Management Accounting Techniques and Tools

VerifiedAdded on 2021/02/22

|13

|5067

|66

AI Summary

This report delves into the world of management accounting, exploring various techniques and tools used to forecast future costs, value stocks, and compare actual performance with budgeted plans. It examines different management accounting research paradigms, realising the richness of psychology theory in contingency-based management accounting research. The document also touches on business strategies and management accounting in response to climate change risk exposure and regulatory uncertainty.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Management Accounting Systems

& Techniques

& Techniques

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION...........................................................................................................................1

LO 1.................................................................................................................................................1

P 1. MA and systems of MA........................................................................................................1

P 2. Contrasting methods of MA reporting.................................................................................2

LO 2.................................................................................................................................................3

P 3 Showing preparation of financial reports of the company by using appropriate techniques

of management accounting system..............................................................................................3

LO 3.................................................................................................................................................7

P 4. Benefits and limitations of budgetary tools..........................................................................7

LO 4.................................................................................................................................................9

P 5 comparing various management accounting systems adopted by different organisations in

order to respond to different financial problems..........................................................................9

CONCLUSION..............................................................................................................................10

REFERENCES..............................................................................................................................11

INTRODUCTION...........................................................................................................................1

LO 1.................................................................................................................................................1

P 1. MA and systems of MA........................................................................................................1

P 2. Contrasting methods of MA reporting.................................................................................2

LO 2.................................................................................................................................................3

P 3 Showing preparation of financial reports of the company by using appropriate techniques

of management accounting system..............................................................................................3

LO 3.................................................................................................................................................7

P 4. Benefits and limitations of budgetary tools..........................................................................7

LO 4.................................................................................................................................................9

P 5 comparing various management accounting systems adopted by different organisations in

order to respond to different financial problems..........................................................................9

CONCLUSION..............................................................................................................................10

REFERENCES..............................................................................................................................11

INTRODUCTION

Management accounting is an effective technique of using various financial and

accounting data in order to get better results which helps internal management of the company in

taking strategic decision. This helps in effective analysis of the financial data in order to predict

the future and it also aids in controlling the functions for better results and outcomes.

This report will examine the importance of management accounting and its different

types of management accounting system. This study will highlight different techniques of

management accounting reporting. This study will also use various cost accounting techniques

such as marginal and absorption costing. It will further evaluate use of various planning tools

which are used for budgetary control. It will further examine various financial difficulty and take

necessary measures to resolve such issue in a timely and systematic manner.

Hargreaves Lansdown plc. is a type of public limited company which was founded in the

year 1981. This is a financial service company, which is headquartered in Bristol, UK.

Hargreaves Lansdown plc. provides various services such as ISA, SIPP, Annuities, currency

services, fund dealing, retirement services, share dealing, investing, drawdown, financial advice,

foreign currency exchange, etc.

LO 1

P 1. MA and systems of MA.

Management accounting (MA) is a crucial process which helps in analysing various

business activities in order to take strategic decision in an accurate and timely manner. MA is a

process which helps internal staff of the organization to take strategic decision. This process

helps in analysing the operations and cost of the Hargreaves Lansdown plc.

MA System

MA system is a systematic process which helps in decision making and formulate an

action plan in order to analyse the action and operation of the business. MA system helps in

controlling cost which leads to higher profitability (Granlund. and Lukka, 2017). MA system

main purpose is to forecast the future and value stock for proper functioning of the Hargreaves

Lansdown plc. This Managerial accounting system aids in financial planning, variance analysis,

capital budgeting analysis and break even analysis which helps in viable decision making for the

future growth of Hargreaves Lansdown plc.

Cost accounting system: This system is known as costing or product costing system. It is

a framework which evaluates the cost of the goods produced or services rendered by the

company. This system helps management in analysing the profit for the business, valuation of

stock and cost control. (Malmi, 2016) established the fact that, accurate estimation of cost for

each good produced is critical for the profitable operations of the Hargreaves Lansdown plc.

Inventory management system: This system is a software system which helps in tracking

the inventories, material tracking, inventory levels and finished products, orders, automated

recording, sales and delivery (Granlund. and Lukka, 2017). This system helps in management in

estimating the required material top produce the desired level of goods. This helps in proper

utilization of resources and also avoid overstocking and under stocking which leads to higher

operational performance and productivity.

Price optimization system: This a systematic framework which analyses and determine

the change in the behaviour of customers with the change in the prices of various products and

services offered by the Hargreaves Lansdown plc. This MA system will find the best price which

will generate higher profits. (Malmi, 2016) sought to determine the fact that, price optimization

system helps in evaluating respond of different customer segment with the change in price. This

1

Management accounting is an effective technique of using various financial and

accounting data in order to get better results which helps internal management of the company in

taking strategic decision. This helps in effective analysis of the financial data in order to predict

the future and it also aids in controlling the functions for better results and outcomes.

This report will examine the importance of management accounting and its different

types of management accounting system. This study will highlight different techniques of

management accounting reporting. This study will also use various cost accounting techniques

such as marginal and absorption costing. It will further evaluate use of various planning tools

which are used for budgetary control. It will further examine various financial difficulty and take

necessary measures to resolve such issue in a timely and systematic manner.

Hargreaves Lansdown plc. is a type of public limited company which was founded in the

year 1981. This is a financial service company, which is headquartered in Bristol, UK.

Hargreaves Lansdown plc. provides various services such as ISA, SIPP, Annuities, currency

services, fund dealing, retirement services, share dealing, investing, drawdown, financial advice,

foreign currency exchange, etc.

LO 1

P 1. MA and systems of MA.

Management accounting (MA) is a crucial process which helps in analysing various

business activities in order to take strategic decision in an accurate and timely manner. MA is a

process which helps internal staff of the organization to take strategic decision. This process

helps in analysing the operations and cost of the Hargreaves Lansdown plc.

MA System

MA system is a systematic process which helps in decision making and formulate an

action plan in order to analyse the action and operation of the business. MA system helps in

controlling cost which leads to higher profitability (Granlund. and Lukka, 2017). MA system

main purpose is to forecast the future and value stock for proper functioning of the Hargreaves

Lansdown plc. This Managerial accounting system aids in financial planning, variance analysis,

capital budgeting analysis and break even analysis which helps in viable decision making for the

future growth of Hargreaves Lansdown plc.

Cost accounting system: This system is known as costing or product costing system. It is

a framework which evaluates the cost of the goods produced or services rendered by the

company. This system helps management in analysing the profit for the business, valuation of

stock and cost control. (Malmi, 2016) established the fact that, accurate estimation of cost for

each good produced is critical for the profitable operations of the Hargreaves Lansdown plc.

Inventory management system: This system is a software system which helps in tracking

the inventories, material tracking, inventory levels and finished products, orders, automated

recording, sales and delivery (Granlund. and Lukka, 2017). This system helps in management in

estimating the required material top produce the desired level of goods. This helps in proper

utilization of resources and also avoid overstocking and under stocking which leads to higher

operational performance and productivity.

Price optimization system: This a systematic framework which analyses and determine

the change in the behaviour of customers with the change in the prices of various products and

services offered by the Hargreaves Lansdown plc. This MA system will find the best price which

will generate higher profits. (Malmi, 2016) sought to determine the fact that, price optimization

system helps in evaluating respond of different customer segment with the change in price. This

1

helps organization in determining the price which best meets the organizational goal and attain

higher profits.

Job costing system: This MA system is a process of assigning manufacturing cost to the

each individual unit of the output or production. This method is used when the each product

produced is different from the other and has a particular amount of cost attached to them. This

method helps in determining the actual cost by evaluating the material, overhead and labour cost.

P 2. Contrasting methods of MA reporting.

Management accounting produces various management accounting reports which helps

in internal stakeholders of the company to take necessary decision and evaluate the financial

position of the company for the particular period. MA reports helps in formulating plan, take

strategic decision, regulating and measuring performance which results in better operational

productivity.

Budget report: It is MA report which compares the actual performance of the company

with the estimated projected plan (Hall, 2016). Budget report helps in determining the variation

and the internal stakeholders will evaluate the cause of the deviation and will take necessary

measures on a timely manner for higher results. On the contrary, (Hall, 2016) argued and

established the fact that, budget report is based on estimation and future prediction which result

in deviation and give inaccurate results when compared with the budgeted plan. In the other

hand, (Tappura and et.al., 2015) said that, budget report is based on past predictions which helps

in determining the future which leads to higher sustainable growth. This report also helps in

prioritizing the spending and control cost for higher operational efficiency.

Accounts receivable report: This is an effective report which analyses the list of various

unpaid customers, to whom goods were given on credit. This report helps in determining the

invoices which are due for payment. It also helps in determining the duration or time period

within which the cash can be recollected from the unpaid customers. Only credit transactions are

entered into the report. The customers owe money to the company with the surety to repay on the

future date. This helps company in determining the financial position of the Hargreaves

Lansdown plc. If the company is collecting cash at a lower rate then it's the warning sign for the

company that it has greater credit risk which leads to lower profitability and operational

efficiency of the business.

Performance report: This is a detailed statement which measures the performance of the

particular activity in relation with the success and generation of profit from the particular

activity. This helps internal stakeholders of the company to analyse the current status of the

project and forecast the progress in order to determine which activity is more beneficial in order

to generate higher profits and achieve desired goal (Tappura and et.al., 2015). This report takes

into consideration utilization of resources, communication in the project progress, effective

management plan, productivity of the employees and monitoring the same in order to prioritize

the particular activity which is highly beneficial for the development and growth of the

Hargreaves Lansdown plc.

Cost report: This is a detailed statement which assist business in determining the cost

attached with the particular unit or the level of production. This report helps in ascertain the

expenses (Turner and et.al., 2017). This helps in controlling cost ad reducing wastage of cash by

allocating cost in a systematic and efficient manner. Cost report determines the cost of project,

goods produced, processes in order to ensure that the financial results are accurate and viable.

The cost report helps in determining the manufacturing cost of producing a particular product.

This is crucial for selling and production plan which helps in strategic decision making. This

2

higher profits.

Job costing system: This MA system is a process of assigning manufacturing cost to the

each individual unit of the output or production. This method is used when the each product

produced is different from the other and has a particular amount of cost attached to them. This

method helps in determining the actual cost by evaluating the material, overhead and labour cost.

P 2. Contrasting methods of MA reporting.

Management accounting produces various management accounting reports which helps

in internal stakeholders of the company to take necessary decision and evaluate the financial

position of the company for the particular period. MA reports helps in formulating plan, take

strategic decision, regulating and measuring performance which results in better operational

productivity.

Budget report: It is MA report which compares the actual performance of the company

with the estimated projected plan (Hall, 2016). Budget report helps in determining the variation

and the internal stakeholders will evaluate the cause of the deviation and will take necessary

measures on a timely manner for higher results. On the contrary, (Hall, 2016) argued and

established the fact that, budget report is based on estimation and future prediction which result

in deviation and give inaccurate results when compared with the budgeted plan. In the other

hand, (Tappura and et.al., 2015) said that, budget report is based on past predictions which helps

in determining the future which leads to higher sustainable growth. This report also helps in

prioritizing the spending and control cost for higher operational efficiency.

Accounts receivable report: This is an effective report which analyses the list of various

unpaid customers, to whom goods were given on credit. This report helps in determining the

invoices which are due for payment. It also helps in determining the duration or time period

within which the cash can be recollected from the unpaid customers. Only credit transactions are

entered into the report. The customers owe money to the company with the surety to repay on the

future date. This helps company in determining the financial position of the Hargreaves

Lansdown plc. If the company is collecting cash at a lower rate then it's the warning sign for the

company that it has greater credit risk which leads to lower profitability and operational

efficiency of the business.

Performance report: This is a detailed statement which measures the performance of the

particular activity in relation with the success and generation of profit from the particular

activity. This helps internal stakeholders of the company to analyse the current status of the

project and forecast the progress in order to determine which activity is more beneficial in order

to generate higher profits and achieve desired goal (Tappura and et.al., 2015). This report takes

into consideration utilization of resources, communication in the project progress, effective

management plan, productivity of the employees and monitoring the same in order to prioritize

the particular activity which is highly beneficial for the development and growth of the

Hargreaves Lansdown plc.

Cost report: This is a detailed statement which assist business in determining the cost

attached with the particular unit or the level of production. This report helps in ascertain the

expenses (Turner and et.al., 2017). This helps in controlling cost ad reducing wastage of cash by

allocating cost in a systematic and efficient manner. Cost report determines the cost of project,

goods produced, processes in order to ensure that the financial results are accurate and viable.

The cost report helps in determining the manufacturing cost of producing a particular product.

This is crucial for selling and production plan which helps in strategic decision making. This

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

gives detailed analysis of the labour capacity, machine capacity and output levels for accurate

results and outcomes (Maas, Schaltegger and Crutzen, 2016). This report helps in cost object

analysis which helps in evaluating the various problems and ascertain the exact cause of the

problem. This report also helps in analysing the trend and inventory valuation for future growth

and success.

Benefits of systems of MA

Cost accounting system: It helps management of Hargreaves Lansdown plc. in future

planning. It helps in giving detailed analysis and evaluation of most profitable and non-

profitable activities. This helps in reducing cost and achieving economies of scale and higher

profitability.

Inventory management system: This system is very useful for Hargreaves Lansdown plc.

in saving time and money by critically determining and tracking the amount of resources, level

of inventory (Noreen, Brewer and Garrison, 2011). This helps in controlling inventory levels and

avoid over and under stocking for higher operational performance and productivity.

Price optimization system: This system helps in determining the change in the demand

and supply of goods and services with variation to different prices (Turner and et.al., 2017). This

helps in estimating the best price which helps in attracting higher customers and results in higher

profitability.

Job costing system: This MA system helps in evaluating the determining the profitability

of each job individually (Bui and De Villiers, 2017). This system helps in detailed analysis of the

various cost attached with the job and also helps to evaluate the specific jobs to determine the

most profitable job for future growth and success. It helps in evaluating the performance of each

job and it also gives accurate results.

Critical evaluation of MA systems of MA reporting

(Turner and et.al., 2017) said that, MA system is an effective process which helps in

determining the financial position and viability of the company which leads to future growth and

development. This helps in increased operational efficiency and lower cost reduction which in

turn results in higher profitability. This system also helps in minimizing the wastage of resources

and disruptions in order to reach higher operational performance. Integration of management

accounting system in Hargreaves Lansdown plc. helps in avoiding duplication of work and

avoids conflict which leads to smooth functioning of the business.(Bui and De Villiers, 2017)

said that, management accounting system may sometimes give inaccurate decision because it

may lead to personal bisness and is based on estimations and future predictions.

(Noreen, Brewer and Garrison, 2011) sought to establish the fact that, integrated

management accounting reporting helps in presenting clear detailed statement of the various

financial transaction. This reduce duplicate work and helps in better decision making for the

internal stakeholders. On the contrary, ((Maas, Schaltegger and Crutzen, 2016)) argued that,

management accounting reporting is a time consuming and a complex process. It does nor

always gives accurate results because it takes into consideration historical data and it neglects

qualitative information.

LO 2

P 3 Showing preparation of financial reports of the company by using appropriate techniques of

management accounting system

Marginal costing:

3

results and outcomes (Maas, Schaltegger and Crutzen, 2016). This report helps in cost object

analysis which helps in evaluating the various problems and ascertain the exact cause of the

problem. This report also helps in analysing the trend and inventory valuation for future growth

and success.

Benefits of systems of MA

Cost accounting system: It helps management of Hargreaves Lansdown plc. in future

planning. It helps in giving detailed analysis and evaluation of most profitable and non-

profitable activities. This helps in reducing cost and achieving economies of scale and higher

profitability.

Inventory management system: This system is very useful for Hargreaves Lansdown plc.

in saving time and money by critically determining and tracking the amount of resources, level

of inventory (Noreen, Brewer and Garrison, 2011). This helps in controlling inventory levels and

avoid over and under stocking for higher operational performance and productivity.

Price optimization system: This system helps in determining the change in the demand

and supply of goods and services with variation to different prices (Turner and et.al., 2017). This

helps in estimating the best price which helps in attracting higher customers and results in higher

profitability.

Job costing system: This MA system helps in evaluating the determining the profitability

of each job individually (Bui and De Villiers, 2017). This system helps in detailed analysis of the

various cost attached with the job and also helps to evaluate the specific jobs to determine the

most profitable job for future growth and success. It helps in evaluating the performance of each

job and it also gives accurate results.

Critical evaluation of MA systems of MA reporting

(Turner and et.al., 2017) said that, MA system is an effective process which helps in

determining the financial position and viability of the company which leads to future growth and

development. This helps in increased operational efficiency and lower cost reduction which in

turn results in higher profitability. This system also helps in minimizing the wastage of resources

and disruptions in order to reach higher operational performance. Integration of management

accounting system in Hargreaves Lansdown plc. helps in avoiding duplication of work and

avoids conflict which leads to smooth functioning of the business.(Bui and De Villiers, 2017)

said that, management accounting system may sometimes give inaccurate decision because it

may lead to personal bisness and is based on estimations and future predictions.

(Noreen, Brewer and Garrison, 2011) sought to establish the fact that, integrated

management accounting reporting helps in presenting clear detailed statement of the various

financial transaction. This reduce duplicate work and helps in better decision making for the

internal stakeholders. On the contrary, ((Maas, Schaltegger and Crutzen, 2016)) argued that,

management accounting reporting is a time consuming and a complex process. It does nor

always gives accurate results because it takes into consideration historical data and it neglects

qualitative information.

LO 2

P 3 Showing preparation of financial reports of the company by using appropriate techniques of

management accounting system

Marginal costing:

3

Marginal; costing is a technique used in management accounting system for the purpose

of preparing income statements of the company. This technique used each variable prodiction

costs incurred by the business as a production cost. On the other hand, alll fixed costs are being

considered as a period cost in the technique. In this regard, all the variable costs incured bythe

firm are being considered at the time of preparing determining cost of production for the

company.

Absorption costing:

As the name describes, absorption costing technique of management accounting system

considers each costs absorbed by the business during a specific time period (Noreen, Brewer and

Garrison, 2011). In this technique, each cost including variable and fixed costs at the time of

production, are being taken into consideration at the time of calculating cost of production.

Difference between marginal costing and absorption costing techniques

The major difference between these two techniques arises at the time of calculating cost

of production for the company. Cost of production derived from marginal costing comes lower

than the absorption costing as it does not consider fixed costs incurred by the company.

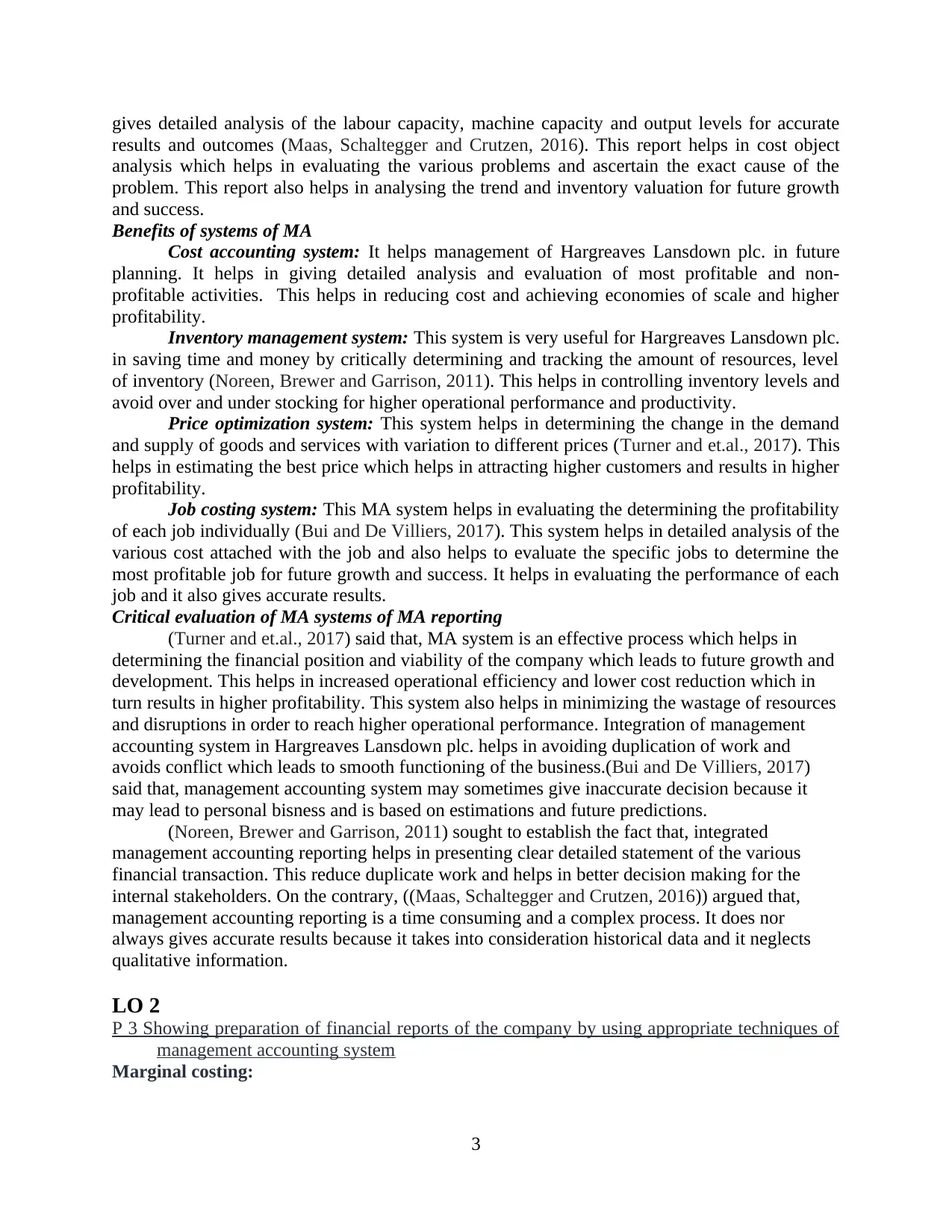

Per unit production cost of Galway Plc using marginal costing technique

Heads amount

Direct material 8

Direct labour 5

Variable production overheads 3

total production cost per unit 16

Income statement of Galway Plc under Marginal costing technique for May

Heads amount amount

sales revenue 15000

less: Cost of production

opening stock 0

Add: Cost of production 8000

less: closing inventories 3200

total cost of production 4800

contribution 10200

less: Fixed costs

production overheads 4000

selling costs 4000

administration overheads 2000

sales commission 750 10750

profit -550

Income statement of Galway Plc under Marginal costing technique for June

Heads amount amount

sales revenue 25000

less: cost of production

opening stock 3200

Add: Cost of production 6080

less: closing Inventories 1920

total cost of production 7360

4

of preparing income statements of the company. This technique used each variable prodiction

costs incurred by the business as a production cost. On the other hand, alll fixed costs are being

considered as a period cost in the technique. In this regard, all the variable costs incured bythe

firm are being considered at the time of preparing determining cost of production for the

company.

Absorption costing:

As the name describes, absorption costing technique of management accounting system

considers each costs absorbed by the business during a specific time period (Noreen, Brewer and

Garrison, 2011). In this technique, each cost including variable and fixed costs at the time of

production, are being taken into consideration at the time of calculating cost of production.

Difference between marginal costing and absorption costing techniques

The major difference between these two techniques arises at the time of calculating cost

of production for the company. Cost of production derived from marginal costing comes lower

than the absorption costing as it does not consider fixed costs incurred by the company.

Per unit production cost of Galway Plc using marginal costing technique

Heads amount

Direct material 8

Direct labour 5

Variable production overheads 3

total production cost per unit 16

Income statement of Galway Plc under Marginal costing technique for May

Heads amount amount

sales revenue 15000

less: Cost of production

opening stock 0

Add: Cost of production 8000

less: closing inventories 3200

total cost of production 4800

contribution 10200

less: Fixed costs

production overheads 4000

selling costs 4000

administration overheads 2000

sales commission 750 10750

profit -550

Income statement of Galway Plc under Marginal costing technique for June

Heads amount amount

sales revenue 25000

less: cost of production

opening stock 3200

Add: Cost of production 6080

less: closing Inventories 1920

total cost of production 7360

4

contribution 17640

less: Fixed costs

production overheads 4000

selling overheads 4000

administration overheads 2000

sales commission 1250 11250

profit 6390

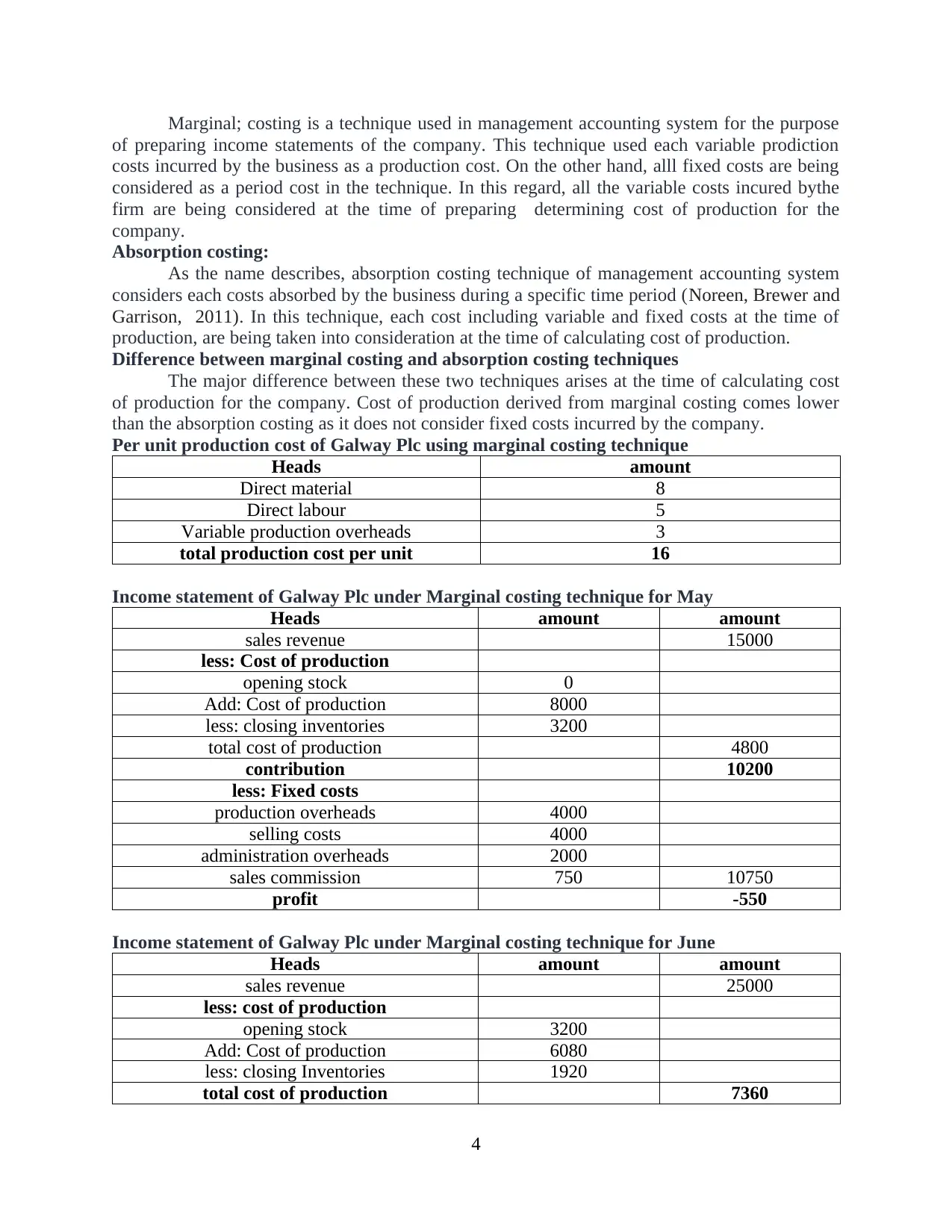

Per unit production cost of Galway Plc using Absorption costing technique

Heads amount

Direct material 8

Direct labour 5

Variable production overheads 3

fixed production overheads 13.33

total production cost per unit 29.33

Income statement of Galway Plc under Absorption costing technique for May

Heads amount amount

sales revenue 15000

less: cost of goods sold

opening stock 0

Add: variable production cost 14667

less: closing inventories 5867 8800

gross profit 6200

under absorbed overheads 587

less: other overheads

selling overheads 4000

administration overheads 2000

sales commission 750 6750

net profit 37

Income statement of Galway Plc under Absorption costing technique for June

Heads amount amount

sales revenue 14667

less: cost of goods sold

opening stock 5867

Add: production overheads 6080

less: closing inventories 3520 8427

gross profit 6240

under absorbed production cost 587

less: other costs

selling overheads 4000

administration overheads 2000

sales commission 733 6733

net profit 93

5

less: Fixed costs

production overheads 4000

selling overheads 4000

administration overheads 2000

sales commission 1250 11250

profit 6390

Per unit production cost of Galway Plc using Absorption costing technique

Heads amount

Direct material 8

Direct labour 5

Variable production overheads 3

fixed production overheads 13.33

total production cost per unit 29.33

Income statement of Galway Plc under Absorption costing technique for May

Heads amount amount

sales revenue 15000

less: cost of goods sold

opening stock 0

Add: variable production cost 14667

less: closing inventories 5867 8800

gross profit 6200

under absorbed overheads 587

less: other overheads

selling overheads 4000

administration overheads 2000

sales commission 750 6750

net profit 37

Income statement of Galway Plc under Absorption costing technique for June

Heads amount amount

sales revenue 14667

less: cost of goods sold

opening stock 5867

Add: production overheads 6080

less: closing inventories 3520 8427

gross profit 6240

under absorbed production cost 587

less: other costs

selling overheads 4000

administration overheads 2000

sales commission 733 6733

net profit 93

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

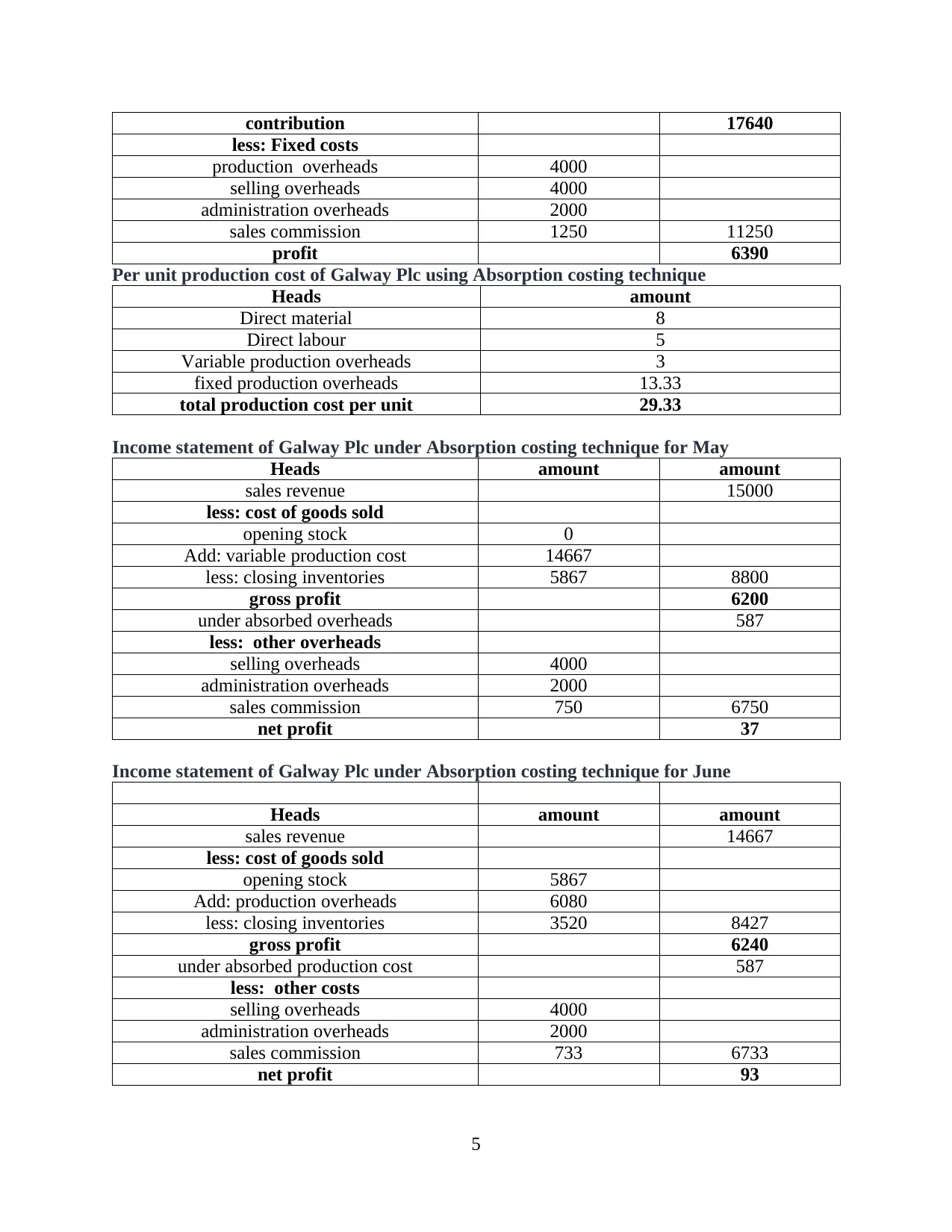

variance analysis

It is a technique that is used by the company for the purpose of detecting inefficiencies

from the business. It can be detected by comparing the actual cost by the budgeted cost. This

technique provides either favourable or adverse results. favourable result shows improvement in

efficiency of the firm, on the other hand, adverse result shows inefficiencies in the business.

Statement showing variance analysis of material of the company

Material usage variance

Particular Amount Amount Variance

Standard hours–

actual hours)

*Standard price (1000-2200)*10 -2000 Adverse

material price variance

Particular Amount Amount Variance

Standard price -

actual prices ) *

Actual hours (10-9.5)*2200 1100 favourable

Inventory valuation

Inventory valuation is a tool that helps financial managers in maintaining records of each

movement in the stock of the company. LIFO, FIFO, weighted average, etc. are various methods

that can be used by the business for the inventory valuation. Each method provides different

results to the business, therefore, the financial manager should analyse each method carefully

and should adopt the most appropriate method as per the need and requirements of the company.

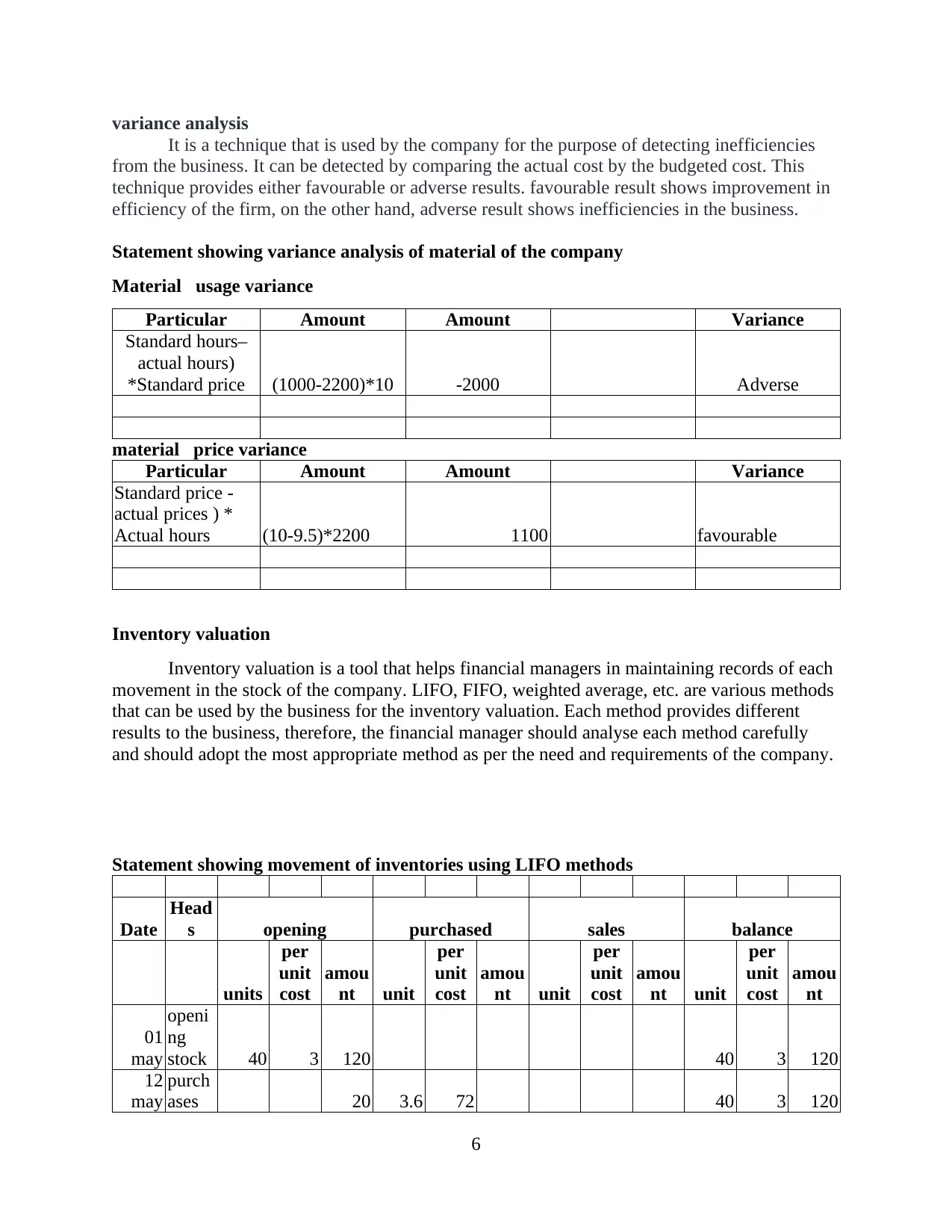

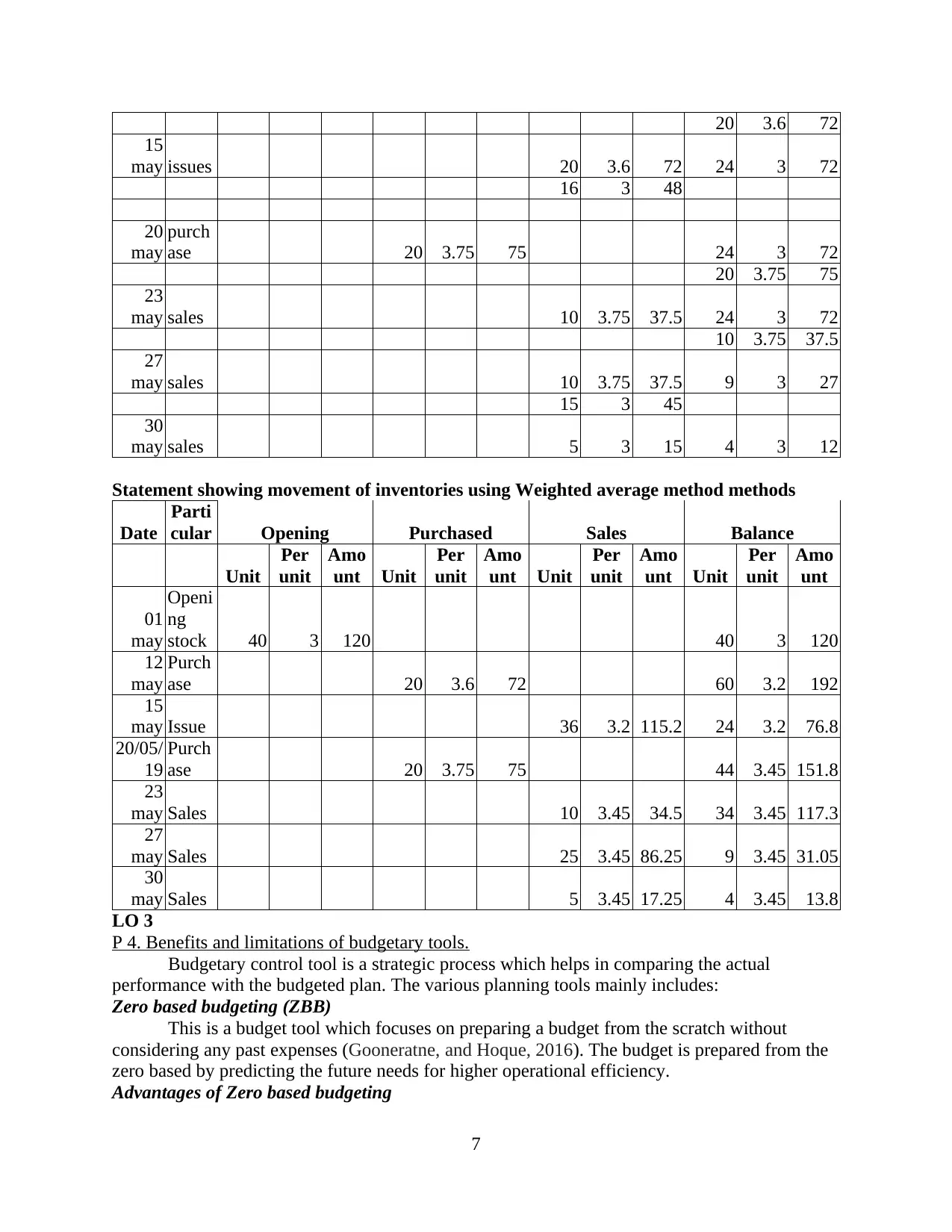

Statement showing movement of inventories using LIFO methods

Date

Head

s opening purchased sales balance

units

per

unit

cost

amou

nt unit

per

unit

cost

amou

nt unit

per

unit

cost

amou

nt unit

per

unit

cost

amou

nt

01

may

openi

ng

stock 40 3 120 40 3 120

12

may

purch

ases 20 3.6 72 40 3 120

6

It is a technique that is used by the company for the purpose of detecting inefficiencies

from the business. It can be detected by comparing the actual cost by the budgeted cost. This

technique provides either favourable or adverse results. favourable result shows improvement in

efficiency of the firm, on the other hand, adverse result shows inefficiencies in the business.

Statement showing variance analysis of material of the company

Material usage variance

Particular Amount Amount Variance

Standard hours–

actual hours)

*Standard price (1000-2200)*10 -2000 Adverse

material price variance

Particular Amount Amount Variance

Standard price -

actual prices ) *

Actual hours (10-9.5)*2200 1100 favourable

Inventory valuation

Inventory valuation is a tool that helps financial managers in maintaining records of each

movement in the stock of the company. LIFO, FIFO, weighted average, etc. are various methods

that can be used by the business for the inventory valuation. Each method provides different

results to the business, therefore, the financial manager should analyse each method carefully

and should adopt the most appropriate method as per the need and requirements of the company.

Statement showing movement of inventories using LIFO methods

Date

Head

s opening purchased sales balance

units

per

unit

cost

amou

nt unit

per

unit

cost

amou

nt unit

per

unit

cost

amou

nt unit

per

unit

cost

amou

nt

01

may

openi

ng

stock 40 3 120 40 3 120

12

may

purch

ases 20 3.6 72 40 3 120

6

20 3.6 72

15

may issues 20 3.6 72 24 3 72

16 3 48

20

may

purch

ase 20 3.75 75 24 3 72

20 3.75 75

23

may sales 10 3.75 37.5 24 3 72

10 3.75 37.5

27

may sales 10 3.75 37.5 9 3 27

15 3 45

30

may sales 5 3 15 4 3 12

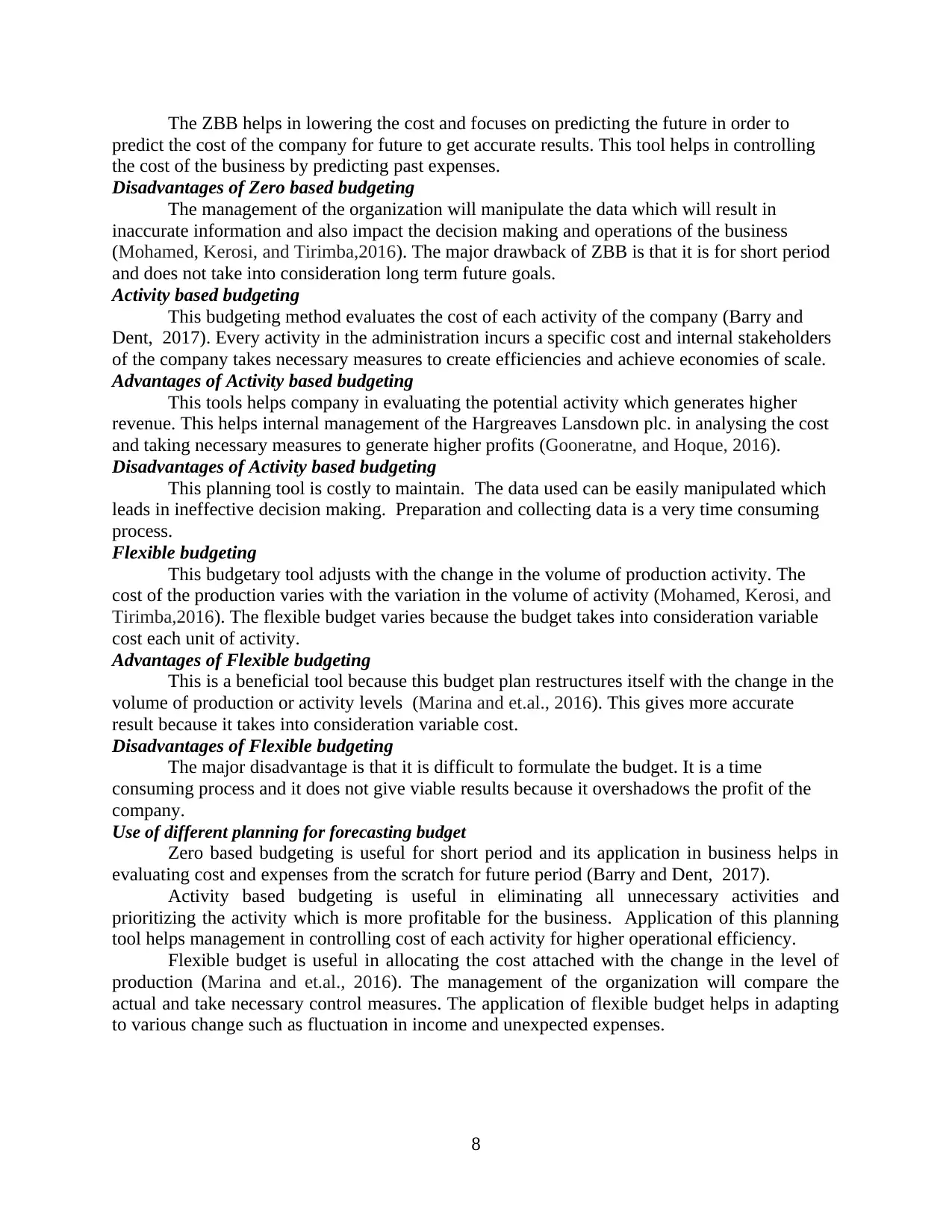

Statement showing movement of inventories using Weighted average method methods

Date

Parti

cular Opening Purchased Sales Balance

Unit

Per

unit

Amo

unt Unit

Per

unit

Amo

unt Unit

Per

unit

Amo

unt Unit

Per

unit

Amo

unt

01

may

Openi

ng

stock 40 3 120 40 3 120

12

may

Purch

ase 20 3.6 72 60 3.2 192

15

may Issue 36 3.2 115.2 24 3.2 76.8

20/05/

19

Purch

ase 20 3.75 75 44 3.45 151.8

23

may Sales 10 3.45 34.5 34 3.45 117.3

27

may Sales 25 3.45 86.25 9 3.45 31.05

30

may Sales 5 3.45 17.25 4 3.45 13.8

LO 3

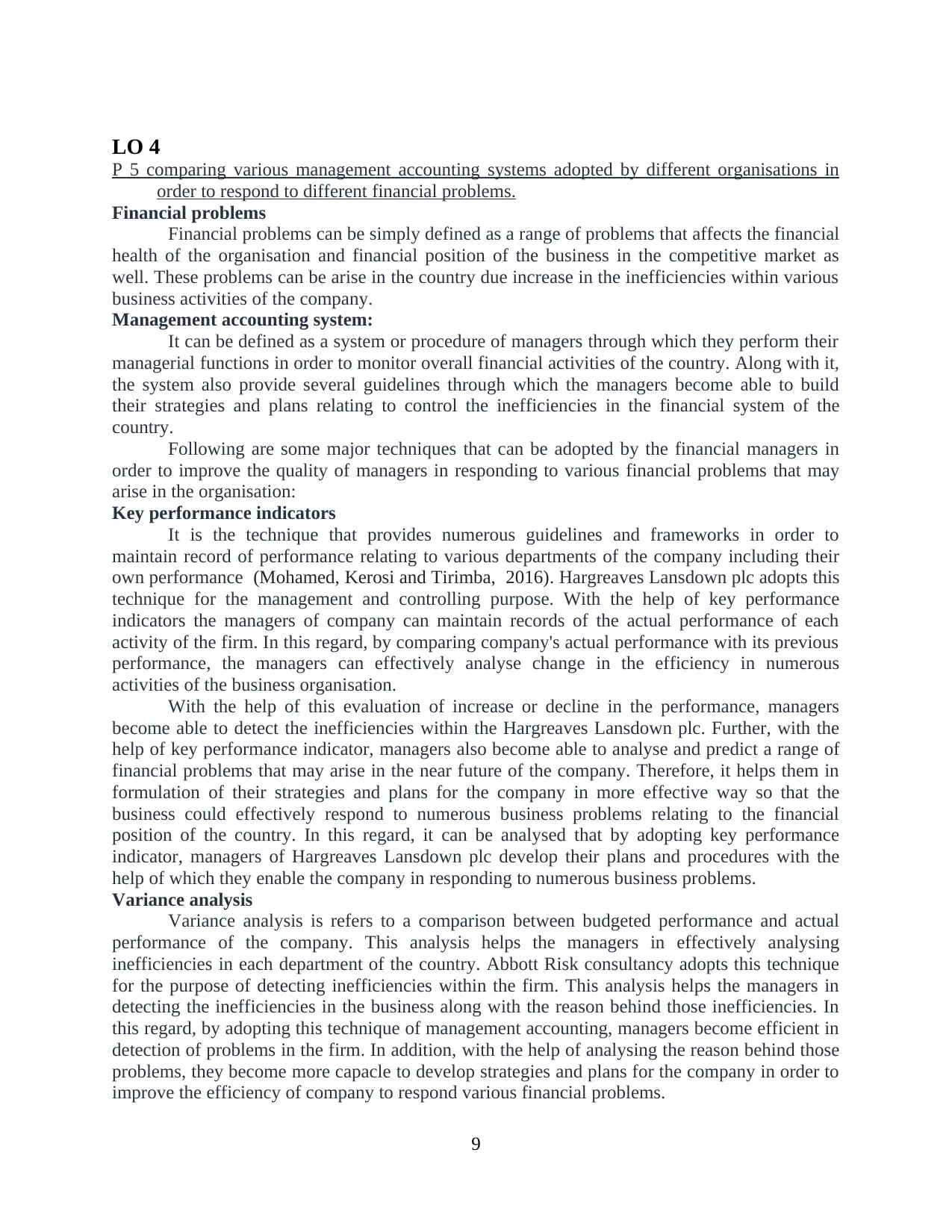

P 4. Benefits and limitations of budgetary tools.

Budgetary control tool is a strategic process which helps in comparing the actual

performance with the budgeted plan. The various planning tools mainly includes:

Zero based budgeting (ZBB)

This is a budget tool which focuses on preparing a budget from the scratch without

considering any past expenses (Gooneratne, and Hoque, 2016). The budget is prepared from the

zero based by predicting the future needs for higher operational efficiency.

Advantages of Zero based budgeting

7

15

may issues 20 3.6 72 24 3 72

16 3 48

20

may

purch

ase 20 3.75 75 24 3 72

20 3.75 75

23

may sales 10 3.75 37.5 24 3 72

10 3.75 37.5

27

may sales 10 3.75 37.5 9 3 27

15 3 45

30

may sales 5 3 15 4 3 12

Statement showing movement of inventories using Weighted average method methods

Date

Parti

cular Opening Purchased Sales Balance

Unit

Per

unit

Amo

unt Unit

Per

unit

Amo

unt Unit

Per

unit

Amo

unt Unit

Per

unit

Amo

unt

01

may

Openi

ng

stock 40 3 120 40 3 120

12

may

Purch

ase 20 3.6 72 60 3.2 192

15

may Issue 36 3.2 115.2 24 3.2 76.8

20/05/

19

Purch

ase 20 3.75 75 44 3.45 151.8

23

may Sales 10 3.45 34.5 34 3.45 117.3

27

may Sales 25 3.45 86.25 9 3.45 31.05

30

may Sales 5 3.45 17.25 4 3.45 13.8

LO 3

P 4. Benefits and limitations of budgetary tools.

Budgetary control tool is a strategic process which helps in comparing the actual

performance with the budgeted plan. The various planning tools mainly includes:

Zero based budgeting (ZBB)

This is a budget tool which focuses on preparing a budget from the scratch without

considering any past expenses (Gooneratne, and Hoque, 2016). The budget is prepared from the

zero based by predicting the future needs for higher operational efficiency.

Advantages of Zero based budgeting

7

The ZBB helps in lowering the cost and focuses on predicting the future in order to

predict the cost of the company for future to get accurate results. This tool helps in controlling

the cost of the business by predicting past expenses.

Disadvantages of Zero based budgeting

The management of the organization will manipulate the data which will result in

inaccurate information and also impact the decision making and operations of the business

(Mohamed, Kerosi, and Tirimba,2016). The major drawback of ZBB is that it is for short period

and does not take into consideration long term future goals.

Activity based budgeting

This budgeting method evaluates the cost of each activity of the company (Barry and

Dent, 2017). Every activity in the administration incurs a specific cost and internal stakeholders

of the company takes necessary measures to create efficiencies and achieve economies of scale.

Advantages of Activity based budgeting

This tools helps company in evaluating the potential activity which generates higher

revenue. This helps internal management of the Hargreaves Lansdown plc. in analysing the cost

and taking necessary measures to generate higher profits (Gooneratne, and Hoque, 2016).

Disadvantages of Activity based budgeting

This planning tool is costly to maintain. The data used can be easily manipulated which

leads in ineffective decision making. Preparation and collecting data is a very time consuming

process.

Flexible budgeting

This budgetary tool adjusts with the change in the volume of production activity. The

cost of the production varies with the variation in the volume of activity (Mohamed, Kerosi, and

Tirimba,2016). The flexible budget varies because the budget takes into consideration variable

cost each unit of activity.

Advantages of Flexible budgeting

This is a beneficial tool because this budget plan restructures itself with the change in the

volume of production or activity levels (Marina and et.al., 2016). This gives more accurate

result because it takes into consideration variable cost.

Disadvantages of Flexible budgeting

The major disadvantage is that it is difficult to formulate the budget. It is a time

consuming process and it does not give viable results because it overshadows the profit of the

company.

Use of different planning for forecasting budget

Zero based budgeting is useful for short period and its application in business helps in

evaluating cost and expenses from the scratch for future period (Barry and Dent, 2017).

Activity based budgeting is useful in eliminating all unnecessary activities and

prioritizing the activity which is more profitable for the business. Application of this planning

tool helps management in controlling cost of each activity for higher operational efficiency.

Flexible budget is useful in allocating the cost attached with the change in the level of

production (Marina and et.al., 2016). The management of the organization will compare the

actual and take necessary control measures. The application of flexible budget helps in adapting

to various change such as fluctuation in income and unexpected expenses.

8

predict the cost of the company for future to get accurate results. This tool helps in controlling

the cost of the business by predicting past expenses.

Disadvantages of Zero based budgeting

The management of the organization will manipulate the data which will result in

inaccurate information and also impact the decision making and operations of the business

(Mohamed, Kerosi, and Tirimba,2016). The major drawback of ZBB is that it is for short period

and does not take into consideration long term future goals.

Activity based budgeting

This budgeting method evaluates the cost of each activity of the company (Barry and

Dent, 2017). Every activity in the administration incurs a specific cost and internal stakeholders

of the company takes necessary measures to create efficiencies and achieve economies of scale.

Advantages of Activity based budgeting

This tools helps company in evaluating the potential activity which generates higher

revenue. This helps internal management of the Hargreaves Lansdown plc. in analysing the cost

and taking necessary measures to generate higher profits (Gooneratne, and Hoque, 2016).

Disadvantages of Activity based budgeting

This planning tool is costly to maintain. The data used can be easily manipulated which

leads in ineffective decision making. Preparation and collecting data is a very time consuming

process.

Flexible budgeting

This budgetary tool adjusts with the change in the volume of production activity. The

cost of the production varies with the variation in the volume of activity (Mohamed, Kerosi, and

Tirimba,2016). The flexible budget varies because the budget takes into consideration variable

cost each unit of activity.

Advantages of Flexible budgeting

This is a beneficial tool because this budget plan restructures itself with the change in the

volume of production or activity levels (Marina and et.al., 2016). This gives more accurate

result because it takes into consideration variable cost.

Disadvantages of Flexible budgeting

The major disadvantage is that it is difficult to formulate the budget. It is a time

consuming process and it does not give viable results because it overshadows the profit of the

company.

Use of different planning for forecasting budget

Zero based budgeting is useful for short period and its application in business helps in

evaluating cost and expenses from the scratch for future period (Barry and Dent, 2017).

Activity based budgeting is useful in eliminating all unnecessary activities and

prioritizing the activity which is more profitable for the business. Application of this planning

tool helps management in controlling cost of each activity for higher operational efficiency.

Flexible budget is useful in allocating the cost attached with the change in the level of

production (Marina and et.al., 2016). The management of the organization will compare the

actual and take necessary control measures. The application of flexible budget helps in adapting

to various change such as fluctuation in income and unexpected expenses.

8

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

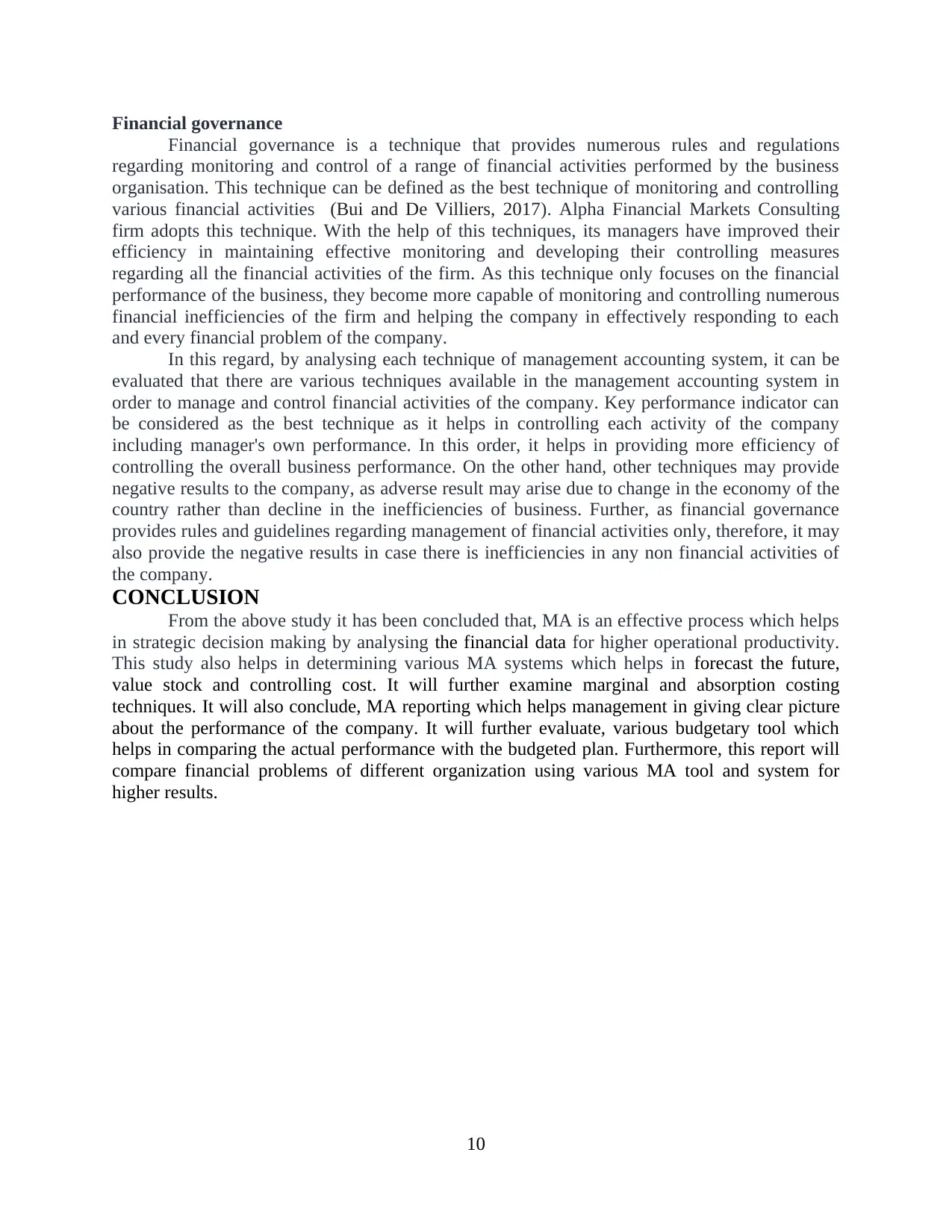

LO 4

P 5 comparing various management accounting systems adopted by different organisations in

order to respond to different financial problems.

Financial problems

Financial problems can be simply defined as a range of problems that affects the financial

health of the organisation and financial position of the business in the competitive market as

well. These problems can be arise in the country due increase in the inefficiencies within various

business activities of the company.

Management accounting system:

It can be defined as a system or procedure of managers through which they perform their

managerial functions in order to monitor overall financial activities of the country. Along with it,

the system also provide several guidelines through which the managers become able to build

their strategies and plans relating to control the inefficiencies in the financial system of the

country.

Following are some major techniques that can be adopted by the financial managers in

order to improve the quality of managers in responding to various financial problems that may

arise in the organisation:

Key performance indicators

It is the technique that provides numerous guidelines and frameworks in order to

maintain record of performance relating to various departments of the company including their

own performance (Mohamed, Kerosi and Tirimba, 2016). Hargreaves Lansdown plc adopts this

technique for the management and controlling purpose. With the help of key performance

indicators the managers of company can maintain records of the actual performance of each

activity of the firm. In this regard, by comparing company's actual performance with its previous

performance, the managers can effectively analyse change in the efficiency in numerous

activities of the business organisation.

With the help of this evaluation of increase or decline in the performance, managers

become able to detect the inefficiencies within the Hargreaves Lansdown plc. Further, with the

help of key performance indicator, managers also become able to analyse and predict a range of

financial problems that may arise in the near future of the company. Therefore, it helps them in

formulation of their strategies and plans for the company in more effective way so that the

business could effectively respond to numerous business problems relating to the financial

position of the country. In this regard, it can be analysed that by adopting key performance

indicator, managers of Hargreaves Lansdown plc develop their plans and procedures with the

help of which they enable the company in responding to numerous business problems.

Variance analysis

Variance analysis is refers to a comparison between budgeted performance and actual

performance of the company. This analysis helps the managers in effectively analysing

inefficiencies in each department of the country. Abbott Risk consultancy adopts this technique

for the purpose of detecting inefficiencies within the firm. This analysis helps the managers in

detecting the inefficiencies in the business along with the reason behind those inefficiencies. In

this regard, by adopting this technique of management accounting, managers become efficient in

detection of problems in the firm. In addition, with the help of analysing the reason behind those

problems, they become more capacle to develop strategies and plans for the company in order to

improve the efficiency of company to respond various financial problems.

9

P 5 comparing various management accounting systems adopted by different organisations in

order to respond to different financial problems.

Financial problems

Financial problems can be simply defined as a range of problems that affects the financial

health of the organisation and financial position of the business in the competitive market as

well. These problems can be arise in the country due increase in the inefficiencies within various

business activities of the company.

Management accounting system:

It can be defined as a system or procedure of managers through which they perform their

managerial functions in order to monitor overall financial activities of the country. Along with it,

the system also provide several guidelines through which the managers become able to build

their strategies and plans relating to control the inefficiencies in the financial system of the

country.

Following are some major techniques that can be adopted by the financial managers in

order to improve the quality of managers in responding to various financial problems that may

arise in the organisation:

Key performance indicators

It is the technique that provides numerous guidelines and frameworks in order to

maintain record of performance relating to various departments of the company including their

own performance (Mohamed, Kerosi and Tirimba, 2016). Hargreaves Lansdown plc adopts this

technique for the management and controlling purpose. With the help of key performance

indicators the managers of company can maintain records of the actual performance of each

activity of the firm. In this regard, by comparing company's actual performance with its previous

performance, the managers can effectively analyse change in the efficiency in numerous

activities of the business organisation.

With the help of this evaluation of increase or decline in the performance, managers

become able to detect the inefficiencies within the Hargreaves Lansdown plc. Further, with the

help of key performance indicator, managers also become able to analyse and predict a range of

financial problems that may arise in the near future of the company. Therefore, it helps them in

formulation of their strategies and plans for the company in more effective way so that the

business could effectively respond to numerous business problems relating to the financial

position of the country. In this regard, it can be analysed that by adopting key performance

indicator, managers of Hargreaves Lansdown plc develop their plans and procedures with the

help of which they enable the company in responding to numerous business problems.

Variance analysis

Variance analysis is refers to a comparison between budgeted performance and actual

performance of the company. This analysis helps the managers in effectively analysing

inefficiencies in each department of the country. Abbott Risk consultancy adopts this technique

for the purpose of detecting inefficiencies within the firm. This analysis helps the managers in

detecting the inefficiencies in the business along with the reason behind those inefficiencies. In

this regard, by adopting this technique of management accounting, managers become efficient in

detection of problems in the firm. In addition, with the help of analysing the reason behind those

problems, they become more capacle to develop strategies and plans for the company in order to

improve the efficiency of company to respond various financial problems.

9

Financial governance

Financial governance is a technique that provides numerous rules and regulations

regarding monitoring and control of a range of financial activities performed by the business

organisation. This technique can be defined as the best technique of monitoring and controlling

various financial activities (Bui and De Villiers, 2017). Alpha Financial Markets Consulting

firm adopts this technique. With the help of this techniques, its managers have improved their

efficiency in maintaining effective monitoring and developing their controlling measures

regarding all the financial activities of the firm. As this technique only focuses on the financial

performance of the business, they become more capable of monitoring and controlling numerous

financial inefficiencies of the firm and helping the company in effectively responding to each

and every financial problem of the company.

In this regard, by analysing each technique of management accounting system, it can be

evaluated that there are various techniques available in the management accounting system in

order to manage and control financial activities of the company. Key performance indicator can

be considered as the best technique as it helps in controlling each activity of the company

including manager's own performance. In this order, it helps in providing more efficiency of

controlling the overall business performance. On the other hand, other techniques may provide

negative results to the company, as adverse result may arise due to change in the economy of the

country rather than decline in the inefficiencies of business. Further, as financial governance

provides rules and guidelines regarding management of financial activities only, therefore, it may

also provide the negative results in case there is inefficiencies in any non financial activities of

the company.

CONCLUSION

From the above study it has been concluded that, MA is an effective process which helps

in strategic decision making by analysing the financial data for higher operational productivity.

This study also helps in determining various MA systems which helps in forecast the future,

value stock and controlling cost. It will further examine marginal and absorption costing

techniques. It will also conclude, MA reporting which helps management in giving clear picture

about the performance of the company. It will further evaluate, various budgetary tool which

helps in comparing the actual performance with the budgeted plan. Furthermore, this report will

compare financial problems of different organization using various MA tool and system for

higher results.

10

Financial governance is a technique that provides numerous rules and regulations

regarding monitoring and control of a range of financial activities performed by the business

organisation. This technique can be defined as the best technique of monitoring and controlling

various financial activities (Bui and De Villiers, 2017). Alpha Financial Markets Consulting

firm adopts this technique. With the help of this techniques, its managers have improved their

efficiency in maintaining effective monitoring and developing their controlling measures

regarding all the financial activities of the firm. As this technique only focuses on the financial

performance of the business, they become more capable of monitoring and controlling numerous

financial inefficiencies of the firm and helping the company in effectively responding to each

and every financial problem of the company.

In this regard, by analysing each technique of management accounting system, it can be

evaluated that there are various techniques available in the management accounting system in

order to manage and control financial activities of the company. Key performance indicator can

be considered as the best technique as it helps in controlling each activity of the company

including manager's own performance. In this order, it helps in providing more efficiency of

controlling the overall business performance. On the other hand, other techniques may provide

negative results to the company, as adverse result may arise due to change in the economy of the

country rather than decline in the inefficiencies of business. Further, as financial governance

provides rules and guidelines regarding management of financial activities only, therefore, it may

also provide the negative results in case there is inefficiencies in any non financial activities of

the company.

CONCLUSION

From the above study it has been concluded that, MA is an effective process which helps

in strategic decision making by analysing the financial data for higher operational productivity.

This study also helps in determining various MA systems which helps in forecast the future,

value stock and controlling cost. It will further examine marginal and absorption costing

techniques. It will also conclude, MA reporting which helps management in giving clear picture

about the performance of the company. It will further evaluate, various budgetary tool which

helps in comparing the actual performance with the budgeted plan. Furthermore, this report will

compare financial problems of different organization using various MA tool and system for

higher results.

10

REFERENCES

Books and Journals

Granlund, M. and Lukka, K., 2017. Investigating highly established research paradigms:

Reviving contextuality in contingency theory based management accounting

research. Critical Perspectives on Accounting. 45. pp.63-80.

Malmi, T., 2016. Managerialist studies in management accounting: 1990–2014. Management

Accounting Research. 31. pp.31-44.

Hall, M., 2016. Realising the richness of psychology theory in contingency-based management

accounting research. Management Accounting Research. 31. pp.63-74.

Tappura, S and et.al., 2015. A management accounting perspective on safety. Safety science. 71.

pp.151-159.

Turner, M.J and et.al., 2017. Hotel property performance: The role of strategic management

accounting. International Journal of Hospitality Management. 63. pp.33-43.

Bui, B. and De Villiers, C., 2017. Business strategies and management accounting in response to

climate change risk exposure and regulatory uncertainty. The British Accounting

Review. 49(1). pp.4-24.

Maas, K., Schaltegger, S. and Crutzen, N., 2016. Integrating corporate sustainability assessment,

management accounting, control, and reporting. Journal of Cleaner Production. 136.

pp.237-248.

Noreen, E.W., Brewer, P.C. and Garrison, R.H., 2011. Managerial accounting for managers.

McGraw-Hill Irwin.

Gooneratne, T.N. and Hoque, Z., 2016. Institutions, agency and the institutionalization of

budgetary control in a hybrid state-owned entity. Critical Perspectives on Accounting. 36.

pp.58-70.

Mohamed, I.A., Kerosi, E. and Tirimba, O.I., 2016. Analysis of the Effectiveness of Budgetary

Control Techniques on Organizational Performance at DaraSalaam Bank Headquarters in

Hargeisa Somaliland.

Barry, J. and Dent, M., 2017. New public management and the professions in the UK:

reconfiguring control?. In Questioning the New Public Management (pp. 7-20). Routledge.

Marina, N and et.al., 2016. Economic assessment and budgetary impact of a telemedicine

procedure and spirometry quality control in the primary care setting. Archivos de

Bronconeumología (English Edition). 52(1). pp.24-28.

Online

Zero-Based Budgeting (ZBB). 2019. [ONLINE]. Available

through:<https://www.investopedia.com/terms/z/zbb.asp>\

11

Books and Journals

Granlund, M. and Lukka, K., 2017. Investigating highly established research paradigms:

Reviving contextuality in contingency theory based management accounting

research. Critical Perspectives on Accounting. 45. pp.63-80.

Malmi, T., 2016. Managerialist studies in management accounting: 1990–2014. Management

Accounting Research. 31. pp.31-44.

Hall, M., 2016. Realising the richness of psychology theory in contingency-based management

accounting research. Management Accounting Research. 31. pp.63-74.

Tappura, S and et.al., 2015. A management accounting perspective on safety. Safety science. 71.

pp.151-159.

Turner, M.J and et.al., 2017. Hotel property performance: The role of strategic management

accounting. International Journal of Hospitality Management. 63. pp.33-43.

Bui, B. and De Villiers, C., 2017. Business strategies and management accounting in response to

climate change risk exposure and regulatory uncertainty. The British Accounting

Review. 49(1). pp.4-24.

Maas, K., Schaltegger, S. and Crutzen, N., 2016. Integrating corporate sustainability assessment,

management accounting, control, and reporting. Journal of Cleaner Production. 136.

pp.237-248.

Noreen, E.W., Brewer, P.C. and Garrison, R.H., 2011. Managerial accounting for managers.

McGraw-Hill Irwin.

Gooneratne, T.N. and Hoque, Z., 2016. Institutions, agency and the institutionalization of

budgetary control in a hybrid state-owned entity. Critical Perspectives on Accounting. 36.

pp.58-70.

Mohamed, I.A., Kerosi, E. and Tirimba, O.I., 2016. Analysis of the Effectiveness of Budgetary

Control Techniques on Organizational Performance at DaraSalaam Bank Headquarters in

Hargeisa Somaliland.

Barry, J. and Dent, M., 2017. New public management and the professions in the UK:

reconfiguring control?. In Questioning the New Public Management (pp. 7-20). Routledge.

Marina, N and et.al., 2016. Economic assessment and budgetary impact of a telemedicine

procedure and spirometry quality control in the primary care setting. Archivos de

Bronconeumología (English Edition). 52(1). pp.24-28.

Online

Zero-Based Budgeting (ZBB). 2019. [ONLINE]. Available

through:<https://www.investopedia.com/terms/z/zbb.asp>\

11

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.