Management Accounting Report: Imda Tech's Performance Analysis

VerifiedAdded on 2020/01/07

|18

|4823

|176

Report

AI Summary

This report provides a comprehensive overview of management accounting principles and their application within the context of Imda Tech, a company specializing in mobile chargers and electronic gadgets. The report begins by differentiating management accounting from financial accounting, highlighting the significance of management accounting tools like variance analysis and budgeting in managerial decision-making. It delves into various aspects, including cost control, responsibility centers, resource utilization, and inventory control, emphasizing the importance of management accounting information for departmental managers. The report further explores different types of management accounting systems, such as cost accounting, inventory management, and job costing systems, and their benefits. It examines budgeting processes, pricing strategies, and the implementation of the balanced scorecard approach. The report also includes a marginal costing analysis, providing an income statement example, which can be used by Imda Tech. The analysis is aimed to assist Imda Tech in improving its internal growth and performance by using management accounting systems.

Management Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION .....................................................................................................................3

TASK1.......................................................................................................................................3

1 Management accounting and difference between same and finance accounting................3

ii)The importance of management accounting information as decision making tool for

department managers..............................................................................................................4

b) Explanation on Different types of management accounting system..................................5

TASK 3......................................................................................................................................9

a. Different types of budget along with their benefits and drawbacks ..................................9

b. Stating the process of preparing budget ..........................................................................10

c. Pricing strategies .............................................................................................................11

TASK 4....................................................................................................................................12

4.1 Define balance score card approach and implementation of same ...............................12

CONCLUSION........................................................................................................................13

REFERENCES.........................................................................................................................16

INTRODUCTION .....................................................................................................................3

TASK1.......................................................................................................................................3

1 Management accounting and difference between same and finance accounting................3

ii)The importance of management accounting information as decision making tool for

department managers..............................................................................................................4

b) Explanation on Different types of management accounting system..................................5

TASK 3......................................................................................................................................9

a. Different types of budget along with their benefits and drawbacks ..................................9

b. Stating the process of preparing budget ..........................................................................10

c. Pricing strategies .............................................................................................................11

TASK 4....................................................................................................................................12

4.1 Define balance score card approach and implementation of same ...............................12

CONCLUSION........................................................................................................................13

REFERENCES.........................................................................................................................16

INTRODUCTION

In the present landscape, business unit focuses on employing management accounting

system for making improvement in the internal growth and performance. Marginal,

absorption and standard costing, budgeting, variance analysis is the most effectual tools that

assist manager in strategic planning. It enables manager to make continuous monitoring of

business performance and provides indication to firm take suitable action within the specified

time frame. In this way, system of management accounting helps firm in achieving the goals

and objectives to the significant level. The present report is based on the case situation of

Imda Tech. Such business unit offers mobile charger and other electronic gazettes to the

customers at suitable prices. The main objective of such assignment is to highlight the

importance of tools and technique that management accounting system contains. Further,

report will develop understanding about the extent to which balance scorecard is aligned with

the organizational goals and objectives.

TASK1

1 Management accounting and difference between same and finance accounting

Management accounting is the domain which is used to record expenses that are

incurred in the business. There are number of tool s of the management accounting like

variance analysis and budget etc. There is a great significance of the management accounting

for the business firms because by using same cost related decisions are taken by the

managers. There is a huge difference between management and finance accounting. The

domain in respect to which both are used is different. Management accounting is used to

make cost related decisions or it can be said that it is used for costing of product (Zimmerman

and Yahya-Zadeh, 2011). On other hand, finance accounting is used to record the expenses

that are related to business operations that are not related to the production operations.

Management accounting is used to keep track record of the production related expenses that

are increasing of decreasing over a period of time. On other hand, financial accounting is

used to keep track record of indirect expenses like sales and distribution expenses. It must be

noted that in management accounting data that is generated through financial accounting is

not taken in to account. Contrary to this, in the financial accounting production related

expenses are taken in to account. This reflects that there is a huge importance of the

In the present landscape, business unit focuses on employing management accounting

system for making improvement in the internal growth and performance. Marginal,

absorption and standard costing, budgeting, variance analysis is the most effectual tools that

assist manager in strategic planning. It enables manager to make continuous monitoring of

business performance and provides indication to firm take suitable action within the specified

time frame. In this way, system of management accounting helps firm in achieving the goals

and objectives to the significant level. The present report is based on the case situation of

Imda Tech. Such business unit offers mobile charger and other electronic gazettes to the

customers at suitable prices. The main objective of such assignment is to highlight the

importance of tools and technique that management accounting system contains. Further,

report will develop understanding about the extent to which balance scorecard is aligned with

the organizational goals and objectives.

TASK1

1 Management accounting and difference between same and finance accounting

Management accounting is the domain which is used to record expenses that are

incurred in the business. There are number of tool s of the management accounting like

variance analysis and budget etc. There is a great significance of the management accounting

for the business firms because by using same cost related decisions are taken by the

managers. There is a huge difference between management and finance accounting. The

domain in respect to which both are used is different. Management accounting is used to

make cost related decisions or it can be said that it is used for costing of product (Zimmerman

and Yahya-Zadeh, 2011). On other hand, finance accounting is used to record the expenses

that are related to business operations that are not related to the production operations.

Management accounting is used to keep track record of the production related expenses that

are increasing of decreasing over a period of time. On other hand, financial accounting is

used to keep track record of indirect expenses like sales and distribution expenses. It must be

noted that in management accounting data that is generated through financial accounting is

not taken in to account. Contrary to this, in the financial accounting production related

expenses are taken in to account. This reflects that there is a huge importance of the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

management accounting for the managers. In terms of use also management and financial

accounting are different from each other. Management accounting is used to measure firm

performance in respect to effective use of resources in the business (Macintosh and

Quattrone, 2010). Contrary to this, in case of financial accounting performance of business

firm in terms of profitability is measured. Thus, in different manner performance of the firm

is measured in financial and management accounting.

ii)The importance of management accounting information as decision making tool for

department managers Cost control: Cost control is the one of the most important function of the

management accounting. Production department main aim is to control cost of the

manufacturing. It is the management accounting that helps managers in identifying

the areas where extravagance is made in the business. The information that is

provided by the management accounting has a significant importance for the

managers of the business firm. This is because on basis of same decisions are taken by

the managers. It can be said that there is a significant importance of management

accounting for the managers. Responsibility center: Responsibility center refers to the concept under which

managers are made accountable for the results that are coming in existence due to

performance of task from their side. Under responsibility center varied information

are created and on that basis performance of the managers is measured by the top

authority. It can be said that there is huge importance of the responsibility center for

the managers. Use of resources: There is a great importance of management accounting for the

production and HR department (Baldvinsdottir, Mitchell and Nørreklit, 2010). This is

because management accounting helps them in identifying the extent to which human

resources are used effectively in the workplace. Moreover, by using management

accounting productivity of employees is also measured that works in different

departments. Hence, it can be said that there is huge importance of management

accounting for the managers because on the basis of same varied decisions are made

by them in respect to use of employees in the business.

Inventory control: Inventory control refers to the process under which level of

inventory is tracked consistently by the managers. They identify the level up to which

accounting are different from each other. Management accounting is used to measure firm

performance in respect to effective use of resources in the business (Macintosh and

Quattrone, 2010). Contrary to this, in case of financial accounting performance of business

firm in terms of profitability is measured. Thus, in different manner performance of the firm

is measured in financial and management accounting.

ii)The importance of management accounting information as decision making tool for

department managers Cost control: Cost control is the one of the most important function of the

management accounting. Production department main aim is to control cost of the

manufacturing. It is the management accounting that helps managers in identifying

the areas where extravagance is made in the business. The information that is

provided by the management accounting has a significant importance for the

managers of the business firm. This is because on basis of same decisions are taken by

the managers. It can be said that there is a significant importance of management

accounting for the managers. Responsibility center: Responsibility center refers to the concept under which

managers are made accountable for the results that are coming in existence due to

performance of task from their side. Under responsibility center varied information

are created and on that basis performance of the managers is measured by the top

authority. It can be said that there is huge importance of the responsibility center for

the managers. Use of resources: There is a great importance of management accounting for the

production and HR department (Baldvinsdottir, Mitchell and Nørreklit, 2010). This is

because management accounting helps them in identifying the extent to which human

resources are used effectively in the workplace. Moreover, by using management

accounting productivity of employees is also measured that works in different

departments. Hence, it can be said that there is huge importance of management

accounting for the managers because on the basis of same varied decisions are made

by them in respect to use of employees in the business.

Inventory control: Inventory control refers to the process under which level of

inventory is tracked consistently by the managers. They identify the level up to which

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

order for purchase of raw material must be placed. Moreover, the extent to which

inventory is excessively stored in the warehouse is also identified on the basis of

management accounting information. On the basis of available information inventory

related decisions are taken by the managers in their business (Ward, 2012). On time

order is placed and it is ensured that inventory cost will remain in control on the

business. Thus, it can be said that there is significant importance of the management

accounting information for the managers.

b) Explanation on Different types of management accounting system

i) Cost accounting system- It is that type of cost accounting system that are used by

the company for the purpose of estimating cost of products to effectively

understanding of profitability analysis, control cost and inventory valuation. The cost

accounting system are those through which company can able to ascertained the

actual cost of goods which is more critical for business profits. It makes sure to the

company that which product gives them profits or not. It is only possible if the

organization ascertain actual or correct cost of the goods that are only when if they

adopt costing accounting (Klychova, Faskhutdinova and Sadrieva, 2014 ). Imda Tech

Limited adopts the cost accounting system by departments for the purpose of

enhancement of their reports. It prepared in various formats and the basic information

is summarized in different ways that helps in decision making. It will improve the

management reports that involve actual costing in that it record the actual material

cost, labor. The main benefits from actual system in which it only takes the original

cost that is incurred as it does not take any budgeted or standard amount. It is the

simplest method in that there is no need any preplanning of standard costing and it

takes actual cost that must be allocated and compiled. Thus, on the other side there is

a normal costing in which the component of material and labor are to be taken as an

actual cost. The accuracy of cost can be defines when there is a difference in standard

costing and actual cost. Thus, there is an another costing that is standard is the

establishment of estimated standard cost for some activities within the organization.

ii)Inventory management system- Advancement in the technology due to which

there is an establishment of inventory management system that are adopted by most

the company. It is used for the purpose of manage all the financial and non-financial

information for the purpose of enhancing the management accounting reports. The

main feature of this system is that it track or keep all the record regard to company’s

inventory is excessively stored in the warehouse is also identified on the basis of

management accounting information. On the basis of available information inventory

related decisions are taken by the managers in their business (Ward, 2012). On time

order is placed and it is ensured that inventory cost will remain in control on the

business. Thus, it can be said that there is significant importance of the management

accounting information for the managers.

b) Explanation on Different types of management accounting system

i) Cost accounting system- It is that type of cost accounting system that are used by

the company for the purpose of estimating cost of products to effectively

understanding of profitability analysis, control cost and inventory valuation. The cost

accounting system are those through which company can able to ascertained the

actual cost of goods which is more critical for business profits. It makes sure to the

company that which product gives them profits or not. It is only possible if the

organization ascertain actual or correct cost of the goods that are only when if they

adopt costing accounting (Klychova, Faskhutdinova and Sadrieva, 2014 ). Imda Tech

Limited adopts the cost accounting system by departments for the purpose of

enhancement of their reports. It prepared in various formats and the basic information

is summarized in different ways that helps in decision making. It will improve the

management reports that involve actual costing in that it record the actual material

cost, labor. The main benefits from actual system in which it only takes the original

cost that is incurred as it does not take any budgeted or standard amount. It is the

simplest method in that there is no need any preplanning of standard costing and it

takes actual cost that must be allocated and compiled. Thus, on the other side there is

a normal costing in which the component of material and labor are to be taken as an

actual cost. The accuracy of cost can be defines when there is a difference in standard

costing and actual cost. Thus, there is an another costing that is standard is the

establishment of estimated standard cost for some activities within the organization.

ii)Inventory management system- Advancement in the technology due to which

there is an establishment of inventory management system that are adopted by most

the company. It is used for the purpose of manage all the financial and non-financial

information for the purpose of enhancing the management accounting reports. The

main feature of this system is that it track or keep all the record regard to company’s

day to day operations. Thus, it is used as a computer based system through which firm

track the stock levels, sales, orders and deliveries. It is also used by the manufacturing

company in which they develop a bills of material, production-related documents and

sales. Most of the firms used this accounting system software for the purpose of

ignoring the outdated stock level and goods overstock (Taipaleenmäki, 2014). It is

that tool for the purpose of managing the stock data which are earlier stored in into the

hard copy or in excel spread sheets. Therefore, it is highly made up of various

elements that all the people are work together develops a stock that are cohesive for

most companies system. The Imda Company adopts the stock management system for

the purpose of keep all the record regard to their day to day operations. Thus, it is

used as a computer based system through which firm track the stock levels, sales,

orders and deliveries. It is also used by the manufacturing company in which they

developed a bill of material, production-related documents and sales. Therefore

inventory accounting system software for the purpose of ignoring the outdated stock

level and goods overstock. In the modern time period all the stocks are to be prepared

through system application that are highly design to maintaining complex plans

regard to inventory plans. The cited company adopt the ERP system that are across

the all offices, departments, location, factories that help them in controlling the stock

levels, cost, wastage of resources and save time.

iv) Job costing system- It is a that procedure in which the accumulating data regard

to cost are take which are associated with the service job. Thus, this information are

needed for the purpose of enter the information regard to cost to a client under which

the cost are reimbursed. These data is mainly used for the purpose of measuring the

company’s accuracy. It is also used by most of the organization for the purpose of

assigning the stock cost that are of manufactured products (Lowe and De Loo, 2014).

Imda limited used the job costing system in which they are capable of tracking the

material cost that are mainly used while during the job course. The Company can

tracking the cost of by the manual tracking of that particular material are on the

costing sheets. The data can be charging through the online terminals in the

storehouse and production department. Furthermore, the job costing system that are

used to tracking the cost regard to labor which are used on the job. Thus, if job is

related to the direct labor and services that are highly related to job cost. The cost of

labor is assign to the timesheet, punch lock, network time lock application on the

track the stock levels, sales, orders and deliveries. It is also used by the manufacturing

company in which they develop a bills of material, production-related documents and

sales. Most of the firms used this accounting system software for the purpose of

ignoring the outdated stock level and goods overstock (Taipaleenmäki, 2014). It is

that tool for the purpose of managing the stock data which are earlier stored in into the

hard copy or in excel spread sheets. Therefore, it is highly made up of various

elements that all the people are work together develops a stock that are cohesive for

most companies system. The Imda Company adopts the stock management system for

the purpose of keep all the record regard to their day to day operations. Thus, it is

used as a computer based system through which firm track the stock levels, sales,

orders and deliveries. It is also used by the manufacturing company in which they

developed a bill of material, production-related documents and sales. Therefore

inventory accounting system software for the purpose of ignoring the outdated stock

level and goods overstock. In the modern time period all the stocks are to be prepared

through system application that are highly design to maintaining complex plans

regard to inventory plans. The cited company adopt the ERP system that are across

the all offices, departments, location, factories that help them in controlling the stock

levels, cost, wastage of resources and save time.

iv) Job costing system- It is a that procedure in which the accumulating data regard

to cost are take which are associated with the service job. Thus, this information are

needed for the purpose of enter the information regard to cost to a client under which

the cost are reimbursed. These data is mainly used for the purpose of measuring the

company’s accuracy. It is also used by most of the organization for the purpose of

assigning the stock cost that are of manufactured products (Lowe and De Loo, 2014).

Imda limited used the job costing system in which they are capable of tracking the

material cost that are mainly used while during the job course. The Company can

tracking the cost of by the manual tracking of that particular material are on the

costing sheets. The data can be charging through the online terminals in the

storehouse and production department. Furthermore, the job costing system that are

used to tracking the cost regard to labor which are used on the job. Thus, if job is

related to the direct labor and services that are highly related to job cost. The cost of

labor is assign to the timesheet, punch lock, network time lock application on the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

computer system. Thus, the data can be store in the mobile phones or over the

internet. Furthermore, the Company assign the overhead cost that are at the

accounting period and the cost amount can be assigned to the different jobs that are

highly based upon the allocation methodology.

TASK 2

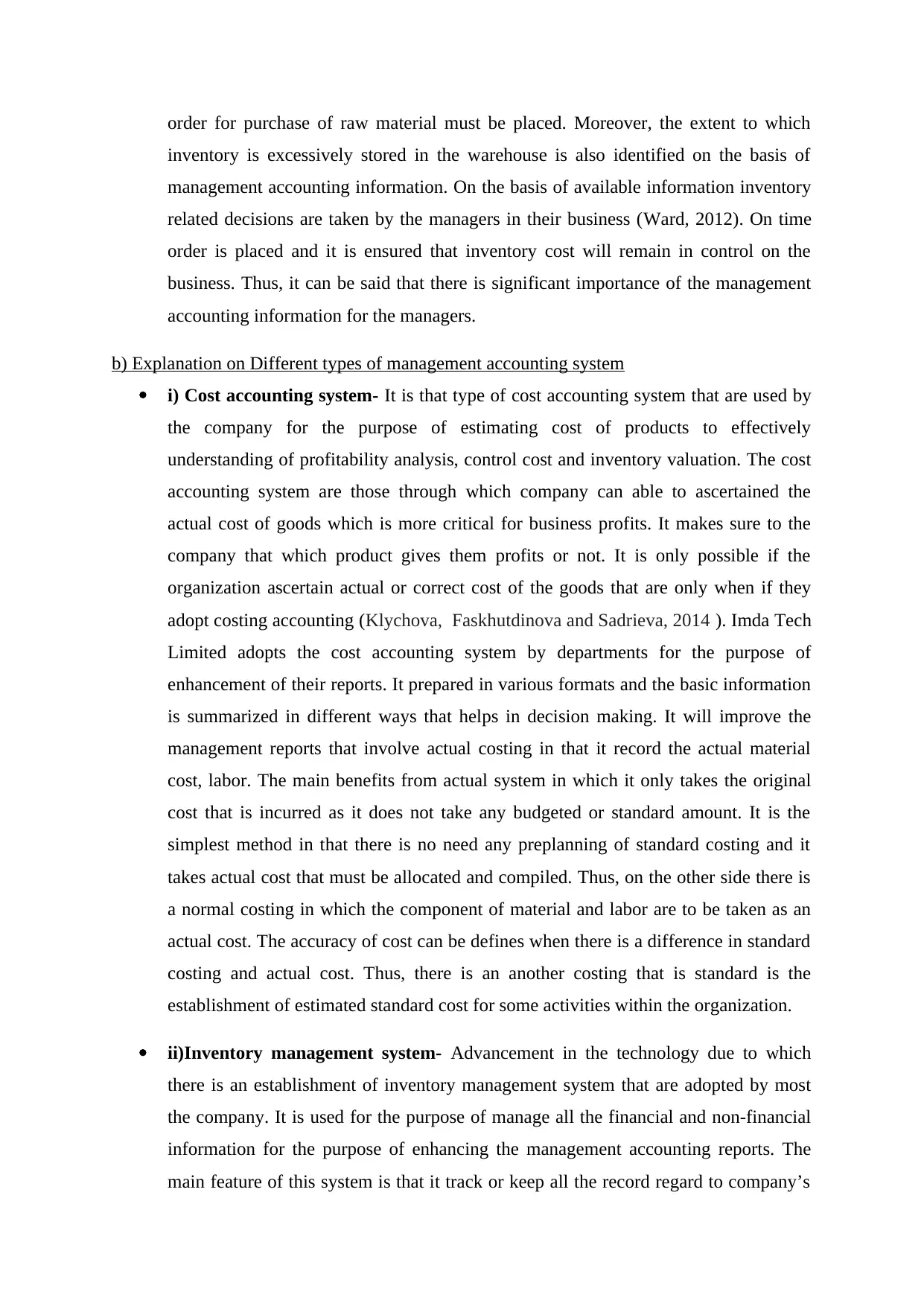

I) Marginal costing method- It is that type of costing which shows that there is an

increase or decrease in the opportunity cost if there is an additional unit produces

within the company. The calculation purposes to determine the unit cost and

prepared the income statement by the management account. It does not consider

the all types of cost that are only variable cost are the variable overheads expenses

and variable selling, distribution and administration expenses. Therefore, at the

time of determining cost of goods sold it only consider direct material, labor,

variable production and overhead expenses. Thus , the cost of goods sold is

deducting from the sales revenues and after that variable total expensed are also

less to estimate the net profit.

Income statement for the 1 September 2010

Particulars

Amount

(£)

Amount(

£)

Sales value 52500

Less: Cost of Goods sold

Opening stock

Variable cost of production

(15*2000)=30000

Closing stock(500*15)=7500

(52500-30000) 22500

Gross profit 15000

Less: Variable expenses

Variable production overhead

internet. Furthermore, the Company assign the overhead cost that are at the

accounting period and the cost amount can be assigned to the different jobs that are

highly based upon the allocation methodology.

TASK 2

I) Marginal costing method- It is that type of costing which shows that there is an

increase or decrease in the opportunity cost if there is an additional unit produces

within the company. The calculation purposes to determine the unit cost and

prepared the income statement by the management account. It does not consider

the all types of cost that are only variable cost are the variable overheads expenses

and variable selling, distribution and administration expenses. Therefore, at the

time of determining cost of goods sold it only consider direct material, labor,

variable production and overhead expenses. Thus , the cost of goods sold is

deducting from the sales revenues and after that variable total expensed are also

less to estimate the net profit.

Income statement for the 1 September 2010

Particulars

Amount

(£)

Amount(

£)

Sales value 52500

Less: Cost of Goods sold

Opening stock

Variable cost of production

(15*2000)=30000

Closing stock(500*15)=7500

(52500-30000) 22500

Gross profit 15000

Less: Variable expenses

Variable production overhead

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Variable administration

expenses(52500*15%)

Total variable expenses 7875

Contribution

(52500-

22500-

7875) 22125

Less: Fixed cost 15000

Less:Non production cost 10000

Profit/ loss

(22125-

15000-

10000) -2875

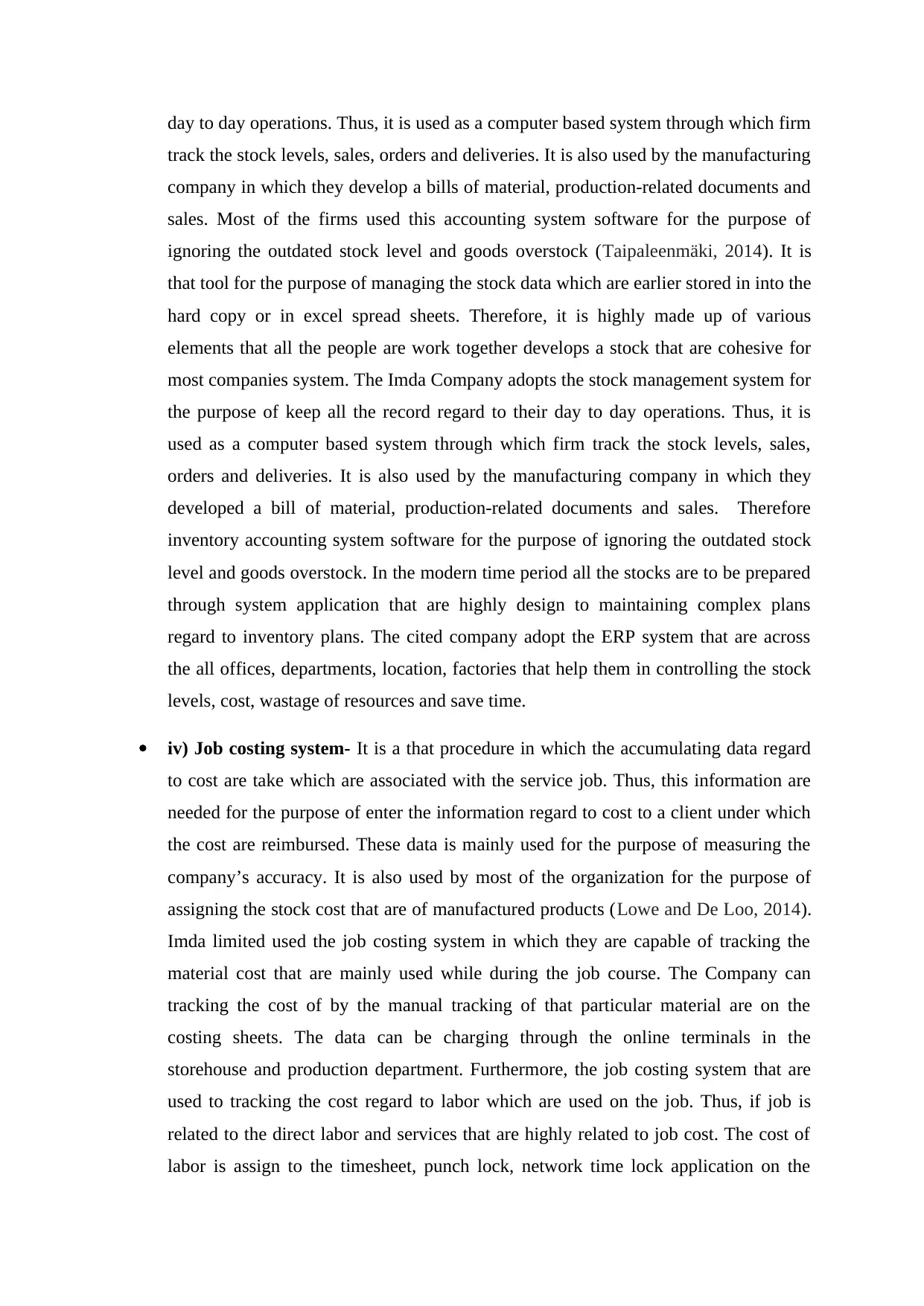

Reconciliation

Reconciliation

Absorption profit -375

Less fixed overhead on stock (500-0*5) -2500

Marginal profit -2875

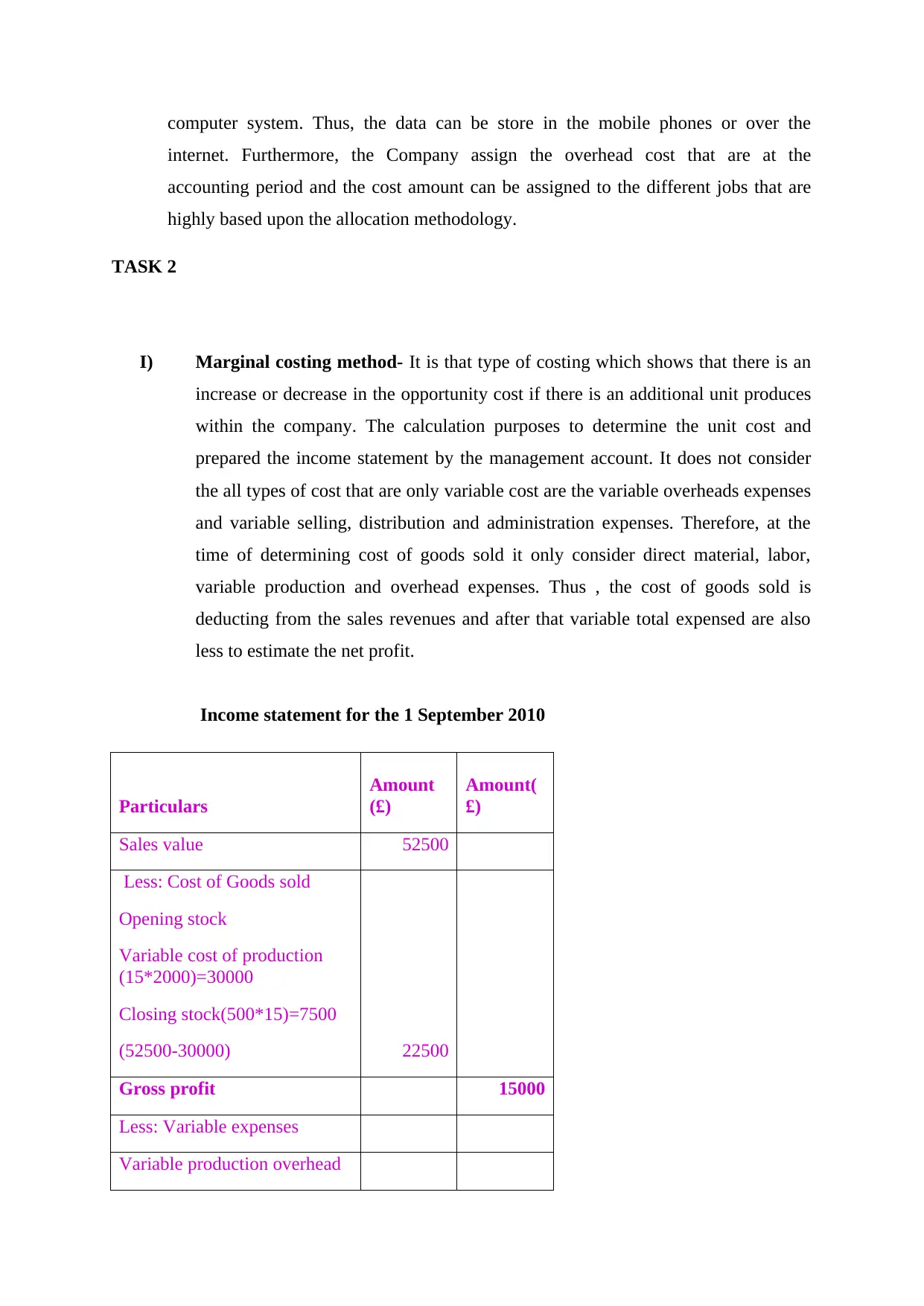

I) Absorption costing method

The Absorption costing method in which it can be define as a full costing in that it takes all

type of expenses that are fixed and variable. Thus, at the time of calculating cost of goods

sold it takes direct material, labor, variable production, selling expenses and also take fixed

selling, administration expenses. Therefore, at the time of calculating they net profit in which

cost of goods sold, variable and fixed expenses are to be deducting from the sales revenue.

Income statement for the 1 September 2010

Particulars

Amount

(£)

Amount(

£)

Sales value 52500

Less: Cost of Goods sold 30000

expenses(52500*15%)

Total variable expenses 7875

Contribution

(52500-

22500-

7875) 22125

Less: Fixed cost 15000

Less:Non production cost 10000

Profit/ loss

(22125-

15000-

10000) -2875

Reconciliation

Reconciliation

Absorption profit -375

Less fixed overhead on stock (500-0*5) -2500

Marginal profit -2875

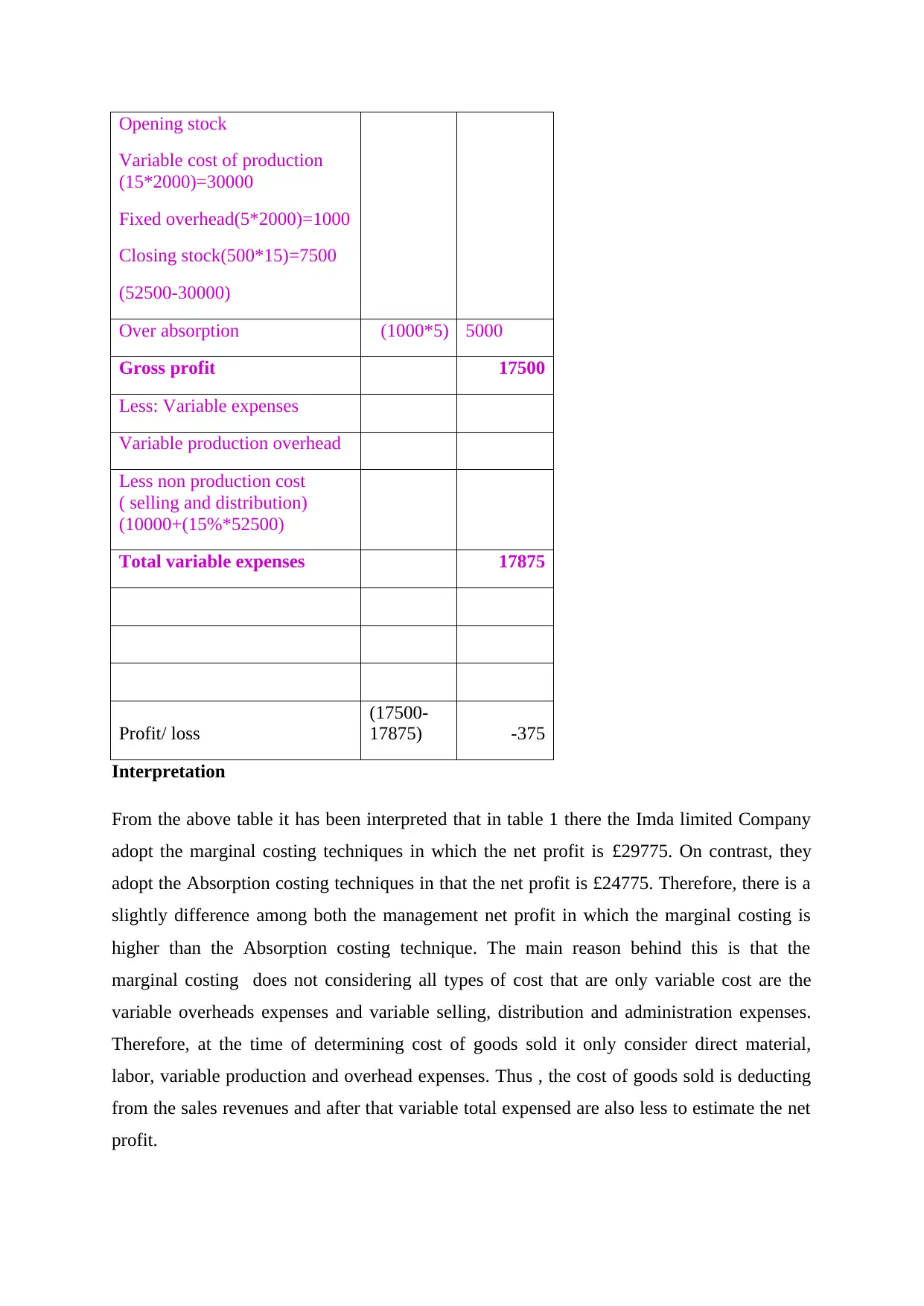

I) Absorption costing method

The Absorption costing method in which it can be define as a full costing in that it takes all

type of expenses that are fixed and variable. Thus, at the time of calculating cost of goods

sold it takes direct material, labor, variable production, selling expenses and also take fixed

selling, administration expenses. Therefore, at the time of calculating they net profit in which

cost of goods sold, variable and fixed expenses are to be deducting from the sales revenue.

Income statement for the 1 September 2010

Particulars

Amount

(£)

Amount(

£)

Sales value 52500

Less: Cost of Goods sold 30000

Opening stock

Variable cost of production

(15*2000)=30000

Fixed overhead(5*2000)=1000

Closing stock(500*15)=7500

(52500-30000)

Over absorption (1000*5) 5000

Gross profit 17500

Less: Variable expenses

Variable production overhead

Less non production cost

( selling and distribution)

(10000+(15%*52500)

Total variable expenses 17875

Profit/ loss

(17500-

17875) -375

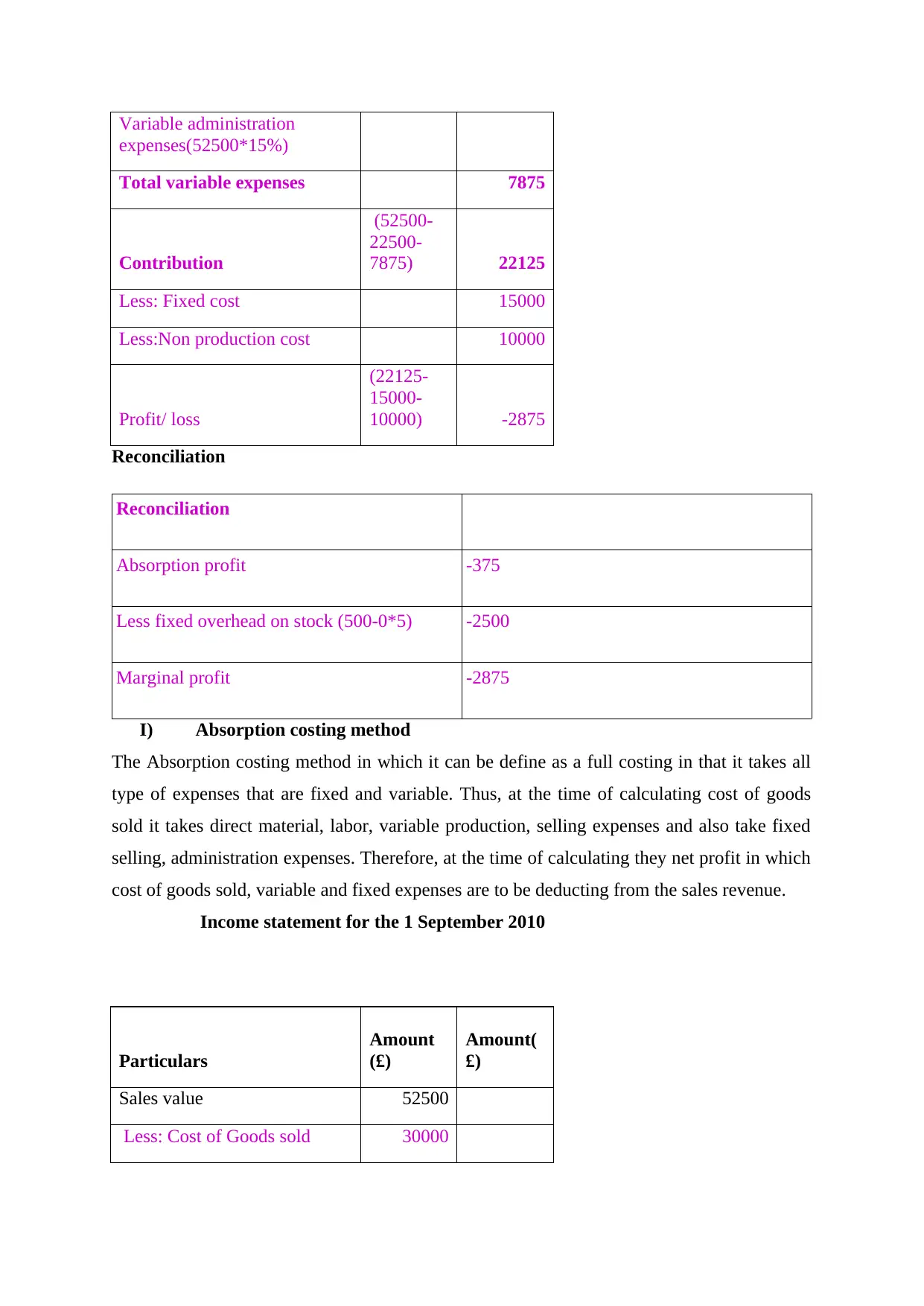

Interpretation

From the above table it has been interpreted that in table 1 there the Imda limited Company

adopt the marginal costing techniques in which the net profit is £29775. On contrast, they

adopt the Absorption costing techniques in that the net profit is £24775. Therefore, there is a

slightly difference among both the management net profit in which the marginal costing is

higher than the Absorption costing technique. The main reason behind this is that the

marginal costing does not considering all types of cost that are only variable cost are the

variable overheads expenses and variable selling, distribution and administration expenses.

Therefore, at the time of determining cost of goods sold it only consider direct material,

labor, variable production and overhead expenses. Thus , the cost of goods sold is deducting

from the sales revenues and after that variable total expensed are also less to estimate the net

profit.

Variable cost of production

(15*2000)=30000

Fixed overhead(5*2000)=1000

Closing stock(500*15)=7500

(52500-30000)

Over absorption (1000*5) 5000

Gross profit 17500

Less: Variable expenses

Variable production overhead

Less non production cost

( selling and distribution)

(10000+(15%*52500)

Total variable expenses 17875

Profit/ loss

(17500-

17875) -375

Interpretation

From the above table it has been interpreted that in table 1 there the Imda limited Company

adopt the marginal costing techniques in which the net profit is £29775. On contrast, they

adopt the Absorption costing techniques in that the net profit is £24775. Therefore, there is a

slightly difference among both the management net profit in which the marginal costing is

higher than the Absorption costing technique. The main reason behind this is that the

marginal costing does not considering all types of cost that are only variable cost are the

variable overheads expenses and variable selling, distribution and administration expenses.

Therefore, at the time of determining cost of goods sold it only consider direct material,

labor, variable production and overhead expenses. Thus , the cost of goods sold is deducting

from the sales revenues and after that variable total expensed are also less to estimate the net

profit.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

There are several studies has been done over the management costing techniques in

which it has been investigated that Absorption costing is the best to prepared net profit. The

main reason behind this is that it takes all the type of cost that sold it takes direct material,

labor, variable production, selling expenses and also take fixed selling, administration

expenses

TASK 3

a. Different types of budget along with their benefits and drawbacks

Budget may be served as a financial expression of activities which business unit will

perform in the near future. It clearly entails sources of income and areas of expenses

pertaining to the specified time frame.

Incremental budgeting: In the case of incremental budgeting system managers

prepares financial framework by adding some percentage in the previous year budget. Hence,

Imda Tech can easily prepare such budget with the high level of ease and thereby would

become able to act accordingly.

Advantages

Ease of preparation and implementation

Assists in eliminating rivalry and builds value of equality among the departments

Disadvantages

Disconnect from reality is one of the major aspects which in turn affects the

significance of incremental budgeting system to a great extent (Rubin, 2016). Moreover,

funding requirement vary according to the market trend, customers expectations and

competitors framework.

Zero base budgeting: In such technique manager starts with zero based and prepare

financial plan according to best alternatives assessed for performing each activity.

Advantages

Facilitates focused operations, lower cost and disciplined execution

which it has been investigated that Absorption costing is the best to prepared net profit. The

main reason behind this is that it takes all the type of cost that sold it takes direct material,

labor, variable production, selling expenses and also take fixed selling, administration

expenses

TASK 3

a. Different types of budget along with their benefits and drawbacks

Budget may be served as a financial expression of activities which business unit will

perform in the near future. It clearly entails sources of income and areas of expenses

pertaining to the specified time frame.

Incremental budgeting: In the case of incremental budgeting system managers

prepares financial framework by adding some percentage in the previous year budget. Hence,

Imda Tech can easily prepare such budget with the high level of ease and thereby would

become able to act accordingly.

Advantages

Ease of preparation and implementation

Assists in eliminating rivalry and builds value of equality among the departments

Disadvantages

Disconnect from reality is one of the major aspects which in turn affects the

significance of incremental budgeting system to a great extent (Rubin, 2016). Moreover,

funding requirement vary according to the market trend, customers expectations and

competitors framework.

Zero base budgeting: In such technique manager starts with zero based and prepare

financial plan according to best alternatives assessed for performing each activity.

Advantages

Facilitates focused operations, lower cost and disciplined execution

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Ensure optimum allocation of funds according to the importance of activities

(Bogsnes, 2016)

Disadvantages

Highly time intensive process

It is highly difficult for the manager to justify each and every aspect of activity and

associated expenses.

Activity based budgeting

Advantages

ABB technique assists in making optimum allocation of overhead on the basis of cost

driver

Better planning and controlling the performance

Disadvantages

In this, manager of the firm has to devote more time to develop competent financial

framework.

Business entity has to organize training for developing understanding among the

personnel regarding such budgeting system (Baiocchi and Ganuza, 2014). This in turn

imposes high cost in front of firm.

b. Stating the process of preparing budget

Defining goals and objectives: In the first step, manager of Imda Tech makes

assessment of goals and objectives. Moreover, financial framework is highly aligned

with the organizational aims and objectives.

Analyzing activities: Once goals have been evaluated thereafter manager makes

assessment of activities which needs to undertake for ensuring smooth functioning of

operations. Hence, at this stage manager identifies the fund requires for incurring

material, labor and overhead expenses.

Preparing budget: In this, manager makes estimation of sales revenue and other

income level or aspect. Hence, budget is prepared by higher authority through the

(Bogsnes, 2016)

Disadvantages

Highly time intensive process

It is highly difficult for the manager to justify each and every aspect of activity and

associated expenses.

Activity based budgeting

Advantages

ABB technique assists in making optimum allocation of overhead on the basis of cost

driver

Better planning and controlling the performance

Disadvantages

In this, manager of the firm has to devote more time to develop competent financial

framework.

Business entity has to organize training for developing understanding among the

personnel regarding such budgeting system (Baiocchi and Ganuza, 2014). This in turn

imposes high cost in front of firm.

b. Stating the process of preparing budget

Defining goals and objectives: In the first step, manager of Imda Tech makes

assessment of goals and objectives. Moreover, financial framework is highly aligned

with the organizational aims and objectives.

Analyzing activities: Once goals have been evaluated thereafter manager makes

assessment of activities which needs to undertake for ensuring smooth functioning of

operations. Hence, at this stage manager identifies the fund requires for incurring

material, labor and overhead expenses.

Preparing budget: In this, manager makes estimation of sales revenue and other

income level or aspect. Hence, budget is prepared by higher authority through the

means of proper allocation of income and expenditure. In this third stage, managers

prepares budget and send it for final approval.

Evaluating variances: To monitor the performance manager makes comparison of

actual performance in against to the standard aspects (Holston, Issarny and Parra,

2016). Hence, such assessment or evaluation helps manager in identify the department

which fails to perform in accordance with the budgeting framework.

Taking corrective measure or action: In the last stage of budget preparation, manager

makes efforts to assess the causes of deviations. By evaluating this, manager would

become able to undertake suitable measure timely. For instance: By making

assessment manager of Imda tech has been identified that labor variance occurred

because employees failed to perform activities in an effectual way. Hence, by

organizing training session as well as conducting workshops business unit can motive

personnel and thereby raise their efficiency level.

Hence, by following the above mentioned steps firm can develop suitable budget and

become able to carry out activities in the best possible way.

c. Pricing strategies

There are several kinds of pricing strategies that Imda Tech can undertake to

determine the suitable price of chargers and electronic gazettes is enumerated below:

Cost-plus pricing strategy: In accordance with such strategy by adding gross margin

in the cost per unit Imda Tech can set suitable price of charger. Hence, by following

the below mentioned formula firm can determine cost of per or each charger is

enumerated below:

Cost per unit = Total cost / Number of chargers manufactured

Price per charger = Cost + (Cost per unit * gross margin%)

Penetration pricing strategy: It entails that business unit should set lower price of the

products offers on initial level (Pricing strategies, 2017). Once, loyalty has been built

towards the brand then company would become able to charge higher prices for the

products offered. Hence, such pricing strategy helps company in getting benefits in

long run.

prepares budget and send it for final approval.

Evaluating variances: To monitor the performance manager makes comparison of

actual performance in against to the standard aspects (Holston, Issarny and Parra,

2016). Hence, such assessment or evaluation helps manager in identify the department

which fails to perform in accordance with the budgeting framework.

Taking corrective measure or action: In the last stage of budget preparation, manager

makes efforts to assess the causes of deviations. By evaluating this, manager would

become able to undertake suitable measure timely. For instance: By making

assessment manager of Imda tech has been identified that labor variance occurred

because employees failed to perform activities in an effectual way. Hence, by

organizing training session as well as conducting workshops business unit can motive

personnel and thereby raise their efficiency level.

Hence, by following the above mentioned steps firm can develop suitable budget and

become able to carry out activities in the best possible way.

c. Pricing strategies

There are several kinds of pricing strategies that Imda Tech can undertake to

determine the suitable price of chargers and electronic gazettes is enumerated below:

Cost-plus pricing strategy: In accordance with such strategy by adding gross margin

in the cost per unit Imda Tech can set suitable price of charger. Hence, by following

the below mentioned formula firm can determine cost of per or each charger is

enumerated below:

Cost per unit = Total cost / Number of chargers manufactured

Price per charger = Cost + (Cost per unit * gross margin%)

Penetration pricing strategy: It entails that business unit should set lower price of the

products offers on initial level (Pricing strategies, 2017). Once, loyalty has been built

towards the brand then company would become able to charge higher prices for the

products offered. Hence, such pricing strategy helps company in getting benefits in

long run.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.