Marginal and Absorption Costing

VerifiedAdded on 2023/01/12

|10

|1066

|38

AI Summary

This document provides information on marginal and absorption costing, including the calculation of net income and cash budget. It covers topics such as sales, cost of goods sold, variable and fixed costs, and cash collections and disbursements. The assignment is related to management accounting.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Management

Accounting

Accounting

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

Table of Contents.............................................................................................................................2

TASK 2............................................................................................................................................1

2.1................................................................................................................................................1

2.2................................................................................................................................................4

2.3................................................................................................................................................5

3.1................................................................................................................................................7

Table of Contents.............................................................................................................................2

TASK 2............................................................................................................................................1

2.1................................................................................................................................................1

2.2................................................................................................................................................4

2.3................................................................................................................................................5

3.1................................................................................................................................................7

TASK 2

2.1

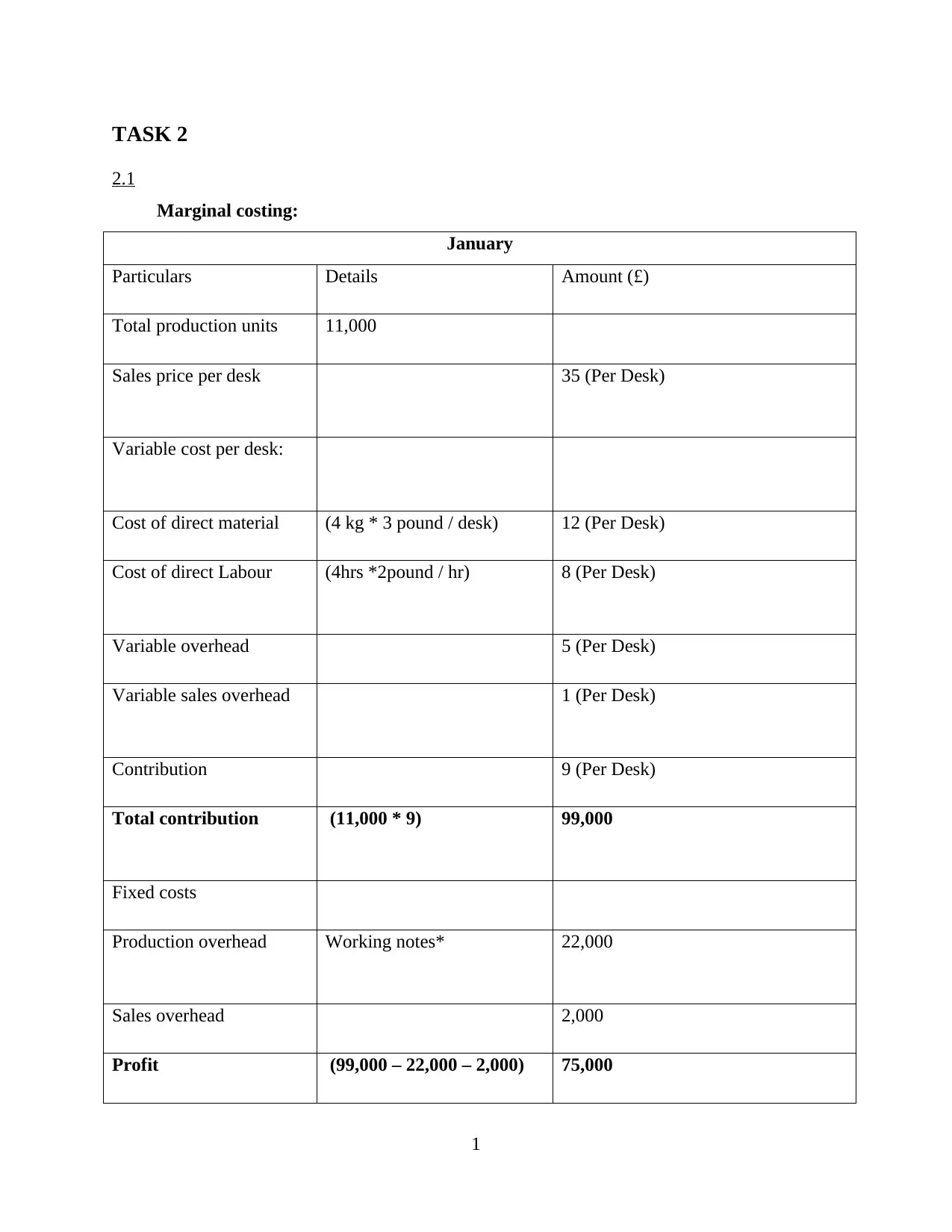

Marginal costing:

January

Particulars Details Amount (£)

Total production units 11,000

Sales price per desk 35 (Per Desk)

Variable cost per desk:

Cost of direct material (4 kg * 3 pound / desk) 12 (Per Desk)

Cost of direct Labour (4hrs *2pound / hr) 8 (Per Desk)

Variable overhead 5 (Per Desk)

Variable sales overhead 1 (Per Desk)

Contribution 9 (Per Desk)

Total contribution (11,000 * 9) 99,000

Fixed costs

Production overhead Working notes* 22,000

Sales overhead 2,000

Profit (99,000 – 22,000 – 2,000) 75,000

1

2.1

Marginal costing:

January

Particulars Details Amount (£)

Total production units 11,000

Sales price per desk 35 (Per Desk)

Variable cost per desk:

Cost of direct material (4 kg * 3 pound / desk) 12 (Per Desk)

Cost of direct Labour (4hrs *2pound / hr) 8 (Per Desk)

Variable overhead 5 (Per Desk)

Variable sales overhead 1 (Per Desk)

Contribution 9 (Per Desk)

Total contribution (11,000 * 9) 99,000

Fixed costs

Production overhead Working notes* 22,000

Sales overhead 2,000

Profit (99,000 – 22,000 – 2,000) 75,000

1

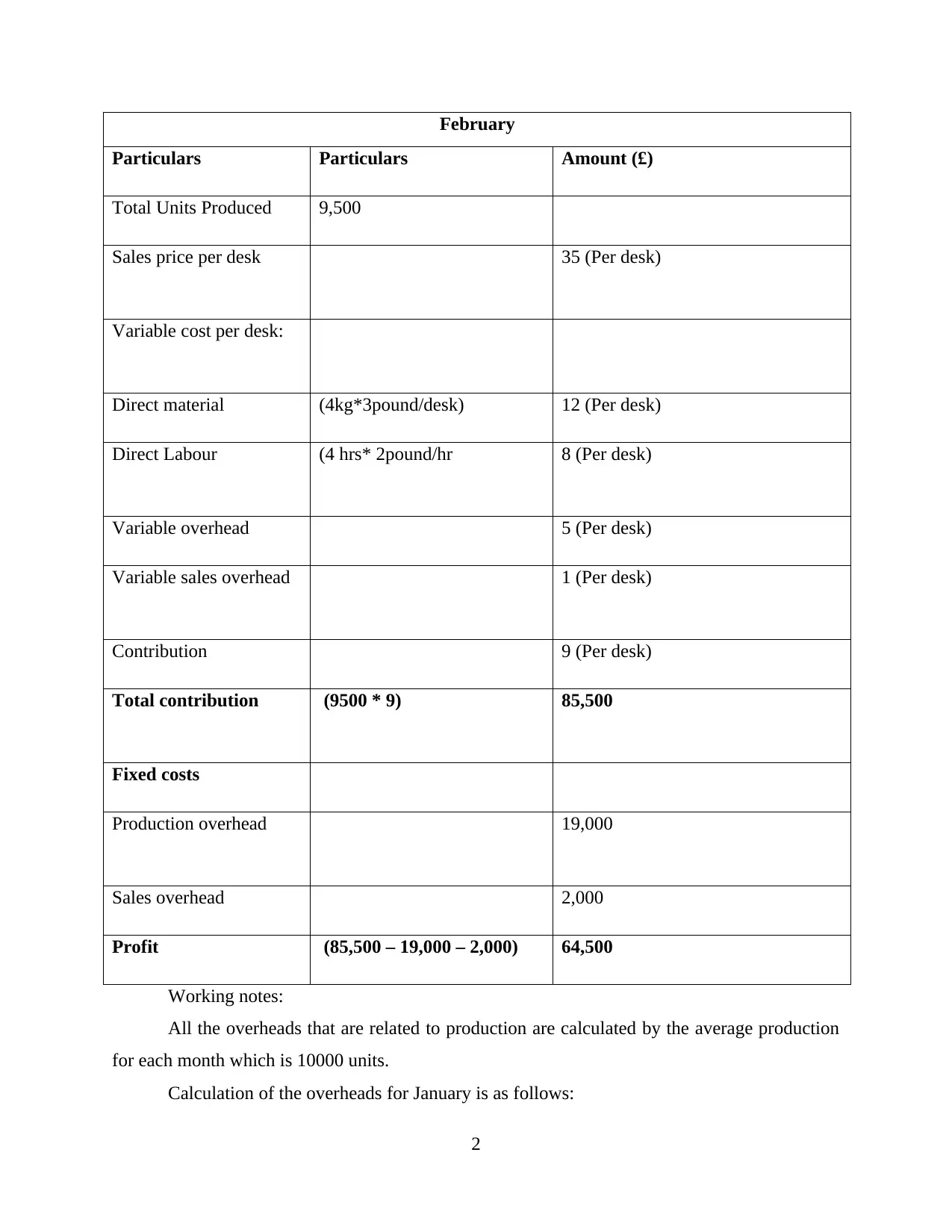

February

Particulars Particulars Amount (£)

Total Units Produced 9,500

Sales price per desk 35 (Per desk)

Variable cost per desk:

Direct material (4kg*3pound/desk) 12 (Per desk)

Direct Labour (4 hrs* 2pound/hr 8 (Per desk)

Variable overhead 5 (Per desk)

Variable sales overhead 1 (Per desk)

Contribution 9 (Per desk)

Total contribution (9500 * 9) 85,500

Fixed costs

Production overhead 19,000

Sales overhead 2,000

Profit (85,500 – 19,000 – 2,000) 64,500

Working notes:

All the overheads that are related to production are calculated by the average production

for each month which is 10000 units.

Calculation of the overheads for January is as follows:

2

Particulars Particulars Amount (£)

Total Units Produced 9,500

Sales price per desk 35 (Per desk)

Variable cost per desk:

Direct material (4kg*3pound/desk) 12 (Per desk)

Direct Labour (4 hrs* 2pound/hr 8 (Per desk)

Variable overhead 5 (Per desk)

Variable sales overhead 1 (Per desk)

Contribution 9 (Per desk)

Total contribution (9500 * 9) 85,500

Fixed costs

Production overhead 19,000

Sales overhead 2,000

Profit (85,500 – 19,000 – 2,000) 64,500

Working notes:

All the overheads that are related to production are calculated by the average production

for each month which is 10000 units.

Calculation of the overheads for January is as follows:

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

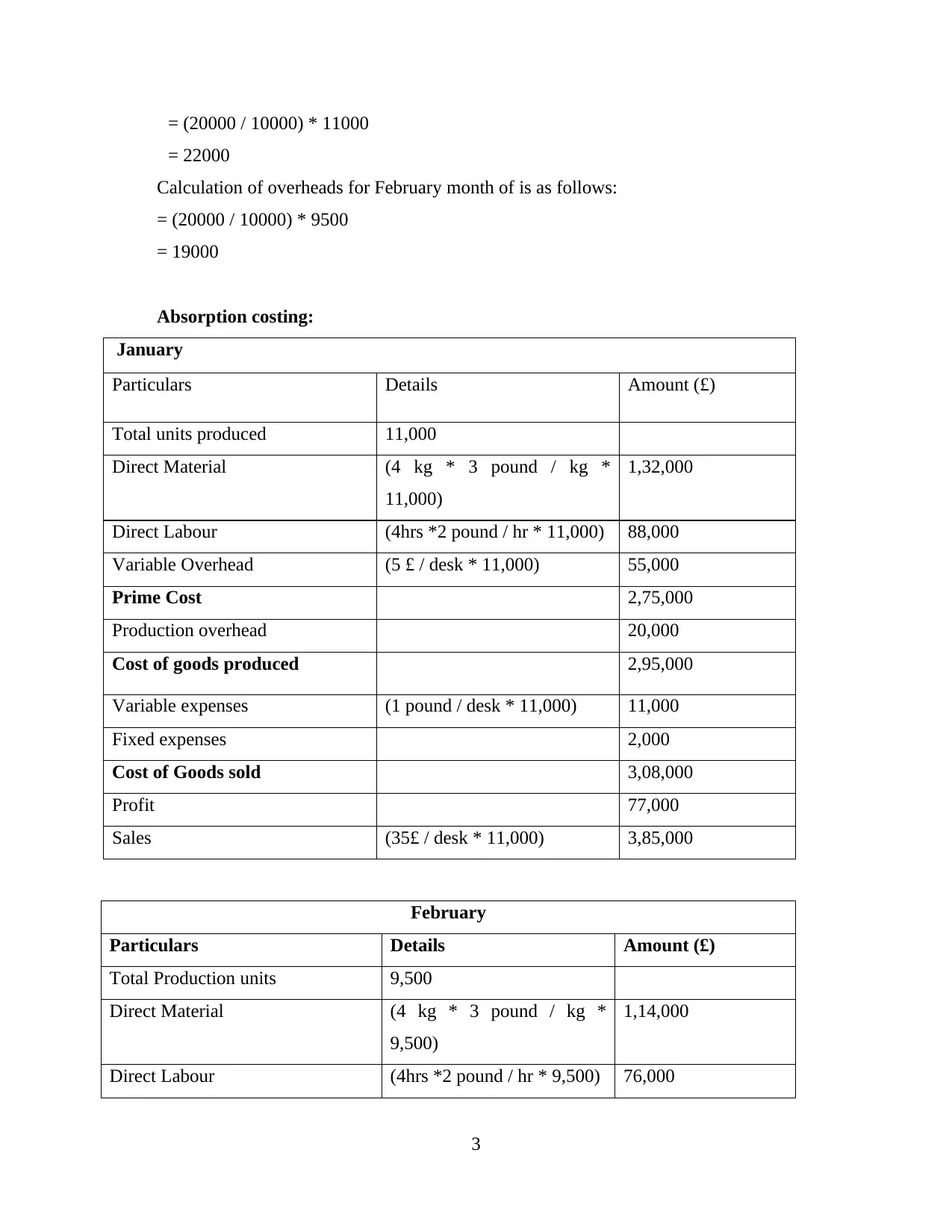

= (20000 / 10000) * 11000

= 22000

Calculation of overheads for February month of is as follows:

= (20000 / 10000) * 9500

= 19000

Absorption costing:

January

Particulars Details Amount (£)

Total units produced 11,000

Direct Material (4 kg * 3 pound / kg *

11,000)

1,32,000

Direct Labour (4hrs *2 pound / hr * 11,000) 88,000

Variable Overhead (5 £ / desk * 11,000) 55,000

Prime Cost 2,75,000

Production overhead 20,000

Cost of goods produced 2,95,000

Variable expenses (1 pound / desk * 11,000) 11,000

Fixed expenses 2,000

Cost of Goods sold 3,08,000

Profit 77,000

Sales (35£ / desk * 11,000) 3,85,000

February

Particulars Details Amount (£)

Total Production units 9,500

Direct Material (4 kg * 3 pound / kg *

9,500)

1,14,000

Direct Labour (4hrs *2 pound / hr * 9,500) 76,000

3

= 22000

Calculation of overheads for February month of is as follows:

= (20000 / 10000) * 9500

= 19000

Absorption costing:

January

Particulars Details Amount (£)

Total units produced 11,000

Direct Material (4 kg * 3 pound / kg *

11,000)

1,32,000

Direct Labour (4hrs *2 pound / hr * 11,000) 88,000

Variable Overhead (5 £ / desk * 11,000) 55,000

Prime Cost 2,75,000

Production overhead 20,000

Cost of goods produced 2,95,000

Variable expenses (1 pound / desk * 11,000) 11,000

Fixed expenses 2,000

Cost of Goods sold 3,08,000

Profit 77,000

Sales (35£ / desk * 11,000) 3,85,000

February

Particulars Details Amount (£)

Total Production units 9,500

Direct Material (4 kg * 3 pound / kg *

9,500)

1,14,000

Direct Labour (4hrs *2 pound / hr * 9,500) 76,000

3

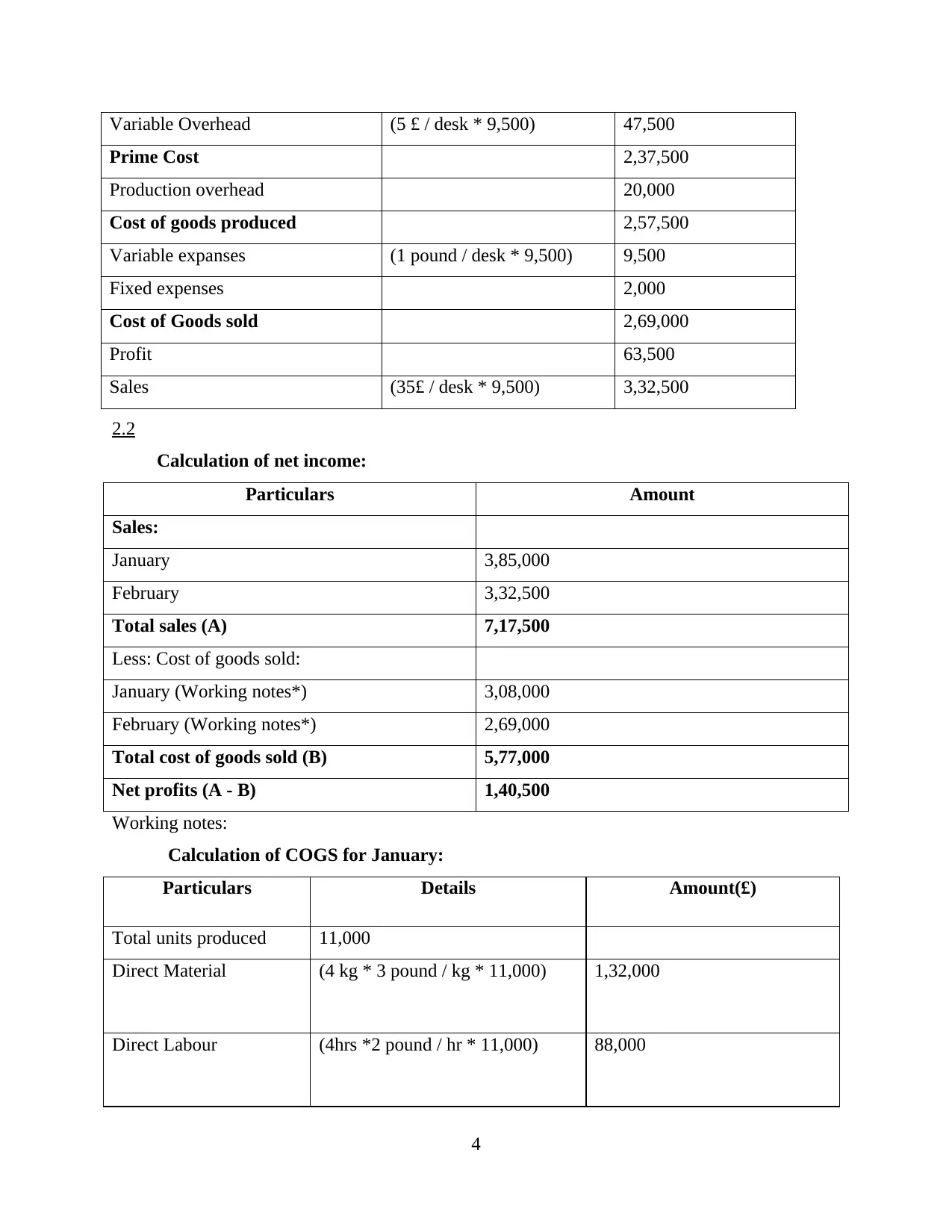

Variable Overhead (5 £ / desk * 9,500) 47,500

Prime Cost 2,37,500

Production overhead 20,000

Cost of goods produced 2,57,500

Variable expanses (1 pound / desk * 9,500) 9,500

Fixed expenses 2,000

Cost of Goods sold 2,69,000

Profit 63,500

Sales (35£ / desk * 9,500) 3,32,500

2.2

Calculation of net income:

Particulars Amount

Sales:

January 3,85,000

February 3,32,500

Total sales (A) 7,17,500

Less: Cost of goods sold:

January (Working notes*) 3,08,000

February (Working notes*) 2,69,000

Total cost of goods sold (B) 5,77,000

Net profits (A - B) 1,40,500

Working notes:

Calculation of COGS for January:

Particulars Details Amount(£)

Total units produced 11,000

Direct Material (4 kg * 3 pound / kg * 11,000) 1,32,000

Direct Labour (4hrs *2 pound / hr * 11,000) 88,000

4

Prime Cost 2,37,500

Production overhead 20,000

Cost of goods produced 2,57,500

Variable expanses (1 pound / desk * 9,500) 9,500

Fixed expenses 2,000

Cost of Goods sold 2,69,000

Profit 63,500

Sales (35£ / desk * 9,500) 3,32,500

2.2

Calculation of net income:

Particulars Amount

Sales:

January 3,85,000

February 3,32,500

Total sales (A) 7,17,500

Less: Cost of goods sold:

January (Working notes*) 3,08,000

February (Working notes*) 2,69,000

Total cost of goods sold (B) 5,77,000

Net profits (A - B) 1,40,500

Working notes:

Calculation of COGS for January:

Particulars Details Amount(£)

Total units produced 11,000

Direct Material (4 kg * 3 pound / kg * 11,000) 1,32,000

Direct Labour (4hrs *2 pound / hr * 11,000) 88,000

4

Variable Overhead (5 pound / desk * 11,000) 55,000

Prime Cost 2,75,000

Production overhead 20,000

Cost of goods produced 2,95,000

Variable expenses (1 pound / desk * 11,000) 11,000

fixed expenses 2,000

Cost of Goods sold 3,08,000

Calculation of COGS for February:

Particulars Particulars Amount(£)

Total produced units 9,500

Direct Material (4 kg * 3 pound / kg * 9,500) 1,14,000

Direct Labour (4hrs *2 pound / hr * 9,500) 76,000

Variable Overhead (5 £ / desk * 9,500) 47,500

Prime Cost 2,37,500

Production overhead 20,000

Cost of goods produced 2,57,500

Variable expenses (1 pound / desk * 9,500) 9,500

Fixed expenses 2,000

Cost of Goods sold 2,69,000

2.3

Month Total hours spent Expenditures

5

Prime Cost 2,75,000

Production overhead 20,000

Cost of goods produced 2,95,000

Variable expenses (1 pound / desk * 11,000) 11,000

fixed expenses 2,000

Cost of Goods sold 3,08,000

Calculation of COGS for February:

Particulars Particulars Amount(£)

Total produced units 9,500

Direct Material (4 kg * 3 pound / kg * 9,500) 1,14,000

Direct Labour (4hrs *2 pound / hr * 9,500) 76,000

Variable Overhead (5 £ / desk * 9,500) 47,500

Prime Cost 2,37,500

Production overhead 20,000

Cost of goods produced 2,57,500

Variable expenses (1 pound / desk * 9,500) 9,500

Fixed expenses 2,000

Cost of Goods sold 2,69,000

2.3

Month Total hours spent Expenditures

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

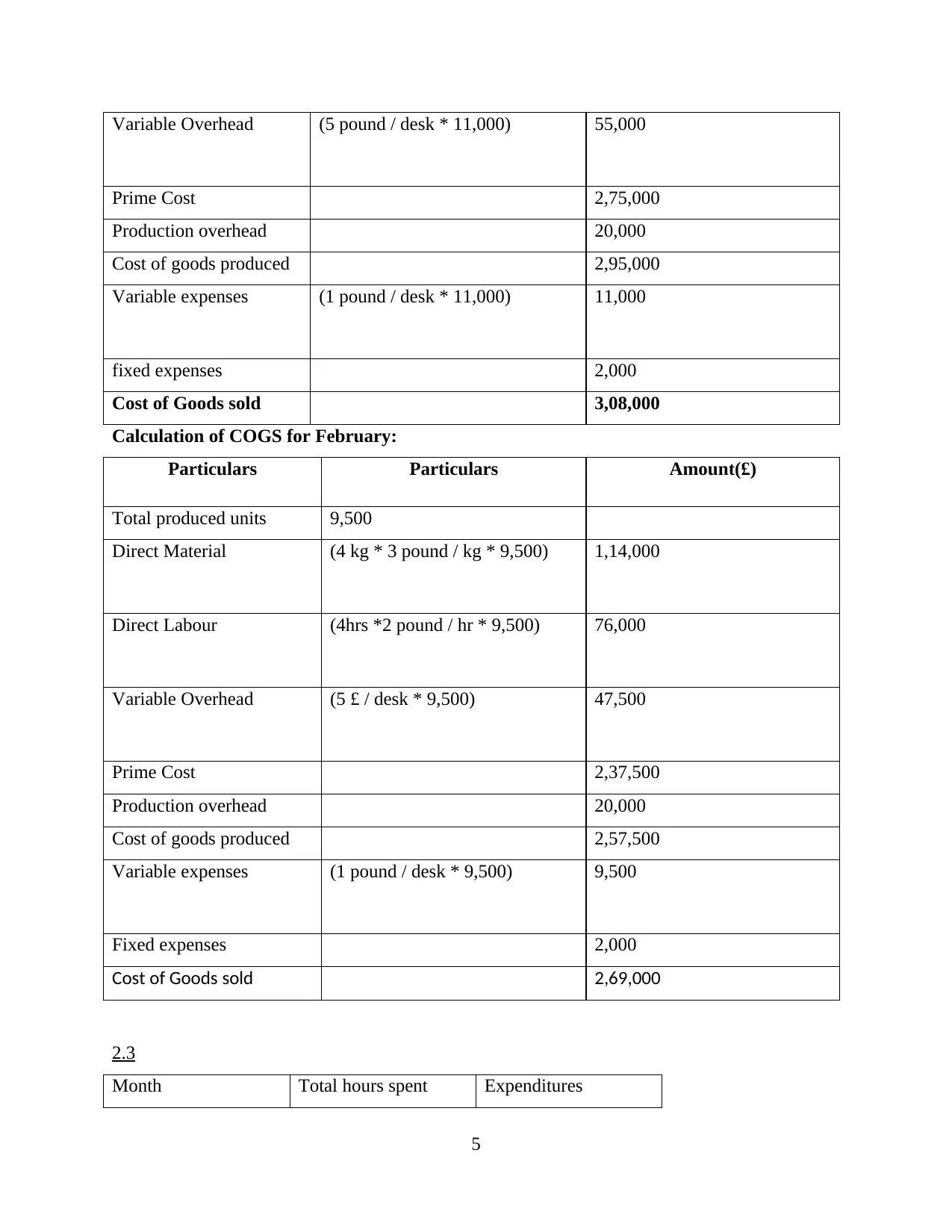

Jan. 630 7960

Feb. 505 7410

Mar. 705 8285

Apr. 555 7535

May 750 9110

Jun. 795 9820

Highest hours (June)

= 795

Lowest hours (Feb) =

505

Variable cost = (9820 – 7410) / (795 – 505)

= 8.31 Per unit

Fixed cost = 9820 – (795 * 8.31)

= 3213.55

(B).

Opening inventory Units Per unit cost Total cost

Purchase during the

year

100 10 1,000

200 11 2,200

130 13.85 1,800

LIFO

Units Per unit cost Total

130 13.85 143.85

200 11 2200

70 10 700

COGS 3043.85

Closing stock (30 * 10) 300

FIFO

Units Per unit cost Total

100 10 1000

200 11 2,200

6

Feb. 505 7410

Mar. 705 8285

Apr. 555 7535

May 750 9110

Jun. 795 9820

Highest hours (June)

= 795

Lowest hours (Feb) =

505

Variable cost = (9820 – 7410) / (795 – 505)

= 8.31 Per unit

Fixed cost = 9820 – (795 * 8.31)

= 3213.55

(B).

Opening inventory Units Per unit cost Total cost

Purchase during the

year

100 10 1,000

200 11 2,200

130 13.85 1,800

LIFO

Units Per unit cost Total

130 13.85 143.85

200 11 2200

70 10 700

COGS 3043.85

Closing stock (30 * 10) 300

FIFO

Units Per unit cost Total

100 10 1000

200 11 2,200

6

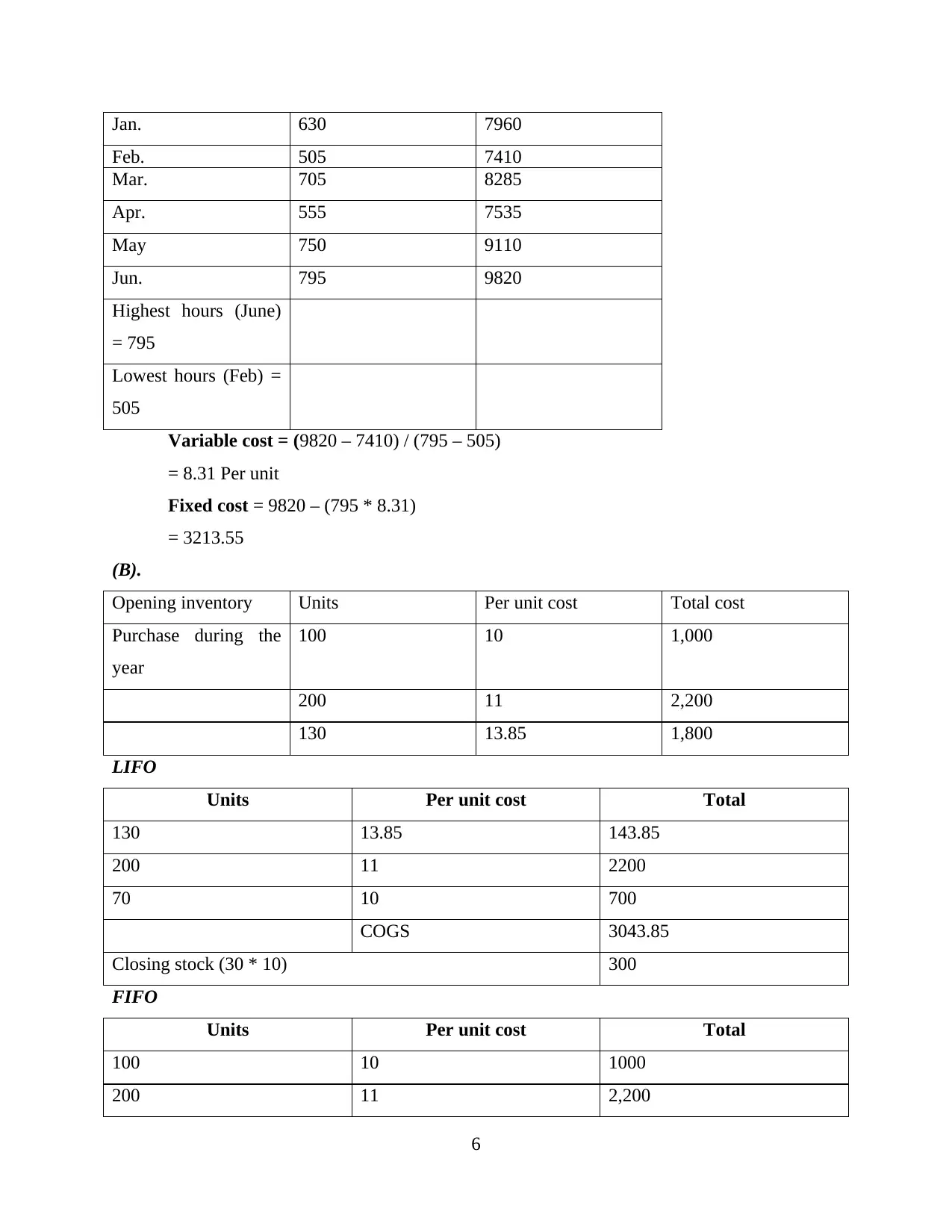

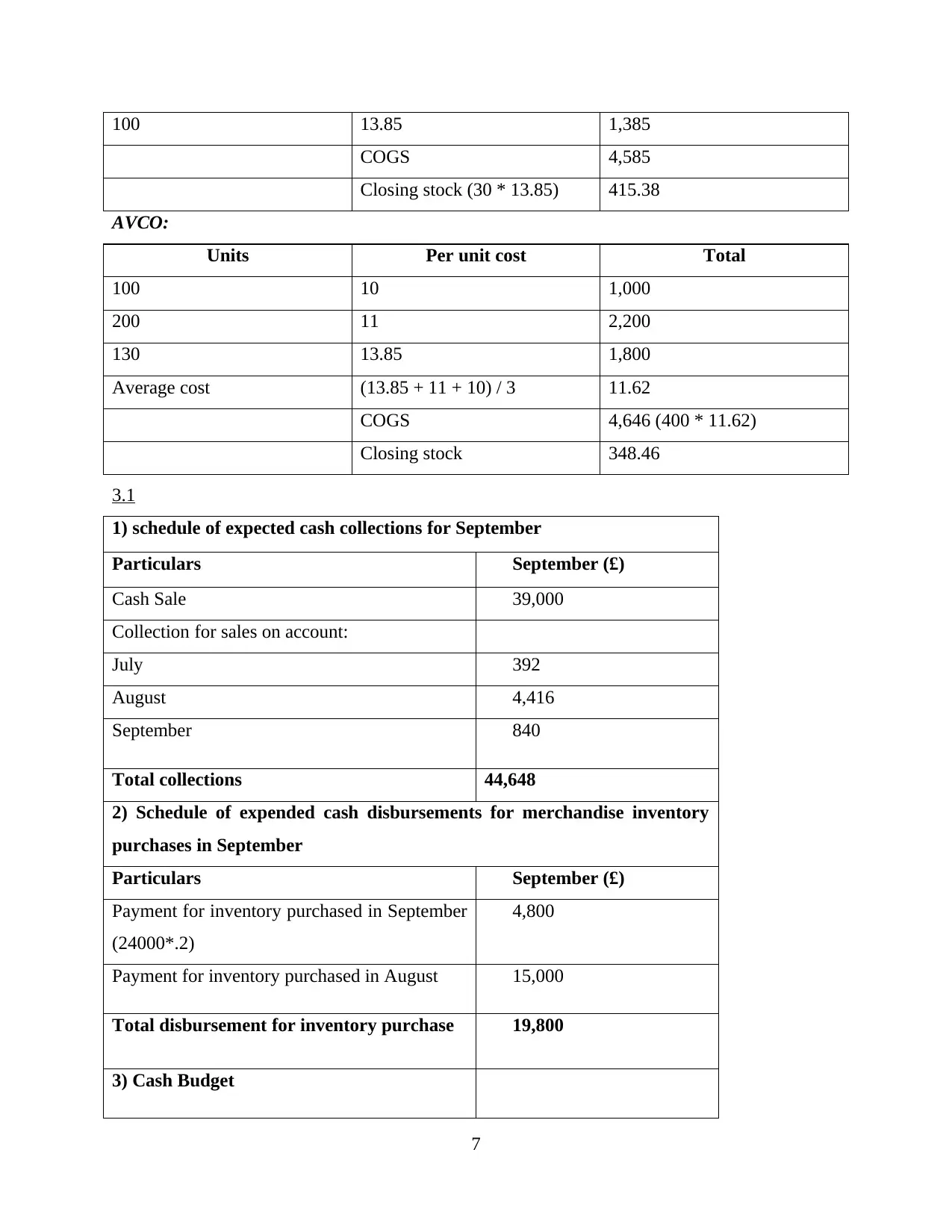

100 13.85 1,385

COGS 4,585

Closing stock (30 * 13.85) 415.38

AVCO:

Units Per unit cost Total

100 10 1,000

200 11 2,200

130 13.85 1,800

Average cost (13.85 + 11 + 10) / 3 11.62

COGS 4,646 (400 * 11.62)

Closing stock 348.46

3.1

1) schedule of expected cash collections for September

Particulars September (£)

Cash Sale 39,000

Collection for sales on account:

July 392

August 4,416

September 840

Total collections 44,648

2) Schedule of expended cash disbursements for merchandise inventory

purchases in September

Particulars September (£)

Payment for inventory purchased in September

(24000*.2)

4,800

Payment for inventory purchased in August 15,000

Total disbursement for inventory purchase 19,800

3) Cash Budget

7

COGS 4,585

Closing stock (30 * 13.85) 415.38

AVCO:

Units Per unit cost Total

100 10 1,000

200 11 2,200

130 13.85 1,800

Average cost (13.85 + 11 + 10) / 3 11.62

COGS 4,646 (400 * 11.62)

Closing stock 348.46

3.1

1) schedule of expected cash collections for September

Particulars September (£)

Cash Sale 39,000

Collection for sales on account:

July 392

August 4,416

September 840

Total collections 44,648

2) Schedule of expended cash disbursements for merchandise inventory

purchases in September

Particulars September (£)

Payment for inventory purchased in September

(24000*.2)

4,800

Payment for inventory purchased in August 15,000

Total disbursement for inventory purchase 19,800

3) Cash Budget

7

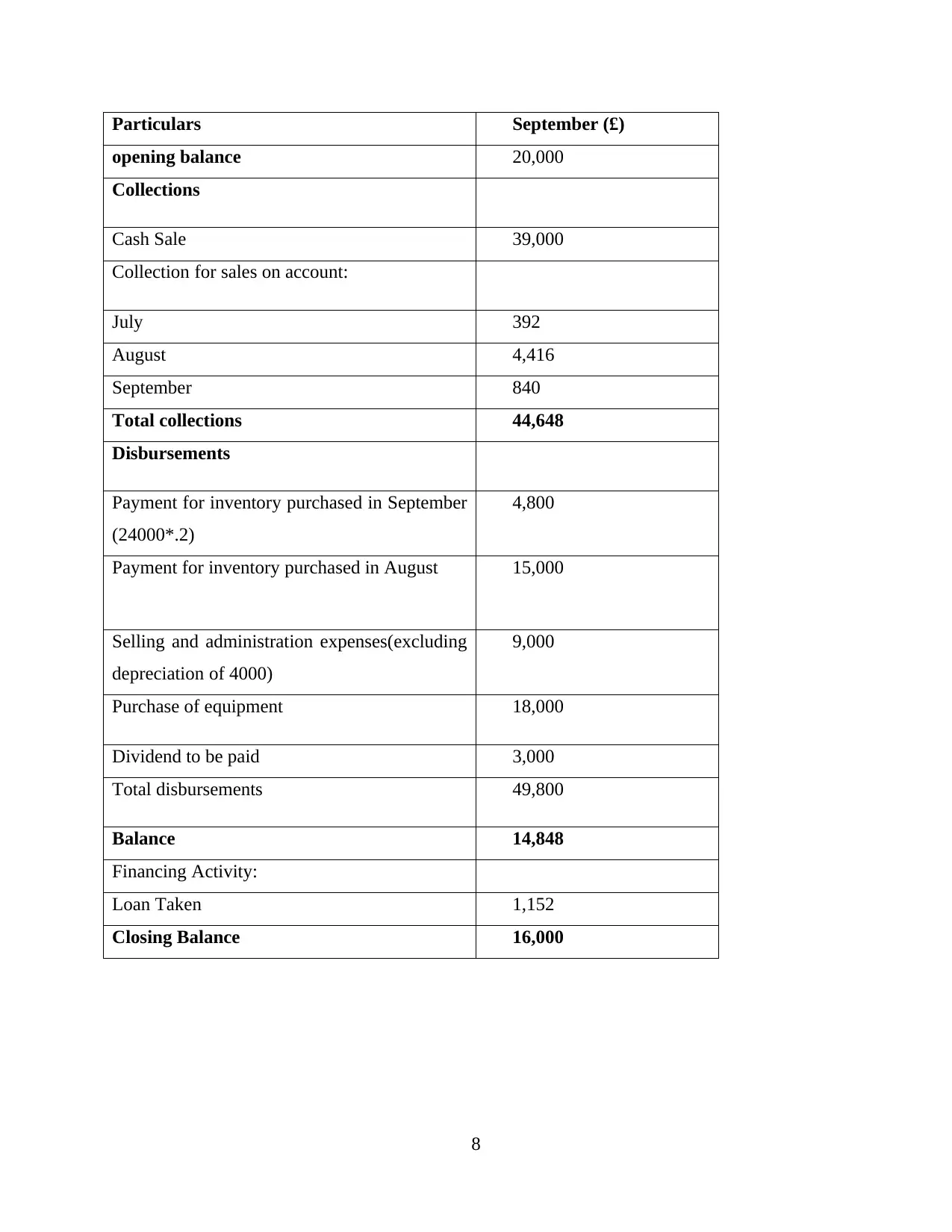

Particulars September (£)

opening balance 20,000

Collections

Cash Sale 39,000

Collection for sales on account:

July 392

August 4,416

September 840

Total collections 44,648

Disbursements

Payment for inventory purchased in September

(24000*.2)

4,800

Payment for inventory purchased in August 15,000

Selling and administration expenses(excluding

depreciation of 4000)

9,000

Purchase of equipment 18,000

Dividend to be paid 3,000

Total disbursements 49,800

Balance 14,848

Financing Activity:

Loan Taken 1,152

Closing Balance 16,000

8

opening balance 20,000

Collections

Cash Sale 39,000

Collection for sales on account:

July 392

August 4,416

September 840

Total collections 44,648

Disbursements

Payment for inventory purchased in September

(24000*.2)

4,800

Payment for inventory purchased in August 15,000

Selling and administration expenses(excluding

depreciation of 4000)

9,000

Purchase of equipment 18,000

Dividend to be paid 3,000

Total disbursements 49,800

Balance 14,848

Financing Activity:

Loan Taken 1,152

Closing Balance 16,000

8

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.