Management Accounting Report

VerifiedAdded on 2020/12/10

|16

|4997

|211

Report

AI Summary

This report examines the application of management accounting principles in Airdri Group, a retail organization specializing in hand dryer products. It analyzes various management accounting systems, costing methods, planning tools, and financial reporting techniques. The report also explores how these tools can be used to address financial problems and achieve sustainable success for the organization.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Management

Accounting

Accounting

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

P1. Management accounting and different types of management accounting system...........3

P2. Explain different methods used for management accounting reporting..........................5

M1. Benefits of managements accounting system.................................................................6

D1. Evaluate the management accounting system and management accounting report........7

TASK 2............................................................................................................................................7

P3. Different types of costing methods which are used in calculation of net profit...............7

t...............................................................................................................................................9

M2.Range of Management account techniques......................................................................9

D2. Evaluate financial reports helps in business activities...................................................10

TASK 3..........................................................................................................................................10

P4 The advantages and disadvantages of different types of planning tools used for budgetary

control...................................................................................................................................10

M3 The use of different planning tools and their application for preparing and forecasting

budgets..................................................................................................................................12

D3 Evaluate how planning tools for accounting respond appropriately to solving financial

problems to lead organisations to sustainable success.........................................................12

TASK 4..........................................................................................................................................13

P5 Compare how organisations are adapting management accounting systems to respond to

financial problems................................................................................................................13

M4.Analye how management accounting can solve financial problems.............................15

CONCLUSION..............................................................................................................................15

REFERENCES..............................................................................................................................16

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

P1. Management accounting and different types of management accounting system...........3

P2. Explain different methods used for management accounting reporting..........................5

M1. Benefits of managements accounting system.................................................................6

D1. Evaluate the management accounting system and management accounting report........7

TASK 2............................................................................................................................................7

P3. Different types of costing methods which are used in calculation of net profit...............7

t...............................................................................................................................................9

M2.Range of Management account techniques......................................................................9

D2. Evaluate financial reports helps in business activities...................................................10

TASK 3..........................................................................................................................................10

P4 The advantages and disadvantages of different types of planning tools used for budgetary

control...................................................................................................................................10

M3 The use of different planning tools and their application for preparing and forecasting

budgets..................................................................................................................................12

D3 Evaluate how planning tools for accounting respond appropriately to solving financial

problems to lead organisations to sustainable success.........................................................12

TASK 4..........................................................................................................................................13

P5 Compare how organisations are adapting management accounting systems to respond to

financial problems................................................................................................................13

M4.Analye how management accounting can solve financial problems.............................15

CONCLUSION..............................................................................................................................15

REFERENCES..............................................................................................................................16

INTRODUCTION

Management accounting is a technique which is used by the management in its

organisation so that it can know the financial and managerial information of its business. It

provide helps to the managers so that they can take important decisions in their company. In this

report chosen company is Airdri Group. It is a retailing organisation which deals in various types

hand dryer products and it is established in United Kingdom. The aim of company is to identify

and solve financial problems through management accounting system. This report has discuss

about the various topics like: management accounting report, system and methods and

appropriate techniques of cost analysis and planning tools of management accounting. Apart

from this it also talks about the management accounting system to respond the financial

problems.

TASK 1.

P1. Management accounting and different types of management accounting system

Management accounting is tool which is used to evaluate the business activities. There

are basically two types of accounting such as management accounting and financial accounting.

It provides help to the management so that it can makes effective plans so that organisation run

its business successfully (Management accounting. 2018). It helps to prepare management

reports which gives true and reliable information and data which is essential to take decisions on

regular basis. By using it organisation can know its financial position. It is a process of

analysing, summarizing, gathering and communicating information to the management of

company so that its accomplish its objectives. Airdri Group can apply it so that it can minimizes

or solves the financial problems as a result it can maximization its revenue. Organisation can use

different types of management accounting system which are described as below:

Cost accounting system:

Cost accounting system can be used by the management to ascertain the cost of its

products and services and it is also knows as product costing system. Analysis of cost can help

the company in profitability analysis and cost control. Management accounting officer can help

Airdri Group to ascertain the cost involvement in the production of goods. It helps the

organisation to minimise the cost so that profit margin can be enhanced. There are basically two

types of cost accounting system which are as follows:

Management accounting is a technique which is used by the management in its

organisation so that it can know the financial and managerial information of its business. It

provide helps to the managers so that they can take important decisions in their company. In this

report chosen company is Airdri Group. It is a retailing organisation which deals in various types

hand dryer products and it is established in United Kingdom. The aim of company is to identify

and solve financial problems through management accounting system. This report has discuss

about the various topics like: management accounting report, system and methods and

appropriate techniques of cost analysis and planning tools of management accounting. Apart

from this it also talks about the management accounting system to respond the financial

problems.

TASK 1.

P1. Management accounting and different types of management accounting system

Management accounting is tool which is used to evaluate the business activities. There

are basically two types of accounting such as management accounting and financial accounting.

It provides help to the management so that it can makes effective plans so that organisation run

its business successfully (Management accounting. 2018). It helps to prepare management

reports which gives true and reliable information and data which is essential to take decisions on

regular basis. By using it organisation can know its financial position. It is a process of

analysing, summarizing, gathering and communicating information to the management of

company so that its accomplish its objectives. Airdri Group can apply it so that it can minimizes

or solves the financial problems as a result it can maximization its revenue. Organisation can use

different types of management accounting system which are described as below:

Cost accounting system:

Cost accounting system can be used by the management to ascertain the cost of its

products and services and it is also knows as product costing system. Analysis of cost can help

the company in profitability analysis and cost control. Management accounting officer can help

Airdri Group to ascertain the cost involvement in the production of goods. It helps the

organisation to minimise the cost so that profit margin can be enhanced. There are basically two

types of cost accounting system which are as follows:

Job order costing:

Job order costing is a technique which is used by the organisations to ascertain the cost of

manufacturing of an individual batch or a product. This system can be used by the company

when it manufacture various types of goods which are different from each other. It can be used

by Airdri Group to analyse the cost involvement in direct labour, direct material or overheads.

Process costing:

Process costing is used in production or manufacturing industry where company

differentiate their processes and produce a standard product then it can apply process costing

system to ascertain the cost of production. It can be evaluated by allocating all process cost to the

total units produced. Airdri Group can use this method because it deals in various types of

products and services so that they can analyse the process cost of its units which are

manufactured by them (Banerjee, 2012).

Inventory management system:

Inventory can be in form of goods or material which can be finished product or raw

material. It is hold by the organisation for the ultimate objective of resale. Airdri Group can

apply this system in its company so that is can effectively manage the stock of its business. There

are various software or applications which can be used by the management to manage the

inventory. This system can control the incoming and outgoing inventory so the company can

ascertain the present stock in the warehouse.

Price optimizing system:

This system is used to ascertain the accurate price of the products and services. It is

essential for an organisation to decide the appropriate price so that more number of consumers

show their interest to buy the goods of company. Airdri GroupLtd should use this system so that

is can determine the appropriate prices of its different products and services and it can help the

organisation to maximize the sales. So it can generates the more revenue. Consumers are price

conscious so it is important for it to decide the reasonable price so that maximum customer can

attract towards the company and show their willingness to purchase the products.

Job costing system:

This system includes the process of combined information about the cost associated with

a particular service job or production. It reflects that an organisation is able to ascertain the

Job order costing is a technique which is used by the organisations to ascertain the cost of

manufacturing of an individual batch or a product. This system can be used by the company

when it manufacture various types of goods which are different from each other. It can be used

by Airdri Group to analyse the cost involvement in direct labour, direct material or overheads.

Process costing:

Process costing is used in production or manufacturing industry where company

differentiate their processes and produce a standard product then it can apply process costing

system to ascertain the cost of production. It can be evaluated by allocating all process cost to the

total units produced. Airdri Group can use this method because it deals in various types of

products and services so that they can analyse the process cost of its units which are

manufactured by them (Banerjee, 2012).

Inventory management system:

Inventory can be in form of goods or material which can be finished product or raw

material. It is hold by the organisation for the ultimate objective of resale. Airdri Group can

apply this system in its company so that is can effectively manage the stock of its business. There

are various software or applications which can be used by the management to manage the

inventory. This system can control the incoming and outgoing inventory so the company can

ascertain the present stock in the warehouse.

Price optimizing system:

This system is used to ascertain the accurate price of the products and services. It is

essential for an organisation to decide the appropriate price so that more number of consumers

show their interest to buy the goods of company. Airdri GroupLtd should use this system so that

is can determine the appropriate prices of its different products and services and it can help the

organisation to maximize the sales. So it can generates the more revenue. Consumers are price

conscious so it is important for it to decide the reasonable price so that maximum customer can

attract towards the company and show their willingness to purchase the products.

Job costing system:

This system includes the process of combined information about the cost associated with

a particular service job or production. It reflects that an organisation is able to ascertain the

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

appropriate cost of the particular jobs. Airdri Group can use this system so that it can determine

the effective cost of specific job in the company. So by using management accounting system

organisation to minimize or reduce the financial problems and able to generates more revenue.

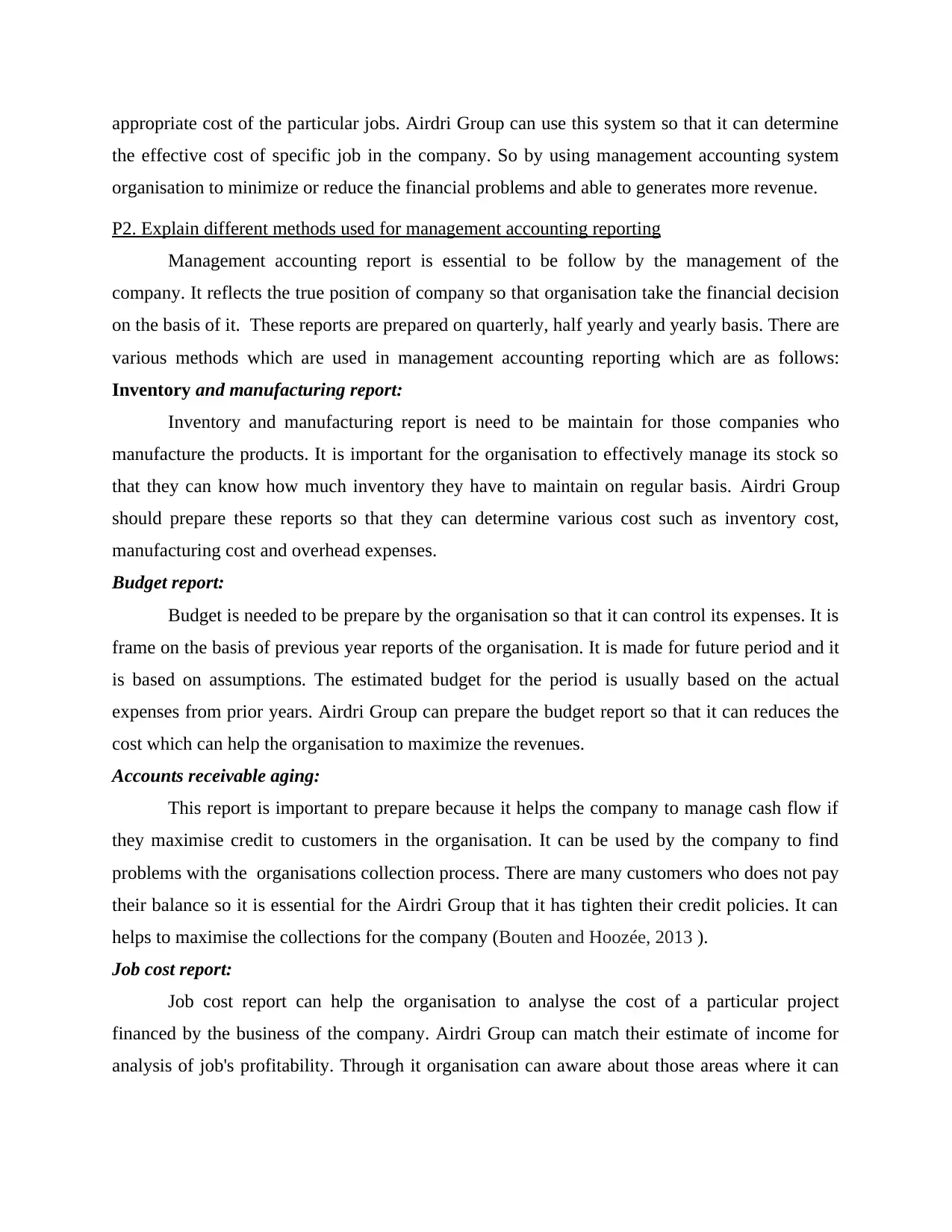

P2. Explain different methods used for management accounting reporting

Management accounting report is essential to be follow by the management of the

company. It reflects the true position of company so that organisation take the financial decision

on the basis of it. These reports are prepared on quarterly, half yearly and yearly basis. There are

various methods which are used in management accounting reporting which are as follows:

Inventory and manufacturing report:

Inventory and manufacturing report is need to be maintain for those companies who

manufacture the products. It is important for the organisation to effectively manage its stock so

that they can know how much inventory they have to maintain on regular basis. Airdri Group

should prepare these reports so that they can determine various cost such as inventory cost,

manufacturing cost and overhead expenses.

Budget report:

Budget is needed to be prepare by the organisation so that it can control its expenses. It is

frame on the basis of previous year reports of the organisation. It is made for future period and it

is based on assumptions. The estimated budget for the period is usually based on the actual

expenses from prior years. Airdri Group can prepare the budget report so that it can reduces the

cost which can help the organisation to maximize the revenues.

Accounts receivable aging:

This report is important to prepare because it helps the company to manage cash flow if

they maximise credit to customers in the organisation. It can be used by the company to find

problems with the organisations collection process. There are many customers who does not pay

their balance so it is essential for the Airdri Group that it has tighten their credit policies. It can

helps to maximise the collections for the company (Bouten and Hoozée, 2013 ).

Job cost report:

Job cost report can help the organisation to analyse the cost of a particular project

financed by the business of the company. Airdri Group can match their estimate of income for

analysis of job's profitability. Through it organisation can aware about those areas where it can

the effective cost of specific job in the company. So by using management accounting system

organisation to minimize or reduce the financial problems and able to generates more revenue.

P2. Explain different methods used for management accounting reporting

Management accounting report is essential to be follow by the management of the

company. It reflects the true position of company so that organisation take the financial decision

on the basis of it. These reports are prepared on quarterly, half yearly and yearly basis. There are

various methods which are used in management accounting reporting which are as follows:

Inventory and manufacturing report:

Inventory and manufacturing report is need to be maintain for those companies who

manufacture the products. It is important for the organisation to effectively manage its stock so

that they can know how much inventory they have to maintain on regular basis. Airdri Group

should prepare these reports so that they can determine various cost such as inventory cost,

manufacturing cost and overhead expenses.

Budget report:

Budget is needed to be prepare by the organisation so that it can control its expenses. It is

frame on the basis of previous year reports of the organisation. It is made for future period and it

is based on assumptions. The estimated budget for the period is usually based on the actual

expenses from prior years. Airdri Group can prepare the budget report so that it can reduces the

cost which can help the organisation to maximize the revenues.

Accounts receivable aging:

This report is important to prepare because it helps the company to manage cash flow if

they maximise credit to customers in the organisation. It can be used by the company to find

problems with the organisations collection process. There are many customers who does not pay

their balance so it is essential for the Airdri Group that it has tighten their credit policies. It can

helps to maximise the collections for the company (Bouten and Hoozée, 2013 ).

Job cost report:

Job cost report can help the organisation to analyse the cost of a particular project

financed by the business of the company. Airdri Group can match their estimate of income for

analysis of job's profitability. Through it organisation can aware about those areas where it can

maximise the revenues and than it will not focuses on those domains which are not giving the

sufficient profits to the company.

Financial report:

Financial report can be used by the company to analyse their accounts and financial

statements. It provides important and valuable information about the profit and loss which is earn

by the organisation. Airdri Group can consider its revenues by using this report which can be

useful in the decision making process. It helps the company to make its future strategies and

investment plan.

Pro forma cash flow:

Pro forma cash flow is useful for the organisation because it provides useful information

regarding cash flow. Airdri Group can prepare this report so that it can know about the inflow

and outflow of cash in their business. It helps the company to take important decisions about the

management of fund which is required to perform regular activities and operations of the

organisation (Bryer, 2013).

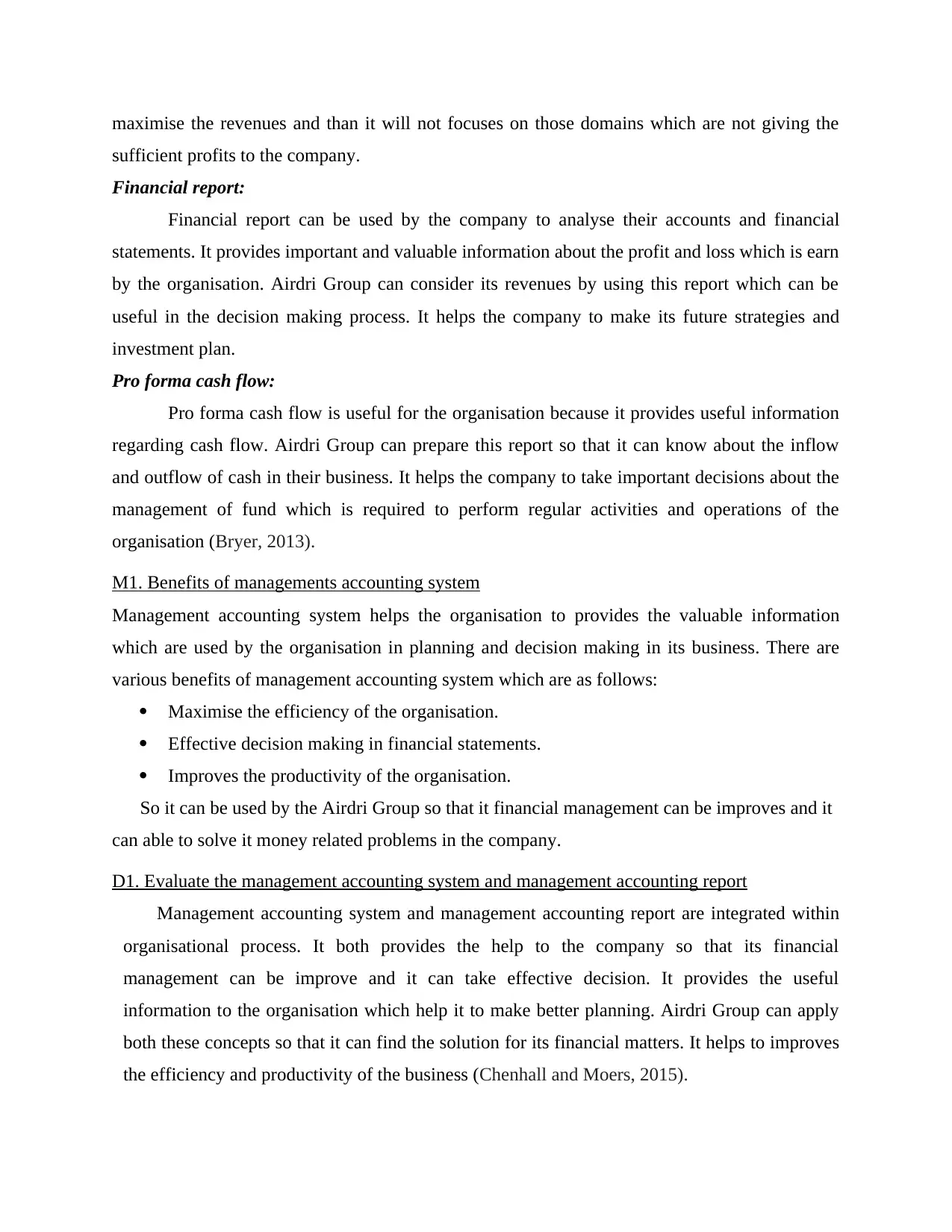

M1. Benefits of managements accounting system

Management accounting system helps the organisation to provides the valuable information

which are used by the organisation in planning and decision making in its business. There are

various benefits of management accounting system which are as follows:

Maximise the efficiency of the organisation.

Effective decision making in financial statements.

Improves the productivity of the organisation.

So it can be used by the Airdri Group so that it financial management can be improves and it

can able to solve it money related problems in the company.

D1. Evaluate the management accounting system and management accounting report

Management accounting system and management accounting report are integrated within

organisational process. It both provides the help to the company so that its financial

management can be improve and it can take effective decision. It provides the useful

information to the organisation which help it to make better planning. Airdri Group can apply

both these concepts so that it can find the solution for its financial matters. It helps to improves

the efficiency and productivity of the business (Chenhall and Moers, 2015).

sufficient profits to the company.

Financial report:

Financial report can be used by the company to analyse their accounts and financial

statements. It provides important and valuable information about the profit and loss which is earn

by the organisation. Airdri Group can consider its revenues by using this report which can be

useful in the decision making process. It helps the company to make its future strategies and

investment plan.

Pro forma cash flow:

Pro forma cash flow is useful for the organisation because it provides useful information

regarding cash flow. Airdri Group can prepare this report so that it can know about the inflow

and outflow of cash in their business. It helps the company to take important decisions about the

management of fund which is required to perform regular activities and operations of the

organisation (Bryer, 2013).

M1. Benefits of managements accounting system

Management accounting system helps the organisation to provides the valuable information

which are used by the organisation in planning and decision making in its business. There are

various benefits of management accounting system which are as follows:

Maximise the efficiency of the organisation.

Effective decision making in financial statements.

Improves the productivity of the organisation.

So it can be used by the Airdri Group so that it financial management can be improves and it

can able to solve it money related problems in the company.

D1. Evaluate the management accounting system and management accounting report

Management accounting system and management accounting report are integrated within

organisational process. It both provides the help to the company so that its financial

management can be improve and it can take effective decision. It provides the useful

information to the organisation which help it to make better planning. Airdri Group can apply

both these concepts so that it can find the solution for its financial matters. It helps to improves

the efficiency and productivity of the business (Chenhall and Moers, 2015).

TASK 2

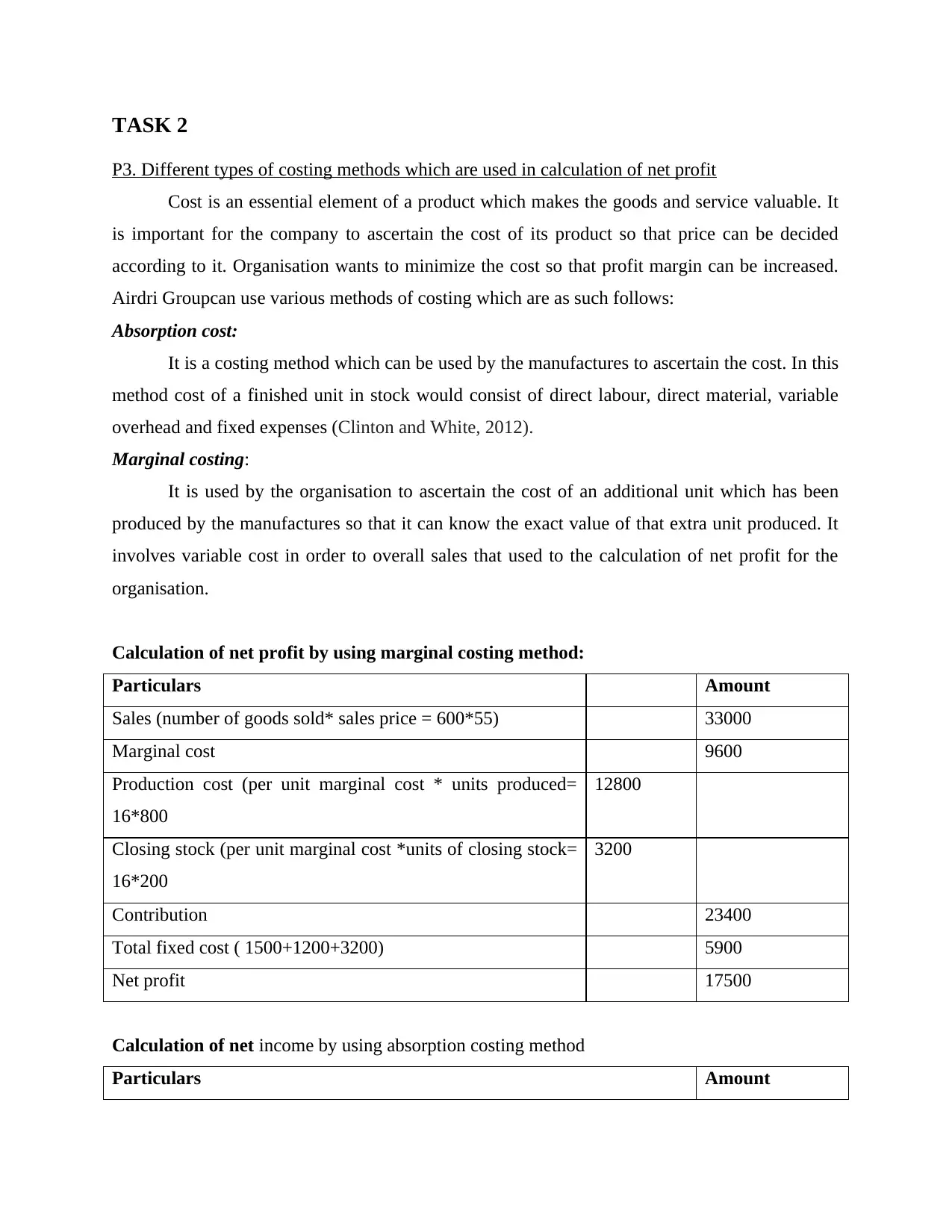

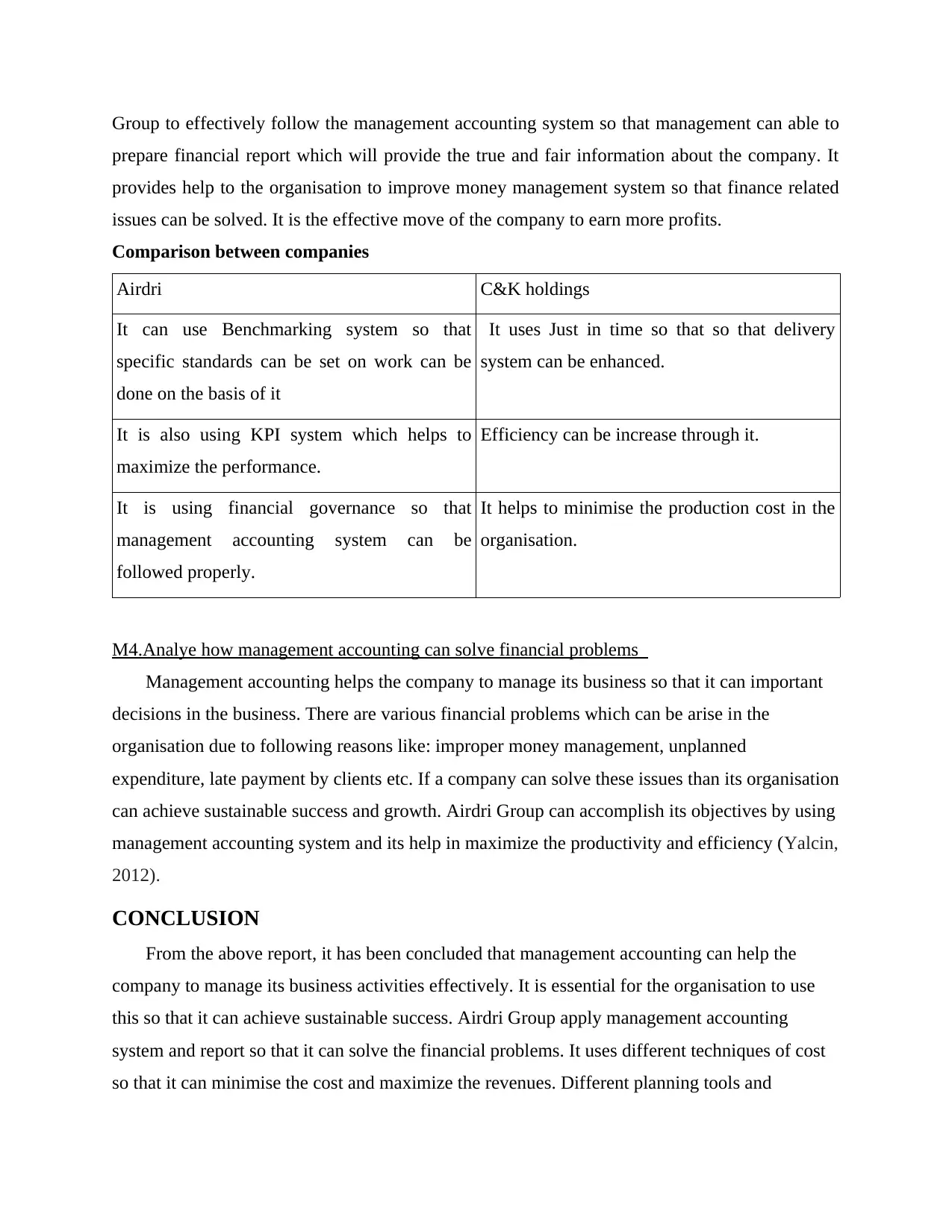

P3. Different types of costing methods which are used in calculation of net profit

Cost is an essential element of a product which makes the goods and service valuable. It

is important for the company to ascertain the cost of its product so that price can be decided

according to it. Organisation wants to minimize the cost so that profit margin can be increased.

Airdri Groupcan use various methods of costing which are as such follows:

Absorption cost:

It is a costing method which can be used by the manufactures to ascertain the cost. In this

method cost of a finished unit in stock would consist of direct labour, direct material, variable

overhead and fixed expenses (Clinton and White, 2012).

Marginal costing:

It is used by the organisation to ascertain the cost of an additional unit which has been

produced by the manufactures so that it can know the exact value of that extra unit produced. It

involves variable cost in order to overall sales that used to the calculation of net profit for the

organisation.

Calculation of net profit by using marginal costing method:

Particulars Amount

Sales (number of goods sold* sales price = 600*55) 33000

Marginal cost 9600

Production cost (per unit marginal cost * units produced=

16*800

12800

Closing stock (per unit marginal cost *units of closing stock=

16*200

3200

Contribution 23400

Total fixed cost ( 1500+1200+3200) 5900

Net profit 17500

Calculation of net income by using absorption costing method

Particulars Amount

P3. Different types of costing methods which are used in calculation of net profit

Cost is an essential element of a product which makes the goods and service valuable. It

is important for the company to ascertain the cost of its product so that price can be decided

according to it. Organisation wants to minimize the cost so that profit margin can be increased.

Airdri Groupcan use various methods of costing which are as such follows:

Absorption cost:

It is a costing method which can be used by the manufactures to ascertain the cost. In this

method cost of a finished unit in stock would consist of direct labour, direct material, variable

overhead and fixed expenses (Clinton and White, 2012).

Marginal costing:

It is used by the organisation to ascertain the cost of an additional unit which has been

produced by the manufactures so that it can know the exact value of that extra unit produced. It

involves variable cost in order to overall sales that used to the calculation of net profit for the

organisation.

Calculation of net profit by using marginal costing method:

Particulars Amount

Sales (number of goods sold* sales price = 600*55) 33000

Marginal cost 9600

Production cost (per unit marginal cost * units produced=

16*800

12800

Closing stock (per unit marginal cost *units of closing stock=

16*200

3200

Contribution 23400

Total fixed cost ( 1500+1200+3200) 5900

Net profit 17500

Calculation of net income by using absorption costing method

Particulars Amount

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Sales (total units sold * price of selling= 600*55) 33000

Cost of goods sold (actual sales* per unit expenses= 600*23.375) 4025

Gross Profit 18975

Selling and administration expenditure ( actual sales* variable sales

overhead+ selling and administration cost= 1*2700+600

3300

Net profit 15675

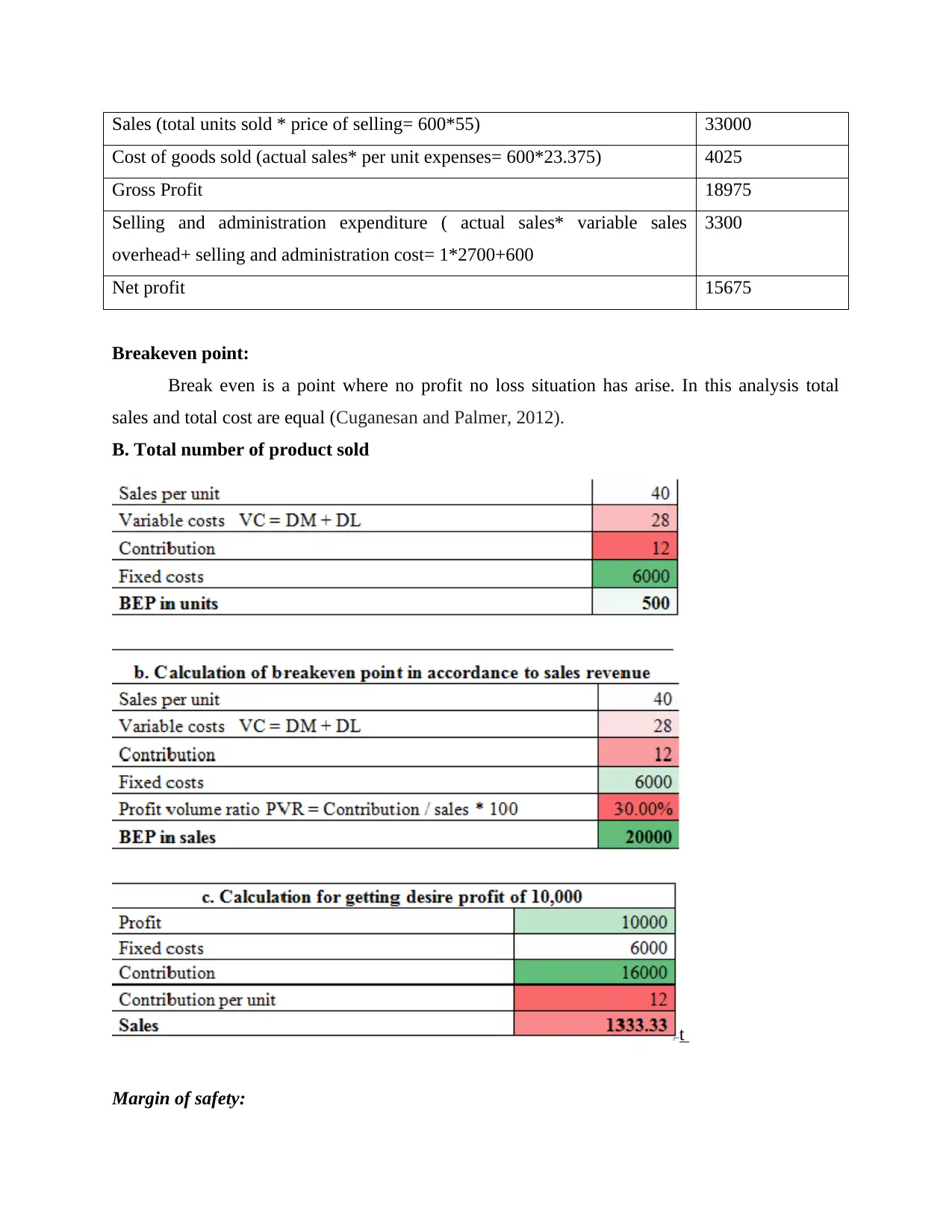

Breakeven point:

Break even is a point where no profit no loss situation has arise. In this analysis total

sales and total cost are equal (Cuganesan and Palmer, 2012).

B. Total number of product sold

t

Margin of safety:

Cost of goods sold (actual sales* per unit expenses= 600*23.375) 4025

Gross Profit 18975

Selling and administration expenditure ( actual sales* variable sales

overhead+ selling and administration cost= 1*2700+600

3300

Net profit 15675

Breakeven point:

Break even is a point where no profit no loss situation has arise. In this analysis total

sales and total cost are equal (Cuganesan and Palmer, 2012).

B. Total number of product sold

t

Margin of safety:

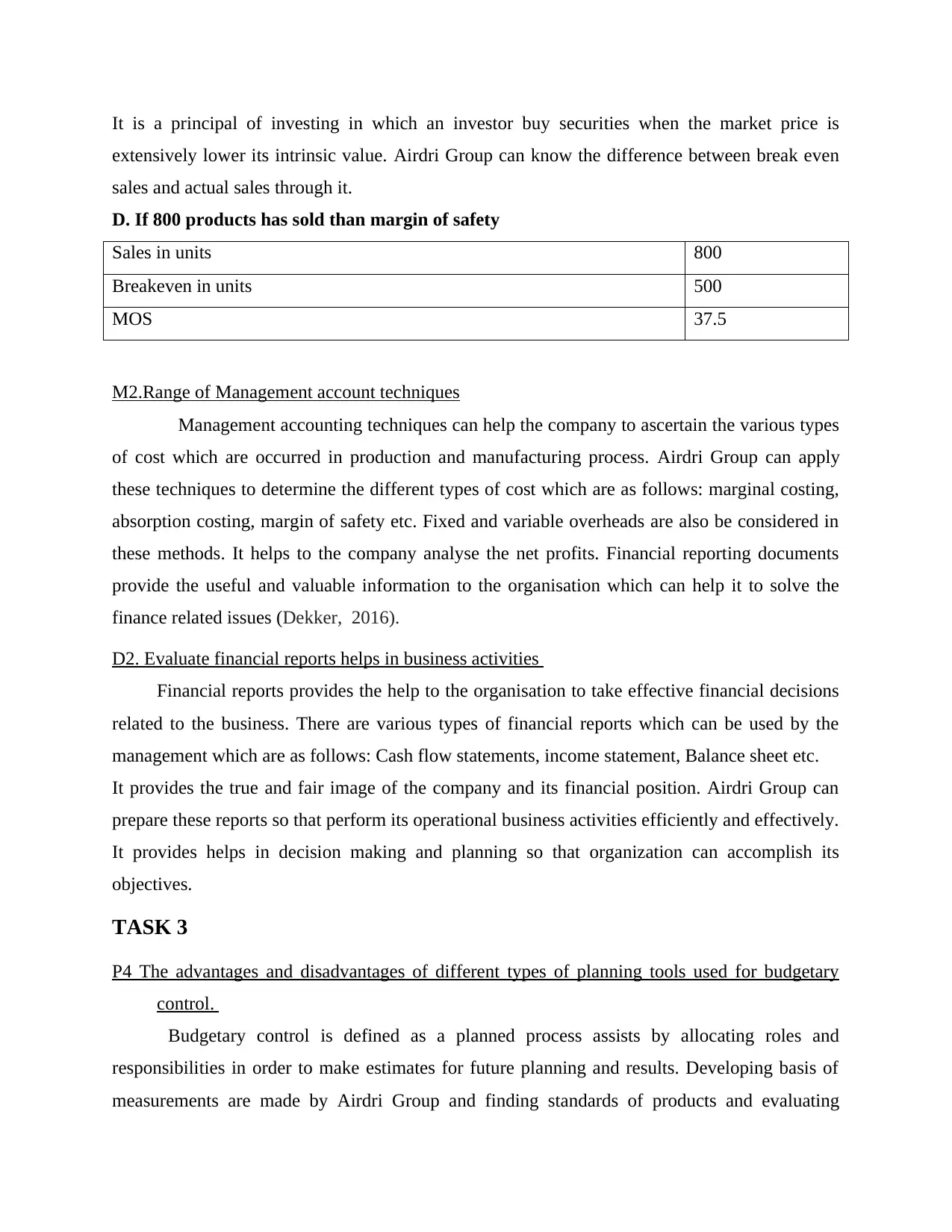

It is a principal of investing in which an investor buy securities when the market price is

extensively lower its intrinsic value. Airdri Group can know the difference between break even

sales and actual sales through it.

D. If 800 products has sold than margin of safety

Sales in units 800

Breakeven in units 500

MOS 37.5

M2.Range of Management account techniques

Management accounting techniques can help the company to ascertain the various types

of cost which are occurred in production and manufacturing process. Airdri Group can apply

these techniques to determine the different types of cost which are as follows: marginal costing,

absorption costing, margin of safety etc. Fixed and variable overheads are also be considered in

these methods. It helps to the company analyse the net profits. Financial reporting documents

provide the useful and valuable information to the organisation which can help it to solve the

finance related issues (Dekker, 2016).

D2. Evaluate financial reports helps in business activities

Financial reports provides the help to the organisation to take effective financial decisions

related to the business. There are various types of financial reports which can be used by the

management which are as follows: Cash flow statements, income statement, Balance sheet etc.

It provides the true and fair image of the company and its financial position. Airdri Group can

prepare these reports so that perform its operational business activities efficiently and effectively.

It provides helps in decision making and planning so that organization can accomplish its

objectives.

TASK 3

P4 The advantages and disadvantages of different types of planning tools used for budgetary

control.

Budgetary control is defined as a planned process assists by allocating roles and

responsibilities in order to make estimates for future planning and results. Developing basis of

measurements are made by Airdri Group and finding standards of products and evaluating

extensively lower its intrinsic value. Airdri Group can know the difference between break even

sales and actual sales through it.

D. If 800 products has sold than margin of safety

Sales in units 800

Breakeven in units 500

MOS 37.5

M2.Range of Management account techniques

Management accounting techniques can help the company to ascertain the various types

of cost which are occurred in production and manufacturing process. Airdri Group can apply

these techniques to determine the different types of cost which are as follows: marginal costing,

absorption costing, margin of safety etc. Fixed and variable overheads are also be considered in

these methods. It helps to the company analyse the net profits. Financial reporting documents

provide the useful and valuable information to the organisation which can help it to solve the

finance related issues (Dekker, 2016).

D2. Evaluate financial reports helps in business activities

Financial reports provides the help to the organisation to take effective financial decisions

related to the business. There are various types of financial reports which can be used by the

management which are as follows: Cash flow statements, income statement, Balance sheet etc.

It provides the true and fair image of the company and its financial position. Airdri Group can

prepare these reports so that perform its operational business activities efficiently and effectively.

It provides helps in decision making and planning so that organization can accomplish its

objectives.

TASK 3

P4 The advantages and disadvantages of different types of planning tools used for budgetary

control.

Budgetary control is defined as a planned process assists by allocating roles and

responsibilities in order to make estimates for future planning and results. Developing basis of

measurements are made by Airdri Group and finding standards of products and evaluating

efficiency. It is based on process for preparing budgets and figures in order to arrive deviations.

Controlling is a process used by every organisation. This technique is pursued by Airdri Group

for attaining objectives and goals. In this, estimations are made in order to deal with future needs

in orderly basis for a given period of time (Kaplan and Atkinson, 2015).

Their are different types used for controlling implemented by managers in year to year

are stated as under. Cash budget: In this budget, cash receipts and payments are made from which cash

position arises. This requirements are made when planning and composing cash use for business

concern. Airdri Group helps management in concerned with income and payments for

controlling purpose. Company sales and and production is used for forecasting budgets along

with details of spending and receivables.

Flexible budget: it is a budget that adjusts for modification in magnitude of activity. This

is a form of variable budget for estimating revenues and payments in actual amount of outcome.

Company Airdri Group uses this budget for predicting in both cases best and worse in scenario

for coming accounting period of time.

Planning tools: The instruments using in this tools are related with implementing of programs,

initiatives. In this detailed description are provided to Airdri Group about their implementing

plans and procedures. These tools are specifically initiated by checklists of things to do and

action items (Parker, 2012).

Forecasting: It is a futuristic process by making use of past and present data which helps for

commonly analysing trends. This process is made on predictions in a general form. Airdri Group

refers uses statistical methods in order to forecast accurately as possible. The advantages and

disadvantages are defined as under.

Advantages

In participation, employees provides opportunity in team performance by having unity

and coordination (Quinn and Jackson, 2014).

It facilitates new identification of demanding products in market trends.

Airdri Group enables in leading with resources by assuring for making large amount of

profits for long term.

Forecasting is helpful for making coordination and control efficiently.

Their use is made in order to overcome uncertainties of future events.

Controlling is a process used by every organisation. This technique is pursued by Airdri Group

for attaining objectives and goals. In this, estimations are made in order to deal with future needs

in orderly basis for a given period of time (Kaplan and Atkinson, 2015).

Their are different types used for controlling implemented by managers in year to year

are stated as under. Cash budget: In this budget, cash receipts and payments are made from which cash

position arises. This requirements are made when planning and composing cash use for business

concern. Airdri Group helps management in concerned with income and payments for

controlling purpose. Company sales and and production is used for forecasting budgets along

with details of spending and receivables.

Flexible budget: it is a budget that adjusts for modification in magnitude of activity. This

is a form of variable budget for estimating revenues and payments in actual amount of outcome.

Company Airdri Group uses this budget for predicting in both cases best and worse in scenario

for coming accounting period of time.

Planning tools: The instruments using in this tools are related with implementing of programs,

initiatives. In this detailed description are provided to Airdri Group about their implementing

plans and procedures. These tools are specifically initiated by checklists of things to do and

action items (Parker, 2012).

Forecasting: It is a futuristic process by making use of past and present data which helps for

commonly analysing trends. This process is made on predictions in a general form. Airdri Group

refers uses statistical methods in order to forecast accurately as possible. The advantages and

disadvantages are defined as under.

Advantages

In participation, employees provides opportunity in team performance by having unity

and coordination (Quinn and Jackson, 2014).

It facilitates new identification of demanding products in market trends.

Airdri Group enables in leading with resources by assuring for making large amount of

profits for long term.

Forecasting is helpful for making coordination and control efficiently.

Their use is made in order to overcome uncertainties of future events.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Disadvantages

Disorganised or quality form of data and information is received for forecasting.

In this, the data received is in inaccurate form in recorded events. Airdri Group concerned with the system that fails to answer a logic question.

Scenario planning: This planning tool is used for examining how strategy would be changes

according to Airdri Group future terms. It is a concept of developing plans from step by step with

successful process. Its advantages and disadvantages are considered as under.

Advantages

It emerges expertise thinking and designs.

Scenario examines real vision and open creativity.

Disadvantages

They having unlike possibilities for making well known plans. Plans are made not mainly for making profits.

Contingency planning:

This planning tools is used for current basis of trends which is used by Airdri Group in

adjusting need of strategy. It is no longer sufficient in use for development by having

fluctuations, unpredictability (Senftlechner and Hiebl, 2015).

Advantages

Many of the organisation prefer their use because it is safe.

It is an established approach adopted by Oak Cash & Carry.

Disadvantages

In this, they put effort into those who are causing wasted.

They are identifying discontinuous in change.

M3 The use of different planning tools and their application for preparing and forecasting

budgets

For forecasting budgets it is useful in an order to make use of planning tools. The use of

these budgets are their for analysing past and present data to generate future aspects. This

method is accurately possible for making statistical records of a project. Planning tools are

determined in 3 forms like contingency, scenario and forecasting planning. These three uses are

analysed by Airdri Group in forming budgets. For preparing budgets it is useful in a way to

make team performances by coordinating and unity. They are analysing in a manner to overcome

Disorganised or quality form of data and information is received for forecasting.

In this, the data received is in inaccurate form in recorded events. Airdri Group concerned with the system that fails to answer a logic question.

Scenario planning: This planning tool is used for examining how strategy would be changes

according to Airdri Group future terms. It is a concept of developing plans from step by step with

successful process. Its advantages and disadvantages are considered as under.

Advantages

It emerges expertise thinking and designs.

Scenario examines real vision and open creativity.

Disadvantages

They having unlike possibilities for making well known plans. Plans are made not mainly for making profits.

Contingency planning:

This planning tools is used for current basis of trends which is used by Airdri Group in

adjusting need of strategy. It is no longer sufficient in use for development by having

fluctuations, unpredictability (Senftlechner and Hiebl, 2015).

Advantages

Many of the organisation prefer their use because it is safe.

It is an established approach adopted by Oak Cash & Carry.

Disadvantages

In this, they put effort into those who are causing wasted.

They are identifying discontinuous in change.

M3 The use of different planning tools and their application for preparing and forecasting

budgets

For forecasting budgets it is useful in an order to make use of planning tools. The use of

these budgets are their for analysing past and present data to generate future aspects. This

method is accurately possible for making statistical records of a project. Planning tools are

determined in 3 forms like contingency, scenario and forecasting planning. These three uses are

analysed by Airdri Group in forming budgets. For preparing budgets it is useful in a way to

make team performances by coordinating and unity. They are analysing in a manner to overcome

uncertainties for future aspects. Scenario planning is made in a way to make expertise thinking

with open creativity in their working process. Contingency planning is prefer for use safely and it

is well established by an organisation.

D3 Evaluate how planning tools for accounting respond appropriately to solving financial

problems to lead organisations to sustainable success.

In this, planning tools are examined appropriately in solving financial problems of an

accounting period. Tools are determined by resolving errors occur in any problems relating to

financial terms. For leading with succession terms Airdri Group occur many of the problems

regarding with data and resolving it by using tools. In forecasting planning they are maintaining

statistical records of the data or information recorded. The uses of all the three tools leading

organisation a sustainable success in accounting terms (Soin and Collier, 2013).

TASK 4

P5 Compare how organisations are adapting management accounting systems to respond to

financial problems.

Financial problem is that situation when origination faces the issues related to the finance. It is

the backbone of organisation and without it companies cannot survive and continue its business.

Airdri Groupcan solve its financial problems by following the management accounting system.

There are various financial problems which can be faced by the company which are as follows:

Unplanned expenditure:

Unplanned expenditure can hamper the performance of the organisation. It can increase

the inefficiency in the company. It can be in the form of excess expenses in advertising and if

any uncertainty arises than organisation have to spent money. For example: due to the

earthquake building of company has damaged so that it have to spend the funds for the repairing.

It can be the reason of unplanned expenses and due to it Airdri Group has to suffer from the

financial problem (Tessier and Otley, 2012).

Late payments by clients:

It can be the reason of the financial problems which is faced by the organisation. Due to

the late payment from clients or customers can be the reason of financial issues so Airdri Group

should tight the credit policy so that payments can be come on time and it can meet its regular

operational expenditures in the company.

with open creativity in their working process. Contingency planning is prefer for use safely and it

is well established by an organisation.

D3 Evaluate how planning tools for accounting respond appropriately to solving financial

problems to lead organisations to sustainable success.

In this, planning tools are examined appropriately in solving financial problems of an

accounting period. Tools are determined by resolving errors occur in any problems relating to

financial terms. For leading with succession terms Airdri Group occur many of the problems

regarding with data and resolving it by using tools. In forecasting planning they are maintaining

statistical records of the data or information recorded. The uses of all the three tools leading

organisation a sustainable success in accounting terms (Soin and Collier, 2013).

TASK 4

P5 Compare how organisations are adapting management accounting systems to respond to

financial problems.

Financial problem is that situation when origination faces the issues related to the finance. It is

the backbone of organisation and without it companies cannot survive and continue its business.

Airdri Groupcan solve its financial problems by following the management accounting system.

There are various financial problems which can be faced by the company which are as follows:

Unplanned expenditure:

Unplanned expenditure can hamper the performance of the organisation. It can increase

the inefficiency in the company. It can be in the form of excess expenses in advertising and if

any uncertainty arises than organisation have to spent money. For example: due to the

earthquake building of company has damaged so that it have to spend the funds for the repairing.

It can be the reason of unplanned expenses and due to it Airdri Group has to suffer from the

financial problem (Tessier and Otley, 2012).

Late payments by clients:

It can be the reason of the financial problems which is faced by the organisation. Due to

the late payment from clients or customers can be the reason of financial issues so Airdri Group

should tight the credit policy so that payments can be come on time and it can meet its regular

operational expenditures in the company.

Improper money management system:

Improper money management system can be the reason of financial problem because

without it a company cannot make effective investment plan. Airdri Group should properly

manage its fund so that it can make effective planning for future expansions or investment. It can

help the organisation to make better decisions and solve the finance related issues. There are

various ways through which financial problems can be solved and these ways are as following:

Benchmarking:

It is a technique which can be used by the organisation so solve the financial problems in

its business. It is a system in which company set the specific standards for the accomplishment of

work and according to this members have to perform. Airdri Group can use it so that it can

maximise its productivity and it leads to generates more revenue for the company so that

financial problem can be solve. It can set the benchmark for its debtors so make the payments

within set benchmark so it help to solve the finance related issues (Ward, 2012).

Key performance indicator:

Key performance indicator is tool which is a measurable value that demonstrates how

effectively an organisation can accomplish its goal. It is used by the Airdri Group to determine

its success at reaching targets. It helps the company to maximise its performance so that it can

solve the finance related problem. It is divided into two parts which are as follows:

Financial:

This type of performance indicator can solve the finance related issues in the organisation. It can

help the Airdri Group to improve the financial performance so that money related issues can be

solved. It can solve the problem of unplanned expenditure which can helps the company to make

effective financial management.

Non financial:

This type of performance indicator can solve the non financial matters in the organisation. If

employees are not working as per the requirements than it helps to improves the performance of

the employees so that productivity can be enhanced and efficiency can be improve. Airdri Group

can use it so that efficiency can be maximized (Wickramasinghe and Alawattage, 2012).

Financial governance:

Financial governance can help the management to follow the rules, regulations,

policies and laws which are needed to be maintaining by the organisation. It can help the Airdri

Improper money management system can be the reason of financial problem because

without it a company cannot make effective investment plan. Airdri Group should properly

manage its fund so that it can make effective planning for future expansions or investment. It can

help the organisation to make better decisions and solve the finance related issues. There are

various ways through which financial problems can be solved and these ways are as following:

Benchmarking:

It is a technique which can be used by the organisation so solve the financial problems in

its business. It is a system in which company set the specific standards for the accomplishment of

work and according to this members have to perform. Airdri Group can use it so that it can

maximise its productivity and it leads to generates more revenue for the company so that

financial problem can be solve. It can set the benchmark for its debtors so make the payments

within set benchmark so it help to solve the finance related issues (Ward, 2012).

Key performance indicator:

Key performance indicator is tool which is a measurable value that demonstrates how

effectively an organisation can accomplish its goal. It is used by the Airdri Group to determine

its success at reaching targets. It helps the company to maximise its performance so that it can

solve the finance related problem. It is divided into two parts which are as follows:

Financial:

This type of performance indicator can solve the finance related issues in the organisation. It can

help the Airdri Group to improve the financial performance so that money related issues can be

solved. It can solve the problem of unplanned expenditure which can helps the company to make

effective financial management.

Non financial:

This type of performance indicator can solve the non financial matters in the organisation. If

employees are not working as per the requirements than it helps to improves the performance of

the employees so that productivity can be enhanced and efficiency can be improve. Airdri Group

can use it so that efficiency can be maximized (Wickramasinghe and Alawattage, 2012).

Financial governance:

Financial governance can help the management to follow the rules, regulations,

policies and laws which are needed to be maintaining by the organisation. It can help the Airdri

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Group to effectively follow the management accounting system so that management can able to

prepare financial report which will provide the true and fair information about the company. It

provides help to the organisation to improve money management system so that finance related

issues can be solved. It is the effective move of the company to earn more profits.

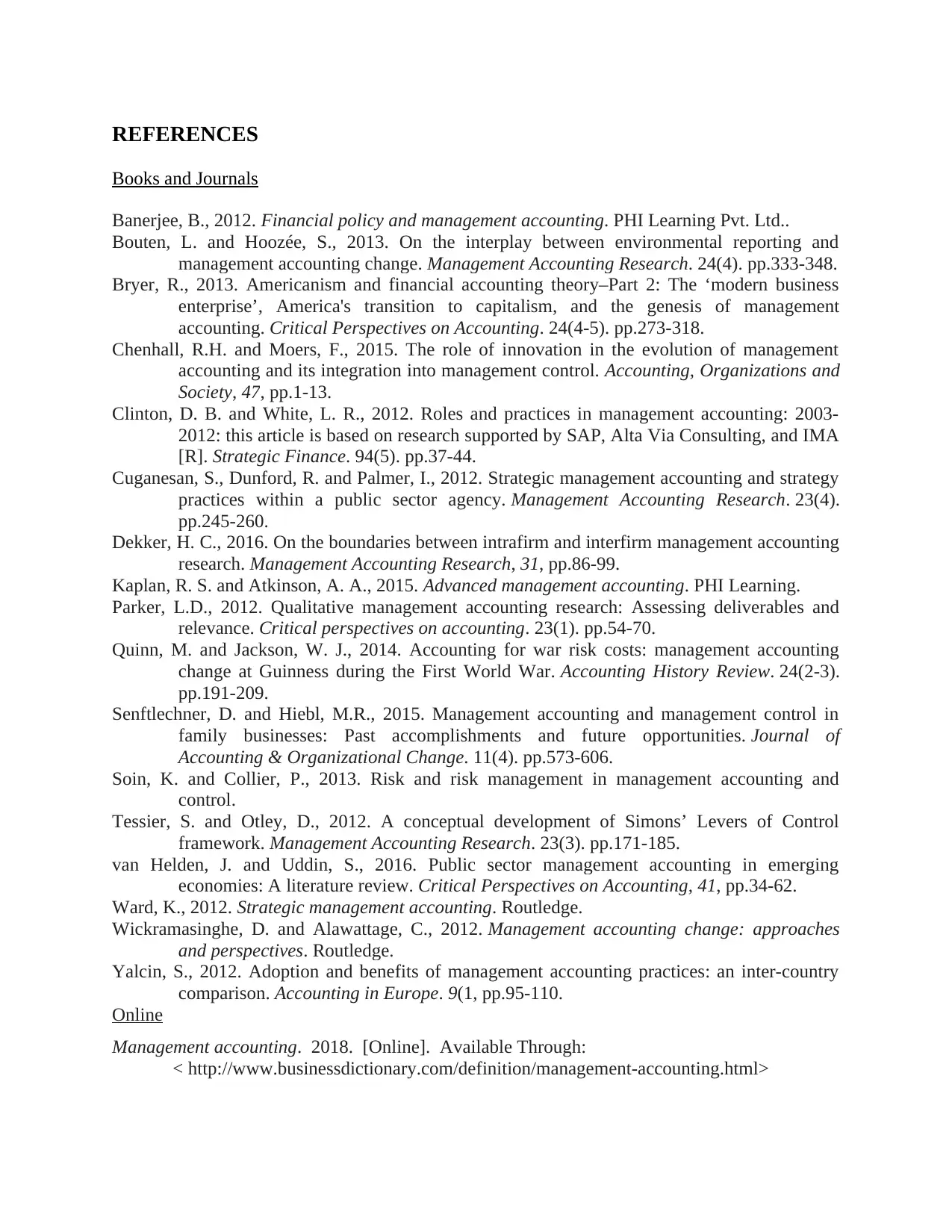

Comparison between companies

Airdri C&K holdings

It can use Benchmarking system so that

specific standards can be set on work can be

done on the basis of it

It uses Just in time so that so that delivery

system can be enhanced.

It is also using KPI system which helps to

maximize the performance.

Efficiency can be increase through it.

It is using financial governance so that

management accounting system can be

followed properly.

It helps to minimise the production cost in the

organisation.

M4.Analye how management accounting can solve financial problems

Management accounting helps the company to manage its business so that it can important

decisions in the business. There are various financial problems which can be arise in the

organisation due to following reasons like: improper money management, unplanned

expenditure, late payment by clients etc. If a company can solve these issues than its organisation

can achieve sustainable success and growth. Airdri Group can accomplish its objectives by using

management accounting system and its help in maximize the productivity and efficiency (Yalcin,

2012).

CONCLUSION

From the above report, it has been concluded that management accounting can help the

company to manage its business activities effectively. It is essential for the organisation to use

this so that it can achieve sustainable success. Airdri Group apply management accounting

system and report so that it can solve the financial problems. It uses different techniques of cost

so that it can minimise the cost and maximize the revenues. Different planning tools and

prepare financial report which will provide the true and fair information about the company. It

provides help to the organisation to improve money management system so that finance related

issues can be solved. It is the effective move of the company to earn more profits.

Comparison between companies

Airdri C&K holdings

It can use Benchmarking system so that

specific standards can be set on work can be

done on the basis of it

It uses Just in time so that so that delivery

system can be enhanced.

It is also using KPI system which helps to

maximize the performance.

Efficiency can be increase through it.

It is using financial governance so that

management accounting system can be

followed properly.

It helps to minimise the production cost in the

organisation.

M4.Analye how management accounting can solve financial problems

Management accounting helps the company to manage its business so that it can important

decisions in the business. There are various financial problems which can be arise in the

organisation due to following reasons like: improper money management, unplanned

expenditure, late payment by clients etc. If a company can solve these issues than its organisation

can achieve sustainable success and growth. Airdri Group can accomplish its objectives by using

management accounting system and its help in maximize the productivity and efficiency (Yalcin,

2012).

CONCLUSION

From the above report, it has been concluded that management accounting can help the

company to manage its business activities effectively. It is essential for the organisation to use

this so that it can achieve sustainable success. Airdri Group apply management accounting

system and report so that it can solve the financial problems. It uses different techniques of cost

so that it can minimise the cost and maximize the revenues. Different planning tools and

budgetary system used by the company for better decisions making process so that it can make

effective planning to achieve the objectives.

effective planning to achieve the objectives.

REFERENCES

Books and Journals

Banerjee, B., 2012. Financial policy and management accounting. PHI Learning Pvt. Ltd..

Bouten, L. and Hoozée, S., 2013. On the interplay between environmental reporting and

management accounting change. Management Accounting Research. 24(4). pp.333-348.

Bryer, R., 2013. Americanism and financial accounting theory–Part 2: The ‘modern business

enterprise’, America's transition to capitalism, and the genesis of management

accounting. Critical Perspectives on Accounting. 24(4-5). pp.273-318.

Chenhall, R.H. and Moers, F., 2015. The role of innovation in the evolution of management

accounting and its integration into management control. Accounting, Organizations and

Society, 47, pp.1-13.

Clinton, D. B. and White, L. R., 2012. Roles and practices in management accounting: 2003-

2012: this article is based on research supported by SAP, Alta Via Consulting, and IMA

[R]. Strategic Finance. 94(5). pp.37-44.

Cuganesan, S., Dunford, R. and Palmer, I., 2012. Strategic management accounting and strategy

practices within a public sector agency. Management Accounting Research. 23(4).

pp.245-260.

Dekker, H. C., 2016. On the boundaries between intrafirm and interfirm management accounting

research. Management Accounting Research, 31, pp.86-99.

Kaplan, R. S. and Atkinson, A. A., 2015. Advanced management accounting. PHI Learning.

Parker, L.D., 2012. Qualitative management accounting research: Assessing deliverables and

relevance. Critical perspectives on accounting. 23(1). pp.54-70.

Quinn, M. and Jackson, W. J., 2014. Accounting for war risk costs: management accounting

change at Guinness during the First World War. Accounting History Review. 24(2-3).

pp.191-209.

Senftlechner, D. and Hiebl, M.R., 2015. Management accounting and management control in

family businesses: Past accomplishments and future opportunities. Journal of

Accounting & Organizational Change. 11(4). pp.573-606.

Soin, K. and Collier, P., 2013. Risk and risk management in management accounting and

control.

Tessier, S. and Otley, D., 2012. A conceptual development of Simons’ Levers of Control

framework. Management Accounting Research. 23(3). pp.171-185.

van Helden, J. and Uddin, S., 2016. Public sector management accounting in emerging

economies: A literature review. Critical Perspectives on Accounting, 41, pp.34-62.

Ward, K., 2012. Strategic management accounting. Routledge.

Wickramasinghe, D. and Alawattage, C., 2012. Management accounting change: approaches

and perspectives. Routledge.

Yalcin, S., 2012. Adoption and benefits of management accounting practices: an inter-country

comparison. Accounting in Europe. 9(1, pp.95-110.

Online

Management accounting. 2018. [Online]. Available Through:

< http://www.businessdictionary.com/definition/management-accounting.html>

Books and Journals

Banerjee, B., 2012. Financial policy and management accounting. PHI Learning Pvt. Ltd..

Bouten, L. and Hoozée, S., 2013. On the interplay between environmental reporting and

management accounting change. Management Accounting Research. 24(4). pp.333-348.

Bryer, R., 2013. Americanism and financial accounting theory–Part 2: The ‘modern business

enterprise’, America's transition to capitalism, and the genesis of management

accounting. Critical Perspectives on Accounting. 24(4-5). pp.273-318.

Chenhall, R.H. and Moers, F., 2015. The role of innovation in the evolution of management

accounting and its integration into management control. Accounting, Organizations and

Society, 47, pp.1-13.

Clinton, D. B. and White, L. R., 2012. Roles and practices in management accounting: 2003-

2012: this article is based on research supported by SAP, Alta Via Consulting, and IMA

[R]. Strategic Finance. 94(5). pp.37-44.

Cuganesan, S., Dunford, R. and Palmer, I., 2012. Strategic management accounting and strategy

practices within a public sector agency. Management Accounting Research. 23(4).

pp.245-260.

Dekker, H. C., 2016. On the boundaries between intrafirm and interfirm management accounting

research. Management Accounting Research, 31, pp.86-99.

Kaplan, R. S. and Atkinson, A. A., 2015. Advanced management accounting. PHI Learning.

Parker, L.D., 2012. Qualitative management accounting research: Assessing deliverables and

relevance. Critical perspectives on accounting. 23(1). pp.54-70.

Quinn, M. and Jackson, W. J., 2014. Accounting for war risk costs: management accounting

change at Guinness during the First World War. Accounting History Review. 24(2-3).

pp.191-209.

Senftlechner, D. and Hiebl, M.R., 2015. Management accounting and management control in

family businesses: Past accomplishments and future opportunities. Journal of

Accounting & Organizational Change. 11(4). pp.573-606.

Soin, K. and Collier, P., 2013. Risk and risk management in management accounting and

control.

Tessier, S. and Otley, D., 2012. A conceptual development of Simons’ Levers of Control

framework. Management Accounting Research. 23(3). pp.171-185.

van Helden, J. and Uddin, S., 2016. Public sector management accounting in emerging

economies: A literature review. Critical Perspectives on Accounting, 41, pp.34-62.

Ward, K., 2012. Strategic management accounting. Routledge.

Wickramasinghe, D. and Alawattage, C., 2012. Management accounting change: approaches

and perspectives. Routledge.

Yalcin, S., 2012. Adoption and benefits of management accounting practices: an inter-country

comparison. Accounting in Europe. 9(1, pp.95-110.

Online

Management accounting. 2018. [Online]. Available Through:

< http://www.businessdictionary.com/definition/management-accounting.html>

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.