Management Accounting Report: Absorption and Marginal Costing Methods

VerifiedAdded on 2020/01/28

|10

|2370

|49

Report

AI Summary

This report delves into the core concepts of management accounting, focusing on the application and comparison of absorption and marginal costing methods. It begins by preparing profit and loss statements using both costing methods for two quarters, followed by the creation of a reconciliation statement for each quarter. The report then critically evaluates and assesses the absorption costing method against the marginal costing system, highlighting their respective advantages and limitations. Absorption costing, which considers both direct and indirect costs, is presented as a method that provides a comprehensive view of profitability and inventory valuation. The report emphasizes its benefits, such as considering fixed costs and providing a fair view of profit margins. Conversely, the report acknowledges the marginal costing system, focusing on variable costs, and discusses its drawbacks, including the potential for misleading results due to the exclusion of fixed costs. The report concludes by summarizing the key differences between the two methods and asserting the superiority of absorption costing for providing reliable information to management and stakeholders, thereby facilitating sound decision-making. The report is supported by a comprehensive list of references to academic journals and online resources.

Management Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION......................................................................................................................3

PART 1.......................................................................................................................................3

1. Preparing profit & loss a/c by using both marginal and absorption costing method.........3

2. Producing a reconciliation statement for each quarter.......................................................5

PART 2.......................................................................................................................................5

Critically evaluating and assessing absorption costing method in against to marginal

system.....................................................................................................................................5

CONCLUSION..........................................................................................................................8

REFERENCES...........................................................................................................................9

INTRODUCTION......................................................................................................................3

PART 1.......................................................................................................................................3

1. Preparing profit & loss a/c by using both marginal and absorption costing method.........3

2. Producing a reconciliation statement for each quarter.......................................................5

PART 2.......................................................................................................................................5

Critically evaluating and assessing absorption costing method in against to marginal

system.....................................................................................................................................5

CONCLUSION..........................................................................................................................8

REFERENCES...........................................................................................................................9

INTRODUCTION

Management accounting is highly concerned with the preparation of daily financial

reports in accordance with the cost principles and techniques. This field of finance is highly

significant which in turn helps company in making suitable business decision. Further,

management accounting system also provides assistance to the firm in setting highly suitable

price for the products and services which are offered by it. The present report is based on the

case scenario which will provide deeper insight deeper insight about different types of

costing methods such as absorption and marginal.

PART 1

1. Preparing profit & loss a/c by using both marginal and absorption costing method

Absorption costing method: P& a/c

Particulars Quarter 1 Quarter 2

Sales revenue

1740000

0

1957500

0

Less: Absorption cost of sales

Opening stock - 2328000

Add: Production cost 11640000

1396800

0

Total production cost

1164000

0

1629600

0

Less: Closing stock 2328000 5820000

Absorption cost of production 9312000

1047600

0 9099000

Gross profit 8088000

1026300

0

variable selling overhead 720000 810000

Fixed sales and distribution overhead 450000 450000

Less: Total selling and distribution

overhead 1170000 1260000

Normal Profit 6918000 7839000

Less: Under absorption

Net profit 6828000 7779000

P&L statement according to variable costing method:

Management accounting is highly concerned with the preparation of daily financial

reports in accordance with the cost principles and techniques. This field of finance is highly

significant which in turn helps company in making suitable business decision. Further,

management accounting system also provides assistance to the firm in setting highly suitable

price for the products and services which are offered by it. The present report is based on the

case scenario which will provide deeper insight deeper insight about different types of

costing methods such as absorption and marginal.

PART 1

1. Preparing profit & loss a/c by using both marginal and absorption costing method

Absorption costing method: P& a/c

Particulars Quarter 1 Quarter 2

Sales revenue

1740000

0

1957500

0

Less: Absorption cost of sales

Opening stock - 2328000

Add: Production cost 11640000

1396800

0

Total production cost

1164000

0

1629600

0

Less: Closing stock 2328000 5820000

Absorption cost of production 9312000

1047600

0 9099000

Gross profit 8088000

1026300

0

variable selling overhead 720000 810000

Fixed sales and distribution overhead 450000 450000

Less: Total selling and distribution

overhead 1170000 1260000

Normal Profit 6918000 7839000

Less: Under absorption

Net profit 6828000 7779000

P&L statement according to variable costing method:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

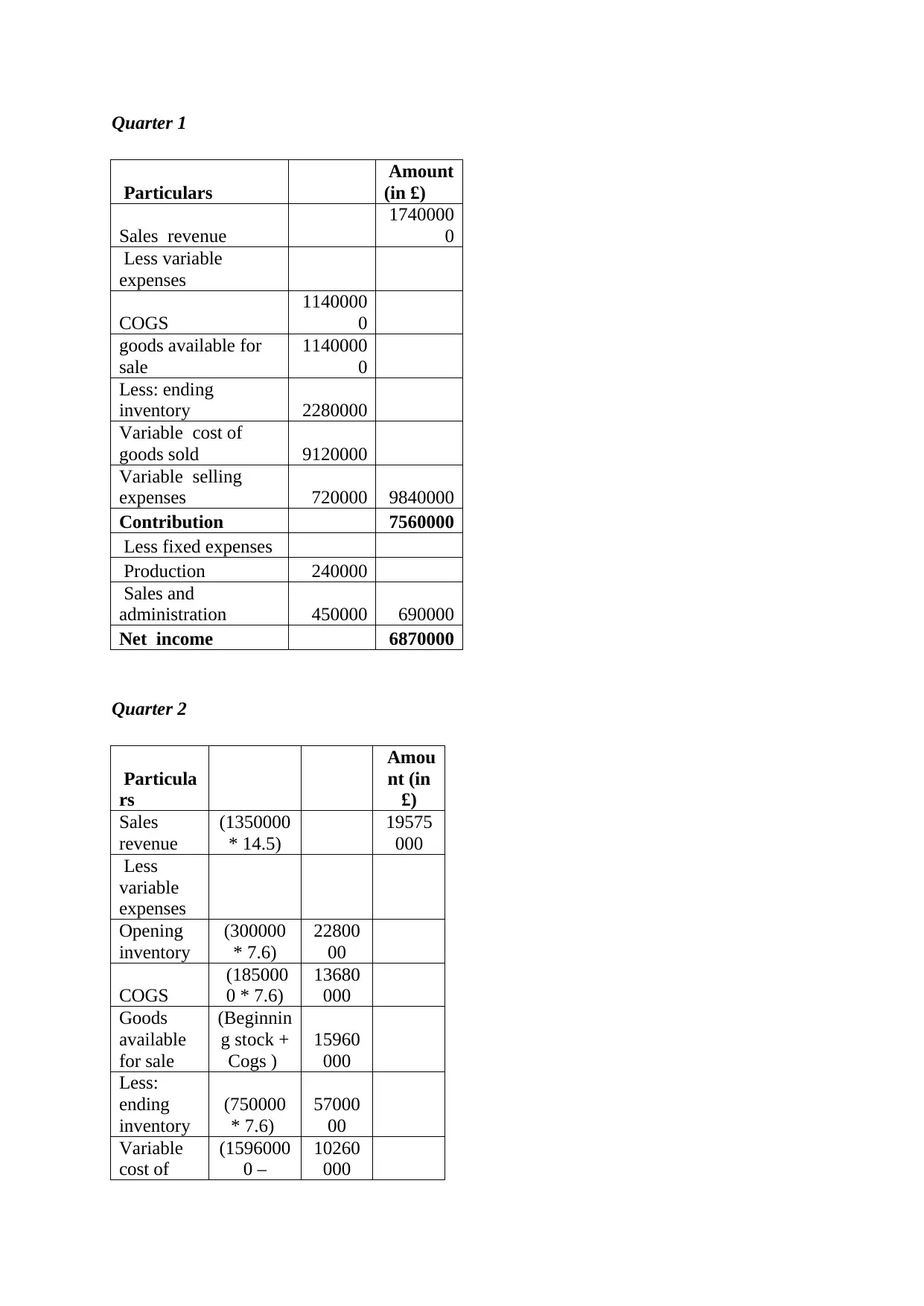

Quarter 1

Particulars

Amount

(in £)

Sales revenue

1740000

0

Less variable

expenses

COGS

1140000

0

goods available for

sale

1140000

0

Less: ending

inventory 2280000

Variable cost of

goods sold 9120000

Variable selling

expenses 720000 9840000

Contribution 7560000

Less fixed expenses

Production 240000

Sales and

administration 450000 690000

Net income 6870000

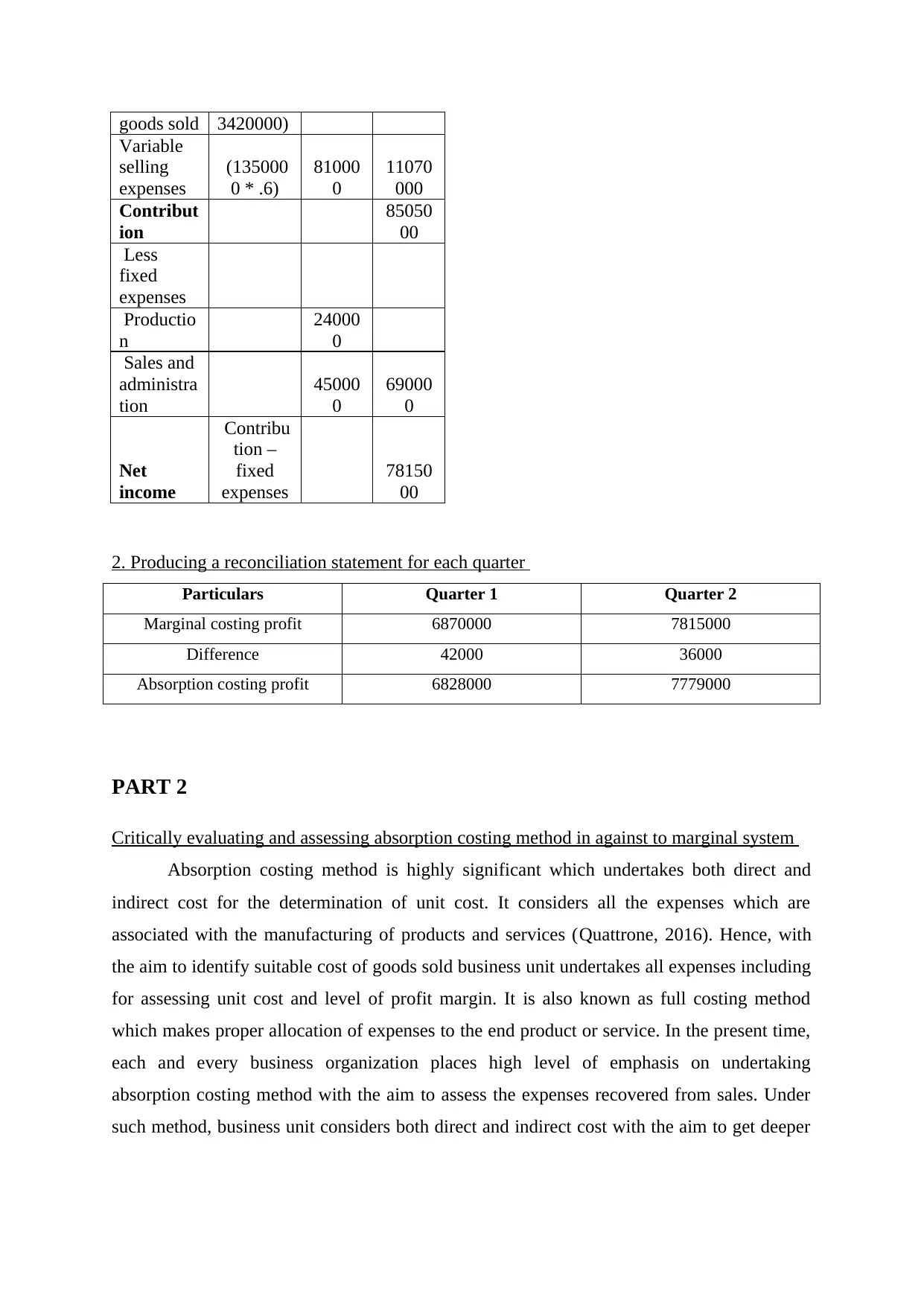

Quarter 2

Particula

rs

Amou

nt (in

£)

Sales

revenue

(1350000

* 14.5)

19575

000

Less

variable

expenses

Opening

inventory

(300000

* 7.6)

22800

00

COGS

(185000

0 * 7.6)

13680

000

Goods

available

for sale

(Beginnin

g stock +

Cogs )

15960

000

Less:

ending

inventory

(750000

* 7.6)

57000

00

Variable

cost of

(1596000

0 –

10260

000

Particulars

Amount

(in £)

Sales revenue

1740000

0

Less variable

expenses

COGS

1140000

0

goods available for

sale

1140000

0

Less: ending

inventory 2280000

Variable cost of

goods sold 9120000

Variable selling

expenses 720000 9840000

Contribution 7560000

Less fixed expenses

Production 240000

Sales and

administration 450000 690000

Net income 6870000

Quarter 2

Particula

rs

Amou

nt (in

£)

Sales

revenue

(1350000

* 14.5)

19575

000

Less

variable

expenses

Opening

inventory

(300000

* 7.6)

22800

00

COGS

(185000

0 * 7.6)

13680

000

Goods

available

for sale

(Beginnin

g stock +

Cogs )

15960

000

Less:

ending

inventory

(750000

* 7.6)

57000

00

Variable

cost of

(1596000

0 –

10260

000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

goods sold 3420000)

Variable

selling

expenses

(135000

0 * .6)

81000

0

11070

000

Contribut

ion

85050

00

Less

fixed

expenses

Productio

n

24000

0

Sales and

administra

tion

45000

0

69000

0

Net

income

Contribu

tion –

fixed

expenses

78150

00

2. Producing a reconciliation statement for each quarter

Particulars Quarter 1 Quarter 2

Marginal costing profit 6870000 7815000

Difference 42000 36000

Absorption costing profit 6828000 7779000

PART 2

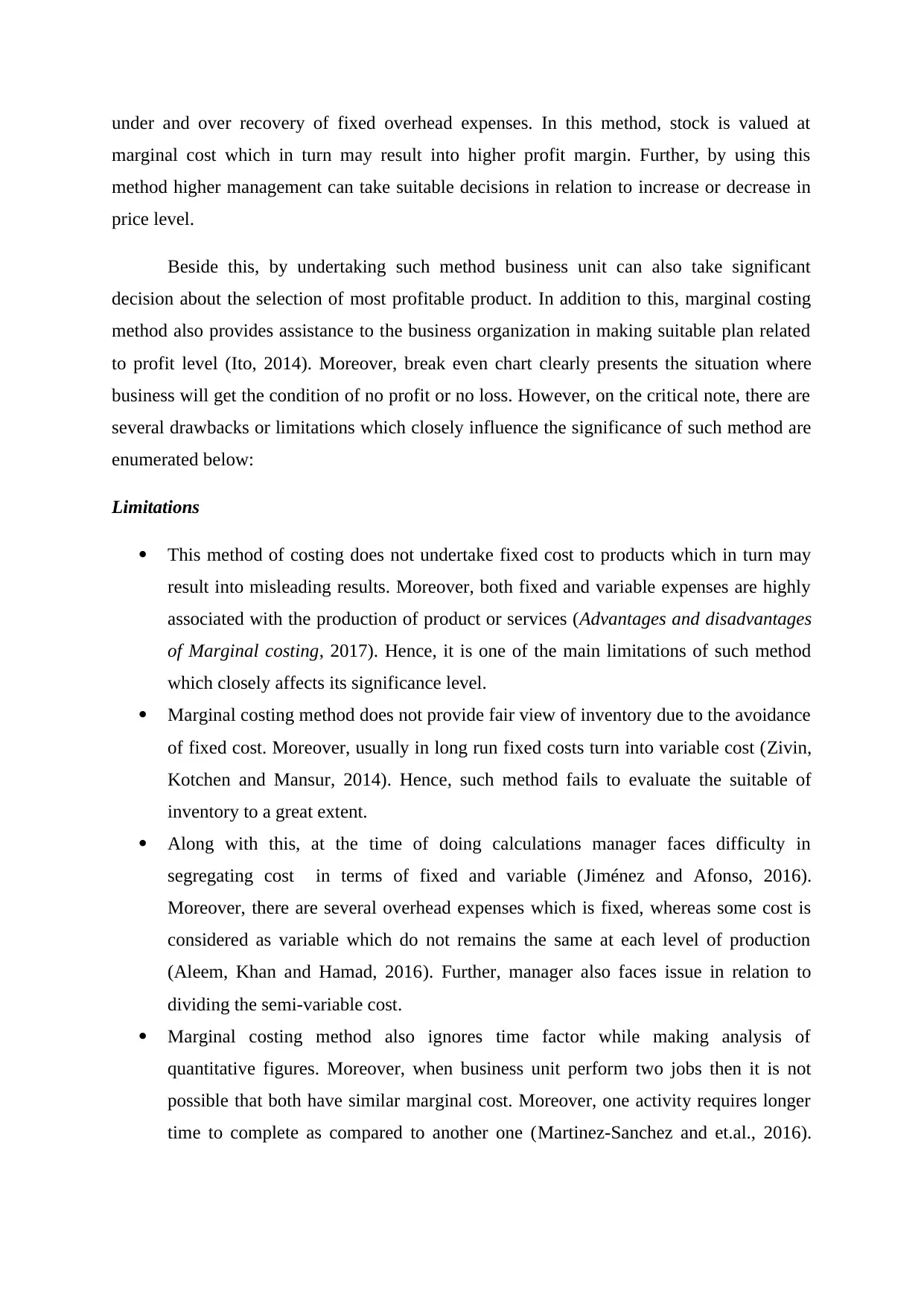

Critically evaluating and assessing absorption costing method in against to marginal system

Absorption costing method is highly significant which undertakes both direct and

indirect cost for the determination of unit cost. It considers all the expenses which are

associated with the manufacturing of products and services (Quattrone, 2016). Hence, with

the aim to identify suitable cost of goods sold business unit undertakes all expenses including

for assessing unit cost and level of profit margin. It is also known as full costing method

which makes proper allocation of expenses to the end product or service. In the present time,

each and every business organization places high level of emphasis on undertaking

absorption costing method with the aim to assess the expenses recovered from sales. Under

such method, business unit considers both direct and indirect cost with the aim to get deeper

Variable

selling

expenses

(135000

0 * .6)

81000

0

11070

000

Contribut

ion

85050

00

Less

fixed

expenses

Productio

n

24000

0

Sales and

administra

tion

45000

0

69000

0

Net

income

Contribu

tion –

fixed

expenses

78150

00

2. Producing a reconciliation statement for each quarter

Particulars Quarter 1 Quarter 2

Marginal costing profit 6870000 7815000

Difference 42000 36000

Absorption costing profit 6828000 7779000

PART 2

Critically evaluating and assessing absorption costing method in against to marginal system

Absorption costing method is highly significant which undertakes both direct and

indirect cost for the determination of unit cost. It considers all the expenses which are

associated with the manufacturing of products and services (Quattrone, 2016). Hence, with

the aim to identify suitable cost of goods sold business unit undertakes all expenses including

for assessing unit cost and level of profit margin. It is also known as full costing method

which makes proper allocation of expenses to the end product or service. In the present time,

each and every business organization places high level of emphasis on undertaking

absorption costing method with the aim to assess the expenses recovered from sales. Under

such method, business unit considers both direct and indirect cost with the aim to get deeper

insight about profit or loss aspect (Wagenhofer, 2016). All these aspects show that absorption

costing method is highly effective as compared to other alternative systems.

Advantages of absorption costing method: There are several benefits which such costing

method carries with itself:

Fixed cost consideration: This method recognizes the importance of fixed cost while

making determination of gross and net profit. It assumes that fixed cost is also highly

associated with the production of goods and services (Kaplan and Atkinson, 2015).

Hence, business unit considers fixed cost for assessing the level of profit margin and

thereby presents fair view of monetary aspects to a great extent.

Avoidance of separation: This method completely ignores the cost separation in

terms of fixed and variable. Moreover, both costs are the main parts of production

activities which in turn help in turn helps in assessing the expenses incurred by firm

during the period (Fullerton, Kennedy and Widener, 2014). In this way, by deducting

both fixed and variable expenses from sales revenue company can determine the level

of profit.

Appropriate view of profit margin: Firm can also identify the suitable amount of

profit by employing the technique of absorption costing (Chenhall and Moers, 2015).

In this way, such method offers high level of benefit to the firm which is planning to

get desired level of profit margin from future sales.

In addition to this, such method provides high level of assistance to manager in

making proper valuation of stock (Fullerton, Kennedy and Widener, 2013). Thus, by

considering this manager of the firm can prepare highly suitable and effectual

business report.

Absorption costing is one of the most effectual reforms over the marginal system which

in turn helps in making valuation of stock and assessing profit margin in an effectual way.

Marginal costing system provides deeper insight about the extent to which changes

will take place in the cost and profit margin on the production of one additional unit. In other

words, marginal costing method entails the changes take place in cost sheet according to the

level of output. This method of costing is highly effectual which can be used by manager

with high level of ease (Suomala, Lyly-Yrjänäinen and Lukka, 2014). Moreover, such

method completely eliminates difficulties in relation to the allocation, apportionment and

absorption of overhead aspect. Thus, such method is highly free from the complication of

costing method is highly effective as compared to other alternative systems.

Advantages of absorption costing method: There are several benefits which such costing

method carries with itself:

Fixed cost consideration: This method recognizes the importance of fixed cost while

making determination of gross and net profit. It assumes that fixed cost is also highly

associated with the production of goods and services (Kaplan and Atkinson, 2015).

Hence, business unit considers fixed cost for assessing the level of profit margin and

thereby presents fair view of monetary aspects to a great extent.

Avoidance of separation: This method completely ignores the cost separation in

terms of fixed and variable. Moreover, both costs are the main parts of production

activities which in turn help in turn helps in assessing the expenses incurred by firm

during the period (Fullerton, Kennedy and Widener, 2014). In this way, by deducting

both fixed and variable expenses from sales revenue company can determine the level

of profit.

Appropriate view of profit margin: Firm can also identify the suitable amount of

profit by employing the technique of absorption costing (Chenhall and Moers, 2015).

In this way, such method offers high level of benefit to the firm which is planning to

get desired level of profit margin from future sales.

In addition to this, such method provides high level of assistance to manager in

making proper valuation of stock (Fullerton, Kennedy and Widener, 2013). Thus, by

considering this manager of the firm can prepare highly suitable and effectual

business report.

Absorption costing is one of the most effectual reforms over the marginal system which

in turn helps in making valuation of stock and assessing profit margin in an effectual way.

Marginal costing system provides deeper insight about the extent to which changes

will take place in the cost and profit margin on the production of one additional unit. In other

words, marginal costing method entails the changes take place in cost sheet according to the

level of output. This method of costing is highly effectual which can be used by manager

with high level of ease (Suomala, Lyly-Yrjänäinen and Lukka, 2014). Moreover, such

method completely eliminates difficulties in relation to the allocation, apportionment and

absorption of overhead aspect. Thus, such method is highly free from the complication of

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

under and over recovery of fixed overhead expenses. In this method, stock is valued at

marginal cost which in turn may result into higher profit margin. Further, by using this

method higher management can take suitable decisions in relation to increase or decrease in

price level.

Beside this, by undertaking such method business unit can also take significant

decision about the selection of most profitable product. In addition to this, marginal costing

method also provides assistance to the business organization in making suitable plan related

to profit level (Ito, 2014). Moreover, break even chart clearly presents the situation where

business will get the condition of no profit or no loss. However, on the critical note, there are

several drawbacks or limitations which closely influence the significance of such method are

enumerated below:

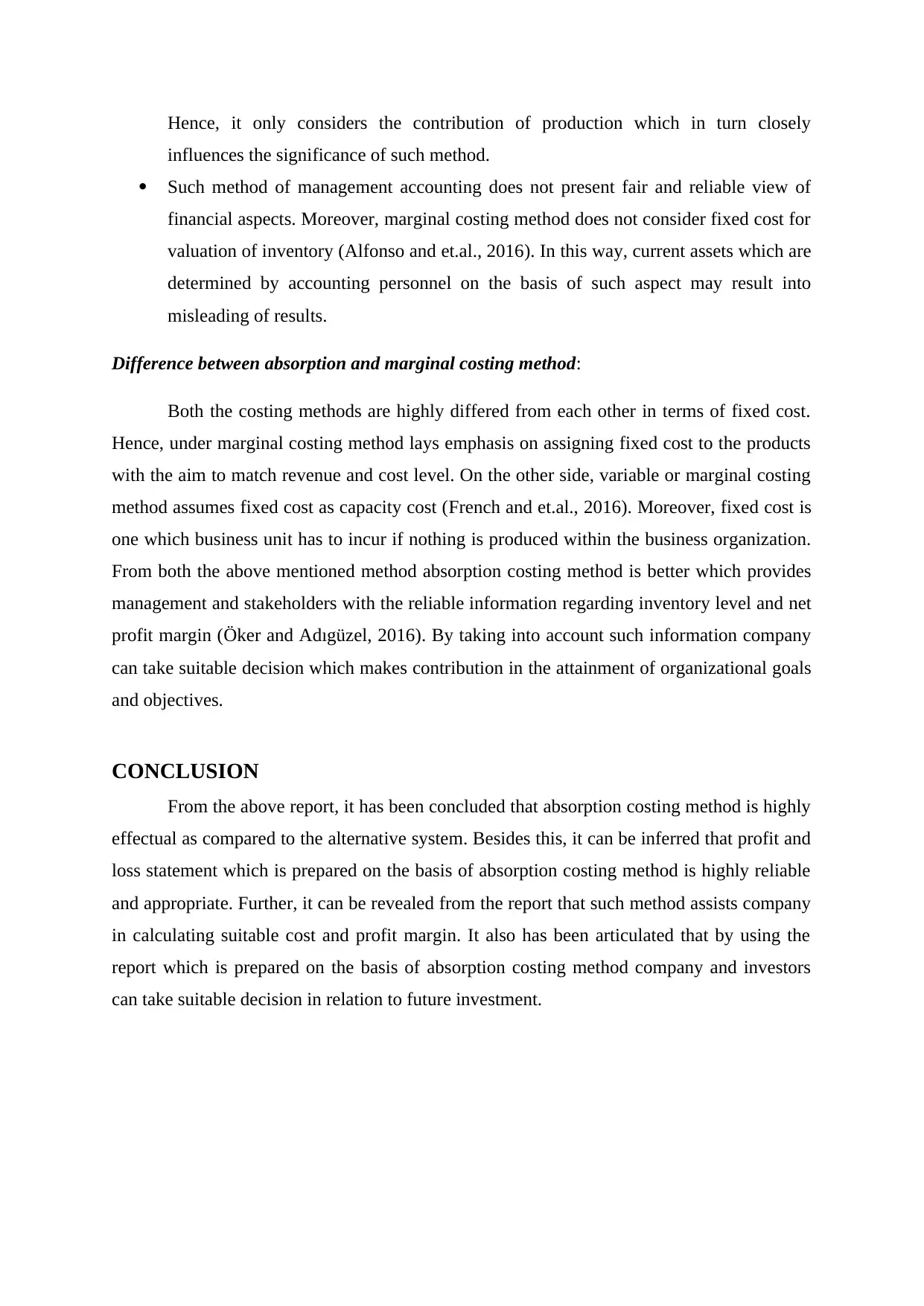

Limitations

This method of costing does not undertake fixed cost to products which in turn may

result into misleading results. Moreover, both fixed and variable expenses are highly

associated with the production of product or services (Advantages and disadvantages

of Marginal costing, 2017). Hence, it is one of the main limitations of such method

which closely affects its significance level.

Marginal costing method does not provide fair view of inventory due to the avoidance

of fixed cost. Moreover, usually in long run fixed costs turn into variable cost (Zivin,

Kotchen and Mansur, 2014). Hence, such method fails to evaluate the suitable of

inventory to a great extent.

Along with this, at the time of doing calculations manager faces difficulty in

segregating cost in terms of fixed and variable (Jiménez and Afonso, 2016).

Moreover, there are several overhead expenses which is fixed, whereas some cost is

considered as variable which do not remains the same at each level of production

(Aleem, Khan and Hamad, 2016). Further, manager also faces issue in relation to

dividing the semi-variable cost.

Marginal costing method also ignores time factor while making analysis of

quantitative figures. Moreover, when business unit perform two jobs then it is not

possible that both have similar marginal cost. Moreover, one activity requires longer

time to complete as compared to another one (Martinez-Sanchez and et.al., 2016).

marginal cost which in turn may result into higher profit margin. Further, by using this

method higher management can take suitable decisions in relation to increase or decrease in

price level.

Beside this, by undertaking such method business unit can also take significant

decision about the selection of most profitable product. In addition to this, marginal costing

method also provides assistance to the business organization in making suitable plan related

to profit level (Ito, 2014). Moreover, break even chart clearly presents the situation where

business will get the condition of no profit or no loss. However, on the critical note, there are

several drawbacks or limitations which closely influence the significance of such method are

enumerated below:

Limitations

This method of costing does not undertake fixed cost to products which in turn may

result into misleading results. Moreover, both fixed and variable expenses are highly

associated with the production of product or services (Advantages and disadvantages

of Marginal costing, 2017). Hence, it is one of the main limitations of such method

which closely affects its significance level.

Marginal costing method does not provide fair view of inventory due to the avoidance

of fixed cost. Moreover, usually in long run fixed costs turn into variable cost (Zivin,

Kotchen and Mansur, 2014). Hence, such method fails to evaluate the suitable of

inventory to a great extent.

Along with this, at the time of doing calculations manager faces difficulty in

segregating cost in terms of fixed and variable (Jiménez and Afonso, 2016).

Moreover, there are several overhead expenses which is fixed, whereas some cost is

considered as variable which do not remains the same at each level of production

(Aleem, Khan and Hamad, 2016). Further, manager also faces issue in relation to

dividing the semi-variable cost.

Marginal costing method also ignores time factor while making analysis of

quantitative figures. Moreover, when business unit perform two jobs then it is not

possible that both have similar marginal cost. Moreover, one activity requires longer

time to complete as compared to another one (Martinez-Sanchez and et.al., 2016).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Hence, it only considers the contribution of production which in turn closely

influences the significance of such method.

Such method of management accounting does not present fair and reliable view of

financial aspects. Moreover, marginal costing method does not consider fixed cost for

valuation of inventory (Alfonso and et.al., 2016). In this way, current assets which are

determined by accounting personnel on the basis of such aspect may result into

misleading of results.

Difference between absorption and marginal costing method:

Both the costing methods are highly differed from each other in terms of fixed cost.

Hence, under marginal costing method lays emphasis on assigning fixed cost to the products

with the aim to match revenue and cost level. On the other side, variable or marginal costing

method assumes fixed cost as capacity cost (French and et.al., 2016). Moreover, fixed cost is

one which business unit has to incur if nothing is produced within the business organization.

From both the above mentioned method absorption costing method is better which provides

management and stakeholders with the reliable information regarding inventory level and net

profit margin (Öker and Adıgüzel, 2016). By taking into account such information company

can take suitable decision which makes contribution in the attainment of organizational goals

and objectives.

CONCLUSION

From the above report, it has been concluded that absorption costing method is highly

effectual as compared to the alternative system. Besides this, it can be inferred that profit and

loss statement which is prepared on the basis of absorption costing method is highly reliable

and appropriate. Further, it can be revealed from the report that such method assists company

in calculating suitable cost and profit margin. It also has been articulated that by using the

report which is prepared on the basis of absorption costing method company and investors

can take suitable decision in relation to future investment.

influences the significance of such method.

Such method of management accounting does not present fair and reliable view of

financial aspects. Moreover, marginal costing method does not consider fixed cost for

valuation of inventory (Alfonso and et.al., 2016). In this way, current assets which are

determined by accounting personnel on the basis of such aspect may result into

misleading of results.

Difference between absorption and marginal costing method:

Both the costing methods are highly differed from each other in terms of fixed cost.

Hence, under marginal costing method lays emphasis on assigning fixed cost to the products

with the aim to match revenue and cost level. On the other side, variable or marginal costing

method assumes fixed cost as capacity cost (French and et.al., 2016). Moreover, fixed cost is

one which business unit has to incur if nothing is produced within the business organization.

From both the above mentioned method absorption costing method is better which provides

management and stakeholders with the reliable information regarding inventory level and net

profit margin (Öker and Adıgüzel, 2016). By taking into account such information company

can take suitable decision which makes contribution in the attainment of organizational goals

and objectives.

CONCLUSION

From the above report, it has been concluded that absorption costing method is highly

effectual as compared to the alternative system. Besides this, it can be inferred that profit and

loss statement which is prepared on the basis of absorption costing method is highly reliable

and appropriate. Further, it can be revealed from the report that such method assists company

in calculating suitable cost and profit margin. It also has been articulated that by using the

report which is prepared on the basis of absorption costing method company and investors

can take suitable decision in relation to future investment.

REFERENCES

Books and Journals

Aleem, M., Khan, A. H. and Hamad, W., 2016. A comparative study of the different costing

techniques and their application in the pharmaceutical companies. The Audit Financiar

journal. 12(143).

Alfonso, Y. N. and et.al., 2016. Trends in the Marginal Cost of Male Circumcision in Rural

Rakai Uganda. JAIDS Journal of Acquired Immune Deficiency Syndromes. 73(5). pp.564-

571.

Chenhall, R. H. and Moers, F., 2015. The role of innovation in the evolution of management

accounting and its integration into management control. Accounting, Organizations and

Society. 47. pp.1-13.

French, K. E. and et.al., 2016. Value based care and bundled payments: Anesthesia care costs

for outpatient oncology surgery using time-driven activity-based costing. In Healthcare

(Vol. 4, No. 3, pp. 173-180). Elsevier.

Fullerton, R. R., Kennedy, F. A. and Widener, S. K., 2013. Management accounting and

control practices in a lean manufacturing environment. Accounting, Organizations and

Society. 38(1). pp.50-71.

Fullerton, R. R., Kennedy, F. A. and Widener, S. K., 2014. Lean manufacturing and firm

performance: The incremental contribution of lean management accounting practices.

Journal of Operations Management. 32(7). pp.414-428.

Ito, K., 2014. Do consumers respond to marginal or average price? Evidence from nonlinear

electricity pricing. The American Economic Review. 104(2). pp.537-563.

Jiménez, V. and Afonso, P., 2016. Risk assessment in costing systems using costing at risk

(CaR): An application to the Coffee production cost. In Industrial Engineering and

Engineering Management (IEEM), 2016 IEEE International Conference on (pp. 1315-

1319). IEEE.

Kaplan, R. S. and Atkinson, A. A., 2015. Advanced management accounting. PHI Learning.

Books and Journals

Aleem, M., Khan, A. H. and Hamad, W., 2016. A comparative study of the different costing

techniques and their application in the pharmaceutical companies. The Audit Financiar

journal. 12(143).

Alfonso, Y. N. and et.al., 2016. Trends in the Marginal Cost of Male Circumcision in Rural

Rakai Uganda. JAIDS Journal of Acquired Immune Deficiency Syndromes. 73(5). pp.564-

571.

Chenhall, R. H. and Moers, F., 2015. The role of innovation in the evolution of management

accounting and its integration into management control. Accounting, Organizations and

Society. 47. pp.1-13.

French, K. E. and et.al., 2016. Value based care and bundled payments: Anesthesia care costs

for outpatient oncology surgery using time-driven activity-based costing. In Healthcare

(Vol. 4, No. 3, pp. 173-180). Elsevier.

Fullerton, R. R., Kennedy, F. A. and Widener, S. K., 2013. Management accounting and

control practices in a lean manufacturing environment. Accounting, Organizations and

Society. 38(1). pp.50-71.

Fullerton, R. R., Kennedy, F. A. and Widener, S. K., 2014. Lean manufacturing and firm

performance: The incremental contribution of lean management accounting practices.

Journal of Operations Management. 32(7). pp.414-428.

Ito, K., 2014. Do consumers respond to marginal or average price? Evidence from nonlinear

electricity pricing. The American Economic Review. 104(2). pp.537-563.

Jiménez, V. and Afonso, P., 2016. Risk assessment in costing systems using costing at risk

(CaR): An application to the Coffee production cost. In Industrial Engineering and

Engineering Management (IEEM), 2016 IEEE International Conference on (pp. 1315-

1319). IEEE.

Kaplan, R. S. and Atkinson, A. A., 2015. Advanced management accounting. PHI Learning.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Martinez-Sanchez, V. and et.al., 2016. Estimation of marginal costs at existing waste

treatment facilities. Waste Management. 50. pp.364-375.

Öker, F. and Adıgüzel, H., 2016. Time‐driven activity‐based costing: An implementation in a

manufacturing company. Journal of Corporate Accounting & Finance. 27(3). pp.39-56.

Quattrone, P., 2016. Management accounting goes digital: Will the move make it wiser?.

Management Accounting Research. 31, pp.118-122.

Suomala, P., Lyly-Yrjänäinen, J. and Lukka, K., 2014. Battlefield around interventions: A

reflective analysis of conducting interventionist research in management accounting.

Management Accounting Research. 25(4). pp.304-314.

Wagenhofer, A., 2016. Exploiting regulatory changes for research in management

accounting. Management Accounting Research. 31. pp.112-117.

Zivin, J. S. G., Kotchen, M. J. and Mansur, E. T., 2014. Spatial and temporal heterogeneity of

marginal emissions: Implications for electric cars and other electricity-shifting policies.

Journal of Economic Behavior & Organization. 107. pp.248-268.

Online

Advantages and disadvantages of Marginal costing. 2017. Online. Available through: <

https://www.scribd.com/document/115714369/Advantages-and-Disadvantages-of-

Marginal-Costing>. [Accessed on 30th January 2017].

treatment facilities. Waste Management. 50. pp.364-375.

Öker, F. and Adıgüzel, H., 2016. Time‐driven activity‐based costing: An implementation in a

manufacturing company. Journal of Corporate Accounting & Finance. 27(3). pp.39-56.

Quattrone, P., 2016. Management accounting goes digital: Will the move make it wiser?.

Management Accounting Research. 31, pp.118-122.

Suomala, P., Lyly-Yrjänäinen, J. and Lukka, K., 2014. Battlefield around interventions: A

reflective analysis of conducting interventionist research in management accounting.

Management Accounting Research. 25(4). pp.304-314.

Wagenhofer, A., 2016. Exploiting regulatory changes for research in management

accounting. Management Accounting Research. 31. pp.112-117.

Zivin, J. S. G., Kotchen, M. J. and Mansur, E. T., 2014. Spatial and temporal heterogeneity of

marginal emissions: Implications for electric cars and other electricity-shifting policies.

Journal of Economic Behavior & Organization. 107. pp.248-268.

Online

Advantages and disadvantages of Marginal costing. 2017. Online. Available through: <

https://www.scribd.com/document/115714369/Advantages-and-Disadvantages-of-

Marginal-Costing>. [Accessed on 30th January 2017].

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.