Management Accounting for Cost & Control - Desklib

VerifiedAdded on 2023/06/13

|19

|3458

|426

AI Summary

This article discusses the theory of Panopticism, functions of management accounting, perpetual inventory system, and more. It also includes answers to various questions related to accounting. Subject: Management Accounting, Course Code: ACC00724, College/University: Holmes Institute

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: MANAGEMENT ACCOUNTING FOR COST & CONTROL

Management Accounting for Cost & Control

Name of the Student:

Name of the University:

Author’s Note:

Management Accounting for Cost & Control

Name of the Student:

Name of the University:

Author’s Note:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1

MANAGEMENT ACCOUNTING FOR COST & CONTROL

Table of Contents

Answer to Question No 1................................................................................................................3

Answer to Question No 2................................................................................................................3

Answer to Question No 3................................................................................................................4

Answer to Question No 4:...............................................................................................................6

Normal View:..............................................................................................................................6

Manufacturing Statement:.......................................................................................................6

Income Statement:...................................................................................................................7

Formula View:.............................................................................................................................8

Manufacturing Statement:.......................................................................................................8

Income Statement:...................................................................................................................9

Answer to Question No 5..............................................................................................................10

Answer to Question No 6:.............................................................................................................10

Answer to Question No 7:.............................................................................................................11

Answer to Question No 8:.............................................................................................................11

Requirement a:...........................................................................................................................11

Requirement b:...........................................................................................................................11

Requirement c:...........................................................................................................................12

Answer to Question No 9:.............................................................................................................13

Answer to Question 10:.................................................................................................................15

MANAGEMENT ACCOUNTING FOR COST & CONTROL

Table of Contents

Answer to Question No 1................................................................................................................3

Answer to Question No 2................................................................................................................3

Answer to Question No 3................................................................................................................4

Answer to Question No 4:...............................................................................................................6

Normal View:..............................................................................................................................6

Manufacturing Statement:.......................................................................................................6

Income Statement:...................................................................................................................7

Formula View:.............................................................................................................................8

Manufacturing Statement:.......................................................................................................8

Income Statement:...................................................................................................................9

Answer to Question No 5..............................................................................................................10

Answer to Question No 6:.............................................................................................................10

Answer to Question No 7:.............................................................................................................11

Answer to Question No 8:.............................................................................................................11

Requirement a:...........................................................................................................................11

Requirement b:...........................................................................................................................11

Requirement c:...........................................................................................................................12

Answer to Question No 9:.............................................................................................................13

Answer to Question 10:.................................................................................................................15

2

MANAGEMENT ACCOUNTING FOR COST & CONTROL

Direct Method:...........................................................................................................................15

Step Method:..............................................................................................................................15

Reciprocal Method:...................................................................................................................15

Reference List................................................................................................................................17

MANAGEMENT ACCOUNTING FOR COST & CONTROL

Direct Method:...........................................................................................................................15

Step Method:..............................................................................................................................15

Reciprocal Method:...................................................................................................................15

Reference List................................................................................................................................17

3

MANAGEMENT ACCOUNTING FOR COST & CONTROL

Answer to Question No 1

The theory of Panopticism is based on panopticon which was developed by an English

philosopher, Jeremy Bentham. The concept stated a structure of prison system which involved

supervision of the inmates of the prisons. As per the concept, a prison be circular in structure and

have a tower from where a guard can supervise every activity of the prisoners with the prisoners

being able to see the guard. Later Michel Foucault adopted the concept of panopticon on the

basis of which the theory of panopticism was developed (Brunon-Ernst, 2016). As per the view

of Foucault, panopticon is useful for effective surveillance and monitoring activities which can

results in modification of the attitudes of individuals. The use of such surveillance and

monitoring activities are applied in a prison so that the attitude of the prisoners can be adjusted

and modified. The use of panopticon is mainly used for the disciplinary actions which are used in

the prisons (Brown, 2014). The framework is also useful for collection of data which can be

obtained during surveillance activities.

For example, in todays world of control and technological advancements the application

of panopticon is quite relevant. The data can be collected with the use of data mining activities

and the data thus collected can be made available to the companies and individuals for the

purpose of surveillance of data. the basic use of a panopticon is for the surveillance of business

or individuals.

The relevance of Panopticism is very useful for the management accounting process

which can be used in the management for the purpose of keeping track of all the transactions in a

business and also ensure that the transactions which are recorded are correctly represented

without any mistakes or errors. Moreover once the errors or mistakes in the transaction are

MANAGEMENT ACCOUNTING FOR COST & CONTROL

Answer to Question No 1

The theory of Panopticism is based on panopticon which was developed by an English

philosopher, Jeremy Bentham. The concept stated a structure of prison system which involved

supervision of the inmates of the prisons. As per the concept, a prison be circular in structure and

have a tower from where a guard can supervise every activity of the prisoners with the prisoners

being able to see the guard. Later Michel Foucault adopted the concept of panopticon on the

basis of which the theory of panopticism was developed (Brunon-Ernst, 2016). As per the view

of Foucault, panopticon is useful for effective surveillance and monitoring activities which can

results in modification of the attitudes of individuals. The use of such surveillance and

monitoring activities are applied in a prison so that the attitude of the prisoners can be adjusted

and modified. The use of panopticon is mainly used for the disciplinary actions which are used in

the prisons (Brown, 2014). The framework is also useful for collection of data which can be

obtained during surveillance activities.

For example, in todays world of control and technological advancements the application

of panopticon is quite relevant. The data can be collected with the use of data mining activities

and the data thus collected can be made available to the companies and individuals for the

purpose of surveillance of data. the basic use of a panopticon is for the surveillance of business

or individuals.

The relevance of Panopticism is very useful for the management accounting process

which can be used in the management for the purpose of keeping track of all the transactions in a

business and also ensure that the transactions which are recorded are correctly represented

without any mistakes or errors. Moreover once the errors or mistakes in the transaction are

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4

MANAGEMENT ACCOUNTING FOR COST & CONTROL

identified then the management can apply corrective measures to change the transaction and

record a correct one.

Answer to Question No 2

Management accounting process may be defined as the application of financial data and

results which can be applied in the decision-making process, performance management system

and also for forecasting of results (Fullerton, Kennedy & Widener, 2014). The major functions

which are associated with management account are discussed below:

1. Planning and Forecasting: The process of planning involves forecasting and planning

ahead of the activities of the business with a view of pursuing the goals and objective of

the business. The purpose behind planning activities of the businesses is to ensure that the

management of the company takes into consideration all the aspects of the business

which are cost, finances, operations, marketing and similar other activities of the business

in the decision-making process. Moreover, another importance of the planning process is

that the targets and various performance standards are set. The various decisions which

are taken in the planning process by the management can be related to allocation of

funds, decisions relating to operations, numerous decisions relating to costs and finances.

Some of the main tools which are used by the management in the planning process is the

use of budgets, value chain analysis. The preparation of the budget is the responsibility of

the management and which requires ample judgements and estimation which is possible

through the planning process. For example, the process of planning involves budgeting

for various financial and other resources for which standards are set as per the estimates

of the management and also on the basis of previous year’s performance of the company.

MANAGEMENT ACCOUNTING FOR COST & CONTROL

identified then the management can apply corrective measures to change the transaction and

record a correct one.

Answer to Question No 2

Management accounting process may be defined as the application of financial data and

results which can be applied in the decision-making process, performance management system

and also for forecasting of results (Fullerton, Kennedy & Widener, 2014). The major functions

which are associated with management account are discussed below:

1. Planning and Forecasting: The process of planning involves forecasting and planning

ahead of the activities of the business with a view of pursuing the goals and objective of

the business. The purpose behind planning activities of the businesses is to ensure that the

management of the company takes into consideration all the aspects of the business

which are cost, finances, operations, marketing and similar other activities of the business

in the decision-making process. Moreover, another importance of the planning process is

that the targets and various performance standards are set. The various decisions which

are taken in the planning process by the management can be related to allocation of

funds, decisions relating to operations, numerous decisions relating to costs and finances.

Some of the main tools which are used by the management in the planning process is the

use of budgets, value chain analysis. The preparation of the budget is the responsibility of

the management and which requires ample judgements and estimation which is possible

through the planning process. For example, the process of planning involves budgeting

for various financial and other resources for which standards are set as per the estimates

of the management and also on the basis of previous year’s performance of the company.

5

MANAGEMENT ACCOUNTING FOR COST & CONTROL

The budgeting techniques are used by management for various important decisions

regarding allocation of funds, financing and cost reduction decisions and also measuring

of variances.

2. Organising: This is one of the functions of management which is followed by planning

process. The method of organising involves the proper utilization of resources, setting up

of different departments and assigning the respective works to such departments. The

process of organising involves combination of human resources, financial resources and

physical resources for the purpose of executing the business activities of the company.

The basic function of organising is that of an administration as well as proper functioning

of the organisation. The next step after planning process is organising as planning process

establishes what activities are to be engaged in by the company and also the goals of the

business whereas organising states the easiest and the most reliant way in which the

management can achieve the plans and also the goals as established by the business.

3. Controlling: The function of controlling deals with the measurement of the performance

of the company in comparison to previously set standards of performance. Therefore, it

can be said that the controlling activities of the business is useful to measure how much

the company has achieve and whether the activities of the business are in pursuance of

the goals of the business. The controlling activities of the business applies techniques like

budget analysis, standard costing techniques, variances analysis and similar other

techniques. The controlling activities of a business also focuses on the establishing the

reasons as to why the standard which were set in the planning process cannot be achieved

and the actions which are taken by the management for correcting such factors.

MANAGEMENT ACCOUNTING FOR COST & CONTROL

The budgeting techniques are used by management for various important decisions

regarding allocation of funds, financing and cost reduction decisions and also measuring

of variances.

2. Organising: This is one of the functions of management which is followed by planning

process. The method of organising involves the proper utilization of resources, setting up

of different departments and assigning the respective works to such departments. The

process of organising involves combination of human resources, financial resources and

physical resources for the purpose of executing the business activities of the company.

The basic function of organising is that of an administration as well as proper functioning

of the organisation. The next step after planning process is organising as planning process

establishes what activities are to be engaged in by the company and also the goals of the

business whereas organising states the easiest and the most reliant way in which the

management can achieve the plans and also the goals as established by the business.

3. Controlling: The function of controlling deals with the measurement of the performance

of the company in comparison to previously set standards of performance. Therefore, it

can be said that the controlling activities of the business is useful to measure how much

the company has achieve and whether the activities of the business are in pursuance of

the goals of the business. The controlling activities of the business applies techniques like

budget analysis, standard costing techniques, variances analysis and similar other

techniques. The controlling activities of a business also focuses on the establishing the

reasons as to why the standard which were set in the planning process cannot be achieved

and the actions which are taken by the management for correcting such factors.

6

MANAGEMENT ACCOUNTING FOR COST & CONTROL

Answer to Question No 3

Van Halen was a rock band which is engaged in rock band performance. The band

operation scale grew larger in mid 1980s and the band started to move from small cities to large

cities for stage performance. As the operations of the band increases therefore there was a need

for controlling the activities of the band. Thus, the checklist system was introduced to effectively

manage all the activities of the band. The checklist of the band was included a rider- no brown

M&Ms. The checklist was sent to every location where the band will be performing to state the

conditions of the band and also the term of engagement which are to be followed other the band

can cancel the scheduled performance. One of the conditions which was included in the checklist

that the band did not want a single brown M&Ms. The band requested for pretzels and yoghurts

before each performance. Thus, from the above discussions, it can be clearly said that the band

used the checklist as a control device for managing activities of the business.

MANAGEMENT ACCOUNTING FOR COST & CONTROL

Answer to Question No 3

Van Halen was a rock band which is engaged in rock band performance. The band

operation scale grew larger in mid 1980s and the band started to move from small cities to large

cities for stage performance. As the operations of the band increases therefore there was a need

for controlling the activities of the band. Thus, the checklist system was introduced to effectively

manage all the activities of the band. The checklist of the band was included a rider- no brown

M&Ms. The checklist was sent to every location where the band will be performing to state the

conditions of the band and also the term of engagement which are to be followed other the band

can cancel the scheduled performance. One of the conditions which was included in the checklist

that the band did not want a single brown M&Ms. The band requested for pretzels and yoghurts

before each performance. Thus, from the above discussions, it can be clearly said that the band

used the checklist as a control device for managing activities of the business.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

MANAGEMENT ACCOUNTING FOR COST & CONTROL

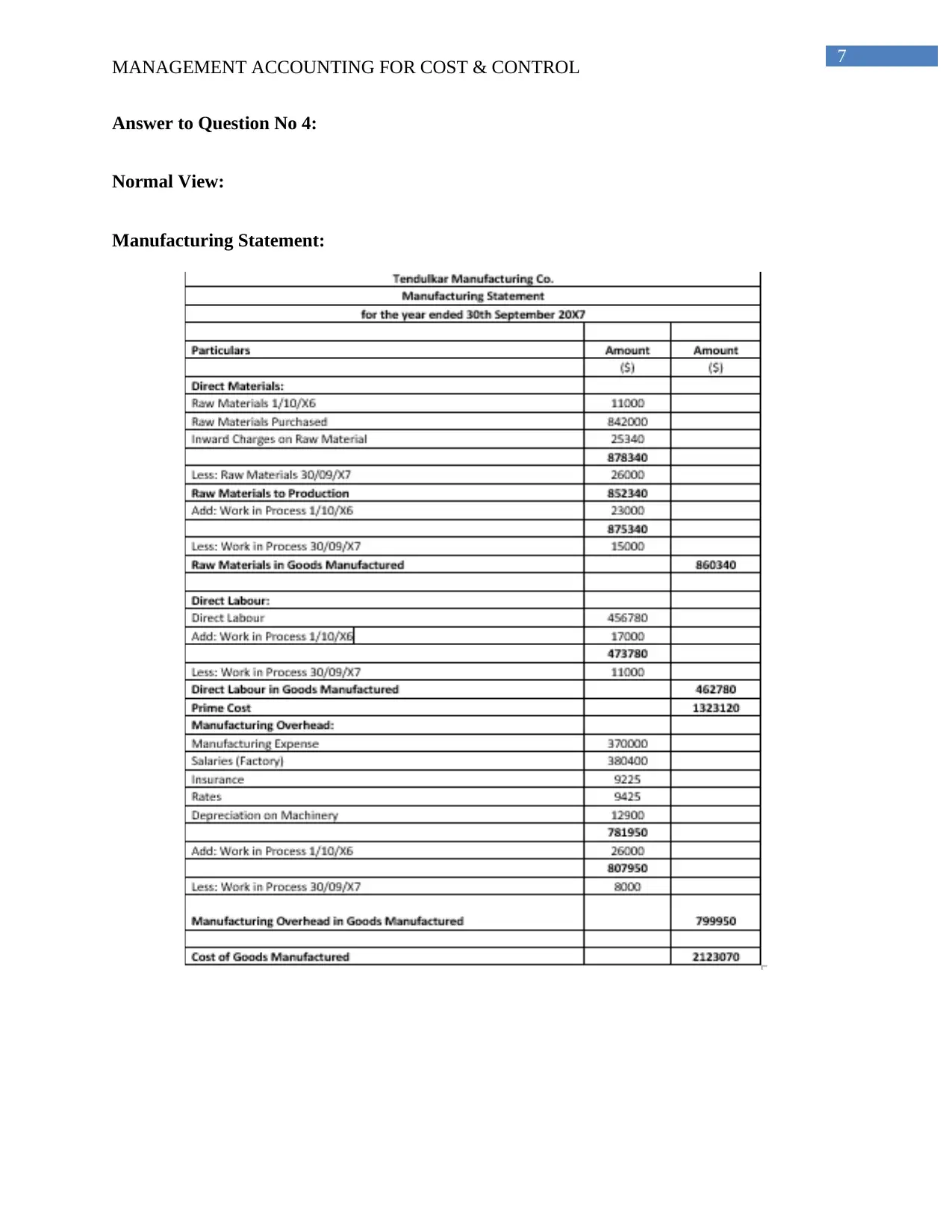

Answer to Question No 4:

Normal View:

Manufacturing Statement:

MANAGEMENT ACCOUNTING FOR COST & CONTROL

Answer to Question No 4:

Normal View:

Manufacturing Statement:

8

MANAGEMENT ACCOUNTING FOR COST & CONTROL

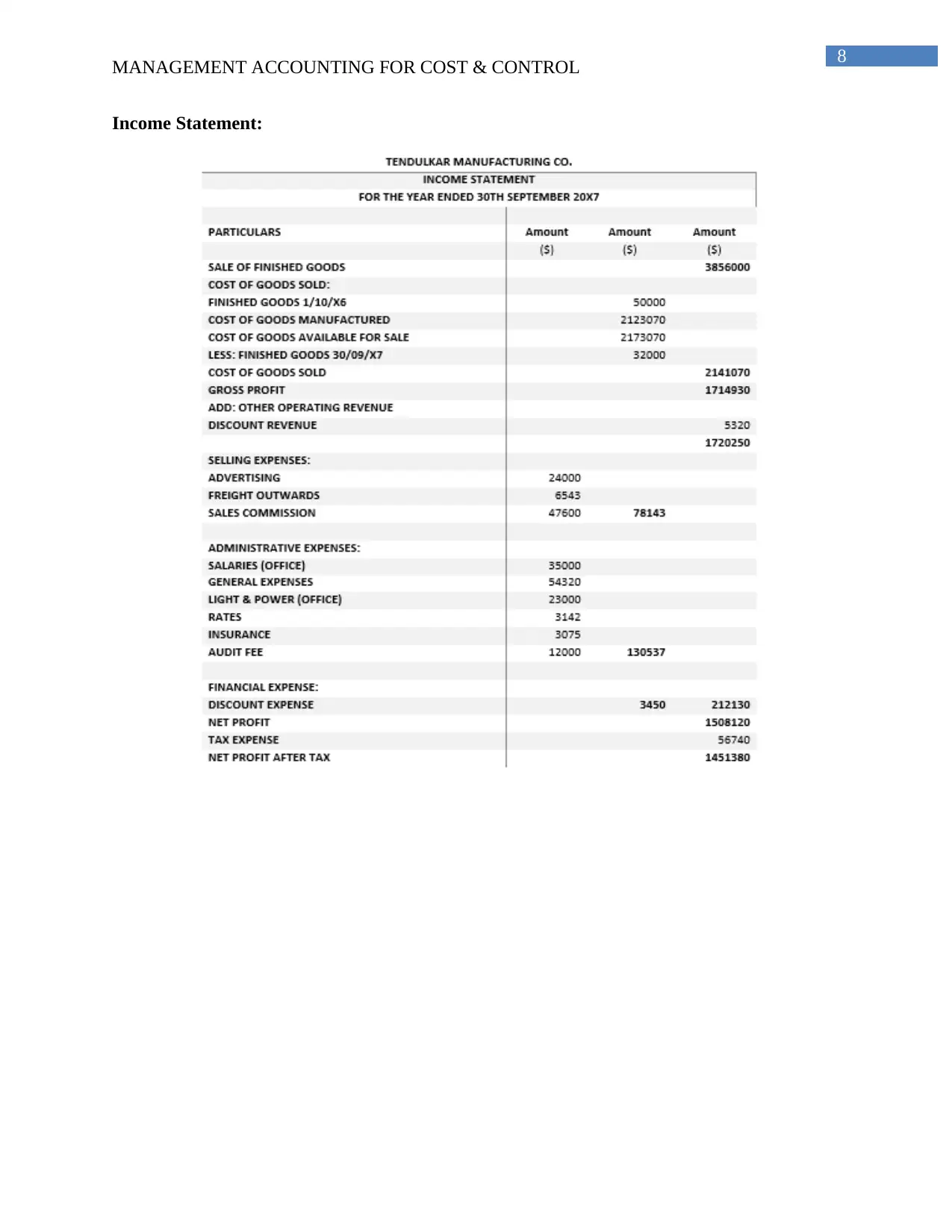

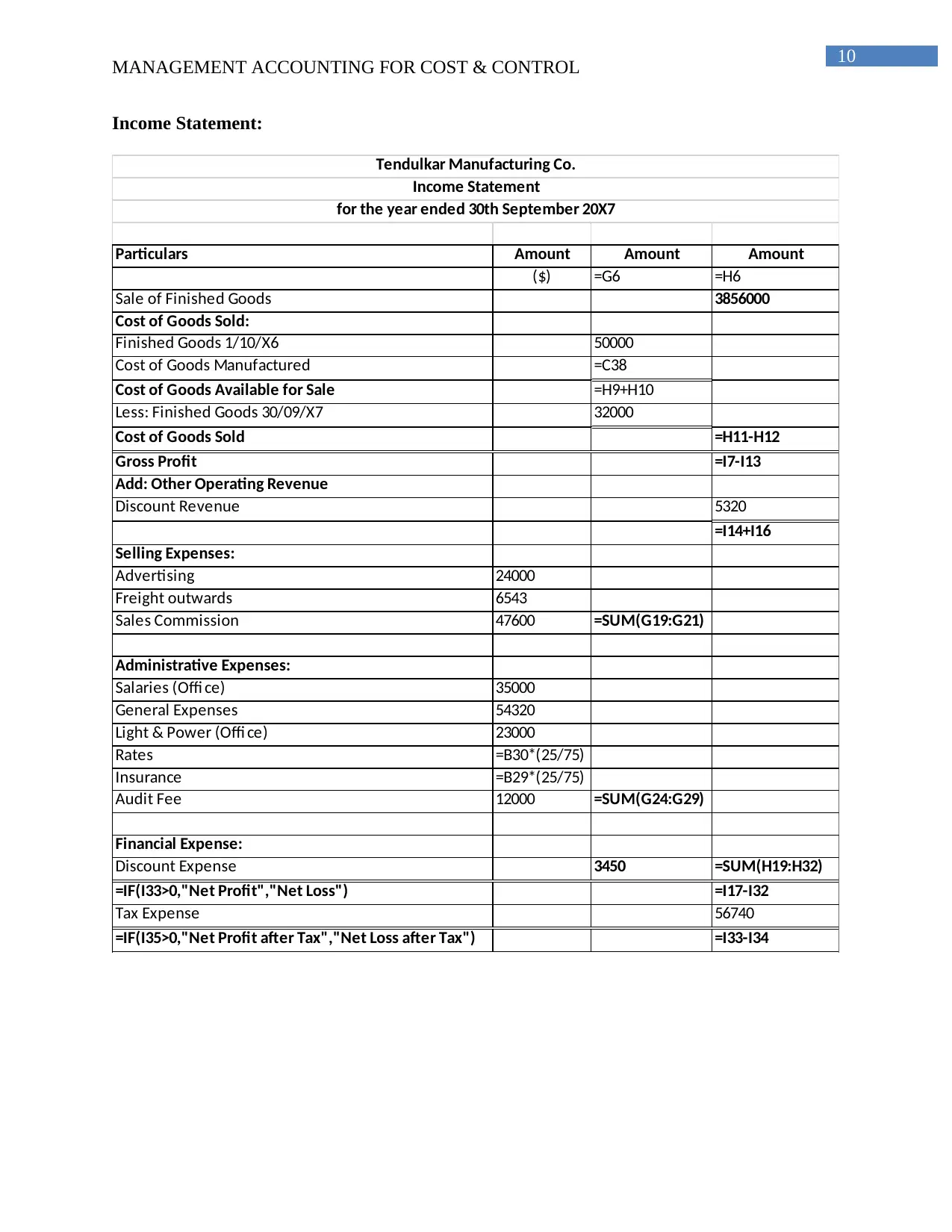

Income Statement:

MANAGEMENT ACCOUNTING FOR COST & CONTROL

Income Statement:

9

MANAGEMENT ACCOUNTING FOR COST & CONTROL

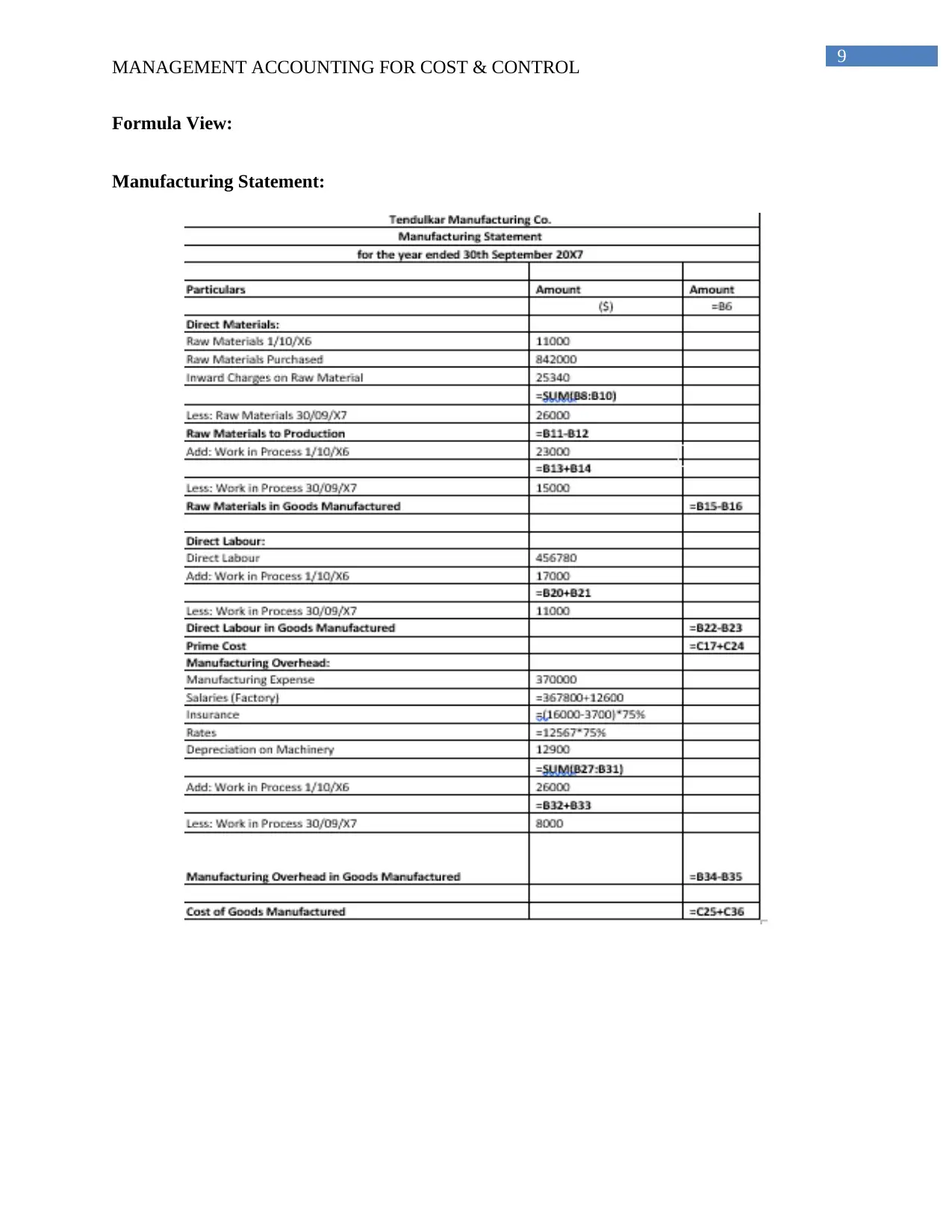

Formula View:

Manufacturing Statement:

MANAGEMENT ACCOUNTING FOR COST & CONTROL

Formula View:

Manufacturing Statement:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10

MANAGEMENT ACCOUNTING FOR COST & CONTROL

Income Statement:

Particulars Amount Amount Amount

($) =G6 =H6

Sale of Finished Goods 3856000

Cost of Goods Sold:

Finished Goods 1/10/X6 50000

Cost of Goods Manufactured =C38

Cost of Goods Available for Sale =H9+H10

Less: Finished Goods 30/09/X7 32000

Cost of Goods Sold =H11-H12

Gross Profit =I7-I13

Add: Other Operating Revenue

Discount Revenue 5320

=I14+I16

Selling Expenses:

Advertising 24000

Freight outwards 6543

Sales Commission 47600 =SUM(G19:G21)

Administrative Expenses:

Salaries (Offi ce) 35000

General Expenses 54320

Light & Power (Offi ce) 23000

Rates =B30*(25/75)

Insurance =B29*(25/75)

Audit Fee 12000 =SUM(G24:G29)

Financial Expense:

Discount Expense 3450 =SUM(H19:H32)

=IF(I33>0,"Net Profit","Net Loss") =I17-I32

Tax Expense 56740

=IF(I35>0,"Net Profit after Tax","Net Loss after Tax") =I33-I34

Tendulkar Manufacturing Co.

Income Statement

for the year ended 30th September 20X7

MANAGEMENT ACCOUNTING FOR COST & CONTROL

Income Statement:

Particulars Amount Amount Amount

($) =G6 =H6

Sale of Finished Goods 3856000

Cost of Goods Sold:

Finished Goods 1/10/X6 50000

Cost of Goods Manufactured =C38

Cost of Goods Available for Sale =H9+H10

Less: Finished Goods 30/09/X7 32000

Cost of Goods Sold =H11-H12

Gross Profit =I7-I13

Add: Other Operating Revenue

Discount Revenue 5320

=I14+I16

Selling Expenses:

Advertising 24000

Freight outwards 6543

Sales Commission 47600 =SUM(G19:G21)

Administrative Expenses:

Salaries (Offi ce) 35000

General Expenses 54320

Light & Power (Offi ce) 23000

Rates =B30*(25/75)

Insurance =B29*(25/75)

Audit Fee 12000 =SUM(G24:G29)

Financial Expense:

Discount Expense 3450 =SUM(H19:H32)

=IF(I33>0,"Net Profit","Net Loss") =I17-I32

Tax Expense 56740

=IF(I35>0,"Net Profit after Tax","Net Loss after Tax") =I33-I34

Tendulkar Manufacturing Co.

Income Statement

for the year ended 30th September 20X7

11

MANAGEMENT ACCOUNTING FOR COST & CONTROL

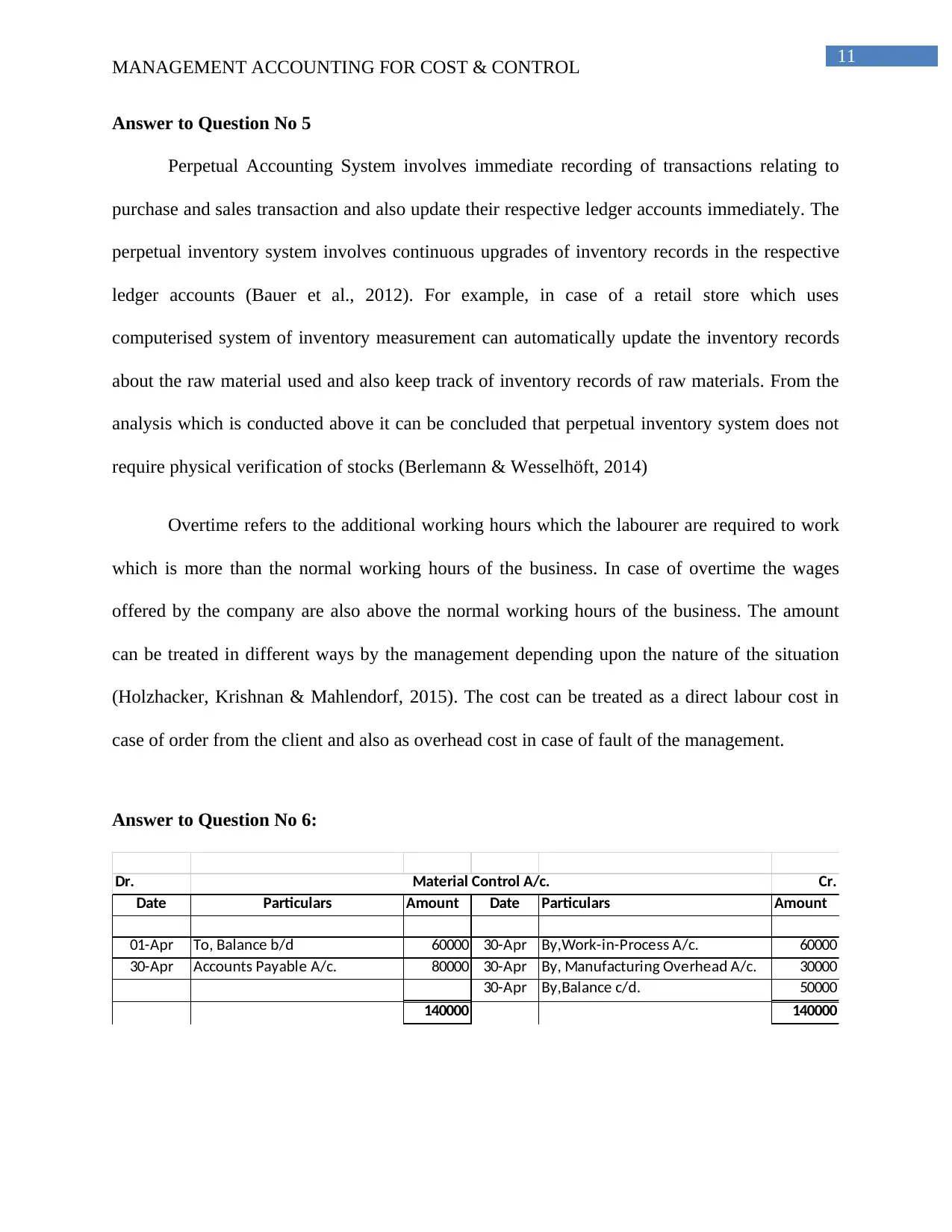

Answer to Question No 5

Perpetual Accounting System involves immediate recording of transactions relating to

purchase and sales transaction and also update their respective ledger accounts immediately. The

perpetual inventory system involves continuous upgrades of inventory records in the respective

ledger accounts (Bauer et al., 2012). For example, in case of a retail store which uses

computerised system of inventory measurement can automatically update the inventory records

about the raw material used and also keep track of inventory records of raw materials. From the

analysis which is conducted above it can be concluded that perpetual inventory system does not

require physical verification of stocks (Berlemann & Wesselhöft, 2014)

Overtime refers to the additional working hours which the labourer are required to work

which is more than the normal working hours of the business. In case of overtime the wages

offered by the company are also above the normal working hours of the business. The amount

can be treated in different ways by the management depending upon the nature of the situation

(Holzhacker, Krishnan & Mahlendorf, 2015). The cost can be treated as a direct labour cost in

case of order from the client and also as overhead cost in case of fault of the management.

Answer to Question No 6:

Dr. Cr.

Date Particulars Amount Date Particulars Amount

01-Apr To, Balance b/d 60000 30-Apr By,Work-in-Process A/c. 60000

30-Apr Accounts Payable A/c. 80000 30-Apr By, Manufacturing Overhead A/c. 30000

30-Apr By,Balance c/d. 50000

140000 140000

Material Control A/c.

MANAGEMENT ACCOUNTING FOR COST & CONTROL

Answer to Question No 5

Perpetual Accounting System involves immediate recording of transactions relating to

purchase and sales transaction and also update their respective ledger accounts immediately. The

perpetual inventory system involves continuous upgrades of inventory records in the respective

ledger accounts (Bauer et al., 2012). For example, in case of a retail store which uses

computerised system of inventory measurement can automatically update the inventory records

about the raw material used and also keep track of inventory records of raw materials. From the

analysis which is conducted above it can be concluded that perpetual inventory system does not

require physical verification of stocks (Berlemann & Wesselhöft, 2014)

Overtime refers to the additional working hours which the labourer are required to work

which is more than the normal working hours of the business. In case of overtime the wages

offered by the company are also above the normal working hours of the business. The amount

can be treated in different ways by the management depending upon the nature of the situation

(Holzhacker, Krishnan & Mahlendorf, 2015). The cost can be treated as a direct labour cost in

case of order from the client and also as overhead cost in case of fault of the management.

Answer to Question No 6:

Dr. Cr.

Date Particulars Amount Date Particulars Amount

01-Apr To, Balance b/d 60000 30-Apr By,Work-in-Process A/c. 60000

30-Apr Accounts Payable A/c. 80000 30-Apr By, Manufacturing Overhead A/c. 30000

30-Apr By,Balance c/d. 50000

140000 140000

Material Control A/c.

12

MANAGEMENT ACCOUNTING FOR COST & CONTROL

Journal Entry:

Dr. Cr.

Date Particulars Amount Amount

30-Apr Manufacturing Overhead A/c……Dr. 30000

To, Material Control A/c. 30000

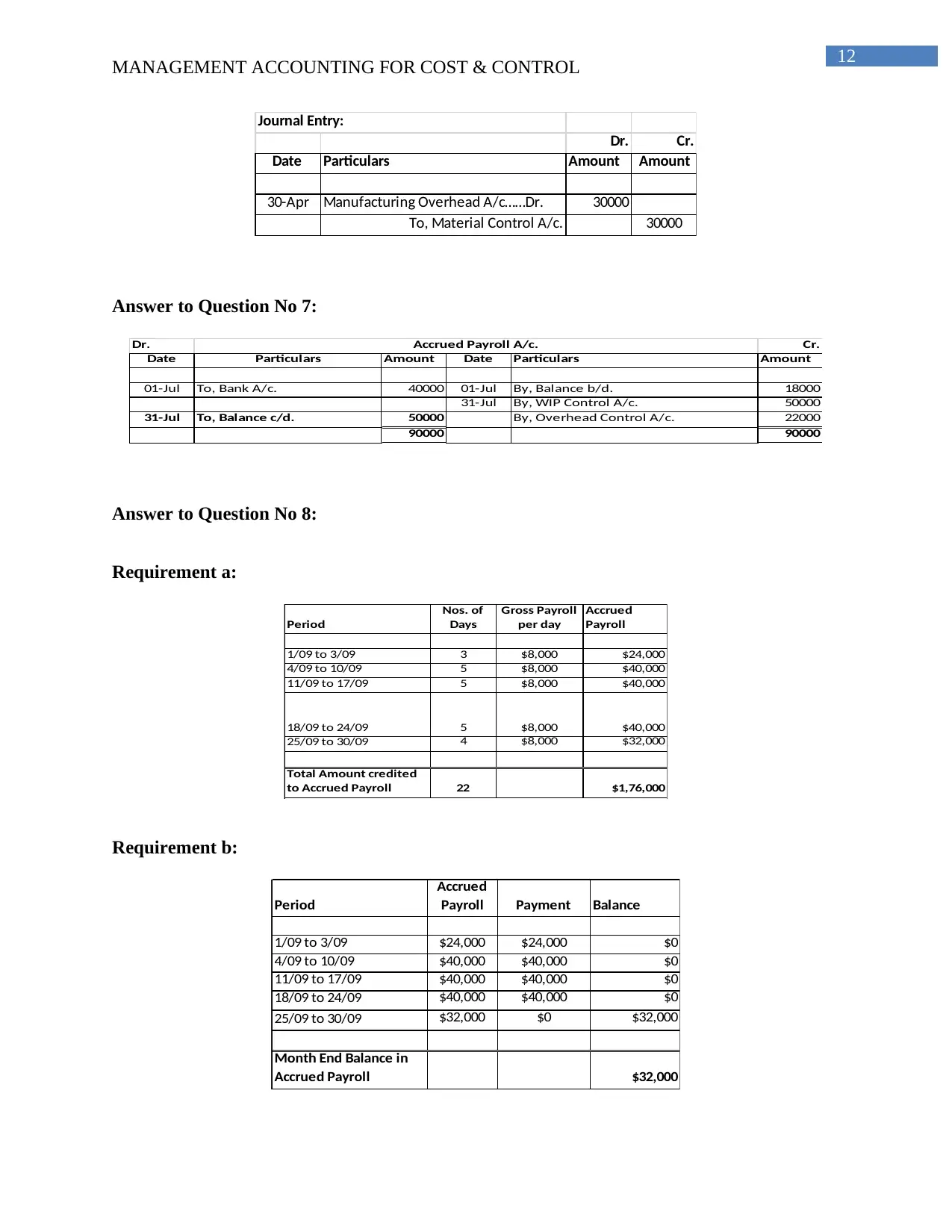

Answer to Question No 7:

Dr. Cr.

Date Particulars Amount Date Particulars Amount

01-Jul To, Bank A/c. 40000 01-Jul By, Balance b/d. 18000

31-Jul By, WIP Control A/c. 50000

31-Jul To, Balance c/d. 50000 By, Overhead Control A/c. 22000

90000 90000

Accrued Payroll A/c.

Answer to Question No 8:

Requirement a:

Period

Nos. of

Days

Gross Payroll

per day

Accrued

Payroll

1/09 to 3/09 3 $8,000 $24,000

4/09 to 10/09 5 $8,000 $40,000

11/09 to 17/09 5 $8,000 $40,000

18/09 to 24/09 5 $8,000 $40,000

25/09 to 30/09 4 $8,000 $32,000

Total Amount credited

to Accrued Payroll 22 $1,76,000

Requirement b:

Period

Accrued

Payroll Payment Balance

1/09 to 3/09 $24,000 $24,000 $0

4/09 to 10/09 $40,000 $40,000 $0

11/09 to 17/09 $40,000 $40,000 $0

18/09 to 24/09 $40,000 $40,000 $0

25/09 to 30/09 $32,000 $0 $32,000

Month End Balance in

Accrued Payroll $32,000

MANAGEMENT ACCOUNTING FOR COST & CONTROL

Journal Entry:

Dr. Cr.

Date Particulars Amount Amount

30-Apr Manufacturing Overhead A/c……Dr. 30000

To, Material Control A/c. 30000

Answer to Question No 7:

Dr. Cr.

Date Particulars Amount Date Particulars Amount

01-Jul To, Bank A/c. 40000 01-Jul By, Balance b/d. 18000

31-Jul By, WIP Control A/c. 50000

31-Jul To, Balance c/d. 50000 By, Overhead Control A/c. 22000

90000 90000

Accrued Payroll A/c.

Answer to Question No 8:

Requirement a:

Period

Nos. of

Days

Gross Payroll

per day

Accrued

Payroll

1/09 to 3/09 3 $8,000 $24,000

4/09 to 10/09 5 $8,000 $40,000

11/09 to 17/09 5 $8,000 $40,000

18/09 to 24/09 5 $8,000 $40,000

25/09 to 30/09 4 $8,000 $32,000

Total Amount credited

to Accrued Payroll 22 $1,76,000

Requirement b:

Period

Accrued

Payroll Payment Balance

1/09 to 3/09 $24,000 $24,000 $0

4/09 to 10/09 $40,000 $40,000 $0

11/09 to 17/09 $40,000 $40,000 $0

18/09 to 24/09 $40,000 $40,000 $0

25/09 to 30/09 $32,000 $0 $32,000

Month End Balance in

Accrued Payroll $32,000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13

MANAGEMENT ACCOUNTING FOR COST & CONTROL

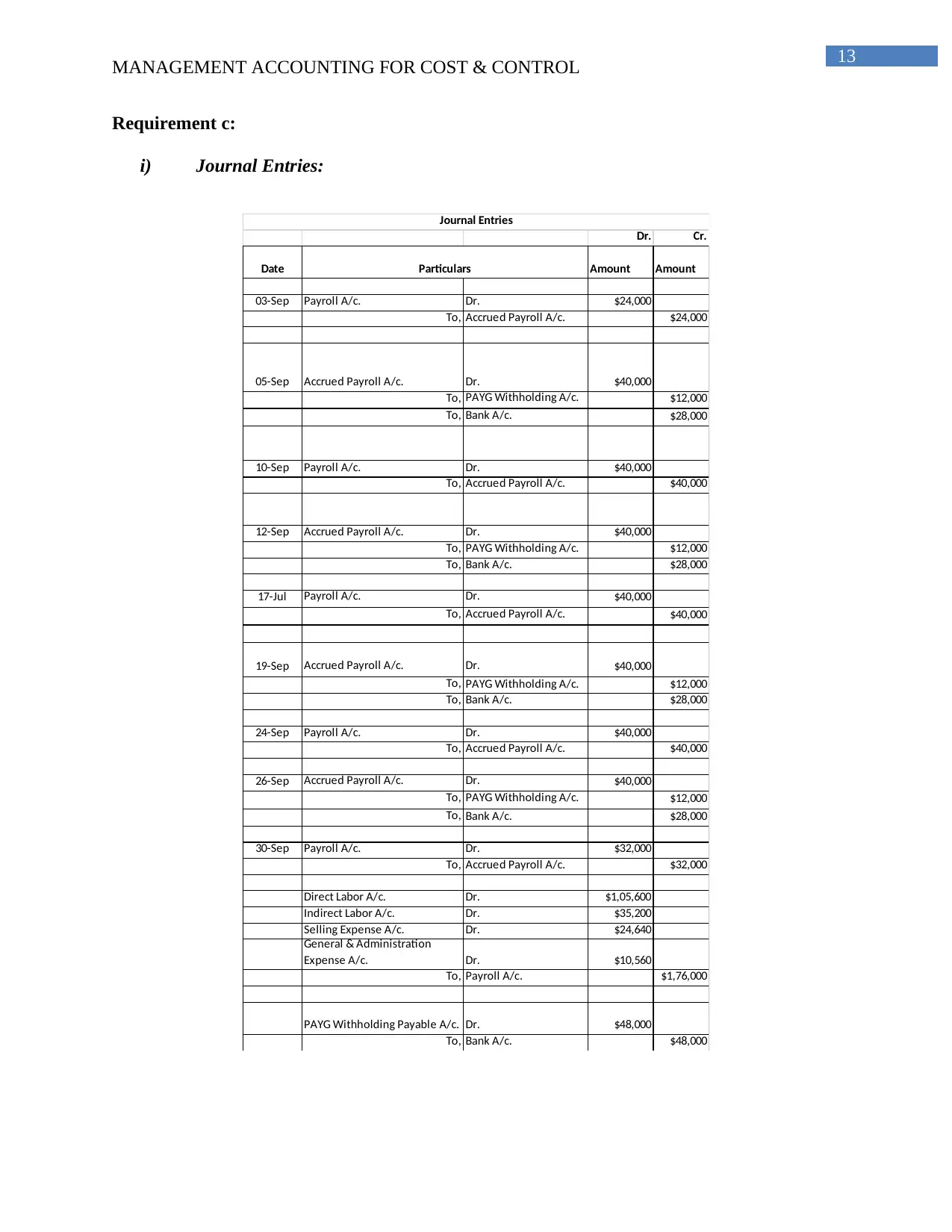

Requirement c:

i) Journal Entries:

Dr. Cr.

Date Amount Amount

03-Sep Payroll A/c. Dr. $24,000

To, Accrued Payroll A/c. $24,000

05-Sep Accrued Payroll A/c. Dr. $40,000

To, PAYG Withholding A/c. $12,000

To, Bank A/c. $28,000

10-Sep Payroll A/c. Dr. $40,000

To, Accrued Payroll A/c. $40,000

12-Sep Accrued Payroll A/c. Dr. $40,000

To, PAYG Withholding A/c. $12,000

To, Bank A/c. $28,000

17-Jul Payroll A/c. Dr. $40,000

To, Accrued Payroll A/c. $40,000

19-Sep Accrued Payroll A/c. Dr. $40,000

To, PAYG Withholding A/c. $12,000

To, Bank A/c. $28,000

24-Sep Payroll A/c. Dr. $40,000

To, Accrued Payroll A/c. $40,000

26-Sep Accrued Payroll A/c. Dr. $40,000

To, PAYG Withholding A/c. $12,000

To, Bank A/c. $28,000

30-Sep Payroll A/c. Dr. $32,000

To, Accrued Payroll A/c. $32,000

Direct Labor A/c. Dr. $1,05,600

Indirect Labor A/c. Dr. $35,200

Selling Expense A/c. Dr. $24,640

General & Administration

Expense A/c. Dr. $10,560

To, Payroll A/c. $1,76,000

PAYG Withholding Payable A/c. Dr. $48,000

To, Bank A/c. $48,000

Particulars

Journal Entries

MANAGEMENT ACCOUNTING FOR COST & CONTROL

Requirement c:

i) Journal Entries:

Dr. Cr.

Date Amount Amount

03-Sep Payroll A/c. Dr. $24,000

To, Accrued Payroll A/c. $24,000

05-Sep Accrued Payroll A/c. Dr. $40,000

To, PAYG Withholding A/c. $12,000

To, Bank A/c. $28,000

10-Sep Payroll A/c. Dr. $40,000

To, Accrued Payroll A/c. $40,000

12-Sep Accrued Payroll A/c. Dr. $40,000

To, PAYG Withholding A/c. $12,000

To, Bank A/c. $28,000

17-Jul Payroll A/c. Dr. $40,000

To, Accrued Payroll A/c. $40,000

19-Sep Accrued Payroll A/c. Dr. $40,000

To, PAYG Withholding A/c. $12,000

To, Bank A/c. $28,000

24-Sep Payroll A/c. Dr. $40,000

To, Accrued Payroll A/c. $40,000

26-Sep Accrued Payroll A/c. Dr. $40,000

To, PAYG Withholding A/c. $12,000

To, Bank A/c. $28,000

30-Sep Payroll A/c. Dr. $32,000

To, Accrued Payroll A/c. $32,000

Direct Labor A/c. Dr. $1,05,600

Indirect Labor A/c. Dr. $35,200

Selling Expense A/c. Dr. $24,640

General & Administration

Expense A/c. Dr. $10,560

To, Payroll A/c. $1,76,000

PAYG Withholding Payable A/c. Dr. $48,000

To, Bank A/c. $48,000

Particulars

Journal Entries

14

MANAGEMENT ACCOUNTING FOR COST & CONTROL

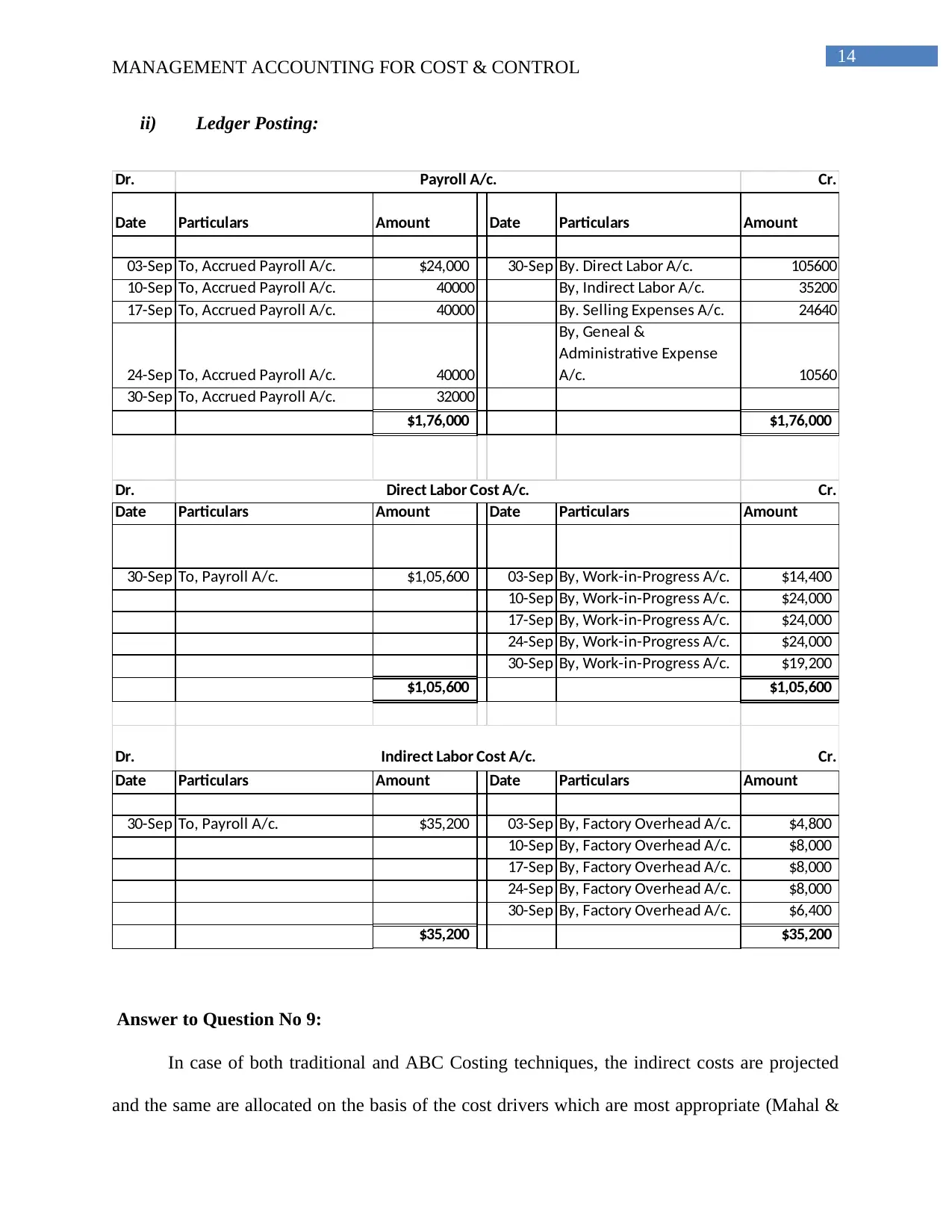

ii) Ledger Posting:

Dr. Cr.

Date Particulars Amount Date Particulars Amount

03-Sep To, Accrued Payroll A/c. $24,000 30-Sep By. Direct Labor A/c. 105600

10-Sep To, Accrued Payroll A/c. 40000 By, Indirect Labor A/c. 35200

17-Sep To, Accrued Payroll A/c. 40000 By. Selling Expenses A/c. 24640

24-Sep To, Accrued Payroll A/c. 40000

By, Geneal &

Administrative Expense

A/c. 10560

30-Sep To, Accrued Payroll A/c. 32000

$1,76,000 $1,76,000

Dr. Cr.

Date Particulars Amount Date Particulars Amount

30-Sep To, Payroll A/c. $1,05,600 03-Sep By, Work-in-Progress A/c. $14,400

10-Sep By, Work-in-Progress A/c. $24,000

17-Sep By, Work-in-Progress A/c. $24,000

24-Sep By, Work-in-Progress A/c. $24,000

30-Sep By, Work-in-Progress A/c. $19,200

$1,05,600 $1,05,600

Dr. Cr.

Date Particulars Amount Date Particulars Amount

30-Sep To, Payroll A/c. $35,200 03-Sep By, Factory Overhead A/c. $4,800

10-Sep By, Factory Overhead A/c. $8,000

17-Sep By, Factory Overhead A/c. $8,000

24-Sep By, Factory Overhead A/c. $8,000

30-Sep By, Factory Overhead A/c. $6,400

$35,200 $35,200

Indirect Labor Cost A/c.

Payroll A/c.

Direct Labor Cost A/c.

Answer to Question No 9:

In case of both traditional and ABC Costing techniques, the indirect costs are projected

and the same are allocated on the basis of the cost drivers which are most appropriate (Mahal &

MANAGEMENT ACCOUNTING FOR COST & CONTROL

ii) Ledger Posting:

Dr. Cr.

Date Particulars Amount Date Particulars Amount

03-Sep To, Accrued Payroll A/c. $24,000 30-Sep By. Direct Labor A/c. 105600

10-Sep To, Accrued Payroll A/c. 40000 By, Indirect Labor A/c. 35200

17-Sep To, Accrued Payroll A/c. 40000 By. Selling Expenses A/c. 24640

24-Sep To, Accrued Payroll A/c. 40000

By, Geneal &

Administrative Expense

A/c. 10560

30-Sep To, Accrued Payroll A/c. 32000

$1,76,000 $1,76,000

Dr. Cr.

Date Particulars Amount Date Particulars Amount

30-Sep To, Payroll A/c. $1,05,600 03-Sep By, Work-in-Progress A/c. $14,400

10-Sep By, Work-in-Progress A/c. $24,000

17-Sep By, Work-in-Progress A/c. $24,000

24-Sep By, Work-in-Progress A/c. $24,000

30-Sep By, Work-in-Progress A/c. $19,200

$1,05,600 $1,05,600

Dr. Cr.

Date Particulars Amount Date Particulars Amount

30-Sep To, Payroll A/c. $35,200 03-Sep By, Factory Overhead A/c. $4,800

10-Sep By, Factory Overhead A/c. $8,000

17-Sep By, Factory Overhead A/c. $8,000

24-Sep By, Factory Overhead A/c. $8,000

30-Sep By, Factory Overhead A/c. $6,400

$35,200 $35,200

Indirect Labor Cost A/c.

Payroll A/c.

Direct Labor Cost A/c.

Answer to Question No 9:

In case of both traditional and ABC Costing techniques, the indirect costs are projected

and the same are allocated on the basis of the cost drivers which are most appropriate (Mahal &

15

MANAGEMENT ACCOUNTING FOR COST & CONTROL

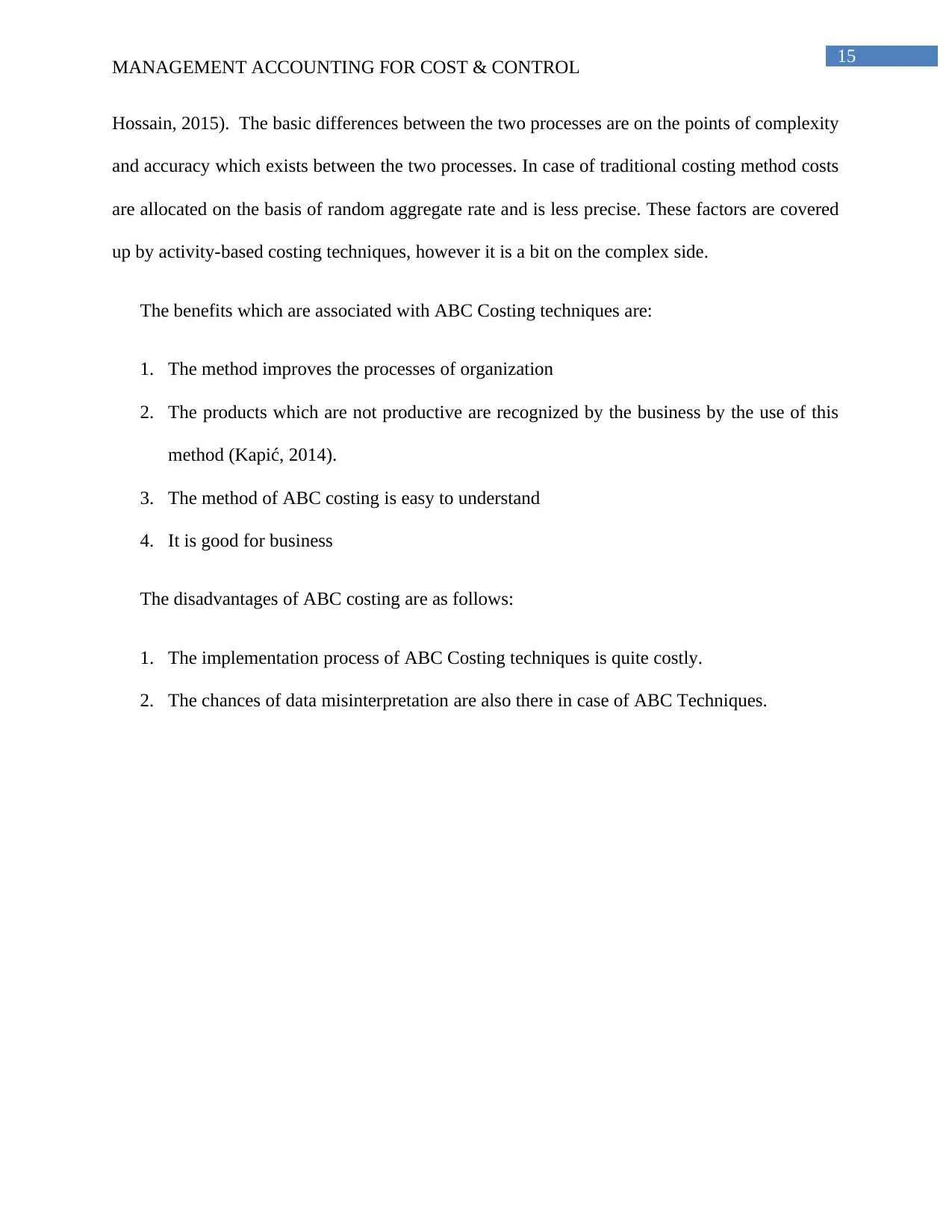

Hossain, 2015). The basic differences between the two processes are on the points of complexity

and accuracy which exists between the two processes. In case of traditional costing method costs

are allocated on the basis of random aggregate rate and is less precise. These factors are covered

up by activity-based costing techniques, however it is a bit on the complex side.

The benefits which are associated with ABC Costing techniques are:

1. The method improves the processes of organization

2. The products which are not productive are recognized by the business by the use of this

method (Kapić, 2014).

3. The method of ABC costing is easy to understand

4. It is good for business

The disadvantages of ABC costing are as follows:

1. The implementation process of ABC Costing techniques is quite costly.

2. The chances of data misinterpretation are also there in case of ABC Techniques.

MANAGEMENT ACCOUNTING FOR COST & CONTROL

Hossain, 2015). The basic differences between the two processes are on the points of complexity

and accuracy which exists between the two processes. In case of traditional costing method costs

are allocated on the basis of random aggregate rate and is less precise. These factors are covered

up by activity-based costing techniques, however it is a bit on the complex side.

The benefits which are associated with ABC Costing techniques are:

1. The method improves the processes of organization

2. The products which are not productive are recognized by the business by the use of this

method (Kapić, 2014).

3. The method of ABC costing is easy to understand

4. It is good for business

The disadvantages of ABC costing are as follows:

1. The implementation process of ABC Costing techniques is quite costly.

2. The chances of data misinterpretation are also there in case of ABC Techniques.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

16

MANAGEMENT ACCOUNTING FOR COST & CONTROL

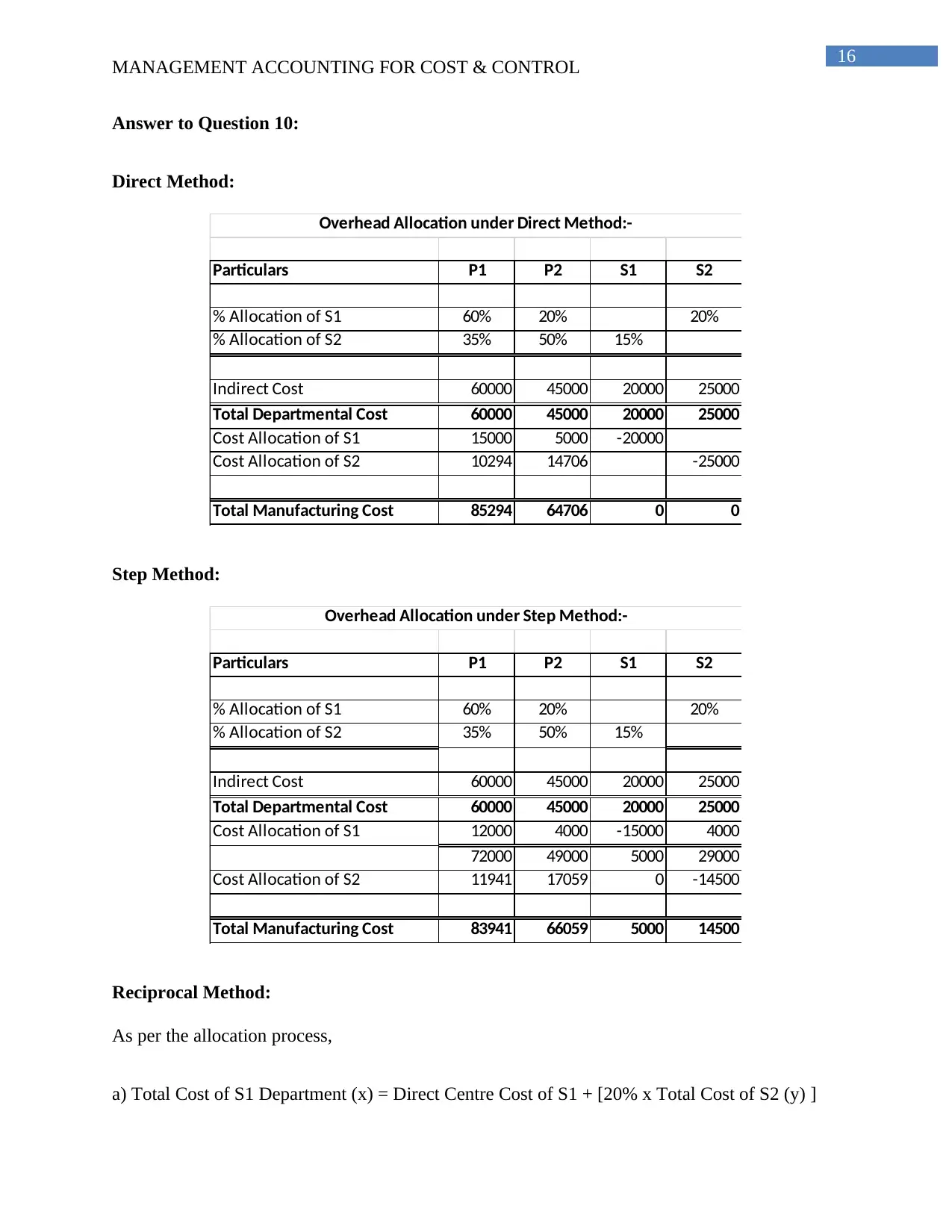

Answer to Question 10:

Direct Method:

Particulars P1 P2 S1 S2

% Allocation of S1 60% 20% 20%

% Allocation of S2 35% 50% 15%

Indirect Cost 60000 45000 20000 25000

Total Departmental Cost 60000 45000 20000 25000

Cost Allocation of S1 15000 5000 -20000

Cost Allocation of S2 10294 14706 -25000

Total Manufacturing Cost 85294 64706 0 0

Overhead Allocation under Direct Method:-

Step Method:

Particulars P1 P2 S1 S2

% Allocation of S1 60% 20% 20%

% Allocation of S2 35% 50% 15%

Indirect Cost 60000 45000 20000 25000

Total Departmental Cost 60000 45000 20000 25000

Cost Allocation of S1 12000 4000 -15000 4000

72000 49000 5000 29000

Cost Allocation of S2 11941 17059 0 -14500

Total Manufacturing Cost 83941 66059 5000 14500

Overhead Allocation under Step Method:-

Reciprocal Method:

As per the allocation process,

a) Total Cost of S1 Department (x) = Direct Centre Cost of S1 + [20% x Total Cost of S2 (y) ]

MANAGEMENT ACCOUNTING FOR COST & CONTROL

Answer to Question 10:

Direct Method:

Particulars P1 P2 S1 S2

% Allocation of S1 60% 20% 20%

% Allocation of S2 35% 50% 15%

Indirect Cost 60000 45000 20000 25000

Total Departmental Cost 60000 45000 20000 25000

Cost Allocation of S1 15000 5000 -20000

Cost Allocation of S2 10294 14706 -25000

Total Manufacturing Cost 85294 64706 0 0

Overhead Allocation under Direct Method:-

Step Method:

Particulars P1 P2 S1 S2

% Allocation of S1 60% 20% 20%

% Allocation of S2 35% 50% 15%

Indirect Cost 60000 45000 20000 25000

Total Departmental Cost 60000 45000 20000 25000

Cost Allocation of S1 12000 4000 -15000 4000

72000 49000 5000 29000

Cost Allocation of S2 11941 17059 0 -14500

Total Manufacturing Cost 83941 66059 5000 14500

Overhead Allocation under Step Method:-

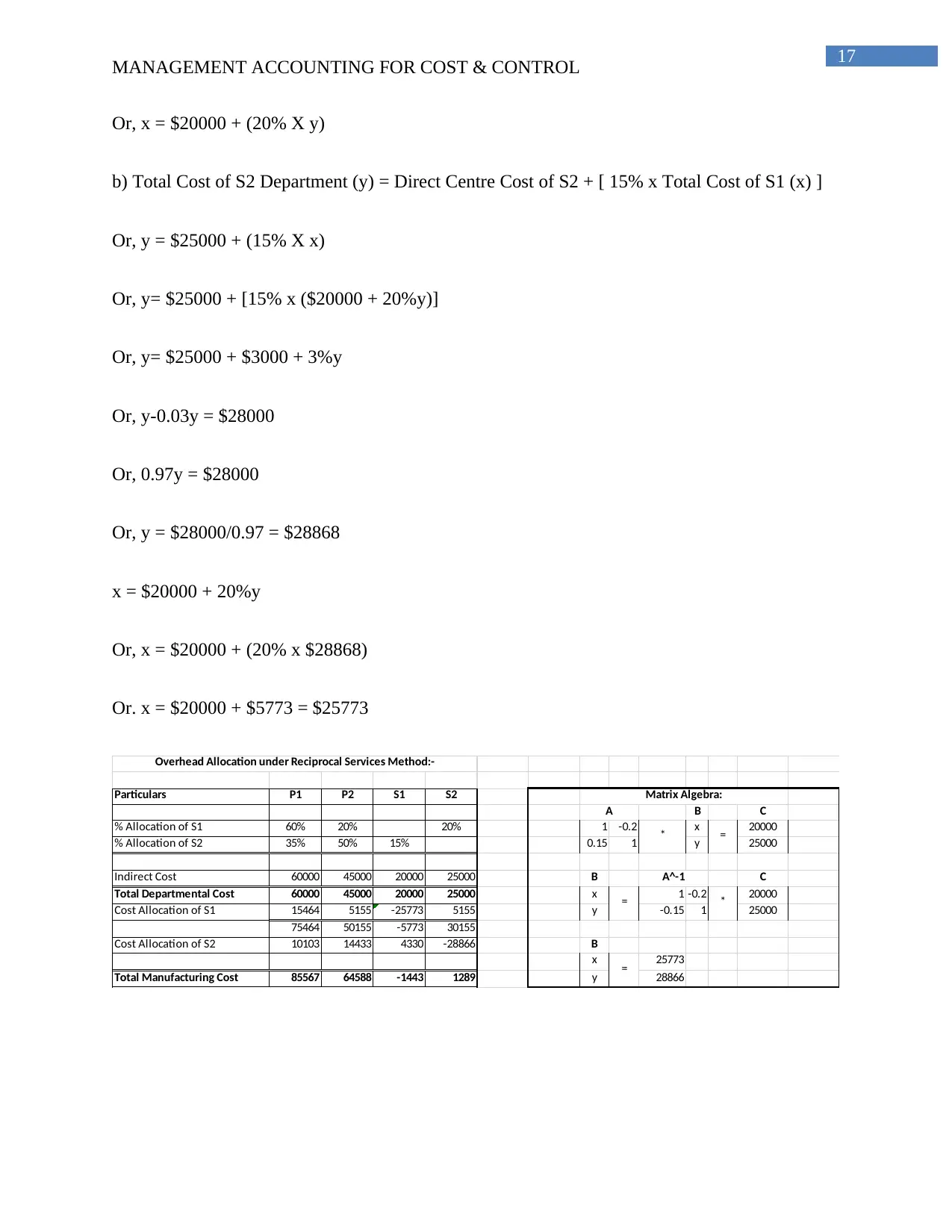

Reciprocal Method:

As per the allocation process,

a) Total Cost of S1 Department (x) = Direct Centre Cost of S1 + [20% x Total Cost of S2 (y) ]

17

MANAGEMENT ACCOUNTING FOR COST & CONTROL

Or, x = $20000 + (20% X y)

b) Total Cost of S2 Department (y) = Direct Centre Cost of S2 + [ 15% x Total Cost of S1 (x) ]

Or, y = $25000 + (15% X x)

Or, y= $25000 + [15% x ($20000 + 20%y)]

Or, y= $25000 + $3000 + 3%y

Or, y-0.03y = $28000

Or, 0.97y = $28000

Or, y = $28000/0.97 = $28868

x = $20000 + 20%y

Or, x = $20000 + (20% x $28868)

Or. x = $20000 + $5773 = $25773

Particulars P1 P2 S1 S2

B C

% Allocation of S1 60% 20% 20% 1 -0.2 x 20000

% Allocation of S2 35% 50% 15% 0.15 1 y 25000

Indirect Cost 60000 45000 20000 25000 B C

Total Departmental Cost 60000 45000 20000 25000 x 1 -0.2 20000

Cost Allocation of S1 15464 5155 -25773 5155 y -0.15 1 25000

75464 50155 -5773 30155

Cost Allocation of S2 10103 14433 4330 -28866 B

x 25773

Total Manufacturing Cost 85567 64588 -1443 1289 y 28866

=

A^-1

*

=

Overhead Allocation under Reciprocal Services Method:-

A

*

Matrix Algebra:

=

MANAGEMENT ACCOUNTING FOR COST & CONTROL

Or, x = $20000 + (20% X y)

b) Total Cost of S2 Department (y) = Direct Centre Cost of S2 + [ 15% x Total Cost of S1 (x) ]

Or, y = $25000 + (15% X x)

Or, y= $25000 + [15% x ($20000 + 20%y)]

Or, y= $25000 + $3000 + 3%y

Or, y-0.03y = $28000

Or, 0.97y = $28000

Or, y = $28000/0.97 = $28868

x = $20000 + 20%y

Or, x = $20000 + (20% x $28868)

Or. x = $20000 + $5773 = $25773

Particulars P1 P2 S1 S2

B C

% Allocation of S1 60% 20% 20% 1 -0.2 x 20000

% Allocation of S2 35% 50% 15% 0.15 1 y 25000

Indirect Cost 60000 45000 20000 25000 B C

Total Departmental Cost 60000 45000 20000 25000 x 1 -0.2 20000

Cost Allocation of S1 15464 5155 -25773 5155 y -0.15 1 25000

75464 50155 -5773 30155

Cost Allocation of S2 10103 14433 4330 -28866 B

x 25773

Total Manufacturing Cost 85567 64588 -1443 1289 y 28866

=

A^-1

*

=

Overhead Allocation under Reciprocal Services Method:-

A

*

Matrix Algebra:

=

18

MANAGEMENT ACCOUNTING FOR COST & CONTROL

Reference List

Berlemann, M., & Wesselhöft, J. E. (2014). Estimating aggregate capital stocks using the

perpetual inventory method. Review of Economics, 65(1), 1-34.

Brown, F. (2014). The power of panopticism.

Brunon-Ernst, A. (2016). Deconstructing panopticism into the plural panopticons. In Beyond

Foucault (pp. 33-58). Routledge.

Fullerton, R. R., Kennedy, F. A., & Widener, S. K. (2014). Lean manufacturing and firm

performance: The incremental contribution of lean management accounting practices. Journal

of Operations Management, 32(7-8), 414-428.

Holzhacker, M., Krishnan, R., & Mahlendorf, M. D. (2015). The impact of changes in regulation

on cost behavior. Contemporary Accounting Research, 32(2), 534-566.

Kapić, J. (2014). ACTIVITY BASED COSTING-ABC. Business Consultant/Poslovni

Konsultant, 6(32).

Mahal, I., & Hossain, A. (2015). Activity-Based Costing (ABC)–An Effective Tool for Better

Management. Research Journal of Finance and Accounting, 6(4), 66-74.

MANAGEMENT ACCOUNTING FOR COST & CONTROL

Reference List

Berlemann, M., & Wesselhöft, J. E. (2014). Estimating aggregate capital stocks using the

perpetual inventory method. Review of Economics, 65(1), 1-34.

Brown, F. (2014). The power of panopticism.

Brunon-Ernst, A. (2016). Deconstructing panopticism into the plural panopticons. In Beyond

Foucault (pp. 33-58). Routledge.

Fullerton, R. R., Kennedy, F. A., & Widener, S. K. (2014). Lean manufacturing and firm

performance: The incremental contribution of lean management accounting practices. Journal

of Operations Management, 32(7-8), 414-428.

Holzhacker, M., Krishnan, R., & Mahlendorf, M. D. (2015). The impact of changes in regulation

on cost behavior. Contemporary Accounting Research, 32(2), 534-566.

Kapić, J. (2014). ACTIVITY BASED COSTING-ABC. Business Consultant/Poslovni

Konsultant, 6(32).

Mahal, I., & Hossain, A. (2015). Activity-Based Costing (ABC)–An Effective Tool for Better

Management. Research Journal of Finance and Accounting, 6(4), 66-74.

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.