Management Accounting Research Trends

VerifiedAdded on 2020/06/05

|16

|4900

|64

AI Summary

This assignment delves into the current landscape of management accounting research, examining prominent themes and forecasting future developments. It draws upon a selection of scholarly articles to analyze various aspects of the field, including budgeting practices, sustainability considerations, digital advancements, and the evolving role of management accounting knowledge.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P.1. Explanation of management accounting and essential requirement of different

management accounting systems...........................................................................................1

P.2. Different method used for management accounting reporting........................................4

P.3. Absorption and marginal costing approach.....................................................................6

TASK 3............................................................................................................................................8

P.4. Advantage and disadvantage of using different planning tools that can be used for

budgeting control at workplace..............................................................................................8

P.5. Adoption of management accounting system to respond to financial management.....10

CONCLUSION..............................................................................................................................11

REFERENCES..............................................................................................................................13

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P.1. Explanation of management accounting and essential requirement of different

management accounting systems...........................................................................................1

P.2. Different method used for management accounting reporting........................................4

P.3. Absorption and marginal costing approach.....................................................................6

TASK 3............................................................................................................................................8

P.4. Advantage and disadvantage of using different planning tools that can be used for

budgeting control at workplace..............................................................................................8

P.5. Adoption of management accounting system to respond to financial management.....10

CONCLUSION..............................................................................................................................11

REFERENCES..............................................................................................................................13

INTRODUCTION

In this investigation, we would discuss about to the all tools and techniques of

management accounting which is essential for better manage Toyota automotive firm's financial

issues and circumstances. We would take a look at management accounting and given the

essential requirements of different types of management accounting system. We would discuss

about to the different method used for management accounting reporting. We will calculate

costs using appropriate techniques of cost analysis to prepare an income statements using

marginal and absorption costs. Moreover, in this research we would take a look on the advantage

and disadvantage of different types of planning used for budgeting control. Ultimately we would

have discussion on compare how organizations are adopting management accounting systems to

response to financial issues within Toyota automotive business.

TASK 1

P.1. Explanation of management accounting and essential requirement of different management

accounting systems

To

The director of the Toyota automotive, japan, Date 23-1-2018

Sub: management accounting method and their significance

Management accounting is the process in which business operational work are managed

in this approach. Usually, all the businesses which are operating in production and

manufacturing sector goals to control their overall costing in the plants of the firm. Centering

requires to be improved the internal efficiency of the business operation so that cost remain

would in favor of standard costing rate (Zoni, Dossi, and Morelli, 2012). There are several

numbers of tools and techniques are presented in the management accounting which compare

its performance and standard to their current position and make suggestion to business, where

are necessary changes required and implement innovation at that position. Several sorts of

analysis such as variance analysis, budgeting, etc. are included in these approaches to that

making hard core business decision whenever required it in the business. All these strategies

have to done in order to importance of the company because these strategies and approaches

helps the business in working in right direction in legislative manner. It is because, there are

many of management accounting system reflects appropriate firms in which data, information

or facts could be stored in the books of accounting. This is the data that is prepared by the

1

In this investigation, we would discuss about to the all tools and techniques of

management accounting which is essential for better manage Toyota automotive firm's financial

issues and circumstances. We would take a look at management accounting and given the

essential requirements of different types of management accounting system. We would discuss

about to the different method used for management accounting reporting. We will calculate

costs using appropriate techniques of cost analysis to prepare an income statements using

marginal and absorption costs. Moreover, in this research we would take a look on the advantage

and disadvantage of different types of planning used for budgeting control. Ultimately we would

have discussion on compare how organizations are adopting management accounting systems to

response to financial issues within Toyota automotive business.

TASK 1

P.1. Explanation of management accounting and essential requirement of different management

accounting systems

To

The director of the Toyota automotive, japan, Date 23-1-2018

Sub: management accounting method and their significance

Management accounting is the process in which business operational work are managed

in this approach. Usually, all the businesses which are operating in production and

manufacturing sector goals to control their overall costing in the plants of the firm. Centering

requires to be improved the internal efficiency of the business operation so that cost remain

would in favor of standard costing rate (Zoni, Dossi, and Morelli, 2012). There are several

numbers of tools and techniques are presented in the management accounting which compare

its performance and standard to their current position and make suggestion to business, where

are necessary changes required and implement innovation at that position. Several sorts of

analysis such as variance analysis, budgeting, etc. are included in these approaches to that

making hard core business decision whenever required it in the business. All these strategies

have to done in order to importance of the company because these strategies and approaches

helps the business in working in right direction in legislative manner. It is because, there are

many of management accounting system reflects appropriate firms in which data, information

or facts could be stored in the books of accounting. This is the data that is prepared by the

1

system which helps business in accomplishing several results and application of these

approaches which assists in remove the all barriers of management accounting and also helps in

better manage of their accounts at several levels within the firm. Different management

accounting system that are available for the enterprises are as following:

Cost accounting system: Cost accounting approach is most vital approach for every

business to manage their cost accounting system (Yalcin, 2012). In this approach, there

are cost and expenses of Toyota automotive are recorded on the basis of their fixed

expenses, variable expenses and semi variable expenses. Nature of all these expenses is

totally different from each other. In this cost accounting system, all these categories of

expenses are recorded and calculated in these approach and mention section. There are

several advantages are associated with the cost accounting system because on the basis

of examining records and data, manager would be known by this how much fund they

are required to spend fixed, semi-variable and variable section. This approach would

help them to cost control in the Toyota automotive business and make adjustment in it to

reduce the cost increment in manufacturing process of Toyota automotive corporation.

Thus, it could be said that there is vast significance of cost accounting system within the

Toyota business. The Toyota automotive firm can use this accounting system to manage

their all costing issues and problems in the business to make them more efficient to cost

reduction and developing all the exercises which is required to be taken to manage huge

situation of cost increment can be reduced. Job costing system: Job costing system is the approach which is majorly used by those

companies which is current running in the manufacture industry. Numbers of times,

there are a huge need for company to acquire customized product for their clients and

customers by paying large amount for it (Wu, and Boateng, 2010). Due to the various

specification in the products of Toyota automotive business, there must be different-

different costing are available for those products and services. So it is very essential for

Toyota automotive firm to decide a separate price of their every customized products

and services to manage costing of essential materials within the firm. Job costing

approach assist the firm to accomplish their desired targets and goals and separate books

are maintained for each of their products and services and several types of expenses are

2

approaches which assists in remove the all barriers of management accounting and also helps in

better manage of their accounts at several levels within the firm. Different management

accounting system that are available for the enterprises are as following:

Cost accounting system: Cost accounting approach is most vital approach for every

business to manage their cost accounting system (Yalcin, 2012). In this approach, there

are cost and expenses of Toyota automotive are recorded on the basis of their fixed

expenses, variable expenses and semi variable expenses. Nature of all these expenses is

totally different from each other. In this cost accounting system, all these categories of

expenses are recorded and calculated in these approach and mention section. There are

several advantages are associated with the cost accounting system because on the basis

of examining records and data, manager would be known by this how much fund they

are required to spend fixed, semi-variable and variable section. This approach would

help them to cost control in the Toyota automotive business and make adjustment in it to

reduce the cost increment in manufacturing process of Toyota automotive corporation.

Thus, it could be said that there is vast significance of cost accounting system within the

Toyota business. The Toyota automotive firm can use this accounting system to manage

their all costing issues and problems in the business to make them more efficient to cost

reduction and developing all the exercises which is required to be taken to manage huge

situation of cost increment can be reduced. Job costing system: Job costing system is the approach which is majorly used by those

companies which is current running in the manufacture industry. Numbers of times,

there are a huge need for company to acquire customized product for their clients and

customers by paying large amount for it (Wu, and Boateng, 2010). Due to the various

specification in the products of Toyota automotive business, there must be different-

different costing are available for those products and services. So it is very essential for

Toyota automotive firm to decide a separate price of their every customized products

and services to manage costing of essential materials within the firm. Job costing

approach assist the firm to accomplish their desired targets and goals and separate books

are maintained for each of their products and services and several types of expenses are

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

recorded and calculated in them. It could be assumed that job costing is more suitable

for the Toyota automotive business, because they are manufacturing multiple of their

product and service within the firm and there is essential need for manage their costing

and make separate costing for them to identify their range and quality (vVan der Stede,

2015). Toyota automotive company is one of the growing business in the japan and all

over the world, and in this company broad range of products are manufacture and sell so

that there must be all the parts and customized products costing must be in proper

manner to manage their high costing level and these activities would assist to better

management accounting in the Toyota automotive business.

Process costing system: Process costing methodologies is used by mostly corporations

in terms because this approach assists the business to prepare costing of their product

line more efficiently (Suomala, and Lyly-Yrjänäinen, 2012). In the process costing

method, normally, costing of each form is calculated and then reliable cost is associated

to identify whole cost of each product line. There are several advantages of

implementing this method in the business, one is, with the help of this approach it can

easily find out that which production process is increasingly at their high rate and

required manage on time to control cost in the Toyota automotive firm. It may be said

that heavy amount of data can be collected with the help of process costing techniques

rather than any other strategy of costing in management accounting. If Toyota

automotive firm does not adopt this accounting system in its firm, then there could be

find out major issues.

Inventory management: Considering the operations under this managements accounting

technique in which determination of various operations will be adequate and helpful as

per recognizing the inventory stability in the organization. Inflows and outflows of the

stock will be administered and managed as per having effective control on the

operational efficiency.

P.2. Different method used for management accounting reporting

There are several approaches of management accounting reporting because of verity of

operational activities are exercising within the Toyota automotive business (Shields, 2015). In

these different variety of management accounting report, company performance is measured and

3

for the Toyota automotive business, because they are manufacturing multiple of their

product and service within the firm and there is essential need for manage their costing

and make separate costing for them to identify their range and quality (vVan der Stede,

2015). Toyota automotive company is one of the growing business in the japan and all

over the world, and in this company broad range of products are manufacture and sell so

that there must be all the parts and customized products costing must be in proper

manner to manage their high costing level and these activities would assist to better

management accounting in the Toyota automotive business.

Process costing system: Process costing methodologies is used by mostly corporations

in terms because this approach assists the business to prepare costing of their product

line more efficiently (Suomala, and Lyly-Yrjänäinen, 2012). In the process costing

method, normally, costing of each form is calculated and then reliable cost is associated

to identify whole cost of each product line. There are several advantages of

implementing this method in the business, one is, with the help of this approach it can

easily find out that which production process is increasingly at their high rate and

required manage on time to control cost in the Toyota automotive firm. It may be said

that heavy amount of data can be collected with the help of process costing techniques

rather than any other strategy of costing in management accounting. If Toyota

automotive firm does not adopt this accounting system in its firm, then there could be

find out major issues.

Inventory management: Considering the operations under this managements accounting

technique in which determination of various operations will be adequate and helpful as

per recognizing the inventory stability in the organization. Inflows and outflows of the

stock will be administered and managed as per having effective control on the

operational efficiency.

P.2. Different method used for management accounting reporting

There are several approaches of management accounting reporting because of verity of

operational activities are exercising within the Toyota automotive business (Shields, 2015). In

these different variety of management accounting report, company performance is measured and

3

examined at different-different level in the firm. Different approaches of management accounting

reporting are as following: Budget reporting: In this budget reporting report, there are several of items are covered

and their standard are given in the table. Again these standard are effective results in

order to acquiring by qualifying corporation performances. On comparison of both value

and data about to the Toyota automotive performance is examined by the junior

accountant and manager of this business. Hence, this reports would not help in the

examination of its own performance in context of standard but is also helps in measure

their previous year performance and find out relevant changes in the firm and know how

many changes are acquired from their current performance to their last performances.

Thus, it could be examined that budget reporting is very essential for Toyota automotive

to assist in measuring their performance at various region. Hence, the firm want to bring

their budgeting reports towards right direction in terms to accomplish their goals and

objectives within the business (Quattrone, 2016). Toyota automotive business need to

prepare their appropriate budgeting reports and it is simply to formulate this reports to

their expertise employee and need to hire strong technical background persons who are

eligible to prepare it. Moreover, there must be requirement of take care while preparing

the budgeting report and on the basis of it forecasting by approximation growth rate of

sales revenue and expenses in the business. In order to solve these issue, a skilled person

should be hired to make a favorable budgeting report to the firm. All these advantage of

budgeting now comes to disadvantage of this reporting, there are major disadvantage of

this reporting is that assuming is made on it and on the basis on standard are determined

that could be wrong in the future time period (Qu, S. Q., Cooper, D. J. and Ezzamel, M.,

2010). This reporting might be proved wrong for the future in terms of get their all

forecasting standard because many of time in the organization, it could be seen that

manager set negative value of their standard because several of time it had been seen that

forecasting values does not match to their actual vale. Thus, this is the big limitation of

budget reporting within the Toyota automotive business. Job cost report: This is another most vital reporting system because under this in report

costing different role of business projects are formulated in the books and accounts. This

reporting method is used by several of business venture at workplace nowadays. In this

4

reporting are as following: Budget reporting: In this budget reporting report, there are several of items are covered

and their standard are given in the table. Again these standard are effective results in

order to acquiring by qualifying corporation performances. On comparison of both value

and data about to the Toyota automotive performance is examined by the junior

accountant and manager of this business. Hence, this reports would not help in the

examination of its own performance in context of standard but is also helps in measure

their previous year performance and find out relevant changes in the firm and know how

many changes are acquired from their current performance to their last performances.

Thus, it could be examined that budget reporting is very essential for Toyota automotive

to assist in measuring their performance at various region. Hence, the firm want to bring

their budgeting reports towards right direction in terms to accomplish their goals and

objectives within the business (Quattrone, 2016). Toyota automotive business need to

prepare their appropriate budgeting reports and it is simply to formulate this reports to

their expertise employee and need to hire strong technical background persons who are

eligible to prepare it. Moreover, there must be requirement of take care while preparing

the budgeting report and on the basis of it forecasting by approximation growth rate of

sales revenue and expenses in the business. In order to solve these issue, a skilled person

should be hired to make a favorable budgeting report to the firm. All these advantage of

budgeting now comes to disadvantage of this reporting, there are major disadvantage of

this reporting is that assuming is made on it and on the basis on standard are determined

that could be wrong in the future time period (Qu, S. Q., Cooper, D. J. and Ezzamel, M.,

2010). This reporting might be proved wrong for the future in terms of get their all

forecasting standard because many of time in the organization, it could be seen that

manager set negative value of their standard because several of time it had been seen that

forecasting values does not match to their actual vale. Thus, this is the big limitation of

budget reporting within the Toyota automotive business. Job cost report: This is another most vital reporting system because under this in report

costing different role of business projects are formulated in the books and accounts. This

reporting method is used by several of business venture at workplace nowadays. In this

4

approach all the product lines are individually figures are calculated in order to expenses

that are mane in the firm (Nakajima, 2010). Hence, it could be assumed that job coasting

provide the vital information about to each cost of product line and for these benefits,

most of the companies are preparing their proper job costing reporting at the workplace

within the business. The Toyota automotive firm must prepare job costing reporting for

their different product lines on regular basis to make them more effective to the firm and

also know that which product lines is out of control in the business and according to it

efficiently manage them. Income statement: Income statement is one of the management accounting approach

which is essential for Toyota automotive business. Under this, the depth of separatism of

expenses in not done in the business (Libby, and Lindsay, 2010). One could see the

ultimate value of the all expenses within the Toyota automotive firm. Income statements

should be quarterly prepared to know about to the which section is performing good and

which section performing badly. This approach also furnishes the overall income

performance of the Toyota automotive firm and due to this reason, it is majorly used in

the business for making decision. One of the limitation of income statement that it does

not show segregation for making decision. Thus, in could be identified by the looking at

the income statement of that is making expenses which firm expenditure are highly made

such as expenses in social media, public relations etc.

Accounting receivable reporting: Accounting reporting is another form of preparing

reporting within the Toyota automotive firm. In this approach business receivable

transaction are reported in the books of accounts and firm would be able to know that

how many receivable transactions turned in to bed debts into the business and how many

encased directly in the little time period (Johnson, 2013). Cash management methodology

is effectively improved on the basis of account receivable reporting approach. Thus, it

could be said that there is high need of accounting receivable reporting in the Toyota

automotive firm. The Toyota automotive need to prepare accounting receivable reporting

frequently because there are several debtors can be find in the business and with the help

of this approach, it could be identified effectively. If there are bed debtors number

increasing frequently then there is a huge chance of cash could be locked into bed debts

5

that are mane in the firm (Nakajima, 2010). Hence, it could be assumed that job coasting

provide the vital information about to each cost of product line and for these benefits,

most of the companies are preparing their proper job costing reporting at the workplace

within the business. The Toyota automotive firm must prepare job costing reporting for

their different product lines on regular basis to make them more effective to the firm and

also know that which product lines is out of control in the business and according to it

efficiently manage them. Income statement: Income statement is one of the management accounting approach

which is essential for Toyota automotive business. Under this, the depth of separatism of

expenses in not done in the business (Libby, and Lindsay, 2010). One could see the

ultimate value of the all expenses within the Toyota automotive firm. Income statements

should be quarterly prepared to know about to the which section is performing good and

which section performing badly. This approach also furnishes the overall income

performance of the Toyota automotive firm and due to this reason, it is majorly used in

the business for making decision. One of the limitation of income statement that it does

not show segregation for making decision. Thus, in could be identified by the looking at

the income statement of that is making expenses which firm expenditure are highly made

such as expenses in social media, public relations etc.

Accounting receivable reporting: Accounting reporting is another form of preparing

reporting within the Toyota automotive firm. In this approach business receivable

transaction are reported in the books of accounts and firm would be able to know that

how many receivable transactions turned in to bed debts into the business and how many

encased directly in the little time period (Johnson, 2013). Cash management methodology

is effectively improved on the basis of account receivable reporting approach. Thus, it

could be said that there is high need of accounting receivable reporting in the Toyota

automotive firm. The Toyota automotive need to prepare accounting receivable reporting

frequently because there are several debtors can be find in the business and with the help

of this approach, it could be identified effectively. If there are bed debtors number

increasing frequently then there is a huge chance of cash could be locked into bed debts

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

of the firm. Accounting receivable reporting assist the manager to ensure that all the

debts funds are received form their debtors effectively in the Toyota automotive firm.

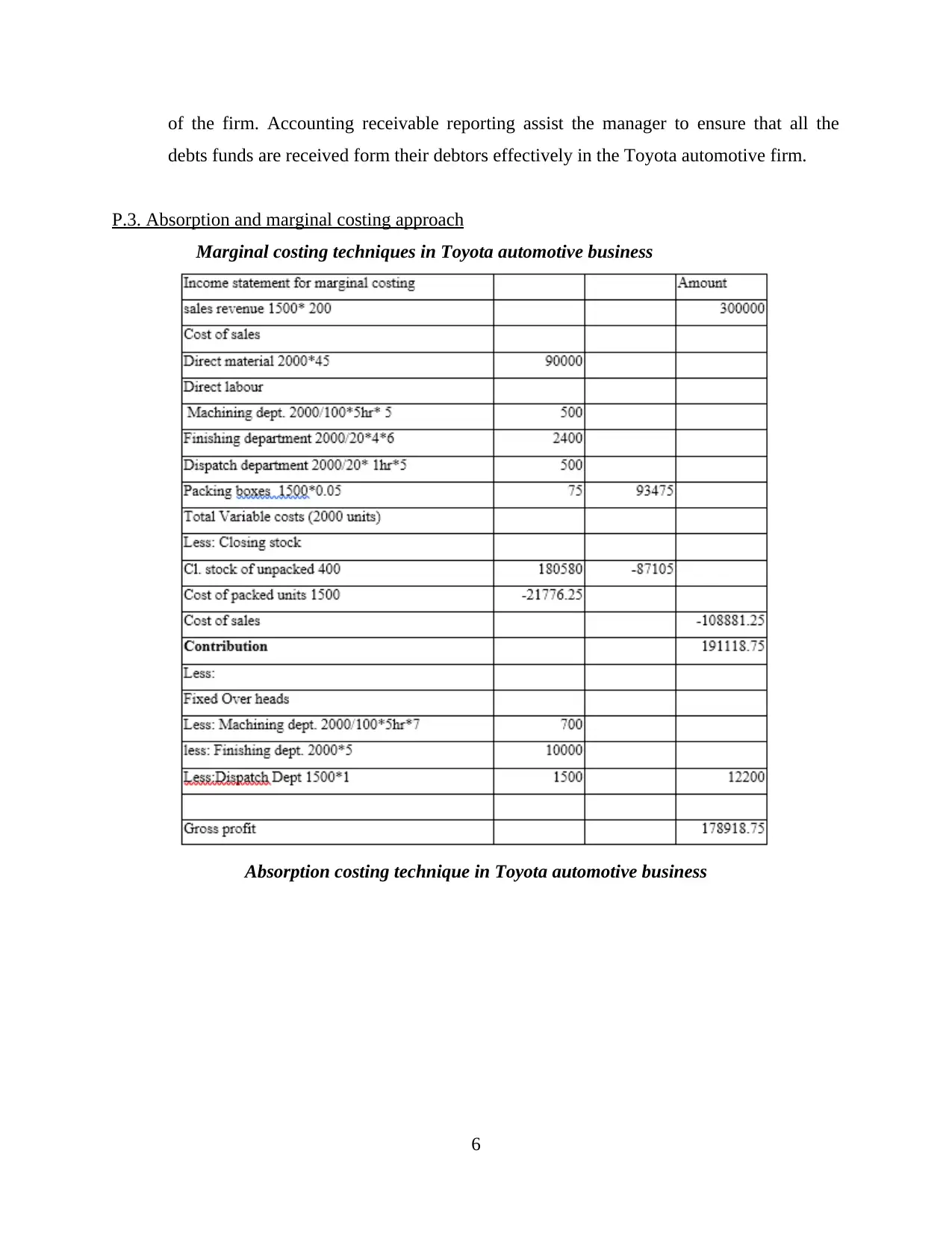

P.3. Absorption and marginal costing approach

Marginal costing techniques in Toyota automotive business

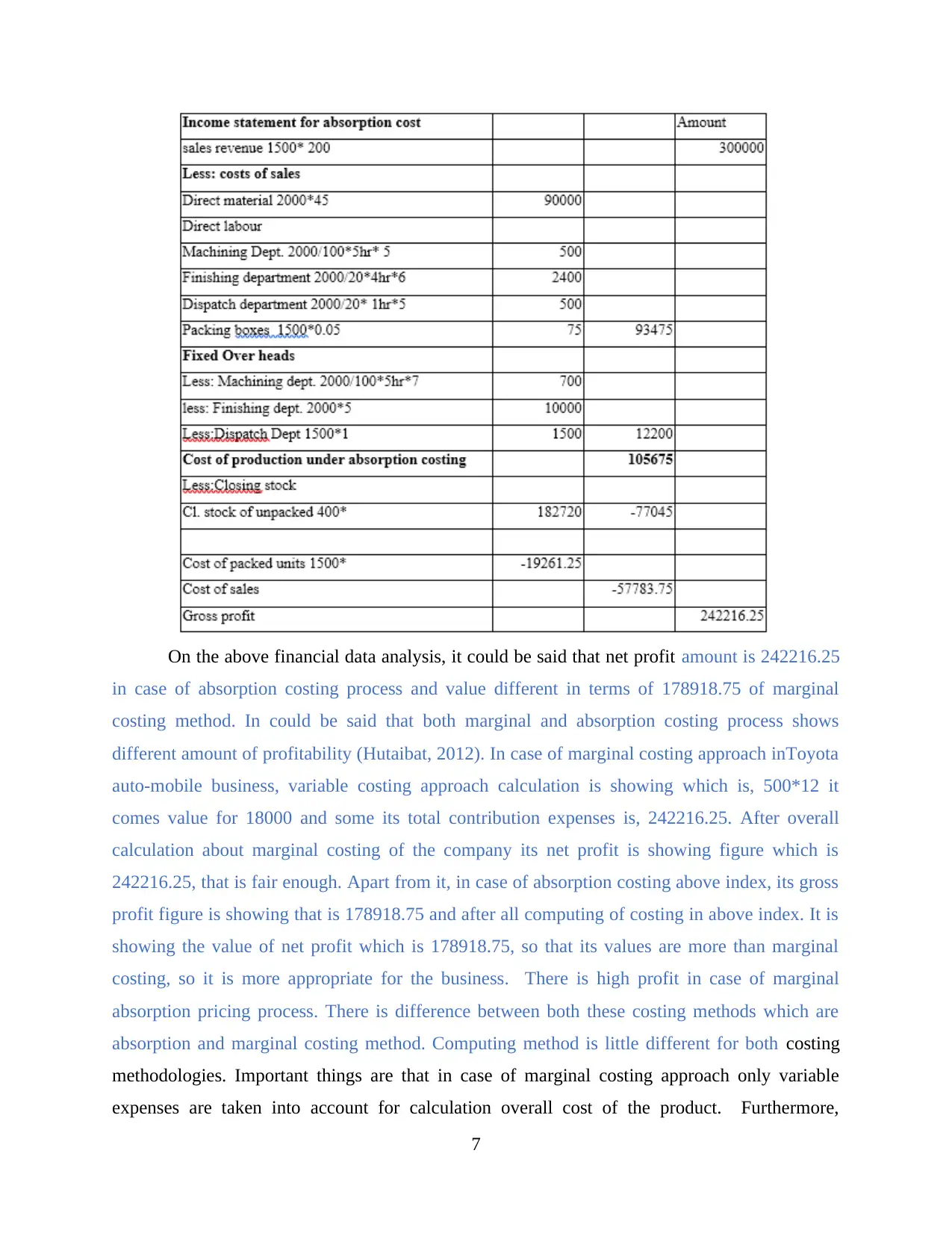

Absorption costing technique in Toyota automotive business

6

debts funds are received form their debtors effectively in the Toyota automotive firm.

P.3. Absorption and marginal costing approach

Marginal costing techniques in Toyota automotive business

Absorption costing technique in Toyota automotive business

6

On the above financial data analysis, it could be said that net profit amount is 242216.25

in case of absorption costing process and value different in terms of 178918.75 of marginal

costing method. In could be said that both marginal and absorption costing process shows

different amount of profitability (Hutaibat, 2012). In case of marginal costing approach inToyota

auto-mobile business, variable costing approach calculation is showing which is, 500*12 it

comes value for 18000 and some its total contribution expenses is, 242216.25. After overall

calculation about marginal costing of the company its net profit is showing figure which is

242216.25, that is fair enough. Apart from it, in case of absorption costing above index, its gross

profit figure is showing that is 178918.75 and after all computing of costing in above index. It is

showing the value of net profit which is 178918.75, so that its values are more than marginal

costing, so it is more appropriate for the business. There is high profit in case of marginal

absorption pricing process. There is difference between both these costing methods which are

absorption and marginal costing method. Computing method is little different for both costing

methodologies. Important things are that in case of marginal costing approach only variable

expenses are taken into account for calculation overall cost of the product. Furthermore,

7

in case of absorption costing process and value different in terms of 178918.75 of marginal

costing method. In could be said that both marginal and absorption costing process shows

different amount of profitability (Hutaibat, 2012). In case of marginal costing approach inToyota

auto-mobile business, variable costing approach calculation is showing which is, 500*12 it

comes value for 18000 and some its total contribution expenses is, 242216.25. After overall

calculation about marginal costing of the company its net profit is showing figure which is

242216.25, that is fair enough. Apart from it, in case of absorption costing above index, its gross

profit figure is showing that is 178918.75 and after all computing of costing in above index. It is

showing the value of net profit which is 178918.75, so that its values are more than marginal

costing, so it is more appropriate for the business. There is high profit in case of marginal

absorption pricing process. There is difference between both these costing methods which are

absorption and marginal costing method. Computing method is little different for both costing

methodologies. Important things are that in case of marginal costing approach only variable

expenses are taken into account for calculation overall cost of the product. Furthermore,

7

absorption costing is completely opposite and under this both fixed and variable expenses are

taken into account to do costing of method indicate more profitability than absorption costing

process due to inn-inclusion of fixed expenses in both businesses. Hence, by doing so outcome

of these disbursal on enterprise revenue is calculated and it could be said that investigation help

managers in making decisions more in proper manner. It can be said that firms must use both

approaches at workplace as there are few of positive and negative points associated with these

approaches. According to need these approaches must be used at workplace and proper judgment

of disbursal must be done in the enterprise so that better decisions can be made and operations

can be governed in proper manner within Toyota automotive business.

TASK 3

P.4. Advantage and disadvantage of using different planning tools that can be used for budgeting

control at workplace

There are several kinds of tools that are using by many business companies for their

budgeting control at workplace and all of them have some advantage and disadvantage (Haskin,

2010). Different kinds of business tools that are available to the firms which are budgeting and

capital budgeting approaches, are as following:

Cash budget: This is most vital kind of budgeting which is fitted out for all types of

business ventures (Harris, and Durden, 2012). In this cash budget approach estimation is

made about inflow and outflow statement and from that net available balance is identified

in the business. By using all cash expenditure budget planning is prepared about to

expenditure that are made in the firm. Moreover, in could be said that all expenditure

statements to be prepared with efforts of determining limits and according to this plan

would be prepared. On the basis of this approach, it could be said that cash budget is one

of the major essential tool for business. There are several advantages and disadvantage of

cash budget are as following:

Advantage:

The major advantage of cash budget is all the expenses and cash flows in the Toyota

automotive firm can be identified and with the help of tools effective manage them as

well (Goretzki, Strauss, and Weber 2013). This would increase the profit generation of

the business.

8

taken into account to do costing of method indicate more profitability than absorption costing

process due to inn-inclusion of fixed expenses in both businesses. Hence, by doing so outcome

of these disbursal on enterprise revenue is calculated and it could be said that investigation help

managers in making decisions more in proper manner. It can be said that firms must use both

approaches at workplace as there are few of positive and negative points associated with these

approaches. According to need these approaches must be used at workplace and proper judgment

of disbursal must be done in the enterprise so that better decisions can be made and operations

can be governed in proper manner within Toyota automotive business.

TASK 3

P.4. Advantage and disadvantage of using different planning tools that can be used for budgeting

control at workplace

There are several kinds of tools that are using by many business companies for their

budgeting control at workplace and all of them have some advantage and disadvantage (Haskin,

2010). Different kinds of business tools that are available to the firms which are budgeting and

capital budgeting approaches, are as following:

Cash budget: This is most vital kind of budgeting which is fitted out for all types of

business ventures (Harris, and Durden, 2012). In this cash budget approach estimation is

made about inflow and outflow statement and from that net available balance is identified

in the business. By using all cash expenditure budget planning is prepared about to

expenditure that are made in the firm. Moreover, in could be said that all expenditure

statements to be prepared with efforts of determining limits and according to this plan

would be prepared. On the basis of this approach, it could be said that cash budget is one

of the major essential tool for business. There are several advantages and disadvantage of

cash budget are as following:

Advantage:

The major advantage of cash budget is all the expenses and cash flows in the Toyota

automotive firm can be identified and with the help of tools effective manage them as

well (Goretzki, Strauss, and Weber 2013). This would increase the profit generation of

the business.

8

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Another main advantage of cash budgeting is, it is easy to made for every business and

there is no need for hire specific skilled person to prepare cash budget.

Disadvantage: The main disadvantage of this approach is that it is made on the basis of approximation

and if the estimation goes wrong in the future then it would make negative impact on the

firm.

Fixed Budget: Fixed budget is another option that is available to Toyota automotive

business. It is totally inverse of cash budget as in this manner of budget measure of all

elements of budget is made different (Gates, Nicolas, and Walker, 2012). Like cash

budget there are some variants of merit and demerit of fixed budget.

Advantage:

One of the main Advantage of fixed budget is its value always remain same and it would

never change. Thus, Toyota automotive firm manager required to prepare it with their full

dedication and efforts.

Another main advantage of fixed budgeting is that one just required to take a look at

budgeting and also make ensure that it can be implemented in company even business

circumstances changes frequently.

Disadvantage: One of the major disadvantage of fixed budgeting is that in the situation is change rapidly

in the firm then it is not possible to effective use of fixed budget within the Toyota

automotive corporation. There is always possibility of making wrong decision by using

this method.

Zero based Budgeting: it is different form above approaches, in this approach portion are

not simply made to each department within the firm until manager of this company

present own department budget in front of their senor manager (Fadzil, and Rababah,

2012). There are few advantages and disadvantage of zero based budgeting as following:

Advantage:

The major Advantage of this budgeting is that a systematic process if followed in the

preparation method of zero based budgeting and many appropriate tools are used by their

experts. Hence, it could be said that it is more effectively beneficial for the Toyota

automotive business.

9

there is no need for hire specific skilled person to prepare cash budget.

Disadvantage: The main disadvantage of this approach is that it is made on the basis of approximation

and if the estimation goes wrong in the future then it would make negative impact on the

firm.

Fixed Budget: Fixed budget is another option that is available to Toyota automotive

business. It is totally inverse of cash budget as in this manner of budget measure of all

elements of budget is made different (Gates, Nicolas, and Walker, 2012). Like cash

budget there are some variants of merit and demerit of fixed budget.

Advantage:

One of the main Advantage of fixed budget is its value always remain same and it would

never change. Thus, Toyota automotive firm manager required to prepare it with their full

dedication and efforts.

Another main advantage of fixed budgeting is that one just required to take a look at

budgeting and also make ensure that it can be implemented in company even business

circumstances changes frequently.

Disadvantage: One of the major disadvantage of fixed budgeting is that in the situation is change rapidly

in the firm then it is not possible to effective use of fixed budget within the Toyota

automotive corporation. There is always possibility of making wrong decision by using

this method.

Zero based Budgeting: it is different form above approaches, in this approach portion are

not simply made to each department within the firm until manager of this company

present own department budget in front of their senor manager (Fadzil, and Rababah,

2012). There are few advantages and disadvantage of zero based budgeting as following:

Advantage:

The major Advantage of this budgeting is that a systematic process if followed in the

preparation method of zero based budgeting and many appropriate tools are used by their

experts. Hence, it could be said that it is more effectively beneficial for the Toyota

automotive business.

9

Disadvantage: One of the main disadvantage of this approach is, it is totally time consuming and lengthy

process, which could create negative impact on the business.

Capital budgeting method: In this approach project development process if completed

and under this project value method. Some of their advantage and disadvantage of this

capital budgeting method are as following:

Advantage:

Major advantage of this approach is that projection is made about to expenses that could

be incurred in business project. Thus, planning goes hand in hand with passage of project

duration period.

Disadvantage:

Major disadvantage of this method is that with increase in duration project cost may be

raised and it could be hard task to set up project in appropriate way which make the cause

of waste of time.

P.5. Adoption of management accounting system to respond to financial management

Most of the firm are facing their financial issues and problems within the business. It is

the management accounting system that are used to respond to financial issues (Boyns, and

Edwards, 2013). Some management accounting strategies that could be utilized to response to

financial problem are as following: Key performance of indicators: Key performance indicator is one of the essential tool

that is used to solve business financial problems (Bennett, and James, eds., 2017).

Volkswagen automotive business is currently facing many of their financial issues such

as cash availability in the business. In context of solving financial issues of firm KPI

could be used in which actual value are compare to their standard value in the business

and it could recognize that how much big is firm's current financial issues. According to

the level of issues in the firm, with the help of KPI tools an appropriate solution can be

implemented in terms of effective response to the all financial problems of Volkswagen

automotive business as compare to Toyota business in the industry. Balanced score card: Balanced score card is one of the essential tool that is used for

measuring their financial performances and their score cards (Abdel-Kader, ed., 2011).

There are four parameters in where company performance could be measured and

10

process, which could create negative impact on the business.

Capital budgeting method: In this approach project development process if completed

and under this project value method. Some of their advantage and disadvantage of this

capital budgeting method are as following:

Advantage:

Major advantage of this approach is that projection is made about to expenses that could

be incurred in business project. Thus, planning goes hand in hand with passage of project

duration period.

Disadvantage:

Major disadvantage of this method is that with increase in duration project cost may be

raised and it could be hard task to set up project in appropriate way which make the cause

of waste of time.

P.5. Adoption of management accounting system to respond to financial management

Most of the firm are facing their financial issues and problems within the business. It is

the management accounting system that are used to respond to financial issues (Boyns, and

Edwards, 2013). Some management accounting strategies that could be utilized to response to

financial problem are as following: Key performance of indicators: Key performance indicator is one of the essential tool

that is used to solve business financial problems (Bennett, and James, eds., 2017).

Volkswagen automotive business is currently facing many of their financial issues such

as cash availability in the business. In context of solving financial issues of firm KPI

could be used in which actual value are compare to their standard value in the business

and it could recognize that how much big is firm's current financial issues. According to

the level of issues in the firm, with the help of KPI tools an appropriate solution can be

implemented in terms of effective response to the all financial problems of Volkswagen

automotive business as compare to Toyota business in the industry. Balanced score card: Balanced score card is one of the essential tool that is used for

measuring their financial performances and their score cards (Abdel-Kader, ed., 2011).

There are four parameters in where company performance could be measured and

10

evaluated effectively. These four parameters are financial, customer, stakeholder, internal

process and organisational capability. On the basis of these four parameters some targets

are prepared for the firm and their actual performances is compared in front of their

targets. By doing these exercises in Volkswagen auto-mobile organisation, its

performances are examined and developed and find out some areas in which improper

management of cash in identifies. According to their score card, it helps the firm to

identify their relevant issues and effectively solve their financial problems with the help

of its tools and techniques. As compare to Toyota business is implementing in the

business, this approach assists Volkswagen business in better manner.

Financial governance: Financial governance is one of the major approach which is used

for efficiently response to the Toyota automotive firm's financial issues. In this strategy,

there are some rule are regulations are predetermined and some requirement to be

followed while performing their task (Bebbington, Unerman, and O'Dwyer, eds., 2014.).

In some situation in which someone is performing financial activity within the business

and make any mistake in the firm which would make cause of the financial issues in the

firm then the person would particularly responsible for this financial issues within the

Toyota automotive business and it would be response to the financial issues of the

corporation. Such form of exercise makes that on before performing any action would

think about it before performing any action regarding to the financial concern of the firm

and ensure that take right action against towards the financial issues of the Toyota

automotive firm and solve all the financial issues that is facing by Volkswagen which is

generated by changing in various situation and business performances.

CONCLUSION

On the basis on above discussion, we have concluded that management accounting is one

of the major part of every business which have many significant for the Toyota automotive firm.

Because there are number of management accounting methods and strategic tools and techniques

which helps the Toyota automotive business to measuring company performance effectively. In

the conclusion, it is also mentioned about to that management accounting is selected by

considering number of elements and according to the circumstance some method must be

implemented within the corporation. It is also concluded that various form of reporting method

must be used in the firm to make appropriate financial decision on favor of generating more

11

process and organisational capability. On the basis of these four parameters some targets

are prepared for the firm and their actual performances is compared in front of their

targets. By doing these exercises in Volkswagen auto-mobile organisation, its

performances are examined and developed and find out some areas in which improper

management of cash in identifies. According to their score card, it helps the firm to

identify their relevant issues and effectively solve their financial problems with the help

of its tools and techniques. As compare to Toyota business is implementing in the

business, this approach assists Volkswagen business in better manner.

Financial governance: Financial governance is one of the major approach which is used

for efficiently response to the Toyota automotive firm's financial issues. In this strategy,

there are some rule are regulations are predetermined and some requirement to be

followed while performing their task (Bebbington, Unerman, and O'Dwyer, eds., 2014.).

In some situation in which someone is performing financial activity within the business

and make any mistake in the firm which would make cause of the financial issues in the

firm then the person would particularly responsible for this financial issues within the

Toyota automotive business and it would be response to the financial issues of the

corporation. Such form of exercise makes that on before performing any action would

think about it before performing any action regarding to the financial concern of the firm

and ensure that take right action against towards the financial issues of the Toyota

automotive firm and solve all the financial issues that is facing by Volkswagen which is

generated by changing in various situation and business performances.

CONCLUSION

On the basis on above discussion, we have concluded that management accounting is one

of the major part of every business which have many significant for the Toyota automotive firm.

Because there are number of management accounting methods and strategic tools and techniques

which helps the Toyota automotive business to measuring company performance effectively. In

the conclusion, it is also mentioned about to that management accounting is selected by

considering number of elements and according to the circumstance some method must be

implemented within the corporation. It is also concluded that various form of reporting method

must be used in the firm to make appropriate financial decision on favor of generating more

11

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

profitability for Toyota automotive corporation. Particular some methods must be used in the

firm to solve all their financial problems and manage their favorable situation.

12

firm to solve all their financial problems and manage their favorable situation.

12

REFERENCES

Books and Journals

Abdel-Kader, M. G. ed., 2011. Review of management accounting research. Springer.

Ahmad, K., 2012. The use of management accounting practices in Malaysian SMEs.

Bebbington, J., Unerman, J. and O'Dwyer, B. eds., 2014. Sustainability accounting and

accountability. Routledge.

Bennett, M. and James, P. eds., 2017. The Green bottom line: environmental accounting for

management: current practice and future trends. Routledge.

Boyns, T. and Edwards, J. R., 2013. A history of management accounting: The British

experience. Vol. 12. Routledge.

Fadzil, F. H. B. and Rababah, A., 2012. Management accounting change: ABC adoption and

implementation. Journal of Accounting and Auditing. 2012. p.1.

Gates, S., Nicolas, J. L. and Walker, P. L., 2012. Enterprise risk management: A process for

enhanced management and improved performance. Management accounting quarterly, 13.

3. pp. 28-38.

Goretzki, L., Strauss, E. and Weber, J., 2013. An institutional perspective on the changes in

management accountants’ professional role. Management Accounting Research, 24(1),

pp.41-63.

Harris, J. and Durden, C., 2012. Management accounting research: An analysis of recent themes

and directions for the future. Journal of Applied Management Accounting Research. 10. 2.

p. 21.

Haskin, D., 2010. Teaching special decisions in a lean accounting environment. American

Journal of Business Education. 3. 6. p. 91.

Hutaibat, K. A., 2012. Interest in the management accounting profession: accounting students’

perceptions in Jordanian universities. Asian Social Science, 8. 3. p. 303.

Johnson, H. T., 2013. A New Approach to Management Accounting History. RLE Accountin.

Vol. 41. Routledge.

Libby, T. and Lindsay, R. M., 2010. Beyond budgeting or budgeting reconsidered? A survey of

North-American budgeting practice. Management accounting research. 21. 1. pp. 56-75.

Nakajima, M., 2010. Environmental management accounting for sustainable manufacturing:

establishing mangement system of material flow cost accounting. MFCA.

13

Books and Journals

Abdel-Kader, M. G. ed., 2011. Review of management accounting research. Springer.

Ahmad, K., 2012. The use of management accounting practices in Malaysian SMEs.

Bebbington, J., Unerman, J. and O'Dwyer, B. eds., 2014. Sustainability accounting and

accountability. Routledge.

Bennett, M. and James, P. eds., 2017. The Green bottom line: environmental accounting for

management: current practice and future trends. Routledge.

Boyns, T. and Edwards, J. R., 2013. A history of management accounting: The British

experience. Vol. 12. Routledge.

Fadzil, F. H. B. and Rababah, A., 2012. Management accounting change: ABC adoption and

implementation. Journal of Accounting and Auditing. 2012. p.1.

Gates, S., Nicolas, J. L. and Walker, P. L., 2012. Enterprise risk management: A process for

enhanced management and improved performance. Management accounting quarterly, 13.

3. pp. 28-38.

Goretzki, L., Strauss, E. and Weber, J., 2013. An institutional perspective on the changes in

management accountants’ professional role. Management Accounting Research, 24(1),

pp.41-63.

Harris, J. and Durden, C., 2012. Management accounting research: An analysis of recent themes

and directions for the future. Journal of Applied Management Accounting Research. 10. 2.

p. 21.

Haskin, D., 2010. Teaching special decisions in a lean accounting environment. American

Journal of Business Education. 3. 6. p. 91.

Hutaibat, K. A., 2012. Interest in the management accounting profession: accounting students’

perceptions in Jordanian universities. Asian Social Science, 8. 3. p. 303.

Johnson, H. T., 2013. A New Approach to Management Accounting History. RLE Accountin.

Vol. 41. Routledge.

Libby, T. and Lindsay, R. M., 2010. Beyond budgeting or budgeting reconsidered? A survey of

North-American budgeting practice. Management accounting research. 21. 1. pp. 56-75.

Nakajima, M., 2010. Environmental management accounting for sustainable manufacturing:

establishing mangement system of material flow cost accounting. MFCA.

13

Qu, S. Q., Cooper, D. J. and Ezzamel, M., 2010. Creating and popularising a global

management accounting idea: The case of the Balanced Scorecard. Chartered Institute of

Management Accountants.

Quattrone, P., 2016. Management accounting goes digital: Will the move make it wiser?.

Management Accounting Research. 31. pp. 118-122.

Shields, M. D., 2015. Established management accounting knowledge. Journal of Management

Accounting Research. 27. 1. pp. 123-132.

Suomala, P. and Lyly-Yrjänäinen, J., 2012. Management accounting research in practice:

Lessons learned from an interventionist approach. Routledge.

Van der Stede, W. A., 2015. Management accounting: Where from, where now, where to?.

Journal of Management Accounting Research. 27. 1. pp. 171-176.

Wu, J. and Boateng, A., 2010. Factors influencing changes in Chinese management accounting

practices. Journal of Change Management. 10. 3. pp. 315-329.

Yalcin, S., 2012. Adoption and benefits of management accounting practices: an inter-country

comparison. Accounting in Europe. 9. 1. pp.9 5-110.

Zoni, L., Dossi, A. and Morelli, M., 2012. Management accounting system . MAS. change: field

evidence. Asia-Pacific Journal of Accounting & Economics. 19. 1. pp. 119-138.

14

management accounting idea: The case of the Balanced Scorecard. Chartered Institute of

Management Accountants.

Quattrone, P., 2016. Management accounting goes digital: Will the move make it wiser?.

Management Accounting Research. 31. pp. 118-122.

Shields, M. D., 2015. Established management accounting knowledge. Journal of Management

Accounting Research. 27. 1. pp. 123-132.

Suomala, P. and Lyly-Yrjänäinen, J., 2012. Management accounting research in practice:

Lessons learned from an interventionist approach. Routledge.

Van der Stede, W. A., 2015. Management accounting: Where from, where now, where to?.

Journal of Management Accounting Research. 27. 1. pp. 171-176.

Wu, J. and Boateng, A., 2010. Factors influencing changes in Chinese management accounting

practices. Journal of Change Management. 10. 3. pp. 315-329.

Yalcin, S., 2012. Adoption and benefits of management accounting practices: an inter-country

comparison. Accounting in Europe. 9. 1. pp.9 5-110.

Zoni, L., Dossi, A. and Morelli, M., 2012. Management accounting system . MAS. change: field

evidence. Asia-Pacific Journal of Accounting & Economics. 19. 1. pp. 119-138.

14

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.