Management Accounting Report: Financial Strategies for AstraZeneca

VerifiedAdded on 2023/01/17

|15

|2644

|69

Report

AI Summary

This report provides a comprehensive analysis of management accounting practices, focusing on the case of AstraZeneca. It begins with an introduction to management accounting and explores different management accounting systems, including cost accounting, inventory management, and price optimization. The report then delves into the preparation of financial statements using both marginal and absorption costing methods, providing detailed calculations and comparisons. Furthermore, it examines the advantages and disadvantages of planning tools and their application in budgetary control. Finally, the report addresses the adaptation of management accounting systems to respond to financial issues, such as lack of sales revenue, with a focus on benchmarking and balance scorecards. The report concludes by summarizing the key findings and emphasizing the importance of effective management accounting for organizational success.

Management Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

TASK 1............................................................................................................................................1

P1 Management accounting and essential requirement of different type of management

accounting systems......................................................................................................................1

P2 Explanation of different management accounting reports.....................................................2

TASK 2............................................................................................................................................3

P3 Preparation of financial statements using marginal and absorption costing..........................3

TASK 3............................................................................................................................................7

P4 Explanation of advantages and disadvantages of planning tools along with their use for

budgetary control........................................................................................................................7

TASK 4............................................................................................................................................8

P5 Adaptation of management accounting systems to respond financial issues .......................8

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................9

.........................................................................................................................................................9

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

TASK 1............................................................................................................................................1

P1 Management accounting and essential requirement of different type of management

accounting systems......................................................................................................................1

P2 Explanation of different management accounting reports.....................................................2

TASK 2............................................................................................................................................3

P3 Preparation of financial statements using marginal and absorption costing..........................3

TASK 3............................................................................................................................................7

P4 Explanation of advantages and disadvantages of planning tools along with their use for

budgetary control........................................................................................................................7

TASK 4............................................................................................................................................8

P5 Adaptation of management accounting systems to respond financial issues .......................8

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................9

.........................................................................................................................................................9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Management accounting refers as an effective practice used by an organisation to

identifying, measuring, analysing and interpreting financial information to business managers. In

addition, it is a field of accounting that gives financial and economic information for managers as

well as to other internal users. The application of different methods of management accounting

has their own various benefits which are attained by an organisation. This will provides an

opportunity to bring consistency in business operations through ascertainment of coordination in

between the internal department workings. The organisation which is considered for completion

is named as AstraZeneca. This organisation has their operations in manufacturing sector. The

main aim of this report is about determination of benefits associated with the use of management

accounting methods (Abdullahj and et.al, 2015).

The aspects which are covers in the report includes information about different type of

management accounting systems along with their benefits and various management accounting

reports. Also, covers about preparation of income statement by the use of marginal and

absorption costing methods, use of planning tools for budgetary control and adaptation of

management accounting systems to respond financial problems.

MAIN BODY

TASK 1

P1 Management accounting and essential requirement of different type of management

accounting systems

Management Accounting

This includes the use of accounting methods and techniques that help to ascertain

financial information regarding operations of an organisation. This will be further used by the

management of an organisation to build decisions and frame strategies to attain growth

(Management Accounting. 2018).

Management Accounting systems

The different kind of methods persists under this includes cost accounting, inventory

management, price optimisation etc. All these have their own different working from the

organisation perspective. Further, this will provide information which is use by internal

management to made department functioning more profound in overall nature. AstraZeneca is

1

Management accounting refers as an effective practice used by an organisation to

identifying, measuring, analysing and interpreting financial information to business managers. In

addition, it is a field of accounting that gives financial and economic information for managers as

well as to other internal users. The application of different methods of management accounting

has their own various benefits which are attained by an organisation. This will provides an

opportunity to bring consistency in business operations through ascertainment of coordination in

between the internal department workings. The organisation which is considered for completion

is named as AstraZeneca. This organisation has their operations in manufacturing sector. The

main aim of this report is about determination of benefits associated with the use of management

accounting methods (Abdullahj and et.al, 2015).

The aspects which are covers in the report includes information about different type of

management accounting systems along with their benefits and various management accounting

reports. Also, covers about preparation of income statement by the use of marginal and

absorption costing methods, use of planning tools for budgetary control and adaptation of

management accounting systems to respond financial problems.

MAIN BODY

TASK 1

P1 Management accounting and essential requirement of different type of management

accounting systems

Management Accounting

This includes the use of accounting methods and techniques that help to ascertain

financial information regarding operations of an organisation. This will be further used by the

management of an organisation to build decisions and frame strategies to attain growth

(Management Accounting. 2018).

Management Accounting systems

The different kind of methods persists under this includes cost accounting, inventory

management, price optimisation etc. All these have their own different working from the

organisation perspective. Further, this will provide information which is use by internal

management to made department functioning more profound in overall nature. AstraZeneca is

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

manufacturing organisation. Application of management accounting techniques within their

operations has huge opportunities regarding betterment of their functions along with

accomplishment of organisational objectives. The detailed description regarding application of

management-accounting methods upon AstraZeneca is provided below:

Cost accounting system: The use of this method has more importance for manufacturing

organisation like AstraZeneca. This will provides an opportunity in ascertainment of the total

cost of production through analysis of the each and every input cost that involves in the process

of carrying each stage production activities. The contribution of this information in future will be

used for the purpose of cost reduction (Anghelache and et.al, 2019).

Inventory management system: One of the effective accounting method that aid in

building internal activities of the organisation more profound through proper allocation and

utilisation of resources. This provides an opportunity regarding management of inventory so, the

cost will be minimised and profit margin in future will be increased.

Price optimisation system: This system provides an opportunity to the management of

an organisation regarding ascertainment of the reaction of individuals over different pricing of

the products. The benefit associated with its application is related to management of pricing of

products according to the tastes of consumers along with attainment of competitiveness in their

operations.

P2 Explanation of different management accounting reports

Management accounting reports are those which are framed by the accountant after

ascertainment of information from the application of management accounting techniques. The

importance of information recorded in these different reports is high for an organisation. This

will not only improves the current performance but also aid in development of future

development strategies (Brînză and Bengescu, 2016). Different management accounting reports

and their importance in relation to AstraZeneca is defined below:

Inventory management report: This report includes the information related to the level

of inventory within the organisation. This help the organisation to make the decisions about

ordering of raw materials along with the time period. The main importance ascertained by an

organisation through this is about overcoming from the over capitalisation of stocks along with

optimum utilisation of available resources.

2

operations has huge opportunities regarding betterment of their functions along with

accomplishment of organisational objectives. The detailed description regarding application of

management-accounting methods upon AstraZeneca is provided below:

Cost accounting system: The use of this method has more importance for manufacturing

organisation like AstraZeneca. This will provides an opportunity in ascertainment of the total

cost of production through analysis of the each and every input cost that involves in the process

of carrying each stage production activities. The contribution of this information in future will be

used for the purpose of cost reduction (Anghelache and et.al, 2019).

Inventory management system: One of the effective accounting method that aid in

building internal activities of the organisation more profound through proper allocation and

utilisation of resources. This provides an opportunity regarding management of inventory so, the

cost will be minimised and profit margin in future will be increased.

Price optimisation system: This system provides an opportunity to the management of

an organisation regarding ascertainment of the reaction of individuals over different pricing of

the products. The benefit associated with its application is related to management of pricing of

products according to the tastes of consumers along with attainment of competitiveness in their

operations.

P2 Explanation of different management accounting reports

Management accounting reports are those which are framed by the accountant after

ascertainment of information from the application of management accounting techniques. The

importance of information recorded in these different reports is high for an organisation. This

will not only improves the current performance but also aid in development of future

development strategies (Brînză and Bengescu, 2016). Different management accounting reports

and their importance in relation to AstraZeneca is defined below:

Inventory management report: This report includes the information related to the level

of inventory within the organisation. This help the organisation to make the decisions about

ordering of raw materials along with the time period. The main importance ascertained by an

organisation through this is about overcoming from the over capitalisation of stocks along with

optimum utilisation of available resources.

2

Performance Report: This report includes the information about the performance of

employees. The importance of this is huge for an organisation as provides an opportunity to

remove issues and fill the gap through bring improvement in the performance of employees.

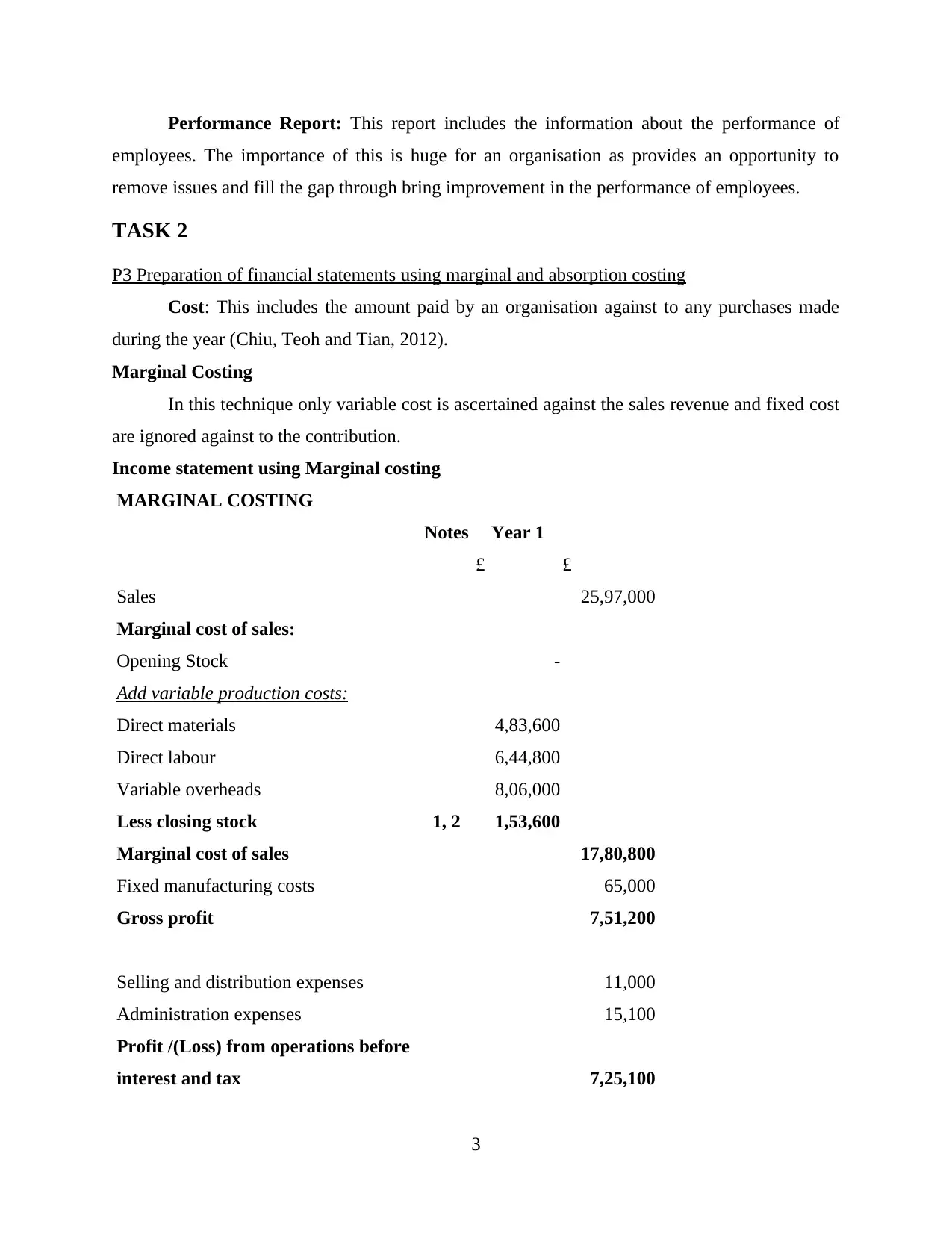

TASK 2

P3 Preparation of financial statements using marginal and absorption costing

Cost: This includes the amount paid by an organisation against to any purchases made

during the year (Chiu, Teoh and Tian, 2012).

Marginal Costing

In this technique only variable cost is ascertained against the sales revenue and fixed cost

are ignored against to the contribution.

Income statement using Marginal costing

MARGINAL COSTING

Notes Year 1

£ £

Sales 25,97,000

Marginal cost of sales:

Opening Stock -

Add variable production costs:

Direct materials 4,83,600

Direct labour 6,44,800

Variable overheads 8,06,000

Less closing stock 1, 2 1,53,600

Marginal cost of sales 17,80,800

Fixed manufacturing costs 65,000

Gross profit 7,51,200

Selling and distribution expenses 11,000

Administration expenses 15,100

Profit /(Loss) from operations before

interest and tax 7,25,100

3

employees. The importance of this is huge for an organisation as provides an opportunity to

remove issues and fill the gap through bring improvement in the performance of employees.

TASK 2

P3 Preparation of financial statements using marginal and absorption costing

Cost: This includes the amount paid by an organisation against to any purchases made

during the year (Chiu, Teoh and Tian, 2012).

Marginal Costing

In this technique only variable cost is ascertained against the sales revenue and fixed cost

are ignored against to the contribution.

Income statement using Marginal costing

MARGINAL COSTING

Notes Year 1

£ £

Sales 25,97,000

Marginal cost of sales:

Opening Stock -

Add variable production costs:

Direct materials 4,83,600

Direct labour 6,44,800

Variable overheads 8,06,000

Less closing stock 1, 2 1,53,600

Marginal cost of sales 17,80,800

Fixed manufacturing costs 65,000

Gross profit 7,51,200

Selling and distribution expenses 11,000

Administration expenses 15,100

Profit /(Loss) from operations before

interest and tax 7,25,100

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

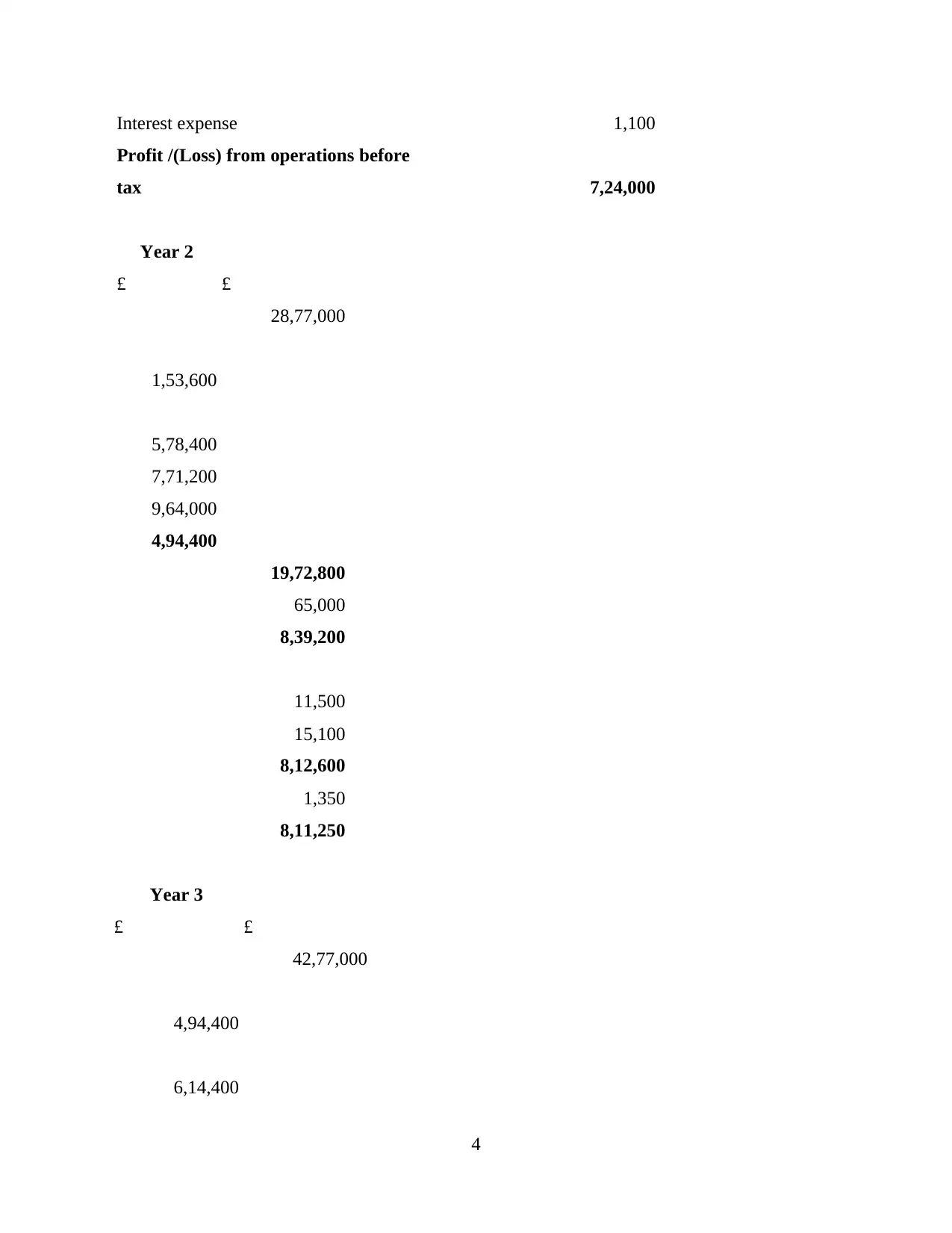

Interest expense 1,100

Profit /(Loss) from operations before

tax 7,24,000

Year 2

£ £

28,77,000

1,53,600

5,78,400

7,71,200

9,64,000

4,94,400

19,72,800

65,000

8,39,200

11,500

15,100

8,12,600

1,350

8,11,250

Year 3

£ £

42,77,000

4,94,400

6,14,400

4

Profit /(Loss) from operations before

tax 7,24,000

Year 2

£ £

28,77,000

1,53,600

5,78,400

7,71,200

9,64,000

4,94,400

19,72,800

65,000

8,39,200

11,500

15,100

8,12,600

1,350

8,11,250

Year 3

£ £

42,77,000

4,94,400

6,14,400

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

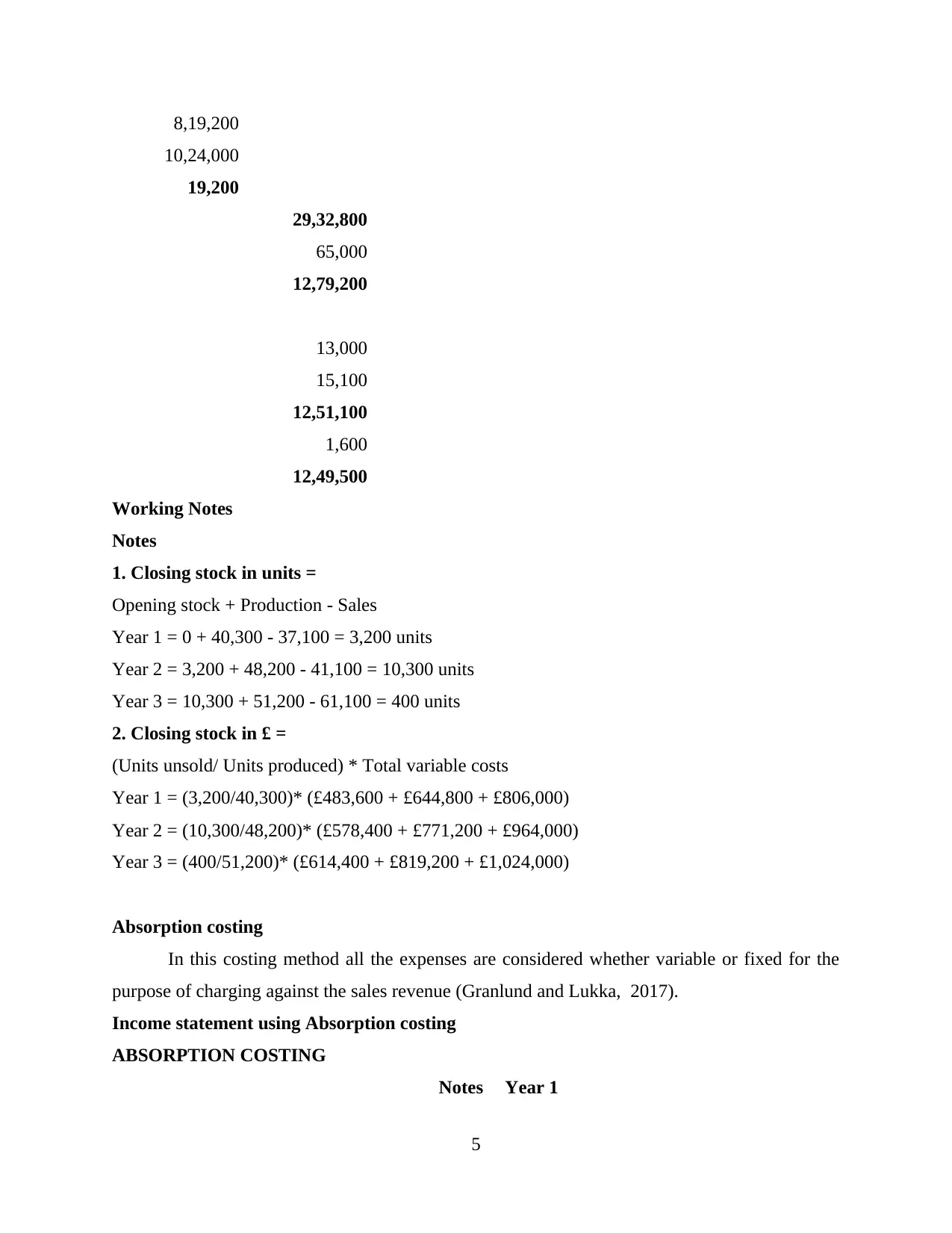

8,19,200

10,24,000

19,200

29,32,800

65,000

12,79,200

13,000

15,100

12,51,100

1,600

12,49,500

Working Notes

Notes

1. Closing stock in units =

Opening stock + Production - Sales

Year 1 = 0 + 40,300 - 37,100 = 3,200 units

Year 2 = 3,200 + 48,200 - 41,100 = 10,300 units

Year 3 = 10,300 + 51,200 - 61,100 = 400 units

2. Closing stock in £ =

(Units unsold/ Units produced) * Total variable costs

Year 1 = (3,200/40,300)* (£483,600 + £644,800 + £806,000)

Year 2 = (10,300/48,200)* (£578,400 + £771,200 + £964,000)

Year 3 = (400/51,200)* (£614,400 + £819,200 + £1,024,000)

Absorption costing

In this costing method all the expenses are considered whether variable or fixed for the

purpose of charging against the sales revenue (Granlund and Lukka, 2017).

Income statement using Absorption costing

ABSORPTION COSTING

Notes Year 1

5

10,24,000

19,200

29,32,800

65,000

12,79,200

13,000

15,100

12,51,100

1,600

12,49,500

Working Notes

Notes

1. Closing stock in units =

Opening stock + Production - Sales

Year 1 = 0 + 40,300 - 37,100 = 3,200 units

Year 2 = 3,200 + 48,200 - 41,100 = 10,300 units

Year 3 = 10,300 + 51,200 - 61,100 = 400 units

2. Closing stock in £ =

(Units unsold/ Units produced) * Total variable costs

Year 1 = (3,200/40,300)* (£483,600 + £644,800 + £806,000)

Year 2 = (10,300/48,200)* (£578,400 + £771,200 + £964,000)

Year 3 = (400/51,200)* (£614,400 + £819,200 + £1,024,000)

Absorption costing

In this costing method all the expenses are considered whether variable or fixed for the

purpose of charging against the sales revenue (Granlund and Lukka, 2017).

Income statement using Absorption costing

ABSORPTION COSTING

Notes Year 1

5

£ £

Sales 25,97,000

Cost of sales:

Opening Stock* -

Add total production costs:

Direct materials 4,83,600

Direct labour 6,44,800

Variable overheads 8,06,000

Fixed manufacturing costs 65,000

Less closing stock** 1,2 1,58,761

Cost of sales 18,40,639

Gross profit 7,56,361

Distribution expenses 11,000

Administration expenses 15,100

Profit /(Loss) from operations before

interest and tax 7,30,261

Interest 1,100

Profit /(Loss) from operations before tax 7,29,161

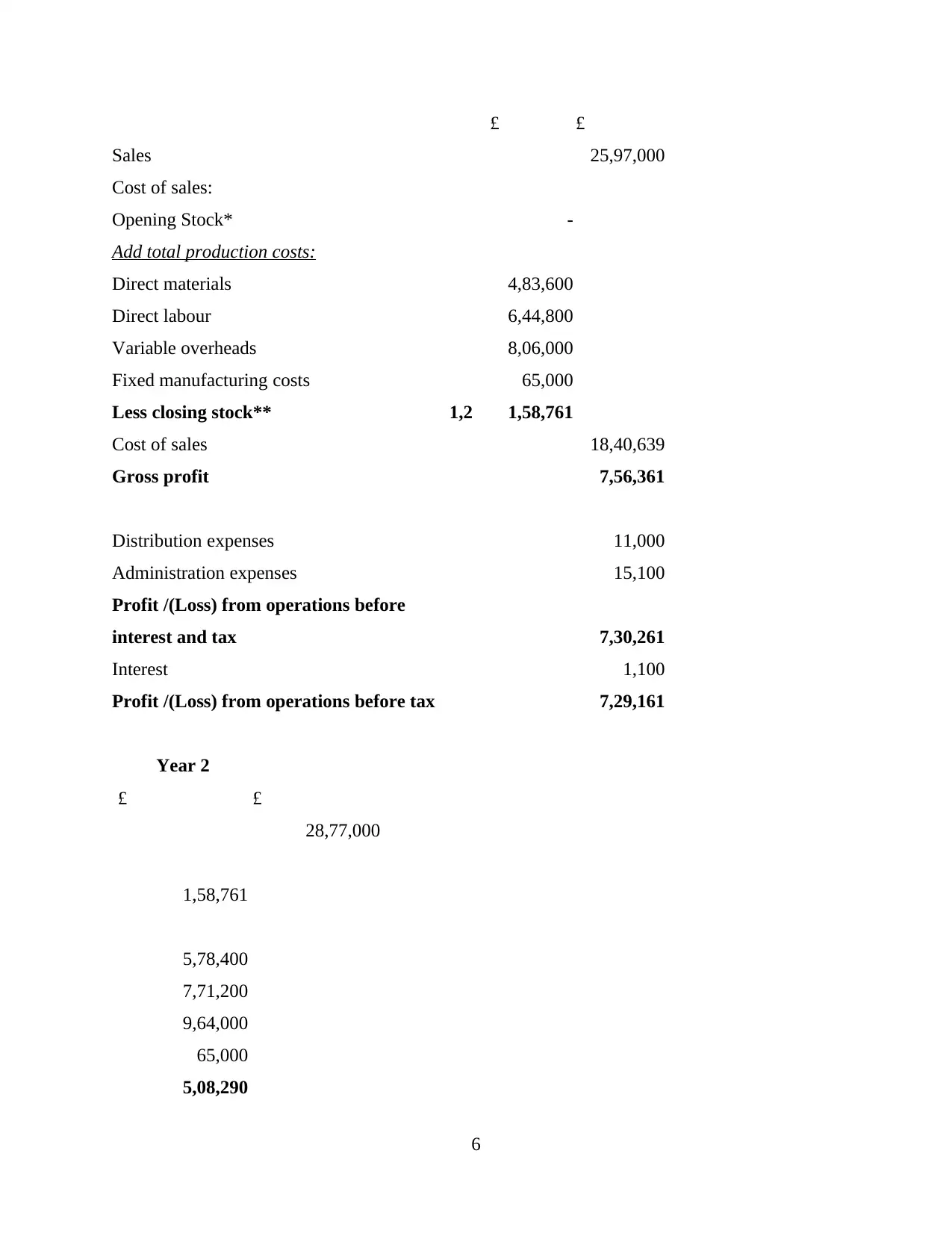

Year 2

£ £

28,77,000

1,58,761

5,78,400

7,71,200

9,64,000

65,000

5,08,290

6

Sales 25,97,000

Cost of sales:

Opening Stock* -

Add total production costs:

Direct materials 4,83,600

Direct labour 6,44,800

Variable overheads 8,06,000

Fixed manufacturing costs 65,000

Less closing stock** 1,2 1,58,761

Cost of sales 18,40,639

Gross profit 7,56,361

Distribution expenses 11,000

Administration expenses 15,100

Profit /(Loss) from operations before

interest and tax 7,30,261

Interest 1,100

Profit /(Loss) from operations before tax 7,29,161

Year 2

£ £

28,77,000

1,58,761

5,78,400

7,71,200

9,64,000

65,000

5,08,290

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

20,29,071

8,47,929

11,500

15,100

8,21,329

1,350

8,19,979

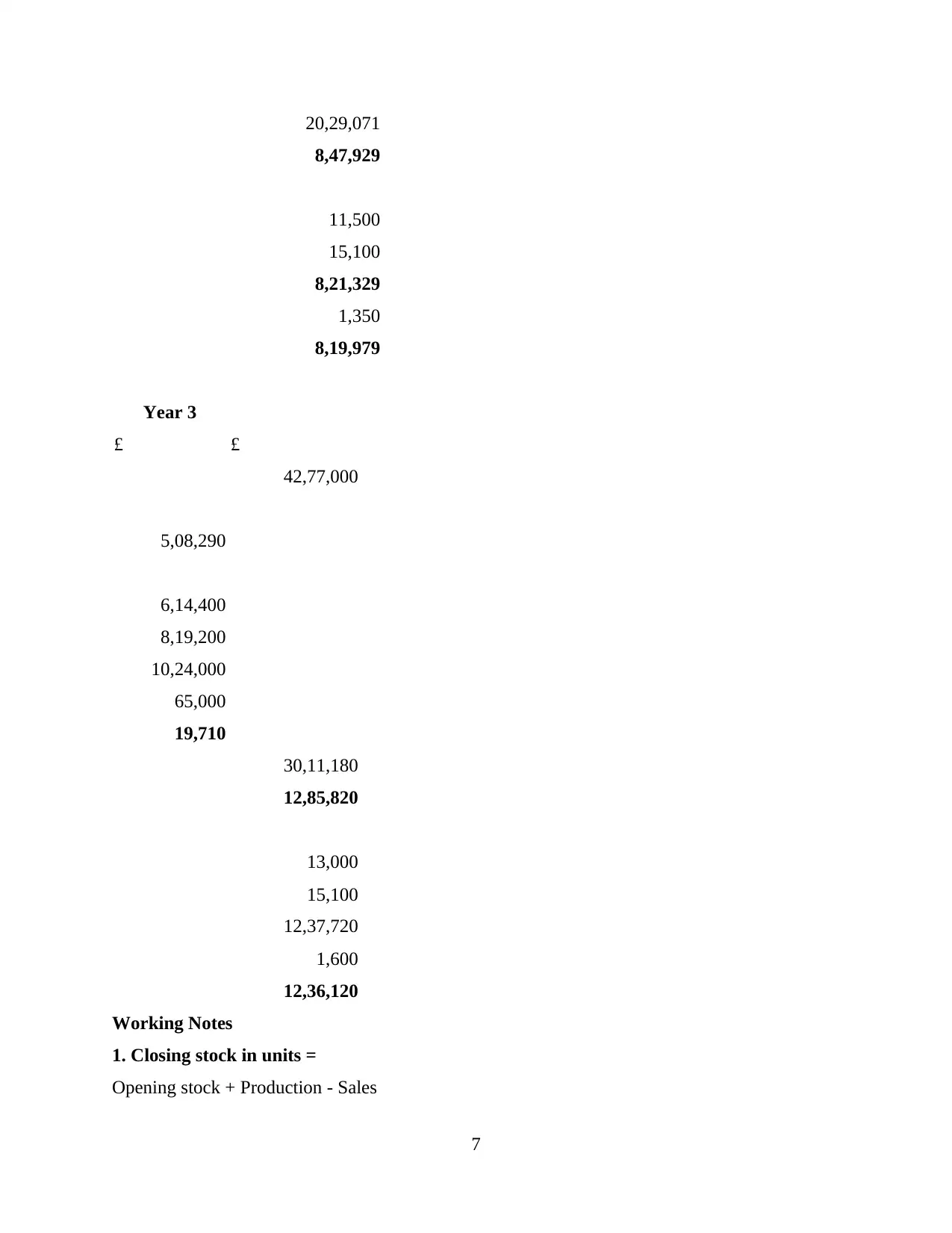

Year 3

£ £

42,77,000

5,08,290

6,14,400

8,19,200

10,24,000

65,000

19,710

30,11,180

12,85,820

13,000

15,100

12,37,720

1,600

12,36,120

Working Notes

1. Closing stock in units =

Opening stock + Production - Sales

7

8,47,929

11,500

15,100

8,21,329

1,350

8,19,979

Year 3

£ £

42,77,000

5,08,290

6,14,400

8,19,200

10,24,000

65,000

19,710

30,11,180

12,85,820

13,000

15,100

12,37,720

1,600

12,36,120

Working Notes

1. Closing stock in units =

Opening stock + Production - Sales

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

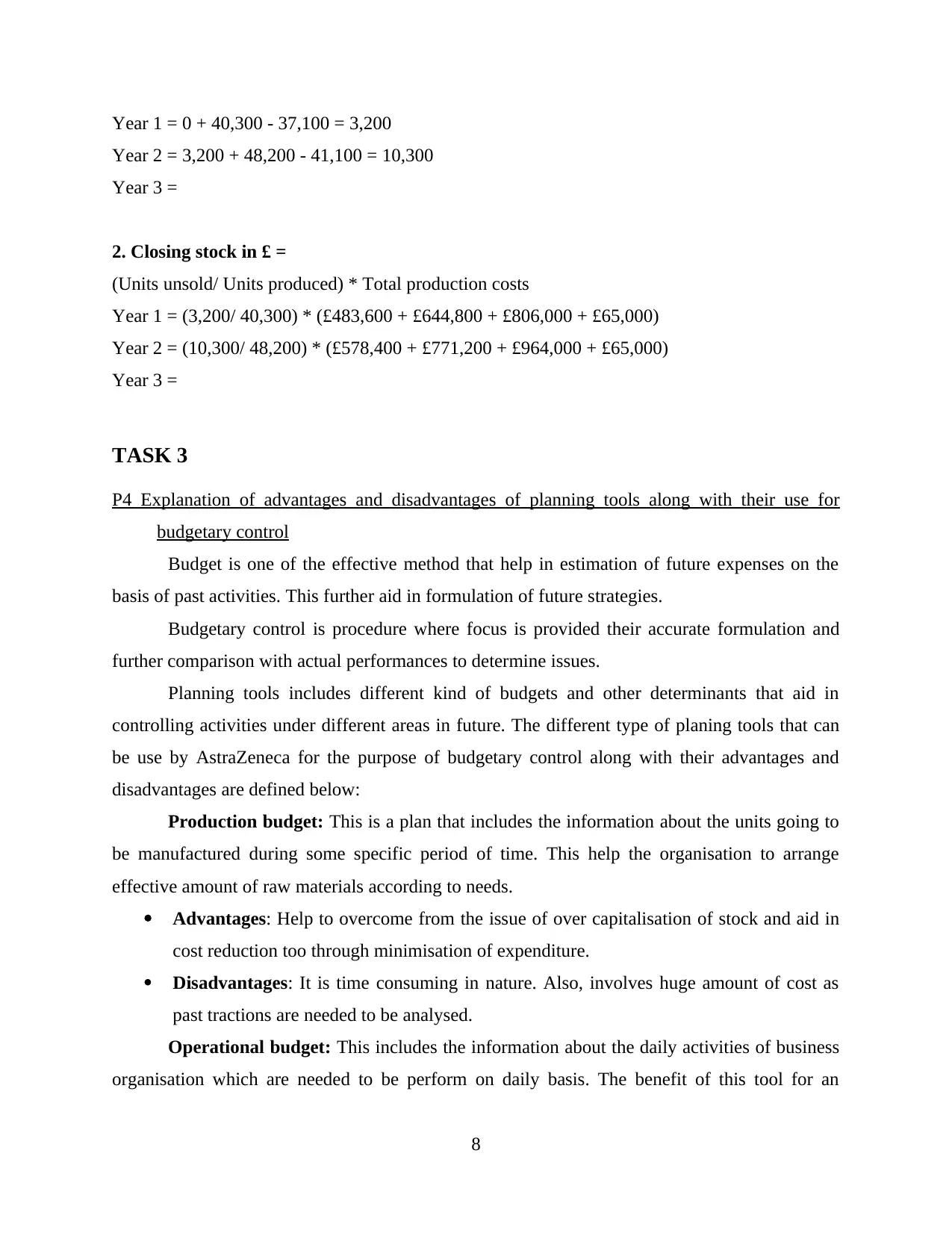

Year 1 = 0 + 40,300 - 37,100 = 3,200

Year 2 = 3,200 + 48,200 - 41,100 = 10,300

Year 3 =

2. Closing stock in £ =

(Units unsold/ Units produced) * Total production costs

Year 1 = (3,200/ 40,300) * (£483,600 + £644,800 + £806,000 + £65,000)

Year 2 = (10,300/ 48,200) * (£578,400 + £771,200 + £964,000 + £65,000)

Year 3 =

TASK 3

P4 Explanation of advantages and disadvantages of planning tools along with their use for

budgetary control

Budget is one of the effective method that help in estimation of future expenses on the

basis of past activities. This further aid in formulation of future strategies.

Budgetary control is procedure where focus is provided their accurate formulation and

further comparison with actual performances to determine issues.

Planning tools includes different kind of budgets and other determinants that aid in

controlling activities under different areas in future. The different type of planing tools that can

be use by AstraZeneca for the purpose of budgetary control along with their advantages and

disadvantages are defined below:

Production budget: This is a plan that includes the information about the units going to

be manufactured during some specific period of time. This help the organisation to arrange

effective amount of raw materials according to needs.

Advantages: Help to overcome from the issue of over capitalisation of stock and aid in

cost reduction too through minimisation of expenditure.

Disadvantages: It is time consuming in nature. Also, involves huge amount of cost as

past tractions are needed to be analysed.

Operational budget: This includes the information about the daily activities of business

organisation which are needed to be perform on daily basis. The benefit of this tool for an

8

Year 2 = 3,200 + 48,200 - 41,100 = 10,300

Year 3 =

2. Closing stock in £ =

(Units unsold/ Units produced) * Total production costs

Year 1 = (3,200/ 40,300) * (£483,600 + £644,800 + £806,000 + £65,000)

Year 2 = (10,300/ 48,200) * (£578,400 + £771,200 + £964,000 + £65,000)

Year 3 =

TASK 3

P4 Explanation of advantages and disadvantages of planning tools along with their use for

budgetary control

Budget is one of the effective method that help in estimation of future expenses on the

basis of past activities. This further aid in formulation of future strategies.

Budgetary control is procedure where focus is provided their accurate formulation and

further comparison with actual performances to determine issues.

Planning tools includes different kind of budgets and other determinants that aid in

controlling activities under different areas in future. The different type of planing tools that can

be use by AstraZeneca for the purpose of budgetary control along with their advantages and

disadvantages are defined below:

Production budget: This is a plan that includes the information about the units going to

be manufactured during some specific period of time. This help the organisation to arrange

effective amount of raw materials according to needs.

Advantages: Help to overcome from the issue of over capitalisation of stock and aid in

cost reduction too through minimisation of expenditure.

Disadvantages: It is time consuming in nature. Also, involves huge amount of cost as

past tractions are needed to be analysed.

Operational budget: This includes the information about the daily activities of business

organisation which are needed to be perform on daily basis. The benefit of this tool for an

8

organisation is that provides a opportunity to control operational expenses along with aid in

enhancement of working capital (Huang and et.al, 2019).

Advantages: This will help an organisation effective management of funds of an

organisation. The is so because better control can be established over daily expenditures.

Disadvantages: The main disadvantage of this budget that not includes the information

about capital expenses. This has direct impact over the effectiveness of an organisation.

Capital Budget: This budget covers the information about organisation future large

investment and expenses. The responsibility to build this was upon finance manager.

Advantages: This help to know which investment choice help to attain better return in

future by an organisation.

Disadvantages: The information included was long term in nature and it can be

reversible in nature. So, any activity in future can turns out the result.

TASK 4

P5 Adaptation of management accounting systems to respond financial issues

Financial issues is referred as a kind of pessimistic situation where organisation do have

efficacious capital for performing various activities. It is vital for business concern to resolve

problems as quickly because this drives them towards dissolution. There are many forms of

financial problems that are faced through entities such as AstraZeneca. Few of them are

discussed below:

Lack of sales revenue: It is financial problem that is associated with sales because of

minimisation into units of sales. This is the problems which become the reasons of enhancing

few another issues like in appropriate structure of capital and reducing financial liquidity. In

context of AstraZeneca, this is examined that they are facing the problems because of which its

sales get minimised annually.

Various approaches that is utilised for addressing the financial issues are described below:

Benchmarking: This is define as a type of approaches which is used to find monetary

issues in which the financial performance of business concern are compared with

competitive entities (Namakon and Inanga, 2014). Due to this. Firm, may able to get

knowledge about the concepts that whose performance is weak. AstraZeneca can apply

benchmarking techniques with an intent to find exact issues.

9

enhancement of working capital (Huang and et.al, 2019).

Advantages: This will help an organisation effective management of funds of an

organisation. The is so because better control can be established over daily expenditures.

Disadvantages: The main disadvantage of this budget that not includes the information

about capital expenses. This has direct impact over the effectiveness of an organisation.

Capital Budget: This budget covers the information about organisation future large

investment and expenses. The responsibility to build this was upon finance manager.

Advantages: This help to know which investment choice help to attain better return in

future by an organisation.

Disadvantages: The information included was long term in nature and it can be

reversible in nature. So, any activity in future can turns out the result.

TASK 4

P5 Adaptation of management accounting systems to respond financial issues

Financial issues is referred as a kind of pessimistic situation where organisation do have

efficacious capital for performing various activities. It is vital for business concern to resolve

problems as quickly because this drives them towards dissolution. There are many forms of

financial problems that are faced through entities such as AstraZeneca. Few of them are

discussed below:

Lack of sales revenue: It is financial problem that is associated with sales because of

minimisation into units of sales. This is the problems which become the reasons of enhancing

few another issues like in appropriate structure of capital and reducing financial liquidity. In

context of AstraZeneca, this is examined that they are facing the problems because of which its

sales get minimised annually.

Various approaches that is utilised for addressing the financial issues are described below:

Benchmarking: This is define as a type of approaches which is used to find monetary

issues in which the financial performance of business concern are compared with

competitive entities (Namakon and Inanga, 2014). Due to this. Firm, may able to get

knowledge about the concepts that whose performance is weak. AstraZeneca can apply

benchmarking techniques with an intent to find exact issues.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.