Management Accounting: Cost Analysis, Financial Planning & Integration

VerifiedAdded on 2023/06/16

|18

|4394

|302

Report

AI Summary

This report provides a detailed analysis of management accounting principles and their application within a medium-sized electrical engineering contractor, Smith Brothers. It covers the role of management accounting systems, including cost accounting, job costing, inventory management, and price optimization. The report includes a calculation of an income statement using both marginal and absorption costing techniques to highlight the financial performance and position of the firm. It further evaluates how management accounting is integrated within the organization, focusing on budgeting and operational decision-making. The report concludes with recommendations for addressing financial problems using management accounting tools and planning strategies to ensure business success.

Management Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

Introduction .....................................................................................................................................3

PART 1............................................................................................................................................3

1.Principles of management accounting.....................................................................................3

2.The role of management accounting and management accounting systems............................4

3 Calculate costs using appropriate techniques of cost analysis for formulating an income

statement using marginal and absorption costs...........................................................................6

4. Evaluating how management accounting is integrated within the organization.....................9

CONCLUSION................................................................................................................................9

PART 2..........................................................................................................................................10

1.Explaining the use of planning tools used in management accounting ................................10

2.Comparing different ways in which organizations could use management accounting to

respond to financial problems...................................................................................................12

3. Recommendations.................................................................................................................14

CONCLUSION .............................................................................................................................14

REFERENCES..............................................................................................................................16

Introduction .....................................................................................................................................3

PART 1............................................................................................................................................3

1.Principles of management accounting.....................................................................................3

2.The role of management accounting and management accounting systems............................4

3 Calculate costs using appropriate techniques of cost analysis for formulating an income

statement using marginal and absorption costs...........................................................................6

4. Evaluating how management accounting is integrated within the organization.....................9

CONCLUSION................................................................................................................................9

PART 2..........................................................................................................................................10

1.Explaining the use of planning tools used in management accounting ................................10

2.Comparing different ways in which organizations could use management accounting to

respond to financial problems...................................................................................................12

3. Recommendations.................................................................................................................14

CONCLUSION .............................................................................................................................14

REFERENCES..............................................................................................................................16

INTRODUCTION

Management accounting is the systematic process in which company prepare reports

about business transactions that help them to make strategic decisions. The present report will

provide detailed information about medium-sized organization smith brothers deals electrical

engineering contractor and providing services in high voltage projects. In addition to that, the

study will calculate income statement using variable costings in order to support business

success. The present report will provide principle of management accounting. Further the case

study will give information about role of management accounting system and benefits of the

function to the company.

PART 1

1.Principles of management accounting.

Management accounting is the method used by company in order to find financial

information so that managers and top-level management can make decisions on the basis of

relevant data. The detailed information provide highlights about company's wealth and financial

position of the firm. Management accounting done by company should be ensured proper

utilization of available resources effectively (Management accounting and its importance, 2021).

The system of management accounting can provide different methods and approaches to control

the costs. The main objective of the management accounting is to avoid errors, mistakes and

minimize losses in order to make profit, so it will ultimately increase productivity.

Designing and compiling

Accounting reports, transaction and other related information should be designed in

proper way to meet organizational goals and deal with business issues. The management

accounting system should be compiled systematically with the help of relevant information based

on previous data.

Control at source Accounting

Management accounting helps to control costs which are incurred during the business

operations (Mahmoudian and et.al., 2021). The detailed information about raw materials, repairs

and maintenance etc. are provided in the form of qualitative and quantitative information.

Accounting for inflation

Management accounting is the systematic process in which company prepare reports

about business transactions that help them to make strategic decisions. The present report will

provide detailed information about medium-sized organization smith brothers deals electrical

engineering contractor and providing services in high voltage projects. In addition to that, the

study will calculate income statement using variable costings in order to support business

success. The present report will provide principle of management accounting. Further the case

study will give information about role of management accounting system and benefits of the

function to the company.

PART 1

1.Principles of management accounting.

Management accounting is the method used by company in order to find financial

information so that managers and top-level management can make decisions on the basis of

relevant data. The detailed information provide highlights about company's wealth and financial

position of the firm. Management accounting done by company should be ensured proper

utilization of available resources effectively (Management accounting and its importance, 2021).

The system of management accounting can provide different methods and approaches to control

the costs. The main objective of the management accounting is to avoid errors, mistakes and

minimize losses in order to make profit, so it will ultimately increase productivity.

Designing and compiling

Accounting reports, transaction and other related information should be designed in

proper way to meet organizational goals and deal with business issues. The management

accounting system should be compiled systematically with the help of relevant information based

on previous data.

Control at source Accounting

Management accounting helps to control costs which are incurred during the business

operations (Mahmoudian and et.al., 2021). The detailed information about raw materials, repairs

and maintenance etc. are provided in the form of qualitative and quantitative information.

Accounting for inflation

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

It is important for management team of the company to assess the capital value

contributed by the owners of the firm. Therefore, management accounting system keep track on

rate of inflation to judge the real value of the money. The rate of inflation is taken into

consideration in order to evaluate the business performance and financial health of the company.

Utilization of resources

The business available resources should be effectively used in order to maintain cost,

expenses and other activities. The management accounting system should be ensure about that

the firm utilize its available resources.

Forward looking approach

The management accounting system can guess the problems through different method in

order to provide future looking approach.

2.The role of management accounting and management accounting systems

The major role of management accounting is to conduct a relevant information which is

based on cost analysis, expenses done by the company, profits made by the firm and give

recommendations for future business activities (Gunarathne, Lee and Hitigala Kaluarachchilage,

2021). The managers of the smith brothers do their duties such as recording of transaction, risk

management, planning for future goals, managing organization investments in order to make

decisions.

Management accounting system plays a vital role in forecasting future related business

needs and for strategic planning with the help of market research. The management team of

smith brother can analyse and maintain reports such as liquidity, cash flow statements and other

transactions.

Different types of management accounting systems.

Cost accounting systems- It is the system used to estimate the products costs for

profitability analysis, inventory valuation and cost control. The major role of cost accounting

system is to lower the cost of the business transaction in order to make profit margins. By

controlling relevant items in the firm, the managers can improve profit maximization

(Maheshwari, Maheshwari and Maheshwari, 2021). Smith brothers management team uses this

system to make good costing system by ensuring proper accounting for overheads, labour and

raw materials.

contributed by the owners of the firm. Therefore, management accounting system keep track on

rate of inflation to judge the real value of the money. The rate of inflation is taken into

consideration in order to evaluate the business performance and financial health of the company.

Utilization of resources

The business available resources should be effectively used in order to maintain cost,

expenses and other activities. The management accounting system should be ensure about that

the firm utilize its available resources.

Forward looking approach

The management accounting system can guess the problems through different method in

order to provide future looking approach.

2.The role of management accounting and management accounting systems

The major role of management accounting is to conduct a relevant information which is

based on cost analysis, expenses done by the company, profits made by the firm and give

recommendations for future business activities (Gunarathne, Lee and Hitigala Kaluarachchilage,

2021). The managers of the smith brothers do their duties such as recording of transaction, risk

management, planning for future goals, managing organization investments in order to make

decisions.

Management accounting system plays a vital role in forecasting future related business

needs and for strategic planning with the help of market research. The management team of

smith brother can analyse and maintain reports such as liquidity, cash flow statements and other

transactions.

Different types of management accounting systems.

Cost accounting systems- It is the system used to estimate the products costs for

profitability analysis, inventory valuation and cost control. The major role of cost accounting

system is to lower the cost of the business transaction in order to make profit margins. By

controlling relevant items in the firm, the managers can improve profit maximization

(Maheshwari, Maheshwari and Maheshwari, 2021). Smith brothers management team uses this

system to make good costing system by ensuring proper accounting for overheads, labour and

raw materials.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Benefits- with the help of this method, company can minimize wastage and determine the selling

price of the products or services. This system calculates the profit and loss made on each product

in order to make profitability.

Drawbacks- The major disadvantage, it is very costly in nature and sometimes the results are

misleading which can affect the efficiency of the business.

Job costing system- This system is used by firm to keep track on cost of materials that

are being used during course of the job and provides detailed information about it.

Benefits- The system provides analysis of the labour, overhead and materials for each job in the

firm. It will be useful because it can easily keep record on all expenses done by the company on

regular basis.

Drawbacks- sometimes this system create conflict within the company because of overload

paperwork as the overheads cannot be controlled.

Inventory management system- It is the system used by company to keep track on

goods throughout their entire supply chain. This system provide detailed information about

inventory management approaches in the business. The process provides a real time view of

inventory across all selling channels in the firm (Astuty and Pasaribu, 2021). Smith brothers used

ERP method of inventory management which is known as enterprise resources planning. It

allows to manage all business activities such as logistics, planning and financial activities.

Benefits- It is beneficial for the company because it helps to manage multiple locations and

stocks outs. This system keeps proper track on stocks in order to reduce risk of overselling and to

control unnecessary expenditure. It improves business negotiation for cost savings while making

inventory related decisions. The system helps the company to minimize stock outs and excess

stock in order to simplify inventory control system.

Drawback- The major disadvantage of this method, it is expensive process and show limited

elimination of risk in the business.

Price optimization system- This system of management accounting gives proper

understanding about how much business the company obtain within profitability levels on the

basis of how sensitive their customer are to changes in prices of product. It is mathematical

process that can be used to calculate about the demand of products at different price levels.

Smith brothers management team combine the important data with inventory levels in order to

suggest prices that will increase profits.

price of the products or services. This system calculates the profit and loss made on each product

in order to make profitability.

Drawbacks- The major disadvantage, it is very costly in nature and sometimes the results are

misleading which can affect the efficiency of the business.

Job costing system- This system is used by firm to keep track on cost of materials that

are being used during course of the job and provides detailed information about it.

Benefits- The system provides analysis of the labour, overhead and materials for each job in the

firm. It will be useful because it can easily keep record on all expenses done by the company on

regular basis.

Drawbacks- sometimes this system create conflict within the company because of overload

paperwork as the overheads cannot be controlled.

Inventory management system- It is the system used by company to keep track on

goods throughout their entire supply chain. This system provide detailed information about

inventory management approaches in the business. The process provides a real time view of

inventory across all selling channels in the firm (Astuty and Pasaribu, 2021). Smith brothers used

ERP method of inventory management which is known as enterprise resources planning. It

allows to manage all business activities such as logistics, planning and financial activities.

Benefits- It is beneficial for the company because it helps to manage multiple locations and

stocks outs. This system keeps proper track on stocks in order to reduce risk of overselling and to

control unnecessary expenditure. It improves business negotiation for cost savings while making

inventory related decisions. The system helps the company to minimize stock outs and excess

stock in order to simplify inventory control system.

Drawback- The major disadvantage of this method, it is expensive process and show limited

elimination of risk in the business.

Price optimization system- This system of management accounting gives proper

understanding about how much business the company obtain within profitability levels on the

basis of how sensitive their customer are to changes in prices of product. It is mathematical

process that can be used to calculate about the demand of products at different price levels.

Smith brothers management team combine the important data with inventory levels in order to

suggest prices that will increase profits.

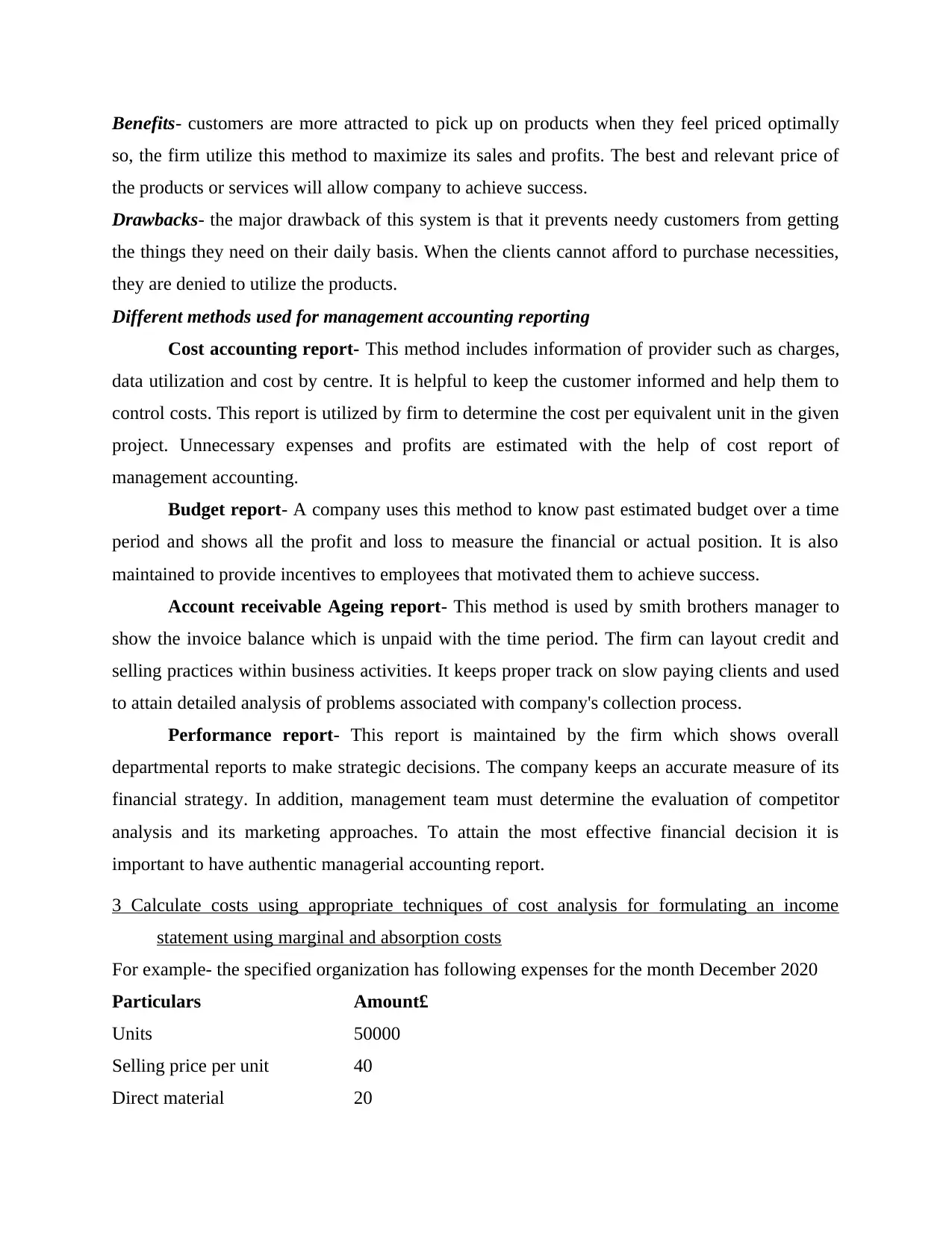

Benefits- customers are more attracted to pick up on products when they feel priced optimally

so, the firm utilize this method to maximize its sales and profits. The best and relevant price of

the products or services will allow company to achieve success.

Drawbacks- the major drawback of this system is that it prevents needy customers from getting

the things they need on their daily basis. When the clients cannot afford to purchase necessities,

they are denied to utilize the products.

Different methods used for management accounting reporting

Cost accounting report- This method includes information of provider such as charges,

data utilization and cost by centre. It is helpful to keep the customer informed and help them to

control costs. This report is utilized by firm to determine the cost per equivalent unit in the given

project. Unnecessary expenses and profits are estimated with the help of cost report of

management accounting.

Budget report- A company uses this method to know past estimated budget over a time

period and shows all the profit and loss to measure the financial or actual position. It is also

maintained to provide incentives to employees that motivated them to achieve success.

Account receivable Ageing report- This method is used by smith brothers manager to

show the invoice balance which is unpaid with the time period. The firm can layout credit and

selling practices within business activities. It keeps proper track on slow paying clients and used

to attain detailed analysis of problems associated with company's collection process.

Performance report- This report is maintained by the firm which shows overall

departmental reports to make strategic decisions. The company keeps an accurate measure of its

financial strategy. In addition, management team must determine the evaluation of competitor

analysis and its marketing approaches. To attain the most effective financial decision it is

important to have authentic managerial accounting report.

3 Calculate costs using appropriate techniques of cost analysis for formulating an income

statement using marginal and absorption costs

For example- the specified organization has following expenses for the month December 2020

Particulars Amount£

Units 50000

Selling price per unit 40

Direct material 20

so, the firm utilize this method to maximize its sales and profits. The best and relevant price of

the products or services will allow company to achieve success.

Drawbacks- the major drawback of this system is that it prevents needy customers from getting

the things they need on their daily basis. When the clients cannot afford to purchase necessities,

they are denied to utilize the products.

Different methods used for management accounting reporting

Cost accounting report- This method includes information of provider such as charges,

data utilization and cost by centre. It is helpful to keep the customer informed and help them to

control costs. This report is utilized by firm to determine the cost per equivalent unit in the given

project. Unnecessary expenses and profits are estimated with the help of cost report of

management accounting.

Budget report- A company uses this method to know past estimated budget over a time

period and shows all the profit and loss to measure the financial or actual position. It is also

maintained to provide incentives to employees that motivated them to achieve success.

Account receivable Ageing report- This method is used by smith brothers manager to

show the invoice balance which is unpaid with the time period. The firm can layout credit and

selling practices within business activities. It keeps proper track on slow paying clients and used

to attain detailed analysis of problems associated with company's collection process.

Performance report- This report is maintained by the firm which shows overall

departmental reports to make strategic decisions. The company keeps an accurate measure of its

financial strategy. In addition, management team must determine the evaluation of competitor

analysis and its marketing approaches. To attain the most effective financial decision it is

important to have authentic managerial accounting report.

3 Calculate costs using appropriate techniques of cost analysis for formulating an income

statement using marginal and absorption costs

For example- the specified organization has following expenses for the month December 2020

Particulars Amount£

Units 50000

Selling price per unit 40

Direct material 20

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Direct labour 10

Variable production overhead 4

Variable selling expenses 5

Fixed manufacturing

Overheads 200000

Fixed admin and distribution

costs 50000.00

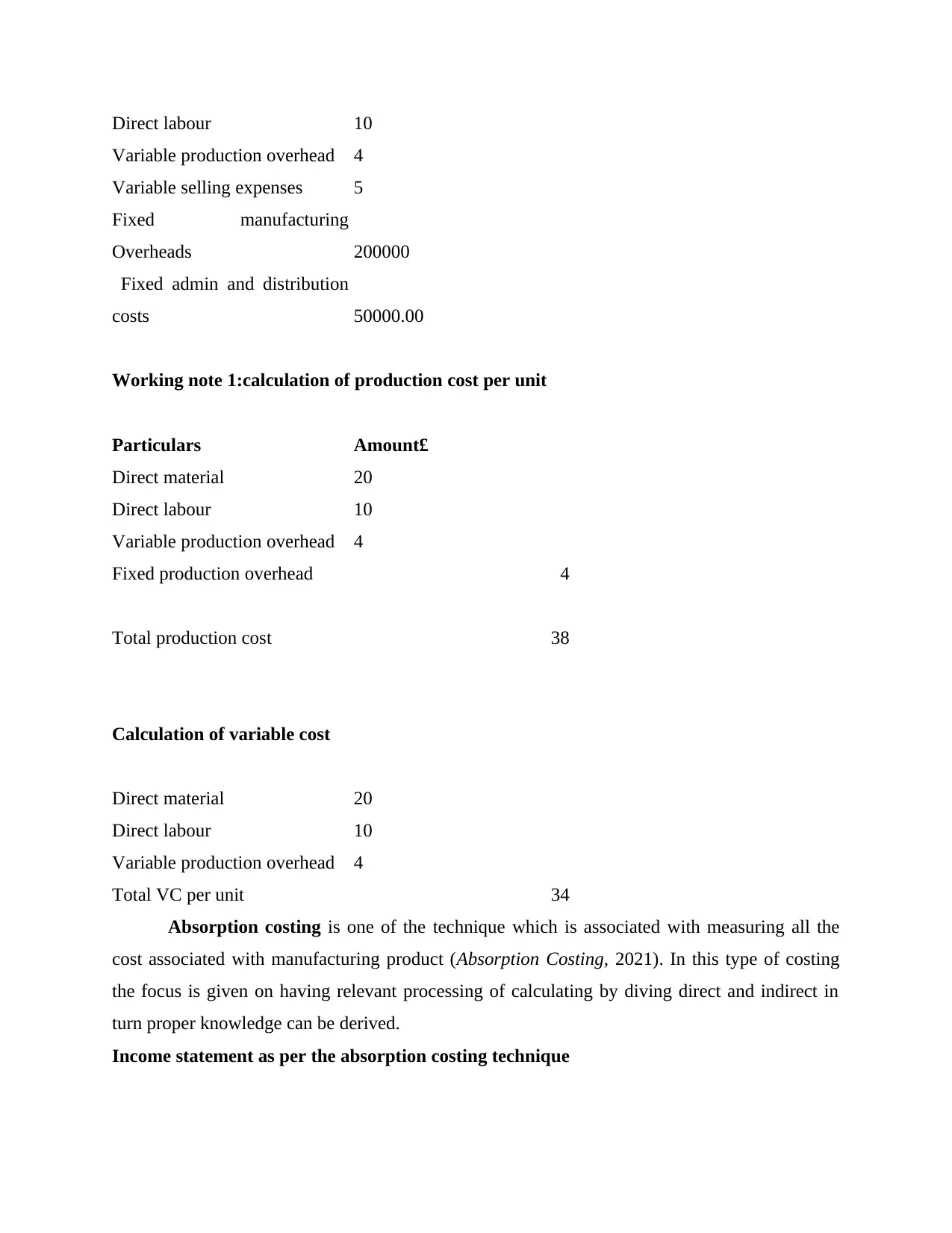

Working note 1:calculation of production cost per unit

Particulars Amount£

Direct material 20

Direct labour 10

Variable production overhead 4

Fixed production overhead 4

Total production cost 38

Calculation of variable cost

Direct material 20

Direct labour 10

Variable production overhead 4

Total VC per unit 34

Absorption costing is one of the technique which is associated with measuring all the

cost associated with manufacturing product (Absorption Costing, 2021). In this type of costing

the focus is given on having relevant processing of calculating by diving direct and indirect in

turn proper knowledge can be derived.

Income statement as per the absorption costing technique

Variable production overhead 4

Variable selling expenses 5

Fixed manufacturing

Overheads 200000

Fixed admin and distribution

costs 50000.00

Working note 1:calculation of production cost per unit

Particulars Amount£

Direct material 20

Direct labour 10

Variable production overhead 4

Fixed production overhead 4

Total production cost 38

Calculation of variable cost

Direct material 20

Direct labour 10

Variable production overhead 4

Total VC per unit 34

Absorption costing is one of the technique which is associated with measuring all the

cost associated with manufacturing product (Absorption Costing, 2021). In this type of costing

the focus is given on having relevant processing of calculating by diving direct and indirect in

turn proper knowledge can be derived.

Income statement as per the absorption costing technique

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

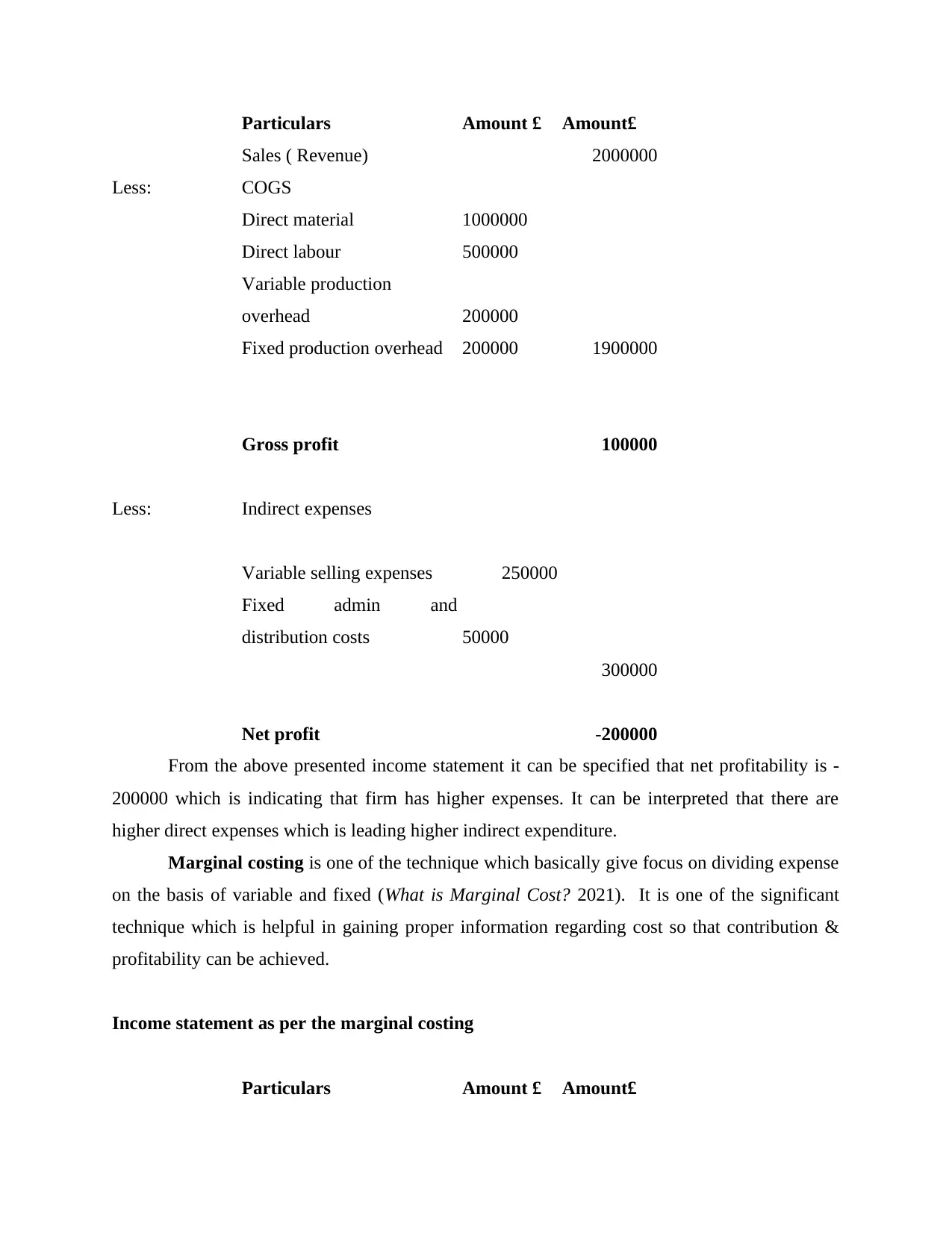

Particulars Amount £ Amount£

Sales ( Revenue) 2000000

Less: COGS

Direct material 1000000

Direct labour 500000

Variable production

overhead 200000

Fixed production overhead 200000 1900000

Gross profit 100000

Less: Indirect expenses

Variable selling expenses 250000

Fixed admin and

distribution costs 50000

300000

Net profit -200000

From the above presented income statement it can be specified that net profitability is -

200000 which is indicating that firm has higher expenses. It can be interpreted that there are

higher direct expenses which is leading higher indirect expenditure.

Marginal costing is one of the technique which basically give focus on dividing expense

on the basis of variable and fixed (What is Marginal Cost? 2021). It is one of the significant

technique which is helpful in gaining proper information regarding cost so that contribution &

profitability can be achieved.

Income statement as per the marginal costing

Particulars Amount £ Amount£

Sales ( Revenue) 2000000

Less: COGS

Direct material 1000000

Direct labour 500000

Variable production

overhead 200000

Fixed production overhead 200000 1900000

Gross profit 100000

Less: Indirect expenses

Variable selling expenses 250000

Fixed admin and

distribution costs 50000

300000

Net profit -200000

From the above presented income statement it can be specified that net profitability is -

200000 which is indicating that firm has higher expenses. It can be interpreted that there are

higher direct expenses which is leading higher indirect expenditure.

Marginal costing is one of the technique which basically give focus on dividing expense

on the basis of variable and fixed (What is Marginal Cost? 2021). It is one of the significant

technique which is helpful in gaining proper information regarding cost so that contribution &

profitability can be achieved.

Income statement as per the marginal costing

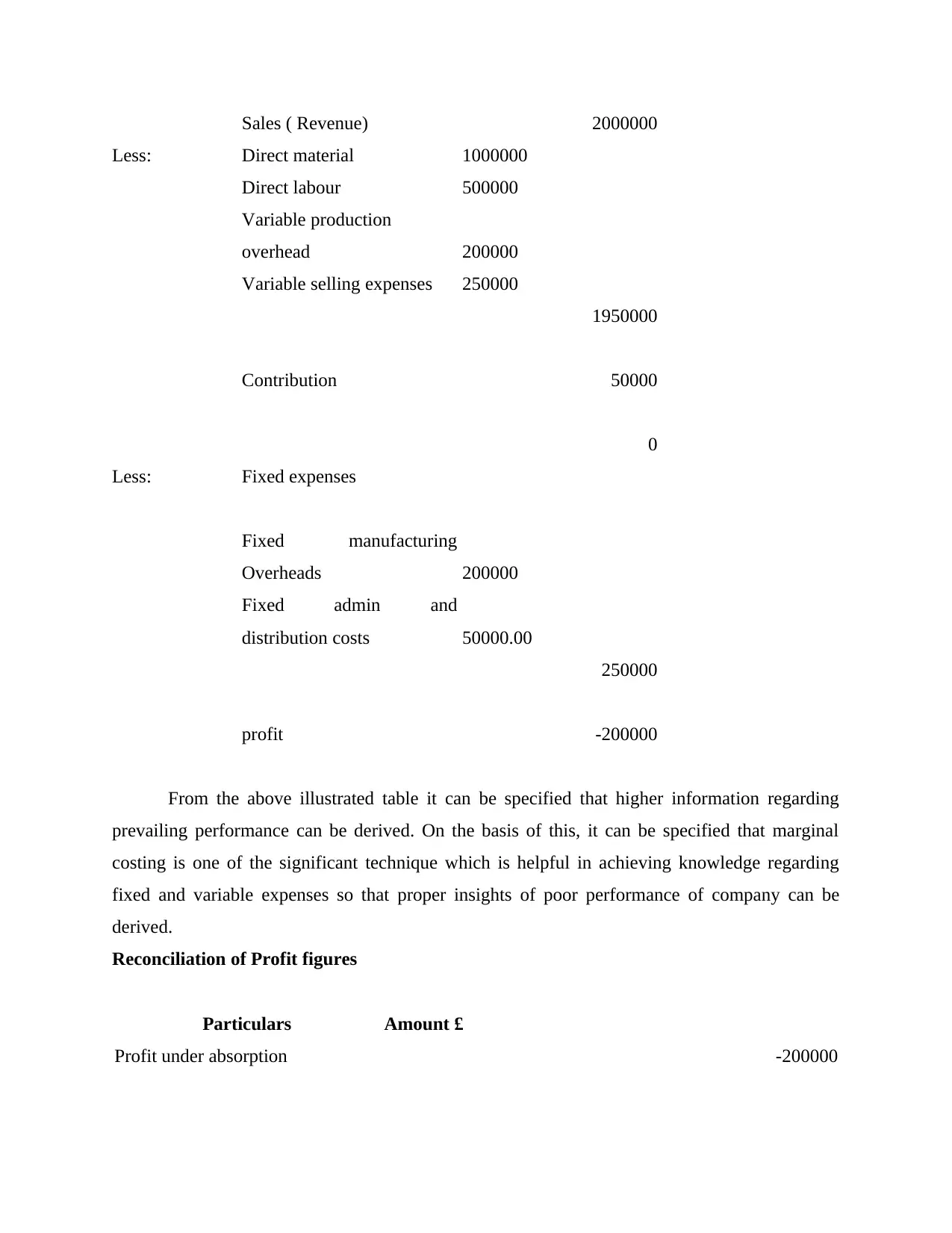

Particulars Amount £ Amount£

Sales ( Revenue) 2000000

Less: Direct material 1000000

Direct labour 500000

Variable production

overhead 200000

Variable selling expenses 250000

1950000

Contribution 50000

0

Less: Fixed expenses

Fixed manufacturing

Overheads 200000

Fixed admin and

distribution costs 50000.00

250000

profit -200000

From the above illustrated table it can be specified that higher information regarding

prevailing performance can be derived. On the basis of this, it can be specified that marginal

costing is one of the significant technique which is helpful in achieving knowledge regarding

fixed and variable expenses so that proper insights of poor performance of company can be

derived.

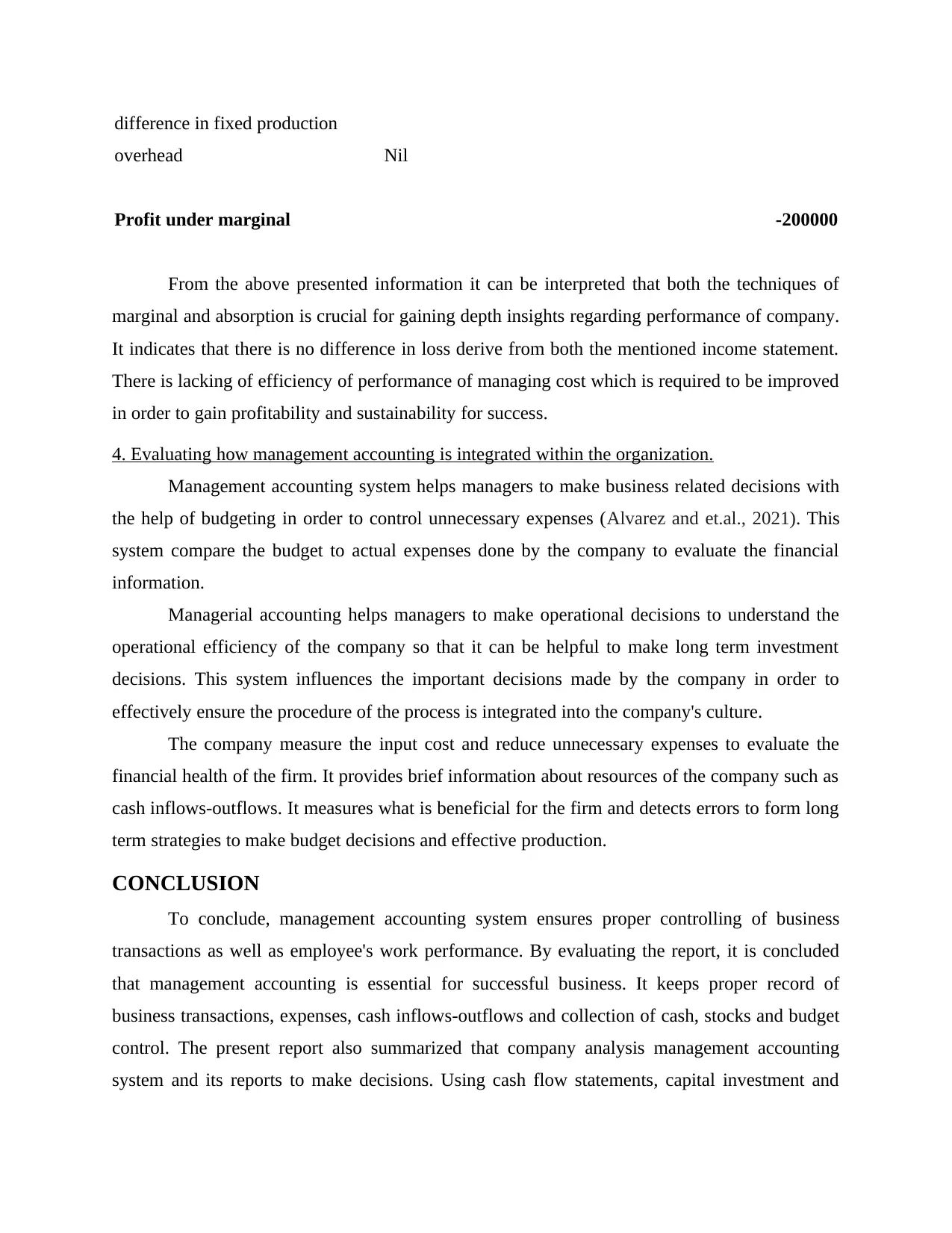

Reconciliation of Profit figures

Particulars Amount £

Profit under absorption -200000

Less: Direct material 1000000

Direct labour 500000

Variable production

overhead 200000

Variable selling expenses 250000

1950000

Contribution 50000

0

Less: Fixed expenses

Fixed manufacturing

Overheads 200000

Fixed admin and

distribution costs 50000.00

250000

profit -200000

From the above illustrated table it can be specified that higher information regarding

prevailing performance can be derived. On the basis of this, it can be specified that marginal

costing is one of the significant technique which is helpful in achieving knowledge regarding

fixed and variable expenses so that proper insights of poor performance of company can be

derived.

Reconciliation of Profit figures

Particulars Amount £

Profit under absorption -200000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

difference in fixed production

overhead Nil

Profit under marginal -200000

From the above presented information it can be interpreted that both the techniques of

marginal and absorption is crucial for gaining depth insights regarding performance of company.

It indicates that there is no difference in loss derive from both the mentioned income statement.

There is lacking of efficiency of performance of managing cost which is required to be improved

in order to gain profitability and sustainability for success.

4. Evaluating how management accounting is integrated within the organization.

Management accounting system helps managers to make business related decisions with

the help of budgeting in order to control unnecessary expenses (Alvarez and et.al., 2021). This

system compare the budget to actual expenses done by the company to evaluate the financial

information.

Managerial accounting helps managers to make operational decisions to understand the

operational efficiency of the company so that it can be helpful to make long term investment

decisions. This system influences the important decisions made by the company in order to

effectively ensure the procedure of the process is integrated into the company's culture.

The company measure the input cost and reduce unnecessary expenses to evaluate the

financial health of the firm. It provides brief information about resources of the company such as

cash inflows-outflows. It measures what is beneficial for the firm and detects errors to form long

term strategies to make budget decisions and effective production.

CONCLUSION

To conclude, management accounting system ensures proper controlling of business

transactions as well as employee's work performance. By evaluating the report, it is concluded

that management accounting is essential for successful business. It keeps proper record of

business transactions, expenses, cash inflows-outflows and collection of cash, stocks and budget

control. The present report also summarized that company analysis management accounting

system and its reports to make decisions. Using cash flow statements, capital investment and

overhead Nil

Profit under marginal -200000

From the above presented information it can be interpreted that both the techniques of

marginal and absorption is crucial for gaining depth insights regarding performance of company.

It indicates that there is no difference in loss derive from both the mentioned income statement.

There is lacking of efficiency of performance of managing cost which is required to be improved

in order to gain profitability and sustainability for success.

4. Evaluating how management accounting is integrated within the organization.

Management accounting system helps managers to make business related decisions with

the help of budgeting in order to control unnecessary expenses (Alvarez and et.al., 2021). This

system compare the budget to actual expenses done by the company to evaluate the financial

information.

Managerial accounting helps managers to make operational decisions to understand the

operational efficiency of the company so that it can be helpful to make long term investment

decisions. This system influences the important decisions made by the company in order to

effectively ensure the procedure of the process is integrated into the company's culture.

The company measure the input cost and reduce unnecessary expenses to evaluate the

financial health of the firm. It provides brief information about resources of the company such as

cash inflows-outflows. It measures what is beneficial for the firm and detects errors to form long

term strategies to make budget decisions and effective production.

CONCLUSION

To conclude, management accounting system ensures proper controlling of business

transactions as well as employee's work performance. By evaluating the report, it is concluded

that management accounting is essential for successful business. It keeps proper record of

business transactions, expenses, cash inflows-outflows and collection of cash, stocks and budget

control. The present report also summarized that company analysis management accounting

system and its reports to make decisions. Using cash flow statements, capital investment and

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

marketing research company can analyse performance of the business. Managers can make short

term and long term strategic decisions with the help of financial reports. At last, the report has

summarized that an effective managerial report provide information regarding market factors,

profitability and team's performance.

PART 2

1.Explaining the use of planning tools used in management accounting

Analysing the financial statement and business transaction is the main tool of

management accounting system. Every company collect data, financial information which

includes cash flow, profit and loss, expenditures and fund flow statements. So, it is important to

keep proper track on budget and use different tools to maintain budgetary control.

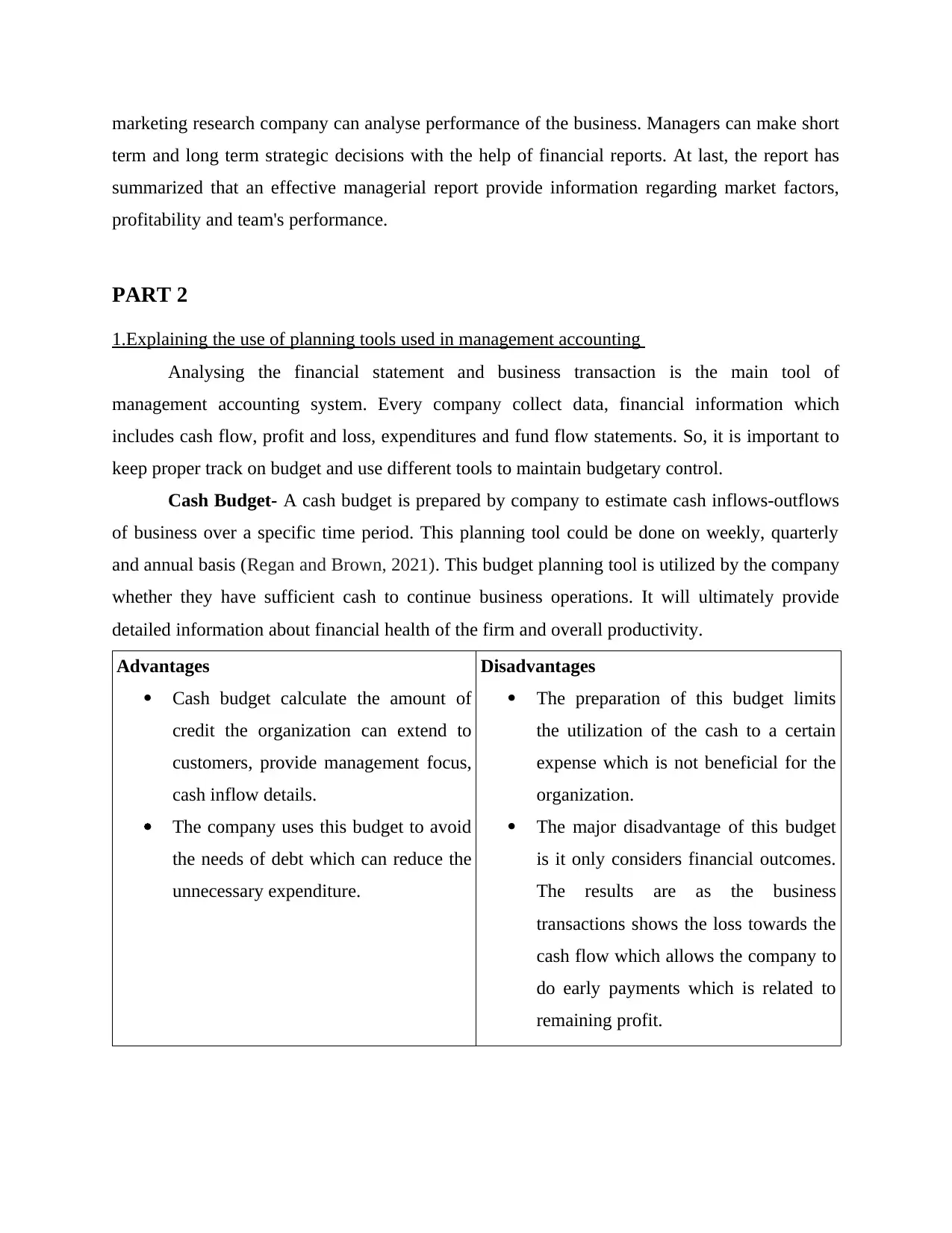

Cash Budget- A cash budget is prepared by company to estimate cash inflows-outflows

of business over a specific time period. This planning tool could be done on weekly, quarterly

and annual basis (Regan and Brown, 2021). This budget planning tool is utilized by the company

whether they have sufficient cash to continue business operations. It will ultimately provide

detailed information about financial health of the firm and overall productivity.

Advantages

Cash budget calculate the amount of

credit the organization can extend to

customers, provide management focus,

cash inflow details.

The company uses this budget to avoid

the needs of debt which can reduce the

unnecessary expenditure.

Disadvantages

The preparation of this budget limits

the utilization of the cash to a certain

expense which is not beneficial for the

organization.

The major disadvantage of this budget

is it only considers financial outcomes.

The results are as the business

transactions shows the loss towards the

cash flow which allows the company to

do early payments which is related to

remaining profit.

term and long term strategic decisions with the help of financial reports. At last, the report has

summarized that an effective managerial report provide information regarding market factors,

profitability and team's performance.

PART 2

1.Explaining the use of planning tools used in management accounting

Analysing the financial statement and business transaction is the main tool of

management accounting system. Every company collect data, financial information which

includes cash flow, profit and loss, expenditures and fund flow statements. So, it is important to

keep proper track on budget and use different tools to maintain budgetary control.

Cash Budget- A cash budget is prepared by company to estimate cash inflows-outflows

of business over a specific time period. This planning tool could be done on weekly, quarterly

and annual basis (Regan and Brown, 2021). This budget planning tool is utilized by the company

whether they have sufficient cash to continue business operations. It will ultimately provide

detailed information about financial health of the firm and overall productivity.

Advantages

Cash budget calculate the amount of

credit the organization can extend to

customers, provide management focus,

cash inflow details.

The company uses this budget to avoid

the needs of debt which can reduce the

unnecessary expenditure.

Disadvantages

The preparation of this budget limits

the utilization of the cash to a certain

expense which is not beneficial for the

organization.

The major disadvantage of this budget

is it only considers financial outcomes.

The results are as the business

transactions shows the loss towards the

cash flow which allows the company to

do early payments which is related to

remaining profit.

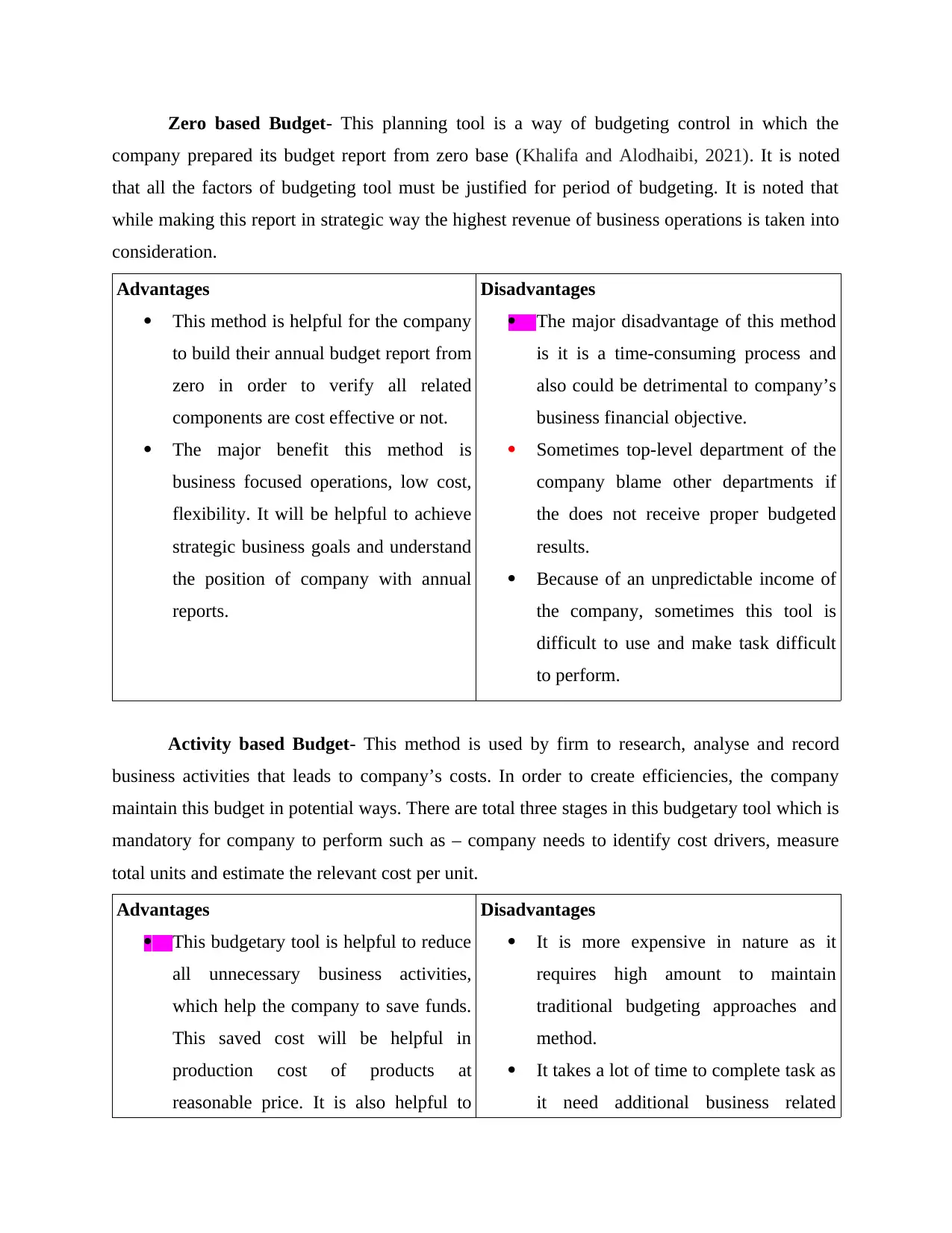

Zero based Budget- This planning tool is a way of budgeting control in which the

company prepared its budget report from zero base (Khalifa and Alodhaibi, 2021). It is noted

that all the factors of budgeting tool must be justified for period of budgeting. It is noted that

while making this report in strategic way the highest revenue of business operations is taken into

consideration.

Advantages

This method is helpful for the company

to build their annual budget report from

zero in order to verify all related

components are cost effective or not.

The major benefit this method is

business focused operations, low cost,

flexibility. It will be helpful to achieve

strategic business goals and understand

the position of company with annual

reports.

Disadvantages

The major disadvantage of this method

is it is a time-consuming process and

also could be detrimental to company’s

business financial objective.

Sometimes top-level department of the

company blame other departments if

the does not receive proper budgeted

results.

Because of an unpredictable income of

the company, sometimes this tool is

difficult to use and make task difficult

to perform.

Activity based Budget- This method is used by firm to research, analyse and record

business activities that leads to company’s costs. In order to create efficiencies, the company

maintain this budget in potential ways. There are total three stages in this budgetary tool which is

mandatory for company to perform such as – company needs to identify cost drivers, measure

total units and estimate the relevant cost per unit.

Advantages

This budgetary tool is helpful to reduce

all unnecessary business activities,

which help the company to save funds.

This saved cost will be helpful in

production cost of products at

reasonable price. It is also helpful to

Disadvantages

It is more expensive in nature as it

requires high amount to maintain

traditional budgeting approaches and

method.

It takes a lot of time to complete task as

it need additional business related

company prepared its budget report from zero base (Khalifa and Alodhaibi, 2021). It is noted

that all the factors of budgeting tool must be justified for period of budgeting. It is noted that

while making this report in strategic way the highest revenue of business operations is taken into

consideration.

Advantages

This method is helpful for the company

to build their annual budget report from

zero in order to verify all related

components are cost effective or not.

The major benefit this method is

business focused operations, low cost,

flexibility. It will be helpful to achieve

strategic business goals and understand

the position of company with annual

reports.

Disadvantages

The major disadvantage of this method

is it is a time-consuming process and

also could be detrimental to company’s

business financial objective.

Sometimes top-level department of the

company blame other departments if

the does not receive proper budgeted

results.

Because of an unpredictable income of

the company, sometimes this tool is

difficult to use and make task difficult

to perform.

Activity based Budget- This method is used by firm to research, analyse and record

business activities that leads to company’s costs. In order to create efficiencies, the company

maintain this budget in potential ways. There are total three stages in this budgetary tool which is

mandatory for company to perform such as – company needs to identify cost drivers, measure

total units and estimate the relevant cost per unit.

Advantages

This budgetary tool is helpful to reduce

all unnecessary business activities,

which help the company to save funds.

This saved cost will be helpful in

production cost of products at

reasonable price. It is also helpful to

Disadvantages

It is more expensive in nature as it

requires high amount to maintain

traditional budgeting approaches and

method.

It takes a lot of time to complete task as

it need additional business related

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.