Management Accounting: Customer Profitability & Transfer Pricing

VerifiedAdded on 2023/06/07

|8

|2153

|108

Report

AI Summary

This management accounting report analyzes customer profitability for Louise Fairbern's interior design business, covering two distribution channels: consulting and commercial window treatments. The analysis includes gross revenue, direct costs, overhead allocation, and discounts to determine net profit for each client. The report recommends strategies such as reducing discounts and re-evaluating unprofitable client relationships to mitigate losses. Additionally, the report explores transfer pricing scenarios for Super Chips, aiming to optimize profitability between divisions. The document concludes that the business is incurring losses and suggests implementing the recommendations to improve financial performance. This report also provides computations for transfer pricing and the impact of switching production processes, offering a comprehensive financial overview and strategic advice.

MANAGEMENT ACCOUNTING

SCENARIO 1

PART 1

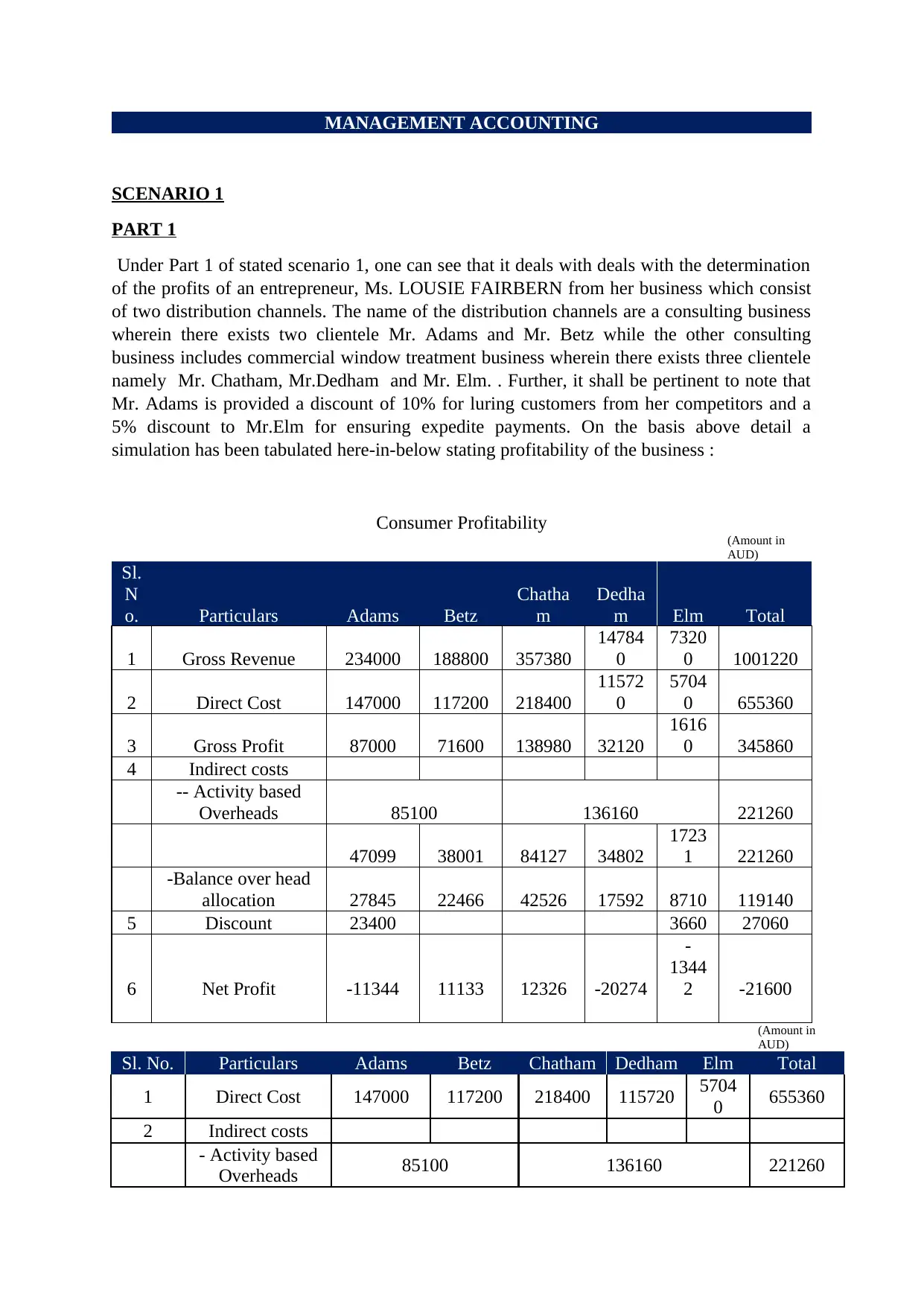

Under Part 1 of stated scenario 1, one can see that it deals with deals with the determination

of the profits of an entrepreneur, Ms. LOUSIE FAIRBERN from her business which consist

of two distribution channels. The name of the distribution channels are a consulting business

wherein there exists two clientele Mr. Adams and Mr. Betz while the other consulting

business includes commercial window treatment business wherein there exists three clientele

namely Mr. Chatham, Mr.Dedham and Mr. Elm. . Further, it shall be pertinent to note that

Mr. Adams is provided a discount of 10% for luring customers from her competitors and a

5% discount to Mr.Elm for ensuring expedite payments. On the basis above detail a

simulation has been tabulated here-in-below stating profitability of the business :

Consumer Profitability (Amount in

AUD)

Sl.

N

o. Particulars Adams Betz

Chatha

m

Dedha

m Elm Total

1 Gross Revenue 234000 188800 357380

14784

0

7320

0 1001220

2 Direct Cost 147000 117200 218400

11572

0

5704

0 655360

3 Gross Profit 87000 71600 138980 32120

1616

0 345860

4 Indirect costs

-- Activity based

Overheads 85100 136160 221260

47099 38001 84127 34802

1723

1 221260

-Balance over head

allocation 27845 22466 42526 17592 8710 119140

5 Discount 23400 3660 27060

6 Net Profit -11344 11133 12326 -20274

-

1344

2 -21600

(Amount in

AUD)

Sl. No. Particulars Adams Betz Chatham Dedham Elm Total

1 Direct Cost 147000 117200 218400 115720 5704

0 655360

2 Indirect costs

- Activity based

Overheads 85100 136160 221260

SCENARIO 1

PART 1

Under Part 1 of stated scenario 1, one can see that it deals with deals with the determination

of the profits of an entrepreneur, Ms. LOUSIE FAIRBERN from her business which consist

of two distribution channels. The name of the distribution channels are a consulting business

wherein there exists two clientele Mr. Adams and Mr. Betz while the other consulting

business includes commercial window treatment business wherein there exists three clientele

namely Mr. Chatham, Mr.Dedham and Mr. Elm. . Further, it shall be pertinent to note that

Mr. Adams is provided a discount of 10% for luring customers from her competitors and a

5% discount to Mr.Elm for ensuring expedite payments. On the basis above detail a

simulation has been tabulated here-in-below stating profitability of the business :

Consumer Profitability (Amount in

AUD)

Sl.

N

o. Particulars Adams Betz

Chatha

m

Dedha

m Elm Total

1 Gross Revenue 234000 188800 357380

14784

0

7320

0 1001220

2 Direct Cost 147000 117200 218400

11572

0

5704

0 655360

3 Gross Profit 87000 71600 138980 32120

1616

0 345860

4 Indirect costs

-- Activity based

Overheads 85100 136160 221260

47099 38001 84127 34802

1723

1 221260

-Balance over head

allocation 27845 22466 42526 17592 8710 119140

5 Discount 23400 3660 27060

6 Net Profit -11344 11133 12326 -20274

-

1344

2 -21600

(Amount in

AUD)

Sl. No. Particulars Adams Betz Chatham Dedham Elm Total

1 Direct Cost 147000 117200 218400 115720 5704

0 655360

2 Indirect costs

- Activity based

Overheads 85100 136160 221260

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

47099 38001 84127 34802 1723

1 221260

-Balance over

head allocation 27845 22466 42526 17592 8710 119140

3 Total Cost 221944 177667 345053 168114 8298

1 995760

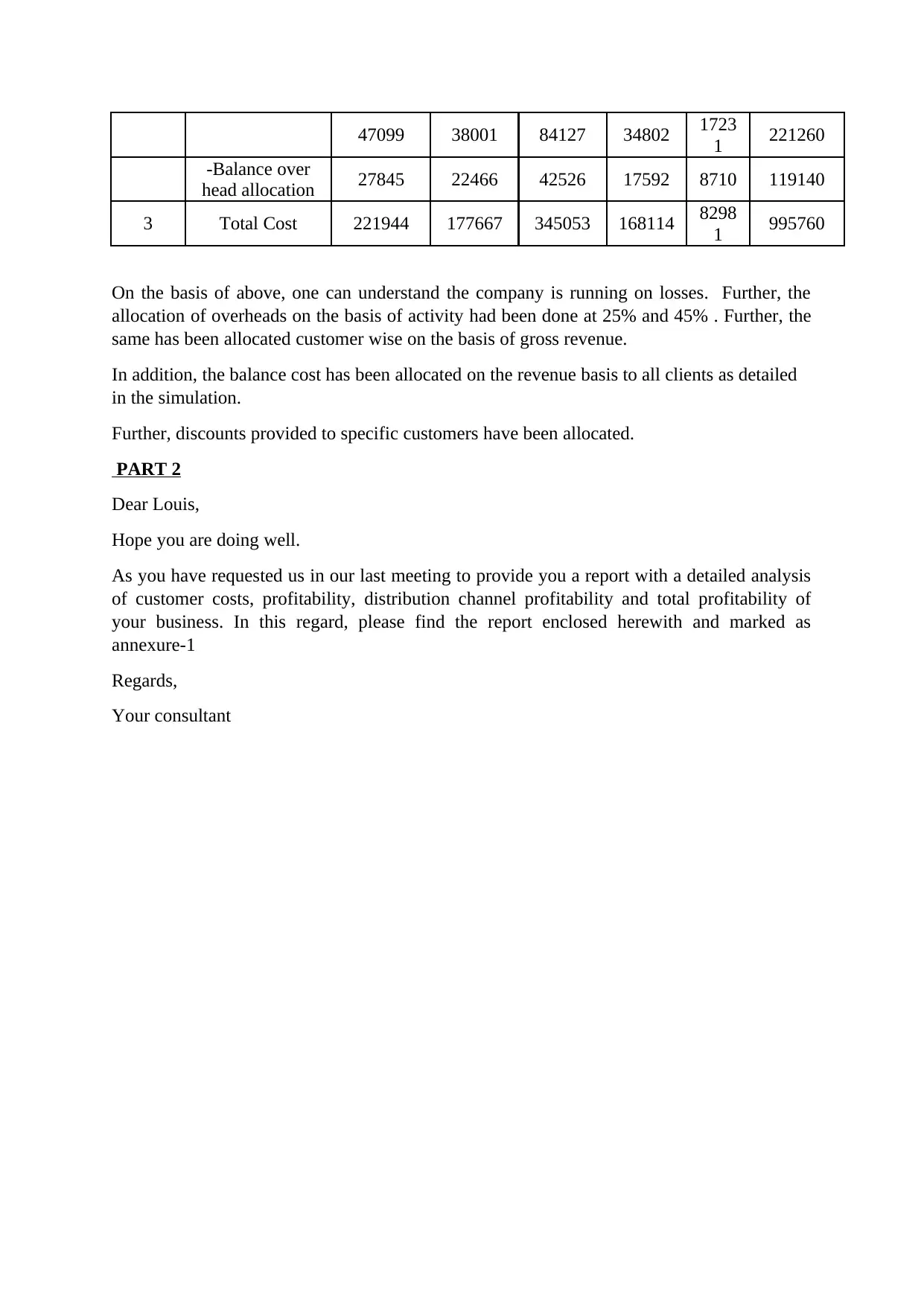

On the basis of above, one can understand the company is running on losses. Further, the

allocation of overheads on the basis of activity had been done at 25% and 45% . Further, the

same has been allocated customer wise on the basis of gross revenue.

In addition, the balance cost has been allocated on the revenue basis to all clients as detailed

in the simulation.

Further, discounts provided to specific customers have been allocated.

PART 2

Dear Louis,

Hope you are doing well.

As you have requested us in our last meeting to provide you a report with a detailed analysis

of customer costs, profitability, distribution channel profitability and total profitability of

your business. In this regard, please find the report enclosed herewith and marked as

annexure-1

Regards,

Your consultant

1 221260

-Balance over

head allocation 27845 22466 42526 17592 8710 119140

3 Total Cost 221944 177667 345053 168114 8298

1 995760

On the basis of above, one can understand the company is running on losses. Further, the

allocation of overheads on the basis of activity had been done at 25% and 45% . Further, the

same has been allocated customer wise on the basis of gross revenue.

In addition, the balance cost has been allocated on the revenue basis to all clients as detailed

in the simulation.

Further, discounts provided to specific customers have been allocated.

PART 2

Dear Louis,

Hope you are doing well.

As you have requested us in our last meeting to provide you a report with a detailed analysis

of customer costs, profitability, distribution channel profitability and total profitability of

your business. In this regard, please find the report enclosed herewith and marked as

annexure-1

Regards,

Your consultant

Annexure-1

Report on Louise Fairbern Business

Introduction

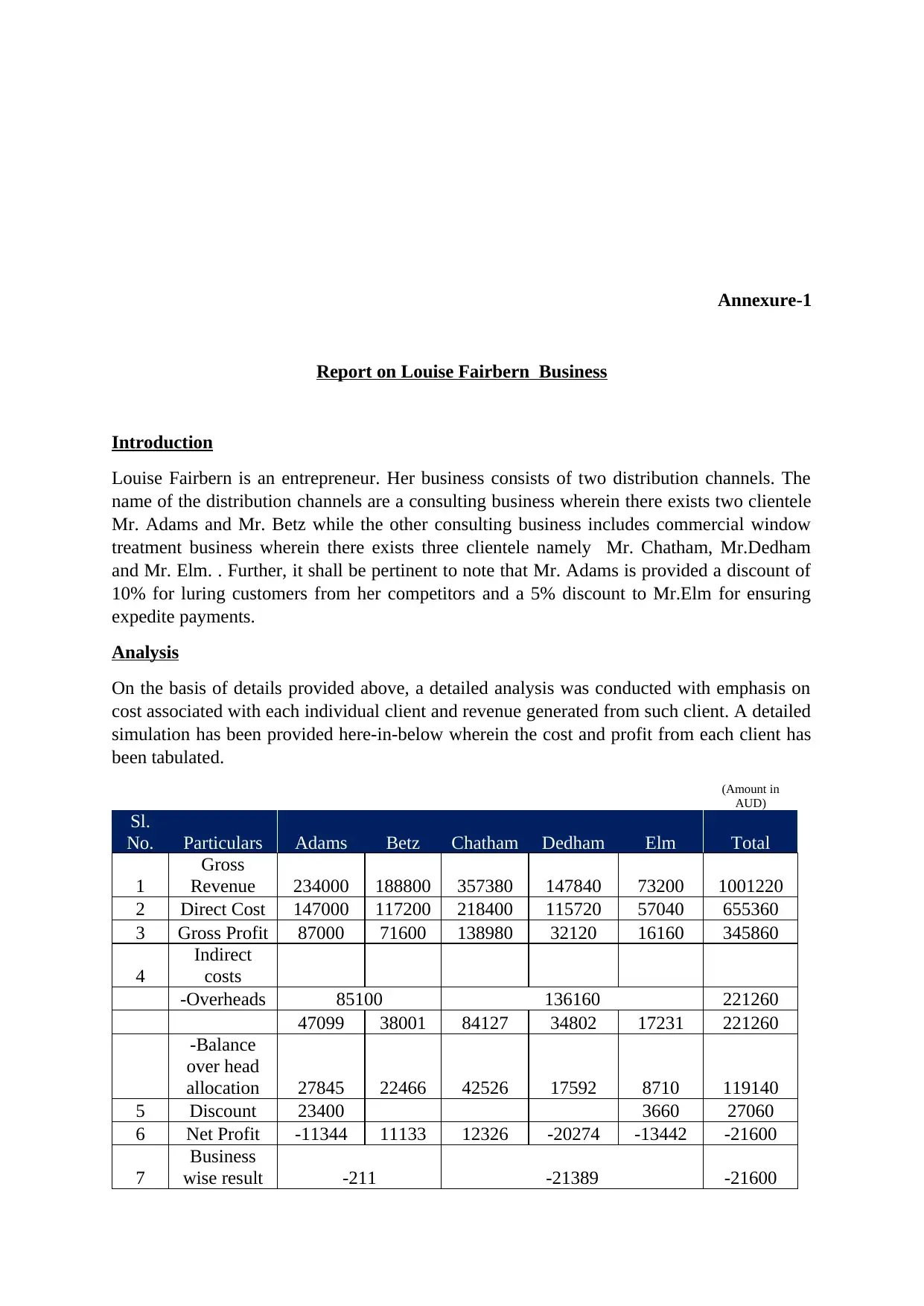

Louise Fairbern is an entrepreneur. Her business consists of two distribution channels. The

name of the distribution channels are a consulting business wherein there exists two clientele

Mr. Adams and Mr. Betz while the other consulting business includes commercial window

treatment business wherein there exists three clientele namely Mr. Chatham, Mr.Dedham

and Mr. Elm. . Further, it shall be pertinent to note that Mr. Adams is provided a discount of

10% for luring customers from her competitors and a 5% discount to Mr.Elm for ensuring

expedite payments.

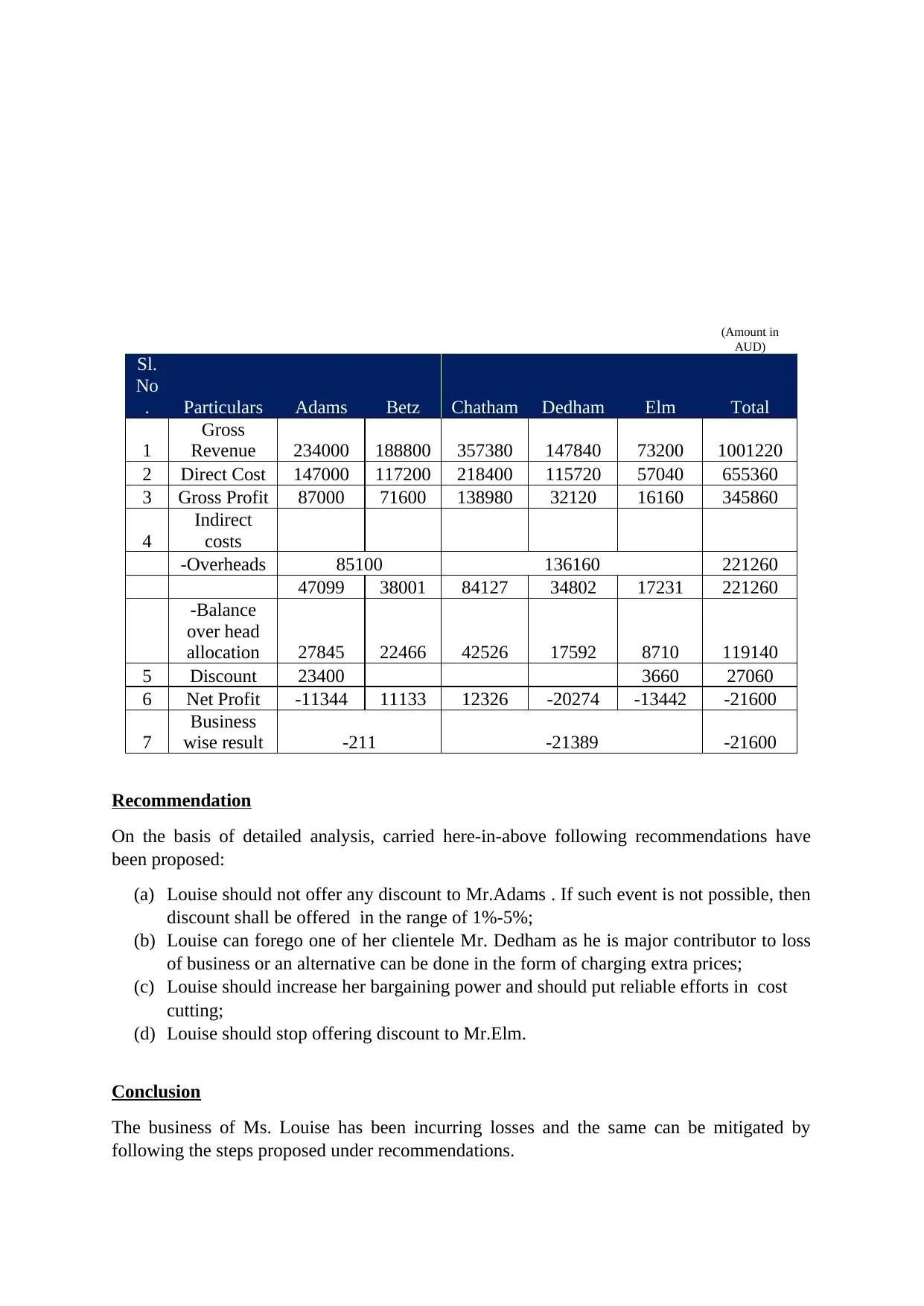

Analysis

On the basis of details provided above, a detailed analysis was conducted with emphasis on

cost associated with each individual client and revenue generated from such client. A detailed

simulation has been provided here-in-below wherein the cost and profit from each client has

been tabulated.

(Amount in

AUD)

Sl.

No. Particulars Adams Betz Chatham Dedham Elm Total

1

Gross

Revenue 234000 188800 357380 147840 73200 1001220

2 Direct Cost 147000 117200 218400 115720 57040 655360

3 Gross Profit 87000 71600 138980 32120 16160 345860

4

Indirect

costs

-Overheads 85100 136160 221260

47099 38001 84127 34802 17231 221260

-Balance

over head

allocation 27845 22466 42526 17592 8710 119140

5 Discount 23400 3660 27060

6 Net Profit -11344 11133 12326 -20274 -13442 -21600

7

Business

wise result -211 -21389 -21600

Report on Louise Fairbern Business

Introduction

Louise Fairbern is an entrepreneur. Her business consists of two distribution channels. The

name of the distribution channels are a consulting business wherein there exists two clientele

Mr. Adams and Mr. Betz while the other consulting business includes commercial window

treatment business wherein there exists three clientele namely Mr. Chatham, Mr.Dedham

and Mr. Elm. . Further, it shall be pertinent to note that Mr. Adams is provided a discount of

10% for luring customers from her competitors and a 5% discount to Mr.Elm for ensuring

expedite payments.

Analysis

On the basis of details provided above, a detailed analysis was conducted with emphasis on

cost associated with each individual client and revenue generated from such client. A detailed

simulation has been provided here-in-below wherein the cost and profit from each client has

been tabulated.

(Amount in

AUD)

Sl.

No. Particulars Adams Betz Chatham Dedham Elm Total

1

Gross

Revenue 234000 188800 357380 147840 73200 1001220

2 Direct Cost 147000 117200 218400 115720 57040 655360

3 Gross Profit 87000 71600 138980 32120 16160 345860

4

Indirect

costs

-Overheads 85100 136160 221260

47099 38001 84127 34802 17231 221260

-Balance

over head

allocation 27845 22466 42526 17592 8710 119140

5 Discount 23400 3660 27060

6 Net Profit -11344 11133 12326 -20274 -13442 -21600

7

Business

wise result -211 -21389 -21600

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

On perusal of the above simulation, it may be understood the following:-

(a) Gross revenue earned by Ms.Louise from her business stands at AUD 10,01,220/- while

the direct cost associated for earning such revenue stands at AUD 6,55,360/- which is

65% of the gross revenue earned from such business. Accordingly contribution cum

gross profits stands at AUD 345860/- nearly 35% of the gross revenue.

(b) Further, it can be understood that the indirect cost of running the business stands at AUD

3,40,400/- . The same is approximately 35% of the gross revenue of the business of

Louise. In addition, for analysing the each customer profitability, these indirect cost has

been allocated to various customers on the basis of revenue earned from making sales/

service to them during the course of business.

Further, 25% of the above stated cost has been allocated to consultancy service and 40%

to window treatment business. Also ,, the same has been allocated customer wise on the

basis of gross revenue.

In addition, the balance cost has been allocated on the revenue basis to all clients as

detailed in the simulation.

(c) Post allocation of aforesaid cost, discount allocated by Louise to her two specific

customers have been taken into consideration. Ms. Louise has offered a discount of 10%

to Adams for attracting customers and a 5% to Elm for quick payment of services

received.

(d) Post allocation of discount to specific customers, it may be seen that business is incurring

losses and there is a loss of near about AUD 21,600/- which stands at approximately 2%

of gross revenue of Louise’s business. Thus, the proposed business is running in loss.

(e) On further analysis of profitability of business of Louise i.e. on the basis of consultancy

wise and window treatment service wise, one may observe that the consultancy service is

incurring a loss of AUD 211 while the business of window treatment service has incurred

losses of AUD 21,389/ which forms a major chunk of losses of the company. Thus,

prima facie it may be seen that both business of Ms. Louis has been incurring losses

(f) Further, going for an indepth analysis on the basis of clientele, it may be observed that

sales made to Adams has incurred a significant loss of AUD 11,344 /-. While the

services that were made to Betz has let the firm to earn a margin of AUD 11,133/- which

is substantially huge. For other customers such as Chatham , Dedham and Elm are

considered, it may be observed that profit /loss of AUD 12,326/-, AUD -20,274 and

AUD 13,442/- respectively has been earned /incurred from them. The table has been

detailed here-in-below:

(a) Gross revenue earned by Ms.Louise from her business stands at AUD 10,01,220/- while

the direct cost associated for earning such revenue stands at AUD 6,55,360/- which is

65% of the gross revenue earned from such business. Accordingly contribution cum

gross profits stands at AUD 345860/- nearly 35% of the gross revenue.

(b) Further, it can be understood that the indirect cost of running the business stands at AUD

3,40,400/- . The same is approximately 35% of the gross revenue of the business of

Louise. In addition, for analysing the each customer profitability, these indirect cost has

been allocated to various customers on the basis of revenue earned from making sales/

service to them during the course of business.

Further, 25% of the above stated cost has been allocated to consultancy service and 40%

to window treatment business. Also ,, the same has been allocated customer wise on the

basis of gross revenue.

In addition, the balance cost has been allocated on the revenue basis to all clients as

detailed in the simulation.

(c) Post allocation of aforesaid cost, discount allocated by Louise to her two specific

customers have been taken into consideration. Ms. Louise has offered a discount of 10%

to Adams for attracting customers and a 5% to Elm for quick payment of services

received.

(d) Post allocation of discount to specific customers, it may be seen that business is incurring

losses and there is a loss of near about AUD 21,600/- which stands at approximately 2%

of gross revenue of Louise’s business. Thus, the proposed business is running in loss.

(e) On further analysis of profitability of business of Louise i.e. on the basis of consultancy

wise and window treatment service wise, one may observe that the consultancy service is

incurring a loss of AUD 211 while the business of window treatment service has incurred

losses of AUD 21,389/ which forms a major chunk of losses of the company. Thus,

prima facie it may be seen that both business of Ms. Louis has been incurring losses

(f) Further, going for an indepth analysis on the basis of clientele, it may be observed that

sales made to Adams has incurred a significant loss of AUD 11,344 /-. While the

services that were made to Betz has let the firm to earn a margin of AUD 11,133/- which

is substantially huge. For other customers such as Chatham , Dedham and Elm are

considered, it may be observed that profit /loss of AUD 12,326/-, AUD -20,274 and

AUD 13,442/- respectively has been earned /incurred from them. The table has been

detailed here-in-below:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

(Amount in

AUD)

Sl.

No

. Particulars Adams Betz Chatham Dedham Elm Total

1

Gross

Revenue 234000 188800 357380 147840 73200 1001220

2 Direct Cost 147000 117200 218400 115720 57040 655360

3 Gross Profit 87000 71600 138980 32120 16160 345860

4

Indirect

costs

-Overheads 85100 136160 221260

47099 38001 84127 34802 17231 221260

-Balance

over head

allocation 27845 22466 42526 17592 8710 119140

5 Discount 23400 3660 27060

6 Net Profit -11344 11133 12326 -20274 -13442 -21600

7

Business

wise result -211 -21389 -21600

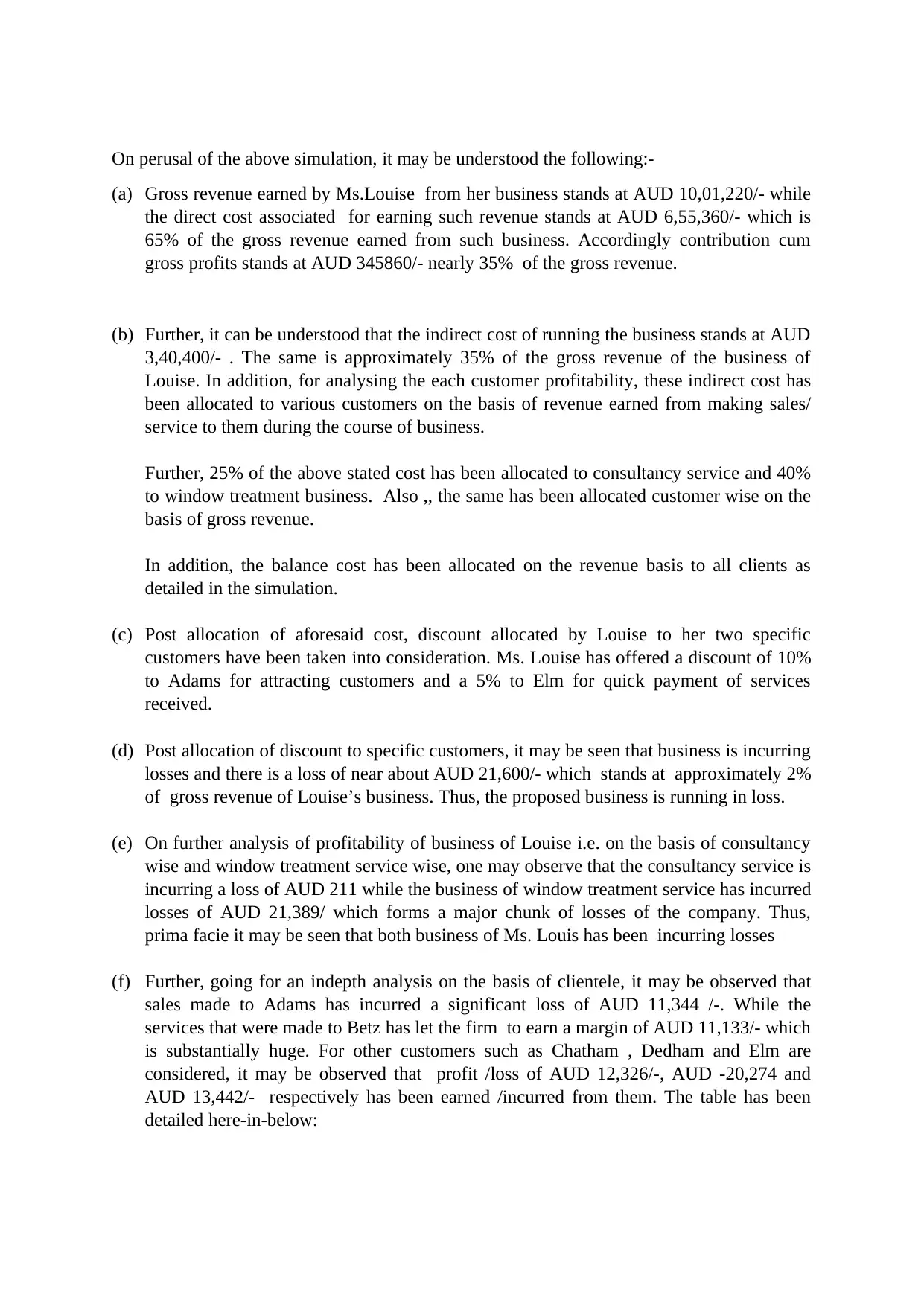

Recommendation

On the basis of detailed analysis, carried here-in-above following recommendations have

been proposed:

(a) Louise should not offer any discount to Mr.Adams . If such event is not possible, then

discount shall be offered in the range of 1%-5%;

(b) Louise can forego one of her clientele Mr. Dedham as he is major contributor to loss

of business or an alternative can be done in the form of charging extra prices;

(c) Louise should increase her bargaining power and should put reliable efforts in cost

cutting;

(d) Louise should stop offering discount to Mr.Elm.

Conclusion

The business of Ms. Louise has been incurring losses and the same can be mitigated by

following the steps proposed under recommendations.

AUD)

Sl.

No

. Particulars Adams Betz Chatham Dedham Elm Total

1

Gross

Revenue 234000 188800 357380 147840 73200 1001220

2 Direct Cost 147000 117200 218400 115720 57040 655360

3 Gross Profit 87000 71600 138980 32120 16160 345860

4

Indirect

costs

-Overheads 85100 136160 221260

47099 38001 84127 34802 17231 221260

-Balance

over head

allocation 27845 22466 42526 17592 8710 119140

5 Discount 23400 3660 27060

6 Net Profit -11344 11133 12326 -20274 -13442 -21600

7

Business

wise result -211 -21389 -21600

Recommendation

On the basis of detailed analysis, carried here-in-above following recommendations have

been proposed:

(a) Louise should not offer any discount to Mr.Adams . If such event is not possible, then

discount shall be offered in the range of 1%-5%;

(b) Louise can forego one of her clientele Mr. Dedham as he is major contributor to loss

of business or an alternative can be done in the form of charging extra prices;

(c) Louise should increase her bargaining power and should put reliable efforts in cost

cutting;

(d) Louise should stop offering discount to Mr.Elm.

Conclusion

The business of Ms. Louise has been incurring losses and the same can be mitigated by

following the steps proposed under recommendations.

SCENARIO 2

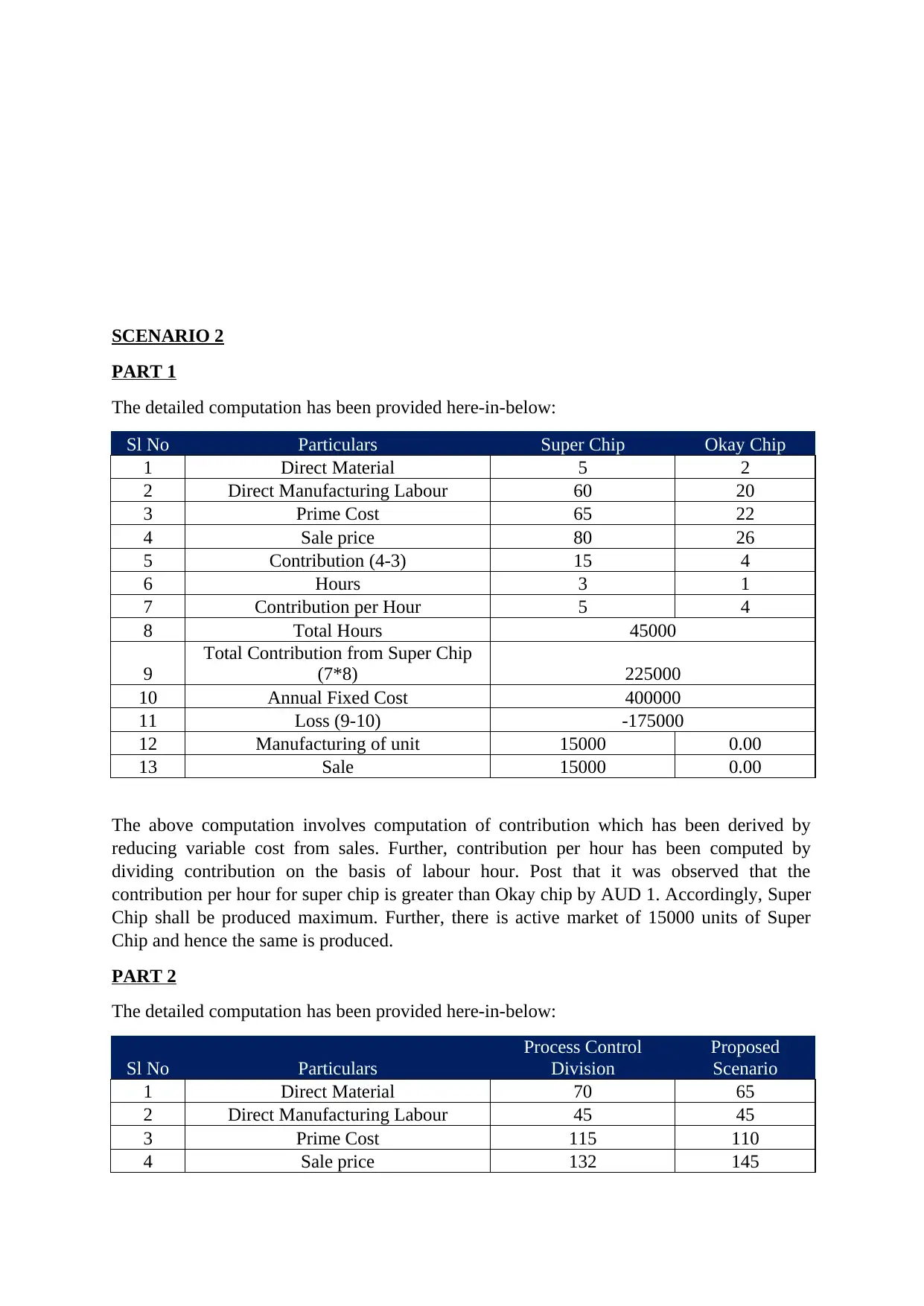

PART 1

The detailed computation has been provided here-in-below:

Sl No Particulars Super Chip Okay Chip

1 Direct Material 5 2

2 Direct Manufacturing Labour 60 20

3 Prime Cost 65 22

4 Sale price 80 26

5 Contribution (4-3) 15 4

6 Hours 3 1

7 Contribution per Hour 5 4

8 Total Hours 45000

9

Total Contribution from Super Chip

(7*8) 225000

10 Annual Fixed Cost 400000

11 Loss (9-10) -175000

12 Manufacturing of unit 15000 0.00

13 Sale 15000 0.00

The above computation involves computation of contribution which has been derived by

reducing variable cost from sales. Further, contribution per hour has been computed by

dividing contribution on the basis of labour hour. Post that it was observed that the

contribution per hour for super chip is greater than Okay chip by AUD 1. Accordingly, Super

Chip shall be produced maximum. Further, there is active market of 15000 units of Super

Chip and hence the same is produced.

PART 2

The detailed computation has been provided here-in-below:

Sl No Particulars

Process Control

Division

Proposed

Scenario

1 Direct Material 70 65

2 Direct Manufacturing Labour 45 45

3 Prime Cost 115 110

4 Sale price 132 145

PART 1

The detailed computation has been provided here-in-below:

Sl No Particulars Super Chip Okay Chip

1 Direct Material 5 2

2 Direct Manufacturing Labour 60 20

3 Prime Cost 65 22

4 Sale price 80 26

5 Contribution (4-3) 15 4

6 Hours 3 1

7 Contribution per Hour 5 4

8 Total Hours 45000

9

Total Contribution from Super Chip

(7*8) 225000

10 Annual Fixed Cost 400000

11 Loss (9-10) -175000

12 Manufacturing of unit 15000 0.00

13 Sale 15000 0.00

The above computation involves computation of contribution which has been derived by

reducing variable cost from sales. Further, contribution per hour has been computed by

dividing contribution on the basis of labour hour. Post that it was observed that the

contribution per hour for super chip is greater than Okay chip by AUD 1. Accordingly, Super

Chip shall be produced maximum. Further, there is active market of 15000 units of Super

Chip and hence the same is produced.

PART 2

The detailed computation has been provided here-in-below:

Sl No Particulars

Process Control

Division

Proposed

Scenario

1 Direct Material 70 65

2 Direct Manufacturing Labour 45 45

3 Prime Cost 115 110

4 Sale price 132 145

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

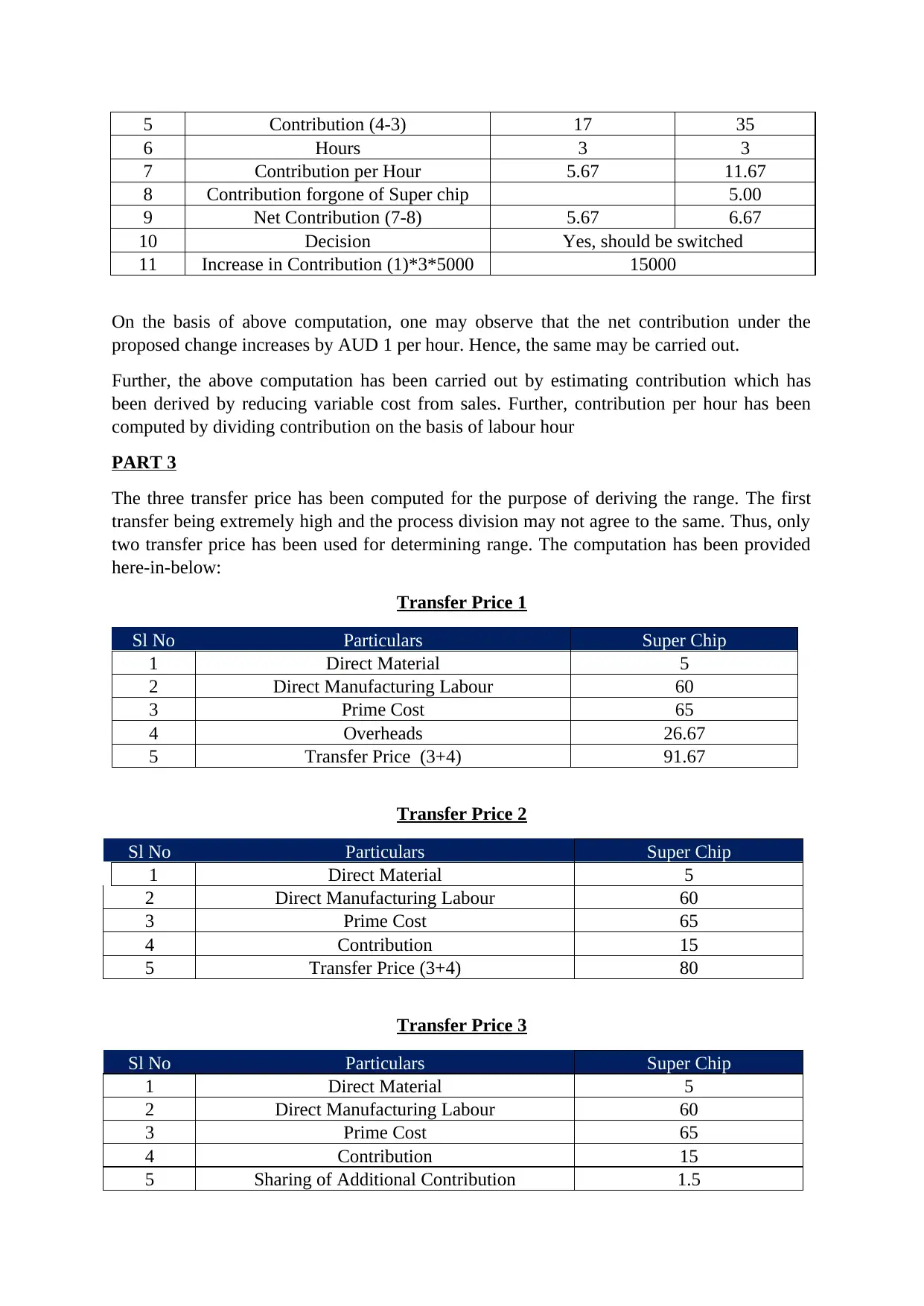

5 Contribution (4-3) 17 35

6 Hours 3 3

7 Contribution per Hour 5.67 11.67

8 Contribution forgone of Super chip 5.00

9 Net Contribution (7-8) 5.67 6.67

10 Decision Yes, should be switched

11 Increase in Contribution (1)*3*5000 15000

On the basis of above computation, one may observe that the net contribution under the

proposed change increases by AUD 1 per hour. Hence, the same may be carried out.

Further, the above computation has been carried out by estimating contribution which has

been derived by reducing variable cost from sales. Further, contribution per hour has been

computed by dividing contribution on the basis of labour hour

PART 3

The three transfer price has been computed for the purpose of deriving the range. The first

transfer being extremely high and the process division may not agree to the same. Thus, only

two transfer price has been used for determining range. The computation has been provided

here-in-below:

Transfer Price 1

Sl No Particulars Super Chip

1 Direct Material 5

2 Direct Manufacturing Labour 60

3 Prime Cost 65

4 Overheads 26.67

5 Transfer Price (3+4) 91.67

Transfer Price 2

Sl No Particulars Super Chip

1 Direct Material 5

2 Direct Manufacturing Labour 60

3 Prime Cost 65

4 Contribution 15

5 Transfer Price (3+4) 80

Transfer Price 3

Sl No Particulars Super Chip

1 Direct Material 5

2 Direct Manufacturing Labour 60

3 Prime Cost 65

4 Contribution 15

5 Sharing of Additional Contribution 1.5

6 Hours 3 3

7 Contribution per Hour 5.67 11.67

8 Contribution forgone of Super chip 5.00

9 Net Contribution (7-8) 5.67 6.67

10 Decision Yes, should be switched

11 Increase in Contribution (1)*3*5000 15000

On the basis of above computation, one may observe that the net contribution under the

proposed change increases by AUD 1 per hour. Hence, the same may be carried out.

Further, the above computation has been carried out by estimating contribution which has

been derived by reducing variable cost from sales. Further, contribution per hour has been

computed by dividing contribution on the basis of labour hour

PART 3

The three transfer price has been computed for the purpose of deriving the range. The first

transfer being extremely high and the process division may not agree to the same. Thus, only

two transfer price has been used for determining range. The computation has been provided

here-in-below:

Transfer Price 1

Sl No Particulars Super Chip

1 Direct Material 5

2 Direct Manufacturing Labour 60

3 Prime Cost 65

4 Overheads 26.67

5 Transfer Price (3+4) 91.67

Transfer Price 2

Sl No Particulars Super Chip

1 Direct Material 5

2 Direct Manufacturing Labour 60

3 Prime Cost 65

4 Contribution 15

5 Transfer Price (3+4) 80

Transfer Price 3

Sl No Particulars Super Chip

1 Direct Material 5

2 Direct Manufacturing Labour 60

3 Prime Cost 65

4 Contribution 15

5 Sharing of Additional Contribution 1.5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

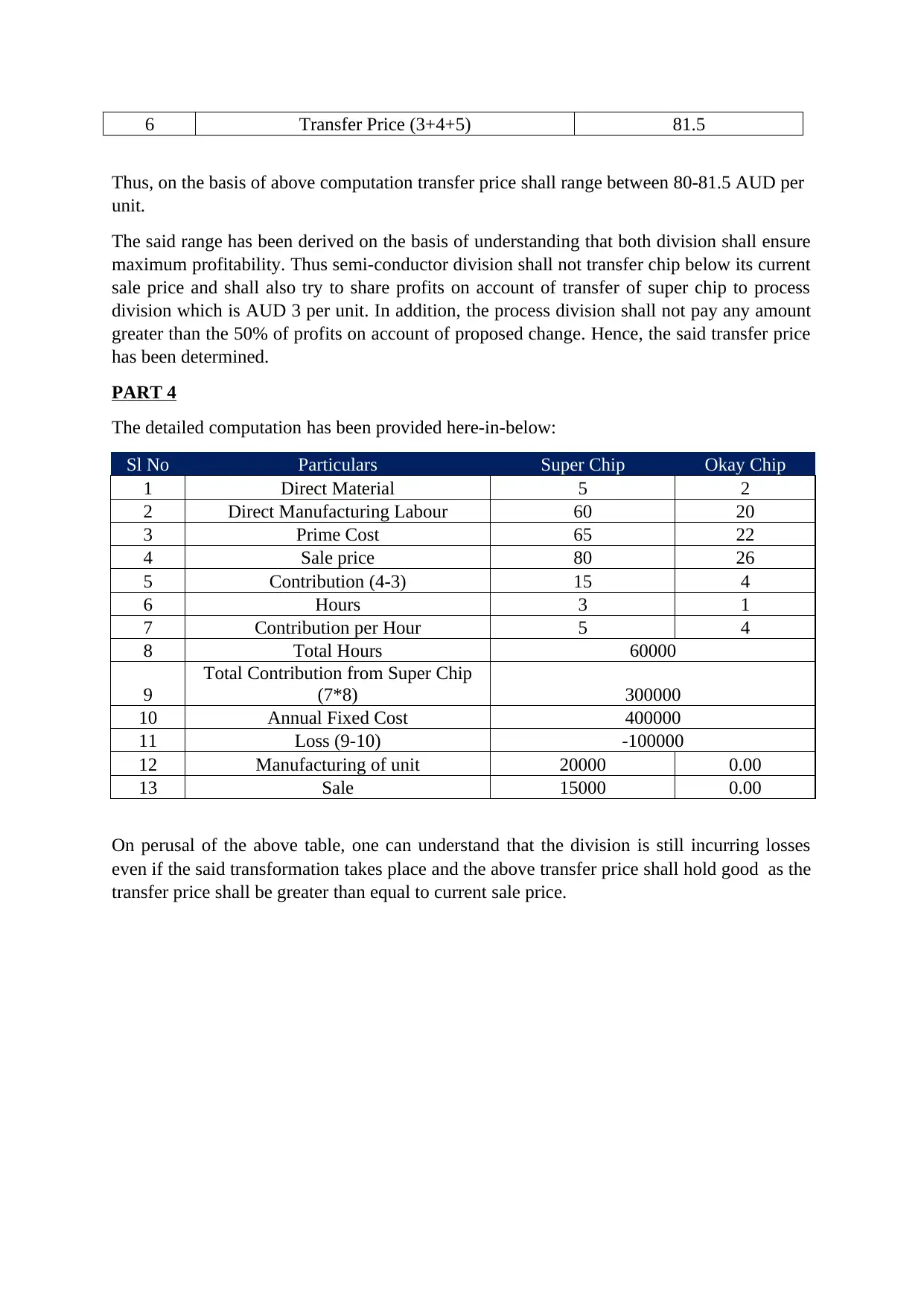

6 Transfer Price (3+4+5) 81.5

Thus, on the basis of above computation transfer price shall range between 80-81.5 AUD per

unit.

The said range has been derived on the basis of understanding that both division shall ensure

maximum profitability. Thus semi-conductor division shall not transfer chip below its current

sale price and shall also try to share profits on account of transfer of super chip to process

division which is AUD 3 per unit. In addition, the process division shall not pay any amount

greater than the 50% of profits on account of proposed change. Hence, the said transfer price

has been determined.

PART 4

The detailed computation has been provided here-in-below:

Sl No Particulars Super Chip Okay Chip

1 Direct Material 5 2

2 Direct Manufacturing Labour 60 20

3 Prime Cost 65 22

4 Sale price 80 26

5 Contribution (4-3) 15 4

6 Hours 3 1

7 Contribution per Hour 5 4

8 Total Hours 60000

9

Total Contribution from Super Chip

(7*8) 300000

10 Annual Fixed Cost 400000

11 Loss (9-10) -100000

12 Manufacturing of unit 20000 0.00

13 Sale 15000 0.00

On perusal of the above table, one can understand that the division is still incurring losses

even if the said transformation takes place and the above transfer price shall hold good as the

transfer price shall be greater than equal to current sale price.

Thus, on the basis of above computation transfer price shall range between 80-81.5 AUD per

unit.

The said range has been derived on the basis of understanding that both division shall ensure

maximum profitability. Thus semi-conductor division shall not transfer chip below its current

sale price and shall also try to share profits on account of transfer of super chip to process

division which is AUD 3 per unit. In addition, the process division shall not pay any amount

greater than the 50% of profits on account of proposed change. Hence, the said transfer price

has been determined.

PART 4

The detailed computation has been provided here-in-below:

Sl No Particulars Super Chip Okay Chip

1 Direct Material 5 2

2 Direct Manufacturing Labour 60 20

3 Prime Cost 65 22

4 Sale price 80 26

5 Contribution (4-3) 15 4

6 Hours 3 1

7 Contribution per Hour 5 4

8 Total Hours 60000

9

Total Contribution from Super Chip

(7*8) 300000

10 Annual Fixed Cost 400000

11 Loss (9-10) -100000

12 Manufacturing of unit 20000 0.00

13 Sale 15000 0.00

On perusal of the above table, one can understand that the division is still incurring losses

even if the said transformation takes place and the above transfer price shall hold good as the

transfer price shall be greater than equal to current sale price.

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.