HNC Unit 5: Management Accounting Systems and Applications

VerifiedAdded on 2023/01/10

|14

|3366

|88

Report

AI Summary

This report examines management accounting systems and their applications within the context of ABC Ltd, a medium-sized manufacturing enterprise. It begins by defining management accounting (MA) and highlighting the significance of various MA systems, including cost accounting, price optimization, inventory management, and job costing. The report then delves into different MA reports such as cost reports, performance reports, and budget reports, evaluating their advantages and integrating them within organizational processes. The analysis includes a computation of profit using both absorption and marginal costing techniques, comparing their suitability. Furthermore, the report explores the benefits and limitations of budgetary control tools like Activity-Based Budgeting (ABB), capital budgeting, and zero-based budgeting. The report concludes by critically evaluating how MA systems and reporting are integrated into organizational processes, emphasizing their role in effective decision-making and achieving organizational goals, as per the HNC Unit 5: Management Accounting assignment brief.

Management Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION

MA means an application of the concepts and techniques in processing projected and

historical monetary data of an entity for enabling management in creating the plan for sensible

economic purpose & making logical decisions in view to accomplish the goals. The present

study is based on ABC Ltd. Medium sized firm operating in the production sector. Furthermore,

the study involves significance of MA systems and use of the different planning tools. Moreover,

it also highlights the system that helps the firm in resolving the financial problems.

LO1.

P1. Explaining the meaning of MA and providing essential need of different MA systems

MA refers to presentation of accounting information for the purpose of formulating

policies that is to be adopted by management and enable in running the routine operations of the

company (Hariyati, Tjahjadi and Soewarno, 2019). It means as describing an accounting

systems, methods and the techniques that with ability and the special knowledge helps the

administration in its respective job for maximize the profits & minimizing the losses.

Importance of MA systems are as follows-

Cost accounting system- This system that is utilized by ABC Ltd for anticipating cost of

their goods in analysing the profits, valuing inventory and controlling the cost. It helps in

estimate correct products cost that is crucial for achieving profits in the business operations. It

also enables the managers in analyzing profitable & non-profitable goods through anticipating

correct product cost. Further, this system helps in anticipating closing value of an inventory,

finished goods, WIP for preparing true and fair final reports.

Price optimization system-It means the use of statistical or mathematical tool for

determining the way in which the customer would respond towards different pricing of the

products and services (Rozhkova, Blinova and Rozhkova, 2017). This system plays an important

role in setting up the most suitable price at which the company can attract large customers and it

results to increase in its sales and profitability levels.

Inventory management system- This system that traces flow of goods in an entire supply

chain starting from transit to delivering the customers. It assists the managers in analysing the

need and availability of an inventory within the workplace. This MA system also helps in

maintaining centralized record of each and every asset and the item in control of an enterprise by

MA means an application of the concepts and techniques in processing projected and

historical monetary data of an entity for enabling management in creating the plan for sensible

economic purpose & making logical decisions in view to accomplish the goals. The present

study is based on ABC Ltd. Medium sized firm operating in the production sector. Furthermore,

the study involves significance of MA systems and use of the different planning tools. Moreover,

it also highlights the system that helps the firm in resolving the financial problems.

LO1.

P1. Explaining the meaning of MA and providing essential need of different MA systems

MA refers to presentation of accounting information for the purpose of formulating

policies that is to be adopted by management and enable in running the routine operations of the

company (Hariyati, Tjahjadi and Soewarno, 2019). It means as describing an accounting

systems, methods and the techniques that with ability and the special knowledge helps the

administration in its respective job for maximize the profits & minimizing the losses.

Importance of MA systems are as follows-

Cost accounting system- This system that is utilized by ABC Ltd for anticipating cost of

their goods in analysing the profits, valuing inventory and controlling the cost. It helps in

estimate correct products cost that is crucial for achieving profits in the business operations. It

also enables the managers in analyzing profitable & non-profitable goods through anticipating

correct product cost. Further, this system helps in anticipating closing value of an inventory,

finished goods, WIP for preparing true and fair final reports.

Price optimization system-It means the use of statistical or mathematical tool for

determining the way in which the customer would respond towards different pricing of the

products and services (Rozhkova, Blinova and Rozhkova, 2017). This system plays an important

role in setting up the most suitable price at which the company can attract large customers and it

results to increase in its sales and profitability levels.

Inventory management system- This system that traces flow of goods in an entire supply

chain starting from transit to delivering the customers. It assists the managers in analysing the

need and availability of an inventory within the workplace. This MA system also helps in

maintaining centralized record of each and every asset and the item in control of an enterprise by

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

facilitating single source of the truth for locating all the items, supplier & vendor information,

total number of the specific items present in stock and the specifications.

Job costing system- It involves process of accumulates information about costs

associated with specific production unit. Such information might be required for the purpose of

submit cost in order to customer under agreement where the costs are been reimbursed (Hopper

and Bui, 2016). This information is crucial for ABC Ltd in identifying accuracy of the firm's

estimating systems that should be able in quoting the prices that allows for the adequate profits.

The information facilitated by such system can also be use for transmission inventory costs to the

manufactured goods.

P2. Explaining different MA reports

While conducting MA, managers depend on the standard final reports containing

earnings statement, balance sheet, and cash flow statement. In addition to this, they too make use

of the additional reports for analysing information of an entity with regard to its budgets, cost

report and the performance report. There are several methods that are been used by the managers

for the purpose of reporting that are as follows-

Cost report- In these report managers includes complete information relating to

product’s price, labour expense, overhead & the other price into account in charge to identify the

price of all items adequately (Phan, Baird and Su, 2017). The overall costs is been separated by

total of items created under this report. In this type of report, overall data is presented in succinct

& the final cost related statement helps the managers to ensure proper control on the price of the

goods against selling costs. It also enables managers of ABC Ltd in proper planning and in

managing the income limits.

Performance report- Accountant in MA uses the spending plans for contrasting the

genuine use & the income with the deliberate sums. After identifying the new budget, change

projected are assessed and overall facts about such amount are been planned on this report. This

report plays a crucial role for firm in keeping appropriate gauge of their scheme towards their

mission.

Budget report- The principal element of MA is making a plan of the expenditure plans

where the budget are prepared by using previous period financial policy & acclimating to the

future prospect anticipation (Ionescu and Bigioi, 2016). In this the manager lists down all sources

of an proceeds and the disbursements where the company try for accomplishing its goals &

total number of the specific items present in stock and the specifications.

Job costing system- It involves process of accumulates information about costs

associated with specific production unit. Such information might be required for the purpose of

submit cost in order to customer under agreement where the costs are been reimbursed (Hopper

and Bui, 2016). This information is crucial for ABC Ltd in identifying accuracy of the firm's

estimating systems that should be able in quoting the prices that allows for the adequate profits.

The information facilitated by such system can also be use for transmission inventory costs to the

manufactured goods.

P2. Explaining different MA reports

While conducting MA, managers depend on the standard final reports containing

earnings statement, balance sheet, and cash flow statement. In addition to this, they too make use

of the additional reports for analysing information of an entity with regard to its budgets, cost

report and the performance report. There are several methods that are been used by the managers

for the purpose of reporting that are as follows-

Cost report- In these report managers includes complete information relating to

product’s price, labour expense, overhead & the other price into account in charge to identify the

price of all items adequately (Phan, Baird and Su, 2017). The overall costs is been separated by

total of items created under this report. In this type of report, overall data is presented in succinct

& the final cost related statement helps the managers to ensure proper control on the price of the

goods against selling costs. It also enables managers of ABC Ltd in proper planning and in

managing the income limits.

Performance report- Accountant in MA uses the spending plans for contrasting the

genuine use & the income with the deliberate sums. After identifying the new budget, change

projected are assessed and overall facts about such amount are been planned on this report. This

report plays a crucial role for firm in keeping appropriate gauge of their scheme towards their

mission.

Budget report- The principal element of MA is making a plan of the expenditure plans

where the budget are prepared by using previous period financial policy & acclimating to the

future prospect anticipation (Ionescu and Bigioi, 2016). In this the manager lists down all sources

of an proceeds and the disbursements where the company try for accomplishing its goals &

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

objectives by remaining within budgeted amounts. Thus, this method of reporting helps in

discovering the approaches for expanding the deals at the time of diminishing the costs.

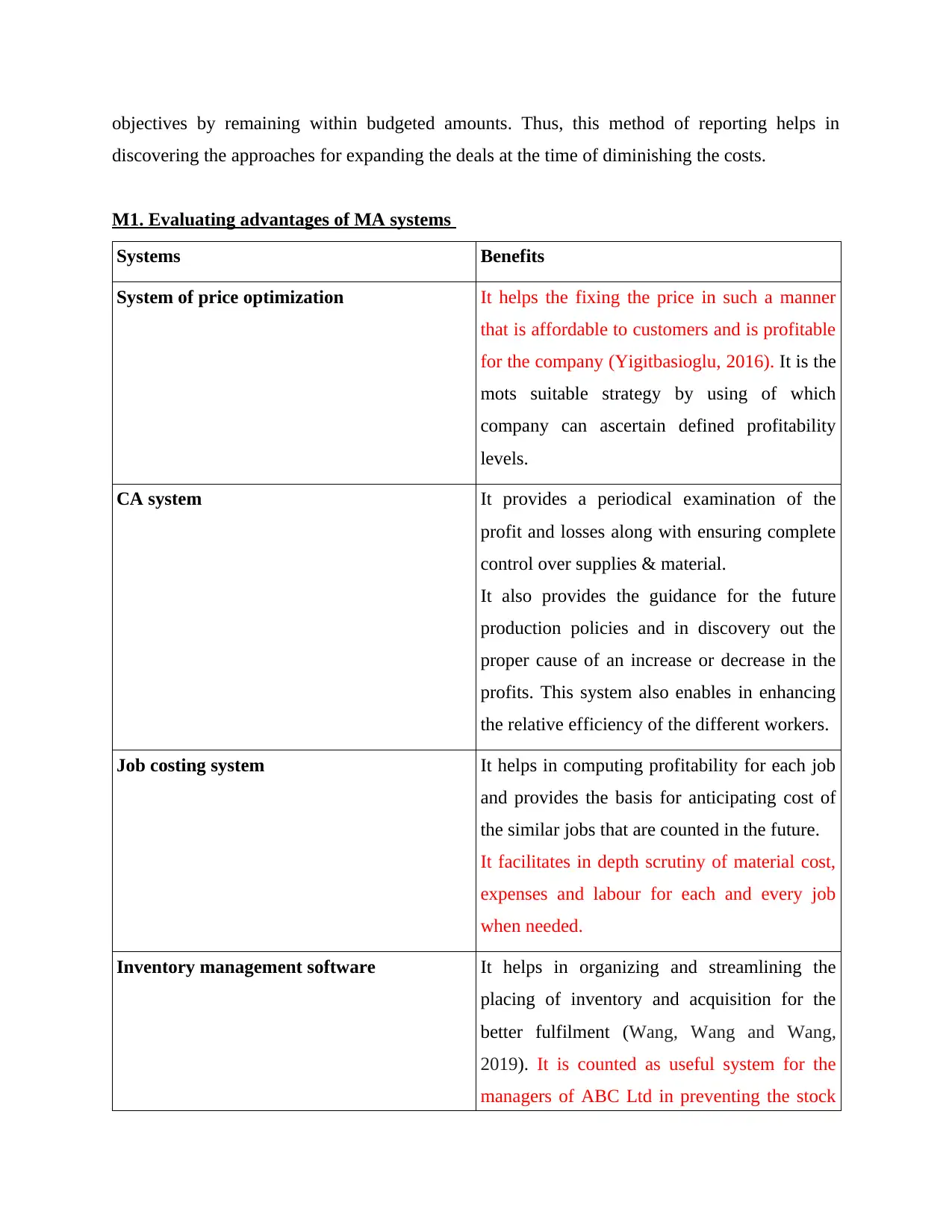

M1. Evaluating advantages of MA systems

Systems Benefits

System of price optimization It helps the fixing the price in such a manner

that is affordable to customers and is profitable

for the company (Yigitbasioglu, 2016). It is the

mots suitable strategy by using of which

company can ascertain defined profitability

levels.

CA system It provides a periodical examination of the

profit and losses along with ensuring complete

control over supplies & material.

It also provides the guidance for the future

production policies and in discovery out the

proper cause of an increase or decrease in the

profits. This system also enables in enhancing

the relative efficiency of the different workers.

Job costing system It helps in computing profitability for each job

and provides the basis for anticipating cost of

the similar jobs that are counted in the future.

It facilitates in depth scrutiny of material cost,

expenses and labour for each and every job

when needed.

Inventory management software It helps in organizing and streamlining the

placing of inventory and acquisition for the

better fulfilment (Wang, Wang and Wang,

2019). It is counted as useful system for the

managers of ABC Ltd in preventing the stock

discovering the approaches for expanding the deals at the time of diminishing the costs.

M1. Evaluating advantages of MA systems

Systems Benefits

System of price optimization It helps the fixing the price in such a manner

that is affordable to customers and is profitable

for the company (Yigitbasioglu, 2016). It is the

mots suitable strategy by using of which

company can ascertain defined profitability

levels.

CA system It provides a periodical examination of the

profit and losses along with ensuring complete

control over supplies & material.

It also provides the guidance for the future

production policies and in discovery out the

proper cause of an increase or decrease in the

profits. This system also enables in enhancing

the relative efficiency of the different workers.

Job costing system It helps in computing profitability for each job

and provides the basis for anticipating cost of

the similar jobs that are counted in the future.

It facilitates in depth scrutiny of material cost,

expenses and labour for each and every job

when needed.

Inventory management software It helps in organizing and streamlining the

placing of inventory and acquisition for the

better fulfilment (Wang, Wang and Wang,

2019). It is counted as useful system for the

managers of ABC Ltd in preventing the stock

outs or the excess stock conditions with this

system or software.

D1. Critically evaluating the ways in which MA systems and reporting are been integrated in

organizational process

The MA reports and methods are integrated to one another as based on the report the

systems within an internal management of the company can be applied in effective way. This

would help in evaluating the systems and the processes in appropriate way and also helps the

managers in making the task performed as per the standards set or the budget prepared so that the

goals could be achieved effectively and efficiently. Thus, there is integration between the reports

and the methods of MA.

LO2.

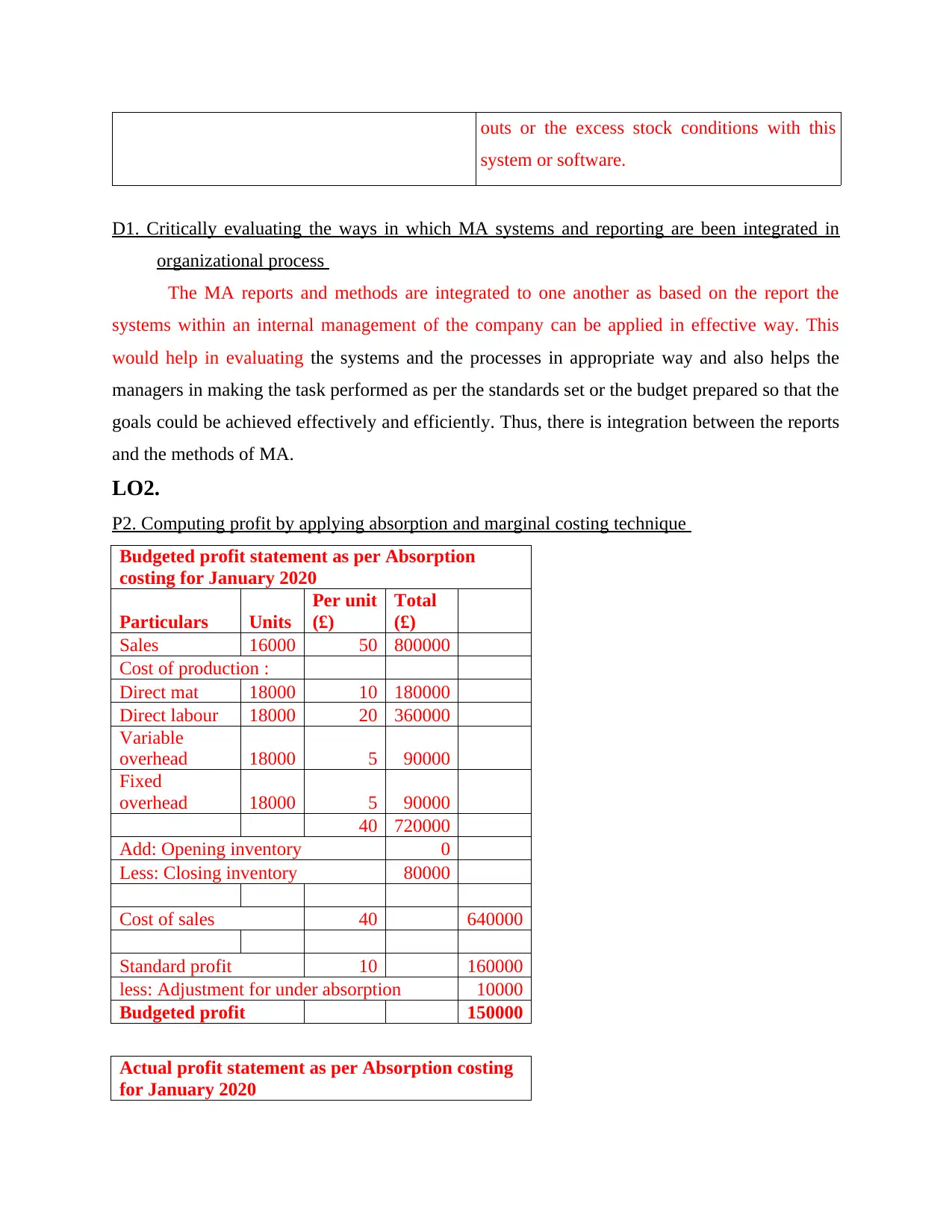

P2. Computing profit by applying absorption and marginal costing technique

Budgeted profit statement as per Absorption

costing for January 2020

Particulars Units

Per unit

(£)

Total

(£)

Sales 16000 50 800000

Cost of production :

Direct mat 18000 10 180000

Direct labour 18000 20 360000

Variable

overhead 18000 5 90000

Fixed

overhead 18000 5 90000

40 720000

Add: Opening inventory 0

Less: Closing inventory 80000

Cost of sales 40 640000

Standard profit 10 160000

less: Adjustment for under absorption 10000

Budgeted profit 150000

Actual profit statement as per Absorption costing

for January 2020

system or software.

D1. Critically evaluating the ways in which MA systems and reporting are been integrated in

organizational process

The MA reports and methods are integrated to one another as based on the report the

systems within an internal management of the company can be applied in effective way. This

would help in evaluating the systems and the processes in appropriate way and also helps the

managers in making the task performed as per the standards set or the budget prepared so that the

goals could be achieved effectively and efficiently. Thus, there is integration between the reports

and the methods of MA.

LO2.

P2. Computing profit by applying absorption and marginal costing technique

Budgeted profit statement as per Absorption

costing for January 2020

Particulars Units

Per unit

(£)

Total

(£)

Sales 16000 50 800000

Cost of production :

Direct mat 18000 10 180000

Direct labour 18000 20 360000

Variable

overhead 18000 5 90000

Fixed

overhead 18000 5 90000

40 720000

Add: Opening inventory 0

Less: Closing inventory 80000

Cost of sales 40 640000

Standard profit 10 160000

less: Adjustment for under absorption 10000

Budgeted profit 150000

Actual profit statement as per Absorption costing

for January 2020

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

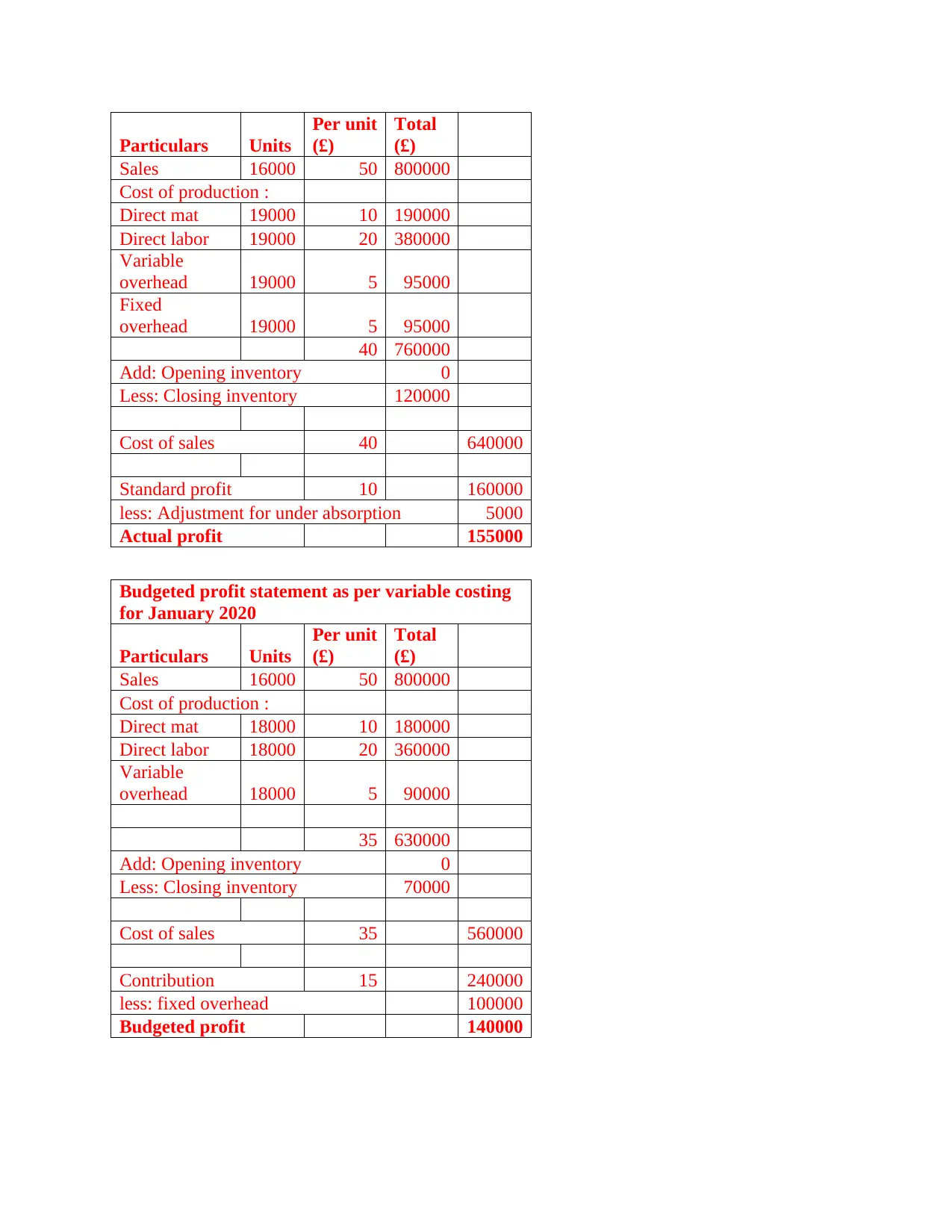

Particulars Units

Per unit

(£)

Total

(£)

Sales 16000 50 800000

Cost of production :

Direct mat 19000 10 190000

Direct labor 19000 20 380000

Variable

overhead 19000 5 95000

Fixed

overhead 19000 5 95000

40 760000

Add: Opening inventory 0

Less: Closing inventory 120000

Cost of sales 40 640000

Standard profit 10 160000

less: Adjustment for under absorption 5000

Actual profit 155000

Budgeted profit statement as per variable costing

for January 2020

Particulars Units

Per unit

(£)

Total

(£)

Sales 16000 50 800000

Cost of production :

Direct mat 18000 10 180000

Direct labor 18000 20 360000

Variable

overhead 18000 5 90000

35 630000

Add: Opening inventory 0

Less: Closing inventory 70000

Cost of sales 35 560000

Contribution 15 240000

less: fixed overhead 100000

Budgeted profit 140000

Per unit

(£)

Total

(£)

Sales 16000 50 800000

Cost of production :

Direct mat 19000 10 190000

Direct labor 19000 20 380000

Variable

overhead 19000 5 95000

Fixed

overhead 19000 5 95000

40 760000

Add: Opening inventory 0

Less: Closing inventory 120000

Cost of sales 40 640000

Standard profit 10 160000

less: Adjustment for under absorption 5000

Actual profit 155000

Budgeted profit statement as per variable costing

for January 2020

Particulars Units

Per unit

(£)

Total

(£)

Sales 16000 50 800000

Cost of production :

Direct mat 18000 10 180000

Direct labor 18000 20 360000

Variable

overhead 18000 5 90000

35 630000

Add: Opening inventory 0

Less: Closing inventory 70000

Cost of sales 35 560000

Contribution 15 240000

less: fixed overhead 100000

Budgeted profit 140000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

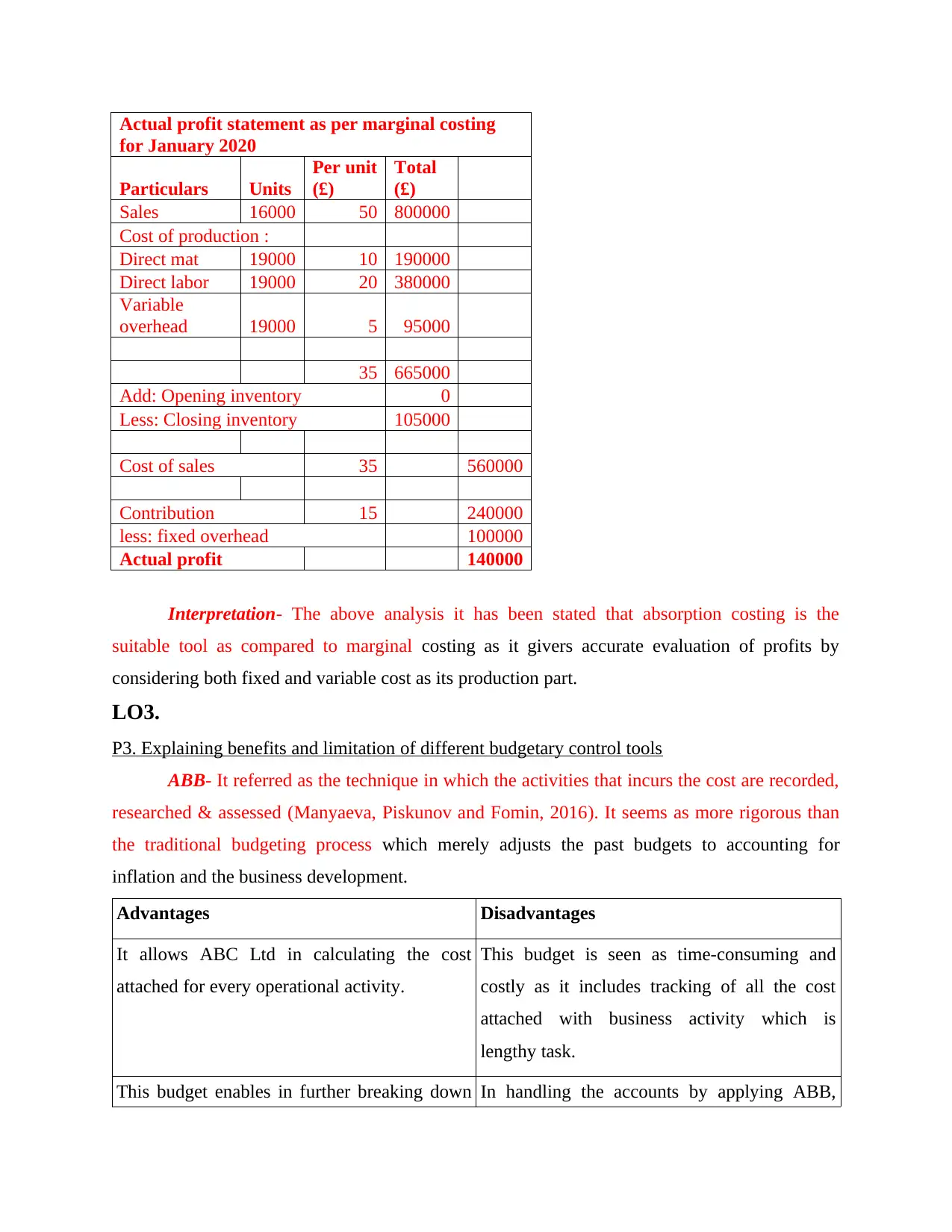

Actual profit statement as per marginal costing

for January 2020

Particulars Units

Per unit

(£)

Total

(£)

Sales 16000 50 800000

Cost of production :

Direct mat 19000 10 190000

Direct labor 19000 20 380000

Variable

overhead 19000 5 95000

35 665000

Add: Opening inventory 0

Less: Closing inventory 105000

Cost of sales 35 560000

Contribution 15 240000

less: fixed overhead 100000

Actual profit 140000

Interpretation- The above analysis it has been stated that absorption costing is the

suitable tool as compared to marginal costing as it givers accurate evaluation of profits by

considering both fixed and variable cost as its production part.

LO3.

P3. Explaining benefits and limitation of different budgetary control tools

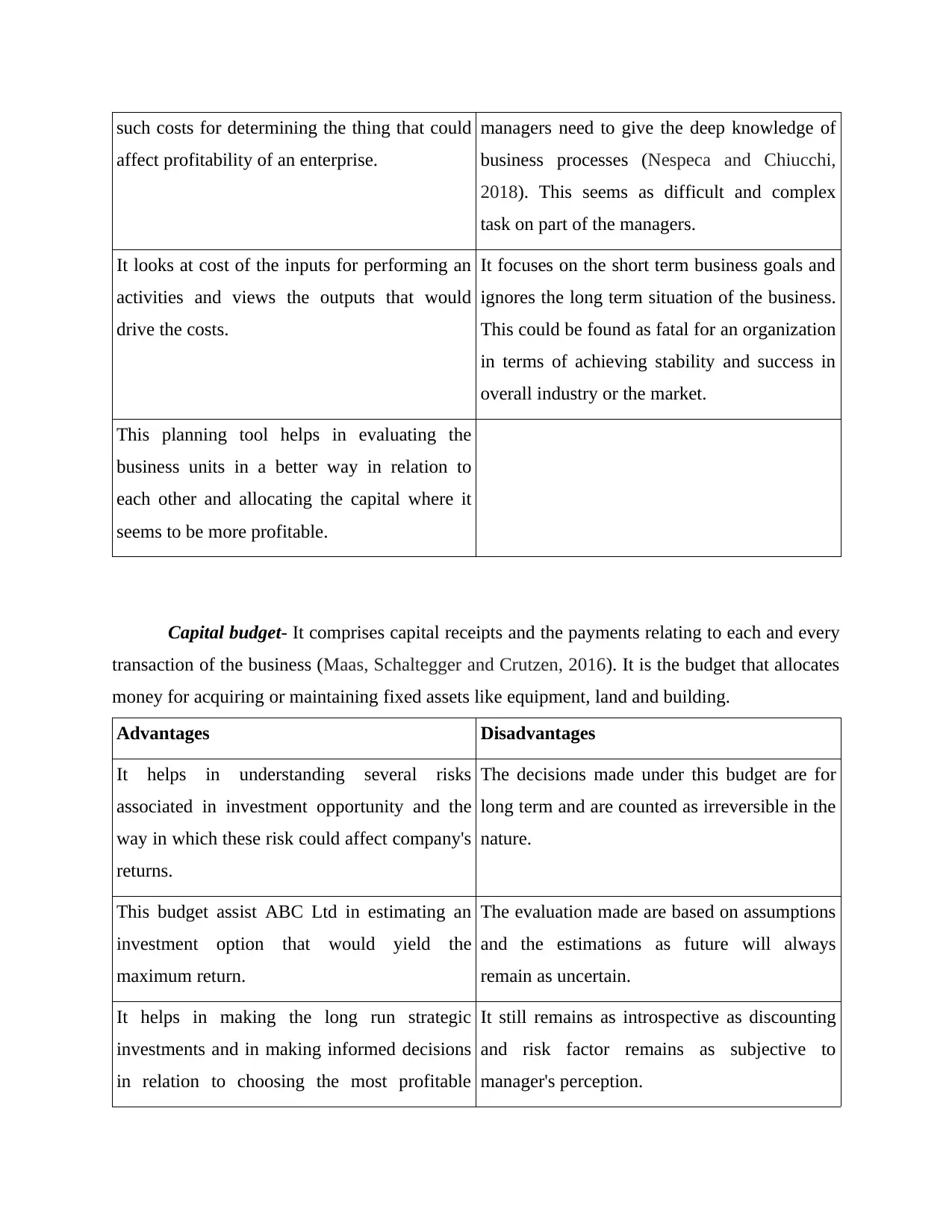

ABB- It referred as the technique in which the activities that incurs the cost are recorded,

researched & assessed (Manyaeva, Piskunov and Fomin, 2016). It seems as more rigorous than

the traditional budgeting process which merely adjusts the past budgets to accounting for

inflation and the business development.

Advantages Disadvantages

It allows ABC Ltd in calculating the cost

attached for every operational activity.

This budget is seen as time-consuming and

costly as it includes tracking of all the cost

attached with business activity which is

lengthy task.

This budget enables in further breaking down In handling the accounts by applying ABB,

for January 2020

Particulars Units

Per unit

(£)

Total

(£)

Sales 16000 50 800000

Cost of production :

Direct mat 19000 10 190000

Direct labor 19000 20 380000

Variable

overhead 19000 5 95000

35 665000

Add: Opening inventory 0

Less: Closing inventory 105000

Cost of sales 35 560000

Contribution 15 240000

less: fixed overhead 100000

Actual profit 140000

Interpretation- The above analysis it has been stated that absorption costing is the

suitable tool as compared to marginal costing as it givers accurate evaluation of profits by

considering both fixed and variable cost as its production part.

LO3.

P3. Explaining benefits and limitation of different budgetary control tools

ABB- It referred as the technique in which the activities that incurs the cost are recorded,

researched & assessed (Manyaeva, Piskunov and Fomin, 2016). It seems as more rigorous than

the traditional budgeting process which merely adjusts the past budgets to accounting for

inflation and the business development.

Advantages Disadvantages

It allows ABC Ltd in calculating the cost

attached for every operational activity.

This budget is seen as time-consuming and

costly as it includes tracking of all the cost

attached with business activity which is

lengthy task.

This budget enables in further breaking down In handling the accounts by applying ABB,

such costs for determining the thing that could

affect profitability of an enterprise.

managers need to give the deep knowledge of

business processes (Nespeca and Chiucchi,

2018). This seems as difficult and complex

task on part of the managers.

It looks at cost of the inputs for performing an

activities and views the outputs that would

drive the costs.

It focuses on the short term business goals and

ignores the long term situation of the business.

This could be found as fatal for an organization

in terms of achieving stability and success in

overall industry or the market.

This planning tool helps in evaluating the

business units in a better way in relation to

each other and allocating the capital where it

seems to be more profitable.

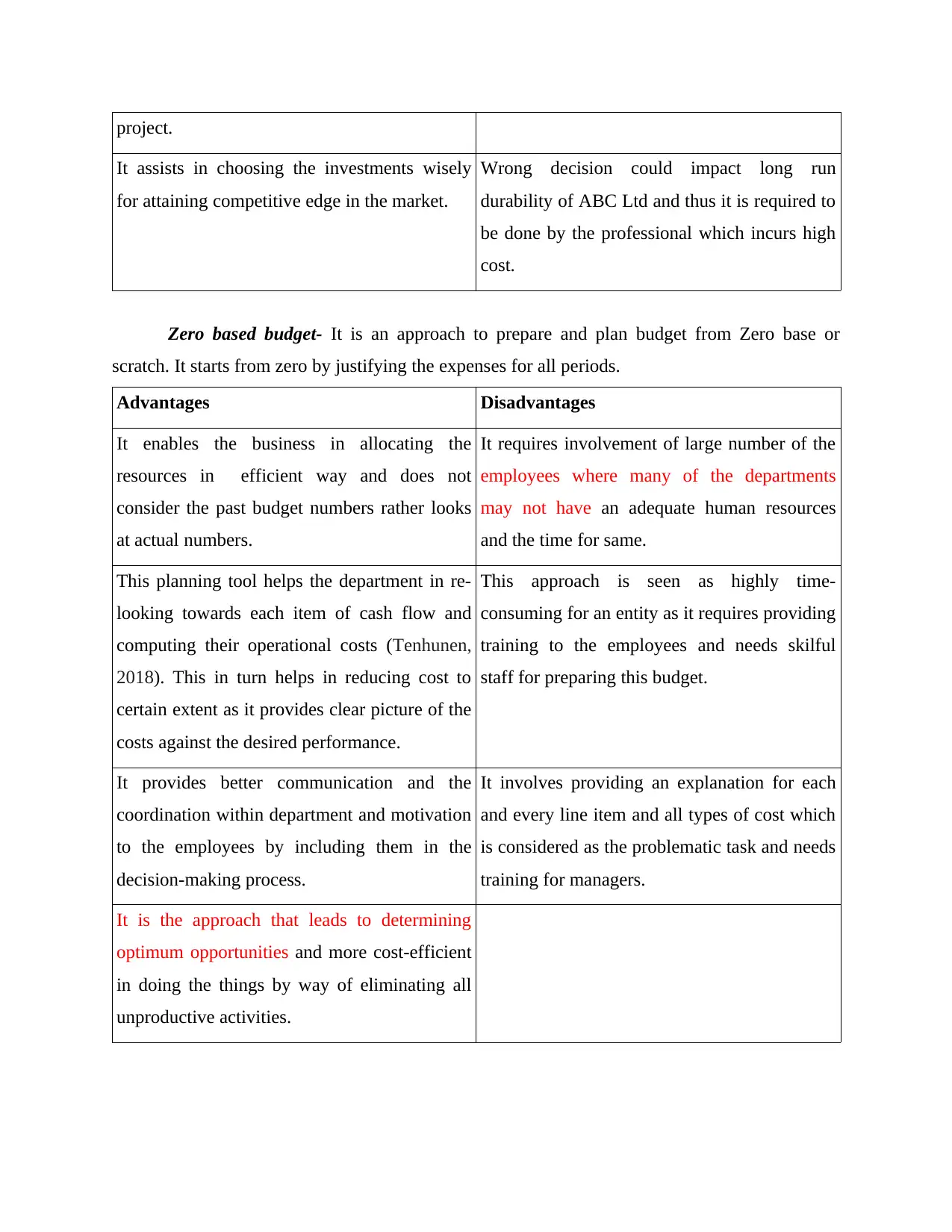

Capital budget- It comprises capital receipts and the payments relating to each and every

transaction of the business (Maas, Schaltegger and Crutzen, 2016). It is the budget that allocates

money for acquiring or maintaining fixed assets like equipment, land and building.

Advantages Disadvantages

It helps in understanding several risks

associated in investment opportunity and the

way in which these risk could affect company's

returns.

The decisions made under this budget are for

long term and are counted as irreversible in the

nature.

This budget assist ABC Ltd in estimating an

investment option that would yield the

maximum return.

The evaluation made are based on assumptions

and the estimations as future will always

remain as uncertain.

It helps in making the long run strategic

investments and in making informed decisions

in relation to choosing the most profitable

It still remains as introspective as discounting

and risk factor remains as subjective to

manager's perception.

affect profitability of an enterprise.

managers need to give the deep knowledge of

business processes (Nespeca and Chiucchi,

2018). This seems as difficult and complex

task on part of the managers.

It looks at cost of the inputs for performing an

activities and views the outputs that would

drive the costs.

It focuses on the short term business goals and

ignores the long term situation of the business.

This could be found as fatal for an organization

in terms of achieving stability and success in

overall industry or the market.

This planning tool helps in evaluating the

business units in a better way in relation to

each other and allocating the capital where it

seems to be more profitable.

Capital budget- It comprises capital receipts and the payments relating to each and every

transaction of the business (Maas, Schaltegger and Crutzen, 2016). It is the budget that allocates

money for acquiring or maintaining fixed assets like equipment, land and building.

Advantages Disadvantages

It helps in understanding several risks

associated in investment opportunity and the

way in which these risk could affect company's

returns.

The decisions made under this budget are for

long term and are counted as irreversible in the

nature.

This budget assist ABC Ltd in estimating an

investment option that would yield the

maximum return.

The evaluation made are based on assumptions

and the estimations as future will always

remain as uncertain.

It helps in making the long run strategic

investments and in making informed decisions

in relation to choosing the most profitable

It still remains as introspective as discounting

and risk factor remains as subjective to

manager's perception.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

project.

It assists in choosing the investments wisely

for attaining competitive edge in the market.

Wrong decision could impact long run

durability of ABC Ltd and thus it is required to

be done by the professional which incurs high

cost.

Zero based budget- It is an approach to prepare and plan budget from Zero base or

scratch. It starts from zero by justifying the expenses for all periods.

Advantages Disadvantages

It enables the business in allocating the

resources in efficient way and does not

consider the past budget numbers rather looks

at actual numbers.

It requires involvement of large number of the

employees where many of the departments

may not have an adequate human resources

and the time for same.

This planning tool helps the department in re-

looking towards each item of cash flow and

computing their operational costs (Tenhunen,

2018). This in turn helps in reducing cost to

certain extent as it provides clear picture of the

costs against the desired performance.

This approach is seen as highly time-

consuming for an entity as it requires providing

training to the employees and needs skilful

staff for preparing this budget.

It provides better communication and the

coordination within department and motivation

to the employees by including them in the

decision-making process.

It involves providing an explanation for each

and every line item and all types of cost which

is considered as the problematic task and needs

training for managers.

It is the approach that leads to determining

optimum opportunities and more cost-efficient

in doing the things by way of eliminating all

unproductive activities.

It assists in choosing the investments wisely

for attaining competitive edge in the market.

Wrong decision could impact long run

durability of ABC Ltd and thus it is required to

be done by the professional which incurs high

cost.

Zero based budget- It is an approach to prepare and plan budget from Zero base or

scratch. It starts from zero by justifying the expenses for all periods.

Advantages Disadvantages

It enables the business in allocating the

resources in efficient way and does not

consider the past budget numbers rather looks

at actual numbers.

It requires involvement of large number of the

employees where many of the departments

may not have an adequate human resources

and the time for same.

This planning tool helps the department in re-

looking towards each item of cash flow and

computing their operational costs (Tenhunen,

2018). This in turn helps in reducing cost to

certain extent as it provides clear picture of the

costs against the desired performance.

This approach is seen as highly time-

consuming for an entity as it requires providing

training to the employees and needs skilful

staff for preparing this budget.

It provides better communication and the

coordination within department and motivation

to the employees by including them in the

decision-making process.

It involves providing an explanation for each

and every line item and all types of cost which

is considered as the problematic task and needs

training for managers.

It is the approach that leads to determining

optimum opportunities and more cost-efficient

in doing the things by way of eliminating all

unproductive activities.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

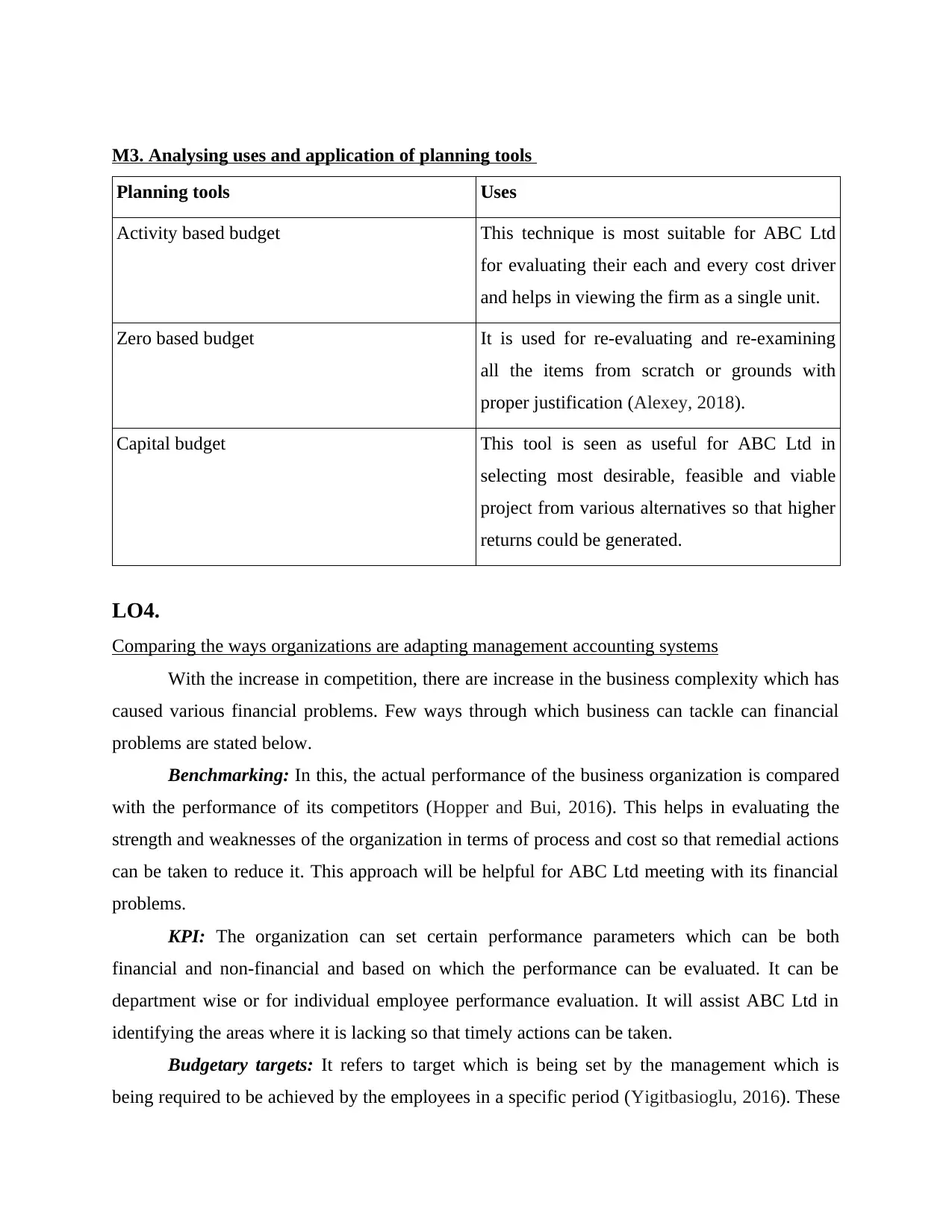

M3. Analysing uses and application of planning tools

Planning tools Uses

Activity based budget This technique is most suitable for ABC Ltd

for evaluating their each and every cost driver

and helps in viewing the firm as a single unit.

Zero based budget It is used for re-evaluating and re-examining

all the items from scratch or grounds with

proper justification (Alexey, 2018).

Capital budget This tool is seen as useful for ABC Ltd in

selecting most desirable, feasible and viable

project from various alternatives so that higher

returns could be generated.

LO4.

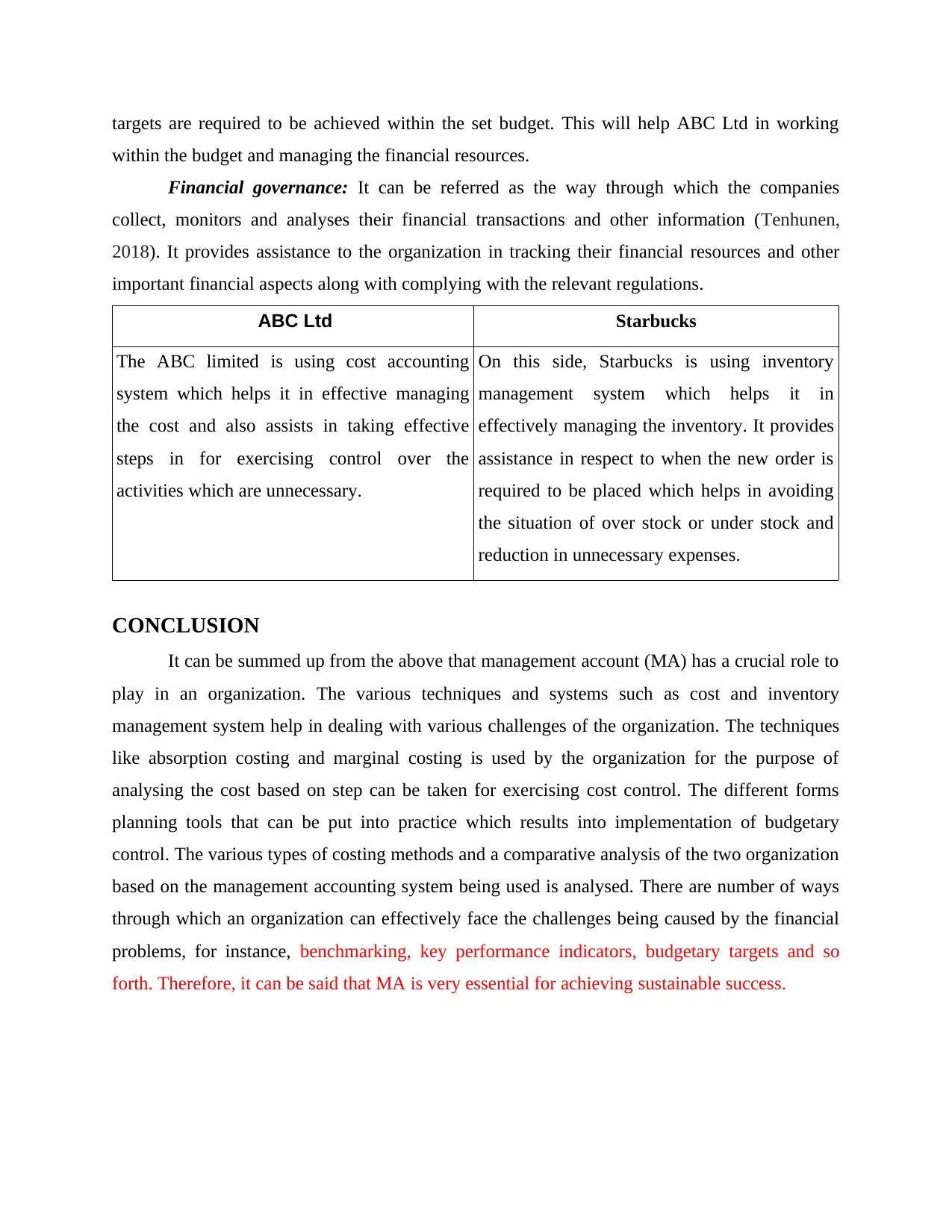

Comparing the ways organizations are adapting management accounting systems

With the increase in competition, there are increase in the business complexity which has

caused various financial problems. Few ways through which business can tackle can financial

problems are stated below.

Benchmarking: In this, the actual performance of the business organization is compared

with the performance of its competitors (Hopper and Bui, 2016). This helps in evaluating the

strength and weaknesses of the organization in terms of process and cost so that remedial actions

can be taken to reduce it. This approach will be helpful for ABC Ltd meeting with its financial

problems.

KPI: The organization can set certain performance parameters which can be both

financial and non-financial and based on which the performance can be evaluated. It can be

department wise or for individual employee performance evaluation. It will assist ABC Ltd in

identifying the areas where it is lacking so that timely actions can be taken.

Budgetary targets: It refers to target which is being set by the management which is

being required to be achieved by the employees in a specific period (Yigitbasioglu, 2016). These

Planning tools Uses

Activity based budget This technique is most suitable for ABC Ltd

for evaluating their each and every cost driver

and helps in viewing the firm as a single unit.

Zero based budget It is used for re-evaluating and re-examining

all the items from scratch or grounds with

proper justification (Alexey, 2018).

Capital budget This tool is seen as useful for ABC Ltd in

selecting most desirable, feasible and viable

project from various alternatives so that higher

returns could be generated.

LO4.

Comparing the ways organizations are adapting management accounting systems

With the increase in competition, there are increase in the business complexity which has

caused various financial problems. Few ways through which business can tackle can financial

problems are stated below.

Benchmarking: In this, the actual performance of the business organization is compared

with the performance of its competitors (Hopper and Bui, 2016). This helps in evaluating the

strength and weaknesses of the organization in terms of process and cost so that remedial actions

can be taken to reduce it. This approach will be helpful for ABC Ltd meeting with its financial

problems.

KPI: The organization can set certain performance parameters which can be both

financial and non-financial and based on which the performance can be evaluated. It can be

department wise or for individual employee performance evaluation. It will assist ABC Ltd in

identifying the areas where it is lacking so that timely actions can be taken.

Budgetary targets: It refers to target which is being set by the management which is

being required to be achieved by the employees in a specific period (Yigitbasioglu, 2016). These

targets are required to be achieved within the set budget. This will help ABC Ltd in working

within the budget and managing the financial resources.

Financial governance: It can be referred as the way through which the companies

collect, monitors and analyses their financial transactions and other information (Tenhunen,

2018). It provides assistance to the organization in tracking their financial resources and other

important financial aspects along with complying with the relevant regulations.

ABC Ltd Starbucks

The ABC limited is using cost accounting

system which helps it in effective managing

the cost and also assists in taking effective

steps in for exercising control over the

activities which are unnecessary.

On this side, Starbucks is using inventory

management system which helps it in

effectively managing the inventory. It provides

assistance in respect to when the new order is

required to be placed which helps in avoiding

the situation of over stock or under stock and

reduction in unnecessary expenses.

CONCLUSION

It can be summed up from the above that management account (MA) has a crucial role to

play in an organization. The various techniques and systems such as cost and inventory

management system help in dealing with various challenges of the organization. The techniques

like absorption costing and marginal costing is used by the organization for the purpose of

analysing the cost based on step can be taken for exercising cost control. The different forms

planning tools that can be put into practice which results into implementation of budgetary

control. The various types of costing methods and a comparative analysis of the two organization

based on the management accounting system being used is analysed. There are number of ways

through which an organization can effectively face the challenges being caused by the financial

problems, for instance, benchmarking, key performance indicators, budgetary targets and so

forth. Therefore, it can be said that MA is very essential for achieving sustainable success.

within the budget and managing the financial resources.

Financial governance: It can be referred as the way through which the companies

collect, monitors and analyses their financial transactions and other information (Tenhunen,

2018). It provides assistance to the organization in tracking their financial resources and other

important financial aspects along with complying with the relevant regulations.

ABC Ltd Starbucks

The ABC limited is using cost accounting

system which helps it in effective managing

the cost and also assists in taking effective

steps in for exercising control over the

activities which are unnecessary.

On this side, Starbucks is using inventory

management system which helps it in

effectively managing the inventory. It provides

assistance in respect to when the new order is

required to be placed which helps in avoiding

the situation of over stock or under stock and

reduction in unnecessary expenses.

CONCLUSION

It can be summed up from the above that management account (MA) has a crucial role to

play in an organization. The various techniques and systems such as cost and inventory

management system help in dealing with various challenges of the organization. The techniques

like absorption costing and marginal costing is used by the organization for the purpose of

analysing the cost based on step can be taken for exercising cost control. The different forms

planning tools that can be put into practice which results into implementation of budgetary

control. The various types of costing methods and a comparative analysis of the two organization

based on the management accounting system being used is analysed. There are number of ways

through which an organization can effectively face the challenges being caused by the financial

problems, for instance, benchmarking, key performance indicators, budgetary targets and so

forth. Therefore, it can be said that MA is very essential for achieving sustainable success.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.