Accounting Report: Costing Methods and Planning Tools

VerifiedAdded on 2023/01/13

|10

|2032

|26

Report

AI Summary

This accounting report delves into management accounting, encompassing data gathering, reporting, and evaluation for internal decision-making. It examines various management accounting systems and reports, emphasizing their integration and benefits. The report includes calculations of net profit using marginal and absorption costing methods, comparing their outcomes. Different planning tools, such as ratio analysis, budgetary control, and standard costing are analyzed, along with their advantages and disadvantages. Additionally, the report presents a monthly expenditure analysis, and provides a financial analysis using financial ratios to identify financial problems and propose measures to reduce them, with a focus on achieving sustainable success. The report concludes by summarizing the effectiveness of management accounting in supporting decision-making and resolving financial issues.

Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION ..........................................................................................................................1

PROJECT 1......................................................................................................................................1

Covered in PPT...........................................................................................................................1

PROJECT 2......................................................................................................................................1

Calculation of net profit by using various costing methods........................................................1

Various types of management accounting techniques................................................................2

Data interpretation by using costing method..............................................................................2

Advantage and disadvantage of various types of planning tools................................................2

Monthly expenditure for July and August..................................................................................4

Calculation of accounting system to analyse financial problems...............................................4

Measures to reduce financial problems in order to lead towards sustainable success................5

Analysis of planning tools used in company...............................................................................5

CONCLUSION ...............................................................................................................................5

REFERENCES ...............................................................................................................................7

INTRODUCTION ..........................................................................................................................1

PROJECT 1......................................................................................................................................1

Covered in PPT...........................................................................................................................1

PROJECT 2......................................................................................................................................1

Calculation of net profit by using various costing methods........................................................1

Various types of management accounting techniques................................................................2

Data interpretation by using costing method..............................................................................2

Advantage and disadvantage of various types of planning tools................................................2

Monthly expenditure for July and August..................................................................................4

Calculation of accounting system to analyse financial problems...............................................4

Measures to reduce financial problems in order to lead towards sustainable success................5

Analysis of planning tools used in company...............................................................................5

CONCLUSION ...............................................................................................................................5

REFERENCES ...............................................................................................................................7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

In business term, the field of accounting that is related with gathering, reporting,

summarizing and evaluating important information into internal reports of company that supper

management team to make effective decision (Bennett, Schaltegger and Zvezdov, 2011). There

are various system and reports that are beneficial in making and presenting detailed information

about different task and activities of company. MA is also supportive in determining the actual

reasons for negative results or problems and help in making better plans to remove these issues.

In this presentation report, several important MA system and reports are elaborated with

their integration and benefits to company process. Report also covers use of MA techniques to

calculate net profit and use of planning tools to make decision. In addition, importance of MA

tools in determining and resolving financial issues are discussed.

PROJECT 1

Covered in PPT

PROJECT 2

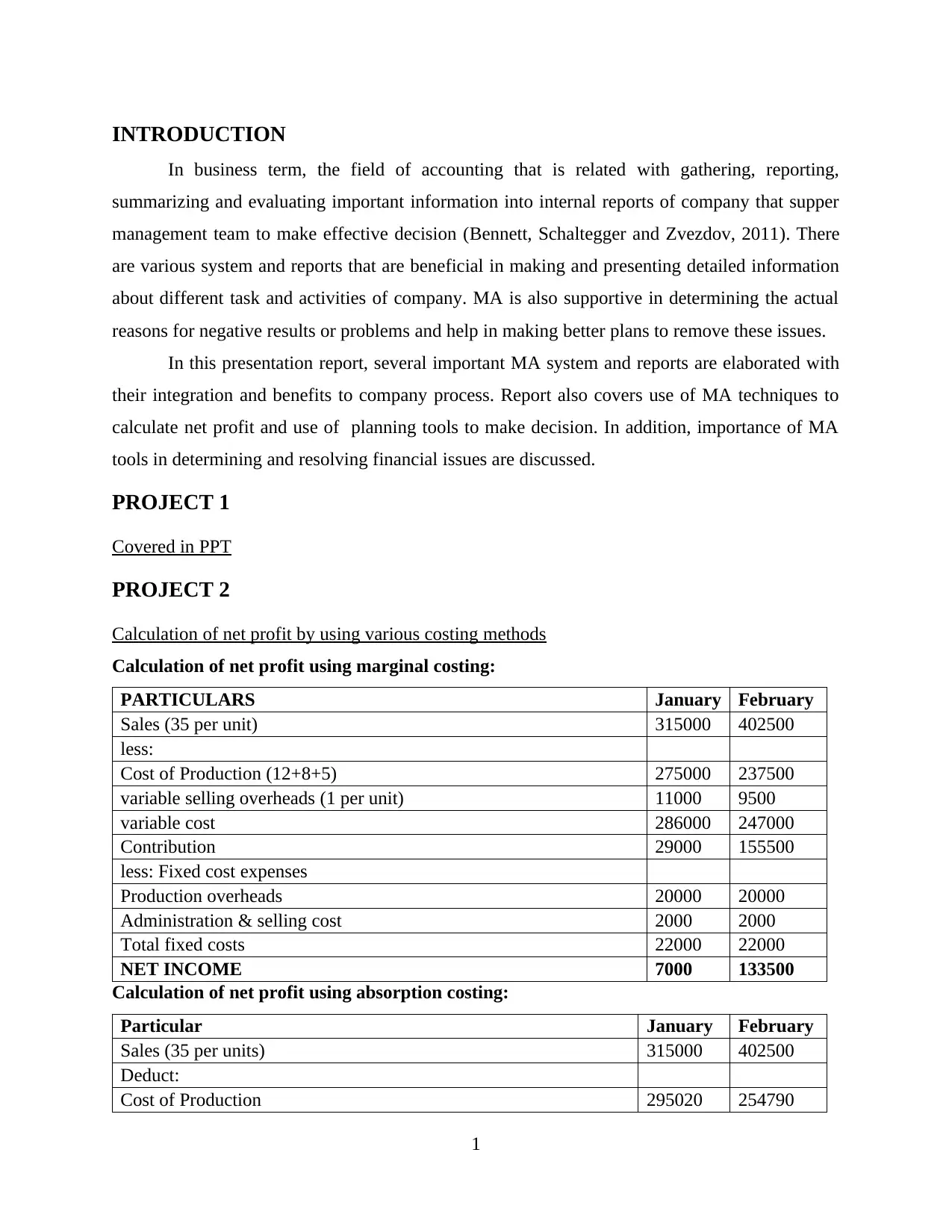

Calculation of net profit by using various costing methods

Calculation of net profit using marginal costing:

PARTICULARS January February

Sales (35 per unit) 315000 402500

less:

Cost of Production (12+8+5) 275000 237500

variable selling overheads (1 per unit) 11000 9500

variable cost 286000 247000

Contribution 29000 155500

less: Fixed cost expenses

Production overheads 20000 20000

Administration & selling cost 2000 2000

Total fixed costs 22000 22000

NET INCOME 7000 133500

Calculation of net profit using absorption costing:

Particular January February

Sales (35 per units) 315000 402500

Deduct:

Cost of Production 295020 254790

1

In business term, the field of accounting that is related with gathering, reporting,

summarizing and evaluating important information into internal reports of company that supper

management team to make effective decision (Bennett, Schaltegger and Zvezdov, 2011). There

are various system and reports that are beneficial in making and presenting detailed information

about different task and activities of company. MA is also supportive in determining the actual

reasons for negative results or problems and help in making better plans to remove these issues.

In this presentation report, several important MA system and reports are elaborated with

their integration and benefits to company process. Report also covers use of MA techniques to

calculate net profit and use of planning tools to make decision. In addition, importance of MA

tools in determining and resolving financial issues are discussed.

PROJECT 1

Covered in PPT

PROJECT 2

Calculation of net profit by using various costing methods

Calculation of net profit using marginal costing:

PARTICULARS January February

Sales (35 per unit) 315000 402500

less:

Cost of Production (12+8+5) 275000 237500

variable selling overheads (1 per unit) 11000 9500

variable cost 286000 247000

Contribution 29000 155500

less: Fixed cost expenses

Production overheads 20000 20000

Administration & selling cost 2000 2000

Total fixed costs 22000 22000

NET INCOME 7000 133500

Calculation of net profit using absorption costing:

Particular January February

Sales (35 per units) 315000 402500

Deduct:

Cost of Production 295020 254790

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Gross Profit 19980 147710

LESS:

Fixed and variable expenses:

Variable sales overheads (@1 per unit) 9000 11500

Fixed selling expenses 2000 2000

Total costs 11000 13500

NET INCOME 8980 134210

Various types of management accounting techniques

Management accounting methods are crucial instruments that enable a company measure

its net income by deducting all the costs involved during that time (Callahan, Stetz and Brooks,

2011). Such strategies are used by a furniture distributor like UCK to profit from the benefits of

optimal resource usage and sustainable development and growth. UCK furniture typically uses

marginal cost approach to become more precise, since it is known to be the most effective and

efficient system. This is because it represents more productivity and that only pays variable

expenses toward sales revenue. On the other side it is stated that other management reporting

methods include normal costing, absorption costing, historical costing etc. The primary purpose

of such methods is to assess net productivity from either the information presented in

management records and studies, including estimation of various factors such as fixed and

variable income, as well as the total paid by the company when paying all overhead costs.

Data interpretation by using costing method

The above calculation define that both costing approaches are beneficial that are used to

evaluate the net profit of UCK furniture for a respective year (Christ, 2014). As per the marginal

costing the contribution for month of January is far lesser than the amount of February month.

As in January the contribution is 29000 and in February it is 155500 thus the net profit after

writing off fixed costs in the month of January is 7000 and in February is 133500.

From the absorption costing method it is determined that net income in this method is

higher than net profit from marginal costing. Such as the net income in month of January is 8980

and for month of February it is 134210. the main difference between the net profit figure is the

treatment of variable cost which gets absorbed in case of absorption costing.

Advantage and disadvantage of various types of planning tools

In Management accounting, different kind of planning tool is used which is consider to

be most important component through which the company may undertake while making business

2

LESS:

Fixed and variable expenses:

Variable sales overheads (@1 per unit) 9000 11500

Fixed selling expenses 2000 2000

Total costs 11000 13500

NET INCOME 8980 134210

Various types of management accounting techniques

Management accounting methods are crucial instruments that enable a company measure

its net income by deducting all the costs involved during that time (Callahan, Stetz and Brooks,

2011). Such strategies are used by a furniture distributor like UCK to profit from the benefits of

optimal resource usage and sustainable development and growth. UCK furniture typically uses

marginal cost approach to become more precise, since it is known to be the most effective and

efficient system. This is because it represents more productivity and that only pays variable

expenses toward sales revenue. On the other side it is stated that other management reporting

methods include normal costing, absorption costing, historical costing etc. The primary purpose

of such methods is to assess net productivity from either the information presented in

management records and studies, including estimation of various factors such as fixed and

variable income, as well as the total paid by the company when paying all overhead costs.

Data interpretation by using costing method

The above calculation define that both costing approaches are beneficial that are used to

evaluate the net profit of UCK furniture for a respective year (Christ, 2014). As per the marginal

costing the contribution for month of January is far lesser than the amount of February month.

As in January the contribution is 29000 and in February it is 155500 thus the net profit after

writing off fixed costs in the month of January is 7000 and in February is 133500.

From the absorption costing method it is determined that net income in this method is

higher than net profit from marginal costing. Such as the net income in month of January is 8980

and for month of February it is 134210. the main difference between the net profit figure is the

treatment of variable cost which gets absorbed in case of absorption costing.

Advantage and disadvantage of various types of planning tools

In Management accounting, different kind of planning tool is used which is consider to

be most important component through which the company may undertake while making business

2

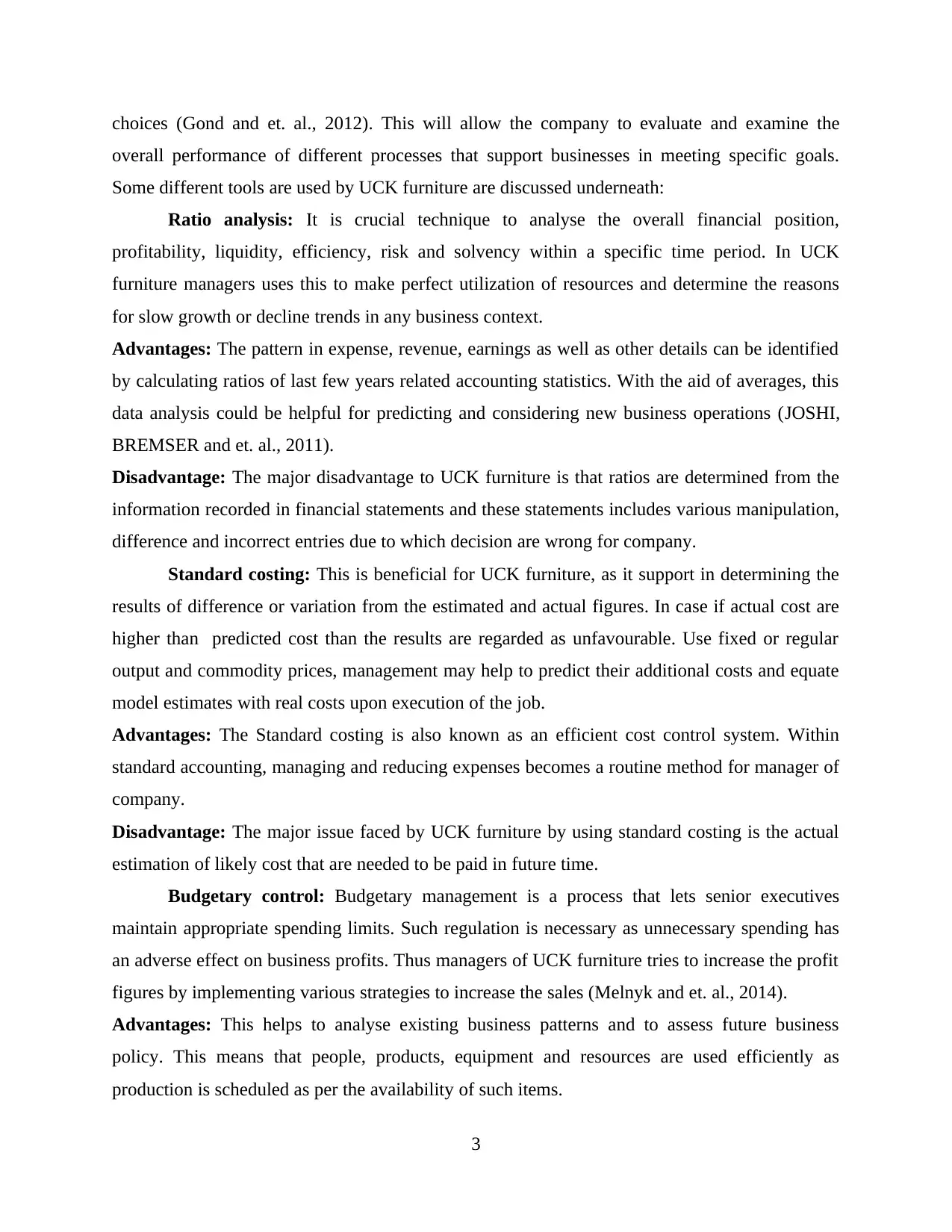

choices (Gond and et. al., 2012). This will allow the company to evaluate and examine the

overall performance of different processes that support businesses in meeting specific goals.

Some different tools are used by UCK furniture are discussed underneath:

Ratio analysis: It is crucial technique to analyse the overall financial position,

profitability, liquidity, efficiency, risk and solvency within a specific time period. In UCK

furniture managers uses this to make perfect utilization of resources and determine the reasons

for slow growth or decline trends in any business context.

Advantages: The pattern in expense, revenue, earnings as well as other details can be identified

by calculating ratios of last few years related accounting statistics. With the aid of averages, this

data analysis could be helpful for predicting and considering new business operations (JOSHI,

BREMSER and et. al., 2011).

Disadvantage: The major disadvantage to UCK furniture is that ratios are determined from the

information recorded in financial statements and these statements includes various manipulation,

difference and incorrect entries due to which decision are wrong for company.

Standard costing: This is beneficial for UCK furniture, as it support in determining the

results of difference or variation from the estimated and actual figures. In case if actual cost are

higher than predicted cost than the results are regarded as unfavourable. Use fixed or regular

output and commodity prices, management may help to predict their additional costs and equate

model estimates with real costs upon execution of the job.

Advantages: The Standard costing is also known as an efficient cost control system. Within

standard accounting, managing and reducing expenses becomes a routine method for manager of

company.

Disadvantage: The major issue faced by UCK furniture by using standard costing is the actual

estimation of likely cost that are needed to be paid in future time.

Budgetary control: Budgetary management is a process that lets senior executives

maintain appropriate spending limits. Such regulation is necessary as unnecessary spending has

an adverse effect on business profits. Thus managers of UCK furniture tries to increase the profit

figures by implementing various strategies to increase the sales (Melnyk and et. al., 2014).

Advantages: This helps to analyse existing business patterns and to assess future business

policy. This means that people, products, equipment and resources are used efficiently as

production is scheduled as per the availability of such items.

3

overall performance of different processes that support businesses in meeting specific goals.

Some different tools are used by UCK furniture are discussed underneath:

Ratio analysis: It is crucial technique to analyse the overall financial position,

profitability, liquidity, efficiency, risk and solvency within a specific time period. In UCK

furniture managers uses this to make perfect utilization of resources and determine the reasons

for slow growth or decline trends in any business context.

Advantages: The pattern in expense, revenue, earnings as well as other details can be identified

by calculating ratios of last few years related accounting statistics. With the aid of averages, this

data analysis could be helpful for predicting and considering new business operations (JOSHI,

BREMSER and et. al., 2011).

Disadvantage: The major disadvantage to UCK furniture is that ratios are determined from the

information recorded in financial statements and these statements includes various manipulation,

difference and incorrect entries due to which decision are wrong for company.

Standard costing: This is beneficial for UCK furniture, as it support in determining the

results of difference or variation from the estimated and actual figures. In case if actual cost are

higher than predicted cost than the results are regarded as unfavourable. Use fixed or regular

output and commodity prices, management may help to predict their additional costs and equate

model estimates with real costs upon execution of the job.

Advantages: The Standard costing is also known as an efficient cost control system. Within

standard accounting, managing and reducing expenses becomes a routine method for manager of

company.

Disadvantage: The major issue faced by UCK furniture by using standard costing is the actual

estimation of likely cost that are needed to be paid in future time.

Budgetary control: Budgetary management is a process that lets senior executives

maintain appropriate spending limits. Such regulation is necessary as unnecessary spending has

an adverse effect on business profits. Thus managers of UCK furniture tries to increase the profit

figures by implementing various strategies to increase the sales (Melnyk and et. al., 2014).

Advantages: This helps to analyse existing business patterns and to assess future business

policy. This means that people, products, equipment and resources are used efficiently as

production is scheduled as per the availability of such items.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Disadvantage: Budgets will act as strategic effort restrictions, as each director seeks to achieve

the goals that are budgeted.

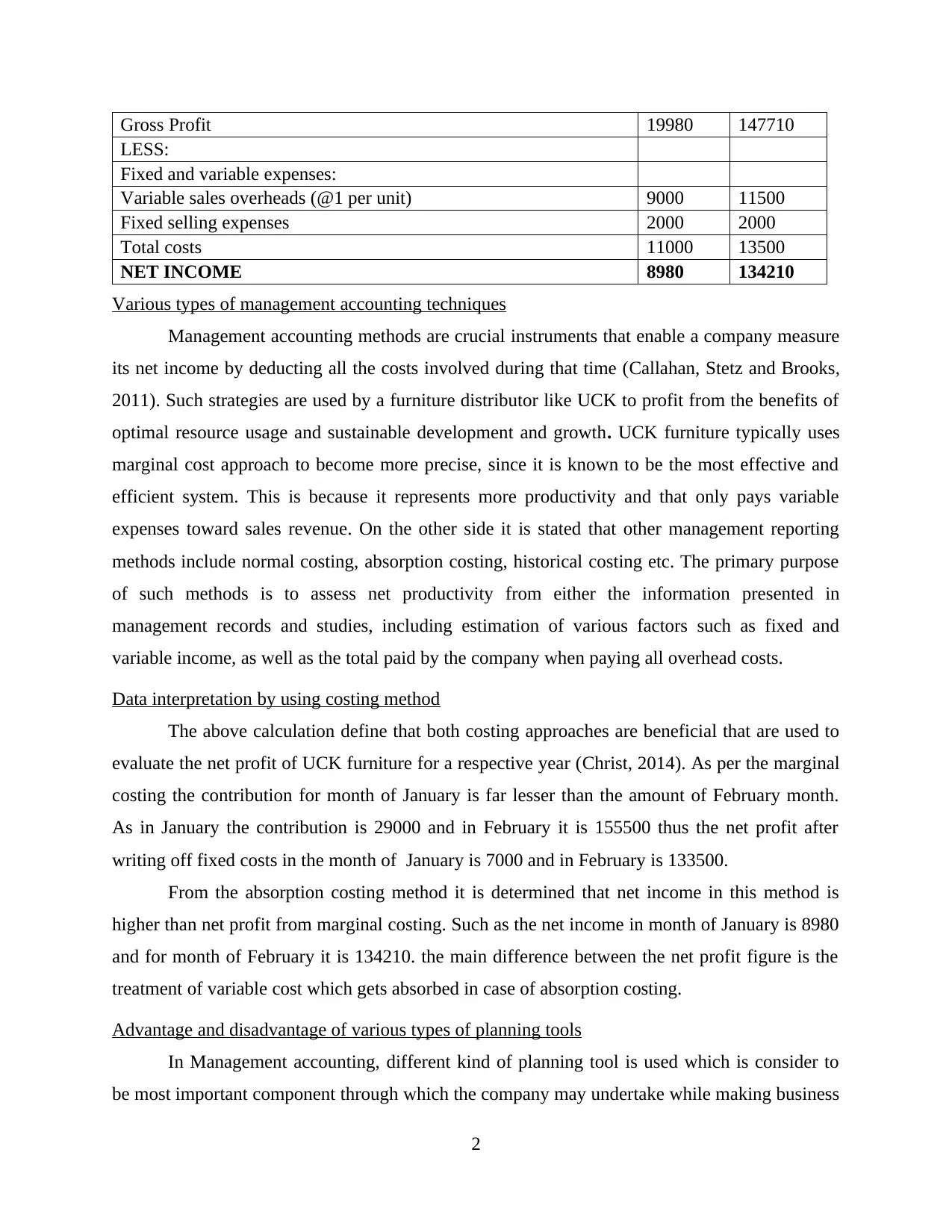

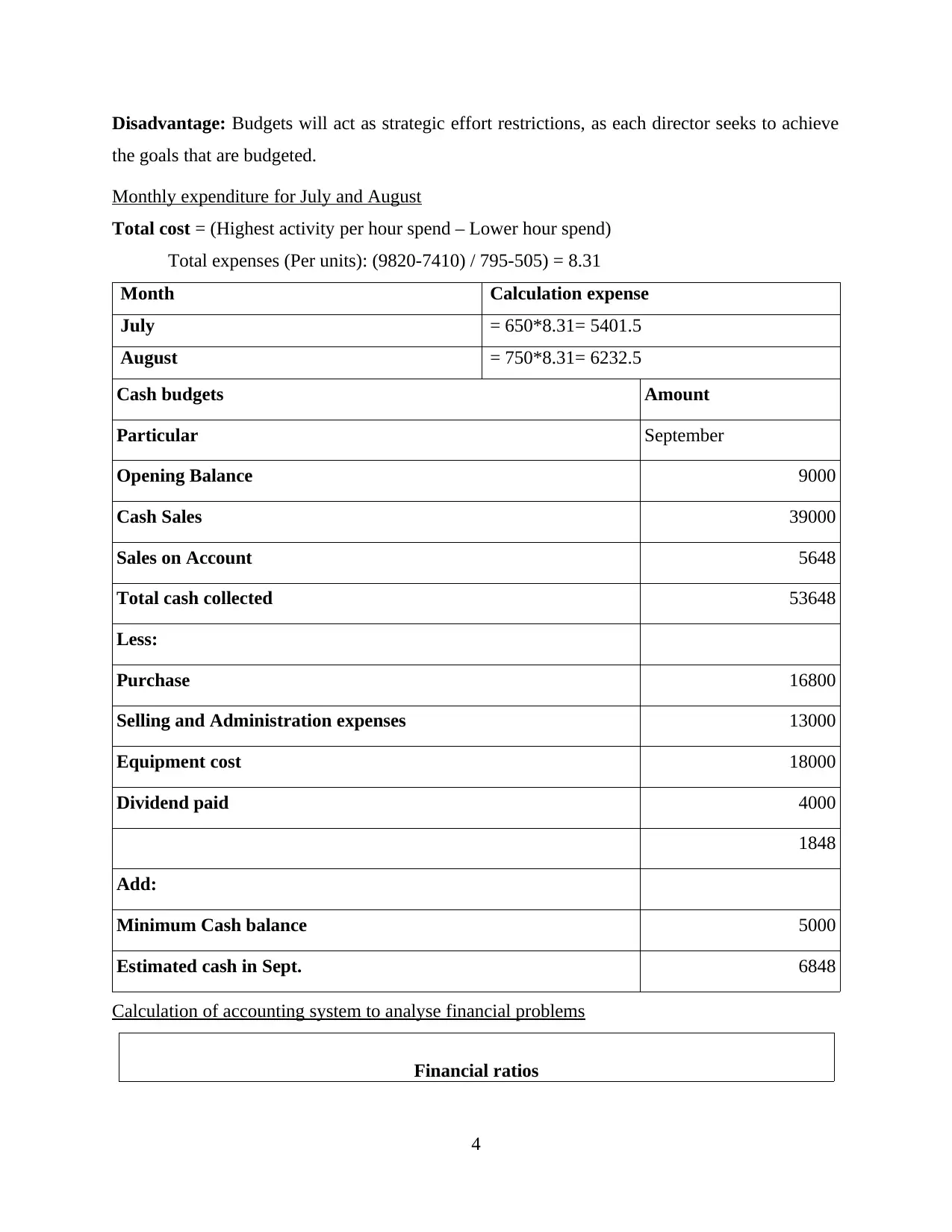

Monthly expenditure for July and August

Total cost = (Highest activity per hour spend – Lower hour spend)

Total expenses (Per units): (9820-7410) / 795-505) = 8.31

Month Calculation expense

July = 650*8.31= 5401.5

August = 750*8.31= 6232.5

Cash budgets Amount

Particular September

Opening Balance 9000

Cash Sales 39000

Sales on Account 5648

Total cash collected 53648

Less:

Purchase 16800

Selling and Administration expenses 13000

Equipment cost 18000

Dividend paid 4000

1848

Add:

Minimum Cash balance 5000

Estimated cash in Sept. 6848

Calculation of accounting system to analyse financial problems

Financial ratios

4

the goals that are budgeted.

Monthly expenditure for July and August

Total cost = (Highest activity per hour spend – Lower hour spend)

Total expenses (Per units): (9820-7410) / 795-505) = 8.31

Month Calculation expense

July = 650*8.31= 5401.5

August = 750*8.31= 6232.5

Cash budgets Amount

Particular September

Opening Balance 9000

Cash Sales 39000

Sales on Account 5648

Total cash collected 53648

Less:

Purchase 16800

Selling and Administration expenses 13000

Equipment cost 18000

Dividend paid 4000

1848

Add:

Minimum Cash balance 5000

Estimated cash in Sept. 6848

Calculation of accounting system to analyse financial problems

Financial ratios

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

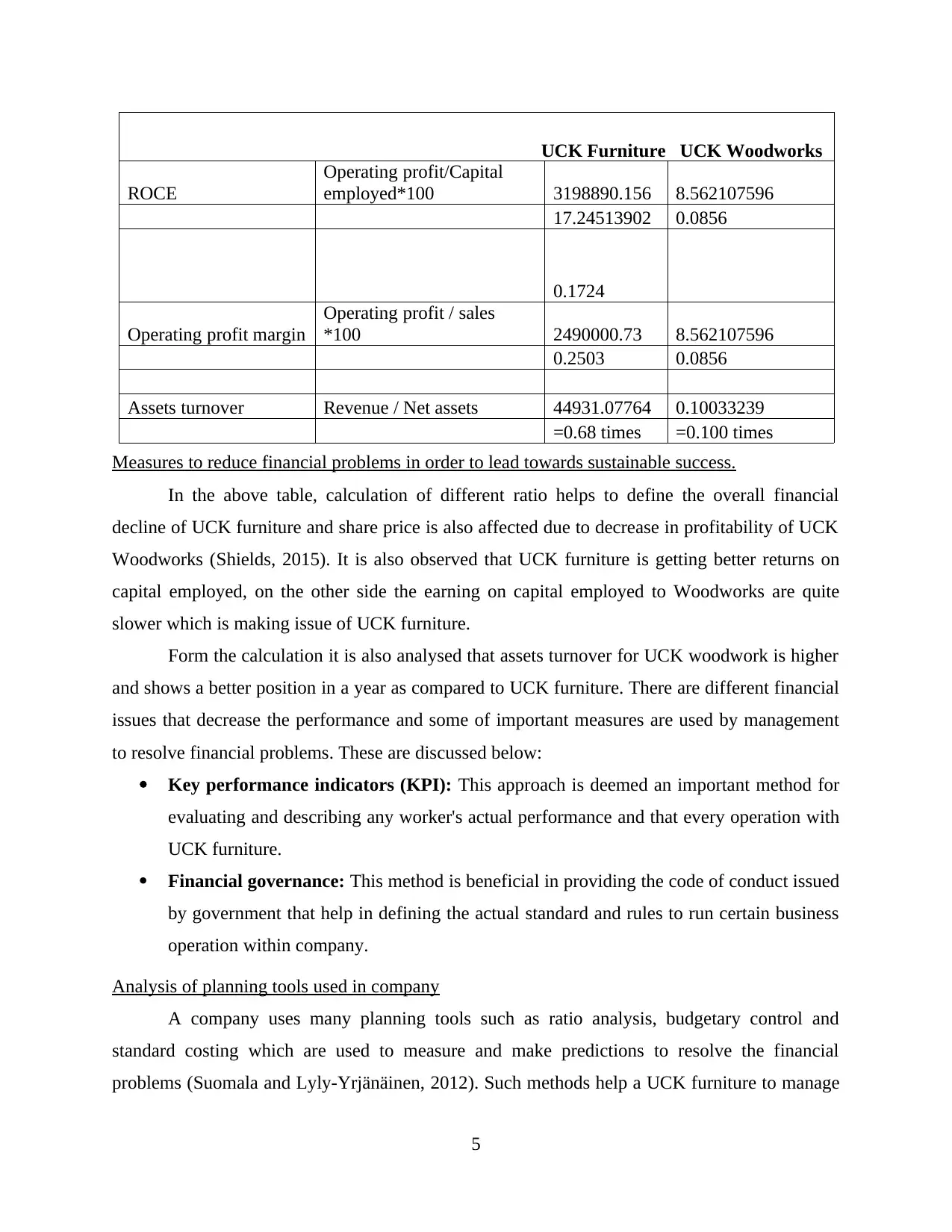

UCK Furniture UCK Woodworks

ROCE

Operating profit/Capital

employed*100 3198890.156 8.562107596

17.24513902 0.0856

0.1724

Operating profit margin

Operating profit / sales

*100 2490000.73 8.562107596

0.2503 0.0856

Assets turnover Revenue / Net assets 44931.07764 0.10033239

=0.68 times =0.100 times

Measures to reduce financial problems in order to lead towards sustainable success.

In the above table, calculation of different ratio helps to define the overall financial

decline of UCK furniture and share price is also affected due to decrease in profitability of UCK

Woodworks (Shields, 2015). It is also observed that UCK furniture is getting better returns on

capital employed, on the other side the earning on capital employed to Woodworks are quite

slower which is making issue of UCK furniture.

Form the calculation it is also analysed that assets turnover for UCK woodwork is higher

and shows a better position in a year as compared to UCK furniture. There are different financial

issues that decrease the performance and some of important measures are used by management

to resolve financial problems. These are discussed below:

Key performance indicators (KPI): This approach is deemed an important method for

evaluating and describing any worker's actual performance and that every operation with

UCK furniture.

Financial governance: This method is beneficial in providing the code of conduct issued

by government that help in defining the actual standard and rules to run certain business

operation within company.

Analysis of planning tools used in company

A company uses many planning tools such as ratio analysis, budgetary control and

standard costing which are used to measure and make predictions to resolve the financial

problems (Suomala and Lyly-Yrjänäinen, 2012). Such methods help a UCK furniture to manage

5

ROCE

Operating profit/Capital

employed*100 3198890.156 8.562107596

17.24513902 0.0856

0.1724

Operating profit margin

Operating profit / sales

*100 2490000.73 8.562107596

0.2503 0.0856

Assets turnover Revenue / Net assets 44931.07764 0.10033239

=0.68 times =0.100 times

Measures to reduce financial problems in order to lead towards sustainable success.

In the above table, calculation of different ratio helps to define the overall financial

decline of UCK furniture and share price is also affected due to decrease in profitability of UCK

Woodworks (Shields, 2015). It is also observed that UCK furniture is getting better returns on

capital employed, on the other side the earning on capital employed to Woodworks are quite

slower which is making issue of UCK furniture.

Form the calculation it is also analysed that assets turnover for UCK woodwork is higher

and shows a better position in a year as compared to UCK furniture. There are different financial

issues that decrease the performance and some of important measures are used by management

to resolve financial problems. These are discussed below:

Key performance indicators (KPI): This approach is deemed an important method for

evaluating and describing any worker's actual performance and that every operation with

UCK furniture.

Financial governance: This method is beneficial in providing the code of conduct issued

by government that help in defining the actual standard and rules to run certain business

operation within company.

Analysis of planning tools used in company

A company uses many planning tools such as ratio analysis, budgetary control and

standard costing which are used to measure and make predictions to resolve the financial

problems (Suomala and Lyly-Yrjänäinen, 2012). Such methods help a UCK furniture to manage

5

the risk and provide a number of potential scenarios so that reasonable precautions could be

implemented.

CONCLUSION

In the end of report, it is concluded that MA is an effective process that support in

making valuable reports with the help of system to ease the decision making process of internal

manager. Various costing methods such as marginal and absorption costing are used to calculate

the net profit for the year. Different planning tools such as Ratio analysis, Standard costing and

Budgetary control are effective in determining the financial issues and making effective ways to

resolve these issues.

6

implemented.

CONCLUSION

In the end of report, it is concluded that MA is an effective process that support in

making valuable reports with the help of system to ease the decision making process of internal

manager. Various costing methods such as marginal and absorption costing are used to calculate

the net profit for the year. Different planning tools such as Ratio analysis, Standard costing and

Budgetary control are effective in determining the financial issues and making effective ways to

resolve these issues.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

REFERENCES

Books and Journals:

Bennett, M., Schaltegger, S. and Zvezdov, D., 2011. Environmental management accounting. In

Review of management accounting research (pp. 53-84). Palgrave Macmillan, London.

Callahan, K. R., Stetz, G. S. and Brooks, L. M., 2011. Project Management Accounting, with

Website: Budgeting, Tracking, and Reporting Costs and Profitability (Vol. 565). John

Wiley & Sons.

Christ, K. L., 2014. Water management accounting and the wine supply chain: Empirical

evidence from Australia. The British Accounting Review, 46(4). pp.379-396.

Gond, J. P., and et. al., 2012. Configuring management control systems: Theorizing the

integration of strategy and sustainability. Management Accounting Research, 23(3).

pp.205-223.

JOSHI, P. L., BREMSER, and et. al., 2011. Diffusion of management accounting practices in

gulf cooperation council countries. Accounting Perspectives, 10(1). pp.23-53.

Melnyk, S. A., and et. al., 2014. Is performance measurement and management fit for the

future?. Management Accounting Research, 25(2). pp.173-186.

Shields, M. D., 2015. Established management accounting knowledge. Journal of Management

Accounting Research, 27(1). pp.123-132.

Suomala, P. and Lyly-Yrjänäinen, J., 2012. Management accounting research in practice:

Lessons learned from an interventionist approach. Routledge.

7

Books and Journals:

Bennett, M., Schaltegger, S. and Zvezdov, D., 2011. Environmental management accounting. In

Review of management accounting research (pp. 53-84). Palgrave Macmillan, London.

Callahan, K. R., Stetz, G. S. and Brooks, L. M., 2011. Project Management Accounting, with

Website: Budgeting, Tracking, and Reporting Costs and Profitability (Vol. 565). John

Wiley & Sons.

Christ, K. L., 2014. Water management accounting and the wine supply chain: Empirical

evidence from Australia. The British Accounting Review, 46(4). pp.379-396.

Gond, J. P., and et. al., 2012. Configuring management control systems: Theorizing the

integration of strategy and sustainability. Management Accounting Research, 23(3).

pp.205-223.

JOSHI, P. L., BREMSER, and et. al., 2011. Diffusion of management accounting practices in

gulf cooperation council countries. Accounting Perspectives, 10(1). pp.23-53.

Melnyk, S. A., and et. al., 2014. Is performance measurement and management fit for the

future?. Management Accounting Research, 25(2). pp.173-186.

Shields, M. D., 2015. Established management accounting knowledge. Journal of Management

Accounting Research, 27(1). pp.123-132.

Suomala, P. and Lyly-Yrjänäinen, J., 2012. Management accounting research in practice:

Lessons learned from an interventionist approach. Routledge.

7

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.