Management Accounting

VerifiedAdded on 2022/12/28

|10

|494

|42

PowerPoint Presentation

AI Summary

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Management

Accounting

System

Accounting

System

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Content

Introduction

Management Accounting

Management Accounting Systems

Management Accounting Reporting

Conclusion

Introduction

Management Accounting

Management Accounting Systems

Management Accounting Reporting

Conclusion

INTRODUCTION

This report will focus on the basics of management accounting.

Management accounting helps the business or any organization to

analyze data from financial information provided by financial

accounting. Management accounting is the procedure of identifying

analyzing, interpreting and communicating the financial information

which helps the business to achieve its goals.

This report will focus on the basics of management accounting.

Management accounting helps the business or any organization to

analyze data from financial information provided by financial

accounting. Management accounting is the procedure of identifying

analyzing, interpreting and communicating the financial information

which helps the business to achieve its goals.

Accounting techniques

Absorption costing- Absorption Costing means a costing system for

paying for all production costs. This approach is used by the

management to bear the costs of a commodity. Specific costs and

indirect costs are all included. Materials, workers working in

manufacturing, are direct expenses. Included are plant leasing,

management expenses, regulatory and Insurance Indirect costs.

Absorption costing- Absorption Costing means a costing system for

paying for all production costs. This approach is used by the

management to bear the costs of a commodity. Specific costs and

indirect costs are all included. Materials, workers working in

manufacturing, are direct expenses. Included are plant leasing,

management expenses, regulatory and Insurance Indirect costs.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Continue

Marginal costing- Marginal costing is a methodology of costs, where

even the marginal costs, i.e. variable costs for units of costs, are paid,

while fixed costs for that time are entirely excluded from the

expenditure.

Marginal costing- Marginal costing is a methodology of costs, where

even the marginal costs, i.e. variable costs for units of costs, are paid,

while fixed costs for that time are entirely excluded from the

expenditure.

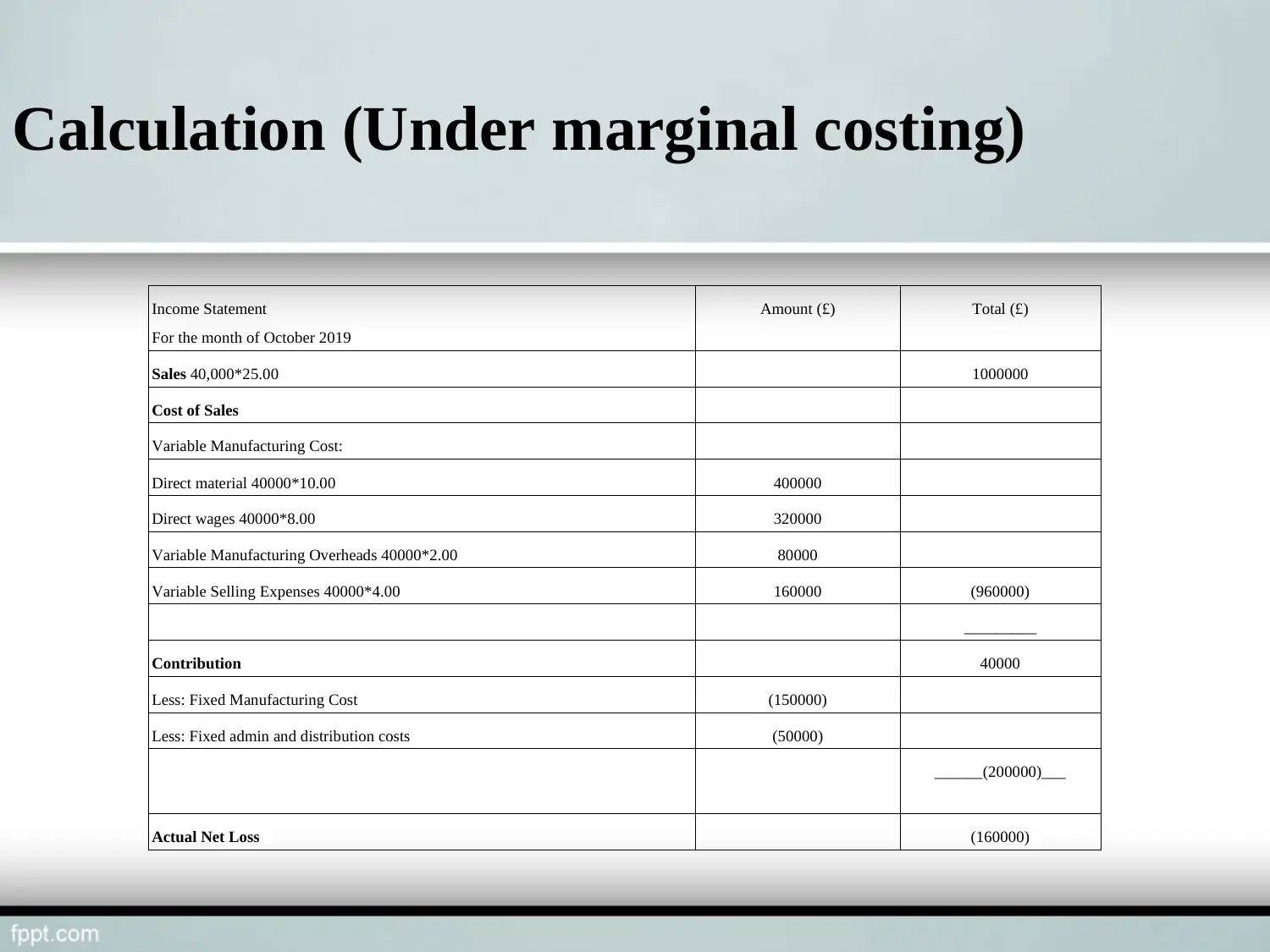

Calculation (Under marginal costing)

Income Statement

For the month of October 2019

Amount (£) Total (£)

Sales 40,000*25.00 1000000

Cost of Sales

Variable Manufacturing Cost:

Direct material 40000*10.00 400000

Direct wages 40000*8.00 320000

Variable Manufacturing Overheads 40000*2.00 80000

Variable Selling Expenses 40000*4.00 160000 (960000)

_________

Contribution 40000

Less: Fixed Manufacturing Cost (150000)

Less: Fixed admin and distribution costs (50000)

______(200000)___

Actual Net Loss (160000)

Income Statement

For the month of October 2019

Amount (£) Total (£)

Sales 40,000*25.00 1000000

Cost of Sales

Variable Manufacturing Cost:

Direct material 40000*10.00 400000

Direct wages 40000*8.00 320000

Variable Manufacturing Overheads 40000*2.00 80000

Variable Selling Expenses 40000*4.00 160000 (960000)

_________

Contribution 40000

Less: Fixed Manufacturing Cost (150000)

Less: Fixed admin and distribution costs (50000)

______(200000)___

Actual Net Loss (160000)

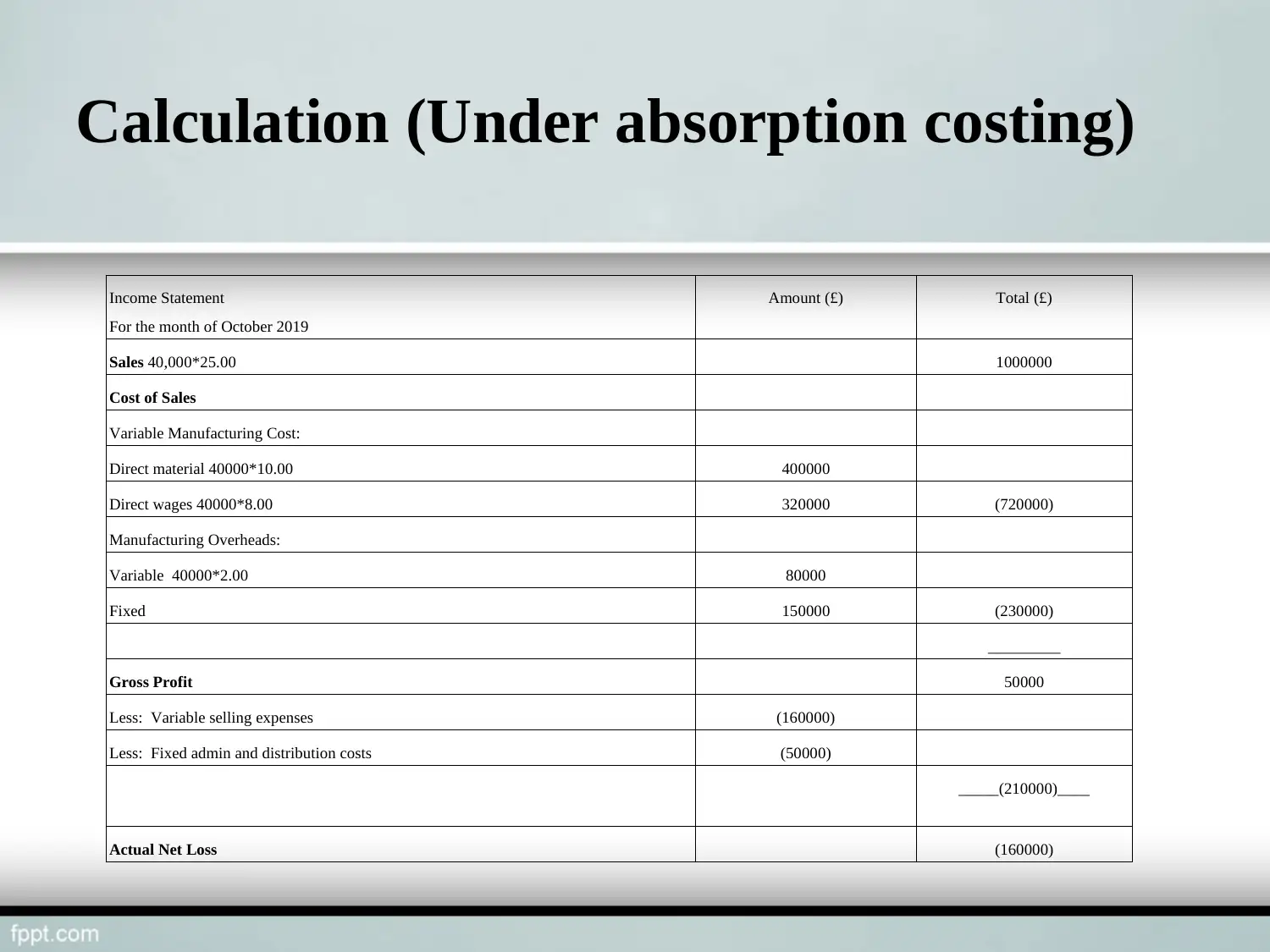

Calculation (Under absorption costing)

Income Statement

For the month of October 2019

Amount (£) Total (£)

Sales 40,000*25.00 1000000

Cost of Sales

Variable Manufacturing Cost:

Direct material 40000*10.00 400000

Direct wages 40000*8.00 320000 (720000)

Manufacturing Overheads:

Variable 40000*2.00 80000

Fixed 150000 (230000)

_________

Gross Profit 50000

Less: Variable selling expenses (160000)

Less: Fixed admin and distribution costs (50000)

_____(210000)____

Actual Net Loss (160000)

Income Statement

For the month of October 2019

Amount (£) Total (£)

Sales 40,000*25.00 1000000

Cost of Sales

Variable Manufacturing Cost:

Direct material 40000*10.00 400000

Direct wages 40000*8.00 320000 (720000)

Manufacturing Overheads:

Variable 40000*2.00 80000

Fixed 150000 (230000)

_________

Gross Profit 50000

Less: Variable selling expenses (160000)

Less: Fixed admin and distribution costs (50000)

_____(210000)____

Actual Net Loss (160000)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Conclusion

In accordance of above project report this can be concluded that

accounting techniques are too crucial for companies in order to

produce income statement. As well as to this, there is different

outcome under absorption and marginal costing due to its approach

to consider cost.

In accordance of above project report this can be concluded that

accounting techniques are too crucial for companies in order to

produce income statement. As well as to this, there is different

outcome under absorption and marginal costing due to its approach

to consider cost.

References

Klychova, G. and et. al, 2019, December. Improvement of the Tool

of Strategic Management Accounting. In Energy Management of

Municipal Transportation Facilities and Transport (pp. 669-686).

Springer, Cham.

Amoako, G. K. and et. al, 2021. Institutional isomorphism,

environmental management accounting and environmental

accountability: a review. Environment, Development and

Sustainability, pp.1-16.

Klychova, G. and et. al, 2019, December. Improvement of the Tool

of Strategic Management Accounting. In Energy Management of

Municipal Transportation Facilities and Transport (pp. 669-686).

Springer, Cham.

Amoako, G. K. and et. al, 2021. Institutional isomorphism,

environmental management accounting and environmental

accountability: a review. Environment, Development and

Sustainability, pp.1-16.

THANK YOU

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.