Management Accounting Report: J Rotherham Limited Case Study

VerifiedAdded on 2020/10/05

|18

|5229

|178

Report

AI Summary

This report provides a comprehensive analysis of management accounting practices at J Rotherham Limited, a hand-carved stone manufacturing company. The report delves into various aspects of management accounting, including cost accounting systems, job costing, inventory management, and price optimization. It examines different methods used for management accounting reporting, such as account receivable reports, inventory management reports, performance reports, and budget reports. The benefits and applications of these systems are discussed, along with the integration of management accounting with organizational processes. Furthermore, the report explores the advantages and disadvantages of planning tools used for budgetary control, including cash budgets. The analysis includes the calculation of costs using appropriate techniques and the application of a range of management accounting techniques. Finally, the report compares how organizations adapt management accounting systems to address financial challenges, providing a detailed overview of the company's financial strategies and reporting methods.

Management

Accounting

Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

PART 1............................................................................................................................................1

A Management accounting and basic requirements of its systems..............................................1

B. Different methods that are used for management accounting reporting.................................2

C. Benefits of management accounting system and their applications........................................3

D. Integration of management accounting system and reporting with organisational processes 4

PART 2............................................................................................................................................5

Advantages and disadvantages of planning tools used for budgetary control............................5

TASK 2............................................................................................................................................7

PART 1............................................................................................................................................7

Calculation of cost using appropriate techniques of cost analysis..............................................7

PART 2............................................................................................................................................8

Application of a range of management accounting techniques...................................................8

TASK 3............................................................................................................................................9

Comparison of the way in which organisations adapt management accounting systems............9

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................15

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

PART 1............................................................................................................................................1

A Management accounting and basic requirements of its systems..............................................1

B. Different methods that are used for management accounting reporting.................................2

C. Benefits of management accounting system and their applications........................................3

D. Integration of management accounting system and reporting with organisational processes 4

PART 2............................................................................................................................................5

Advantages and disadvantages of planning tools used for budgetary control............................5

TASK 2............................................................................................................................................7

PART 1............................................................................................................................................7

Calculation of cost using appropriate techniques of cost analysis..............................................7

PART 2............................................................................................................................................8

Application of a range of management accounting techniques...................................................8

TASK 3............................................................................................................................................9

Comparison of the way in which organisations adapt management accounting systems............9

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Management accounting can be defined as the process of monitoring, analysing,

controlling and measuring performance of the company for a specific period of time. It is very

beneficial for the internal stakeholders because it can help them to analyse actual status of the

organisation. For better execution of the organisational activities it is very important for

managers to keep proper record so that higher profits can be acquired by the enterprise

(Management accounting, 2018). The organisation which is selected for this report is J

Rotherham Limited which was established in year 1927 by Henry Rotherham. It is a

manufacturing company of hand carved stones. Currently the organisation is operating its

business in Yorkshire, UK.

This project report covers various topics such as management accounting its systems,

reports, benefits, requirements, calculation of costs with the help of different costing techniques

etc. Planning tools, their advantages and disadvantages and comparison of the ways in which

organisations use management accounting to respond financial problems are also been discussed

under this assignment.

TASK 1

PART 1

A Management accounting and basic requirements of its systems

Management accounting: It is the process of managing, controlling, monitoring and

analysing organisation's performance so that higher profits can be acquired in future. In J

Rotherham Limited management accounting is conducted on yearly basis so that strategies

decision can be formulated by managers for the betterment of the organisation. Four different

types of systems are followed by management of J Rotherham Limited in order to gather detailed

information regarding company's performance (Bennett and James, 2017). All of them are

described below:

Cost accounting system- It refers to framework that is used through organisations to

estimate cost of products for evaluation of inventory, profitability analysis and cost control. The

main requirement of this system is to estimating accurate cost of goods for make the business

operations profitable. It is mainly used through the producers in order to record the production

relates activities by using perceptual inventory system. The J Rotherham Limited use this system

1

Management accounting can be defined as the process of monitoring, analysing,

controlling and measuring performance of the company for a specific period of time. It is very

beneficial for the internal stakeholders because it can help them to analyse actual status of the

organisation. For better execution of the organisational activities it is very important for

managers to keep proper record so that higher profits can be acquired by the enterprise

(Management accounting, 2018). The organisation which is selected for this report is J

Rotherham Limited which was established in year 1927 by Henry Rotherham. It is a

manufacturing company of hand carved stones. Currently the organisation is operating its

business in Yorkshire, UK.

This project report covers various topics such as management accounting its systems,

reports, benefits, requirements, calculation of costs with the help of different costing techniques

etc. Planning tools, their advantages and disadvantages and comparison of the ways in which

organisations use management accounting to respond financial problems are also been discussed

under this assignment.

TASK 1

PART 1

A Management accounting and basic requirements of its systems

Management accounting: It is the process of managing, controlling, monitoring and

analysing organisation's performance so that higher profits can be acquired in future. In J

Rotherham Limited management accounting is conducted on yearly basis so that strategies

decision can be formulated by managers for the betterment of the organisation. Four different

types of systems are followed by management of J Rotherham Limited in order to gather detailed

information regarding company's performance (Bennett and James, 2017). All of them are

described below:

Cost accounting system- It refers to framework that is used through organisations to

estimate cost of products for evaluation of inventory, profitability analysis and cost control. The

main requirement of this system is to estimating accurate cost of goods for make the business

operations profitable. It is mainly used through the producers in order to record the production

relates activities by using perceptual inventory system. The J Rotherham Limited use this system

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

to capture production cost through assessing input cost of production. Company mainly use the

cost accounting system to take effective decision related to the financial accounting.

Job costing system- It refers to system that company mainly used for accumulating as

well as assigning the production cost of an individual output. It is mainly costing method that is

applied in the industries where production cost is mainly measured through number of the

completed jobs. Under this, information may be needed for submit cost information to consumer

under contract where the cost is reimbursed. J Rotherham Limited uses this system for

monitoring the expense that assigns price of the each product and also enable the manager to

keep track of all the expenses at workplace. On the other hand, it is a technique of costing where

amount of the work dine is on form of job completed (Christ, 2014).

Inventory management system- The inventory management refers to ongoing process

of moving the products in and out of location of firm. It is combination of the technology as well

as process that oversees monitoring of stocked goods. The J Rotherham Limited use inventory

management system for determining the each inventory items and their related information. The

better management of an inventory helps in minimizing the cost which keep finances as well as

accounts in check. On the other hand, there is an inventory software system that track the

inventory orders, levels, deliveries and sales.

Price optimisation system- The price optimization refers to use of the mathematical

analysis through firm identify how consumers will respond to various costs of its services as well

as products by various channels. J Rotherham Limited use this system to identify the costs that

will meet with its set objectives for an instance enhancing operating profit.

B. Different methods that are used for management accounting reporting

Management accounting reporting: The process of formulating management reports is

known as management accounting reporting. It is used to analyse the detailed information

regarding the organisation. In J Rotherham Limited managers generate various reports in order to

keep record of the company (Fullerton, Kennedy and Widener, 2014). Following are the reports

that are created by the management are as follows:

Account receivable report: Such type of report is generated by those companies which

are dealing in credit with its clients. It helps to analyse the total owed amount that is

required to be paid by the customers. In J Rotherham Limited account receivable report is

generated by the managers to keep a track record of the outstanding amount of clients. It

2

cost accounting system to take effective decision related to the financial accounting.

Job costing system- It refers to system that company mainly used for accumulating as

well as assigning the production cost of an individual output. It is mainly costing method that is

applied in the industries where production cost is mainly measured through number of the

completed jobs. Under this, information may be needed for submit cost information to consumer

under contract where the cost is reimbursed. J Rotherham Limited uses this system for

monitoring the expense that assigns price of the each product and also enable the manager to

keep track of all the expenses at workplace. On the other hand, it is a technique of costing where

amount of the work dine is on form of job completed (Christ, 2014).

Inventory management system- The inventory management refers to ongoing process

of moving the products in and out of location of firm. It is combination of the technology as well

as process that oversees monitoring of stocked goods. The J Rotherham Limited use inventory

management system for determining the each inventory items and their related information. The

better management of an inventory helps in minimizing the cost which keep finances as well as

accounts in check. On the other hand, there is an inventory software system that track the

inventory orders, levels, deliveries and sales.

Price optimisation system- The price optimization refers to use of the mathematical

analysis through firm identify how consumers will respond to various costs of its services as well

as products by various channels. J Rotherham Limited use this system to identify the costs that

will meet with its set objectives for an instance enhancing operating profit.

B. Different methods that are used for management accounting reporting

Management accounting reporting: The process of formulating management reports is

known as management accounting reporting. It is used to analyse the detailed information

regarding the organisation. In J Rotherham Limited managers generate various reports in order to

keep record of the company (Fullerton, Kennedy and Widener, 2014). Following are the reports

that are created by the management are as follows:

Account receivable report: Such type of report is generated by those companies which

are dealing in credit with its clients. It helps to analyse the total owed amount that is

required to be paid by the customers. In J Rotherham Limited account receivable report is

generated by the managers to keep a track record of the outstanding amount of clients. It

2

is beneficial for the company as it may help to tighten the credit policy by analysing the

owed amount.

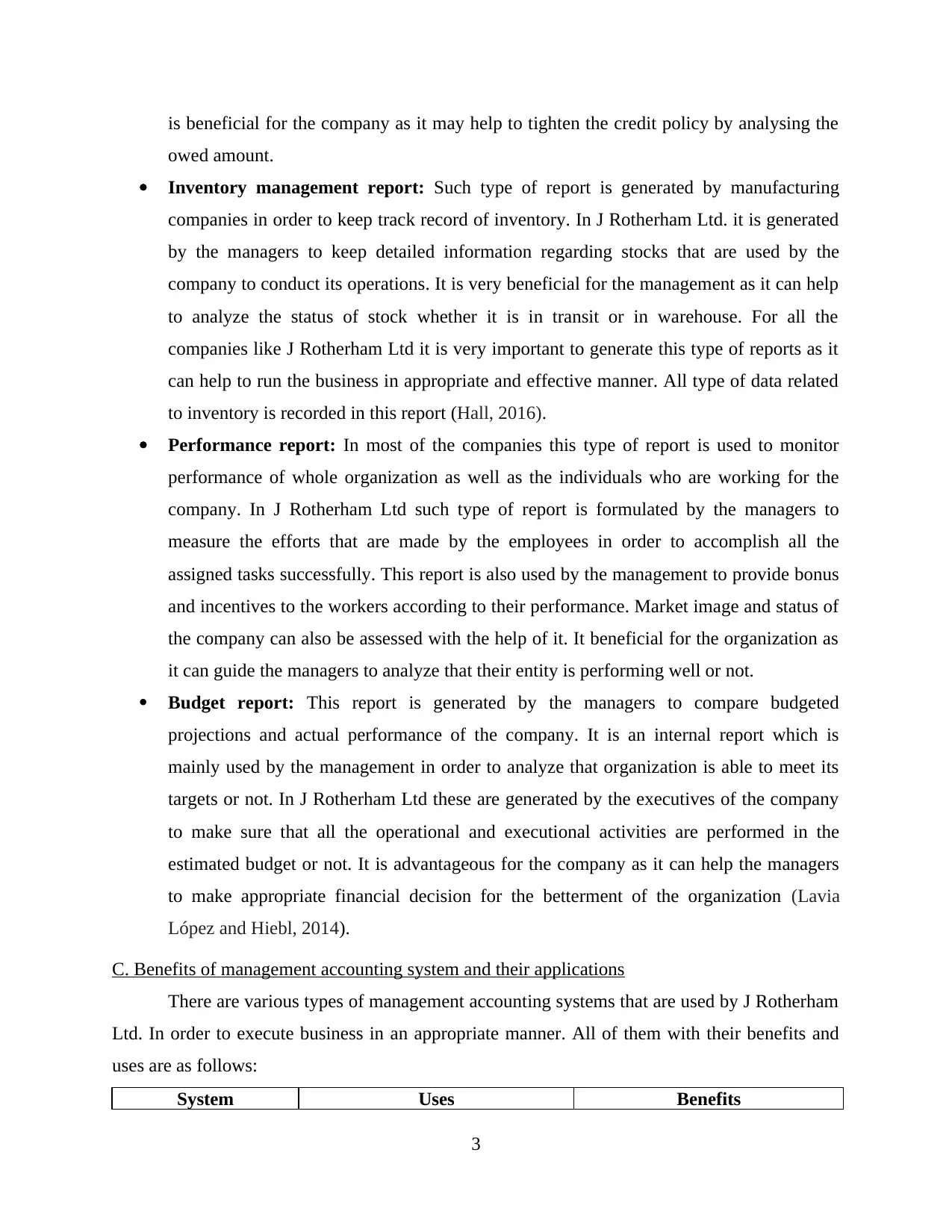

Inventory management report: Such type of report is generated by manufacturing

companies in order to keep track record of inventory. In J Rotherham Ltd. it is generated

by the managers to keep detailed information regarding stocks that are used by the

company to conduct its operations. It is very beneficial for the management as it can help

to analyze the status of stock whether it is in transit or in warehouse. For all the

companies like J Rotherham Ltd it is very important to generate this type of reports as it

can help to run the business in appropriate and effective manner. All type of data related

to inventory is recorded in this report (Hall, 2016).

Performance report: In most of the companies this type of report is used to monitor

performance of whole organization as well as the individuals who are working for the

company. In J Rotherham Ltd such type of report is formulated by the managers to

measure the efforts that are made by the employees in order to accomplish all the

assigned tasks successfully. This report is also used by the management to provide bonus

and incentives to the workers according to their performance. Market image and status of

the company can also be assessed with the help of it. It beneficial for the organization as

it can guide the managers to analyze that their entity is performing well or not.

Budget report: This report is generated by the managers to compare budgeted

projections and actual performance of the company. It is an internal report which is

mainly used by the management in order to analyze that organization is able to meet its

targets or not. In J Rotherham Ltd these are generated by the executives of the company

to make sure that all the operational and executional activities are performed in the

estimated budget or not. It is advantageous for the company as it can help the managers

to make appropriate financial decision for the betterment of the organization (Lavia

López and Hiebl, 2014).

C. Benefits of management accounting system and their applications

There are various types of management accounting systems that are used by J Rotherham

Ltd. In order to execute business in an appropriate manner. All of them with their benefits and

uses are as follows:

System Uses Benefits

3

owed amount.

Inventory management report: Such type of report is generated by manufacturing

companies in order to keep track record of inventory. In J Rotherham Ltd. it is generated

by the managers to keep detailed information regarding stocks that are used by the

company to conduct its operations. It is very beneficial for the management as it can help

to analyze the status of stock whether it is in transit or in warehouse. For all the

companies like J Rotherham Ltd it is very important to generate this type of reports as it

can help to run the business in appropriate and effective manner. All type of data related

to inventory is recorded in this report (Hall, 2016).

Performance report: In most of the companies this type of report is used to monitor

performance of whole organization as well as the individuals who are working for the

company. In J Rotherham Ltd such type of report is formulated by the managers to

measure the efforts that are made by the employees in order to accomplish all the

assigned tasks successfully. This report is also used by the management to provide bonus

and incentives to the workers according to their performance. Market image and status of

the company can also be assessed with the help of it. It beneficial for the organization as

it can guide the managers to analyze that their entity is performing well or not.

Budget report: This report is generated by the managers to compare budgeted

projections and actual performance of the company. It is an internal report which is

mainly used by the management in order to analyze that organization is able to meet its

targets or not. In J Rotherham Ltd these are generated by the executives of the company

to make sure that all the operational and executional activities are performed in the

estimated budget or not. It is advantageous for the company as it can help the managers

to make appropriate financial decision for the betterment of the organization (Lavia

López and Hiebl, 2014).

C. Benefits of management accounting system and their applications

There are various types of management accounting systems that are used by J Rotherham

Ltd. In order to execute business in an appropriate manner. All of them with their benefits and

uses are as follows:

System Uses Benefits

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Cost accounting

system

It is used by J Rotherham Ltd. To

analyze the cost of each item

which is sold by the company.

Cost accounting system is

beneficial for J Rutherham as it

can help the managers to

determine exact cost of the units

of the organization.

Inventory

management system

It is used by managers of the

organization in order to keep track

record of the stock which is used

for manufacturing purpose.

This system is beneficial for the

enterprise as it may guide the

management to track the

inventory whether it is in transit

or warehouse.

Job costing system Job costing system is used in J

Rotherham Ltd. To analyze the

cost involved in the jobs that are

performed by the company.

It is beneficial for the

organization as it can help the

managers to analyze the cost of

jobs that are performed according

specifications of customers.

Price optimization

system

This system is used by the

managers to set the best suitable

price for the products of the

company.

Price optimization system is

beneficial for J Rutheram Ltd. As

it helps the managers to meet the

expectations of the customers by

deciding appropriate price for the

products.

D. Integration of management accounting system and reporting with organisational processes

In J Rotherham Ltd different types of system are followed and various types of reports

are generated in order to strengthen the position of the company in the market. Price optimization

system is used for the organizational process in which best suitable price for the items of the

company. Job costing system is used by the managers to analyze the cost of different activities

that are performed by the organization according to the specification of the clients. Account

receivable reports are mainly used to strengthen the credit policies of the company by assessing

4

system

It is used by J Rotherham Ltd. To

analyze the cost of each item

which is sold by the company.

Cost accounting system is

beneficial for J Rutherham as it

can help the managers to

determine exact cost of the units

of the organization.

Inventory

management system

It is used by managers of the

organization in order to keep track

record of the stock which is used

for manufacturing purpose.

This system is beneficial for the

enterprise as it may guide the

management to track the

inventory whether it is in transit

or warehouse.

Job costing system Job costing system is used in J

Rotherham Ltd. To analyze the

cost involved in the jobs that are

performed by the company.

It is beneficial for the

organization as it can help the

managers to analyze the cost of

jobs that are performed according

specifications of customers.

Price optimization

system

This system is used by the

managers to set the best suitable

price for the products of the

company.

Price optimization system is

beneficial for J Rutheram Ltd. As

it helps the managers to meet the

expectations of the customers by

deciding appropriate price for the

products.

D. Integration of management accounting system and reporting with organisational processes

In J Rotherham Ltd different types of system are followed and various types of reports

are generated in order to strengthen the position of the company in the market. Price optimization

system is used for the organizational process in which best suitable price for the items of the

company. Job costing system is used by the managers to analyze the cost of different activities

that are performed by the organization according to the specification of the clients. Account

receivable reports are mainly used to strengthen the credit policies of the company by assessing

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

total owed amount by the clients. Performance reports are generated by the management to

determine the business entity is performing well in the market or not. It is also used to monitor

performance of the staff members.

PART 2

Advantages and disadvantages of planning tools used for budgetary control

Budget is a tool that calculates the expenses and earning of business within the certified

period and take measures to achieve goals according to planned figures. These are based on the

prediction of managers. It requires knowledge and experience on part of individual to accurately

manage the working of organisation. These helps in guiding them to keep finances under control.

Overutilization of money can cause burden, on the other hand underutilization can affect

efficiency of business (Messner, 2016). Budgetary Control is process of ensuring the

performance of company by comparing present financial situation with estimated revenues and

expenditures. J Rotherham limited is firm of stonemason that builds kitchen interiors and does

other architectural work. It manages it's accounts on daily basis and maintained appropriate

budgets before the production and delivering of it's products. The process of budget

development begins with forecasting situation of market, sales, costs which will incur. It is

important to analyse economic conditions before investing money into something as these affect

directly to condition of business. Sales are being predicted to estimate customer responsiveness

and determining costs will help in understanding how much extra has been put. This helps in the

decision making of managers. J Rotherham takes into account the efforts of entire employees.

Together they make plans on building model by examining the amount required to design and

develop products, raw material, equipments, machinery, labour various cost attached to these

along with resources needed to complete the entire projects. The three main planning tools of

budgets are as follows

Cash budget- This budget helps in the ascertaining the flow of cash within the

organisation as well as outside of it. This is used to analyse the requirement of finance for the

operation of business. J Rotherham maintains this budget to analyse the needs of finances and it

also provides necessary information about various appropriate sources from where the funds are

being generated (Modell, 2014).

Advantages:

5

determine the business entity is performing well in the market or not. It is also used to monitor

performance of the staff members.

PART 2

Advantages and disadvantages of planning tools used for budgetary control

Budget is a tool that calculates the expenses and earning of business within the certified

period and take measures to achieve goals according to planned figures. These are based on the

prediction of managers. It requires knowledge and experience on part of individual to accurately

manage the working of organisation. These helps in guiding them to keep finances under control.

Overutilization of money can cause burden, on the other hand underutilization can affect

efficiency of business (Messner, 2016). Budgetary Control is process of ensuring the

performance of company by comparing present financial situation with estimated revenues and

expenditures. J Rotherham limited is firm of stonemason that builds kitchen interiors and does

other architectural work. It manages it's accounts on daily basis and maintained appropriate

budgets before the production and delivering of it's products. The process of budget

development begins with forecasting situation of market, sales, costs which will incur. It is

important to analyse economic conditions before investing money into something as these affect

directly to condition of business. Sales are being predicted to estimate customer responsiveness

and determining costs will help in understanding how much extra has been put. This helps in the

decision making of managers. J Rotherham takes into account the efforts of entire employees.

Together they make plans on building model by examining the amount required to design and

develop products, raw material, equipments, machinery, labour various cost attached to these

along with resources needed to complete the entire projects. The three main planning tools of

budgets are as follows

Cash budget- This budget helps in the ascertaining the flow of cash within the

organisation as well as outside of it. This is used to analyse the requirement of finance for the

operation of business. J Rotherham maintains this budget to analyse the needs of finances and it

also provides necessary information about various appropriate sources from where the funds are

being generated (Modell, 2014).

Advantages:

5

The main advantage of preparing this budget is that business never ran out of money.

This helps in controlling the organisation's spending habits. It maintains the liquidity of

company. Decisions can be taken to use cash in more productive activities.

Another advantage of this is availed by the managers as they are in better position to

take decisions. Evaluation of alternatives and adoption of most effective one amongst

them is the most difficult aspect which needs to be considered to achieve profits.

Disadvantages

This budget suffers from lack of flexibility, business being complex activity requires

changes from time to time.

Lack of accuracy is one of it's disadvantages as it depend too much estimates based on

future (Nielsen, Mitchell and Nørreklit, 2015).

Master budget- This budget is prepared for various functions performing in the

company. It involved estimation of all budgets related to inventory, selling, cash, financial

statements and other areas. Evaluation of long term plans is the main purpose of creating it.

Advantages

Equal attention is paid on every department

Detecting errors is also essential, creating this budget helps in finding the possible faults.

Such mistakes should be removed to ensure the smooth functioning of organisation.

Disadvantages

Creating this is tedious as it involves preparation of multiple budgets. Making

amendments becomes difficult task.

Another disadvantage connected to this is that it does not specify the exact amount of

money being spend on each department.

Zero based budgeting- under this type of budgeting after every month or certain amount

of period, budget is prepared from zero base regardless of how much has been earned or spent in

previous time period. J Rotherham uses this to understand it's manufacturing expenditure.

Advantages

It determines the reason behind expenses this aspect makes it easier for the planning of

concrete actions that needs to be taken at right time.

This also helps to identify the out of date processes which are not helping in increasing

the profits (Otley, 2016).

6

This helps in controlling the organisation's spending habits. It maintains the liquidity of

company. Decisions can be taken to use cash in more productive activities.

Another advantage of this is availed by the managers as they are in better position to

take decisions. Evaluation of alternatives and adoption of most effective one amongst

them is the most difficult aspect which needs to be considered to achieve profits.

Disadvantages

This budget suffers from lack of flexibility, business being complex activity requires

changes from time to time.

Lack of accuracy is one of it's disadvantages as it depend too much estimates based on

future (Nielsen, Mitchell and Nørreklit, 2015).

Master budget- This budget is prepared for various functions performing in the

company. It involved estimation of all budgets related to inventory, selling, cash, financial

statements and other areas. Evaluation of long term plans is the main purpose of creating it.

Advantages

Equal attention is paid on every department

Detecting errors is also essential, creating this budget helps in finding the possible faults.

Such mistakes should be removed to ensure the smooth functioning of organisation.

Disadvantages

Creating this is tedious as it involves preparation of multiple budgets. Making

amendments becomes difficult task.

Another disadvantage connected to this is that it does not specify the exact amount of

money being spend on each department.

Zero based budgeting- under this type of budgeting after every month or certain amount

of period, budget is prepared from zero base regardless of how much has been earned or spent in

previous time period. J Rotherham uses this to understand it's manufacturing expenditure.

Advantages

It determines the reason behind expenses this aspect makes it easier for the planning of

concrete actions that needs to be taken at right time.

This also helps to identify the out of date processes which are not helping in increasing

the profits (Otley, 2016).

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Disadvantage

Many times employees does not have the required skills to prepare such budgets as it

requires one to have deeper analytical ability therefore it is not preferred.

It is also rigid in nature similar to master budget.

Analysis of the use of different planning tools and their applications

Managers of J Rutherham are using three planning tools such as operating, master and

zero-based budgets in order to forecast and formulate budget. All of the guide the managers to

analyze requirements of the company and then form the budgets in appropriate manner. It is very

important for the business entity to take all of the in to consideration while forecasting budget in

order to estimate it accurately.

Evaluation of the use of planning tools to solve financial problems

Management of J Rotherham Ltd. are using three different types of planning tools such as

operating, master and zero-based budget. All of them helps to deal with financial problem such

as late payments by clients, unexpected expenses and improper money management system by

forecasting them in advance. All of them helps managers to be prepare for the issues in future so

that these can be resolved appropriately. These planning tools may guide the management to take

appropriate actions at the time of problematic situation so that they can respond them in effective

manner.

TASK 2

PART 1

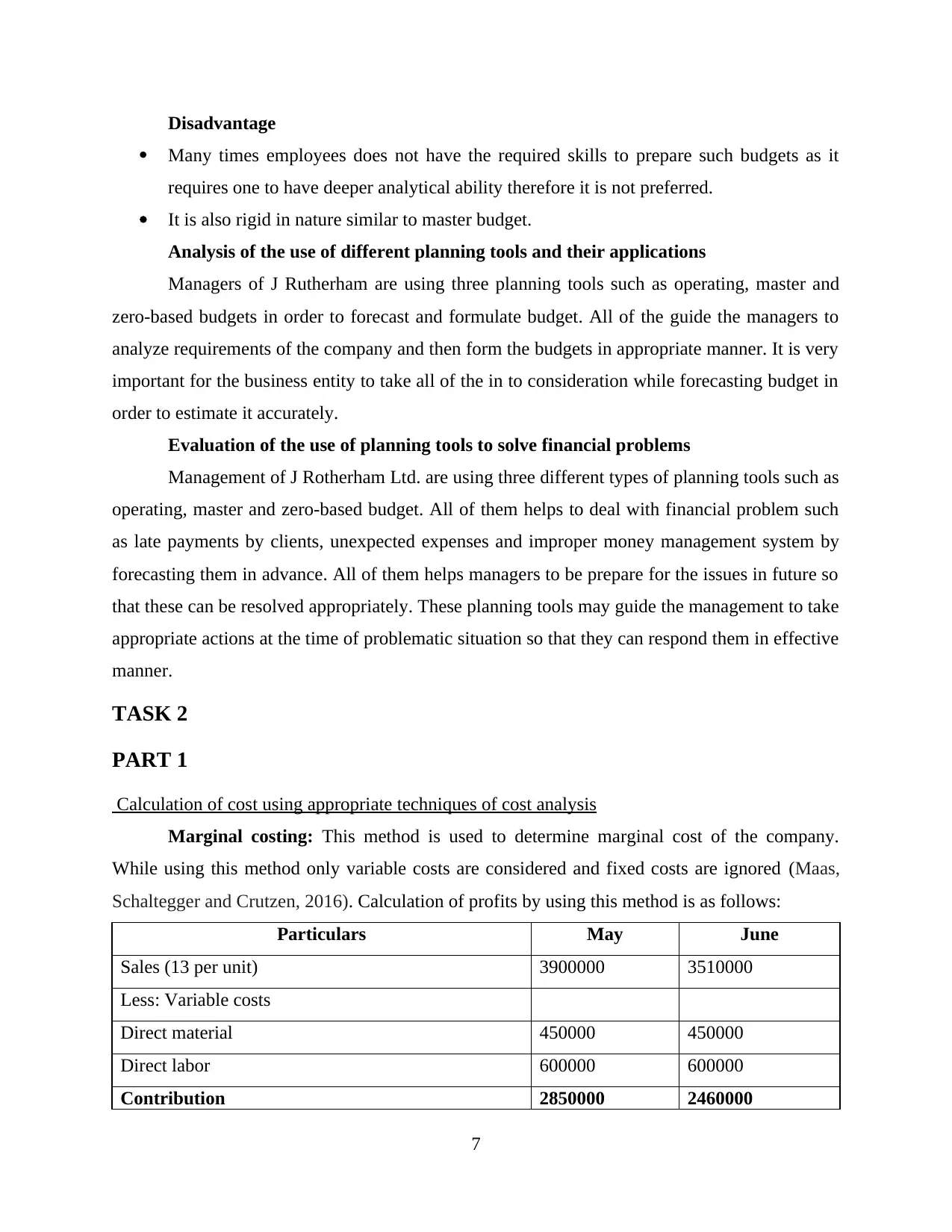

Calculation of cost using appropriate techniques of cost analysis

Marginal costing: This method is used to determine marginal cost of the company.

While using this method only variable costs are considered and fixed costs are ignored (Maas,

Schaltegger and Crutzen, 2016). Calculation of profits by using this method is as follows:

Particulars May June

Sales (13 per unit) 3900000 3510000

Less: Variable costs

Direct material 450000 450000

Direct labor 600000 600000

Contribution 2850000 2460000

7

Many times employees does not have the required skills to prepare such budgets as it

requires one to have deeper analytical ability therefore it is not preferred.

It is also rigid in nature similar to master budget.

Analysis of the use of different planning tools and their applications

Managers of J Rutherham are using three planning tools such as operating, master and

zero-based budgets in order to forecast and formulate budget. All of the guide the managers to

analyze requirements of the company and then form the budgets in appropriate manner. It is very

important for the business entity to take all of the in to consideration while forecasting budget in

order to estimate it accurately.

Evaluation of the use of planning tools to solve financial problems

Management of J Rotherham Ltd. are using three different types of planning tools such as

operating, master and zero-based budget. All of them helps to deal with financial problem such

as late payments by clients, unexpected expenses and improper money management system by

forecasting them in advance. All of them helps managers to be prepare for the issues in future so

that these can be resolved appropriately. These planning tools may guide the management to take

appropriate actions at the time of problematic situation so that they can respond them in effective

manner.

TASK 2

PART 1

Calculation of cost using appropriate techniques of cost analysis

Marginal costing: This method is used to determine marginal cost of the company.

While using this method only variable costs are considered and fixed costs are ignored (Maas,

Schaltegger and Crutzen, 2016). Calculation of profits by using this method is as follows:

Particulars May June

Sales (13 per unit) 3900000 3510000

Less: Variable costs

Direct material 450000 450000

Direct labor 600000 600000

Contribution 2850000 2460000

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

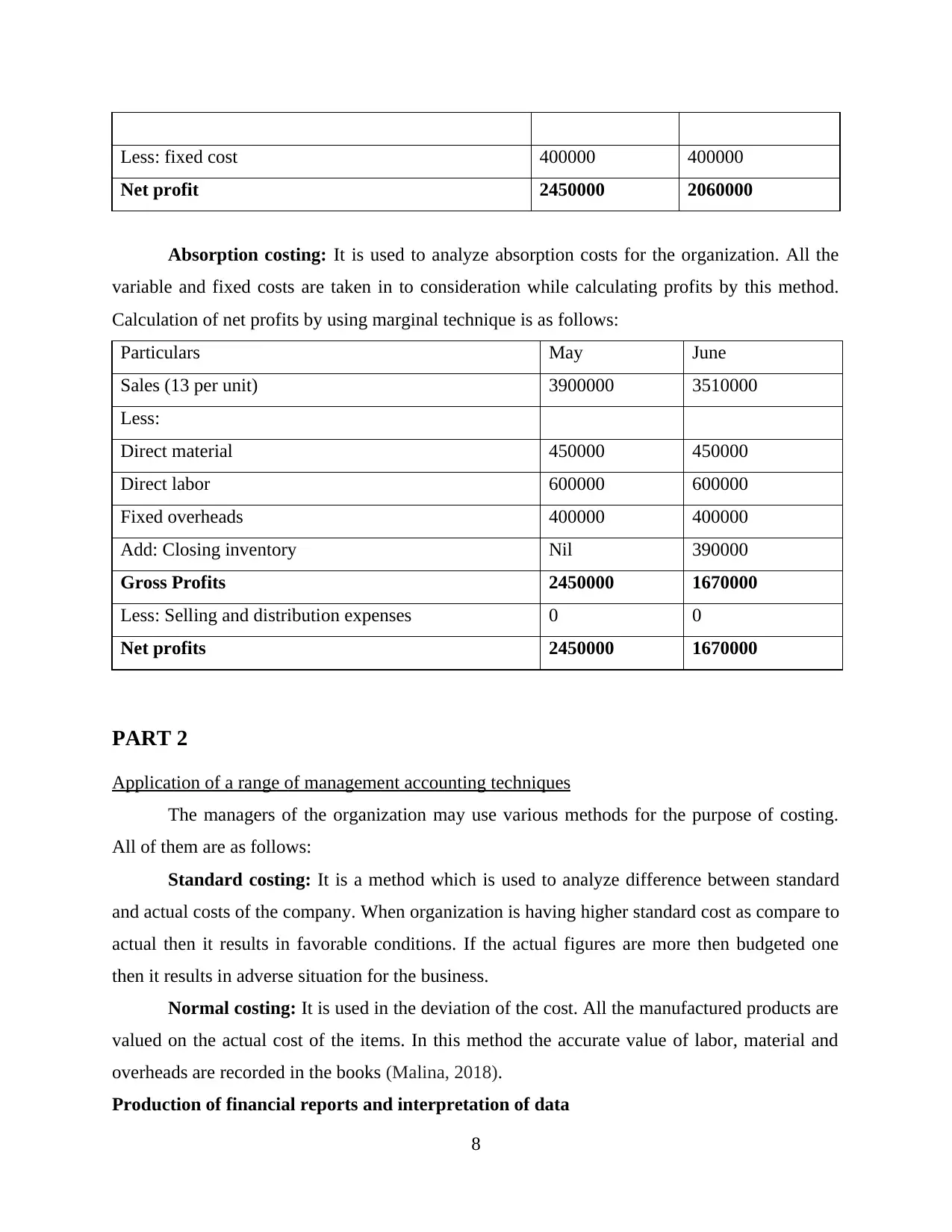

Less: fixed cost 400000 400000

Net profit 2450000 2060000

Absorption costing: It is used to analyze absorption costs for the organization. All the

variable and fixed costs are taken in to consideration while calculating profits by this method.

Calculation of net profits by using marginal technique is as follows:

Particulars May June

Sales (13 per unit) 3900000 3510000

Less:

Direct material 450000 450000

Direct labor 600000 600000

Fixed overheads 400000 400000

Add: Closing inventory Nil 390000

Gross Profits 2450000 1670000

Less: Selling and distribution expenses 0 0

Net profits 2450000 1670000

PART 2

Application of a range of management accounting techniques

The managers of the organization may use various methods for the purpose of costing.

All of them are as follows:

Standard costing: It is a method which is used to analyze difference between standard

and actual costs of the company. When organization is having higher standard cost as compare to

actual then it results in favorable conditions. If the actual figures are more then budgeted one

then it results in adverse situation for the business.

Normal costing: It is used in the deviation of the cost. All the manufactured products are

valued on the actual cost of the items. In this method the accurate value of labor, material and

overheads are recorded in the books (Malina, 2018).

Production of financial reports and interpretation of data

8

Net profit 2450000 2060000

Absorption costing: It is used to analyze absorption costs for the organization. All the

variable and fixed costs are taken in to consideration while calculating profits by this method.

Calculation of net profits by using marginal technique is as follows:

Particulars May June

Sales (13 per unit) 3900000 3510000

Less:

Direct material 450000 450000

Direct labor 600000 600000

Fixed overheads 400000 400000

Add: Closing inventory Nil 390000

Gross Profits 2450000 1670000

Less: Selling and distribution expenses 0 0

Net profits 2450000 1670000

PART 2

Application of a range of management accounting techniques

The managers of the organization may use various methods for the purpose of costing.

All of them are as follows:

Standard costing: It is a method which is used to analyze difference between standard

and actual costs of the company. When organization is having higher standard cost as compare to

actual then it results in favorable conditions. If the actual figures are more then budgeted one

then it results in adverse situation for the business.

Normal costing: It is used in the deviation of the cost. All the manufactured products are

valued on the actual cost of the items. In this method the accurate value of labor, material and

overheads are recorded in the books (Malina, 2018).

Production of financial reports and interpretation of data

8

While calculating profits by marginal costing method it has resulted in 2850000 for May

and 2460000 for June. The absorption costing technique has resulted in the profits of 2450000

for May and 1670000 for June. The reason behind the difference is fixed cost and closing

inventory because in marginal costing these are not considered and in absorption technique both

of them are considered for the purpose of calculating profits.

TASK 3

Comparison of the way in which organisations adapt management accounting systems

Now a days all the business entities are facing money related problems that are known as

financial issues. When the company is not having sufficient monetary resources to execute

business operations (Renz, 2016). Currently J Rotherham Ltd is also dealing with some of them.

All of them are affecting business execution activities of the company. All the money related

problems of the company are as follows:

Sudden expenses: There are various types of expenses that may take place suddenly and

the managers of J Rotherham Ltd are required to deal with them in appropriate manner. All of

them results in lack of money for business operations. For example, repair of machinery is one of

the unexpected expenses which may take place suddenly and then managers are required to pay

them from the reserved amount. It creates a deficiency of funds for the organisation.

Late payments by clients: Some times clients who buy goods on credit make late

payments which also results in financial issues. It affects the operational efficiency of J

Rotherham Ltd. It is very important for managers to tighten the credit policy so that the

outstanding amount could be recovered by the entity on time (Salterio, 2015)).

Improper money management system: Money management system of J Rotherham

Ltd. is not proper because the managers are not using the right accounting principles. It is very

important for the organisation to hire skilled staff members so that all the accounting related

activities can be conducted in appropriate manner.

The management of J Rotherham Ltd. Are using two different techniques to identify all

of the financial issues. Both of them are as follows:

Benchmarking: It is a technique which is used to compare organisation’s policies with

competitors so that the issues of the company can be analysed. In Benchmarking is used by the

9

and 2460000 for June. The absorption costing technique has resulted in the profits of 2450000

for May and 1670000 for June. The reason behind the difference is fixed cost and closing

inventory because in marginal costing these are not considered and in absorption technique both

of them are considered for the purpose of calculating profits.

TASK 3

Comparison of the way in which organisations adapt management accounting systems

Now a days all the business entities are facing money related problems that are known as

financial issues. When the company is not having sufficient monetary resources to execute

business operations (Renz, 2016). Currently J Rotherham Ltd is also dealing with some of them.

All of them are affecting business execution activities of the company. All the money related

problems of the company are as follows:

Sudden expenses: There are various types of expenses that may take place suddenly and

the managers of J Rotherham Ltd are required to deal with them in appropriate manner. All of

them results in lack of money for business operations. For example, repair of machinery is one of

the unexpected expenses which may take place suddenly and then managers are required to pay

them from the reserved amount. It creates a deficiency of funds for the organisation.

Late payments by clients: Some times clients who buy goods on credit make late

payments which also results in financial issues. It affects the operational efficiency of J

Rotherham Ltd. It is very important for managers to tighten the credit policy so that the

outstanding amount could be recovered by the entity on time (Salterio, 2015)).

Improper money management system: Money management system of J Rotherham

Ltd. is not proper because the managers are not using the right accounting principles. It is very

important for the organisation to hire skilled staff members so that all the accounting related

activities can be conducted in appropriate manner.

The management of J Rotherham Ltd. Are using two different techniques to identify all

of the financial issues. Both of them are as follows:

Benchmarking: It is a technique which is used to compare organisation’s policies with

competitors so that the issues of the company can be analysed. In Benchmarking is used by the

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.