Management Accounting Techniques and Analysis

VerifiedAdded on 2020/07/22

|20

|4975

|29

AI Summary

This report provides an analysis of management accounting techniques and their application to Holder Construction. It discusses the importance of cost control and performance management through appropriate decision-making. The report also highlights the advantages of activity-based budgeting, cost accounting, job costing, and variance analysis in facilitating business decisions and improving performance. Additionally, it emphasizes the significance of management accounting systems in contributing to organizational goals.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Management Accounting

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TABLE OF CONTENTS

INTRODUCTION......................................................................................................................1

SECTION 1................................................................................................................................1

1. Explaining the importance of management accounting in the decision making aspects...1

2. Assessing different types of management accounting systems that can be used within the

firm.........................................................................................................................................2

3. Critically evaluate management accounting systems that are assessed above..................3

4..............................................................................................................................................5

a. Preparing statements by using absorption and marginal costing system...........................5

b. Stating reasons due to which profit as per each technique is different..............................9

c. Reconciliation statement....................................................................................................9

SECTION 2..............................................................................................................................10

Comparing and contrasting planning tools that can be undertaken in accordance with

management accounting.......................................................................................................10

Presenting the manner in which management accounting systems help in responding

monetary problems...............................................................................................................14

CONCLUSION........................................................................................................................16

REFERENCES.........................................................................................................................17

INTRODUCTION......................................................................................................................1

SECTION 1................................................................................................................................1

1. Explaining the importance of management accounting in the decision making aspects...1

2. Assessing different types of management accounting systems that can be used within the

firm.........................................................................................................................................2

3. Critically evaluate management accounting systems that are assessed above..................3

4..............................................................................................................................................5

a. Preparing statements by using absorption and marginal costing system...........................5

b. Stating reasons due to which profit as per each technique is different..............................9

c. Reconciliation statement....................................................................................................9

SECTION 2..............................................................................................................................10

Comparing and contrasting planning tools that can be undertaken in accordance with

management accounting.......................................................................................................10

Presenting the manner in which management accounting systems help in responding

monetary problems...............................................................................................................14

CONCLUSION........................................................................................................................16

REFERENCES.........................................................................................................................17

INTRODUCTION

Management accounting field of finance deals with the aspects of performance

evaluation and management. For the purpose of making effective day to day and short term

business decisions manager requires timely and accurate statistical or financial information.

In this regard, MA tools and techniques help in preparing reports that furnishes information

regarding the monetary aspects of the firm. Managerial accounting reports give input for

decision making and thereby make contribution in the attainment of organizational goals and

objectives. The present report is based on Holder Construction, a manufacturing medium

sized business unit, which will provide deepe insight about the different types of MA

systems. Further, report depicts the manner in which MA aid in suitable decision making.

Besides this, it also shed light on the tools that ensure suitable financial planning. It also

presents how MA tools help in preventing and dealing with monetary issues.

SECTION 1

1. Explaining the importance of management accounting in the decision making aspects

Management accounting is the process of preparing accounts and reports that provides

manager with suitable inputs for decision making. In the business organization, managers are

usually faced with countless problems. In this regard, role and significance of management

accounting in decision making aspects are as follows:

Provides assistance in making forecast about future:

MA tools such as activity & zero base budgeting helps in preparing suitable financial

plan and thereby helps in making prediction about the future (Ionescu, 2016). Hence, using

such techniques manager of Holder Construction can assess the revenue or profit margin will

be generated over the expenses.

Facilitates performance evaluation

Management accounting field of finance deals with the aspects of performance

evaluation and management. For the purpose of making effective day to day and short term

business decisions manager requires timely and accurate statistical or financial information.

In this regard, MA tools and techniques help in preparing reports that furnishes information

regarding the monetary aspects of the firm. Managerial accounting reports give input for

decision making and thereby make contribution in the attainment of organizational goals and

objectives. The present report is based on Holder Construction, a manufacturing medium

sized business unit, which will provide deepe insight about the different types of MA

systems. Further, report depicts the manner in which MA aid in suitable decision making.

Besides this, it also shed light on the tools that ensure suitable financial planning. It also

presents how MA tools help in preventing and dealing with monetary issues.

SECTION 1

1. Explaining the importance of management accounting in the decision making aspects

Management accounting is the process of preparing accounts and reports that provides

manager with suitable inputs for decision making. In the business organization, managers are

usually faced with countless problems. In this regard, role and significance of management

accounting in decision making aspects are as follows:

Provides assistance in making forecast about future:

MA tools such as activity & zero base budgeting helps in preparing suitable financial

plan and thereby helps in making prediction about the future (Ionescu, 2016). Hence, using

such techniques manager of Holder Construction can assess the revenue or profit margin will

be generated over the expenses.

Facilitates performance evaluation

Variance analysis technique of MA enables manager to do comparison of actual

performance with the standards. Hence, by assessing deviations and associated causes

manager of Holder Construction can take appropriate decision for further improvement.

Assists in taking decision (make or buy):

In the context of manufacturing firms, managers face issue in deciding whether they

need to make or buy component of products from outside. Hence, such issue can be resolved

by the manager more effectually through conducting make or buy analysis (Fullerton,

Kennedy and Widener, 2013). Thus, comparing profit associated with both the options

manager of Holder Construction can select the profitable one.

Helps in taking decision about sales and profit

MA helps manager in assessing the number of units which they need to sell for

recovering the expenses incurred. Further, marginal costing assessment also assists manager

in determining the level of sales that need to be made for the generation of desired profit

margin.

2. Assessing different types of management accounting systems that can be used within the

firm

Management accounting refers to the process of analyzing cost and operations which

in turn helps in preparing financial reports. Hence, report that is prepared as per MA

significantly aid in managers decision making and thereby helps in achieving goals. There are

several types of management accounting systems that can be used by Holder Construction

for managing internal operations, cost control and profit maximization.

Job costing: This system helps in accumulating information about the costs associated

with specific production or services. By undertaking job costing systems, manager of

Holder Construction can assess or trace cost related to specific jobs. Job costing

system also helps in assessing whether cost or expenses can be reduced in further

production or not (Job Costing, 2018).

Cost accounting: For manufacturing products or services, business unit incurs several

expenses such as direct and indirect. Hence, using the system of cost accounting

Holder Construction can accumulate all the expenses such as material, labour and

overhead. Hence, by dividing total expenses from the number of units manufactured

unit cost can be identified. Along with this, cost accounting system also helps in

performance with the standards. Hence, by assessing deviations and associated causes

manager of Holder Construction can take appropriate decision for further improvement.

Assists in taking decision (make or buy):

In the context of manufacturing firms, managers face issue in deciding whether they

need to make or buy component of products from outside. Hence, such issue can be resolved

by the manager more effectually through conducting make or buy analysis (Fullerton,

Kennedy and Widener, 2013). Thus, comparing profit associated with both the options

manager of Holder Construction can select the profitable one.

Helps in taking decision about sales and profit

MA helps manager in assessing the number of units which they need to sell for

recovering the expenses incurred. Further, marginal costing assessment also assists manager

in determining the level of sales that need to be made for the generation of desired profit

margin.

2. Assessing different types of management accounting systems that can be used within the

firm

Management accounting refers to the process of analyzing cost and operations which

in turn helps in preparing financial reports. Hence, report that is prepared as per MA

significantly aid in managers decision making and thereby helps in achieving goals. There are

several types of management accounting systems that can be used by Holder Construction

for managing internal operations, cost control and profit maximization.

Job costing: This system helps in accumulating information about the costs associated

with specific production or services. By undertaking job costing systems, manager of

Holder Construction can assess or trace cost related to specific jobs. Job costing

system also helps in assessing whether cost or expenses can be reduced in further

production or not (Job Costing, 2018).

Cost accounting: For manufacturing products or services, business unit incurs several

expenses such as direct and indirect. Hence, using the system of cost accounting

Holder Construction can accumulate all the expenses such as material, labour and

overhead. Hence, by dividing total expenses from the number of units manufactured

unit cost can be identified. Along with this, cost accounting system also helps in

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

setting suitable price of the offerings. By adding desired margin % in unit cost, firm

can determine or set price of the offerings.

Inventory management: In the context of Holder Construction, stock management is

highly significant because it imposes cost in front of the firm such as holding,

ordering etc. Hence, using tools such as economic order quantity, just in time (JIT) etc

concerned manufacturing firm can manage stock more effectually and thereby exerts

control cost level (Macintosh and Quattrone, 2010). Thus, MA tools ensure

effective inventory management as well as smooth functioning of the business

operations and functions.

Price optimization: Such MA system helps in assessing and evaluating the

willingness of customers pertaining to pricing aspects. Hence, by getting information

about the money that customers are ready to pay Holder Construction can set suitable

prices of the products or services.

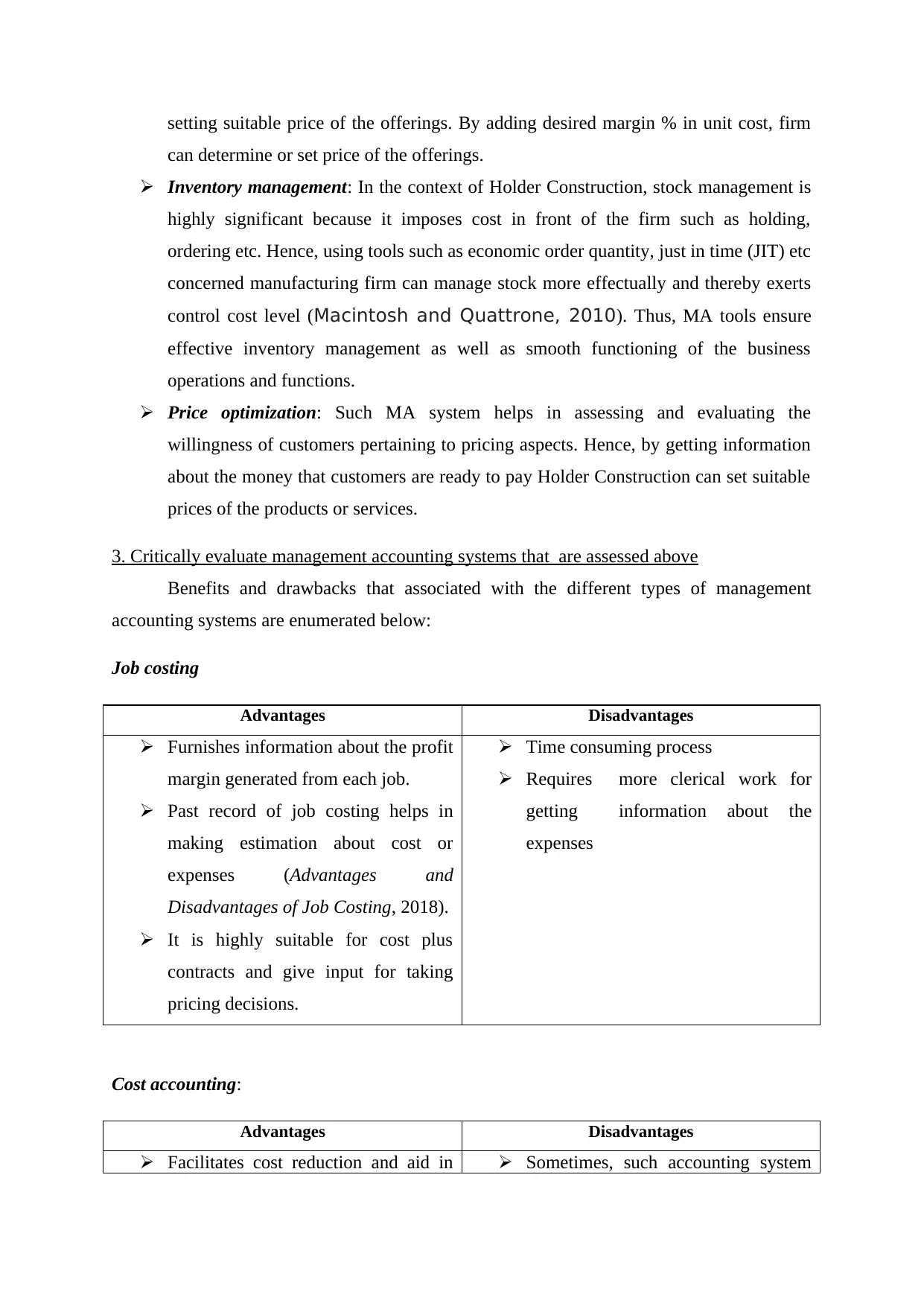

3. Critically evaluate management accounting systems that are assessed above

Benefits and drawbacks that associated with the different types of management

accounting systems are enumerated below:

Job costing

Advantages Disadvantages

Furnishes information about the profit

margin generated from each job.

Past record of job costing helps in

making estimation about cost or

expenses (Advantages and

Disadvantages of Job Costing, 2018).

It is highly suitable for cost plus

contracts and give input for taking

pricing decisions.

Time consuming process

Requires more clerical work for

getting information about the

expenses

Cost accounting:

Advantages Disadvantages

Facilitates cost reduction and aid in Sometimes, such accounting system

can determine or set price of the offerings.

Inventory management: In the context of Holder Construction, stock management is

highly significant because it imposes cost in front of the firm such as holding,

ordering etc. Hence, using tools such as economic order quantity, just in time (JIT) etc

concerned manufacturing firm can manage stock more effectually and thereby exerts

control cost level (Macintosh and Quattrone, 2010). Thus, MA tools ensure

effective inventory management as well as smooth functioning of the business

operations and functions.

Price optimization: Such MA system helps in assessing and evaluating the

willingness of customers pertaining to pricing aspects. Hence, by getting information

about the money that customers are ready to pay Holder Construction can set suitable

prices of the products or services.

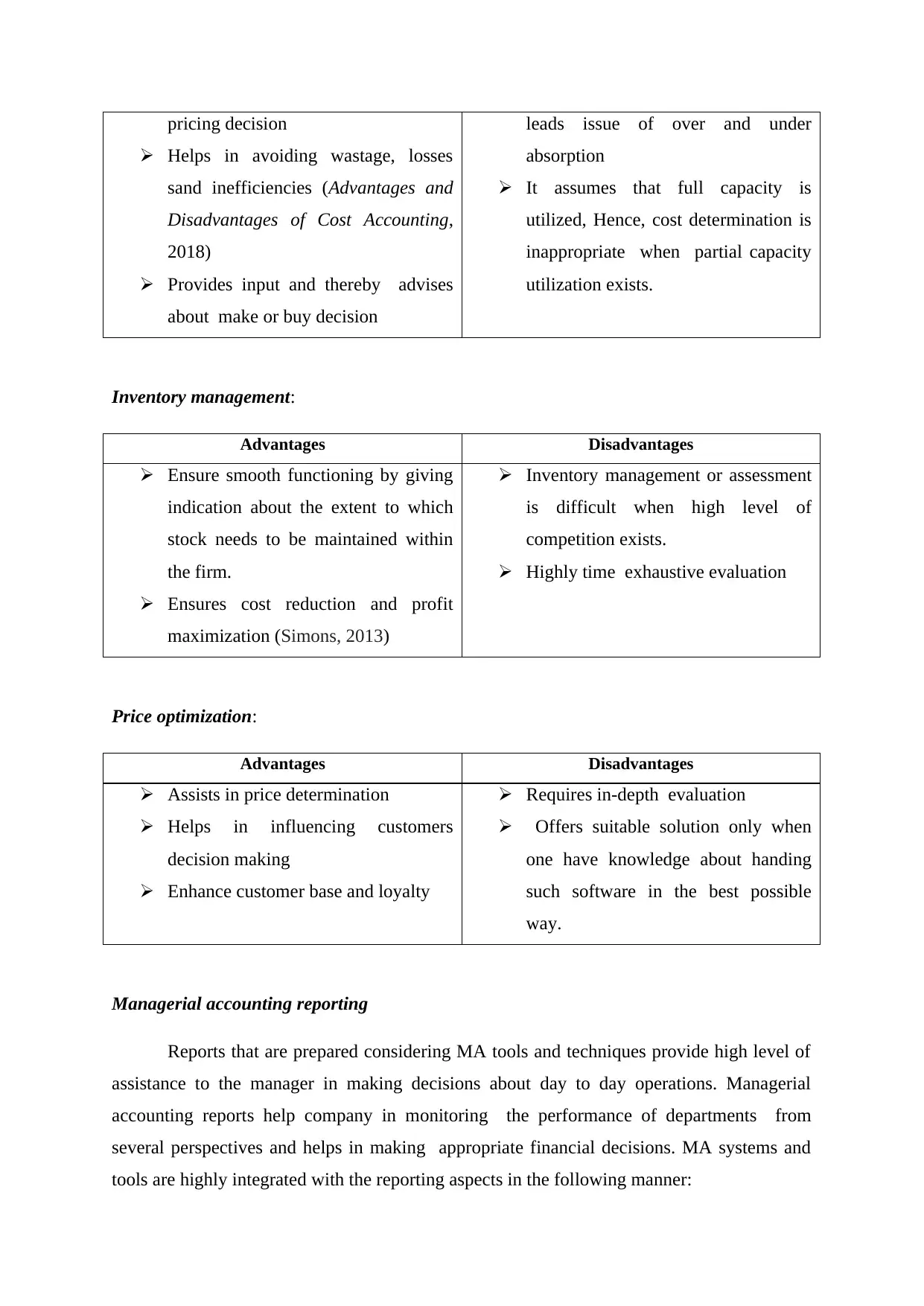

3. Critically evaluate management accounting systems that are assessed above

Benefits and drawbacks that associated with the different types of management

accounting systems are enumerated below:

Job costing

Advantages Disadvantages

Furnishes information about the profit

margin generated from each job.

Past record of job costing helps in

making estimation about cost or

expenses (Advantages and

Disadvantages of Job Costing, 2018).

It is highly suitable for cost plus

contracts and give input for taking

pricing decisions.

Time consuming process

Requires more clerical work for

getting information about the

expenses

Cost accounting:

Advantages Disadvantages

Facilitates cost reduction and aid in Sometimes, such accounting system

pricing decision

Helps in avoiding wastage, losses

sand inefficiencies (Advantages and

Disadvantages of Cost Accounting,

2018)

Provides input and thereby advises

about make or buy decision

leads issue of over and under

absorption

It assumes that full capacity is

utilized, Hence, cost determination is

inappropriate when partial capacity

utilization exists.

Inventory management:

Advantages Disadvantages

Ensure smooth functioning by giving

indication about the extent to which

stock needs to be maintained within

the firm.

Ensures cost reduction and profit

maximization (Simons, 2013)

Inventory management or assessment

is difficult when high level of

competition exists.

Highly time exhaustive evaluation

Price optimization:

Advantages Disadvantages

Assists in price determination

Helps in influencing customers

decision making

Enhance customer base and loyalty

Requires in-depth evaluation

Offers suitable solution only when

one have knowledge about handing

such software in the best possible

way.

Managerial accounting reporting

Reports that are prepared considering MA tools and techniques provide high level of

assistance to the manager in making decisions about day to day operations. Managerial

accounting reports help company in monitoring the performance of departments from

several perspectives and helps in making appropriate financial decisions. MA systems and

tools are highly integrated with the reporting aspects in the following manner:

Helps in avoiding wastage, losses

sand inefficiencies (Advantages and

Disadvantages of Cost Accounting,

2018)

Provides input and thereby advises

about make or buy decision

leads issue of over and under

absorption

It assumes that full capacity is

utilized, Hence, cost determination is

inappropriate when partial capacity

utilization exists.

Inventory management:

Advantages Disadvantages

Ensure smooth functioning by giving

indication about the extent to which

stock needs to be maintained within

the firm.

Ensures cost reduction and profit

maximization (Simons, 2013)

Inventory management or assessment

is difficult when high level of

competition exists.

Highly time exhaustive evaluation

Price optimization:

Advantages Disadvantages

Assists in price determination

Helps in influencing customers

decision making

Enhance customer base and loyalty

Requires in-depth evaluation

Offers suitable solution only when

one have knowledge about handing

such software in the best possible

way.

Managerial accounting reporting

Reports that are prepared considering MA tools and techniques provide high level of

assistance to the manager in making decisions about day to day operations. Managerial

accounting reports help company in monitoring the performance of departments from

several perspectives and helps in making appropriate financial decisions. MA systems and

tools are highly integrated with the reporting aspects in the following manner:

Budget report: This report furnishes contains information about both favourable and

unfavourable variance. Budget report provides deeper insight to the managers about

the extent to goals is met pertaining to the specified time frame. Hence, budget report

helps company in setting standards for the future time period (Ward, 2012). It also

helps management team in identifying the training requirement of personnel and

developing suitable incentive plans for them. Thus, it can be entailed that budget

report helps manager in formulating suitable growth strategies that aid in success.

Receivable report: Accounts receivable report helps in ascertaining the time period

within which debtors are making payment due to them. Hence, such record provides

high level of assistance to Holder Construction in determining whether they need to

make modifications in the existing credit policy or not (Alcouffe, Berland and Levant,

2008). Moreover, working capital position and level of bad debt is highly affected

from the period to which credit is granted to the customers.

Job costing report: By undertaking and evaluating job cost report manager can assess

the expenses related to specific activities. Job costing report helps in making

evaluation of profitability aspects as it facilitates comparison between actual and

planned revenue (Baldvinsdottir, Mitchell and Nørreklit, 2010). Hence, job cost report

helps in identifying low performing areas and thereby helps in taking measures for

improvement. Further, such report helps in ascertaining areas or projects where funds

need to be allocated for getting high margin.

Hence, by taking into account all the above mentioned reports management team of

Holder Construction can develop competent strategies and policy framework. Thus, both

management accounting systems as well as reports provide assistance to the company in

monitoring performance and making profitable decisions.

4.

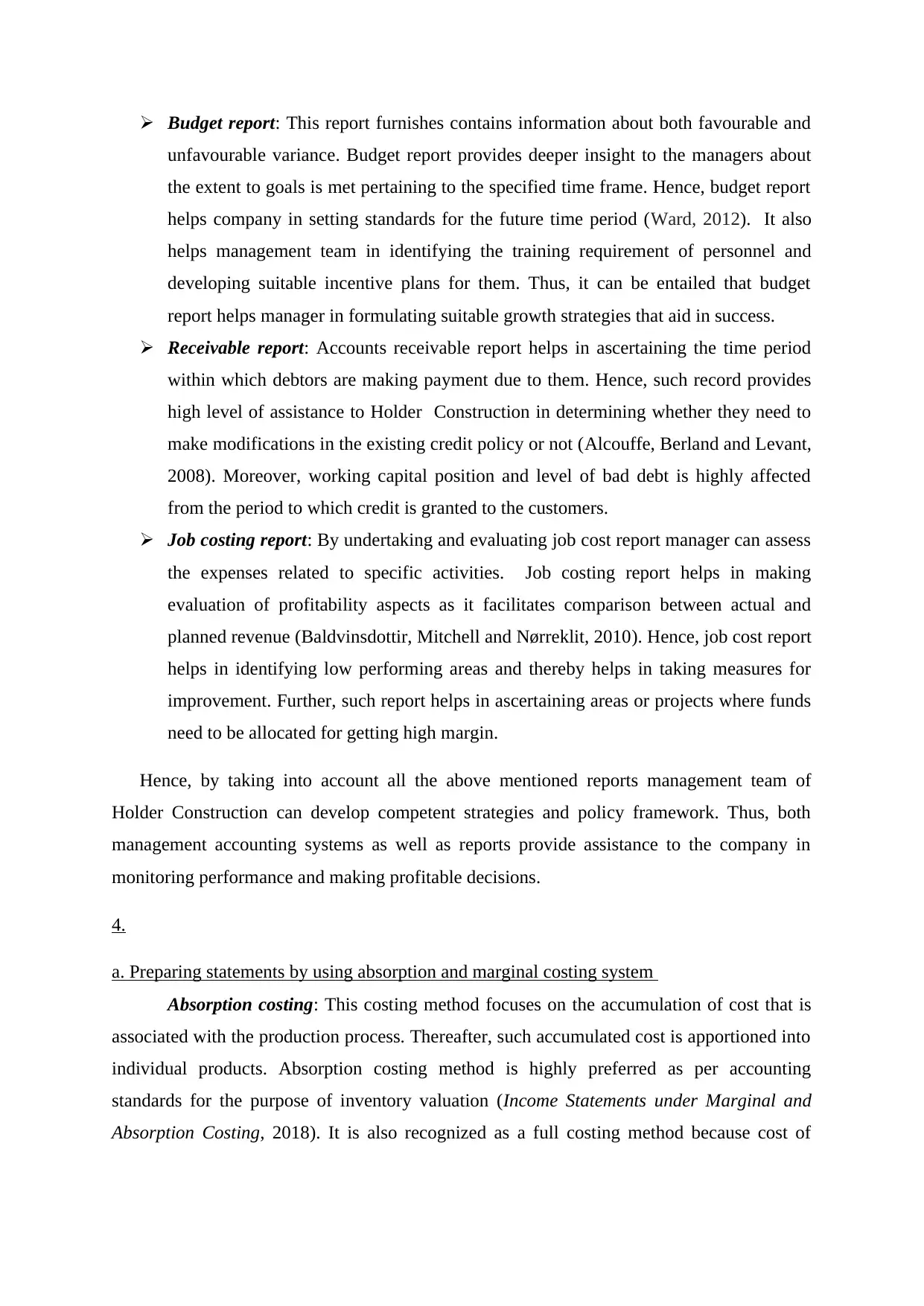

a. Preparing statements by using absorption and marginal costing system

Absorption costing: This costing method focuses on the accumulation of cost that is

associated with the production process. Thereafter, such accumulated cost is apportioned into

individual products. Absorption costing method is highly preferred as per accounting

standards for the purpose of inventory valuation (Income Statements under Marginal and

Absorption Costing, 2018). It is also recognized as a full costing method because cost of

unfavourable variance. Budget report provides deeper insight to the managers about

the extent to goals is met pertaining to the specified time frame. Hence, budget report

helps company in setting standards for the future time period (Ward, 2012). It also

helps management team in identifying the training requirement of personnel and

developing suitable incentive plans for them. Thus, it can be entailed that budget

report helps manager in formulating suitable growth strategies that aid in success.

Receivable report: Accounts receivable report helps in ascertaining the time period

within which debtors are making payment due to them. Hence, such record provides

high level of assistance to Holder Construction in determining whether they need to

make modifications in the existing credit policy or not (Alcouffe, Berland and Levant,

2008). Moreover, working capital position and level of bad debt is highly affected

from the period to which credit is granted to the customers.

Job costing report: By undertaking and evaluating job cost report manager can assess

the expenses related to specific activities. Job costing report helps in making

evaluation of profitability aspects as it facilitates comparison between actual and

planned revenue (Baldvinsdottir, Mitchell and Nørreklit, 2010). Hence, job cost report

helps in identifying low performing areas and thereby helps in taking measures for

improvement. Further, such report helps in ascertaining areas or projects where funds

need to be allocated for getting high margin.

Hence, by taking into account all the above mentioned reports management team of

Holder Construction can develop competent strategies and policy framework. Thus, both

management accounting systems as well as reports provide assistance to the company in

monitoring performance and making profitable decisions.

4.

a. Preparing statements by using absorption and marginal costing system

Absorption costing: This costing method focuses on the accumulation of cost that is

associated with the production process. Thereafter, such accumulated cost is apportioned into

individual products. Absorption costing method is highly preferred as per accounting

standards for the purpose of inventory valuation (Income Statements under Marginal and

Absorption Costing, 2018). It is also recognized as a full costing method because cost of

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

finished stock includes all the costs associated with production such as material, labour, fixed

and variable manufacturing overhead.

Marginal costing: Under this method, variable expenses such as material, labour etc

are charged to cost units. Further, as per marginal costing system, fixed cost are written off in

against to the aggregate contribution assessed. Marginal costing system helps in identifying

the level of increase or decrease which takes place in total production costs as per output.

Computation of unit under both the costing methods such as follows:

Particulars

Absorption

(in£)

Marginal

(in £)

Production cost of sales

Fixed 0.65 0.65

Variable 0.20

Cost of one unit of

production 0.85 0.65

Absorption costing

Quarter 1:

Particulars Quarter 1: Amount (in £)

Sales revenue 66000

Opening stock

Cost of goods manufactured (78000*.85) = 66300

and variable manufacturing overhead.

Marginal costing: Under this method, variable expenses such as material, labour etc

are charged to cost units. Further, as per marginal costing system, fixed cost are written off in

against to the aggregate contribution assessed. Marginal costing system helps in identifying

the level of increase or decrease which takes place in total production costs as per output.

Computation of unit under both the costing methods such as follows:

Particulars

Absorption

(in£)

Marginal

(in £)

Production cost of sales

Fixed 0.65 0.65

Variable 0.20

Cost of one unit of

production 0.85 0.65

Absorption costing

Quarter 1:

Particulars Quarter 1: Amount (in £)

Sales revenue 66000

Opening stock

Cost of goods manufactured (78000*.85) = 66300

Closing stock (12000*.85) = 10200

COGS (Opening inventory + purchase –

closing stock) 56100

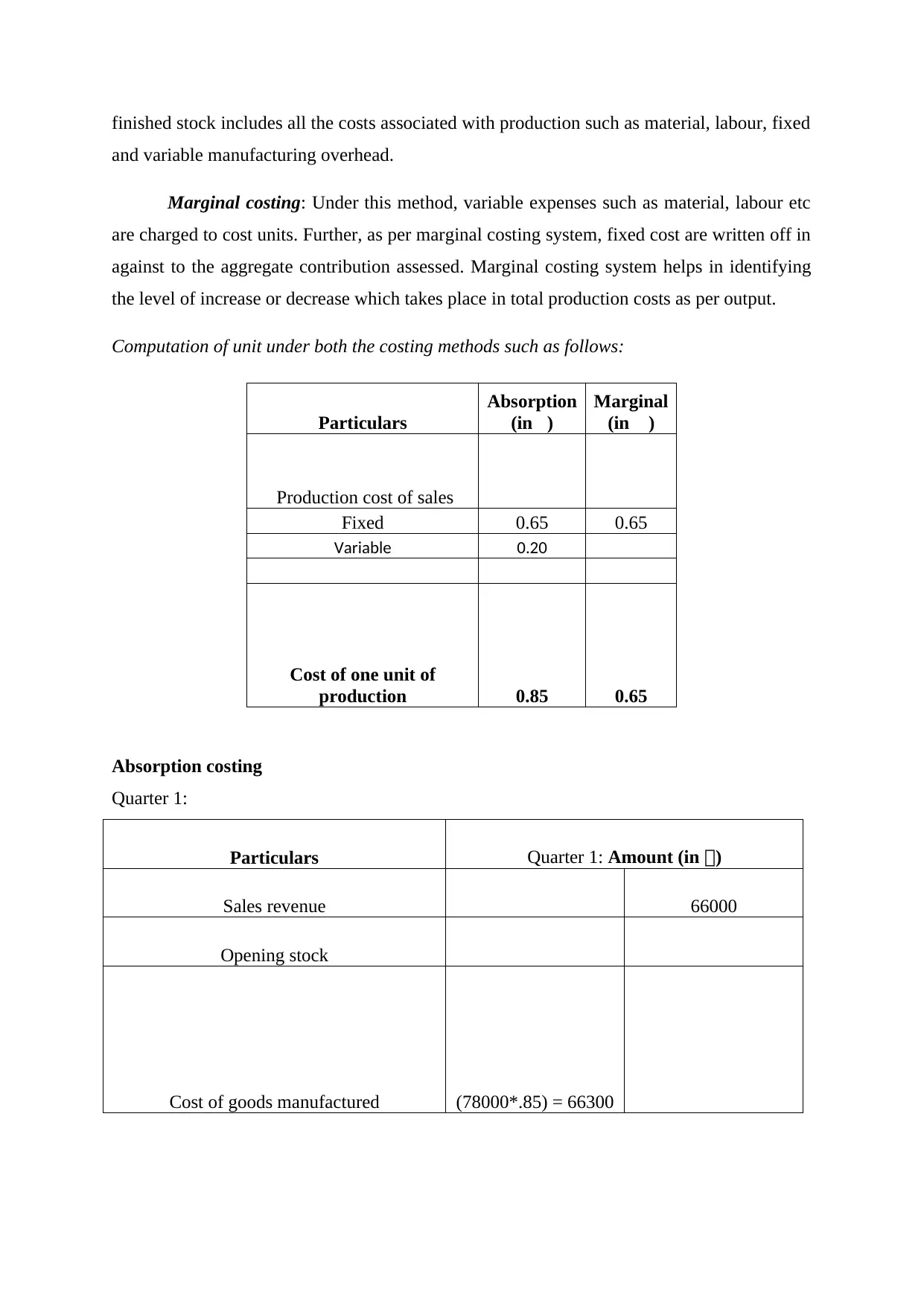

Gross profit at normal: (Sales – COGS) 9900

Less: Over absorbed production overhead (400)

GP at actual 9500

Less: Fixed selling & administration

expenses 5200

Net profit 4300

¿−absorbed ¿ overheads= Actual ¿ production overheads – Budgeted ¿ overheads

¿ £(78000∗.20) – 16000

¿ £ 15600 – £ 16000

¿ £ 400

Gross profit =sales – cost of goods sold

¿ £ 66,000 – 56500

¿ 9,500

Net profit=Gross profit – total other overheads

¿ £ 9,500−£ 5200

¿ £ 4,300

Quarter 2:

Particulars

Quarter 2: Amount (in £)

COGS (Opening inventory + purchase –

closing stock) 56100

Gross profit at normal: (Sales – COGS) 9900

Less: Over absorbed production overhead (400)

GP at actual 9500

Less: Fixed selling & administration

expenses 5200

Net profit 4300

¿−absorbed ¿ overheads= Actual ¿ production overheads – Budgeted ¿ overheads

¿ £(78000∗.20) – 16000

¿ £ 15600 – £ 16000

¿ £ 400

Gross profit =sales – cost of goods sold

¿ £ 66,000 – 56500

¿ 9,500

Net profit=Gross profit – total other overheads

¿ £ 9,500−£ 5200

¿ £ 4,300

Quarter 2:

Particulars

Quarter 2: Amount (in £)

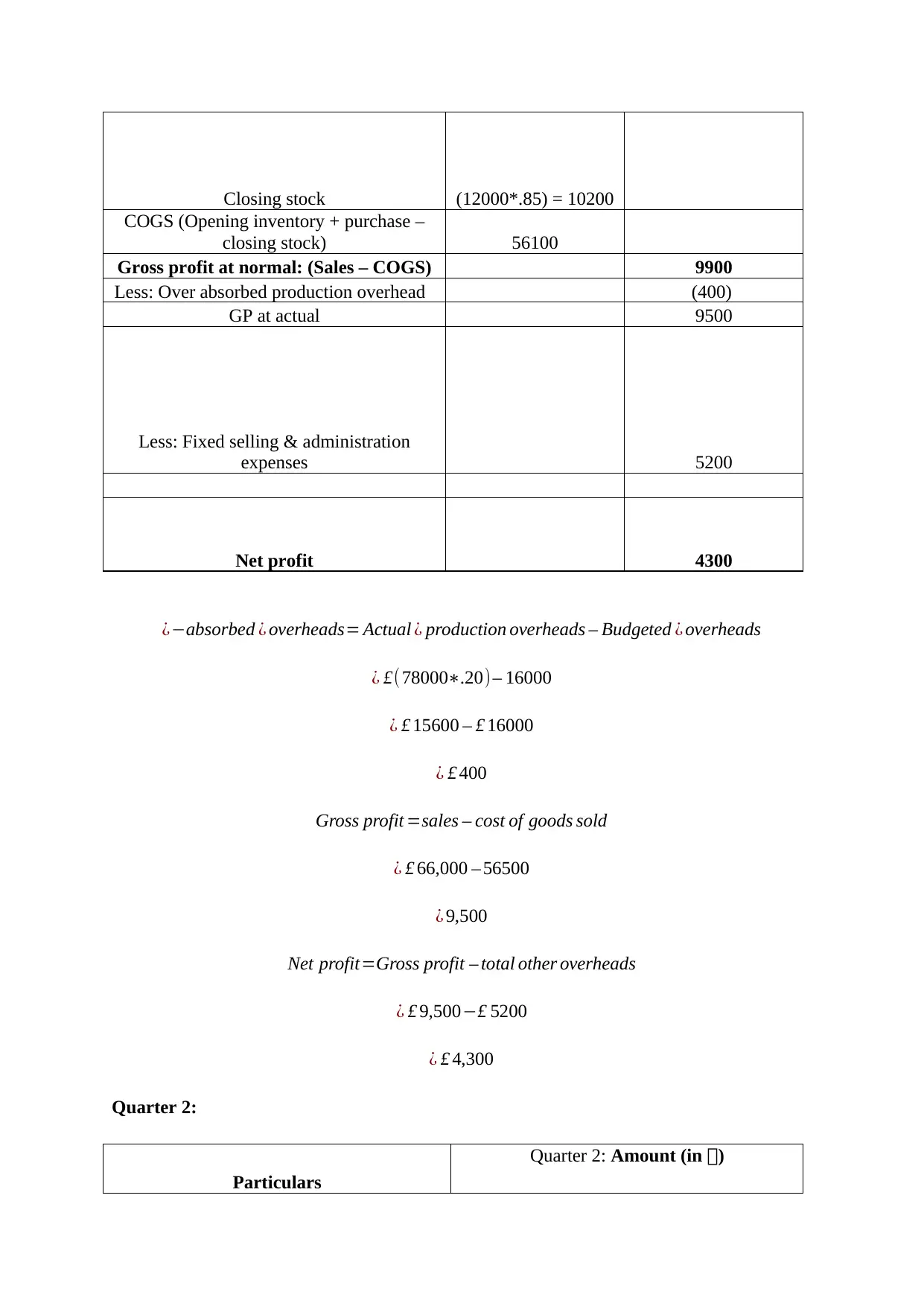

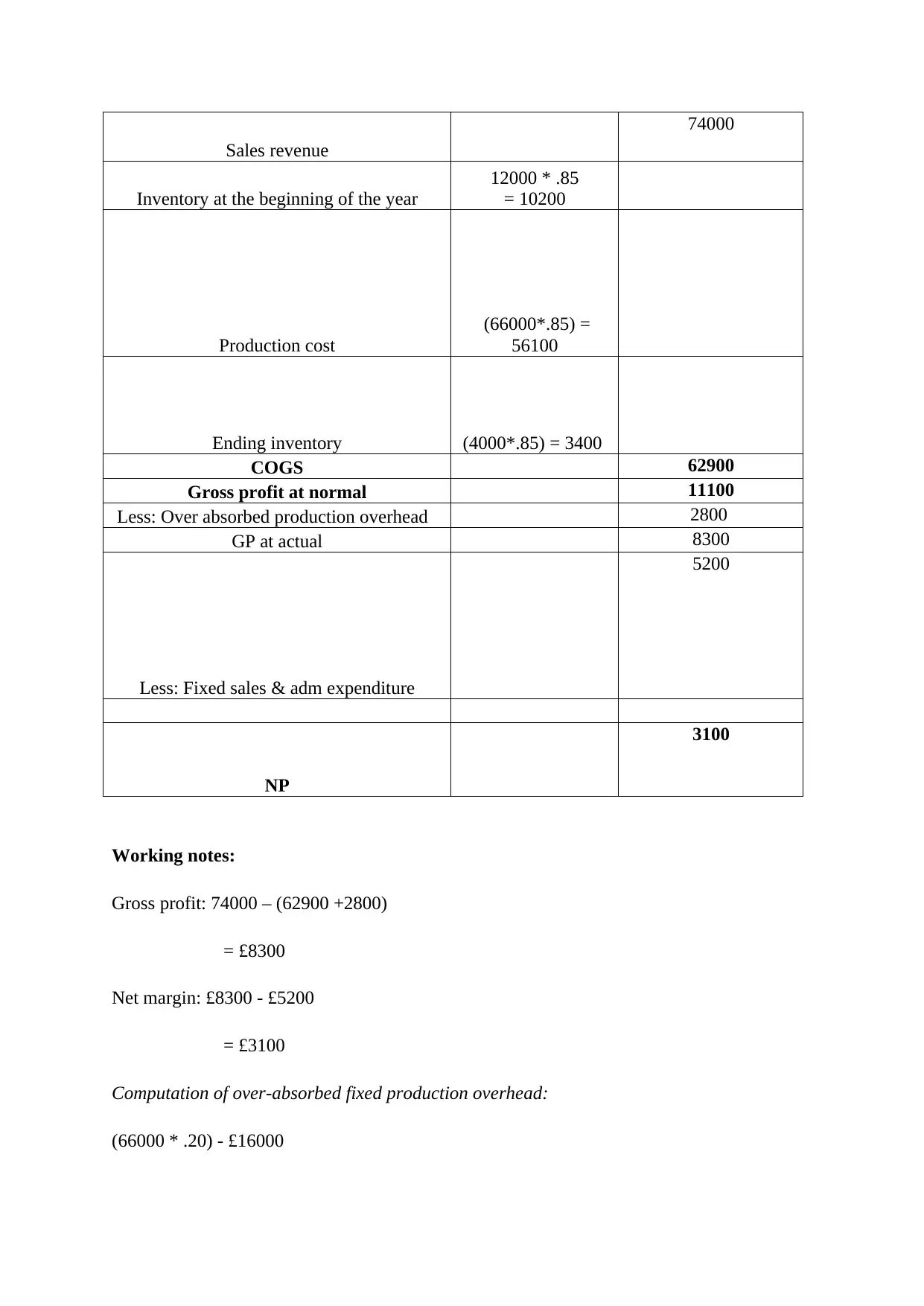

Sales revenue

74000

Inventory at the beginning of the year

12000 * .85

= 10200

Production cost

(66000*.85) =

56100

Ending inventory (4000*.85) = 3400

COGS 62900

Gross profit at normal 11100

Less: Over absorbed production overhead 2800

GP at actual 8300

Less: Fixed sales & adm expenditure

5200

NP

3100

Working notes:

Gross profit: 74000 – (62900 +2800)

= £8300

Net margin: £8300 - £5200

= £3100

Computation of over-absorbed fixed production overhead:

(66000 * .20) - £16000

74000

Inventory at the beginning of the year

12000 * .85

= 10200

Production cost

(66000*.85) =

56100

Ending inventory (4000*.85) = 3400

COGS 62900

Gross profit at normal 11100

Less: Over absorbed production overhead 2800

GP at actual 8300

Less: Fixed sales & adm expenditure

5200

NP

3100

Working notes:

Gross profit: 74000 – (62900 +2800)

= £8300

Net margin: £8300 - £5200

= £3100

Computation of over-absorbed fixed production overhead:

(66000 * .20) - £16000

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

= £13200 - £16000

= £2800

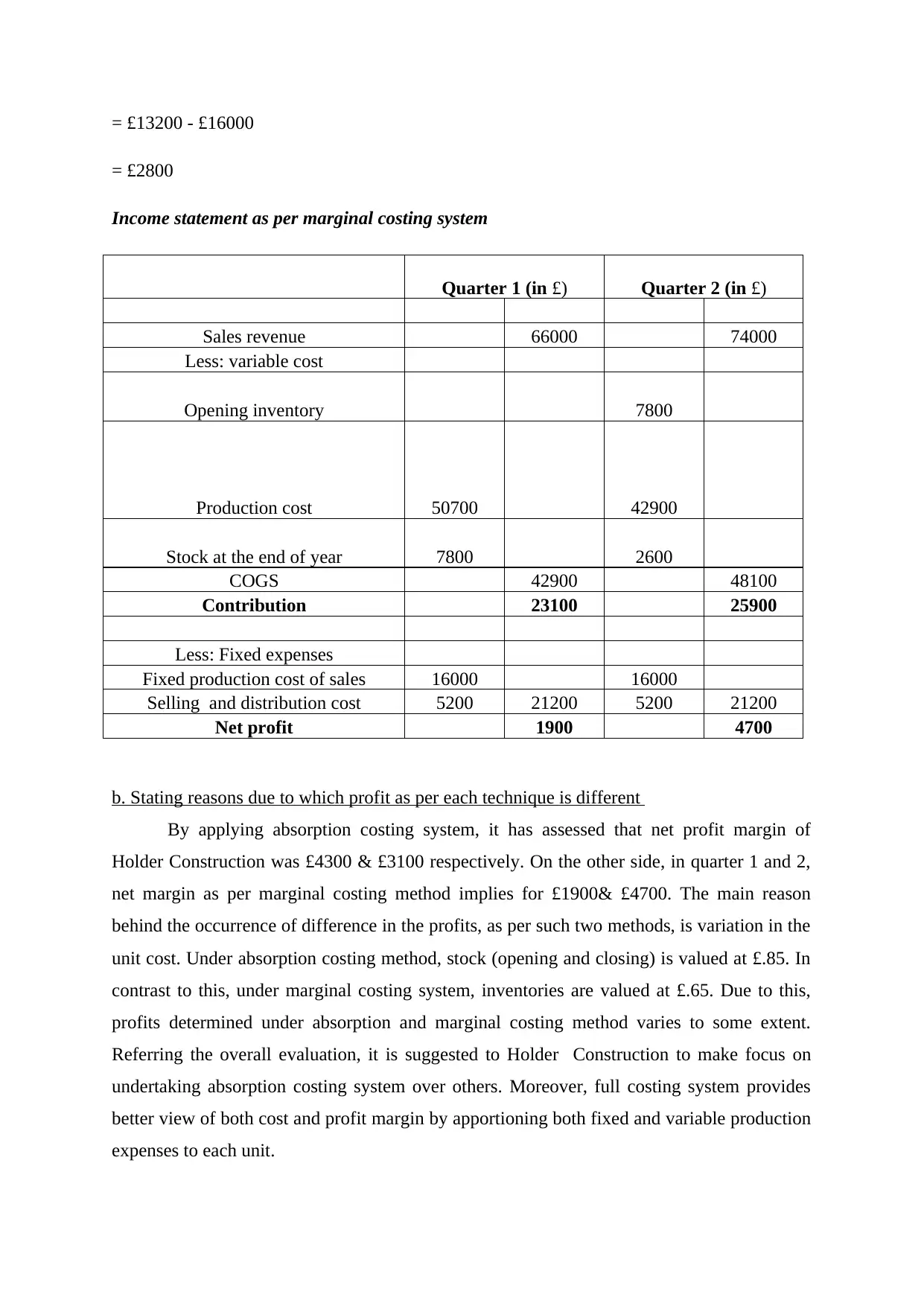

Income statement as per marginal costing system

Quarter 1 (in £) Quarter 2 (in £)

Sales revenue 66000 74000

Less: variable cost

Opening inventory 7800

Production cost 50700 42900

Stock at the end of year 7800 2600

COGS 42900 48100

Contribution 23100 25900

Less: Fixed expenses

Fixed production cost of sales 16000 16000

Selling and distribution cost 5200 21200 5200 21200

Net profit 1900 4700

b. Stating reasons due to which profit as per each technique is different

By applying absorption costing system, it has assessed that net profit margin of

Holder Construction was £4300 & £3100 respectively. On the other side, in quarter 1 and 2,

net margin as per marginal costing method implies for £1900& £4700. The main reason

behind the occurrence of difference in the profits, as per such two methods, is variation in the

unit cost. Under absorption costing method, stock (opening and closing) is valued at £.85. In

contrast to this, under marginal costing system, inventories are valued at £.65. Due to this,

profits determined under absorption and marginal costing method varies to some extent.

Referring the overall evaluation, it is suggested to Holder Construction to make focus on

undertaking absorption costing system over others. Moreover, full costing system provides

better view of both cost and profit margin by apportioning both fixed and variable production

expenses to each unit.

= £2800

Income statement as per marginal costing system

Quarter 1 (in £) Quarter 2 (in £)

Sales revenue 66000 74000

Less: variable cost

Opening inventory 7800

Production cost 50700 42900

Stock at the end of year 7800 2600

COGS 42900 48100

Contribution 23100 25900

Less: Fixed expenses

Fixed production cost of sales 16000 16000

Selling and distribution cost 5200 21200 5200 21200

Net profit 1900 4700

b. Stating reasons due to which profit as per each technique is different

By applying absorption costing system, it has assessed that net profit margin of

Holder Construction was £4300 & £3100 respectively. On the other side, in quarter 1 and 2,

net margin as per marginal costing method implies for £1900& £4700. The main reason

behind the occurrence of difference in the profits, as per such two methods, is variation in the

unit cost. Under absorption costing method, stock (opening and closing) is valued at £.85. In

contrast to this, under marginal costing system, inventories are valued at £.65. Due to this,

profits determined under absorption and marginal costing method varies to some extent.

Referring the overall evaluation, it is suggested to Holder Construction to make focus on

undertaking absorption costing system over others. Moreover, full costing system provides

better view of both cost and profit margin by apportioning both fixed and variable production

expenses to each unit.

c. Reconciliation statement

Profitability reconciliation statement

Quarter 1

Particulars Amount

Net profit as per absorption costing method 4300

Less: Fixed production overhead on ending inventory (12000 units @ .20 each) 2400

Net profit as per marginal costing method 1900

Quarter 2

Particulars Amount

Net profit as per absorption costing method 4300

Add: Fixed production overhead in ending inventory (4000 units @ .20 each) 800

Less: Fixed cost element in opening stock (12000 units @ .20 each) 2400

Net profit as per marginal costing method 3100

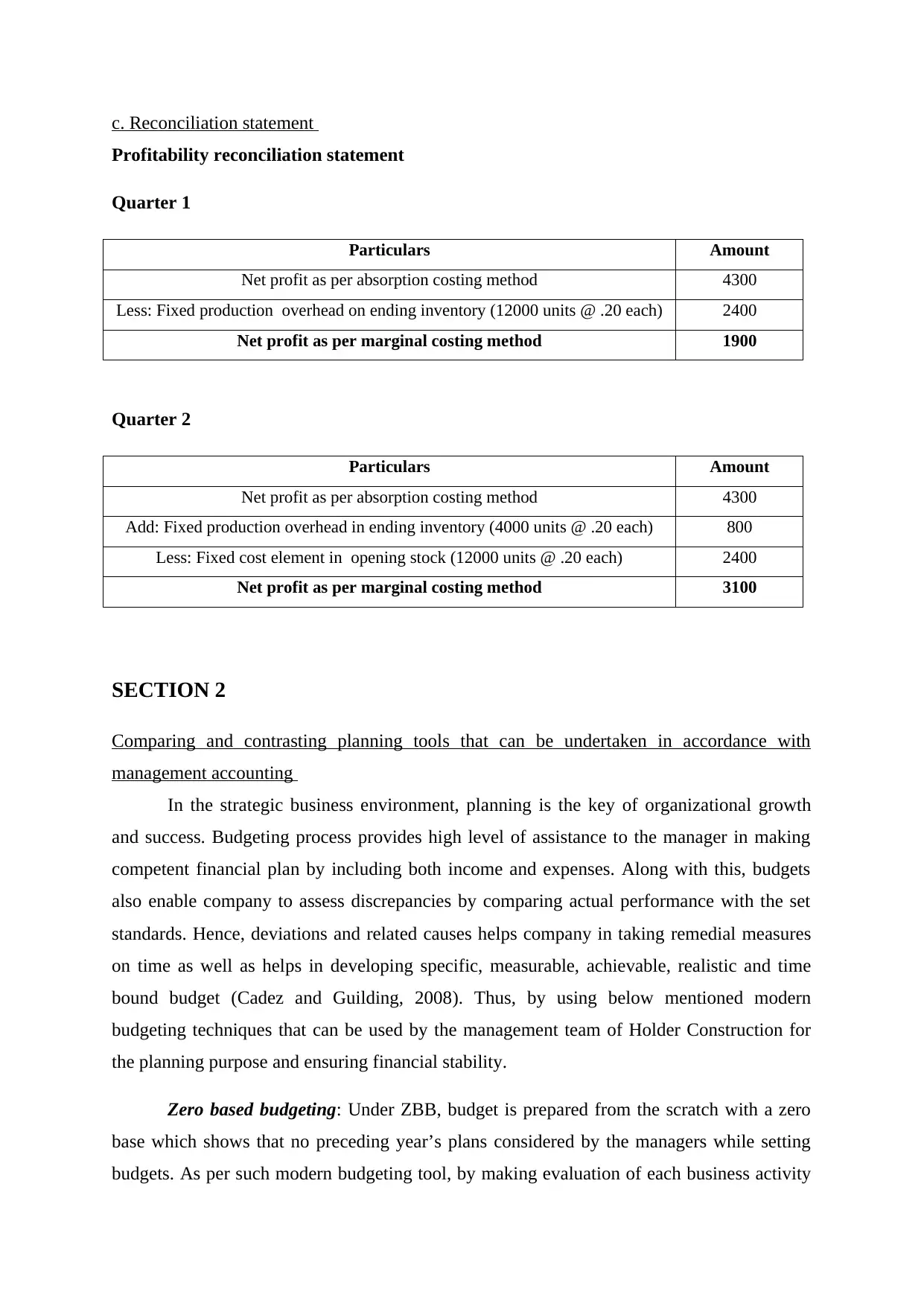

SECTION 2

Comparing and contrasting planning tools that can be undertaken in accordance with

management accounting

In the strategic business environment, planning is the key of organizational growth

and success. Budgeting process provides high level of assistance to the manager in making

competent financial plan by including both income and expenses. Along with this, budgets

also enable company to assess discrepancies by comparing actual performance with the set

standards. Hence, deviations and related causes helps company in taking remedial measures

on time as well as helps in developing specific, measurable, achievable, realistic and time

bound budget (Cadez and Guilding, 2008). Thus, by using below mentioned modern

budgeting techniques that can be used by the management team of Holder Construction for

the planning purpose and ensuring financial stability.

Zero based budgeting: Under ZBB, budget is prepared from the scratch with a zero

base which shows that no preceding year’s plans considered by the managers while setting

budgets. As per such modern budgeting tool, by making evaluation of each business activity

Profitability reconciliation statement

Quarter 1

Particulars Amount

Net profit as per absorption costing method 4300

Less: Fixed production overhead on ending inventory (12000 units @ .20 each) 2400

Net profit as per marginal costing method 1900

Quarter 2

Particulars Amount

Net profit as per absorption costing method 4300

Add: Fixed production overhead in ending inventory (4000 units @ .20 each) 800

Less: Fixed cost element in opening stock (12000 units @ .20 each) 2400

Net profit as per marginal costing method 3100

SECTION 2

Comparing and contrasting planning tools that can be undertaken in accordance with

management accounting

In the strategic business environment, planning is the key of organizational growth

and success. Budgeting process provides high level of assistance to the manager in making

competent financial plan by including both income and expenses. Along with this, budgets

also enable company to assess discrepancies by comparing actual performance with the set

standards. Hence, deviations and related causes helps company in taking remedial measures

on time as well as helps in developing specific, measurable, achievable, realistic and time

bound budget (Cadez and Guilding, 2008). Thus, by using below mentioned modern

budgeting techniques that can be used by the management team of Holder Construction for

the planning purpose and ensuring financial stability.

Zero based budgeting: Under ZBB, budget is prepared from the scratch with a zero

base which shows that no preceding year’s plans considered by the managers while setting

budgets. As per such modern budgeting tool, by making evaluation of each business activity

and ways to perform the same funds are allocated (Otley, 2016). In the modern era, ZBB is

highly appropriate planning tool because it lays emphasis on the justification of every line of

item. This planning tool includes structured process that facilitates competent financial plan

and effectual use of monetary resources. Steps that ZBB includes are enumerated below:

Task identification or assessment’

Assessing alternative ways for task accomplishment

Evaluation of alternatives and funding sources

Allocation of funds as per priorities pertaining to business activities

Advantages:

ZBB focuses on relooking each & every item of cash flow and thereby helps in

developing accurate plan. Thus, suitable operational cost can be calculated by Holder

Construction using such technique.

It facilitates optimum allocation of funds by avoiding redundant activities from the

plan.

When budgets are prepared according to ZBB then company also involves its

personnel in the decision making aspects. Thus, ZBB places positive impact on

employee motivation and encourages them to carry out activities prominently (Zero

based budgeting, 2018).

Further, it promotes operational efficiency by avoiding or eliminating unproductive

activities.

Disadvantages:

It requires high manpower specifically managers for justifying every detail pertaining

to the expenses.

Expert personnel are another main requirement for preparing and executing budget as

per ZBB. Hence, in the absence of having skilled people firm will face difficulty in

getting the desired level of outcome or success.

As per ZBB, for arriving at solid foundation, pertaining to decision making, manager

has to devote more time. Further, sometimes, mangers face issue in defining expenses

so budget preparation as per ZBB considered as time consuming or exhaustive

process.

highly appropriate planning tool because it lays emphasis on the justification of every line of

item. This planning tool includes structured process that facilitates competent financial plan

and effectual use of monetary resources. Steps that ZBB includes are enumerated below:

Task identification or assessment’

Assessing alternative ways for task accomplishment

Evaluation of alternatives and funding sources

Allocation of funds as per priorities pertaining to business activities

Advantages:

ZBB focuses on relooking each & every item of cash flow and thereby helps in

developing accurate plan. Thus, suitable operational cost can be calculated by Holder

Construction using such technique.

It facilitates optimum allocation of funds by avoiding redundant activities from the

plan.

When budgets are prepared according to ZBB then company also involves its

personnel in the decision making aspects. Thus, ZBB places positive impact on

employee motivation and encourages them to carry out activities prominently (Zero

based budgeting, 2018).

Further, it promotes operational efficiency by avoiding or eliminating unproductive

activities.

Disadvantages:

It requires high manpower specifically managers for justifying every detail pertaining

to the expenses.

Expert personnel are another main requirement for preparing and executing budget as

per ZBB. Hence, in the absence of having skilled people firm will face difficulty in

getting the desired level of outcome or success.

As per ZBB, for arriving at solid foundation, pertaining to decision making, manager

has to devote more time. Further, sometimes, mangers face issue in defining expenses

so budget preparation as per ZBB considered as time consuming or exhaustive

process.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Personal biasness in the ranking of decision packages also affects the significance of

ZBB technique.

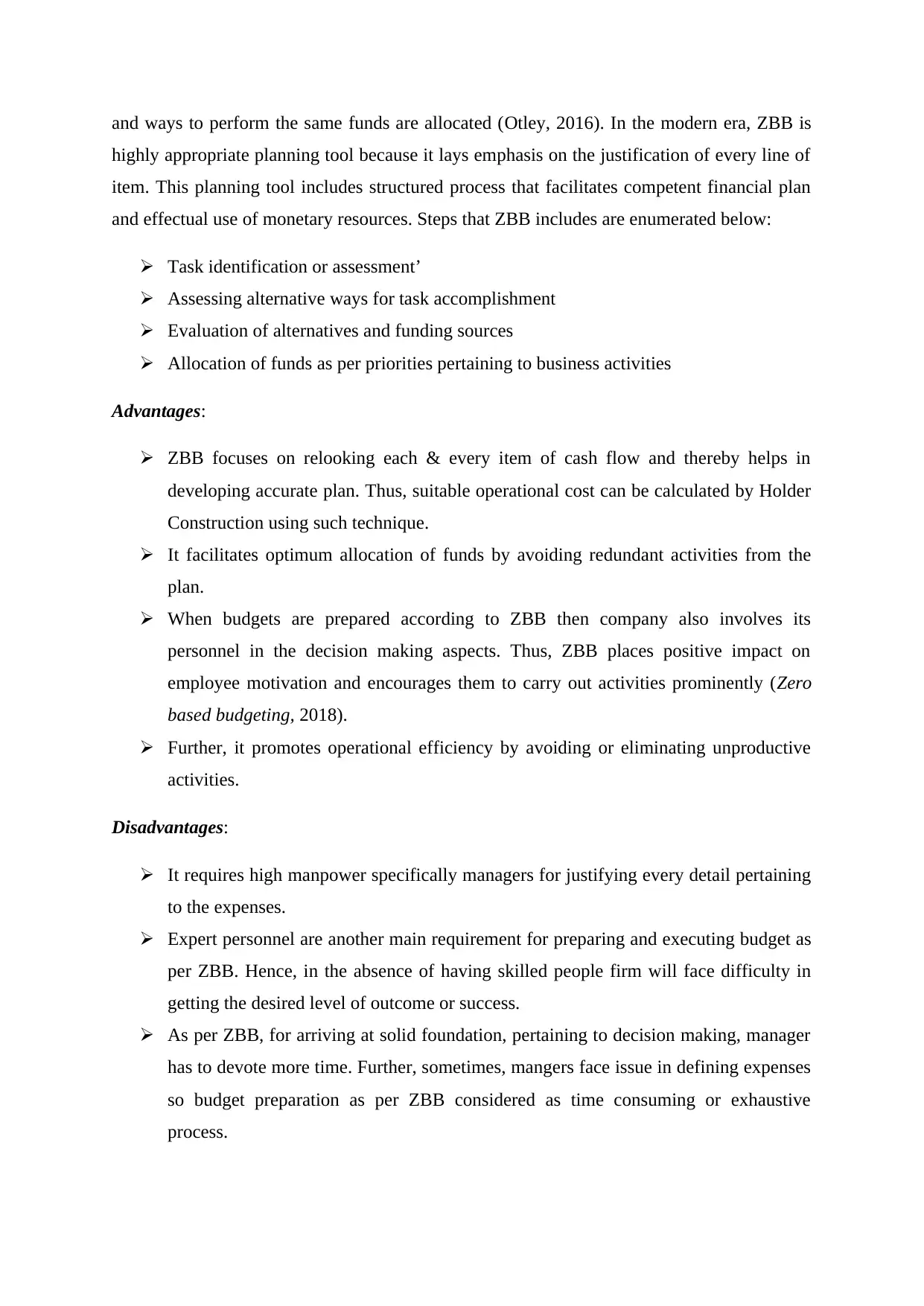

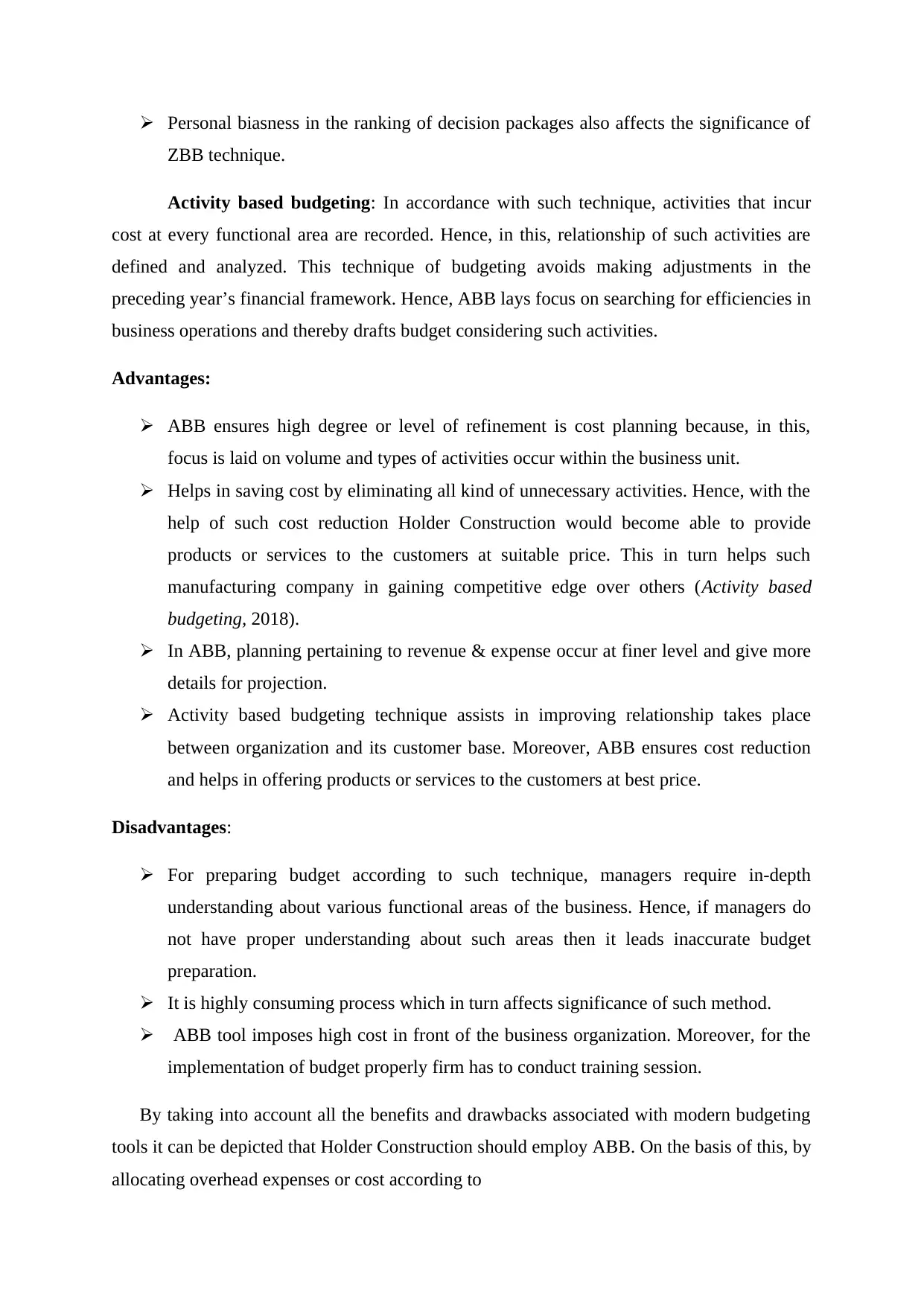

Activity based budgeting: In accordance with such technique, activities that incur

cost at every functional area are recorded. Hence, in this, relationship of such activities are

defined and analyzed. This technique of budgeting avoids making adjustments in the

preceding year’s financial framework. Hence, ABB lays focus on searching for efficiencies in

business operations and thereby drafts budget considering such activities.

Advantages:

ABB ensures high degree or level of refinement is cost planning because, in this,

focus is laid on volume and types of activities occur within the business unit.

Helps in saving cost by eliminating all kind of unnecessary activities. Hence, with the

help of such cost reduction Holder Construction would become able to provide

products or services to the customers at suitable price. This in turn helps such

manufacturing company in gaining competitive edge over others (Activity based

budgeting, 2018).

In ABB, planning pertaining to revenue & expense occur at finer level and give more

details for projection.

Activity based budgeting technique assists in improving relationship takes place

between organization and its customer base. Moreover, ABB ensures cost reduction

and helps in offering products or services to the customers at best price.

Disadvantages:

For preparing budget according to such technique, managers require in-depth

understanding about various functional areas of the business. Hence, if managers do

not have proper understanding about such areas then it leads inaccurate budget

preparation.

It is highly consuming process which in turn affects significance of such method.

ABB tool imposes high cost in front of the business organization. Moreover, for the

implementation of budget properly firm has to conduct training session.

By taking into account all the benefits and drawbacks associated with modern budgeting

tools it can be depicted that Holder Construction should employ ABB. On the basis of this, by

allocating overhead expenses or cost according to

ZBB technique.

Activity based budgeting: In accordance with such technique, activities that incur

cost at every functional area are recorded. Hence, in this, relationship of such activities are

defined and analyzed. This technique of budgeting avoids making adjustments in the

preceding year’s financial framework. Hence, ABB lays focus on searching for efficiencies in

business operations and thereby drafts budget considering such activities.

Advantages:

ABB ensures high degree or level of refinement is cost planning because, in this,

focus is laid on volume and types of activities occur within the business unit.

Helps in saving cost by eliminating all kind of unnecessary activities. Hence, with the

help of such cost reduction Holder Construction would become able to provide

products or services to the customers at suitable price. This in turn helps such

manufacturing company in gaining competitive edge over others (Activity based

budgeting, 2018).

In ABB, planning pertaining to revenue & expense occur at finer level and give more

details for projection.

Activity based budgeting technique assists in improving relationship takes place

between organization and its customer base. Moreover, ABB ensures cost reduction

and helps in offering products or services to the customers at best price.

Disadvantages:

For preparing budget according to such technique, managers require in-depth

understanding about various functional areas of the business. Hence, if managers do

not have proper understanding about such areas then it leads inaccurate budget

preparation.

It is highly consuming process which in turn affects significance of such method.

ABB tool imposes high cost in front of the business organization. Moreover, for the

implementation of budget properly firm has to conduct training session.

By taking into account all the benefits and drawbacks associated with modern budgeting

tools it can be depicted that Holder Construction should employ ABB. On the basis of this, by

allocating overhead expenses or cost according to

Capital budgeting tools: In the context of Holder Construction, for ensuring smooth

functioning of the business operations and functions manager needs to make capital

investments. In other words, for the maximization of productivity and profitability such

manufacturing firm requires making investment in machineries, latest equipments etc. Thus,

more options are available for the investment purpose then business entity faces difficulty in

making selection of the best one (Reome and Sinclair, 2017). In this regard, capital budgeting

tools are highly significant which helps in determining whether the concerned proposal will

aid in the profit or growth of the firm. Such techniques include NPV, payback period, internal

and average rate of return which helps in evaluating the viability of proposed investment in

monetary terms.

In accordance with the selection criteria’s business unit should select and investment

in the project having high NPV, ARR and IRR. However, capital budgeting tools namely

payback period and ARR are criticized on the basis of aspects that it completely avoids time

value of money concept which has high level of importance in the present times. Further, IRR

method includes complex assessment because in this analyst has to select two discounting

factors.

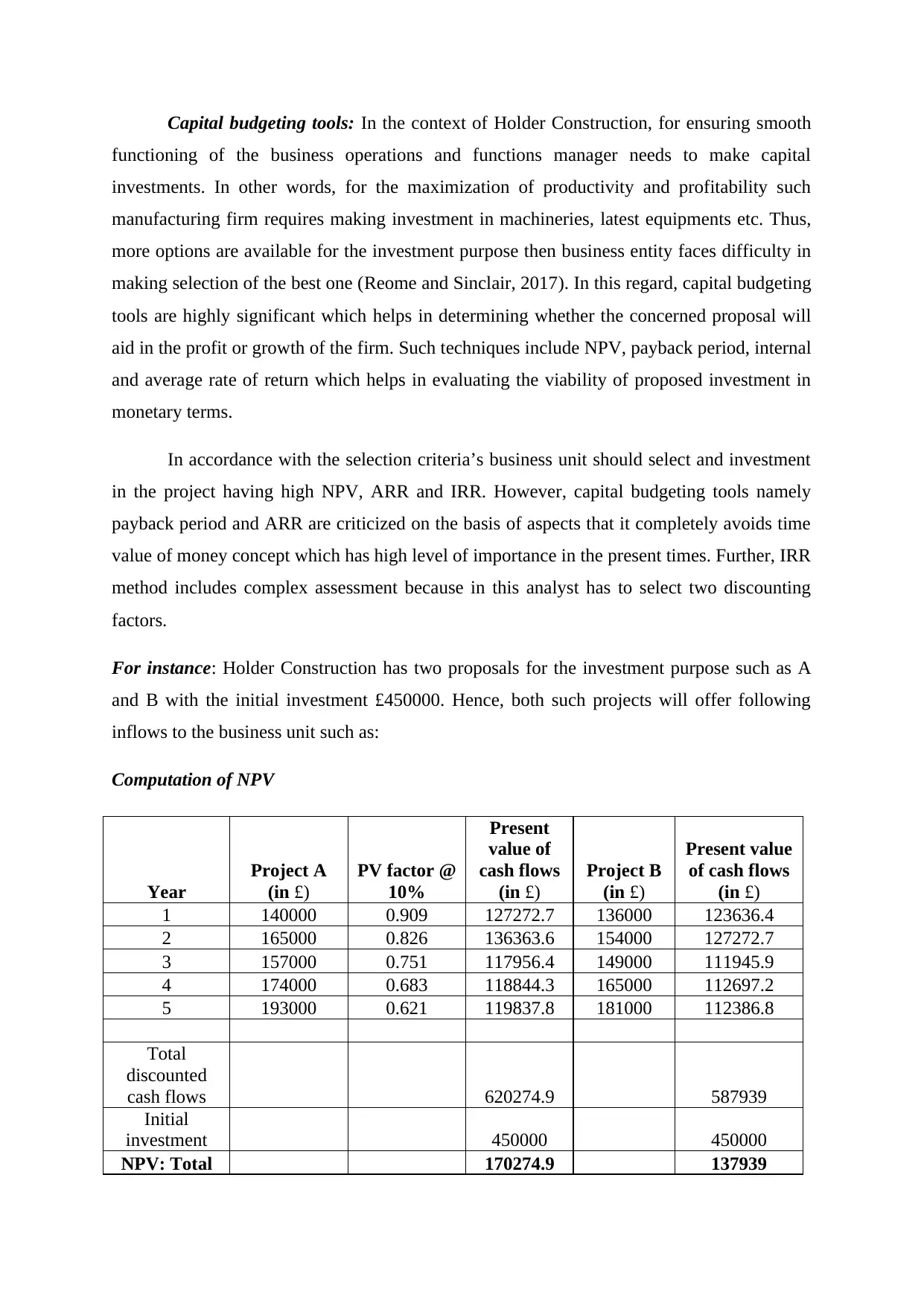

For instance: Holder Construction has two proposals for the investment purpose such as A

and B with the initial investment £450000. Hence, both such projects will offer following

inflows to the business unit such as:

Computation of NPV

Year

Project A

(in £)

PV factor @

10%

Present

value of

cash flows

(in £)

Project B

(in £)

Present value

of cash flows

(in £)

1 140000 0.909 127272.7 136000 123636.4

2 165000 0.826 136363.6 154000 127272.7

3 157000 0.751 117956.4 149000 111945.9

4 174000 0.683 118844.3 165000 112697.2

5 193000 0.621 119837.8 181000 112386.8

Total

discounted

cash flows 620274.9 587939

Initial

investment 450000 450000

NPV: Total 170274.9 137939

functioning of the business operations and functions manager needs to make capital

investments. In other words, for the maximization of productivity and profitability such

manufacturing firm requires making investment in machineries, latest equipments etc. Thus,

more options are available for the investment purpose then business entity faces difficulty in

making selection of the best one (Reome and Sinclair, 2017). In this regard, capital budgeting

tools are highly significant which helps in determining whether the concerned proposal will

aid in the profit or growth of the firm. Such techniques include NPV, payback period, internal

and average rate of return which helps in evaluating the viability of proposed investment in

monetary terms.

In accordance with the selection criteria’s business unit should select and investment

in the project having high NPV, ARR and IRR. However, capital budgeting tools namely

payback period and ARR are criticized on the basis of aspects that it completely avoids time

value of money concept which has high level of importance in the present times. Further, IRR

method includes complex assessment because in this analyst has to select two discounting

factors.

For instance: Holder Construction has two proposals for the investment purpose such as A

and B with the initial investment £450000. Hence, both such projects will offer following

inflows to the business unit such as:

Computation of NPV

Year

Project A

(in £)

PV factor @

10%

Present

value of

cash flows

(in £)

Project B

(in £)

Present value

of cash flows

(in £)

1 140000 0.909 127272.7 136000 123636.4

2 165000 0.826 136363.6 154000 127272.7

3 157000 0.751 117956.4 149000 111945.9

4 174000 0.683 118844.3 165000 112697.2

5 193000 0.621 119837.8 181000 112386.8

Total

discounted

cash flows 620274.9 587939

Initial

investment 450000 450000

NPV: Total 170274.9 137939

discounted

cash flows –

initial

investment

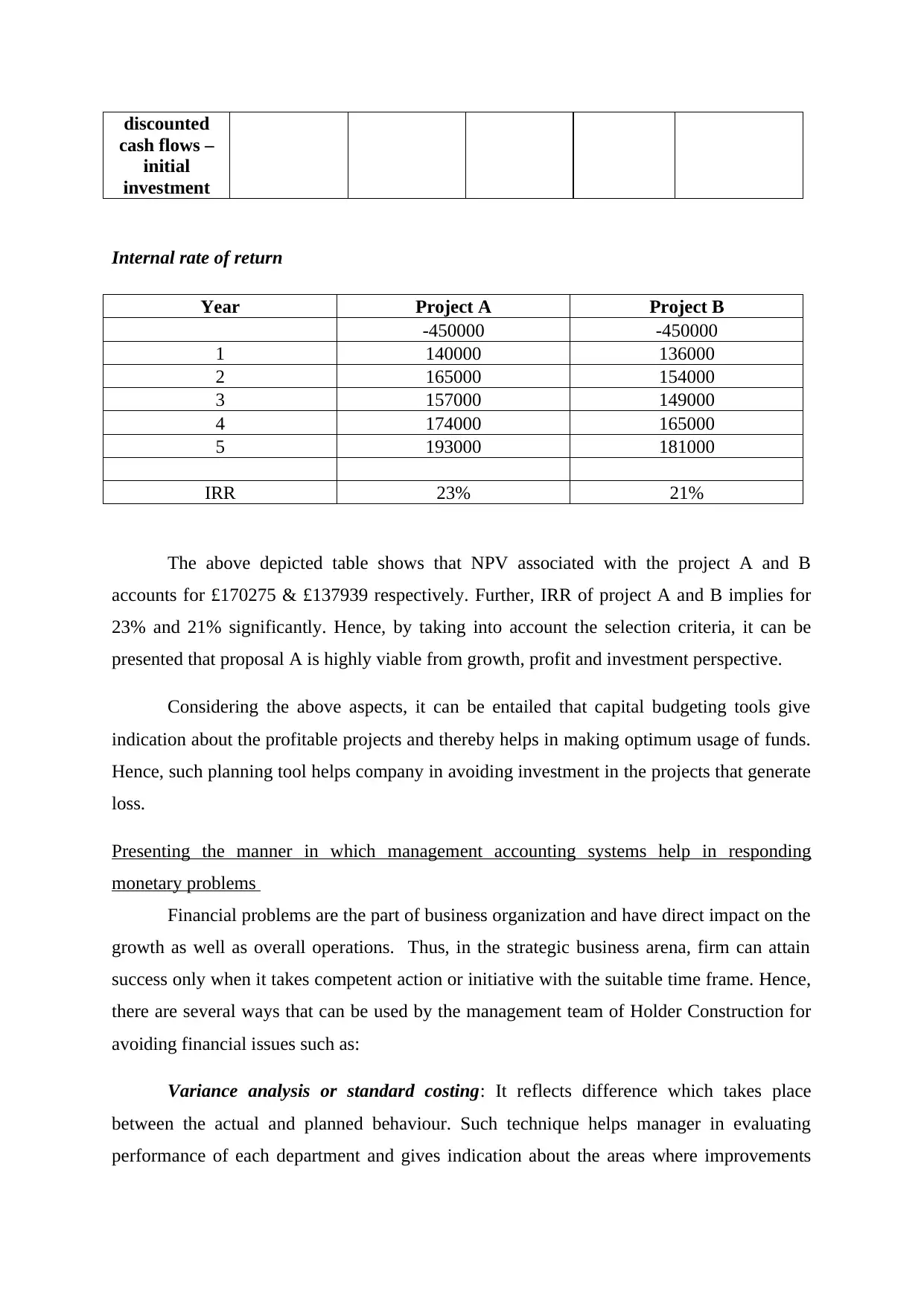

Internal rate of return

Year Project A Project B

-450000 -450000

1 140000 136000

2 165000 154000

3 157000 149000

4 174000 165000

5 193000 181000

IRR 23% 21%

The above depicted table shows that NPV associated with the project A and B

accounts for £170275 & £137939 respectively. Further, IRR of project A and B implies for

23% and 21% significantly. Hence, by taking into account the selection criteria, it can be

presented that proposal A is highly viable from growth, profit and investment perspective.

Considering the above aspects, it can be entailed that capital budgeting tools give

indication about the profitable projects and thereby helps in making optimum usage of funds.

Hence, such planning tool helps company in avoiding investment in the projects that generate

loss.

Presenting the manner in which management accounting systems help in responding

monetary problems

Financial problems are the part of business organization and have direct impact on the

growth as well as overall operations. Thus, in the strategic business arena, firm can attain

success only when it takes competent action or initiative with the suitable time frame. Hence,

there are several ways that can be used by the management team of Holder Construction for

avoiding financial issues such as:

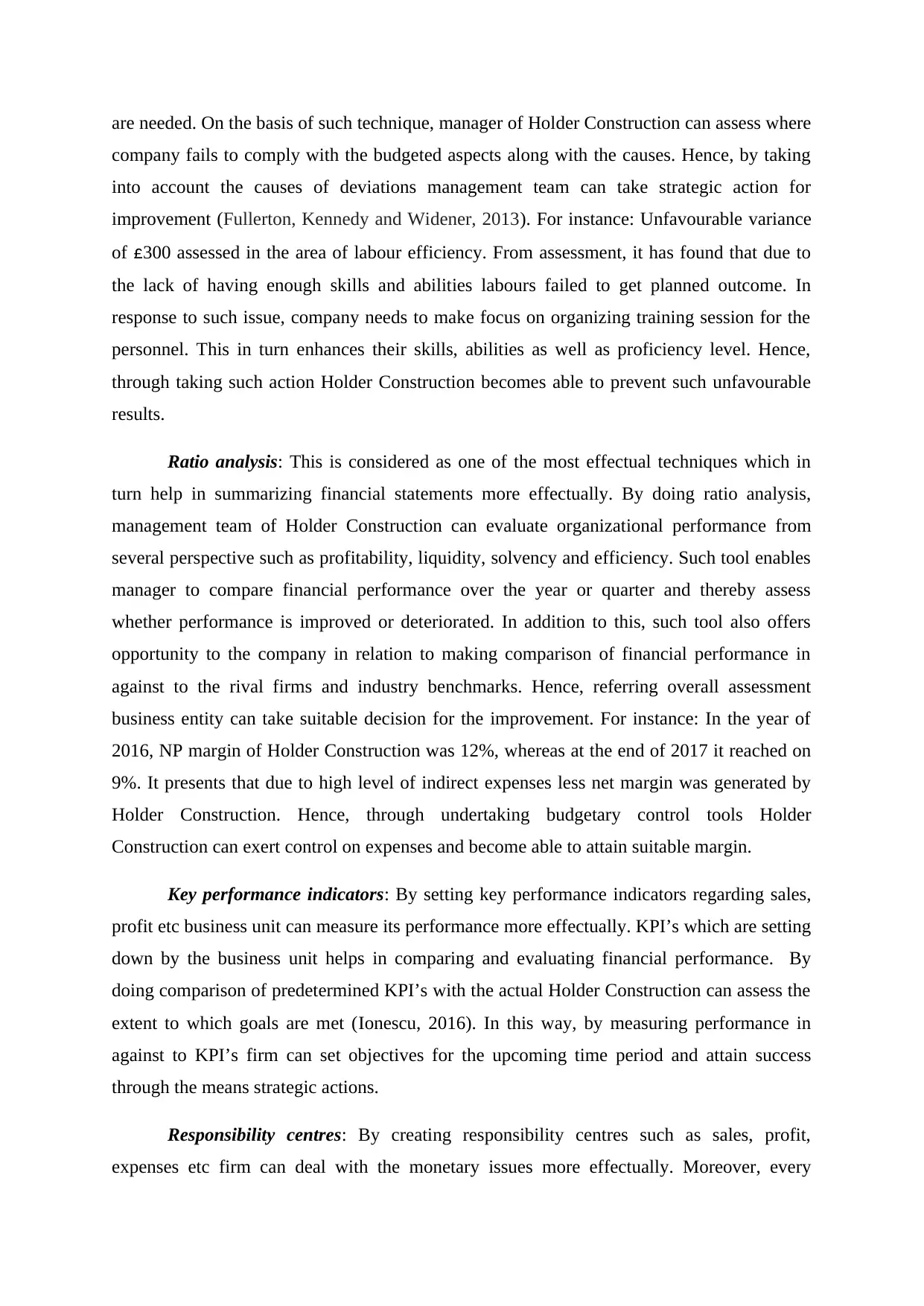

Variance analysis or standard costing: It reflects difference which takes place

between the actual and planned behaviour. Such technique helps manager in evaluating

performance of each department and gives indication about the areas where improvements

cash flows –

initial

investment

Internal rate of return

Year Project A Project B

-450000 -450000

1 140000 136000

2 165000 154000

3 157000 149000

4 174000 165000

5 193000 181000

IRR 23% 21%

The above depicted table shows that NPV associated with the project A and B

accounts for £170275 & £137939 respectively. Further, IRR of project A and B implies for

23% and 21% significantly. Hence, by taking into account the selection criteria, it can be

presented that proposal A is highly viable from growth, profit and investment perspective.

Considering the above aspects, it can be entailed that capital budgeting tools give

indication about the profitable projects and thereby helps in making optimum usage of funds.

Hence, such planning tool helps company in avoiding investment in the projects that generate

loss.

Presenting the manner in which management accounting systems help in responding

monetary problems

Financial problems are the part of business organization and have direct impact on the

growth as well as overall operations. Thus, in the strategic business arena, firm can attain

success only when it takes competent action or initiative with the suitable time frame. Hence,

there are several ways that can be used by the management team of Holder Construction for

avoiding financial issues such as:

Variance analysis or standard costing: It reflects difference which takes place

between the actual and planned behaviour. Such technique helps manager in evaluating

performance of each department and gives indication about the areas where improvements

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

are needed. On the basis of such technique, manager of Holder Construction can assess where

company fails to comply with the budgeted aspects along with the causes. Hence, by taking

into account the causes of deviations management team can take strategic action for

improvement (Fullerton, Kennedy and Widener, 2013). For instance: Unfavourable variance

of £300 assessed in the area of labour efficiency. From assessment, it has found that due to

the lack of having enough skills and abilities labours failed to get planned outcome. In

response to such issue, company needs to make focus on organizing training session for the

personnel. This in turn enhances their skills, abilities as well as proficiency level. Hence,

through taking such action Holder Construction becomes able to prevent such unfavourable

results.

Ratio analysis: This is considered as one of the most effectual techniques which in

turn help in summarizing financial statements more effectually. By doing ratio analysis,

management team of Holder Construction can evaluate organizational performance from

several perspective such as profitability, liquidity, solvency and efficiency. Such tool enables

manager to compare financial performance over the year or quarter and thereby assess

whether performance is improved or deteriorated. In addition to this, such tool also offers

opportunity to the company in relation to making comparison of financial performance in

against to the rival firms and industry benchmarks. Hence, referring overall assessment

business entity can take suitable decision for the improvement. For instance: In the year of

2016, NP margin of Holder Construction was 12%, whereas at the end of 2017 it reached on

9%. It presents that due to high level of indirect expenses less net margin was generated by

Holder Construction. Hence, through undertaking budgetary control tools Holder

Construction can exert control on expenses and become able to attain suitable margin.

Key performance indicators: By setting key performance indicators regarding sales,

profit etc business unit can measure its performance more effectually. KPI’s which are setting

down by the business unit helps in comparing and evaluating financial performance. By

doing comparison of predetermined KPI’s with the actual Holder Construction can assess the

extent to which goals are met (Ionescu, 2016). In this way, by measuring performance in

against to KPI’s firm can set objectives for the upcoming time period and attain success

through the means strategic actions.

Responsibility centres: By creating responsibility centres such as sales, profit,

expenses etc firm can deal with the monetary issues more effectually. Moreover, every

company fails to comply with the budgeted aspects along with the causes. Hence, by taking

into account the causes of deviations management team can take strategic action for

improvement (Fullerton, Kennedy and Widener, 2013). For instance: Unfavourable variance

of £300 assessed in the area of labour efficiency. From assessment, it has found that due to

the lack of having enough skills and abilities labours failed to get planned outcome. In

response to such issue, company needs to make focus on organizing training session for the

personnel. This in turn enhances their skills, abilities as well as proficiency level. Hence,

through taking such action Holder Construction becomes able to prevent such unfavourable

results.

Ratio analysis: This is considered as one of the most effectual techniques which in

turn help in summarizing financial statements more effectually. By doing ratio analysis,

management team of Holder Construction can evaluate organizational performance from

several perspective such as profitability, liquidity, solvency and efficiency. Such tool enables

manager to compare financial performance over the year or quarter and thereby assess

whether performance is improved or deteriorated. In addition to this, such tool also offers

opportunity to the company in relation to making comparison of financial performance in

against to the rival firms and industry benchmarks. Hence, referring overall assessment

business entity can take suitable decision for the improvement. For instance: In the year of

2016, NP margin of Holder Construction was 12%, whereas at the end of 2017 it reached on

9%. It presents that due to high level of indirect expenses less net margin was generated by

Holder Construction. Hence, through undertaking budgetary control tools Holder

Construction can exert control on expenses and become able to attain suitable margin.

Key performance indicators: By setting key performance indicators regarding sales,

profit etc business unit can measure its performance more effectually. KPI’s which are setting

down by the business unit helps in comparing and evaluating financial performance. By

doing comparison of predetermined KPI’s with the actual Holder Construction can assess the

extent to which goals are met (Ionescu, 2016). In this way, by measuring performance in

against to KPI’s firm can set objectives for the upcoming time period and attain success

through the means strategic actions.

Responsibility centres: By creating responsibility centres such as sales, profit,

expenses etc firm can deal with the monetary issues more effectually. Moreover, every

responsibility centre is assigned with some specific goals that need to be achieved. Hence, in

the case of responsibility centre, business unit takes input from the managers of concerned

department about the reasons due to which they failed to meet budgeted figures. Thus,

referring such causes Holder Construction can take appropriate measure that contributes in

organizational success. Further, input given by the managers also helps in preparing

competent financial plan for the upcoming time period.

CONCLUSION

By summing up this report, it can be concluded that MA is highly significant which in

turn facilitates cost control and performance management through appropriate decision

making. Further, it can be depicted that management accounting systems provide high level

of assistance to Holder Construction in making suitable business decisions and thereby make

contribution in the attainment of organizational goals. It has been articulated that Holder

Construction should focus on undertaking activity based modern budgeting technique that

highly suits to the manufacturing business units. This in turn helps company in developing

suitable budget as per the cost driver. Besides this, it can be inferred from the evaluation that

through performing ratio analysis Holder Construction can evaluate performance and

becomes able to improve the same through undertaking strategic measures. Further, it can be

summarized from the report that through employing the techniques of variance analysis and

capital budgeting Holder Construction can respond monetary issues prominently.

the case of responsibility centre, business unit takes input from the managers of concerned

department about the reasons due to which they failed to meet budgeted figures. Thus,

referring such causes Holder Construction can take appropriate measure that contributes in

organizational success. Further, input given by the managers also helps in preparing

competent financial plan for the upcoming time period.

CONCLUSION

By summing up this report, it can be concluded that MA is highly significant which in

turn facilitates cost control and performance management through appropriate decision

making. Further, it can be depicted that management accounting systems provide high level

of assistance to Holder Construction in making suitable business decisions and thereby make

contribution in the attainment of organizational goals. It has been articulated that Holder

Construction should focus on undertaking activity based modern budgeting technique that

highly suits to the manufacturing business units. This in turn helps company in developing

suitable budget as per the cost driver. Besides this, it can be inferred from the evaluation that

through performing ratio analysis Holder Construction can evaluate performance and

becomes able to improve the same through undertaking strategic measures. Further, it can be

summarized from the report that through employing the techniques of variance analysis and

capital budgeting Holder Construction can respond monetary issues prominently.

REFERENCES

Books and Journals

Alcouffe, S., Berland, N. and Levant, Y., 2008. Actor-networks and the diffusion of

management accounting innovations: A comparative study. Management Accounting

Research. 19(1). pp.1-17.

Baldvinsdottir, G., Mitchell, F. and Nørreklit, H., 2010. Issues in the relationship between

theory and practice in management accounting. Management Accounting Research. 21(2).

pp.79-82.

Cadez, S. and Guilding, C., 2008. An exploratory investigation of an integrated contingency

model of strategic management accounting. Accounting, organizations and society. 33(7).

pp.836-863.

Fullerton, R. R., Kennedy, F. A. and Widener, S. K., 2013. Management accounting and

control practices in a lean manufacturing environment. Accounting, Organizations and

Society. 38(1). pp.50-71.

Ionescu, L., 2016. The Role of the Professional Accountants in Business Administration.

In International Conference on Economic Sciences and Business Administration.

SpiruHaret University. 3(1). pp.184-188.

Macintosh, N.B. and Quattrone, P., 2010. Management accounting and

control systems: An organizational and sociological approach. John

Wiley & Sons.

Otley, D., 2016. The contingency theory of management accounting and control: 1980–

2014. Management accounting research. 31. pp.45-62.

Reome, C. and Sinclair, T. A., 2017. Better Budgeting Is Good Governance. Shared

Governance in Higher Education, Volume 2: New Paradigms, Evolving Perspectives.

p.121.

Simons, R., 2013. Performance Measurement and Control Systems for Implementing Strategy

Text and Cases: Pearson New International Edition. Pearson Higher Ed.

Books and Journals

Alcouffe, S., Berland, N. and Levant, Y., 2008. Actor-networks and the diffusion of

management accounting innovations: A comparative study. Management Accounting

Research. 19(1). pp.1-17.

Baldvinsdottir, G., Mitchell, F. and Nørreklit, H., 2010. Issues in the relationship between

theory and practice in management accounting. Management Accounting Research. 21(2).

pp.79-82.

Cadez, S. and Guilding, C., 2008. An exploratory investigation of an integrated contingency

model of strategic management accounting. Accounting, organizations and society. 33(7).

pp.836-863.

Fullerton, R. R., Kennedy, F. A. and Widener, S. K., 2013. Management accounting and

control practices in a lean manufacturing environment. Accounting, Organizations and

Society. 38(1). pp.50-71.

Ionescu, L., 2016. The Role of the Professional Accountants in Business Administration.

In International Conference on Economic Sciences and Business Administration.

SpiruHaret University. 3(1). pp.184-188.

Macintosh, N.B. and Quattrone, P., 2010. Management accounting and

control systems: An organizational and sociological approach. John

Wiley & Sons.

Otley, D., 2016. The contingency theory of management accounting and control: 1980–

2014. Management accounting research. 31. pp.45-62.

Reome, C. and Sinclair, T. A., 2017. Better Budgeting Is Good Governance. Shared

Governance in Higher Education, Volume 2: New Paradigms, Evolving Perspectives.

p.121.

Simons, R., 2013. Performance Measurement and Control Systems for Implementing Strategy

Text and Cases: Pearson New International Edition. Pearson Higher Ed.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Ward, K., 2012. Strategic management accounting. Routledge.

Online

Activity based budgeting. 2018. [Online]. Available through:

<https://www.accountingtools.com/articles/activity-based-budgeting.html>.

Advantages and Disadvantages of Cost Accounting. 2018. [Online]. Available through:

<https://accountlearning.com/advantages-disadvantages-cost-accounting/>.

Advantages and Disadvantages of Job Costing. 2018. [Online]. Available through:

<https://accountlearning.com/advantages-disadvantages-job-costing/>.

Income Statements under Marginal and Absorption Costing. 2018. [Online]. Available

through: <http://www.financialaccountancy.org/marginal-costing/income-statements-

under-marginal-and-absorption-costing/>.

Job Costing. 2018. [Online]. Available through:

<https://www.accountingtools.com/articles/2017/5/14/job-costing>.

Zero based budgeting. 2018. [Online]. Available through:

<https://efinancemanagement.com/budgeting/zero-based>.

Online

Activity based budgeting. 2018. [Online]. Available through:

<https://www.accountingtools.com/articles/activity-based-budgeting.html>.

Advantages and Disadvantages of Cost Accounting. 2018. [Online]. Available through:

<https://accountlearning.com/advantages-disadvantages-cost-accounting/>.

Advantages and Disadvantages of Job Costing. 2018. [Online]. Available through:

<https://accountlearning.com/advantages-disadvantages-job-costing/>.

Income Statements under Marginal and Absorption Costing. 2018. [Online]. Available

through: <http://www.financialaccountancy.org/marginal-costing/income-statements-

under-marginal-and-absorption-costing/>.

Job Costing. 2018. [Online]. Available through:

<https://www.accountingtools.com/articles/2017/5/14/job-costing>.

Zero based budgeting. 2018. [Online]. Available through:

<https://efinancemanagement.com/budgeting/zero-based>.

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.