Analysis of Management Accounting Principles and Techniques

VerifiedAdded on 2023/01/06

|13

|3293

|30

Report

AI Summary

This report delves into the core principles of management accounting (MA), emphasizing its role in providing crucial information to internal management for decision-making, contrasting it with financial accounting. It explores key MA principles like designing and compiling information, management by exception, and absorption of overhead costs. The report examines various MA systems, including cost accounting, inventory management, job costing, and price optimization systems, highlighting their benefits and applications. It then analyzes different techniques used in MA, such as cost reports, budget reports, and inventory reports, demonstrating how they aid in strategic planning, expense monitoring, and profitability maintenance. Furthermore, the report compares and contrasts absorption costing and marginal costing, illustrating their application through income statements and interpreting their impact on profitability. It also discusses various planning tools for budgetary control, including zero-based budgeting, capital budgeting, and activity-based budgeting, evaluating their advantages and disadvantages. The report integrates these concepts to provide a holistic understanding of MA's role in organizational financial management and strategic decision-making.

Management Accounting

Principles

Principles

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................3

TASK ONE......................................................................................................................................3

PART A...........................................................................................................................................3

1. Management accounting (MA) and its principles...................................................................3

2. Role of MA and MA system...................................................................................................3

Way Management accounting is integrated within an organization...........................................6

PART B............................................................................................................................................6

TASK TWO.....................................................................................................................................7

PART A...........................................................................................................................................7

Comparison and contrast between planning tools that are used for budgetary control in

accounting management..............................................................................................................7

PART B............................................................................................................................................9

INTRODUCTION...........................................................................................................................3

TASK ONE......................................................................................................................................3

PART A...........................................................................................................................................3

1. Management accounting (MA) and its principles...................................................................3

2. Role of MA and MA system...................................................................................................3

Way Management accounting is integrated within an organization...........................................6

PART B............................................................................................................................................6

TASK TWO.....................................................................................................................................7

PART A...........................................................................................................................................7

Comparison and contrast between planning tools that are used for budgetary control in

accounting management..............................................................................................................7

PART B............................................................................................................................................9

INTRODUCTION

Management accounting is an important part of accounting with the main aim of

providing in-depth and meaningful information to the internal managerial team. It is different

from that of financial management as it considers both monetary and non-monetary aspects

while taking decision. This report provides an insight about the MA and its systems and

techniques that can be used for various purposes. The different planning tools in mA and the

usefulness of MA in responding to financial problems.

TASK ONE

PART A

1. Management accounting (MA) and its principles.

MA is basically the technique or a process which is being used for the purpose of analysing the

business operation and its performance through the way of preparing the relevant reports and

accounts for assisting the management in undertaking the decision.

Principles of MA

Designing and compiling: The business related information should be compiled and

recorded in an appropriate manner which can be easily understood by its users and meets with

the business requirement.

Management by exception: It useful while presenting the information, which means that

the budgetary control system and the costing techniques is being applied (Ameen, Ahmed and

Abd Hafez, 2018). Through this way, the pre-determined budget is compared with the actual

outcome in order to determine the deviation.

Absorption of Overhead Costs: The overhead cost pertaining to the production is

absorbed in a pre-determined basis. Therefore, the method selected should bring in the accurate

and right result.

2. Role of MA and MA system

Role of MA

Developing financial strategies: With the help of the budgets and other useful reports,

the management accountants of the organization can undertake decisions with regard to forming

strategies.

Management accounting is an important part of accounting with the main aim of

providing in-depth and meaningful information to the internal managerial team. It is different

from that of financial management as it considers both monetary and non-monetary aspects

while taking decision. This report provides an insight about the MA and its systems and

techniques that can be used for various purposes. The different planning tools in mA and the

usefulness of MA in responding to financial problems.

TASK ONE

PART A

1. Management accounting (MA) and its principles.

MA is basically the technique or a process which is being used for the purpose of analysing the

business operation and its performance through the way of preparing the relevant reports and

accounts for assisting the management in undertaking the decision.

Principles of MA

Designing and compiling: The business related information should be compiled and

recorded in an appropriate manner which can be easily understood by its users and meets with

the business requirement.

Management by exception: It useful while presenting the information, which means that

the budgetary control system and the costing techniques is being applied (Ameen, Ahmed and

Abd Hafez, 2018). Through this way, the pre-determined budget is compared with the actual

outcome in order to determine the deviation.

Absorption of Overhead Costs: The overhead cost pertaining to the production is

absorbed in a pre-determined basis. Therefore, the method selected should bring in the accurate

and right result.

2. Role of MA and MA system

Role of MA

Developing financial strategies: With the help of the budgets and other useful reports,

the management accountants of the organization can undertake decisions with regard to forming

strategies.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Monitoring expenses: The management of the organization can prepare different types of

budgets which can be static, flexible or the rolling out, that permits the leader or the managers in

effectively monitoring the expenses (Ghasemi and et.al., 2016).

Maintaining profitability: The management accountants can make use of various tools

which will help in ensuring the profitability by the way of break even analysis. It will help

determine the various cost incurred by the organization.

Management accounting system and its benefits

Cost accounting system

It is used by the manufacturers for the purpose of recording the various production

activities with the help of perpetual inventory system. It used for determining the cost and

profitability associated with each of such activity.

Benefits:It helps the management in measuring the efficiency in regard to the cost and time.

This also assist in reducing the expenditure which is unnecessary.

Application: This system is basically used by the manufacturing companies in keeping track of

the cost incurred in different process.

Inventory management system:

This MA system works on ensuring that the goods are moving at the right place and at

the right time (Shields and Shelleman, 2016). In simple words, it records the movement of stock

from one process to another and the timely delivery of the same to its end users.

Benefits: It works on reducing the inaccuracies which earlier caused due to human error. It also

helps in maintaining the right level of inventory which leads to reduction in wastage.

Application: This system is mainly used by the organizations which are required to maintain

huge stock of inventory.

Job costing system:

Under this system, the cost is assigned to the various activities with respect to the specific

job involved. It is useful in keeping track of the cost pertaining to each job which is important for

the business operation.

Benefits: The profitability attached to the each job can be easily determined and it also provides

with the basis in determining the cost of the other similar jobs.

Application: It is mainly useful in the construction industry or the other industry where cost is

required to be allocated to the multiple projects.

budgets which can be static, flexible or the rolling out, that permits the leader or the managers in

effectively monitoring the expenses (Ghasemi and et.al., 2016).

Maintaining profitability: The management accountants can make use of various tools

which will help in ensuring the profitability by the way of break even analysis. It will help

determine the various cost incurred by the organization.

Management accounting system and its benefits

Cost accounting system

It is used by the manufacturers for the purpose of recording the various production

activities with the help of perpetual inventory system. It used for determining the cost and

profitability associated with each of such activity.

Benefits:It helps the management in measuring the efficiency in regard to the cost and time.

This also assist in reducing the expenditure which is unnecessary.

Application: This system is basically used by the manufacturing companies in keeping track of

the cost incurred in different process.

Inventory management system:

This MA system works on ensuring that the goods are moving at the right place and at

the right time (Shields and Shelleman, 2016). In simple words, it records the movement of stock

from one process to another and the timely delivery of the same to its end users.

Benefits: It works on reducing the inaccuracies which earlier caused due to human error. It also

helps in maintaining the right level of inventory which leads to reduction in wastage.

Application: This system is mainly used by the organizations which are required to maintain

huge stock of inventory.

Job costing system:

Under this system, the cost is assigned to the various activities with respect to the specific

job involved. It is useful in keeping track of the cost pertaining to each job which is important for

the business operation.

Benefits: The profitability attached to the each job can be easily determined and it also provides

with the basis in determining the cost of the other similar jobs.

Application: It is mainly useful in the construction industry or the other industry where cost is

required to be allocated to the multiple projects.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

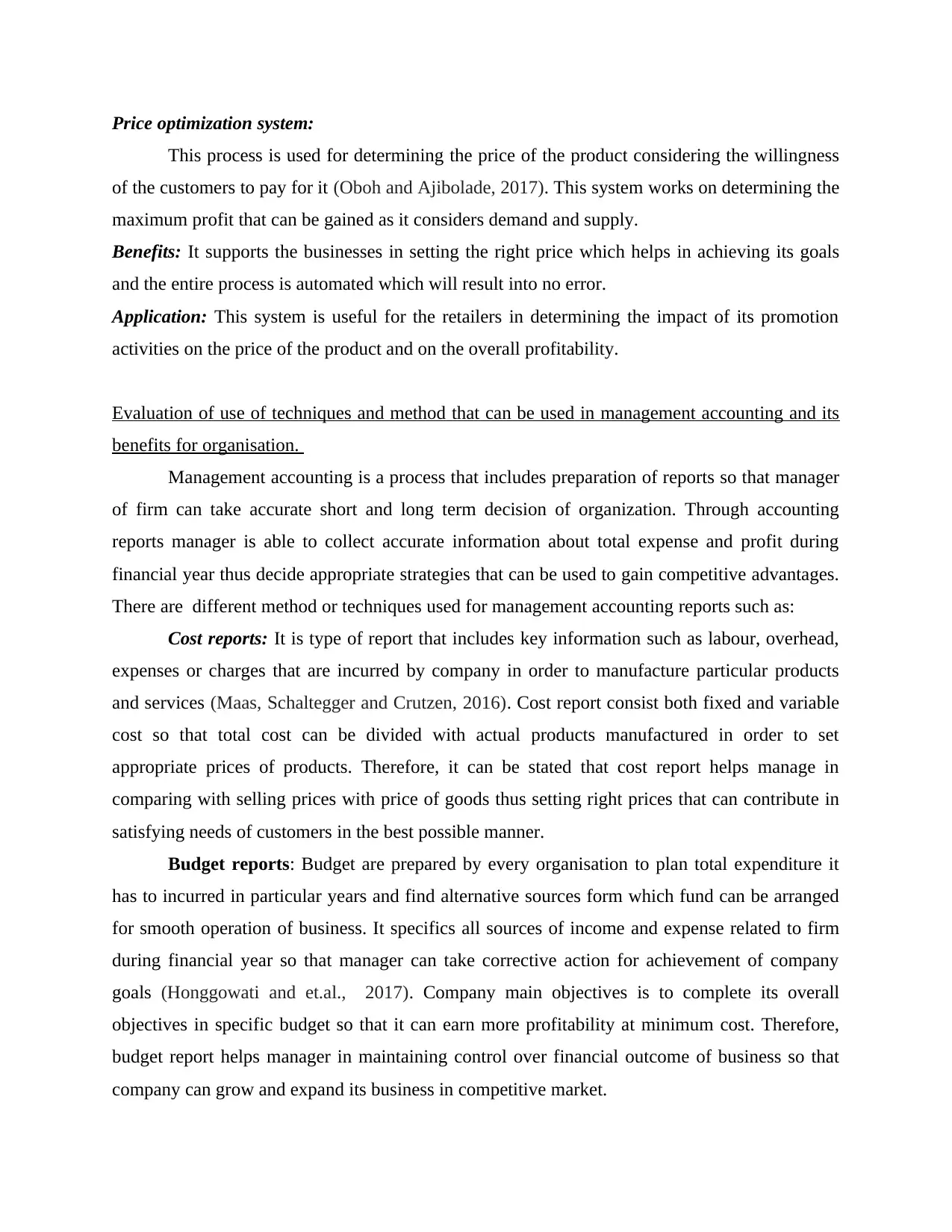

Price optimization system:

This process is used for determining the price of the product considering the willingness

of the customers to pay for it (Oboh and Ajibolade, 2017). This system works on determining the

maximum profit that can be gained as it considers demand and supply.

Benefits: It supports the businesses in setting the right price which helps in achieving its goals

and the entire process is automated which will result into no error.

Application: This system is useful for the retailers in determining the impact of its promotion

activities on the price of the product and on the overall profitability.

Evaluation of use of techniques and method that can be used in management accounting and its

benefits for organisation.

Management accounting is a process that includes preparation of reports so that manager

of firm can take accurate short and long term decision of organization. Through accounting

reports manager is able to collect accurate information about total expense and profit during

financial year thus decide appropriate strategies that can be used to gain competitive advantages.

There are different method or techniques used for management accounting reports such as:

Cost reports: It is type of report that includes key information such as labour, overhead,

expenses or charges that are incurred by company in order to manufacture particular products

and services (Maas, Schaltegger and Crutzen, 2016). Cost report consist both fixed and variable

cost so that total cost can be divided with actual products manufactured in order to set

appropriate prices of products. Therefore, it can be stated that cost report helps manage in

comparing with selling prices with price of goods thus setting right prices that can contribute in

satisfying needs of customers in the best possible manner.

Budget reports: Budget are prepared by every organisation to plan total expenditure it

has to incurred in particular years and find alternative sources form which fund can be arranged

for smooth operation of business. It specifics all sources of income and expense related to firm

during financial year so that manager can take corrective action for achievement of company

goals (Honggowati and et.al., 2017). Company main objectives is to complete its overall

objectives in specific budget so that it can earn more profitability at minimum cost. Therefore,

budget report helps manager in maintaining control over financial outcome of business so that

company can grow and expand its business in competitive market.

This process is used for determining the price of the product considering the willingness

of the customers to pay for it (Oboh and Ajibolade, 2017). This system works on determining the

maximum profit that can be gained as it considers demand and supply.

Benefits: It supports the businesses in setting the right price which helps in achieving its goals

and the entire process is automated which will result into no error.

Application: This system is useful for the retailers in determining the impact of its promotion

activities on the price of the product and on the overall profitability.

Evaluation of use of techniques and method that can be used in management accounting and its

benefits for organisation.

Management accounting is a process that includes preparation of reports so that manager

of firm can take accurate short and long term decision of organization. Through accounting

reports manager is able to collect accurate information about total expense and profit during

financial year thus decide appropriate strategies that can be used to gain competitive advantages.

There are different method or techniques used for management accounting reports such as:

Cost reports: It is type of report that includes key information such as labour, overhead,

expenses or charges that are incurred by company in order to manufacture particular products

and services (Maas, Schaltegger and Crutzen, 2016). Cost report consist both fixed and variable

cost so that total cost can be divided with actual products manufactured in order to set

appropriate prices of products. Therefore, it can be stated that cost report helps manage in

comparing with selling prices with price of goods thus setting right prices that can contribute in

satisfying needs of customers in the best possible manner.

Budget reports: Budget are prepared by every organisation to plan total expenditure it

has to incurred in particular years and find alternative sources form which fund can be arranged

for smooth operation of business. It specifics all sources of income and expense related to firm

during financial year so that manager can take corrective action for achievement of company

goals (Honggowati and et.al., 2017). Company main objectives is to complete its overall

objectives in specific budget so that it can earn more profitability at minimum cost. Therefore,

budget report helps manager in maintaining control over financial outcome of business so that

company can grow and expand its business in competitive market.

Inventory report: It is another method or report which is used in management

accounting as it include key information related to total amount of inventory present in the firm.

Company can make use of physical or electronic document in order to record data related to total

inventory at particular point of time and need to be in future for satisfaction of customers

requirement (Hiebl and Richter, 2018). Manager through inventory report is able to control cost

and make the best utilization of resources by ordering raw material as an when required. Thus, it

helps in management of stock, reduce in wastage of resources and delivering products or services

to customers within limited time frame and cost.

Way Management accounting is integrated within an organization

Management accounting generally used to help the organization in making variety of the

different type reports in regard to the issue which is faced by the organization and solution of the

same. This types of reports generally used to help the management at the time of making variety

of different type of the decision in the organization. On the basis of the same decision

organization is able to improve the productivity and profitability of the business in the positive

manner. This integration also help the company in getting ready for variety of future uncertainty

as well.

PART B

Absorption costing: It is required for financial reporting as it content all cost that are

incurred in manufacturing of particular products and services of company. Absorption costing

includes both direct and indirect cost some of them are rent, insurance, labour and direct material

that are used in production or delivery of services.

Marginal costing: On the other hand margin cost can be termed as additional cost that is

incurred by enterprise in order to manufacture additional unit in the organizations. So, in margin

costing, fixed cost are treated as expense or cost during particular period and variable cost is

included in actual cost of products.

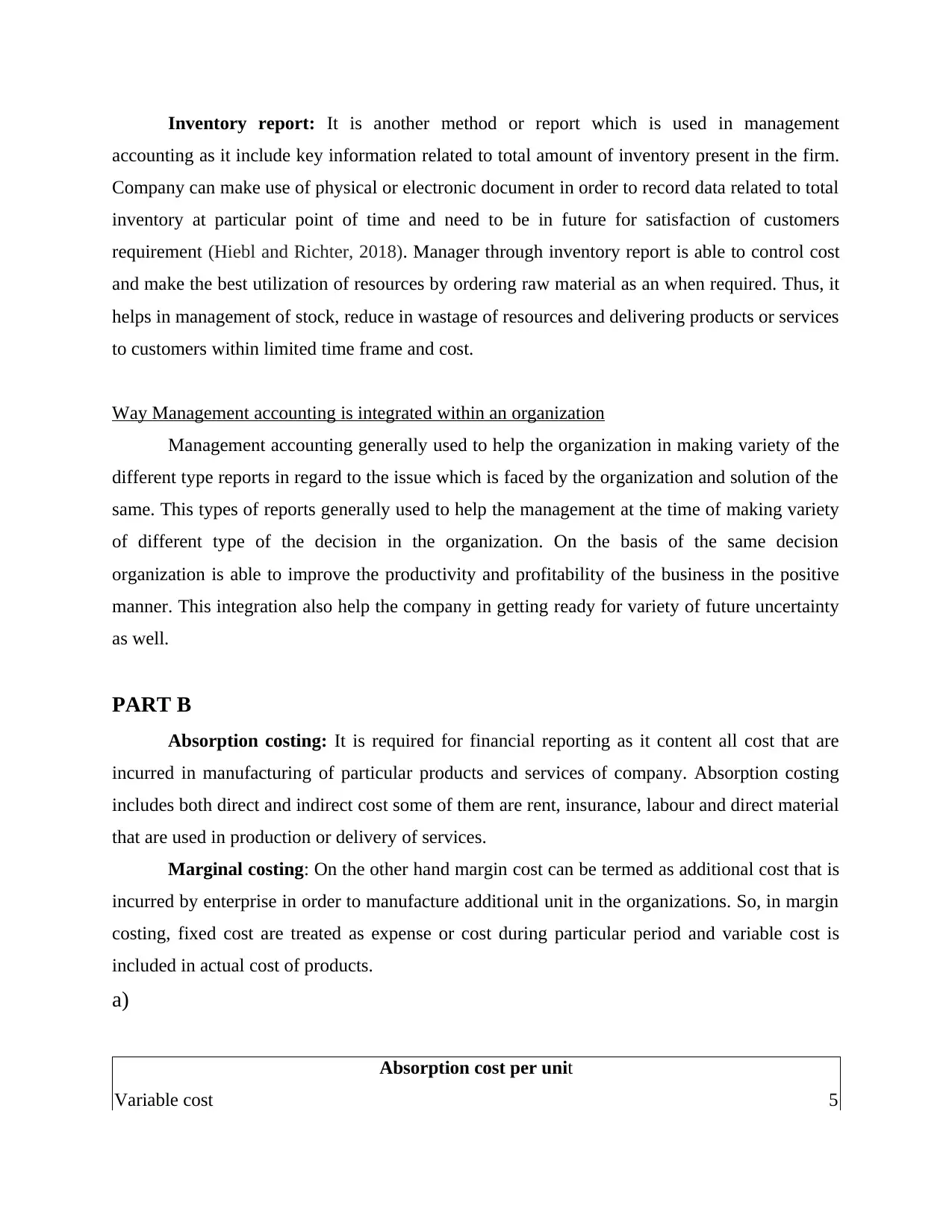

a)

Absorption cost per unit

Variable cost 5

accounting as it include key information related to total amount of inventory present in the firm.

Company can make use of physical or electronic document in order to record data related to total

inventory at particular point of time and need to be in future for satisfaction of customers

requirement (Hiebl and Richter, 2018). Manager through inventory report is able to control cost

and make the best utilization of resources by ordering raw material as an when required. Thus, it

helps in management of stock, reduce in wastage of resources and delivering products or services

to customers within limited time frame and cost.

Way Management accounting is integrated within an organization

Management accounting generally used to help the organization in making variety of the

different type reports in regard to the issue which is faced by the organization and solution of the

same. This types of reports generally used to help the management at the time of making variety

of different type of the decision in the organization. On the basis of the same decision

organization is able to improve the productivity and profitability of the business in the positive

manner. This integration also help the company in getting ready for variety of future uncertainty

as well.

PART B

Absorption costing: It is required for financial reporting as it content all cost that are

incurred in manufacturing of particular products and services of company. Absorption costing

includes both direct and indirect cost some of them are rent, insurance, labour and direct material

that are used in production or delivery of services.

Marginal costing: On the other hand margin cost can be termed as additional cost that is

incurred by enterprise in order to manufacture additional unit in the organizations. So, in margin

costing, fixed cost are treated as expense or cost during particular period and variable cost is

included in actual cost of products.

a)

Absorption cost per unit

Variable cost 5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Administration cost 0.03

Selling and distribution cost 0.028

Variable expenses 3

Fixed cost 0.34

Total 8.398

Marginal cost per unit

Variable cost 5

Administration cost 0.03

Selling and distribution cost 0.028

Variable expenses 3

Total 8.058

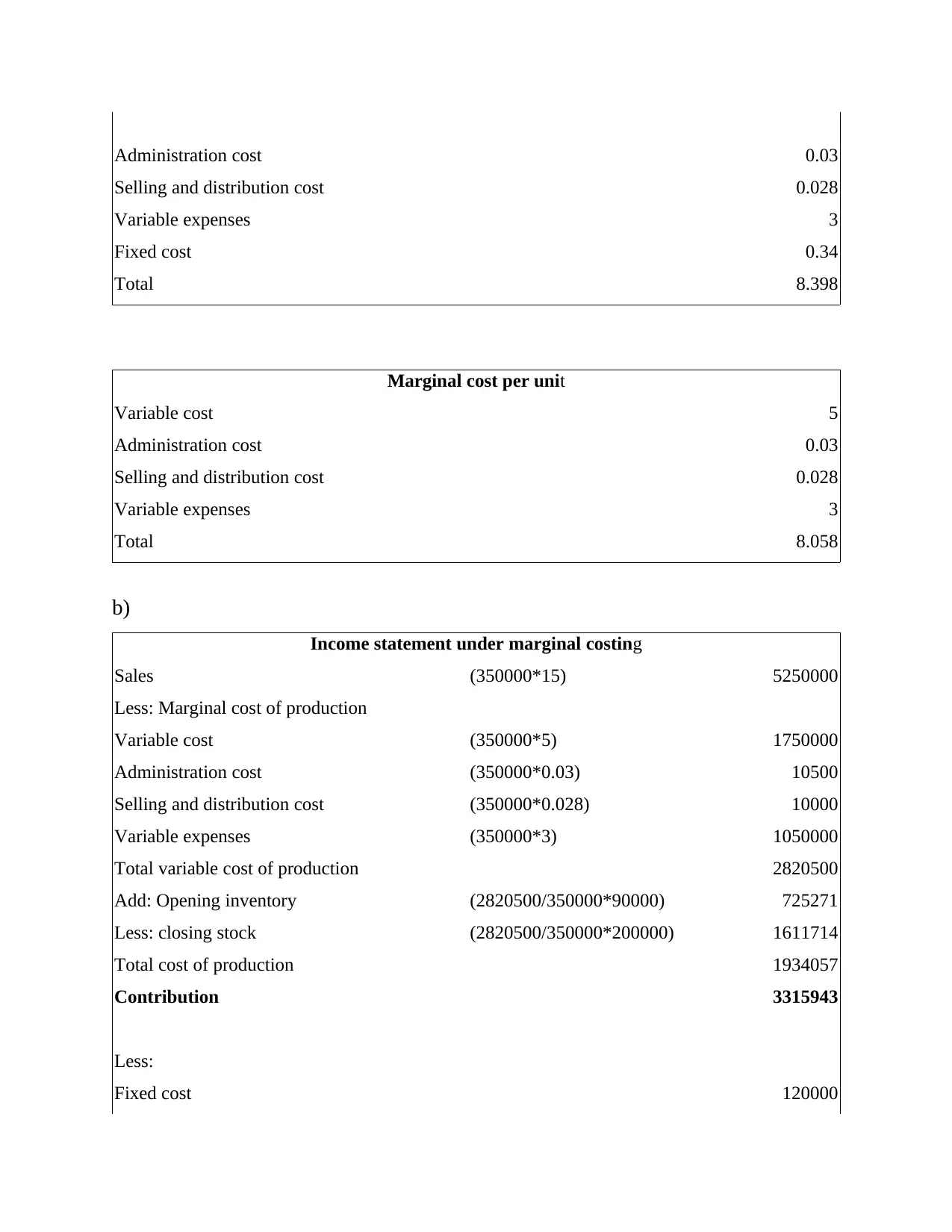

b)

Income statement under marginal costing

Sales (350000*15) 5250000

Less: Marginal cost of production

Variable cost (350000*5) 1750000

Administration cost (350000*0.03) 10500

Selling and distribution cost (350000*0.028) 10000

Variable expenses (350000*3) 1050000

Total variable cost of production 2820500

Add: Opening inventory (2820500/350000*90000) 725271

Less: closing stock (2820500/350000*200000) 1611714

Total cost of production 1934057

Contribution 3315943

Less:

Fixed cost 120000

Selling and distribution cost 0.028

Variable expenses 3

Fixed cost 0.34

Total 8.398

Marginal cost per unit

Variable cost 5

Administration cost 0.03

Selling and distribution cost 0.028

Variable expenses 3

Total 8.058

b)

Income statement under marginal costing

Sales (350000*15) 5250000

Less: Marginal cost of production

Variable cost (350000*5) 1750000

Administration cost (350000*0.03) 10500

Selling and distribution cost (350000*0.028) 10000

Variable expenses (350000*3) 1050000

Total variable cost of production 2820500

Add: Opening inventory (2820500/350000*90000) 725271

Less: closing stock (2820500/350000*200000) 1611714

Total cost of production 1934057

Contribution 3315943

Less:

Fixed cost 120000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Fixed expense 100000

Depreciation expense 21000

Salaries 200000

Total fixed cost 441000

Net income 2874943

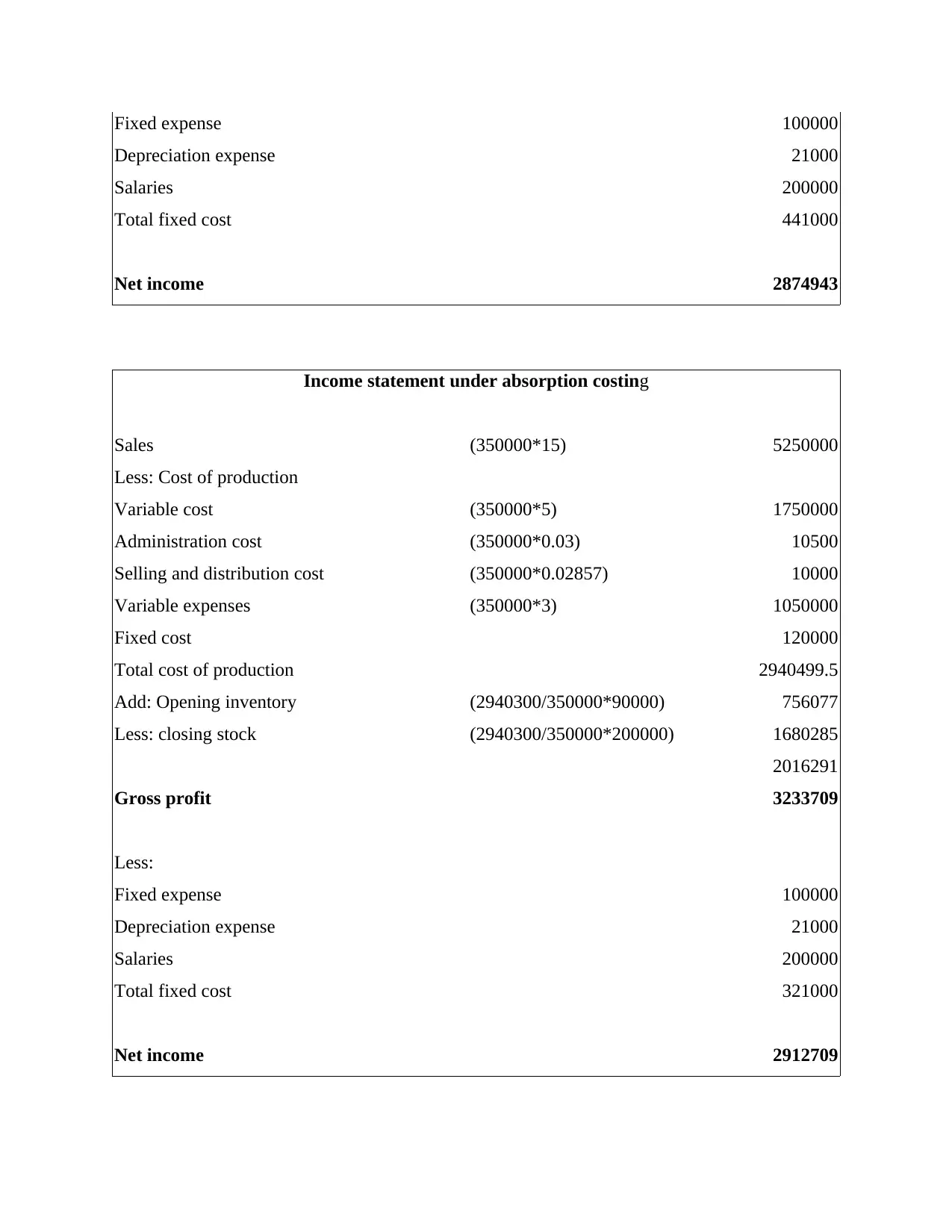

Income statement under absorption costing

Sales (350000*15) 5250000

Less: Cost of production

Variable cost (350000*5) 1750000

Administration cost (350000*0.03) 10500

Selling and distribution cost (350000*0.02857) 10000

Variable expenses (350000*3) 1050000

Fixed cost 120000

Total cost of production 2940499.5

Add: Opening inventory (2940300/350000*90000) 756077

Less: closing stock (2940300/350000*200000) 1680285

2016291

Gross profit 3233709

Less:

Fixed expense 100000

Depreciation expense 21000

Salaries 200000

Total fixed cost 321000

Net income 2912709

Depreciation expense 21000

Salaries 200000

Total fixed cost 441000

Net income 2874943

Income statement under absorption costing

Sales (350000*15) 5250000

Less: Cost of production

Variable cost (350000*5) 1750000

Administration cost (350000*0.03) 10500

Selling and distribution cost (350000*0.02857) 10000

Variable expenses (350000*3) 1050000

Fixed cost 120000

Total cost of production 2940499.5

Add: Opening inventory (2940300/350000*90000) 756077

Less: closing stock (2940300/350000*200000) 1680285

2016291

Gross profit 3233709

Less:

Fixed expense 100000

Depreciation expense 21000

Salaries 200000

Total fixed cost 321000

Net income 2912709

Interpretation: It can be inferred form the above that the profit under absorption costing is

higher than marginal method which is because the Absorption costing considers both direct and

indirect cost which is not the case of marginal costing resulting into difference in the amount.

The absorption costing is widely used as it also used for the financial statement reporting and

meets with the IFRS requirement as well.

TASK TWO

PART A

Comparison and contrast between planning tools that are used for budgetary control in

accounting management

Budgetary control is system that is used to control overall cost by coordinating with

several departments that actual fund that they will require in order to accomplish particular

activities. The main objective of budget control is make optimum utilization of resources so that

company can earn maximum profit margin and achieve its goals. Thus, it is process that is used

to monitor performance of organisation in terms of monetary. There are differences planning tool

that are used by firms for budget controlling such as zero based budgeting, capital budget and

activity based budgeting. Such as:

Zero based budget: It is one of the planning tool for budget control in which no base is

considered or used for preparation of budget of firm (Taborda and Sousa, 2020). Each expense

are justified for every new period, or are made as per needs and requirement in organisation.

Thus, each year new budget is prepared regardless of budget in previous years for effective

operation of business.

Advantages:

Emphases more on decision making thus it meant overall expense that company will

incurred in order to proceed particular activities so that it can gain competitive

advantages.

Disadvantages

higher than marginal method which is because the Absorption costing considers both direct and

indirect cost which is not the case of marginal costing resulting into difference in the amount.

The absorption costing is widely used as it also used for the financial statement reporting and

meets with the IFRS requirement as well.

TASK TWO

PART A

Comparison and contrast between planning tools that are used for budgetary control in

accounting management

Budgetary control is system that is used to control overall cost by coordinating with

several departments that actual fund that they will require in order to accomplish particular

activities. The main objective of budget control is make optimum utilization of resources so that

company can earn maximum profit margin and achieve its goals. Thus, it is process that is used

to monitor performance of organisation in terms of monetary. There are differences planning tool

that are used by firms for budget controlling such as zero based budgeting, capital budget and

activity based budgeting. Such as:

Zero based budget: It is one of the planning tool for budget control in which no base is

considered or used for preparation of budget of firm (Taborda and Sousa, 2020). Each expense

are justified for every new period, or are made as per needs and requirement in organisation.

Thus, each year new budget is prepared regardless of budget in previous years for effective

operation of business.

Advantages:

Emphases more on decision making thus it meant overall expense that company will

incurred in order to proceed particular activities so that it can gain competitive

advantages.

Disadvantages

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

The biggest disadvantages of zero based budgeting is that it is does take into consider the

expense that are made for longer time frame. At the same time it is difficult for manager

to understand expense that are essential or not so its benefits are in qualitative nature.

Capital based budgeting: It is another type of budget controlling that includes effective

evaluation of major or big investment that company in planning to make in future circumstances

(Aureli and et.al., 2019). Thus, it is mostly used to determined that way long term investment

such as machinery, building are wroth for investment through capital structure or not.

Advantages

Capital budgeting helps manager in understanding associated risk with particular long

term investment and its impact on company operation.

Disadvantage

Future is uncertain so prediction or assumptions made by such method may not be beneficial for

the organisation.

Activity based budgeting: In this type of budget control, management analysis and interpret

actual cost that is incurred by company to complete particular activity on basis of previous years.

Thus, manager make use of record and previous data in order to set budget for future financial

years so that all expense can be meet and company can attained its objectives.

Advantages:

Manager through activity based budgeting can eliminate activities that are unnecessary

thus save cost of firm and helps in gaining competitive advantages.

Disadvantages:

Activity based budgeting is complex in nature as it require effective analysis and

evaluation of each factor before deciding actual expense that need to be incurred in

particular activity.

expense that are made for longer time frame. At the same time it is difficult for manager

to understand expense that are essential or not so its benefits are in qualitative nature.

Capital based budgeting: It is another type of budget controlling that includes effective

evaluation of major or big investment that company in planning to make in future circumstances

(Aureli and et.al., 2019). Thus, it is mostly used to determined that way long term investment

such as machinery, building are wroth for investment through capital structure or not.

Advantages

Capital budgeting helps manager in understanding associated risk with particular long

term investment and its impact on company operation.

Disadvantage

Future is uncertain so prediction or assumptions made by such method may not be beneficial for

the organisation.

Activity based budgeting: In this type of budget control, management analysis and interpret

actual cost that is incurred by company to complete particular activity on basis of previous years.

Thus, manager make use of record and previous data in order to set budget for future financial

years so that all expense can be meet and company can attained its objectives.

Advantages:

Manager through activity based budgeting can eliminate activities that are unnecessary

thus save cost of firm and helps in gaining competitive advantages.

Disadvantages:

Activity based budgeting is complex in nature as it require effective analysis and

evaluation of each factor before deciding actual expense that need to be incurred in

particular activity.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

PART B

Management accounting can be applied in variety of the different way in general. All the

organization generally used to adopt the management accounting by considering variety of

different method. For example in the Case of Corus Technology organization has adopted the

cost accounting system in a way that it used to help them in improving the efficiency of task

carried out in the organization (Sohrabi, 2017). It has been identified that In the late ninety's

organization generally used to outsourced their operation to other companies this used to

increase the cost of the product in the long run. For the same reason to reduce the cost of the

company organization management has taken the decision to improve the level of technology

used by innovating a tool in which lamination was possible in the organization itself. Hence,

with the help of this type of technology usage in the organization, Corus was able to adopt the

Cost management system in the best way and it has also helped the company in reducing the cost

of the product. This has helped the company in getting competitive advantage in the market as

well.

At the same time in the case of Coco Cola it has been identified that they used to adopt

the inventory management system in the organization to see good sort of the success in the

market. As case study identified that Coco Cola has changed the offering of the company on the

timely basis so that consumer in the market are attracted toward the product of the company.

Case study highlights that in the past the company was only selling coco cola as their product

but in last 20 years they have managed their inventory in the best way possible. As company has

acquired variety of the different soft drink selling companies (Rizza and Ruggeri, 2018). This has

helped the company in expanding the product line of the company in the market as more number

of product is offered in the name of Coco cola. It has also helped the company in managing the

competition in the best way possible in the market. Not only that it has been also identified that

Coco Cola has also managed the inventory in the best way possible by improving the quality of

marketing and consumer understanding in the market.

CONCLUSION

It can be concluded from above report that management accounting plays an important

roles in planning, controlling and monitoring activities that can be used in effective achievement

of goals. There are several methods that are used by manager in order to maintained records of

Management accounting can be applied in variety of the different way in general. All the

organization generally used to adopt the management accounting by considering variety of

different method. For example in the Case of Corus Technology organization has adopted the

cost accounting system in a way that it used to help them in improving the efficiency of task

carried out in the organization (Sohrabi, 2017). It has been identified that In the late ninety's

organization generally used to outsourced their operation to other companies this used to

increase the cost of the product in the long run. For the same reason to reduce the cost of the

company organization management has taken the decision to improve the level of technology

used by innovating a tool in which lamination was possible in the organization itself. Hence,

with the help of this type of technology usage in the organization, Corus was able to adopt the

Cost management system in the best way and it has also helped the company in reducing the cost

of the product. This has helped the company in getting competitive advantage in the market as

well.

At the same time in the case of Coco Cola it has been identified that they used to adopt

the inventory management system in the organization to see good sort of the success in the

market. As case study identified that Coco Cola has changed the offering of the company on the

timely basis so that consumer in the market are attracted toward the product of the company.

Case study highlights that in the past the company was only selling coco cola as their product

but in last 20 years they have managed their inventory in the best way possible. As company has

acquired variety of the different soft drink selling companies (Rizza and Ruggeri, 2018). This has

helped the company in expanding the product line of the company in the market as more number

of product is offered in the name of Coco cola. It has also helped the company in managing the

competition in the best way possible in the market. Not only that it has been also identified that

Coco Cola has also managed the inventory in the best way possible by improving the quality of

marketing and consumer understanding in the market.

CONCLUSION

It can be concluded from above report that management accounting plays an important

roles in planning, controlling and monitoring activities that can be used in effective achievement

of goals. There are several methods that are used by manager in order to maintained records of

accounts so that it can take accurate decision for growth and success of enterprise. At last, it can

be concluded that budgetary control techniques helps in the best utilization of financial resources

so that company can gain competitive advantages.

be concluded that budgetary control techniques helps in the best utilization of financial resources

so that company can gain competitive advantages.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.