Management Accounting: Principles, Techniques, Integration & Benefits

VerifiedAdded on 2023/06/08

|15

|4515

|257

Report

AI Summary

This report provides a comprehensive overview of management accounting principles and techniques, focusing on their application in solving financial management problems within organizations. It begins by outlining the core principles of management accounting, including designing and compiling information, management by exception, cost control at source, overhead absorption, and resource utilization. The report then details the role of management accounting and its systems in facilitating forecasting, budgeting, and asset protection. It also explores the use of variable and absorption costing techniques, presenting calculations for an income statement using variable costing. The integration of management accounting within an organization is discussed, emphasizing the importance of a structured approach and the combination of different management accounting methods. Finally, the report highlights the benefits of management accounting, such as improved inventory management and cost bookkeeping, and concludes by underscoring its critical role in enhancing organizational value and decision-making.

Unit 5-Management

Accounting

Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

PART 1............................................................................................................................................3

1. Management Accounting Principles...................................................................................3

2. Role of management accounting and its systems...........................................................4

3. Use of techniques and methods in management accounting by presenting calculations

for an income statement using variable costings...............................................................5

4. Integration of management accounting within the organisation.................................8

5. The benefits of function to the organisation.............................................................9

6. Conclusions.......................................................................................................................9

PART 2..........................................................................................................................................10

Comparison between management accounting tools...........................................................10

Application of management accounting for solving financial problems..............................13

Recommendations for sustainable business.........................................................................13

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

INTRODUCTION...........................................................................................................................3

PART 1............................................................................................................................................3

1. Management Accounting Principles...................................................................................3

2. Role of management accounting and its systems...........................................................4

3. Use of techniques and methods in management accounting by presenting calculations

for an income statement using variable costings...............................................................5

4. Integration of management accounting within the organisation.................................8

5. The benefits of function to the organisation.............................................................9

6. Conclusions.......................................................................................................................9

PART 2..........................................................................................................................................10

Comparison between management accounting tools...........................................................10

Application of management accounting for solving financial problems..............................13

Recommendations for sustainable business.........................................................................13

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

INTRODUCTION

Management accounting may be seen as a practical tool aimed at solving the day to day

financial management problems faced by decision makers in the private and public sectors. In

today's competitive world, managers from different managerial backgrounds need an

understanding of the tools of management accounting when making financial decisions, they

must also be aware of the qualitative issues affecting such decisions. This report has been

divided in two parts. The first one is “management accounting principles” and the second one is

“effective planning tools for managing accounts”. In the first part the principles and role of

management accounting and its systems are briefly explained using the techniques of absorption

and marginal costing. Further, this part is summed up by describing its integration and benefits in

the business. While in the second part, multiple management tools and techniques are used while

providing the comparison and contrast between them. Moreover, the financial problems faced by

the organization are discussed thoroughly (Alawattage and Wickramasinghe, 2021).

PART 1

1.Management Accounting Principles

Management accounting is accounting (i.e. producing useful information) for

management. In this sense, 'accounting' includes the production of all information useful in

running the organisation. Such information may be financial or non-financial, actual or

estimated, based in the past or the future, related to profits/losses, costs/incomes, volumes,

trends, etc. Similarly, 'management' may include the activities of individuals in a number of

positions, for example senior managers, mid-level and lower level managers, executive directors

with management responsibilities. Management accounting is orientated towards the future. It is

primarily concerned with the provision of information to managers to help them plan, evaluate

and control activities- Proctor. It encompasses techniques and processes that are intended to

provide financial and non-financial information to people within an organisation to make better

decisions and thereby achieve organisational control and enhance organisational effectiveness-

Wilson and Wai.

Principles of Management Accounting

Management accounting may be seen as a practical tool aimed at solving the day to day

financial management problems faced by decision makers in the private and public sectors. In

today's competitive world, managers from different managerial backgrounds need an

understanding of the tools of management accounting when making financial decisions, they

must also be aware of the qualitative issues affecting such decisions. This report has been

divided in two parts. The first one is “management accounting principles” and the second one is

“effective planning tools for managing accounts”. In the first part the principles and role of

management accounting and its systems are briefly explained using the techniques of absorption

and marginal costing. Further, this part is summed up by describing its integration and benefits in

the business. While in the second part, multiple management tools and techniques are used while

providing the comparison and contrast between them. Moreover, the financial problems faced by

the organization are discussed thoroughly (Alawattage and Wickramasinghe, 2021).

PART 1

1.Management Accounting Principles

Management accounting is accounting (i.e. producing useful information) for

management. In this sense, 'accounting' includes the production of all information useful in

running the organisation. Such information may be financial or non-financial, actual or

estimated, based in the past or the future, related to profits/losses, costs/incomes, volumes,

trends, etc. Similarly, 'management' may include the activities of individuals in a number of

positions, for example senior managers, mid-level and lower level managers, executive directors

with management responsibilities. Management accounting is orientated towards the future. It is

primarily concerned with the provision of information to managers to help them plan, evaluate

and control activities- Proctor. It encompasses techniques and processes that are intended to

provide financial and non-financial information to people within an organisation to make better

decisions and thereby achieve organisational control and enhance organisational effectiveness-

Wilson and Wai.

Principles of Management Accounting

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

The following are the generally accepted principles of management accounting:

Designing and Compiling: Accounting information, records, reports and other evidence

of past, present or future results should be compiled and designed to meet the

requirements of the business or the specific problem, if any. The management accounting

system is designed in such a manner which presents the relevant data for solving a

particular problem.

Management by Exception: It is followed when presenting information to management. It

means that standard costing techniques and budgetary control system are followed in the

management accounting system. The actual performance is compared with pre-

determined one and the deviations are calculated. The unfavourable deviations are

informed precisely to management.

Control at Source Accounting: This principle says “Costs are controlled at the points at

which they are incurred”. The details of material issues and utilization and usage of

services such as machine, power, repairs and maintenance, etc. are prepared in the form

of quantitative and qualitative information. Control can be exercised over materials,

employees and service providing devices in this way.

Absorption of Overhead Costs: The overhead costs are the combination of indirect

materials, indirect labour and indirect expenses. They are absorbed on any predetermined

basis. The selected method for absorption should bring about the desired results in the

most equitable manner.

Utilisation of Resources: Available resources should be used effectively. Some resources

are available in plenty and some are available in scarcity throughout the year. Hence the

management system should ensure the proper utilisation of available resources.

2. Role of management accounting and its systems

Management accounting and management accountants may be in a position to have a

significant influence upon the actions and strategies of organisations. With this potential

influence comes the burden of ensuring that management accounting information is generated

and communicated in a responsible fashion. The management accountant's role is a responsible

one which can have direct effects on people both within and outside of the organisation. The

management accountant, as the provider of performance monitoring information, acts as an

Designing and Compiling: Accounting information, records, reports and other evidence

of past, present or future results should be compiled and designed to meet the

requirements of the business or the specific problem, if any. The management accounting

system is designed in such a manner which presents the relevant data for solving a

particular problem.

Management by Exception: It is followed when presenting information to management. It

means that standard costing techniques and budgetary control system are followed in the

management accounting system. The actual performance is compared with pre-

determined one and the deviations are calculated. The unfavourable deviations are

informed precisely to management.

Control at Source Accounting: This principle says “Costs are controlled at the points at

which they are incurred”. The details of material issues and utilization and usage of

services such as machine, power, repairs and maintenance, etc. are prepared in the form

of quantitative and qualitative information. Control can be exercised over materials,

employees and service providing devices in this way.

Absorption of Overhead Costs: The overhead costs are the combination of indirect

materials, indirect labour and indirect expenses. They are absorbed on any predetermined

basis. The selected method for absorption should bring about the desired results in the

most equitable manner.

Utilisation of Resources: Available resources should be used effectively. Some resources

are available in plenty and some are available in scarcity throughout the year. Hence the

management system should ensure the proper utilisation of available resources.

2. Role of management accounting and its systems

Management accounting and management accountants may be in a position to have a

significant influence upon the actions and strategies of organisations. With this potential

influence comes the burden of ensuring that management accounting information is generated

and communicated in a responsible fashion. The management accountant's role is a responsible

one which can have direct effects on people both within and outside of the organisation. The

management accountant, as the provider of performance monitoring information, acts as an

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

important and influential link in the chain between management and employees, and between

shareholders and management. (Dalla Via and Van Rinsum, 2019)

The role of management accounting includes:

Establishing, coordinating and administering plans to facilitate the forecasting of sales,

expense budgets and cost standards that will permit profit planning, capital budgeting and

financing.

Formulating accounting policy and procedures. Comparisons made between actual and

expected activities should help the management in proper fixation of responsibility and

also in the evaluation of the various functional and divisional heads.

Responsibility for the protection of the business assets to the extent possible by external

controls, internal auditing and insurance coverage.

Responsibility for tax policies and procedures, supervising and coordinating the reports

required by various authorities.

Continuously being aware of economic and social forces as well as the effect of

governmental policies and actions on business activities.

An effective management accounting system reaches into all departments of a business:

marketing, human resources, finance, operations and sales. To provide critical information to be

used in operational business decision making, internal management accounting systems are used.

These systems can be used by a manufacturing company to help in the costing and managing of

their process. A hospital might use these systems to assist them in insurance billing and other in-

house requirements. These systems vary within the industry they are used in and allow for

functionalities and report specific to that industry.

3. Use of techniques and methods in management accounting by presenting calculations for

an income statement using variable costings

The expenditure required to create and sell products and services or to acquire the assets

is called cost. When sold or consume, it is charged to expense. For analysis purposes, cost may

be designated as a variable cost which varies with the level of activity. A cost can instead be said

as a fixed cost which does not vary with the changes in the level of activity.

shareholders and management. (Dalla Via and Van Rinsum, 2019)

The role of management accounting includes:

Establishing, coordinating and administering plans to facilitate the forecasting of sales,

expense budgets and cost standards that will permit profit planning, capital budgeting and

financing.

Formulating accounting policy and procedures. Comparisons made between actual and

expected activities should help the management in proper fixation of responsibility and

also in the evaluation of the various functional and divisional heads.

Responsibility for the protection of the business assets to the extent possible by external

controls, internal auditing and insurance coverage.

Responsibility for tax policies and procedures, supervising and coordinating the reports

required by various authorities.

Continuously being aware of economic and social forces as well as the effect of

governmental policies and actions on business activities.

An effective management accounting system reaches into all departments of a business:

marketing, human resources, finance, operations and sales. To provide critical information to be

used in operational business decision making, internal management accounting systems are used.

These systems can be used by a manufacturing company to help in the costing and managing of

their process. A hospital might use these systems to assist them in insurance billing and other in-

house requirements. These systems vary within the industry they are used in and allow for

functionalities and report specific to that industry.

3. Use of techniques and methods in management accounting by presenting calculations for

an income statement using variable costings

The expenditure required to create and sell products and services or to acquire the assets

is called cost. When sold or consume, it is charged to expense. For analysis purposes, cost may

be designated as a variable cost which varies with the level of activity. A cost can instead be said

as a fixed cost which does not vary with the changes in the level of activity.

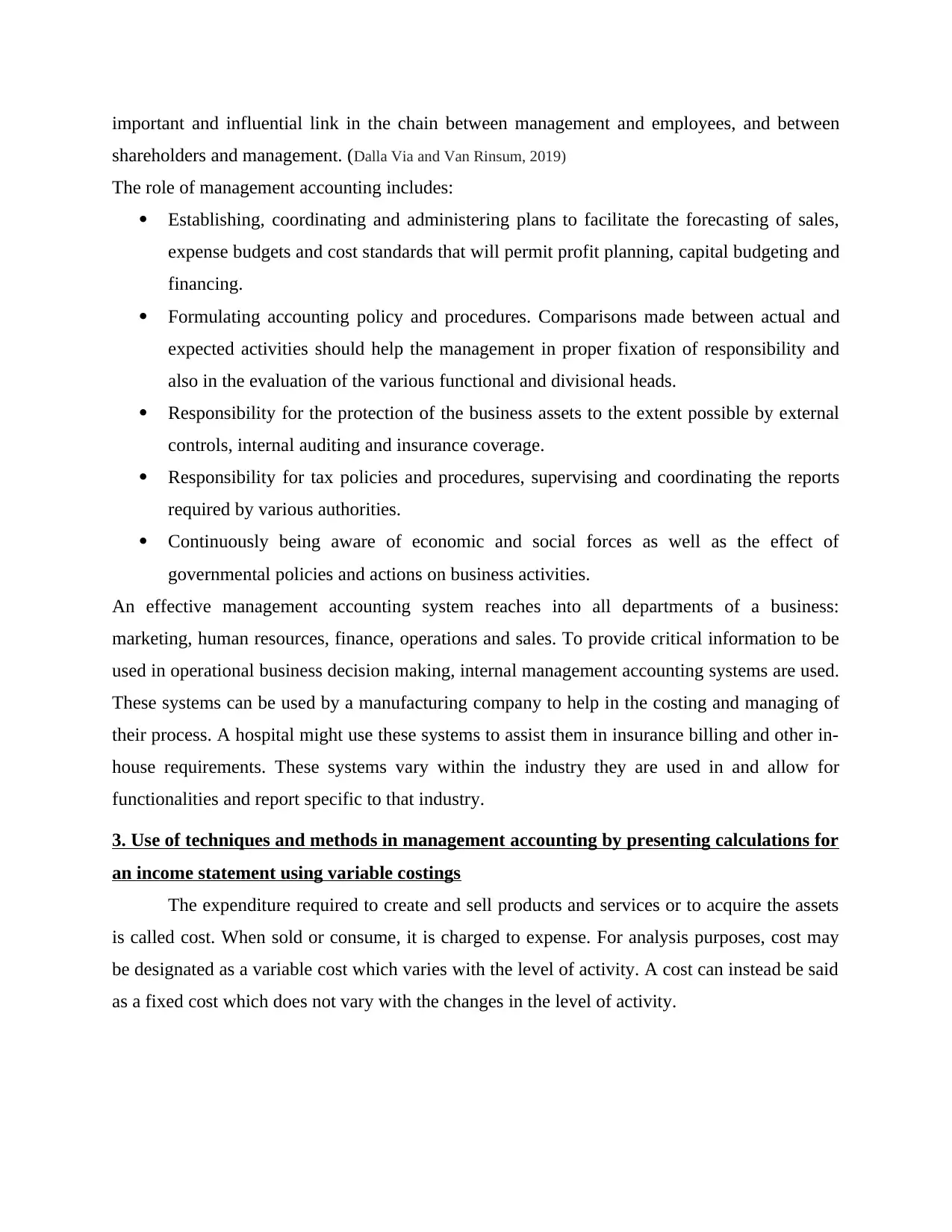

Marginal Costing: It refers to the ascertainment of marginal costs by differentiating between

fixed costs and variable costs and the effect on profit of the changes in volume or type of output.

In this case, only the variable costs are charged to products or operations while fixed costs are

charged to profit and loss account of the period in which they arise.

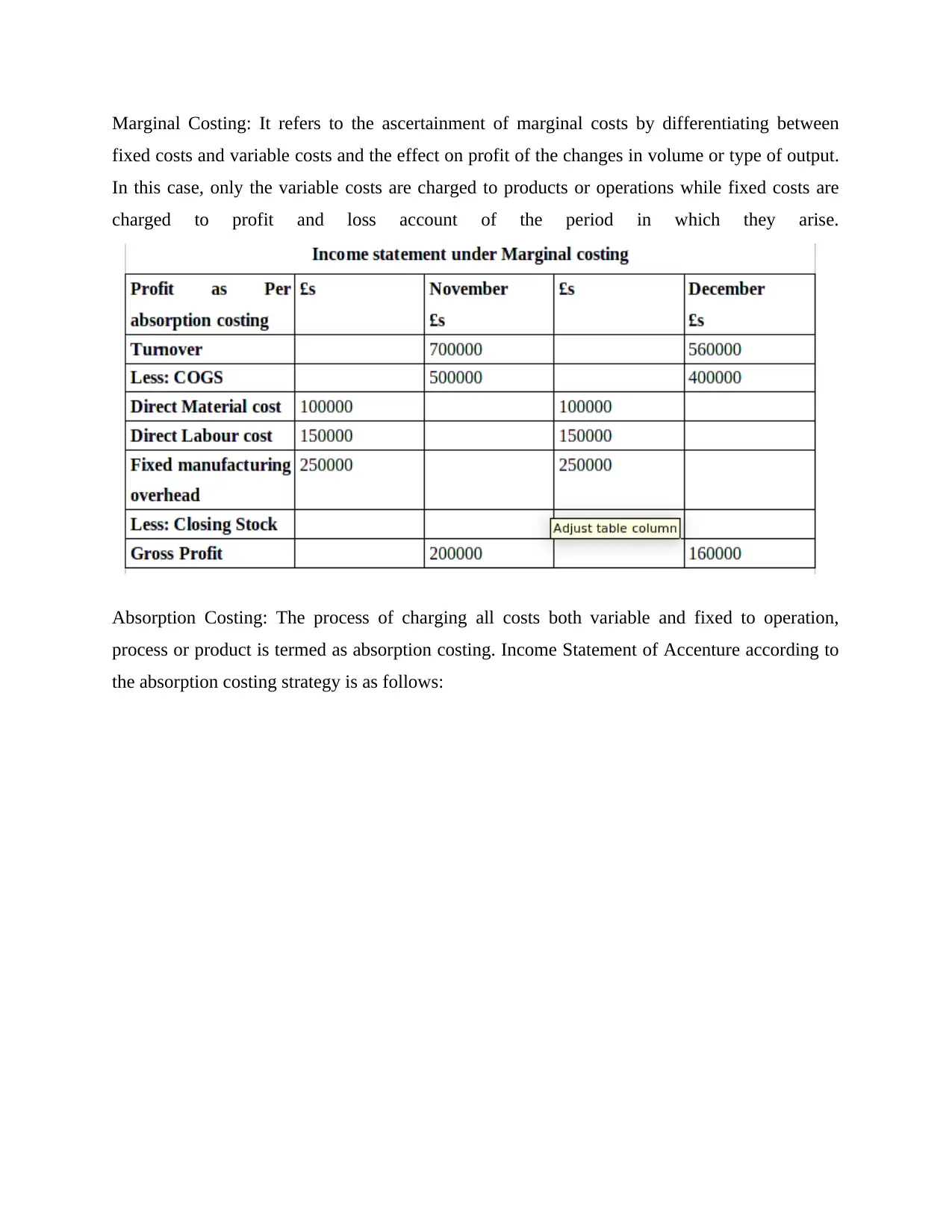

Absorption Costing: The process of charging all costs both variable and fixed to operation,

process or product is termed as absorption costing. Income Statement of Accenture according to

the absorption costing strategy is as follows:

fixed costs and variable costs and the effect on profit of the changes in volume or type of output.

In this case, only the variable costs are charged to products or operations while fixed costs are

charged to profit and loss account of the period in which they arise.

Absorption Costing: The process of charging all costs both variable and fixed to operation,

process or product is termed as absorption costing. Income Statement of Accenture according to

the absorption costing strategy is as follows:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

The reports formulated above are legitimate and true to the management's best knowledge, due to

the fact that various organisational decisions could be dependent on them. The above data

included in the reports, are examined by authorised personnels in Accenture. The concept of

variable costing concentrates on exclusion of fixed manufacturing overheads to calculate profit

earned. The fixed cost is usually included in cost of production, and is used in Absorption

costing, in which fixed overheads are allocated to products. Even though variable costing can

provide relevant information, however it cannot be used for the purpose of financial reporting as

per the accounting frameworks such as IFRS or GAAP. Following are the merits of variable

costing and how it helps management in accounting:

Planning and controlling – The variable costing income statements are better for internal

usage for short term planning and controlling tasks. To carry out the functions, managers

must understand and project how various costs of different nature, will change in

response to change in level of activities.

Product pricing decisions – The management addresses the orders related to product or

services, when variable costing suggests so, if abnormal and contingent conditions exist.

Variable costing defines the minimum sales price under aforesaid conditions and

the fact that various organisational decisions could be dependent on them. The above data

included in the reports, are examined by authorised personnels in Accenture. The concept of

variable costing concentrates on exclusion of fixed manufacturing overheads to calculate profit

earned. The fixed cost is usually included in cost of production, and is used in Absorption

costing, in which fixed overheads are allocated to products. Even though variable costing can

provide relevant information, however it cannot be used for the purpose of financial reporting as

per the accounting frameworks such as IFRS or GAAP. Following are the merits of variable

costing and how it helps management in accounting:

Planning and controlling – The variable costing income statements are better for internal

usage for short term planning and controlling tasks. To carry out the functions, managers

must understand and project how various costs of different nature, will change in

response to change in level of activities.

Product pricing decisions – The management addresses the orders related to product or

services, when variable costing suggests so, if abnormal and contingent conditions exist.

Variable costing defines the minimum sales price under aforesaid conditions and

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

provides important information in context to the contribution margin and most profitable

policies of pricing.

No effect of inventory changes – In variable costing, the profit is defined as a function of

sales only, hence will remain unaffected by the changes in inventory, whether closing or

opening.

Segmental reporting – The segmented reports which are drafted on the basis of variable

costing is more preferable as it results in accurate analysation of profitability related to

plants, products, activities, territories and other segments. It elementally concentrates on

the contribution that individual segments make in the course of business.

4. Integration of management accounting within the organisation

Today's managers cannot ignore the role of management accountants since competition is

increasingly causing the demand for quality products and services. According to a study, for all

industries, the managers prioritized the following factors: “customer's satisfaction, quality of

product or services, running and controlling of management operation, and company

profitability”. To achieve these, managers felt that they needed a strong form of management

system and management accounting was considered as the main tool towards guiding them to the

realisation of the stated goals. Through many studies it was clear that management accounting

was more valuable and relevant to manufacturing industries as they constantly have to monitor

their production costs, manage their pricing, budget their capital for present maximisation and

future sustainability, and effective decision making. Since organisation can be different based on

their operations and activities, management accountants should be engaged through a structured

approach that identifies the critical operational aspects of each unit or department. There are

numerous management accounting processes like Activity Based Costing (ABC),

Grenzplankosterechnung (GPK), lean accounting, resource consumption accounting (RCA),

among others. ABC, GPK and RCA are the most popular as they are applicable in numerous

organisations. One of the most guaranteed approaches of ensuring the management accounting

information on cost accounting is highly effective is combining different management

accounting methods in the analysis of processes and development of guiding data. In this regard,

the possibility of integrating all these processes has to continuously be used to ensure the culture

of management accounting is also accurate and detailed. In the long term the organisations'

performance improves, leads to competitive advantage and also the management has a support

policies of pricing.

No effect of inventory changes – In variable costing, the profit is defined as a function of

sales only, hence will remain unaffected by the changes in inventory, whether closing or

opening.

Segmental reporting – The segmented reports which are drafted on the basis of variable

costing is more preferable as it results in accurate analysation of profitability related to

plants, products, activities, territories and other segments. It elementally concentrates on

the contribution that individual segments make in the course of business.

4. Integration of management accounting within the organisation

Today's managers cannot ignore the role of management accountants since competition is

increasingly causing the demand for quality products and services. According to a study, for all

industries, the managers prioritized the following factors: “customer's satisfaction, quality of

product or services, running and controlling of management operation, and company

profitability”. To achieve these, managers felt that they needed a strong form of management

system and management accounting was considered as the main tool towards guiding them to the

realisation of the stated goals. Through many studies it was clear that management accounting

was more valuable and relevant to manufacturing industries as they constantly have to monitor

their production costs, manage their pricing, budget their capital for present maximisation and

future sustainability, and effective decision making. Since organisation can be different based on

their operations and activities, management accountants should be engaged through a structured

approach that identifies the critical operational aspects of each unit or department. There are

numerous management accounting processes like Activity Based Costing (ABC),

Grenzplankosterechnung (GPK), lean accounting, resource consumption accounting (RCA),

among others. ABC, GPK and RCA are the most popular as they are applicable in numerous

organisations. One of the most guaranteed approaches of ensuring the management accounting

information on cost accounting is highly effective is combining different management

accounting methods in the analysis of processes and development of guiding data. In this regard,

the possibility of integrating all these processes has to continuously be used to ensure the culture

of management accounting is also accurate and detailed. In the long term the organisations'

performance improves, leads to competitive advantage and also the management has a support

system that is effective to its needs. One of the strongest technique applied when seeking to

create a culture in an organisation is rewarding the culture. This causes the habit or approach to

performance is sustained or even improved further. The successful application of management

accounting can be noted in various ways including: the maximisation of organisational resources,

continued control of costs amid the growing organisational profits and better staff and customer

satisfaction (Hui, 2019).

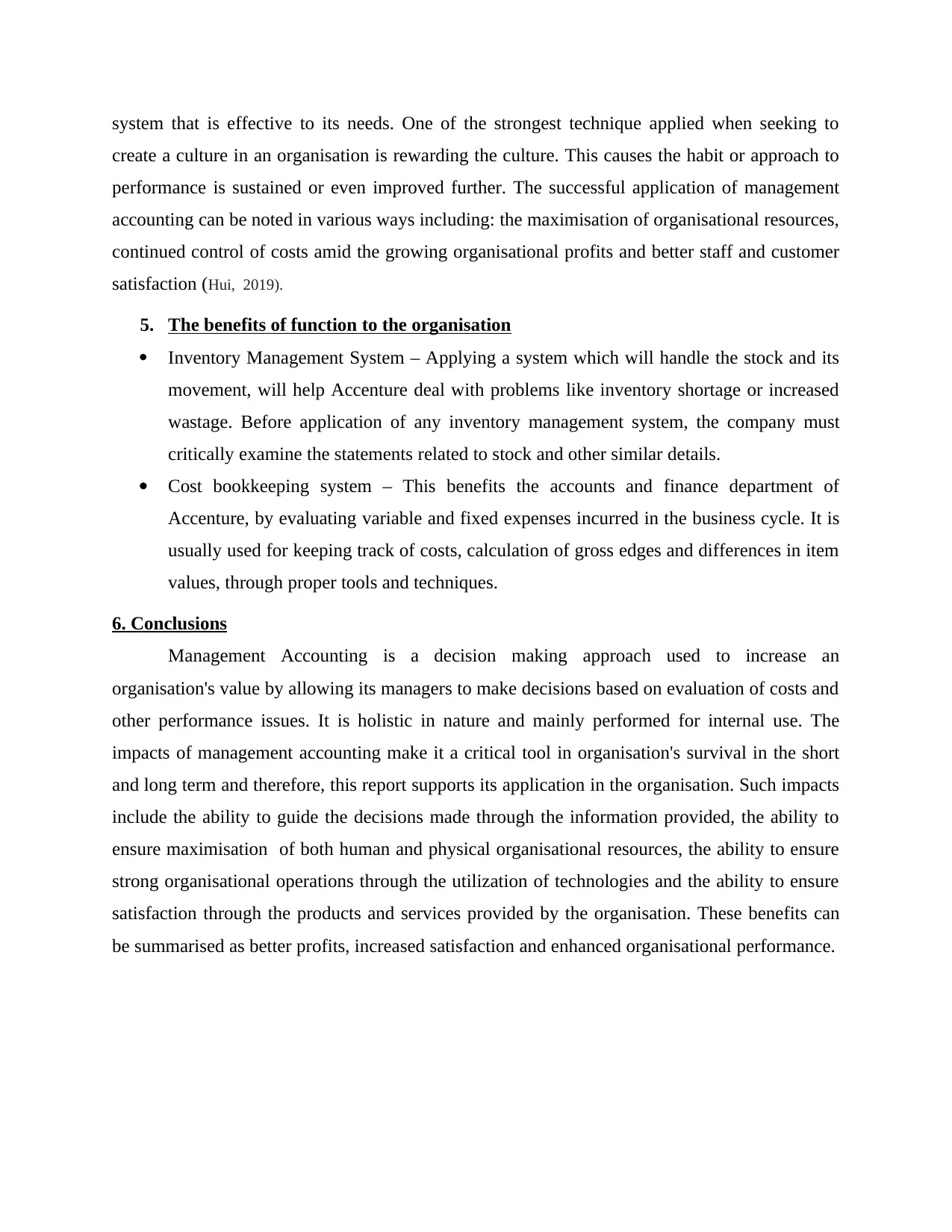

5. The benefits of function to the organisation

Inventory Management System – Applying a system which will handle the stock and its

movement, will help Accenture deal with problems like inventory shortage or increased

wastage. Before application of any inventory management system, the company must

critically examine the statements related to stock and other similar details.

Cost bookkeeping system – This benefits the accounts and finance department of

Accenture, by evaluating variable and fixed expenses incurred in the business cycle. It is

usually used for keeping track of costs, calculation of gross edges and differences in item

values, through proper tools and techniques.

6. Conclusions

Management Accounting is a decision making approach used to increase an

organisation's value by allowing its managers to make decisions based on evaluation of costs and

other performance issues. It is holistic in nature and mainly performed for internal use. The

impacts of management accounting make it a critical tool in organisation's survival in the short

and long term and therefore, this report supports its application in the organisation. Such impacts

include the ability to guide the decisions made through the information provided, the ability to

ensure maximisation of both human and physical organisational resources, the ability to ensure

strong organisational operations through the utilization of technologies and the ability to ensure

satisfaction through the products and services provided by the organisation. These benefits can

be summarised as better profits, increased satisfaction and enhanced organisational performance.

create a culture in an organisation is rewarding the culture. This causes the habit or approach to

performance is sustained or even improved further. The successful application of management

accounting can be noted in various ways including: the maximisation of organisational resources,

continued control of costs amid the growing organisational profits and better staff and customer

satisfaction (Hui, 2019).

5. The benefits of function to the organisation

Inventory Management System – Applying a system which will handle the stock and its

movement, will help Accenture deal with problems like inventory shortage or increased

wastage. Before application of any inventory management system, the company must

critically examine the statements related to stock and other similar details.

Cost bookkeeping system – This benefits the accounts and finance department of

Accenture, by evaluating variable and fixed expenses incurred in the business cycle. It is

usually used for keeping track of costs, calculation of gross edges and differences in item

values, through proper tools and techniques.

6. Conclusions

Management Accounting is a decision making approach used to increase an

organisation's value by allowing its managers to make decisions based on evaluation of costs and

other performance issues. It is holistic in nature and mainly performed for internal use. The

impacts of management accounting make it a critical tool in organisation's survival in the short

and long term and therefore, this report supports its application in the organisation. Such impacts

include the ability to guide the decisions made through the information provided, the ability to

ensure maximisation of both human and physical organisational resources, the ability to ensure

strong organisational operations through the utilization of technologies and the ability to ensure

satisfaction through the products and services provided by the organisation. These benefits can

be summarised as better profits, increased satisfaction and enhanced organisational performance.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

PART 2

Comparison between management accounting tools

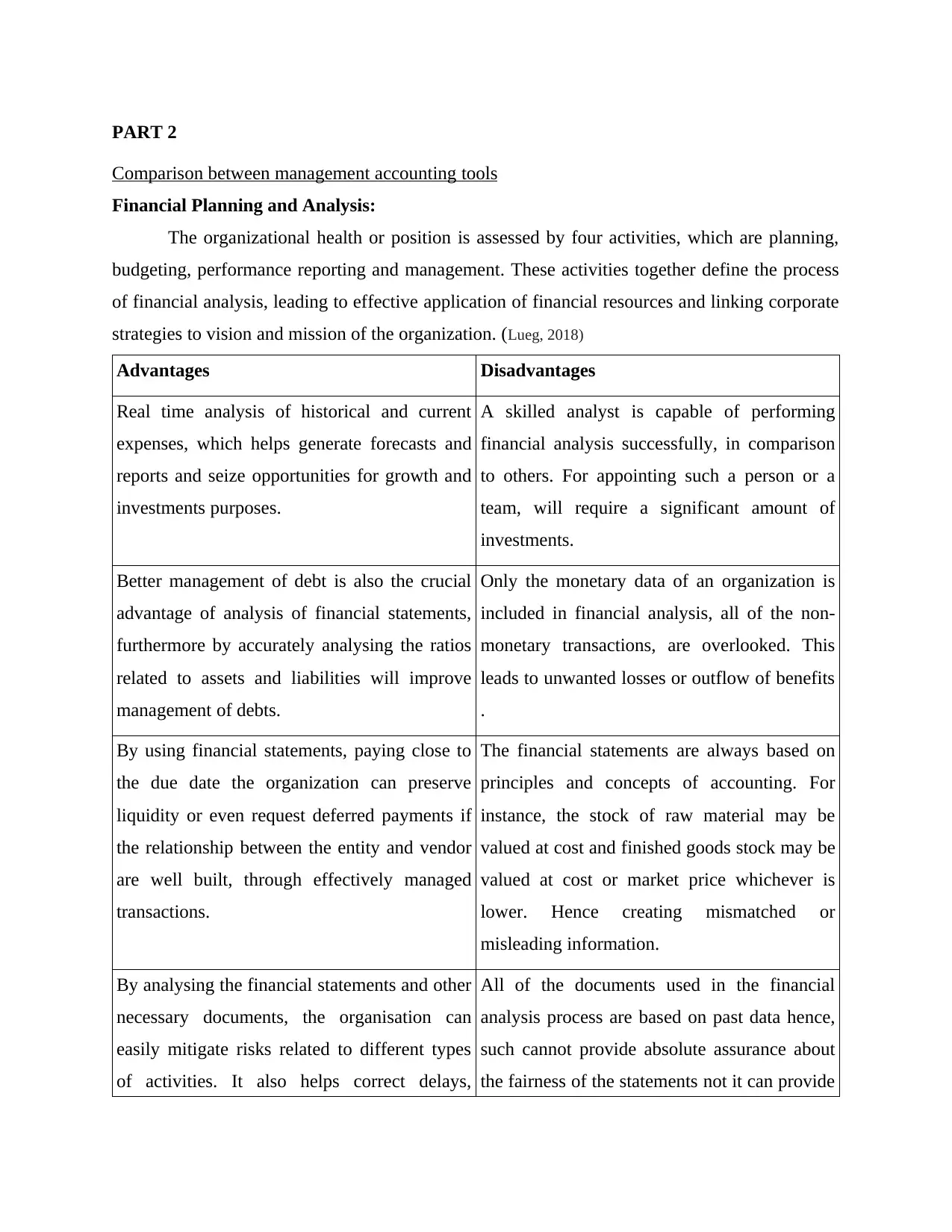

Financial Planning and Analysis:

The organizational health or position is assessed by four activities, which are planning,

budgeting, performance reporting and management. These activities together define the process

of financial analysis, leading to effective application of financial resources and linking corporate

strategies to vision and mission of the organization. (Lueg, 2018)

Advantages Disadvantages

Real time analysis of historical and current

expenses, which helps generate forecasts and

reports and seize opportunities for growth and

investments purposes.

A skilled analyst is capable of performing

financial analysis successfully, in comparison

to others. For appointing such a person or a

team, will require a significant amount of

investments.

Better management of debt is also the crucial

advantage of analysis of financial statements,

furthermore by accurately analysing the ratios

related to assets and liabilities will improve

management of debts.

Only the monetary data of an organization is

included in financial analysis, all of the non-

monetary transactions, are overlooked. This

leads to unwanted losses or outflow of benefits

.

By using financial statements, paying close to

the due date the organization can preserve

liquidity or even request deferred payments if

the relationship between the entity and vendor

are well built, through effectively managed

transactions.

The financial statements are always based on

principles and concepts of accounting. For

instance, the stock of raw material may be

valued at cost and finished goods stock may be

valued at cost or market price whichever is

lower. Hence creating mismatched or

misleading information.

By analysing the financial statements and other

necessary documents, the organisation can

easily mitigate risks related to different types

of activities. It also helps correct delays,

All of the documents used in the financial

analysis process are based on past data hence,

such cannot provide absolute assurance about

the fairness of the statements not it can provide

Comparison between management accounting tools

Financial Planning and Analysis:

The organizational health or position is assessed by four activities, which are planning,

budgeting, performance reporting and management. These activities together define the process

of financial analysis, leading to effective application of financial resources and linking corporate

strategies to vision and mission of the organization. (Lueg, 2018)

Advantages Disadvantages

Real time analysis of historical and current

expenses, which helps generate forecasts and

reports and seize opportunities for growth and

investments purposes.

A skilled analyst is capable of performing

financial analysis successfully, in comparison

to others. For appointing such a person or a

team, will require a significant amount of

investments.

Better management of debt is also the crucial

advantage of analysis of financial statements,

furthermore by accurately analysing the ratios

related to assets and liabilities will improve

management of debts.

Only the monetary data of an organization is

included in financial analysis, all of the non-

monetary transactions, are overlooked. This

leads to unwanted losses or outflow of benefits

.

By using financial statements, paying close to

the due date the organization can preserve

liquidity or even request deferred payments if

the relationship between the entity and vendor

are well built, through effectively managed

transactions.

The financial statements are always based on

principles and concepts of accounting. For

instance, the stock of raw material may be

valued at cost and finished goods stock may be

valued at cost or market price whichever is

lower. Hence creating mismatched or

misleading information.

By analysing the financial statements and other

necessary documents, the organisation can

easily mitigate risks related to different types

of activities. It also helps correct delays,

All of the documents used in the financial

analysis process are based on past data hence,

such cannot provide absolute assurance about

the fairness of the statements not it can provide

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

inefficiencies and iterative improvements will

refine the business process.

basis for forecasting or estimating future

values.

For instance, Accenture applies multiple ratios

and trend analysis to effectively manage its

business without wasting resources and at the

same time, maintaining productivity.

The financial analysis of a large firm such as

Accenture requires well qualified team and up-

to-date software, which are expensive in most

cases.

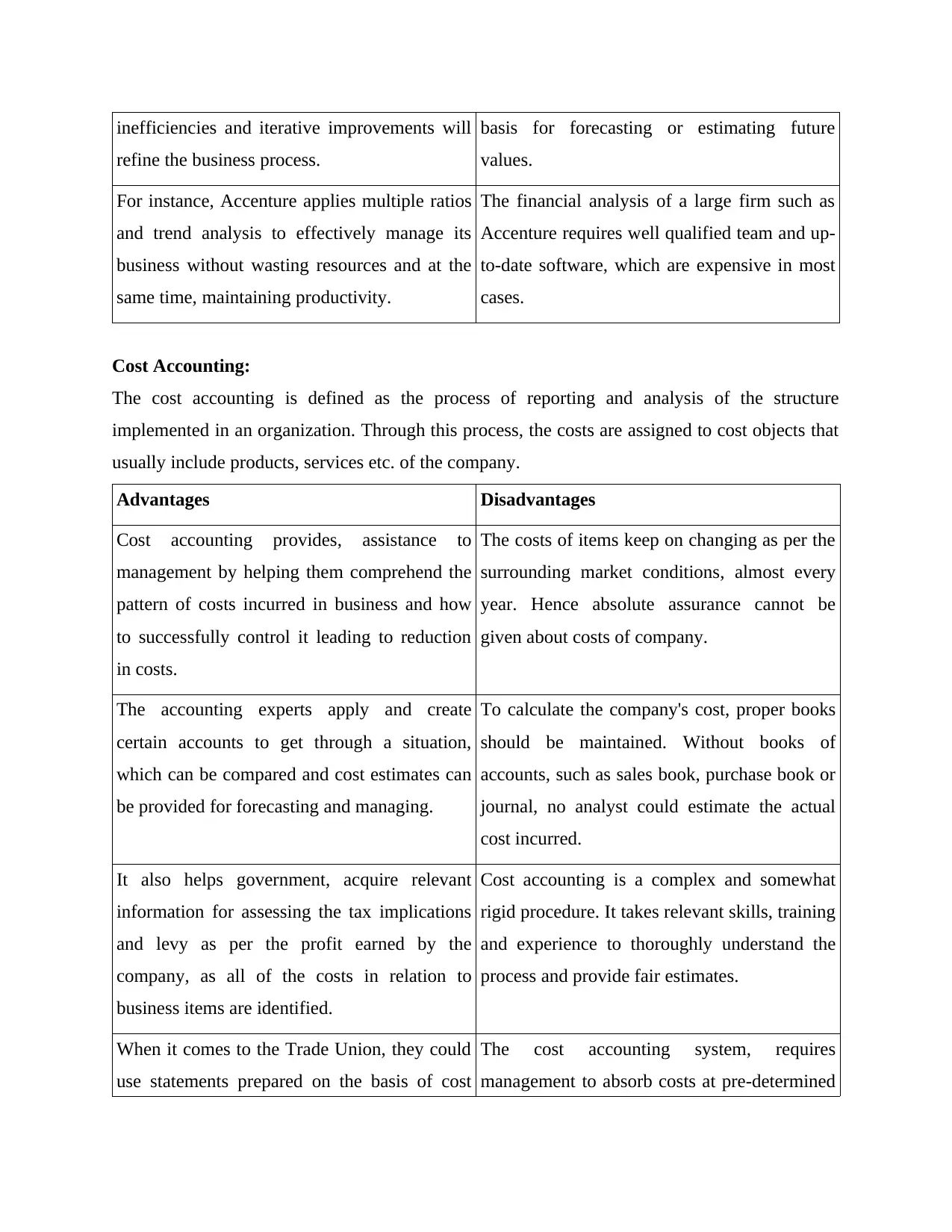

Cost Accounting:

The cost accounting is defined as the process of reporting and analysis of the structure

implemented in an organization. Through this process, the costs are assigned to cost objects that

usually include products, services etc. of the company.

Advantages Disadvantages

Cost accounting provides, assistance to

management by helping them comprehend the

pattern of costs incurred in business and how

to successfully control it leading to reduction

in costs.

The costs of items keep on changing as per the

surrounding market conditions, almost every

year. Hence absolute assurance cannot be

given about costs of company.

The accounting experts apply and create

certain accounts to get through a situation,

which can be compared and cost estimates can

be provided for forecasting and managing.

To calculate the company's cost, proper books

should be maintained. Without books of

accounts, such as sales book, purchase book or

journal, no analyst could estimate the actual

cost incurred.

It also helps government, acquire relevant

information for assessing the tax implications

and levy as per the profit earned by the

company, as all of the costs in relation to

business items are identified.

Cost accounting is a complex and somewhat

rigid procedure. It takes relevant skills, training

and experience to thoroughly understand the

process and provide fair estimates.

When it comes to the Trade Union, they could

use statements prepared on the basis of cost

The cost accounting system, requires

management to absorb costs at pre-determined

refine the business process.

basis for forecasting or estimating future

values.

For instance, Accenture applies multiple ratios

and trend analysis to effectively manage its

business without wasting resources and at the

same time, maintaining productivity.

The financial analysis of a large firm such as

Accenture requires well qualified team and up-

to-date software, which are expensive in most

cases.

Cost Accounting:

The cost accounting is defined as the process of reporting and analysis of the structure

implemented in an organization. Through this process, the costs are assigned to cost objects that

usually include products, services etc. of the company.

Advantages Disadvantages

Cost accounting provides, assistance to

management by helping them comprehend the

pattern of costs incurred in business and how

to successfully control it leading to reduction

in costs.

The costs of items keep on changing as per the

surrounding market conditions, almost every

year. Hence absolute assurance cannot be

given about costs of company.

The accounting experts apply and create

certain accounts to get through a situation,

which can be compared and cost estimates can

be provided for forecasting and managing.

To calculate the company's cost, proper books

should be maintained. Without books of

accounts, such as sales book, purchase book or

journal, no analyst could estimate the actual

cost incurred.

It also helps government, acquire relevant

information for assessing the tax implications

and levy as per the profit earned by the

company, as all of the costs in relation to

business items are identified.

Cost accounting is a complex and somewhat

rigid procedure. It takes relevant skills, training

and experience to thoroughly understand the

process and provide fair estimates.

When it comes to the Trade Union, they could

use statements prepared on the basis of cost

The cost accounting system, requires

management to absorb costs at pre-determined

accounting to effectively calculate Bonus and

remuneration can be fixed reasonably.

rates, which many-a-times lead to over or

under absorption of overheads, be it fixed or

variable.

The most important matter for which cost

accounting is used in organizations such as

Accenture, is for setting up costs and

comparing them with the standard set.

Due to cost accounting being a process which

uses past data, Accenture's management cannot

use it to estimate asset price on their present

values.

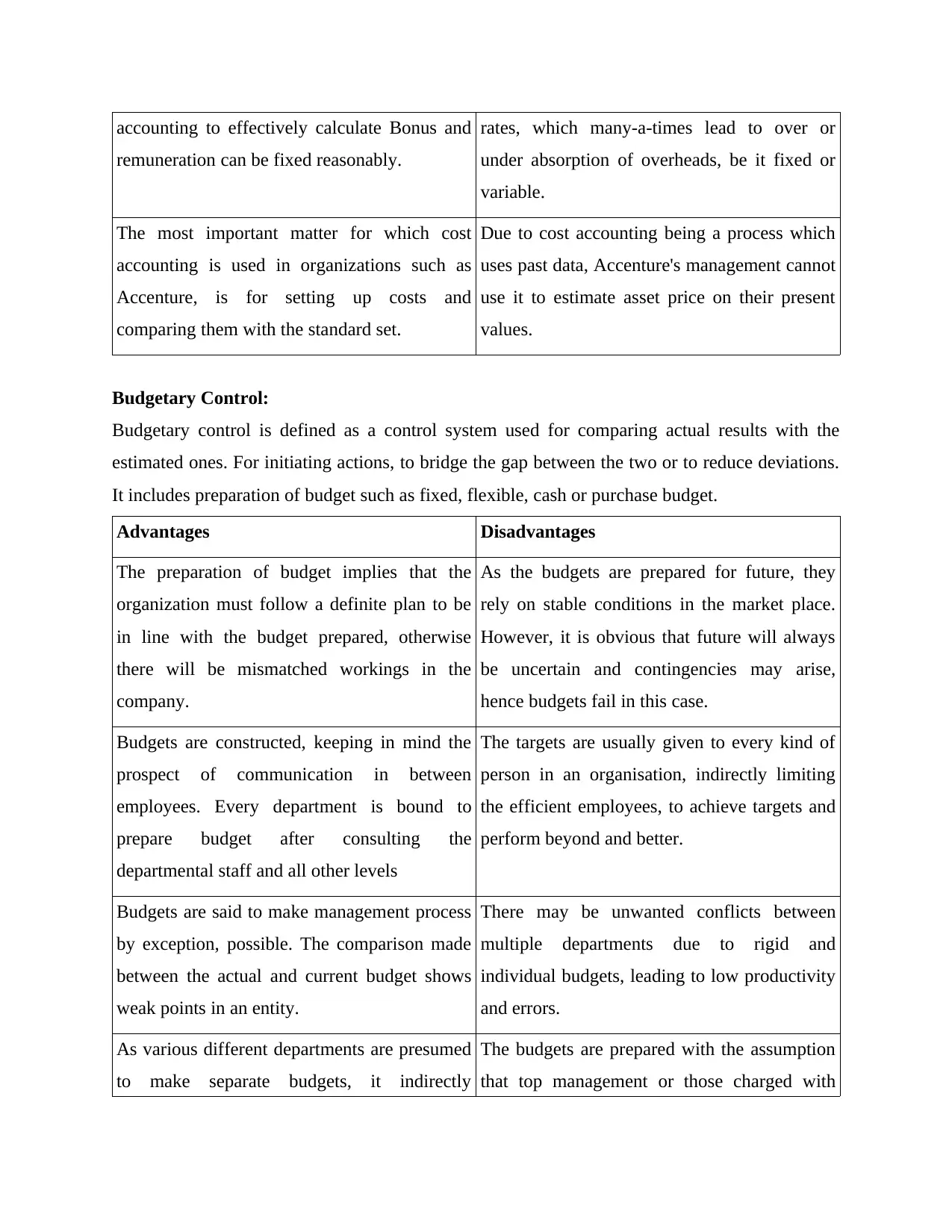

Budgetary Control:

Budgetary control is defined as a control system used for comparing actual results with the

estimated ones. For initiating actions, to bridge the gap between the two or to reduce deviations.

It includes preparation of budget such as fixed, flexible, cash or purchase budget.

Advantages Disadvantages

The preparation of budget implies that the

organization must follow a definite plan to be

in line with the budget prepared, otherwise

there will be mismatched workings in the

company.

As the budgets are prepared for future, they

rely on stable conditions in the market place.

However, it is obvious that future will always

be uncertain and contingencies may arise,

hence budgets fail in this case.

Budgets are constructed, keeping in mind the

prospect of communication in between

employees. Every department is bound to

prepare budget after consulting the

departmental staff and all other levels

The targets are usually given to every kind of

person in an organisation, indirectly limiting

the efficient employees, to achieve targets and

perform beyond and better.

Budgets are said to make management process

by exception, possible. The comparison made

between the actual and current budget shows

weak points in an entity.

There may be unwanted conflicts between

multiple departments due to rigid and

individual budgets, leading to low productivity

and errors.

As various different departments are presumed

to make separate budgets, it indirectly

The budgets are prepared with the assumption

that top management or those charged with

remuneration can be fixed reasonably.

rates, which many-a-times lead to over or

under absorption of overheads, be it fixed or

variable.

The most important matter for which cost

accounting is used in organizations such as

Accenture, is for setting up costs and

comparing them with the standard set.

Due to cost accounting being a process which

uses past data, Accenture's management cannot

use it to estimate asset price on their present

values.

Budgetary Control:

Budgetary control is defined as a control system used for comparing actual results with the

estimated ones. For initiating actions, to bridge the gap between the two or to reduce deviations.

It includes preparation of budget such as fixed, flexible, cash or purchase budget.

Advantages Disadvantages

The preparation of budget implies that the

organization must follow a definite plan to be

in line with the budget prepared, otherwise

there will be mismatched workings in the

company.

As the budgets are prepared for future, they

rely on stable conditions in the market place.

However, it is obvious that future will always

be uncertain and contingencies may arise,

hence budgets fail in this case.

Budgets are constructed, keeping in mind the

prospect of communication in between

employees. Every department is bound to

prepare budget after consulting the

departmental staff and all other levels

The targets are usually given to every kind of

person in an organisation, indirectly limiting

the efficient employees, to achieve targets and

perform beyond and better.

Budgets are said to make management process

by exception, possible. The comparison made

between the actual and current budget shows

weak points in an entity.

There may be unwanted conflicts between

multiple departments due to rigid and

individual budgets, leading to low productivity

and errors.

As various different departments are presumed

to make separate budgets, it indirectly

The budgets are prepared with the assumption

that top management or those charged with

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.