Comprehensive Report on Management Accounting Systems & Techniques

VerifiedAdded on 2024/06/28

|25

|4784

|157

Report

AI Summary

This report provides a detailed analysis of management accounting systems and techniques, covering essential requirements, different types of reports, and the benefits of these systems within a business context. It includes explanations of absorption and marginal costing methods, preparation of income statements, break-even analysis, and margin of safety calculations. Furthermore, the report discusses planning tools for budgetary control, analyzes the adaptation of management accounting systems to respond to financial problems, and evaluates how planning tools can be used to solve these problems, leading the organization to sustainable success. The report emphasizes the integration of management accounting systems and reporting within an organization, highlighting their importance in effective decision-making and resource utilization. Desklib provides this document as a valuable resource for students studying management accounting, along with a wide range of study tools and solved assignments.

Management Accounting Systems &

Techniques

1

Techniques

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Introduction......................................................................................................................................4

Task 1.............................................................................................................................................. 5

A. Explain management accounting and give the essential requirements of different types of

management accounting systems to the chosen scenario giving examples.................................5

B. Explain different management accounting reports used by your chosen organization and

justify the importance of such reports to management................................................................7

C. Evaluate the benefits of the systems you have mentioned in A and how they are applied in

the given business context...........................................................................................................9

D. Critically evaluate how the management accounting systems and management accounting

reporting are integrated into your organization.........................................................................10

Task 2.............................................................................................................................................11

A- 1) Explain absorption costing and marginal costing methods..............................................11

A- 2) prepare an Income Statement based on the calculations of costs as per the information is

given above using both a) absorption costing method and b) marginal costing method...........12

B. a) breakeven units................................................................................................................. 13

B. b. breakeven sales in value....................................................................................................13

B. c. Units to be sold for 10000 profit.......................................................................................13

B. d. Calculation of margin of safety.........................................................................................13

C. Apply the range of management accounting techniques and produce appropriate financial

reporting documents accurately for the scenarios given in Task 2............................................14

D. Produce financial reports that accurately apply and interpret the data for the business

activities shown in the scenarios in Task 2 above.....................................................................15

2

Introduction......................................................................................................................................4

Task 1.............................................................................................................................................. 5

A. Explain management accounting and give the essential requirements of different types of

management accounting systems to the chosen scenario giving examples.................................5

B. Explain different management accounting reports used by your chosen organization and

justify the importance of such reports to management................................................................7

C. Evaluate the benefits of the systems you have mentioned in A and how they are applied in

the given business context...........................................................................................................9

D. Critically evaluate how the management accounting systems and management accounting

reporting are integrated into your organization.........................................................................10

Task 2.............................................................................................................................................11

A- 1) Explain absorption costing and marginal costing methods..............................................11

A- 2) prepare an Income Statement based on the calculations of costs as per the information is

given above using both a) absorption costing method and b) marginal costing method...........12

B. a) breakeven units................................................................................................................. 13

B. b. breakeven sales in value....................................................................................................13

B. c. Units to be sold for 10000 profit.......................................................................................13

B. d. Calculation of margin of safety.........................................................................................13

C. Apply the range of management accounting techniques and produce appropriate financial

reporting documents accurately for the scenarios given in Task 2............................................14

D. Produce financial reports that accurately apply and interpret the data for the business

activities shown in the scenarios in Task 2 above.....................................................................15

2

Task 3.............................................................................................................................................16

A. Explain the advantages and disadvantages of different types of planning tools for budgetary

control. Here, you should provide examples of at least two types of planning tool used for the

chosen organization...................................................................................................................16

B. Show the application of the planning tools for preparing, forecasting and analyzing budgets.

................................................................................................................................................... 18

C. Compare how your organization (Scenario chosen for the purpose) is different in adapting

management accounting systems to respond to financial problems. This should be supported

with examples and illustrations.................................................................................................19

D. Analyse how your management accounting techniques could respond to financial problems

and lead the organization to sustainable success.......................................................................21

E. Evaluate how planning tools could be used to solve financial problems and lead the

organization to sustainable success...........................................................................................22

Conclusion..................................................................................................................................... 23

References:.................................................................................................................................... 24

3

A. Explain the advantages and disadvantages of different types of planning tools for budgetary

control. Here, you should provide examples of at least two types of planning tool used for the

chosen organization...................................................................................................................16

B. Show the application of the planning tools for preparing, forecasting and analyzing budgets.

................................................................................................................................................... 18

C. Compare how your organization (Scenario chosen for the purpose) is different in adapting

management accounting systems to respond to financial problems. This should be supported

with examples and illustrations.................................................................................................19

D. Analyse how your management accounting techniques could respond to financial problems

and lead the organization to sustainable success.......................................................................21

E. Evaluate how planning tools could be used to solve financial problems and lead the

organization to sustainable success...........................................................................................22

Conclusion..................................................................................................................................... 23

References:.................................................................................................................................... 24

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Introduction

In the report which is to be presented all of the aspects which are there in relation to the

management accounting will be taken into consideration. In this various systems which are to be

used will be considered and with the help of them, the reporting will be made. The company will

be making various calculations in which the profit will be calculated and also the break-even

points will be identified with the determination of margin of safety. All the planning tools which

will be used for the proper attainment of the objectives will be considered. There will be a

determination of the financial problems which are faced and then the manner in which they will

be resolved will be considered so that it is possible for the entity to attain the sustainable success.

4

In the report which is to be presented all of the aspects which are there in relation to the

management accounting will be taken into consideration. In this various systems which are to be

used will be considered and with the help of them, the reporting will be made. The company will

be making various calculations in which the profit will be calculated and also the break-even

points will be identified with the determination of margin of safety. All the planning tools which

will be used for the proper attainment of the objectives will be considered. There will be a

determination of the financial problems which are faced and then the manner in which they will

be resolved will be considered so that it is possible for the entity to attain the sustainable success.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Task 1

Introduction:

The management accounting and the other aspects which are related to it will be discussed in the

report provided below. All of the importance and the systems will be considered by which

further reporting will be made possible.

A. Explain management accounting and give the essential requirements of different types

of management accounting systems to the chosen scenario giving examples.

Management accounting is the process which will be used by all the companies as it helps in the

completion of the operations in such a manner that the objectives of the company are attained. In

this, the data will be collected, interpreted and analyzed for the proper making of the decisions in

the company. By the help of them, all of the goals which have been set by them will be achieved.

In this, the various aspects which are there will be considered and for the inclusion of the

financial aspects, there will be the use of another technique which is a financial accounting

(Taipaleenmäki and Ikäheimo, 2013). With the help of that, it will be possible to include all of

the important information in the accounts so that it can be used for the carrying of various

processes. The information that will be needed will be collected with the help of the systems

which are available and the main are discussed below:

Cost accounting systems: This is the system which will be useful in reference to the cost which

is involved in the business. For that there will be required to identify the costs which are there

and they will be classified in the types which are basically two variable costs which will be

changing on the continuous basis with the deviation in the volume and the fixed expenses will be

the ones that remain same and no change will be made in them (Lopez-Valeiras, et. al., 2015).

The calculation of the same will be made with the help of various methods that are available and

that include normal costing in which the overheads will be based on the targets set and other

expenses on actual amounts. The standard costing will be used when the set standards will be

used and the actual costing will be used for the calculation of the actual cost which is incurred in

the business.

5

Introduction:

The management accounting and the other aspects which are related to it will be discussed in the

report provided below. All of the importance and the systems will be considered by which

further reporting will be made possible.

A. Explain management accounting and give the essential requirements of different types

of management accounting systems to the chosen scenario giving examples.

Management accounting is the process which will be used by all the companies as it helps in the

completion of the operations in such a manner that the objectives of the company are attained. In

this, the data will be collected, interpreted and analyzed for the proper making of the decisions in

the company. By the help of them, all of the goals which have been set by them will be achieved.

In this, the various aspects which are there will be considered and for the inclusion of the

financial aspects, there will be the use of another technique which is a financial accounting

(Taipaleenmäki and Ikäheimo, 2013). With the help of that, it will be possible to include all of

the important information in the accounts so that it can be used for the carrying of various

processes. The information that will be needed will be collected with the help of the systems

which are available and the main are discussed below:

Cost accounting systems: This is the system which will be useful in reference to the cost which

is involved in the business. For that there will be required to identify the costs which are there

and they will be classified in the types which are basically two variable costs which will be

changing on the continuous basis with the deviation in the volume and the fixed expenses will be

the ones that remain same and no change will be made in them (Lopez-Valeiras, et. al., 2015).

The calculation of the same will be made with the help of various methods that are available and

that include normal costing in which the overheads will be based on the targets set and other

expenses on actual amounts. The standard costing will be used when the set standards will be

used and the actual costing will be used for the calculation of the actual cost which is incurred in

the business.

5

Price optimization systems: In the company, the product will be provided by it to the

consumers at a certain rate and that is known as the price which is a very essential part of the

business. It is required that there shall be the appropriate price which shall be set so that the

profits are increased and also they are affordable for all. For that, the response of customers at

different prices will be analyzed and feedback will be obtained to take the further decisions about

price. The calculation will be made by using the various strategies which are there and for that

the company will be considering them such as the price skimming, cost-based, value-based and

various approaches.

Inventory management systems: The processes which are undertaken in the business required

the inventory and that shall be maintained in a proper manner and for that effective decision in

this respect shall be taken. The proper inventory management techniques shall be used such as

economic order quantity or just in time approach by which the required level of stock will be

managed. This will be ensuring that there is no wastage which is made and also shortage is not

faced. The valuation will be made in an appropriate manner so that proper recording in the

accounts is made possible and this will be with the help of methods such as weighted average,

FIFO, and LIFO.

6

consumers at a certain rate and that is known as the price which is a very essential part of the

business. It is required that there shall be the appropriate price which shall be set so that the

profits are increased and also they are affordable for all. For that, the response of customers at

different prices will be analyzed and feedback will be obtained to take the further decisions about

price. The calculation will be made by using the various strategies which are there and for that

the company will be considering them such as the price skimming, cost-based, value-based and

various approaches.

Inventory management systems: The processes which are undertaken in the business required

the inventory and that shall be maintained in a proper manner and for that effective decision in

this respect shall be taken. The proper inventory management techniques shall be used such as

economic order quantity or just in time approach by which the required level of stock will be

managed. This will be ensuring that there is no wastage which is made and also shortage is not

faced. The valuation will be made in an appropriate manner so that proper recording in the

accounts is made possible and this will be with the help of methods such as weighted average,

FIFO, and LIFO.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

B. Explain different management accounting reports used by your chosen organization and

justify the importance of such reports to management.

The company uses the information for various processes and that will be possible when proper

records will be maintained with the help of reporting. This will be essential for the management

and various types of reports which will be formulated are as follows:

Budget report: The Company is required to identify all of the incomes and expenses which will

have to be met by it in the coming period and for that, it is required that proper estimates shall be

made. All of the findings and the estimates which will be made will be recorded in the budget. In

that, they will be incorporated in such a manner that they will be followed by all and for that

proper implementation of the same will be made (Klychova, et. al., 2014). This will be the plan

which will be made and by the help of that it will be possible for the management to manage the

activities in such manner that no adverse impact is made and also proper utilization of the

resources will be made possible.

Variance report: The performance of the company does not remain constant and for that, it is

required that there shall be proper analyzation which shall be made and the deviations which are

involved will be identified with the help of that. The actual performance of the company will be

evaluated and will be further compared with the standards which are set so that the variance

which is present among them is identified (Glantz, et. al., 2016). This will be entered in the

report so that can be brought to the notice of management which will be considering it and

designing such process and actions that will be helping in the elimination of them and also the

budget for the coming period will be made after taking them in consideration.

Job cost report: The cost which is incurred in the company in respect of the several jobs will

have to be managed in a proper manner and for that, it will be identified. There will be the use of

this report so that all of the information in this respect can be entered at the one place (Sullivan,

2018). There will be the calculation of the total cost by considering all of the expenses which

have been incurred and that will then be allocated in such manner that the cost of each job can be

ascertained.

7

justify the importance of such reports to management.

The company uses the information for various processes and that will be possible when proper

records will be maintained with the help of reporting. This will be essential for the management

and various types of reports which will be formulated are as follows:

Budget report: The Company is required to identify all of the incomes and expenses which will

have to be met by it in the coming period and for that, it is required that proper estimates shall be

made. All of the findings and the estimates which will be made will be recorded in the budget. In

that, they will be incorporated in such a manner that they will be followed by all and for that

proper implementation of the same will be made (Klychova, et. al., 2014). This will be the plan

which will be made and by the help of that it will be possible for the management to manage the

activities in such manner that no adverse impact is made and also proper utilization of the

resources will be made possible.

Variance report: The performance of the company does not remain constant and for that, it is

required that there shall be proper analyzation which shall be made and the deviations which are

involved will be identified with the help of that. The actual performance of the company will be

evaluated and will be further compared with the standards which are set so that the variance

which is present among them is identified (Glantz, et. al., 2016). This will be entered in the

report so that can be brought to the notice of management which will be considering it and

designing such process and actions that will be helping in the elimination of them and also the

budget for the coming period will be made after taking them in consideration.

Job cost report: The cost which is incurred in the company in respect of the several jobs will

have to be managed in a proper manner and for that, it will be identified. There will be the use of

this report so that all of the information in this respect can be entered at the one place (Sullivan,

2018). There will be the calculation of the total cost by considering all of the expenses which

have been incurred and that will then be allocated in such manner that the cost of each job can be

ascertained.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The decision making of the company will be made strong with the help of these reports and so it

is very important that they are maintained in an appropriate manner. The data which will be used

in this will be the relevant and reliance can be placed on the same which will help in making the

best decisions.

8

is very important that they are maintained in an appropriate manner. The data which will be used

in this will be the relevant and reliance can be placed on the same which will help in making the

best decisions.

8

C. Evaluate the benefits of the systems you have mentioned in A and how they are applied

in the given business context.

The company will be using the systems which have been explained above and with the help of

them, it will be possible for it to attain several advantages. There will be making of the proper

plans by the help of this and also the decisions will be made in the more improved manner and

that will be making the whole process more relevant (Yalcin, 2012). The control system will be

made strong by which all of the expenses will be minimized and that will lead to a reduction in

the total cost. There will be an increase in the profits by this which will be making the business

more successful as the performance will be improved.

9

in the given business context.

The company will be using the systems which have been explained above and with the help of

them, it will be possible for it to attain several advantages. There will be making of the proper

plans by the help of this and also the decisions will be made in the more improved manner and

that will be making the whole process more relevant (Yalcin, 2012). The control system will be

made strong by which all of the expenses will be minimized and that will lead to a reduction in

the total cost. There will be an increase in the profits by this which will be making the business

more successful as the performance will be improved.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

D. Critically evaluate how the management accounting systems and management

accounting reporting are integrated into your organization.

The processes which are involved in the management accounting are interlinked and there is the

need to identify that. The systems and the reports which are used in the process are integrated

and this is due to various reasons. There will be a requirement of both in the entity as the reports

will be formulated by the use of the systems which will be providing them with the information

that is needed to make the report (Dekker, 2016). There are various types of the data which is

needed and that will be collected from several departments and this will be making them get

integrated with all others and also with the organization to make the process successful.

10

accounting reporting are integrated into your organization.

The processes which are involved in the management accounting are interlinked and there is the

need to identify that. The systems and the reports which are used in the process are integrated

and this is due to various reasons. There will be a requirement of both in the entity as the reports

will be formulated by the use of the systems which will be providing them with the information

that is needed to make the report (Dekker, 2016). There are various types of the data which is

needed and that will be collected from several departments and this will be making them get

integrated with all others and also with the organization to make the process successful.

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Task 2

A- 1) Explain absorption costing and marginal costing methods.

The cost can be ascertained with the use of various methods and with the help of them it will be

possible for the company to determine the profits as the income statement will be made. They are

explained below:

Absorption costing: This is the technique which is used in the business and with the help of this

the cost will be ascertained. There will be proper allocation which will be made under this of all

the expenses which are there and the cost will be ascertained after considering all of this. There

will be consideration of all the variable and fixed expenses under this. The company will be

making the use of this so that income statement is developed in such aa manner that proper profit

is determined.

Marginal costing: The Company will be using this and in this, only the variable aspects of the

cost will be considered. There will be no allocation of the fixed cost that has been incurred. The

contribution will be identified by the reduction of variable amounts only (Maria, 2017). In this,

the profit will be obtained after reducing all of the fixed cost and there will be no apportionment

of them which will be making the profit to be different.

11

A- 1) Explain absorption costing and marginal costing methods.

The cost can be ascertained with the use of various methods and with the help of them it will be

possible for the company to determine the profits as the income statement will be made. They are

explained below:

Absorption costing: This is the technique which is used in the business and with the help of this

the cost will be ascertained. There will be proper allocation which will be made under this of all

the expenses which are there and the cost will be ascertained after considering all of this. There

will be consideration of all the variable and fixed expenses under this. The company will be

making the use of this so that income statement is developed in such aa manner that proper profit

is determined.

Marginal costing: The Company will be using this and in this, only the variable aspects of the

cost will be considered. There will be no allocation of the fixed cost that has been incurred. The

contribution will be identified by the reduction of variable amounts only (Maria, 2017). In this,

the profit will be obtained after reducing all of the fixed cost and there will be no apportionment

of them which will be making the profit to be different.

11

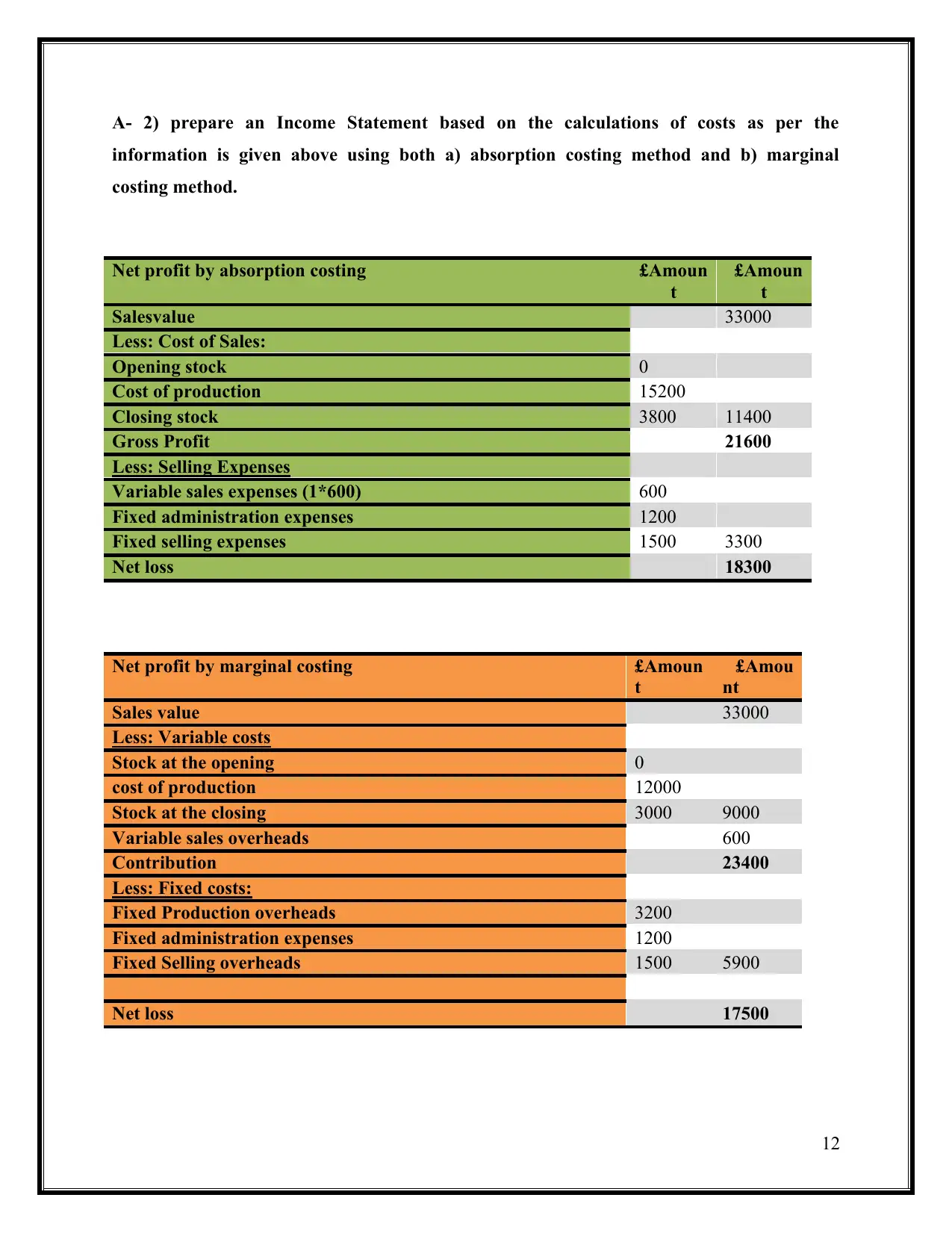

A- 2) prepare an Income Statement based on the calculations of costs as per the

information is given above using both a) absorption costing method and b) marginal

costing method.

Net profit by absorption costing £Amoun

t

£Amoun

t

Salesvalue 33000

Less: Cost of Sales:

Opening stock 0

Cost of production 15200

Closing stock 3800 11400

Gross Profit 21600

Less: Selling Expenses

Variable sales expenses (1*600) 600

Fixed administration expenses 1200

Fixed selling expenses 1500 3300

Net loss 18300

Net profit by marginal costing £Amoun

t

£Amou

nt

Sales value 33000

Less: Variable costs

Stock at the opening 0

cost of production 12000

Stock at the closing 3000 9000

Variable sales overheads 600

Contribution 23400

Less: Fixed costs:

Fixed Production overheads 3200

Fixed administration expenses 1200

Fixed Selling overheads 1500 5900

Net loss 17500

12

information is given above using both a) absorption costing method and b) marginal

costing method.

Net profit by absorption costing £Amoun

t

£Amoun

t

Salesvalue 33000

Less: Cost of Sales:

Opening stock 0

Cost of production 15200

Closing stock 3800 11400

Gross Profit 21600

Less: Selling Expenses

Variable sales expenses (1*600) 600

Fixed administration expenses 1200

Fixed selling expenses 1500 3300

Net loss 18300

Net profit by marginal costing £Amoun

t

£Amou

nt

Sales value 33000

Less: Variable costs

Stock at the opening 0

cost of production 12000

Stock at the closing 3000 9000

Variable sales overheads 600

Contribution 23400

Less: Fixed costs:

Fixed Production overheads 3200

Fixed administration expenses 1200

Fixed Selling overheads 1500 5900

Net loss 17500

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 25

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.