Management Accounting Report: Jeffrey and Sons, Semester 1

VerifiedAdded on 2020/01/15

|20

|5194

|130

Report

AI Summary

This report delves into the core concepts of management accounting, offering a detailed analysis of cost classifications, job costing, and absorption costing techniques. It meticulously calculates job costs for a specific scenario, demonstrating the application of different costing methods. The report then explores absorption costing, including the allocation of overheads and the calculation of overhead absorption rates, ultimately analyzing the impact of different allocation bases. Furthermore, the report constructs and analyzes a cost report, identifying variances, their causes, and potential corrective actions. Key performance indicators are discussed, along with methods to reduce costs and enhance product quality. The report also examines the budgeting process, proposing suitable budgeting methods for Jeffrey and Sons, and prepares production and material budgets, as well as a cash budget. Finally, it addresses variance analysis, preparing an operating statement and providing recommendations for improvement, all within the context of a manufacturing organization named Jeffrey and Sons, aiming to achieve its organizational goals.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

1.1 Types of cost classification....................................................................................................1

1.2 Calculation of job costs.........................................................................................................2

1.3 Absorption costing technique................................................................................................3

1.4 Analysing the cost data..........................................................................................................5

Task 2...............................................................................................................................................6

2.1 Preparation and analysis of cost report..................................................................................6

2.2 Performance indicator for areas of improvements.................................................................7

2.3 Methods to reduce the cost, improve quality.........................................................................8

Task 3...............................................................................................................................................9

3.1 Budgeting process..................................................................................................................9

3.2 Budgeting methods for Jeffrey and Sons.............................................................................10

3.3 Preparation of production and material budget...................................................................11

3.4 Preparation of cash budget...................................................................................................12

Task 4.............................................................................................................................................13

4.1 Identify variances, its causes and taking corrective actions................................................13

4.2 Preparation of operating statement......................................................................................14

4.3 Report the findings..............................................................................................................15

CONCLUSION..............................................................................................................................15

REFERENCES..............................................................................................................................16

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

1.1 Types of cost classification....................................................................................................1

1.2 Calculation of job costs.........................................................................................................2

1.3 Absorption costing technique................................................................................................3

1.4 Analysing the cost data..........................................................................................................5

Task 2...............................................................................................................................................6

2.1 Preparation and analysis of cost report..................................................................................6

2.2 Performance indicator for areas of improvements.................................................................7

2.3 Methods to reduce the cost, improve quality.........................................................................8

Task 3...............................................................................................................................................9

3.1 Budgeting process..................................................................................................................9

3.2 Budgeting methods for Jeffrey and Sons.............................................................................10

3.3 Preparation of production and material budget...................................................................11

3.4 Preparation of cash budget...................................................................................................12

Task 4.............................................................................................................................................13

4.1 Identify variances, its causes and taking corrective actions................................................13

4.2 Preparation of operating statement......................................................................................14

4.3 Report the findings..............................................................................................................15

CONCLUSION..............................................................................................................................15

REFERENCES..............................................................................................................................16

List of tables

Table 1: Classification of Costs.......................................................................................................1

Table 2: Calculation of unit cost and total job cost for job 444......................................................2

Table 3: Allocation of overheads to the production department.....................................................3

Table 4: Reapportioning the service or support department costs to the production departments..4

Table 5: Calculation of Overhead Absorption Rates.......................................................................5

Table 6: Calculation of overhead charge.........................................................................................5

Table 7: Calculation of overhead absorption rates using labour hours as a basis...........................5

Table 8: Calculation of cost.............................................................................................................5

Table 9: Calculation of Actual Costs for business...........................................................................6

Table 10: The difference between the highest and lowest costs......................................................6

Table 11: Cost Report......................................................................................................................6

Table 12: Production budget of Jeffrey & Son's............................................................................11

Table 13: Material purchase budget of Jeffrey & Son's................................................................12

Table 14: Cash Budget...................................................................................................................12

Table 15: Calculation of variances................................................................................................13

Table 16; Operating Statement......................................................................................................14

Table 1: Classification of Costs.......................................................................................................1

Table 2: Calculation of unit cost and total job cost for job 444......................................................2

Table 3: Allocation of overheads to the production department.....................................................3

Table 4: Reapportioning the service or support department costs to the production departments..4

Table 5: Calculation of Overhead Absorption Rates.......................................................................5

Table 6: Calculation of overhead charge.........................................................................................5

Table 7: Calculation of overhead absorption rates using labour hours as a basis...........................5

Table 8: Calculation of cost.............................................................................................................5

Table 9: Calculation of Actual Costs for business...........................................................................6

Table 10: The difference between the highest and lowest costs......................................................6

Table 11: Cost Report......................................................................................................................6

Table 12: Production budget of Jeffrey & Son's............................................................................11

Table 13: Material purchase budget of Jeffrey & Son's................................................................12

Table 14: Cash Budget...................................................................................................................12

Table 15: Calculation of variances................................................................................................13

Table 16; Operating Statement......................................................................................................14

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Management accounting is a branch of accounting which helps in taking different types

of managerial decisions for the company. The interpretation of figures assists in adopting

strategic actions. The purpose of this research study is to analyse the cost information within the

business. It shows the impact of budgeting process on the organization (Jorgensen, Patrick and

Soderstrom, 2012). Further the development of cost reduction and management procedures are

also shown. The report shows how the data is collected, compiled and evaluated. The whole

information is processed to make it useful for the business managers. At last the report will end

in investigating the process of budgetary planning and control. The study is in context with a

manufacturing organization named Jeffrey and Sons. It will discuss all the various management

accounting practices and technique for achieving the organizational goals.

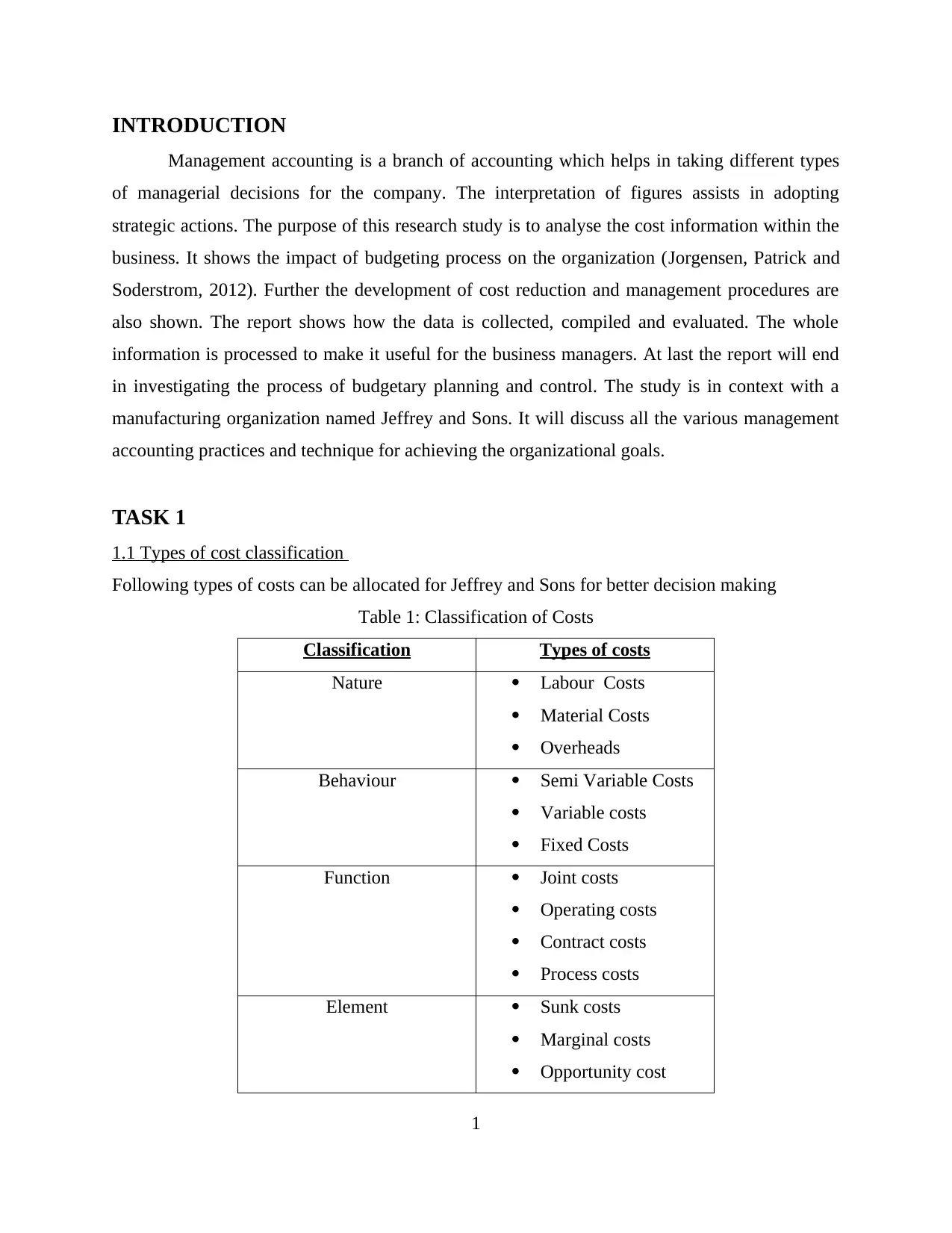

TASK 1

1.1 Types of cost classification

Following types of costs can be allocated for Jeffrey and Sons for better decision making

Table 1: Classification of Costs

Classification Types of costs

Nature Labour Costs

Material Costs

Overheads

Behaviour Semi Variable Costs

Variable costs

Fixed Costs

Function Joint costs

Operating costs

Contract costs

Process costs

Element Sunk costs

Marginal costs

Opportunity cost

1

Management accounting is a branch of accounting which helps in taking different types

of managerial decisions for the company. The interpretation of figures assists in adopting

strategic actions. The purpose of this research study is to analyse the cost information within the

business. It shows the impact of budgeting process on the organization (Jorgensen, Patrick and

Soderstrom, 2012). Further the development of cost reduction and management procedures are

also shown. The report shows how the data is collected, compiled and evaluated. The whole

information is processed to make it useful for the business managers. At last the report will end

in investigating the process of budgetary planning and control. The study is in context with a

manufacturing organization named Jeffrey and Sons. It will discuss all the various management

accounting practices and technique for achieving the organizational goals.

TASK 1

1.1 Types of cost classification

Following types of costs can be allocated for Jeffrey and Sons for better decision making

Table 1: Classification of Costs

Classification Types of costs

Nature Labour Costs

Material Costs

Overheads

Behaviour Semi Variable Costs

Variable costs

Fixed Costs

Function Joint costs

Operating costs

Contract costs

Process costs

Element Sunk costs

Marginal costs

Opportunity cost

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Differential cost

Normal costs

Material cost – These are the expenses related to the production of Exquisite product for

the business. For example it includes raw material, material for produced finished goods

etc.

Labour cost – The costs is allocated on the basis of hours, days and months. It includes

wages, salary given to the employees for the amount of goods that they have served

(Kaplan and Atkinson, 2015).

Direct and indirect cost – The direct expenses can be traced directly to a particular cost

center or cost object such as department, process and product. It includes costs such as

wages, cement etc. Indirect costs are the expenses which are not allocated in appropriate

manner to the specified objects (Mohapatra, 2015). It includes expenses such as

insurance, depreciation etc.

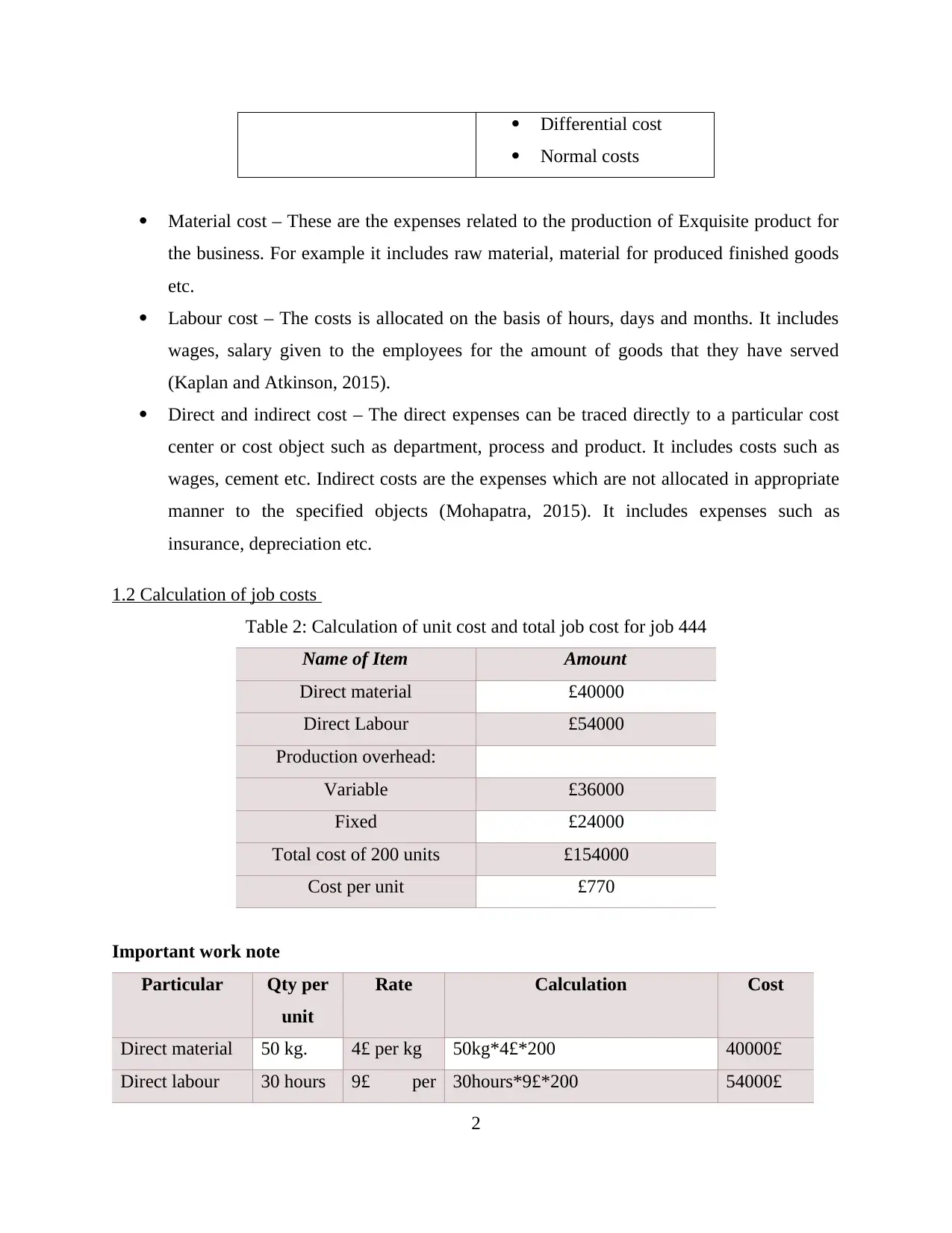

1.2 Calculation of job costs

Table 2: Calculation of unit cost and total job cost for job 444

Name of Item Amount

Direct material £40000

Direct Labour £54000

Production overhead:

Variable £36000

Fixed £24000

Total cost of 200 units £154000

Cost per unit £770

Important work note

Particular Qty per

unit

Rate Calculation Cost

Direct material 50 kg. 4£ per kg 50kg*4£*200 40000£

Direct labour 30 hours 9£ per 30hours*9£*200 54000£

2

Normal costs

Material cost – These are the expenses related to the production of Exquisite product for

the business. For example it includes raw material, material for produced finished goods

etc.

Labour cost – The costs is allocated on the basis of hours, days and months. It includes

wages, salary given to the employees for the amount of goods that they have served

(Kaplan and Atkinson, 2015).

Direct and indirect cost – The direct expenses can be traced directly to a particular cost

center or cost object such as department, process and product. It includes costs such as

wages, cement etc. Indirect costs are the expenses which are not allocated in appropriate

manner to the specified objects (Mohapatra, 2015). It includes expenses such as

insurance, depreciation etc.

1.2 Calculation of job costs

Table 2: Calculation of unit cost and total job cost for job 444

Name of Item Amount

Direct material £40000

Direct Labour £54000

Production overhead:

Variable £36000

Fixed £24000

Total cost of 200 units £154000

Cost per unit £770

Important work note

Particular Qty per

unit

Rate Calculation Cost

Direct material 50 kg. 4£ per kg 50kg*4£*200 40000£

Direct labour 30 hours 9£ per 30hours*9£*200 54000£

2

hour

Variable

production

overhead

30 hours 6£ per

hour

30 hours*6£*200 36000£

Fixed

production

overhead

(80000£)/(20000

hours)*(30*200)

24000£

Cost per unit (154000£)/(200 Units) 770£

Following costing method will be used for Jeffrey and Sons

Job costing technique – Under this approach costs is charged according to the expenditure

incurred for a particular job. Job cost sheet are created in order to allocate and segment the

expenses. It helps in performing identification for the costs. For Jeffrey and Sons it is the most

appropriate technique as the company is having many departments for work (Fisher and

Krumwiede, 2015). According to the given condition, cost data have been provided for job no.

444 that manufactures 200 units. Under this sheet, material costs, labor costs, variable and fixed

costs are needed for producing 200 units of products.

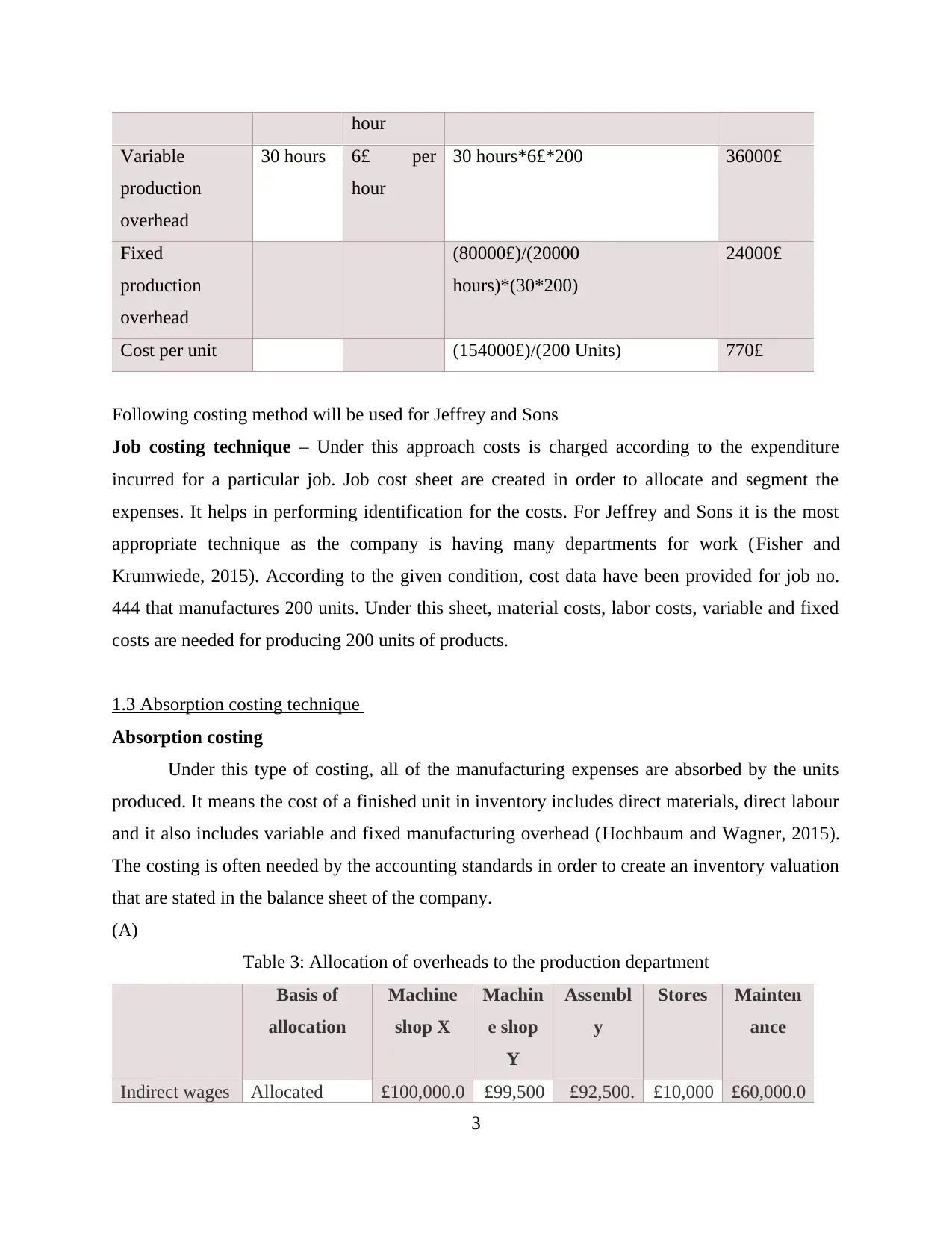

1.3 Absorption costing technique

Absorption costing

Under this type of costing, all of the manufacturing expenses are absorbed by the units

produced. It means the cost of a finished unit in inventory includes direct materials, direct labour

and it also includes variable and fixed manufacturing overhead (Hochbaum and Wagner, 2015).

The costing is often needed by the accounting standards in order to create an inventory valuation

that are stated in the balance sheet of the company.

(A)

Table 3: Allocation of overheads to the production department

Basis of

allocation

Machine

shop X

Machin

e shop

Y

Assembl

y

Stores Mainten

ance

Indirect wages Allocated £100,000.0 £99,500 £92,500. £10,000 £60,000.0

3

Variable

production

overhead

30 hours 6£ per

hour

30 hours*6£*200 36000£

Fixed

production

overhead

(80000£)/(20000

hours)*(30*200)

24000£

Cost per unit (154000£)/(200 Units) 770£

Following costing method will be used for Jeffrey and Sons

Job costing technique – Under this approach costs is charged according to the expenditure

incurred for a particular job. Job cost sheet are created in order to allocate and segment the

expenses. It helps in performing identification for the costs. For Jeffrey and Sons it is the most

appropriate technique as the company is having many departments for work (Fisher and

Krumwiede, 2015). According to the given condition, cost data have been provided for job no.

444 that manufactures 200 units. Under this sheet, material costs, labor costs, variable and fixed

costs are needed for producing 200 units of products.

1.3 Absorption costing technique

Absorption costing

Under this type of costing, all of the manufacturing expenses are absorbed by the units

produced. It means the cost of a finished unit in inventory includes direct materials, direct labour

and it also includes variable and fixed manufacturing overhead (Hochbaum and Wagner, 2015).

The costing is often needed by the accounting standards in order to create an inventory valuation

that are stated in the balance sheet of the company.

(A)

Table 3: Allocation of overheads to the production department

Basis of

allocation

Machine

shop X

Machin

e shop

Y

Assembl

y

Stores Mainten

ance

Indirect wages Allocated £100,000.0 £99,500 £92,500. £10,000 £60,000.0

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

and

supervision

0 .00 00 .00 0

Indirect

materials

Allocated £100,000.0

0

£100,00

0.00

£40,000.

00

£4,000.

00

£9,000.00

Light and

heating

Area occupied £10,000.00 £5,000.

00

£15,000.

00

£15,000

.00

£5,000.00

Rent Area Occupied £20,000.00 £10,000

.00

£30,000.

00

£30,000

.00

£10,000.0

0

Insurance and

machinery

Machinery

book value

£7,947.02 £4,966.

89

£993.38 £496.69 £596.03

Depreciation

of machinery

Machinery

book value

£79,470.20 £49,668

.87

£9,933.7

7

£4,966.

89

£5,960.26

Insurance of

building

Area occupied £5,000.00 £2,500.

00

£7,500.0

0

£7,500.

00

£2,500.00

Salaries of

works

management

Number of

employees

£24,000.00 £16,000

.00

£24,000.

00

£8,000.

00

£8,000.00

Total cost of

overhead

£346,417.0

2

£287,63

6.00

£219,927

.00

£79,964

.00

£101,056.

00

(B)

Table 4: Reapportioning the service or support department costs to the production departments

Particular Basis Machine X Machine Y Assembly

Primary

Distribution

As Stated

Earlier

346417.02£ 287636£ 219927£

Stores

Department

Direct material

(4:3:1)

39982£ 29987£ 9995£

Maintenance

Department

Maintenance

machine hours

(12:8:5)

48506.88£ 32337.92£ 20211.2£

Total cost 434905.9£ 349960.92£ 250133.2£

4

supervision

0 .00 00 .00 0

Indirect

materials

Allocated £100,000.0

0

£100,00

0.00

£40,000.

00

£4,000.

00

£9,000.00

Light and

heating

Area occupied £10,000.00 £5,000.

00

£15,000.

00

£15,000

.00

£5,000.00

Rent Area Occupied £20,000.00 £10,000

.00

£30,000.

00

£30,000

.00

£10,000.0

0

Insurance and

machinery

Machinery

book value

£7,947.02 £4,966.

89

£993.38 £496.69 £596.03

Depreciation

of machinery

Machinery

book value

£79,470.20 £49,668

.87

£9,933.7

7

£4,966.

89

£5,960.26

Insurance of

building

Area occupied £5,000.00 £2,500.

00

£7,500.0

0

£7,500.

00

£2,500.00

Salaries of

works

management

Number of

employees

£24,000.00 £16,000

.00

£24,000.

00

£8,000.

00

£8,000.00

Total cost of

overhead

£346,417.0

2

£287,63

6.00

£219,927

.00

£79,964

.00

£101,056.

00

(B)

Table 4: Reapportioning the service or support department costs to the production departments

Particular Basis Machine X Machine Y Assembly

Primary

Distribution

As Stated

Earlier

346417.02£ 287636£ 219927£

Stores

Department

Direct material

(4:3:1)

39982£ 29987£ 9995£

Maintenance

Department

Maintenance

machine hours

(12:8:5)

48506.88£ 32337.92£ 20211.2£

Total cost 434905.9£ 349960.92£ 250133.2£

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

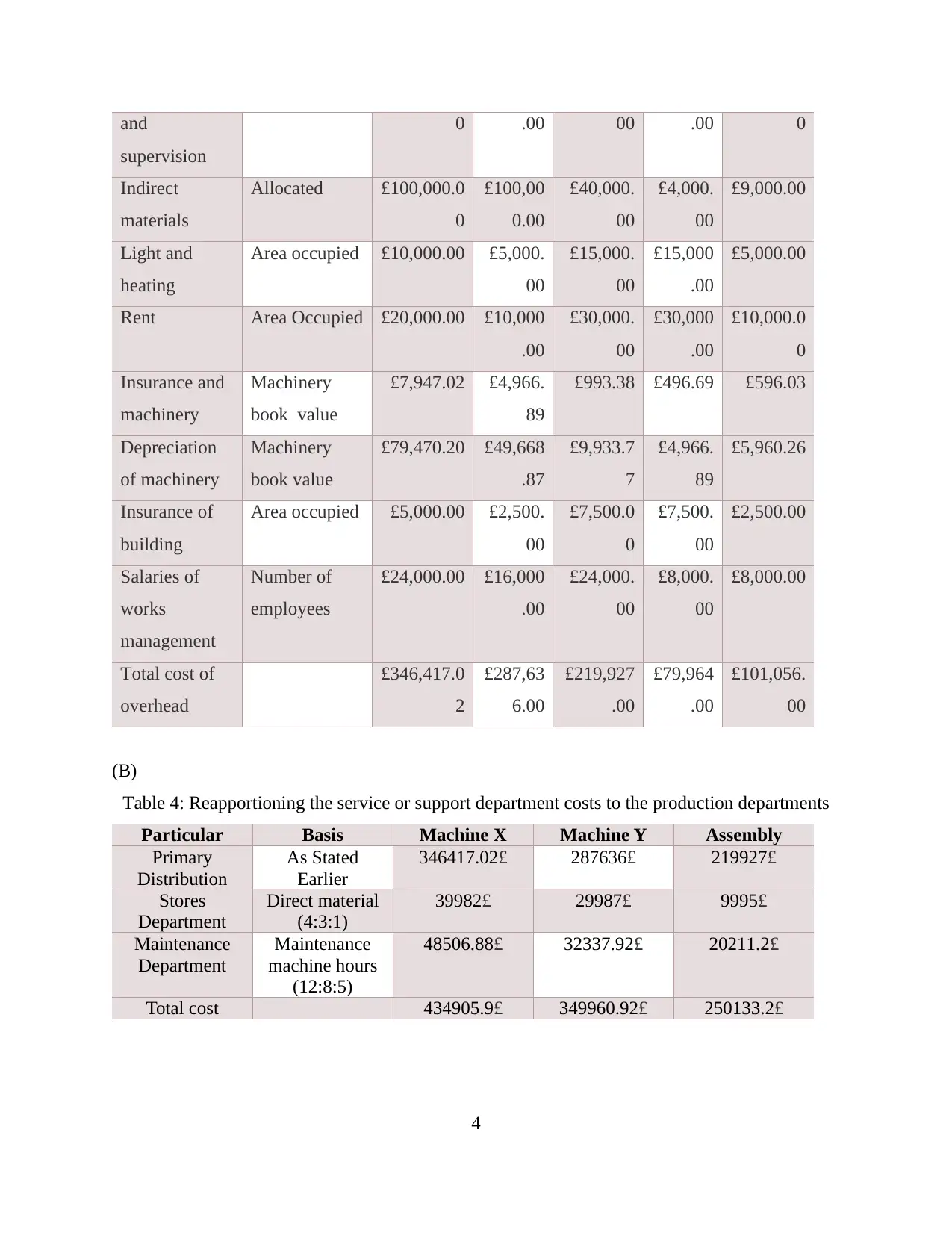

(C)

OAR = Total cost/Actual machine hours

Table 5: Calculation of Overhead Absorption Rates

Particular Machine X Machine Y Assembly

Total cost 434905.9£ 349960.92£ 250133.2£

Actual machine

hours

80000 60000 10000

OAR 5.44£ 5.83£ 25.01£

(D)

Table 6: Calculation of overhead charge

Items Calculation Per unit cost

Material 8£

Labour 2 hours*7.50£ 15£

Production Department

Overheads

Machine X 0.8 hours*5.44£ 4.35£

Machine Y 0.6 hours*5.83£ 3.5£

Assembly 0.1 hours*25.01£ 2.5£

Total cost 33.35£

1.4 Analysing the cost data

Overhead Absorption rate = Total cost/direct labour hours

Table 7: Calculation of overhead absorption rates using labour hours as a basis

Particular Machine X Machine Y Assembly

Total cost 434905.9£ 349960.92£ 250133.2£

Labour hours 200000 150000 200000

OAR 2.17£ 2.33£ 1.25£

According to the given scenario, the finance director of the company is not satisfied with

the existing basis of calculating OAR. Hence company should absorb overheads on the basis of

direct labour hours.

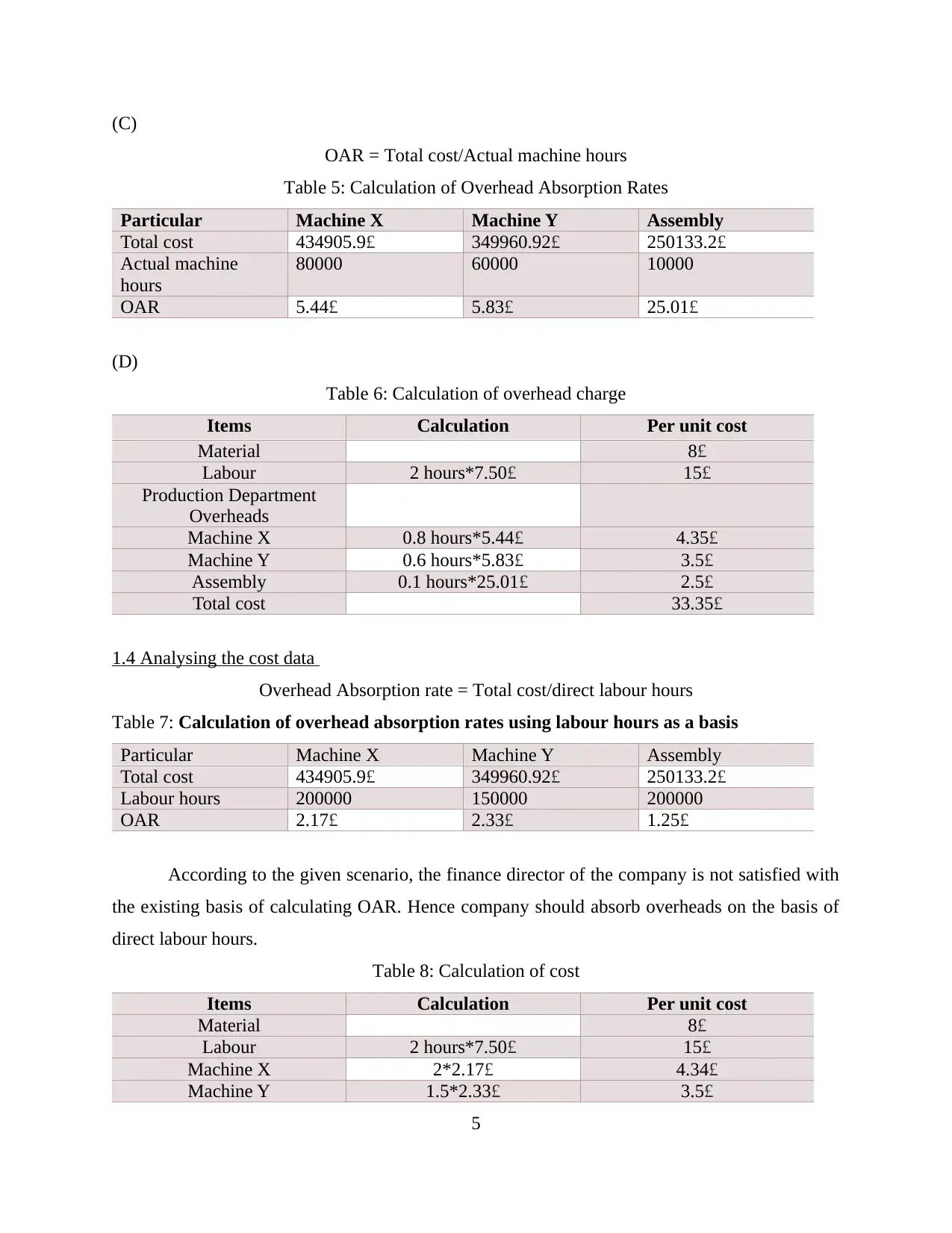

Table 8: Calculation of cost

Items Calculation Per unit cost

Material 8£

Labour 2 hours*7.50£ 15£

Machine X 2*2.17£ 4.34£

Machine Y 1.5*2.33£ 3.5£

5

OAR = Total cost/Actual machine hours

Table 5: Calculation of Overhead Absorption Rates

Particular Machine X Machine Y Assembly

Total cost 434905.9£ 349960.92£ 250133.2£

Actual machine

hours

80000 60000 10000

OAR 5.44£ 5.83£ 25.01£

(D)

Table 6: Calculation of overhead charge

Items Calculation Per unit cost

Material 8£

Labour 2 hours*7.50£ 15£

Production Department

Overheads

Machine X 0.8 hours*5.44£ 4.35£

Machine Y 0.6 hours*5.83£ 3.5£

Assembly 0.1 hours*25.01£ 2.5£

Total cost 33.35£

1.4 Analysing the cost data

Overhead Absorption rate = Total cost/direct labour hours

Table 7: Calculation of overhead absorption rates using labour hours as a basis

Particular Machine X Machine Y Assembly

Total cost 434905.9£ 349960.92£ 250133.2£

Labour hours 200000 150000 200000

OAR 2.17£ 2.33£ 1.25£

According to the given scenario, the finance director of the company is not satisfied with

the existing basis of calculating OAR. Hence company should absorb overheads on the basis of

direct labour hours.

Table 8: Calculation of cost

Items Calculation Per unit cost

Material 8£

Labour 2 hours*7.50£ 15£

Machine X 2*2.17£ 4.34£

Machine Y 1.5*2.33£ 3.5£

5

Assembly 1*1.25£ 1.25£

Total cost 32.09£

Hence it is clear that labour hours allocation is suitable for the business. It has helped in

reducing the cost per unit to 32.09. It will aid the business in reducing the production costs.

Task 2

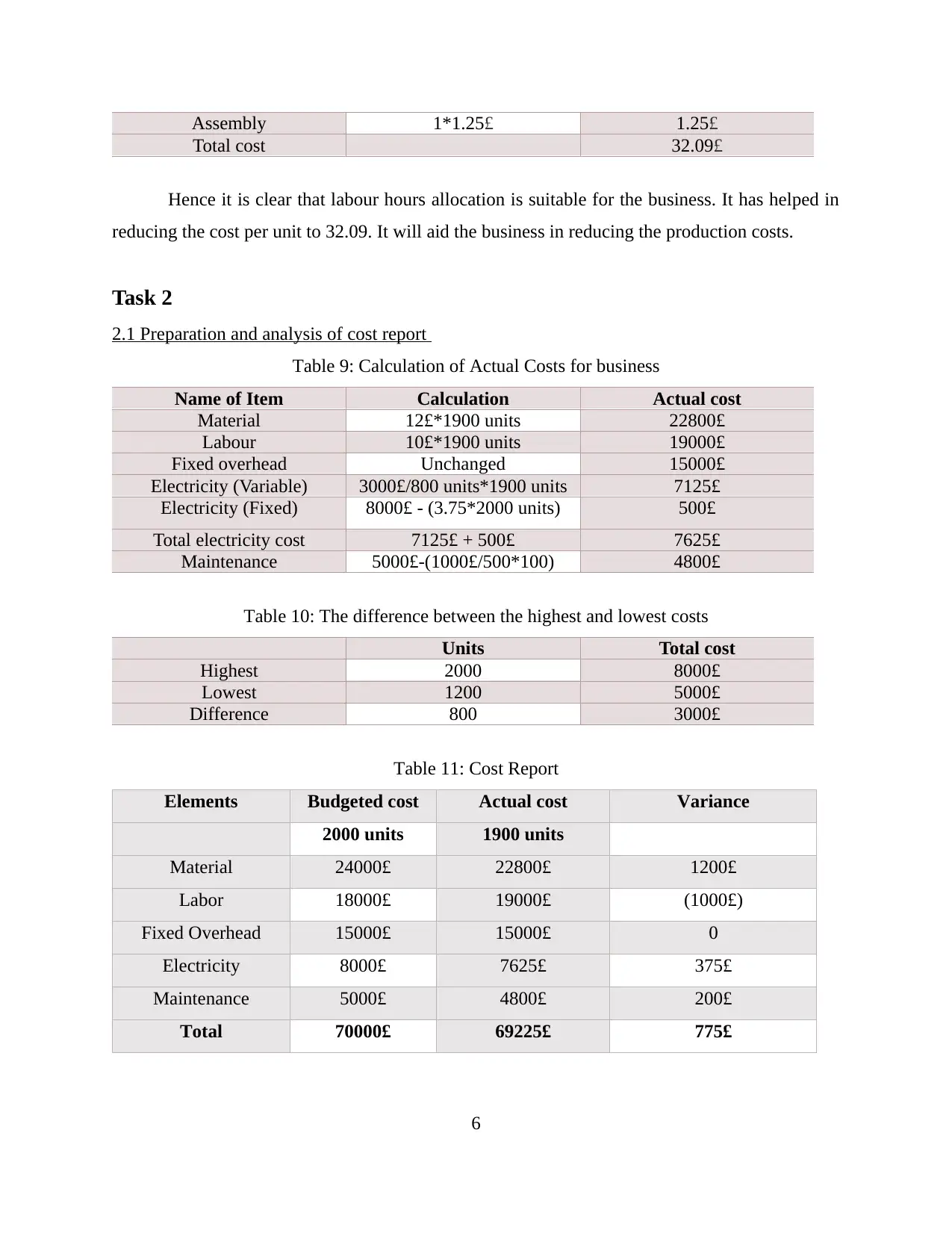

2.1 Preparation and analysis of cost report

Table 9: Calculation of Actual Costs for business

Name of Item Calculation Actual cost

Material 12£*1900 units 22800£

Labour 10£*1900 units 19000£

Fixed overhead Unchanged 15000£

Electricity (Variable) 3000£/800 units*1900 units 7125£

Electricity (Fixed) 8000£ - (3.75*2000 units) 500£

Total electricity cost 7125£ + 500£ 7625£

Maintenance 5000£-(1000£/500*100) 4800£

Table 10: The difference between the highest and lowest costs

Units Total cost

Highest 2000 8000£

Lowest 1200 5000£

Difference 800 3000£

Table 11: Cost Report

Elements Budgeted cost Actual cost Variance

2000 units 1900 units

Material 24000£ 22800£ 1200£

Labor 18000£ 19000£ (1000£)

Fixed Overhead 15000£ 15000£ 0

Electricity 8000£ 7625£ 375£

Maintenance 5000£ 4800£ 200£

Total 70000£ 69225£ 775£

6

Total cost 32.09£

Hence it is clear that labour hours allocation is suitable for the business. It has helped in

reducing the cost per unit to 32.09. It will aid the business in reducing the production costs.

Task 2

2.1 Preparation and analysis of cost report

Table 9: Calculation of Actual Costs for business

Name of Item Calculation Actual cost

Material 12£*1900 units 22800£

Labour 10£*1900 units 19000£

Fixed overhead Unchanged 15000£

Electricity (Variable) 3000£/800 units*1900 units 7125£

Electricity (Fixed) 8000£ - (3.75*2000 units) 500£

Total electricity cost 7125£ + 500£ 7625£

Maintenance 5000£-(1000£/500*100) 4800£

Table 10: The difference between the highest and lowest costs

Units Total cost

Highest 2000 8000£

Lowest 1200 5000£

Difference 800 3000£

Table 11: Cost Report

Elements Budgeted cost Actual cost Variance

2000 units 1900 units

Material 24000£ 22800£ 1200£

Labor 18000£ 19000£ (1000£)

Fixed Overhead 15000£ 15000£ 0

Electricity 8000£ 7625£ 375£

Maintenance 5000£ 4800£ 200£

Total 70000£ 69225£ 775£

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Within Jeffrey & Sons the managers forecasted the business expenditures for

manufacturing of 2000 units. These expenditure involves material, labour, fixed and variable

overheads. The above cost report is prepared on the basis of identification of actual cost for

manufacturing 1900 units and the variance (Budgeting and budgetary control, n.d.).

Reasons for variances

From the above calculated variances it is evident that maintenance, material and

electricity variances impacts the profits in positive manner (Anderson, 2011)

The variance in the labour cost denotes impact on the company’s profitability

Another reason for the variances is the reduction in the production volume which has

decreased from 2000 units to 1900 units.

The actual material costs has also declined due to reduction in the total business

production and on the other side the material prices remain unchanged from the budget

(Cohen and Kaimenaki, 2011).

The high labour rate has resulted in negative labour variance of 1000£.

Electricity costs of semi-variable nature which has remained constant up to 500£ and

after that it has changed according to the changes in volume. Variance of 375£ has

emerged due to reduction in the volume up to 1900 units (Drake and Fabozzi, 2012).

As per the scenario, maintenance is a steeped cost which has increased by 1000£ for

producing 500 additional units and vice versa. Hence because of that the actual cost

decreases up to 4800£ due to reduction of 1000 units.

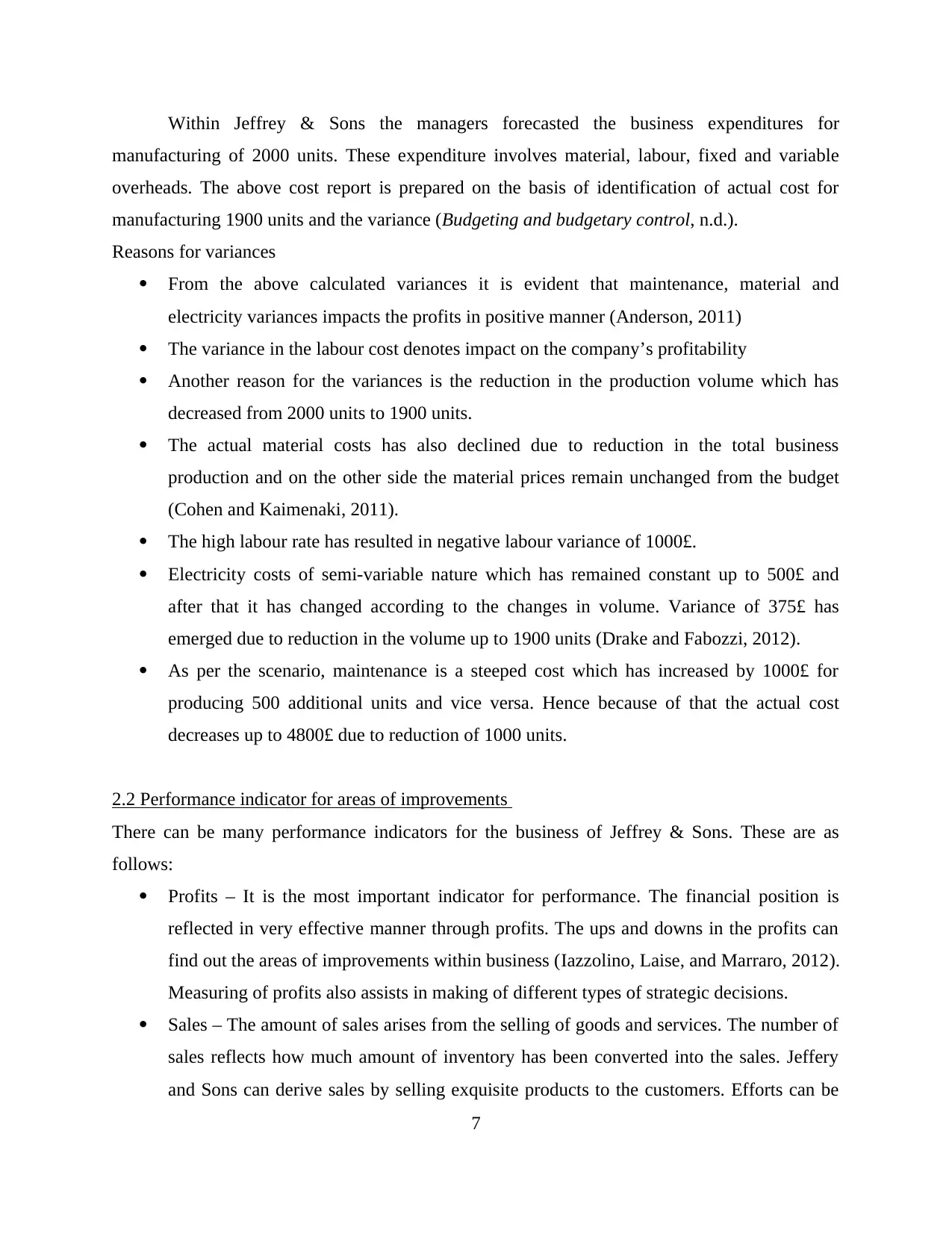

2.2 Performance indicator for areas of improvements

There can be many performance indicators for the business of Jeffrey & Sons. These are as

follows:

Profits – It is the most important indicator for performance. The financial position is

reflected in very effective manner through profits. The ups and downs in the profits can

find out the areas of improvements within business (Iazzolino, Laise, and Marraro, 2012).

Measuring of profits also assists in making of different types of strategic decisions.

Sales – The amount of sales arises from the selling of goods and services. The number of

sales reflects how much amount of inventory has been converted into the sales. Jeffery

and Sons can derive sales by selling exquisite products to the customers. Efforts can be

7

manufacturing of 2000 units. These expenditure involves material, labour, fixed and variable

overheads. The above cost report is prepared on the basis of identification of actual cost for

manufacturing 1900 units and the variance (Budgeting and budgetary control, n.d.).

Reasons for variances

From the above calculated variances it is evident that maintenance, material and

electricity variances impacts the profits in positive manner (Anderson, 2011)

The variance in the labour cost denotes impact on the company’s profitability

Another reason for the variances is the reduction in the production volume which has

decreased from 2000 units to 1900 units.

The actual material costs has also declined due to reduction in the total business

production and on the other side the material prices remain unchanged from the budget

(Cohen and Kaimenaki, 2011).

The high labour rate has resulted in negative labour variance of 1000£.

Electricity costs of semi-variable nature which has remained constant up to 500£ and

after that it has changed according to the changes in volume. Variance of 375£ has

emerged due to reduction in the volume up to 1900 units (Drake and Fabozzi, 2012).

As per the scenario, maintenance is a steeped cost which has increased by 1000£ for

producing 500 additional units and vice versa. Hence because of that the actual cost

decreases up to 4800£ due to reduction of 1000 units.

2.2 Performance indicator for areas of improvements

There can be many performance indicators for the business of Jeffrey & Sons. These are as

follows:

Profits – It is the most important indicator for performance. The financial position is

reflected in very effective manner through profits. The ups and downs in the profits can

find out the areas of improvements within business (Iazzolino, Laise, and Marraro, 2012).

Measuring of profits also assists in making of different types of strategic decisions.

Sales – The amount of sales arises from the selling of goods and services. The number of

sales reflects how much amount of inventory has been converted into the sales. Jeffery

and Sons can derive sales by selling exquisite products to the customers. Efforts can be

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

made to increase the sales if the actual sales are lower as compared to estimated sales

(Robb and Woodyard, 2011).

Costs – It is another performance indicator. Every business expects that costing must not

go higher than the expenses. Increase in costs such as labour, material, overheads etc can

increase the budget for the business also. Hence the variances noticed in the budgets can

find out the areas of improvement within the operations.

Ratio analysis – It is another instrument for measuring the liquidity, solvency, efficiency

and gearing position of the organization (Smith and Jacobs, 2011). Different types of

ratios are calculated to compare the financial performance. However the technique is

based on past performance not the future performance

Financial statements – They are also good reflector of business performance. It includes

three main statements which are balance sheet, cash flow statement and income

statement. They also denotes the liquidity and profitability of the company (Halabi and

Carroll, 2015)

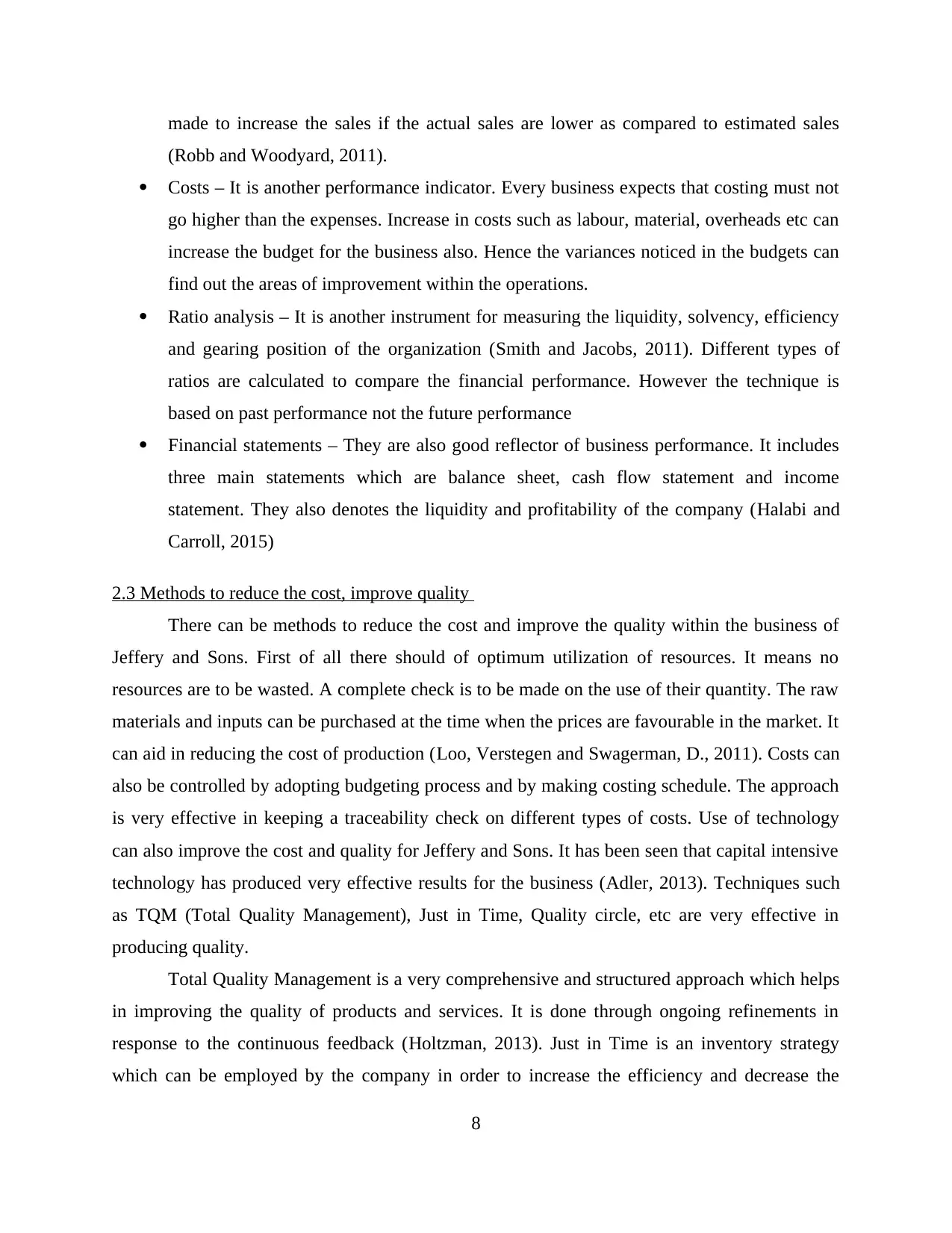

2.3 Methods to reduce the cost, improve quality

There can be methods to reduce the cost and improve the quality within the business of

Jeffery and Sons. First of all there should of optimum utilization of resources. It means no

resources are to be wasted. A complete check is to be made on the use of their quantity. The raw

materials and inputs can be purchased at the time when the prices are favourable in the market. It

can aid in reducing the cost of production (Loo, Verstegen and Swagerman, D., 2011). Costs can

also be controlled by adopting budgeting process and by making costing schedule. The approach

is very effective in keeping a traceability check on different types of costs. Use of technology

can also improve the cost and quality for Jeffery and Sons. It has been seen that capital intensive

technology has produced very effective results for the business (Adler, 2013). Techniques such

as TQM (Total Quality Management), Just in Time, Quality circle, etc are very effective in

producing quality.

Total Quality Management is a very comprehensive and structured approach which helps

in improving the quality of products and services. It is done through ongoing refinements in

response to the continuous feedback (Holtzman, 2013). Just in Time is an inventory strategy

which can be employed by the company in order to increase the efficiency and decrease the

8

(Robb and Woodyard, 2011).

Costs – It is another performance indicator. Every business expects that costing must not

go higher than the expenses. Increase in costs such as labour, material, overheads etc can

increase the budget for the business also. Hence the variances noticed in the budgets can

find out the areas of improvement within the operations.

Ratio analysis – It is another instrument for measuring the liquidity, solvency, efficiency

and gearing position of the organization (Smith and Jacobs, 2011). Different types of

ratios are calculated to compare the financial performance. However the technique is

based on past performance not the future performance

Financial statements – They are also good reflector of business performance. It includes

three main statements which are balance sheet, cash flow statement and income

statement. They also denotes the liquidity and profitability of the company (Halabi and

Carroll, 2015)

2.3 Methods to reduce the cost, improve quality

There can be methods to reduce the cost and improve the quality within the business of

Jeffery and Sons. First of all there should of optimum utilization of resources. It means no

resources are to be wasted. A complete check is to be made on the use of their quantity. The raw

materials and inputs can be purchased at the time when the prices are favourable in the market. It

can aid in reducing the cost of production (Loo, Verstegen and Swagerman, D., 2011). Costs can

also be controlled by adopting budgeting process and by making costing schedule. The approach

is very effective in keeping a traceability check on different types of costs. Use of technology

can also improve the cost and quality for Jeffery and Sons. It has been seen that capital intensive

technology has produced very effective results for the business (Adler, 2013). Techniques such

as TQM (Total Quality Management), Just in Time, Quality circle, etc are very effective in

producing quality.

Total Quality Management is a very comprehensive and structured approach which helps

in improving the quality of products and services. It is done through ongoing refinements in

response to the continuous feedback (Holtzman, 2013). Just in Time is an inventory strategy

which can be employed by the company in order to increase the efficiency and decrease the

8

waste. Under this process, the goods are received only when they are needed in the production

process. Hence it reduces the inventory costs. It is a good approach to maintain quality and to

make optimum utilization of the resources. Quality circle is another very effectual approach to

maintain quality throughout the processes (Boyns and Edwards, 2013). Under this method, a

quality circle is made which means employees are engaged to find out the solution for a specific

problem.

Task 3

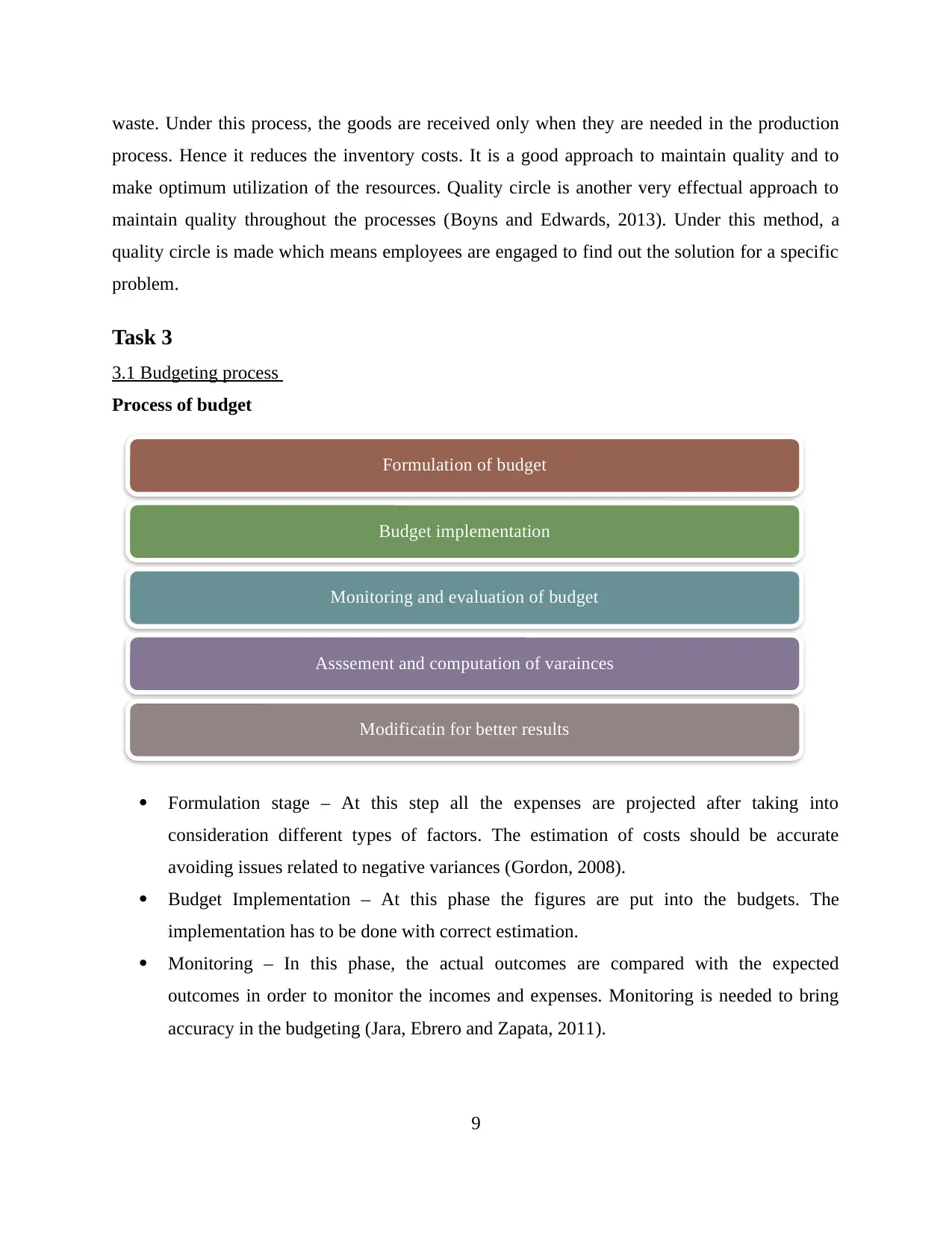

3.1 Budgeting process

Process of budget

Formulation stage – At this step all the expenses are projected after taking into

consideration different types of factors. The estimation of costs should be accurate

avoiding issues related to negative variances (Gordon, 2008).

Budget Implementation – At this phase the figures are put into the budgets. The

implementation has to be done with correct estimation.

Monitoring – In this phase, the actual outcomes are compared with the expected

outcomes in order to monitor the incomes and expenses. Monitoring is needed to bring

accuracy in the budgeting (Jara, Ebrero and Zapata, 2011).

9

Formulation of budget

Budget implementation

Monitoring and evaluation of budget

Asssement and computation of varainces

Modificatin for better results

process. Hence it reduces the inventory costs. It is a good approach to maintain quality and to

make optimum utilization of the resources. Quality circle is another very effectual approach to

maintain quality throughout the processes (Boyns and Edwards, 2013). Under this method, a

quality circle is made which means employees are engaged to find out the solution for a specific

problem.

Task 3

3.1 Budgeting process

Process of budget

Formulation stage – At this step all the expenses are projected after taking into

consideration different types of factors. The estimation of costs should be accurate

avoiding issues related to negative variances (Gordon, 2008).

Budget Implementation – At this phase the figures are put into the budgets. The

implementation has to be done with correct estimation.

Monitoring – In this phase, the actual outcomes are compared with the expected

outcomes in order to monitor the incomes and expenses. Monitoring is needed to bring

accuracy in the budgeting (Jara, Ebrero and Zapata, 2011).

9

Formulation of budget

Budget implementation

Monitoring and evaluation of budget

Asssement and computation of varainces

Modificatin for better results

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.