Management Accounting Report - BTEC Level 4 Business, Semester 1

VerifiedAdded on 2023/01/12

|11

|3424

|44

Report

AI Summary

This management accounting report analyzes various techniques and tools used by organizations, focusing on a case study of Prime Furniture in London. The report covers microeconomic techniques such as cost analysis, cost-volume-profit, and flexible budgeting, along with absorption and marginal costing methods, supported by calculations and income statements. It delves into product costing, differentiating between fixed, variable, and overhead costs, and explores cost allocation and costing systems like normal, standard, and activity-based costing. The report further examines inventory costing, valuation methods, and budgeting for planning and control, including capital and operating budgets, and explores different pricing strategies. It also assesses strategic planning using PEST and SWOT analyses, Porter's five forces, and discusses methods for identifying financial problems, such as benchmarking and KPIs. The report provides a comprehensive overview of management accounting principles and their practical applications within a business context.

Management accounting

report

report

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION......................................................................................................................3

Task 2.........................................................................................................................................3

LO2............................................................................................................................................3

Microeconomic techniques....................................................................................................3

Product costing.......................................................................................................................5

Cost of inventory....................................................................................................................6

LO3............................................................................................................................................6

Using budgets for planning and control.................................................................................6

Pricing....................................................................................................................................7

Common costing systems.......................................................................................................7

Strategic planning...................................................................................................................8

LO4............................................................................................................................................8

Identifying financial problems...............................................................................................8

Financial governance.............................................................................................................8

Management accounting skill sets.........................................................................................9

Effective strategies and systems.............................................................................................9

CONCLUSION..........................................................................................................................9

REFERENCES.........................................................................................................................10

INTRODUCTION......................................................................................................................3

Task 2.........................................................................................................................................3

LO2............................................................................................................................................3

Microeconomic techniques....................................................................................................3

Product costing.......................................................................................................................5

Cost of inventory....................................................................................................................6

LO3............................................................................................................................................6

Using budgets for planning and control.................................................................................6

Pricing....................................................................................................................................7

Common costing systems.......................................................................................................7

Strategic planning...................................................................................................................8

LO4............................................................................................................................................8

Identifying financial problems...............................................................................................8

Financial governance.............................................................................................................8

Management accounting skill sets.........................................................................................9

Effective strategies and systems.............................................................................................9

CONCLUSION..........................................................................................................................9

REFERENCES.........................................................................................................................10

INTRODUCTION

Management accounting is the accounting system which is used by the organization

for taking business related decisions. In this information is collected by the internal

management team from the finance department which is analysed further for taking strategic

business decisions. In this report, Prime Furniture is taken as an organization which is based

in London. This report provides the insight about various types of management accounting

techniques and tools. It also states about that way’s organization can use management

accounting for dealing with financial problems.

Task 2

LO2

Microeconomic techniques

Cost: It is the value that is spent by the business of producing a product or a service.

It can also be said that the amount spent on procuring machines and equipment’s of the

organization.

Cost analysis: It is the relationship between cost and output. It helps in identifying

the optimum level of production by arranging the cost and the output in such a manner in

order to increase the productivity of the organization.

Cost-volume profit: It is the method of accounting that looks at the impact of cost at

different levels of volume (Punniyamoorthy, 2017). It helps in determining the break-even

point which helps in taking short term economic decisions.

Flexible budgeting: These budgets are those which can be adjusted the change in the

volume or level of activity (Lees, 2017). This budget is a very useful tool as it helps in

measuring managers efficiency.

Cost variances: It refers to the difference in the performance level when the actual

outcome defers from the standard performance set by the organization (Scott, 2019).

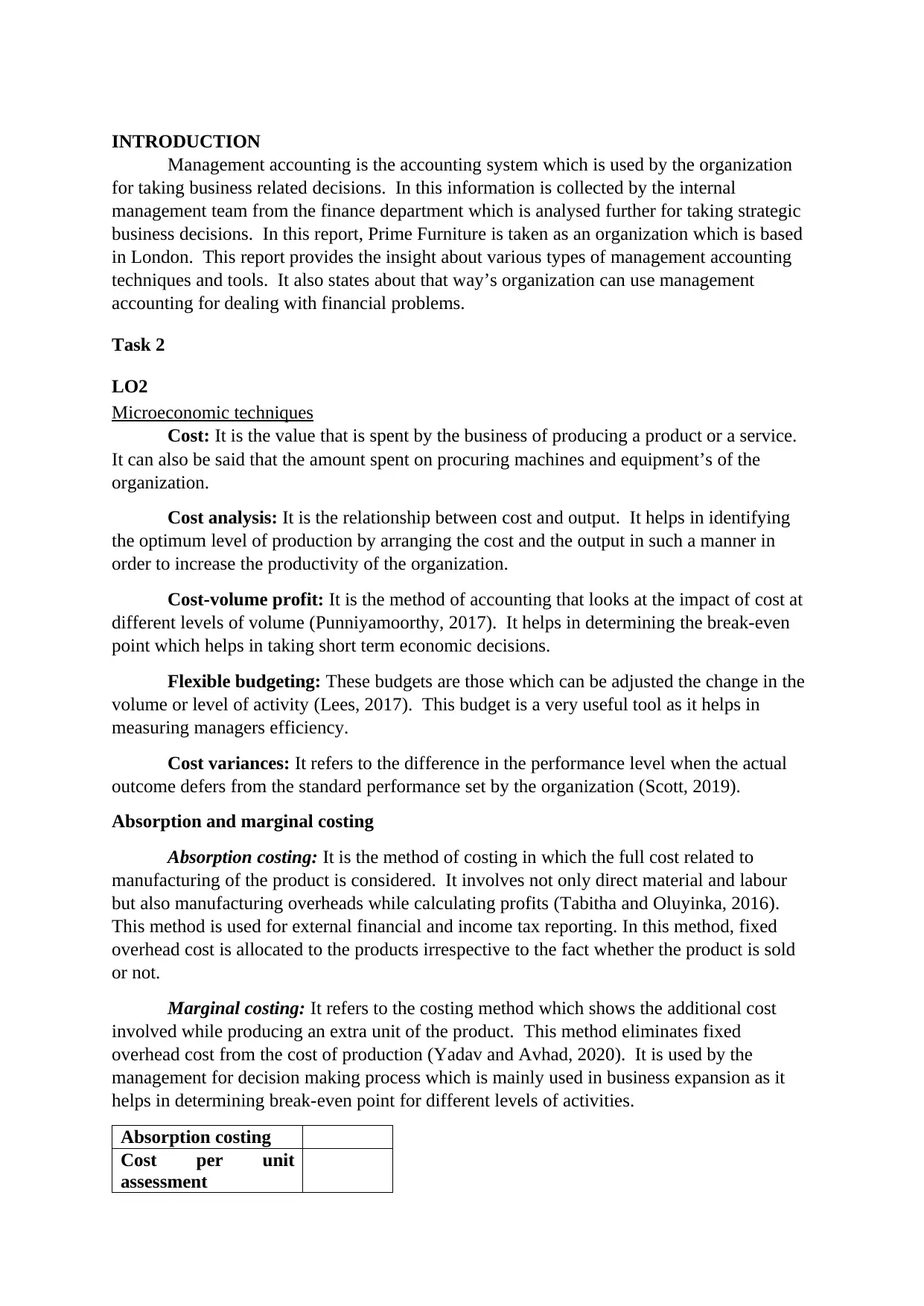

Absorption and marginal costing

Absorption costing: It is the method of costing in which the full cost related to

manufacturing of the product is considered. It involves not only direct material and labour

but also manufacturing overheads while calculating profits (Tabitha and Oluyinka, 2016).

This method is used for external financial and income tax reporting. In this method, fixed

overhead cost is allocated to the products irrespective to the fact whether the product is sold

or not.

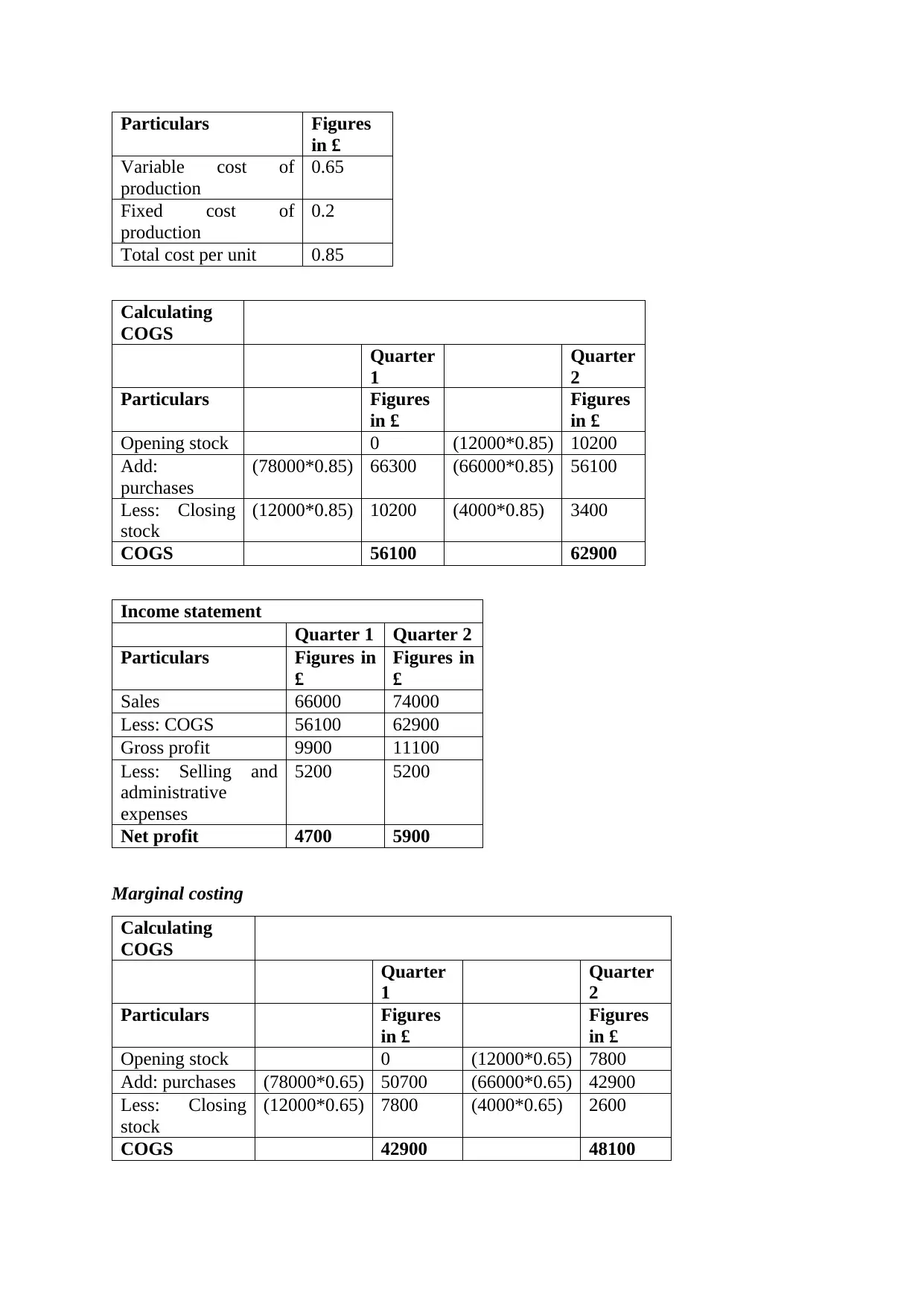

Marginal costing: It refers to the costing method which shows the additional cost

involved while producing an extra unit of the product. This method eliminates fixed

overhead cost from the cost of production (Yadav and Avhad, 2020). It is used by the

management for decision making process which is mainly used in business expansion as it

helps in determining break-even point for different levels of activities.

Absorption costing

Cost per unit

assessment

Management accounting is the accounting system which is used by the organization

for taking business related decisions. In this information is collected by the internal

management team from the finance department which is analysed further for taking strategic

business decisions. In this report, Prime Furniture is taken as an organization which is based

in London. This report provides the insight about various types of management accounting

techniques and tools. It also states about that way’s organization can use management

accounting for dealing with financial problems.

Task 2

LO2

Microeconomic techniques

Cost: It is the value that is spent by the business of producing a product or a service.

It can also be said that the amount spent on procuring machines and equipment’s of the

organization.

Cost analysis: It is the relationship between cost and output. It helps in identifying

the optimum level of production by arranging the cost and the output in such a manner in

order to increase the productivity of the organization.

Cost-volume profit: It is the method of accounting that looks at the impact of cost at

different levels of volume (Punniyamoorthy, 2017). It helps in determining the break-even

point which helps in taking short term economic decisions.

Flexible budgeting: These budgets are those which can be adjusted the change in the

volume or level of activity (Lees, 2017). This budget is a very useful tool as it helps in

measuring managers efficiency.

Cost variances: It refers to the difference in the performance level when the actual

outcome defers from the standard performance set by the organization (Scott, 2019).

Absorption and marginal costing

Absorption costing: It is the method of costing in which the full cost related to

manufacturing of the product is considered. It involves not only direct material and labour

but also manufacturing overheads while calculating profits (Tabitha and Oluyinka, 2016).

This method is used for external financial and income tax reporting. In this method, fixed

overhead cost is allocated to the products irrespective to the fact whether the product is sold

or not.

Marginal costing: It refers to the costing method which shows the additional cost

involved while producing an extra unit of the product. This method eliminates fixed

overhead cost from the cost of production (Yadav and Avhad, 2020). It is used by the

management for decision making process which is mainly used in business expansion as it

helps in determining break-even point for different levels of activities.

Absorption costing

Cost per unit

assessment

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Particulars Figures

in £

Variable cost of

production

0.65

Fixed cost of

production

0.2

Total cost per unit 0.85

Calculating

COGS

Quarter

1

Quarter

2

Particulars Figures

in £

Figures

in £

Opening stock 0 (12000*0.85) 10200

Add:

purchases

(78000*0.85) 66300 (66000*0.85) 56100

Less: Closing

stock

(12000*0.85) 10200 (4000*0.85) 3400

COGS 56100 62900

Income statement

Quarter 1 Quarter 2

Particulars Figures in

£

Figures in

£

Sales 66000 74000

Less: COGS 56100 62900

Gross profit 9900 11100

Less: Selling and

administrative

expenses

5200 5200

Net profit 4700 5900

Marginal costing

Calculating

COGS

Quarter

1

Quarter

2

Particulars Figures

in £

Figures

in £

Opening stock 0 (12000*0.65) 7800

Add: purchases (78000*0.65) 50700 (66000*0.65) 42900

Less: Closing

stock

(12000*0.65) 7800 (4000*0.65) 2600

COGS 42900 48100

in £

Variable cost of

production

0.65

Fixed cost of

production

0.2

Total cost per unit 0.85

Calculating

COGS

Quarter

1

Quarter

2

Particulars Figures

in £

Figures

in £

Opening stock 0 (12000*0.85) 10200

Add:

purchases

(78000*0.85) 66300 (66000*0.85) 56100

Less: Closing

stock

(12000*0.85) 10200 (4000*0.85) 3400

COGS 56100 62900

Income statement

Quarter 1 Quarter 2

Particulars Figures in

£

Figures in

£

Sales 66000 74000

Less: COGS 56100 62900

Gross profit 9900 11100

Less: Selling and

administrative

expenses

5200 5200

Net profit 4700 5900

Marginal costing

Calculating

COGS

Quarter

1

Quarter

2

Particulars Figures

in £

Figures

in £

Opening stock 0 (12000*0.65) 7800

Add: purchases (78000*0.65) 50700 (66000*0.65) 42900

Less: Closing

stock

(12000*0.65) 7800 (4000*0.65) 2600

COGS 42900 48100

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

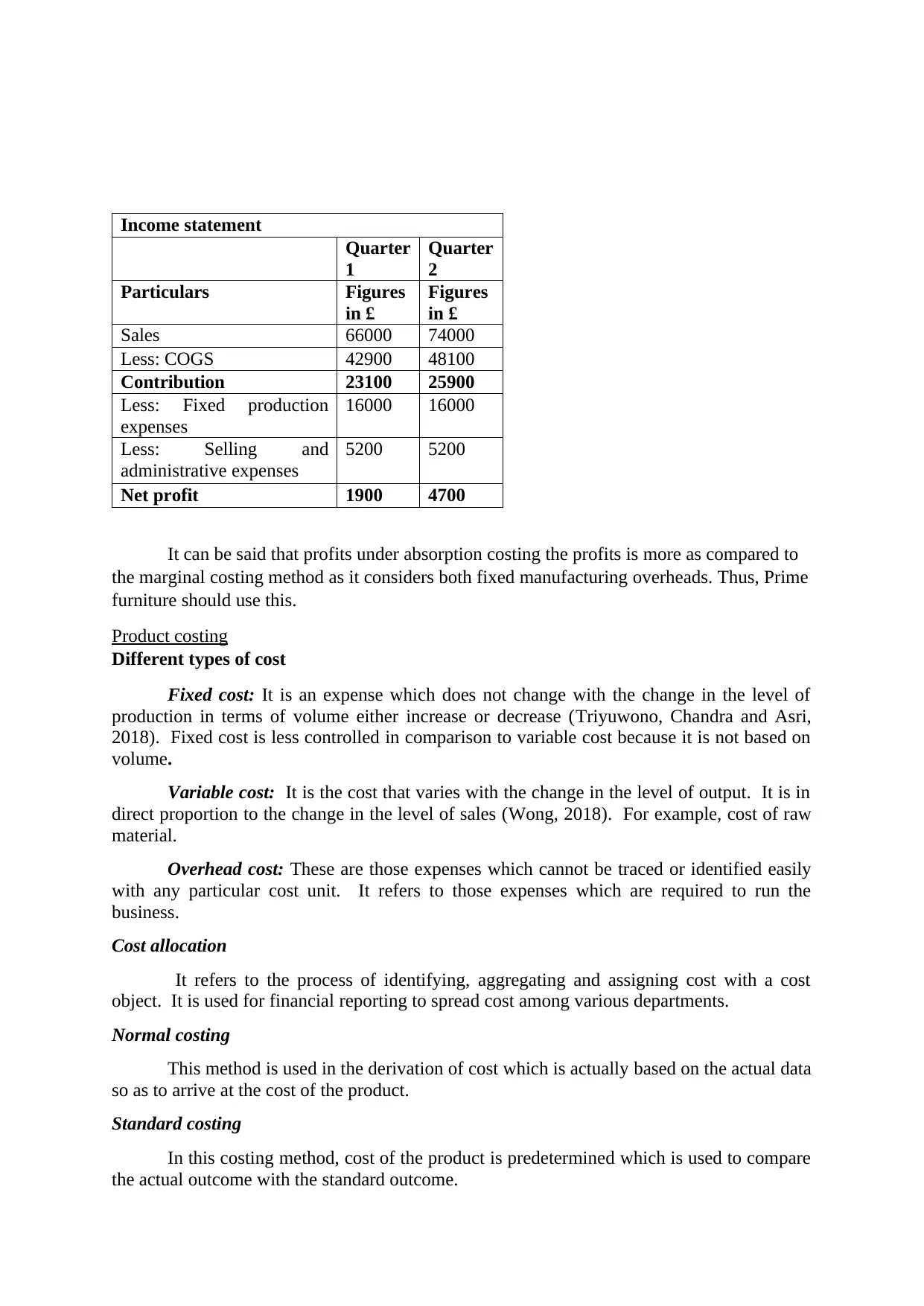

Income statement

Quarter

1

Quarter

2

Particulars Figures

in £

Figures

in £

Sales 66000 74000

Less: COGS 42900 48100

Contribution 23100 25900

Less: Fixed production

expenses

16000 16000

Less: Selling and

administrative expenses

5200 5200

Net profit 1900 4700

It can be said that profits under absorption costing the profits is more as compared to

the marginal costing method as it considers both fixed manufacturing overheads. Thus, Prime

furniture should use this.

Product costing

Different types of cost

Fixed cost: It is an expense which does not change with the change in the level of

production in terms of volume either increase or decrease (Triyuwono, Chandra and Asri,

2018). Fixed cost is less controlled in comparison to variable cost because it is not based on

volume.

Variable cost: It is the cost that varies with the change in the level of output. It is in

direct proportion to the change in the level of sales (Wong, 2018). For example, cost of raw

material.

Overhead cost: These are those expenses which cannot be traced or identified easily

with any particular cost unit. It refers to those expenses which are required to run the

business.

Cost allocation

It refers to the process of identifying, aggregating and assigning cost with a cost

object. It is used for financial reporting to spread cost among various departments.

Normal costing

This method is used in the derivation of cost which is actually based on the actual data

so as to arrive at the cost of the product.

Standard costing

In this costing method, cost of the product is predetermined which is used to compare

the actual outcome with the standard outcome.

Quarter

1

Quarter

2

Particulars Figures

in £

Figures

in £

Sales 66000 74000

Less: COGS 42900 48100

Contribution 23100 25900

Less: Fixed production

expenses

16000 16000

Less: Selling and

administrative expenses

5200 5200

Net profit 1900 4700

It can be said that profits under absorption costing the profits is more as compared to

the marginal costing method as it considers both fixed manufacturing overheads. Thus, Prime

furniture should use this.

Product costing

Different types of cost

Fixed cost: It is an expense which does not change with the change in the level of

production in terms of volume either increase or decrease (Triyuwono, Chandra and Asri,

2018). Fixed cost is less controlled in comparison to variable cost because it is not based on

volume.

Variable cost: It is the cost that varies with the change in the level of output. It is in

direct proportion to the change in the level of sales (Wong, 2018). For example, cost of raw

material.

Overhead cost: These are those expenses which cannot be traced or identified easily

with any particular cost unit. It refers to those expenses which are required to run the

business.

Cost allocation

It refers to the process of identifying, aggregating and assigning cost with a cost

object. It is used for financial reporting to spread cost among various departments.

Normal costing

This method is used in the derivation of cost which is actually based on the actual data

so as to arrive at the cost of the product.

Standard costing

In this costing method, cost of the product is predetermined which is used to compare

the actual outcome with the standard outcome.

Activity based costing

This method of costing identifies the different activities in the organization and then

assigns the cost incurred in activity to the particular product or services (Lueg and Storgaard,

2017).

Costing plays an important role in setting the price of the product as the

businesses adds the profit margin to the actual cost incurred on the product and then offers

the products and services in the market at the rate determined.

Cost of inventory

Inventory cost: It is the cost incurred with the purpose to procure, store and

management of inventory (Galdi and et.al, 2019). There are 2 types of inventory cost.

Ordering cost: it is the cost that is incurred for processing an order to a supplier. It is

included in the determining economic order quantity.

Carrying cost: it is the cost related to storing all the unsold goods. It includes all the

cost in respect to warehousing, transportation, handling, tax and insurance of the goods as

well as shrinkage and opportunity cost.

Reducing the inventory cost will result in increasing profit margins of the product and

also helps in increasing the profitability and efficiency of the business. Thus, it is very

beneficial.

Inventory valuation methods

First-in, first-out: This method is an assumption in which the goods which are

purchased first are supposed to be sold first. This method is considered the most suitable

method for valuing inventory.

Last-in, first-out: It is also based on assumption that the last item placed in the

inventory is to be sold out first by the end of the specific period.

Weighted average: Under this, cost of goods available is divided by the number of

units available which derives the weighted average cost per unit.

LO3

Using budgets for planning and control

Budget is a financial plan mostly prepared for a year. It includes estimated revenue

and expenses and cash flows of Prime Furnitures for a specific period. The two types of

budgets are stated below.

Capital budget: This budget is prepared in respect to investment. It helps in analysing

the future investment and expenditure (Soares and et.al, 2020). For instance, whether to

purchase new machinery or replace the existing one or whether to invest in the research and

development or not.

Operating budget: It is the forecast of the expected revenue and expenditure for the

future period which is expected by the business to achieve.

Alternative methods of budgeting

Incremental budgeting: It is the budget which is prepared either using previous year

budget or actual performance in which the additional amount is added or subtracted while

This method of costing identifies the different activities in the organization and then

assigns the cost incurred in activity to the particular product or services (Lueg and Storgaard,

2017).

Costing plays an important role in setting the price of the product as the

businesses adds the profit margin to the actual cost incurred on the product and then offers

the products and services in the market at the rate determined.

Cost of inventory

Inventory cost: It is the cost incurred with the purpose to procure, store and

management of inventory (Galdi and et.al, 2019). There are 2 types of inventory cost.

Ordering cost: it is the cost that is incurred for processing an order to a supplier. It is

included in the determining economic order quantity.

Carrying cost: it is the cost related to storing all the unsold goods. It includes all the

cost in respect to warehousing, transportation, handling, tax and insurance of the goods as

well as shrinkage and opportunity cost.

Reducing the inventory cost will result in increasing profit margins of the product and

also helps in increasing the profitability and efficiency of the business. Thus, it is very

beneficial.

Inventory valuation methods

First-in, first-out: This method is an assumption in which the goods which are

purchased first are supposed to be sold first. This method is considered the most suitable

method for valuing inventory.

Last-in, first-out: It is also based on assumption that the last item placed in the

inventory is to be sold out first by the end of the specific period.

Weighted average: Under this, cost of goods available is divided by the number of

units available which derives the weighted average cost per unit.

LO3

Using budgets for planning and control

Budget is a financial plan mostly prepared for a year. It includes estimated revenue

and expenses and cash flows of Prime Furnitures for a specific period. The two types of

budgets are stated below.

Capital budget: This budget is prepared in respect to investment. It helps in analysing

the future investment and expenditure (Soares and et.al, 2020). For instance, whether to

purchase new machinery or replace the existing one or whether to invest in the research and

development or not.

Operating budget: It is the forecast of the expected revenue and expenditure for the

future period which is expected by the business to achieve.

Alternative methods of budgeting

Incremental budgeting: It is the budget which is prepared either using previous year

budget or actual performance in which the additional amount is added or subtracted while

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

making the new budget (Ouassini, 2018). It is the easiest method of budgeting as it does not

require any complex calculations.

Activity based budgeting: It is based on activity-based costing in which budget is

prepared after considered all the cost incurred and based on which resources are allocated to

the activities. This helps the management in effectively managing the operational requirement

by providing better process and decision-making basis.

Behavioural implication of budget

Dysfunctional behaviour: When the manager of the organization participates in the

budgeting process they feel as sense of conformity with the goals. But, many times because

of improper management managers feels negative and such behaviour is called dysfunctional

behaviour.

Participative budgeting: There are two types of budgeting (Derfuss, 2016). In top-

down budgeting, top management people formulate the budget for whole organization and in

down-top budget, employees are given opportunity to participate in the budgeting process.

This gives appositive message to the employees.

Pricing

Pricing is the method in which the organization sets the price of its product and

services for creating market offerings. Pricing strategies used by competitors are stated

below.

Premium pricing: In this, price of the product is set high with the core objective of

gaining higher profits and attracting premium customer segment.

Penetration pricing: Under this, organizations keep its profit margins low for

attracting customers (Jung, Park and Choi, 2018). The Prime Furniture is using this strategy

with the purpose of increasing its customer base. This strategy tends to reduce market

competition by forcing small competitors to exit the market.

Competitive pricing: In this strategy, the prices is determined based on the prices set

by the other competitors. The aim is to lower the price in comparison to the competitors. This

strategy helps in gaining market share.

The organization Prime Furniture considers using demand and supply for determining

the price of its products. It helps it in estimating the price that the customers are willing to

pay and according to which profit margin is set.

Common costing systems

Actual costing: In this the business entity measures the actual cost direct labour,

material and overhead costs for manufacturing the product and determines the cost of specific

product.

Job costing: It is the costing system in which tracks the cost by job and helps in

standardizing the profitability for each job separately (Collis and Hussey, 2017).

Process costing: In this, the cost is traced and accumulated and allocates the indirect

costs to the production process.

Batch costing: In this, production takes place in a batch consisting of certain number

of products and is taken as cost units.

require any complex calculations.

Activity based budgeting: It is based on activity-based costing in which budget is

prepared after considered all the cost incurred and based on which resources are allocated to

the activities. This helps the management in effectively managing the operational requirement

by providing better process and decision-making basis.

Behavioural implication of budget

Dysfunctional behaviour: When the manager of the organization participates in the

budgeting process they feel as sense of conformity with the goals. But, many times because

of improper management managers feels negative and such behaviour is called dysfunctional

behaviour.

Participative budgeting: There are two types of budgeting (Derfuss, 2016). In top-

down budgeting, top management people formulate the budget for whole organization and in

down-top budget, employees are given opportunity to participate in the budgeting process.

This gives appositive message to the employees.

Pricing

Pricing is the method in which the organization sets the price of its product and

services for creating market offerings. Pricing strategies used by competitors are stated

below.

Premium pricing: In this, price of the product is set high with the core objective of

gaining higher profits and attracting premium customer segment.

Penetration pricing: Under this, organizations keep its profit margins low for

attracting customers (Jung, Park and Choi, 2018). The Prime Furniture is using this strategy

with the purpose of increasing its customer base. This strategy tends to reduce market

competition by forcing small competitors to exit the market.

Competitive pricing: In this strategy, the prices is determined based on the prices set

by the other competitors. The aim is to lower the price in comparison to the competitors. This

strategy helps in gaining market share.

The organization Prime Furniture considers using demand and supply for determining

the price of its products. It helps it in estimating the price that the customers are willing to

pay and according to which profit margin is set.

Common costing systems

Actual costing: In this the business entity measures the actual cost direct labour,

material and overhead costs for manufacturing the product and determines the cost of specific

product.

Job costing: It is the costing system in which tracks the cost by job and helps in

standardizing the profitability for each job separately (Collis and Hussey, 2017).

Process costing: In this, the cost is traced and accumulated and allocates the indirect

costs to the production process.

Batch costing: In this, production takes place in a batch consisting of certain number

of products and is taken as cost units.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contract costing: In this cost is traced according to the specific contract. It is mostly

used in construction company.

Strategic planning

PEST

Political factor: This factor is unfavourable as there is political instability in UK.

Economic factor: It is favourable as lower interest rate will help the organization in

getting funds at lower rate (SHTAL and et.al, 2018).

Social factor: It is unfavourable as the market trend keeps on changing.

Technology factor: This factor is unfavourable as it is difficult for Prime Furniture to

decide which technology is beneficial to it.

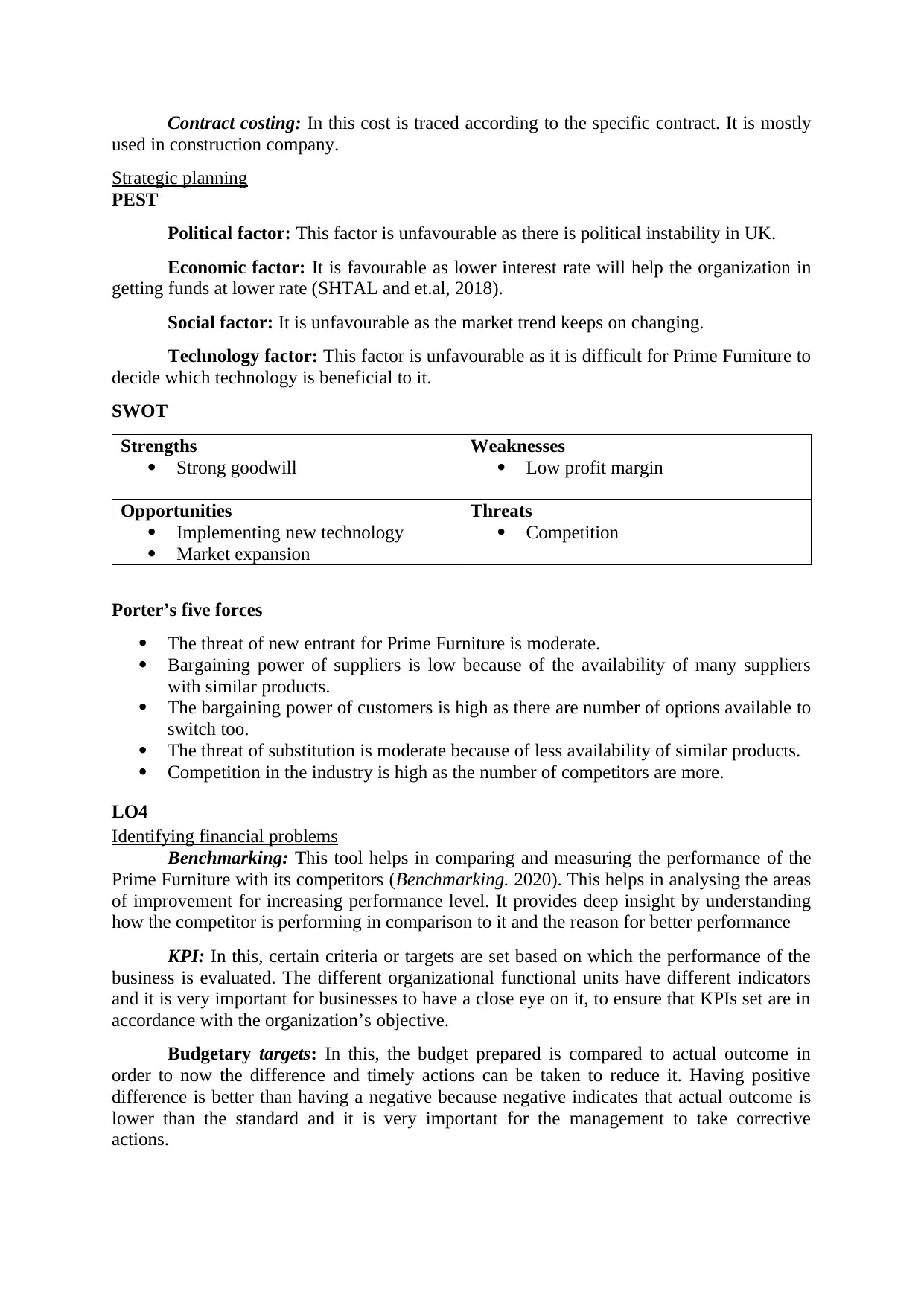

SWOT

Strengths

Strong goodwill

Weaknesses

Low profit margin

Opportunities

Implementing new technology

Market expansion

Threats

Competition

Porter’s five forces

The threat of new entrant for Prime Furniture is moderate.

Bargaining power of suppliers is low because of the availability of many suppliers

with similar products.

The bargaining power of customers is high as there are number of options available to

switch too.

The threat of substitution is moderate because of less availability of similar products.

Competition in the industry is high as the number of competitors are more.

LO4

Identifying financial problems

Benchmarking: This tool helps in comparing and measuring the performance of the

Prime Furniture with its competitors (Benchmarking. 2020). This helps in analysing the areas

of improvement for increasing performance level. It provides deep insight by understanding

how the competitor is performing in comparison to it and the reason for better performance

KPI: In this, certain criteria or targets are set based on which the performance of the

business is evaluated. The different organizational functional units have different indicators

and it is very important for businesses to have a close eye on it, to ensure that KPIs set are in

accordance with the organization’s objective.

Budgetary targets: In this, the budget prepared is compared to actual outcome in

order to now the difference and timely actions can be taken to reduce it. Having positive

difference is better than having a negative because negative indicates that actual outcome is

lower than the standard and it is very important for the management to take corrective

actions.

used in construction company.

Strategic planning

PEST

Political factor: This factor is unfavourable as there is political instability in UK.

Economic factor: It is favourable as lower interest rate will help the organization in

getting funds at lower rate (SHTAL and et.al, 2018).

Social factor: It is unfavourable as the market trend keeps on changing.

Technology factor: This factor is unfavourable as it is difficult for Prime Furniture to

decide which technology is beneficial to it.

SWOT

Strengths

Strong goodwill

Weaknesses

Low profit margin

Opportunities

Implementing new technology

Market expansion

Threats

Competition

Porter’s five forces

The threat of new entrant for Prime Furniture is moderate.

Bargaining power of suppliers is low because of the availability of many suppliers

with similar products.

The bargaining power of customers is high as there are number of options available to

switch too.

The threat of substitution is moderate because of less availability of similar products.

Competition in the industry is high as the number of competitors are more.

LO4

Identifying financial problems

Benchmarking: This tool helps in comparing and measuring the performance of the

Prime Furniture with its competitors (Benchmarking. 2020). This helps in analysing the areas

of improvement for increasing performance level. It provides deep insight by understanding

how the competitor is performing in comparison to it and the reason for better performance

KPI: In this, certain criteria or targets are set based on which the performance of the

business is evaluated. The different organizational functional units have different indicators

and it is very important for businesses to have a close eye on it, to ensure that KPIs set are in

accordance with the organization’s objective.

Budgetary targets: In this, the budget prepared is compared to actual outcome in

order to now the difference and timely actions can be taken to reduce it. Having positive

difference is better than having a negative because negative indicates that actual outcome is

lower than the standard and it is very important for the management to take corrective

actions.

Financial governance

It includes how the organizations track the financial transaction, performance,

compliance and operation of the business which helps in identifying the risk factor

(Financial Governance. 2020). The risk related to poor financial governance are fraud,

material errors, regulatory penalties, lack of stakeholder’s trust and confidence and poor

decision making.

Financial governance as a monitoring system will help in collecting varied

information about the business in relation to compliance, disclosure, financial transaction etc.

It is the policies and procedures that the businesses use to effectively manage its data. It

includes internal controls, financial policies, internal and external audits, data security and

tracking.

Management accounting skill sets

Characteristics of effective management accountant

Competence: The professional is required to expert in the field having relevant

knowledge and skills. Also, should perform the duties according to the relevant laws and

regulations. The professional is required to provide accurate, clear and concise information.

Integrity: It is the important duty of the management accountant to communicate with the

business associates in the organization on a timely basis in order to avoid or mitigate any

conflict that may rise. The profession should refrain from engaging into the activities that is

ethical duties or prejudice to the interest of others.

Credibility: The effective management accountant will disclose all the relevant

information that may have an influence on user’s understanding and in the decision making

of the organization. It is also required to disclose any discrepancy in the information,

procedures and in the internal control system in accordance with applicable law.

Confidentiality: An effective management accountant will tend to maintain the

confidentiality of the information and will not disclose it to any outsider except when

authorized or required legally. Also, should inform all the relevant user or partners or

employees with respect to the use of information and maintaining confidentiality. The

management accountant is also required to monitor the performance of the employees for

ensuring compliance.

These characteristics or skills will help in effectively managing the challenges in a

systematic manner. It will help in identifying the unnecessary expense which can be

eliminated and result into reduction in cost. It helps in formulating better and effective

plan which can ensure success of the organization and in meeting with financial problems

(What Skills are Important to be a Management Accountant? 2020).

Effective strategies and systems

It is the responsibility of Prime Furniture to make a correct disclosure about the

financial position of the business. By providing right information will help the company in

taking better and relevant decisions which will provide more benefits to them. This will help

the organization in effectively and efficiently managing the business.

CONCLUSION

It can be concluded that management accounting has a several roles to play in the

effective management of the business. The costing techniques like cost volume analysis

which can be beneficial for the Prime Furniture for determining the break-even point. There

different budgeting, pricing and costing method that can be used by Prime Furniture.

It includes how the organizations track the financial transaction, performance,

compliance and operation of the business which helps in identifying the risk factor

(Financial Governance. 2020). The risk related to poor financial governance are fraud,

material errors, regulatory penalties, lack of stakeholder’s trust and confidence and poor

decision making.

Financial governance as a monitoring system will help in collecting varied

information about the business in relation to compliance, disclosure, financial transaction etc.

It is the policies and procedures that the businesses use to effectively manage its data. It

includes internal controls, financial policies, internal and external audits, data security and

tracking.

Management accounting skill sets

Characteristics of effective management accountant

Competence: The professional is required to expert in the field having relevant

knowledge and skills. Also, should perform the duties according to the relevant laws and

regulations. The professional is required to provide accurate, clear and concise information.

Integrity: It is the important duty of the management accountant to communicate with the

business associates in the organization on a timely basis in order to avoid or mitigate any

conflict that may rise. The profession should refrain from engaging into the activities that is

ethical duties or prejudice to the interest of others.

Credibility: The effective management accountant will disclose all the relevant

information that may have an influence on user’s understanding and in the decision making

of the organization. It is also required to disclose any discrepancy in the information,

procedures and in the internal control system in accordance with applicable law.

Confidentiality: An effective management accountant will tend to maintain the

confidentiality of the information and will not disclose it to any outsider except when

authorized or required legally. Also, should inform all the relevant user or partners or

employees with respect to the use of information and maintaining confidentiality. The

management accountant is also required to monitor the performance of the employees for

ensuring compliance.

These characteristics or skills will help in effectively managing the challenges in a

systematic manner. It will help in identifying the unnecessary expense which can be

eliminated and result into reduction in cost. It helps in formulating better and effective

plan which can ensure success of the organization and in meeting with financial problems

(What Skills are Important to be a Management Accountant? 2020).

Effective strategies and systems

It is the responsibility of Prime Furniture to make a correct disclosure about the

financial position of the business. By providing right information will help the company in

taking better and relevant decisions which will provide more benefits to them. This will help

the organization in effectively and efficiently managing the business.

CONCLUSION

It can be concluded that management accounting has a several roles to play in the

effective management of the business. The costing techniques like cost volume analysis

which can be beneficial for the Prime Furniture for determining the break-even point. There

different budgeting, pricing and costing method that can be used by Prime Furniture.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Methods such as benchmarking, KPIs can be used to face the financial problems. All these

can be achieved by effective management accounting skills.

can be achieved by effective management accounting skills.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books and journals

Collis, J. and Hussey, R., 2017. Cost and management accounting. Macmillan International

Higher Education.

Derfuss, K., 2016. Reconsidering the participative budgeting–performance relation: A meta-

analysis regarding the impact of level of analysis, sample selection, measurement, and

industry influences. The British Accounting Review. 48(1). pp.17-37.

Galdi, F. C. and et.al, 2019. Accounting for Inventory Costs and Real Earnings Management

Behavior. Available at SSRN 3480492.

Jung, I., Park, I. and Choi, J. H., 2018. Examining the performance index of retail pricing

strategies under different types of competition. International Journal of Revenue

Management. 10(3-4). pp.290-325.

Lees, N. D., 2017. A Flexible, Incentivized Budgeting System for Academic Departments.

Lueg, R. and Storgaard, N., 2017. The adoption and implementation of Activity-based

Costing: A systematic literature review. International Journal of Strategic

Management. 17(2). pp.7-24.

Ouassini, I., 2018. An introduction to the concept of Incremental Budgeting and Beyond

Budgeting. Available at SSRN 3140059.

Punniyamoorthy, R., 2017. Examining Cost Volume Profit And Decision Tree Analysis Of A

Selected Company. World Wide Journal Of Multidiscipl Inary Research And

Development Wwjmrd. 3(9). pp.224-233.

Scott, P., 2019. Introduction to Management Accounting. Oxford University Press, USA.

SHTAL, T. V. and et.al, 2018. Methods of analysis of the external environment of business

activities. Revista ESPACIOS. 39(12).

Soares, C. A. P. and et.al, 2020. INVESTMENT CAPITAL BUDGET METHOD

ORIENTED TO PROJECT MANAGEMENT. GSJ. 8(3).

Tabitha, N. and Oluyinka, I. O., 2016. Cost Accounting Techniques Adopted By

Manufacturing And Service Industry Within The Last Decade. International Journal

Of Advances In Management And Economics. 5(1). pp.48-61.

Triyuwono, E., Chandra, F. and Asri, M., 2018. Costing Assignment Approaches. Available

at SSRN 3209974.

Wong, I., 2018. Managerial Accounting Strategies for Optimal Costs.

Yadav, R. R. and Avhad, S. M., 2020. INTRODUCTION TO COST AND MANAGERIAL

ACCOUNTING.

Online

Benchmarking. 2020. [Online]. Available Through:<

https://businessjargons.com/benchmarking.html>.

Financial Governance. 2020. [Online]. Available Through:<

https://www.tagetik.com/en/glossary/financial-governance#.XpHJE_gzbDc>.

What Skills are Important to be a Management Accountant? 2020. [Online]. Available

Through:< https://www.online-accounting-degrees.net/faq/what-skills-are-important-

to-be-a-management-accountant/>.

Books and journals

Collis, J. and Hussey, R., 2017. Cost and management accounting. Macmillan International

Higher Education.

Derfuss, K., 2016. Reconsidering the participative budgeting–performance relation: A meta-

analysis regarding the impact of level of analysis, sample selection, measurement, and

industry influences. The British Accounting Review. 48(1). pp.17-37.

Galdi, F. C. and et.al, 2019. Accounting for Inventory Costs and Real Earnings Management

Behavior. Available at SSRN 3480492.

Jung, I., Park, I. and Choi, J. H., 2018. Examining the performance index of retail pricing

strategies under different types of competition. International Journal of Revenue

Management. 10(3-4). pp.290-325.

Lees, N. D., 2017. A Flexible, Incentivized Budgeting System for Academic Departments.

Lueg, R. and Storgaard, N., 2017. The adoption and implementation of Activity-based

Costing: A systematic literature review. International Journal of Strategic

Management. 17(2). pp.7-24.

Ouassini, I., 2018. An introduction to the concept of Incremental Budgeting and Beyond

Budgeting. Available at SSRN 3140059.

Punniyamoorthy, R., 2017. Examining Cost Volume Profit And Decision Tree Analysis Of A

Selected Company. World Wide Journal Of Multidiscipl Inary Research And

Development Wwjmrd. 3(9). pp.224-233.

Scott, P., 2019. Introduction to Management Accounting. Oxford University Press, USA.

SHTAL, T. V. and et.al, 2018. Methods of analysis of the external environment of business

activities. Revista ESPACIOS. 39(12).

Soares, C. A. P. and et.al, 2020. INVESTMENT CAPITAL BUDGET METHOD

ORIENTED TO PROJECT MANAGEMENT. GSJ. 8(3).

Tabitha, N. and Oluyinka, I. O., 2016. Cost Accounting Techniques Adopted By

Manufacturing And Service Industry Within The Last Decade. International Journal

Of Advances In Management And Economics. 5(1). pp.48-61.

Triyuwono, E., Chandra, F. and Asri, M., 2018. Costing Assignment Approaches. Available

at SSRN 3209974.

Wong, I., 2018. Managerial Accounting Strategies for Optimal Costs.

Yadav, R. R. and Avhad, S. M., 2020. INTRODUCTION TO COST AND MANAGERIAL

ACCOUNTING.

Online

Benchmarking. 2020. [Online]. Available Through:<

https://businessjargons.com/benchmarking.html>.

Financial Governance. 2020. [Online]. Available Through:<

https://www.tagetik.com/en/glossary/financial-governance#.XpHJE_gzbDc>.

What Skills are Important to be a Management Accountant? 2020. [Online]. Available

Through:< https://www.online-accounting-degrees.net/faq/what-skills-are-important-

to-be-a-management-accountant/>.

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.