Management Accounting Report: Harrods Limited Case Study Analysis

VerifiedAdded on 2020/07/22

|17

|4804

|31

Report

AI Summary

This report provides a comprehensive overview of management accounting (MA) principles and their application within an organization, specifically using Harrods Limited as a case study. The report begins with an introduction to MA, its different types, and its crucial role in decision-making. It then delves into various methods of MA reporting, including segmental reports, performance reports, and inventory management reports. The core of the report focuses on the calculation of marginal and absorption costs, highlighting the differences and implications of each method on profit and loss statements. Furthermore, the report explores different budgeting tools, such as zero-based budgeting, along with their respective advantages and disadvantages. The analysis extends to the adoption of an accounting system within an organization, emphasizing the benefits of MA and its impact on addressing financial problems. The report utilizes data from Harrods Limited, a retail SME, to illustrate the practical application of these concepts, concluding with recommendations for the company's MA system.

Management Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

P-1 Management accounting (MA) and its different types.........................................................1

P-2 Various methods of MA reporting.......................................................................................3

P-3 Calculation of marginal costs and absorption costs..............................................................5

P-4 Different budgeting tools with their pros and cons..............................................................7

P-5 Adoption of accounting system in organisation.................................................................10

M-1 Benefits of MA within an organisation.............................................................................12

M-2 MA techniques and its benefits.........................................................................................12

M-3 Different planning tools and their applications.................................................................13

M-4 How financial problems and MA leads to success............................................................13

CONCLUSION:.............................................................................................................................14

REFERENCES:.............................................................................................................................15

INTRODUCTION...........................................................................................................................1

P-1 Management accounting (MA) and its different types.........................................................1

P-2 Various methods of MA reporting.......................................................................................3

P-3 Calculation of marginal costs and absorption costs..............................................................5

P-4 Different budgeting tools with their pros and cons..............................................................7

P-5 Adoption of accounting system in organisation.................................................................10

M-1 Benefits of MA within an organisation.............................................................................12

M-2 MA techniques and its benefits.........................................................................................12

M-3 Different planning tools and their applications.................................................................13

M-4 How financial problems and MA leads to success............................................................13

CONCLUSION:.............................................................................................................................14

REFERENCES:.............................................................................................................................15

INTRODUCTION

Management accounting (MA) plays a very crucial role in every big, medium and small

organization. A concept of knowledge in which financial plans are schedules, applied at the

workplace, analysed and evaluated is known as management accounting (MA). It controls,

manages and communicate goals and objectives to the overall organization. Businesses consider

this particular aspect within working environment for making those kinds of decisions which are

related to internal criteria. It helps in maintaining and evaluating the financial performance by

preparing plans and budgets for specific time period. The present assignment shows various

system and methods which are used to take several decisions and complete process of MA

report. This report will show the requirements in preparing different types of MA systems. In

additional to this, profit and loss accounts formulated in the project by using two MA techniques

i.e. marginal as well as absorption costing. Also the pros and cons of different planning tools for

preparing budgetary control. At the end of current study it shows the effect of organization in

adopting the MA system to survive and respond to their financial problems.

For undertaking this report the organisation selected is Harrods Limited Company. The

cited firm is small and medium enterprise and belongs to retail sector. Thus, this report will help

in developing a relevant management accounting system for the cited establishment.

P-1 Management accounting (MA) and its different types

Business Report

From – Management Accounting officer

To- General manager

Harrods Limited Company

Subject- Management accounting system

Introduction- This report gives a brief description of cost accounting should be used in

Harrods Limited as it will help in control the flow of goods from manufacture to warehouse. As

a management accounting officer of Harrods Limited Company it is required that the company

Management accounting (MA) plays a very crucial role in every big, medium and small

organization. A concept of knowledge in which financial plans are schedules, applied at the

workplace, analysed and evaluated is known as management accounting (MA). It controls,

manages and communicate goals and objectives to the overall organization. Businesses consider

this particular aspect within working environment for making those kinds of decisions which are

related to internal criteria. It helps in maintaining and evaluating the financial performance by

preparing plans and budgets for specific time period. The present assignment shows various

system and methods which are used to take several decisions and complete process of MA

report. This report will show the requirements in preparing different types of MA systems. In

additional to this, profit and loss accounts formulated in the project by using two MA techniques

i.e. marginal as well as absorption costing. Also the pros and cons of different planning tools for

preparing budgetary control. At the end of current study it shows the effect of organization in

adopting the MA system to survive and respond to their financial problems.

For undertaking this report the organisation selected is Harrods Limited Company. The

cited firm is small and medium enterprise and belongs to retail sector. Thus, this report will help

in developing a relevant management accounting system for the cited establishment.

P-1 Management accounting (MA) and its different types

Business Report

From – Management Accounting officer

To- General manager

Harrods Limited Company

Subject- Management accounting system

Introduction- This report gives a brief description of cost accounting should be used in

Harrods Limited as it will help in control the flow of goods from manufacture to warehouse. As

a management accounting officer of Harrods Limited Company it is required that the company

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

uses cost accounting MA system.

Management accounting system

The key difference between managerial and finance accounting is that managerial

accounting helps managers to take decisions within the organization while financial accounting

helps in providing information to outside parties. MA is the process of preparing accounting

reports that provide timely and accurate financial information required by managers to take

daily decisions. These reports identify, measure, analyse, intercept and communicate the

organization goals. MA can be done by various techniques like margin analysis, constraint

analysis, capital budgeting, trend analysis, product costing and lean financial modelling.

Different types of MA:

Price optimisation:- This system helps to determine the prices of different products. It

is an analysis in which the company determines how customers will respond to the

different prices of their products. By using this the company can meet its objectives of

maximising profits (Williams,, 2014).This strategy helps the company to know how

much business it can obtain by changing the price of its products. It is an important

component of overall price management which is crucial in determining profitability. It

can be used to estimate the elasticity of demand.

Cost accounting:- It is a technique of classifying and recording the cost incurred for

producing the product. It includes the ascertainment of cost of every process, service or

unit. It deals with the selling and distribution of products along with cost of production.

It also helps in controlling the cost by managing the overheads and wages that has been

incurred on the products. These cost relates to sales and profitability of the business.

Job costing: It involves the accumulation of costs of material, labour and overhead for a

specific product or batch. It is generally used in batch processing where the company is

engaged in production of different kind of products. The company gets the costs of a

particular product and its overall sales and profit (Renz, 2016).The company is able to

Management accounting system

The key difference between managerial and finance accounting is that managerial

accounting helps managers to take decisions within the organization while financial accounting

helps in providing information to outside parties. MA is the process of preparing accounting

reports that provide timely and accurate financial information required by managers to take

daily decisions. These reports identify, measure, analyse, intercept and communicate the

organization goals. MA can be done by various techniques like margin analysis, constraint

analysis, capital budgeting, trend analysis, product costing and lean financial modelling.

Different types of MA:

Price optimisation:- This system helps to determine the prices of different products. It

is an analysis in which the company determines how customers will respond to the

different prices of their products. By using this the company can meet its objectives of

maximising profits (Williams,, 2014).This strategy helps the company to know how

much business it can obtain by changing the price of its products. It is an important

component of overall price management which is crucial in determining profitability. It

can be used to estimate the elasticity of demand.

Cost accounting:- It is a technique of classifying and recording the cost incurred for

producing the product. It includes the ascertainment of cost of every process, service or

unit. It deals with the selling and distribution of products along with cost of production.

It also helps in controlling the cost by managing the overheads and wages that has been

incurred on the products. These cost relates to sales and profitability of the business.

Job costing: It involves the accumulation of costs of material, labour and overhead for a

specific product or batch. It is generally used in batch processing where the company is

engaged in production of different kind of products. The company gets the costs of a

particular product and its overall sales and profit (Renz, 2016).The company is able to

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

identify its low profit area and then take actions regarding improvements in that area.

Inventory management: It is a process of ordering and storing or raw materials,

components or finished goods of a company. In retail industry the inputs and outputs are

the core components in it. A large amount of inventory can be liable to a company and

there is always risk of theft or damage Shortage of inventory can extremely affect the

production of business (Quattrone, 2016). So it is important that organisation must

maintain accurate and proper record of its inventory.

Conclusion: At the end, the cost accounting will be required to classifying and summarizing

various alternative course of action, so the production of goods will record income and revenue

from time to time, so it will impact on production, selling and distribution, and the inventory

management supervise the flow of goods and facilitate to point of sale. The organisation has set

the data which is used for the operating time so the business run smoothly. Price optimisation

will help Harrods Limited to determine the price of products and maximize profit.

P-2 Various methods of MA reporting.

From – Management Accounting officer

To- General manager

Harrods Limited Company

Subject- Management accounting reports

Introduction- In this there is a brief description of different MA reports that is used by

organisations is shown. These reports helps small business managers and owners to monitor

companies financial performance and can be prepared weekly, monthly or quarterly. There are

various types of reports.:

Importance of MA reports:

Provides information- main purpose of preparing report is that it provides information to

various levels of management (Maas, and et.al, 2016). It provides information like cash

inflow and outflow, fund inflow and outflow,etc. to the managers, chairman, supervisor,etc.

Selection- In the report only relevant information is included. It brings many alternatives out of

Inventory management: It is a process of ordering and storing or raw materials,

components or finished goods of a company. In retail industry the inputs and outputs are

the core components in it. A large amount of inventory can be liable to a company and

there is always risk of theft or damage Shortage of inventory can extremely affect the

production of business (Quattrone, 2016). So it is important that organisation must

maintain accurate and proper record of its inventory.

Conclusion: At the end, the cost accounting will be required to classifying and summarizing

various alternative course of action, so the production of goods will record income and revenue

from time to time, so it will impact on production, selling and distribution, and the inventory

management supervise the flow of goods and facilitate to point of sale. The organisation has set

the data which is used for the operating time so the business run smoothly. Price optimisation

will help Harrods Limited to determine the price of products and maximize profit.

P-2 Various methods of MA reporting.

From – Management Accounting officer

To- General manager

Harrods Limited Company

Subject- Management accounting reports

Introduction- In this there is a brief description of different MA reports that is used by

organisations is shown. These reports helps small business managers and owners to monitor

companies financial performance and can be prepared weekly, monthly or quarterly. There are

various types of reports.:

Importance of MA reports:

Provides information- main purpose of preparing report is that it provides information to

various levels of management (Maas, and et.al, 2016). It provides information like cash

inflow and outflow, fund inflow and outflow,etc. to the managers, chairman, supervisor,etc.

Selection- In the report only relevant information is included. It brings many alternatives out of

which management has to choose best one.

Controlling- these are prepared to measure the actual performance of employees. If there

occurs any variances then corrective actions are taken by the management to control that. In this

way it helps in controlling.

Achieving overall objectives- It gives the management a clear idea and instructions on how to

increase profits which will help them in achieving their overall objectives.

Segmental report: These reports discloses the financial statements of various operating

segments of the company. It helps the creditors and investors giving the information

regarding the financial results and position of most important operating units of the

company. It is mostly been used by public held entities rather than privately held ones.

An operating segment is engaged in activities where it can incur expenses and earn

revenue. These reports are generally used where there are similar products, services,

customers or distribution methods (Fullerton, and et.al, 2014) It uses various

information I.e material expense items, interest expense, revenues, depreciation, income

tax expense, etc.

Performance report: - It shows the outcome of an activity or work of an individual

within a specific time frame. It compares the actual outcomes with standard as well as

variance between these two figures. This report is important because immediate action

can be taken if there is an unfavourable variance.

Inventory management report: These reports are generally used in companies which

produces different types of products. A comparison is made by management between

different production line within the company by comparing working hours, labour cost,

per unit cost, overhead cost, etc. Low performing production units are identified and

improved by providing more funds. It is done to make the production process more

efficient (Fullerton, and et.al, 2013).

Accounts receivables ageing report: It helps the managers in managing cash flow and

identifying from how long a customer is the creditor of business. It allows the business

Controlling- these are prepared to measure the actual performance of employees. If there

occurs any variances then corrective actions are taken by the management to control that. In this

way it helps in controlling.

Achieving overall objectives- It gives the management a clear idea and instructions on how to

increase profits which will help them in achieving their overall objectives.

Segmental report: These reports discloses the financial statements of various operating

segments of the company. It helps the creditors and investors giving the information

regarding the financial results and position of most important operating units of the

company. It is mostly been used by public held entities rather than privately held ones.

An operating segment is engaged in activities where it can incur expenses and earn

revenue. These reports are generally used where there are similar products, services,

customers or distribution methods (Fullerton, and et.al, 2014) It uses various

information I.e material expense items, interest expense, revenues, depreciation, income

tax expense, etc.

Performance report: - It shows the outcome of an activity or work of an individual

within a specific time frame. It compares the actual outcomes with standard as well as

variance between these two figures. This report is important because immediate action

can be taken if there is an unfavourable variance.

Inventory management report: These reports are generally used in companies which

produces different types of products. A comparison is made by management between

different production line within the company by comparing working hours, labour cost,

per unit cost, overhead cost, etc. Low performing production units are identified and

improved by providing more funds. It is done to make the production process more

efficient (Fullerton, and et.al, 2013).

Accounts receivables ageing report: It helps the managers in managing cash flow and

identifying from how long a customer is the creditor of business. It allows the business

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

to extend their credit to customers. It helps in finding out the problem in collection

process of business. It includes the invoices that are 30,60 days or more. The business

should make strong credit policies if any customer is unable to pay their balances. It

also helps the collection department to view their old debts and restricting customers by

not giving them further debt.

Job cost reports- It shows expenses for a specific unit. They are matched with the revenue to

evaluate each units profitability. It helps in identifying the areas where there are growth

opportunities instead of wasting time and money low profit margin areas. It is also used in

analysing the expenses during the progress of unit so that managers can improve the areas

where cost is being incurred(Ax, and Greve, , 2017)

Conclusion:

Harrods Limited Company should use the technique of inventory management report as it will

help in identifying the remaining stock. As it operates in retail industry so there are various

products. It should maintain record of each item so that if there is excess stock the company can

use it in production of other products.

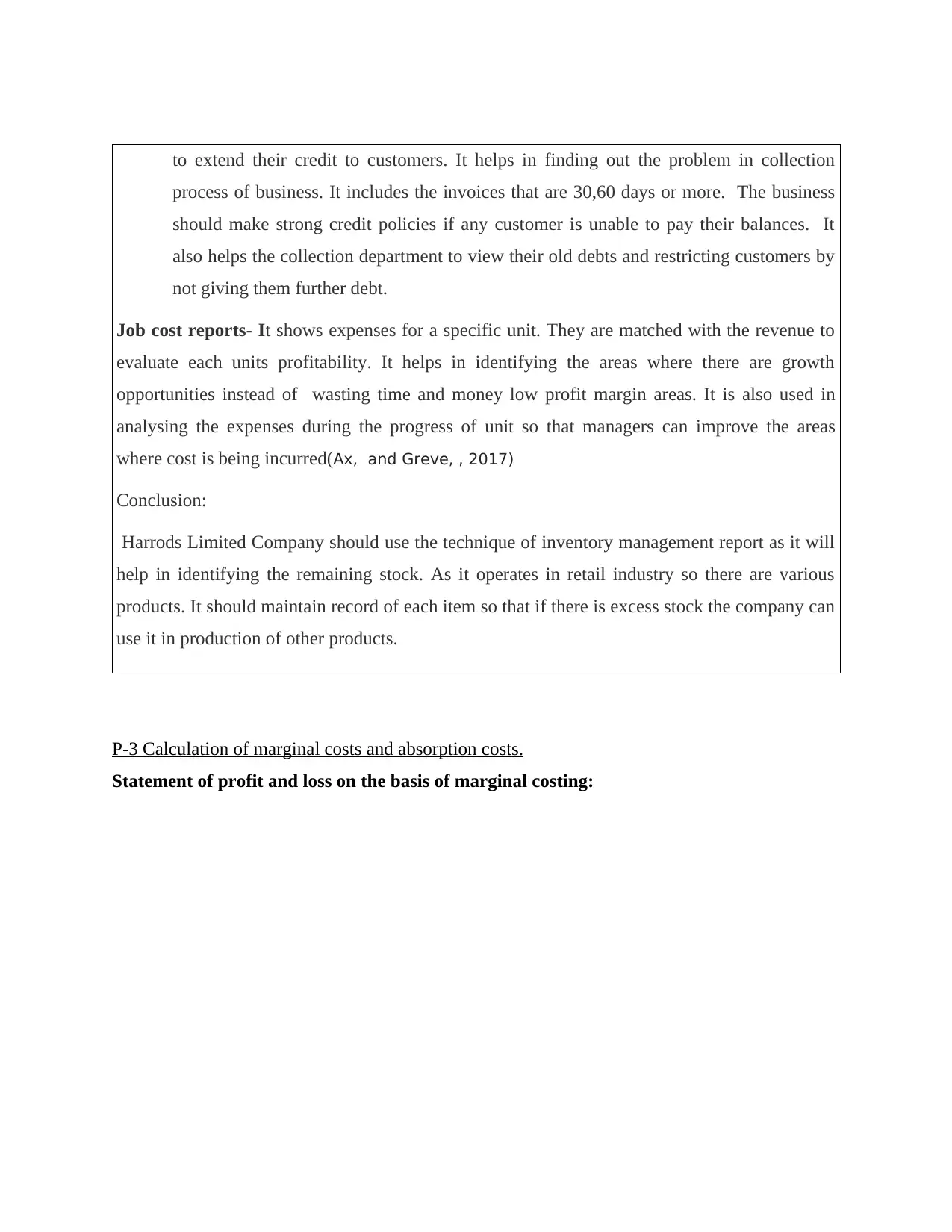

P-3 Calculation of marginal costs and absorption costs.

Statement of profit and loss on the basis of marginal costing:

process of business. It includes the invoices that are 30,60 days or more. The business

should make strong credit policies if any customer is unable to pay their balances. It

also helps the collection department to view their old debts and restricting customers by

not giving them further debt.

Job cost reports- It shows expenses for a specific unit. They are matched with the revenue to

evaluate each units profitability. It helps in identifying the areas where there are growth

opportunities instead of wasting time and money low profit margin areas. It is also used in

analysing the expenses during the progress of unit so that managers can improve the areas

where cost is being incurred(Ax, and Greve, , 2017)

Conclusion:

Harrods Limited Company should use the technique of inventory management report as it will

help in identifying the remaining stock. As it operates in retail industry so there are various

products. It should maintain record of each item so that if there is excess stock the company can

use it in production of other products.

P-3 Calculation of marginal costs and absorption costs.

Statement of profit and loss on the basis of marginal costing:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

From the above calculation it shows that net profit of Harrods Limited is 4300 for accounting

year. In calculating marginal costs only the variable costs is considered. Including the production

cost affects the net profit.

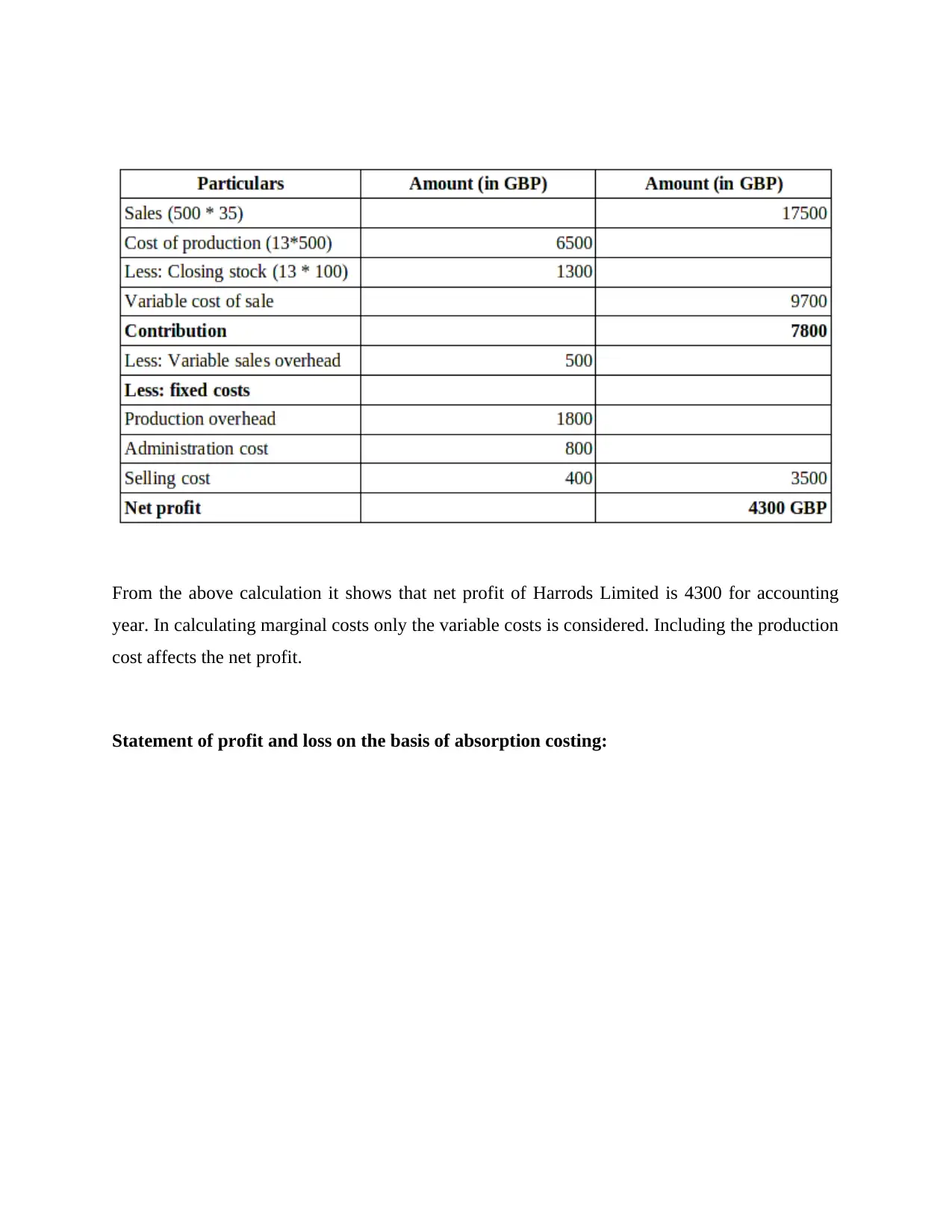

Statement of profit and loss on the basis of absorption costing:

year. In calculating marginal costs only the variable costs is considered. Including the production

cost affects the net profit.

Statement of profit and loss on the basis of absorption costing:

From the above calculation it shows that net profit of Harrods Limited is 6600 for accounting

year. In calculating absorption cost both fixed and variable costs is considered. But it does not

include production cost. So this affects the net profit of the firm.

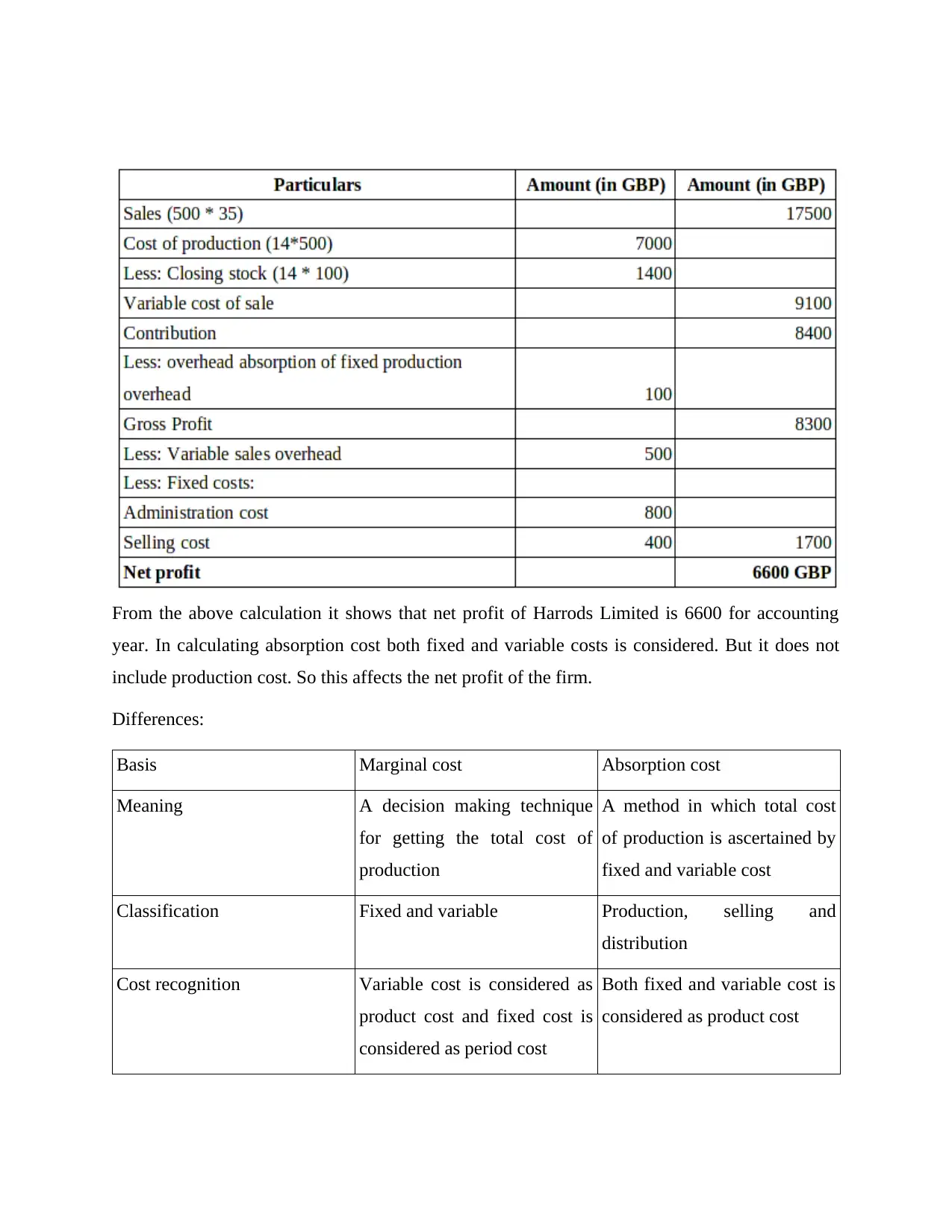

Differences:

Basis Marginal cost Absorption cost

Meaning A decision making technique

for getting the total cost of

production

A method in which total cost

of production is ascertained by

fixed and variable cost

Classification Fixed and variable Production, selling and

distribution

Cost recognition Variable cost is considered as

product cost and fixed cost is

considered as period cost

Both fixed and variable cost is

considered as product cost

year. In calculating absorption cost both fixed and variable costs is considered. But it does not

include production cost. So this affects the net profit of the firm.

Differences:

Basis Marginal cost Absorption cost

Meaning A decision making technique

for getting the total cost of

production

A method in which total cost

of production is ascertained by

fixed and variable cost

Classification Fixed and variable Production, selling and

distribution

Cost recognition Variable cost is considered as

product cost and fixed cost is

considered as period cost

Both fixed and variable cost is

considered as product cost

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Highlights Contribution per unit Profit per unit

Cost per unit Opening and closing stock

does not influence the cost per

unit

Opening and closing stock

influences the cost per unit.

Profitability It does not get affected It gets affected.

Cost data Presented to total contribution

of each product

Presented in conventional way.

Decision making It is used in decision making

process

It is used for external reporting

Inventory valuation It is not used for inventory

valuation

It can be used for inventory

valuation

Fixed production overhead It does not consider fixed

production overhead

Fixed production overhead s

considered.

P-4 Different budgeting tools with their pros and cons

Zero based budgeting- it is a method in which all the expenses are made to zero for each new

period. Managers have to justify that a project is essential and of high priority. The benefit of this

budgeting helps in maintaining the balance between all departments (Otley, and Emmanuel,,

2013)

Advantages:

It is useful for non profit or service organisations as cost can be saved in inefficient

operations.

It do not carry any inefficiency as the same is carried to next year.

It promotes operational efficiency as it is not based on incremental approach.

Cost per unit Opening and closing stock

does not influence the cost per

unit

Opening and closing stock

influences the cost per unit.

Profitability It does not get affected It gets affected.

Cost data Presented to total contribution

of each product

Presented in conventional way.

Decision making It is used in decision making

process

It is used for external reporting

Inventory valuation It is not used for inventory

valuation

It can be used for inventory

valuation

Fixed production overhead It does not consider fixed

production overhead

Fixed production overhead s

considered.

P-4 Different budgeting tools with their pros and cons

Zero based budgeting- it is a method in which all the expenses are made to zero for each new

period. Managers have to justify that a project is essential and of high priority. The benefit of this

budgeting helps in maintaining the balance between all departments (Otley, and Emmanuel,,

2013)

Advantages:

It is useful for non profit or service organisations as cost can be saved in inefficient

operations.

It do not carry any inefficiency as the same is carried to next year.

It promotes operational efficiency as it is not based on incremental approach.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

It helps in active participation of all executives.

Disadvantage-

A very time consuming process as a lot of paper work is involved in this.

It restricts the managers in developing new ideas and changes.

It is tough to implement it because of lack of acceptance by employees in some

departments like research and development.

Incremental budgeting- A budget which is prepared by using previous year budget. In this

increment is made in for every resources required. It is not recommended as it fails in accounting

changing circumstances (Quinn, M., 2014) It is stable as changes made are gradual. It helps in

operating department on the basis of funds allocated. It is assumed that activities will continue to

work in same way as it don't.

Advantages-

It is very simple to understand as it provides flexibility in preparing.

It allows gradual changes in the organisation.

By avoiding conflicts between various departments as it keeps everyone on same page.

Disadvantages-

It is made by assuming that expenses will be same as previous year but in business

frequent changes always occur.

It do not provide any extra fund for employees as a incentive. This demoralizes the

employees motivation.

It encourages higher spendings so that the budget is maintained next year also.

Fixed budgeting- It is a budget which does not change irrespective of any change in sales. It is

based on single level of activity (Renz,, 2016) It is assumed that company will work only on

specified level.

Advantages-

Disadvantage-

A very time consuming process as a lot of paper work is involved in this.

It restricts the managers in developing new ideas and changes.

It is tough to implement it because of lack of acceptance by employees in some

departments like research and development.

Incremental budgeting- A budget which is prepared by using previous year budget. In this

increment is made in for every resources required. It is not recommended as it fails in accounting

changing circumstances (Quinn, M., 2014) It is stable as changes made are gradual. It helps in

operating department on the basis of funds allocated. It is assumed that activities will continue to

work in same way as it don't.

Advantages-

It is very simple to understand as it provides flexibility in preparing.

It allows gradual changes in the organisation.

By avoiding conflicts between various departments as it keeps everyone on same page.

Disadvantages-

It is made by assuming that expenses will be same as previous year but in business

frequent changes always occur.

It do not provide any extra fund for employees as a incentive. This demoralizes the

employees motivation.

It encourages higher spendings so that the budget is maintained next year also.

Fixed budgeting- It is a budget which does not change irrespective of any change in sales. It is

based on single level of activity (Renz,, 2016) It is assumed that company will work only on

specified level.

Advantages-

These budgets need not to be updated continuously throughout the year.

It gives a strong insight to company costs and profits by performing the variance analysis.

This allows company to see where they are underestimating or overestimating its revenue

and expenses.

It helps in controlling costs by making smart decisions.

Disadvantage-

Its lack of flexibility restricts the company to allocate additional resources if there is any

change in departments performance ( Williams, 2014)

It is based on previous data so new business may find it difficult in implementing them.

Companies having fluctuations in sales can not implement this budget.

You need a budget- It is spreadsheet layout that is very easy to understand. It can create a

monthly budget in few minutes. Rather than creating budget on future income it creates by using

previous year income. It helps in creating reports and graphs that shows that where all the money

is going. Its advantage is that it helps in easy creating of budgets of every month. It also shows a

clear description of distribution of money. A budget can be made within minutes. Its

disadvantage is that it does not download transactions from financial institutions rather the user

have to download it from banks and then upload it into this software.

Personal capital- It helps in tracking both budget and investment accounts. It helps in

downloading the transactions manually. The cash flow is tracked by the expenses made in each

category. It tracks both the investment I.e taxable and retirement and also asset allocation,

returns, dividends,etc. (Quinn,, 2014)

Quicken- it is designed to handle all the finances including investment, bill pay and reporting. It

will automatically download transactions by connecting to financial institution.

Mint- It is just like quicken as it provides a wealth of information on spending, budgets, and

trends. Once you have entered basic information such as income, assets, liabilities, and net worth

it automatically tracks money.

It gives a strong insight to company costs and profits by performing the variance analysis.

This allows company to see where they are underestimating or overestimating its revenue

and expenses.

It helps in controlling costs by making smart decisions.

Disadvantage-

Its lack of flexibility restricts the company to allocate additional resources if there is any

change in departments performance ( Williams, 2014)

It is based on previous data so new business may find it difficult in implementing them.

Companies having fluctuations in sales can not implement this budget.

You need a budget- It is spreadsheet layout that is very easy to understand. It can create a

monthly budget in few minutes. Rather than creating budget on future income it creates by using

previous year income. It helps in creating reports and graphs that shows that where all the money

is going. Its advantage is that it helps in easy creating of budgets of every month. It also shows a

clear description of distribution of money. A budget can be made within minutes. Its

disadvantage is that it does not download transactions from financial institutions rather the user

have to download it from banks and then upload it into this software.

Personal capital- It helps in tracking both budget and investment accounts. It helps in

downloading the transactions manually. The cash flow is tracked by the expenses made in each

category. It tracks both the investment I.e taxable and retirement and also asset allocation,

returns, dividends,etc. (Quinn,, 2014)

Quicken- it is designed to handle all the finances including investment, bill pay and reporting. It

will automatically download transactions by connecting to financial institution.

Mint- It is just like quicken as it provides a wealth of information on spending, budgets, and

trends. Once you have entered basic information such as income, assets, liabilities, and net worth

it automatically tracks money.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.