Comparative Analysis of Costing Systems: Traditional vs. ABC

VerifiedAdded on 2021/05/30

|9

|1367

|228

Report

AI Summary

This report provides a comprehensive analysis of product costing using traditional and activity-based costing systems. It begins by outlining the limitations of traditional costing, which often allocates overhead based on volume-based cost drivers like machine or labor hours, potentially distorting product costs. The report then presents a detailed cost allocation analysis for a company, Happy Traveller Ltd, under both traditional and activity-based costing methods. Under the traditional system, overheads are allocated using a single overhead recovery rate based on machine hours, while the activity-based costing (ABC) method allocates overheads based on activity cost drivers. The report compares the manufacturing costs of two products, simple and complex luggage, under both systems, highlighting how ABC provides a more accurate picture of product costs. It concludes by discussing the advantages of ABC, such as improved decision-making and cost management, and its application within the company, emphasizing the need for identifying activities, cost drivers, and driver rates for effective implementation. The report references relevant literature to support its analysis and findings.

Management Accounting

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Introduction

The overhead cost comprises significant part of the overall cost of production,

particularly in the manufacturing firms. The overhead costs in most of cases can not be traced to

any particular product or service and hence, the allocation of overhead cost becomes an

important issue for the management. The allocation of overhead should be based on some

consistent and rationale basis else it may show distorted picture of the product cost. In the

traditional costing system, the allocation of overheads is done based on volume based cost

drivers such as machine hours and or labor hours. However, the allocation in fashion is not

considered to be appropriate (Kim, 2017). Thus, to overcome limitation of traditional costing

system, the activity based costing system came into existence. In this context, this report deals

with analysis of product cost based on traditional costing system and activity based costing

system. Further, the report also describes the advantages of activity based costing and its

application in the company.

Analysis under Traditional Costing System

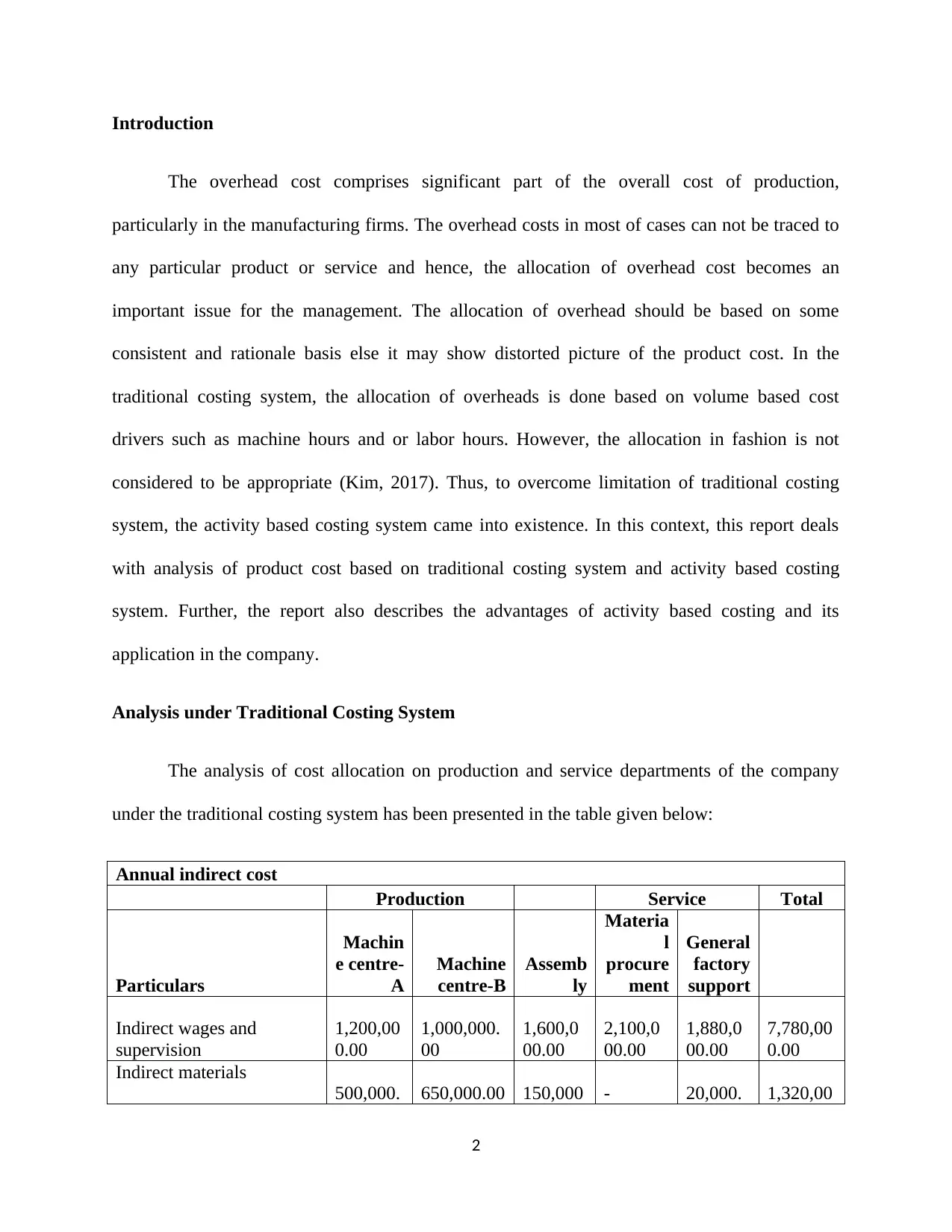

The analysis of cost allocation on production and service departments of the company

under the traditional costing system has been presented in the table given below:

Annual indirect cost

Production Service Total

Particulars

Machin

e centre-

A

Machine

centre-B

Assemb

ly

Materia

l

procure

ment

General

factory

support

Indirect wages and

supervision

1,200,00

0.00

1,000,000.

00

1,600,0

00.00

2,100,0

00.00

1,880,0

00.00

7,780,00

0.00

Indirect materials

500,000. 650,000.00 150,000 - 20,000. 1,320,00

2

The overhead cost comprises significant part of the overall cost of production,

particularly in the manufacturing firms. The overhead costs in most of cases can not be traced to

any particular product or service and hence, the allocation of overhead cost becomes an

important issue for the management. The allocation of overhead should be based on some

consistent and rationale basis else it may show distorted picture of the product cost. In the

traditional costing system, the allocation of overheads is done based on volume based cost

drivers such as machine hours and or labor hours. However, the allocation in fashion is not

considered to be appropriate (Kim, 2017). Thus, to overcome limitation of traditional costing

system, the activity based costing system came into existence. In this context, this report deals

with analysis of product cost based on traditional costing system and activity based costing

system. Further, the report also describes the advantages of activity based costing and its

application in the company.

Analysis under Traditional Costing System

The analysis of cost allocation on production and service departments of the company

under the traditional costing system has been presented in the table given below:

Annual indirect cost

Production Service Total

Particulars

Machin

e centre-

A

Machine

centre-B

Assemb

ly

Materia

l

procure

ment

General

factory

support

Indirect wages and

supervision

1,200,00

0.00

1,000,000.

00

1,600,0

00.00

2,100,0

00.00

1,880,0

00.00

7,780,00

0.00

Indirect materials

500,000. 650,000.00 150,000 - 20,000. 1,320,00

2

00 .00 00 0.00

Total

1,700,00

0.00

1,650,000.

00

1,750,0

00.00

2,100,0

00.00

1,900,0

00.00

9,100,00

0.00

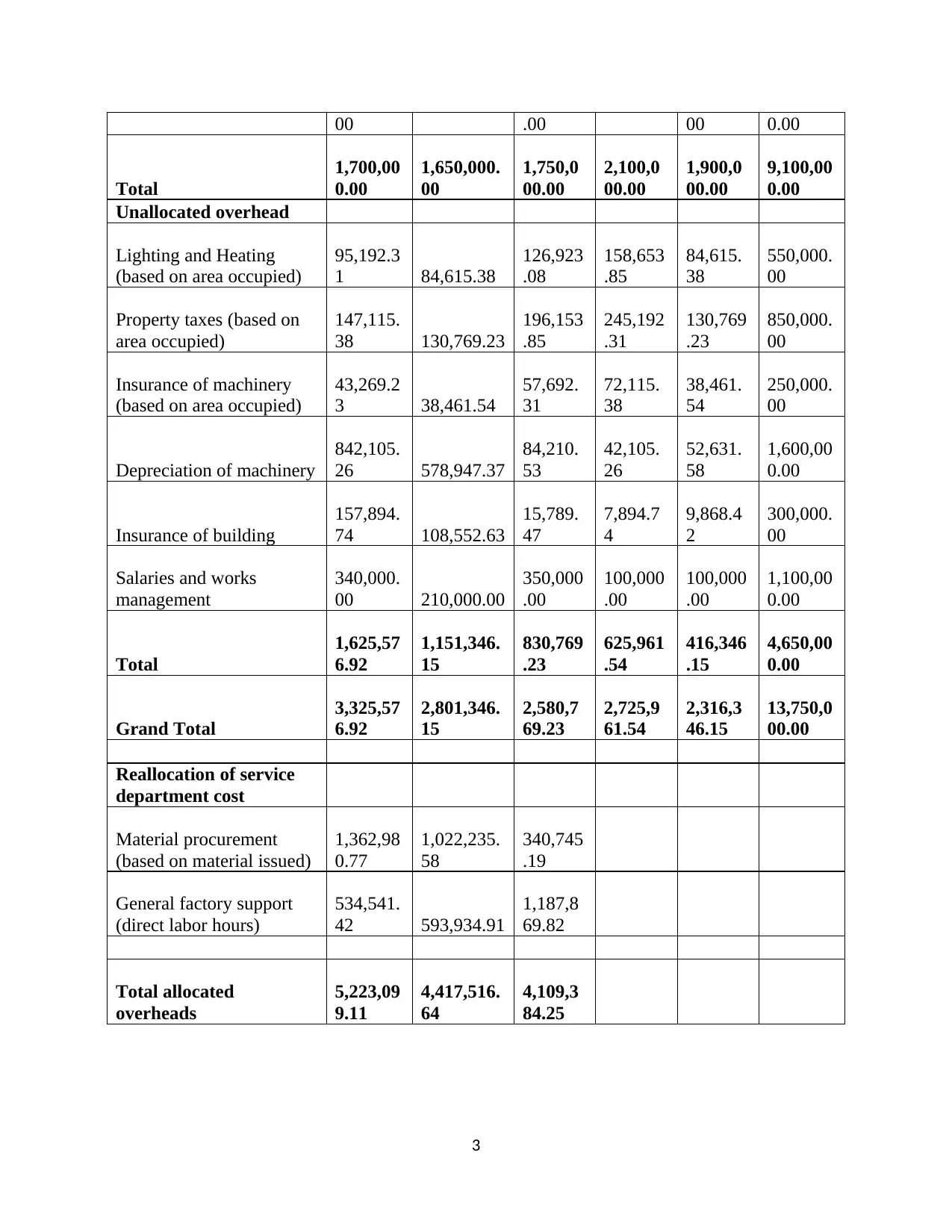

Unallocated overhead

Lighting and Heating

(based on area occupied)

95,192.3

1 84,615.38

126,923

.08

158,653

.85

84,615.

38

550,000.

00

Property taxes (based on

area occupied)

147,115.

38 130,769.23

196,153

.85

245,192

.31

130,769

.23

850,000.

00

Insurance of machinery

(based on area occupied)

43,269.2

3 38,461.54

57,692.

31

72,115.

38

38,461.

54

250,000.

00

Depreciation of machinery

842,105.

26 578,947.37

84,210.

53

42,105.

26

52,631.

58

1,600,00

0.00

Insurance of building

157,894.

74 108,552.63

15,789.

47

7,894.7

4

9,868.4

2

300,000.

00

Salaries and works

management

340,000.

00 210,000.00

350,000

.00

100,000

.00

100,000

.00

1,100,00

0.00

Total

1,625,57

6.92

1,151,346.

15

830,769

.23

625,961

.54

416,346

.15

4,650,00

0.00

Grand Total

3,325,57

6.92

2,801,346.

15

2,580,7

69.23

2,725,9

61.54

2,316,3

46.15

13,750,0

00.00

Reallocation of service

department cost

Material procurement

(based on material issued)

1,362,98

0.77

1,022,235.

58

340,745

.19

General factory support

(direct labor hours)

534,541.

42 593,934.91

1,187,8

69.82

Total allocated

overheads

5,223,09

9.11

4,417,516.

64

4,109,3

84.25

3

Total

1,700,00

0.00

1,650,000.

00

1,750,0

00.00

2,100,0

00.00

1,900,0

00.00

9,100,00

0.00

Unallocated overhead

Lighting and Heating

(based on area occupied)

95,192.3

1 84,615.38

126,923

.08

158,653

.85

84,615.

38

550,000.

00

Property taxes (based on

area occupied)

147,115.

38 130,769.23

196,153

.85

245,192

.31

130,769

.23

850,000.

00

Insurance of machinery

(based on area occupied)

43,269.2

3 38,461.54

57,692.

31

72,115.

38

38,461.

54

250,000.

00

Depreciation of machinery

842,105.

26 578,947.37

84,210.

53

42,105.

26

52,631.

58

1,600,00

0.00

Insurance of building

157,894.

74 108,552.63

15,789.

47

7,894.7

4

9,868.4

2

300,000.

00

Salaries and works

management

340,000.

00 210,000.00

350,000

.00

100,000

.00

100,000

.00

1,100,00

0.00

Total

1,625,57

6.92

1,151,346.

15

830,769

.23

625,961

.54

416,346

.15

4,650,00

0.00

Grand Total

3,325,57

6.92

2,801,346.

15

2,580,7

69.23

2,725,9

61.54

2,316,3

46.15

13,750,0

00.00

Reallocation of service

department cost

Material procurement

(based on material issued)

1,362,98

0.77

1,022,235.

58

340,745

.19

General factory support

(direct labor hours)

534,541.

42 593,934.91

1,187,8

69.82

Total allocated

overheads

5,223,09

9.11

4,417,516.

64

4,109,3

84.25

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

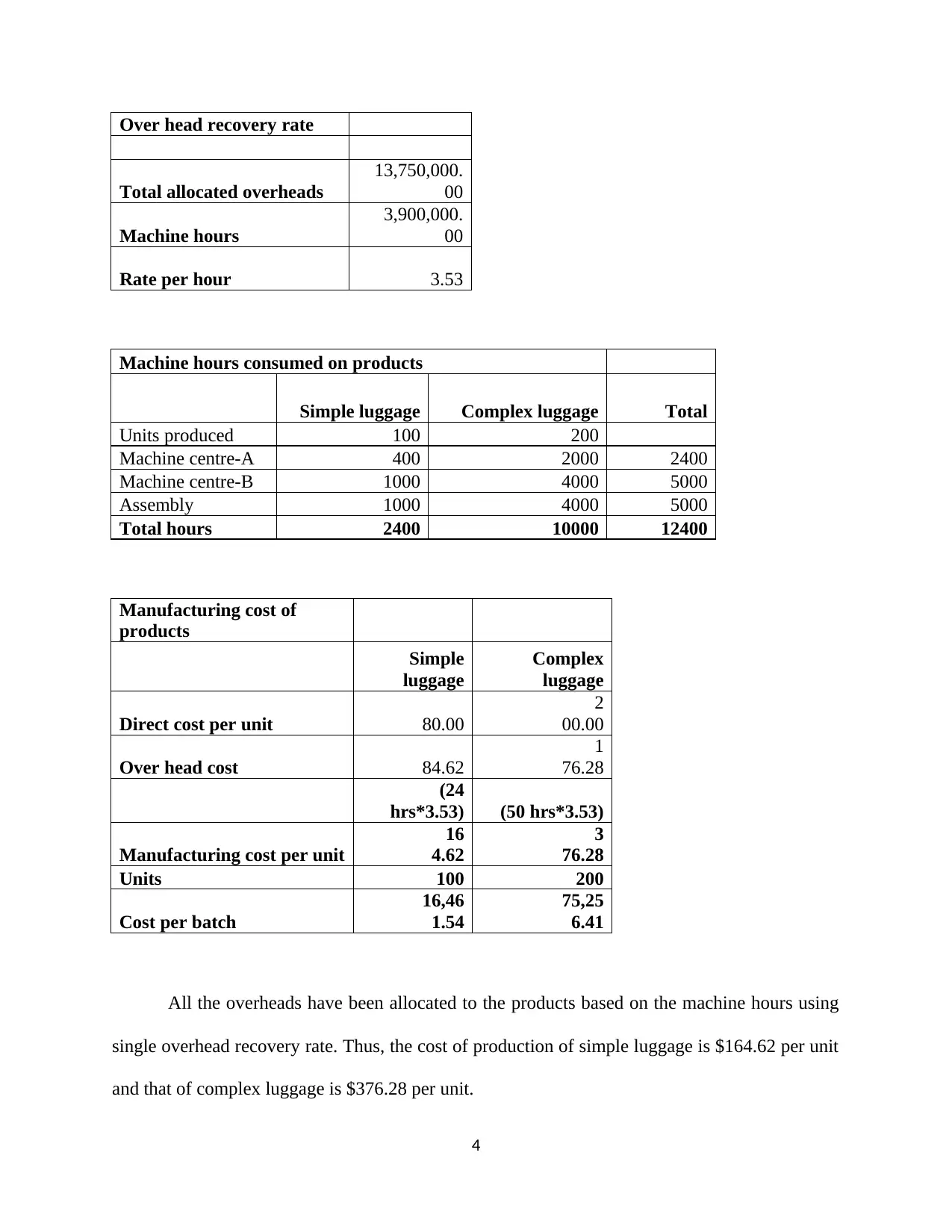

Over head recovery rate

Total allocated overheads

13,750,000.

00

Machine hours

3,900,000.

00

Rate per hour 3.53

Machine hours consumed on products

Simple luggage Complex luggage Total

Units produced 100 200

Machine centre-A 400 2000 2400

Machine centre-B 1000 4000 5000

Assembly 1000 4000 5000

Total hours 2400 10000 12400

Manufacturing cost of

products

Simple

luggage

Complex

luggage

Direct cost per unit 80.00

2

00.00

Over head cost 84.62

1

76.28

(24

hrs*3.53) (50 hrs*3.53)

Manufacturing cost per unit

16

4.62

3

76.28

Units 100 200

Cost per batch

16,46

1.54

75,25

6.41

All the overheads have been allocated to the products based on the machine hours using

single overhead recovery rate. Thus, the cost of production of simple luggage is $164.62 per unit

and that of complex luggage is $376.28 per unit.

4

Total allocated overheads

13,750,000.

00

Machine hours

3,900,000.

00

Rate per hour 3.53

Machine hours consumed on products

Simple luggage Complex luggage Total

Units produced 100 200

Machine centre-A 400 2000 2400

Machine centre-B 1000 4000 5000

Assembly 1000 4000 5000

Total hours 2400 10000 12400

Manufacturing cost of

products

Simple

luggage

Complex

luggage

Direct cost per unit 80.00

2

00.00

Over head cost 84.62

1

76.28

(24

hrs*3.53) (50 hrs*3.53)

Manufacturing cost per unit

16

4.62

3

76.28

Units 100 200

Cost per batch

16,46

1.54

75,25

6.41

All the overheads have been allocated to the products based on the machine hours using

single overhead recovery rate. Thus, the cost of production of simple luggage is $164.62 per unit

and that of complex luggage is $376.28 per unit.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

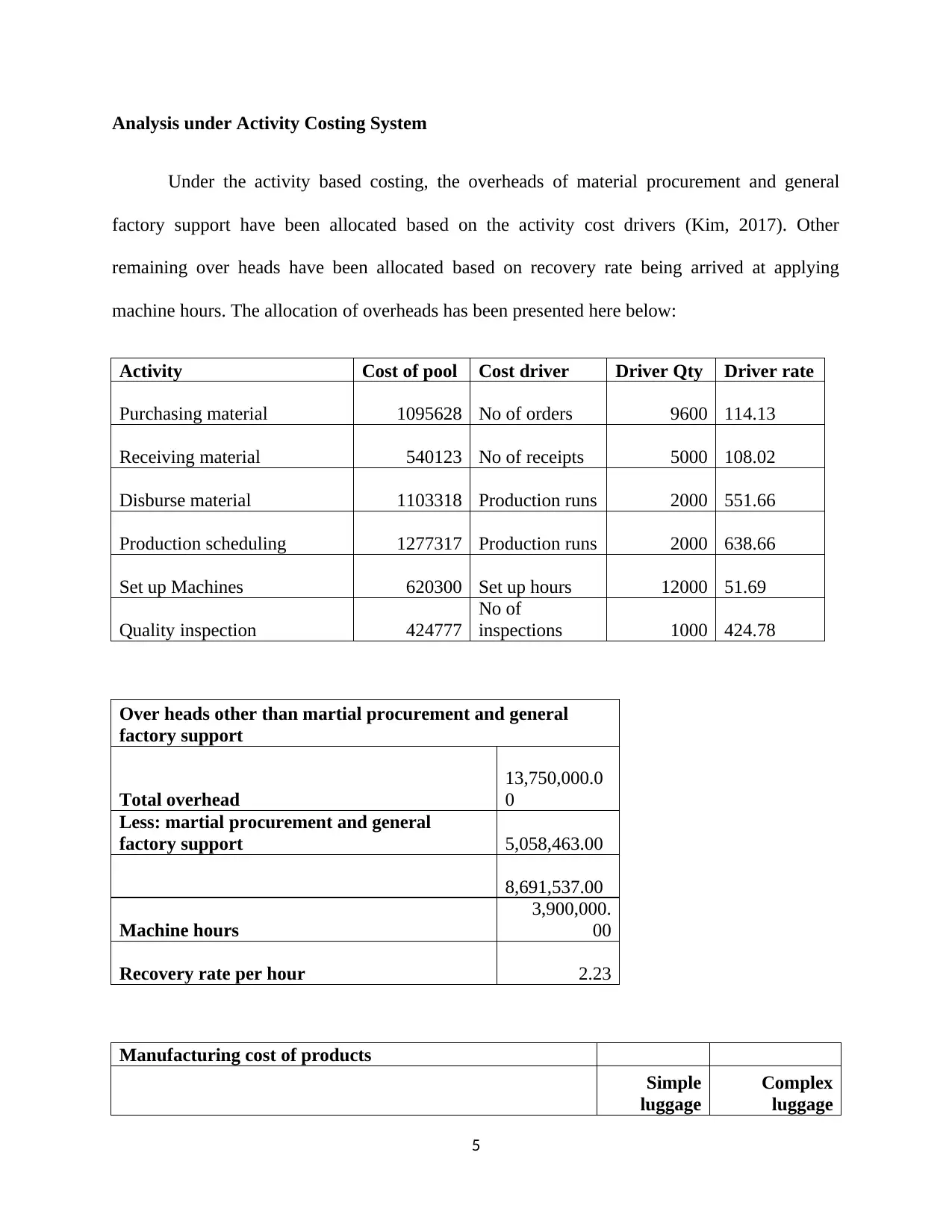

Analysis under Activity Costing System

Under the activity based costing, the overheads of material procurement and general

factory support have been allocated based on the activity cost drivers (Kim, 2017). Other

remaining over heads have been allocated based on recovery rate being arrived at applying

machine hours. The allocation of overheads has been presented here below:

Activity Cost of pool Cost driver Driver Qty Driver rate

Purchasing material 1095628 No of orders 9600 114.13

Receiving material 540123 No of receipts 5000 108.02

Disburse material 1103318 Production runs 2000 551.66

Production scheduling 1277317 Production runs 2000 638.66

Set up Machines 620300 Set up hours 12000 51.69

Quality inspection 424777

No of

inspections 1000 424.78

Over heads other than martial procurement and general

factory support

Total overhead

13,750,000.0

0

Less: martial procurement and general

factory support 5,058,463.00

8,691,537.00

Machine hours

3,900,000.

00

Recovery rate per hour 2.23

Manufacturing cost of products

Simple

luggage

Complex

luggage

5

Under the activity based costing, the overheads of material procurement and general

factory support have been allocated based on the activity cost drivers (Kim, 2017). Other

remaining over heads have been allocated based on recovery rate being arrived at applying

machine hours. The allocation of overheads has been presented here below:

Activity Cost of pool Cost driver Driver Qty Driver rate

Purchasing material 1095628 No of orders 9600 114.13

Receiving material 540123 No of receipts 5000 108.02

Disburse material 1103318 Production runs 2000 551.66

Production scheduling 1277317 Production runs 2000 638.66

Set up Machines 620300 Set up hours 12000 51.69

Quality inspection 424777

No of

inspections 1000 424.78

Over heads other than martial procurement and general

factory support

Total overhead

13,750,000.0

0

Less: martial procurement and general

factory support 5,058,463.00

8,691,537.00

Machine hours

3,900,000.

00

Recovery rate per hour 2.23

Manufacturing cost of products

Simple

luggage

Complex

luggage

5

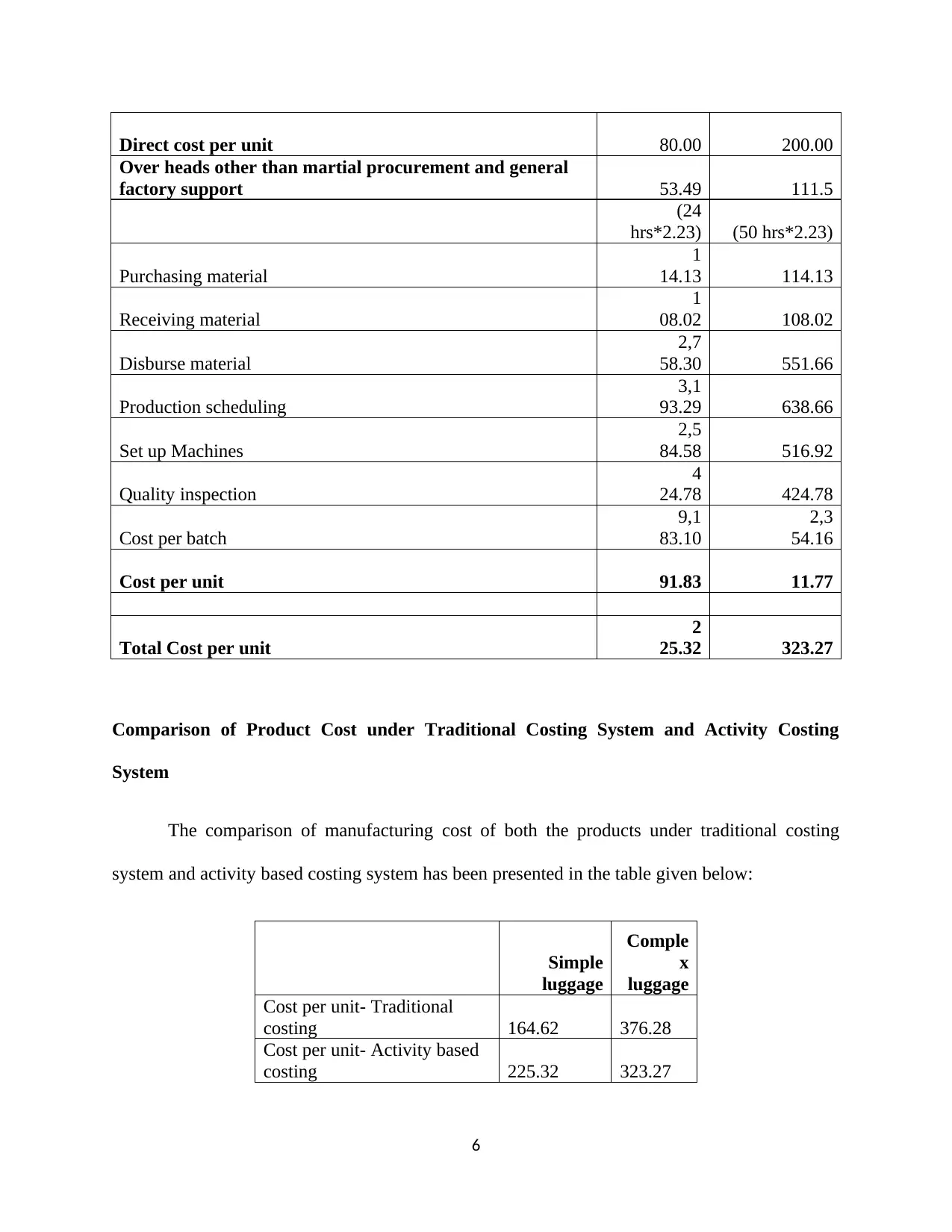

Direct cost per unit 80.00 200.00

Over heads other than martial procurement and general

factory support 53.49 111.5

(24

hrs*2.23) (50 hrs*2.23)

Purchasing material

1

14.13 114.13

Receiving material

1

08.02 108.02

Disburse material

2,7

58.30 551.66

Production scheduling

3,1

93.29 638.66

Set up Machines

2,5

84.58 516.92

Quality inspection

4

24.78 424.78

Cost per batch

9,1

83.10

2,3

54.16

Cost per unit 91.83 11.77

Total Cost per unit

2

25.32 323.27

Comparison of Product Cost under Traditional Costing System and Activity Costing

System

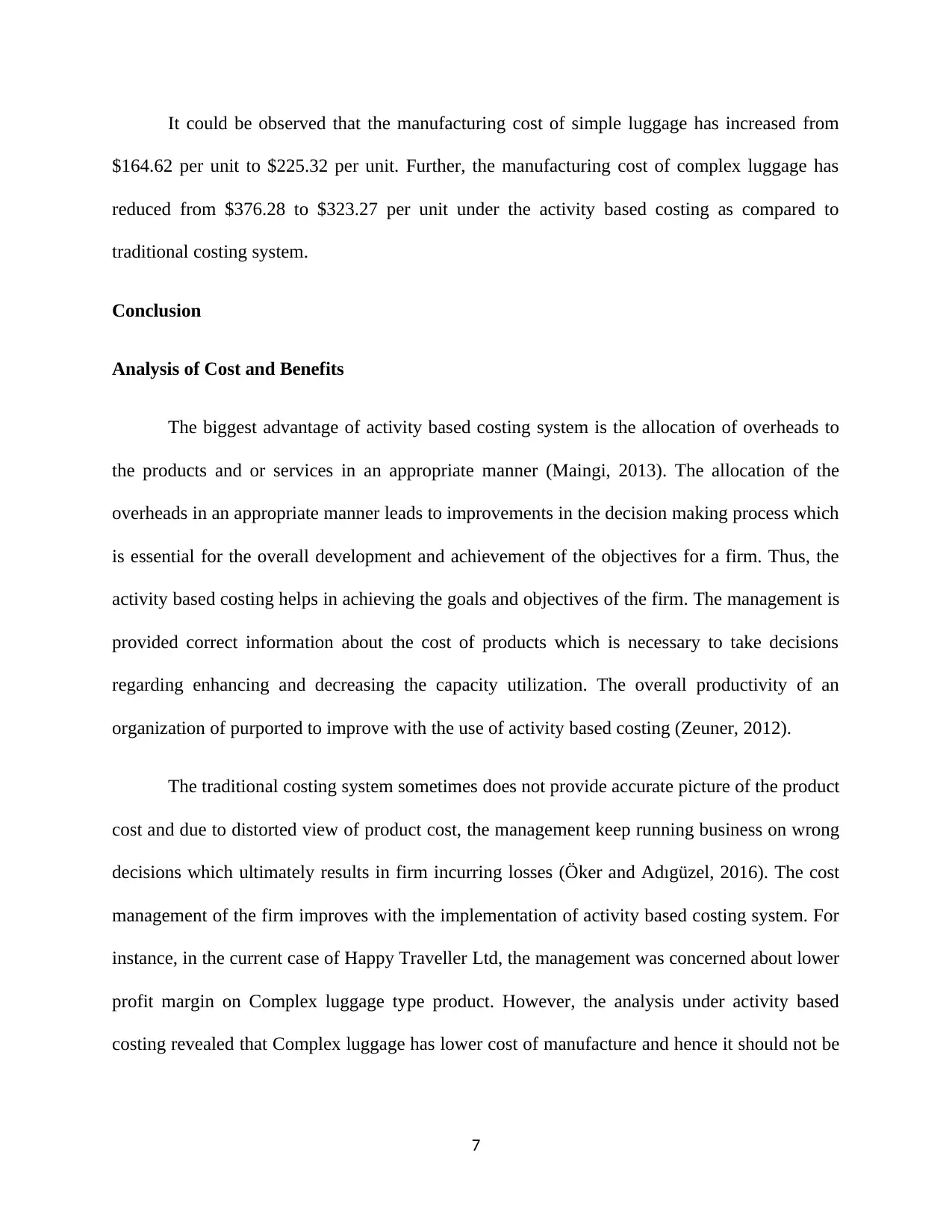

The comparison of manufacturing cost of both the products under traditional costing

system and activity based costing system has been presented in the table given below:

Simple

luggage

Comple

x

luggage

Cost per unit- Traditional

costing 164.62 376.28

Cost per unit- Activity based

costing 225.32 323.27

6

Over heads other than martial procurement and general

factory support 53.49 111.5

(24

hrs*2.23) (50 hrs*2.23)

Purchasing material

1

14.13 114.13

Receiving material

1

08.02 108.02

Disburse material

2,7

58.30 551.66

Production scheduling

3,1

93.29 638.66

Set up Machines

2,5

84.58 516.92

Quality inspection

4

24.78 424.78

Cost per batch

9,1

83.10

2,3

54.16

Cost per unit 91.83 11.77

Total Cost per unit

2

25.32 323.27

Comparison of Product Cost under Traditional Costing System and Activity Costing

System

The comparison of manufacturing cost of both the products under traditional costing

system and activity based costing system has been presented in the table given below:

Simple

luggage

Comple

x

luggage

Cost per unit- Traditional

costing 164.62 376.28

Cost per unit- Activity based

costing 225.32 323.27

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

It could be observed that the manufacturing cost of simple luggage has increased from

$164.62 per unit to $225.32 per unit. Further, the manufacturing cost of complex luggage has

reduced from $376.28 to $323.27 per unit under the activity based costing as compared to

traditional costing system.

Conclusion

Analysis of Cost and Benefits

The biggest advantage of activity based costing system is the allocation of overheads to

the products and or services in an appropriate manner (Maingi, 2013). The allocation of the

overheads in an appropriate manner leads to improvements in the decision making process which

is essential for the overall development and achievement of the objectives for a firm. Thus, the

activity based costing helps in achieving the goals and objectives of the firm. The management is

provided correct information about the cost of products which is necessary to take decisions

regarding enhancing and decreasing the capacity utilization. The overall productivity of an

organization of purported to improve with the use of activity based costing (Zeuner, 2012).

The traditional costing system sometimes does not provide accurate picture of the product

cost and due to distorted view of product cost, the management keep running business on wrong

decisions which ultimately results in firm incurring losses (Öker and Adıgüzel, 2016). The cost

management of the firm improves with the implementation of activity based costing system. For

instance, in the current case of Happy Traveller Ltd, the management was concerned about lower

profit margin on Complex luggage type product. However, the analysis under activity based

costing revealed that Complex luggage has lower cost of manufacture and hence it should not be

7

$164.62 per unit to $225.32 per unit. Further, the manufacturing cost of complex luggage has

reduced from $376.28 to $323.27 per unit under the activity based costing as compared to

traditional costing system.

Conclusion

Analysis of Cost and Benefits

The biggest advantage of activity based costing system is the allocation of overheads to

the products and or services in an appropriate manner (Maingi, 2013). The allocation of the

overheads in an appropriate manner leads to improvements in the decision making process which

is essential for the overall development and achievement of the objectives for a firm. Thus, the

activity based costing helps in achieving the goals and objectives of the firm. The management is

provided correct information about the cost of products which is necessary to take decisions

regarding enhancing and decreasing the capacity utilization. The overall productivity of an

organization of purported to improve with the use of activity based costing (Zeuner, 2012).

The traditional costing system sometimes does not provide accurate picture of the product

cost and due to distorted view of product cost, the management keep running business on wrong

decisions which ultimately results in firm incurring losses (Öker and Adıgüzel, 2016). The cost

management of the firm improves with the implementation of activity based costing system. For

instance, in the current case of Happy Traveller Ltd, the management was concerned about lower

profit margin on Complex luggage type product. However, the analysis under activity based

costing revealed that Complex luggage has lower cost of manufacture and hence it should not be

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

low profit margin. The management was misguided by the improper allocation of overheads on

the product (Zeuner, 2012).

Apply ABC to the Company

The implementation of activity based costing requires extensive changes in the processes

and structures of the company. Further, it is also a time consuming process. The implementation

of activity based costing system in the company may interrupt the operations if it is not handled

adequately (Bradtke, 2007). The activity based costing system works on the basis of

identification of activities being performed in different departments and consumption of these

activities. Thus, in order to implement the activity based costing, it is essential for Happy

Traveller Ltd to identify the activities within the departments and link the consumption of these

activities. Based on this linkage, the company needs to identify the cost drivers and then compute

the cost driver rate to allocate the overhead cost to different (Bradtke, 2007).

8

the product (Zeuner, 2012).

Apply ABC to the Company

The implementation of activity based costing requires extensive changes in the processes

and structures of the company. Further, it is also a time consuming process. The implementation

of activity based costing system in the company may interrupt the operations if it is not handled

adequately (Bradtke, 2007). The activity based costing system works on the basis of

identification of activities being performed in different departments and consumption of these

activities. Thus, in order to implement the activity based costing, it is essential for Happy

Traveller Ltd to identify the activities within the departments and link the consumption of these

activities. Based on this linkage, the company needs to identify the cost drivers and then compute

the cost driver rate to allocate the overhead cost to different (Bradtke, 2007).

8

References

Bradtke, D. 2007. Activity-Based-Costing. GRIN Verlag.

Öker, F. and Adıgüzel, H., 2016. Time‐driven activity‐based costing: An implementation in a

manufacturing company. Journal of Corporate Accounting & Finance, 27(3), pp.39-56

Kim, Y. 2017. Activity Based Costing for Construction Companies. John Wiley & Sons.

Maingi, J. 2013. Advantages & Disadvantages of activity based costing with reference to

economic value addition. GRIN Verlag.

Zeuner, P. 2012. Activity-Based Costing. GRIN Verlag.

9

Bradtke, D. 2007. Activity-Based-Costing. GRIN Verlag.

Öker, F. and Adıgüzel, H., 2016. Time‐driven activity‐based costing: An implementation in a

manufacturing company. Journal of Corporate Accounting & Finance, 27(3), pp.39-56

Kim, Y. 2017. Activity Based Costing for Construction Companies. John Wiley & Sons.

Maingi, J. 2013. Advantages & Disadvantages of activity based costing with reference to

economic value addition. GRIN Verlag.

Zeuner, P. 2012. Activity-Based Costing. GRIN Verlag.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.

![Management Accounting: Costing Analysis of Office Desks - [Company]](/_next/image/?url=https%3A%2F%2Fdesklib.com%2Fmedia%2Fimages%2Fjv%2Fc197923795a34b81bdce50f667d18d4c.jpg&w=256&q=75)