product Y £8000*2 £16000

Labour Hour = £2,64,000/22000 = £12 per hour.

10

Per quarter standard

production 5500

Fixed production cost 75000

Fixed prod. Cost per unit 13.64

Actual cost 80476

absorption -5476

C. Reasons for the difference in the profit figures for the above two methods

There reason for the different profit figures calculated through marginal and absorption

methods is because marginal costing only considers variable cost to calculate contribution

whereas absorption costing method absorbs both fixed addition to variable costs in calculation of

gross revenues.

ANNEX (B)

Q1.

(a) Absorption costing using Labour hour absorption rate: -

Particulars

Product X £6000*1 £6000

Product Y £8000*2 £16000

Labour Hour = £2,64,000/22000 = £12 per hour.

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 23

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.