Comprehensive Management Accounting Report: Costing and Budgeting

VerifiedAdded on 2020/01/28

|19

|5569

|61

Report

AI Summary

This report delves into the realm of management accounting, specifically focusing on costing and budgeting practices within the context of Jeffery and Sons. The report begins by classifying various cost types, including elements, functions, nature, and behavior, providing a foundational understanding of cost structures. It then proceeds to calculate unit and total costs using job costing, followed by the allocation and apportionment of overhead costs across production departments. The analysis includes the calculation of overhead absorption rates and the application of these rates to determine product costs. Furthermore, the report examines variance analysis by comparing budgeted and actual costs, preparing cost reports, and identifying areas for improvement. The budgeting section explores the purpose and methods of budgeting, including the preparation of production and material purchases budgets, as well as cash budgets. Finally, the report concludes with a discussion on variance calculations, the reconciliation of budgeted and actual outcomes, and the reporting of findings to management.

Management Accounting:

Costing And Budgeting

Costing And Budgeting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION ..........................................................................................................................3

TASK 1............................................................................................................................................3

1.1 Varied kind of classifications of cost.....................................................................................3

1.2 Unit cost as well as total cost for job 444..............................................................................5

1.3 Calculation of cost.................................................................................................................5

1.4 Analysis of cost data of exquisite using appropriate technique.............................................7

TASK 2............................................................................................................................................8

2.1 Preparation as well as analysis of cost report........................................................................8

2.2 Utilization of several performance indicators used for identification of areas for potential

improvement................................................................................................................................9

2.3 Suggestion of ways for reduction of costs, enhancing value as well as quality .................10

TASK 3..........................................................................................................................................11

3.1 Purpose and nature of procedure of budgeting to holders of budget of Jeffery and Sons Ltd.

....................................................................................................................................................11

3.2 Appropriate methods of budgeting for organization and its requirements .........................12

3.3 Preparation of production budget and material purchases budget ......................................12

3.4 Preparing cash budget..........................................................................................................13

TASK 4..........................................................................................................................................15

4.1 Calculation of variances, identification of possible outcomes and recommending corrective

actions .......................................................................................................................................15

4.2 Preparation of operating statements reconciling budgeted as well as actual outcomes.......16

4.3 Reporting of findings to management as per the identified centres of responsibility.........16

CONCLUSION .............................................................................................................................17

REFERENCES..............................................................................................................................18

2

INTRODUCTION ..........................................................................................................................3

TASK 1............................................................................................................................................3

1.1 Varied kind of classifications of cost.....................................................................................3

1.2 Unit cost as well as total cost for job 444..............................................................................5

1.3 Calculation of cost.................................................................................................................5

1.4 Analysis of cost data of exquisite using appropriate technique.............................................7

TASK 2............................................................................................................................................8

2.1 Preparation as well as analysis of cost report........................................................................8

2.2 Utilization of several performance indicators used for identification of areas for potential

improvement................................................................................................................................9

2.3 Suggestion of ways for reduction of costs, enhancing value as well as quality .................10

TASK 3..........................................................................................................................................11

3.1 Purpose and nature of procedure of budgeting to holders of budget of Jeffery and Sons Ltd.

....................................................................................................................................................11

3.2 Appropriate methods of budgeting for organization and its requirements .........................12

3.3 Preparation of production budget and material purchases budget ......................................12

3.4 Preparing cash budget..........................................................................................................13

TASK 4..........................................................................................................................................15

4.1 Calculation of variances, identification of possible outcomes and recommending corrective

actions .......................................................................................................................................15

4.2 Preparation of operating statements reconciling budgeted as well as actual outcomes.......16

4.3 Reporting of findings to management as per the identified centres of responsibility.........16

CONCLUSION .............................................................................................................................17

REFERENCES..............................................................................................................................18

2

INTRODUCTION

The term management accounting is includes preparation as well as offering financial and

statistical information that is accurate as well as on time. Such is needed by the executives for

making day to day and short term decisions. The management accounting reports are forward

looking and are confidential as well as can used for internal purpose only (Demski, 2013). The

role of management accounting is suitable in making development of reports on weekly and

monthly basis for internal audiences which is comprised of departments of executives and chief

executive officer. Under management accounting executives makes utilization of provisions of

accounting information for the sake better informing themselves before making decision on the

matters in the firm. This assist in the management as well as performance of the control

functions.

In the present report management accounting has been discussed with respect to Jeffery

and Sons. The study entails to understand the classification of varied kinds of cost. Further it

includes calculation of the costs by using suitable tools. Along with this the present report

involves the purpose as well as nature of the budgeting process.

TASK 1

1.1 Varied kind of classifications of cost

Cost includes all the expenses of the firm that are incurred in producing the products in

the organization. The cost classification is done on several basis that have been discussed in the

manner stated as below:

Elements

There is presence of three elements of product cost that includes labor, material as well as

overhead. Jeffery and Sons is required to purchase material for manufacturing its product.

Therefore the expenses are incurred on material is considered as material cost. For example, in

automobile organization steel is used for production. It is the core part of the product. Lack of

material might nit lead to production with effectiveness. Along with this expenses of labour are

incurred due to payment made to personnel. In contrast to this expenses includes all the

expenditures of organization that are attached with manufacturing carried out by Jeffery and

Sons in the market. For instance, payment done for consumables is considered direct expenses.

3

The term management accounting is includes preparation as well as offering financial and

statistical information that is accurate as well as on time. Such is needed by the executives for

making day to day and short term decisions. The management accounting reports are forward

looking and are confidential as well as can used for internal purpose only (Demski, 2013). The

role of management accounting is suitable in making development of reports on weekly and

monthly basis for internal audiences which is comprised of departments of executives and chief

executive officer. Under management accounting executives makes utilization of provisions of

accounting information for the sake better informing themselves before making decision on the

matters in the firm. This assist in the management as well as performance of the control

functions.

In the present report management accounting has been discussed with respect to Jeffery

and Sons. The study entails to understand the classification of varied kinds of cost. Further it

includes calculation of the costs by using suitable tools. Along with this the present report

involves the purpose as well as nature of the budgeting process.

TASK 1

1.1 Varied kind of classifications of cost

Cost includes all the expenses of the firm that are incurred in producing the products in

the organization. The cost classification is done on several basis that have been discussed in the

manner stated as below:

Elements

There is presence of three elements of product cost that includes labor, material as well as

overhead. Jeffery and Sons is required to purchase material for manufacturing its product.

Therefore the expenses are incurred on material is considered as material cost. For example, in

automobile organization steel is used for production. It is the core part of the product. Lack of

material might nit lead to production with effectiveness. Along with this expenses of labour are

incurred due to payment made to personnel. In contrast to this expenses includes all the

expenditures of organization that are attached with manufacturing carried out by Jeffery and

Sons in the market. For instance, payment done for consumables is considered direct expenses.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Function

On the basis of function classification of cost is done under the categories that are as

follows. Such is comprised of expenses relating with manufacturing and non manufacturing. The

expenses of manufacturing are regarded as production expenses that are incurred in the process

of production by cited firm (Method of costing, 2014). The whole overheads of factory will be

included under manufacturing expenses by Jeffery and Sons. In contrast to this non

manufacturing expenses are not associated with manufacturing procedure of Jeffery and Sons.

This is comprised of office, marketing expenditure and stationery that are not related with

manufacturing.

Nature

There is existence of two cost types under this which includes indirect and direct cost.

Direct cost is regarded as prime cost that is attached to specific object of cost. For instance,

direct cost includes material, labor, production and manufacturing expenses (Albrecht, Stice and

Stice, 2010). In contrast to this expenditures that are not related with manufacturing carried out

by Jeffery and Sons are indirect cost. This involves offices rent and rates.

Behavior

On the basis of behavior cost is categorized as follows. Such is comprised of fixed,

variables, semi-variable and stepped fixed cost. Fixed cost does not relate with product volume

and hence it remains constant. Moreover it is not influenced by the increase or decrease within

the production. In contrast to this variable cost is regarded as one that changes with alteration in

the production volume. Building rent, salary of watchmen, insurance and depreciation are

considered fixed cost (Fullerton, Kennedy and Widener, 2013). However variable cost is

comprised of material as well as wages to labor. Further stepped fixed cost is one which is

constant to certain limit of production and then it enhances to high level after attaining certain

production limit. Following this another one is semi-variable cost which is similar to certain limit

of production and then it alters with the increase or decrease in the production. For example,

semi-variable cost involves telephone bills and electricity.

4

On the basis of function classification of cost is done under the categories that are as

follows. Such is comprised of expenses relating with manufacturing and non manufacturing. The

expenses of manufacturing are regarded as production expenses that are incurred in the process

of production by cited firm (Method of costing, 2014). The whole overheads of factory will be

included under manufacturing expenses by Jeffery and Sons. In contrast to this non

manufacturing expenses are not associated with manufacturing procedure of Jeffery and Sons.

This is comprised of office, marketing expenditure and stationery that are not related with

manufacturing.

Nature

There is existence of two cost types under this which includes indirect and direct cost.

Direct cost is regarded as prime cost that is attached to specific object of cost. For instance,

direct cost includes material, labor, production and manufacturing expenses (Albrecht, Stice and

Stice, 2010). In contrast to this expenditures that are not related with manufacturing carried out

by Jeffery and Sons are indirect cost. This involves offices rent and rates.

Behavior

On the basis of behavior cost is categorized as follows. Such is comprised of fixed,

variables, semi-variable and stepped fixed cost. Fixed cost does not relate with product volume

and hence it remains constant. Moreover it is not influenced by the increase or decrease within

the production. In contrast to this variable cost is regarded as one that changes with alteration in

the production volume. Building rent, salary of watchmen, insurance and depreciation are

considered fixed cost (Fullerton, Kennedy and Widener, 2013). However variable cost is

comprised of material as well as wages to labor. Further stepped fixed cost is one which is

constant to certain limit of production and then it enhances to high level after attaining certain

production limit. Following this another one is semi-variable cost which is similar to certain limit

of production and then it alters with the increase or decrease in the production. For example,

semi-variable cost involves telephone bills and electricity.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

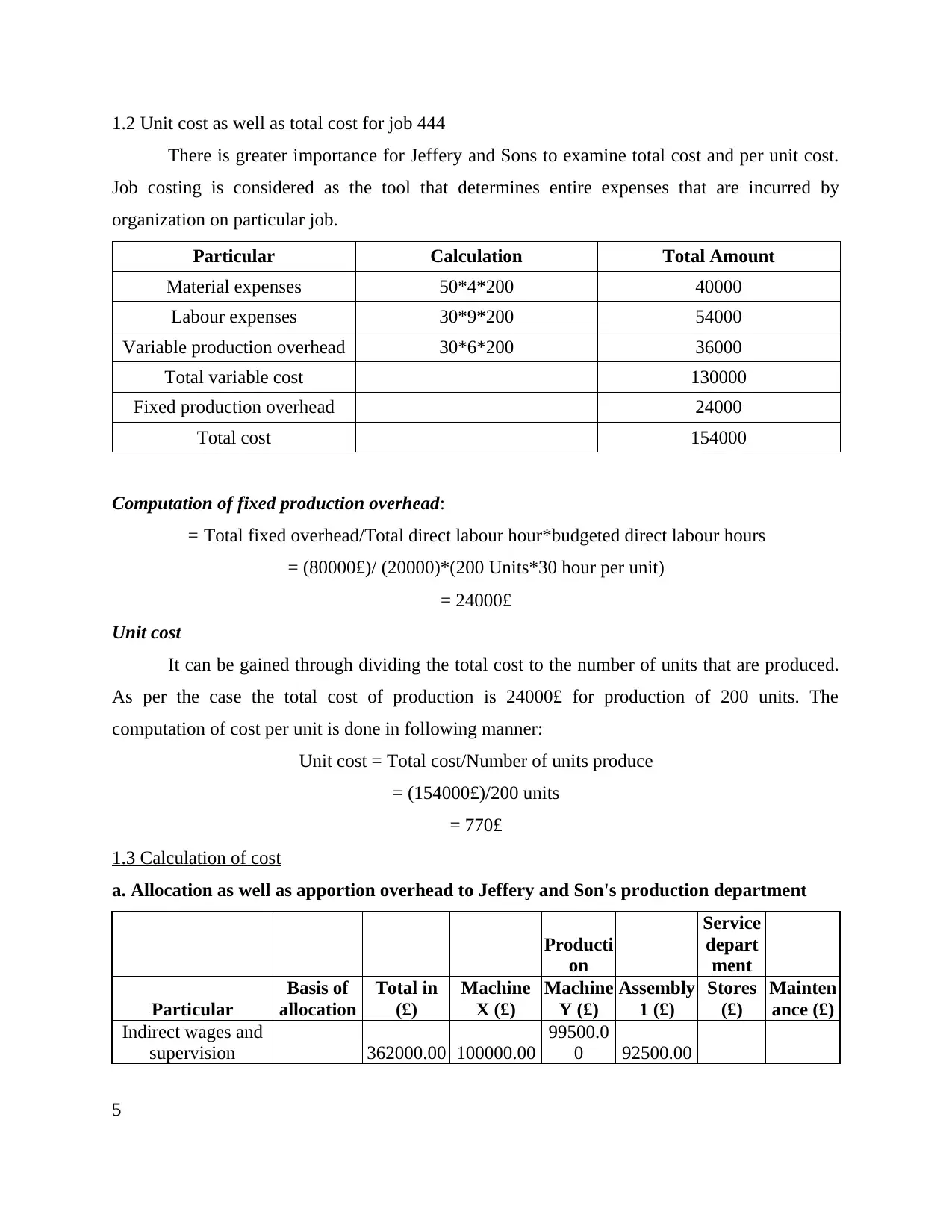

1.2 Unit cost as well as total cost for job 444

There is greater importance for Jeffery and Sons to examine total cost and per unit cost.

Job costing is considered as the tool that determines entire expenses that are incurred by

organization on particular job.

Particular Calculation Total Amount

Material expenses 50*4*200 40000

Labour expenses 30*9*200 54000

Variable production overhead 30*6*200 36000

Total variable cost 130000

Fixed production overhead 24000

Total cost 154000

Computation of fixed production overhead:

= Total fixed overhead/Total direct labour hour*budgeted direct labour hours

= (80000£)/ (20000)*(200 Units*30 hour per unit)

= 24000£

Unit cost

It can be gained through dividing the total cost to the number of units that are produced.

As per the case the total cost of production is 24000£ for production of 200 units. The

computation of cost per unit is done in following manner:

Unit cost = Total cost/Number of units produce

= (154000£)/200 units

= 770£

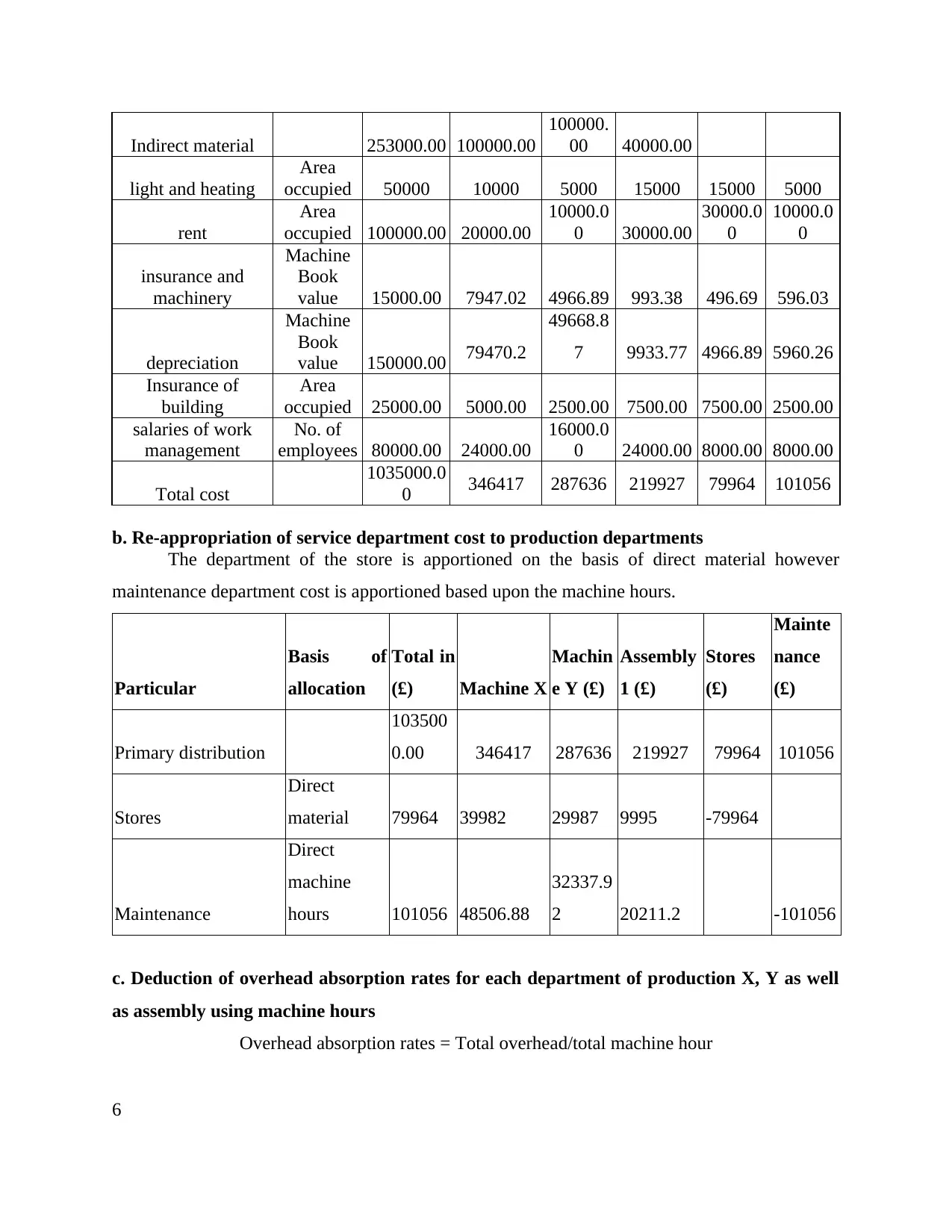

1.3 Calculation of cost

a. Allocation as well as apportion overhead to Jeffery and Son's production department

Producti

on

Service

depart

ment

Particular

Basis of

allocation

Total in

(£)

Machine

X (£)

Machine

Y (£)

Assembly

1 (£)

Stores

(£)

Mainten

ance (£)

Indirect wages and

supervision 362000.00 100000.00

99500.0

0 92500.00

5

There is greater importance for Jeffery and Sons to examine total cost and per unit cost.

Job costing is considered as the tool that determines entire expenses that are incurred by

organization on particular job.

Particular Calculation Total Amount

Material expenses 50*4*200 40000

Labour expenses 30*9*200 54000

Variable production overhead 30*6*200 36000

Total variable cost 130000

Fixed production overhead 24000

Total cost 154000

Computation of fixed production overhead:

= Total fixed overhead/Total direct labour hour*budgeted direct labour hours

= (80000£)/ (20000)*(200 Units*30 hour per unit)

= 24000£

Unit cost

It can be gained through dividing the total cost to the number of units that are produced.

As per the case the total cost of production is 24000£ for production of 200 units. The

computation of cost per unit is done in following manner:

Unit cost = Total cost/Number of units produce

= (154000£)/200 units

= 770£

1.3 Calculation of cost

a. Allocation as well as apportion overhead to Jeffery and Son's production department

Producti

on

Service

depart

ment

Particular

Basis of

allocation

Total in

(£)

Machine

X (£)

Machine

Y (£)

Assembly

1 (£)

Stores

(£)

Mainten

ance (£)

Indirect wages and

supervision 362000.00 100000.00

99500.0

0 92500.00

5

Indirect material 253000.00 100000.00

100000.

00 40000.00

light and heating

Area

occupied 50000 10000 5000 15000 15000 5000

rent

Area

occupied 100000.00 20000.00

10000.0

0 30000.00

30000.0

0

10000.0

0

insurance and

machinery

Machine

Book

value 15000.00 7947.02 4966.89 993.38 496.69 596.03

depreciation

Machine

Book

value 150000.00 79470.2

49668.8

7 9933.77 4966.89 5960.26

Insurance of

building

Area

occupied 25000.00 5000.00 2500.00 7500.00 7500.00 2500.00

salaries of work

management

No. of

employees 80000.00 24000.00

16000.0

0 24000.00 8000.00 8000.00

Total cost

1035000.0

0 346417 287636 219927 79964 101056

b. Re-appropriation of service department cost to production departments

The department of the store is apportioned on the basis of direct material however

maintenance department cost is apportioned based upon the machine hours.

Particular

Basis of

allocation

Total in

(£) Machine X

Machin

e Y (£)

Assembly

1 (£)

Stores

(£)

Mainte

nance

(£)

Primary distribution

103500

0.00 346417 287636 219927 79964 101056

Stores

Direct

material 79964 39982 29987 9995 -79964

Maintenance

Direct

machine

hours 101056 48506.88

32337.9

2 20211.2 -101056

c. Deduction of overhead absorption rates for each department of production X, Y as well

as assembly using machine hours

Overhead absorption rates = Total overhead/total machine hour

6

100000.

00 40000.00

light and heating

Area

occupied 50000 10000 5000 15000 15000 5000

rent

Area

occupied 100000.00 20000.00

10000.0

0 30000.00

30000.0

0

10000.0

0

insurance and

machinery

Machine

Book

value 15000.00 7947.02 4966.89 993.38 496.69 596.03

depreciation

Machine

Book

value 150000.00 79470.2

49668.8

7 9933.77 4966.89 5960.26

Insurance of

building

Area

occupied 25000.00 5000.00 2500.00 7500.00 7500.00 2500.00

salaries of work

management

No. of

employees 80000.00 24000.00

16000.0

0 24000.00 8000.00 8000.00

Total cost

1035000.0

0 346417 287636 219927 79964 101056

b. Re-appropriation of service department cost to production departments

The department of the store is apportioned on the basis of direct material however

maintenance department cost is apportioned based upon the machine hours.

Particular

Basis of

allocation

Total in

(£) Machine X

Machin

e Y (£)

Assembly

1 (£)

Stores

(£)

Mainte

nance

(£)

Primary distribution

103500

0.00 346417 287636 219927 79964 101056

Stores

Direct

material 79964 39982 29987 9995 -79964

Maintenance

Direct

machine

hours 101056 48506.88

32337.9

2 20211.2 -101056

c. Deduction of overhead absorption rates for each department of production X, Y as well

as assembly using machine hours

Overhead absorption rates = Total overhead/total machine hour

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

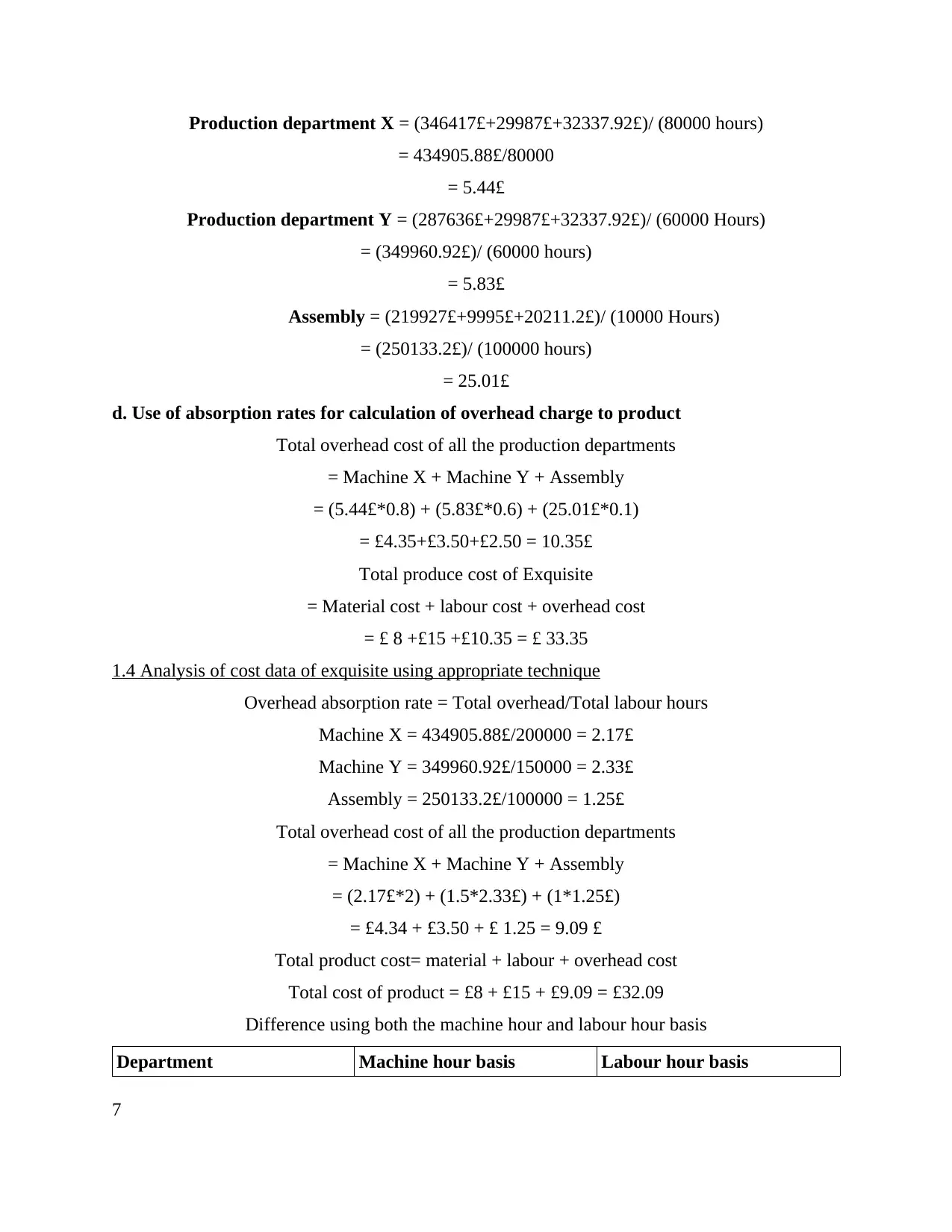

Production department X = (346417£+29987£+32337.92£)/ (80000 hours)

= 434905.88£/80000

= 5.44£

Production department Y = (287636£+29987£+32337.92£)/ (60000 Hours)

= (349960.92£)/ (60000 hours)

= 5.83£

Assembly = (219927£+9995£+20211.2£)/ (10000 Hours)

= (250133.2£)/ (100000 hours)

= 25.01£

d. Use of absorption rates for calculation of overhead charge to product

Total overhead cost of all the production departments

= Machine X + Machine Y + Assembly

= (5.44£*0.8) + (5.83£*0.6) + (25.01£*0.1)

= £4.35+£3.50+£2.50 = 10.35£

Total produce cost of Exquisite

= Material cost + labour cost + overhead cost

= £ 8 +£15 +£10.35 = £ 33.35

1.4 Analysis of cost data of exquisite using appropriate technique

Overhead absorption rate = Total overhead/Total labour hours

Machine X = 434905.88£/200000 = 2.17£

Machine Y = 349960.92£/150000 = 2.33£

Assembly = 250133.2£/100000 = 1.25£

Total overhead cost of all the production departments

= Machine X + Machine Y + Assembly

= (2.17£*2) + (1.5*2.33£) + (1*1.25£)

= £4.34 + £3.50 + £ 1.25 = 9.09 £

Total product cost= material + labour + overhead cost

Total cost of product = £8 + £15 + £9.09 = £32.09

Difference using both the machine hour and labour hour basis

Department Machine hour basis Labour hour basis

7

= 434905.88£/80000

= 5.44£

Production department Y = (287636£+29987£+32337.92£)/ (60000 Hours)

= (349960.92£)/ (60000 hours)

= 5.83£

Assembly = (219927£+9995£+20211.2£)/ (10000 Hours)

= (250133.2£)/ (100000 hours)

= 25.01£

d. Use of absorption rates for calculation of overhead charge to product

Total overhead cost of all the production departments

= Machine X + Machine Y + Assembly

= (5.44£*0.8) + (5.83£*0.6) + (25.01£*0.1)

= £4.35+£3.50+£2.50 = 10.35£

Total produce cost of Exquisite

= Material cost + labour cost + overhead cost

= £ 8 +£15 +£10.35 = £ 33.35

1.4 Analysis of cost data of exquisite using appropriate technique

Overhead absorption rate = Total overhead/Total labour hours

Machine X = 434905.88£/200000 = 2.17£

Machine Y = 349960.92£/150000 = 2.33£

Assembly = 250133.2£/100000 = 1.25£

Total overhead cost of all the production departments

= Machine X + Machine Y + Assembly

= (2.17£*2) + (1.5*2.33£) + (1*1.25£)

= £4.34 + £3.50 + £ 1.25 = 9.09 £

Total product cost= material + labour + overhead cost

Total cost of product = £8 + £15 + £9.09 = £32.09

Difference using both the machine hour and labour hour basis

Department Machine hour basis Labour hour basis

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Machine X 4.35 4.34

Machine Y 3.5 3.5

Assembly 2.5 1.25

Total production overhead 10.35 9.09

Total product cost 33.35 32.09

Thus it can be presented that both total cost of overhead and product cost is lower under

labour hour basis which is 9.09£ as well as 32.09£. Therefore it can be said that such allocation

basis is effective in order to reduce the product cost from 33.35£ to 32.09£.

TASK 2

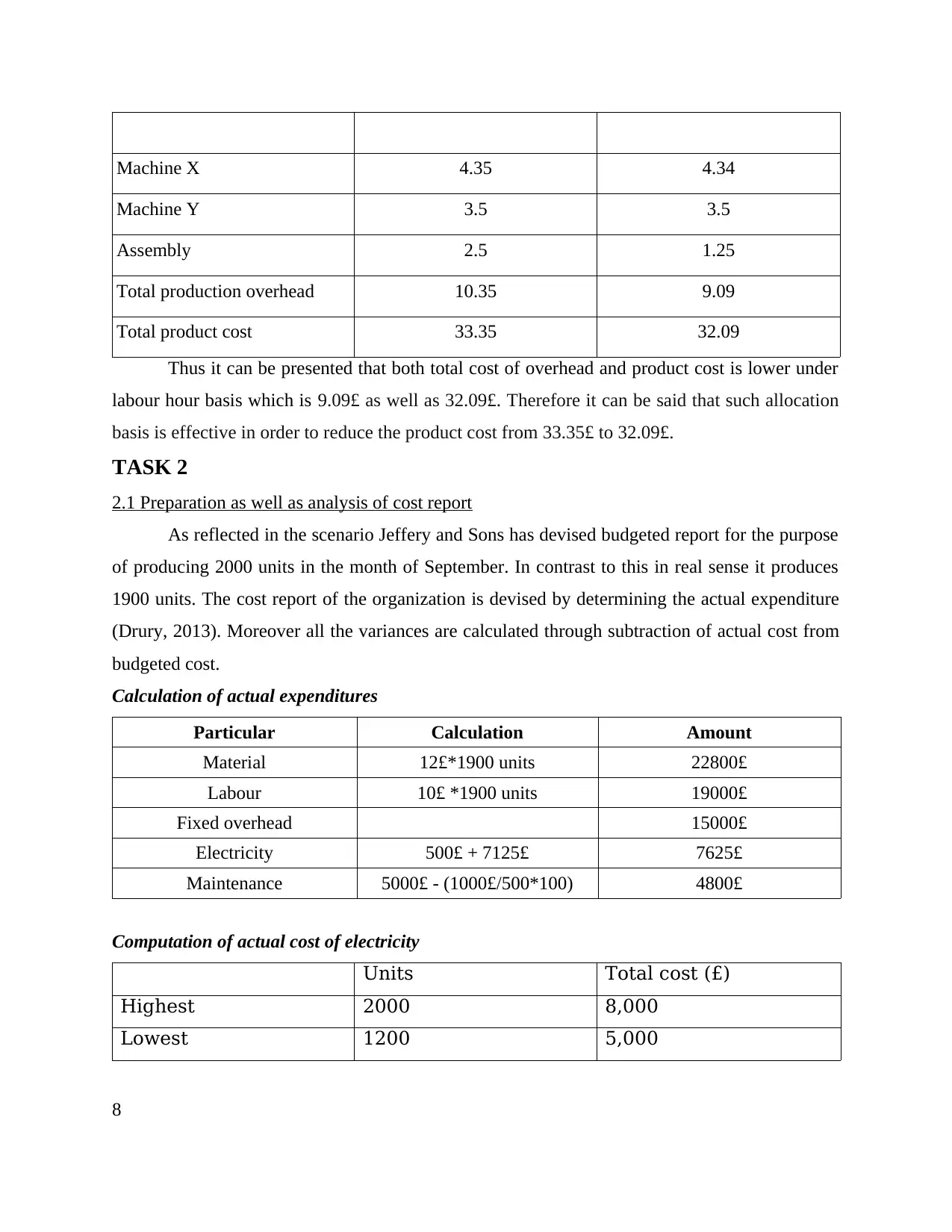

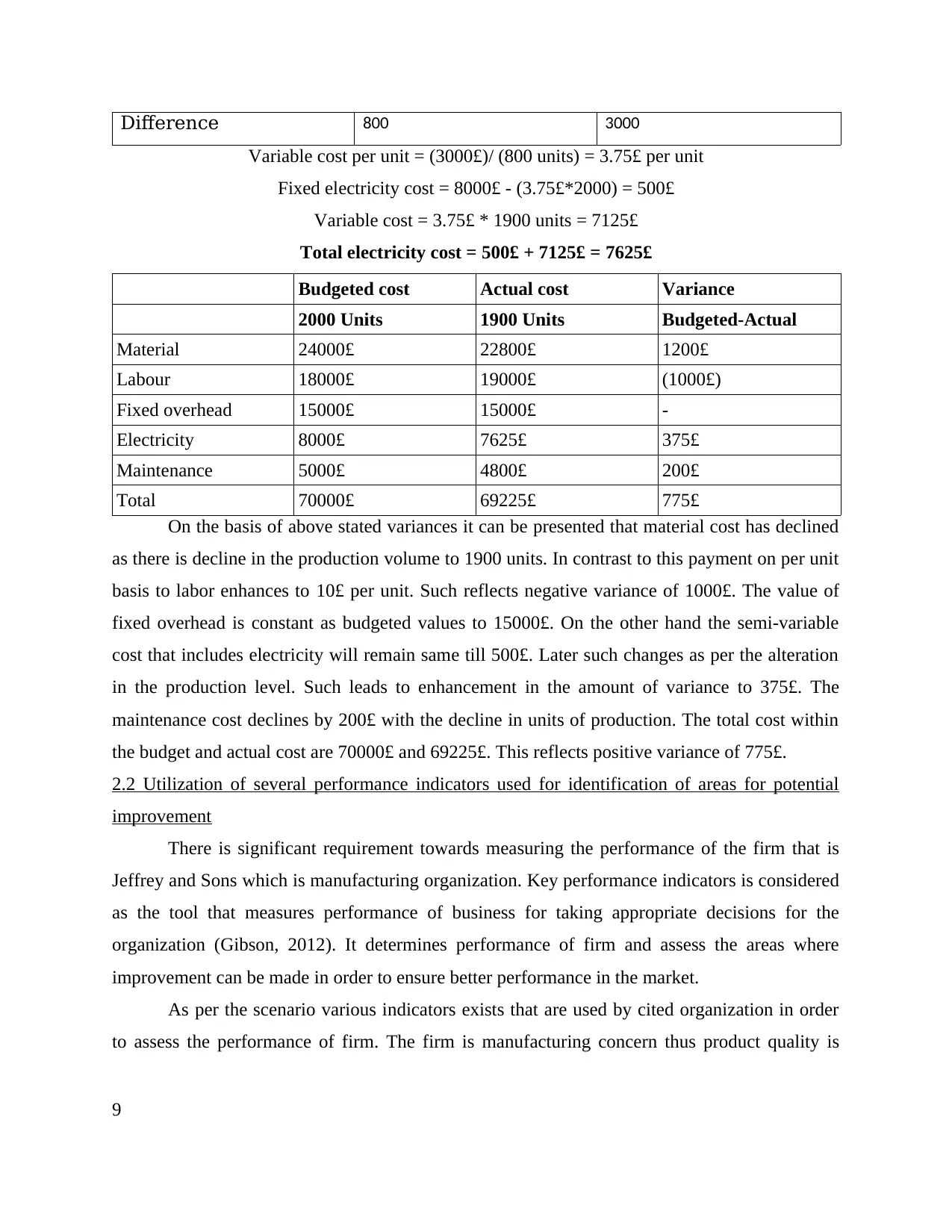

2.1 Preparation as well as analysis of cost report

As reflected in the scenario Jeffery and Sons has devised budgeted report for the purpose

of producing 2000 units in the month of September. In contrast to this in real sense it produces

1900 units. The cost report of the organization is devised by determining the actual expenditure

(Drury, 2013). Moreover all the variances are calculated through subtraction of actual cost from

budgeted cost.

Calculation of actual expenditures

Particular Calculation Amount

Material 12£*1900 units 22800£

Labour 10£ *1900 units 19000£

Fixed overhead 15000£

Electricity 500£ + 7125£ 7625£

Maintenance 5000£ - (1000£/500*100) 4800£

Computation of actual cost of electricity

Units Total cost (£)

Highest 2000 8,000

Lowest 1200 5,000

8

Machine Y 3.5 3.5

Assembly 2.5 1.25

Total production overhead 10.35 9.09

Total product cost 33.35 32.09

Thus it can be presented that both total cost of overhead and product cost is lower under

labour hour basis which is 9.09£ as well as 32.09£. Therefore it can be said that such allocation

basis is effective in order to reduce the product cost from 33.35£ to 32.09£.

TASK 2

2.1 Preparation as well as analysis of cost report

As reflected in the scenario Jeffery and Sons has devised budgeted report for the purpose

of producing 2000 units in the month of September. In contrast to this in real sense it produces

1900 units. The cost report of the organization is devised by determining the actual expenditure

(Drury, 2013). Moreover all the variances are calculated through subtraction of actual cost from

budgeted cost.

Calculation of actual expenditures

Particular Calculation Amount

Material 12£*1900 units 22800£

Labour 10£ *1900 units 19000£

Fixed overhead 15000£

Electricity 500£ + 7125£ 7625£

Maintenance 5000£ - (1000£/500*100) 4800£

Computation of actual cost of electricity

Units Total cost (£)

Highest 2000 8,000

Lowest 1200 5,000

8

Difference 800 3000

Variable cost per unit = (3000£)/ (800 units) = 3.75£ per unit

Fixed electricity cost = 8000£ - (3.75£*2000) = 500£

Variable cost = 3.75£ * 1900 units = 7125£

Total electricity cost = 500£ + 7125£ = 7625£

Budgeted cost Actual cost Variance

2000 Units 1900 Units Budgeted-Actual

Material 24000£ 22800£ 1200£

Labour 18000£ 19000£ (1000£)

Fixed overhead 15000£ 15000£ -

Electricity 8000£ 7625£ 375£

Maintenance 5000£ 4800£ 200£

Total 70000£ 69225£ 775£

On the basis of above stated variances it can be presented that material cost has declined

as there is decline in the production volume to 1900 units. In contrast to this payment on per unit

basis to labor enhances to 10£ per unit. Such reflects negative variance of 1000£. The value of

fixed overhead is constant as budgeted values to 15000£. On the other hand the semi-variable

cost that includes electricity will remain same till 500£. Later such changes as per the alteration

in the production level. Such leads to enhancement in the amount of variance to 375£. The

maintenance cost declines by 200£ with the decline in units of production. The total cost within

the budget and actual cost are 70000£ and 69225£. This reflects positive variance of 775£.

2.2 Utilization of several performance indicators used for identification of areas for potential

improvement

There is significant requirement towards measuring the performance of the firm that is

Jeffrey and Sons which is manufacturing organization. Key performance indicators is considered

as the tool that measures performance of business for taking appropriate decisions for the

organization (Gibson, 2012). It determines performance of firm and assess the areas where

improvement can be made in order to ensure better performance in the market.

As per the scenario various indicators exists that are used by cited organization in order

to assess the performance of firm. The firm is manufacturing concern thus product quality is

9

Variable cost per unit = (3000£)/ (800 units) = 3.75£ per unit

Fixed electricity cost = 8000£ - (3.75£*2000) = 500£

Variable cost = 3.75£ * 1900 units = 7125£

Total electricity cost = 500£ + 7125£ = 7625£

Budgeted cost Actual cost Variance

2000 Units 1900 Units Budgeted-Actual

Material 24000£ 22800£ 1200£

Labour 18000£ 19000£ (1000£)

Fixed overhead 15000£ 15000£ -

Electricity 8000£ 7625£ 375£

Maintenance 5000£ 4800£ 200£

Total 70000£ 69225£ 775£

On the basis of above stated variances it can be presented that material cost has declined

as there is decline in the production volume to 1900 units. In contrast to this payment on per unit

basis to labor enhances to 10£ per unit. Such reflects negative variance of 1000£. The value of

fixed overhead is constant as budgeted values to 15000£. On the other hand the semi-variable

cost that includes electricity will remain same till 500£. Later such changes as per the alteration

in the production level. Such leads to enhancement in the amount of variance to 375£. The

maintenance cost declines by 200£ with the decline in units of production. The total cost within

the budget and actual cost are 70000£ and 69225£. This reflects positive variance of 775£.

2.2 Utilization of several performance indicators used for identification of areas for potential

improvement

There is significant requirement towards measuring the performance of the firm that is

Jeffrey and Sons which is manufacturing organization. Key performance indicators is considered

as the tool that measures performance of business for taking appropriate decisions for the

organization (Gibson, 2012). It determines performance of firm and assess the areas where

improvement can be made in order to ensure better performance in the market.

As per the scenario various indicators exists that are used by cited organization in order

to assess the performance of firm. The firm is manufacturing concern thus product quality is

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

significant that acts as an aid in measurement of the performance. For instance, enhancing the

product quality reflects that performance of Jeffery and Sons is improving. Following this

another measure is productivity of the employees. Improvement in the employees productivity

demonstrates greater production at minimum cost for Jeffery and Sons. Therefore such leads to

enhancement of the performance of organization (Hughes and Bartlett, 2002). Along with this

customer satisfaction measures that capability of the organizational product in offering

satisfaction to the requirements of the customers with greater effectiveness. Higher level of

satisfaction demonstrates better performance of the cited business and vice versa. Moreover

capacity of earning, financial strength and profitability are important tool which determines

performance of Jeffery and Sons. Enhancement in earning, profits and financial status

demonstrates improvement in the organizational performance. In condition of adverse

consequences firm needs to take appropriate decisions in order to bring improvements. This

leads to enhancement in the performance of firm to a significant level.

2.3 Suggestion of ways for reduction of costs, enhancing value as well as quality

By means of decrease in the cost, enhancement in value and product quality organization

can increase its profits and can gain long term growth. The ways of cost reduction, enhancement

in value and quality is being presented in the manner as below:

Reduction in cost

Cost cut is the way with which organization can enhance its profitability. Increase in the

employees efficiency, decrease in unimportant expenses of firm, efficiency in the procedure are

regarded as the way through which cost can be reduced by firm to a greater extent (Jensen,

2003). Further through monitoring of the operations of Jeffery and Sons on every day basis the

firm can identify the factors that can affect the firm negatively. Therefore organization can take

suitable steps for maximizing the cost. For example, For the purpose of minimizing the material

cost cited firm needs to analyze price of suppliers in addition with the quality and purchase from

the best suppliers which offers material at lower rates with suitable quality. Moreover recycling,

use of material scrap and sale of scrap acts as an aid in reducing cost and this enhances the

income.

Improvement in value

10

product quality reflects that performance of Jeffery and Sons is improving. Following this

another measure is productivity of the employees. Improvement in the employees productivity

demonstrates greater production at minimum cost for Jeffery and Sons. Therefore such leads to

enhancement of the performance of organization (Hughes and Bartlett, 2002). Along with this

customer satisfaction measures that capability of the organizational product in offering

satisfaction to the requirements of the customers with greater effectiveness. Higher level of

satisfaction demonstrates better performance of the cited business and vice versa. Moreover

capacity of earning, financial strength and profitability are important tool which determines

performance of Jeffery and Sons. Enhancement in earning, profits and financial status

demonstrates improvement in the organizational performance. In condition of adverse

consequences firm needs to take appropriate decisions in order to bring improvements. This

leads to enhancement in the performance of firm to a significant level.

2.3 Suggestion of ways for reduction of costs, enhancing value as well as quality

By means of decrease in the cost, enhancement in value and product quality organization

can increase its profits and can gain long term growth. The ways of cost reduction, enhancement

in value and quality is being presented in the manner as below:

Reduction in cost

Cost cut is the way with which organization can enhance its profitability. Increase in the

employees efficiency, decrease in unimportant expenses of firm, efficiency in the procedure are

regarded as the way through which cost can be reduced by firm to a greater extent (Jensen,

2003). Further through monitoring of the operations of Jeffery and Sons on every day basis the

firm can identify the factors that can affect the firm negatively. Therefore organization can take

suitable steps for maximizing the cost. For example, For the purpose of minimizing the material

cost cited firm needs to analyze price of suppliers in addition with the quality and purchase from

the best suppliers which offers material at lower rates with suitable quality. Moreover recycling,

use of material scrap and sale of scrap acts as an aid in reducing cost and this enhances the

income.

Improvement in value

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Enhancement in the value can be assured by improving the profitability of the

organization, differentiating in the products and services and enhancing the turnover of the

employees. Moreover with increase in revenue of the business greater aid can be provided to

firm in capturing huge market share as compared to competitors. All these factors that involves

competitive advantage, greater profits and enhancement in value of shareholders facilitates

Jeffery and Sons in increasing value. This leads to enhancement in the value of business to a

greater extent.

Enhancement in quality

Along with this product quality cost is important factor that is required to be improved on

regular time interval. Through innovation, technical production process and advancement in the

technology product quality can be increased. Further with this usage of standard material quality

of cited firm can enhance product quality in an effective manner. Such results in enhancing the

satisfaction level within the customers.

TASK 3

3.1 Purpose and nature of procedure of budgeting to holders of budget of Jeffery and Sons Ltd.

Budget: Planning of the financial and operational activities of Jeffery and Sons requires

budget development. It is considered as the statement that makes accumulation of all the forecast

of the expenses as well as incomes which is borne by cited firm in future course of time (Kaplan

and Atkinson, 2015). Such can be of several types which includes sales budget, purchase budget,

cash budget and production budget.

Purpose and nature of budgeting process

The aim of such is to make estimation of the revenues of the firm and expenses for years

to come in order to make effective planning for the firm. The major purpose behind the

budgeting process revolves around increasing the revenues of the cited business. Further it also

includes declining the expenses in order to increase the profits. Through preparing the budget the

holder of the budget of Jeffery and Sons can manage the operations of firm in an effective

manner. Further they can manage the revenues of firm by making payment of its expenses in

order to enhance the organizational profitability (Mistry and et.al., 2014). Thus the procedure of

budgeting focuses on development of effective communication, coordination, controlling,

planning and evaluation. In addition to this budgeting process makes suitable utilization of

11

organization, differentiating in the products and services and enhancing the turnover of the

employees. Moreover with increase in revenue of the business greater aid can be provided to

firm in capturing huge market share as compared to competitors. All these factors that involves

competitive advantage, greater profits and enhancement in value of shareholders facilitates

Jeffery and Sons in increasing value. This leads to enhancement in the value of business to a

greater extent.

Enhancement in quality

Along with this product quality cost is important factor that is required to be improved on

regular time interval. Through innovation, technical production process and advancement in the

technology product quality can be increased. Further with this usage of standard material quality

of cited firm can enhance product quality in an effective manner. Such results in enhancing the

satisfaction level within the customers.

TASK 3

3.1 Purpose and nature of procedure of budgeting to holders of budget of Jeffery and Sons Ltd.

Budget: Planning of the financial and operational activities of Jeffery and Sons requires

budget development. It is considered as the statement that makes accumulation of all the forecast

of the expenses as well as incomes which is borne by cited firm in future course of time (Kaplan

and Atkinson, 2015). Such can be of several types which includes sales budget, purchase budget,

cash budget and production budget.

Purpose and nature of budgeting process

The aim of such is to make estimation of the revenues of the firm and expenses for years

to come in order to make effective planning for the firm. The major purpose behind the

budgeting process revolves around increasing the revenues of the cited business. Further it also

includes declining the expenses in order to increase the profits. Through preparing the budget the

holder of the budget of Jeffery and Sons can manage the operations of firm in an effective

manner. Further they can manage the revenues of firm by making payment of its expenses in

order to enhance the organizational profitability (Mistry and et.al., 2014). Thus the procedure of

budgeting focuses on development of effective communication, coordination, controlling,

planning and evaluation. In addition to this budgeting process makes suitable utilization of

11

assets of Jeffery and Sons that acts as an aid in yielding greater amount of returns to the business.

Therefore control can be made in order to meet the set targets of cited business. Through

comparison between the actual and budgeted figures evaluation of variances can be done with

greater effectiveness. Therefore Jeffery and Son's management can take decision regarding

reduction of negative variances and attainment of higher profits by business.

3.2 Appropriate methods of budgeting for organization and its requirements

The desire of Jeffery and Sons is to conduct the work with the aim to develop the annual

budget for the future course of time. It is reflected by the means of scenario that volatility in the

market and other forces present in the market makes it impossible for the managers to present the

plan of business. It is being determined that organizational survival to a significant level is

dependent on the firm's capability to take appropriate decisions at the right time. In context of the

present scenario the budget manual of the organization reflects that volume of sales is core

principal in process of budgeting of the firm. In addition to this as per the marketing executive

paramount is the factors which facilitates in maintenance of coordination in the budgeting

process (Newman, Fader and Bliss, 2004). On the basis of above extract it can be gained that

executives of firm prepares budget by means of adopting incremental method for budgeting. In

this actual performance of present year is taken base for the purpose of preparing budget for

future. Therefore such has major drawback which presents that it assumes that all the activities of

present years will continue in years to come as well. Therefore the tool increases both revenues

of business and cost without examining its need and importance.

Thus it is clear that Jeffery and Sons is required to alter its budgeting method. Zero base

budgeting is appropriate for the budgeting purpose. Under this method manager determines the

operating function of the firm for year to come. Further it determines the revenues and expenses

for future course of time. The budget preparation is done without taking into consideration

previous year budget as base. Thus it decreases the unnecessary operating functions. Hence it

leads to reduction in cost of organization (Papaspyropoulos and et.al., 2012). With the budget

development through this tool Jeffery and Sons can ensure allocation of resources with greater

effectiveness that facilitates in enhancement of profits of organization. Further this tool assist the

organization in responding towards the changes that are taking place in the market.

12

Therefore control can be made in order to meet the set targets of cited business. Through

comparison between the actual and budgeted figures evaluation of variances can be done with

greater effectiveness. Therefore Jeffery and Son's management can take decision regarding

reduction of negative variances and attainment of higher profits by business.

3.2 Appropriate methods of budgeting for organization and its requirements

The desire of Jeffery and Sons is to conduct the work with the aim to develop the annual

budget for the future course of time. It is reflected by the means of scenario that volatility in the

market and other forces present in the market makes it impossible for the managers to present the

plan of business. It is being determined that organizational survival to a significant level is

dependent on the firm's capability to take appropriate decisions at the right time. In context of the

present scenario the budget manual of the organization reflects that volume of sales is core

principal in process of budgeting of the firm. In addition to this as per the marketing executive

paramount is the factors which facilitates in maintenance of coordination in the budgeting

process (Newman, Fader and Bliss, 2004). On the basis of above extract it can be gained that

executives of firm prepares budget by means of adopting incremental method for budgeting. In

this actual performance of present year is taken base for the purpose of preparing budget for

future. Therefore such has major drawback which presents that it assumes that all the activities of

present years will continue in years to come as well. Therefore the tool increases both revenues

of business and cost without examining its need and importance.

Thus it is clear that Jeffery and Sons is required to alter its budgeting method. Zero base

budgeting is appropriate for the budgeting purpose. Under this method manager determines the

operating function of the firm for year to come. Further it determines the revenues and expenses

for future course of time. The budget preparation is done without taking into consideration

previous year budget as base. Thus it decreases the unnecessary operating functions. Hence it

leads to reduction in cost of organization (Papaspyropoulos and et.al., 2012). With the budget

development through this tool Jeffery and Sons can ensure allocation of resources with greater

effectiveness that facilitates in enhancement of profits of organization. Further this tool assist the

organization in responding towards the changes that are taking place in the market.

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19