Management Accounting Report: MAS, Costing, and Financial Analysis

VerifiedAdded on 2023/01/19

|16

|4283

|47

Report

AI Summary

This report provides a detailed overview of management accounting, focusing on its role in business operations and decision-making. It begins with a comparison between management accounting and financial accounting, highlighting their differences in terms of legal requirements, format, and data types. The report then explores various Management Accounting Systems (MAS), including cost accounting, inventory management, and job costing systems, along with their benefits and alignment with organizational processes, using Excite Entertainment Limited as a case study. Different types of managerial reports are also discussed, such as cost accounting reports, accounts receivable aging reports, stock reports, and performance reports, along with characteristics of good information. The second part of the report delves into costing methods, comparing absorption and marginal costing techniques, including break-even analysis and its influencing factors. The report includes income statements prepared using both absorption and marginal costing, and interprets the data for a range of business activities.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

TASK 1............................................................................................................................................1

TASK 2............................................................................................................................................5

TASK 3............................................................................................................................................8

TASK 4..........................................................................................................................................10

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

TASK 1............................................................................................................................................1

TASK 2............................................................................................................................................5

TASK 3............................................................................................................................................8

TASK 4..........................................................................................................................................10

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

INTRODUCTION

The management accounting is a form of accounting which is associated with gathering

and analysing of financial & non financial information about companies' transactions in order to

prepare internal reports (Aouni, McGillis and Abdulkarim, 2017). This is the main function of

MA because its objective is to helping companies' managers in decision making by providing

reliable informations. This accounting is not essentially required in companies as other

accounting methods. The objective of project report is to spreading information about role and

functions of MA in the aspect of companies operations and activities. In the project report

various types of MAS , MA reports, planning tools of budgetary control are included. For better

understanding of these tasks a company is chosen which is Excite entertainment limited that

operates in entertainment industry. This company is located in United Kingdom.

MAIN BODY

TASK 1

Section (A)

(a) Comparison between management accounting and financial accounting

Basis Management accounting Financial accounting

Legal

requirement

The management accounting is not

essential for companies to implement

in their operations. It depends on

companies' willing whether they want

to apply this accounting or not.

On contrary, the financial accounting

is essential for companies to apply in

order to produce financial statements.

Format of

presentation

In this accounting, internal reports are

prepared without any particular format.

While in financial accounting,

financial reports are prepared as

accordance to international financial

reporting standards.

Types of data

used

Under, management accounting both

types of data including monetary and

On the other hand, in financial

accounting only monetary information

1

The management accounting is a form of accounting which is associated with gathering

and analysing of financial & non financial information about companies' transactions in order to

prepare internal reports (Aouni, McGillis and Abdulkarim, 2017). This is the main function of

MA because its objective is to helping companies' managers in decision making by providing

reliable informations. This accounting is not essentially required in companies as other

accounting methods. The objective of project report is to spreading information about role and

functions of MA in the aspect of companies operations and activities. In the project report

various types of MAS , MA reports, planning tools of budgetary control are included. For better

understanding of these tasks a company is chosen which is Excite entertainment limited that

operates in entertainment industry. This company is located in United Kingdom.

MAIN BODY

TASK 1

Section (A)

(a) Comparison between management accounting and financial accounting

Basis Management accounting Financial accounting

Legal

requirement

The management accounting is not

essential for companies to implement

in their operations. It depends on

companies' willing whether they want

to apply this accounting or not.

On contrary, the financial accounting

is essential for companies to apply in

order to produce financial statements.

Format of

presentation

In this accounting, internal reports are

prepared without any particular format.

While in financial accounting,

financial reports are prepared as

accordance to international financial

reporting standards.

Types of data

used

Under, management accounting both

types of data including monetary and

On the other hand, in financial

accounting only monetary information

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

non monetary are used in reports. is included.

Different types of MAS :

(b) Cost accounting system – This is a kind of accounting system that links with companies'

financial department because it predicts possible expenses (Vann, 2016). On the basis of it,

business entities allocates their funds in various kind of activities and operations. In addition, this

accounting system is compulsory for companies to apply because of its importance for finance

department as by use of information provided by this accounting system they can focus on those

activities which are high cost consuming. Under this accounting system, various costing

techniques are included such as absorption and marginal costing. Both these techniques help in

the aspect of better decision making regards to fund management. Like the above Excite

entertainment limited company is applying this accounting system in the aspect of controlling

and reducing their expenses as accordance of standard cost.

(c) Inventory management system – It can be defined as a type of accounting system that assess

the information about companies stored material in warehouses and provides guidance to

companies' managers for effective management of inventories (Arunruangsirilert and

Chonglerttham, 2017). This is too crucial for companies because in the absence of it, business

entities can not control storage cost. Basically, the inventory management system consists

various kind of techniques such as just in time, perpetual inventory management system and

periodic inventory system. All these techniques play a significant role for companies in order to

better management of their materials. The just in time technique is important for minimising time

of manufacturing. As well as the perpetual inventory system helps in keeping inventory records

up to date. Like in the aspect of above Excite entertainment limited company, they are managing

their inventories by help of these techniques.

(d) Job costing system – This is a kind of accounting system which is related with process of

computing cost of each job involved in different business activities (Nakajima, Kimura and

Wagner, 2015). In addition, it is mainly used for those companies in which large number of

products are produced. Due to this accounting system price of each unit is being calculated

individually. The job costing system is required in companies for proper assessment of cost

2

Different types of MAS :

(b) Cost accounting system – This is a kind of accounting system that links with companies'

financial department because it predicts possible expenses (Vann, 2016). On the basis of it,

business entities allocates their funds in various kind of activities and operations. In addition, this

accounting system is compulsory for companies to apply because of its importance for finance

department as by use of information provided by this accounting system they can focus on those

activities which are high cost consuming. Under this accounting system, various costing

techniques are included such as absorption and marginal costing. Both these techniques help in

the aspect of better decision making regards to fund management. Like the above Excite

entertainment limited company is applying this accounting system in the aspect of controlling

and reducing their expenses as accordance of standard cost.

(c) Inventory management system – It can be defined as a type of accounting system that assess

the information about companies stored material in warehouses and provides guidance to

companies' managers for effective management of inventories (Arunruangsirilert and

Chonglerttham, 2017). This is too crucial for companies because in the absence of it, business

entities can not control storage cost. Basically, the inventory management system consists

various kind of techniques such as just in time, perpetual inventory management system and

periodic inventory system. All these techniques play a significant role for companies in order to

better management of their materials. The just in time technique is important for minimising time

of manufacturing. As well as the perpetual inventory system helps in keeping inventory records

up to date. Like in the aspect of above Excite entertainment limited company, they are managing

their inventories by help of these techniques.

(d) Job costing system – This is a kind of accounting system which is related with process of

computing cost of each job involved in different business activities (Nakajima, Kimura and

Wagner, 2015). In addition, it is mainly used for those companies in which large number of

products are produced. Due to this accounting system price of each unit is being calculated

individually. The job costing system is required in companies for proper assessment of cost

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

during entire manufacturing process. In the context of above respective company, Excite

entertainment limited their managers are using this accounting system in order to compute cost

of each job separately.

(e) Evaluation about how MAS and management accounting reports are aligned with

organisational process.

It is important for succession of any kind of business entity that there should be

integration of MAS and MA reports with companies process (Murthy and Rooney, 2018). For

example in above Excite entertainment limited they are applying different accounting systems

such as cost accounting system which integrates with finance department. As well as inventory

management system aligns with production department. Apart from it, their accountants are

producing various kind of reports like performance report, stock report which are linked with

their different departments. This shows that MAS and MA reports are aligned with the

companies operations.

Benefits of above mentioned MAS:

Benefit of cost accounting system- This accounting system is useful for companies in

order to control and manage all type of expenditures effectively. In the aspect of above

Excite entertainment limited company, their managers are using this accounting system

for assessment of total expenditures that occurs in their operations.

Benefit of inventory management system – This accounting system tracks the quantity of

stored materials in warehouses (Gomez-Conde and Lopez-Valeiras, 2018). On the basis

of it companies take their futuristic decisions effectively. Such as the above respective

company, is implementing this accounting system for reducing over purchasing

expenditures on the basis of information provided by this accounting system.

Benefits of job costing system – The job costing system is useful for companies in

providing detailed information of each job cost that involves in different activities. For

example the Excite entertainment limited company is using this accounting system for

providing detailed information to their managers about each job.

Section B

3

entertainment limited their managers are using this accounting system in order to compute cost

of each job separately.

(e) Evaluation about how MAS and management accounting reports are aligned with

organisational process.

It is important for succession of any kind of business entity that there should be

integration of MAS and MA reports with companies process (Murthy and Rooney, 2018). For

example in above Excite entertainment limited they are applying different accounting systems

such as cost accounting system which integrates with finance department. As well as inventory

management system aligns with production department. Apart from it, their accountants are

producing various kind of reports like performance report, stock report which are linked with

their different departments. This shows that MAS and MA reports are aligned with the

companies operations.

Benefits of above mentioned MAS:

Benefit of cost accounting system- This accounting system is useful for companies in

order to control and manage all type of expenditures effectively. In the aspect of above

Excite entertainment limited company, their managers are using this accounting system

for assessment of total expenditures that occurs in their operations.

Benefit of inventory management system – This accounting system tracks the quantity of

stored materials in warehouses (Gomez-Conde and Lopez-Valeiras, 2018). On the basis

of it companies take their futuristic decisions effectively. Such as the above respective

company, is implementing this accounting system for reducing over purchasing

expenditures on the basis of information provided by this accounting system.

Benefits of job costing system – The job costing system is useful for companies in

providing detailed information of each job cost that involves in different activities. For

example the Excite entertainment limited company is using this accounting system for

providing detailed information to their managers about each job.

Section B

3

(a) Different types of managerial reports :

MA reports – The management accounting reports are too crucial for companies because

by help of these reports various decisions are taken correctly. These reports are produced by

collecting and analysing monetary & non monetary information about different business

transactions. The above respective company is preparing various management accounting reports

and some of them are mentioned below which are as follows :

Cost accounting reports – In the cost accounting reports, detailed information about

various financing activities is included. These reports are useful for finance department of

any kind of business entity. This is so because by help of information provided by cost

accounting report they guides managers in preparation of strategies and plans. As well as

on the basis of these reports, managers allocates their financial resources into different

kind of business activities. Such as the accountant of above chosen company, Excite

entertainment limited prepare cost accounting report that helps their managers in

assessing total actual expenditures and take further steps accordingly.

Account receivable ageing report – It is a type of report that is prepared by accountants

for informing to their managers about money which is due by their debtors (Porporato,

2015). Due to this report's information companies can make their plan about source of

finance because collection of debt amount acts as financial source. In the absence of

preparation of this report, companies can not manage their debt amount. Thus, this report

is beneficial for companies in order to provide information about total due amount by

their debtors. Such as in the aspect of above Excite entertainment limited company, their

accountants produce this report for evaluating their customers whose amount is due.

Stock report – It can be defined as a kind of report which consists detailed information

about all types of inventories stored in warehouses (Brustbauer, 2016). With the help of

this report, production department can produce new products. It becomes possible under

this report information about prepared material is provided and on the basis of this

companies produce products. Such as the above Excite entertainment limited company's

accountant produce this report for better management of their equipments and gadgets.

Performance report – In order to control and manage the performance of employees and

different activities, the performance report is prepared by companies. Under this report

information about actual outcome and estimated outcome is included which helps to

4

MA reports – The management accounting reports are too crucial for companies because

by help of these reports various decisions are taken correctly. These reports are produced by

collecting and analysing monetary & non monetary information about different business

transactions. The above respective company is preparing various management accounting reports

and some of them are mentioned below which are as follows :

Cost accounting reports – In the cost accounting reports, detailed information about

various financing activities is included. These reports are useful for finance department of

any kind of business entity. This is so because by help of information provided by cost

accounting report they guides managers in preparation of strategies and plans. As well as

on the basis of these reports, managers allocates their financial resources into different

kind of business activities. Such as the accountant of above chosen company, Excite

entertainment limited prepare cost accounting report that helps their managers in

assessing total actual expenditures and take further steps accordingly.

Account receivable ageing report – It is a type of report that is prepared by accountants

for informing to their managers about money which is due by their debtors (Porporato,

2015). Due to this report's information companies can make their plan about source of

finance because collection of debt amount acts as financial source. In the absence of

preparation of this report, companies can not manage their debt amount. Thus, this report

is beneficial for companies in order to provide information about total due amount by

their debtors. Such as in the aspect of above Excite entertainment limited company, their

accountants produce this report for evaluating their customers whose amount is due.

Stock report – It can be defined as a kind of report which consists detailed information

about all types of inventories stored in warehouses (Brustbauer, 2016). With the help of

this report, production department can produce new products. It becomes possible under

this report information about prepared material is provided and on the basis of this

companies produce products. Such as the above Excite entertainment limited company's

accountant produce this report for better management of their equipments and gadgets.

Performance report – In order to control and manage the performance of employees and

different activities, the performance report is prepared by companies. Under this report

information about actual outcome and estimated outcome is included which helps to

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

managers in making effective comparison. For example the managers of Excite

entertainment limited company, utilise this report in order to control the performance of

various kind of activities.

(b) Characteristics of good information.

The good information system consists various kind of characteristic and some of them are

mentioned below such as :

Accuracy – The accounting informations should be accurate in nature because as per it,

companies take crucial decisions.

Relevancy – The accounting information should be as accordance of business

transactions because in the absence of it information will be irrelevant to use.

Timely presentation of information – In addition, this is important that presentation of

accounting information should be on time so that decision can be taken on time.

TASK 2

Section (A)

Absorption and marginal costing method:

There are mainly two types of costing methods in order to prepare the financial

statements and some of them are mentioned below such as :

Absorption costing method – It can be defined as a kind of costing technique in which both costs

are absorbed completely for preparation of income statements. In other words under this method

fixed and variable cost are assigned as product cost (Barnard and Mostert, 2015).

Marginal costing method – Under this method, fixed cost is taken as period cost and variable

cost as unit cost. Thus, in this method both costs are not absorbed.

Contribution – This can be defined as difference between selling price and variable cost. It is

being calculated by below mentioned formula :

Contribution (C) = Sales price of each unit – Variable cost of each unit.

Particulars Amount

Selling price of each unit £40

5

entertainment limited company, utilise this report in order to control the performance of

various kind of activities.

(b) Characteristics of good information.

The good information system consists various kind of characteristic and some of them are

mentioned below such as :

Accuracy – The accounting informations should be accurate in nature because as per it,

companies take crucial decisions.

Relevancy – The accounting information should be as accordance of business

transactions because in the absence of it information will be irrelevant to use.

Timely presentation of information – In addition, this is important that presentation of

accounting information should be on time so that decision can be taken on time.

TASK 2

Section (A)

Absorption and marginal costing method:

There are mainly two types of costing methods in order to prepare the financial

statements and some of them are mentioned below such as :

Absorption costing method – It can be defined as a kind of costing technique in which both costs

are absorbed completely for preparation of income statements. In other words under this method

fixed and variable cost are assigned as product cost (Barnard and Mostert, 2015).

Marginal costing method – Under this method, fixed cost is taken as period cost and variable

cost as unit cost. Thus, in this method both costs are not absorbed.

Contribution – This can be defined as difference between selling price and variable cost. It is

being calculated by below mentioned formula :

Contribution (C) = Sales price of each unit – Variable cost of each unit.

Particulars Amount

Selling price of each unit £40

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Less: variable cost of each unit £10

Contribution per unit £30

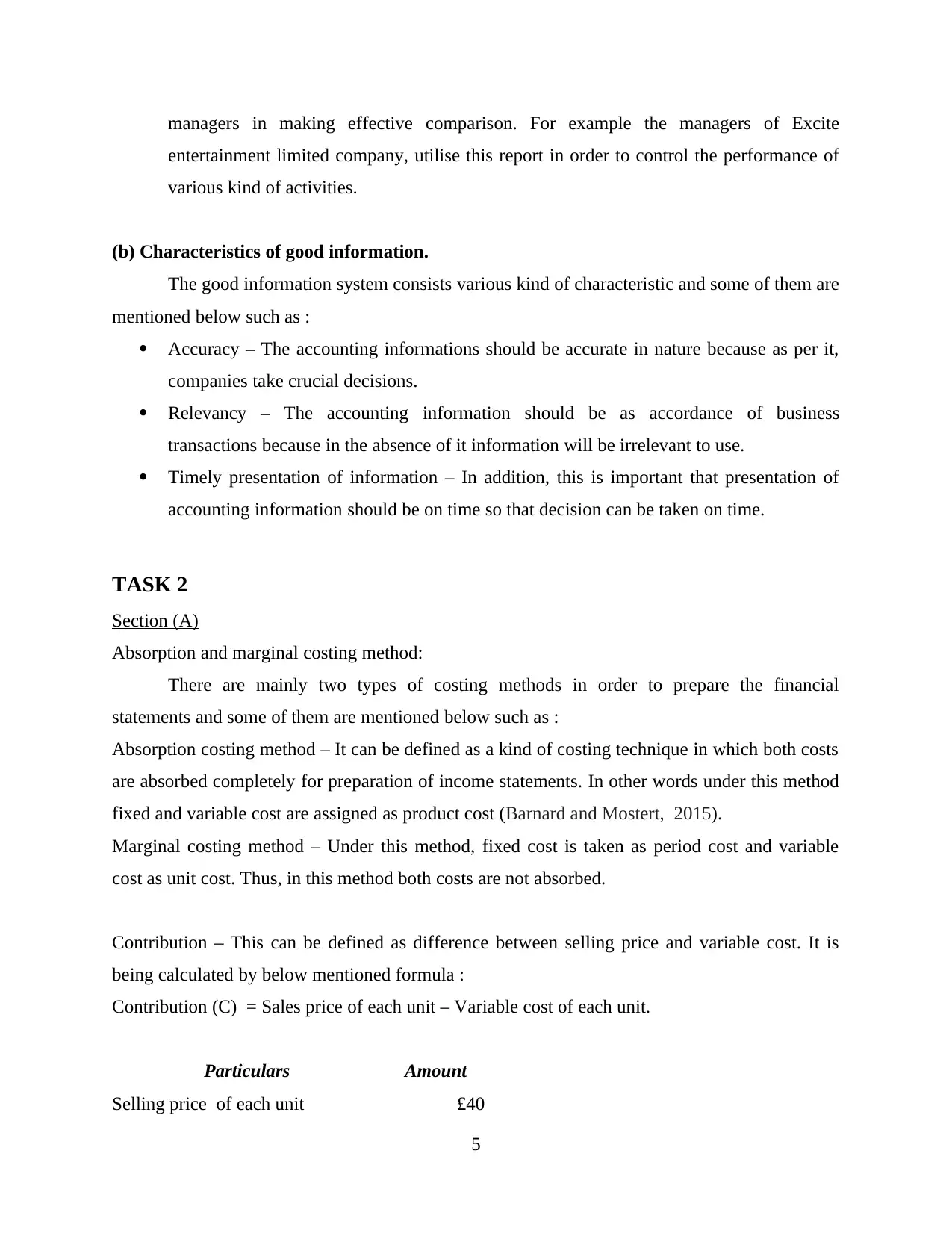

Break even point (in terms of units) = Fixed cost / contribution per unit

Particulars Amount (in £)

Fixed cost (A) 120000

Contribution per unit (B) 30

Break even point (in units) 4000

Thus, number of tickets will be 4000.

Section (B)

Factors that may effect above computed outcome :

Selling price – This is an important factor that may change outcome of break even point.

It is so because if selling price will change then contribution will also change and as a

result BEP will effect (Feeney and Pierce, 2016).

Variable cost – It is also an another factor which can effect the BEP. This is so because

any change in variable cost can lead to change in contribution as well as to break even

point.

Section (C)

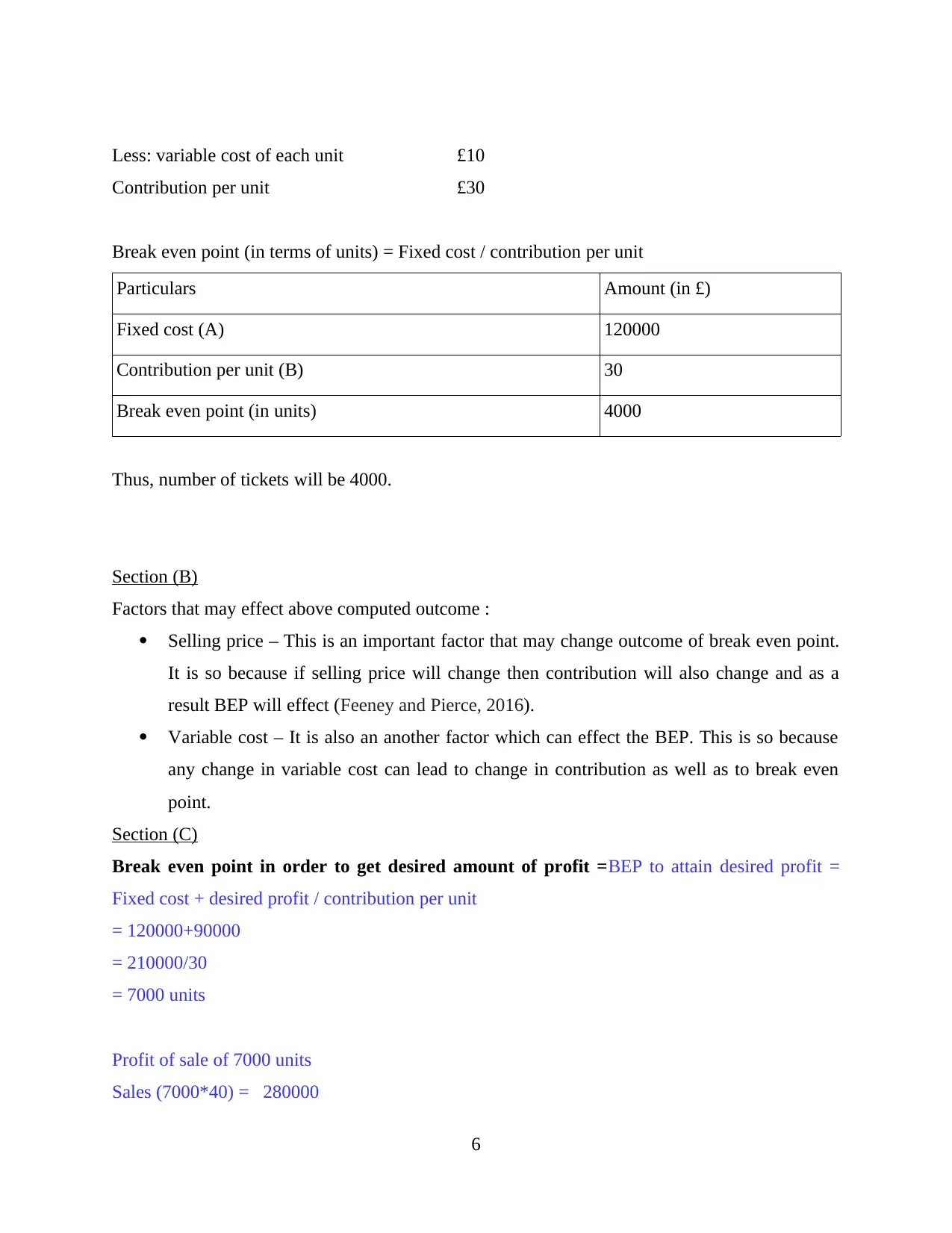

Break even point in order to get desired amount of profit =BEP to attain desired profit =

Fixed cost + desired profit / contribution per unit

= 120000+90000

= 210000/30

= 7000 units

Profit of sale of 7000 units

Sales (7000*40) = 280000

6

Contribution per unit £30

Break even point (in terms of units) = Fixed cost / contribution per unit

Particulars Amount (in £)

Fixed cost (A) 120000

Contribution per unit (B) 30

Break even point (in units) 4000

Thus, number of tickets will be 4000.

Section (B)

Factors that may effect above computed outcome :

Selling price – This is an important factor that may change outcome of break even point.

It is so because if selling price will change then contribution will also change and as a

result BEP will effect (Feeney and Pierce, 2016).

Variable cost – It is also an another factor which can effect the BEP. This is so because

any change in variable cost can lead to change in contribution as well as to break even

point.

Section (C)

Break even point in order to get desired amount of profit =BEP to attain desired profit =

Fixed cost + desired profit / contribution per unit

= 120000+90000

= 210000/30

= 7000 units

Profit of sale of 7000 units

Sales (7000*40) = 280000

6

- Variable cost = 70000

Contribution = 210000

- Fixed cost = 120000

Profit = 90000

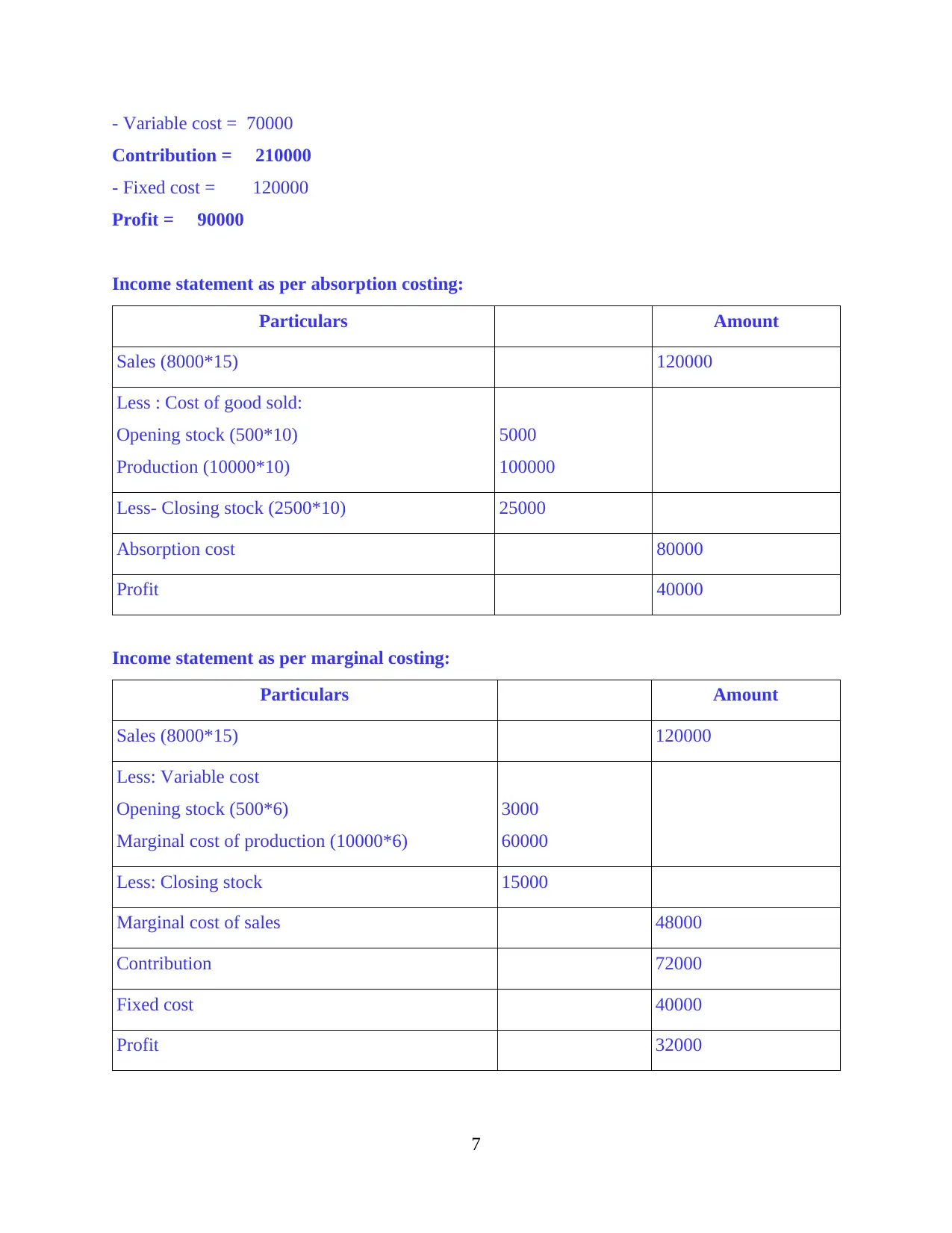

Income statement as per absorption costing:

Particulars Amount

Sales (8000*15) 120000

Less : Cost of good sold:

Opening stock (500*10)

Production (10000*10)

5000

100000

Less- Closing stock (2500*10) 25000

Absorption cost 80000

Profit 40000

Income statement as per marginal costing:

Particulars Amount

Sales (8000*15) 120000

Less: Variable cost

Opening stock (500*6)

Marginal cost of production (10000*6)

3000

60000

Less: Closing stock 15000

Marginal cost of sales 48000

Contribution 72000

Fixed cost 40000

Profit 32000

7

Contribution = 210000

- Fixed cost = 120000

Profit = 90000

Income statement as per absorption costing:

Particulars Amount

Sales (8000*15) 120000

Less : Cost of good sold:

Opening stock (500*10)

Production (10000*10)

5000

100000

Less- Closing stock (2500*10) 25000

Absorption cost 80000

Profit 40000

Income statement as per marginal costing:

Particulars Amount

Sales (8000*15) 120000

Less: Variable cost

Opening stock (500*6)

Marginal cost of production (10000*6)

3000

60000

Less: Closing stock 15000

Marginal cost of sales 48000

Contribution 72000

Fixed cost 40000

Profit 32000

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Interpretation of data for range of business activities.

On the basis of above produced financial statements, this can be find out that value of net

profit is variant by both of the methods. Such as under absorption costing method, the net profit

is of £40000 while in marginal costing method it is of £32000. The cause of difference in profits

is way of considering fixed and non fixed in multiple manner under absorption and marginal

costing.

Management accounting techniques and produce financial statements

The role of MA techniques is very important for companies in order to prepare financial

statements (Guinea, 2016). Like in the aspect of above Excite entertainment limited company,

their income statements are prepared by help of costing techniques such as absorption and

marginal costing. It indicates that MA techniques are useful for preparation of financial

statements.

TASK 3

Benefits and drawback of various kind of planning tools used for budgetary control.

Budget – The term budget can be defined as a projection of possible income and

expenses which may occur in companies in futuristic time period. In the aspect of business

entities, role of budget is important because by help of estimated results they allocate financial

resources in different activities. The above respective company, Excite entertainment limited is

preparing various budgets which are as follows :

Sales budget – This can be defined as a kind of budget that consists detailed information about

futuristic units that a business may sale (Prowle and Lucas, 2016). In addition, this budget

includes information regards to total amount of money which can be earned by selling. Such as

the above Excite entertainment limited company is preparing this budget in order to get

information about how much quantity of units can be sold out in future and on the basis of it

their managers make further plans. This budget has some advantages and disadvantages which

are as follows :

8

On the basis of above produced financial statements, this can be find out that value of net

profit is variant by both of the methods. Such as under absorption costing method, the net profit

is of £40000 while in marginal costing method it is of £32000. The cause of difference in profits

is way of considering fixed and non fixed in multiple manner under absorption and marginal

costing.

Management accounting techniques and produce financial statements

The role of MA techniques is very important for companies in order to prepare financial

statements (Guinea, 2016). Like in the aspect of above Excite entertainment limited company,

their income statements are prepared by help of costing techniques such as absorption and

marginal costing. It indicates that MA techniques are useful for preparation of financial

statements.

TASK 3

Benefits and drawback of various kind of planning tools used for budgetary control.

Budget – The term budget can be defined as a projection of possible income and

expenses which may occur in companies in futuristic time period. In the aspect of business

entities, role of budget is important because by help of estimated results they allocate financial

resources in different activities. The above respective company, Excite entertainment limited is

preparing various budgets which are as follows :

Sales budget – This can be defined as a kind of budget that consists detailed information about

futuristic units that a business may sale (Prowle and Lucas, 2016). In addition, this budget

includes information regards to total amount of money which can be earned by selling. Such as

the above Excite entertainment limited company is preparing this budget in order to get

information about how much quantity of units can be sold out in future and on the basis of it

their managers make further plans. This budget has some advantages and disadvantages which

are as follows :

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Advantages – This budget is helpful for making effective planning and management of financial

activities.

Disadvantage – Any error in the prediction of sales unit may lead to huge financial lose. This is

so because if companies will make production accordance of budgeted output and if sales do not

happens then it may cause to big lose.

Production budget – This is a type of budget that consists detailed information about number of

units which can be produce in a particular time period. Under it, various kind of information

about activities regarding to production such as number of units to be sold and cost which may

occur in the process of manufacturing. Same as the above mentioned budgets this has some

advantages and disadvantages such as:

Advantages – It is beneficial for companies in order to allocate funds as per the requirement of

production process.

Disadvantage – Main drawback of this budget is that it consumes too much time and cost in

order to preparation of budget.

Zero based budget – It can be defined as a kind of budget which consists information about

those activities that justified properly (Endenich and Brandau, 2017). As well as under this

budget, information of last year's budget is neglected completely. Herein, below some

advantages and disadvantages of this budget mentioned that are as follows :

Advantage – This is beneficial for companies in order to accurate estimation of total revenues

and expenses.

Disadvantage – One of the main drawback of this budget that under it, lot of time is taken as well

as time to make estimation.

Use of planning tools for preparing and forecasting of budgets:

The planning tools of budgetary control consists a vital range of budgets and each of

them has own importance for preparation of budgets (Thomson, 2017). This is so because on the

basis of information provided by the budgets companies get aware about which informations are

needed to be acquired in order to forecasting of budget. Like the above Excite entertainment

9

activities.

Disadvantage – Any error in the prediction of sales unit may lead to huge financial lose. This is

so because if companies will make production accordance of budgeted output and if sales do not

happens then it may cause to big lose.

Production budget – This is a type of budget that consists detailed information about number of

units which can be produce in a particular time period. Under it, various kind of information

about activities regarding to production such as number of units to be sold and cost which may

occur in the process of manufacturing. Same as the above mentioned budgets this has some

advantages and disadvantages such as:

Advantages – It is beneficial for companies in order to allocate funds as per the requirement of

production process.

Disadvantage – Main drawback of this budget is that it consumes too much time and cost in

order to preparation of budget.

Zero based budget – It can be defined as a kind of budget which consists information about

those activities that justified properly (Endenich and Brandau, 2017). As well as under this

budget, information of last year's budget is neglected completely. Herein, below some

advantages and disadvantages of this budget mentioned that are as follows :

Advantage – This is beneficial for companies in order to accurate estimation of total revenues

and expenses.

Disadvantage – One of the main drawback of this budget that under it, lot of time is taken as well

as time to make estimation.

Use of planning tools for preparing and forecasting of budgets:

The planning tools of budgetary control consists a vital range of budgets and each of

them has own importance for preparation of budgets (Thomson, 2017). This is so because on the

basis of information provided by the budgets companies get aware about which informations are

needed to be acquired in order to forecasting of budget. Like the above Excite entertainment

9

limited company is using different types of budgets such as production budget, zero based

budget and sales budget that are benefiting them in order to preparation of budgets.

Planning tools to in order to sort out any kind of financial issues.

The planning tools of budgetary control consists various kind of budgets that play a

crucial role from overcoming any kind of financial issues. It is so because in the budgets,

information about financial activities is included that help in keeping an extra site of eye over all

projected income and expenses. On the basis of information derived from planning tools,

managers of companies can get possible alternatives in order to solve any kind of issue. Thus, it

can be formed that planning tools are useful for solving any type of financial problem which

occur in companies operations and activities.

TASK 4

Management accounting systems to respond to financial problems.

Financial governance – The term financial governance can be defined as a kind of

integrated system with financial aspects of companies which keep an extra sight of eye on

financial transactions (Fleischman and Parker, 2017). Basically, it is needed in organisations in

order to assess actual financial issue so that this can be resolved in less time period. If companies

apply this financial framework in their activities and operations then it become easy for them in

order to control financial issue which occur in their operations.

Full compliance system – This can be defined as a kind of system which is associated

with process of dealing from hose operations and activities that are related to misappropriation.

Under it, laws and regulations are applied in operations and activities so that issue can be sorted.

Basically, with the use of full compliance system companies can manage their financial

transaction in more authentic manner. Herein, below some benefits of full compliance system

are mentioned that are as follows :

Disclosure of valuable data in order to take better decisions – This is one of the important

benefit of full disclosure system. As per it, companies can get those data which can be

helpful in the aspect of taking important decisions.

10

budget and sales budget that are benefiting them in order to preparation of budgets.

Planning tools to in order to sort out any kind of financial issues.

The planning tools of budgetary control consists various kind of budgets that play a

crucial role from overcoming any kind of financial issues. It is so because in the budgets,

information about financial activities is included that help in keeping an extra site of eye over all

projected income and expenses. On the basis of information derived from planning tools,

managers of companies can get possible alternatives in order to solve any kind of issue. Thus, it

can be formed that planning tools are useful for solving any type of financial problem which

occur in companies operations and activities.

TASK 4

Management accounting systems to respond to financial problems.

Financial governance – The term financial governance can be defined as a kind of

integrated system with financial aspects of companies which keep an extra sight of eye on

financial transactions (Fleischman and Parker, 2017). Basically, it is needed in organisations in

order to assess actual financial issue so that this can be resolved in less time period. If companies

apply this financial framework in their activities and operations then it become easy for them in

order to control financial issue which occur in their operations.

Full compliance system – This can be defined as a kind of system which is associated

with process of dealing from hose operations and activities that are related to misappropriation.

Under it, laws and regulations are applied in operations and activities so that issue can be sorted.

Basically, with the use of full compliance system companies can manage their financial

transaction in more authentic manner. Herein, below some benefits of full compliance system

are mentioned that are as follows :

Disclosure of valuable data in order to take better decisions – This is one of the important

benefit of full disclosure system. As per it, companies can get those data which can be

helpful in the aspect of taking important decisions.

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.