Analysis of Management Accounting Systems and Financial Problems

VerifiedAdded on 2020/10/22

|14

|4476

|372

AI Summary

The assignment is based on the topic of management accounting systems and financial problems. It requires students to analyze different approaches and techniques used in managing financial information, including material flow cost accounting, design of experiments, and fundamental analysis research. The assignment also covers corporate social responsibility reporting, intellectual capital reporting, and the relationship between innovation capability and performance.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

TASK 1............................................................................................................................................1

P1 Management accounting system............................................................................................1

P2 Different types management accounting reports ..................................................................4

TASK 2............................................................................................................................................6

P3 Break even analysis ...............................................................................................................6

TASK 3............................................................................................................................................7

TASK 4............................................................................................................................................8

P4 Comparison of organization to adopting management accounting system to resolve

financial issues............................................................................................................................8

CONCLUSION..............................................................................................................................10

REFERENCES..............................................................................................................................11

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

TASK 1............................................................................................................................................1

P1 Management accounting system............................................................................................1

P2 Different types management accounting reports ..................................................................4

TASK 2............................................................................................................................................6

P3 Break even analysis ...............................................................................................................6

TASK 3............................................................................................................................................7

TASK 4............................................................................................................................................8

P4 Comparison of organization to adopting management accounting system to resolve

financial issues............................................................................................................................8

CONCLUSION..............................................................................................................................10

REFERENCES..............................................................................................................................11

INTRODUCTION

Management accounting is a process of accounting that are helping to organisation to

giving financial and non financial information for growth of the business. On the basis of these

information business taking effective decisions. (Abdelhak, Grostick, and Hanken, 2014). It is

also known as cost accounting and managerial accounting. Periodic reports of the company

shows as a result of management accounting that will be using by managers and CEO. In this

report taking company ever joy enterprises that is UK based company, who operates in

entertainment and leisure industry in the UK is consulting with Boston consulting group on

writing a reference manual for their management accounting department.

In this report covers several tasks and that are related to management accounting system.

Task first related to definition of management accounting system and different methods of

management accounting reporting. In task two, calculate cost with the help of appropriate cost

techniques. In task three, identify different planning tools of budgetary control, and also identify

advantages and disadvantages. In task four, adopting management accounting syatem for solving

financial problems.

MAIN BODY

TASK 1

P1 Management accounting system

It is describe as process of the company for operating company costs and analysing to

provide accurate financial records, accounts and reports to aid manager decision making process

in achieving business objectives and goals. It is the act of making sense of costing and financial

data and translating that data into useful information for officers and managements within an

organizations (Baker, 2014).

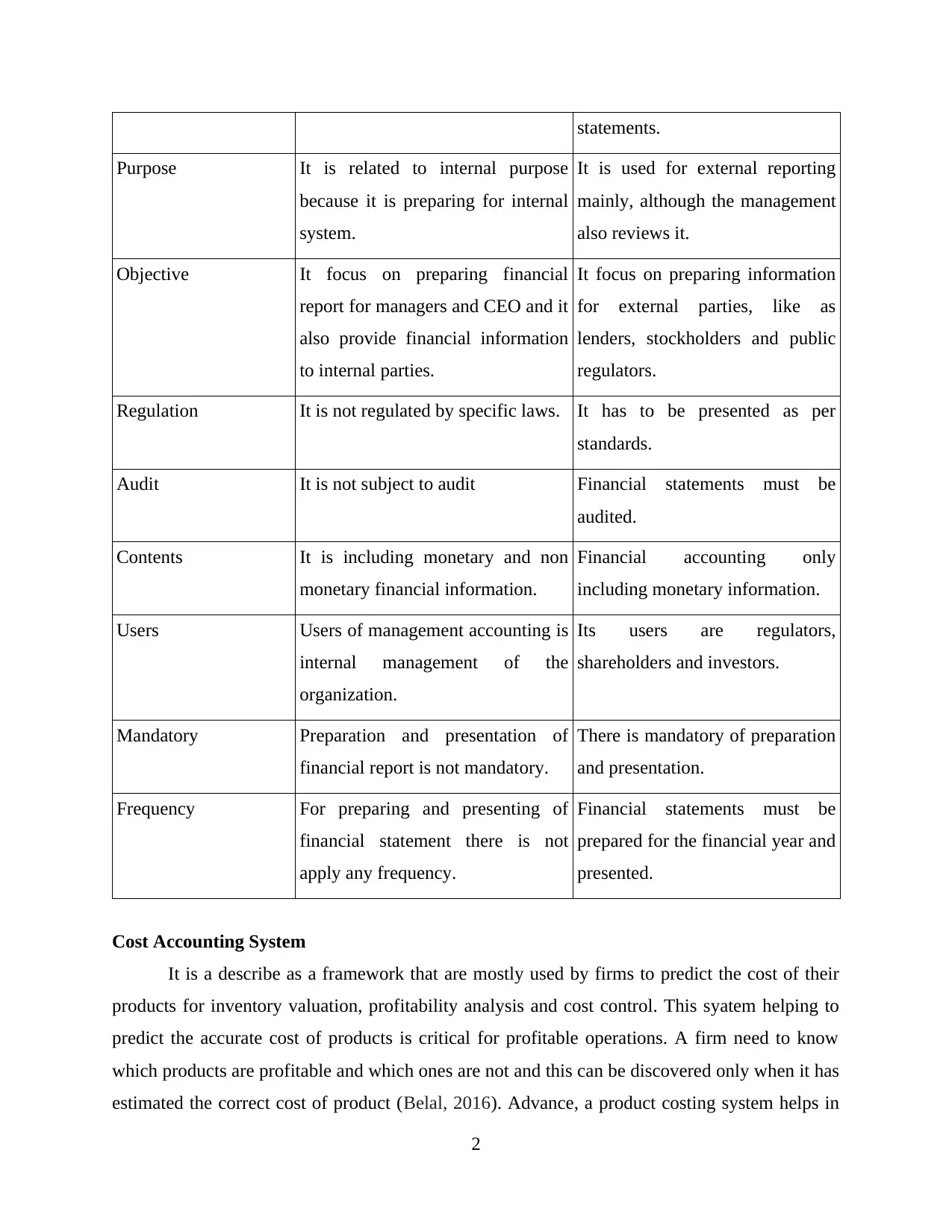

Difference between management accounting and financial accounting

Basis Management accounting Financial accounting

Meaning It is the process of preparing and

providing management accounts

and reports to the management for

taking appropriate decision.

It is a branch of accounting that

keeps track of a company's

financial transaction, recorded and

presentation of financial

1

Management accounting is a process of accounting that are helping to organisation to

giving financial and non financial information for growth of the business. On the basis of these

information business taking effective decisions. (Abdelhak, Grostick, and Hanken, 2014). It is

also known as cost accounting and managerial accounting. Periodic reports of the company

shows as a result of management accounting that will be using by managers and CEO. In this

report taking company ever joy enterprises that is UK based company, who operates in

entertainment and leisure industry in the UK is consulting with Boston consulting group on

writing a reference manual for their management accounting department.

In this report covers several tasks and that are related to management accounting system.

Task first related to definition of management accounting system and different methods of

management accounting reporting. In task two, calculate cost with the help of appropriate cost

techniques. In task three, identify different planning tools of budgetary control, and also identify

advantages and disadvantages. In task four, adopting management accounting syatem for solving

financial problems.

MAIN BODY

TASK 1

P1 Management accounting system

It is describe as process of the company for operating company costs and analysing to

provide accurate financial records, accounts and reports to aid manager decision making process

in achieving business objectives and goals. It is the act of making sense of costing and financial

data and translating that data into useful information for officers and managements within an

organizations (Baker, 2014).

Difference between management accounting and financial accounting

Basis Management accounting Financial accounting

Meaning It is the process of preparing and

providing management accounts

and reports to the management for

taking appropriate decision.

It is a branch of accounting that

keeps track of a company's

financial transaction, recorded and

presentation of financial

1

statements.

Purpose It is related to internal purpose

because it is preparing for internal

system.

It is used for external reporting

mainly, although the management

also reviews it.

Objective It focus on preparing financial

report for managers and CEO and it

also provide financial information

to internal parties.

It focus on preparing information

for external parties, like as

lenders, stockholders and public

regulators.

Regulation It is not regulated by specific laws. It has to be presented as per

standards.

Audit It is not subject to audit Financial statements must be

audited.

Contents It is including monetary and non

monetary financial information.

Financial accounting only

including monetary information.

Users Users of management accounting is

internal management of the

organization.

Its users are regulators,

shareholders and investors.

Mandatory Preparation and presentation of

financial report is not mandatory.

There is mandatory of preparation

and presentation.

Frequency For preparing and presenting of

financial statement there is not

apply any frequency.

Financial statements must be

prepared for the financial year and

presented.

Cost Accounting System

It is a describe as a framework that are mostly used by firms to predict the cost of their

products for inventory valuation, profitability analysis and cost control. This syatem helping to

predict the accurate cost of products is critical for profitable operations. A firm need to know

which products are profitable and which ones are not and this can be discovered only when it has

estimated the correct cost of product (Belal, 2016). Advance, a product costing system helps in

2

Purpose It is related to internal purpose

because it is preparing for internal

system.

It is used for external reporting

mainly, although the management

also reviews it.

Objective It focus on preparing financial

report for managers and CEO and it

also provide financial information

to internal parties.

It focus on preparing information

for external parties, like as

lenders, stockholders and public

regulators.

Regulation It is not regulated by specific laws. It has to be presented as per

standards.

Audit It is not subject to audit Financial statements must be

audited.

Contents It is including monetary and non

monetary financial information.

Financial accounting only

including monetary information.

Users Users of management accounting is

internal management of the

organization.

Its users are regulators,

shareholders and investors.

Mandatory Preparation and presentation of

financial report is not mandatory.

There is mandatory of preparation

and presentation.

Frequency For preparing and presenting of

financial statement there is not

apply any frequency.

Financial statements must be

prepared for the financial year and

presented.

Cost Accounting System

It is a describe as a framework that are mostly used by firms to predict the cost of their

products for inventory valuation, profitability analysis and cost control. This syatem helping to

predict the accurate cost of products is critical for profitable operations. A firm need to know

which products are profitable and which ones are not and this can be discovered only when it has

estimated the correct cost of product (Belal, 2016). Advance, a product costing system helps in

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

estimating the closing value of inventory materials, work in process and finished goods inventory

for the purpose of financial statement preparation. This system works by following raw materials

as they go through the production levels and slowly turn into finished goods in actual time. Its

approach is applicable to all kinds of business, whether it is trading and manufacturing products

or whether it is delivering services.

Inventory management systems

It is the combination of technology because for management of inventory management

system need to software and hardware (Berry, Broadbent, and Otley, 2016). Both technologies

are useful in the company to monitor of stock in the companies and these are dividing into raw

material, work in progress and finished goods. Practically, it means a business can see the small

moving parts of its operations, allowing it to make better investments and decisions. Different

inventory managers focus on different parts of the supply chain, though small businesses are

usually more interested in the ordering and sales end of the chain. With the help of inventory

management system identifying of all types inventories items like as assets, barcode and labels.

Job Costing System

A job costing system including of the process of collect information about the costs

connected with a particular service or production job. This contents may be needful in order to

state the cost data to a customer under a declaration where costs are return. The information is

also useful for determinant the accuracy of a company's calculating system, which should be able

to quote prices that allow for a sensible profit (Chompu-Inwai, Jaimjit and Premsuriyanunt,

2015). These informations are are using to recognise of cost of manufacturing goods. For proper

understand of job costing system using these information are following as-

Direct materials – The job costing system must be able to track the cost of materials that are

used or scrapped during the course of the job.

Direct labour – The job cost accounting system must track the cost of the labour used on a job.

If a job related to services, direct labour may comprise nearly all of the job cost.

Overhead – The job costing system assigns overhead costs to one or more cost pools. At the end

of each accounting period, the total amount in each cost pool is assigned to the several open jobs

based on some allocation methodology.

Price optimization system

3

for the purpose of financial statement preparation. This system works by following raw materials

as they go through the production levels and slowly turn into finished goods in actual time. Its

approach is applicable to all kinds of business, whether it is trading and manufacturing products

or whether it is delivering services.

Inventory management systems

It is the combination of technology because for management of inventory management

system need to software and hardware (Berry, Broadbent, and Otley, 2016). Both technologies

are useful in the company to monitor of stock in the companies and these are dividing into raw

material, work in progress and finished goods. Practically, it means a business can see the small

moving parts of its operations, allowing it to make better investments and decisions. Different

inventory managers focus on different parts of the supply chain, though small businesses are

usually more interested in the ordering and sales end of the chain. With the help of inventory

management system identifying of all types inventories items like as assets, barcode and labels.

Job Costing System

A job costing system including of the process of collect information about the costs

connected with a particular service or production job. This contents may be needful in order to

state the cost data to a customer under a declaration where costs are return. The information is

also useful for determinant the accuracy of a company's calculating system, which should be able

to quote prices that allow for a sensible profit (Chompu-Inwai, Jaimjit and Premsuriyanunt,

2015). These informations are are using to recognise of cost of manufacturing goods. For proper

understand of job costing system using these information are following as-

Direct materials – The job costing system must be able to track the cost of materials that are

used or scrapped during the course of the job.

Direct labour – The job cost accounting system must track the cost of the labour used on a job.

If a job related to services, direct labour may comprise nearly all of the job cost.

Overhead – The job costing system assigns overhead costs to one or more cost pools. At the end

of each accounting period, the total amount in each cost pool is assigned to the several open jobs

based on some allocation methodology.

Price optimization system

3

Price optimization system mention to a process of characteristic that level of price which

is optimal. In different words, it precise setting sensible level of amount that a customer is

willing and able to pay for goods as well as for services. Ingredient that impact price

optimization are degree of competition, market demand and manufacturing costs etc. ever joy

enterprises should not set prices of goods at too much higher level and neither at too much low

level. Because, if prices will be broad then no one will buy and if prices will be low then profit

margin would be low (De Silva, Stratford, and Clark, 2014). For this, price optimization model

has been developed which calculates fluctuation of demand in conformity with change in cost

levels.

P2 Different types management accounting reports

In order to arrange management accounting system, reports are necessarily need to be

prepared. These reports of accounting are used for planning, regulating, performance

measurement and decision making. Management accounting reports are a important part of

making sure that have a absolute picture of how business execute. A broad report of accounting

are produced to every situation of the company that are view of finance relating to company.

Many times it is difficult to maintain for small and medium size companies because they are not

properly apply strategies related to this reports. Management accounting reporting mainly done

to know about overall level of performance of ever joy enterprises. There is no demand of

writing management accounting reports in a specific similar format (Ge and Kim, 2014). These

reports related to different departments of organisation that are presented to situation of business,

they are as follows -

Budget Reports – Accounting reports are relating of budgets are important part of organisation

because it will using for measuring company performance and are make as a whole for small

businesses and department wise, for large organizations. However, each company creates an

overall budget to understand the grand scheme of their business. A budget estimate made based

on previous experiences, though a great budget always caters for unforeseen circumstances that

might arise.

Accounts receivable reports – Business relies heavily on extending credit, then account

receivable aging reports are essential to it. Breaking down the remaining balances of clients into

particular time periods allows managers to identify the defaulters as well as find issues in the

company collection process.

4

is optimal. In different words, it precise setting sensible level of amount that a customer is

willing and able to pay for goods as well as for services. Ingredient that impact price

optimization are degree of competition, market demand and manufacturing costs etc. ever joy

enterprises should not set prices of goods at too much higher level and neither at too much low

level. Because, if prices will be broad then no one will buy and if prices will be low then profit

margin would be low (De Silva, Stratford, and Clark, 2014). For this, price optimization model

has been developed which calculates fluctuation of demand in conformity with change in cost

levels.

P2 Different types management accounting reports

In order to arrange management accounting system, reports are necessarily need to be

prepared. These reports of accounting are used for planning, regulating, performance

measurement and decision making. Management accounting reports are a important part of

making sure that have a absolute picture of how business execute. A broad report of accounting

are produced to every situation of the company that are view of finance relating to company.

Many times it is difficult to maintain for small and medium size companies because they are not

properly apply strategies related to this reports. Management accounting reporting mainly done

to know about overall level of performance of ever joy enterprises. There is no demand of

writing management accounting reports in a specific similar format (Ge and Kim, 2014). These

reports related to different departments of organisation that are presented to situation of business,

they are as follows -

Budget Reports – Accounting reports are relating of budgets are important part of organisation

because it will using for measuring company performance and are make as a whole for small

businesses and department wise, for large organizations. However, each company creates an

overall budget to understand the grand scheme of their business. A budget estimate made based

on previous experiences, though a great budget always caters for unforeseen circumstances that

might arise.

Accounts receivable reports – Business relies heavily on extending credit, then account

receivable aging reports are essential to it. Breaking down the remaining balances of clients into

particular time periods allows managers to identify the defaulters as well as find issues in the

company collection process.

4

Cost accounting reports – Managerial accounting calculate the costs of articles that are

produced. All overheads, raw material costs, labour and any added costs are taken into

accomplishment. A cost report providing a summary of all of this information. This report offers

managers the capability to realize the cost prices of items versus their selling prices. Profit

amount are approximation and monitored through these reports have a clear picture of all the

costs.

Performance reports – It created to appraisal the performance of a company as a whole as well

as for each employee at the ending of a period. Divisional execution reports are also create in

large organizations. Managers use these performance reports to prepare key strategic decisions

about the future of the organization. Individuals are frequently awarding for their loyalty to the

organization and under performing artist are laid off or dealt with as necessitate. Performance

affiliated to managerial accounting reports also offer heavy perception into the working of a

company (Growe and et. al., 2014).

Sales report - Sales reports are helpful for management accounting because they display the

sources of company's incomes, highlighting which approach are least and most successful. Sales

reports detail which of business state earn the most revenue, such as wholesale versus retail

sales, or sales at particular accounts or venues. They can also appearance which of sales people

are create the most and the least income, liberal the basis for awarding bonuses and adjusting

staffing.

Financial report - Financial reports are sometimes reasoned to be a different carnal from

managerial accounting, traditional financial reports also provide useful information to help to

interpret company operations. Profit and loss statement presents how much company has earned

and spent overall, Classifying these numbers for identify and summarizing how much profit

have earned. Balance sheet concise how much company owes and how much it earns. This

information is useful for managerial accounting because it shows how profits and losses have

displace over time, and how much of company's net worth takes the kind of liquid cash that's

acquirable for operations.

Sound accounting System

Building an accounting program that protects the financial unity of a business depends on

the request of a few key principles. These are known as internal controls. The term internal

control usually brings to mind control of fraud. However this is only one aspect of controls in

5

produced. All overheads, raw material costs, labour and any added costs are taken into

accomplishment. A cost report providing a summary of all of this information. This report offers

managers the capability to realize the cost prices of items versus their selling prices. Profit

amount are approximation and monitored through these reports have a clear picture of all the

costs.

Performance reports – It created to appraisal the performance of a company as a whole as well

as for each employee at the ending of a period. Divisional execution reports are also create in

large organizations. Managers use these performance reports to prepare key strategic decisions

about the future of the organization. Individuals are frequently awarding for their loyalty to the

organization and under performing artist are laid off or dealt with as necessitate. Performance

affiliated to managerial accounting reports also offer heavy perception into the working of a

company (Growe and et. al., 2014).

Sales report - Sales reports are helpful for management accounting because they display the

sources of company's incomes, highlighting which approach are least and most successful. Sales

reports detail which of business state earn the most revenue, such as wholesale versus retail

sales, or sales at particular accounts or venues. They can also appearance which of sales people

are create the most and the least income, liberal the basis for awarding bonuses and adjusting

staffing.

Financial report - Financial reports are sometimes reasoned to be a different carnal from

managerial accounting, traditional financial reports also provide useful information to help to

interpret company operations. Profit and loss statement presents how much company has earned

and spent overall, Classifying these numbers for identify and summarizing how much profit

have earned. Balance sheet concise how much company owes and how much it earns. This

information is useful for managerial accounting because it shows how profits and losses have

displace over time, and how much of company's net worth takes the kind of liquid cash that's

acquirable for operations.

Sound accounting System

Building an accounting program that protects the financial unity of a business depends on

the request of a few key principles. These are known as internal controls. The term internal

control usually brings to mind control of fraud. However this is only one aspect of controls in

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

accounting system. The others are efficient and effective operations, believable reporting,

compliance with applicable regulations and laws.

Need – Businesses are adopting sound accounting systems if their bookkeeping and accounting

systems are reliable, able to produce updated and accurate financial information. Sound

accounting helps in proper budgeting so that businesses can plan accordingly. This helps in the

growth of business and accounting was created in response to the development of commerce and

trade.

Importance of the department producing timely,accurate and relevant information –

Accurate, reliable and timely information is vital to effective decision making in almost every

aspect of human endeavour, whether it be undertaken by individuals, governments Businesses

and community organizations. It is an essential component of any effort to persuade

governments, individuals and businesses to make different decisions from the once which they

might make in the absence of particular pieces of information. And it is an integral part of any

attempt to hold those who make decisions accountable for they consequences of the decisions

which they make (Horngren, and Harrison, 2015).

TASK 2

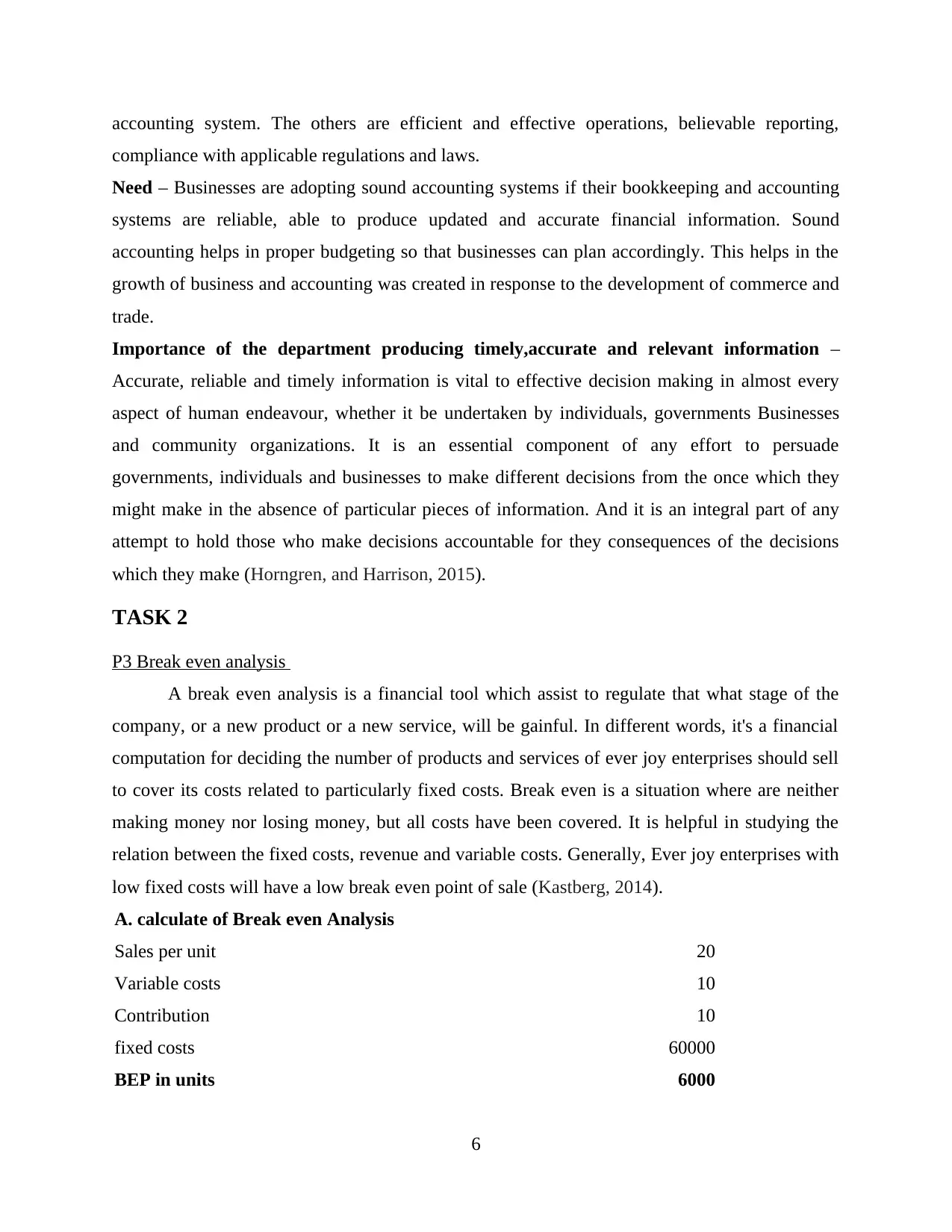

P3 Break even analysis

A break even analysis is a financial tool which assist to regulate that what stage of the

company, or a new product or a new service, will be gainful. In different words, it's a financial

computation for deciding the number of products and services of ever joy enterprises should sell

to cover its costs related to particularly fixed costs. Break even is a situation where are neither

making money nor losing money, but all costs have been covered. It is helpful in studying the

relation between the fixed costs, revenue and variable costs. Generally, Ever joy enterprises with

low fixed costs will have a low break even point of sale (Kastberg, 2014).

A. calculate of Break even Analysis

Sales per unit 20

Variable costs 10

Contribution 10

fixed costs 60000

BEP in units 6000

6

compliance with applicable regulations and laws.

Need – Businesses are adopting sound accounting systems if their bookkeeping and accounting

systems are reliable, able to produce updated and accurate financial information. Sound

accounting helps in proper budgeting so that businesses can plan accordingly. This helps in the

growth of business and accounting was created in response to the development of commerce and

trade.

Importance of the department producing timely,accurate and relevant information –

Accurate, reliable and timely information is vital to effective decision making in almost every

aspect of human endeavour, whether it be undertaken by individuals, governments Businesses

and community organizations. It is an essential component of any effort to persuade

governments, individuals and businesses to make different decisions from the once which they

might make in the absence of particular pieces of information. And it is an integral part of any

attempt to hold those who make decisions accountable for they consequences of the decisions

which they make (Horngren, and Harrison, 2015).

TASK 2

P3 Break even analysis

A break even analysis is a financial tool which assist to regulate that what stage of the

company, or a new product or a new service, will be gainful. In different words, it's a financial

computation for deciding the number of products and services of ever joy enterprises should sell

to cover its costs related to particularly fixed costs. Break even is a situation where are neither

making money nor losing money, but all costs have been covered. It is helpful in studying the

relation between the fixed costs, revenue and variable costs. Generally, Ever joy enterprises with

low fixed costs will have a low break even point of sale (Kastberg, 2014).

A. calculate of Break even Analysis

Sales per unit 20

Variable costs 10

Contribution 10

fixed costs 60000

BEP in units 6000

6

B. Calculation for getting desire profit 30,000

Profit 30000

fixed costs 60000

Add – Contribution 90000

Contribution per unit 10

Sales 9000

C. Calculation of profit on 8000 sales

Sales 160000

Variable costs 80000

Contribution 80000

Less – Fixed costs 60000

Profit 20000

TASK 3

Budget – A budget is a formal statement that are helping to estimate income and expenses of the

company. On the basis of this achieve goals and objectives for future time period. In different

words, a budget is a document that management makes to estimate the revenues and expenses for

an upcoming period based on their goals for the business. The important thing to remember is

these budgets are really just the management's future goals and plans for the business written

down in financial form.

Budgetary control – Budgetary control is the process of determining various actual results with

budgeted results for the enterprises to controlling costs which includes the preparation of

budgets, coordinating the departments and establishing responsibilities, comparing actual

performance with the budgeted and acting upon results to achieve maximum profitability.

Budgetary control as planning in advance of the various functions of a business so that the

business as a whole is controlled (Mio, 2016).

Forecasting tool

It is an important part for preparing plan of action for business and using as method for

approximation of future direction that are affected to Ever joy enterprises by analysis of active

7

Profit 30000

fixed costs 60000

Add – Contribution 90000

Contribution per unit 10

Sales 9000

C. Calculation of profit on 8000 sales

Sales 160000

Variable costs 80000

Contribution 80000

Less – Fixed costs 60000

Profit 20000

TASK 3

Budget – A budget is a formal statement that are helping to estimate income and expenses of the

company. On the basis of this achieve goals and objectives for future time period. In different

words, a budget is a document that management makes to estimate the revenues and expenses for

an upcoming period based on their goals for the business. The important thing to remember is

these budgets are really just the management's future goals and plans for the business written

down in financial form.

Budgetary control – Budgetary control is the process of determining various actual results with

budgeted results for the enterprises to controlling costs which includes the preparation of

budgets, coordinating the departments and establishing responsibilities, comparing actual

performance with the budgeted and acting upon results to achieve maximum profitability.

Budgetary control as planning in advance of the various functions of a business so that the

business as a whole is controlled (Mio, 2016).

Forecasting tool

It is an important part for preparing plan of action for business and using as method for

approximation of future direction that are affected to Ever joy enterprises by analysis of active

7

data. With the help of budgetary control, companies using this planning tool for deciding

expenses of each budget related to all departments. In the end of this forecasting tool, after data

determination and analysis of expectation (Muniesa, 2014). Now verify standard results and

actual results of the company.

Advantage – This tool helping to the company for collect financial information and on the basis

of this company taking effective decision.

Disadvantage – Mainly this tool provides qualitative estimation that are may be right or may be

wrong so it will be effect to company in future.

Scenario tool

Scenario tool using to help in budgetary control because it defines several find out of ever

joy enterprises. Purpose of this system is to put together number of applicant future results that

different from most usually recognized scenario. So Ever joy enterprises can evolve occurrence

plans to deal with different sets of future scenario.

Advantage - This planning tool helping to organizations for taking appropriate decisions, to save

time, to reduce risk and maximum profit. It also face several doubts that are included different

department that are using techniques for taking effective decision making regarding to future

time period.

Disadvantage – This tool exactly not define future situations of the company that will always

helping to future growth.

Contingency tool

This tool provide timely and accurately areas of ever joy enterprises. It will helping to

estimate market strategies that are any time effect to market (Romney and Steinbart, 2015). So

aware from these suddenly changes need to prepare another plan that are helping to over come

critical situations.

Advantage – This tool helping to assess all types situations related to business and market. It is

designed to advance predict situations are coming in future and may be effected to growth of the

business. With the help of this tool prepare effective strategies that are apply on Ever joy

enterprises in future. These strategies are helping to change management according to that and

integrate globalization.

Disadvantage – Contingency tool complex to apply in the management because it is easy to

estimate but according to that prepare strategies and applying in Ever joy enterprises is not easy.

8

expenses of each budget related to all departments. In the end of this forecasting tool, after data

determination and analysis of expectation (Muniesa, 2014). Now verify standard results and

actual results of the company.

Advantage – This tool helping to the company for collect financial information and on the basis

of this company taking effective decision.

Disadvantage – Mainly this tool provides qualitative estimation that are may be right or may be

wrong so it will be effect to company in future.

Scenario tool

Scenario tool using to help in budgetary control because it defines several find out of ever

joy enterprises. Purpose of this system is to put together number of applicant future results that

different from most usually recognized scenario. So Ever joy enterprises can evolve occurrence

plans to deal with different sets of future scenario.

Advantage - This planning tool helping to organizations for taking appropriate decisions, to save

time, to reduce risk and maximum profit. It also face several doubts that are included different

department that are using techniques for taking effective decision making regarding to future

time period.

Disadvantage – This tool exactly not define future situations of the company that will always

helping to future growth.

Contingency tool

This tool provide timely and accurately areas of ever joy enterprises. It will helping to

estimate market strategies that are any time effect to market (Romney and Steinbart, 2015). So

aware from these suddenly changes need to prepare another plan that are helping to over come

critical situations.

Advantage – This tool helping to assess all types situations related to business and market. It is

designed to advance predict situations are coming in future and may be effected to growth of the

business. With the help of this tool prepare effective strategies that are apply on Ever joy

enterprises in future. These strategies are helping to change management according to that and

integrate globalization.

Disadvantage – Contingency tool complex to apply in the management because it is easy to

estimate but according to that prepare strategies and applying in Ever joy enterprises is not easy.

8

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

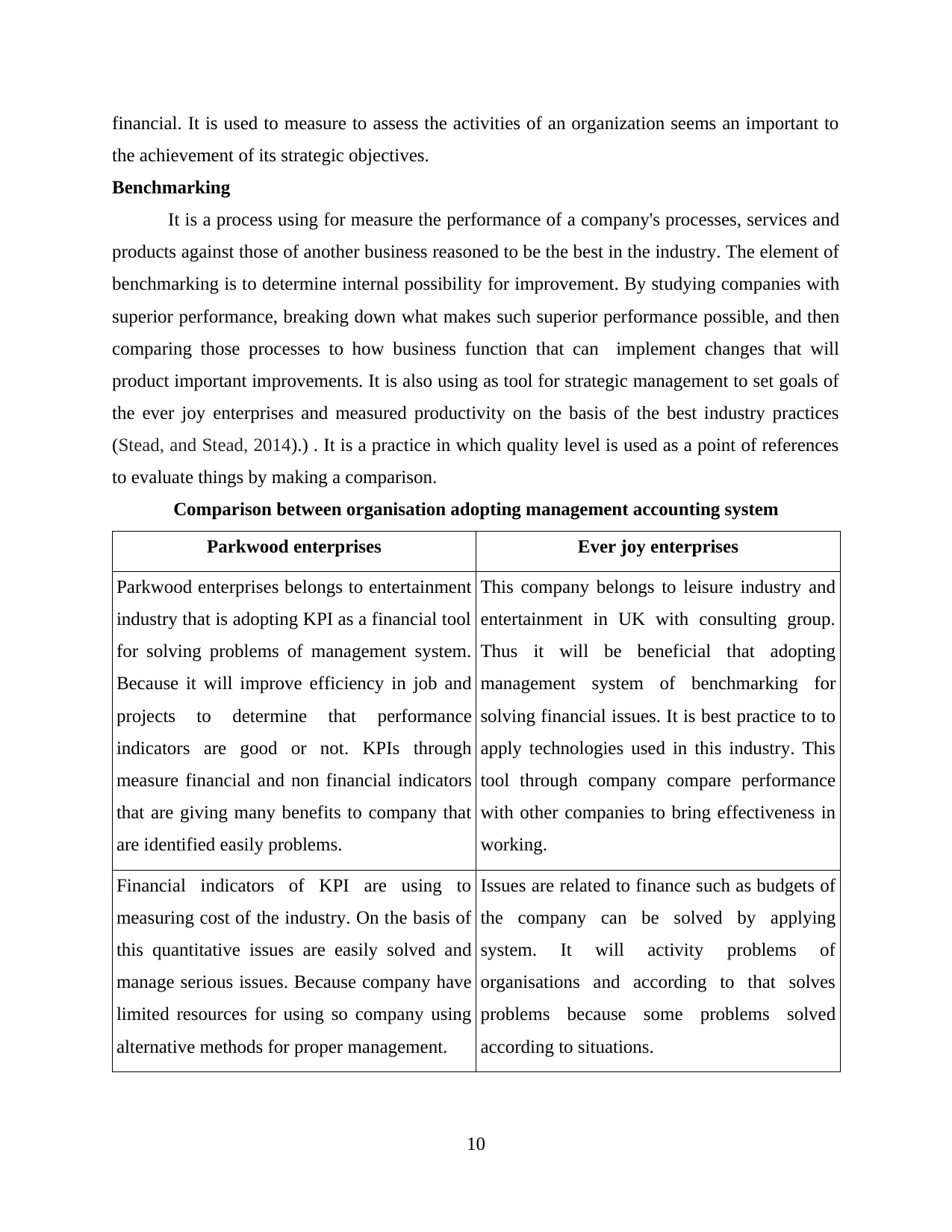

TASK 4

P4 Comparison of organization to adopting management accounting system to resolve financial

issues

Financial issues are related with organizations are defined as monetary issues that can

create stress. Management is always careful about these financial problems because it creates big

problems for the organisations (Saunila, Pekkola, and Ukko,2014). These problems effected like

that improper taxation strategies, inadequacy in working capital and insufficient collateral etc.

so, when ever joy enterprises adopting system of management accounting then it finds ways to

solve these above mentioned issues. Management accounting systems are as following-

KPI

The key performance indicators (KPIs) are one of the most over used and little

understood terms in business management and development. They are too often taken to mean

any metric or data used to measure business performance. It is used as business metrics by

managers and corporate executives to analyse and track factors deemed crucial to the success of

an organization. Effective KPIs focus on the business functions and processes that senior

management sees as most important for measuring progress toward meeting strategic goals and

performance targets (Zeff, 2016). There are two types, financial indicators and non financial

indicators. This tool aids in resolving financial issues like as inefficiency in identifying less and

more profitable areas in a way that it finds key points to organizational success. This can be done

through KPIs as it contributes in meeting performance objectives.

Financial Indicators – Financial KPIs are generally based on financial statement such as Balance

sheet components and income statement and may also report changes in sales growth by

customer segments, channel and product families or in expenses categories. For measure

performance variety of areas, from marketing to HR to finance. Financial performance is

essential to long term success that are including financial indicators such as gross profit margin,

net profit margin, net profit, current ratio, Aging accounts receivables (KPIs financial tools,

2018).

Non financial indicators – Non KPIs consider of measures indicators associate with customer

relationship, operations, cycle time, employees, quality and the organisation's supply chain or its

pipeline. Some people prefer to use the term of non financial performance rather than to extra

financial, suggesting that all measures that contribute to organisational success are ultimately

9

P4 Comparison of organization to adopting management accounting system to resolve financial

issues

Financial issues are related with organizations are defined as monetary issues that can

create stress. Management is always careful about these financial problems because it creates big

problems for the organisations (Saunila, Pekkola, and Ukko,2014). These problems effected like

that improper taxation strategies, inadequacy in working capital and insufficient collateral etc.

so, when ever joy enterprises adopting system of management accounting then it finds ways to

solve these above mentioned issues. Management accounting systems are as following-

KPI

The key performance indicators (KPIs) are one of the most over used and little

understood terms in business management and development. They are too often taken to mean

any metric or data used to measure business performance. It is used as business metrics by

managers and corporate executives to analyse and track factors deemed crucial to the success of

an organization. Effective KPIs focus on the business functions and processes that senior

management sees as most important for measuring progress toward meeting strategic goals and

performance targets (Zeff, 2016). There are two types, financial indicators and non financial

indicators. This tool aids in resolving financial issues like as inefficiency in identifying less and

more profitable areas in a way that it finds key points to organizational success. This can be done

through KPIs as it contributes in meeting performance objectives.

Financial Indicators – Financial KPIs are generally based on financial statement such as Balance

sheet components and income statement and may also report changes in sales growth by

customer segments, channel and product families or in expenses categories. For measure

performance variety of areas, from marketing to HR to finance. Financial performance is

essential to long term success that are including financial indicators such as gross profit margin,

net profit margin, net profit, current ratio, Aging accounts receivables (KPIs financial tools,

2018).

Non financial indicators – Non KPIs consider of measures indicators associate with customer

relationship, operations, cycle time, employees, quality and the organisation's supply chain or its

pipeline. Some people prefer to use the term of non financial performance rather than to extra

financial, suggesting that all measures that contribute to organisational success are ultimately

9

financial. It is used to measure to assess the activities of an organization seems an important to

the achievement of its strategic objectives.

Benchmarking

It is a process using for measure the performance of a company's processes, services and

products against those of another business reasoned to be the best in the industry. The element of

benchmarking is to determine internal possibility for improvement. By studying companies with

superior performance, breaking down what makes such superior performance possible, and then

comparing those processes to how business function that can implement changes that will

product important improvements. It is also using as tool for strategic management to set goals of

the ever joy enterprises and measured productivity on the basis of the best industry practices

(Stead, and Stead, 2014).) . It is a practice in which quality level is used as a point of references

to evaluate things by making a comparison.

Comparison between organisation adopting management accounting system

Parkwood enterprises Ever joy enterprises

Parkwood enterprises belongs to entertainment

industry that is adopting KPI as a financial tool

for solving problems of management system.

Because it will improve efficiency in job and

projects to determine that performance

indicators are good or not. KPIs through

measure financial and non financial indicators

that are giving many benefits to company that

are identified easily problems.

This company belongs to leisure industry and

entertainment in UK with consulting group.

Thus it will be beneficial that adopting

management system of benchmarking for

solving financial issues. It is best practice to to

apply technologies used in this industry. This

tool through company compare performance

with other companies to bring effectiveness in

working.

Financial indicators of KPI are using to

measuring cost of the industry. On the basis of

this quantitative issues are easily solved and

manage serious issues. Because company have

limited resources for using so company using

alternative methods for proper management.

Issues are related to finance such as budgets of

the company can be solved by applying

system. It will activity problems of

organisations and according to that solves

problems because some problems solved

according to situations.

10

the achievement of its strategic objectives.

Benchmarking

It is a process using for measure the performance of a company's processes, services and

products against those of another business reasoned to be the best in the industry. The element of

benchmarking is to determine internal possibility for improvement. By studying companies with

superior performance, breaking down what makes such superior performance possible, and then

comparing those processes to how business function that can implement changes that will

product important improvements. It is also using as tool for strategic management to set goals of

the ever joy enterprises and measured productivity on the basis of the best industry practices

(Stead, and Stead, 2014).) . It is a practice in which quality level is used as a point of references

to evaluate things by making a comparison.

Comparison between organisation adopting management accounting system

Parkwood enterprises Ever joy enterprises

Parkwood enterprises belongs to entertainment

industry that is adopting KPI as a financial tool

for solving problems of management system.

Because it will improve efficiency in job and

projects to determine that performance

indicators are good or not. KPIs through

measure financial and non financial indicators

that are giving many benefits to company that

are identified easily problems.

This company belongs to leisure industry and

entertainment in UK with consulting group.

Thus it will be beneficial that adopting

management system of benchmarking for

solving financial issues. It is best practice to to

apply technologies used in this industry. This

tool through company compare performance

with other companies to bring effectiveness in

working.

Financial indicators of KPI are using to

measuring cost of the industry. On the basis of

this quantitative issues are easily solved and

manage serious issues. Because company have

limited resources for using so company using

alternative methods for proper management.

Issues are related to finance such as budgets of

the company can be solved by applying

system. It will activity problems of

organisations and according to that solves

problems because some problems solved

according to situations.

10

CONCLUSION

From above the discussion, in this report concluded that management accounting

important part of ever joy enterprises for effective management and improve to their financial

conditions. Although, it is not necessarily to be adopted but internal stakeholders remains

satisfied as well as informed about overall performance of the organisation. Different types of

management accounting reports prepare by manger for solving problems and for support to

business operations. Break even analysis using for calculating profit and sales of the

organisation. Planning tools for budgetary control are evaluated to assist in process of forecasting

and preparation of budget. Therefore comparison between two organisation to understand utility

to adopting different management accounting systems and to solve financial problems.

11

From above the discussion, in this report concluded that management accounting

important part of ever joy enterprises for effective management and improve to their financial

conditions. Although, it is not necessarily to be adopted but internal stakeholders remains

satisfied as well as informed about overall performance of the organisation. Different types of

management accounting reports prepare by manger for solving problems and for support to

business operations. Break even analysis using for calculating profit and sales of the

organisation. Planning tools for budgetary control are evaluated to assist in process of forecasting

and preparation of budget. Therefore comparison between two organisation to understand utility

to adopting different management accounting systems and to solve financial problems.

11

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books and Journals

Abdelhak, M., Grostick, S. and Hanken, M. A., 2014. Health Information-E-Book: Management

of a Strategic Resource. Elsevier Health Sciences.

Baker, R., 2014. Qualitative research in accounting: the North American perspective. Qualitative

Research in Accounting & Management. 11(4). pp.278-285.

Belal, A. R., 2016. Corporate social responsibility reporting in developing countries: The case

of Bangladesh. Routledge.

Berry, A. J., Broadbent, J. and Otley, D. T. eds., 2016. Management control: theories, issues and

practices. Macmillan International Higher Education.

Chompu-Inwai, R., Jaimjit, B. and Premsuriyanunt, P., 2015. A combination of Material Flow

Cost Accounting and design of experiments techniques in an SME: the case of a wood

products manufacturing company in northern Thailand. Journal of Cleaner Production.

108. pp.1352-1364.

De Silva, T. A., Stratford, M. and Clark, M., 2014. Intellectual capital reporting: a longitudinal

study of New Zealand companies. Journal of Intellectual Capital. 15(1). pp.157-172.

Ge, W. and Kim, J. B., 2014. Real earnings management and the cost of new corporate bonds.

Journal of Business Research. 67(4). pp.641-647.

Growe, G. and et.al., 2014. The profitability and performance measurement of US regional banks

using the predictive focus of the “fundamental analysis research”. In Advances in

Management Accounting (pp. 189-237). Emerald Group Publishing Limited.

Horngren, C. and Harrison, W., 2015. ACCOUNTING: BSB110. Pearson Higher Education AU.

Kastberg, G., 2014. Framing shared services: Accounting, control and overflows. Critical

perspectives on accounting. 25(8). pp.743-756.

Mio, C. ed., 2016. Integrated reporting: A new accounting disclosure. Springer.

Muniesa, F., 2014. The provoked economy: Economic reality and the performative turn.

Routledge.

Romney, M. B. and Steinbart, P. J., 2015. Accounting information systems. Boston, MA:

Pearson.

Saunila, M., Pekkola, S. and Ukko, J., 2014. The relationship between innovation capability and

performance: The moderating effect of measurement. International Journal of

Productivity and Performance Management. 63(2). pp.234-249.

Stead, J. G. and Stead, W. E., 2014. Sustainable strategic management. Routledge.

Zeff, S. A., 2016. Forging accounting principles in five countries: A history and an analysis of

trends. Routledge.

Online

KPIs financial tools. 2018. [Online] Available through:

<https://www.cgma.org/resources/tools/essential-tools/kpis.html>

12

Books and Journals

Abdelhak, M., Grostick, S. and Hanken, M. A., 2014. Health Information-E-Book: Management

of a Strategic Resource. Elsevier Health Sciences.

Baker, R., 2014. Qualitative research in accounting: the North American perspective. Qualitative

Research in Accounting & Management. 11(4). pp.278-285.

Belal, A. R., 2016. Corporate social responsibility reporting in developing countries: The case

of Bangladesh. Routledge.

Berry, A. J., Broadbent, J. and Otley, D. T. eds., 2016. Management control: theories, issues and

practices. Macmillan International Higher Education.

Chompu-Inwai, R., Jaimjit, B. and Premsuriyanunt, P., 2015. A combination of Material Flow

Cost Accounting and design of experiments techniques in an SME: the case of a wood

products manufacturing company in northern Thailand. Journal of Cleaner Production.

108. pp.1352-1364.

De Silva, T. A., Stratford, M. and Clark, M., 2014. Intellectual capital reporting: a longitudinal

study of New Zealand companies. Journal of Intellectual Capital. 15(1). pp.157-172.

Ge, W. and Kim, J. B., 2014. Real earnings management and the cost of new corporate bonds.

Journal of Business Research. 67(4). pp.641-647.

Growe, G. and et.al., 2014. The profitability and performance measurement of US regional banks

using the predictive focus of the “fundamental analysis research”. In Advances in

Management Accounting (pp. 189-237). Emerald Group Publishing Limited.

Horngren, C. and Harrison, W., 2015. ACCOUNTING: BSB110. Pearson Higher Education AU.

Kastberg, G., 2014. Framing shared services: Accounting, control and overflows. Critical

perspectives on accounting. 25(8). pp.743-756.

Mio, C. ed., 2016. Integrated reporting: A new accounting disclosure. Springer.

Muniesa, F., 2014. The provoked economy: Economic reality and the performative turn.

Routledge.

Romney, M. B. and Steinbart, P. J., 2015. Accounting information systems. Boston, MA:

Pearson.

Saunila, M., Pekkola, S. and Ukko, J., 2014. The relationship between innovation capability and

performance: The moderating effect of measurement. International Journal of

Productivity and Performance Management. 63(2). pp.234-249.

Stead, J. G. and Stead, W. E., 2014. Sustainable strategic management. Routledge.

Zeff, S. A., 2016. Forging accounting principles in five countries: A history and an analysis of

trends. Routledge.

Online

KPIs financial tools. 2018. [Online] Available through:

<https://www.cgma.org/resources/tools/essential-tools/kpis.html>

12

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.