Management Accounting Tools for Dell Company

VerifiedAdded on 2020/10/04

|10

|2502

|154

AI Summary

The provided report discusses how Dell can enhance its performance by utilizing effective management accounting tools. It calculates net profits using marginal and absorption costing methods and utilizes various budgetary tools to improve business growth. The report emphasizes the importance of sound organizational systems, such as financial governance, to control diverse financial problems affecting profitability and growth.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1. Management accounting and its essential requirement of its diverse types of systems...1

M1...........................................................................................................................................2

P2. Explaining diverse methods used for management accounting reporting........................2

D1...........................................................................................................................................3

TASK 2............................................................................................................................................3

P3. Net profit as per absorption and marginal costing approach............................................3

M3 & D1.................................................................................................................................4

TASK 3............................................................................................................................................4

P4. Explain advantages and disadvantages of diverse kind of planning tools implemented used

for budgetary control..............................................................................................................4

M3...........................................................................................................................................5

D3...........................................................................................................................................5

TASK 4............................................................................................................................................6

P5. Management accounting systems in order to respond financial problems.......................6

M4...........................................................................................................................................7

CONCLUSION................................................................................................................................7

REFERENCES................................................................................................................................8

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1. Management accounting and its essential requirement of its diverse types of systems...1

M1...........................................................................................................................................2

P2. Explaining diverse methods used for management accounting reporting........................2

D1...........................................................................................................................................3

TASK 2............................................................................................................................................3

P3. Net profit as per absorption and marginal costing approach............................................3

M3 & D1.................................................................................................................................4

TASK 3............................................................................................................................................4

P4. Explain advantages and disadvantages of diverse kind of planning tools implemented used

for budgetary control..............................................................................................................4

M3...........................................................................................................................................5

D3...........................................................................................................................................5

TASK 4............................................................................................................................................6

P5. Management accounting systems in order to respond financial problems.......................6

M4...........................................................................................................................................7

CONCLUSION................................................................................................................................7

REFERENCES................................................................................................................................8

INTRODUCTION

Management Accounting is a tool which is used by the firm in order to make sustainable

development. However management accountant helps the company for making their business

objectives attainable. In this report, the management accountant uses their available resources in

an optimum manner. So that the sustainable development can be achieved. This report is based

on the Dell company. Under which the cited company would use their resources in an effective

manner. Management accountant in Dell Company optimises their net profits by using

absorption and marginal costing approach. Various advantages and drawbacks of the planning

tools are used by the MA for budgetary tools.TASK 1

P1. Management accounting and its essential requirement of its diverse types of systems

Management accounting is the process by which its comprises various decisions, making

plans and performance management systems and rendering expertness in financial reporting and

controlling. In other words, this can be said that this is the process of incorporating management

report for the firm which renders adequate financial and statistical information needed by the

managers to incorporate regular and short term decisions. However, financial accounting is the

process which records, classified and summarised financial transactions as per the generally

accepted principles of accounting (Advanced Management Accounting, 2017).

Financial Accounting records cash and credit transactions of organisations as per the

nature of expenses and income so that financial statements can be made and that would further

help various stakeholders for making their business decisions effective and efficient. This is the

reason, management accounting provides data for internal use. While, on the other hand, in

financial accounting, this provides data for the external users. FA incorporates adequate and

timely data. While on the other hand, MA stresses on the relevancy and flexibility of data.

The main users of management accounting reports are internal employees of company.

While, on the other hand, users of the financial accounting reporting are mainly outsiders.

Cost Accounting System: This is the cost accounting system which totally relied upon

total cost of production. Management accountant by using this system reduces cost of

production by avoiding wastage of cost. This is mostly used by the firm which has

manufacturing units.

1

Management Accounting is a tool which is used by the firm in order to make sustainable

development. However management accountant helps the company for making their business

objectives attainable. In this report, the management accountant uses their available resources in

an optimum manner. So that the sustainable development can be achieved. This report is based

on the Dell company. Under which the cited company would use their resources in an effective

manner. Management accountant in Dell Company optimises their net profits by using

absorption and marginal costing approach. Various advantages and drawbacks of the planning

tools are used by the MA for budgetary tools.TASK 1

P1. Management accounting and its essential requirement of its diverse types of systems

Management accounting is the process by which its comprises various decisions, making

plans and performance management systems and rendering expertness in financial reporting and

controlling. In other words, this can be said that this is the process of incorporating management

report for the firm which renders adequate financial and statistical information needed by the

managers to incorporate regular and short term decisions. However, financial accounting is the

process which records, classified and summarised financial transactions as per the generally

accepted principles of accounting (Advanced Management Accounting, 2017).

Financial Accounting records cash and credit transactions of organisations as per the

nature of expenses and income so that financial statements can be made and that would further

help various stakeholders for making their business decisions effective and efficient. This is the

reason, management accounting provides data for internal use. While, on the other hand, in

financial accounting, this provides data for the external users. FA incorporates adequate and

timely data. While on the other hand, MA stresses on the relevancy and flexibility of data.

The main users of management accounting reports are internal employees of company.

While, on the other hand, users of the financial accounting reporting are mainly outsiders.

Cost Accounting System: This is the cost accounting system which totally relied upon

total cost of production. Management accountant by using this system reduces cost of

production by avoiding wastage of cost. This is mostly used by the firm which has

manufacturing units.

1

Inventory Management System: This is the system through which the management

accountant optimises the inventory so that he could use company’s resources in an effective

manner.

Job- Costing System: This is the process of costing in which flow of costs is traced by the

job. This system is an adequate one under which direct costs can be determined with certain units

of production.

Price-Optimizing System: This is the tool in which price of the product is determined by

consulting from diverse customers. This is the use of mathematical analysis by organisation in

order to identify how consumers would respond to diverse channels. This is likewise to identify

prices that the organisation identify and this would attain the objectives like- optimising

operating profits.

M1

Management accounting system is the most important tool which reduces the wastage costs

from the unit cost. In addition to this, cash flow of company can be improved effectively. Senior

manager would take effective decisions by taking the help of management accounting system.

P2. Explaining diverse methods used for management accounting reporting

There are various kinds of management accounting reports which are used by the firm in

order to gain sustainable development. Some of them are mentioned hereunder:

Budget Report: This report is an internal report which is used by management for

comparing the budgeted figure and with actual data during the period (Macintosh and Quattrone,

2010). On the other hand, a budget report is framed in order to compare how close budgeted

performance was to actual performance at the time of accounting period.

Operating budget: This is the operating budget in which all the expenses and income

which are related to the operating process are concerned. However, this can be said that

operating budget is totally relied on the past performance of the company.

Accounts Receivable Aging: This is the process of identifying customers who are willing

to pay on time and others who are not. This assessment helps in forming bad debts and in

forming credit guidelines.

Job cost Reports: This report is broken down in various categories which are Labour

Cost, Material Cost, Subcontractor Cost, Field Overhead and Liquidated Damages (Kotas, 2014).

2

accountant optimises the inventory so that he could use company’s resources in an effective

manner.

Job- Costing System: This is the process of costing in which flow of costs is traced by the

job. This system is an adequate one under which direct costs can be determined with certain units

of production.

Price-Optimizing System: This is the tool in which price of the product is determined by

consulting from diverse customers. This is the use of mathematical analysis by organisation in

order to identify how consumers would respond to diverse channels. This is likewise to identify

prices that the organisation identify and this would attain the objectives like- optimising

operating profits.

M1

Management accounting system is the most important tool which reduces the wastage costs

from the unit cost. In addition to this, cash flow of company can be improved effectively. Senior

manager would take effective decisions by taking the help of management accounting system.

P2. Explaining diverse methods used for management accounting reporting

There are various kinds of management accounting reports which are used by the firm in

order to gain sustainable development. Some of them are mentioned hereunder:

Budget Report: This report is an internal report which is used by management for

comparing the budgeted figure and with actual data during the period (Macintosh and Quattrone,

2010). On the other hand, a budget report is framed in order to compare how close budgeted

performance was to actual performance at the time of accounting period.

Operating budget: This is the operating budget in which all the expenses and income

which are related to the operating process are concerned. However, this can be said that

operating budget is totally relied on the past performance of the company.

Accounts Receivable Aging: This is the process of identifying customers who are willing

to pay on time and others who are not. This assessment helps in forming bad debts and in

forming credit guidelines.

Job cost Reports: This report is broken down in various categories which are Labour

Cost, Material Cost, Subcontractor Cost, Field Overhead and Liquidated Damages (Kotas, 2014).

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Inventory and manufacturing report: This is the report which comprises of all details

that are related to inventory. This is an effective report for knowing all the details related to the

management of the firm.

Profit and Loss statement: This is the statement which comprises of all the details related

to the profit and loss of the company during a particular period of time.

D1

Management accounting system and the MA reporting are inter-related to each other as

this can be rightly observed that the with the help of MA systems, reports are made in an

effective manner which would further integrate company’s process.

TASK 2

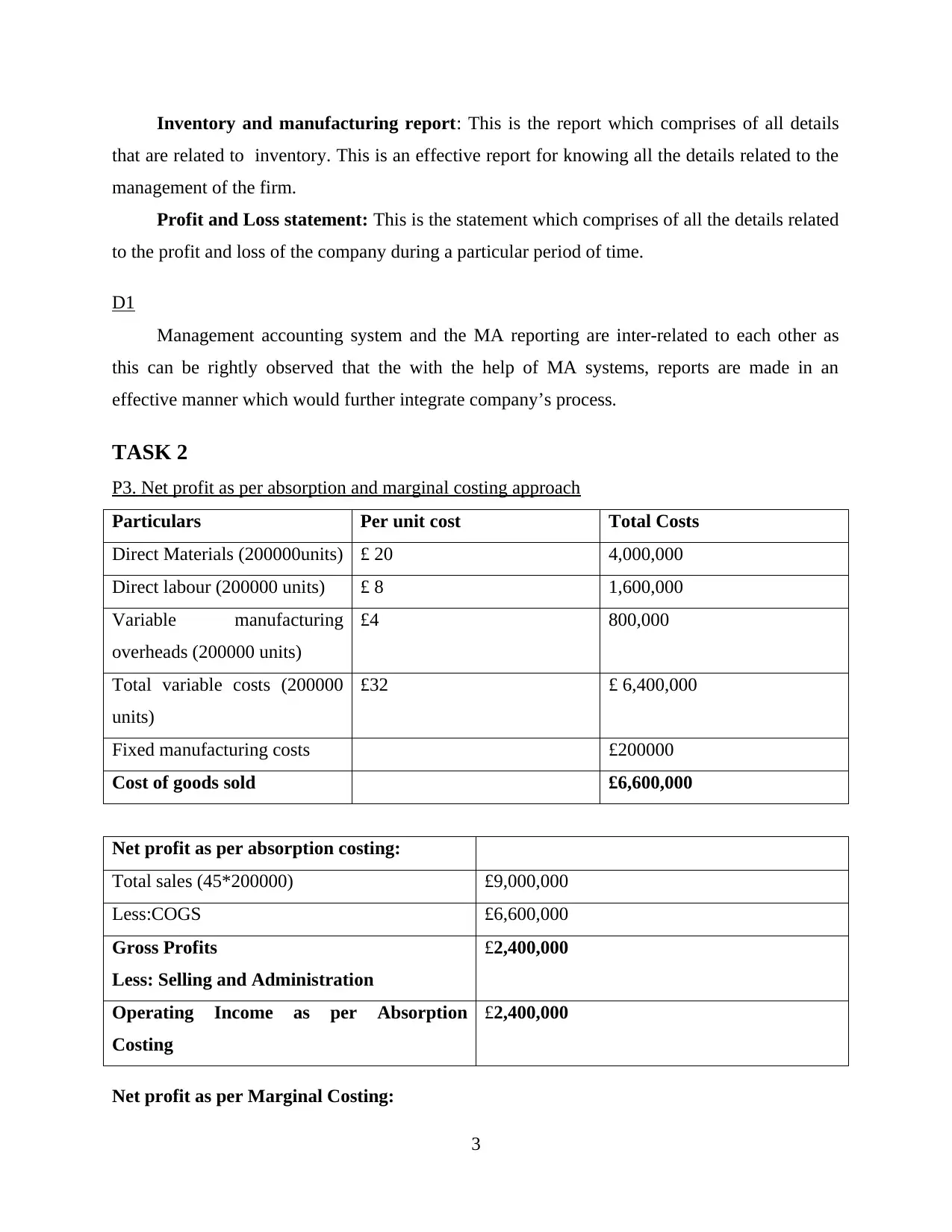

P3. Net profit as per absorption and marginal costing approach

Particulars Per unit cost Total Costs

Direct Materials (200000units) £ 20 4,000,000

Direct labour (200000 units) £ 8 1,600,000

Variable manufacturing

overheads (200000 units)

£4 800,000

Total variable costs (200000

units)

£32 £ 6,400,000

Fixed manufacturing costs £200000

Cost of goods sold £6,600,000

Net profit as per absorption costing:

Total sales (45*200000) £9,000,000

Less:COGS £6,600,000

Gross Profits

Less: Selling and Administration

£2,400,000

Operating Income as per Absorption

Costing

£2,400,000

Net profit as per Marginal Costing:

3

that are related to inventory. This is an effective report for knowing all the details related to the

management of the firm.

Profit and Loss statement: This is the statement which comprises of all the details related

to the profit and loss of the company during a particular period of time.

D1

Management accounting system and the MA reporting are inter-related to each other as

this can be rightly observed that the with the help of MA systems, reports are made in an

effective manner which would further integrate company’s process.

TASK 2

P3. Net profit as per absorption and marginal costing approach

Particulars Per unit cost Total Costs

Direct Materials (200000units) £ 20 4,000,000

Direct labour (200000 units) £ 8 1,600,000

Variable manufacturing

overheads (200000 units)

£4 800,000

Total variable costs (200000

units)

£32 £ 6,400,000

Fixed manufacturing costs £200000

Cost of goods sold £6,600,000

Net profit as per absorption costing:

Total sales (45*200000) £9,000,000

Less:COGS £6,600,000

Gross Profits

Less: Selling and Administration

£2,400,000

Operating Income as per Absorption

Costing

£2,400,000

Net profit as per Marginal Costing:

3

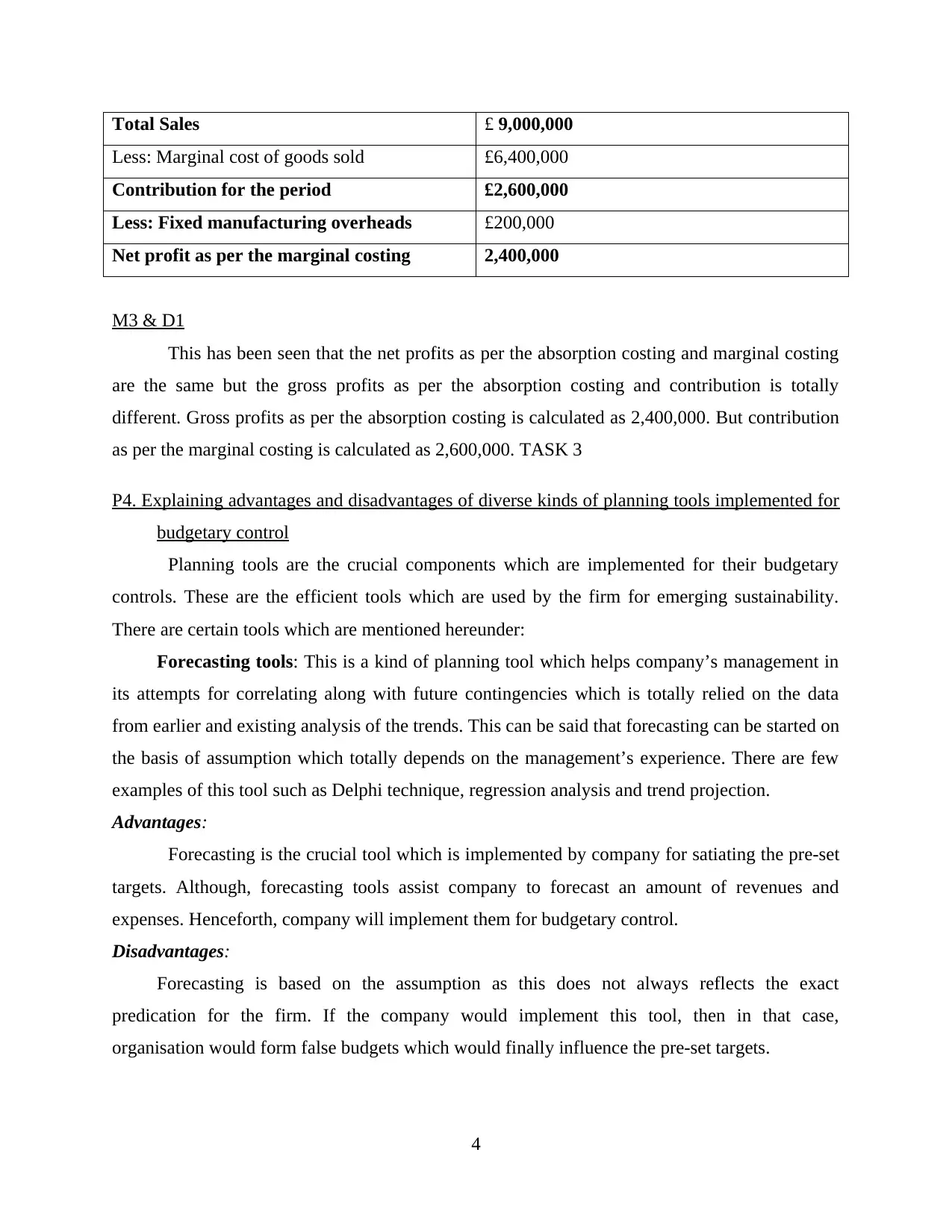

Total Sales £ 9,000,000

Less: Marginal cost of goods sold £6,400,000

Contribution for the period £2,600,000

Less: Fixed manufacturing overheads £200,000

Net profit as per the marginal costing 2,400,000

M3 & D1

This has been seen that the net profits as per the absorption costing and marginal costing

are the same but the gross profits as per the absorption costing and contribution is totally

different. Gross profits as per the absorption costing is calculated as 2,400,000. But contribution

as per the marginal costing is calculated as 2,600,000. TASK 3

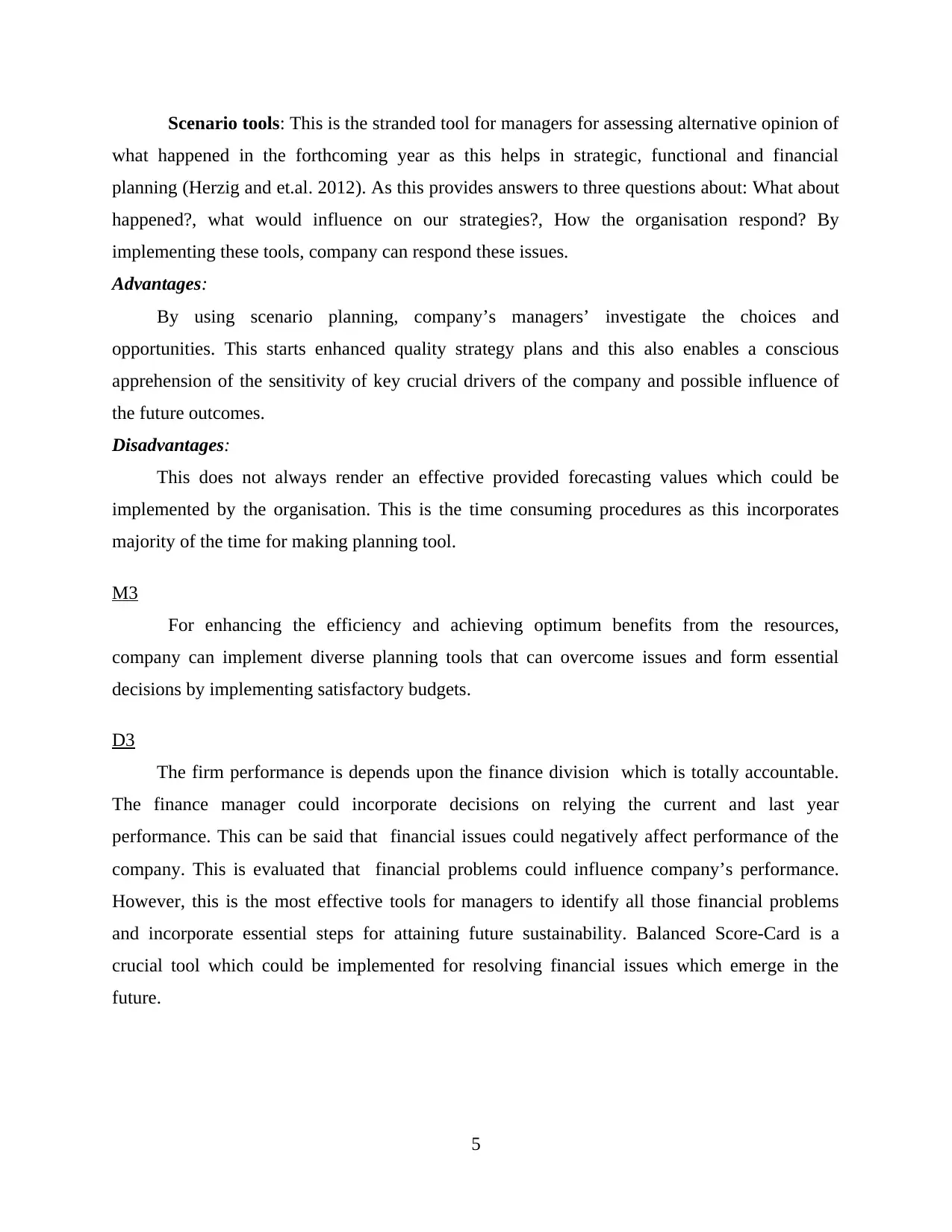

P4. Explaining advantages and disadvantages of diverse kinds of planning tools implemented for

budgetary control

Planning tools are the crucial components which are implemented for their budgetary

controls. These are the efficient tools which are used by the firm for emerging sustainability.

There are certain tools which are mentioned hereunder:

Forecasting tools: This is a kind of planning tool which helps company’s management in

its attempts for correlating along with future contingencies which is totally relied on the data

from earlier and existing analysis of the trends. This can be said that forecasting can be started on

the basis of assumption which totally depends on the management’s experience. There are few

examples of this tool such as Delphi technique, regression analysis and trend projection.

Advantages:

Forecasting is the crucial tool which is implemented by company for satiating the pre-set

targets. Although, forecasting tools assist company to forecast an amount of revenues and

expenses. Henceforth, company will implement them for budgetary control.

Disadvantages:

Forecasting is based on the assumption as this does not always reflects the exact

predication for the firm. If the company would implement this tool, then in that case,

organisation would form false budgets which would finally influence the pre-set targets.

4

Less: Marginal cost of goods sold £6,400,000

Contribution for the period £2,600,000

Less: Fixed manufacturing overheads £200,000

Net profit as per the marginal costing 2,400,000

M3 & D1

This has been seen that the net profits as per the absorption costing and marginal costing

are the same but the gross profits as per the absorption costing and contribution is totally

different. Gross profits as per the absorption costing is calculated as 2,400,000. But contribution

as per the marginal costing is calculated as 2,600,000. TASK 3

P4. Explaining advantages and disadvantages of diverse kinds of planning tools implemented for

budgetary control

Planning tools are the crucial components which are implemented for their budgetary

controls. These are the efficient tools which are used by the firm for emerging sustainability.

There are certain tools which are mentioned hereunder:

Forecasting tools: This is a kind of planning tool which helps company’s management in

its attempts for correlating along with future contingencies which is totally relied on the data

from earlier and existing analysis of the trends. This can be said that forecasting can be started on

the basis of assumption which totally depends on the management’s experience. There are few

examples of this tool such as Delphi technique, regression analysis and trend projection.

Advantages:

Forecasting is the crucial tool which is implemented by company for satiating the pre-set

targets. Although, forecasting tools assist company to forecast an amount of revenues and

expenses. Henceforth, company will implement them for budgetary control.

Disadvantages:

Forecasting is based on the assumption as this does not always reflects the exact

predication for the firm. If the company would implement this tool, then in that case,

organisation would form false budgets which would finally influence the pre-set targets.

4

Scenario tools: This is the stranded tool for managers for assessing alternative opinion of

what happened in the forthcoming year as this helps in strategic, functional and financial

planning (Herzig and et.al. 2012). As this provides answers to three questions about: What about

happened?, what would influence on our strategies?, How the organisation respond? By

implementing these tools, company can respond these issues.

Advantages:

By using scenario planning, company’s managers’ investigate the choices and

opportunities. This starts enhanced quality strategy plans and this also enables a conscious

apprehension of the sensitivity of key crucial drivers of the company and possible influence of

the future outcomes.

Disadvantages:

This does not always render an effective provided forecasting values which could be

implemented by the organisation. This is the time consuming procedures as this incorporates

majority of the time for making planning tool.

M3

For enhancing the efficiency and achieving optimum benefits from the resources,

company can implement diverse planning tools that can overcome issues and form essential

decisions by implementing satisfactory budgets.

D3

The firm performance is depends upon the finance division which is totally accountable.

The finance manager could incorporate decisions on relying the current and last year

performance. This can be said that financial issues could negatively affect performance of the

company. This is evaluated that financial problems could influence company’s performance.

However, this is the most effective tools for managers to identify all those financial problems

and incorporate essential steps for attaining future sustainability. Balanced Score-Card is a

crucial tool which could be implemented for resolving financial issues which emerge in the

future.

5

what happened in the forthcoming year as this helps in strategic, functional and financial

planning (Herzig and et.al. 2012). As this provides answers to three questions about: What about

happened?, what would influence on our strategies?, How the organisation respond? By

implementing these tools, company can respond these issues.

Advantages:

By using scenario planning, company’s managers’ investigate the choices and

opportunities. This starts enhanced quality strategy plans and this also enables a conscious

apprehension of the sensitivity of key crucial drivers of the company and possible influence of

the future outcomes.

Disadvantages:

This does not always render an effective provided forecasting values which could be

implemented by the organisation. This is the time consuming procedures as this incorporates

majority of the time for making planning tool.

M3

For enhancing the efficiency and achieving optimum benefits from the resources,

company can implement diverse planning tools that can overcome issues and form essential

decisions by implementing satisfactory budgets.

D3

The firm performance is depends upon the finance division which is totally accountable.

The finance manager could incorporate decisions on relying the current and last year

performance. This can be said that financial issues could negatively affect performance of the

company. This is evaluated that financial problems could influence company’s performance.

However, this is the most effective tools for managers to identify all those financial problems

and incorporate essential steps for attaining future sustainability. Balanced Score-Card is a

crucial tool which could be implemented for resolving financial issues which emerge in the

future.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

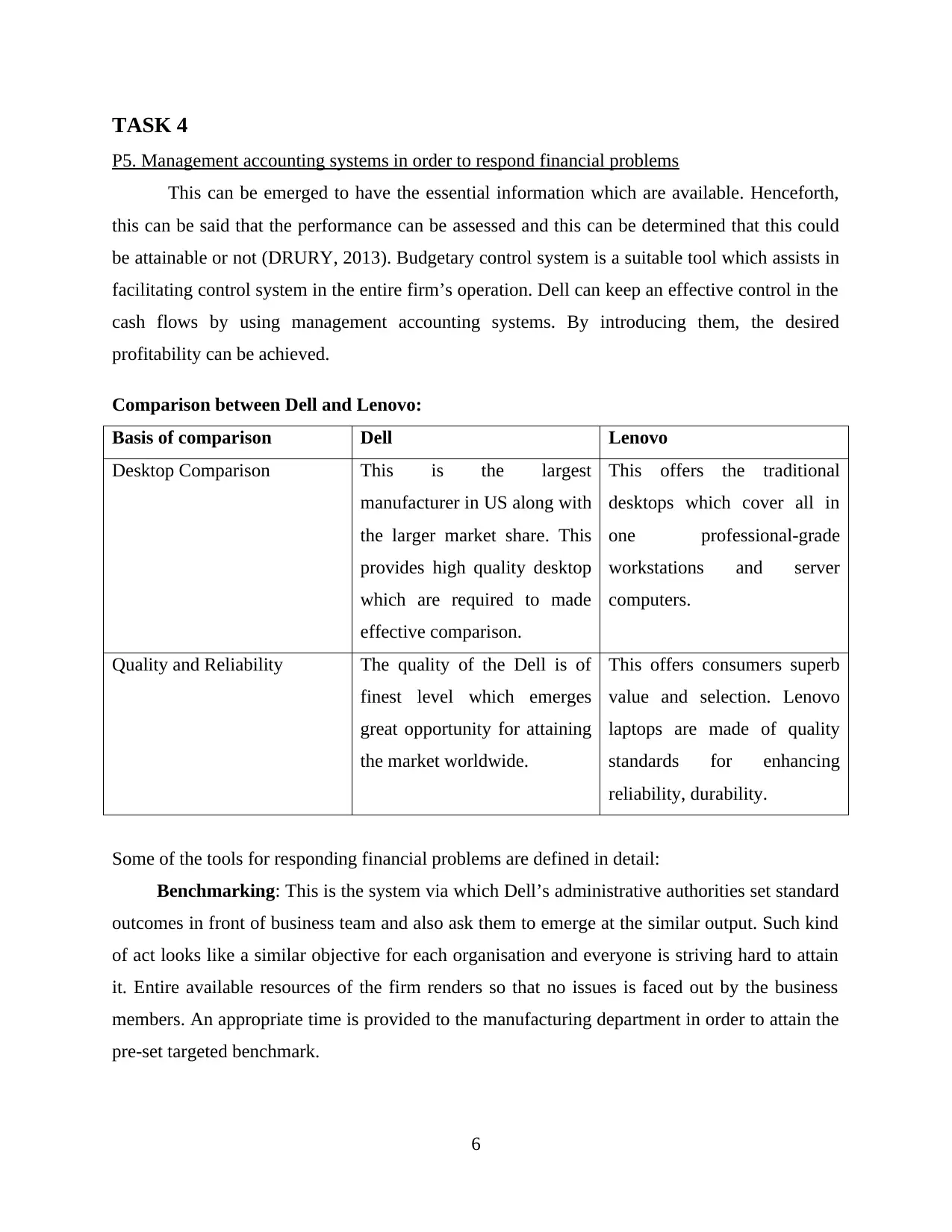

TASK 4

P5. Management accounting systems in order to respond financial problems

This can be emerged to have the essential information which are available. Henceforth,

this can be said that the performance can be assessed and this can be determined that this could

be attainable or not (DRURY, 2013). Budgetary control system is a suitable tool which assists in

facilitating control system in the entire firm’s operation. Dell can keep an effective control in the

cash flows by using management accounting systems. By introducing them, the desired

profitability can be achieved.

Comparison between Dell and Lenovo:

Basis of comparison Dell Lenovo

Desktop Comparison This is the largest

manufacturer in US along with

the larger market share. This

provides high quality desktop

which are required to made

effective comparison.

This offers the traditional

desktops which cover all in

one professional-grade

workstations and server

computers.

Quality and Reliability The quality of the Dell is of

finest level which emerges

great opportunity for attaining

the market worldwide.

This offers consumers superb

value and selection. Lenovo

laptops are made of quality

standards for enhancing

reliability, durability.

Some of the tools for responding financial problems are defined in detail:

Benchmarking: This is the system via which Dell’s administrative authorities set standard

outcomes in front of business team and also ask them to emerge at the similar output. Such kind

of act looks like a similar objective for each organisation and everyone is striving hard to attain

it. Entire available resources of the firm renders so that no issues is faced out by the business

members. An appropriate time is provided to the manufacturing department in order to attain the

pre-set targeted benchmark.

6

P5. Management accounting systems in order to respond financial problems

This can be emerged to have the essential information which are available. Henceforth,

this can be said that the performance can be assessed and this can be determined that this could

be attainable or not (DRURY, 2013). Budgetary control system is a suitable tool which assists in

facilitating control system in the entire firm’s operation. Dell can keep an effective control in the

cash flows by using management accounting systems. By introducing them, the desired

profitability can be achieved.

Comparison between Dell and Lenovo:

Basis of comparison Dell Lenovo

Desktop Comparison This is the largest

manufacturer in US along with

the larger market share. This

provides high quality desktop

which are required to made

effective comparison.

This offers the traditional

desktops which cover all in

one professional-grade

workstations and server

computers.

Quality and Reliability The quality of the Dell is of

finest level which emerges

great opportunity for attaining

the market worldwide.

This offers consumers superb

value and selection. Lenovo

laptops are made of quality

standards for enhancing

reliability, durability.

Some of the tools for responding financial problems are defined in detail:

Benchmarking: This is the system via which Dell’s administrative authorities set standard

outcomes in front of business team and also ask them to emerge at the similar output. Such kind

of act looks like a similar objective for each organisation and everyone is striving hard to attain

it. Entire available resources of the firm renders so that no issues is faced out by the business

members. An appropriate time is provided to the manufacturing department in order to attain the

pre-set targeted benchmark.

6

Financial governance: For operating the business in an optimum manner, this is crucial

that all activities are performed in an effective manner which they are regulated by it. Financial

governance is an effective tool via which dell can be directed and regulated via financial

transactions (Arroyo, 2012). Via this process, the outcome achieved by each employee is

achieved and compared with its desired outcome in order to improve those areas which are

identified and after that adequate planning can be made.

M4

This is observed that there are basically diverse financial problems which affect the firm’s

profitability and growth. Pre-set objectives cannot be fulfilled in the standard time frame. For

controlling all these issues, firm is required to have a sound organised system. Financial

governance is one of the other tools which comprises of many policies and norms that are made

by government for smooth flow of organisation.

CONCLUSION

From the above mentioned report, this can be said that the dell company can improve

their performance by using effective management accounting tools. In this report, net profits are

calculated as per the marginal and absorption costing method. Also, various budgetary tools are

used for improving the performance of company.

7

that all activities are performed in an effective manner which they are regulated by it. Financial

governance is an effective tool via which dell can be directed and regulated via financial

transactions (Arroyo, 2012). Via this process, the outcome achieved by each employee is

achieved and compared with its desired outcome in order to improve those areas which are

identified and after that adequate planning can be made.

M4

This is observed that there are basically diverse financial problems which affect the firm’s

profitability and growth. Pre-set objectives cannot be fulfilled in the standard time frame. For

controlling all these issues, firm is required to have a sound organised system. Financial

governance is one of the other tools which comprises of many policies and norms that are made

by government for smooth flow of organisation.

CONCLUSION

From the above mentioned report, this can be said that the dell company can improve

their performance by using effective management accounting tools. In this report, net profits are

calculated as per the marginal and absorption costing method. Also, various budgetary tools are

used for improving the performance of company.

7

REFERENCES

Books and Journals

Arroyo, P., 2012. Management accounting change and sustainability: an institutional

approach. Journal of Accounting & Organizational Change, 8(3), pp.286-309.

DRURY, C. M., 2013. Management and cost accounting. Springer.

Herzig and et.al. 2012. Environmental management accounting: case studies of South-East Asian

Companies. Routledge.

Kotas, R., 2014. Management accounting for hotels and restaurants. Routledge.

Macintosh, N. B and Quattrone, P., 2010. Management accounting and control systems: An

organizational and sociological approach. John Wiley & Sons.

Otley, D and Emmanuel, K. M. C., 2013. Readings in accounting for management control.

Springer.

Online

Advanced Management Accounting. 2017. [Online]. Available through:

<http://www.bristol.ac.uk/efm/courses/undergraduate/units/level3units/efim30003.html>.

8

Books and Journals

Arroyo, P., 2012. Management accounting change and sustainability: an institutional

approach. Journal of Accounting & Organizational Change, 8(3), pp.286-309.

DRURY, C. M., 2013. Management and cost accounting. Springer.

Herzig and et.al. 2012. Environmental management accounting: case studies of South-East Asian

Companies. Routledge.

Kotas, R., 2014. Management accounting for hotels and restaurants. Routledge.

Macintosh, N. B and Quattrone, P., 2010. Management accounting and control systems: An

organizational and sociological approach. John Wiley & Sons.

Otley, D and Emmanuel, K. M. C., 2013. Readings in accounting for management control.

Springer.

Online

Advanced Management Accounting. 2017. [Online]. Available through:

<http://www.bristol.ac.uk/efm/courses/undergraduate/units/level3units/efim30003.html>.

8

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.