Management Accounting Report: IMDA Tech Ltd. Decision Making Tools

VerifiedAdded on 2020/01/07

|14

|4196

|208

Report

AI Summary

This report analyzes management accounting principles and their application within IMDA Tech Limited. It begins by defining management accounting and contrasting it with financial accounting, emphasizing its role in managerial decision-making. The report then delves into different types of management accounting systems, including cost accounting, inventory management, and job costing. It examines costing methods, comparing absorption and marginal costing. The report also covers budgeting processes, pricing strategies, and the use of the balance scorecard for performance evaluation and financial governance. The report provides a detailed look into how these tools can be used to improve financial performance and strategic decision-making within a business. The provided solution offers a comprehensive understanding of management accounting concepts and their practical implementation.

Management Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION........................................................................................................................................3

TASK 1.........................................................................................................................................................3

a) Definition of management accounting and comparison between management accounting and

financial accounting.................................................................................................................................3

b) Types of management accounting system ..........................................................................................7

TASK 2.........................................................................................................................................................7

1. Using absorption costing method .......................................................................................................7

2. Using marginal costing method...........................................................................................................8

TASK 3.........................................................................................................................................................9

a) Type of Budget and there advantage/disadvantage.............................................................................9

b) Process of preparing a budget...........................................................................................................10

c) Pricing strategies of the business ......................................................................................................10

TASK 4.......................................................................................................................................................10

a) Balance score card approach.............................................................................................................10

1. Use of balance score card for intensification and responding to the financial problems..................11

2. Use of balance scorecard in order to improve the financial governance...........................................11

CONCLUSION..........................................................................................................................................11

REFERENCES...........................................................................................................................................12

INTRODUCTION........................................................................................................................................3

TASK 1.........................................................................................................................................................3

a) Definition of management accounting and comparison between management accounting and

financial accounting.................................................................................................................................3

b) Types of management accounting system ..........................................................................................7

TASK 2.........................................................................................................................................................7

1. Using absorption costing method .......................................................................................................7

2. Using marginal costing method...........................................................................................................8

TASK 3.........................................................................................................................................................9

a) Type of Budget and there advantage/disadvantage.............................................................................9

b) Process of preparing a budget...........................................................................................................10

c) Pricing strategies of the business ......................................................................................................10

TASK 4.......................................................................................................................................................10

a) Balance score card approach.............................................................................................................10

1. Use of balance score card for intensification and responding to the financial problems..................11

2. Use of balance scorecard in order to improve the financial governance...........................................11

CONCLUSION..........................................................................................................................................11

REFERENCES...........................................................................................................................................12

INTRODUCTION

Management accounting is a managerial tool for making the success of organisation. It include

all such report which are prepared by the manager so that they can estimate the actual resources which

are available in the organisation (Wajeetongratana, 2016). Management accounting is a process which

involves policy making, setting the rules and regulations and working as per decided procedure so that

business can utilizes there resources effectively so that they can accomplish there future goals. It also

help help the manager to allocate the funds in appropriate way so that such fund can be used in future as

per need. By following management accounting approach, it make smoothing in operational; activity, in

this way such accounting techniques increases the efficiency of any organisation. Management

accounting and there different approaches such as costing methods help the manager to estimate the

appropriate cost of unit so that manager can determine the actual cost of the products and work

effectively.

In this research report, IMDA Tech Limited is taken as new established company, which can

produce different mobile chargers for specific mobile set and phones. It also describes the various

techniques which are followed by IMDA Tech Limited (UK). In this report it describes the concept of

management accounting make comparison with financial accounting and it also explain the role of

management accounting as business decision making tools which department manager can use to take

right decision in different department. It also describes the various costing system so that manager can

estimate the cost of unit by making effective calculation. This report also describes the budget and

process for setting a right budget by using different pricing strategies. This report explain the balance

scorecard which are blueprint of the company's success and there use to make effective control for

developing the effective strategies in an organisation.

TASK 1

a) Definition of management accounting and comparison between management accounting and financial

accounting

To: Line Manager, Imda Tech UK Limited

From: Management Accounting Officer

Date: 26 May 2017

Subject: Importance of management accounting and difference from financial accounting.

Management accounting is a managerial process which include various management function

such planning, organising, staffing., controlling, directing, motivating etc. so that firm can

accomplishes there goals by using the management function. All such kind of strategies are execute by

Management accounting is a managerial tool for making the success of organisation. It include

all such report which are prepared by the manager so that they can estimate the actual resources which

are available in the organisation (Wajeetongratana, 2016). Management accounting is a process which

involves policy making, setting the rules and regulations and working as per decided procedure so that

business can utilizes there resources effectively so that they can accomplish there future goals. It also

help help the manager to allocate the funds in appropriate way so that such fund can be used in future as

per need. By following management accounting approach, it make smoothing in operational; activity, in

this way such accounting techniques increases the efficiency of any organisation. Management

accounting and there different approaches such as costing methods help the manager to estimate the

appropriate cost of unit so that manager can determine the actual cost of the products and work

effectively.

In this research report, IMDA Tech Limited is taken as new established company, which can

produce different mobile chargers for specific mobile set and phones. It also describes the various

techniques which are followed by IMDA Tech Limited (UK). In this report it describes the concept of

management accounting make comparison with financial accounting and it also explain the role of

management accounting as business decision making tools which department manager can use to take

right decision in different department. It also describes the various costing system so that manager can

estimate the cost of unit by making effective calculation. This report also describes the budget and

process for setting a right budget by using different pricing strategies. This report explain the balance

scorecard which are blueprint of the company's success and there use to make effective control for

developing the effective strategies in an organisation.

TASK 1

a) Definition of management accounting and comparison between management accounting and financial

accounting

To: Line Manager, Imda Tech UK Limited

From: Management Accounting Officer

Date: 26 May 2017

Subject: Importance of management accounting and difference from financial accounting.

Management accounting is a managerial process which include various management function

such planning, organising, staffing., controlling, directing, motivating etc. so that firm can

accomplishes there goals by using the management function. All such kind of strategies are execute by

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

the manager so that organisation can increases there efficiency and set there standard. Management

accounting also use the information, facts, data which are reliable and accurate in nature and considered

as improving managerial tools (Vosselman, 2014).

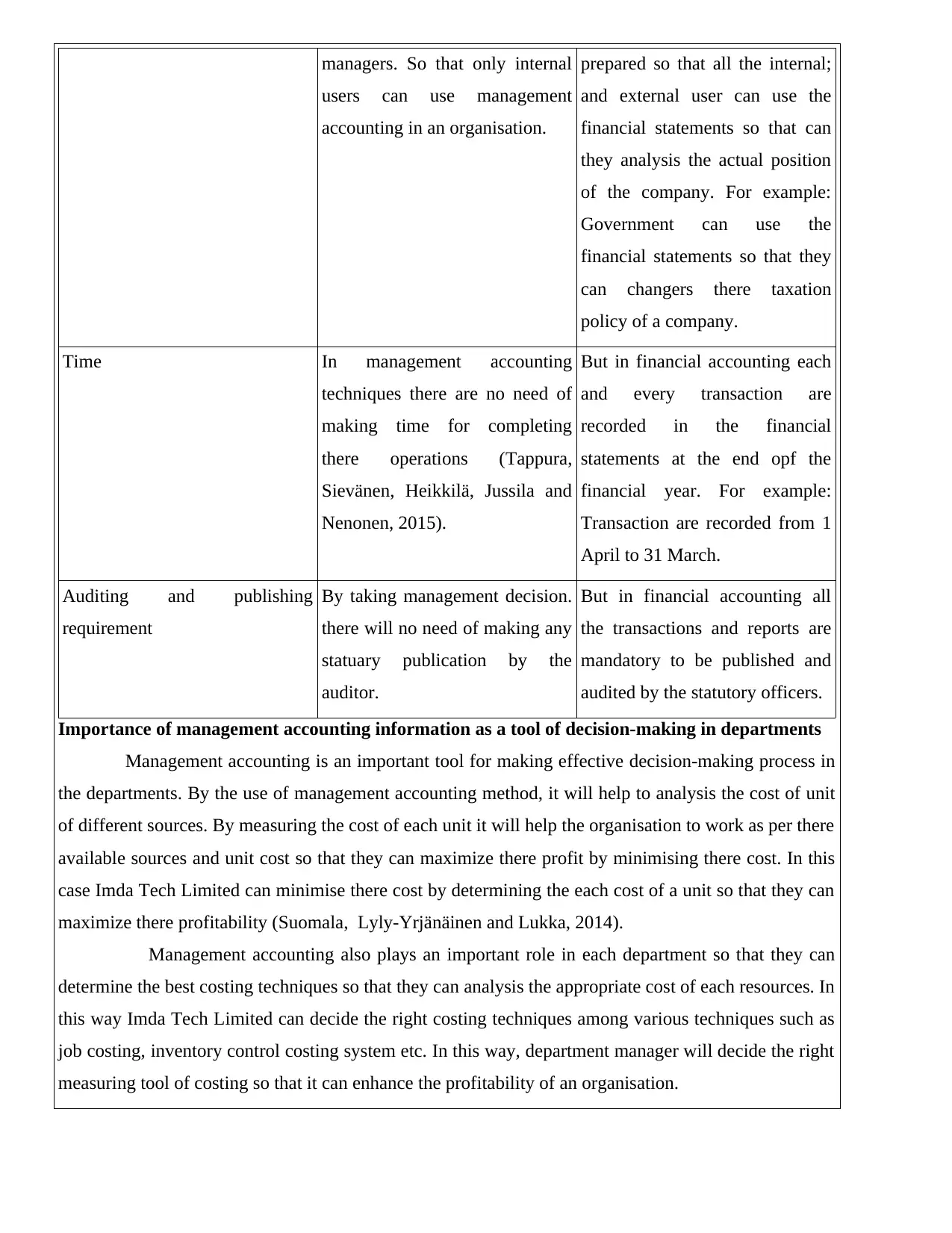

Making comparison between management accounting and financial accounting

Basis of Comparison Management accounting Financial accounting

Meaning/Concept Management accounting is a

managerial function of making

effective plan, organisation of

each activity, directing the work

by the employer and making

effective control on each task

and motivate to the employees.

Management accounting can be

done by using all the

information, facts and arranging

them in a appropriate report

format so that each activities can

be estimate by the managers.

Financial accounting is a

financial process which includes

all the financial activity such

preparing a company's financial

statements such profit and loss

account, cash flow, statements of

affairs etc. so that managers can

determine the company's actual

position at the end of the

accounting period.

Requirement in organisation or

not?

Management accounting is a

process which include the report

of each and every informations

and facts so that it can estimate

and increases the organisation's

capability. So that it is not

necessary to approaching

management accounting process

because this accounting

techniques is followed by the

company as per there need.

Financial accounting is an

essential tool for any

organisation's growth. It include

preparing of financial statements

such income statement, balance

sheet etc. In this way every

business organisation should

maintain the financial accounting

approach so that they can

estimate the company's actual

position.

Objectives The main objective of Imda tech

limited is to make effective

control in business operational

The main objective of using

financial accounting is to know

the actual position of the

accounting also use the information, facts, data which are reliable and accurate in nature and considered

as improving managerial tools (Vosselman, 2014).

Making comparison between management accounting and financial accounting

Basis of Comparison Management accounting Financial accounting

Meaning/Concept Management accounting is a

managerial function of making

effective plan, organisation of

each activity, directing the work

by the employer and making

effective control on each task

and motivate to the employees.

Management accounting can be

done by using all the

information, facts and arranging

them in a appropriate report

format so that each activities can

be estimate by the managers.

Financial accounting is a

financial process which includes

all the financial activity such

preparing a company's financial

statements such profit and loss

account, cash flow, statements of

affairs etc. so that managers can

determine the company's actual

position at the end of the

accounting period.

Requirement in organisation or

not?

Management accounting is a

process which include the report

of each and every informations

and facts so that it can estimate

and increases the organisation's

capability. So that it is not

necessary to approaching

management accounting process

because this accounting

techniques is followed by the

company as per there need.

Financial accounting is an

essential tool for any

organisation's growth. It include

preparing of financial statements

such income statement, balance

sheet etc. In this way every

business organisation should

maintain the financial accounting

approach so that they can

estimate the company's actual

position.

Objectives The main objective of Imda tech

limited is to make effective

control in business operational

The main objective of using

financial accounting is to know

the actual position of the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

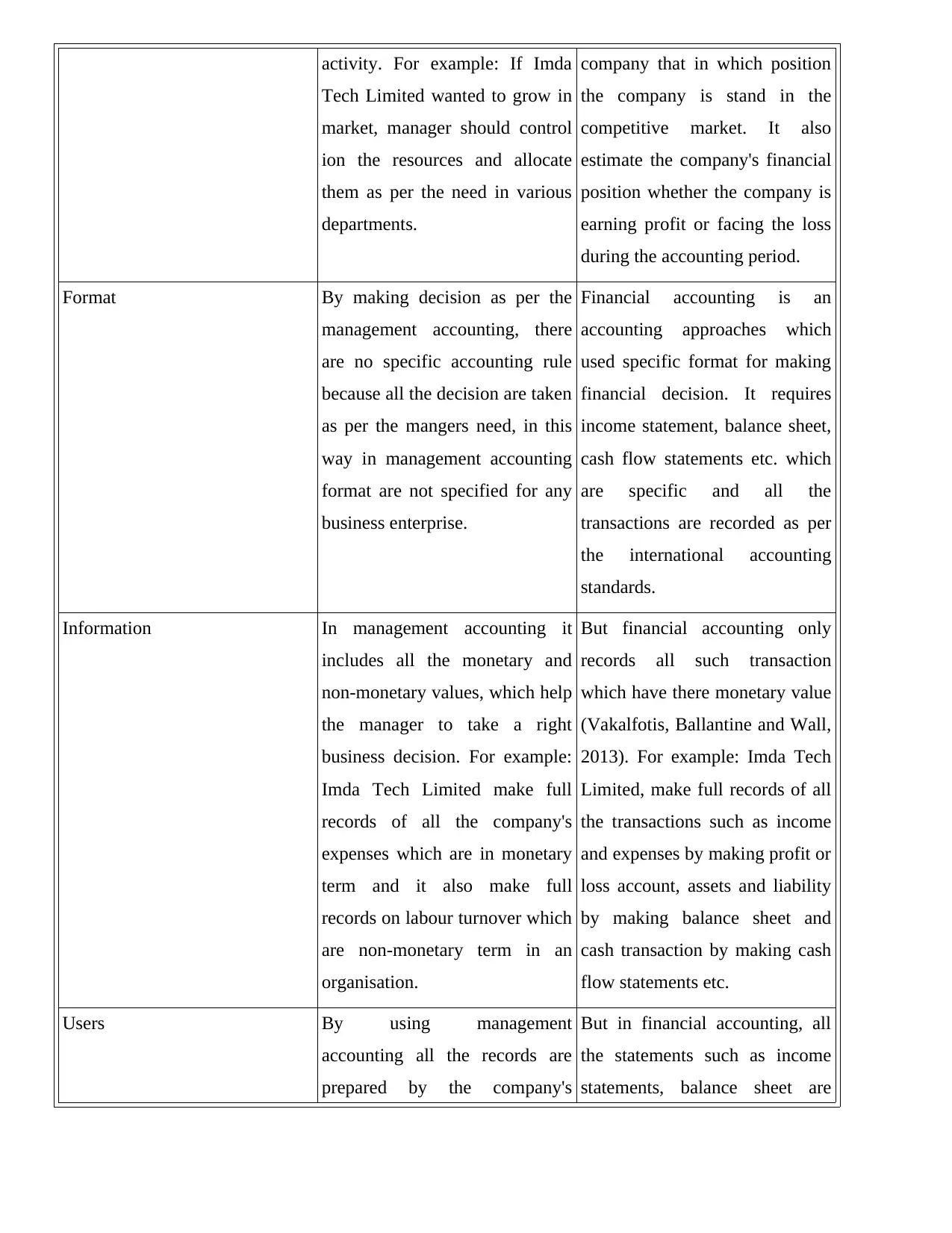

activity. For example: If Imda

Tech Limited wanted to grow in

market, manager should control

ion the resources and allocate

them as per the need in various

departments.

company that in which position

the company is stand in the

competitive market. It also

estimate the company's financial

position whether the company is

earning profit or facing the loss

during the accounting period.

Format By making decision as per the

management accounting, there

are no specific accounting rule

because all the decision are taken

as per the mangers need, in this

way in management accounting

format are not specified for any

business enterprise.

Financial accounting is an

accounting approaches which

used specific format for making

financial decision. It requires

income statement, balance sheet,

cash flow statements etc. which

are specific and all the

transactions are recorded as per

the international accounting

standards.

Information In management accounting it

includes all the monetary and

non-monetary values, which help

the manager to take a right

business decision. For example:

Imda Tech Limited make full

records of all the company's

expenses which are in monetary

term and it also make full

records on labour turnover which

are non-monetary term in an

organisation.

But financial accounting only

records all such transaction

which have there monetary value

(Vakalfotis, Ballantine and Wall,

2013). For example: Imda Tech

Limited, make full records of all

the transactions such as income

and expenses by making profit or

loss account, assets and liability

by making balance sheet and

cash transaction by making cash

flow statements etc.

Users By using management

accounting all the records are

prepared by the company's

But in financial accounting, all

the statements such as income

statements, balance sheet are

Tech Limited wanted to grow in

market, manager should control

ion the resources and allocate

them as per the need in various

departments.

company that in which position

the company is stand in the

competitive market. It also

estimate the company's financial

position whether the company is

earning profit or facing the loss

during the accounting period.

Format By making decision as per the

management accounting, there

are no specific accounting rule

because all the decision are taken

as per the mangers need, in this

way in management accounting

format are not specified for any

business enterprise.

Financial accounting is an

accounting approaches which

used specific format for making

financial decision. It requires

income statement, balance sheet,

cash flow statements etc. which

are specific and all the

transactions are recorded as per

the international accounting

standards.

Information In management accounting it

includes all the monetary and

non-monetary values, which help

the manager to take a right

business decision. For example:

Imda Tech Limited make full

records of all the company's

expenses which are in monetary

term and it also make full

records on labour turnover which

are non-monetary term in an

organisation.

But financial accounting only

records all such transaction

which have there monetary value

(Vakalfotis, Ballantine and Wall,

2013). For example: Imda Tech

Limited, make full records of all

the transactions such as income

and expenses by making profit or

loss account, assets and liability

by making balance sheet and

cash transaction by making cash

flow statements etc.

Users By using management

accounting all the records are

prepared by the company's

But in financial accounting, all

the statements such as income

statements, balance sheet are

managers. So that only internal

users can use management

accounting in an organisation.

prepared so that all the internal;

and external user can use the

financial statements so that can

they analysis the actual position

of the company. For example:

Government can use the

financial statements so that they

can changers there taxation

policy of a company.

Time In management accounting

techniques there are no need of

making time for completing

there operations (Tappura,

Sievänen, Heikkilä, Jussila and

Nenonen, 2015).

But in financial accounting each

and every transaction are

recorded in the financial

statements at the end opf the

financial year. For example:

Transaction are recorded from 1

April to 31 March.

Auditing and publishing

requirement

By taking management decision.

there will no need of making any

statuary publication by the

auditor.

But in financial accounting all

the transactions and reports are

mandatory to be published and

audited by the statutory officers.

Importance of management accounting information as a tool of decision-making in departments

Management accounting is an important tool for making effective decision-making process in

the departments. By the use of management accounting method, it will help to analysis the cost of unit

of different sources. By measuring the cost of each unit it will help the organisation to work as per there

available sources and unit cost so that they can maximize there profit by minimising there cost. In this

case Imda Tech Limited can minimise there cost by determining the each cost of a unit so that they can

maximize there profitability (Suomala, Lyly-Yrjänäinen and Lukka, 2014).

Management accounting also plays an important role in each department so that they can

determine the best costing techniques so that they can analysis the appropriate cost of each resources. In

this way Imda Tech Limited can decide the right costing techniques among various techniques such as

job costing, inventory control costing system etc. In this way, department manager will decide the right

measuring tool of costing so that it can enhance the profitability of an organisation.

users can use management

accounting in an organisation.

prepared so that all the internal;

and external user can use the

financial statements so that can

they analysis the actual position

of the company. For example:

Government can use the

financial statements so that they

can changers there taxation

policy of a company.

Time In management accounting

techniques there are no need of

making time for completing

there operations (Tappura,

Sievänen, Heikkilä, Jussila and

Nenonen, 2015).

But in financial accounting each

and every transaction are

recorded in the financial

statements at the end opf the

financial year. For example:

Transaction are recorded from 1

April to 31 March.

Auditing and publishing

requirement

By taking management decision.

there will no need of making any

statuary publication by the

auditor.

But in financial accounting all

the transactions and reports are

mandatory to be published and

audited by the statutory officers.

Importance of management accounting information as a tool of decision-making in departments

Management accounting is an important tool for making effective decision-making process in

the departments. By the use of management accounting method, it will help to analysis the cost of unit

of different sources. By measuring the cost of each unit it will help the organisation to work as per there

available sources and unit cost so that they can maximize there profit by minimising there cost. In this

case Imda Tech Limited can minimise there cost by determining the each cost of a unit so that they can

maximize there profitability (Suomala, Lyly-Yrjänäinen and Lukka, 2014).

Management accounting also plays an important role in each department so that they can

determine the best costing techniques so that they can analysis the appropriate cost of each resources. In

this way Imda Tech Limited can decide the right costing techniques among various techniques such as

job costing, inventory control costing system etc. In this way, department manager will decide the right

measuring tool of costing so that it can enhance the profitability of an organisation.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Management accounting includes the report opf every information which are related to

business operational activity. Inn this way, management accounting techniques provide the data for the

department managers so that they can estimate or analysis such information and take corrective action

as per the recorded data to increases the cap[ability of an organisation. For Imda Tech Limited use the

such data which are reliable, accurate so that they can measure there department's performance and

improving there activity to accomplishing the goals (Simons, 2013).

b) Types of management accounting system

Cost accounting system- To determine the actual cost in an organisation, cost accounting system

will be used inn an organisation. Cost accounting system mainly help the organisation to increases there

profitability. In this system actual cost, standard cost and normal; cost are determine to understand the

company actual performance. To calculating the actual cost, such calculation is based on there actual

value but in standard costing, the difference between variance and alternative cost are determined in it.

So that Imda Tech Limited firstly estimate the cost of unit so that they can increases the profitability and

make corrective action to improve there performance.

Inventory management system- Inventory management system is a inventory control computer

based system, in which order, sales, level of inventory, bills for the materials, purchases of material etc.

are recorded and managed by using computer based techniques. In this way Imda Tech limited can use

the inventory management system so that they can estimate the availability of the inventory so that it can

use for the future. for example: by using wireless tacking techniques, or identify the radio frequency of

inventories are used to estimate the actual position of inventories in an organisation (Schaltegger,

Gibassier and Zvezdov, 2013).

Job costing system- There are lots of difference products which are produced in an organisation

so that here, job costing system are used so that manager can estimate the position of the products and

used custom equipments so that all the products are produced in a same manner or in a same way.

Price optimising system- Price optimizing system concerned the services and products which are

given to the customers (Renz, 2016). In this the level of customers satisfaction as per the rendered

products for the given price are recorded in it. In this way Imda Tech Limited will maintain there

product's price by analysing the competitor's position and market conditions and make effective changes

in there price. This system is followed by the organisation because it increases the profit earning capacity

of an organisation.

business operational activity. Inn this way, management accounting techniques provide the data for the

department managers so that they can estimate or analysis such information and take corrective action

as per the recorded data to increases the cap[ability of an organisation. For Imda Tech Limited use the

such data which are reliable, accurate so that they can measure there department's performance and

improving there activity to accomplishing the goals (Simons, 2013).

b) Types of management accounting system

Cost accounting system- To determine the actual cost in an organisation, cost accounting system

will be used inn an organisation. Cost accounting system mainly help the organisation to increases there

profitability. In this system actual cost, standard cost and normal; cost are determine to understand the

company actual performance. To calculating the actual cost, such calculation is based on there actual

value but in standard costing, the difference between variance and alternative cost are determined in it.

So that Imda Tech Limited firstly estimate the cost of unit so that they can increases the profitability and

make corrective action to improve there performance.

Inventory management system- Inventory management system is a inventory control computer

based system, in which order, sales, level of inventory, bills for the materials, purchases of material etc.

are recorded and managed by using computer based techniques. In this way Imda Tech limited can use

the inventory management system so that they can estimate the availability of the inventory so that it can

use for the future. for example: by using wireless tacking techniques, or identify the radio frequency of

inventories are used to estimate the actual position of inventories in an organisation (Schaltegger,

Gibassier and Zvezdov, 2013).

Job costing system- There are lots of difference products which are produced in an organisation

so that here, job costing system are used so that manager can estimate the position of the products and

used custom equipments so that all the products are produced in a same manner or in a same way.

Price optimising system- Price optimizing system concerned the services and products which are

given to the customers (Renz, 2016). In this the level of customers satisfaction as per the rendered

products for the given price are recorded in it. In this way Imda Tech Limited will maintain there

product's price by analysing the competitor's position and market conditions and make effective changes

in there price. This system is followed by the organisation because it increases the profit earning capacity

of an organisation.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TASK 2

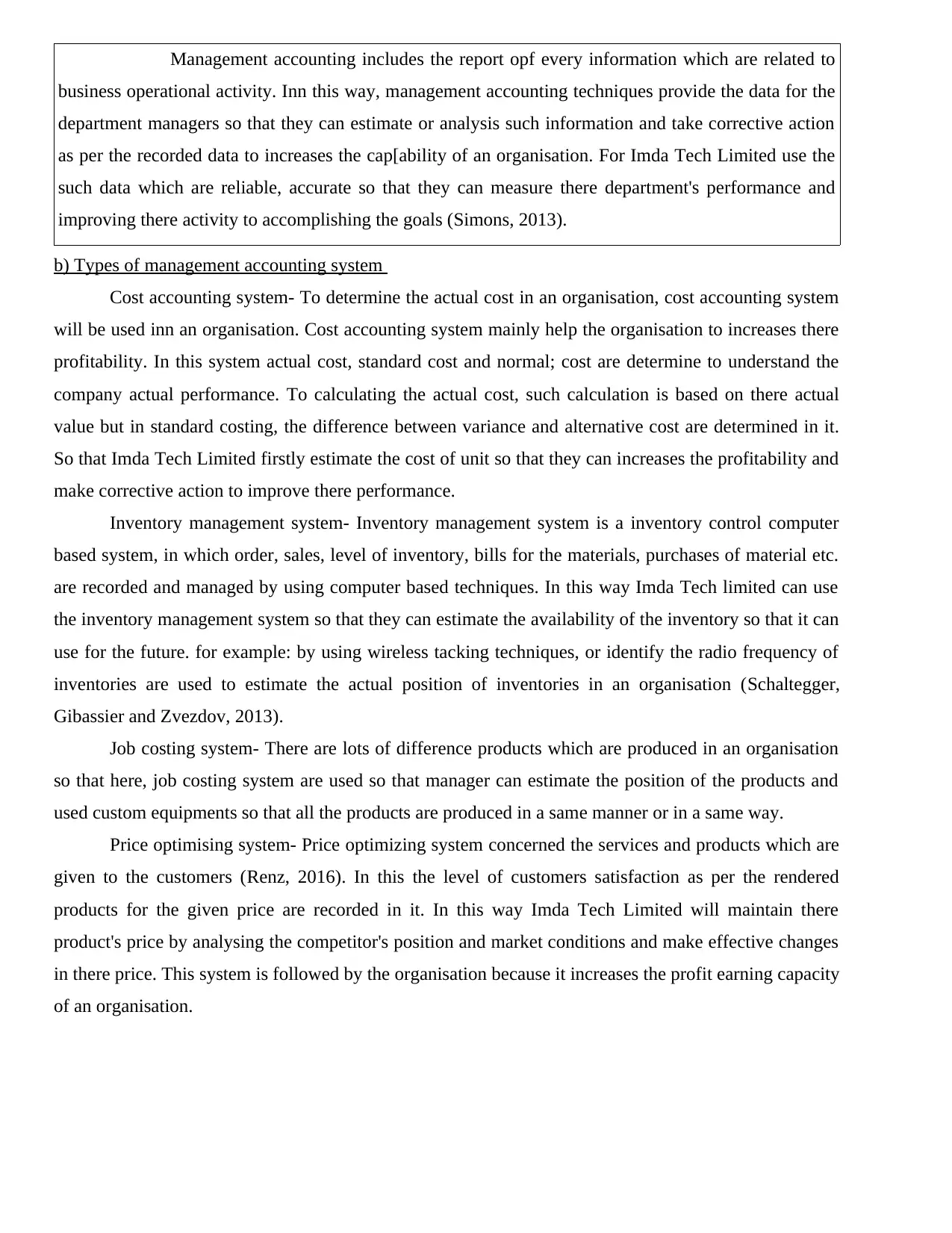

1. Using absorption costing method

In this method, all the indirect expenses and direct cost are used for measuring the cost of the

products (Otley and Emmanuel, 2013). In this Imda Tech limited can use the absorption costing method

to for measuring the cost of there unit, which are as follows:

As per the above calculations it is determine that by using absorption costing company occur

profit or loss of -£375 and gross profit are recorded with 17500. In the absorption method company can

use fixed and variable both the cost for making the calculation.

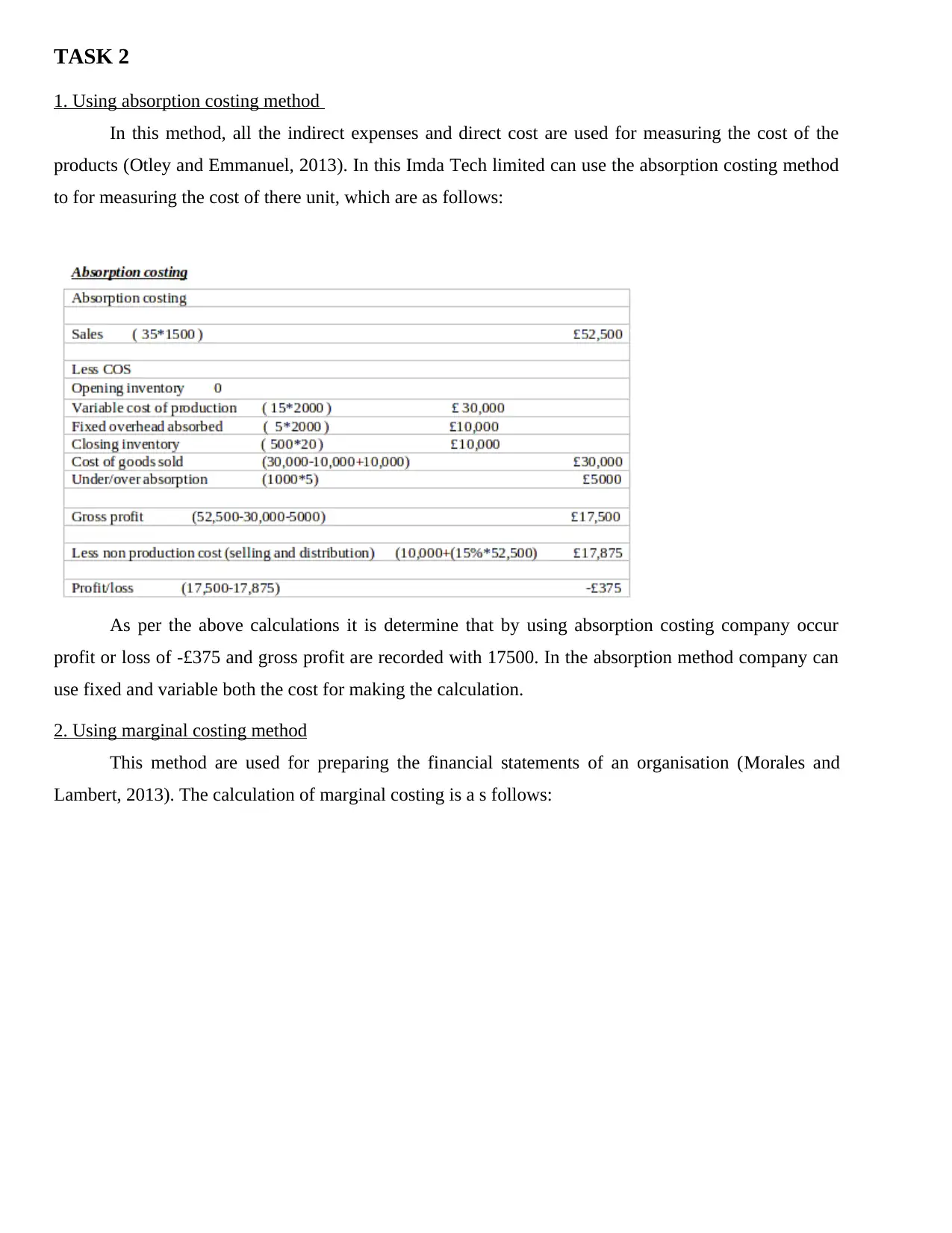

2. Using marginal costing method

This method are used for preparing the financial statements of an organisation (Morales and

Lambert, 2013). The calculation of marginal costing is a s follows:

1. Using absorption costing method

In this method, all the indirect expenses and direct cost are used for measuring the cost of the

products (Otley and Emmanuel, 2013). In this Imda Tech limited can use the absorption costing method

to for measuring the cost of there unit, which are as follows:

As per the above calculations it is determine that by using absorption costing company occur

profit or loss of -£375 and gross profit are recorded with 17500. In the absorption method company can

use fixed and variable both the cost for making the calculation.

2. Using marginal costing method

This method are used for preparing the financial statements of an organisation (Morales and

Lambert, 2013). The calculation of marginal costing is a s follows:

As per the above table is clear that company face the profit or loss by using marginal costing

techniques is -£2,875, because in this method only variable cost are taken in calculation. So in this way

it can be say that marginal cost is reliable as compare to the absorption costing method because in

marginal costing the profitability is higher than absorption method.

Reconciliation

TASK 3

a) Type of Budget and there advantage/disadvantage

Budget are the target in which company can set there task so that they can achieve there goals in

future. There are various type budget , which are as follows:

Capital Budget- The capital budget are those budget which include all the capital asset, cost and

expenses of a company. In capital asset it includes plant, land, building etc. (Lavia López and Hiebl,

2014).

Operational Budget- To determine the operating income and operating expenses of the company,

operational budget are prepared by the company. It include the day to day plan of all the expenses,

revenue and all type of overhead which manager can maintain and pre-determined for there operational

activity.

techniques is -£2,875, because in this method only variable cost are taken in calculation. So in this way

it can be say that marginal cost is reliable as compare to the absorption costing method because in

marginal costing the profitability is higher than absorption method.

Reconciliation

TASK 3

a) Type of Budget and there advantage/disadvantage

Budget are the target in which company can set there task so that they can achieve there goals in

future. There are various type budget , which are as follows:

Capital Budget- The capital budget are those budget which include all the capital asset, cost and

expenses of a company. In capital asset it includes plant, land, building etc. (Lavia López and Hiebl,

2014).

Operational Budget- To determine the operating income and operating expenses of the company,

operational budget are prepared by the company. It include the day to day plan of all the expenses,

revenue and all type of overhead which manager can maintain and pre-determined for there operational

activity.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Cash Budget- This budget are prepared for the estimation of net cash inflow and outflow of the

company. It provide the details of all the cash related data for a specific time period. It al;so help to

estimate the actual cash acquirement in different departments so that it can be fulfil by the managers.

Financial Budget- This budget are prepare for arranging the financial resources in an

organisation. It also analysis that how much fund are require and in which area the fund is really require.

In this way proper allocation of budget are done with the help[ of financial budget (Hiebl, 2014).

Advantage of Budget

Budgets provide relevant information of the resources, fund which help to maintain the

operational activity well.

To analysis the company's power and threat budget are very useful (Kaplan and Atkinson, 2015).

To appraise the performance of the business budget plays an important role.

It also help to increases the profit of a company.

Dis-advantage of budget

Budget are based on past and future estimation so that it can not predictable.

It also make negative impact in business operational activity by taking wrong assumptions.

It also take time and cost so that it is not considered as good (Fullerton, Kennedy and Widener,

2014).

It also make difficulty to prepare a future plan.

b) Process of preparing a budget

Obtaining estimates- The first step is to estimate the ideas of sales, purchase, level of production

and expenses of the company. This idea can be done because it give the actual and current position of the

company.

Coordinating with estimates- In this step when the ideas are determined, than such ideas are

deliver to all the departments of Imda Tech Limited by using a appropriate mode of communication. In

this way company can determine the aim and objective which can be fulfil in future.

Implementing the budget plan- When all the ideas of sales, income, expenses etc. are deliver to

various department, then it will be execute or implement by the employees of such department by

analysis the available resources, labour, material in an organisation (Fullerton, Kennedy and Widener,

2013).

Reporting the progress- Inn this last step as per the above budget company provide feedback for

all the various department and also make some changes or alternation as per the need. Hence in this way

Imda Tech Limited can make there effective budget plan.

company. It provide the details of all the cash related data for a specific time period. It al;so help to

estimate the actual cash acquirement in different departments so that it can be fulfil by the managers.

Financial Budget- This budget are prepare for arranging the financial resources in an

organisation. It also analysis that how much fund are require and in which area the fund is really require.

In this way proper allocation of budget are done with the help[ of financial budget (Hiebl, 2014).

Advantage of Budget

Budgets provide relevant information of the resources, fund which help to maintain the

operational activity well.

To analysis the company's power and threat budget are very useful (Kaplan and Atkinson, 2015).

To appraise the performance of the business budget plays an important role.

It also help to increases the profit of a company.

Dis-advantage of budget

Budget are based on past and future estimation so that it can not predictable.

It also make negative impact in business operational activity by taking wrong assumptions.

It also take time and cost so that it is not considered as good (Fullerton, Kennedy and Widener,

2014).

It also make difficulty to prepare a future plan.

b) Process of preparing a budget

Obtaining estimates- The first step is to estimate the ideas of sales, purchase, level of production

and expenses of the company. This idea can be done because it give the actual and current position of the

company.

Coordinating with estimates- In this step when the ideas are determined, than such ideas are

deliver to all the departments of Imda Tech Limited by using a appropriate mode of communication. In

this way company can determine the aim and objective which can be fulfil in future.

Implementing the budget plan- When all the ideas of sales, income, expenses etc. are deliver to

various department, then it will be execute or implement by the employees of such department by

analysis the available resources, labour, material in an organisation (Fullerton, Kennedy and Widener,

2013).

Reporting the progress- Inn this last step as per the above budget company provide feedback for

all the various department and also make some changes or alternation as per the need. Hence in this way

Imda Tech Limited can make there effective budget plan.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

c) Pricing strategies of the business

Management accountant of Imda Tech Limited will set there product price as per the customer

satisfaction level. Business can use various type of pricing strategies such as absorption pricing, high-

low pricing, limit pricing, cost plus pricing , premium pricing etc. and set there product price. Company

also analysis the market position time-to-time and also examine there competitor pricing strategies so

that as per the above factor they can set there prices. Imda Tech Limited also launches new and specific

charger as per the need, want and preferences of the customers. In this way, accountant set there price in

such a way that company provide the products to there customers and satisfied them and also earn

profitability as per there strategies (DRURY, 2013).

TASK 4

a) Balance score card approach

Balance score card is a fundamental framework of a company which represent company's actual

position that company is working well as per the standard or not (Cooper, Ezzamel and Qu, 2017).

1. Use of balance score card for intensification and responding to the financial problems

IMDA Tech Limited use the balance scorecard so that company can analysis there actual

standard and determine the human resource, consumer perspective etc. after that they can make

innovative changes in there workplace. It is an important tool which was used by cited firm so that they

can measure there performance and take corrective action for improving there activity. As per the case

Imda Tech Limited is facing the loss of 1.5 million GBP so that cited firm give there support so that

company can balance there performance and overcoming there financial issues. In this way company

should adopt SMART objectives such as they try to increase there sales by 30% till the end of 2018 and

also increase there revenue by 35% (Brandau, Endenich, Trapp and Hoffjan, 2013)

2. Use of balance scorecard in order to improve the financial governance

Balance score card is an important tool that help to identify the issues of the organisation and

solving the problems of an organisation. Imda Tech Limited will focus on there customer's need and

preferences so that it can fulfil the customer's need and increases there profit. For example: Marketing

manager of the cited firm is planning to make conservation with the finance department that to allocate

more funds to the marketing section so that they can offer good discounts to the consumers and promote

the brand well.

Internal business practices are also in the balance scorecard techniques (Bodie, 2013). Balance

score card assist the Imda Tech Limited in reducing the gap between excepted and actual performance

and results. With the help of this approach cited firm will be able to accomplish it objectives easily.

Management accountant of Imda Tech Limited will set there product price as per the customer

satisfaction level. Business can use various type of pricing strategies such as absorption pricing, high-

low pricing, limit pricing, cost plus pricing , premium pricing etc. and set there product price. Company

also analysis the market position time-to-time and also examine there competitor pricing strategies so

that as per the above factor they can set there prices. Imda Tech Limited also launches new and specific

charger as per the need, want and preferences of the customers. In this way, accountant set there price in

such a way that company provide the products to there customers and satisfied them and also earn

profitability as per there strategies (DRURY, 2013).

TASK 4

a) Balance score card approach

Balance score card is a fundamental framework of a company which represent company's actual

position that company is working well as per the standard or not (Cooper, Ezzamel and Qu, 2017).

1. Use of balance score card for intensification and responding to the financial problems

IMDA Tech Limited use the balance scorecard so that company can analysis there actual

standard and determine the human resource, consumer perspective etc. after that they can make

innovative changes in there workplace. It is an important tool which was used by cited firm so that they

can measure there performance and take corrective action for improving there activity. As per the case

Imda Tech Limited is facing the loss of 1.5 million GBP so that cited firm give there support so that

company can balance there performance and overcoming there financial issues. In this way company

should adopt SMART objectives such as they try to increase there sales by 30% till the end of 2018 and

also increase there revenue by 35% (Brandau, Endenich, Trapp and Hoffjan, 2013)

2. Use of balance scorecard in order to improve the financial governance

Balance score card is an important tool that help to identify the issues of the organisation and

solving the problems of an organisation. Imda Tech Limited will focus on there customer's need and

preferences so that it can fulfil the customer's need and increases there profit. For example: Marketing

manager of the cited firm is planning to make conservation with the finance department that to allocate

more funds to the marketing section so that they can offer good discounts to the consumers and promote

the brand well.

Internal business practices are also in the balance scorecard techniques (Bodie, 2013). Balance

score card assist the Imda Tech Limited in reducing the gap between excepted and actual performance

and results. With the help of this approach cited firm will be able to accomplish it objectives easily.

CONCLUSION

From the above report it can be concluded that management accounting is an important tool for

taking right decision in the organisation. It help to achieve the goals and support the organisation to

solving there problems effectively. It is the method by which resources are effectively utilized and

allocate as per the need of an organisation. By using various accounting standard and costing techniques,

manager also choose effective costing techniques. It also help top minimize the cost so that it will

increases the profitability in an organisation (Armstrong, 2014).

From the above report it can be concluded that management accounting is an important tool for

taking right decision in the organisation. It help to achieve the goals and support the organisation to

solving there problems effectively. It is the method by which resources are effectively utilized and

allocate as per the need of an organisation. By using various accounting standard and costing techniques,

manager also choose effective costing techniques. It also help top minimize the cost so that it will

increases the profitability in an organisation (Armstrong, 2014).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.