Management accounting systems and techniques Name of the university Student ID Question 1 Management accounting systems and techniques

VerifiedAdded on 2022/08/20

|18

|3497

|11

AI Summary

Management accounting is the procedure involving analysis of operational and business costs for preparing the internal financial records, reports, as well as accounts that eventually assists the managers in making decisions for achieving the business goals. It helps the management in analysing the business needs while considering the events taking place around the business (Kaplan and Atkinson 2015) Role of management accountant Management accountant’s role is performing series of tasks for assuring the financial security of the organisation, essentially managing all the financial matters and hence assisting in driving the

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: MANAGEMENT ACCOUNTING SYSTEMS AND TECHNIQUES

Management accounting systems and techniques

Name of the student

Name of the university

Student ID

Author note

Management accounting systems and techniques

Name of the student

Name of the university

Student ID

Author note

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1MANAGEMENT ACCOUNTING SYSTEMS AND TECHNIQUES

Table of Contents

Question 1........................................................................................................................................2

Answer 2..........................................................................................................................................4

Answer 3..........................................................................................................................................6

Answer 4..........................................................................................................................................8

Answer 5........................................................................................................................................10

Answer 6........................................................................................................................................12

Answer 7........................................................................................................................................13

Reference.......................................................................................................................................16

Table of Contents

Question 1........................................................................................................................................2

Answer 2..........................................................................................................................................4

Answer 3..........................................................................................................................................6

Answer 4..........................................................................................................................................8

Answer 5........................................................................................................................................10

Answer 6........................................................................................................................................12

Answer 7........................................................................................................................................13

Reference.......................................................................................................................................16

2MANAGEMENT ACCOUNTING SYSTEMS AND TECHNIQUES

Question 1

Management accounting

Management accounting is the procedure involving analysis of operational and business

costs for preparing the internal financial records, reports, as well as accounts that eventually

assists the managers in making decisions for achieving the business goals. To be stated

differently, it involves making the financial as well as costing data useful through translating the

same into the valuable information for the officers and management in the organization. It helps

the management in analysing the business needs while considering the events taking place

around the business (Kaplan and Atkinson 2015)

Role of management accountant

Management accountant’s role is performing series of tasks for assuring the financial

security of the organisation, essentially managing all the financial matters and hence assisting in

driving the overall business strategy and management. Other functions performed by the

management accountant are as follows –

Planning accounting function – accounting system in an organization is maintained that

must cover sales forecast, standard costs, profit planning, production planning, resource

allocation, capital budgeting, long-term as well as short-term financial planning. Further,

he is responsible for preparing required process implementing the effective plan.

Reporting – management accountant is requested by top management to prepare reports

for root causes regarding unfavourable operations or event. Management accountant can

highlight real reasons behind the same and the responsible persons (Otley 2016)

Question 1

Management accounting

Management accounting is the procedure involving analysis of operational and business

costs for preparing the internal financial records, reports, as well as accounts that eventually

assists the managers in making decisions for achieving the business goals. To be stated

differently, it involves making the financial as well as costing data useful through translating the

same into the valuable information for the officers and management in the organization. It helps

the management in analysing the business needs while considering the events taking place

around the business (Kaplan and Atkinson 2015)

Role of management accountant

Management accountant’s role is performing series of tasks for assuring the financial

security of the organisation, essentially managing all the financial matters and hence assisting in

driving the overall business strategy and management. Other functions performed by the

management accountant are as follows –

Planning accounting function – accounting system in an organization is maintained that

must cover sales forecast, standard costs, profit planning, production planning, resource

allocation, capital budgeting, long-term as well as short-term financial planning. Further,

he is responsible for preparing required process implementing the effective plan.

Reporting – management accountant is requested by top management to prepare reports

for root causes regarding unfavourable operations or event. Management accountant can

highlight real reasons behind the same and the responsible persons (Otley 2016)

3MANAGEMENT ACCOUNTING SYSTEMS AND TECHNIQUES

Controlling – management accountant is required measuring actual measuring along with

comparing the same with standard one. Based on comparison, reason of differences are

analysed and interpreted which in turn is submitted to top levels of management.

Planning – management accountant are responsible for forecasting the future economic as

well as business planning, formulation of corporate strategies and managing strategic

accounting to achieve the business goals for the short term as well as long term period.

Co-ordinating – management accountant consults with entire level of management to

frame the policy or action programme. These types of consultation bring the co-

ordination among the top management and account department (Maas, Schaltegger and

Crutzen 2016).

Interpreting – information related to accounting are modified as well as presented to the

management with interpretation. Interpretation is made in number of phases. Major

purpose of the same is to provide the management with real reasons regarding the

operating results that can be understood by the management.

Evaluation – management account is required to evaluate the efficiency of the

organization structures, policies as well as procedures adopted to achieve the goals. For

this purpose, he is required to consult with the functional manager as well as top level

executives.

Tax administration – business organizations are required paying various types of taxes

including income tax, value added tax, local government, central government and state

government tax. Regarding this, management accountant is responsible for clearing all

the taxes and maintain records related to accounting (Chenhall and Moers 2015).

Controlling – management accountant is required measuring actual measuring along with

comparing the same with standard one. Based on comparison, reason of differences are

analysed and interpreted which in turn is submitted to top levels of management.

Planning – management accountant are responsible for forecasting the future economic as

well as business planning, formulation of corporate strategies and managing strategic

accounting to achieve the business goals for the short term as well as long term period.

Co-ordinating – management accountant consults with entire level of management to

frame the policy or action programme. These types of consultation bring the co-

ordination among the top management and account department (Maas, Schaltegger and

Crutzen 2016).

Interpreting – information related to accounting are modified as well as presented to the

management with interpretation. Interpretation is made in number of phases. Major

purpose of the same is to provide the management with real reasons regarding the

operating results that can be understood by the management.

Evaluation – management account is required to evaluate the efficiency of the

organization structures, policies as well as procedures adopted to achieve the goals. For

this purpose, he is required to consult with the functional manager as well as top level

executives.

Tax administration – business organizations are required paying various types of taxes

including income tax, value added tax, local government, central government and state

government tax. Regarding this, management accountant is responsible for clearing all

the taxes and maintain records related to accounting (Chenhall and Moers 2015).

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4MANAGEMENT ACCOUNTING SYSTEMS AND TECHNIQUES

Appraisal of the external effects – some changes may be there in the policies of central

and state government. At times, amendments may be there in existing policies. These

amendments and policies have impact on achievement of the business objectives. Level

of impact shall be analysed by management accountant.

Asset protection – this is carried out through maintaining separate register for fixed assets

for each kind of fixed assets. Further, the management accountant can frame regulations

and rules regarding usage of these assets. In addition, insurance coverage can also be

taken for these assets.

Economic appraisal – economic scenario of any nation is published periodically by

central government. It is required by the management accountant to make economic

appraisal as well as finding impact of economic status over business activities. In this

context, management accountant may prepare the report and submit the same before the

top management in addition to the comments (Kihn and Ihantola 2015).

Answer 2

Management accounting role and the part played under each business function are as

follows –

Stewardship accounting – generally management accountants design frame-work

regarding costs as well as financial accountants along with preparing the reports for

regular operational and financial decision making.

Control – management accountant evaluates the accounts and prepares various reports

including budgets, standard costs and interpretation of variance analysis, analysis of cash

Appraisal of the external effects – some changes may be there in the policies of central

and state government. At times, amendments may be there in existing policies. These

amendments and policies have impact on achievement of the business objectives. Level

of impact shall be analysed by management accountant.

Asset protection – this is carried out through maintaining separate register for fixed assets

for each kind of fixed assets. Further, the management accountant can frame regulations

and rules regarding usage of these assets. In addition, insurance coverage can also be

taken for these assets.

Economic appraisal – economic scenario of any nation is published periodically by

central government. It is required by the management accountant to make economic

appraisal as well as finding impact of economic status over business activities. In this

context, management accountant may prepare the report and submit the same before the

top management in addition to the comments (Kihn and Ihantola 2015).

Answer 2

Management accounting role and the part played under each business function are as

follows –

Stewardship accounting – generally management accountants design frame-work

regarding costs as well as financial accountants along with preparing the reports for

regular operational and financial decision making.

Control – management accountant evaluates the accounts and prepares various reports

including budgets, standard costs and interpretation of variance analysis, analysis of cash

5MANAGEMENT ACCOUNTING SYSTEMS AND TECHNIQUES

and cash flow, performance evaluation, liquidity management and the responsibility

accounting for the purpose of control.

Developing MIS – management accountant is responsible for preparing routing reports

and MIS that eventually assists in long-term and short term decision making. It further

assists the managerial personnel from all the levels in taking corrective action at

appropriate time (Kihn and Ihantola 2015).

Capital structure – management accountant’s major role is to raise funds and application

of the same in proper manner. He is also responsible for deciding regarding maintenance

of proper mix among debt and the equity. Raining the funds through debt is considered as

cheaper as the same is deductible under tax. However, at the same time it is considered

as risky as the interest associated with debt needs to be repaid irrespective of the

profitability position of the entity.

Management process – management accountant is in the pivotal position in any

organisation. He carries out the staff function and has authority over accountant and

different other employees. He is responsible for communicating the executives regarding

the business needs and using the information for achieving the same. Relevant

information is shifted by the management accountant from irrelevant to clear form and

presenting the same through reports to the management as well as external interested

parties (Bromwich and Scapens 2016).

Decision making – necessary information is communicated by the management

accountant to the top level management for making short term decisions including lease

or buy, make or buy, optimum mix for the products, investment appraisal, capital

budgeting and project financing. However, management accountant’s job is limited to

and cash flow, performance evaluation, liquidity management and the responsibility

accounting for the purpose of control.

Developing MIS – management accountant is responsible for preparing routing reports

and MIS that eventually assists in long-term and short term decision making. It further

assists the managerial personnel from all the levels in taking corrective action at

appropriate time (Kihn and Ihantola 2015).

Capital structure – management accountant’s major role is to raise funds and application

of the same in proper manner. He is also responsible for deciding regarding maintenance

of proper mix among debt and the equity. Raining the funds through debt is considered as

cheaper as the same is deductible under tax. However, at the same time it is considered

as risky as the interest associated with debt needs to be repaid irrespective of the

profitability position of the entity.

Management process – management accountant is in the pivotal position in any

organisation. He carries out the staff function and has authority over accountant and

different other employees. He is responsible for communicating the executives regarding

the business needs and using the information for achieving the same. Relevant

information is shifted by the management accountant from irrelevant to clear form and

presenting the same through reports to the management as well as external interested

parties (Bromwich and Scapens 2016).

Decision making – necessary information is communicated by the management

accountant to the top level management for making short term decisions including lease

or buy, make or buy, optimum mix for the products, investment appraisal, capital

budgeting and project financing. However, management accountant’s job is limited to

6MANAGEMENT ACCOUNTING SYSTEMS AND TECHNIQUES

delivery of required information in reliable as well as comprehensive form under

management’s decision making process. This means both management accountant as

well as reports of internal accountant cannot make decision for management (Bromwich

and Scapens 2016).

Answer 3

Management accounting is kind of accounting that is prepared keeping in view the

interest of internal users like managers and directors. It is prepared for a specific cost center like

sales, purchases, operating expenses and budgeting etc. It provides information related to finance

to the decision makers present within an organization. On the other hand, financial accounting is

kind of of accounting that helps in presenting the information related to finance to the external

users like shareholders. It is a specific type of accounting which includes recording, categorizing,

summarizing and presenting the accounting information. It helps in recording the transactions in

different financial statements like Balance sheet and income statement relating to the specific

period.

The key difference among financial accounting and management accounting is that the

management accounting is used within management and financial accounting is prepared

for the outsiders (Richardson 2017).

The financial accounting is grounded on accounting laws while management accounting

depends on the need of the user.

The financial accounting is prepared periodically like quarterly or annually while there is

not such compulsion in management accounting. Management accounting is prepared as

per the need. It may be prepared monthly also.

delivery of required information in reliable as well as comprehensive form under

management’s decision making process. This means both management accountant as

well as reports of internal accountant cannot make decision for management (Bromwich

and Scapens 2016).

Answer 3

Management accounting is kind of accounting that is prepared keeping in view the

interest of internal users like managers and directors. It is prepared for a specific cost center like

sales, purchases, operating expenses and budgeting etc. It provides information related to finance

to the decision makers present within an organization. On the other hand, financial accounting is

kind of of accounting that helps in presenting the information related to finance to the external

users like shareholders. It is a specific type of accounting which includes recording, categorizing,

summarizing and presenting the accounting information. It helps in recording the transactions in

different financial statements like Balance sheet and income statement relating to the specific

period.

The key difference among financial accounting and management accounting is that the

management accounting is used within management and financial accounting is prepared

for the outsiders (Richardson 2017).

The financial accounting is grounded on accounting laws while management accounting

depends on the need of the user.

The financial accounting is prepared periodically like quarterly or annually while there is

not such compulsion in management accounting. Management accounting is prepared as

per the need. It may be prepared monthly also.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7MANAGEMENT ACCOUNTING SYSTEMS AND TECHNIQUES

There are some cases when the interest of users of financial and management accounting

can overlap each other. Management accounting is prepared by taking some assumptions and

estimations. The examples of such estimations are creation of provisions and reserves, recording

inventory on the basis of different stock ledger methods like Market value & FIFO, assigning

depreciation methods like straight line and written down value method. If the financial

accounting department found any discrepancies in using these information while preparing

accounting task, it may result in dispute between the two departments of accounting.

In some cases management tries to manipulate and interpret the financial information so

that when these information of management accounting will be used by financial accountants,

the financial statements may show reasonable and reliable view (Ionescu and Ionescu 2016). The

fair view of these statements can increase their compensations and the remuneration margin. The

interest of managers and financial accountants should be same to avoid any dispute of interest.

The preparation of any type of accounting should not be based on personal interest.

The dispute between the different accounting departments may arise if any department is

not following the code of ethics. The conflict may arise when the shareholders interest is

different from others. For example – the management is focusing on increasing production so

they have taken all estimations in accounting concerning their interest. But the outside parties

like shareholders and customers may prefer quality over quantity. This difference between the

ethical interests between the two may raise a conflict (Firmin et al. 2019).

The conflict of interest is a major concern for any organization. Every organization tries

to frame such policies and regulations that can reduce the chances of conflict of interest (Avdeev,

Nassiripour and Wong 2019). The dispute in the interest of financial accounting and

There are some cases when the interest of users of financial and management accounting

can overlap each other. Management accounting is prepared by taking some assumptions and

estimations. The examples of such estimations are creation of provisions and reserves, recording

inventory on the basis of different stock ledger methods like Market value & FIFO, assigning

depreciation methods like straight line and written down value method. If the financial

accounting department found any discrepancies in using these information while preparing

accounting task, it may result in dispute between the two departments of accounting.

In some cases management tries to manipulate and interpret the financial information so

that when these information of management accounting will be used by financial accountants,

the financial statements may show reasonable and reliable view (Ionescu and Ionescu 2016). The

fair view of these statements can increase their compensations and the remuneration margin. The

interest of managers and financial accountants should be same to avoid any dispute of interest.

The preparation of any type of accounting should not be based on personal interest.

The dispute between the different accounting departments may arise if any department is

not following the code of ethics. The conflict may arise when the shareholders interest is

different from others. For example – the management is focusing on increasing production so

they have taken all estimations in accounting concerning their interest. But the outside parties

like shareholders and customers may prefer quality over quantity. This difference between the

ethical interests between the two may raise a conflict (Firmin et al. 2019).

The conflict of interest is a major concern for any organization. Every organization tries

to frame such policies and regulations that can reduce the chances of conflict of interest (Avdeev,

Nassiripour and Wong 2019). The dispute in the interest of financial accounting and

8MANAGEMENT ACCOUNTING SYSTEMS AND TECHNIQUES

management accounting can be reduced significantly if the managers related to the concerned

departments follow their code of ethics reasonably.

Answer 4

Cost reports produced under management accounting

Job costing – report related to job costing is considered as the management tools and is used for

analysing the production or project performance against the forecasted or known standards. Wide

number of business users uses this approach as the major purpose of this report is identifying the

discrepancies as well as beneficial outcomes in form of the financial values. It can further be

used for reporting numerical as well as financial outcomes for production. It has various benefits

as follows –

It helps to determine profitability of each job individually

It offers basis to estimate cost of similar kind of jobs those are to be considered in future

It offers detailed analysis in context of material cost, overheads and labour for each of the

jobs as and when needed (Collis and Hussey 2017)

It helps in controlling the efficiency of plant through confining the attention to the costs

associated with individual jobs.

Defective and spoilage work can be recognised with particular job as well as

responsibility for same can be fixed on the individuals.

Batch costing – it is similar to the job costing where cost is measured in accordance with the

units however on entire job and the same concept is applied with the batch costing. Here costs

including variable and fixed are directed directly towards the batch. It has various benefits as

follows –

management accounting can be reduced significantly if the managers related to the concerned

departments follow their code of ethics reasonably.

Answer 4

Cost reports produced under management accounting

Job costing – report related to job costing is considered as the management tools and is used for

analysing the production or project performance against the forecasted or known standards. Wide

number of business users uses this approach as the major purpose of this report is identifying the

discrepancies as well as beneficial outcomes in form of the financial values. It can further be

used for reporting numerical as well as financial outcomes for production. It has various benefits

as follows –

It helps to determine profitability of each job individually

It offers basis to estimate cost of similar kind of jobs those are to be considered in future

It offers detailed analysis in context of material cost, overheads and labour for each of the

jobs as and when needed (Collis and Hussey 2017)

It helps in controlling the efficiency of plant through confining the attention to the costs

associated with individual jobs.

Defective and spoilage work can be recognised with particular job as well as

responsibility for same can be fixed on the individuals.

Batch costing – it is similar to the job costing where cost is measured in accordance with the

units however on entire job and the same concept is applied with the batch costing. Here costs

including variable and fixed are directed directly towards the batch. It has various benefits as

follows –

9MANAGEMENT ACCOUNTING SYSTEMS AND TECHNIQUES

It helps in reducing the accounting work as costing is carried out in context of the product

batch for homogeneous jobs.

As per this approach, it becomes easy and effective to supervise the time taken by

supervisor in constituting the unit batch. Hence, worker’s and supervisors idle time is

eliminated.

Time loss on account of material transfer, tools and labour issues under batch costing are

eliminated (Collis and Hussey 2017)

Major difference among job costing and batch costing are as follows –

Job costing is used while services rendered or goods are produced in accordance with the

orders of the customers. Conversely, under batch costing goods are produced in lot of the

similar units known as batches.

Under job costing the product has independent identity as each of the jobs is different

from other whereas under batch costing products maintain their individual identity as the

same are manufactured under continuum.

Under job costing, cost is ascertained after completion of each job whereas under batch

costing cost is ascertained for entire batch and thereby cost per unit is determined (Collis

and Hussey 2017)

Inventory costing – it is the method of assigning costs ton inventories. However, it is more than

simple definition. Generally the inventory costing does not include the expenses accrued after

making the sales. For instance, insurance, future carrying and interest cost are not taken into

consideration and freight-out and expenses associated with fulfilment. Costs of stock can be

reduced through following –

It helps in reducing the accounting work as costing is carried out in context of the product

batch for homogeneous jobs.

As per this approach, it becomes easy and effective to supervise the time taken by

supervisor in constituting the unit batch. Hence, worker’s and supervisors idle time is

eliminated.

Time loss on account of material transfer, tools and labour issues under batch costing are

eliminated (Collis and Hussey 2017)

Major difference among job costing and batch costing are as follows –

Job costing is used while services rendered or goods are produced in accordance with the

orders of the customers. Conversely, under batch costing goods are produced in lot of the

similar units known as batches.

Under job costing the product has independent identity as each of the jobs is different

from other whereas under batch costing products maintain their individual identity as the

same are manufactured under continuum.

Under job costing, cost is ascertained after completion of each job whereas under batch

costing cost is ascertained for entire batch and thereby cost per unit is determined (Collis

and Hussey 2017)

Inventory costing – it is the method of assigning costs ton inventories. However, it is more than

simple definition. Generally the inventory costing does not include the expenses accrued after

making the sales. For instance, insurance, future carrying and interest cost are not taken into

consideration and freight-out and expenses associated with fulfilment. Costs of stock can be

reduced through following –

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10MANAGEMENT ACCOUNTING SYSTEMS AND TECHNIQUES

Eliminating obsolete stock – holding large amount of inventories enhances the likelihood

that the stock that is expected to be sold in future now will take valuable space in the

warehouse and will cost more money as compared to the amount paid for the same

(Nisha 2015)

Implementing just-in-time approach – just-in-time is the approach that helps in keeping

approximately no inventory I the warehouse and instead ordering required things at the

moment of requirement. It will eventually eliminate the inventory cost.

Reducing lead times – it is the procedure for lowering the time taken for receiving the

purchase order. Shorter lead time is considered as better. Further it assists in keeping

lower safety stock that is less amount of obsolete stock for the future period (Nisha 2015)

Activity based costing – it assists in assigning the manufacturing overheads to the products in

more logical approach as compared to the traditional approach that allocates the cost on machine

hour basis. ABC approach allocates the costs to activities those are real cause for the overheads.

It then assigns the costs of the activities only to those products that are demanding activities

actually. Variable costs under this approach changes with the production volume whereas the

fixed costs do not change with the production volume. Semi variable costs on the other hand

include both elements of variable as well as fixed costs (Haroun 2015).

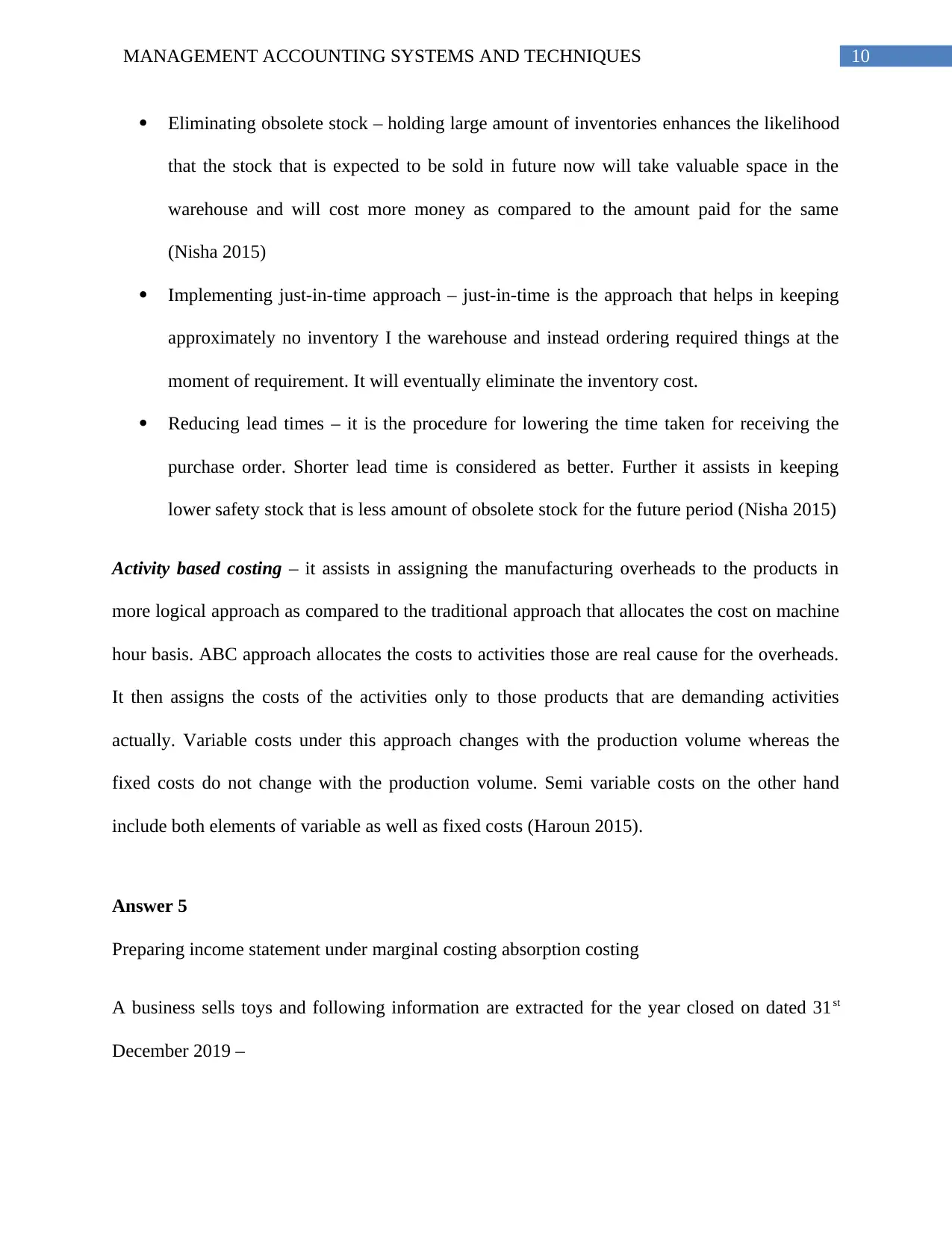

Answer 5

Preparing income statement under marginal costing absorption costing

A business sells toys and following information are extracted for the year closed on dated 31st

December 2019 –

Eliminating obsolete stock – holding large amount of inventories enhances the likelihood

that the stock that is expected to be sold in future now will take valuable space in the

warehouse and will cost more money as compared to the amount paid for the same

(Nisha 2015)

Implementing just-in-time approach – just-in-time is the approach that helps in keeping

approximately no inventory I the warehouse and instead ordering required things at the

moment of requirement. It will eventually eliminate the inventory cost.

Reducing lead times – it is the procedure for lowering the time taken for receiving the

purchase order. Shorter lead time is considered as better. Further it assists in keeping

lower safety stock that is less amount of obsolete stock for the future period (Nisha 2015)

Activity based costing – it assists in assigning the manufacturing overheads to the products in

more logical approach as compared to the traditional approach that allocates the cost on machine

hour basis. ABC approach allocates the costs to activities those are real cause for the overheads.

It then assigns the costs of the activities only to those products that are demanding activities

actually. Variable costs under this approach changes with the production volume whereas the

fixed costs do not change with the production volume. Semi variable costs on the other hand

include both elements of variable as well as fixed costs (Haroun 2015).

Answer 5

Preparing income statement under marginal costing absorption costing

A business sells toys and following information are extracted for the year closed on dated 31st

December 2019 –

11MANAGEMENT ACCOUNTING SYSTEMS AND TECHNIQUES

Sales £ 100,000.00

Cost of raw material £ 24,000.00

Cost of direct labour £ 14,000.00

Manufacturing overhead - variable £ 9,000.00

Manufacturing overhead - fixed £ 7,000.00

Distribution and administration expenses - Variable £ 4,500.00

distribution and administration expenses - Fixed £ 5,000.00

Prepare the income statement for the year closed on 31st December 2019 as per marginal costing

and absorption costing.

Sales £ 100,000.00

Cost of raw material £ 24,000.00

Cost of direct labour £ 14,000.00

Manufacturing overhead - variable £ 9,000.00

Manufacturing overhead - fixed £ 7,000.00

Distribution and administration expenses - Variable £ 4,500.00

distribution and administration expenses - Fixed £ 5,000.00

Prepare the income statement for the year closed on 31st December 2019 as per marginal costing

and absorption costing.

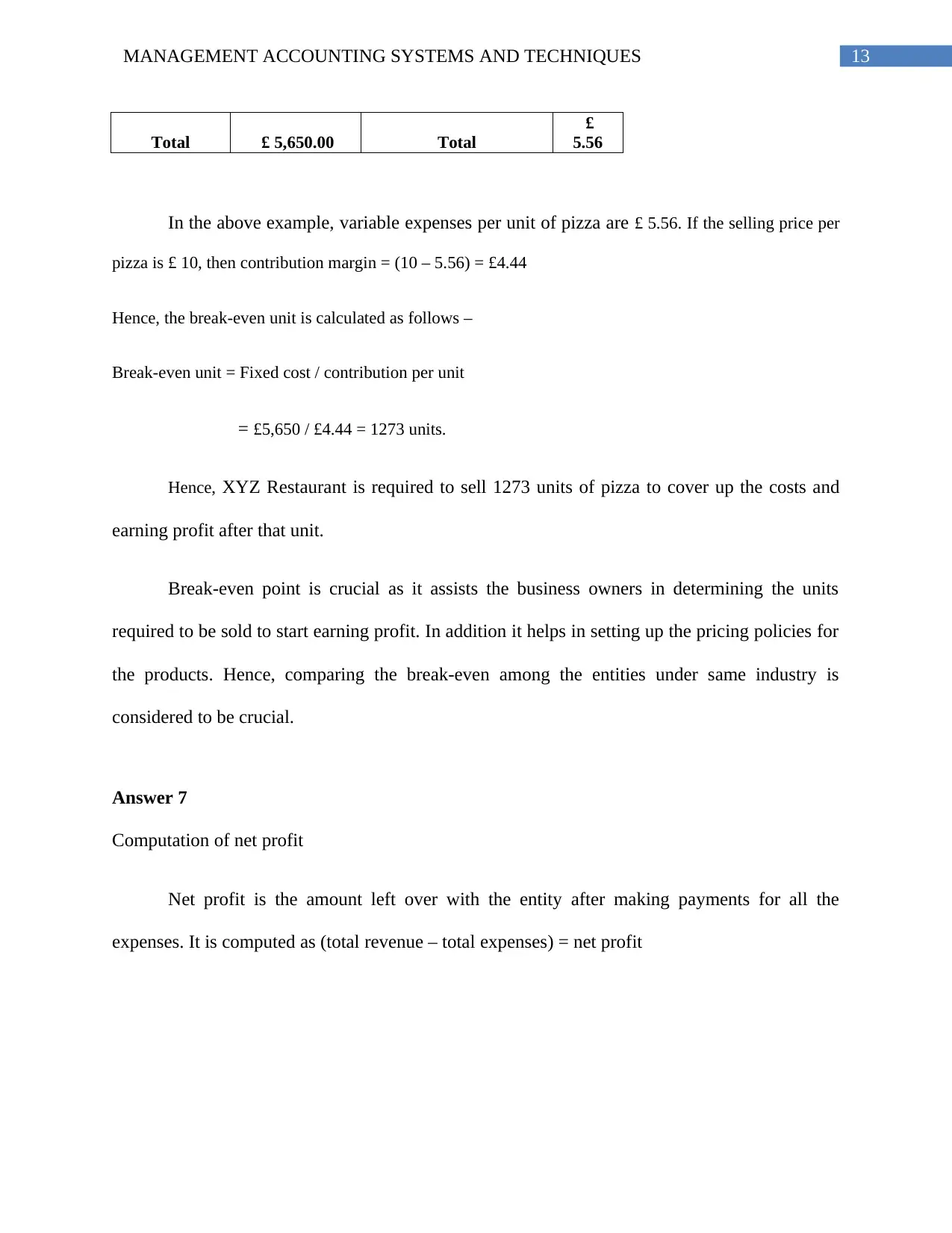

12MANAGEMENT ACCOUNTING SYSTEMS AND TECHNIQUES

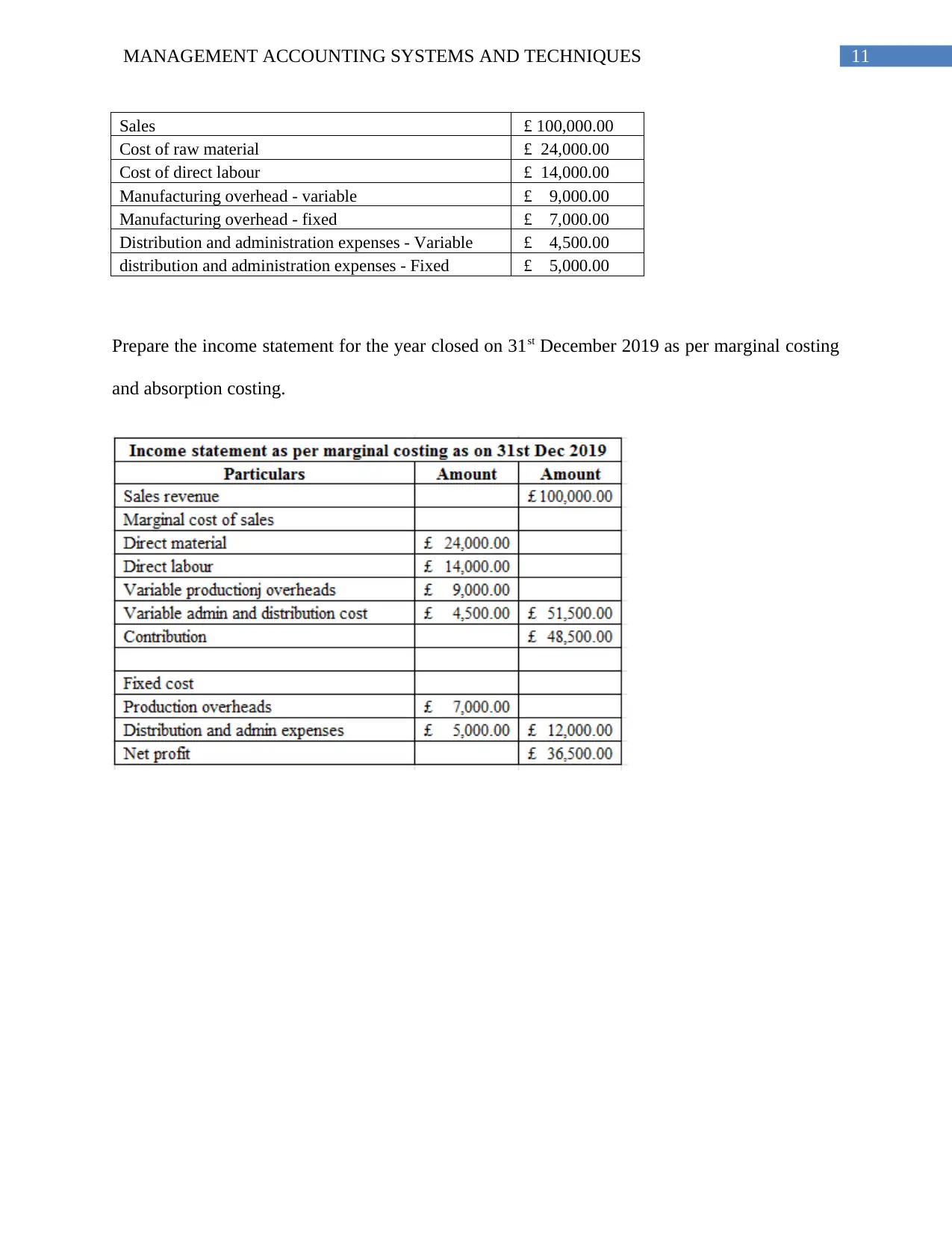

Marginal costing is applicable to those costs to the inventory those are incurred while

each of the units produced individually whereas the absorption cost is applicable to all the

production costs for all the units produced. The entity shall use absorption costing as it considers

both variable costs as well as fixed costs. Further, it uses the gross profit approach which is

generally used by the analysts and investors whereas the marginal cost approach uses

contribution approach and consider only the variable costing (Shields 2015).

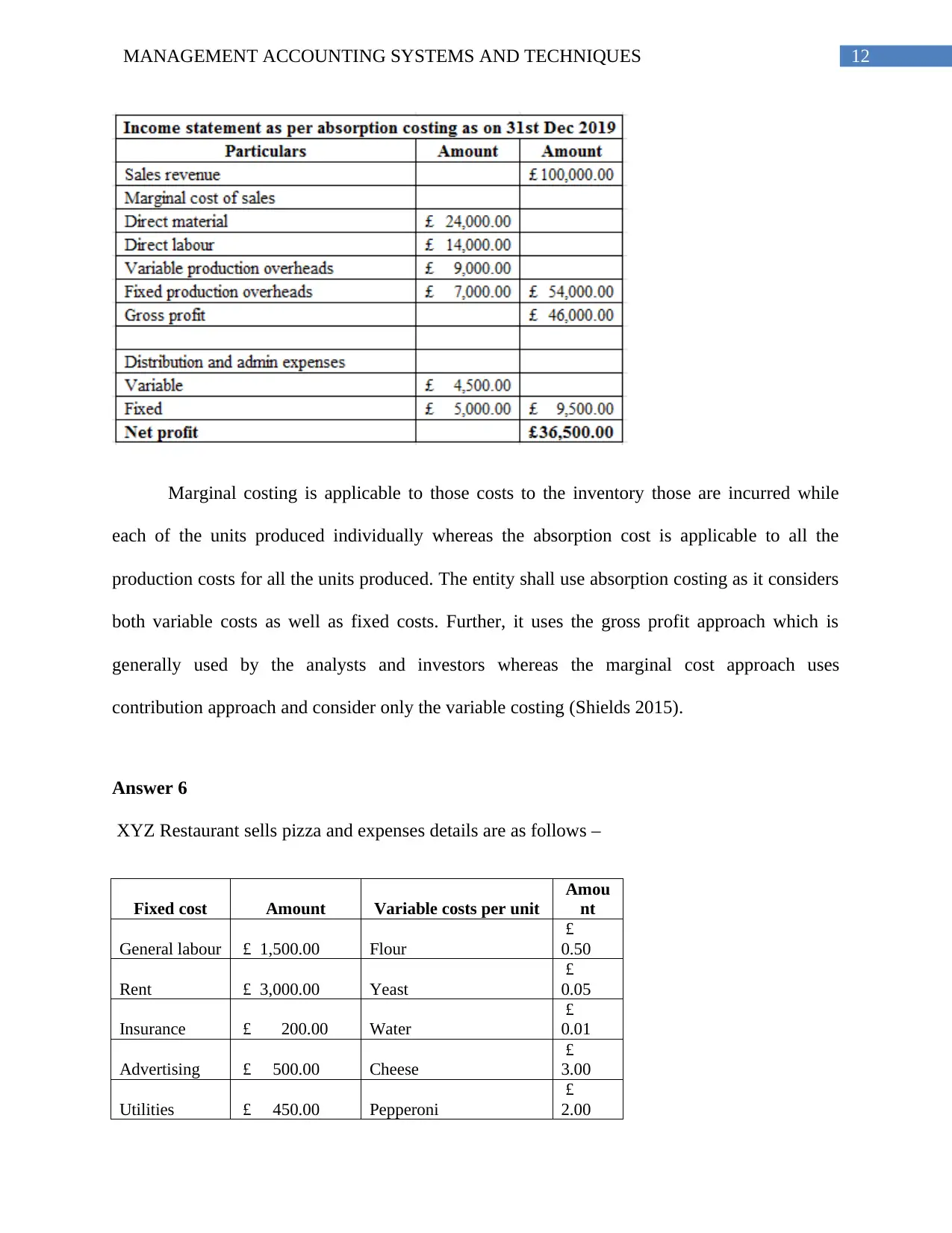

Answer 6

XYZ Restaurant sells pizza and expenses details are as follows –

Fixed cost Amount Variable costs per unit

Amou

nt

General labour £ 1,500.00 Flour

£

0.50

Rent £ 3,000.00 Yeast

£

0.05

Insurance £ 200.00 Water

£

0.01

Advertising £ 500.00 Cheese

£

3.00

Utilities £ 450.00 Pepperoni

£

2.00

Marginal costing is applicable to those costs to the inventory those are incurred while

each of the units produced individually whereas the absorption cost is applicable to all the

production costs for all the units produced. The entity shall use absorption costing as it considers

both variable costs as well as fixed costs. Further, it uses the gross profit approach which is

generally used by the analysts and investors whereas the marginal cost approach uses

contribution approach and consider only the variable costing (Shields 2015).

Answer 6

XYZ Restaurant sells pizza and expenses details are as follows –

Fixed cost Amount Variable costs per unit

Amou

nt

General labour £ 1,500.00 Flour

£

0.50

Rent £ 3,000.00 Yeast

£

0.05

Insurance £ 200.00 Water

£

0.01

Advertising £ 500.00 Cheese

£

3.00

Utilities £ 450.00 Pepperoni

£

2.00

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13MANAGEMENT ACCOUNTING SYSTEMS AND TECHNIQUES

Total £ 5,650.00 Total

£

5.56

In the above example, variable expenses per unit of pizza are £ 5.56. If the selling price per

pizza is £ 10, then contribution margin = (10 – 5.56) = £4.44

Hence, the break-even unit is calculated as follows –

Break-even unit = Fixed cost / contribution per unit

= £5,650 / £4.44 = 1273 units.

Hence, XYZ Restaurant is required to sell 1273 units of pizza to cover up the costs and

earning profit after that unit.

Break-even point is crucial as it assists the business owners in determining the units

required to be sold to start earning profit. In addition it helps in setting up the pricing policies for

the products. Hence, comparing the break-even among the entities under same industry is

considered to be crucial.

Answer 7

Computation of net profit

Net profit is the amount left over with the entity after making payments for all the

expenses. It is computed as (total revenue – total expenses) = net profit

Total £ 5,650.00 Total

£

5.56

In the above example, variable expenses per unit of pizza are £ 5.56. If the selling price per

pizza is £ 10, then contribution margin = (10 – 5.56) = £4.44

Hence, the break-even unit is calculated as follows –

Break-even unit = Fixed cost / contribution per unit

= £5,650 / £4.44 = 1273 units.

Hence, XYZ Restaurant is required to sell 1273 units of pizza to cover up the costs and

earning profit after that unit.

Break-even point is crucial as it assists the business owners in determining the units

required to be sold to start earning profit. In addition it helps in setting up the pricing policies for

the products. Hence, comparing the break-even among the entities under same industry is

considered to be crucial.

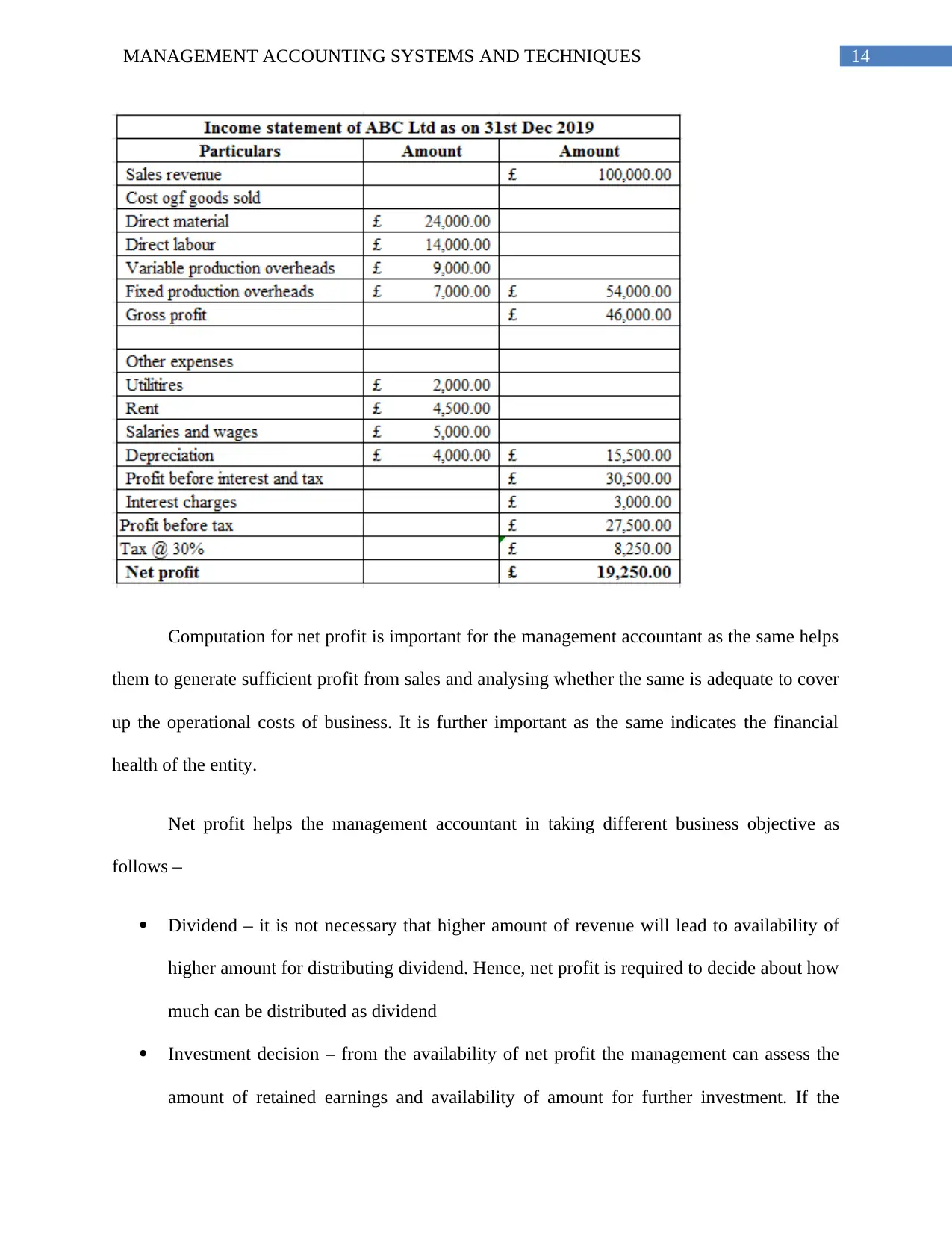

Answer 7

Computation of net profit

Net profit is the amount left over with the entity after making payments for all the

expenses. It is computed as (total revenue – total expenses) = net profit

14MANAGEMENT ACCOUNTING SYSTEMS AND TECHNIQUES

Computation for net profit is important for the management accountant as the same helps

them to generate sufficient profit from sales and analysing whether the same is adequate to cover

up the operational costs of business. It is further important as the same indicates the financial

health of the entity.

Net profit helps the management accountant in taking different business objective as

follows –

Dividend – it is not necessary that higher amount of revenue will lead to availability of

higher amount for distributing dividend. Hence, net profit is required to decide about how

much can be distributed as dividend

Investment decision – from the availability of net profit the management can assess the

amount of retained earnings and availability of amount for further investment. If the

Computation for net profit is important for the management accountant as the same helps

them to generate sufficient profit from sales and analysing whether the same is adequate to cover

up the operational costs of business. It is further important as the same indicates the financial

health of the entity.

Net profit helps the management accountant in taking different business objective as

follows –

Dividend – it is not necessary that higher amount of revenue will lead to availability of

higher amount for distributing dividend. Hence, net profit is required to decide about how

much can be distributed as dividend

Investment decision – from the availability of net profit the management can assess the

amount of retained earnings and availability of amount for further investment. If the

15MANAGEMENT ACCOUNTING SYSTEMS AND TECHNIQUES

company does not have adequate amount of retained earning it will be able to make

further investment in any project or assets.

company does not have adequate amount of retained earning it will be able to make

further investment in any project or assets.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

16MANAGEMENT ACCOUNTING SYSTEMS AND TECHNIQUES

Reference

Avdeev, V., Nassiripour, S. and Wong, H., 2019. Case Study: Ethical Considerations of an

Accounting Professional. Journal of Leadership, Accountability and Ethics, 16(2).

Bromwich, M. and Scapens, R.W., 2016. Management accounting research: 25 years

on. Management Accounting Research, 31, pp.1-9.

Chenhall, R.H. and Moers, F., 2015. The role of innovation in the evolution of management

accounting and its integration into management control. Accounting, Organizations and

Society, 47, pp.1-13.

Collis, J. and Hussey, R., 2017. Cost and management accounting. Macmillan International

Higher Education.

Firmin, M.W., DeWitt, K., Zurlinden, T.E., Smith, L.A. and Shell, A.L., 2019. Differences in

competency and qualification requirements between APA and ACA code of ethics. Journal of

Integrated Social Sciences, 9(1), pp.39-56.

Haroun, A.E., 2015. Maintenance cost estimation: application of activity-based costing as a fair

estimate method. Journal of Quality in Maintenance Engineering.

Ionescu, C. and Ionescu, C., 2016. Frauds and Errors in the Audit of Financial Statements. In

International Conference on Economic Sciences and Business Administration (Vol. 3, No. 1, pp.

174-183). Spiru Haret University.

Kaplan, R.S. and Atkinson, A.A., 2015. Advanced management accounting. PHI Learning.

Reference

Avdeev, V., Nassiripour, S. and Wong, H., 2019. Case Study: Ethical Considerations of an

Accounting Professional. Journal of Leadership, Accountability and Ethics, 16(2).

Bromwich, M. and Scapens, R.W., 2016. Management accounting research: 25 years

on. Management Accounting Research, 31, pp.1-9.

Chenhall, R.H. and Moers, F., 2015. The role of innovation in the evolution of management

accounting and its integration into management control. Accounting, Organizations and

Society, 47, pp.1-13.

Collis, J. and Hussey, R., 2017. Cost and management accounting. Macmillan International

Higher Education.

Firmin, M.W., DeWitt, K., Zurlinden, T.E., Smith, L.A. and Shell, A.L., 2019. Differences in

competency and qualification requirements between APA and ACA code of ethics. Journal of

Integrated Social Sciences, 9(1), pp.39-56.

Haroun, A.E., 2015. Maintenance cost estimation: application of activity-based costing as a fair

estimate method. Journal of Quality in Maintenance Engineering.

Ionescu, C. and Ionescu, C., 2016. Frauds and Errors in the Audit of Financial Statements. In

International Conference on Economic Sciences and Business Administration (Vol. 3, No. 1, pp.

174-183). Spiru Haret University.

Kaplan, R.S. and Atkinson, A.A., 2015. Advanced management accounting. PHI Learning.

17MANAGEMENT ACCOUNTING SYSTEMS AND TECHNIQUES

Kihn, L.A. and Ihantola, E.M., 2015. Approaches to validation and evaluation in qualitative

studies of management accounting. Qualitative Research in Accounting & Management.

Maas, K., Schaltegger, S. and Crutzen, N., 2016. Integrating corporate sustainability assessment,

management accounting, control, and reporting. Journal of Cleaner Production, 136, pp.237-

248.

Nisha, N., 2015. Inventory valuation practices: A developing country perspective. International

Journal of Information Research and Review, 2(7), pp.867-874.

Otley, D., 2016. The contingency theory of management accounting and control: 1980–

2014. Management accounting research, 31, pp.45-62.

Richardson, A.J., 2017. The relationship between management and financial accounting as

professions and technologies of practice. In The Role of the Management Accountant (pp. 246-

261). Routledge.

Shields, M.D., 2015. Established management accounting knowledge. Journal of Management

Accounting Research, 27(1), pp.123-132.

Kihn, L.A. and Ihantola, E.M., 2015. Approaches to validation and evaluation in qualitative

studies of management accounting. Qualitative Research in Accounting & Management.

Maas, K., Schaltegger, S. and Crutzen, N., 2016. Integrating corporate sustainability assessment,

management accounting, control, and reporting. Journal of Cleaner Production, 136, pp.237-

248.

Nisha, N., 2015. Inventory valuation practices: A developing country perspective. International

Journal of Information Research and Review, 2(7), pp.867-874.

Otley, D., 2016. The contingency theory of management accounting and control: 1980–

2014. Management accounting research, 31, pp.45-62.

Richardson, A.J., 2017. The relationship between management and financial accounting as

professions and technologies of practice. In The Role of the Management Accountant (pp. 246-

261). Routledge.

Shields, M.D., 2015. Established management accounting knowledge. Journal of Management

Accounting Research, 27(1), pp.123-132.

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.