Financial Performance: A Management Accounting Report on DIHL Ltd

VerifiedAdded on 2023/06/05

|7

|962

|156

Report

AI Summary

This management accounting report presents a detailed financial analysis of DIHL Ltd for the year 2018. It includes a budgeted net profit statement, break-even analysis, and margin of safety calculations for three shoe types (A, B, and C). The report assesses the impact of variable cost changes on break-even points and recommends production priorities based on contribution margins. The analysis indicates that Shoe A faces challenges in achieving profitability, while Shoe B and Shoe C demonstrate stronger financial performance. The report uses relevant accounting principles and references to support its findings and recommendations, providing insights into DIHL Ltd's financial strategies and operational decisions. Desklib offers a platform for students to access similar solved assignments and past papers for academic support.

Management Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

Question 1..................................................................................................................................3

Question 2..................................................................................................................................4

`Question 3.................................................................................................................................4

(a)...........................................................................................................................................4

(b)...........................................................................................................................................5

Question 4..................................................................................................................................5

(a)...........................................................................................................................................5

(b)...........................................................................................................................................6

References..................................................................................................................................7

Question 1..................................................................................................................................3

Question 2..................................................................................................................................4

`Question 3.................................................................................................................................4

(a)...........................................................................................................................................4

(b)...........................................................................................................................................5

Question 4..................................................................................................................................5

(a)...........................................................................................................................................5

(b)...........................................................................................................................................6

References..................................................................................................................................7

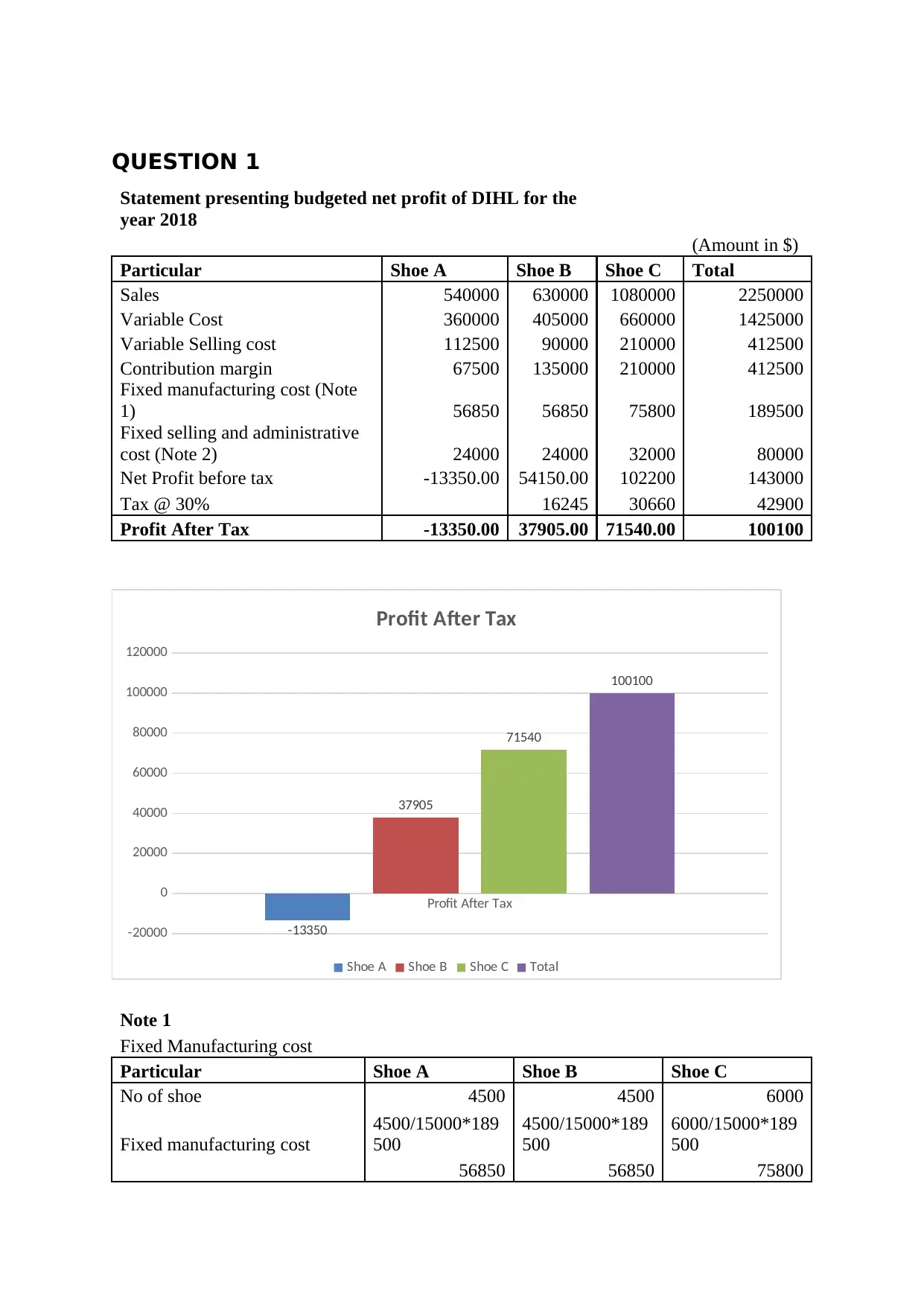

QUESTION 1

Statement presenting budgeted net profit of DIHL for the

year 2018

(Amount in $)

Particular Shoe A Shoe B Shoe C Total

Sales 540000 630000 1080000 2250000

Variable Cost 360000 405000 660000 1425000

Variable Selling cost 112500 90000 210000 412500

Contribution margin 67500 135000 210000 412500

Fixed manufacturing cost (Note

1) 56850 56850 75800 189500

Fixed selling and administrative

cost (Note 2) 24000 24000 32000 80000

Net Profit before tax -13350.00 54150.00 102200 143000

Tax @ 30% 16245 30660 42900

Profit After Tax -13350.00 37905.00 71540.00 100100

Profit After Tax

-20000

0

20000

40000

60000

80000

100000

120000

-13350

37905

71540

100100

Profit After Tax

Shoe A Shoe B Shoe C Total

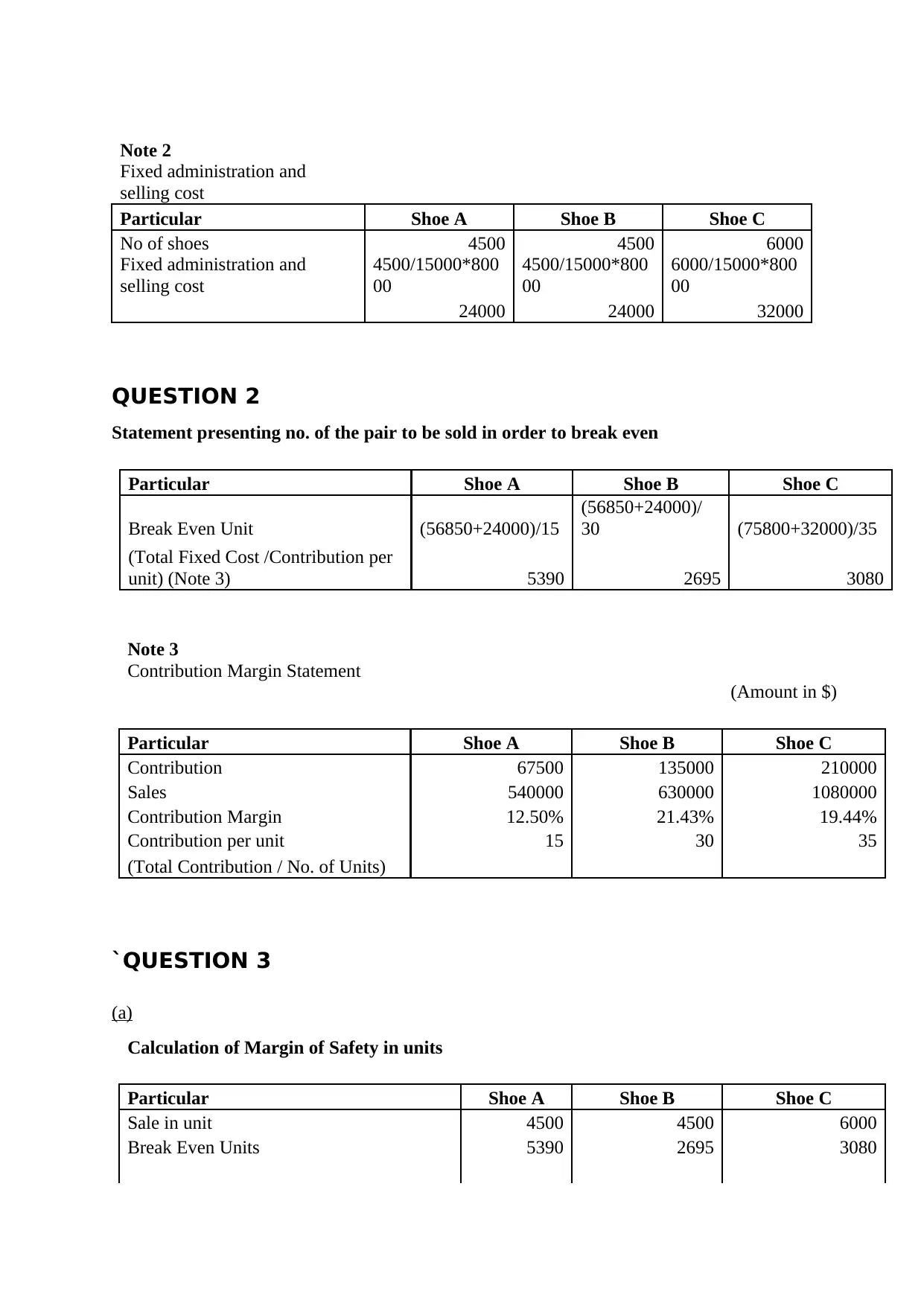

Note 1

Fixed Manufacturing cost

Particular Shoe A Shoe B Shoe C

No of shoe 4500 4500 6000

Fixed manufacturing cost

4500/15000*189

500

4500/15000*189

500

6000/15000*189

500

56850 56850 75800

Statement presenting budgeted net profit of DIHL for the

year 2018

(Amount in $)

Particular Shoe A Shoe B Shoe C Total

Sales 540000 630000 1080000 2250000

Variable Cost 360000 405000 660000 1425000

Variable Selling cost 112500 90000 210000 412500

Contribution margin 67500 135000 210000 412500

Fixed manufacturing cost (Note

1) 56850 56850 75800 189500

Fixed selling and administrative

cost (Note 2) 24000 24000 32000 80000

Net Profit before tax -13350.00 54150.00 102200 143000

Tax @ 30% 16245 30660 42900

Profit After Tax -13350.00 37905.00 71540.00 100100

Profit After Tax

-20000

0

20000

40000

60000

80000

100000

120000

-13350

37905

71540

100100

Profit After Tax

Shoe A Shoe B Shoe C Total

Note 1

Fixed Manufacturing cost

Particular Shoe A Shoe B Shoe C

No of shoe 4500 4500 6000

Fixed manufacturing cost

4500/15000*189

500

4500/15000*189

500

6000/15000*189

500

56850 56850 75800

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Note 2

Fixed administration and

selling cost

Particular Shoe A Shoe B Shoe C

No of shoes 4500 4500 6000

Fixed administration and

selling cost

4500/15000*800

00

4500/15000*800

00

6000/15000*800

00

24000 24000 32000

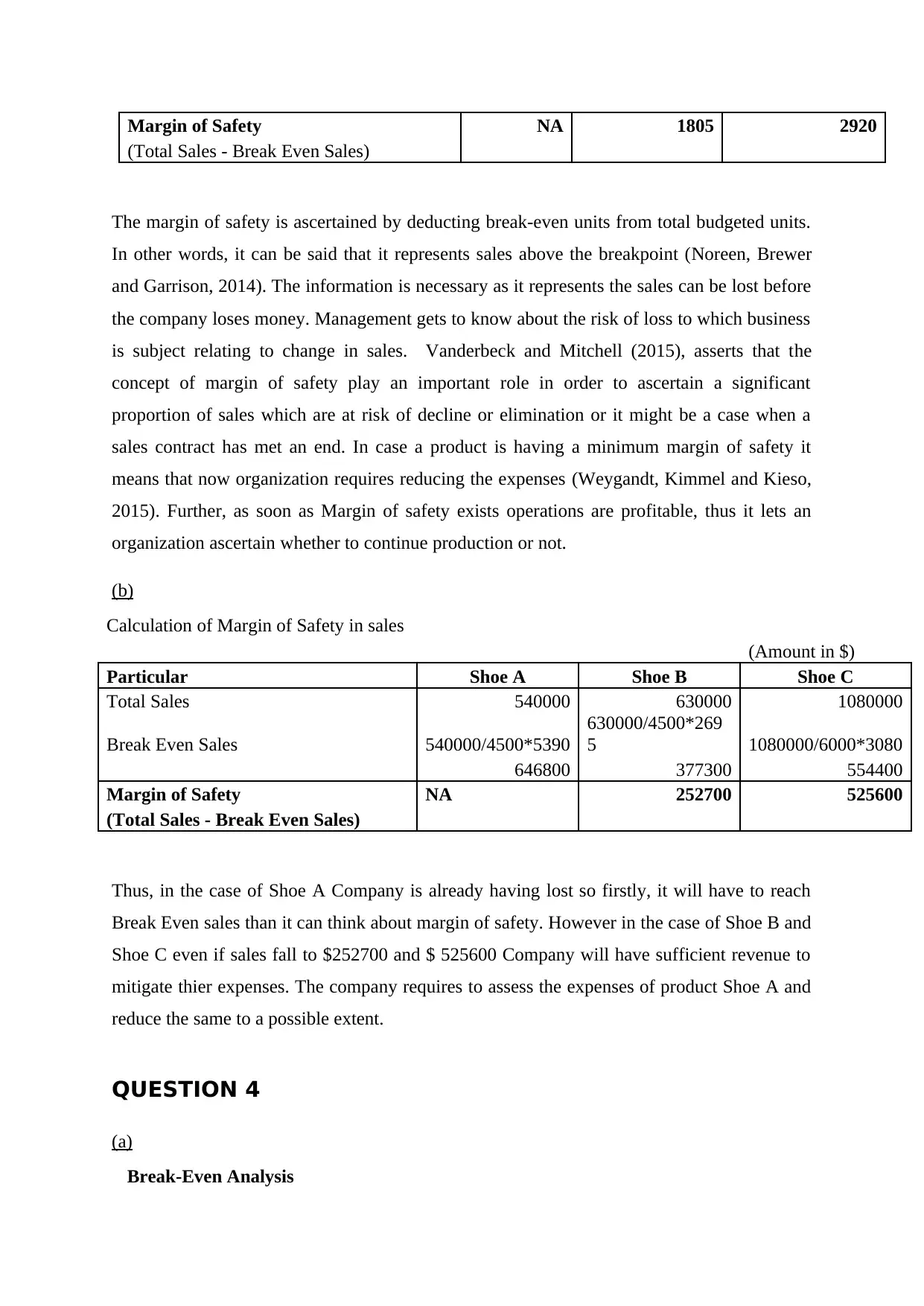

QUESTION 2

Statement presenting no. of the pair to be sold in order to break even

Particular Shoe A Shoe B Shoe C

Break Even Unit (56850+24000)/15

(56850+24000)/

30 (75800+32000)/35

(Total Fixed Cost /Contribution per

unit) (Note 3) 5390 2695 3080

Note 3

Contribution Margin Statement

(Amount in $)

Particular Shoe A Shoe B Shoe C

Contribution 67500 135000 210000

Sales 540000 630000 1080000

Contribution Margin 12.50% 21.43% 19.44%

Contribution per unit 15 30 35

(Total Contribution / No. of Units)

`QUESTION 3

(a)

Calculation of Margin of Safety in units

Particular Shoe A Shoe B Shoe C

Sale in unit 4500 4500 6000

Break Even Units 5390 2695 3080

Fixed administration and

selling cost

Particular Shoe A Shoe B Shoe C

No of shoes 4500 4500 6000

Fixed administration and

selling cost

4500/15000*800

00

4500/15000*800

00

6000/15000*800

00

24000 24000 32000

QUESTION 2

Statement presenting no. of the pair to be sold in order to break even

Particular Shoe A Shoe B Shoe C

Break Even Unit (56850+24000)/15

(56850+24000)/

30 (75800+32000)/35

(Total Fixed Cost /Contribution per

unit) (Note 3) 5390 2695 3080

Note 3

Contribution Margin Statement

(Amount in $)

Particular Shoe A Shoe B Shoe C

Contribution 67500 135000 210000

Sales 540000 630000 1080000

Contribution Margin 12.50% 21.43% 19.44%

Contribution per unit 15 30 35

(Total Contribution / No. of Units)

`QUESTION 3

(a)

Calculation of Margin of Safety in units

Particular Shoe A Shoe B Shoe C

Sale in unit 4500 4500 6000

Break Even Units 5390 2695 3080

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Margin of Safety NA 1805 2920

(Total Sales - Break Even Sales)

The margin of safety is ascertained by deducting break-even units from total budgeted units.

In other words, it can be said that it represents sales above the breakpoint (Noreen, Brewer

and Garrison, 2014). The information is necessary as it represents the sales can be lost before

the company loses money. Management gets to know about the risk of loss to which business

is subject relating to change in sales. Vanderbeck and Mitchell (2015), asserts that the

concept of margin of safety play an important role in order to ascertain a significant

proportion of sales which are at risk of decline or elimination or it might be a case when a

sales contract has met an end. In case a product is having a minimum margin of safety it

means that now organization requires reducing the expenses (Weygandt, Kimmel and Kieso,

2015). Further, as soon as Margin of safety exists operations are profitable, thus it lets an

organization ascertain whether to continue production or not.

(b)

Calculation of Margin of Safety in sales

(Amount in $)

Particular Shoe A Shoe B Shoe C

Total Sales 540000 630000 1080000

Break Even Sales 540000/4500*5390

630000/4500*269

5 1080000/6000*3080

646800 377300 554400

Margin of Safety NA 252700 525600

(Total Sales - Break Even Sales)

Thus, in the case of Shoe A Company is already having lost so firstly, it will have to reach

Break Even sales than it can think about margin of safety. However in the case of Shoe B and

Shoe C even if sales fall to $252700 and $ 525600 Company will have sufficient revenue to

mitigate thier expenses. The company requires to assess the expenses of product Shoe A and

reduce the same to a possible extent.

QUESTION 4

(a)

Break-Even Analysis

(Total Sales - Break Even Sales)

The margin of safety is ascertained by deducting break-even units from total budgeted units.

In other words, it can be said that it represents sales above the breakpoint (Noreen, Brewer

and Garrison, 2014). The information is necessary as it represents the sales can be lost before

the company loses money. Management gets to know about the risk of loss to which business

is subject relating to change in sales. Vanderbeck and Mitchell (2015), asserts that the

concept of margin of safety play an important role in order to ascertain a significant

proportion of sales which are at risk of decline or elimination or it might be a case when a

sales contract has met an end. In case a product is having a minimum margin of safety it

means that now organization requires reducing the expenses (Weygandt, Kimmel and Kieso,

2015). Further, as soon as Margin of safety exists operations are profitable, thus it lets an

organization ascertain whether to continue production or not.

(b)

Calculation of Margin of Safety in sales

(Amount in $)

Particular Shoe A Shoe B Shoe C

Total Sales 540000 630000 1080000

Break Even Sales 540000/4500*5390

630000/4500*269

5 1080000/6000*3080

646800 377300 554400

Margin of Safety NA 252700 525600

(Total Sales - Break Even Sales)

Thus, in the case of Shoe A Company is already having lost so firstly, it will have to reach

Break Even sales than it can think about margin of safety. However in the case of Shoe B and

Shoe C even if sales fall to $252700 and $ 525600 Company will have sufficient revenue to

mitigate thier expenses. The company requires to assess the expenses of product Shoe A and

reduce the same to a possible extent.

QUESTION 4

(a)

Break-Even Analysis

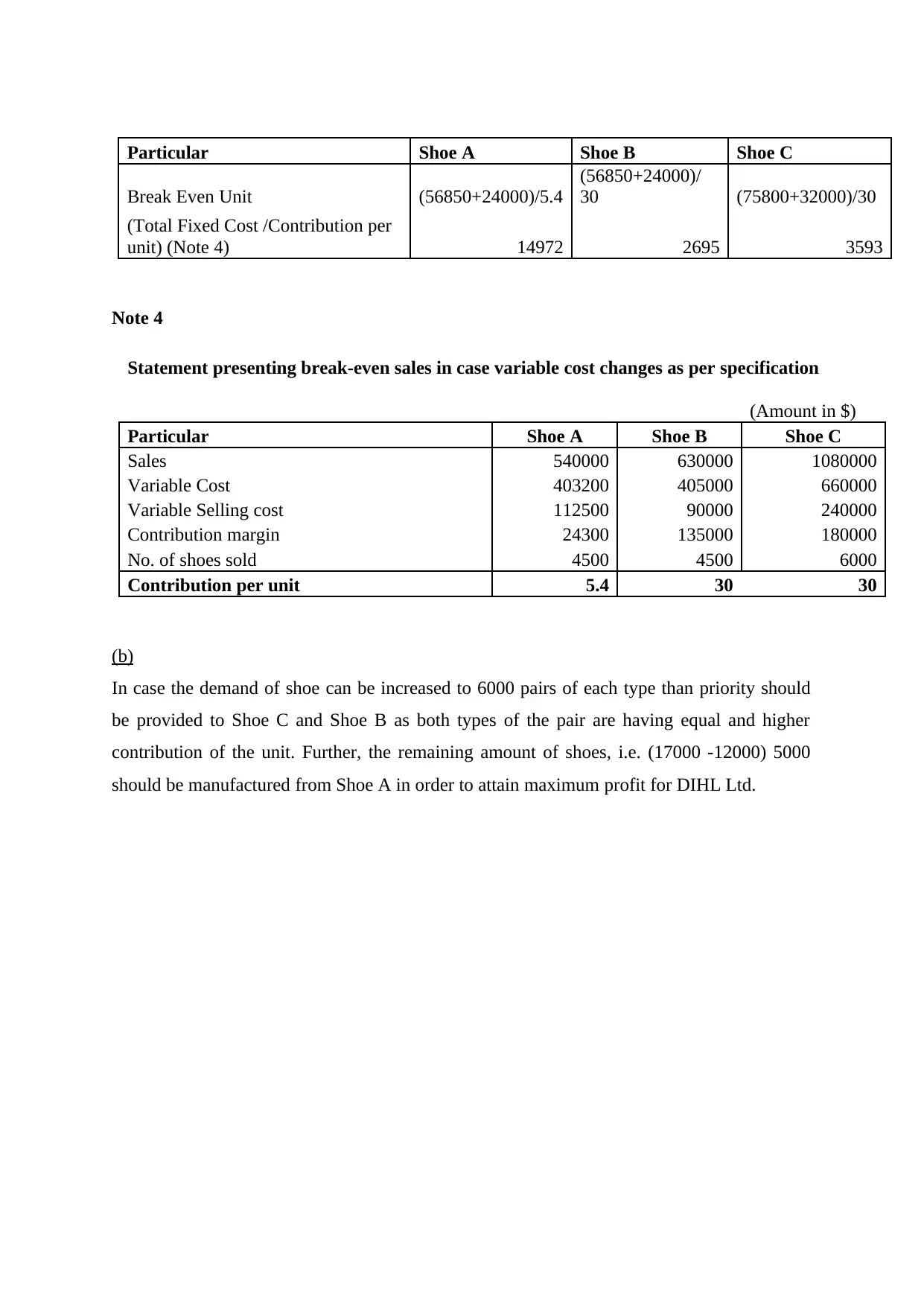

Particular Shoe A Shoe B Shoe C

Break Even Unit (56850+24000)/5.4

(56850+24000)/

30 (75800+32000)/30

(Total Fixed Cost /Contribution per

unit) (Note 4) 14972 2695 3593

Note 4

Statement presenting break-even sales in case variable cost changes as per specification

(Amount in $)

Particular Shoe A Shoe B Shoe C

Sales 540000 630000 1080000

Variable Cost 403200 405000 660000

Variable Selling cost 112500 90000 240000

Contribution margin 24300 135000 180000

No. of shoes sold 4500 4500 6000

Contribution per unit 5.4 30 30

(b)

In case the demand of shoe can be increased to 6000 pairs of each type than priority should

be provided to Shoe C and Shoe B as both types of the pair are having equal and higher

contribution of the unit. Further, the remaining amount of shoes, i.e. (17000 -12000) 5000

should be manufactured from Shoe A in order to attain maximum profit for DIHL Ltd.

Break Even Unit (56850+24000)/5.4

(56850+24000)/

30 (75800+32000)/30

(Total Fixed Cost /Contribution per

unit) (Note 4) 14972 2695 3593

Note 4

Statement presenting break-even sales in case variable cost changes as per specification

(Amount in $)

Particular Shoe A Shoe B Shoe C

Sales 540000 630000 1080000

Variable Cost 403200 405000 660000

Variable Selling cost 112500 90000 240000

Contribution margin 24300 135000 180000

No. of shoes sold 4500 4500 6000

Contribution per unit 5.4 30 30

(b)

In case the demand of shoe can be increased to 6000 pairs of each type than priority should

be provided to Shoe C and Shoe B as both types of the pair are having equal and higher

contribution of the unit. Further, the remaining amount of shoes, i.e. (17000 -12000) 5000

should be manufactured from Shoe A in order to attain maximum profit for DIHL Ltd.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

REFERENCES

Noreen, E.W., Brewer, P.C. and Garrison, R.H., 2014. Managerial accounting for managers.

New York: McGraw-Hill/Irwin.

Vanderbeck, E.J. and Mitchell, M.R., 2015. Principles of cost accounting. Cengage Learning.

Weygandt, J.J., Kimmel, P.D. and Kieso, D.E., 2015. Financial & managerial accounting.

John Wiley & Sons.

Noreen, E.W., Brewer, P.C. and Garrison, R.H., 2014. Managerial accounting for managers.

New York: McGraw-Hill/Irwin.

Vanderbeck, E.J. and Mitchell, M.R., 2015. Principles of cost accounting. Cengage Learning.

Weygandt, J.J., Kimmel, P.D. and Kieso, D.E., 2015. Financial & managerial accounting.

John Wiley & Sons.

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.