Management Accounting for Costs and Control - Detailed Analysis

VerifiedAdded on 2021/06/16

|14

|2536

|43

Homework Assignment

AI Summary

This assignment solution provides a detailed analysis of management accounting principles. It begins with job costing, including the creation of raw material, work-in-process, accounts payable, finished goods, and cost of goods sold accounts, along with related calculations. The solution then delves into process costing, presenting a production cost report, equivalent unit calculations, and cost assignments. A profit analysis is performed for different product grades, determining optimal processing decisions. The assignment continues with variance analysis, calculating material price and usage variances, as well as labor variances. A business report is included, discussing the purpose and application of variance analysis. Finally, the assignment concludes with a budget calculation, projecting costs and revenues over a period, and a discussion of the budgeting process.

Running head: MANAGEMENT ACCOUNTING FOR COSTS AND CONTROL

Management accounting for costs and control

Subject code

Student name and ID number

Assignment task number

Author note

Management accounting for costs and control

Subject code

Student name and ID number

Assignment task number

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MANAGEMENT ACCOUNTING FOR COSTS AND CONTROL

Table of Contents

Question 1..................................................................................................................................2

Question 2..................................................................................................................................4

Question 3..................................................................................................................................6

Question 4..................................................................................................................................7

Question 5................................................................................................................................10

Reference..................................................................................................................................12

Name

Student ID Page 1

Table of Contents

Question 1..................................................................................................................................2

Question 2..................................................................................................................................4

Question 3..................................................................................................................................6

Question 4..................................................................................................................................7

Question 5................................................................................................................................10

Reference..................................................................................................................................12

Name

Student ID Page 1

MANAGEMENT ACCOUNTING FOR COSTS AND CONTROL

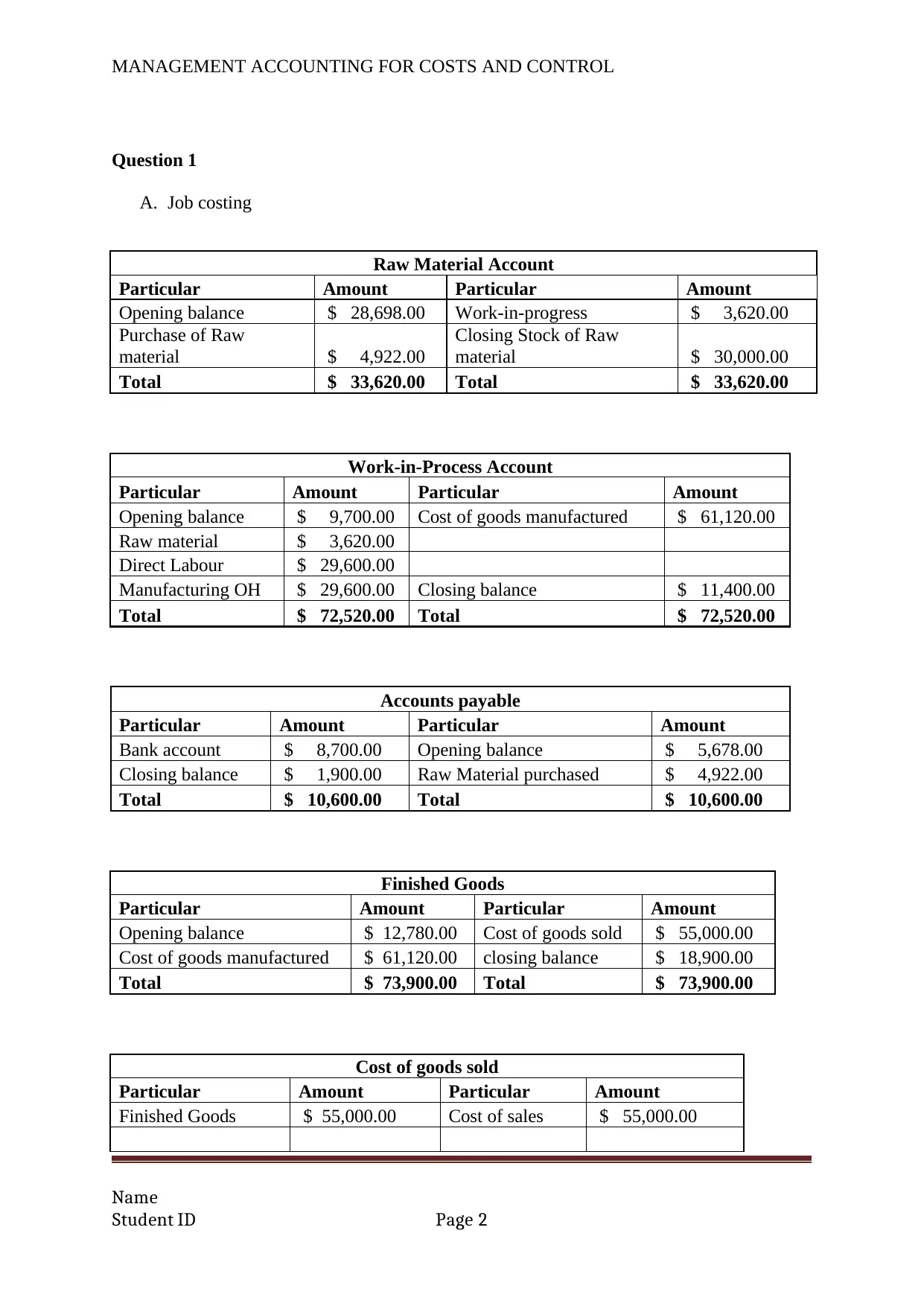

Question 1

A. Job costing

Raw Material Account

Particular Amount Particular Amount

Opening balance $ 28,698.00 Work-in-progress $ 3,620.00

Purchase of Raw

material $ 4,922.00

Closing Stock of Raw

material $ 30,000.00

Total $ 33,620.00 Total $ 33,620.00

Work-in-Process Account

Particular Amount Particular Amount

Opening balance $ 9,700.00 Cost of goods manufactured $ 61,120.00

Raw material $ 3,620.00

Direct Labour $ 29,600.00

Manufacturing OH $ 29,600.00 Closing balance $ 11,400.00

Total $ 72,520.00 Total $ 72,520.00

Accounts payable

Particular Amount Particular Amount

Bank account $ 8,700.00 Opening balance $ 5,678.00

Closing balance $ 1,900.00 Raw Material purchased $ 4,922.00

Total $ 10,600.00 Total $ 10,600.00

Finished Goods

Particular Amount Particular Amount

Opening balance $ 12,780.00 Cost of goods sold $ 55,000.00

Cost of goods manufactured $ 61,120.00 closing balance $ 18,900.00

Total $ 73,900.00 Total $ 73,900.00

Cost of goods sold

Particular Amount Particular Amount

Finished Goods $ 55,000.00 Cost of sales $ 55,000.00

Name

Student ID Page 2

Question 1

A. Job costing

Raw Material Account

Particular Amount Particular Amount

Opening balance $ 28,698.00 Work-in-progress $ 3,620.00

Purchase of Raw

material $ 4,922.00

Closing Stock of Raw

material $ 30,000.00

Total $ 33,620.00 Total $ 33,620.00

Work-in-Process Account

Particular Amount Particular Amount

Opening balance $ 9,700.00 Cost of goods manufactured $ 61,120.00

Raw material $ 3,620.00

Direct Labour $ 29,600.00

Manufacturing OH $ 29,600.00 Closing balance $ 11,400.00

Total $ 72,520.00 Total $ 72,520.00

Accounts payable

Particular Amount Particular Amount

Bank account $ 8,700.00 Opening balance $ 5,678.00

Closing balance $ 1,900.00 Raw Material purchased $ 4,922.00

Total $ 10,600.00 Total $ 10,600.00

Finished Goods

Particular Amount Particular Amount

Opening balance $ 12,780.00 Cost of goods sold $ 55,000.00

Cost of goods manufactured $ 61,120.00 closing balance $ 18,900.00

Total $ 73,900.00 Total $ 73,900.00

Cost of goods sold

Particular Amount Particular Amount

Finished Goods $ 55,000.00 Cost of sales $ 55,000.00

Name

Student ID Page 2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

MANAGEMENT ACCOUNTING FOR COSTS AND CONTROL

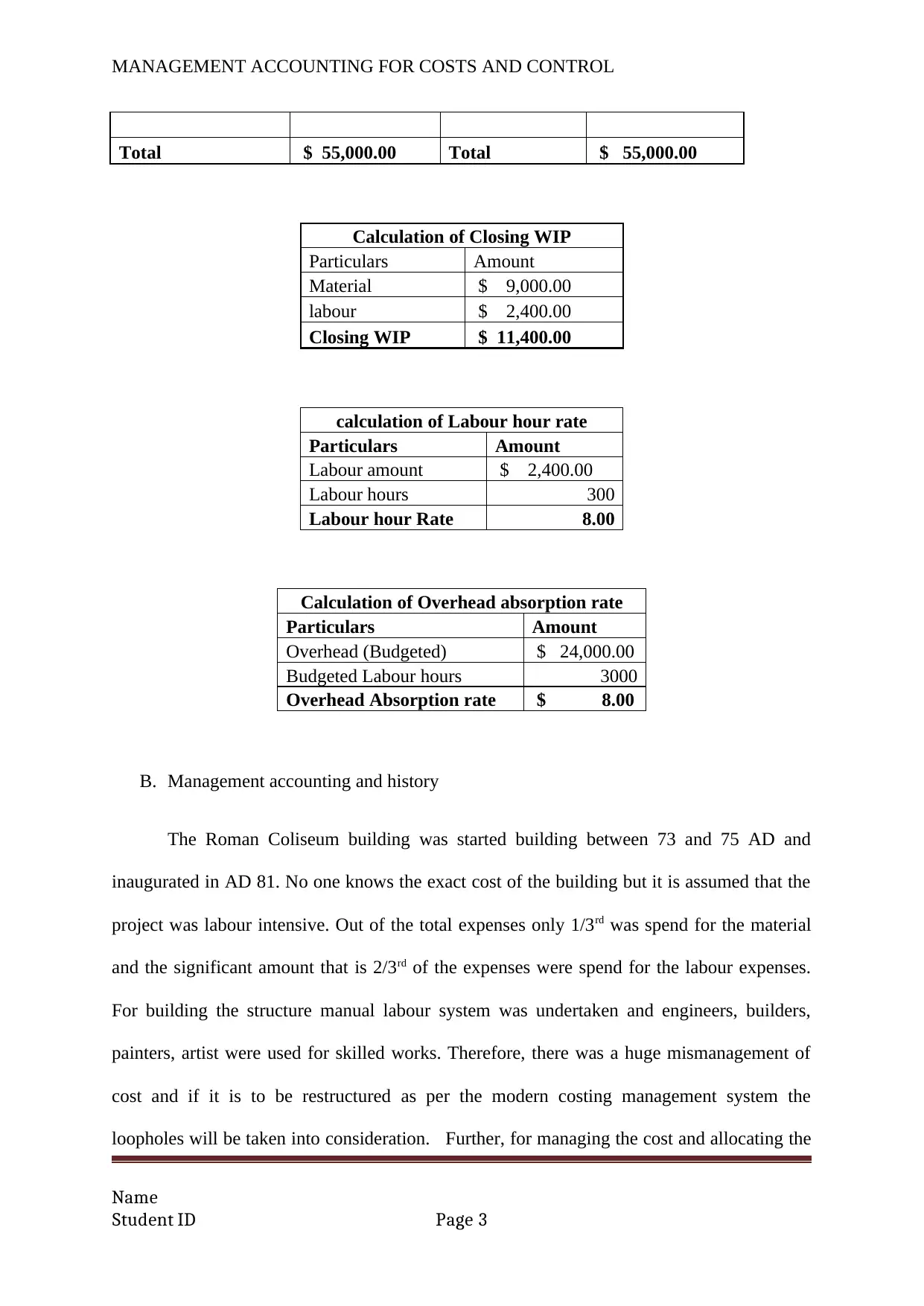

Total $ 55,000.00 Total $ 55,000.00

Calculation of Closing WIP

Particulars Amount

Material $ 9,000.00

labour $ 2,400.00

Closing WIP $ 11,400.00

calculation of Labour hour rate

Particulars Amount

Labour amount $ 2,400.00

Labour hours 300

Labour hour Rate 8.00

Calculation of Overhead absorption rate

Particulars Amount

Overhead (Budgeted) $ 24,000.00

Budgeted Labour hours 3000

Overhead Absorption rate $ 8.00

B. Management accounting and history

The Roman Coliseum building was started building between 73 and 75 AD and

inaugurated in AD 81. No one knows the exact cost of the building but it is assumed that the

project was labour intensive. Out of the total expenses only 1/3rd was spend for the material

and the significant amount that is 2/3rd of the expenses were spend for the labour expenses.

For building the structure manual labour system was undertaken and engineers, builders,

painters, artist were used for skilled works. Therefore, there was a huge mismanagement of

cost and if it is to be restructured as per the modern costing management system the

loopholes will be taken into consideration. Further, for managing the cost and allocating the

Name

Student ID Page 3

Total $ 55,000.00 Total $ 55,000.00

Calculation of Closing WIP

Particulars Amount

Material $ 9,000.00

labour $ 2,400.00

Closing WIP $ 11,400.00

calculation of Labour hour rate

Particulars Amount

Labour amount $ 2,400.00

Labour hours 300

Labour hour Rate 8.00

Calculation of Overhead absorption rate

Particulars Amount

Overhead (Budgeted) $ 24,000.00

Budgeted Labour hours 3000

Overhead Absorption rate $ 8.00

B. Management accounting and history

The Roman Coliseum building was started building between 73 and 75 AD and

inaugurated in AD 81. No one knows the exact cost of the building but it is assumed that the

project was labour intensive. Out of the total expenses only 1/3rd was spend for the material

and the significant amount that is 2/3rd of the expenses were spend for the labour expenses.

For building the structure manual labour system was undertaken and engineers, builders,

painters, artist were used for skilled works. Therefore, there was a huge mismanagement of

cost and if it is to be restructured as per the modern costing management system the

loopholes will be taken into consideration. Further, for managing the cost and allocating the

Name

Student ID Page 3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

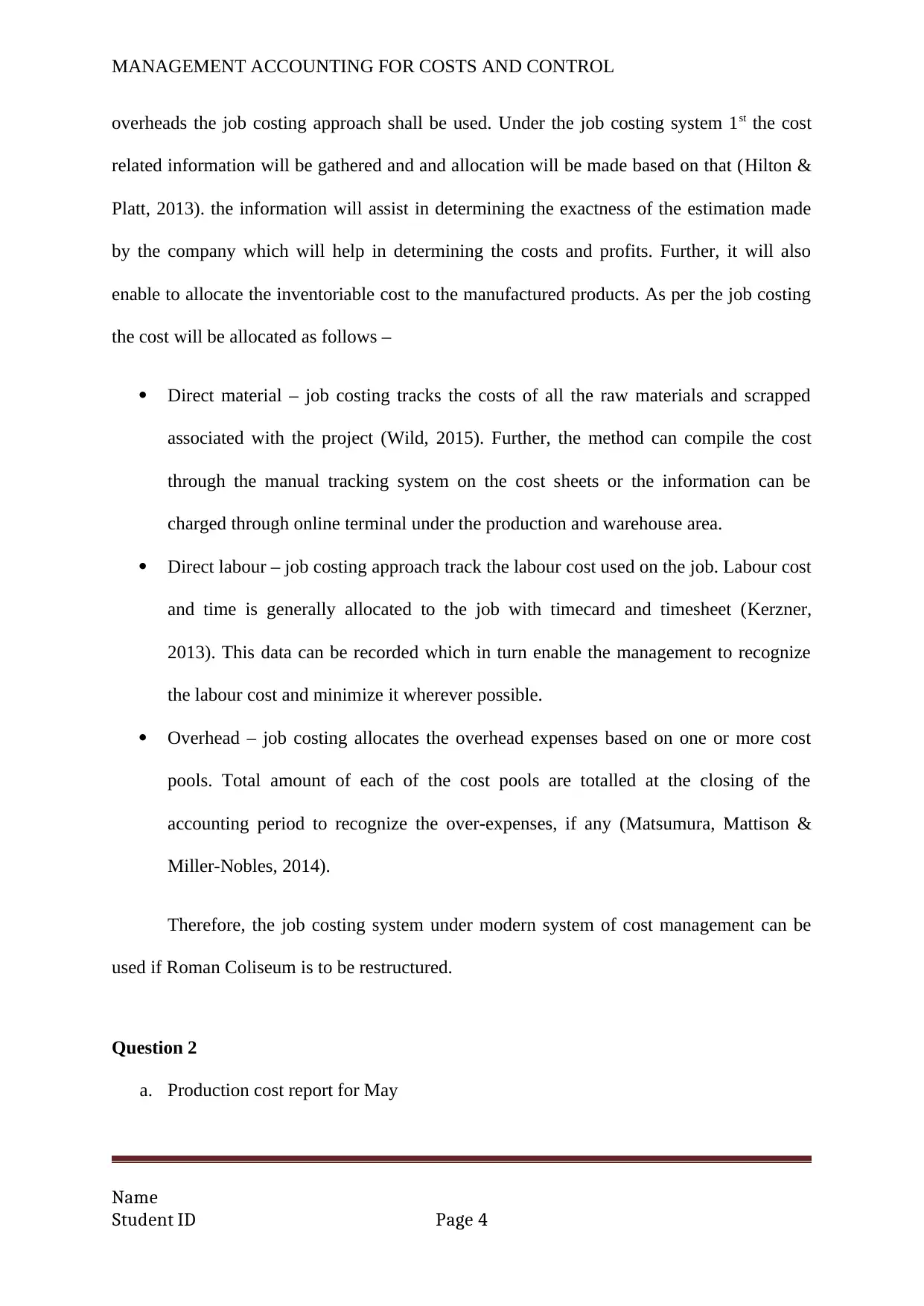

MANAGEMENT ACCOUNTING FOR COSTS AND CONTROL

overheads the job costing approach shall be used. Under the job costing system 1st the cost

related information will be gathered and and allocation will be made based on that (Hilton &

Platt, 2013). the information will assist in determining the exactness of the estimation made

by the company which will help in determining the costs and profits. Further, it will also

enable to allocate the inventoriable cost to the manufactured products. As per the job costing

the cost will be allocated as follows –

Direct material – job costing tracks the costs of all the raw materials and scrapped

associated with the project (Wild, 2015). Further, the method can compile the cost

through the manual tracking system on the cost sheets or the information can be

charged through online terminal under the production and warehouse area.

Direct labour – job costing approach track the labour cost used on the job. Labour cost

and time is generally allocated to the job with timecard and timesheet (Kerzner,

2013). This data can be recorded which in turn enable the management to recognize

the labour cost and minimize it wherever possible.

Overhead – job costing allocates the overhead expenses based on one or more cost

pools. Total amount of each of the cost pools are totalled at the closing of the

accounting period to recognize the over-expenses, if any (Matsumura, Mattison &

Miller-Nobles, 2014).

Therefore, the job costing system under modern system of cost management can be

used if Roman Coliseum is to be restructured.

Question 2

a. Production cost report for May

Name

Student ID Page 4

overheads the job costing approach shall be used. Under the job costing system 1st the cost

related information will be gathered and and allocation will be made based on that (Hilton &

Platt, 2013). the information will assist in determining the exactness of the estimation made

by the company which will help in determining the costs and profits. Further, it will also

enable to allocate the inventoriable cost to the manufactured products. As per the job costing

the cost will be allocated as follows –

Direct material – job costing tracks the costs of all the raw materials and scrapped

associated with the project (Wild, 2015). Further, the method can compile the cost

through the manual tracking system on the cost sheets or the information can be

charged through online terminal under the production and warehouse area.

Direct labour – job costing approach track the labour cost used on the job. Labour cost

and time is generally allocated to the job with timecard and timesheet (Kerzner,

2013). This data can be recorded which in turn enable the management to recognize

the labour cost and minimize it wherever possible.

Overhead – job costing allocates the overhead expenses based on one or more cost

pools. Total amount of each of the cost pools are totalled at the closing of the

accounting period to recognize the over-expenses, if any (Matsumura, Mattison &

Miller-Nobles, 2014).

Therefore, the job costing system under modern system of cost management can be

used if Roman Coliseum is to be restructured.

Question 2

a. Production cost report for May

Name

Student ID Page 4

MANAGEMENT ACCOUNTING FOR COSTS AND CONTROL

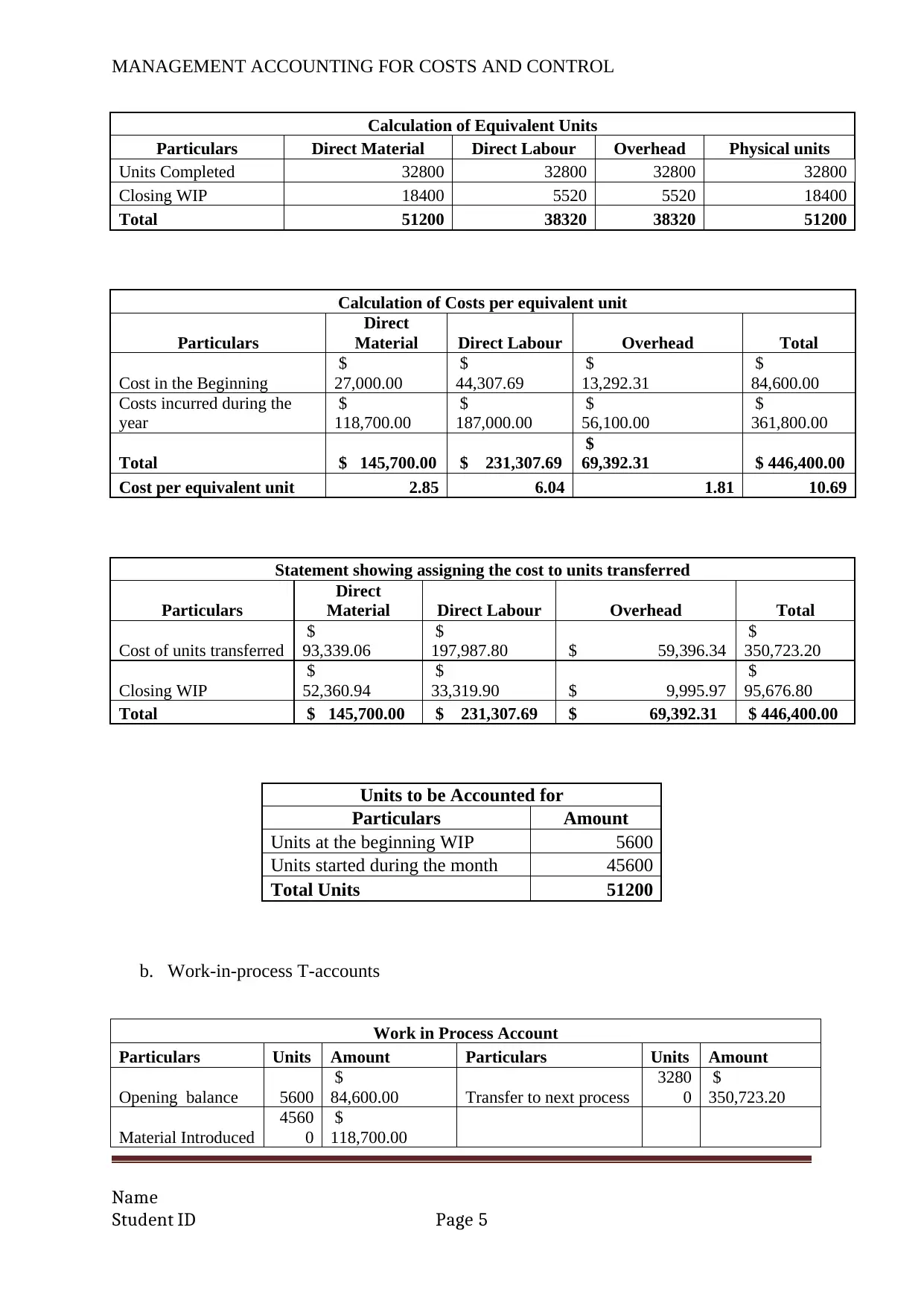

Calculation of Equivalent Units

Particulars Direct Material Direct Labour Overhead Physical units

Units Completed 32800 32800 32800 32800

Closing WIP 18400 5520 5520 18400

Total 51200 38320 38320 51200

Calculation of Costs per equivalent unit

Particulars

Direct

Material Direct Labour Overhead Total

Cost in the Beginning

$

27,000.00

$

44,307.69

$

13,292.31

$

84,600.00

Costs incurred during the

year

$

118,700.00

$

187,000.00

$

56,100.00

$

361,800.00

Total $ 145,700.00 $ 231,307.69

$

69,392.31 $ 446,400.00

Cost per equivalent unit 2.85 6.04 1.81 10.69

Statement showing assigning the cost to units transferred

Particulars

Direct

Material Direct Labour Overhead Total

Cost of units transferred

$

93,339.06

$

197,987.80 $ 59,396.34

$

350,723.20

Closing WIP

$

52,360.94

$

33,319.90 $ 9,995.97

$

95,676.80

Total $ 145,700.00 $ 231,307.69 $ 69,392.31 $ 446,400.00

Units to be Accounted for

Particulars Amount

Units at the beginning WIP 5600

Units started during the month 45600

Total Units 51200

b. Work-in-process T-accounts

Work in Process Account

Particulars Units Amount Particulars Units Amount

Opening balance 5600

$

84,600.00 Transfer to next process

3280

0

$

350,723.20

Material Introduced

4560

0

$

118,700.00

Name

Student ID Page 5

Calculation of Equivalent Units

Particulars Direct Material Direct Labour Overhead Physical units

Units Completed 32800 32800 32800 32800

Closing WIP 18400 5520 5520 18400

Total 51200 38320 38320 51200

Calculation of Costs per equivalent unit

Particulars

Direct

Material Direct Labour Overhead Total

Cost in the Beginning

$

27,000.00

$

44,307.69

$

13,292.31

$

84,600.00

Costs incurred during the

year

$

118,700.00

$

187,000.00

$

56,100.00

$

361,800.00

Total $ 145,700.00 $ 231,307.69

$

69,392.31 $ 446,400.00

Cost per equivalent unit 2.85 6.04 1.81 10.69

Statement showing assigning the cost to units transferred

Particulars

Direct

Material Direct Labour Overhead Total

Cost of units transferred

$

93,339.06

$

197,987.80 $ 59,396.34

$

350,723.20

Closing WIP

$

52,360.94

$

33,319.90 $ 9,995.97

$

95,676.80

Total $ 145,700.00 $ 231,307.69 $ 69,392.31 $ 446,400.00

Units to be Accounted for

Particulars Amount

Units at the beginning WIP 5600

Units started during the month 45600

Total Units 51200

b. Work-in-process T-accounts

Work in Process Account

Particulars Units Amount Particulars Units Amount

Opening balance 5600

$

84,600.00 Transfer to next process

3280

0

$

350,723.20

Material Introduced

4560

0

$

118,700.00

Name

Student ID Page 5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

MANAGEMENT ACCOUNTING FOR COSTS AND CONTROL

Labour

$

187,000.00

overhead

$

56,100.00 Closing balance

1840

0

$

95,676.80

Total

5120

0 $ 446,400.00 Total

5120

0 $ 446,400.00

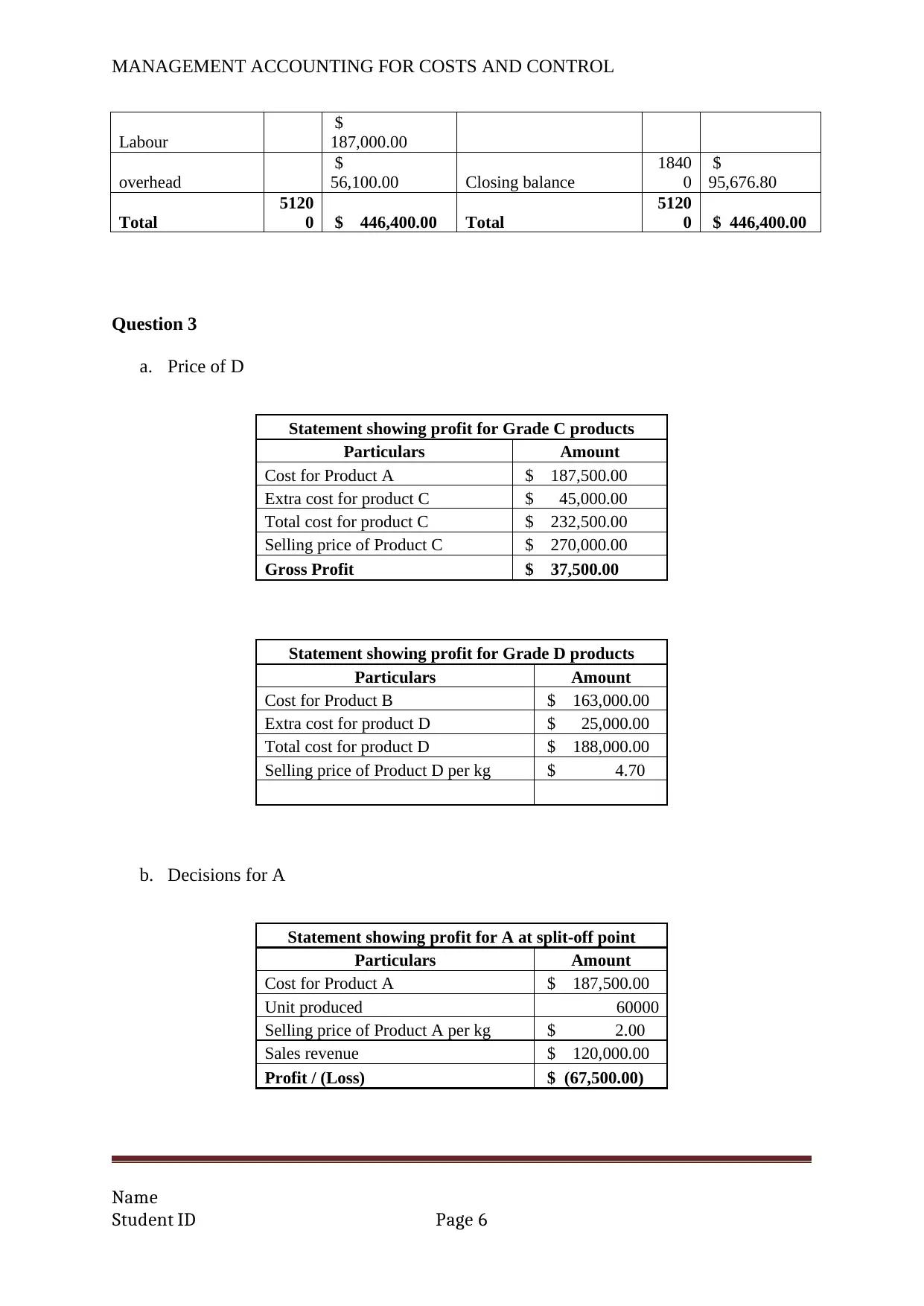

Question 3

a. Price of D

Statement showing profit for Grade C products

Particulars Amount

Cost for Product A $ 187,500.00

Extra cost for product C $ 45,000.00

Total cost for product C $ 232,500.00

Selling price of Product C $ 270,000.00

Gross Profit $ 37,500.00

Statement showing profit for Grade D products

Particulars Amount

Cost for Product B $ 163,000.00

Extra cost for product D $ 25,000.00

Total cost for product D $ 188,000.00

Selling price of Product D per kg $ 4.70

b. Decisions for A

Statement showing profit for A at split-off point

Particulars Amount

Cost for Product A $ 187,500.00

Unit produced 60000

Selling price of Product A per kg $ 2.00

Sales revenue $ 120,000.00

Profit / (Loss) $ (67,500.00)

Name

Student ID Page 6

Labour

$

187,000.00

overhead

$

56,100.00 Closing balance

1840

0

$

95,676.80

Total

5120

0 $ 446,400.00 Total

5120

0 $ 446,400.00

Question 3

a. Price of D

Statement showing profit for Grade C products

Particulars Amount

Cost for Product A $ 187,500.00

Extra cost for product C $ 45,000.00

Total cost for product C $ 232,500.00

Selling price of Product C $ 270,000.00

Gross Profit $ 37,500.00

Statement showing profit for Grade D products

Particulars Amount

Cost for Product B $ 163,000.00

Extra cost for product D $ 25,000.00

Total cost for product D $ 188,000.00

Selling price of Product D per kg $ 4.70

b. Decisions for A

Statement showing profit for A at split-off point

Particulars Amount

Cost for Product A $ 187,500.00

Unit produced 60000

Selling price of Product A per kg $ 2.00

Sales revenue $ 120,000.00

Profit / (Loss) $ (67,500.00)

Name

Student ID Page 6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MANAGEMENT ACCOUNTING FOR COSTS AND CONTROL

From the above calculation it is recognized that when the product A is processed to

produce product C for additional cost of $ 45,000, the product C can be sold for $ 4.50 per kg

and the profit will be $ 37,500. However, if product A is sold at the split-off point at $ 2 per

kg then the cost attributable to the product will be $ 187,500. Therefore, the amount of loss

will be $ 67,500. Therefore the difference will be ($ 37500)-(-$ 67500) = $ 105,000.

Therefore, A must be considered for further processing to produce product C.

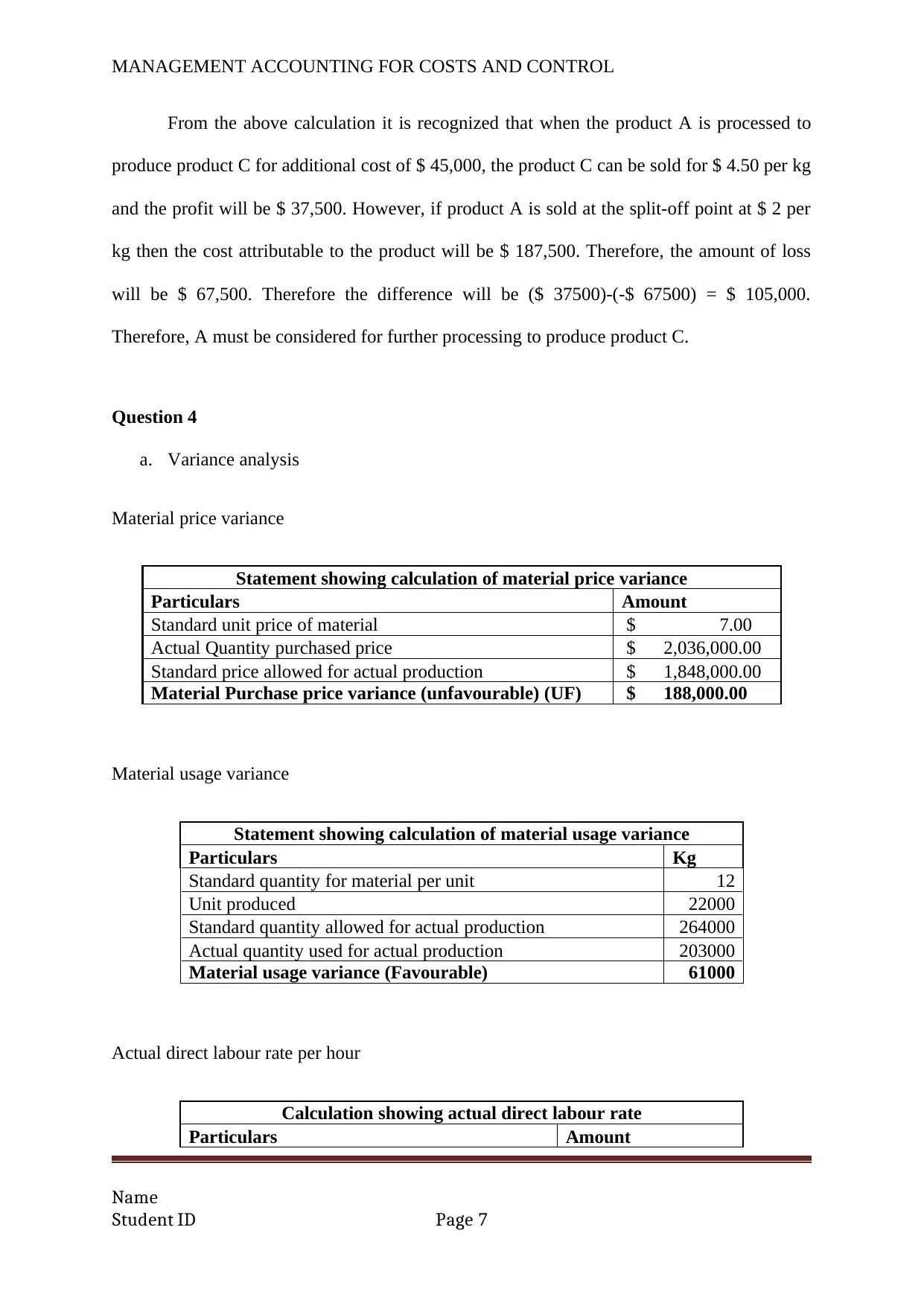

Question 4

a. Variance analysis

Material price variance

Statement showing calculation of material price variance

Particulars Amount

Standard unit price of material $ 7.00

Actual Quantity purchased price $ 2,036,000.00

Standard price allowed for actual production $ 1,848,000.00

Material Purchase price variance (unfavourable) (UF) $ 188,000.00

Material usage variance

Statement showing calculation of material usage variance

Particulars Kg

Standard quantity for material per unit 12

Unit produced 22000

Standard quantity allowed for actual production 264000

Actual quantity used for actual production 203000

Material usage variance (Favourable) 61000

Actual direct labour rate per hour

Calculation showing actual direct labour rate

Particulars Amount

Name

Student ID Page 7

From the above calculation it is recognized that when the product A is processed to

produce product C for additional cost of $ 45,000, the product C can be sold for $ 4.50 per kg

and the profit will be $ 37,500. However, if product A is sold at the split-off point at $ 2 per

kg then the cost attributable to the product will be $ 187,500. Therefore, the amount of loss

will be $ 67,500. Therefore the difference will be ($ 37500)-(-$ 67500) = $ 105,000.

Therefore, A must be considered for further processing to produce product C.

Question 4

a. Variance analysis

Material price variance

Statement showing calculation of material price variance

Particulars Amount

Standard unit price of material $ 7.00

Actual Quantity purchased price $ 2,036,000.00

Standard price allowed for actual production $ 1,848,000.00

Material Purchase price variance (unfavourable) (UF) $ 188,000.00

Material usage variance

Statement showing calculation of material usage variance

Particulars Kg

Standard quantity for material per unit 12

Unit produced 22000

Standard quantity allowed for actual production 264000

Actual quantity used for actual production 203000

Material usage variance (Favourable) 61000

Actual direct labour rate per hour

Calculation showing actual direct labour rate

Particulars Amount

Name

Student ID Page 7

MANAGEMENT ACCOUNTING FOR COSTS AND CONTROL

Standard Direct Labour Rate $ 30.00

Standard direct labour hour 3

Actual units produced 22000

Standard labour expenses allowed $ 1,980,000.00

Direct labour variance (Unfavourable) $ 2,378.00

Actual labour expenses $ 1,982,378.00

Actual labour worked (hours) 60000

Actual labour rate per hour $ 33.04

IF Function –

Statement showing calculation of material price variance

Unfavourabl

e

Particulars Amount

Standard unit price of material $ 7.00

Actual Quantity purchased price

$

2,036,000.00

Standard price allowed for actual production

$

1,848,000.00

Material Purchase price variance $ 188,000.00

Statement showing calculation of material usage variance

Favourable

Particulars Kg

Standard quantity for material per unit 12

Unit produced 22000

Standard quantity allowed for actual production 264000

Actual quantity used for actual production 203000

Material usage variance 61000

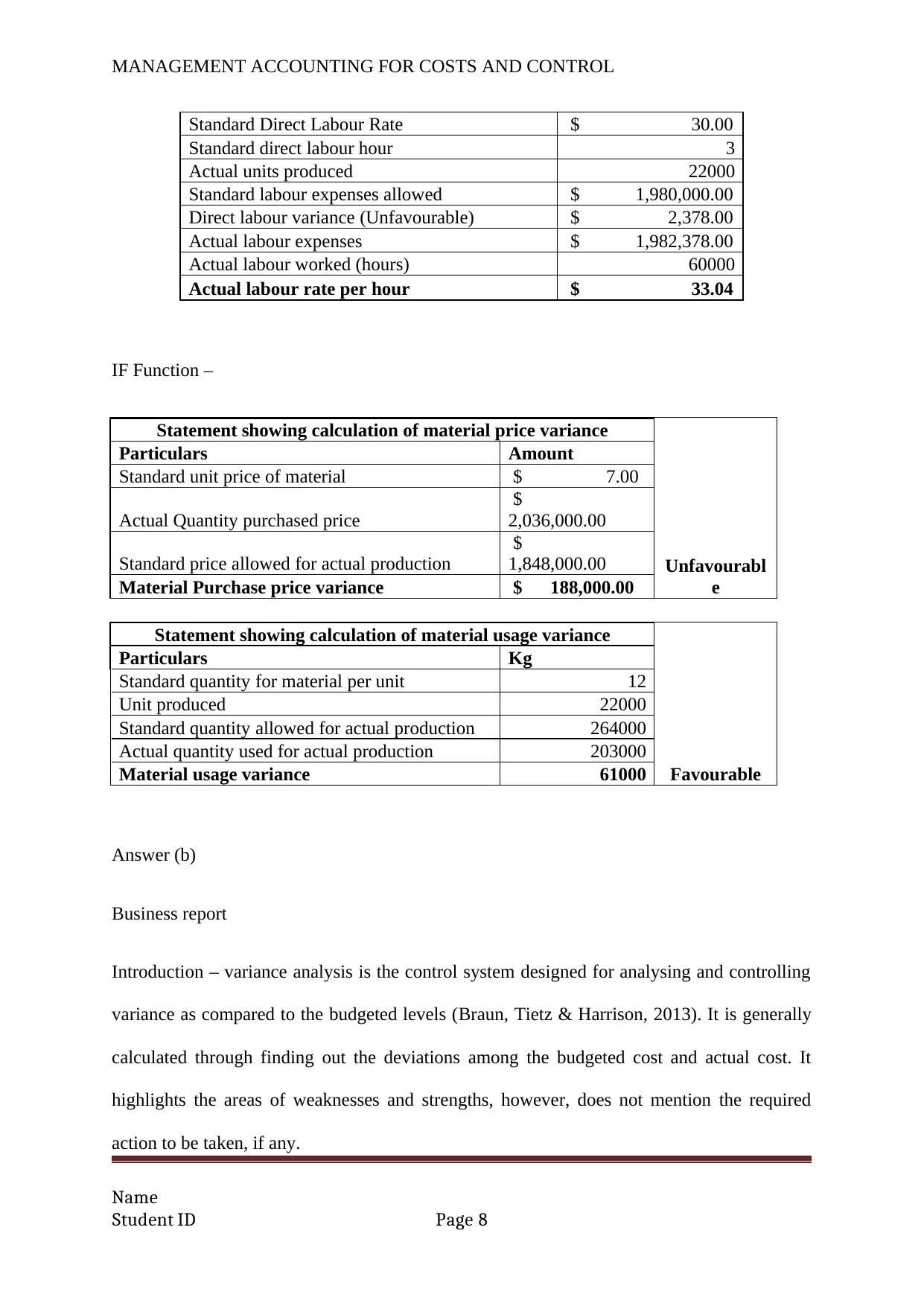

Answer (b)

Business report

Introduction – variance analysis is the control system designed for analysing and controlling

variance as compared to the budgeted levels (Braun, Tietz & Harrison, 2013). It is generally

calculated through finding out the deviations among the budgeted cost and actual cost. It

highlights the areas of weaknesses and strengths, however, does not mention the required

action to be taken, if any.

Name

Student ID Page 8

Standard Direct Labour Rate $ 30.00

Standard direct labour hour 3

Actual units produced 22000

Standard labour expenses allowed $ 1,980,000.00

Direct labour variance (Unfavourable) $ 2,378.00

Actual labour expenses $ 1,982,378.00

Actual labour worked (hours) 60000

Actual labour rate per hour $ 33.04

IF Function –

Statement showing calculation of material price variance

Unfavourabl

e

Particulars Amount

Standard unit price of material $ 7.00

Actual Quantity purchased price

$

2,036,000.00

Standard price allowed for actual production

$

1,848,000.00

Material Purchase price variance $ 188,000.00

Statement showing calculation of material usage variance

Favourable

Particulars Kg

Standard quantity for material per unit 12

Unit produced 22000

Standard quantity allowed for actual production 264000

Actual quantity used for actual production 203000

Material usage variance 61000

Answer (b)

Business report

Introduction – variance analysis is the control system designed for analysing and controlling

variance as compared to the budgeted levels (Braun, Tietz & Harrison, 2013). It is generally

calculated through finding out the deviations among the budgeted cost and actual cost. It

highlights the areas of weaknesses and strengths, however, does not mention the required

action to be taken, if any.

Name

Student ID Page 8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

MANAGEMENT ACCOUNTING FOR COSTS AND CONTROL

Discussion – the main purpose of the variance analysis is exercising the cost reduction and

cost control. It also reveals the efficiency of the management with regard to the preparation

and implementation of the budget and minimization of cost expenses wherever possible

(Kamala et al., 2015). Other purposes those are obtained through the variance analysis are as

follows –

The reason behind the variance analysis can be found out easily which in turn help to

take the remedial measures.

It can be used to fix the responsibility of each employee or each department

separately for each of the variance. For example, if it is observed that the material

variance is large or the labours variance gap is wide the employee in charge of the

department can be asked to take corrective actions.

Variance can be used to segregate the uncontrollable and controllable costs.

Therefore, the controllable cost are further analysed to minimize, wherever possible.

It influence the management to prepare the budget in more efficient way as it is likely

that the management will prefer to minimize the gap between the budget and the

actual cost (Whitecotton, Libby & Phillips, 2013).

Variance analysis can be used in all the operational and financial areas of the

business. It can be used to minimise the expenses, preparation of flexible an deficient budget

and increasing the overall efficiency of the management.

Overhead is the aggregate of indirect expenses, indirect material cost and indirect

labour cost. The overhead cost variance is the difference among the standard cost that is

allowed for actual output and the overhead cost actually incurred (Salako & Yusuf, 2016).

Detailed overhead variance assists in identifying the area where the overhead is over

Name

Student ID Page 9

Discussion – the main purpose of the variance analysis is exercising the cost reduction and

cost control. It also reveals the efficiency of the management with regard to the preparation

and implementation of the budget and minimization of cost expenses wherever possible

(Kamala et al., 2015). Other purposes those are obtained through the variance analysis are as

follows –

The reason behind the variance analysis can be found out easily which in turn help to

take the remedial measures.

It can be used to fix the responsibility of each employee or each department

separately for each of the variance. For example, if it is observed that the material

variance is large or the labours variance gap is wide the employee in charge of the

department can be asked to take corrective actions.

Variance can be used to segregate the uncontrollable and controllable costs.

Therefore, the controllable cost are further analysed to minimize, wherever possible.

It influence the management to prepare the budget in more efficient way as it is likely

that the management will prefer to minimize the gap between the budget and the

actual cost (Whitecotton, Libby & Phillips, 2013).

Variance analysis can be used in all the operational and financial areas of the

business. It can be used to minimise the expenses, preparation of flexible an deficient budget

and increasing the overall efficiency of the management.

Overhead is the aggregate of indirect expenses, indirect material cost and indirect

labour cost. The overhead cost variance is the difference among the standard cost that is

allowed for actual output and the overhead cost actually incurred (Salako & Yusuf, 2016).

Detailed overhead variance assists in identifying the area where the overhead is over

Name

Student ID Page 9

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MANAGEMENT ACCOUNTING FOR COSTS AND CONTROL

absorbed and where it is under absorbed and accordingly the management can take decision

regarding the area where the cost is to be controlled. Further, proper analysis of over head

variance helps in analysing whether the over absorption has been occurred due to over

expenses or due to the department’s inefficiency. Various other reasons that may lead to

unfavourable overhead variances are the quality of raw material. Inferior quality of raw

material may lead lower production quantity and higher amount of overheads. The overhead

expenses may also be due to poor technology for manufacturing or production (Greenberg &

Wilner, 2015). Therefore analysing the overhead variance will assist the management to find

out the actual reason behind the deviation.

Conclusion – from the above discussion it is concluded that the variance analysis helps in

various operational and financial areas of the company to identify various important issues.

These include reason of over-expenses, identification of the areas where the costs are possible

to be controlled, increasing the efficiency of the management in taking corrective measures.

Question 5

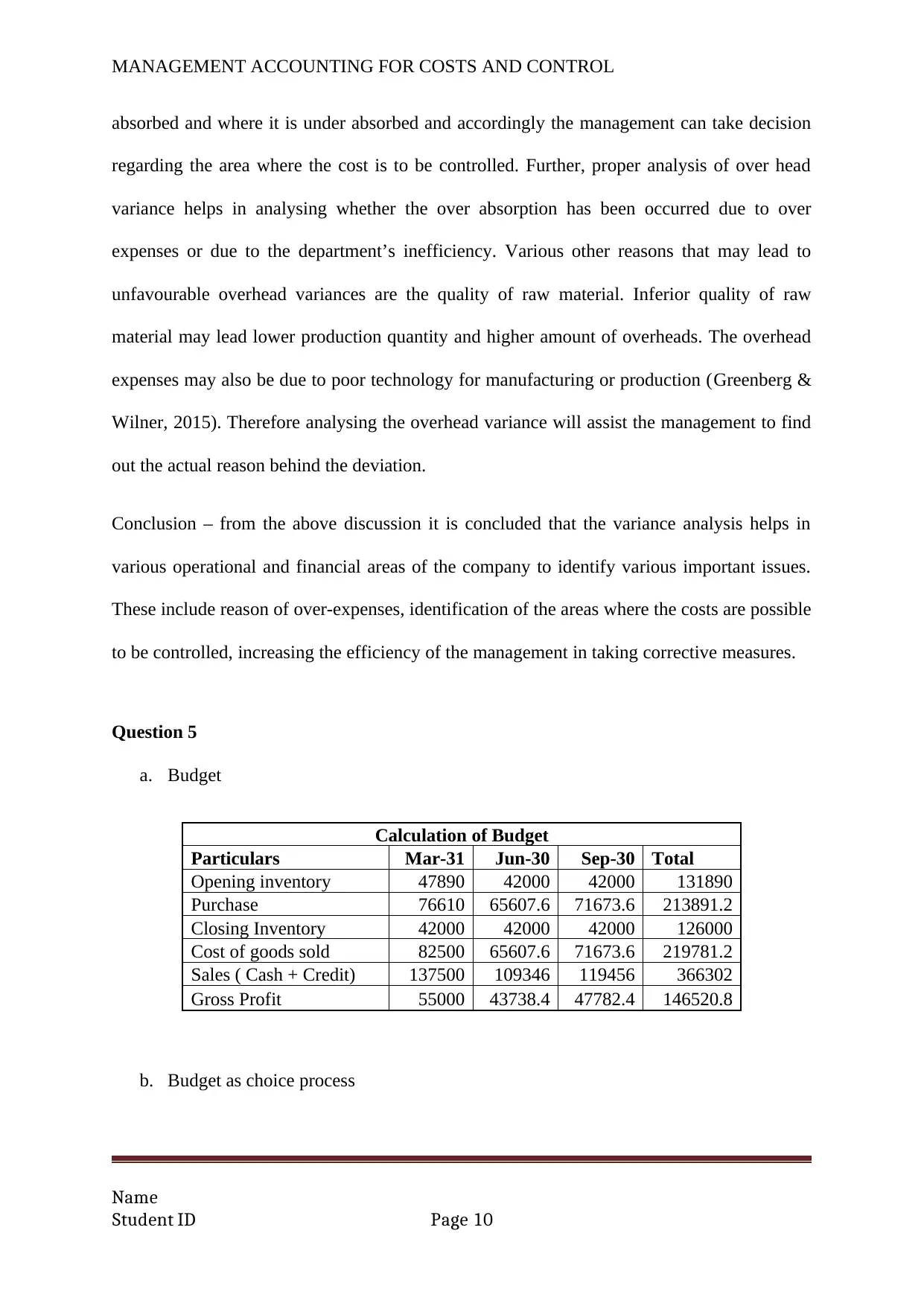

a. Budget

Calculation of Budget

Particulars Mar-31 Jun-30 Sep-30 Total

Opening inventory 47890 42000 42000 131890

Purchase 76610 65607.6 71673.6 213891.2

Closing Inventory 42000 42000 42000 126000

Cost of goods sold 82500 65607.6 71673.6 219781.2

Sales ( Cash + Credit) 137500 109346 119456 366302

Gross Profit 55000 43738.4 47782.4 146520.8

b. Budget as choice process

Name

Student ID Page 10

absorbed and where it is under absorbed and accordingly the management can take decision

regarding the area where the cost is to be controlled. Further, proper analysis of over head

variance helps in analysing whether the over absorption has been occurred due to over

expenses or due to the department’s inefficiency. Various other reasons that may lead to

unfavourable overhead variances are the quality of raw material. Inferior quality of raw

material may lead lower production quantity and higher amount of overheads. The overhead

expenses may also be due to poor technology for manufacturing or production (Greenberg &

Wilner, 2015). Therefore analysing the overhead variance will assist the management to find

out the actual reason behind the deviation.

Conclusion – from the above discussion it is concluded that the variance analysis helps in

various operational and financial areas of the company to identify various important issues.

These include reason of over-expenses, identification of the areas where the costs are possible

to be controlled, increasing the efficiency of the management in taking corrective measures.

Question 5

a. Budget

Calculation of Budget

Particulars Mar-31 Jun-30 Sep-30 Total

Opening inventory 47890 42000 42000 131890

Purchase 76610 65607.6 71673.6 213891.2

Closing Inventory 42000 42000 42000 126000

Cost of goods sold 82500 65607.6 71673.6 219781.2

Sales ( Cash + Credit) 137500 109346 119456 366302

Gross Profit 55000 43738.4 47782.4 146520.8

b. Budget as choice process

Name

Student ID Page 10

MANAGEMENT ACCOUNTING FOR COSTS AND CONTROL

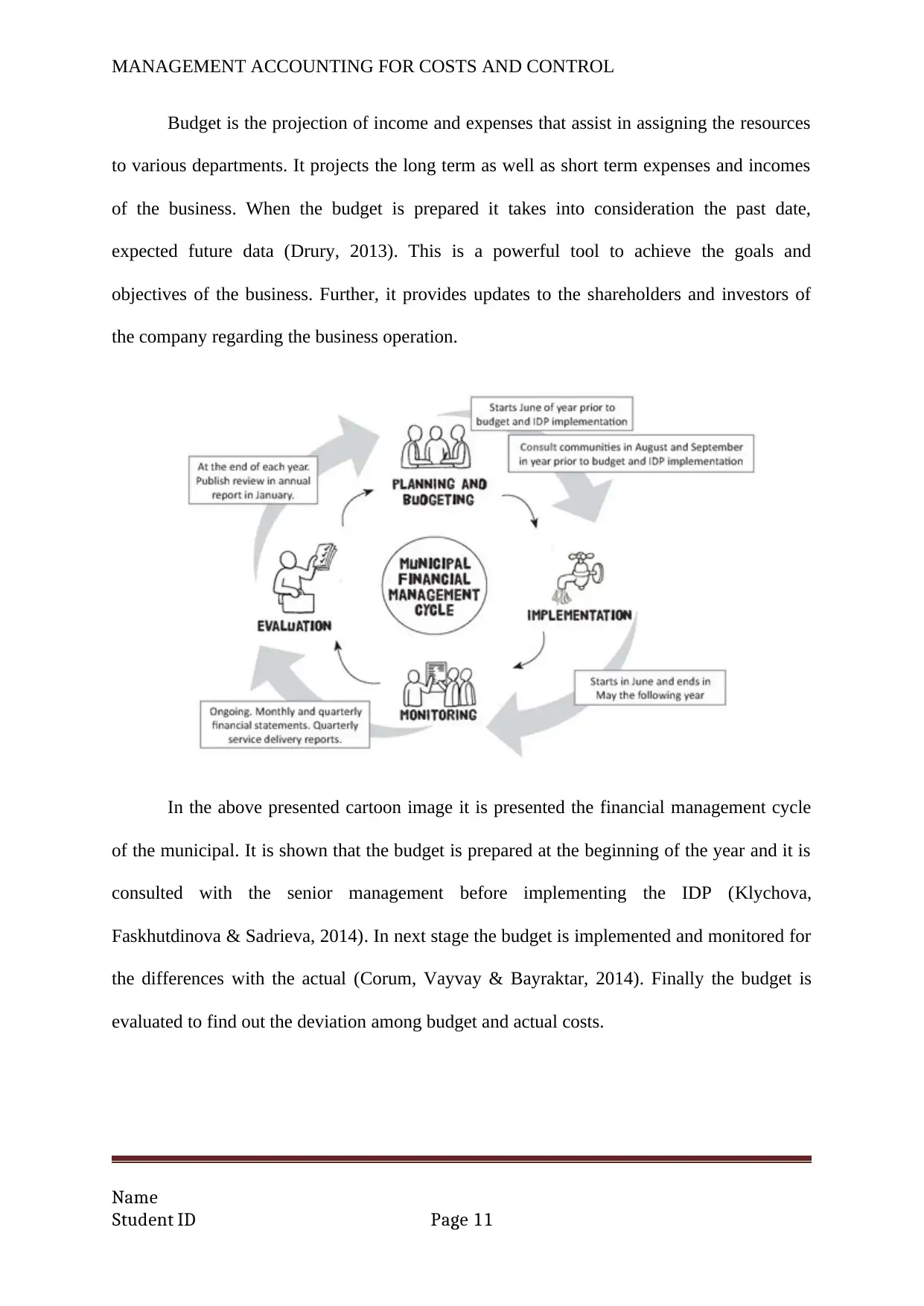

Budget is the projection of income and expenses that assist in assigning the resources

to various departments. It projects the long term as well as short term expenses and incomes

of the business. When the budget is prepared it takes into consideration the past date,

expected future data (Drury, 2013). This is a powerful tool to achieve the goals and

objectives of the business. Further, it provides updates to the shareholders and investors of

the company regarding the business operation.

In the above presented cartoon image it is presented the financial management cycle

of the municipal. It is shown that the budget is prepared at the beginning of the year and it is

consulted with the senior management before implementing the IDP (Klychova,

Faskhutdinova & Sadrieva, 2014). In next stage the budget is implemented and monitored for

the differences with the actual (Corum, Vayvay & Bayraktar, 2014). Finally the budget is

evaluated to find out the deviation among budget and actual costs.

Name

Student ID Page 11

Budget is the projection of income and expenses that assist in assigning the resources

to various departments. It projects the long term as well as short term expenses and incomes

of the business. When the budget is prepared it takes into consideration the past date,

expected future data (Drury, 2013). This is a powerful tool to achieve the goals and

objectives of the business. Further, it provides updates to the shareholders and investors of

the company regarding the business operation.

In the above presented cartoon image it is presented the financial management cycle

of the municipal. It is shown that the budget is prepared at the beginning of the year and it is

consulted with the senior management before implementing the IDP (Klychova,

Faskhutdinova & Sadrieva, 2014). In next stage the budget is implemented and monitored for

the differences with the actual (Corum, Vayvay & Bayraktar, 2014). Finally the budget is

evaluated to find out the deviation among budget and actual costs.

Name

Student ID Page 11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.